Abstract

The aim of this research was to examine the causal link between terrorism and FDI in tourism on the example of a panel of 50 countries for the period from 2000 to 2016. Other control variables were included in order to ensure the validity of the results—number of international tourist arrivals per capita, the KAOPEN index, the KOF Globalisation Index and GDP per capita. The main goal was to look at this issue from the perspective that terrorism does not affect FDI in tourism. The research employed the Granger causality test in a vector autoregressive model (VAR model), the analysis of variance decomposition and the impulse response function within the panel setting. Based on research results, it was found that terrorism does not Granger cause FDI in tourism. The results are in line with recent research related to the subject matter which indicated that the negative effect of terrorism on FDI in tourism was questionable.

JEL Classification:

C33; F21; Z32

1. Introduction

The global economy has faced a sequence of serious challenges in the 21st century. Even though globalisation brought benefits to most stakeholders, the increased interconnectedness of the global economy correspondingly caused several issues. Some of these problems are of a short-term nature (such as the global financial crisis from 2008), while some have long-term features (such as global inequality, sustainable development or terrorism). At the same time, the global economy is predominantly driven by two phenomena, tourism and FDI. The recent decades have seen a powerful boom in touristic development and tourism has been recognised as a global economic driver and one of the fastest growing sectors of the global economy (UNWTO 2017). FDI has also experienced strong growth and is one of the drivers of economic growth as well and also one of the most salient aspects of globalization (Li 2008). In addition, the globalization of tourism is occurring simultaneously with the globalization of the world economy predominantly characterised by international capital movements, most notably in the dimension of its external flow and activity. According to the UNWTO (2018) World Tourism Barometer, arrivals grew by 7% in 2017 and reached a total of 1.322 billion. This number is expected to reach 1.8 billion by 2030. Tourism accounts for 10.4% of the global GDP and 313 million jobs, i.e., 9.9% total employment in 2017 (WTTC 2018). Regarding FDI in tourism from 2003 to 2016, $325 billion in capital expenditure was spent on tourism, and out of 39 sectors, tourism is in tenth place (Shehadi 2017). However, since 2008 greenfield FDI in tourism has constantly been in decline. From 2003 to 2008 the average greenfield FDI in tourism was $33.3 million, and since then it has dropped to $18.9 million (Shehadi 2017). The brand value of all top ten hotel chains dropped significantly during 2016, and this has been attributed to the rise of the sharing economy (Atherton 2016). Companies such as Airbnb have made tourism cheaper and easier, but probably at the cost of FDI in tourism (Shehadi 2017) so they are a threat to the global hospitality industry. Regarding M&A in tourism, the average number of deals in the period from 2012 to 2017 was 327, while the average value was $78.15 billion (Haddad 2018). The peak was reached in 2015 with 385 deals and a value of $200.3 billion (Haddad 2018). In the context of this paper, it is important to emphasize that the total FDI is more than double in very peaceful countries (IEP 2018).

The last decade has seen a mild but steady decline in global peace. The number of terrorist incidents has risen nearly 200% since 2011, while casualties resulting from terrorist activities, and casualties caused by terrorism in OECD member states, have increased by 900% since 2007 (IEP 2018). According to the Global Peace Index (IEP 2018), the global economic impact of violence increased by 2.1% from 2016 to 2017, equivalent to 12.4% of the global GDP, or $1988 per person.

Given the strength that tourism has in economic terms at local and global level, the prospect of it being a generator of peace in the world and the fact that tourism development is often associated with the struggle against poverty (Holden 2013), it is essential to ensure the development of its key elements. This primarily pertains to capital, infrastructure, knowledge and disposal of international marketing and distribution networks whose most efficient developmental driver is FDI in tourism (Barrowclough et al. 2007). FDI in tourism is especially important for less developed destinations, especially when it comes to investing in human resources and skills (Shehadi 2017). FDI in tourism has an effect on international tourist arrivals (Bezić et al. 2010; Perić and Nikšić Radić 2016; Selvanathan et al. 2012; Tang et al. 2007; Zhang et al. 2011) and thus significantly affects economic growth. Even though FDI in tourism has not until recently been emphasized as a key sector of investment promotional agencies of particular countries, today it plays a key role in their plans and is one of the pillars of sustainable development of the global economy (Fingar 2017).

FDI, tourism and terrorism have some dominant common features. They surpass national borders, involve stakeholders of different nationalities and are mutually intertwined. FDI and tourism are strongly linked to terrorism because terrorism affects both the movement of tourists and the movement of FDI. Because of its significant role in job creation, tax revenue contribution, and overall impact on economic growth, FDI is a logical choice for attacks (Lutz and Lutz 2017). International hotels are symbolic targets of western wealth and influence which attract exactly the type of militants who aim to remove foreigners, business travellers, tourists and local elites (Bharwani and Mathews 2012). Tourists also often become targets of terrorism as they are in a way considered as ambassadors of their countries and easy targets, as well as symbolic indirect representatives of enemy governments. Attacks on foreign tourists and international businesses, i.e., citizens of other countries, guarantees greater media attention to terrorists.

Despite the importance FDI plays in tourism, the subject research is very scarce and insufficiently explored (Dwyer et al. 2010; Kundu and Contractor 1999; Perić and Nikšić Radić 2016; Sinclair and Stabler 1991). Nevertheless, it is also possible to conclude that the amount of subject research is continuously growing (Bezić et al. 2010; Craigwell and Moore 2008; Dunning 1981; Endo 2006; Fereidouni and Al-mulali 2014; Katircioglu 2011; Othman et al. 2012; Perić and Nikšić Radić 2016; Salleh et al. 2011; Samimi et al. 2013; Sanford Jr and Dong 2000; Selvanathan et al. 2012; Tang et al. 2007; Zhang et al. 2011). What is surprising is the virtual ignorance of empirical research on the link between terrorism and FDI in tourism. In 1975, Matthews pointed out that literature related to tourism generally lacks the political components of research (Mathews 1975). This issue was somewhat tense in Formica (1996), who pointed out there is no analytical or theoretical research that deals with the link between political risk and FDI in a specific area of hospitality. Fourteen years later Steiner (2010) stated that there has been no significant progress on the matter and researched the link between terrorism and FDI in Egypt, concluding that the negative effect of terrorism on FDI in tourism is overestimated. Once more, with a shorter pause of 8 years, Nikšić Radić and Barišić (2018) pointed out the scarcity of existing research on FDI in tourism and terrorism and concluded that the subject matter is highly complex and that the effect of terrorism on FDI in tourism cannot be generalized. Finally, Nikšić Radić (2018) provided evidence against terrorism as a significant predictor of FDI in tourism.

Given the scarcity of existing research and the absence of research involving a causal link between the subject variables, the current study aims to address this research gap. The aim of this paper is to research the causal relationship between terrorism and FDI in tourism on a panel of 50 countries for the period from 2000 to 2016 modelled on research of Nikšić Radić (2018). Additionally, in order to ensure the reliability of the research results, certain specific control variables will be included in the testing of causality between the mentioned variables. The authors’ starting point is that terrorism does not affect FDI in tourism. There are several arguments in favour of this. Firstly, the last decade has seen a change in consumer and corporation mentality as they started to behave ‘normally’ as a response to terrorism (Oaten et al. 2015). One example of the broadening of the global portfolio in times of growing terrorist threats is the Hongkong and Shanghai Hotels (2016), which point out that ‘It is an unfortunate reality in today’s world that one can never be 100% protected against terrorists in a free and open society’. Smith Travel Research (STR) data suggested that hotel performances in affected destinations typically started to return to normal three months after an attack, as long as there were no further attacks (Doggrell 2017). According to Harper (2017) head of property services for Hotel Partners Africa, the impact of terror attacks across the world is lessening and, in general, international tourism is resilient to terrorism, recovery times for all types of locations are improving and have shortened significantly over the last 15 years (Oaten et al. 2015).

The main contribution of this paper is that, for the first time, to the best of the authors’ knowledge, a causality analysis is used to examine the relationship between FDI in tourism and terrorism on a panel of countries. Another contribution of this paper is that it is not based on the premise that terrorism affects FDI in tourism. The third contribution, and the most important one in the authors’ opinion, is that the results of the research point to the fact that, despite the rising nationalist and populistic excesses around the world promoting closing borders because of the fear of spreading terrorism via migration channels, terrorism does not affect FDI in tourism. Terrorism has become one of today’s threats with which life is still normal, either in terms of tourism or in terms of tourism investment and should be treated like this. Like any other threat to global development, it is necessary to approach it with preventive measures to keep it under control in the long term. This article is composed of five sections. After the introduction, Section 2 presents an overview of the most recent theory on the subject matter. Section 3 describes the data and methodological framework, whereas Section 4 focused on the analysis of the results. As a final point, the conclusions and implications for policies are presented in Section 4.

2. Overview

At the start of the 21st century terrorism became a burning international political problem and it is likely to remain a potential threat to global business (ATKearney 2015; EIU 2008). Terrorism asserts insecurity on individuals and governments. Terror attacks have severe consequences on economic activity (gross domestic product, fixed capital formation, export, consumption expenditure) (Eckstein and Tsiddon 2004), and also on life. The incidence of terrorism appears to be associated with a change in spending from investment towards government expenditures (Blomberg et al. 2004). In addition, larger economies appear to be less likely to suffer from terrorism attacks (Kumar and Liu 2015).

Due to the globalisation process, global companies have at least one common feature with terrorism—they are present everywhere (Krug and Reinmoeller 2003). According to Mazzarella (2005), a decline in investment and operations in high-risk regions is the cost of terrorism which companies face. There are also corporations targeting terroristically high-risk countries, i.e., some investment choices may even be motivated by higher yields because of the higher risk the investments are based on (Asongu et al. 2015).

By analysing the characteristics of terrorism and tourism, it is easy to conclude that the two are essentially complete opposites and do not fit together in the same sentence (Nikšić Radić and Barišić 2018). The touristic demand is sensitive to the impact of terrorist attacks because tourists value peace and enjoying what a tourist destination has to offer (Bassil 2014; Enders et al. 1992; Goldman and Neubauer-Shani 2017; Nikšić Radić et al. 2018). The tourist destination must meet the individual safety of tourists‘ criteria (Maslow 1970; Pearce 2005). As Gilham stated, ‘Tourists vote with their feet in cases where there is a perceived threat to their safety’ (O’Connor et al. 2008). In addition, in the case of tourism, one study discovered that campaigns of attacks have more negative effects than a smaller number of major attacks (Pizam and Fleischer 2002).

The relationship between FDI and the political environment is very complex. Political risk affects pre-investment activities of foreign investors and existing FDI (Feinberg and Gupta 2009). According to Vargas and Sommer (2015), political instability occurs through the interaction between three dimensions of political risk—economic instability, institutional instability and ethnic/religious diversity.

Political risk has mostly been equated with political instability and radical political changes in the host country (Green 1974; Thunell 1977). Every country showing unequal characteristics presents political risk and potential instability (Jarvis and Griffiths 2007). The two terms are, however, different. Instability is a characteristic of the general environment, while risk has a somewhat narrower focus that directly affects a foreign corporation or specific project (Kobrin 1979, 1980). There, the event itself is not important, the event’s effect on business is important (Chermak 1992). Political stability is not in itself a guarantee for tourism or any other type of industry, especially when there is a lack of favourable economic conditions (Levis 1979).

When political risk is considered in the context of FDI it can be defined as ‘the probability that political decisions, events or conditions will significantly affect the profitability of a business actor or the expected value of given economic action’ (Matthee 2011, pp. 2010–11). Contemporary FDI theories treat political risk as the most significant political force affecting patterns in international capital flows, especially in developing countries (Barry and DiGiuseppe 2018). The term political risk was created within the scope of country risk with the aim of considering the type of insolvency in the country, and it is not directly related to financial or economic factors (Sottilotta 2017). The effect of political risk varies depending on the industry FDI is oriented towards (Barry and DiGiuseppe 2018). Research aimed at differences between sectors is scarce and points to the specificities of particular industries (Blanton and Blanton 2012; Dunning 1981).

After the 2001 terrorist attack in the USA terrorism became a source of concern for international investors and entered the scene as a type of political risk (Berry 2007; Lee 2017). Furthermore, terrorism can be viewed as a category of political violence (Latif et al. 2017). Political violence is not a homogenous category. According to Witte et al. (2017), terrorism represents a discontinuous risk with a high level of impact. Similarly, Steiner (2010) views terrorism as violent political unrest when conceptualising dimensions of political risk. There is a well-established strong link between political instability and terrorism (Sonmez and Graefe 1998). Political stability is one of the key factors in attracting FDI while economic and political shocks are a deterrent (Metaxas and Kechagia 2017). Latif et al. (2017) argue that continuous terrorist attacks probably increase political instability and decrease investments. Terrorist incidents increase risks associated with political instability and through this channel deter FDI (Bandyopadhyay et al. 2014).

It has already been emphasized that this research does not take as a postulate the necessity of a negative influence of terrorism on FDI in tourism. There are several reasons the authors assumed this stance. Firstly, in an earlier overview of research on political risk, Kobrin (1979) concluded that the empirical evidence is inconsistent and presents mixed results regarding the effect of political instability on FDI stocks or flow. Secondly, already in 1983, it was indicated that terrorism in general does not significantly affect FDI, even though it had significant localised effects in places such as the Basque region in Spain or in Northern Ireland (Crenshaw 1983, p. 6). Ultimately, all subsequent research casts doubt on such a postulate, as displayed in the table below.

As can be seen from Table 1, available empirical studies have recognized different results considering the relationship between political instability, political risk or just terrorism and FDI. Schneider and Frey (1985), Nigh (1985), Globerman and Shapiro (2003), Enders et al. (2006), Abadie and Gardeazabal (2008) and Powers and Choi (2012) argued that political instability, political risk or terrorism negatively influenced the FDI inflows. Interestingly, certain researches such as Fatehi-Sedeh and Safizadeh (1989), Olibe and Crumbley (1997), Li and Resnick (2003), Sethi et al. (2003), Li (2006), Kolstad and Villanger (2008), Steiner (2010), Blonigen and Piger (2014) and Nikšić Radić (2018) provided evidence that observed variables did not have a significant impact on FDI. Most interesting of all, certain researches such as Loree and Guisinger (1995), Mihalache (2010), Tosun et al. (2014) and Lutz and Lutz (2017) provided evidence that observed variables could even contribute to FDI. Research closely related to the impact of terrorism on FDI in tourism is very scarce. Steiner (2010) is the only one which links terrorism and FDI in tourism and concludes that a clear link between the observed variables cannot be determined, and Nikšić Radić (2018) is the only one which found that terrorism is not significant for attracting FDI in tourism. Bearing in mind the diverse results of research related to the impact of observed variables on the total FDI inflows into the economy, and focusing narrowly on the scarcity of research related to the impact of terrorism on FDI in tourism, it is justified not to start from the premise that terrorism necessarily affects FDI in tourism.

Table 1.

Effect of political instability, political risk and terrorism on FDI flow.

FDI holders take into account political instability when making investment decisions (Li 2006). When considering the relationship between FDI and terrorism, it should be borne in mind that a foreign investor has a long-term business horizon. Thus, FDI itself becomes a barrier to exit because if the investor decides to disinvest, they cannot do it at no extra cost (Rivoli and Salorio 1996). This implies that the exit barrier makes the investor anticipate the political and economic development of a potential country or region, including potential political violence and terrorism (Li 2006). The fact that investors take political instability into account when making investment decisions is further shown in research by Bass et al. (1977) and Porcano (1993). The level of terrorism risk may influence future business, i.e., expected profit and growth potential. This leads to the conclusion that the scope of the effect of a terrorist attack is not what matters, but the scope of the unexpected effects of that attack (Hallberg 2016). A large anticipated attack will ultimately become internalised and have less consequences, while a small unanticipated attack will have more severe consequences because it will not be internalised (Li 2006). FDI in tourism is mostly oriented towards large hotel complexes (Barrowclough et al. 2007), so it is likely that such investments take into account the long-term business horizon and that market risk analyses definitely consider potential political instability, including possible terrorist attacks in that country. Terrorist attacks are one of the external risks which particularly affect the hotel business (Bharwani and Mathews 2012).

3. Limitations, Data and Methodological Framework

3.1. Research Limitations

Before going further with explaining the dataset and the methodology used in this research, it is necessary to clearly state that the authors are aware of the limitations of the present study. The main limitation of this study refers to the number of countries included in the panel survey as well as the missing values for individual years of individual countries (insights into the missing data are located in the Appendix A, Table A2). However, this is a common feature of FDI-oriented research on a particular sector, as the industrial coverage of FDI reporting is limited (UNCTAD forthcoming). It should also be pointed out that FDI in tourism is concentrated primarily in developed countries (Barrowclough et al. 2007).

3.2. Data

The data set, following Nikšić Radić (2018), comprises annual time series data from 2000 to 2016 in order to investigate the causal relationship between FDI in tourism and terrorism on a panel of 50 countries (the list of countries and summary statistics can be found in the Appendix A, Table A1 and Table A2). The representativeness of the sample is supported by the fact that it includes 50 countries, which make up 72% of total international tourism receipts (Nikšić Radić 2018). The selection of this sample was made due to data availability of variable FDI inflows in tourism. The variable FDI in tourism (fdi-t) was obtained from OECD, UNCTAD and the Vienna Institute for International Economic Studies databases. The variable employed is in millions of US dollars.

Terrorism data are derived from The Global Terrorism Database (GTD) (START 2018). According to START (2017), for an incident to be categorised as terrorist, the following attributes must be present: The incident must be intentional, the incident must entail some level of violence or immediate threat of violence and the perpetrators of the incidents must be sub-national actors. In order for the results to be more valid, this article uses total international casualties (intall) and total international incidents (intatt) as the terrorism variables. Total casualties include both injuries and fatalities (killed). Additionally, for an incident to be included into the total casualties variable it must meet all three GTD criteria, including only successful attacks and excluding ambiguous cases. The GTD database does not provide a column distinguishing domestic and international terrorist incidents per se. Decomposition was done following an established methodology by Enders et al. (2011) and Kis-Katos et al. (2011).

In order to secure the validity of the research results, four control variables were included in the research. The variables international tourist arrivals (INTARRpercapita) and GDP per capita (GDPpercapita) were obtained from the World Bank database. The Chinn-Ito index (KAOPEN) is an index that measures a country’s degree of capital account openness. The index runs from −1.85 to 2.5, and a higher value indicates a smaller number of restrictions on the capital account, i.e., a smaller number of national restrictions on the capital account. The KAOPEN index was obtained from http://web.pdx.edu/~ito/Chinn-Ito_website.htm. The KOF Globalisation Index (KOFGI) (Gygli et al. 2018) measures the economic, social and political dimensions of globalisation. It was introduced by Dreher (2006). The data was obtained from the KOF Swiss Economic Institute (Gygli et al. 2018).

All variables are in the logarithmic form.

3.3. Econometric Methodology

This research uses panel VAR approach. The VAR methodology is well suited to the set research goals since there is no a priori theory of causal relationships between variables of interest, namely terrorism and FDI in tourism. Panel Granger causality analysis allows for defining the direction of the link between terrorism and FDI in tourism. As a final point, impulse response functions (IRFs) help to determine the dynamic links between terrorism and FDI in tourism.

The analysis started by testing stationarity. The order of integration of the variables involved in the model are defined by using the Fischer Augmented Dickey–Fuller (Fischer -ADF.—) test. The unit root test is conducted against the null hypothesis of a unit root present and by an autoregressive procedure based on an appropriate number of lags. Selection of the optimal lag length is fundamental for the consistency of VAR models (Liu 2005).

As part of the evaluation of the VAR model, the following models are specified as the next step:

where logfdi_t is logarithmic form of the FDI in tourism, logintatt is logarithmic form of international terrorist attack and logintall is logarithmic form of total international casualties; CV1,…k are control variables and p is the optimal lag length.

This paper employs a Granger causality test and applies the VAR framework within the panel setting. The causality model is used to detect the direction of causality between the two observed variables. The Granger causality between variables X and Y is simply defined as ‘Granger X causes Y if Y can be better predicted using data from both X and Y instead of using data from just Y’. The Granger causality test is grounded on a simple Wald test. The Wald test allows testing the significance of the lagged values of the second variable. The null hypothesis of no causality is rejected if the Wald test is significant:

H0: b1 = b2 = … = bp = 0, against HA: ‘Not H0’, is a test that X does not Granger-cause Y (Equation (3)).

H0: e1 = e2 = … = ep = 0, against HA: ‘Not H0’, is a test that Y does not Granger-cause X (Equation (4)).

The rejection of the H0 implies there is Granger causality, i.e., it implies a statistically significant causal relationship.

Lastly, within the set VAR model, a variance decomposition analysis is carried out, as well as the impulse response function examination The impulse response functions (IRFs) use Monte Carlo (MC) simulations for the confidence intervals. The Choleski decomposition of variance–covariance matrix residuals is followed to compute the impulse-response functions (IRFs) and the variance decompositions.

Abrigo and Love (2015) published a package of .ado files for Stata that enables the use of panel vector auto regression (pVAR), including sub-routines to implement Granger (1969) causality tests analysis, the impulse response functions (IRFs) and variance decomposition in this research.

4. Research Results

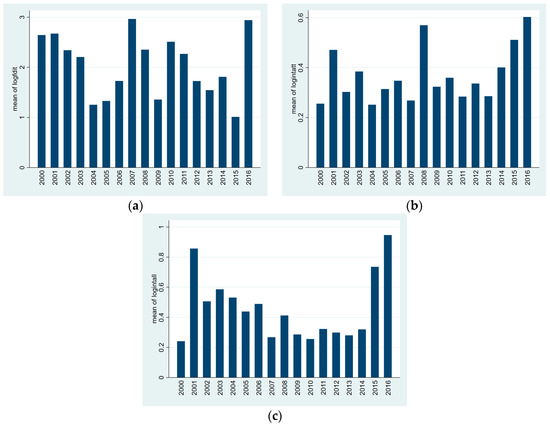

In adherence with the earlier-described research methodology, a panel unit root test is employed to determine whether there is a unit root present. The only variable where a time trend and drift term were included was for the international arrival per capita variable. Stationarity of the variables was tested for all time series, and the results of the unit root test indicate that all series are stationary in level, which is evident from the Table 2 (the graphs of the observed time series averaged of main variables of interest, across countries, can be found in the Appendix A, Figure A1).

Table 2.

ADF-Fischer unit root test results.

Thus, it is possible to conclude that all the observed series do not contain the unit root given that the null hypothesis for non-stationarity has been rejected.

To ensure the reliability of the VAR model, the next step was to choose the optimal lag length of the VAR models. The panel VAR used the first four lags of FDI in tourism and international terrorist attack, FDI in tourism and total international casualties as instruments, respectively. The optimal number of lags was chosen with the help of the usual information criteria, such as Hansen J test, Akaike information criterion (MAIC), the modified Bayesian information criterion (MBIC) and the modified Hannan-Quinn information criterion (MQIC). Based on the above-mentioned criterion, as optimal lag length, 1 is selected.

As suggested by Abrigo and Love (2015) a first-order panel VAR model is fitted with the same specification of instruments as above using GMM estimation. Since the database comprises missing values this research further follows Holtz-Eakin et al. (1988). The “GMM-style” instruments are used to replace instrument lags with missing values with zeroes. The consequence of such an approach is a larger sample of estimates and estimates that are more reliable.

The next step was to test the Granger causality relationship. Classic Granger causality involves performing the Wald test for the first p parameters of other variables in the VAR model, and, if the Wald test was significant, rejecting the null hypothesis of no causality. The results of the test are shown in Table 3.

Table 3.

Granger Causality Test.

The results of the Granger test indicate that the total casualties in international terrorist attacks and the number of international attacks do not affect FDI in tourism. The results remain the same when control variables are implemented in testing. It may be concluded that all the null hypotheses could not be rejected. The situation is the same the other way around. FDI in tourism does not affect international terrorist attacks or the total number of casualties from international terrorist attacks in any way.

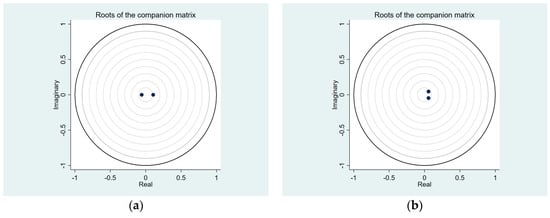

Prior to estimation of impulse-response functions (IRFs) and variance decompositions (FEVD), the stability condition of the estimated panel was checked. The dynamic stability of the VAR models is shown in Figure 1.

Figure 1.

Stability of the VAR models: (a) logfdit and logintatt; (b) logfdit and logintall.

According to Lutkepohl (2005) and Hamilton (1994), a VAR model is stable if all the roots are strictly less than one. None of the roots is outside of the circles so it is possible to conclude that the VAR models are stable. In other words, the outcomes and conclusions following from this analysis are not questionable.

The variance decomposition of the first pair of variables, logfdit and logintatt, and the second pair of variables, logfdit and logintall, is shown in Appendix A (Table A3). The analysis was conducted for the prognostic period of the next 10 years. The variance decomposition shows the relative share of individual variables in the explanation of the variance of the second variable in the following periods. All the variables almost fully explain their prognostic errors as far as the prognostic period is concerned. Following Abrigo and Love (2015) the IRF confidence intervals are computed using 200 Monte Carlo simulations based on the estimated model.

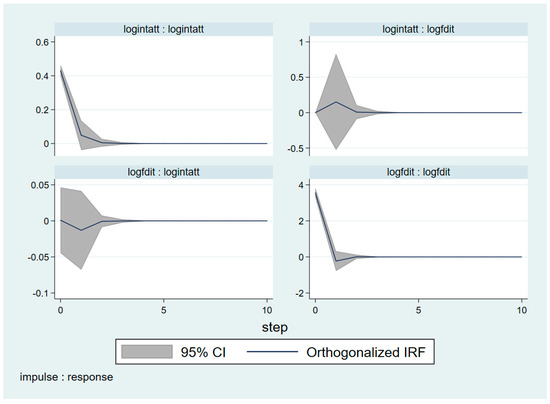

Finally, impulse response functions are calculated as the reaction of each endogenous variable to unit shock in system variables. The analysis was conducted for the prognostic period of 10 years.

The results of the Impulse response function (IRF) from the Cholesky decomposition in Figure 2 concerning international terrorism attacks and FDI in tourism endorse the results obtained from the Granger causality test. The shock of a one standard deviation change in logintatt has a practically neutral influence on logfdit. In addition, the shock of one standard deviation in logfdit has a neutral influence on logintatt.

Figure 2.

Impulse response of international terrorism attacks and FDI in tourism.

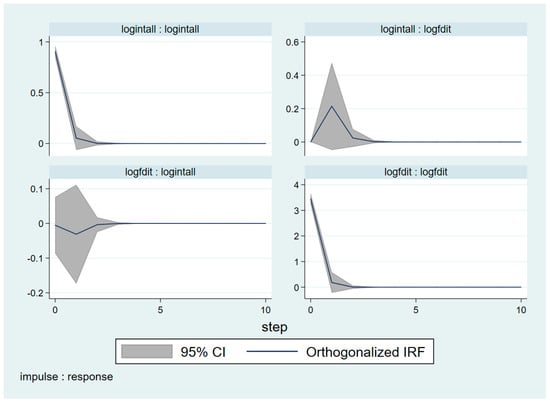

The situation is the same with the other pair of variables. The results from the impulse-response function in Figure 3 regarding international terrorism death and injures and FDI in tourism confirm the results obtained from the Granger causality test. The shock of a one standard deviation change in logintall has an almost neutral influence on logfdit. In addition, the shock of a one standard deviation in logfdit has a neutral influence on logintall.

Figure 3.

Impulse response of international terrorism deaths and injuries and FDI in tourism.

The implementation of Granger’s causality test, variance decomposition analysis and impulse response functions lead to the same result. The example of the panel of countries proves that there is no causal relationship between terrorism and FDI in tourism. The variables of terrorism fully explain their prognostic mistakes and the increase in terrorism for one standard deviation does not lead to a decrease in FDI in tourism.

5. Concluding Remarks

The results of the conducted research have confirmed the justification of the established research ground. The example of a panel of countries has shown that there is no causality between terrorism and FDI in tourism in the Granger sense. Such a result was expected. Firstly, terrorism does not considerably influence the long-term behaviour of tourists. According to the WTTC study, it takes 13 months for tourism to make progress from a terrorist attack (Zillman 2015). Considering that tourist demand elicits tourist supply, it is logical to expect that investors in tourism will act in accordance with that trend. Secondly, global companies were conscious that terrorist threats raised business costs even in the 1980s. The risk of terrorism was then the second most substantial impediment to global business (Ryans Jr and Shanklin 1980). The risk of terrorism is one of the external risks that corporations take into count when making plans and expanding business to a selected investment location, and they operate in the long-term. The market data also indicate that hotel corporations are recovering faster from terrorist attacks (Oaten et al. 2015).

Such research results have significant political implications. The fact is that open borders make it easier for terrorists to move around and engage in terrorist activities. On the other hand, open borders also enable FDI to enter a country, as well as countries to get actively involved in globalisation processes. Open borders also allow for tourists to travel more easily and enjoy the benefits of tourism in particular economies. On the one hand, FDI in tourism can attract terrorist attacks, but it can also have a beneficial effect on political instability in a country. Large foreign corporations act as a sort of magnet for terrorists as they symbolise western values, i.e., everything that terrorist attacks focus on. Such attacks on objects full of tourists also attract heavy media attention, which works in favour of causing terror, that being one of the goals of terrorist attacks. However, when taking market trends into account, it is more likely that FDI affects the political stability of a country. A large presence of foreign investors in a country is a symbol of the country’s economic maturity and inclusion in globalisation processes. It seems appropriate to quote Friedman (1996), who pointed out in 1996 that ‘No two countries that both have a McDonald’s have ever fought a war against each other’. It may also be useful to bear in mind a research which proved that economic globalisation has an indirect negative effect on transnational terrorism, considering that FDI and international exchange affect economic development (Li and Schaub 2004).

In view of the various nationalist and populist appearances that are rapidly spreading around the world and calling for the closure of borders, such scientific research is needed. It points to the fact that terrorism has so many negative long-term consequences and that it has become one of the threats of today with which life is still normal. It is also important to emphasize that most terrorist attacks in the world do not actually cause deaths or injuries, as the violence involves property rather than people (Stohl 2003, p. 86). The further development of countries must be based on active participation in globalization processes, and that is only possible through open economies. Furthermore, the bearers of political authority are currently mostly busy putting out fires and enacting various security measures. However, political activities need to be oriented towards preventative antiterrorist measures, as they are the only thing which can secure long-term safety from terrorism (De Silva 2017). According to UNESCO (2017), appropriate, inclusive and unbiased quality education precludes youth from assembling violent fanatical groups.

The authors believe that the results presented in this research paper should be treated as a starting point for future research on the effects of terrorism on FDI in tourism. These results should be further validated on the level of each country, perhaps by using quarterly data, because each country has its own peculiarities.

Author Contributions

M.N.R. focused on econometrics and interpretation of the results. D.D. and M.B.S. studied the literature.

Funding

This work was supported by the University of Rijeka under the Grant ZP UNIRI 8/16.

Acknowledgments

The author would like to thank the anonymous referees for helpful suggestions and comments.

Conflicts of Interest

The authors declare no conflict of interest. The funders had no role in the design of the study; in the collection, analyses or interpretation of data; in the writing of the manuscript or in the decision to publish the results.

Appendix A

Table A1.

Summary statistics.

Table A1.

Summary statistics.

| Variable | Obs | Mean | Std. Dev. | Min | Max |

|---|---|---|---|---|---|

| logfdit | 574 | 2.006643 | 3.790301 | −8.149729 | 8.835171 |

| logintatt | 850 | 0.3685579 | 0.7320667 | 0 | 4.204693 |

| logintall | 850 | 0.4570625 | 1.317708 | 0 | 9.789254 |

| logintarr_p | 850 | 0.4626352 | 0.3558233 | 0 | 1.847234 |

| logka_open | 745 | 0.5320018 | 0.2047938 | 0 | 0.6931472 |

| logkofgi | 784 | 4.293395 | 0.1655348 | 3.667282 | 4.507197 |

| loggdppc | 850 | 9.616736 | 1.223536 | 5.547282 | 11.62597 |

Source: Authors’ calculations.

Table A2.

Missing observations for the FDI inflow in tourism.

Table A2.

Missing observations for the FDI inflow in tourism.

| Year | Missing Data Ratio | Country | Missing Data Ratio | Country | Missing Data Ratio | Country | Missing Data Ratio |

|---|---|---|---|---|---|---|---|

| 2000 | 0.60 | Australia | 0.12 | Iceland | 0.00 | Norway | 0.65 |

| 2001 | 0.52 | Austria | 0.24 | India | 0.29 | Poland | 0.00 |

| 2002 | 0.46 | Belgium | 0.65 | Ireland | 0.53 | Portugal | 0.35 |

| 2003 | 0.46 | Bosnia and Herzegovina | 0.65 | Israel | 0.59 | Russia | 0.59 |

| 2004 | 0.42 | Bulgaria | 0.82 | Italy | 0.00 | Serbia | 0.65 |

| 2005 | 0.34 | Chile | 0.35 | Kazakhstan | 0.59 | Slovak Republic | 0.12 |

| 2006 | 0.28 | China | 0.88 | Korea | 0.00 | Slovenia | 0.35 |

| 2007 | 0.32 | Croatia | 0.00 | Kosovo | 0.71 | Spain | 0.06 |

| 2008 | 0.30 | Czech Republic | 0.06 | Latvia | 0.00 | Sweden | 0.71 |

| 2009 | 0.28 | Denmark | 0.18 | Lithuania | 0.24 | Switzerland | 0.88 |

| 2010 | 0.20 | Estonia | 0.00 | Luxembourg | 0.29 | Thailand | 0.29 |

| 2011 | 0.22 | Finland | 0.41 | Macedonia | 0.53 | Tunisia | 0.12 |

| 2012 | 0.18 | France | 0.00 | Mauritius | 0.11 | Turkey | 0.18 |

| 2013 | 0.24 | Germany | 0.06 | Mexico | 0.24 | United Kingdom | 0.24 |

| 2014 | 0.20 | Greece | 0.06 | Morocco | 0.59 | United States | 0.00 |

| 2015 | 0.24 | Hong Kong | 0.24 | Mozambique | 0.71 | Vietnam | 0.88 |

| 2016 | 0.26 | Hungary | 0.06 | Netherland | 0.00 |

Source: Authors’ calculations.

Figure A1.

Observed time series averaged across countries: (a) logfdit; (b) logintatt; (c) logintall. Source: Authors’ calculations.

Table A3.

Variance decomposition.

Table A3.

Variance decomposition.

| Variance Period | Variance Decomposition of Logfdit | Variance Decomposition of Intatt | ||

| Logfdit | Logintatt | Logfdit | Logintatt | |

| 0 | 0 | 0 | 0 | 0 |

| 1 | 1 | 0 | 4.37 × 10−6 | 0.9999956 |

| 2 | 0.9981868 | 0.0018131 | 0.0009129 | 0.9990872 |

| 3 | 0.9981825 | 0.0018175 | 0.0009149 | 0.9990851 |

| 4 | 0.9981824 | 0.0018176 | 0.000915 | 0.9990851 |

| 5 | 0.9981824 | 0.0018176 | 0.000915 | 0.9990851 |

| 6 | 0.9981824 | 0.0018176 | 0.000915 | 0.9990851 |

| 7 | 0.9981824 | 0.0018176 | 0.000915 | 0.9990851 |

| 8 | 0.9981824 | 0.0018176 | 0.000915 | 0.9990851 |

| 9 | 0.9981824 | 0.0018176 | 0.000915 | 0.9990851 |

| 10 | 0.9981824 | 0.0018176 | 0.000915 | 0.9990851 |

| Variance Period | Variance Decomposition of Logfdit | Variance Decomposition of Intall | ||

| Logfdit | Logintall | Logfdit | Logintall | |

| 0 | 0 | 0 | 0 | 0 |

| 1 | 1 | 0 | 0.000034 | 0.999966 |

| 2 | 0.9961649 | 0.0038351 | 0.0012115 | 0.9987885 |

| 3 | 0.9961168 | 0.0038831 | 0.0012261 | 0.9987739 |

| 4 | 0.9961166 | 0.0038834 | 0.0012261 | 0.9987739 |

| 5 | 0.9961166 | 0.0038834 | 0.0012261 | 0.9987739 |

| 6 | 0.9961166 | 0.0038834 | 0.0012261 | 0.9987739 |

| 7 | 0.9961166 | 0.0038834 | 0.0012261 | 0.9987739 |

| 8 | 0.9961166 | 0.0038834 | 0.0012261 | 0.9987739 |

| 9 | 0.9961166 | 0.0038834 | 0.0012261 | 0.9987739 |

| 10 | 0.9961166 | 0.0038834 | 0.0012261 | 0.9987739 |

Source: Authors’ calculations.

References

- Abadie, Alberto, and Javier Gardeazabal. 2008. Terrorism and the world economy. European Economic Review 52: 1–27. [Google Scholar] [CrossRef]

- Abrigo, Michael R. M., and Inessa Love. 2015. Estimation of Panel Vector Autoregression in Stata: A Package of Programs. Available online: http://paneldataconference2015.ceu.hu/Program/Michael-Abrigo.pdf (accessed on 21 June 2018).

- Asongu, Simplice, Uchenna Efobi, and Ibukun Beecroft. 2015. FDI, Aid, Terrorism: Conditional Threshold Evidence from Developing Countries. Yaoundé: African Governance and Development Institute, pp. 1–26. [Google Scholar] [CrossRef]

- Atherton, Mike. 2016. Facing New Threats: Challenges and Risk in Today’s Travel Industry. Available online: http://www.manticpoint.com/blog/facing-new-threats-challenges-and-risk-in-todays-travel-industry (accessed on 28 June 2018).

- ATKearney. 2015. The 2015 A.T. Kearney Foreign Direct Investment Confidence Index: Connected Risks—Investing in a Divergent World. Chicago: ATKearney. [Google Scholar]

- Bandyopadhyay, Subhayuand, Todd Sandler, and Javed Younas. 2014. Foreign direct investment, aid, and terrorism. Oxford Economic Papers 66: 25–50. [Google Scholar] [CrossRef]

- Barrowclough, Diana, Anne Miroux, and Hafiz Mirza, eds. 2007. FDI in Tourism: The Development Dimension. New York and Geneva: UNCTAD. [Google Scholar]

- Barry, Colin M., and Matthew DiGiuseppe. 2018. Transparency, Risk, and FDI. Political Research Quarterly 72: 132–46. [Google Scholar] [CrossRef]

- Bass, Bernard M., Donald W. McGregor, and James L. Walters. 1977. Selecting foreign plant sites: Economic, social and political considerations. The Academy of Management Journal 20: 535–51. [Google Scholar]

- Bassil, Charbel. 2014. The Effect of Terrorism on Tourism Demand in the Middle East. Peace Economics, Peace Science, and Public Policy 20: 669–84. [Google Scholar] [CrossRef]

- Berry, Charles. 2007. The Convergence of the Terrorism Insurance and Political Risk Insurance Markets for Emerging Market Risk: Why It Is Necessary and How It Will Come About. In International Political Risk Management: Needs of the Present, Challenges for the Future. Edited by Theodore H. Moran, Gerald T. West and Keith Martin. Washington, DC: The World Bank, pp. 13–35. [Google Scholar]

- Bezić, Heri, Maja Nikšić Radić, and Tomislav Kandžija. 2010. Foreign direct investments in the tourism sector of the Republic of Croatia. Valahian Journal of Economic Studies-An International Review of Theories and Applied Studies in Performance Management 1: 21–28. [Google Scholar]

- Bharwani, Sonia, and David Mathews. 2012. Risk identification and analysis in the hospitality industry: Practitioners’ perspectives from India. Worldwide Hospitality and Tourism Themes 4: 410–27. [Google Scholar] [CrossRef]

- Blanton, Robert G., and Shannon L. Blanton. 2012. Rights, institutions, and foreign direct investment: An empirical assessment. Foreign Policy Analysis 8: 431–51. [Google Scholar] [CrossRef]

- Blomberg, S. Brock, Gregory D. Hess, and Athanasios Orphanides. 2004. The macroeconomic consequences of terrorism. Journal of Monetary Economics 51: 1007–32. [Google Scholar] [CrossRef]

- Blonigen, Bruce A., and Jeremy Piger. 2014. Determinants of foreign direct investment. Canadian Journal of Economics/Revue Canadienne D’économique 47: 775–812. [Google Scholar] [CrossRef]

- Chermak, Janie M. 1992. Political risk analysis: Past and present. Resources Policy 18: 167–78. [Google Scholar] [CrossRef]

- Craigwell, Roland, and Winston Moore. 2008. Foreign direct investment and tourism in SIDS: Evidence from panel causality tests. Tourism Analysis 13: 427–32. [Google Scholar]

- Crenshaw, Martha. 1983. Terrorism, Legitimacy, and Power: The Consequences of Political Violence: Essays. Middletown: Wesleyan University Press. [Google Scholar]

- De Silva, Samantha. 2017. Role of Education in the Prevention of Violent. Working Paper World Bank Group. Available online: http://documents.worldbank.org/curated/en/448221510079762554/Role-of-education-in-the-prevention-of-violent-extremism (accessed on 28 June 2018).

- Doggrell, Katherine. 2017. This Is More Threatening to Hotel Revenue than Terror Attacks. Available online: https://www.hotelmanagement.net/own/more-threatening-to-hotel-revenue-than-terror-attacks (accessed on 22 April 2018).

- Dreher, Axel. 2006. Does globalization affect growth? Evidence from a new index of globalization. Applied Economics 38: 1091–110. [Google Scholar] [CrossRef]

- Dunning, J. H. 1981. International Production and the Multinational Enterprise. London: Allen & Unwin. [Google Scholar]

- Dwyer, Larry, Peter Forsyth, and Wayne Dwyer. 2010. Tourism Economics and Policy. Cheltenham: Channel View Publications. [Google Scholar]

- Eckstein, Zvi, and Daniel Tsiddon. 2004. Macroeconomic consequences of terror: Theory and the case of Israel. Journal of Monetary Economics 51: 971–1002. [Google Scholar] [CrossRef]

- EIU. 2008. Risk 2018: Planning for an Unpredictable Decade. New York: EIU. [Google Scholar]

- Enders, Walter, Todd Sandler, and Gerald F. Parise. 1992. An Econometric Analysis of the Impact of Terrorism on Tourism. Kyklos 45: 531–54. [Google Scholar] [CrossRef]

- Enders, Walter, Adolfo Sachsida, and Todd Sandler. 2006. The impact of transnational terrorism on US foreign direct investment. Political Research Quarterly 59: 517–31. [Google Scholar] [CrossRef]

- Enders, Walter, Todd Sandler, and Khusrav Gaibulloev. 2011. Domestic versus transnational terrorism: Data, decomposition, and dynamics. Journal of Peace Research 48: 319–37. [Google Scholar] [CrossRef]

- Endo, Kumi. 2006. Foreign direct investment in tourism—Flows and volumes. Tourism Management 27: 600–14. [Google Scholar] [CrossRef]

- Fatehi-Sedeh, Kamal, and M. Hossein Safizadeh. 1989. The association between political instability and flow of foreign direct investment. Management International Review 29: 4–13. Available online: https://www.jstor.org/stable/40227943 (accessed on 15 June 2018).

- Feinberg, Susan E., and Anil K. Gupta. 2009. MNC subsidiaries and country risk: Internalization as a safeguard against weak external institutions. Academy of Management Journal 52: 381–99. [Google Scholar] [CrossRef]

- Fereidouni, Hassan Gholipour, and Usama Al-mulali. 2014. The interaction between tourism and FDI in real estate in OECD countries. Current Issues in Tourism 17: 105–13. [Google Scholar] [CrossRef]

- Fingar, Courtney. 2017. Inside fDi: Why the Tourism Industry is Finally Going Places. Available online: https://www.fdiintelligence.com/Inside-fDi/Inside-fDi-Why-the-tourism-industry-is-finally-going-places (accessed on 29 May 2018).

- Formica, Sandro. 1996. Political risk analysis in relation to foreign direct investment: A view from the hospitality industry. The Tourist Review 51: 15–23. [Google Scholar] [CrossRef]

- Friedman, Thomas L. 1996. Foreign Affairs Big Mac I. Available online: https://www.nytimes.com/1996/12/08/opinion/foreign-affairs-big-mac-i.html (accessed on 6 June 2018).

- Globerman, Steven, and Daniel Shapiro. 2003. Governance infrastructure and US foreign direct investment. Journal of International Business Studies 34: 19–39. [Google Scholar] [CrossRef]

- Goldman, Ogen S., and Michal Neubauer-Shani. 2017. Does international tourism affect transnational terrorism? Journal of Travel Research 56: 451–67. [Google Scholar] [CrossRef]

- Granger, Clive WJ. 1969. Investigating causal relations by econometric models and cross-spectral methods. Econometrica 37: 424–38. [Google Scholar] [CrossRef]

- Green, Robert T. 1974. Political structures as a predictor of radical political change. Columbia Journal of World Business 9: 28–36. [Google Scholar]

- Gygli, Savina, Florian Haelg, and Jan-Egbert Sturm. 2018. The KOF Globalisation Index—Revisited. KOF Working Papers. Zurich: ETH Zurich. [Google Scholar] [CrossRef]

- Haddad, Stéphane. 2018. M&A in Hospitality: Stick or Twist? Available online: https://www.hotel-online.com/press_releases/release/ma-in-hospitality-stick-or-twist (accessed on 15 July 2018).

- Hallberg, Arvid. 2016. Expecting the Unexpected: The Marginal Effect of Unanticipated Terrorist Attacks on Foreign Direct Investment in Israel and Turkey. Dissertation. Available online: http://urn.kb.se/resolve?urn=urn:nbn:se:uu:diva-297402 (accessed on 10 May 2018).

- Harper, David. 2017. The Diminishing Impact of Terrorism. Available online: http://hotelspec.com/wp-content/uploads/2017/10/The-diminishing-impact-of-terrorism.pdf (accessed on 13 June 2018).

- Hitchcock, Michael, and I. Nyoman Darma Putra. 2005. The Bali bombings: Tourism crisis management and conflict avoidance. Current Issues in Tourism 8: 62–76. [Google Scholar] [CrossRef]

- Holden, Andrew. 2013. Tourism, Poverty and Development. London: Routledge. [Google Scholar]

- Holtz-Eakin, Douglas, Whitney Newey, and Harvey S. Rosen. 1988. Estimating vector autoregressions with panel data. Econometrica 56: 1371–95. [Google Scholar] [CrossRef]

- Hongkong and Shanghai Hotels. 2016. The Hongkong and Shanghai Hotels Annual Report 2015: Tradition meets Innovation. Hong Kong: The Hongkong and Shanghai Hotels. [Google Scholar]

- IEP. 2018. Global Peace Index 2018. New York: IEP, p. 58. [Google Scholar]

- Jarvis, Darryl S. L., and Martin Griffiths. 2007. Learning to fly: The evolution of political risk analysis. Global Society 21: 5–21. [Google Scholar] [CrossRef]

- Katircioglu, Salih. 2011. The Bounds Test to the Level Relationship and Causality between Foreign Direct Investment and International Tourism: The Case of Turkey. Ekonomie a Management 14: 6–13. Available online: http://www.ekonomie-management.cz/download/1346061130_0a07/2011_01_katircioglu.pdf (accessed on 25 May 2018).

- Kis-Katos, Krisztina, Helge Liebert, and Günther G. Schulze. 2011. On the origin of domestic and international terrorism. European Journal of Political Economy 27: S17–S36. [Google Scholar] [CrossRef]

- Kobrin, Stephen J. 1979. Political risk: A review and reconsideration. Journal of International Business Studies 10: 67–80. [Google Scholar] [CrossRef]

- Kobrin, Stephen J. 1980. Foreign enterprise and forced divestment in LDCs. International Organization 34: 65–88. [Google Scholar] [CrossRef]

- Kolstad, Ivar, and Espen Villanger. 2008. Determinants of foreign direct investment in services. European Journal of Political Economy 24: 518–33. [Google Scholar] [CrossRef]

- Krug, Barbara, and Patrick Reinmoeller. 2003. The Hidden Cost of Ubiquity: Globalisation and Terrorism. ERIM Report Series, No. ERS-2003-062-ORG. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=463810 (accessed on 28 May 2018).

- Kumar, Sanjay, and Jiangxia Liu. 2015. Contagion in International Stock Markets from Terrorist Attacks. Edited by Karin Glaser. Hague: Eleven International Publishing. [Google Scholar]

- Kundu, Sumit K., and Farok J. Contractor. 1999. Country location choices of service multinationals: An empirical study of the international hotel sector. Journal of International Management 5: 299–317. [Google Scholar] [CrossRef]

- Latif, Zahid, Zeng Jianqiu, Shafaq Salam, Zulfiqar Hussain Pathan, Nasir Jan, and Muhammad Zahid Tunio. 2017. FDI and ‘political’violence in Pakistan’s telecommunications. Human Systems Management 36: 341–52. [Google Scholar] [CrossRef]

- Lee, Chia-yi. 2017. Terrorism, Counterterrorism Aid, and Foreign Direct Investment. Foreign Policy Analysis 13: 168–87. [Google Scholar] [CrossRef]

- Levis, Mario. 1979. Does political instability in developing countries affect foreign investment flow? An empirical examination. Management International Review 19: 59–68. [Google Scholar]

- Li, Quan. 2006. Political Violence and Foreign Direct Investment. In Regional Economic Integration. Edited by Michele Fratianni. Bingley: Emerald Group Publishing Limited, pp. 225–49. [Google Scholar]

- Li, Quan. 2008. Foreign direct investment and interstate military conflict. Journal of International Affairs 62: 53–66. Available online: https://www.jstor.org/stable/24358144 (accessed on 25 May 2018).

- Li, Quan, and Adam Resnick. 2003. Reversal of Fortunes: Democratic Institutions and Foreign Direct Investment Inflows to Developing Countries. International Organization 57: 175–211. [Google Scholar] [CrossRef]

- Li, Quan, and Drew Schaub. 2004. Economic Globalization and Transnational Terrorism A Pooled Time-Series Analysis. Journal of Conflict Resolution 48: 230–58. [Google Scholar] [CrossRef]

- Liu, Wen-Hsien. 2005. Determinants of the semiconductor industry cycles. Journal of Policy Modeling 27: 853–66. [Google Scholar] [CrossRef]

- Loree, David W., and Stephen E. Guisinger. 1995. Policy and non-policy determinants of US equity foreign direct investment. Journal of International Business Studies 26: 281–99. [Google Scholar] [CrossRef]

- Lutkepohl, H. 2005. New Introduction to Multiple Time Series Analysis. New York: Springer. [Google Scholar]

- Lutz, James M., and Brenda J. Lutz. 2006. International Terrorism in Latin America: Efforts on Foreign Investment and Tourism. Journal of Social, Political, and Economic Studies 31: 321–38. Available online: http://www.jspes.org/fall2006_lutz.html (accessed on 14 June 2018).

- Lutz, Brenda J., and James M. Lutz. 2017. Globalization and the Economic Consequences of Terrorism. New York: Springer. [Google Scholar]

- Maslow, Abraham Harold. 1970. Motivation and Personality, 2nd ed. New York: Harper & Row. [Google Scholar]

- Mathews, Harry G. 1975. International tourism and political science research. Annals of Tourism Research 2: 195–203. [Google Scholar] [CrossRef]

- Matthee, Heinrich. 2011. Political Risk Analysis. In International Encyclopedia of Political Science. Edited by Bertrand Badie, Dirk Berg-Schlosser and Leonardo Morlino. Thousand Oaks: Sage, pp. 2010–13. [Google Scholar]

- Mazzarella, John J. 2005. Terrorism and Multinational Corporations: International Business Deals with the Costs of Geopolitical Conflict. Major Themes in Economics 7: 59–73. [Google Scholar]

- Metaxas, Theodore, and Polyxeni Kechagia. 2017. FDI and Terrorism in developing Asia: Approaches and Discussion. Munich Personal RePEc Archive. No. 78165. Munich: University Library of Munich, Available online: https://mpra.ub.uni-muenchen.de/78165/ (accessed on 14 June 2018).

- Mihalache, Andreea S. 2010. Who’s afraid of political violence? Evidence from industry level FDI flows. Paper Presented at the Annual Meeting of the Theory vs. Policy? Connecting Scholars and Practioners, New Orleans, LA, USA, February 17–20. [Google Scholar]

- Nigh, Douglas. 1985. The effect of political events on United States direct foreign investment: A pooled time-series cross-sectional analysis. Journal of International Business Studies 16: 1–17. [Google Scholar] [CrossRef]

- Nikšić Radić, Maja. 2018. Terrorism as a Determinant of Attracting FDI in Tourism: Panel Analysis. Sustainability 10: 4553. [Google Scholar] [CrossRef]

- Nikšić Radić, Maja, and Matea Barišić. 2018. Does Terrorism have a Limited Impact on International Investments in Tourism? Some Theoretical Considerations. Almatourism-Journal of Tourism, Culture and Territorial Development 9: 153–64. [Google Scholar]

- Nikšić Radić, Maja, Daniel Dragičević, and Marina Barkiđija Sotošek. 2018. The tourism-led terrorism hypothesis--evidence from Italy, Spain, UK, Germany and Turkey. Journal of International Studies 11: 236–49. [Google Scholar] [CrossRef]

- O’Connor, Noëlle, Mary Rose Stafford, and Gerry Gallagher. 2008. The impact of global terrorism on Ireland’s tourism industry: An industry perspective. Tourism and Hospitality Research 8: 351–63. [Google Scholar] [CrossRef]

- Oaten, Simon, Katharine Le Quesne, and Harry Segal. 2015. Adapting to Uncertainty—The Global Hotel Industry. Geneva. Available online: Deloitte LLPhttp://www3.weforum.org/docs/TT15/WEF_TTCR_Chapter1.2_2015.pdf (accessed on 14 June 2018).

- Olibe, Kingsley O., and C. Larry Crumbley. 1997. Determinants of US private foreign direct investments in OPEC nations: From public and non-public policy perspectives. Journal of Public Budgeting, Accounting & Financial Management 9: 331–55. [Google Scholar] [CrossRef]

- Othman, R., Norlida H. M. Salleh, and Tamat Sarmidi. 2012. Analysis of Causal Relationship between Tourism Development, Economic Growth and Foreign Direct Investment: An ARDL Approach. Journal of Applied Sciences 12: 1245–54. [Google Scholar] [CrossRef]

- Pearce, Philip L. 2005. Tourist Behaviour: Themes and Conceptual Schemes. Bristol: Channel View Publications. [Google Scholar]

- Perić, Jože, and Maja Nikšić Radić. 2016. FDI-led tourism growth hypothesis: Empirical evidence from Croatian tourism. European Journal of Tourism, Hospitality and Recreation 7: 168–75. [Google Scholar] [CrossRef]

- Pizam, Abraham, and Aliza Fleischer. 2002. Severity versus frequency of acts of terrorism: Which has a larger impact on tourism demand? Journal of Travel Research 40: 337–39. [Google Scholar] [CrossRef]

- Porcano, Thomas M. 1993. Factors affecting the foreign direct investment decision of firms from and into major industrialized countries. Multinational Business Review 1: 26. [Google Scholar]

- Powers, Matthew, and Seung-Whan Choi. 2012. Does transnational terrorism reduce foreign direct investment? Business-related versus non-business-related terrorism. Journal of Peace Research 49: 407–22. [Google Scholar] [CrossRef]

- Rivoli, Pietra, and Eugene Salorio. 1996. Foreign direct investment and investment under uncertainty. Journal of International Business Studies 27: 335–57. [Google Scholar] [CrossRef]

- Ryans, John K., Jr., and William L. Shanklin. 1980. How managers cope with terrorism. California Management Review 23: 66–72. [Google Scholar] [CrossRef]

- Salleh, Norlida Hanim Mohd, Redzuan Othman, and Tamat Sarmidi. 2011. An Analysis of The Relationships Between Tourism Development And Foreign Direct Investment: An Empirical Study In Elected Major Asian Countries. International Journal of Business and Social Science 2: 250–57. [Google Scholar]

- Samimi, Ahmad Jafari, Somaye Sadeghi, and Soraya Sadeghi. 2013. The Relationship between Foreign Direct Investment and Tourism Development: Evidence from Developing Countries. Institutions and Economies 5: 59–68. [Google Scholar]

- Sanford, Douglas M., Jr., and Huiping Dong. 2000. Investment in familiar territory: Tourism and new foreign direct investment. Tourism Economics 6: 205–19. [Google Scholar] [CrossRef]

- Schneider, Friedrich, and Bruno S. Frey. 1985. Economic and political determinants of foreign direct investment. World Development 13: 161–75. [Google Scholar] [CrossRef]

- Selvanathan, Saroja, E. Antony Selvanathan, and Brinda Viswanathan. 2012. Causality between foreign direct investment and tourism: Empirical evidence from India. Tourism Analysis 17: 91–98. [Google Scholar] [CrossRef]

- Sethi, Deepak, Stephen E. Guisinger, Steven E. Phelan, and David M. Berg. 2003. Trends in foreign direct investment flows: A theoretical and empirical analysis. Journal of International Business Studies 34: 315–26. [Google Scholar] [CrossRef]

- Shehadi, Sebastian. 2017. On a Journey: Tourism Takes a New Turn towards Sustainable Development. Available online: https://www.fdiintelligence.com/Sectors/Hotels-Tourism/On-a-journey-tourism-takes-a-new-turn-towards-sustainable-development (accessed on 14 June 2018).

- Sinclair, Thea A., and M. J. Stabler. 1991. The Tourism Industry: An International Analysis. Wallingford: CAB International. [Google Scholar]

- Sonmez, Sevil F., and Alan R. Graefe. 1998. Influence of terrorism risk on foreign tourism decisions. Annals of Tourism Research 25: 112–44. [Google Scholar] [CrossRef]

- Sottilotta, Cecilia Emma. 2017. Rethinking Political Risk: Concepts, Theories, Challenges. New York: Routledge. [Google Scholar]

- START. 2017. Global Terrorism Database Codebook: Inclusion Criteria and Variables. Available online: http://www.start.umd.edu/gtd/downloads/Codebook.pdf (accessed on 15 January 2018).

- START. 2018. Global Terrorism Database (Data File). College Park: National Consortium for the Study of Terrorism and Responses to Terrorism. [Google Scholar]

- Steiner, Christian. 2010. An overestimated relationship? Violent political unrest and tourism foreign direct investment in the Middle East. International Journal of Tourism Research 12: 726–38. [Google Scholar] [CrossRef]

- Stohl, Michael. 2003. The Mystery of the New Global Terrorism: Old Myths, New Realities? In The New Global Terrorism: Characteristics, Causes, Controls. Edited by Charles W. Kegley. Upper Saddle River: Pearson. [Google Scholar]

- Tang, Sumei, E. Antony Selvanathan, and Saroja Selvanathan. 2007. The relationship between foreign direct investment and tourism: Empirical evidence from China. Tourism Economics 13: 25–39. [Google Scholar] [CrossRef]

- Thunell, Lars H. 1977. Political Risks in International Business: Investment Behavior of Multinational Corporations. New York and London: Praeger Publishers. [Google Scholar]

- Tosun, M. Umur, M. Onur Yurdakul, and Pelin Varol Iyidogan. 2014. The relationship between corruption and foreign direct investment inflows in Turkey: An empirical examination. Transylvanian Review of Administrative Sciences 10: 247–57. [Google Scholar]

- UNCTAD. Forthcoming. Methods of Data Collection and National Policies in the Treatment of FDI. Available online: http://unctad.org/en/Pages/DIAE/Methods-of-Data-Collection-and-National-Policies-in-the-Treatment-of-FDI.aspx (accessed on 15 May 2018).

- UNESCO. 2017. Preventing Violent Extremism through Education: A Guide for Policy-Makers. Paris: UNESCO. [Google Scholar]

- UNWTO. 2017. UNWTO Tourism Highlights: 2017 Edition. Madrid: UNWTO. [Google Scholar]

- UNWTO. 2018. UNWTO World Tourism Barometer. Madrid: UNWTO. [Google Scholar]

- Vargas, Mauricio, and Florian Sommer. 2015. Political Risks and Their Impact on Government Bonds. Frankfurt am Main: Union Investment Institutional GmbH. [Google Scholar]

- Witte, Caroline T., Martijn J. Burger, Elena I. Ianchovichina, and Enrico Pennings. 2017. Dodging bullets: The heterogeneous effect of political violence on greenfield FDI. Journal of International Business Studies 48: 862–92. [Google Scholar] [CrossRef]

- WTTC. 2018. Travel & Tourism Global Economic Impact and Issues 2018. London: WTTC. [Google Scholar]

- Zhang, Jianhong, Haico Ebbers, and Chaohong Zhou. 2011. Flows of Tourists, Commodities and Investment: The Case of China. In Tourism Economics: Impact Analysis. Edited by Alvaro Matias, Peter Nijkamp and Manuela Sarmento. New York: Springer, pp. 43–63. [Google Scholar]

- Zillman, Claire. 2015. Terrorism’s Effect on Tourism Doesn’t Last Very Long. Available online: http://fortune.com/2015/11/30/terrorism-tourism-paris/ (accessed on 16 September 2017).

- Hamilton, James D. 1994. Time Series Analysis. Princeton: Princeton University Press. [Google Scholar]

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).