Abstract

The national scale of catastrophic losses risk linked to state catastrophe bonds (SCB) is enormous. It can reduce investors’ interest in buying them because the capital required and the loss probability are also significant. To overcome this, the SCB can be made on a smaller regional scale, known as a regional catastrophe bond (RCB). Through RCBs, the catastrophic loss risk investors bear becomes smaller, which can increase investors’ interest in buying them. Unfortunately, RCB issuance faced a fundamental obstacle, where its complex pricing model needed further study. Therefore, this study aims to model it. The model uniquely involves the inflation rate modeled using the Fisher equation and the nonbinary scheme of coupon and redemption value payments modeled by a compound Poisson process. In addition, the model is applied to Indonesia’s catastrophe data, resulting in all provinces’ RCB price estimation and the effects of several variables on RCB price. This research can guide the RCB pricing process of the country’s regions. The estimated RCB prices can be used by Indonesia’s government if RCBs are to be issued one day. Finally, the effects of the inflation rate, catastrophe intensity, and geographical location on RCB prices can guide investors in selecting bond portfolios.

Keywords:

regional catastrophe bond; pricing; inflation rate; nonbinary payment scheme; application; Indonesia MSC:

60G50; 60G55; 60H35; 91B70; 91G30

1. Introduction

Catastrophe bonds from the government are financial securities used in its catastrophe insurance to increase coverage costs, reduce financial stress, and reduce the potential bankruptcy of insurers when government claims occur. It is a new mechanism developed from traditional insurance mechanisms that were previously unable to afford enormous coverage costs [1], e.g., at least 16 insurers who failed to pay during the 1992 Hurricane Andrew catastrophe [2].

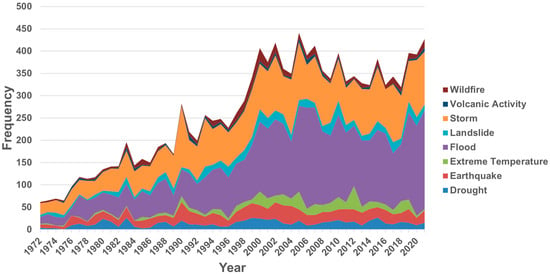

One type of catastrophe bond commonly issued by the government is a state catastrophe bond (SCB). Unfortunately, these bonds have one fundamental drawback, where the national catastrophic losses associated with them are too enormous [3]. Moreover, this is exacerbated by the current situation, where, according to The International Disaster Database, all countries worldwide are experiencing a trend of increasing intensity and losses from every type of catastrophe, e.g., earthquakes, floods, extreme temperatures, and storms [4,5] as seen in Figure 1 (the increasing tendency can be seen from the area under the curve, which tends to get bigger yearly). In other words, this causes catastrophic losses for each country, projected to get bigger over time. This projection decreases investor interest because they are unwilling to accept a more significant risk of catastrophic losses than usual from the insured and the insurer. At a time when the risk of catastrophic losses increases, the chances of claims occurring and investors losing their capital in bonds also increase. Thus, the shortfall in this country’s catastrophe bonds must be overcome as soon as possible [6,7].

Figure 1.

Frequency of several types of catastrophes in the world from 1972–2021.

One of the solutions to overcome the problem of too large an area scale in the SCB is to make it into a smaller regional scale. It is then referred to as a regional catastrophe bond (RCB). By reducing the scale of the area, the risk of catastrophic losses borne by investors will also be more negligible, which can further increase investor interest in participating in catastrophe bonds [8,9]. Several regions in one country had insured their catastrophic risks in catastrophe bonds, summarized in Table 1.

Table 1.

Several regions in one country that had insured their catastrophic risks in catastrophe bonds.

Table 1 shows that, in 2013, RCBs were issued in Florida, a state of the United States of America (USA), for hurricane financing [10,11]. The bonds were issued by Sunshine Re 2013-1 as a special-purpose vehicle (SPV) and had a face value of 20 million US Dollars (USD). Then, in 2020, RCBs were issued in Los Angeles, which is part of California, USA, to finance the wildfire catastrophe. The bonds were issued by Power Protective Re Ltd. as an SPV, and had a face value of 50 million USD [12]. Last but not least, in 2020, RCBs were issued in California, USA, for earthquake financing. The bonds were issued by Swiss Re Capital Market as an SPV and had a significant face value, which is 775 million USD [13].

Even though regions in a country have issued RCBs, fundamental obstacles are unfortunately faced where the RCB pricing framework has not been studied much. It is because this security is still newly developed. Several studies regarding the design of an RCB pricing framework or its application are discussed in this paragraph and summarized in Table 2.

Table 2.

Several studies regarding the design of an RCB pricing framework or its application.

Table 2 shows that, in general, all models use nominal interest rates to calculate the present value of coupons and redemption values. Then, in general, all models use binary coupon and redemption value payment schemes, that is, when a claim occurs and when there is no claim. In detail, Hardle and Cabrera [14] modeled RCB prices using a nonhomogeneous compound Poisson process and the peaks over threshold method. The model was then applied to three zones in Mexico. Zone 1 contained the Guerrero area, Zone 2 contained the Oaxaca area, and Zone 3 contained several areas, such as Morelos, Tlaxcala, and Hidalgo. Then, Shao et al. [15] designed a catastrophe bond model for earthquakes using the extreme value theory applied to California earthquake data. Karagiannis et al. [16] devised a bond pricing framework to cover losses in the agricultural sector using the utility indifference pricing method, which was then applied to weather data in two cities in Iran, Mashhad and Tabriz. Then, Hofer et al. [17] designed an RCB pricing framework that considers spatial uncertainty using a nonhomogeneous compound Poisson process. Then, they applied this framework in forming an RCB portfolio that explicitly bears the risk of damage to residential buildings in Italy due to earthquakes. Mistry and Lombardi [18] computed RCB prices specific to earthquakes in Benevento, Italy, based on a high-spatial-resolution hazard and exposure model. They also analyzed the way that the RCB increased the catastrophe resistance in the region. Then, Vakili and Ghaffari-Hadigheh [19] modeled catastrophe bond pricing as an uncertain optimization problem, focusing on investor ruin measures. They applied their model to catastrophe data in a region in Sweden. Anggraeni et al. [20] developed a catastrophe bond price model for earthquakes using copula and extreme value theory. They applied the model to earthquake data in West Java Province, Indonesia. Furthermore, Mistry and Lombardi [21] proposed a stochastic approach to estimate RCB prices using the Monte Carlo method and asset-location attributes applied in ten provinces in southern Italy, these being Avellino, Benevento, Campobasso, Caserta, Foggia, Isernia, Matera, Napoli, Potenza, and Salerno. The results show that spatial resolution affects the average annual loss and RCB prices.

Gaps from previous studies are discussed in this paragraph. Based on the studies presented in Table 2, there has been no study involving the inflation rate in designing regional catastrophe bond prices. It is essential to estimate the return expected by investors more accurately, which is called the real interest rate. Then, based on Table 2, no study considers nonbinary payment schemes of coupon and redemption value. Nonbinary schemes can vary the payment proportion of the coupon and redemption value from each region based on the intensity of each catastrophe. Thus, the estimated RCB prices in each region will adjust to the intensity of the catastrophe more fairly.

Based on the research gaps described, this study aims to design a pricing framework for RCBs by considering the inflation rate and nonbinary payment schemes of coupon and redemption value. We use Fisher’s equation model [22] to model the inflation rate. This model can estimate the actual bond return based on the real interest rate obtained from the relationship between the nominal interest and inflation rates [23,24]. Then, the risk of loss is represented by the catastrophic aggregate loss, modeled using a compound Poisson process (CPP). CPP can integrate loss risk modeling and catastrophe intensity risk modeling simultaneously, making modeling time efficient [25]. After the modeling, the pricing model is applied to catastrophe data in Indonesia from 2009 to 2022. The application uses the cumulative distribution function approximation method of CPP introduced by Chaubey et al. [26] and detailed in the rule of thumb by Reijnen et al. [27]. Finally, the effects of the inflation rate, nonbinary payment scheme, catastrophe intensity, geographic location, and the term on RCB prices, particularly in Indonesia, are analyzed. Indonesia was chosen for the following reasons:

- This country is geologically the fifth most catastrophe-prone country in the world based on The International Disaster Database. Geologically, this country is traversed by three major plate confluences and is located between two continents and two oceans.

- Based on The International Disaster Database, among the world’s top five most catastrophe-prone countries, Indonesia has not had a history of issuing catastrophe bonds. Hence, it is very interesting to estimate.

This research can help regions in a country determine regional catastrophe bond prices. Then, the results of the estimated RCB prices in Indonesia can also be used as a reference if the bonds are to be issued one day. Finally, the effects of the inflation rate, nonbinary payment scheme, catastrophe intensity, geographic location, and the term on RCB prices can also be used by investors to measure risk when selecting and compiling their bond portfolio.

The remaining sections of this article are designed as follows. Section 2 briefly explains RCBs and their structure. Then, Section 3 contains the design of the RCB price model framework. Next, Section 4 discusses the application of the model in estimating RCB prices in each province in Indonesia. Section 5 contains analyses of the effects of the inflation rate, nonbinary payment scheme, catastrophe intensity, geographic location, and the term on RCB prices. The final section contains a summary of this article and conclusions.

2. A Brief RCB Structure Explanation

The sponsors, special-purpose vehicles (SPV), and investors comprise the three primary components of the catastrophe-risk securitization structure via RCBs [14,28]. The SPV provides a catastrophe-risk transfer contract to the sponsor, which is the regional government, an insurer, or a reinsurer. Then, the sponsor pays the SPV a premium in exchange for the transfer. After that, the SPV releases the RCB following contract execution and premium payment. In detail, the RCB term is generally not long and ranges from one to five years [29]. After the RCB is sold, the proceeds and the premium paid by the sponsor before are invested in safe short-term financial assets [30]. The investment income is next deposited in a trust account. The SPV converts it into floating interest rate swap payments to strengthen the sponsor’s and investor’s immunity from interest rate and default risks [29,31]. This converting is conducted based on official benchmark interest rates worldwide, e.g., London Interbank Offered Rate (LIBOR) (USD-LIBOR was abandoned in June 2023) and Secured Overnight Financing Rate (SOFR). Finally, in nonbinary payment schemes, coupons, and redemption values from the RCB are charged to investors based on the aggregate loss that occurs. Investors receive the coupon and redemption value from the RCB in full if the aggregate loss of the catastrophe is in the smallest aggregate loss interval [32].

3. Modeling Framework

3.1. Mathematical Notations

The mathematical variable notations used in this study are as follows:

- (a)

- Triple is a probability space of catastrophe aggregate loss, where represents sample space, represents -algebra of subsets of , and represents a probability measure on .

- (b)

- is a positive integer representing a country’s many administrative regions.

- (c)

- is the set of positive integers up to , representing the order index of the administrative regions of a country.

- (d)

- is a positive integer representing the term of the RCB in years.

- (e)

- is the set of positive integers up to , representing the year index.

- (f)

- represents the number of catastrophes that occurred in the -th administration until time .

- (g)

- is the set of nonnegative integers up to , representing the catastrophe sequence index that occurred in the -th administrative region until time .

- (h)

- represents the -th catastrophe loss in the -th administrative region.

- (i)

- represents the aggregate catastrophe loss in the -th administrative region until time .

- (j)

- represents the constant nominal interest rate in the -th administrative region.

- (k)

- is the set of positive real numbers, representing the constant inflation rate in the -th administrative region.

- (l)

- represents the constant coupon value in year of the RCB in the -th administrative region.

- (m)

- represents the redemption value of the RCB in the -th administrative region on the maturity date.

- (n)

- represents the price of a zero-coupon RCB with a term of years in the -th administrative region.

- (o)

- represents the price of a coupon-paying RCB with a term of years in the -th administrative region.

- (p)

- is the number of aggregate loss intervals for determining claims.

- (q)

- is the set of positive integers up to , representing the order of the aggregate loss interval index.

- (r)

- is an increasing sequence representing the threshold value of the aggregate catastrophic losses on the RCB. The values of these variables are generally different for each country and adjusted for historical data on catastrophe losses in that country.

- (s)

- is a descending sequence representing the set of payment proportions of coupon and redemption value on the RCB. The maximum value of is 1. Meanwhile, the minimum value of can be adjusted according to the risk aversion tendency of the investor. For example, if the investor does not want to lose the coupon and the redemption value is more than 0.5, the minimum value is 0.5.

3.2. Regional Catastrophic Aggregate Loss Model via a Compound Poisson Process

The catastrophic aggregate loss in the -th state administration region until time modeled by a compound Poisson process is expressed as follows:

where represents the Poisson process with intensity , and are nonnegative random variables. is assumed to be independent and identically distributed (i.i.d.) random variables. It means that the losses from each catastrophe in each region have the same characteristics and do not affect one another. Then, and are assumed to be independent. It means that the number of catastrophes that occurred in each region did not affect the losses.

To measure the risk in Equation (1), it can be conducted through its cumulative distribution function (CDF) [33]. The CDF value at represents the probability that a maximum loss of will not occur. The CDF of is expressed as follows:

3.3. Regional Catastrophe Bond Pricing Model

The RCB price model in this study was designed in two forms, namely zero-coupon and coupon-paying RCBs. Through zero-coupon RCBs, investors only receive payment of the redemption value on the maturity date [34]. The redemption amount paid at maturity depends on the amount of the catastrophic aggregate loss at that time. Mathematically, the redemption value payment scheme for zero-coupon RCBs in the -th administrative region expressed as a random variable is stated as follows:

where is a constant representing the redemption value of RCBs in the -th administrative region.

The price of zero-coupon RCBs in the -th administrative region is modeled as the present value of the expected redemption value random variable in Equation (3). Mathematically, it is written as follows:

where , , , , represents a probability measure corresponding to the distribution of , and is often called the risk-neutral price measure. In more detail, the form in Equation (4) is Fisher’s real interest rate equation [22,23].

Next is the modeling of the coupon-paying RCB price. Through these bonds, investors receive payment of the redemption value on the maturity date and an annual coupon [35]. The coupon amount paid in year depends on the catastrophic aggregate losses in that year. Mathematically, the coupon payment scheme on RCBs in the -th administrative region represented as a random variable is expressed as follows:

where is a constant representing the nominal value of the RCB coupons in the -th administrative region. The coupon-paying RCB prices in the -th administrative region are modeled as the sum of the zero-coupon bond prices and the present value of the expected coupon random variables in Equation (5). Mathematically, it is formulated as follows:

where , , , , represents a probability measure corresponding to the distribution of , and is often called the risk-neutral price measure.

3.4. Approximation Methods to Compute the CDF Value of

The value of CDF is generally difficult to determine using ordinary operations, except when has an exponential distribution. Therefore, this study uses the distribution approach introduced by Chaubey et al. [26] and developed by Reijnen et al. [27]. The distribution approach in this method is based on average (), standard deviation (), skewness (), kurtosis (), and the -th cumulant () of . Furthermore, two methods of approximating the distribution are used, which are inverse-Gaussian (IG) and gamma inverse-Gaussian (GIG) distributions, presented in Table 3.

Table 3.

Two approximation methods of distribution.

The selection criteria of these two methods are based on the skewness of () and . These criteria are as follows [27]:

- (a)

- If and , the GIG distribution can be applied to more accurately determine the CDF value of .

- (b)

- If and , the IG distribution can be applied to more accurately determine the CDF value of .

4. Application Model in Indonesia’s Provinces

4.1. Brief Description of the Data

Equations (4) and (6) are applied to catastrophe loss and frequency data in each province in Indonesia from 2009 to 2022. The data were obtained from the Republic of Indonesia’s National Catastrophe Management Agency at the following link: https://dibi.bnpb.go.id, accessed on 14 February 2023. The administrative region of the data is a province, and the number is . Then, statistical descriptives of catastrophe loss and frequency data from each province in Indonesia are presented in Table 4.

Table 4.

Statistical descriptives of catastrophe loss and frequency data from each province in Indonesia.

Table 4 shows that the Provinces of Central Java, West Java, and East Java are the provinces with Indonesia’s first, second, and third largest average and deviation standards of annual catastrophe intensity and losses, respectively. The three provinces are located on Java Island, which is very prone to catastrophe. Then, the provinces of Aceh, South Sulawesi, South Kalimantan, Papua, and Bali are the provinces with the highest average and deviation standard of annual catastrophe intensity and losses on Sumatra, Sulawesi, Kalimantan, Papua, and the Nusa Tenggara Islands, respectively. Meanwhile, the province with the lowest average and deviation standard of annual catastrophe intensity and losses is West Papua Province.

4.2. Determinating Single Catastrophic Loss Distribution

Losses between catastrophes in each province based on the assumption of the compound Poisson process in Section 3.2 are independent and identically distributed. Therefore, the distributions are determined simultaneously. The selected theoretical distribution options are following the characteristics of the data. The characteristics of the exact data used are as follows:

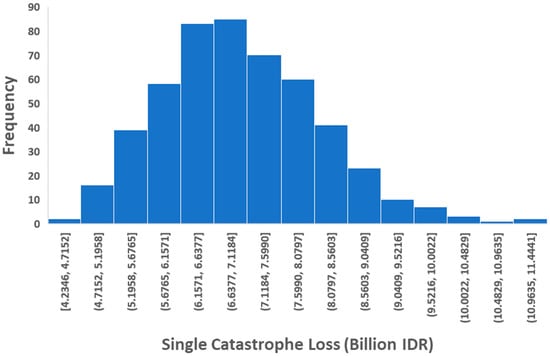

- The data have extreme values in the right tail of the histogram, as shown in Figure 2. In other words, the tail of the distribution is fatter on the right.

Figure 2. Histogram of single catastrophe loss data in Indonesia.

Figure 2. Histogram of single catastrophe loss data in Indonesia. - The data have a positive skewness, namely 0.5201. It is because the data are spread out more on the left than the average. This characteristic also aligns with the previous characteristic, where data with a fat right tail of the distribution generally have positive skewness [30].

Based on the characteristics of the data above, the theoretic distribution options chosen are those with a thick right tail. A list of distribution options with a thick right tail is given in Table 5. Then, using the maximum likelihood estimation method, each parameter estimate of each distribution is given in Table 6. Then, the fit between the exact data distribution and the distribution in Table 5 are checked using the Kolmogorov–Smirnov (KS), Anderson–Darling (AD), and Chi-Square (CS) tests. With a significance level of 0.05, the results of examining the fit using the three tests are presented in Table 7. The results of the distribution fit test in Table 7 show that the gamma distribution has the smallest statistical value in each test. Therefore, the gamma distribution represents the distribution of single catastrophe losses in Indonesia.

Table 5.

Several probability distributions with thick right tails.

Table 6.

Results of distribution parameter estimates for single catastrophe loss data.

Table 7.

Kolmogorov–Smirnov, Anderson–Darling, and Chi-Square test results.

4.3. Estimated Regional Catastrophe Bond Prices in Each Province

In estimating the price of RCBs in each province, the values of the required variables are determined first. The list of variable values used is presented in Table 8.

Table 8.

Variable values used in estimating RCB prices.

Based on Table 8, the term of the RCB is given as one year. This period was chosen so that the risk of loss from bonds is not too significant so that it can be more attractive to investors. Then, there are loss threshold values, namely . is the -th percentile of the annual loss data due to catastrophe in Table 4 in column 5. Then, the redemption value and coupon proportion are an arithmetic sequence with a difference of . The minimum value of this proportion () is 0.5. If the catastrophic aggregate losses exceed the enormous threshold value, the investor receives half of the redemption and coupon. Then, the nominal interest rate and inflation are adjusted according to actual data that have been rounded up from Bank Indonesia in December 2022. Finally, the annual redemption and coupon values of RCBs in each province are given the same value. These are 1 IDR and 0.05 IDR, respectively.

Before estimating the RCB prices of each province, the distribution approximation method for each is analyzed first. This analysis was conducted based on the skewness value of and the kurtosis of . The analysis result of determining the distribution approximation method for each province is given in Table 9.

Table 9.

The analysis results of determining the distribution approximation method .

Table 9 shows that the kurtosis value of is in the interval . Then, the skewness value of X is the same, namely 0.1564, because it is assumed to be identical. The skewness value is in the interval . Thus, the distribution of is approximated by the GIG distribution. Furthermore, with the variable values in Table 8, the RCB prices of each province are determined using Equations (4) and (6). A list of RCB prices for each province is given in Table 10.

Table 10.

Estimated results of RCB prices for each province in Indonesia.

Table 10 shows that West Papua, West Sulawesi, North Maluku, Papua, and Gorontalo Provinces have the first, second, third, fourth, and fifth highest zero-coupon and coupon-paying RCB prices among all provinces in Indonesia, respectively. Then, Central Java, East Java, West Java, Aceh, and South Sulawesi Provinces have the first, second, third, fourth, and fifth lowest zero-coupon and coupon-paying RCB prices among all provinces in Indonesia.

5. Discussion

5.1. The Effect of the Inflation Rate on RCB Prices

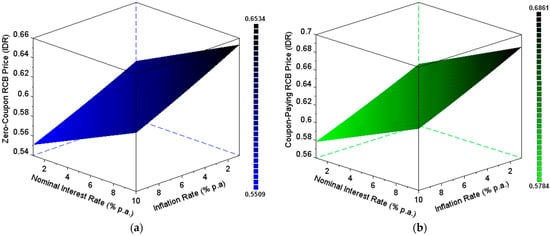

The analysis of the effect of the inflation rate on RCB prices is discussed in this section. Mathematically, based on Equations (4) and (6), the value of the inflation rate is inversely proportional to the RCB price. In other words, the greater the inflation rate, the lower the RCB price, and vice versa. It is rational because if the inflation rate is low, the returns from RCBs obtained by investors will be high. Hence, the demand for buying RCBs increases, but the issuance of RCBs is limited. Therefore, the price of RCBs has also increased. It also applies to the opposite when the inflation rate is high. In addition, we show this visually in Figure 3 regarding the effect of the inflation rate on RCB prices. The visualized RCB price is the RCB price in Aceh Province only to shorten the writing, and all variables are the same in Table 8 except for the inflation rate and nominal interest rate. Figure 3 also visualizes the effect of the nominal interest rate on the RCB price, where the nominal interest rate appears to be directly proportional to the RCB price. It can also be seen in Equations (4) and (6). It is appropriate because if the nominal interest rate is high, the return from the RCB will be high. Hence, the demand for RCBs increases, but the issuance is limited. Therefore, the price of RCBs is high. The effect of the nominal rate of interest in this study is in line with Burnecki et al. [36].

Figure 3.

(a) The effect of inflation rate and nominal interest rate on zero-coupon RCB price; (b) The effect of inflation rate and nominal interest rate on coupon-paying RCB price.

5.2. The Effect of the Nonbinary Payment Scheme on RCB Prices

In this section, we analyze how the nonbinary payment scheme of coupon and redemption value on RCB prices is affected. In other words, this section also presents a comparison between estimated RCB prices resulting from nonbinary and binary scheme models. The nonbinary scheme is given in Equations (3) and (5), and the values are given in Table 8. Meanwhile, the binary scheme of the coupon payment and redemption value are, respectively, expressed as follows:

and

Then, the zero-coupon and coupon-paying RCB price models of this binary scheme are, respectively, expressed as follows:

and

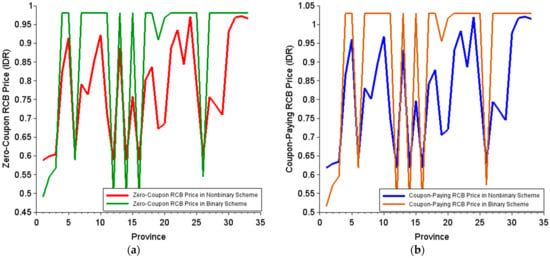

Assume that dan A comparison of RCB prices from models with nonbinary and binary schemes from each province is shown in Figure 4.

Figure 4.

(a) A comparison between the zero-coupon RCB prices of models with the binary and nonbinary payment schemes of coupon and redemption values; (b) A comparison between the coupon-paying RCB prices of models with the binary and nonbinary payment schemes of coupon and redemption values.

Figure 4 shows that the RCB price of the model with the nonbinary scheme is more convergent towards the center than the RCB price of the model with the binary scheme. It can be interpreted that the RCB price of the model with the nonbinary scheme is fairer than the RCB price of the model with the binary scheme. This fairness means that the RCB price in the nonbinary scheme is neither too cheap nor too expensive. If the RCB price is too low, it will be detrimental to the sponsor because the funds they receive from the RCBs will be small. Then, if the RCB price is too high, this will be detrimental to investors because the funds they invest should be cheaper.

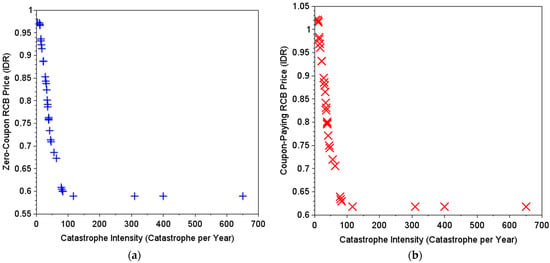

5.3. The Effect of Provincial Catastrophe Intensity in Indonesia on RCB Prices

Based on the estimated results of provincial RCB prices in Indonesia in Table 10, some things can be discussed further. This discussion is related to the analysis of the effect of the catastrophe intensity of each province on the price of its bonds. To facilitate this analysis, we first visualize the scatter plot of each province’s bond price and catastrophe intensity in Figure 5.

Figure 5.

(a) Scatter plot between catastrophe intensity and zero-coupon bond prices from each province in Indonesia; (b) Scatter plot between catastrophe intensity and coupon-paying bond prices from each province in Indonesia.

Figure 5 shows an inverse relationship between the catastrophe intensity of each province in Indonesia and its RCB price, where the higher the catastrophe intensity in a province, the lower the RCB price, and vice versa. It is logically rational because the higher the intensity of the catastrophe in a province, the higher the catastrophic aggregate losses will exceed the threshold values. It makes investors less interested in catastrophe bonds because they fear a massive loss of redemption and coupon values. Therefore, the price of RCBs becomes cheap. This relationship can be seen in Section 4.3, where the top five provinces with the highest and lowest RCB prices are also the top five with the lowest and highest catastrophic intensity, respectively. The relationship obtained is in line with several previous studies, namely Ma and Ma [30], Chao [37], and Ibrahim et al. [34].

The inverse relationship between intensity and bond prices from Figure 5 dips sharply over the zero to one hundred intensity intervals and begins to decline slowly after that. It further indicates that the distribution of catastrophic losses, including in Indonesia, has a thick right tail due to sloping slowly in that direction.

5.4. The Effect of Geographical Location of Provinces in Indonesia on RCB Prices

The effect of the geographical location of each province in Indonesia on the price of the RCBs is also something that can be discussed further. Geologically, the territory of Indonesia is above the earth’s surface, where the world’s plates meet underneath [38,39,40]. In particular, this is the territory of Indonesia which is located around the state border line in the south, such as the provinces of Aceh, North Sumatra, West Sumatra, South Sumatra, Banten, West Java, Central Java, East Java, Bali, West Nusa Tenggara, and East Nusa Tenggara. As a result, these provinces are frequently hit by geological catastrophes, especially earthquakes, volcanic eruptions, and tsunamis. This geographical location affects the price of RCBs in these provinces, where the prices are low compared to other provinces. Seven of the ten provinces with the lowest RCB prices in Indonesia are some of these provinces, as shown in Table 11. It is logical because the geographical location causes the probability of claims from RCBs to be high, making it less attractive to investors and decreasing RCB prices.

Table 11.

Ten Provinces with the Lowest RCB Prices in Indonesia.

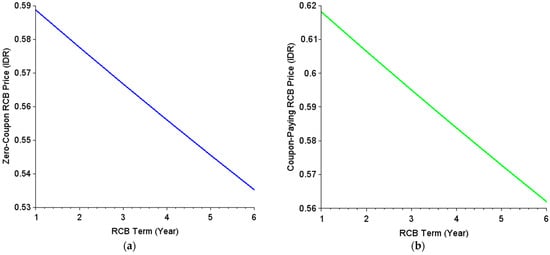

5.5. The Effect of the RCB Term on RCB Prices

The effect of the RCB term on its price is analyzed in this section. For reasons of simplicity, the variables used are in Table 8, while the values for the RCB term variables are defined by . Then, the approximation distribution of the ’s CDF used is also the same as in Table 9, the GIG distribution. Finally, the province analyzed is Aceh (). The effect of the RCB term on its price is visualized in Figure 6.

Figure 6.

(a) The effect of RCB term on zero-coupon RCB Price; (b) The effect of RCB term on coupon-paying RCB Price.

Figure 6 shows that the RCB term is inversely proportional to its price. It means that the longer the RCB term, the lower the price, and vice versa. Rationally, this is normal because the longer the RCB term, the greater the risk of claims from the RCB. It has implications for decreased investor interest, resulting in low RCB prices.

5.6. Comparation of Catastrophe Loss in SCBs and RCBs

As the data presented in Table 4 show, catastrophic losses from individual provinces are smaller than catastrophic losses from a single country. Catastrophe losses from individual provinces range from IDR 26 million to IDR 6 trillion, while catastrophe losses from the country are IDR 20 trillion. It happens because the regional scale of the province is smaller than the scale of the country. The larger the scale of a country, the greater the risk of catastrophe, and vice versa. This condition causes a large amount of funds to be provided, and the risk of claims from RCBs is lower than SCBs. Hence, investors’ interest in participating in catastrophe funding is higher. Therefore, RCBs can be an alternative solution for catastrophe funding in the future.

6. Conclusions

This study aims to design a pricing framework for regional catastrophe bonds by considering the inflation rate and nonbinary payment schemes in coupon and redemption values. The inflation rate is involved in estimating investors’ expected return more accurately and is modeled using Fisher’s equation. Then, nonbinary payment schemes are involved in varying the proportion of coupon and redemption values from each region based on each catastrophe intensity. The framework is modeled using a compound Poisson process.

In addition to modeling, this study provides an application of its use in Indonesian catastrophe data. The model application was conducted using the distribution approximation method, proposed and developed by Chaubey et al. [26] and Reijnen et al. [27], respectively. The model application shows an inverse relationship between the inflation rate and RCB price, where low inflation causes a high RCB return, increasing demand. At the same time, RCB issuance is limited, resulting in higher prices. Then, an inverse relationship is also shown between the catastrophe intensity of each province in Indonesia and its RCB price, where the higher the catastrophe intensity in a province, the lower the RCB price, and vice versa. It is logically rational because the higher the intensity of the catastrophe in a province, the higher the catastrophic aggregate losses will exceed the threshold values. Hence, the RCB price decreases. Then, nonbinary payment schemes of coupon and redemption value make the RCB price fairer, which means it is not too cheap or expensive. Then, the term of RCB has a disproportionate relationship with the price, where the longer the term of the RCB, the cheaper the price, and vice versa. It is logical because the longer the term of the RCB, the greater the risk of catastrophe. Hence, investor interest decreases, and the price also decreases. Finally, the geographical location of a region also affects the price of RCBs in that region. The more catastrophic triggers in a region, e.g., meeting points between plates and a large area of dry land, the lower the price of RCBs from that region, and vice versa.

This research can help regions in a country determine RCB prices. Then, the results of the estimated RCB prices in Indonesia can also be used as a reference if the bonds are to be issued one day. Finally, the effects of the inflation rate, nonbinary payment scheme, catastrophe intensity, geographic location, and the term on RCB prices can also be used by investors to measure risk when selecting and compiling their bond portfolio.

As a suggestion for future research, the correlation level of catastrophe frequency between regions can be considered. Involving this factor is logical because its influence on RCB prices is possible. Then, the use of the jumping process can be considered for study in the future because jumping can exist in catastrophe loss data in a country, e.g., losses from the Aceh Tsunami in 2004, which were very extreme in value compared to other catastrophes there. Then, the risk of default can also be considered in the model because each region generally owns it. Lastly, it can be assumed that the interest rate and inflation in Fisher’s equation are not constant. It can better describe the situation, where the two are not always constant yearly.

Author Contributions

Conceptualization, S. and H.N.; methodology, R. and M.D.J.; software, R.A.I.; validation, S., H.N. and R.; formal analysis, R.A.I.; investigation, R.A.H. and M.D.J.; resources, S.; data curation, R.A.H.; writing—original draft preparation, R.A.I.; writing—review and editing, S.; visualization, R.A.H.; supervision, S.; project administration, H.N.; funding acquisition, S. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by Universitas Padjadjaran with grant number 1549/UN6.3.1/PT.00/2023.

Data Availability Statement

Data are contained within the article.

Acknowledgments

Thanks to Universitas Padjadjaran for providing the RDPD grant for the 2023 fiscal year with contract number: 1549/UN6.3.1/PT.00/2023.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Nowak, P.; Romaniuk, M. Valuing Catastrophe Bonds Involving Correlation and CIR Interest Rate Model. Comput. Appl. Math. 2018, 37, 365–394. [Google Scholar] [CrossRef]

- Born, P.; Viscusi, W.K. The Catastrophic Effects of Natural Disasters on Insurance Markets. J. Risk Uncertain. 2006, 33, 55–72. [Google Scholar] [CrossRef]

- Zimbidis, A.A.; Frangos, N.E.; Pantelous, A.A. Modeling Earthquake Risk via Extreme Value Theory and Pricing the Respective Catastrophe Bonds. ASTIN Bull. 2007, 37, 163–183. [Google Scholar] [CrossRef]

- Sukono; Juahir, H.; Ibrahim, R.A.; Saputra, M.P.A.; Hidayat, Y.; Prihanto, I.G. Application of Compound Poisson Process in Pricing Catastrophe Bonds: A Systematic Literature Review. Mathematics 2022, 10, 2668. [Google Scholar] [CrossRef]

- Coronese, M.; Lamperti, F.; Keller, K.; Chiaromonte, F.; Roventini, A. Evidence for Sharp Increase in the Economic Damages of Extreme Natural Disasters. Proc. Natl. Acad. Sci. USA 2019, 116, 21450–21455. [Google Scholar] [CrossRef]

- Anggraeni, W.; Supian, S.; Sukono; Halim, N.B.A. Earthquake Catastrophe Bond Pricing Using Extreme Value Theory: A Mini-Review Approach. Mathematics 2022, 10, 4196. [Google Scholar] [CrossRef]

- Ibrahim, R.A.; Sukono, S.; Napitupulu, H.; Ibrahim, R.I.; Johansyah, M.D.; Saputra, J. Estimating Flood Catastrophe Bond Prices Using Approximation Method of the Loss Aggregate Distribution: Evidence from Indonesia. Decis. Sci. Lett. 2023, 12, 179–190. [Google Scholar] [CrossRef]

- Painter, M. An Inconvenient Cost: The Effects of Climate Change on Municipal Bonds. J. Financ. Econ. 2020, 135, 468–482. [Google Scholar] [CrossRef]

- Schultz, P. The Market for New Issues of Municipal Bonds: The Roles of Transparency and Limited Access to Retail Investors. J. Financ. Econ. 2012, 106, 492–512. [Google Scholar] [CrossRef]

- Herrmann, M.; Hibbeln, M. Trading and Liquidity in the Catastrophe Bond Market. J. Risk Insur. 2023, 90, 283–328. [Google Scholar] [CrossRef]

- Schwarcz, S.L. Catastrophe Bonds, Pandemics, and Risk Securitization. SSRN Electron. J. 2020. [Google Scholar] [CrossRef]

- Ando, S.; Fu, C.; Roch, F.; Wiriadinata, U. Sovereign Climate Debt Instruments: An Overview of the Green and Catastrophe Bond Markets. Staff Clim. Notes 2022, 2022, 1–28. [Google Scholar] [CrossRef]

- Braun, A.; Herrmann, M.; Hibbeln, M.T. Common Risk Factors in the Cross Section of Catastrophe Bond Returns. SSRN Electron. J. 2022. [Google Scholar] [CrossRef]

- Härdle, W.K.; Cabrera, B.L. Calibrating CAT Bonds for Mexican Earthquakes. J. Risk Insur. 2010, 77, 625–650. [Google Scholar] [CrossRef]

- Shao, J.; Pantelous, A.; Papaioannou, A.D. Catastrophe Risk Bonds with Applications to Earthquakes. Eur. Actuar. J. 2015, 5, 113–138. [Google Scholar] [CrossRef]

- Karagiannis, N.; Assa, H.; Pantelous, A.A.; Turvey, C.G. Modelling and Pricing of Catastrophe Risk Bonds with a Temperature-Based Agricultural Application. Quant. Financ. 2016, 16, 1949–1959. [Google Scholar] [CrossRef]

- Hofer, L.; Zanini, M.A.; Gardoni, P. Risk-Based Catastrophe Bond Design for a Spatially Distributed Portfolio. Struct. Saf. 2020, 83, 101908. [Google Scholar] [CrossRef]

- Mistry, H.K.; Lombardi, D. Pricing Risk-Based Catastrophe Bonds for Earthquakes at an Urban Scale. Sci. Rep. 2022, 12, 9729. [Google Scholar] [CrossRef]

- Vakili, W.; Ghaffari-Hadigheh, A. CAT Bond Pricing in Uncertain Environment. Iran. J. Manag. Stud. 2022, 15, 347–364. [Google Scholar]

- Anggraeni, W.; Supian, S.; Sukono; Halim, N.A. Single Earthquake Bond Pricing Framework with Double Trigger Parameters Based on Multi Regional Seismic Information. Mathematics 2023, 11, 689. [Google Scholar] [CrossRef]

- Mistry, H.K.; Lombardi, D. A Stochastic Exposure Model for Seismic Risk Assessment and Pricing of Catastrophe Bonds. Nat. Hazards 2023, 117, 803–829. [Google Scholar] [CrossRef]

- Kierzkowski, H. A Generalization of the Fisher Equation. Econ. Rec. 1979, 55, 261–266. [Google Scholar] [CrossRef]

- Groenewold, N. The Adjustment of the Real Interest Rate to Inflation. Appl. Econ. 1989, 21, 947–956. [Google Scholar] [CrossRef]

- Carmichael, J.; Stebbing, P.W. Fisher’s Paradox and the Theory of Interest. Am. Econ. Rev. 1983, 73, 619–630. [Google Scholar]

- Ibrahim, R.A.; Sukono; Napitupulu, H.; Ibrahim, R.I. How to Price Catastrophe Bonds for Sustainable Earthquake Funding? A Systematic Review of the Pricing Framework. Sustainability 2023, 15, 7705. [Google Scholar] [CrossRef]

- Chaubey, Y.P.; Garrido, J.; Trudeau, S. On the Computation of Aggregate Claims Distributions: Some New Approximations. Insur. Math. Econ. 1998, 23, 215–230. [Google Scholar] [CrossRef]

- Reijnen, R.; Albers, W.; Kallenberg, W.C.M. Approximations for Stop-Loss Reinsurance Premiums. Insur. Math. Econ. 2005, 36, 237–250. [Google Scholar] [CrossRef]

- Chao, W.; Zou, H. Multiple-Event Catastrophe Bond Pricing Based on CIR-Copula-POT Model. Discret. Dyn. Nat. Soc. 2018, 2018, 5068480. [Google Scholar] [CrossRef]

- Cummins, J.D.; Weiss, M.A. Convergence of Insurance and Financial Markets: Hybrid and Securitized Risk-Transfer Solutions. J. Risk Insur. 2009, 76, 493–545. [Google Scholar] [CrossRef]

- Ma, Z.-G.; Ma, C.-Q. Pricing Catastrophe Risk Bonds: A Mixed Approximation Method. Insur. Math. Econ. 2013, 52, 243–254. [Google Scholar] [CrossRef]

- Cummins, J.D. CAT Bonds and Other Risk-Linked Securities: State of the Market and Recent Developments. SSRN Electron. J. 2007. [Google Scholar] [CrossRef]

- Gunardi, G.; Setiawan, E.P. Valuation of Indonesian Catastrophic Earthquake Bonds with Generalized Extreme Value (GEV) Distribution and Cox-Ingersoll-Ross (CIR) Interest Rate Model. In Proceedings of the 2014 International Conference on Actuarial Science and Statistics, Bandung, Indonesia, 21–23 October 2015; AIP Conference Proceedings. pp. 1–14. [Google Scholar]

- Deng, G.; Liu, S.; Li, L.; Deng, C.; Yu, W. Research on the Pricing of Global Drought Catastrophe Bonds. Math. Probl. Eng. 2020, 2020, 3898191. [Google Scholar] [CrossRef]

- Ibrahim, R.A.; Sukono; Napitupulu, H. Multiple-Trigger Catastrophe Bond Pricing Model and Its Simulation Using Numerical Methods. Mathematics 2022, 10, 1363. [Google Scholar] [CrossRef]

- Sukono; Ibrahim, R.A.; Saputra, M.P.A.; Hidayat, Y.; Juahir, H.; Prihanto, I.G.; Halim, N.B.A. Modeling Multiple-Event Catastrophe Bond Prices Involving the Trigger Event Correlation, Interest, and Inflation Rates. Mathematics 2022, 10, 4685. [Google Scholar] [CrossRef]

- Burnecki, K.; Giuricich, M.N.; Palmowski, Z. Valuation of Contingent Convertible Catastrophe Bonds—The Case for Equity Conversion. Insur. Math. Econ. 2019, 88, 238–254. [Google Scholar] [CrossRef]

- Chao, W. Valuing Multirisk Catastrophe Reinsurance Based on the Cox–Ingersoll–Ross (CIR) Model. Discret. Dyn. Nat. Soc. 2021, 2021, 8818486. [Google Scholar] [CrossRef]

- Muttaqy, F.; Dian Nugraha, A.; Syuhada, S.; Mori, J.; Tyasbudi Puspito, N.; Trisnia Sasmi, A.; Supendi, P.; Rohadi, S. Anisotropy Variations in the Continental Crust of Central—East Java Region, Indonesia from Local Shear Wave Splitting. J. Asian Earth Sci. 2023, 249, 105632. [Google Scholar] [CrossRef]

- Setiawan, A.; Zulfakriza, Z.; Nugraha, A.D.; Rosalia, S.; Priyono, A.; Widiyantoro, S.; Sahara, D.P.; Marjiyono, M.; Setiawan, J.H.; Lelono, E.B.; et al. Delineation of Sedimentary Basin Structure beneath the Banyumas Basin, Central Java, Indonesia, Using Ambient Seismic Noise Tomography. Geosci. Lett. 2021, 8, 31. [Google Scholar] [CrossRef]

- Hall, R. Late Jurassic–Cenozoic Reconstructions of the Indonesian Region and the Indian Ocean. Tectonophysics 2012, 570–571, 1–41. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).