1. Introduction

Corruption is a widespread and systemic issue with far-reaching consequences for sustainable economic development (

Appiah et al., 2019;

Kim et al., 2017), impacting efficient resource allocation (

Jancsics, 2019), social equity (

Johnston & Fritzen, 2020), and public trust in institutions (

Bauhr & Charron, 2025). In recent decades, the increasing perception of corruption, along with numerous public scandals, has brought this topic to the forefront of both public and academic agendas (

Gonzalez et al., 2019;

Gouvêa Maciel et al., 2024). In a global context marked by economic instability, geopolitical tensions, and health crises, corruption not only exacerbates income inequality (

Yan & Wen, 2020) but also undermines the foundations of sustainable development (

Hoinaru et al., 2020;

Saha & Ben Ali, 2017).

Unequal income distribution remains one of the most persistent sources of social imbalance (

Krylova et al., 2023). This is often exacerbated by endemic corruption, which reduces the efficiency of public resource redistribution (

Epstein & Gang, 2019) and limits equal access to essential public services (

Mugellini et al., 2021) such as education (

Damijan, 2023), healthcare (

Chichi, 2023), and social protection (

Banerjee et al., 2024). At the same time, corruption affects the quality of governance (

Monteduro et al., 2016), skews public policymaking, and hinders human capital investment, essential aspects for long-term economic development (

Caporale et al., 2015).

Income inequality can no longer be regarded solely as an outcome of market mechanisms (

Nolan et al., 2019;

Polacko, 2021) or productivity gaps (

Savaș & Çakmak Şahin, 2021), but rather as a direct consequence of institutional weaknesses (

Oualy, 2021) and poor governance capacity (

Ngamaba et al., 2018). Corruption exacerbates the vulnerabilities of the low-income households (

Sayeed, 2023), especially during periods of economic instability, reducing their ability to adapt and to benefit from state support. This weakens not only equity but also social resilience, key elements of sustainable economic development (

Akhtar et al., 2025).

While a significant body of research explores the effects of corruption on economic performance and inequality, several critical gaps remain, particularly in the European Union countries. Despite growing attention to corruption and inequality, most studies either treat the EU as institutionally homogenous or adopt a country-specific focus, leaving insufficient understanding of how differing institutional capacities and governance structures shape unequal growth trajectories across member states.

The objective of this paper is to analyze the relation between corruption, income inequality, and sustainable economic development in the European Union. By employing econometric models applied to distinct subsamples (EU-27, NMS, and OMS), this paper aims to highlight how the perception of corruption influences income distribution and the potential for sustainable development in economies at different levels of institutional and economic maturity. In the present study, the variable measuring corruption is one that reflects the subjective nature of the phenomenon, namely the Corruption Perceptions Index, developed by Transparency International, which relies on the perceptions and evaluations of social and institutional actors rather than on direct measures of acts of corruption.

However, Transparency International’s approach has been widely critiqued for privileging the perspectives of business elites, foreign investors, and institutional stakeholders, often marginalizing the views of civil society and ordinary citizens who directly experience corruption in everyday interactions with the public sector and the government. Consequently, while the Corruption Perception Index serves as a prominent and influential benchmark for the phenomena, it cannot be regarded as a comprehensive measure of corruption and should be complemented with alternative indicators such as Edelman’s Trust Barometer, media independence indices, or assessments of judicial integrity, which better capture public trust and the societal dimensions of corruption.

This suggests that the research results reflect the general climate of trust and the reported experiences regarding the functioning of public institutions, rather than the actual and quantifiable incidence of corruption.

In doing so, it acknowledges the structural nature of the factors under examination and clarifies that the scope of the research is confined to a quantitative economic perspective. Within the framework, the analysis seeks to capture general patterns of evolution, interpreting them as indicative of overarching tendencies rather than as exhaustive accounts of individual cases or specific practices.

The paper aims to address the following research questions:

- -

How does the perception of corruption relate to income inequality in the EU?

- -

Are there significant differences between old (OMS) and new (NMS) member states regarding the impact of corruption on economic equity?

The novelty of the paper is to develop a framework that connects corruption not only to GDP growth but also to sustainable development dimensions, capturing its effects on long-term equity and prosperity in the EU.

Regarding the findings of the research, it is important to mention that the results should be understood as macro-patterns at the national level, reflecting structural regularities, aggregate tendencies, and institutional diversity.

The relation between corruption and inequality is characterized by a self-reinforcing loop, where the more corrupt states tend to also have an increased inequality level. The present analysis is characterized by an exploratory and descriptive approach, aiming to identify structural regularities and general trends without formulating exhaustive explanations or pursuing the testing of strict causal hypotheses.

However, the findings of the present research highlighted that the impact of education is not linear it appears rather as contingent upon broader contextual conditions, variations in accordance with the institutional settings, and the socio-economic background, which may amplify, moderate, or even redirect its effects on the outcomes under investigation.

The remainder of the paper is organized as follows:

Section 2 approaches the literature review; data and methods are addressed in

Section 3;

Section 4 approaches the results;

Section 5 is dedicated to discussions and the limitation of the research, while conclusions are presented in

Section 6.

2. Literature Review

The rise in income inequality observed in recent decades has been accompanied by significant macroeconomic risks (

Kind et al., 2017). Income inequality is frequently associated with financial instability (

Padayachee, 2017), economic stagnation (

Akyüz, 2018), declining domestic demand (

Zucman, 2019), and weakened aggregate consumption (

Ferreira et al., 2015). This relationship directly impacts economic development, as high levels of inequality reduce the economy’s ability to stimulate growth and to fully harness its potential (

Peterson, 2017;

Škare & Prziklas Druzeta, 2016;

Trump, 2020).

Inequality leads to cumulative effects (

Carlisle & Maloney, 2023) high-income households tend to save more, while lower-income households allocate a larger share of their income, thus limiting the aggregate potential for savings and investment at the societal level. This dynamic sustains economic inequalities, limits upward mobility, and negatively impacts long-term economic growth (

Howarth & Kennedy, 2016;

Mdingi & Ho, 2021).

Furthermore, income inequality cannot be dissociated from the institutional structure of the state and the quality of the governance (

Schneider, 2016). Nations marked by fragile institutions, political unrest, and endemic corruption generally tend to experience higher levels of inequality (

Bulut & Çavuşoğlu, 2023;

Elsässer & Schäfer, 2023). In these settings, public policies are often captured by narrow interest groups, leading to inefficient income redistribution (

Erikson, 2015;

Martinez-Vazquez et al., 2017), and investments in education and healthcare end up being chronically underfunded (

McPake et al., 2023).

Corruption misappropriates public funds, diverting them from their productive and essential social functions, such as health, education, infrastructure, and social protection, and redirecting them toward personal enrichment, clientelist networks, or narrow interest groups that often fail to reflect the broader needs of society, benefiting only a small elite (

Charmaine et al., 2024;

Jimenez Serrano et al., 2025). Through these mechanisms, corruption undermines the redistributive role of the state and significantly weakens governments’ capacity to implement fair and effective economic policies (

Burguet et al., 2018). Rather than mobilizing and channeling resources to reduce inequalities and support sustainable development, funds are redirected to privileged groups who disproportionately benefit, thereby deepening economic polarization.

This process has systemic effects on citizens’ trust in public institutions. When governments are perceived as corrupt and inefficient, trust in economic policies and the rule of law declines significantly (

Zhang & Kim, 2018). This results in a delegitimization of public intervention and a withdrawal of citizens from economic and active civic participation, which perpetuates instability and weakens social cohesion.

Cumulatively, corruption evolves into a structural driver of a self-reinforcing cycle of inequality and persistent underdevelopment (

Meyer et al., 2025). On one hand, inequality creates favorable conditions for corruption by weakening democratic oversight and institutional accountability (

Berggren & Bjørnskov, 2020). On the other hand, corruption deepens inequality by obstructing equitable access to socio-economic opportunities, reinforcing a system in which social mobility becomes increasingly difficult (

Boarini et al., 2018). Thus, corruption is not merely a moral or administrative issue but a major economic factor that hinders economic growth, distorts resource allocation, and undermines any genuine effort to reduce social disparities (

Jimenez Serrano et al., 2025;

López Claros, 2015).

Also, an aspect that is worth highlighting regarding the institutional analysis is the role of trade unions, especially in the OECD member states, regarding the labor force market and wage politics. The trade unions contribute to the increase in institutional transparency through their collective negotiation mechanisms and their capacity to establish clear standards in labor market regulation. In this way, they can function like relevant actors in consolidating the anticorruption policies, offering a counterweight to the tendencies of institutional capture by business interests or political actors (

Gumbrell-McCormick & Hyman, 2019).

The importance of these institutions is especially visible in countries such as Germany or France, where the trade unions act like a pillar of civil society against the rent-seeking behavior of economic and political elites. Through promoting sustainable wage growth and limiting the excessive income differences, these organizations not only reduce the social inequalities, they also increase the legitimacy and the resilience of the democratic institution. In this regard, the role of the trade unions goes beyond the purely economic domain, emerging as a crucial component of transparent and fair governance (

Valentini et al., 2020).

The link between economic growth and income inequality is inherently complex and multidimensional, generating significant debate in the academic literature (

Huynh & Tran, 2023). Although economic development is often perceived as a natural means of improving the overall standard of living and reducing the disparities, empirical evidence suggests that the relationship between growth and equity is far from guaranteed or linear (

Wuepper & Lybbert, 2017). In certain contexts, economic growth can contribute to the expansion of the middle class, increased employment, and a more equitable distribution of resources by strengthening the state’s capacity to implement effective redistributive policies (

Clements et al., 2015). Nonetheless, the positive outcomes are not guaranteed, relying heavily on the design and implementation of social and economic policies.

A growing body of empirical research shows that in many economies, income inequality persists despite economic growth, suggesting that growth alone is not sufficient to ensure equitable development (

Chletsos & Sintos, 2023). This reality challenges the notion that economic progress, in itself, inevitably leads to a reduction in income disparities. On the contrary, in the absence of strong institutions and effective redistribution mechanisms, the benefits of growth may become concentrated within a narrow segment of the population, intensifying economic polarization and social exclusion. This underscores the importance of state intervention through well-targeted public policies aimed at promoting both economic growth and the correction of existing structural imbalances in income distribution (

Adanma & Ogunbiyi, 2024).

In this regard, the state plays a crucial role in ensuring that the outcomes of development are shared equitably through investments in education, healthcare, social protection, and infrastructure. Institutional quality is an essential part of the process, as transparent, accountable, and efficient governments are better positioned to implement inclusive economic policies that respond fairly to the needs of the population.

Economic development should not be viewed in isolation but in relation to other structural factors and the public policies in place. Sustainable economic development is only possible under conditions where governance is oriented toward inclusion and economic policies are designed to reduce inequality and provide real opportunities for all citizens, regardless of their socio-economic status.

Tertiary education and employment rate are key factors in addressing and explaining income inequality. Access to stable, well-paid jobs is one of the main routes out of poverty, improving living standards and reducing economic disparities. However, this access is uneven and shaped by education levels, local economic conditions, and national employment policies. Education often enhances adaptability and employability in a context of global changes regarding the labor market, especially digitalization, green transition, and automation. Moreover, higher education is associated with greater civic engagement, trust in institutions, and support for redistributive policies, fostering this way social cohesion (

Kochan & Riordan, 2016;

Mijs, 2021;

Reinders et al., 2021;

Sauer et al., 2023).

Unequal access to education contributes significantly to income gaps and limits social mobility, especially when disparities are tied to regional or socio-economic background. In such contexts, education can either reduce inequality or reinforce it, depending on policy choices. Unemployment, especially long-term or structural, exacerbates exclusion and affects vulnerable groups most. High unemployment lowers household income and deepens polarization. Therefore, reducing inequality requires integrated strategies that combine quality, accessible education with active labor market policies to ensure broad, equitable participation and inclusive, sustainable development (

Koswara, 2024).

Public expenditures on social protection can serve as an effective tool for reducing inequality, provided they are well-targeted and not undermined by corruption or political clientelism. Countries that allocate resources fairly to equitable and effective social support systems generally succeed in maintaining lower levels of income polarization and in reducing the risk of social exclusion. The effectiveness of these systems depends on political stability and the state’s institutional capacity to manage economic resources in a transparent and accountable manner (

Popova, 2023).

Corruption and political instability severely undermine the state’s ability to redistribute income effectively. In the absence of strong institutions and a predictable governance framework, social support policies risk being captured by elites or applied unevenly, further exacerbating income disparities. This risk is particularly acute in emerging or transitional economies, where democratic institutions are often fragile and economic policies can be inconsistent and vulnerable to political influence, limiting their capacity to support inclusive development and to reduce inequality (

Kaplan & Akçoraoğlu, 2017;

Singh, 2019).

Income inequality has a significant impact on economic development, affecting growth dynamics, resource allocation efficiency, and macroeconomic stability. Societies marked by pronounced income disparities are more vulnerable to social instability, exhibit weaker domestic demand, and have a reduced capacity to harness the full potential of human capital. In such contexts, economic development tends to be fragmented and unsustainable, disproportionately benefiting only certain social groups. Understanding this systemic impact is essential for designing public policies capable of mitigating the negative effects of inequality and creating the foundations for sustainable, equitable, and socially inclusive growth (

Jauch & Watzka, 2016;

Omar & Inaba, 2020;

Ratnawati, 2020).

3. Data and Methods

This paper shows the effect of corruption on income inequality, emphasizing how factors such as urbanization, education, employment, and social spending can either amplify or mitigate this phenomenon, directly influencing an economy’s ability to sustain equitable and sustainable development.

The research design of this article is based on the PCSE model proposed by

Yu (

2010), a study that concludes that income inequality at the country level is significantly influenced by the level of education, investments in social protection expenditures, and the employment rate. Moreover, the results are sensitive to the estimation technique used.

This analysis covers the period 2003–2023 and includes all 27 member states of the European Union, as follows: Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, and Sweden. The research analyzes the impact of corruption on income inequality in the New Member States (NMS) and Old Member States (OMS) of the European Union. The New Member States include Bulgaria, Croatia, Cyprus, Czechia, Estonia, Hungary, Latvia, Lithuania, Malta, Poland, Romania, Slovakia, and Slovenia. The Old Member States are Austria, Belgium, Denmark, Finland, France, Germany, Greece, Ireland, Italy, Luxembourg, the Netherlands, Portugal, Spain, and Sweden. The sample division is anchored in the 2004 enlargement, which marked a significant shift in the structure of the Union and highlighted economic and institutional differences between the two groups (

Anders & Lorenz, 2021;

Olsen, 2020;

Vachudova, 2019). Due to the structural variation in the present sample, such an approach allows a more accurate analysis. Given that the group of New Member States is composed both of former satellite states of the USSR and former Soviet republics, distinct particularities can be observed in their modes of organization and governance, which affect the control of corruption and the dynamics of income inequality. Thus, the division between old and New Member States seeks to emphasize these structural variations.

In addition to the variables used in Yu’s study, this paper further addresses income inequality by using institutional and socio-economic factors suitable for the countries included in the research. These variables significantly influence income inequality across the analyzed states.

The current research adapts the variables used in the model to the structure of the European Union, aiming to assess the extent to which these factors influence income inequality among member states. The model uses the Gini Index as the dependent variable and includes the following independent variables: GDP per capita, the percentage of GDP allocated to social protection, the share of the population with tertiary education, the Corruption Perceptions Index, the unemployment rate, and the degree of urbanization. While national aggregates provide consistency in cross-country comparison, they may dilute the regional disparities within member states that are often central to understanding the dynamics of corruption and inequality.

Table 1 presents the variables used in the model, the abbreviations, the units of measure, and the source of the data used in the model in order to gain a comprehensive understanding of the relationship between these factors and income inequality.

To assess the effect of corruption on income inequality, the following model was applied:

In the regression equation, the Gini Index is the dependent variable, while the independent variables include GDP_PCi,t, Sp_Expi,t, TEdi,t, Unempi,t, Urbi,t, and Corri,t, i represents each country in the dataset, while t denotes the time periods. β represents the coefficients of each variable, while δ, γ, and µ are the error terms. Within the study, four econometric models were applied, as detailed below.

Firstly, the ordinary least squares method is not feasible in the analysis, since the conducted tests revealed the presence of heteroskedasticity. This problem affects the consistency and efficiency of the estimations, leading to misrepresented standard errors and, implicitly, to unreliable statistical conclusions. In such a context, the use of the OLS regression would generate results that cannot be considered valid for robust interpretations.

Secondly, the random effects model and the fixed effects model encounter significant technical difficulties, since they fail to achieve convergence throughout all iterations. The lack of convergence suggests instability in the parameter estimations and raises concerns regarding the validity of the models for the dataset under analysis. These limitations considerably reduce the level of confidence that can be placed in the results obtained through these techniques.

Although the panel-corrected standard error estimations manage to partially compensate for the distortions caused by heteroskedasticity and the correlation between units, they do not remove the fundamental uncertainties related to the issue of causality and the correct specification of the model. Thus, even when these estimates seem to yield more robust results, they still leave open questions regarding the validity of the theoretical conclusions and the practical applicability of the econometric model.

The Gini Index was chosen as the dependent variable, as it most frequently and concisely reflects the level of income distribution inequality (

Charles et al., 2022;

Giorgi & Gigliarano, 2017;

Sitthiyot & Holasut, 2020). GDP per capita was included to capture the relation between economic development and inequality (

Brueckner & Lederman, 2018;

Oishi & Kesebir, 2015;

Vu & Nghiem, 2016;

Yang & Greaney, 2017). The percentage of GDP allocated to social protection reflects the state’s role in income redistribution, while the level of tertiary education highlights human capital and access to economic opportunities (

Arshed et al., 2019;

Coady & Dizioli, 2018;

Munir & Kanwal, 2020;

Nabassaga et al., 2021). The models used in the research fail to capture the qualitative variations in accessibility and in the distribution of educational opportunities, as these lie beyond its scope of validity.

Corruption perception was included to capture the quality of governance, as institutions play a crucial role in promoting equity and inclusive economic development. A high level of perceived corruption is often associated with weak institutions, inefficient redistribution, and limited access to opportunities, which can exacerbate income inequality (

Batabyal & Chowdhury, 2015;

Policardo et al., 2019;

Saha et al., 2021). The use of subjective variables, such as the Corruption Perceptions Index, requires careful consideration when interpreting and applying the results. This is because the index reflects the views of experts and the business environment regarding corruption, rather than objective measurements of the phenomena. Therefore, objectivity cannot be guaranteed, and the variation in the score can express either real changes in the extent of the phenomenon of corruption or changes in the way it is perceived by different actors. Hence, the results should be interpreted with caution, and wherever possible, they should be supplemented with objective data such as judicial statistics, official reports, or concrete anti-corruption measures in order to outline a more accurate representation of reality. The Corruption Perceptions Index (CPI), published annually by Transparency International, provides a comparative assessment of perceived corruption in the public sector. Scores range from 0, indicating very high levels of corruption, to 100, reflecting very low levels (

Transparency International, 2025). Between 2003 and 2023, the European Union registered only a modest improvement in its average CPI score, rising from 61.2 to 64.6 points. This limited gain of 3.4 points over two decades suggests a relative stability of the overall landscape, without evidence of major structural transformation. However, a closer analysis shows that significant changes are concentrated in certain regions rather than occurring uniformly across the board.

The Eastern region stands out through a clearly positive trajectory. The average CPI scores increased by nearly eleven points between 2003 and 2009 and 2017–2023. This trend reflects the process of institutional convergence driven by EU accession conditionalities, post-accession monitoring mechanisms, and reforms aimed at strengthening the rule of law. Illustrative examples include Bulgaria (+34 points), Latvia (+22), and Estonia (+21), all of which underscore the magnitude of the progress. At the same time, however, several questions remain regarding the socio-economic dimension of this trajectory. In Eastern European countries, concerns have been raised about the potential concentration of wealth among elites, the implications of income tax policies, and the ongoing challenges in revenue collection (

Dimitrova, 2020). These factors may not directly undermine the progress reflected in CPI scores, but they highlight structural vulnerabilities that can impact perceptions of fairness and institutional legitimacy in the long run (

Imerman, 2018).

The Northern countries, although they continue to occupy the top positions in the European ranking, have recorded a moderate decline in scores in recent years. This evolution does not indicate a growing corruption but rather a gradual erosion of their long-standing comparative advantage. The Western countries had a similar trajectory, with a slight loss of points, reflecting stagnation and, in some cases, vulnerabilities related to integrity scandals or institutional weaknesses. This trend is often associated with structural causes such as decreased investment in social protection or uneven distribution of economic growth, which, while not directly linked to corruption, can exacerbate perceptions of institutional fragility (

Sakamoto, 2021).

The Southern states, such as Italy, Greece, Spain, or Portugal, present a virtually flat dynamic in the long run. The fluctuations can be explained primarily by contextual factors such as economic crises, reforms, or political controversies rather than by a consistent structural trend. Taken as a whole, the region remains characterized by a lower level of scores, but without major variations between the beginning and the end of the period under review.

These findings confirm that each state—that is, each country—sustains a fixed baseline level of corruption, around which variations in varying intensity emerge. In the East, these deviations are substantial and positive, suggesting a convergence process. In North and West Europe, the variations are negative but moderate, indicating an erosion of the initial advantage. In the South, the deviations are minimal, pointing to a structural stability.

The general landscape of the perceived corruption in the European Union in the 2003–2023 period is one of relative stability at the general level, with significant localized transformations. Eastern Europe shows visible convergence and substantial gains, while Northern and Western Europe register a slight loss of ground, and Southern Europe remains almost unchanged. The final outcome is a narrowing of structural differences between regions, without, however, altering the fundamental order: the Nordic and Western states remain the least corrupt, whereas the Southern and Eastern states continue to display higher levels of perceived corruption, even though the gaps are diminishing.

The unemployment rate reflects labor market distortions that may increase inequality, while the degree of urbanization is relevant, as urbanization is often linked to greater economic mobility and the reduction in regional disparities (

Carvalho & Di Guilmi, 2020;

Ogbeide & Agu, 2015). Although including cultural or political variables would have constituted a significant advantage for the present research, contributing to obtaining more accurate results, the lack of such data at the European level required their exclusion from the present analysis. Therefore, the results can be interpreted rather as macro-patterns at the state level, which tend to blur regional disparities and to omit the qualitative dimensions of the phenomenon.

To test the interdependence among the variables included in the dataset, we used a correlation matrix. This statistical instrument summarizes the data in the dataset, providing information about the direction and strength of the relationships between variables. The research employs panel data analysis techniques, as they are the most appropriate for the structure of the dataset. The study uses a time-series cross-sectional dataset collected from the 27 European Union member states over multiple years.

The analysis highlights the occurrence of correlations within the variables, but these results shouldn’t be mistaken for absolute causal relationships, as methodological limitations prevent the attribution of cause–effect links and restrict the interpretation to the level of observable associations.

The applied model accounts for unobserved heterogeneity specific to each unit (

Zaki et al., 2022), thereby producing more robust estimates while reducing errors caused by the omitted variables.

Additionally, to correct for issues of autocorrelation and heteroscedasticity in the panel data (

Kumar, 2023), the study applies robust estimation techniques such as PCSE (Panel-Corrected Standard Errors), which are particularly well-suited for datasets with a large number of cross-sectional units and relatively short time periods, as is the case here.

Table 2 presents a statistical description of the main variables used in the research for the EU-27.

According to

Table 2, the variable with the highest standard deviation is the Corruption Perception Index (Corr), at 16.39, indicating substantial variation in governance quality perceptions across countries. With values ranging from 28 to 97 and a mean of 63.78, this dispersion reflects significant heterogeneity in institutional integrity and public trust in governance among the sampled countries.

The second highest standard deviation is associated with the degree of urbanization (Urb), at 12.71. Despite a relatively high mean value of 72.52, the urbanization rate ranges from 51.08 to 98.19, revealing pronounced differences in the extent of urban development across countries. The third highest dispersion is observed for the percentage of the population with tertiary education (TEd), which has a standard deviation of 8.46. With a mean of 25.37 and values ranging from 7.9 to 46.6, this variability reflects significant differences in access to and attainment of higher education across nations. This dispersion underscores variation in the capacity of countries to produce a highly skilled labor force.

In contrast, the variable with the lowest standard deviation is unemployment (Unemp), at 2.56, with a mean of 5.22 and values ranging from 1.3 to 17.3. This suggests relatively low variability in unemployment rates across the sample. The Gini Index shows moderate dispersion, with a standard deviation of 3.70, values between 23.2 and 41.3, and a mean of 31.29, pointing to differences in income inequality across countries, though not extremely pronounced.

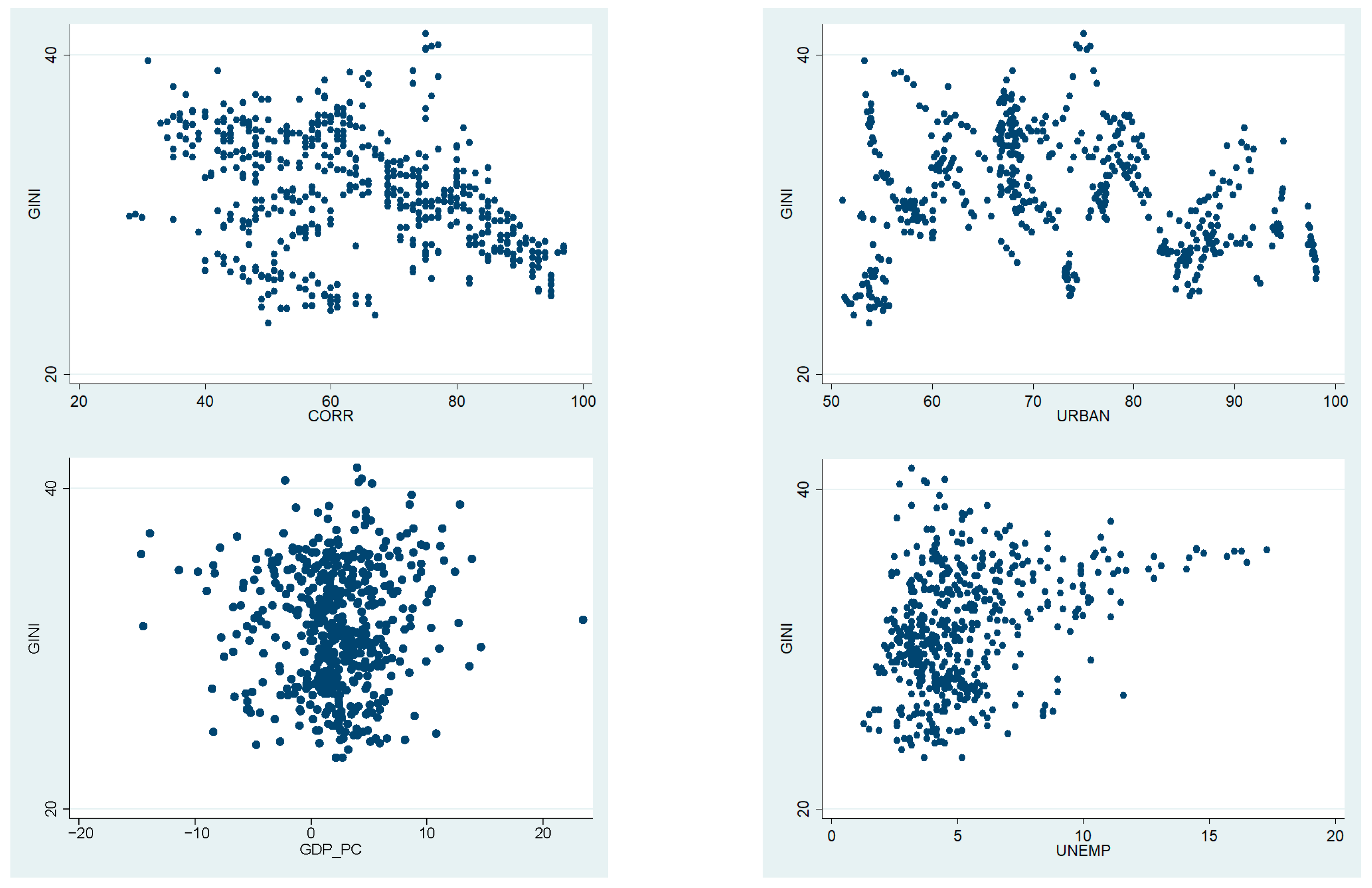

Social Protection Expenditure (Sp_Exp) and GDP per capita (GDP_PC) both show similar levels of variability, with standard deviations of 4.09. For Sp_Exp, values range from 7.5 to 27.1, and the mean is 16.45, suggesting diverse levels of allocation for social protection. GDP_PC, with values from –14.64 to 23.44 and a mean of 2.05, reflects notable disparities in economic development. Regarding data coverage, most variables include 567 observations, except for Gini (524), Sp_Exp (546), and TEd (566), pointing to some missing data that may be relevant in the estimation strategy. Looking at the scatterplot in the

Appendix A,

Figure A1, it enables us to form an overall view of the relationship between income inequality and the other variables across the European Union.

Table 3 provides descriptive statistics for both New Member States (NMS) and Old Member States (OMS).

For the New Member States (NMS), the highest standard deviation is recorded for the degree of urbanization (10.84), corruption perception index (10.5), and tertiary education (8.11), reflecting a high degree of variability between the countries.

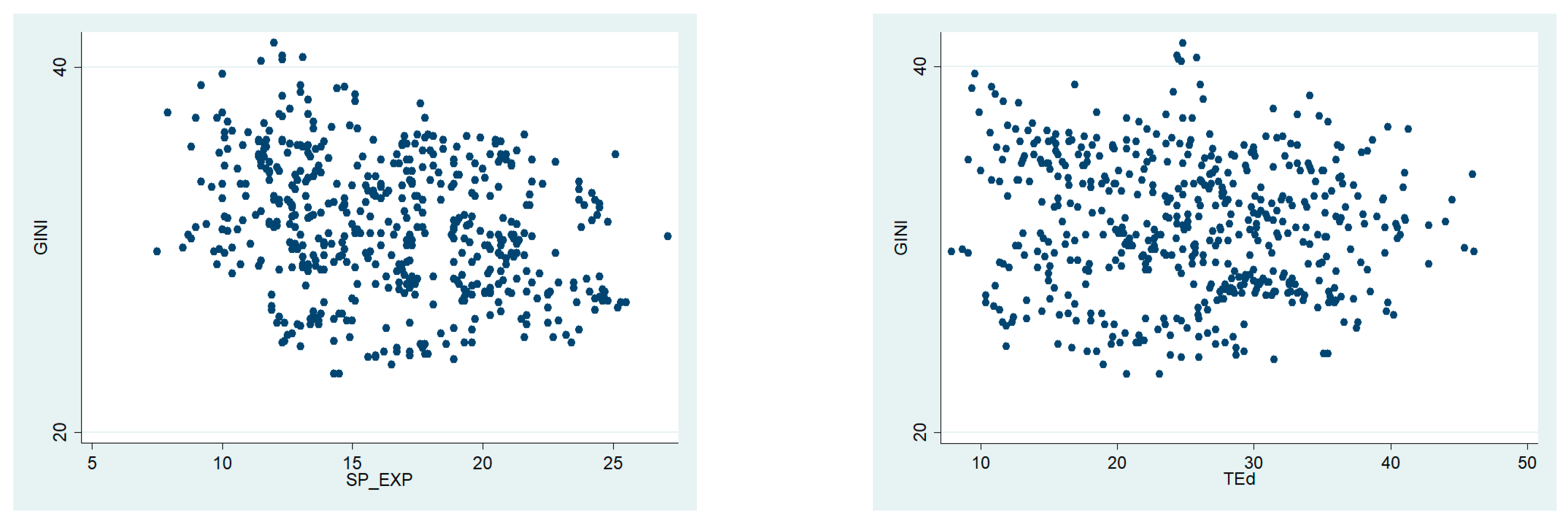

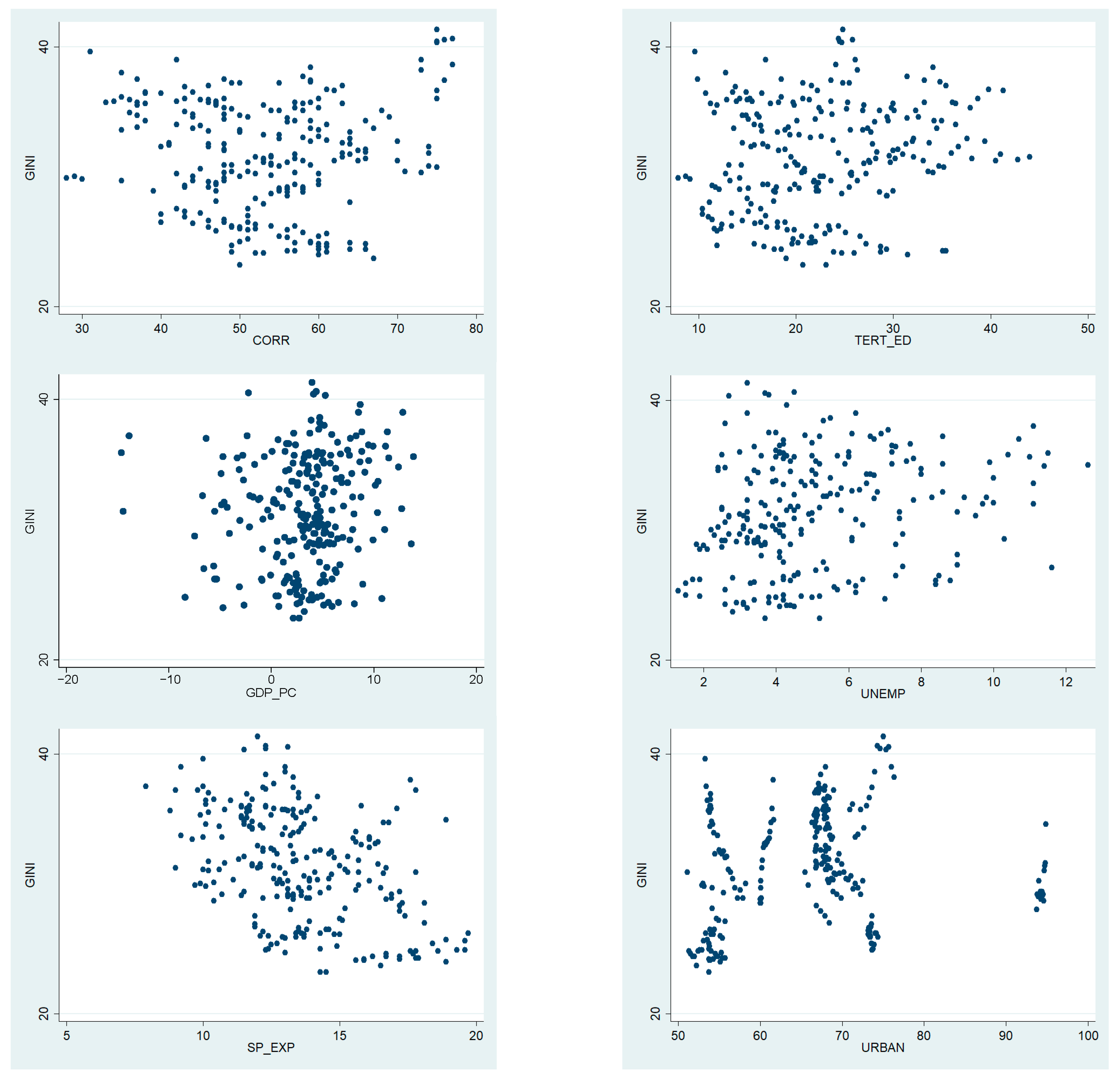

In the Old Member States (OMS), the highest variability is observed in corruption perception (14.7), degree of urbanization (11.45), and tertiary education (8.0). Significant differences in means and dispersion, particularly in GINI, degree of urbanization, and corruption perception, suggest the existence of structural imbalances between the two groups, which is relevant for interpreting the econometric results. The scatterplots in

Appendix A Figure A2 and

Figure A3 emphasize the relationships between income inequality and the explanatory variables for both the New and Old Member States of the European Union.

4. Results

Table 4,

Table 5 and

Table 6 present the correlation matrices for the entire European Union, the New Member States, and the Old Member States, respectively.

In the sample covering the entire European Union, the strongest positive correlation is observed between the Corruption Perception Index (Corr) and the percentage of the population with tertiary education (r = 0.5449), suggesting that countries with better-educated populations tend to have more favorable perceptions of governance and lower levels of perceived corruption. Similarly, the Corruption Perception Index is positively correlated with the urbanization rate (r = 0.5317), suggesting that more urbanized countries report a higher governance quality. Another noteworthy correlation is between Corr and the Sp_Exp (r = 0.5061), implying that the countries with a higher perceived corruption have higher allocation with social protection.

The strongest negative correlations are found between the Corruption Perception Index and income inequality (GINI) (r = −0.3213), between social protection expenditures (Sp_Exp) and GINI (r = −0.2881), and between corruption and unemployment (r = −0.2523).

The findings indicate that higher levels of economic development and increased social spending are correlated with reduced income inequality (

Cammeraat, 2020). From a social policy standpoint, sustained investment in inclusive welfare systems can help address social and economic disparities, especially in societies facing governance challenges or widespread perceptions of corruption (

Koeswayo et al., 2024). In addition to their redistributive effects, well-designed social protection schemes can reduce long-term structural inequalities by expanding access to healthcare, education, and employment opportunities. These improvements foster social cohesion and enhance the legitimacy of democratic institutions (

Charron & Rothstein, 2018).

The observed relationship suggests a broader policy implication: social spending should be regarded as a strategic investment in societal stability rather than solely as a budgetary expense. By addressing the risks associated with poverty and social exclusion, governments can decrease the likelihood of political discontent and help maintain public trust in state institutions. In settings where corruption is prevalent, a robust welfare system can partially offset governance deficits by demonstrating responsiveness to citizens’ needs and reinforcing perceptions of fairness.

In practical terms, these results underscore the need to design social protection policies as both economic stabilizers and tools for building trust and institutional resilience. Strengthening welfare regimes should be integrated into broader governance strategies, where efforts to reduce inequality and enhance transparency reinforce each other and contribute to economic development and democratic consolidation.

For the Old Member States (OMS), the strongest positive correlations are observed between tertiary education (TEd) and the degree of urbanization (0.4817), as well as between TEd and Corr (r = 0.42873). A notable positive association is also found between the Corruption Perception Index (Corr) and the degree of urbanization (r = 0.3899).

The strongest negative correlation appears between Corr and the Gini index (r = −0.7706), suggesting that in countries where corruption is perceived to be lower, income inequality is also reduced. Other noteworthy negative correlations include those between urbanization and GINI (r = −0.5432) and between unemployment rate and Corr (r = −0.4931), indicating that urban development and higher education levels may contribute to reducing inequality in these countries.

For the New Member States (NMS), the strongest positive correlations are found between TEd and Corr (r = 0.6029) and between Urban and CorrI (r = 0.2496). These results suggest that a higher level of tertiary education is associated with greater income and more favorable perceptions of governance. The most significant negative correlations are observed between social protection expenditures (Sp_Exp) and GINI (r = −0.4584) and between Sp_Exp and Urban (r = −0.3811), indicating that countries with a higher degree of urbanization and greater social spending tend to exhibit lower levels of income inequality.

Three types of models were used in the analysis: OLS, random effects model (REM), and fixed effects model (FEM), as these are among the most widely applied approaches in panel data research (

Ang & Dong, 2023;

Basumatary & Das, 2024;

Wang et al., 2021). Given the specific limitations of each model, the study also employed the PCSE (panel-corrected standard errors) method for the full EU-27 sample as well as for the NMS and OMS groups.

The general sample was analyzed using an OLS regression model over the 2003–2023 period. However, the White test produced a p-value of 0.000, indicating the presence of heteroskedasticity and suggesting that the OLS model is not appropriate in this case. Multicollinearity was assessed using the Variance Inflation Factors (VIF), with a mean value of 1.61 and no individual values exceeding the threshold of 5, confirming the absence of multicollinearity.

To evaluate the suitability of a random effects model (REM), the Breusch–Pagan Lagrange multiplier test was applied and returned a p-value of 0.0000, indicating that the REM is more appropriate than OLS for this panel dataset. The REM results revealed significant variation across countries, further supporting the use of a panel data approach over a simple OLS model. The Hausman test (χ2 = 7.30; p = 0.2942) indicates that the differences between the fixed effects and the random effects estimators are not statistically significant, supporting the use of the random effects model (REM) as consistent and efficient. To assess the robustness of the panel model, several diagnostic tests were conducted. The Wooldridge test confirmed the presence of first-order autocorrelation within units (p = 0.0000), while the Pesaran test did not detect statistically significant cross-sectional dependence (p = 0.0978). However, the average absolute correlation between units (0.379) suggests a potential moderate cross-sectional correlation. On the other hand, the Ramsey RESET test (p = 0.2094) did not indicate any issues related to functional misspecification, thus confirming the appropriateness of the model specification. Given this context, and to obtain valid standard error estimates while correcting for autocorrelation, heteroskedasticity, and potential cross-sectional dependence, the use of the PCSE (panel-corrected standard errors) method was warranted.

In the OLS model, the variables with a statistically significant impact on income inequality, as measured by the Gini coefficient, were social protection expenditures and the unemployment rate. In the REM, the statistically significant variables were GDP per capita, social protection expenditures, unemployment rate, and marginally significant for Corr. The FEM had statistically significant determinants of income inequality with a negative impact on the GDP per capita (Sp_Exp) and a positive impact on the Unemp, Urban, and Corr. In the PCSE model, the statistically significant determinants of income inequality are GDP per capita, social protection expenditures, and unemployment rate.

The same analysis was conducted for the Old Member States (OMS) of the EU. The White test indicated for this subsample the presence of heteroskedasticity with a p-value of 0.0000 < 0.05. Thus, the OLS model is not suitable. The variance inflation factors (VIF) results for all variables averaged 1.49, ruling out the presence of multicollinearity in the model. The Breusch–Pagan Lagrangian multiplier test for random effects showed a p-value of 0.0000, meaning that the use of REM is more appropriate than OLS for this sample. Based on the Hausman test results (p = 0.7925), the REM is consistent and efficient under this specification. The Wooldridge test for autocorrelation confirmed the presence of autocorrelation in the sample, yielding a p-value of 0.0000 < 0.05. The Pesaran test rejected the existence of cross-sectional dependence, with a value of 0.5371 > 0.05. The Ramsey RESET test had a result of p = 0.0001 < 0.05.

The OLS model had all variables statistically significantly impacting income inequality. GDP per capita, social protection expenditures, tertiary education, degree of urbanization, and corruption perception index had a significant impact on the income inequality, while only the unemployment rate had a positive and significant impact.

In the REM, the unemployment rate had a positive and significant effect, while social protection expenditures, the degree of urbanization, and the corruption perception index had significant negative effects, and the remaining variables were statistically insignificant. The FEM confirmed the negative impact of social protection expenditures, urbanization, and corruption perception. The unemployment rate significantly and positively influenced income inequality. In the PCSE model, GDP_PC, Sp_Exp, Urban, and Corr were statistically significant, with negative effects, while the unemployment rate had a positive and statistically significant influence on income inequality.

For the subsample of New Member States (NMS) of the EU, the White test indicated the presence of heteroskedasticity with a p-value of 0.0000, making the OLS model unsuitable. The variance inflation factors (VIF) results for all variables averaged 1.43, ruling out the presence of multicollinearity in the model. Random effects were indicated as a more suitable method than OLS due to the result of the Breusch–Pagan Lagrangian multiplier test which showed a result of p = 0.0000. The Hausman test showed that the more suitable method is the REM, random effects model, given the results of p-value 0.1511. The Wooldridge test result confirmed autocorrelation in the NMS subsample, with p = 0.0008. The Pesaran test yielded a p-value of 0.3514, and the Ramsey RESET test returned a p-value of 0.9829.

In the OLS model, just social protection expenditure and unemployment rate had a statistically significant impact on the dependent variable. Sp_Exp was negatively correlated with Gini, suggesting that a higher allocation within social protection expenditure can reduce the inequality. Unemployment had a positive significant effect, suggesting that higher unemployment is associated with higher inequality. The rest of the variables were not significant in the model. The random effects model reveals increased statistical significance for several variables. GDP_PC becomes significantly negative, suggesting that higher levels of economic development are associated with reduced income inequality. Sp_Exp and Unemp remain statistically significant, with the same direction of effects as in the OLS. The Corruption Perception Index becomes significant and positive, indicating a link between higher perceived corruption and increased inequality, possibly through inefficient redistributive policies. In the FEM, unemployment and social protection expenditures remain significant and maintain their direction, while tertiary education (TERT_ED) becomes significantly negative. Urbanization and corruption perception continue to have significant positive effects, suggesting that country-specific contextual factors play an important role. GDP per capita, while negative, is not statistically significant in this model. The PCSE model produces results largely consistent with the previous models, but with more precise standard errors. GDP_PC is significantly negative at the 1% level. Sp_Exp and TEd are also associated with lower levels of GINI, while unemployment remains a significant positive determinant of inequality (

Table 4,

Table 5 and

Table 6).

Table 7 presents the regression results for the EU-27.

Table 8 presents the regression results for the OMS and NMS subsamples.

5. Discussion

The analysis of the income inequality in the European Union, both at the level of the entire EU-27 and separately for the Old Member States (OMS) and the New Member States (NMS), highlights essential structural relationships between economic, institutional, and social indicators (

Feruni et al., 2020). The gap between the New Member States and the Old Member States of the European Union persists, manifesting itself in various dimensions such as institutional capacity, social structures, political integration, or economic performance. These differences reflect both historical trajectories and the challenges regarding convergences within an expanding Union (

Capello & Cerisola, 2021;

Iammarino et al., 2019). The newer states were unable to adapt their institutions to the European Union format, being held captive by their Soviet history. The imperfect correspondence observed between the REM and FEM results is also a reflection of the structural dissimilarities among the countries included in the sample and its two subsamples. More profoundly, this inconsistency points to institutional differences, confirming that significant divergences between member states persist.

The newer member states of the European Union were unable to adapt their institutional environment to the European Union format, being held captive by their Soviet background, which continued to guide their political culture, administrative practices, and the mindset of the ruling elites. This historical burden generated persistent structural weaknesses, such as fragile rule of law, lack of trust in the democratic mechanism, and bureaucratic inefficiency. As a result, instead of swiftly aligning with the EU’s institutional standards and values, these states reproduced old governance patterns, where informal networks, corruption, and centralized decision-making prevailed. These acts hindered the creation of transparent market economies, hindering effective social policymaking, stimulating income inequality, and perpetuating high levels of corruption, which further undermined both public trust and sustainable development (

Schultz & Harutyunyan, 2015).

Consistently the data show that corruption perception, unemployment rate, and urbanization degree are central factors that influence growth of the income inequality. In contrast, social protection spending, education level, and balanced urbanization act, in most cases, as compensatory factors, reducing social and economic disparities. Previous studies emphasized the bidirectional and sometimes non-linear relationship between income inequality and corruption, highlighting that while higher inequality can create incentives and opportunities for corrupt practices, corruption itself may exacerbate distributive imbalances, with the strength and direction of this association varying across regions, income groups, and institutional settings (

Policardo & Carrera, 2018;

Sulemana & Kpienbaareh, 2018).

The link between corruption and income inequality is complex, and it depends on the level of development of the country due to the mechanisms through which the two phenomena influence each other varying significantly across economies. In the developed economies, where the institutions are more solid and the informal sector is reduced, corruption has a direct effect on income redistribution, accentuating social polarization and limiting vulnerable groups’ access to quality public services. In contrast, in the emerging countries or the developing countries, where the informal economy plays a major role and the redistributive policies are less effective, the income inequality can become itself a cause of corruption because the big differences between social groups create motivations and opportunities for corrupt practices. Recent studies show that this relationship is not linear; in some environments, an increase in inequality can reduce corruption through strengthening social control or through pressure for reforms, but beyond a certain threshold, the effect reverses, with inequality fueling corruption and blocking sustainable economic development. Thus, the bidirectional and often nonlinear nature of this relationship makes anticorruption and inequality-reduction policies inseparable, requiring adaptations at the country level and according to the stage of development.

Within the EU-27, the relationship between corruption perception and income inequality is particularly relevant. Countries facing higher levels of corruption tend to exhibit greater income disparities, suggesting that public resources are distributed inefficiently or even diverted toward privileged groups (

You, 2021). Corruption undermines the effectiveness of redistributive policies, diverts public investments, affects the quality of social services, and weakens citizens’ trust in the state. This creates a vicious cycle: corruption fuels inequality, and inequality perpetuates corruption, as economically advantaged groups exert greater influence over the decision-making process and have little interest in pursuing structural reforms (

Sánchez & Goda, 2018).

In the developed economies from the Old Member States, the institutional systems are more robust, allowing public policies to operate within a more stable and transparent framework (

Meijer et al., 2018). In these countries, tertiary education and urbanization significantly contribute to reducing income inequality, reflecting the capacity of these societies to transpose economic development into real opportunities for social mobility (

Browman et al., 2019). Moreover, the negative impact of corruption is weaker, as it is better understood and controlled, and it has less impact on income distribution (

Ariely & Uslaner, 2017). In such states, social inclusion policies, educational infrastructure, and fiscal systems are more effectively integrated into the economic mechanisms, providing a stronger foundation for reducing disparities (

Giordono et al., 2019). On the other hand, in the New Member States (NMS), the situation is significantly different. Although there has been progress in terms of economic development and rising education levels, these elements do not automatically translate into a reduction in inequality. The corruption remains a systematic factor, with major implications for resource distribution, access to public services, and fiscal equity. In this context, even well-intentioned policies can be undermined by clientelism, political favoritism, and lack of transparency (

Gordon, 2025). Thus, in the NMS, tertiary education sometimes has a paradoxical effect, exacerbating inequality, as access to and benefits from higher education remain unevenly distributed across regions and social groups.

Another relevant aspect is the role of urbanization. While it appears to contribute to a more balanced income distribution in the OMS, in the NMS it is often associated with economic polarization. The income levels and the opportunities tend to be concentrated in bigger cities, while the rural areas or the less developed areas remain excluded from the benefits of modernization. This dynamic can exacerbate internal migration, social fragmentation, and even political instability, which runs counter to the principles of sustainable development.

In the three analyzed groups, the public expenditures for social protection have essential role in inequality reduction. Where such policies have been supported and effectively implemented, their redistributive effects have been evident. However, their efficiency directly depends on the institutional context and the quality of governance. In the absence of effective anti-corruption measures and transparent administration, even the most generous welfare systems can become inefficient or unfair (

Devereux et al., 2017).

The results of the analysis highlight that sustainable development cannot be achieved solely through economic growth. Without equitable income distribution, universal access to education and quality public services, and transparent and accountable institutions, any economic progress risks being fragile and uneven. This dynamic can also be associated with the phenomenon of selective education, wherein access to high-quality educational opportunities and their long-term benefits are disproportionately reaped by societal elites, while broader segments of the population remain excluded. Such a concentration of educational advantages not only reinforces existing privileges but also deepens structural disparities, limiting social mobility, perpetuating unequal access to resources, and ultimately widening both economic and social inequalities (

Lu & Siddiqui, 2024;

Uslaner & Rothstein, 2016). High levels of inequality undermine social cohesion, reduce economic efficiency, and fuel public dissatisfaction, which in turn erodes political stability and long-term sustainability (

Coscieme et al., 2020).

Combating corruption, reducing unemployment, and strengthening social policies are not merely ethical objectives but essential conditions for sustainable and inclusive development (

Saher et al., 2024). Each of these components acts synergistically: an educated and equitable society is more economically resilient, more innovative, and better equipped to face future challenges, whether related to the green transition, digitalization, or population aging.

Therefore, European policies should be tailored to the specific context of each country while following a common direction: mitigating an economic development founded on equity, institutional integrity, and social cohesion (

Davidescu et al., 2024). In this sense, the policy recommendations outlined here should be understood as general guidelines, which need to be carefully adapted to the specific realities and context of each member state. Addressing these issues of corruption and income inequality is not merely a matter of social justice; it became a strategic necessity for the consolidation of the European Union. This is not only a matter of social justice but also a strategic necessity for the future of the European Union. At the same time, while PCSE estimates correct for heteroskedasticity and autocorrelation, they do not fully eliminate the risk of ambiguous causal relationships or specification errors.

6. Conclusions and Policy Implications

Using econometric models on different groups (all EU-27 countries, New Member States—NMS, and Old Member States—OMS), this study investigates how perceptions of corruption affect income distribution and development potential, considering countries’ varying institutional and economic maturity.

The results of this study highlight the critical role that socio-economic and institutional factors play in shaping income inequality within the European Union. Income inequality is not merely a reflection of differences in productivity or market dynamics but rather a manifestation of deeper structural deficiencies, such as unequal access to opportunities, weak governance, and persistent institutional imbalances and differences at the European Union level. Especially, corruption proves to be a significant impediment regarding economic equity, undermining the state’s ability to redistribute resources in an efficient and equitable manner. Public resources are frequently misallocated, ending up fueling narrow group interests’, which sustains economic inequality and undermines societal unity.

Given the results of the study, several important policy implications emerge. Strengthening of the anti-corruption policies is more than just a moral imperative; it is a fundamental condition for sustainable economic development. A transparent, efficient, and responsible institution can foster conditions for redistributive policy implementation, greater equity, and enhanced public confidence. Moreover, investments in tertiary education, especially when equitably distributed, contribute to human capital development, facilitating social mobility. At the same time, while well-calibrated social spending plays a crucial role in offsetting economic vulnerabilities, a balanced urbanization might reduce regional disparities. This effect is contingent upon the capacity of the state to integrate the underdeveloped regions in the socio-economic environment.

A comparative analysis of New Member States (NMS) and Old Member States (OMS) reveals that both groups encounter distinct yet equally significant challenges. NMS have achieved notable progress through institutional convergence driven by European Union accession requirements but continue to experience governance weaknesses and inconsistent enforcement of the rule of law. Although OMS are frequently regarded as institutional benchmarks, the findings presented here indicate that this perception may obscure critical vulnerabilities. Inequality within OMS has risen relative to historical levels and has emerged as a prominent social issue.

Corruption in OMS does not always manifest in the overt forms observed in NMS. Instead, it is often associated with the influence of revolving doors, lobbying, political donations, and vested economic interests, which are subtle yet powerful mechanisms capable of capturing state institutions. The conviction of former French President Nicolas Sarkozy illustrates that even established democracies remain susceptible to political corruption (

Collard & Dreyfus, 2025).

Therefore, the comparison between NMS and OMS should not foster complacency about the resilience of OMS institutions. Rather, it highlights the necessity of critically evaluating the evolving dynamics of corruption and inequality within both groups. NMS must focus on consolidating institutional reforms and enhancing their effectiveness, while OMS faces the challenge of addressing increasing economic inequality and mitigating risks linked to systemic and interest-driven corruption. Addressing these issues is crucial for maintaining institutional legitimacy within member states and for enhancing the cohesion and resilience of the European Union as a whole.

In this context, resilience refers to the capacity of European Union member states to withstand crises and corruption pressures while sustaining effective governance, public trust, and the ability to adapt policies to safeguard democracy and cohesion.

However, the study outlines some limitations that must be acknowledged in the interpretation of the results. Firstly, the use of national aggregate data may obscure significant regional disparities, especially in the states with a pronounced internal polarization. This broad-brush approach might reduce the visibility of some critical phenomena that manifest locally and need to be addressed through differentiated policies. Secondly, the inclusion of perception-based variables, such as the Corruption Perception Index, involves an inevitable degree of subjectivity. The perceptions might be influenced by different factors, political or media-related, which may affect the accuracy of governance measurement.

The Corruption Perceptions Index (CPI) predominantly captures the viewpoints of elites, business leaders, and foreign investors. This emphasis may neglect the experiences of citizens and civil society actors who confront corruption in routine institutional interactions. Consequently, measurement bias can arise, as these perceptions are susceptible to political or media influences, which may potentially undermine the accuracy of governance assessments.

To mitigate these limitations, future research should complement Transparency International data with alternative or proxy measures of corruption. Relevant indicators may include the frequency of corruption references in media, documented convictions and high-profile scandals, levels of lobbying and vested interests, indices of judicial independence, trust in government metrics, and broader governance indicators such as those from Freedom House. Integrating these diverse sources would facilitate a more nuanced and multidimensional assessment of corruption.

Moreover, the absence of contextual factors, such as cultural institutional history or the political specificities of each country, limits the analysis’s ability to fully capture the underlying mechanisms of income inequality. These limitations also open up valuable avenues for future research. Sub-national-level data usage in future studies would improve empirical robustness, highlight territorial disparities, and provide a more precise framework for more specific policy recommendations regarding regional-level issues. Additionally, incorporating cultural and political variables could help deepen our understanding of how institutions relate to economic equity and development. Employing more diverse research methods, such as qualitative approaches and the use of more refined data, could help reveal how education operates in the New Member States, whether as a driver of social inclusion or as a factor of social polarization.

Future research could further investigate the role of urbanization amid the ongoing digital transition and demographic transformations, as well as how educational policies influence access to opportunities within an ever-evolving economic landscape. While future research could employ different econometric approaches using causal inference methodologies (such as instrumental variables, GMM, or dynamic models), the present study should be understood primarily as describing associations rather than providing definitive proof of causal relationships. In this respect, further studies might employ longitudinal designs or instrumental variable procedures, which could more robustly establish both the direction and the strength of the relationship between corruption and inequality.

In conclusion, this research reaffirms the idea that sustainable economic development cannot be separated from the dimension of social equity. Reducing income inequality is not merely a matter of social justice but a fundamental condition for political stability, long-term economic growth, and social cohesion. Institutional strengthening, combating corruption, effectively targeting social policies, and expanding access to education are necessary steps toward a more equitable, resilient, and sustainable European Union. Thus, given the diversity and polarization in the institutional backgrounds of European Union member states, policies should be carefully tailored to the specific institutional, political, and socio-economic contexts of each country in order to foster genuine economic convergence. Here, convergence should be perceived as more than just the way we help all economies grow. It also means keeping the European Union as a strong group of countries working together. If both Old and New Member States do not reach similar standards in honesty, fighting corruption, and ensuring income is shared fairly, the problem is not just slower growth; it is also a significant challenge. It can also weaken trust in the European Union. Brexit demonstrated that ongoing differences and feelings of unfairness can erode unity and drive countries apart. This makes convergence important for both economic success and the EU’s long-term stability.