Abstract

This study examines herding behavior in six MENA stock markets, with a focus on the impact of geopolitical risks and downward/upward market conditions during COVID-19/non-COVID-19 periods. Empirical results reveal significant differences among MENA countries regarding herding behavior and the impact of geopolitical events. We conclude that herding was more pronounced during the COVID-19 pandemic, especially during downward markets. Additionally, we found that geopolitical risks further amplified herding during dramatic market periods, particularly at lower quantiles. An exception was the Saudi stock market, which exhibited resilience to geopolitical risks, likely due to strong government support and robust policies. In contrast, Lebanon’s stock market has been exposed to an increased herding due to political instability. These findings suggest that regulators should enhance mechanisms to monitor market activities and introduce efficient policies to mitigate systematic risk and strengthen financial stability during downturns.

1. Introduction

The COVID-19 pandemic has had a dramatic impact on the global world economy, and it is considered one of the largest economic and financial crises to hit the world. This pandemic has caused declines in all countries of the world but in different ways; emerging countries experienced the most harm (; ; etc.). Government intervention in countries also played an important role in alleviating the severity of this crisis. This pandemic lasted for more than two years and attracted research examining the impact of the COVID-19 pandemic on different fields: economic, social, industrial, political, financial, psychological, etc. (; ; etc.). In this study, we examine the impact of the COVID-19 pandemic and geopolitical risks on herding behavior bias by integrating financial, psychological, and political concepts. This bias, which is driven by psychological and social factors, can occur in many financial situations. It is considered a phenomenon in which investors make their decisions based on the actions of other investors in the market, rather than on their own independent analysis. Herding can occur when investors act collectively without any centralized direction. Furthermore, we think that during this pandemic period, there are many anomalies and inefficiencies characterizing financial markets. During such a period, policymakers, analysts, dealers, and investors alike have uncertainties and ambiguities in making decisions about buying and selling stocks in the market, despite the efforts made by governments to mitigate this crisis. As these government initiatives differ from one country to another, geopolitical risks may affect nations differently.

In recent years, researchers have been interested in analyzing the behavioral characteristics of investors and how they decide to follow the crowd during abnormal moments, especially during high fluctuations of prices in the market or moments of highly bad/good news. In the face of these special times, investors in the stock market are influenced by their own emotions and social interactions, which may affect their decisions. These decisions can lead to some behavioral biases in the market, namely, herding behavior, which are mainly detected during crises, downturns, and high-tension periods (; ; ; etc.). Consequently, studying the effect of the COVID-19 pandemic on the behavior of investors and analyzing the effect of geopolitical risks on herding behavior in some MENA stock markets is of great interest.

Since the COVID-19 pandemic, many authors have been interested in analyzing the effect of irrational financial behavioral biases on the efficiency of stock markets all over the world. Some of them highlight the importance of analysis of the impact of COVID-19 on herding behavior, i.e., during crises, investors abandon their decisions about selling/buying stocks and decide to follow the crowd. Uncertainty surrounding this pandemic and ambiguity about the severity of this virus, the unknown finish date of this pandemic, and the return to normal life caused investors, especially smaller and younger investors, to worry about the future of the stock market. Evaluating the COVID-19 pandemic’s effects has been a major subject in the modern finance literature, with numerous studies and journal special issues dedicated to comparing pre- and post-crisis conditions.

In this paper we try to examine the property of herding in the MENA stock market and its link with geopolitical risks. Additionally, due to the heavy dependence of this behavior on stress periods and external shocks, we analyze herding in these markets considering its importance during the COVID-19 period. We selected the following six MENA countries: Egypt, Jordan, Lebanon, Morocco, Tunisia, and Saudi Arabia. The selection of these countries is justified by the fact that this group of countries provides geographic diversity, diversity in political systems and economies, and, crucially, more reliable data availability compared to other states in the region, making a comparative study feasible. Additionally, governments of these countries reacted differently to unexpected events, especially during the COVID-19 pandemic. A relevant example of this context can be found in the study of (), which demonstrates that COVID-19 pandemic has significantly affected countries and that MENA countries followed different economic strategies and policies to respond adequately to the difficulties. It is in this context that, for example, Saudi Arabia government has known how to manage difficult situations due to its strong state capacity, oil influence, and geopolitical strategies; while for geopolitical risks in Lebanon, such a country has known difficulties for a long time, exacerbated the crisis due to its weak institutional strategies, economic difficulties (hyperinflation, …), and political unresponsiveness. On a different side, Moroccan and Tunisian stock markets are similar, but they can react differently to geopolitical risks due to Morocco’s political stability, diversification, and geopolitical alliances with the EU and US, leading to a more resilient stock market. In contrast, Tunisia’s stock market faces greater changes and difficulties due to the political chaos and a potential lack of external support. In the same way, geopolitical risks in Jordan amplified economic fragility and increased public debt, negatively impacting stock market performance during the COVID-19 period, whereas geopolitical risks in Egypt were overshadowed because of macroeconomic and political stability supporting the confidence of investors during the COVID-19 pandemic despite the amplified tensions with Ethiopia (Grand Ethiopian Renaissance Dam, GERD). This study is motivated by a desire to understand how uncertainty, represented in geopolitical risks, influenced herding behavior whereby investors tend to imitate the actions of others rather than following their own analysis in MENA stock markets, especially during periods of instability.

The COVID-19 pandemic has triggered a global financial crisis followed by the significant negative impact of geopolitical risks, which further amplified investor uncertainty. Furthermore, during this critical period of business cycle recession, policymakers, regulators, and politicians were compelled to intervene to confront the financial difficulties and mitigate the situation (; ; ). Geopolitical tensions further complicate market dynamics, shaping investor behavior in distinct ways across different countries. These dynamics may vary across MENA stock markets because of their different financial and economic characteristics and political interventions ().

It is supposed that geopolitical risks could act as an accelerating factor in the COVID-19 pandemic period that contributes to an increase in herding behavior in countries where institutions are weak. However, it is expected that the interventions of governments and their success in alleviating the crisis depend heavily on the pre-existing geopolitical stability. Furthermore, this research explores how geopolitical risks, conflicts, and diplomatic tensions during the COVID-19 pandemic interacted with market psychology and impacted herding behavior differently across countries. When a major geopolitical event occurs (sudden conflict, war, or the imposition of severe sanctions), it can create substantial uncertainty, making fundamental analysis more difficult. Due to a lack of information, investors often abandon their own market analysis and decide to follow the dominant market trend. This action can push individuals to herd into perceived safe havens or assets out of risk, consequently amplifying market volatility and diverging prices from their fundamental values.

This paper investigates two main objectives: The first is to examine the presence of herding behavior in some MENA stock markets (Egypt, Jordan, Lebanon, Morocco, Tunisia, and Saudi Arabia) both during and outside the COVID-19 pandemic period. The second is to analyze the impact of geopolitical risks on herding behavior, with a specific focus on how different government policy responses and pre-existing country conditions during the pandemic influenced this effect. The contribution of this paper is to study herding behavior by integrating the role of geopolitical risks as a key moderator to explain cross-country differences in investor behavior across COVID-19 and non-COVID-19 periods.

Guided by these dynamics, our study addresses the following three main hypotheses:

H1.

There is significant evidence of an increase in herding behavior in MENA stock market during COVID-19 pandemic.

H2.

Geopolitical risks have a significant impact on herding behavior.

H3.

The effect of geopolitical risks on herding behavior significantly differs across MENA stock markets.

Finally, it should be noted that despite the growing literature devoted to the herding behavior bias analysis, there is a significant gap in understanding the specific connection between this bias and geopolitical risks. In addition, while recent previous studies have explored the influence of certain factors on herding, such as the economic policy uncertainty and financial crises, the distinct impact of geopolitical tensions—a prevalent feature in the MENA region during COVID-19 periods—remains markedly underexplored. This paper addresses this void by being the first, to our knowledge, to empirically investigate the impact of geopolitical risk on herding behavior during COVID-19 and make a comparison with the non-COVID-19 period within six MENA countries. Our findings provide critical insights for investors and policymakers by revealing how tensions can amplify irrational crowd-following, thereby destabilizing markets. This enhances the behavioral finance literature and offers a deeper understanding of market dynamics in MENA countries, such regions highly susceptible to political shocks and significant differences between countries.

The remainder of this paper is organized as follows. After the introduction presented in Section 1, Section 2 briefly presents the herding behavior in the period of the COVID-19 pandemic. Section 3 is devoted to the presentation of the herding behavior methodology. In Section 4, we describe data and we analyze the empirical results. Finally, Section 5 concludes the paper.

2. COVID-19 Pandemic and Herding Behavior: Is There Evidence?

Since the spread of the COVID-19 pandemic, many researchers have been interested in comparing the situation before and after this disaster event. Many journals have published special issues to study the effect of this crisis on different fields. The finance domain area is one of the most important sectors that has drawn interest due to the huge spread of this pandemic, as this sector is one of the most touched sectors and largely affected. Authors were interested especially in the behavior of decision-makers, intermediaries, dealers, and investors toward this pandemic and how each one reacts to minimize damage and losses. Therefore, as is documented in many studies, the COVID-19 epidemic has significantly changed investor behavior across stock markets around the world (). This pandemic triggered extreme market volatility and unexpected high fluctuations, contributing to the amplification of herding behavior in stock markets, where investors ignore their own decisions and follow others’ actions. In fact, because of the COVID-19 pandemic and the lockdown of activities, global financial sectors were severely and negatively impacted. Investors do not exactly know what to do in trading transactions: do they follow the others in the markets, make their own decisions, or wait and do not rush? Empirical studies and market data suggested that herding was more pronounced during this critical period, but with significant regional and temporal differences (; ). Additionally, because of fear, social influence, and loss of investor confidence, herding behavior was a crucial feature of the COVID-19 pandemic. However, its intensity varied across markets, government policies, and countries. During the COVID-19 pandemic, herding behavior can be detected in several ways. For example, () used high-frequency data for the period of COVID-19 ranging from January 2020 to December 2020 and concluded that investors in European stock markets exhibited significant herding behavior, leading to market inefficiencies and volatility. () investigated the impact of COVID-19 on herding behavior in global stock markets and found evidence of a strong association between the COVID-19 pandemic and herding behavior. Specifically, they concluded that increased uncertainty caused by COVID-19 led to high price fluctuations in stock markets and, therefore, following the others can drive security prices away from equilibrium supported by fundamentals.

() concluded that the primary causes of herding behavior bias come from inadequate knowledge, reputation, and incomplete information. Furthermore, these reasons for herding behavior may result from increased uncertainty, which in turn may lead to an increase in trading, as less informed investors tend to mimic others. In this regard, () distinguished that the increase in the number of deaths from the COVID-19 pandemic makes investors more cautious and afraid, which in turn causes herding among investors to become more obvious.

Recent papers insist on the importance of uncertainty, information asymmetry, risk aversion, market fragility, and organizational flaws in analyzing herding behavior in financial markets, especially in countries suffering from weaker institutional structures (; ; ). Following that logic, geopolitical risks can amplify herding behavior through several theoretical mechanisms. For example, according to the information cascades theory, geopolitical risks can increase uncertainty in the market; therefore, investors face difficulties assessing fundamentals. For countries where the institutional environment is weak, there is an absence of transparency in information, and investors try to mimic the actions of others rather than use their independent analyses. Generally, behavioral finance theories suggest that rational decision making is dominated by fear, implying, therefore, that investors in countries suffering from governance and institutional regulation try to herd into safe investments and stable markets rather than sell-offs in local stock markets. Meanwhile, increased geopolitical risks intensify risk aversion, and investors search for safe assets.

In an uncertain environment where information is imperfect, investors often believe that others in the market are better informed and can make better decisions. Consequently, they do not have confidence in their own knowledge, and they attempt to obtain information from the financial decisions of other investors in the market. Subsequently, when uncertainty is high, the tendency of investors to emulate others is greater. Events such as the trade war between the U.S. and China in 2018–2019, the Russian invasion of Ukraine in 2022, and the COVID-19 pandemic starting in March 2020 were associated with highly unpredictable policy announcements that increase uncertainty. These events trigger geopolitical risks, and investors try to herd into specific types of stocks. For instance, at the beginning of the COVID-19 pandemic, a movement of herding behavior was distinguished into Tech and Stay-Home stocks. () examined the impact of the conflict between Russia and Ukraine and the COVID-19 pandemic on herding behavior. He concluded different significant results during both crises regarding herding behavior. He concluded that geopolitical confusion had a limited effect on herding during the Russia–Ukraine war, whereas the COVID-19 outbreak significantly intensified herding behavior. () studied the herding behavior of the G20 stock markets. Through robust multifractal detrended fluctuation analysis, they concluded significantly different results regarding herding behavior during the periods of the Russia–Ukraine war and the outbreak of the COVID-19 pandemic. They concluded that there was evidence of herding behavior for the majority of G20 stock markets during the conflict between Russia and Ukraine and an absence of herding during the COVID-19 pandemic in most G20 countries. () examined the impact of economic policy uncertainty on herding behavior in the Chinese stock market. Their findings indicate that economic policy uncertainty had a significant impact on herding behavior with varied directional effects depending on factors such as the economic environment, the regulatory frameworks, etc.

Additionally, () declared that results on herding behavior during the coronavirus pandemic rely on the empirical methods, and findings differ regarding the effect of this pandemic on herding in developed, emerging, and frontier European stock markets. By using static and rolling regression methods they concluded that fear-driven selling and buying were common as investors reacted to news and trends rather than making decisions based on fundamental analysis. They found that herding behavior is more prevalent in developed European stock markets than in frontier and emerging markets during the COVID-19 pandemic.

During times of crisis, uncertainty significantly impacts herding in financial markets. However, () concluded that during periods of high economic policy uncertainty, investors in the U.S. REITs market tend to follow the decisions of other investors. In the same context, () concluded that high levels of housing price uncertainty in the UK’s housing markets increase herding behavior, especially in the UK regions where there is evidence of high institutional investors. They highlighted that investors are more likely to replace their own private beliefs by mimicking others in the financial market in periods of high uncertainty, which leads to an amplification of herding behavior due to asset mispricing. Additionally, herding behavior can be associated significantly with some external shocks such as geopolitical risks, oil price fluctuations, investors’ sentiment, and information asymmetry (; ; ; ).

Overall, the COVID-19 pandemic highlighted how herding behavior can amplify both positive and negative responses in different financial markets because of uncertain conditions, but markets are impacted in a different way. Also, the impact of external factors (such as geopolitical risks) during this epidemic may not be the same across markets. Arguably, clear communication and good governance and leadership play an important role in guiding the behavior, especially during crises. Consequently, it is essential to conduct a study on herding behavior and the influence of geopolitical risks in the MENA financial markets both during and outside the COVID-19 pandemic. This research will help to evaluate the differences in policies across these nations and their effectiveness in alleviating the impacts of the epidemic.

3. Herding Behavior Modeling

Most papers have investigated the analysis of herding behavior in different stock markets (developed, emerging, developing, etc.) using the basic methodologies of () and (). Some studies have proposed modifications to these methods to account for the significant impact of external factors or specific characteristics on herding behavior, such as oil price fluctuations, uncertainty, special events, and investor sentiment (; ; ; ). According to the original idea of (), we will consider the following CSAD method to analyze herding behavior:

where

and it represents the cross-sectional absolute standard deviation.

and it represents the stock return of firm i on day t. is the closing price of the firm stock i on day t.

represents the stock market return of firm i on day t.

N represents the number of firms in our sample.

Equation (1) examines the non-linear relationship between the return dispersion and the aggregate market return. The non-linear relationship in this equation is represented by the variable and it will be justified when the estimated coefficient is significant. Consequently, when this coefficient is positive and significant, any increase or decrease in stock return will increase CSAD at an increasing rate and, therefore, an anti-herding behavior can be detected, whereas a negative coefficient will increase or decrease CSAD at a slower rate, implying a herding behavior bias in the market.

The MENA region is heavily exposed to geopolitical tensions, including Gulf conflicts, political transitions, and economic difficulties. Compared to developed markets, MENA markets often have lower liquidity and weaker investor protection. Herding behavior can be considered a critical action because it is the behavioral locomotive that translates uncertainty into market inefficiency. Herding occurs when there is a collective movement of investors in the same direction towards perceived safe havens. During periods of high geopolitical risk, tensions may cause investors to avoid riskier markets (e.g., Lebanon and Tunisia) and herd into stronger state markets (e.g., Saudi Arabia). This creates asymmetric effects and significant differences across MENA markets. During COVID-19, herding might have been more uniformly negative, but differing government interventions across countries may lead to different results regarding herding behavior between these countries. In the volatile context of MENA markets, we can better understand the impact of geopolitical risks and the COVID-19 pandemic on herding behavior through the following channel: when a new event generates deep uncertainty, it significantly affects investor confidence in their own analysis, encouraging them to follow the crowd. This concept of herding behavior can explain the reasons behind the severity of market crashes, the geopolitical risks and uncertainties, and the asymmetric effects experienced across various countries.

In this paper we propose a modified version of Equation (1) to account for the possible impact of geopolitical risks on herd behavior and the asymmetries between downward and upward market conditions for both COVID-19 and non-COVID-19 periods in the MENA countries. We considered the following equation:

- GPR: geopolitical risk index1.

According to Equation (2), a positive estimated coefficient increases CSAD, thereby contributing to a decrease in herding behavior bias in the market. Conversely, a negative value decreases CSAD and increases herding. Equation (2) serves as an extension of the model introduced by () to analyze herding during and outside COVID-19 pandemic under bearish and bullish market conditions. The coefficient may be either positive or negative with a possible varying significance which depends on the influence of political decisions in each country.

For the estimation of Equation (2), we use quantile regression analysis to account for outliers characterizing financial series. In this study, we focus on lower and upper tails at the 5% and 95% levels to examine herding behavior under different market conditions. However, this estimation method is recognized as one of the most pertinent and robust approaches for analyzing herding behavior (; ; ; ; ; ; ; ). The ultimate objective of this paper is to assess whether geopolitical risks influence herding behavior in MENA stock markets differently across nations, during COVID-19 and non-COVID-19 periods, as well as during both downward and upward market conditions.

4. Main Empirical Results

4.1. Data and Descriptive Statistics

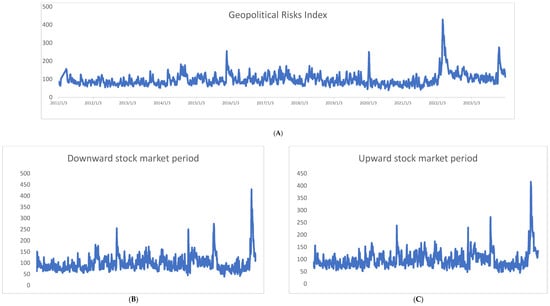

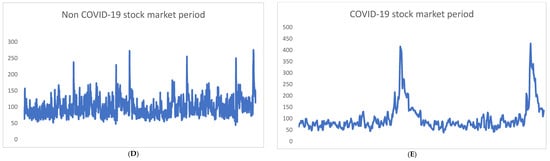

The financial information regarding price stock firms and stock market index for the six MENA markets (Egypt, Jordan, Lebanon, Morocco, Saudi Arabia, and Tunisia) was collected from the website investing.com for the period 4 January 2011–29 December 2023. From these daily data series, we construct variables for our model, i.e., the variables of cross-sectional absolute deviation (CSAD) and stock market return (Rmt) for all samples, COVID-192, non-COVID-19, and downward and upward periods for the six MENA countries. The geopolitical risk index (GPR variable) is collected from the website “https://www.policyuncertainty.com/gpr.html (accessed on 16 December 2024)” for the same period3. To have a clear idea and understand the characteristics of the sample under different conditions, the table in Appendix A presents the descriptive statistics and data stationarity tests of the variables. Across the six MENA countries, we can notice that the CSAD values are generally higher during the COVID-19 period, indicating, therefore, an increased market volatility and the evidence of a potential herding behavior in these markets during this critical period. The geopolitical risk index was slightly higher and more variable during the COVID-19 outbreak period compared to the non-COVID-19 period. Additionally, the average geopolitical risk during upward and downward stock market conditions remained almost the same, with slightly more variability during downward stock market periods. These differences highlight how geopolitical risk can fluctuate based on external events like pandemics and market conditions. In all series, we observe high skewness and kurtosis values, suggesting the presence of extreme values and a non-normal distribution. This highlights the importance of using models that account for outliers. Consequently, we employ quantile regression models in this study. Finally, ADF unit root tests demonstrate that all variables are stationary at a 1% significance level, rejecting the null hypothesis of unit root.

4.2. Empirical Results

Appendix B reports the estimations of Equation (2) at lower and upper quantiles, 5% and 95%, at downward and upward market conditions for six different MENA countries considering the impact of geopolitical risks. We look for the sign and statistical significance of both herding and geopolitical risk coefficient estimates. The results suggest a significant difference in the reaction of investors between countries, level markets, and COVID-19 and non-COVID-19 periods. Considering the negative effect of the COVID-19 outbreak for all countries of the world, we wondered if the negative performance of investors during this period caused by higher market anxiety led to an increase in herding. Herding behavior was more prevalent during the COVID-19 pandemic than during the non-COVID-19 period in most MENA countries during both downward and upward market conditions. These countries had a significant impact on global supply chains and market stability. This effect varies from country to country in the MENA region, with herding behavior being strong in most cases during the COVID-19 recession. Furthermore, during the COVID-19 pandemic, herding behavior is more apparent in periods when the stock market returns are negative. We notice the absence of herding behavior during non-COVID-19 upper tails, whereas herding is stronger at lower tails (5%) than upper tails (95%) during the COVID-19 outbreak.

This increased evidence of herding behavior during periods of market stress, such as the COVID-19 pandemic, encourages regulators and policymakers to enhance strong mechanisms to monitor market activities that can help investors to identify abnormal trading patterns and to mitigate the probable stock market manipulation. In addition, regulators should introduce policies, such as risk management practices and the diversification of strategies, to reduce systematic risk and strengthen financial stability, especially during downturns.

On the other hand, geopolitical risks, such as conflicts, political instability, dramatic events, and economic sanctions, can significantly impact financial markets and can further amplify herding behavior, especially during down markets. Results suggest positive and significant coefficients relating to geopolitical risks in most countries at the lower quantile, 5%, indicating, therefore, that geopolitical risks increased, but only slightly, herding behavior during dramatic market periods. During COVID-19 periods and negative stock market returns, geopolitical events led to a disruption in the economic activity and high fluctuations in commodity prices, therefore affecting investor confidence. The anxiety among investors led to irrational decision making and strengthened herding behavior. Geopolitical risks did not affect herding behavior in both COVID-19 and non-COVID-19 periods in the Saudi stock market. This result suggests that the Saudi stock market, compared to other MENA markets, may have exceptional characteristics, such as strong government support and robust economic policies that safeguard it from the impact of geopolitical risks. Investors in the Saudi market are considered more confident in their investment strategies, and policymakers can focus on other factors that influence market stability and investors’ decisions, such as economic diversification, oil price fluctuations, and regulatory frameworks. On the contrary, geopolitical risks contribute to increased herding behavior in the Lebanon stock market in most cases for all periods at different quantiles. In fact, political instability characterizing this country significantly impacts Lebanese financial markets because of the increase in uncertainty and the stronger investor sentiment influence. Empirically, as summarized in Appendix C, we can notice that the hypotheses mentioned above in this paper are mostly confirmed and prove that herding behavior bias is more relevant during periods of crises, as investors cannot rely on their own decisions. Additionally, the connection between geopolitical risks and herding behavior during stressful periods such as COVID-19 pandemic is crucial, as political decisions can serve as a significant factor that can change the behavior of investors and market dynamics, thereby increasing the probability of herding behavior. It was confirmed that this connection differs across MENA countries.

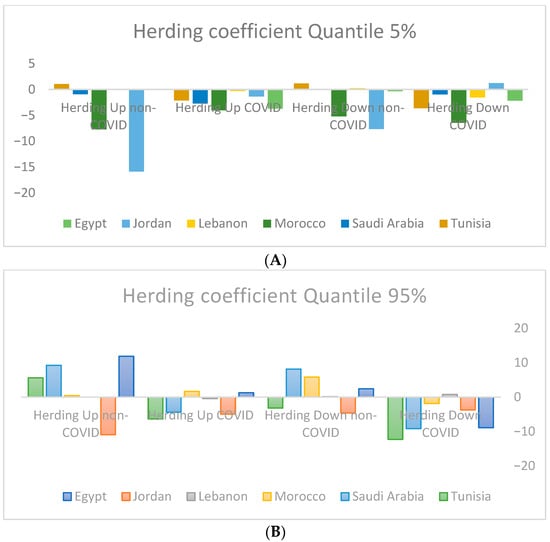

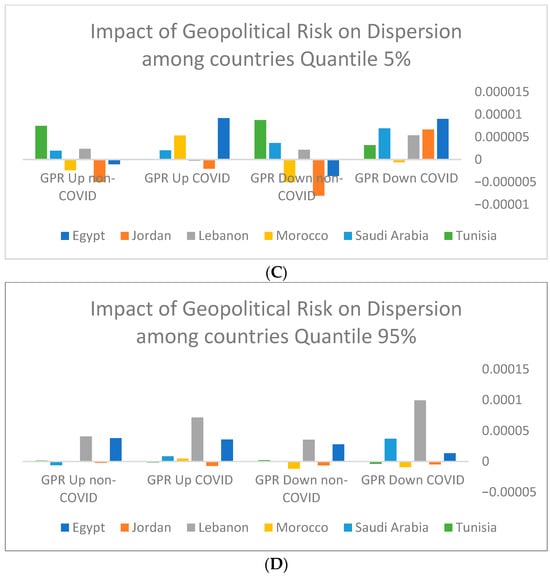

Figure 1 highlights the significant differences between countries and periods regarding the evidence of herding, and the impact of geopolitical risk on herding during both downward and upward periods. The graphs clearly show that Lebanon registered the lowest levels of herding, especially during COVID-19. We distinguish that Morocco and Tunisia show the strongest evidence of herding during downward market conditions for both COVID-19 and non-COVID-19 periods, but it is more amplified during the pandemic.

Figure 1.

(A) Herding coefficient for the lower quantile, 5%. Source: Own processing based on estimations. (B) Herding coefficient for the upper quantile, 95%. Source: Own processing based on estimations. (C) Impact of geopolitical risk on dispersion for the lower quantile, 5%. Source: Own processing based on estimations. (D) Impact of geopolitical risk on dispersion for the upper quantile, 95%. Source: Own processing based on estimations.

Although the GPR coefficients are very small, they are most notable for the case of Lebanon. This country has the largest positive GPR coefficients, indicating, therefore, that geopolitical risk in Lebanon significantly increases herding behavior, especially during downward market conditions. Conversely, GPR coefficients are positive and very small in Egypt and Saudi Arabia, which implies, therefore, that geopolitical risk tends to slightly increase the collective behavior of investors. Additionally, the impact of GPR was generally more pronounced during the COVID-19 period, with most of the coefficients being larger in magnitude compared to the non-COVID-19 period.

While our empirical results confirm the statistical significance of geopolitical risks in amplifying herding behavior, particularly at the lower quantiles 5% during the COVID-19 period, it is essential to consider the economic magnitude of this effect. For instance, as noted, a substantial 100-point increase in the GPR index corresponds to only a 0.00995 unit increase in the CSAD-based herding measure for Lebanon during the COVID-19 downturn. The small coefficient related to the GPR index implies that there are other factors not captured in our model, such as country-specific macroeconomic shocks, liquidity conditions, or firm-level information, that play a more substantial role in detecting herding. This can be investigated in future research.

Considering these findings, authorities and regulators in these countries should implement targeted mechanisms to mitigate distortions caused by herding behavior. For example, the implementation of circuit breakers is justified by the strong herding observed during downward markets, as they can calm trading activity and avoid panic selling. Furthermore, as information asymmetry is considered the major key driver of herding, transparency of firms in the market during periods of geopolitical tensions would encourage investors to make more independent decisions and prevent copying from others. Finally, investor education initiatives focused on behavioral biases can build a more resilient investor base, particularly in vulnerable markets like Lebanon and Tunisia. These specific interventions, adapted in the MENA markets, would directly address the systematic risks amplified by herding behavior during periods of crises.

5. Conclusions

Herding behavior is one of the most studied biases in recent years, as investors attempt to follow the others in the market, especially during stress periods such as the COVID-19 pandemic. This study examines this bias in six MENA stock markets by analyzing the novel impact of geopolitical risk (GPR) during both the COVID-19 pandemic and normal periods. This pandemic has affected all sectors in all countries around the world. An important factor affecting the investors’ decision is the economic and financial situation, where asymmetrical and stressful periods can be significant factors in analyzing herding behavior. Furthermore, uncertainty in financial markets can have a significant impact on the irrational herding behavior of investors. During the COVID-19 pandemic, uncertainty increases, and asymmetries between low- and high-uncertainty periods can be an important feature in analyzing herding behavior differently during and outside the COVID-19 pandemic. In this paper, we attempted to examine the evidence of herding behavior and to compare the evidence of this bias among periods and countries in some MENA stock markets. From the same perspective, we believe that during periods of significant market stress, GPR often intensifies herding as investors seek safe investments amidst unpredictable events like wars, conflict, or terrorism. Relating this consensus to the COVID-19 pandemic, which represented a period of intense GPR, can offer a particularly relevant insight. The pandemic was not just a crisis in the health sector but also a major source of geopolitical tension and unprecedented economic policy interventions. Consequently, incorporating the GPR channel would lead to a comprehensive examination of herd behavior during the COVID-19 market turbulence in the MENA countries. To the best of our knowledge, our work contributes to the existing empirical literature on the impact of financial geopolitical risks on herding behavior during and outside COVID-19 periods in the MENA markets. This study is an extension of the work of (), where we compare the impact of geopolitical risks on herding behavior outside and amid the COVID-19 pandemic under both upward and downward market conditions.

Based on daily data frequency from 4 January 2011 to 29 December 2023, the empirical findings on herding behavior and geopolitical risk (GPR) effects in six MENA stock markets (Egypt, Jordan, Lebanon, Morocco, Saudi Arabia, and Tunisia), covering COVID-19 and non-COVID-19 periods, demonstrate that herding behavior intensified during COVID-19, particularly in downward markets, with some differences across MENA countries. Geopolitical risks exacerbated herding at the 5% quantile, reflecting investor anxiety during crises. Notably, Saudi Arabia exhibited resilience to geopolitical shocks, likely due to strong institutional safeguards, while Lebanon’s persistent political instability amplified herding across all market conditions. These findings highlight the need for enhanced regulatory oversight, risk management policies, and investor education to mitigate herding-induced market distortions, particularly during crises. Policymakers should adapt interventions to country-specific vulnerabilities, emphasizing economic diversification and stability mechanisms.

This study contributes to the behavioral finance literature in the following way: it empirically demonstrates that geopolitical risk (GPR) acts as a non-linear amplifier of herding behavior in some MENA stock markets, especially during the extreme stress of the COVID-19 pandemic and in downward market conditions. By using a quantile regression framework, we revealed the nuanced, country-specific nature of this phenomenon; most notably, the resilience of Saudi Arabia was contrasted with the severe vulnerability of Lebanon. However, the concentration on a single behavioral bias and the aggregate nature of the GPR index, which might not capture nation-specific political events, can be considered significant limitations. Future research could integrate additional anomalies or higher-frequency data. According to the findings of this study, MENA markets require specific regulatory frameworks. Regulators should place a high priority on improving information transparency and establishing real-time market surveillance systems to detect herding patterns in markets that are particularly vulnerable, like Lebanon and Tunisia. Conversely, in markets that are more resilient, such as Saudi Arabia, policymakers can focus on strengthening the existing stability through economic diversification and investor education programs that mitigate the tendency to follow the crowd. This strategy can be crucial for building systemic resilience against the compound shocks of health crises and geopolitical turbulence.

Funding

This research received no external funding.

Data Availability Statement

These data were derived from the following resource available in https://www.investing.com and www.policyuncertainty.com/gpr.html (accessed on 16 December 2024).

Conflicts of Interest

The authors declare no conflicts of interest.

Appendix A. Descriptive Statistics

Notes: The following table summarizes the descriptive statistics of our study data for the six selected MENA countries: Cross-sectional absolute deviation (CSAD), stock market return (Rmt), outside COVID-19 period (non-COVID), COVID-19 pandemic period (COVID), and all the period of study (All).

Table A1.

Descriptive statistics of the six MENA stock markets.

Table A1.

Descriptive statistics of the six MENA stock markets.

| Egypt | Full Period | Downward Period | Upward Period | |||||||||||||||

| Return (Rmt) | Dispersion (CSAD) | Return (Rmt) | Dispersion (CSAD) | Return (Rmt) | Dispersion (CSAD) | |||||||||||||

| All | COVID | Non-COVID | All | COVID | Non-COVID | All | COVID | Non-COVID | All | COVID | Non-COVID | All | COVID | Non-COVID | All | COVID | Non-COVID | |

| Mean | 0.0005 | −7 × 10−0’ | 0.0008 | 0.0140 | 0.0152 | 0.0137 | −0.01024 | −0.0100 | −0.0103 | 0.0137 | 0.0151 | 0.0133 | 0.0101 | 0.0085 | 0.0105 | 0.01421 | 0.0152 | 0.0140 |

| Std | 0.0003 | 0.0006 | 0.0003 | 0.0001 | 0.0002 | 0.0002 | 0.00723 | 0.0006 | 0.0003 | 0.0122 | 0.0003 | 0.0002 | 0.0078 | 0.0005 | 0.0003 | 0.01292 | 0.0003 | 0.0002 |

| Median | 0.0007 | 0.0001 | 0.0009 | 0.0126 | 0.0142 | 0.0122 | 0.01071 | −0.0075 | −0.0072 | 0.0076 | 0.0138 | 0.0119 | 0.0095 | 0.0062 | 0.0082 | 0.00854 | 0.0145 | 0.0126 |

| Kurtosis | 5.1740 | 8.0332 | 4.6618 | 175.473 | 5.6684 | 173.5376 | 14.4998 | 19.4011 | 13.285 | 108.32 | 5.5960 | 115.1297 | 8.2389 | 8.7208 | 8.1748 | 209.68 | 5.4277 | 198.2454 |

| Skewness | −0.399 | −0.903 | −0.3153 | 8.8321 | 1.7717 | 9.1381 | −2.92797 | −3.6267 | −2.7498 | 6.5879 | 1.8669 | 7.1179 | 2.2769 | 2.4929 | 2.2439 | 10.1817 | 1.6004 | 10.2099 |

| Minimum | −0.105 | −0.093 | −0.1052 | 0.0020 | 0.0053 | 0.0020 | −0.10521 | −0.0934 | −0.1052 | 0.0025 | 0.0069 | 0.0025 | 6 × 10−6 | 0.0001 | 0.0000 | 0.00204 | 0.0053 | 0.0020 |

| Maximum | 0.0759 | 0.0592 | 0.0759 | 0.2174 | 0.0458 | 0.2174 | −4.9 × 10−6 | 0.0000 | 0.0000 | 0.164 | 0.0458 | 0.1640 | 0.0759 | 0.0592 | 0.0759 | 0.21739 | 0.0439 | 0.2174 |

| ADF [p-value] | −45.1 [0.000] | −12.1 [0.000] | −4.4 [0.0002] | −17.5 [0.000] | −11.8 [0.000] | −17.7 [0.000] | −16.1 [0.000] | −4.2 [0.0007] | −18.7 [0.000] | −14.4 [0.000] | −12.5 [0.000] | −13.3 [0.000] | −22.5 [0.000] | −12.1 [0.000] | −20.6 [0.000] | −13.3 [0.000] | −11.8 [0.000] | −11.9 [0.000] |

| Observations | 3128 | 578 | 2550 | 3128 | 578 | 2550 | 1476 | 288 | 1188 | 1476 | 288 | 1188 | 1652 | 290 | 1362 | 1652 | 290 | 1362 |

| Jordan | Full Period | Downward Period | Upward Period | |||||||||||||||

| Return (Rmt) | Dispersion (CSAD) | Return (Rmt) | Dispersion (CSAD) | Return (Rmt) | Dispersion (CSAD) | |||||||||||||

| All | COVID | Non-COVID | All | COVID | Non-COVID | All | COVID | Non-COVID | All | COVID | Non-COVID | All | COVID | Non-COVID | All | COVID | Non-COVID | |

| Mean | 0.0000 | 0.0006 | −0.0001 | 0.0111 | 0.0107 | 0.0112 | −0.0033 | −0.0041 | −0.0032 | 0.0109 | 0.0103 | 0.0110 | 0.0035 | 0.0046 | 0.0032 | 0.0113 | 0.0111 | 0.0114 |

| Std | 0.0048 | 0.0064 | 0.0044 | 0.0042 | 0.0041 | 0.0042 | 0.0034 | 0.0046 | 0.0031 | 0.0044 | 0.0039 | 0.0044 | 0.0035 | 0.0048 | 0.0031 | 0.0039 | 0.0043 | 0.0039 |

| Median | 0.0000 | 0.0003 | −0.0001 | 0.0107 | 0.0104 | 0.0108 | −0.0024 | −0.0025 | −0.0024 | 0.0106 | 0.0101 | 0.0107 | 0.0025 | 0.0031 | 0.0024 | 0.0108 | 0.0106 | 0.0110 |

| Kurtosis | 5.4806 | 6.6901 | 2.8926 | 61.1843 | 1.7188 | 72.9053 | 19.2584 | 26.3468 | 6.5741 | 102.93 | 1.8963 | 113.311 | 7.8716 | 5.7064 | 5.7780 | 0.5375 | 1.5822 | 0.2080 |

| Skewness | 0.0274 | −0.139 | 0.0476 | 3.3983 | 1.0075 | 3.8828 | −2.8693 | −3.7107 | −2.0404 | 5.5103 | 1.0473 | 6.0615 | 2.3606 | 2.1807 | 2.0813 | 0.6032 | 0.9592 | 0.5031 |

| Minimum | −0.045 | −0.047 | −0.0261 | 0.0000 | 0.0000 | 0.0000 | −0.0448 | −0.0448 | −0.0261 | 0.0017 | 0.0037 | 0.0017 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 |

| Maximum | 0.0977 | 0.0275 | 0.0977 | 0.0211 | 0.0285 | 0.0275 | 0.0977 | 0.0000 | 0.0285 | 0.0275 | 0.0977 | 0.0000 | 0.0254 | 0.0211 | 0.0274 | 0.0000 | 0.0285 | 0.0275 |

| ADF [p-value] | −12.4 [0.000] | −46.6 [0.000] | −11.4 [0.000] | −43.6 [0.000] | −7.3 [0.000] | −18.2 [0.000] | −11.7 [0.000] | −16.6 [0.000] | −12.3 [0.000] | −20.6 [0.000] | −10.8 [0.000] | −15.5 [0.000] | −11.5 [0.000] | −20.6 [0.000] | −7.1 [0.000] | −13.6 [0.000] | −5.4 [0.000] | −10.2 [0.000] |

| Observations | 3051 | 523 | 2528 | 3051 | 523 | 2528 | 1532 | 240 | 1292 | 1532 | 240 | 1292 | 1519 | 283 | 1236 | 1519 | 283 | 1236 |

| Lebanon | Full Period | Downward Period | Upward Period | |||||||||||||||

| Return (Rmt) | Dispersion (CSAD) | Return (Rmt) | Dispersion (CSAD) | Return (Rmt) | Dispersion (CSAD) | |||||||||||||

| All | COVID | Non-COVID | All | COVID | Non-COVID | All | COVID | Non-COVID | All | COVID | Non-COVID | All | COVID | Non-COVID | All | COVID | Non-COVID | |

| Mean | 0.0039 | 0.0073 | 0.0294 | 0.0211 | 0.0266 | 0.0194 | −0.016 | 0.0243 | 0.0152 | 0.0166 | 0.0239 | −0.0147 | 0.0258 | 0.0306 | 0.0219 | 0.026 | 0.0308 | 0.0219 |

| Std | 0.0871 | 0.0474 | 0.0537 | 0.0275 | 0.016 | 0.0852 | 0.009 | 0.0098 | 0.0083 | 0.0105 | 0.0083 | 0.0085 | 0.0095 | 0.0171 | 0.0149 | 0.0112 | 0.0145 | 0.0149 |

| Median | −0.0007 | −0.001 | −0.000 | 0.0108 | 0.0352 | 0.00977 | 0.0318 | 0.2234 | 0.0315 | 0.0306 | 0.2235 | 0.0322 | 0.1924 | 0.0409 | 0.0260 | 0.192 | 0.0468 | 0.0260 |

| Kurtosis | 2181.3 | 11.77 | 1679.61 | 2074.57 | 15.718 | 1723.97 | 422.38 | 825.15 | 554.69 | 495.56 | 821.720 | 500.323 | 1087.96 | 12.047 | 18.66 | 1101.05 | 11.88 | 18.66 |

| Skewness | 43.759 | 1.719 | 39.943 | 45.656 | 3.54 | 40.930 | −16.66 | 28.586 | 20.752 | 18.465 | 28.49 | −19.32 | 32.52 | 3.177 | 3.712 | 32.81 | 3.215 | 3.712 |

| Minimum | −0.216 | −0.216 | −0.2117 | 0.000 | 0.000 | 0.000 | −0.216 | −0.216 | −0.2004 | 0.0000 | 0.0000 | 0.00717 | 0.0000 | 0.0000 | 0.0005 | 0.000 | 0.0000 | 0.0005 |

| Maximum | 0.278 | 0.163 | 0.278 | 0.2587 | 0.2587 | 0.2246 | 0.0000 | 0.0000 | 0.0000 | 0.4610 | 0.4610 | 0.2136 | 0.278 | 0.278 | 0.259 | 0.2905 | 0.2905 | 0.1939 |

| ADF [p-value] | −55.2 [0.000] | −10.6 [0.000] | −37.5 [0.000] | −42.7 [0.000] | −12.9 [0.000] | −38.4 [0.000] | −20.7 [0.000] | −12.4 [0.000] | −18.8 [0.000] | −20.5 [0.000] | −8.08 [0.000] | −19.2 [0.000] | −24.8 [0.000] | −7.8 [0.000] | −29.1 [0.000] | −33.7 [0.000] | −7.5 [0.000] | −29.1 [0.000] |

| Observations | 2415 | 572 | 1843 | 2415 | 572 | 1843 | 1261 | 842 | 1001 | 1261 | 842 | 1001 | 1154 | 312 | 260 | 1154 | 312 | 260 |

| Morocco | Full Period | Downward Period | Upward Period | |||||||||||||||

| Return (Rmt) | Dispersion (CSAD) | Return (Rmt) | Dispersion (CSAD) | Return (Rmt) | Dispersion (CSAD) | |||||||||||||

| All | COVID | Non-COVID | All | COVID | Non-COVID | All | COVID | Non-COVID | All | COVID | Non-COVID | All | COVID | Non-COVID | All | COVID | Non-COVID | |

| Mean | 0.0000 | 0.0000 | 0.0000 | 0.0105 | 0.0101 | 0.0105 | −0.0046 | −0.0056 | −0.0044 | 0.0105 | 0.0103 | 0.0105 | 0.0045 | 0.0051 | 0.0044 | 0.0045 | 0.0051 | 0.0106 |

| Std | 0.0069 | 0.0094 | 0.0062 | 0.0046 | 0.0047 | 0.0046 | 0.0054 | 0.0092 | 0.0042 | 0.0046 | 0.0052 | 0.0045 | 0.0049 | 0.006 | 0.0045 | 0.0049 | 0.0060 | 0.0046 |

| Median | 0.0001 | 0.0002 | 0.0000 | 0.0098 | 0.0094 | 0.0099 | −0.0033 | −0.0031 | −0.0033 | 0.0097 | 0.0095 | 0.0099 | 0.0031 | 0.0036 | 0.0031 | 0.0031 | 0.0036 | 0.0100 |

| Kurtosis | 17.621 | 23.365 | 4.8309 | 6.6563 | 10.790 | 5.7371 | 55.3772 | 33.4697 | 7.8272 | 3.9005 | 9.6039 | 1.6827 | 18.514 | 21.0557 | 14.0170 | 18.5138 | 21.0557 | 9.2527 |

| Skewness | −0.852 | −2.242 | 0.2983 | 1.4384 | 2.2377 | 1.2513 | −5.3094 | −5.0277 | −2.1504 | 1.2339 | 2.2342 | 0.9024 | 3.2414 | 3.8123 | 2.7822 | 3.2414 | 3.8123 | 1.5635 |

| Minimum | −0.088 | −0.088 | −0.0382 | 0.0000 | 0.0013 | 0.0000 | −0.0882 | −0.0882 | −0.0382 | 0.0013 | 0.0013 | 0.0014 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 |

| Maximum | 0.0545 | 0.0545 | 0.0508 | 0.0579 | 0.0461 | 0.0579 | 0.0000 | 0.0000 | 0.0000 | 0.0461 | 0.0461 | 0.0398 | 0.0545 | 0.0545 | 0.0508 | 0.0545 | 0.0545 | 0.0579 |

| ADF [p-value] | −23.6 [0.000] | −20.7 [0.000] | −44.3 [0.000] | −16.1 [0.000] | −8.9 [0.000] | −15.7 [0.000] | −11.6 [0.000] | −12.7 [0.000] | −27.9 [0.000] | −12.5 [0.000] | −6.7 [0.000] | −19.2 [0.000] | −21.6 [0.000] | −13.1 [0.000] | −20.2 [0.000] | −21.6 [0.000] | −13.1 [0.000] | −11.9 [0.000] |

| Observations | 3237 | 585 | 2652 | 3237 | 585 | 2652 | 1593 | 280 | 1313 | 1593 | 280 | 1313 | 1644 | 305 | 1339 | 1644 | 305 | 1339 |

| Saudi Arabia | Full Period | Downward Period | Upward Period | |||||||||||||||

| Return (Rmt) | Dispersion (CSAD) | Return (Rmt) | Dispersion (CSAD) | Return (Rmt) | Dispersion (CSAD) | |||||||||||||

| All | COVID | Non-COVID | All | COVID | Non-COVID | All | COVID | Non-COVID | All | COVID | Non-COVID | All | COVID | Non-COVID | All | COVID | Non-COVID | |

| Mean | 0.0002 | 0.0008 | 0.0001 | 0.0107 | 0.0115 | 0.0105 | −0.0074 | −0.0080 | −0.0073 | 0.0107 | 0.0119 | 0.0105 | 0.0065 | 0.0068 | 0.0065 | 0.0107 | 0.0113 | 0.0105 |

| Std | 0.0106 | 0.0116 | 0.0104 | 0.0095 | 0.0047 | 0.0103 | 0.0092 | 0.0116 | 0.0086 | 0.0053 | 0.0056 | 0.0052 | 0.0070 | 0.0069 | 0.0070 | 0.0120 | 0.0040 | 0.0132 |

| Median | 0.0007 | 0.0015 | 0.0005 | 0.0095 | 0.0104 | 0.0094 | −0.0047 | −0.0047 | −0.0046 | 0.0095 | 0.0103 | 0.0094 | 0.0048 | 0.0051 | 0.0047 | 0.0096 | 0.0105 | 0.0094 |

| Kurtosis | 11.192 | 14.249 | 10.1245 | 1400.35 | 3.6081 | 1263.651 | 17.1435 | 17.7381 | 14.6625 | 6.1517 | 3.5998 | 6.9446 | 27.340 | 22.1140 | 28.6598 | 1038.31 | 0.4542 | 875.3916 |

| Skewness | −0.777 | −1.737 | −0.4899 | 31.6361 | 1.4509 | 30.7500 | −3.4725 | −3.7523 | −3.2102 | 2.0206 | 1.6400 | 2.1235 | 3.7559 | 3.4142 | 3.8418 | 29.2477 | 0.7853 | 27.1715 |

| Minimum | −0.083 | −0.086 | −0.0727 | 0.0000 | 0.0042 | 0.0000 | −0.0832 | −0.0832 | −0.0727 | 0.0026 | 0.0042 | 0.0026 | 0.0000 | 0.0001 | 0.0000 | 0.0000 | 0.0042 | 0.0000 |

| Maximum | 0.0892 | 0.0707 | 0.0892 | 0.4497 | 0.0376 | 0.4497 | 0.0000 | 0.0000 | 0.0000 | 0.0481 | 0.0376 | 0.0481 | 0.0892 | 0.0707 | 0.0892 | 0.4497 | 0.0263 | 0.4497 |

| ADF [p-value] | −43.8 [0.000] | −23.3 [0.000] | −41.7 [0.000] | −23.2 [0.000] | −5.69 [0.000] | −16.2 [0.000] | −11.9 [0.000] | −7.2 [0.000] | −14.1 [0.000] | −12.8 [0.000] | −6.6 [0.000] | −11.8 [0.000] | −18.8 [0.000] | −14.6 [0.000] | −17.1 [0.000] | −26.4 [0.000] | −8.4 [0.000] | −35.7 [0.000] |

| Observations | 3252 | 584 | 2668 | 3252 | 584 | 2668 | 1472 | 236 | 1236 | 1472 | 236 | 1236 | 1780 | 348 | 1432 | 1780 | 348 | 1432 |

| Tunisia | Full Period | Downward Period | Upward Period | |||||||||||||||

| Return (Rmt) | Dispersion (CSAD) | Return (Rmt) | Dispersion (CSAD) | Return (Rmt) | Dispersion (CSAD) | |||||||||||||

| All | COVID | Non-COVID | All | COVID | Non-COVID | All | COVID | Non-COVID | All | COVID | Non-COVID | All | COVID | Non-COVID | All | COVID | Non-COVID | |

| Mean | 0.0002 | 0.0001 | 0.0002 | 0.0092 | 0.0097 | 0.0091 | −0.0032 | −0.0034 | −0.0032 | 0.0090 | 0.0096 | 0.0088 | 0.0032 | 0.0030 | 0.0033 | 0.0095 | 0.0097 | 0.0094 |

| Std | 0.0049 | 0.0050 | 0.0049 | 0.0035 | 0.0034 | 0.0035 | 0.0041 | 0.0048 | 0.0039 | 0.0034 | 0.0035 | 0.0034 | 0.0034 | 0.0029 | 0.0035 | 0.0035 | 0.0033 | 0.0036 |

| Median | 0.0002 | 0.0003 | 0.0001 | 0.0088 | 0.0092 | 0.0087 | −0.0021 | −0.0021 | −0.0021 | 0.0085 | 0.0091 | 0.0084 | 0.0023 | 0.0024 | 0.0023 | 0.0091 | 0.0093 | 0.009 |

| Kurtosis | 13.362 | 16.214 | 12.6900 | 4.1030 | 1.8553 | 4.6450 | 27.271 | 27.6436 | 26.0762 | 4.7867 | 1.2033 | 5.8450 | 23.669 | 6.3207 | 24.8964 | 3.6563 | 2.5444 | 3.8737 |

| Skewness | −0.825 | −2.190 | −0.5072 | 1.3514 | 0.9651 | 1.4425 | −4.3605 | −4.5884 | −4.2181 | 1.4542 | 0.9362 | 1.5879 | 3.4721 | 2.0100 | 3.6243 | 1.2728 | 0.9993 | 1.3302 |

| Minimum | −0.041 | −0.041 | −0.0406 | 0.0000 | 0.0033 | 0.0000 | −0.0410 | −0.0413 | −0.0406 | 0.0024 | 0.0033 | 0.0024 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0034 | 0.0000 |

| Maximum | 0.0419 | 0.0192 | 0.0419 | 0.0343 | 0.0278 | 0.0343 | 0.0000 | 0.0000 | 0.0000 | 0.0343 | 0.0239 | 0.0343 | 0.0419 | 0.0192 | 0.0419 | 0.0328 | 0.0278 | 0.0328 |

| ADF [p-value] | −41.8 [0.000] | −16.4 [0.000] | −38.5 [0.000] | −14.1 [0.000] | −6.9 [0.000] | −15.4 [0.000] | −15.3 [0.000] | −8.7 [0.000] | −15.7 [0.000] | −11.6 [0.000] | −5.1 [0.000] | −11.1 [0.000] | −22.7 [0.000] | −12.8 [0.000] | −20.7 [0.000] | −10.2 [0.000] | −8.9 [0.000] | −12.4 [0.000] |

| Observations | 3238 | 586 | 2652 | 3238 | 586 | 2652 | 1534 | 268 | 1266 | 1534 | 268 | 1266 | 1704 | 318 | 1386 | 1704 | 318 | 1386 |

Source: Own processing. Notes: The following table summarizes the descriptive statistics of the Geopolitical Risk Index (GPR) GPR, stock market return (Rmt), outside COVID-19 period (non-COVID), COVID-19 pandemic period (COVID), and all the period of study (All).

Table A2.

Descriptive statistics of the Geopolitical Risk Index.

Table A2.

Descriptive statistics of the Geopolitical Risk Index.

| Geopolitical Risk Index (January 2011–December 2023 Daily Data) | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| Full Period | Downward Period | Upward Period | |||||||

| GPR | All | non-COVID | COVID | All | non-COVID | COVID | All | non-COVID | COVID |

| Mean | 98.35472 | 98.1194 | 99.3929 | 98.32765 | 97.51158884 | 101.9879327 | 98.38502 | 98.6495 | 96.8157 |

| Median | 89.8371 | 92.00259 | 80.68528 | 89.29002 | 92.14398956 | 82.31444168 | 90.3169 | 91.8408 | 79.7252 |

| Std | 35.81419 | 27.68474 | 59.69934 | 36.38634 | 26.31625218 | 58.97796024 | 35.17507 | 28.82457134 | 60.3985 |

| Kurtosis | 17.44052 | 5.45242 | 9.522462 | 15.91628 | 3.916794733 | 9.938304877 | 19.41006 | 6.239832919 | 9.4318 |

| Skewness | 3.130593 | 1.684715 | 2.88806 | 3.072834 | 1.378386752 | 2.854495419 | 3.202703 | 1.87363995 | 2.9541 |

| Minimum | 38.49681 | 44.32216 | 38.49681 | 38.49681 | 47.87134171 | 44.55092239 | 44.55092 | 44.32216263 | 38.4968 |

| Maximum | 429.1786 | 275.4055 | 429.1786 | 429.1786 | 272.4951782 | 415.9637756 | 415.9638 | 275.4055481 | 429.1785 |

| ADF p-value | −10.1 [0.000] | −12.3 [0.000] | −4.98 [0.000] | −9.8 [0.000] | −11.5 [0.000] | −4.17 [0.0007] | −8.3 [0.000] | −10.7 [0.000] | −4.87 [0.0002] |

| Observations | 3128 | 2550 | 578 | 1652 | 1188 | 288 | 1476 | 1362 | 290 |

Source: Own processing.

Figure A1.

(A) Geopolitical Risk Index for the period 4 January 2011–29 December 2023.; (B) Downward stock market return for the period 4 January 2011–29 December 2023; (C) Upward stock market return for the period 4 January 2011–29 December 2023; (D) Non-COVID-19 stock market return for the period 4 January 2011–29 December 2023; (E) COVID-19 stock market return for the period 14 February 2020–30 June 2022.

Appendix B. Quantile Model Estimations

In this table, we present the estimations of the following herding behavior equation:

and .

Rm,t: stock market return, GPR: geopolitical risk index.

Table A3.

Quantile regression results.

Table A3.

Quantile regression results.

| Egypt | Jordan | Lebanon | Morocco | Saudi Arabia | Tunisia | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Quantiles | τ = 5% | τ = 95% | τ = 5% | τ = 95% | τ = 5% | τ = 95% | τ = 5% | τ = 95% | τ = 5% | τ = 95% | τ = 5% | τ = 95% |

| Constant | 0.00399 a | 0.0146 a | 0.0153 a | 0.0045 a | 0.000301 a | 0.00544 a | 0.00288 a | 0.0146 a | 0.00505 a | 0.0140 a | 0.00301 a | 0.0129 a |

| 0.381 a | 0.891 a | 0.411 a | 0.562 c | 0.821 a | 0.622 a | 0.684 a | 0.529 a | 0.329 a | 0.874 a | 0.692 a | 0.765 a | |

| 0.448 a | 0.290 a | 0.734 a | 0.703 a | 0.801 a | 0.884 a | 0.751 a | 0.598 a | 0.358 a | 0.277 b | 0.456 a | 0.488 a | |

| 0.566 a | 0.461 b | 0.538 a | 0.694 a | 0.902 a | 0.912 a | 0.578 a | 0.232 a | 0.437 a | 0.429 a | 0.928 a | 1.374 a | |

| 0.454 a | 0.104 | 0.868 a | 0.761 a | 0.792 a | 0.940 a | 0.772 a | 0.628 a | 0.415 a | 0.294 c | 0.505 a | 0.631 b | |

| −2.181 a | −8.893 a | 1.214 | −3.716 b | −1.545 a | 0.755 | −6.443 a | −1.869 b | −0.967 | −9.145 a | −3.619 a | −12.287 a | |

| −0.354 | 2.408 a | −7.639 a | −4.620 | 0.232 a | 0.122 a | −5.197 a | 5.803 c | 0.12 | 8.152 | 1.164 | −3.167 | |

| −3.699 a | 1.273 | −1.353 | −4.914 | −0.317 b | −0.435 | −4.054 b | 1.671 | −2.724 a | −4.394 a | −2.141 c | −6.376 | |

| 0.0524 | 11.855 a | −15.875 a | −10.907 | 0.0322 a | 0.00907 a | −7.728 a | 0.441 | −0.94 a | 9.235 b | 1.041 | 5.602 | |

| 9.02 × 10−6 b | 1.33 × 10−5 | 6.67 × 10−6 b | −4.73 × 10−6 c | 5.37 × 10−6 b | 9.95 × 10−5 c | −6.15 × 10−7 | −9.18 × 10−6 a | 6.92 × 10−6 | 3.70 × 10−5 | 3.18 × 10−6 a | −3.72 × 10−6 | |

| −3.67 × 10−6 | 2.78 × 10−5 b | −8.01 × 10−6 a | −6.33 × 10−6 b | 2.16 × 10−6 b | 3.80 × 10−5 c | −5.05 × 10−6 b | −1.17 × 10−5 a | 3.65 × 10−6 | 1.52 × 10−7 | 8.78 × 10−6 a | 2.19 × 10−6 | |

| 9.21 × 10−6 b | 3.56 × 10−5 | −2.01 × 10−6 | −7.22 × 10−6 c | −2.84 × 10−7 | 7.15 × 10−5 b | 5.33 × 10−6 | 4.69 × 10−6 | 2.05 × 10−6 | 8.35 × 10−6 | 8.68 × 10−8 | −1.56 × 10−6 b | |

| −1.03 × 10−6 | 3.80 × 10−5 b | −4.97 × 10−6 b | −2.38 × 10−6 | 2.37 × 10−6 c | 4.08 × 10−5 a | −2.39 × 10−6 | −1.10 × 10−6 | 1.94 × 10−6 | −6.15 × 10−6 | 7.48 × 10−6 a | 1.41 × 10−6 | |

| Pseudo R2 | 0.302 | 0.276 | 0.151 | 0.159 | 0.408 | 0.467 | 0.232 | 0.274 | 0.202 | 0.217 | 0.188 | 0.216 |

| Quasi-LR | 999.54 a | 646.16 a | 632.54 a | 344.882 a | 1062.24 a | 1043.51 a | 620.31 a | 487.32 a | 1083.2 a | 533.19 a | 383.35 a | 431.14 a |

Note: a, b, and c represent significance at the 1%, 5%, and 10% levels in the one tailed test, respectively. Source: Own processing.

Appendix C

Table A4.

Confirmation of the Hypotheses.

Table A4.

Confirmation of the Hypotheses.

| Hypothesis | H1 | H2 | H3 | |||

|---|---|---|---|---|---|---|

| Country | Lower Tail | Upper Tail | Lower Tail | Upper Tail | ||

| Egypt | Confirmed | Confirmed | Confirmed | Non-Confirmed | Confirmed | |

| Jordan | Non-Confirmed | Confirmed | Non-Confirmed | Confirmed | ||

| Lebanon | Confirmed | Non-Confirmed | Confirmed | Confirmed | ||

| Morocco | Confirmed | Confirmed | Non-Confirmed | Confirmed | ||

| Saudi Arabia | Non-Confirmed | Confirmed | Non-Confirmed | Non-Confirmed | ||

| Tunisia | Confirmed | Confirmed | Confirmed | Non-Confirmed | ||

Source: Own processing based on estimations.

Notes

| 1 | GPR variable is a quantitative measure which is designed to capture the level of risk and uncertainty in the international environment. This measure is associated with wars, terrorism, and tensions between states. |

| 2 | While the COVID-19 timeline was broadly aligned across Lebanon, Tunisia, Morocco, Jordan, Egypt, and Saudi Arabia, the dates of first cases and lifting of restrictions varied. In our analysis, we use the following period for each country: Egypt (14/02/2020–30/06/2022); Jordan (02/03/2020–07/04/2022); Lebanon (21/02/2020–07/04/2022); Morocco (02/03/2020–30/04/2022); Tunisia (02/03/2020–30/06/2022); and Saudi Arabia (02/03/2020–05/03/2022). |

| 3 | In their seminal work, () constructed a Geopolitical Risk Index (GPR) based on the frequency of newspaper articles that discuss the negative geopolitical events, tensions, and risks. |

References

- Ahmed Memon, B., Aslam, F., Naveed, H. M., Ferreira, P., & Ganiev, O. (2024). Influence of the Russia–Ukraine war and COVID-19 pandemic on the efficiency and herding behavior of stock markets: Evidence from G20 Nations. Economies, 12(5), 106. [Google Scholar] [CrossRef]

- Ahn, K., Cong, L., Jang, H., & Kim, D. S. (2024). Business cycle and herding behavior in stock returns: Theory and evidence. Financial Innovation, 10(1), 6. [Google Scholar] [CrossRef]

- Akhtaruzzaman, M., Boubaker, S., & Sensoy, A. (2021). Financial contagion during COVID-19 crisis. Finance Research Letters, 38, 101604. [Google Scholar] [CrossRef] [PubMed]

- Akin, I., & Akin, M. (2024). Behavioral finance impacts on US stock market volatility: An analysis of market anomalies. Behavioural Public Policy, 1–25. [Google Scholar] [CrossRef]

- Aslam, F., Ferreira, P., Ali, H., & Kauser, S. (2022). Herding behavior during the COVID-19 pandemic: A comparison between Asian and European stock markets based on intraday multifractality. Eurasian Economic Review, 12(2), 333–359. [Google Scholar] [CrossRef]

- Atrous, R. (2025). Clean and Dirty cryptocurrencies: Herding behavior during recent geopolitical crises. International Journal of Economics, Business and Management Research, 9(8), 140–156. [Google Scholar] [CrossRef]

- Baker, S. R., Bloom, N., Davis, S. J., & Terry, S. J. (2020). COVID-induced economic uncertainty. (No. w26983). National Bureau of Economic Research. [Google Scholar] [CrossRef]

- Bikhchandani, S., & Sharma, S. (2000). Herd behavior in financial markets. IMF Staff Papers, 47(3), 279–310. [Google Scholar] [CrossRef]

- Bogdan, S., Suštar, N., & Draženović, B. O. (2022). Herding behavior in developed, emerging, and frontier European stock markets during COVID-19 pandemic. Journal of Risk and Financial Management, 15(9), 400. [Google Scholar] [CrossRef]

- Bouri, E., Demirer, R., Gupta, R., & Nel, J. (2021). COVID-19 pandemic and investor herding in international stock markets. Risks, 9, 168. [Google Scholar] [CrossRef]

- Burke, M., Fry, J., Kemp, S., & Woodhouse, D. (2022). Attention to authority: The behavioural finance of COVID-19. Finance Research Letters, 49, 103081. [Google Scholar] [CrossRef]

- Caldara, D., & Iacoviello, M. (2022). Measuring geopolitical risk. American Economic Review, 112(4), 1194–1225. [Google Scholar] [CrossRef]

- Chang, E. C., Cheng, J. W., & Khorana, A. (2000). An examination of herd behavior in equity markets: An international perspective. Journal of Banking and Finance, 24(10), 1651–1679. [Google Scholar] [CrossRef]

- Chiang, T. C., Li, J., & Tan, L. (2010). Empirical investigation of herding behavior in Chinese stock markets: Evidence from quantile regression analysis. Global Finance Journal, 21(1), 111–124. [Google Scholar] [CrossRef]

- Christie, W. G., & Huang, R. D. (1995). Following the pied piper: Do individual returns herd around the market. Financial Analysts Journal, 51(4), 31–37. [Google Scholar] [CrossRef]

- Coskun, E. A., Lau, C. K. M., & Kahyaoglu, H. (2020). Uncertainty and herding behavior: Evidence from cryptocurrencies. Research in International Business and Finance, 54, 101284. [Google Scholar] [CrossRef]

- Enni, H. (2025). Herding behaviour during the COVID-19: Evidence from the German, US and UK stock markets. Available online: https://urn.fi/URN:NBN:fi-fe202502038713 (accessed on 28 October 2025).

- Gabbori, D., Awartani, B., Maghyereh, A., & Virk, N. (2021). OPEC meetings, oil market volatility and herding behaviour in the Saudi Arabia stock market. International Journal of Finance & Economics, 26(1), 870–888. [Google Scholar] [CrossRef]

- Ghorbel, A., Snene, Y., & Frikha, W. (2023). Does herding behavior explain the contagion of the COVID-19 crisis? Review of Behavioral Finance, 15(6), 889–915. [Google Scholar] [CrossRef]

- Hajizadeh, A., Seyedmohammadi, M., Nosratnejad, S., Najafi, B., Sadeghi-Bazargani, H., & Imani, A. (2024). A scoping review of COVID-19 economic response policies in the MENA countries: Lessons learned for Iran for future pandemics. Health Economics Review, 14(1), 106. [Google Scholar] [CrossRef]

- Ismiyati, I., Nurlatifasari, R., & Sumarlam, S. (2021). Coronavirus in news text: Critical discourse analysis detik. Com news portal. Journal of English Language Teaching and Linguistics, 6, 195–210. [Google Scholar] [CrossRef]

- Koutmos, D. (2024). Twitter economic uncertainty and herding behavior in ESG markets. Journal of Risk and Financial Management, 17(11), 502. [Google Scholar] [CrossRef]

- Lin, W., & Li, Y. (2019, August 2–4). Economic policy uncertainty and US REITs herding behaviors. 2019 Annual Conference of the Society for Management and Economics (Vol. 4, pp. 24–29), Madrid, Spain. Available online: https://www.webofproceedings.org/proceedings_series/ECOM/MSE2018/MSE1221006.pdf (accessed on 28 October 2025).

- Łukowski, M., Śliwiński, P., Gemra, K., & Maruszewski, J. (2025). Assessing risk and loss aversion: COVID-19 and investor behavior in the Polish stock market. Central European Management Journal, 1–17. [Google Scholar] [CrossRef]

- Medhioub, I. (2025). Impact of geopolitical risks on herding behavior in some MENA stock markets. Journal of Risk and Financial Management, 18(2), 85. [Google Scholar] [CrossRef]

- Medhioub, I., & Chaffai, M. (2021). Herding behaviour theory and oil price dispersion: A sectoral analysis of the Gulf Cooperation Council stock market. Journal of Asset Management, 22(1), 43–50. [Google Scholar] [CrossRef]

- Mohamad, A. (2024). Herding behaviour surrounding the Russo–Ukraine war and COVID-19 pandemic: Evidence from energy, metal, livestock and grain commodities. Review of Behavioral Finance, 16(5), 925–957. [Google Scholar] [CrossRef]

- Ngene, G. M., & Gupta, R. (2023). Impact of housing price uncertainty on herding behavior: Evidence from UK’s regional housing markets. Journal of Housing and the Built Environment, 38(2), 931–949. [Google Scholar] [CrossRef]

- Phadkantha, R., Yamaka, W., & Sriboonchitta, S. (2018, January 15–16). Analysis of herding behavior using Bayesian quantile regression. In International Econometric Conference of Vietnam (pp. 795–805). Springer International Publishing. [Google Scholar] [CrossRef]

- Ramelli, S., & Wagner, A. F. (2020). Feverish stock price reactions to COVID-19. The Review of Corporate Finance Studies, 9(3), 622–655. [Google Scholar] [CrossRef]

- Rubbaniy, G., Tee, K., Iren, P., & Abdennadher, S. (2022). Investors’ mood and herd investing: A quantile-on-quantile regression explanation from crypto market. Finance Research Letters, 47, 102585. [Google Scholar] [CrossRef]

- Salisu, A. A., & Akanni, L. O. (2020). Constructing a global fear index for the COVID-19 pandemic. Emerging Markets Finance and Trade, 56(10), 2310–2331. [Google Scholar] [CrossRef]

- Shrotryia, V. K., & Kalra, H. (2021). Analysis of sectoral herding through quantile regression: A study of S&P BSE 500 stocks. International Journal of Business & Economics, 20(1), 1–16. [Google Scholar]

- Sikder, M., Zhang, W., & Ahmod, U. (2020). The consequential impact of the COVID-19 pandemic on global emerging economy. American Journal of Economics, 10(6), 325–331. Available online: http://article.sapub.org/10.5923.j.economics.20201006.02.html (accessed on 28 October 2025).

- Ulussever, T., & Demirer, R. (2017). Investor herds and oil prices evidence in the Gulf Cooperation Council (GCC) equity markets. Central Bank Review, 17(3), 77–89. [Google Scholar] [CrossRef]

- Wang, C., Wang, D., Abbas, J., Duan, K., & Mubeen, R. (2021). Global financial crisis, smart lockdown strategies, and the COVID-19 spillover impacts: A global perspective implications from southeast Asia. Frontiers in Psychiatry, 12, 643783. [Google Scholar] [CrossRef]

- Wei, L., & Ahmad, Z. (2025). Impact of economic policy uncertainty on herd behavior in China stock market. International Journal of Banking and Finance, 20(2), 1–19. [Google Scholar] [CrossRef]

- Wu, G., Yang, B., & Zhao, N. (2020). Herding behavior in Chinese stock markets during COVID-19. Emerging Markets Finance and Trade, 56(15), 3578–3587. [Google Scholar] [CrossRef]

- Zhou, J., & Anderson, R. I. (2013). An empirical investigation of herding behavior in the US REIT market. The Journal of Real Estate Finance and Economics, 47, 83–108. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).