Abstract

This study analyses macroeconomic trends in Southeast Asian countries and their implications for climate change, focusing on urbanisation, GDP per capita, energy intensity, FDI, inflation, and trade. Using panel data from 1970 to 2020, we investigate climate change drivers across Indonesia, Malaysia, the Philippines, Singapore, and Thailand through panel ARDL with PMG and MG analyses, along with Hausman tests. Our results highlight the need for tailored urbanisation policies for sustainability, as the consistent positive correlation between GDPs per capita and emissions, underscores the challenge of decoupling economic growth from emissions. Urbanisation’s varying impact calls for proactive planning, and mixed FDI results suggest nuanced investment approaches aligned with sustainability. Inflation’s negative impact hints at environmental benefits during price increases, necessitating integrated economic and climate policies. The positive relationship between trade openness and emissions emphasises the need for eco-conscious trade agreements to mitigate emissions from industrial activity. Our study stresses the importance of considering macroeconomic heterogeneity in crafting climate policies. Policymakers must adopt multifaceted approaches that prioritise sustainability across economic growth, energy efficiency, technology adoption, and trade to balance development with environmental preservation. This approach enables Southeast Asian countries to contribute effectively to global climate change mitigation.

1. Introduction

Over the past two decades, the issue of global warming, propelled by the emissions of greenhouse gases (GHGs), has risen to the forefront of global consciousness, sparking widespread concern, and prompting concerted action. In response to the urgent need to mitigate climate change, a series of diverse climate agreements have been forged, underscoring the collective commitment of nations to combat this existential threat. Among these landmark agreements stands the United Nations Framework Convention for Climate Change (UNFCCC), an international treaty aimed at coordinating global efforts to confront climate change. The adoption of the Kyoto Protocol within the framework of the UNFCCC marked a pivotal moment in the international community’s response to climate change, representing a significant leap forward in addressing the complex challenges posed by global warming. By establishing targets to manage emissions and striving to stabilise GHG concentrations at scientifically acceptable levels, the protocol laid the groundwork for subsequent agreements and initiatives aimed at combating climate change and fostering global sustainability. Despite criticisms regarding its effectiveness and level of ambition, the Kyoto Protocol served as a crucial initial step, galvanising international action, and providing a foundation upon which ongoing efforts have been built (Gerden 2018; Tran 2022).

Moreover, recognising the disparities in technological and financial resources between developed and developing nations, the Kyoto Protocol mandates that developed countries facilitate the transfer of technology and provide financial assistance to support the emission reduction efforts of their less developed counterparts (Atici 2022). This provision aims to ensure equitable participation and progress in addressing climate change across the global community with three adaptable mechanisms; the Clean Development Mechanism (CDM), Joint Implementation (JI), and Emissions Trading (ET) (Mitić et al. 2017). These mechanisms offer countries a flexible framework to pursue emission reduction targets while promoting international collaboration in the fight against climate change. By fostering partnerships and sharing expertise and resources, these measures aim to enhance the effectiveness and efficiency of global efforts to combat climate change, ultimately contributing to a more sustainable future for all nations.

The Climate Change Performance Index (CCPI) 2015 serves as a comprehensive evaluation tool, analysing and contrasting the efforts of 61 countries that collectively account for over 90% of the world’s energy-related CO2 emissions (Burck et al. 2014). This index provides valuable insights into each nation’s commitment and their effectiveness in addressing climate change. In alignment with the urgent need for climate action, the Paris Agreement sets ambitious targets aimed at curbing the alarming rise in greenhouse gas (GHG) emissions. It stipulates that by 2020, countries must begin reversing the upward trajectory of emissions. Furthermore, by the year 2050, emissions should be slashed to half of their 1990 levels and reduced to one-fifth of their 2010 levels. These stringent targets are designed to limit global warming to less than 2 °C above pre-industrial levels, a critical threshold for averting catastrophic climate impacts.

The potential ramifications of climate change on the environment, society, and economy are poised to be substantial, yet the precise magnitude of climate sensitivity and the resultant shifts in global temperature across varying concentration pathways remain uncertain (Parry et al. 2001). Development is frequently intertwined with climate change and its repercussions, with developing nations often under scrutiny for their perceived contributions to the issue.

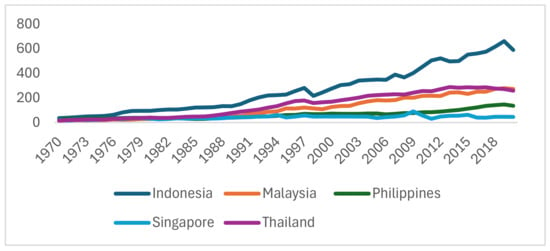

On the other hand, the development of economic development in ASEAN from 1970 to 2020 has experienced various phases and significant transformations. In 1967, ASEAN (Association of Southeast Asian Nations) was founded by its five member countries, namely Indonesia, Malaysia, the Philippines, Singapore, and Thailand, with the aim of increasing economic and political cooperation among these nations. During its early years, ASEAN’s focus was on basic economic development and job creation. Regional development programs, such as the ASEAN Free Trade Area (AFTA) established in 1992, aimed to strengthen economic integration among member countries by reducing trade and investment barriers (Pastpipatkul et al. 2022). Over the following decades, ASEAN experienced significant economic growth, driven by various factors including trade liberalisation, foreign direct investment, and growth in the manufacturing sector. In the 21st century, ASEAN has transformed into one of the largest and most dynamic economic regions globally. The launch of the ASEAN Economic Community in 2015 aimed to increase economic integration and connectivity among member countries (Mohd Nor et al. 2020). However, challenges remain, including development gaps between member countries, economic inequality, and the negative impact of the global financial crisis. Additionally, climate change and the COVID-19 pandemic have had a serious impact on economic growth in the ASEAN region (Ahmad et al. 2022). Thus, while ASEAN has achieved significant achievements in economic development from 1970 to 2020, new challenges and opportunities will continue to influence the direction and scale of economic development in the future. However, the number of emissions produced increases every year, with Indonesia at the top. Figure 1 illustrates the amount of carbon emissions in selected ASEAN countries from 1970 to 2020.

Figure 1.

Total carbon emissions from selected countries in ASEAN in 1970–2020.

Various efforts are being made collectively through ASEAN institutions, such as the ASEAN State of Climate Change Report (ASEAN 2021), which maps the road to carbon neutrality by 2050 (Pereira and Shaw 2022). In this report, we document the implementation of practices aimed at addressing climate-smart and nature-based solutions (NbS), including agroforestry, the protection of mangrove forests, and support for initiatives to reduce emissions from deforestation and forest degradation (REDD+) certification.

The study’s extensive sampling period affords a comprehensive overview of these nations’ impact on climate change through their economic endeavours. By delving into the economic activities of these countries over the decades, the study aims to shed light on their evolving role in shaping climate dynamics and to identify potential avenues for bolstering their contributions to global emission reduction efforts. The relationship between macroeconomics and climate change in ASEAN as depicted in Figure 2 involves understanding how various macroeconomic factors influence the emission of greenhouse gases and subsequently impact climate patterns. Urbanisation, the migration of people from rural to urban areas, often driven by economic opportunities, can lead to increased energy consumption, infrastructure development, and industrial activities, all of which contribute to greenhouse gas emissions. Economic growth, as measured by Gross Domestic Product (GDP) per capita, is typically associated with increased consumption, industrial production, and energy use, leading to higher emissions. Energy intensity, indicating inefficiency in energy use, correlates with higher emissions in countries with high energy intensity. Foreign Direct Investment (FDI) can stimulate economic growth and industrial development, but its environmental impact depends on the nature of the investments and the stringency of environmental regulations. Inflation, influencing consumption patterns and economic activities, may temporarily reduce emissions if higher prices lead to reduced demand and production. Trade openness can increase industrial activity and transportation, potentially leading to higher emissions through the import and export of goods with significant carbon footprints. Understanding these relationships is crucial for policymakers in ASEAN to develop effective strategies for mitigating climate change while promoting sustainable economic growth. By considering the interplay between macroeconomic factors and climate change, policymakers can design policies that encourage green investments, promote energy efficiency, and reduce emissions without compromising economic development goals.

Figure 2.

Graphical representation of macroeconomic variables impacting climate change.

This study employs five Southeast Asian nations—Indonesia, Malaysia, the Philippines, Singapore, and Thailand—that have not only witnessed consistent and robust economic growth but have also actively engaged in initiatives aimed at curbing global emissions under the Kyoto Protocol. Therefore, the objective of this study is to examine a cohort of developing countries in Southeast Asia possessing considerable economic potential and a steadfast commitment to sustainable development and emission reduction in the context of efforts to mitigate climate change. For this purpose, we employ an Autoregressive Distributed Lag panel, which is able to handle heterogeneity, identify long-term and short-term relationships, and overcome integration and cointegration problems. Furthermore, this study extends the model by reducing the sample size of countries to test the stability and fit of the model.

2. Literature Review

The literature exploring the relationship between macroeconomics and climate change reveals a spectrum of research findings, indicating the absence of a universally accepted benchmark for measuring the impact of economic activity on climate dynamics. Studies on this subject have yielded varying degrees of success and have employed diverse methodologies to analyse the complex interplay between economic indicators and environmental outcomes. For instance, Pao et al. (2011) utilised co-integration techniques and causality tests to examine the dynamic correlations between pollutant emissions, energy utilisation, and actual production in Russia spanning from 1990 to 2007. Their findings unveiled an elastic relationship between emissions and energy usage, implying that higher energy consumption is responsive to changes in emissions over the long run. However, Waheed et al. (2019) reported that energy usage has a positive correlation with environmental impact. Industrial processes, which heavily rely on energy consumption, contribute to increased carbon emissions and pollution. The results showed that emissions were inelastic with respect to output, suggesting that increases in production did not significantly impact emissions levels. Additionally, the study advocated for investment in infrastructure to enhance energy efficiency and the implementation of energy conservation measures as effective strategies for mitigating emissions. These findings align with the conclusions drawn by Saboori and Sulaiman (2013), and Sharma (2011).

Economic development in Southeast Asia is a complex tapestry interwoven with ongoing environmental challenges. Amidst this dynamic landscape, rapid economic growth has emerged as a double-edged sword, delivering both progress and peril to the region’s socio-economic fabric. On one hand, this surge in economic activity has propelled social advancement, fostering improvements in living standards, reductions in poverty rates, and expanded access to vital services such as education and healthcare. However, it has also cast a shadow of environmental concern, as burgeoning industries and urban centres strain natural resources and contribute to ecological degradation. This complexity is connected to green finance, which involves comprehensive support from the financial services industry for sustainable growth, resulting from the harmony between economic, social, and environmental interests. Bennink (2023) states that public participation is lacking appropriate affordance, not only because of the lack of transparency regarding the exact qualifications of green products and production processes.

Yet, amidst these challenges, there exists a glimmer of hope for sustainable development. Research conducted by Apergis and Payne (2010), Fong et al. (2020), and Shahbaz et al. (2013) sheds light on a compelling correlation between economic growth and environmental conservation. Their findings suggest that increases in GDP, the quintessential measure of economic activity, could potentially herald a decline in CO2 emission levels, presenting a pathway towards a more environmentally responsible future. This nuanced relationship underscores the intricate interplay between economic prosperity and environmental stewardship in Southeast Asia. It underscores the imperative for policymakers, businesses, and civil society to embrace holistic strategies that reconcile economic growth with ecological preservation. By fostering innovation, promoting sustainable practices, and forging collaborative partnerships, the region can chart a course towards a prosperous and sustainable future for generations to come.

However, while rapid economic growth has undeniably propelled social and economic progress, it has also ushered in a host of detrimental effects on the environment. From widespread forest degradation to ecosystem damage, and from pervasive air and water pollution to the looming spectre of climate change, the environmental toll of rapid development is increasingly evident. Menyah and Wolde-Rufael (2010) elucidated a fundamental truth: economic growth and carbon emissions share a symbiotic relationship, each influencing the other in a complex interplay. As economies surge forward, so too do carbon emissions, as industries clamour to meet escalating demands for goods and services. This assertion finds resonance in the research of Nasir et al. (2019) who corroborated that swift economic expansion invariably correlates with environmental deterioration. Waheed et al. (2019) further underscored the adverse environmental repercussions of rapid economic growth. Their findings elucidate a stark reality: the relentless pursuit of economic prosperity often exacts a heavy toll on our planet’s fragile ecosystems, jeopardising the very foundations of sustainable development.

In essence, while economic growth holds the promise of prosperity and progress, its unchecked trajectory poses formidable challenges to environmental sustainability. As we navigate the complexities of global development, it becomes imperative to strike a delicate balance—one that fosters economic prosperity without compromising the integrity of our planet’s natural ecosystems. Only through concerted efforts to reconcile economic imperatives with environmental stewardship can we chart a course toward a truly sustainable future for generations to come. These divergent findings underscore the complexity of the relationship between economic growth and environmental sustainability and highlight the need for further research to elucidate the nuanced mechanisms at play.

Urbanisation is another factor that influences climate change through CO2 emissions. Recognised as a key catalyst for economic advancement in developing nations, it exerts a dual influence on CO2 emissions, with both positive and negative implications. Urbanisation, the process of increasing numbers of people migrating from rural to urban areas, often leads to significant changes in land use, energy consumption patterns, and greenhouse gas emissions.

One of the main impacts of urbanisation is the increase in greenhouse gas emissions, particularly from the transportation, industrial, and residential sectors. The rise in the number of motorised vehicles, the use of fossil energy, and industrial waste in cities can result in large amounts of carbon dioxide (CO2), methane (CH4), and other gas emissions, contributing to global warming and climate change. Studies by Cole and Neumayer (2004), and Poumanyvong and Kaneko (2010) underscore the positive correlation between urbanisation and CO2 emissions. Their research reveals that as urbanisation progresses, CO2 emissions tend to rise, reflecting the heightened energy demands and consumption patterns associated with urban living.

However, urbanisation can also present an opportunity to mitigate the impacts of climate change if managed wisely. Sustainable urban development, including the utilisation of renewable energy, implementation of efficient public transportation systems, and adoption of environmentally friendly urban designs, can contribute to reducing greenhouse gas emissions and enhancing cities’ resilience to the effects of climate change. Martínez-Zarzoso and Maruotti (2011) introduce a nuanced perspective, identifying an inverted U-shaped relationship between urbanisation and CO2 emissions. Their findings suggest that while urbanisation initially contributes to escalating emissions, reaching a certain threshold can precipitate a decline in CO2 emissions. This inflection point signifies that at higher levels of urbanisation, factors such as improved infrastructure, technological advancements, and the implementation of environmentally conscious policies may mitigate emissions, ultimately leading to a reduction in CO2 output.

Together, these research findings underscore the intricate dynamics at play in the relationship between urbanisation and CO2 emissions. While urbanisation can indeed exacerbate emissions due to increased energy consumption and industrial activities, it also presents opportunities for implementing sustainable urban planning strategies that can effectively curb emissions. As urbanisation continues to unfold in developing countries, it is imperative to leverage these opportunities to foster environmentally sustainable growth trajectories.

Furthermore, research examining the repercussions of climate change-related economic activities presents conflicting conclusions Paul and Bhattacharya (2004) delved into the factors influencing alterations in the levels of energy-related CO2 emissions. Employing the decomposition method, they scrutinised observed changes through four components: the pollution coefficient, energy intensity, structural alterations, and economic activity, focusing on India’s primary economic sectors from 1980 to 1996. Their findings revealed that economic expansion exerted the most substantial positive influence on changes in CO2 emissions across all significant economic sectors. However, Saboori et al. (2022) conducted a study using Saudi Arabian data, uncovering no definitive long-term relationship between energy use and growth. These results underscore the complexity of the interactions between economic growth, energy consumption, and CO2 emissions, suggesting that contextual factors and varying methodologies may yield divergent findings.

Foreign Direct Investment (FDI) has been a subject of considerable interest in the context of climate change mitigation and sustainable development. Scholars have explored how FDI inflows affect environmental outcomes, particularly in terms of greenhouse gas emissions (Chen et al. 2023). Some studies suggest that FDI can lead to increased emissions due to the establishment of energy-intensive industries and the adoption of polluting technologies in host countries (Bukša et al. 2022; Philip et al. 2021; Soussane et al. 2023). However, other research argues that FDI can contribute to emissions reduction through the transfer of cleaner technologies, improved environmental management practices, and investments in renewable energy projects (Chang et al. 2022). The relationship between FDI and emissions is complex and depends on various factors such as the sectoral composition of FDI, host country regulations, and technological advancements. Understanding the environmental implications of FDI is essential for policymakers to attract sustainable investments and promote low-carbon development pathways.

Inflation, as a macroeconomic phenomenon, has implications for climate change through its influence on consumption patterns, production activities, and policy responses (Goodwin et al. 2022; Li et al. 2023). While inflation can temporarily reduce emissions by dampening economic activities and consumer demand, its long-term impact on climate change is less clear (Andersson et al. 2020). Some studies suggest that higher inflation rates may lead to reduced investment in carbon-intensive industries and encourage the adoption of energy-efficient technologies (Bassi et al. 2009; Dissanayake et al. 2020; Napp et al. 2014). However, inflation can also create uncertainties in the economy, leading to short-term policy measures that prioritise economic stabilisation over environmental concerns (Bistline et al. 2023; Konradt and Weder di Mauro 2023; Xu et al. 2023). The relationship between inflation and climate change is nuanced and requires further exploration to understand its implications for long-term sustainability.

Trade plays a significant role in shaping global emissions patterns and environmental outcomes. The expansion of international trade has led to increased production, transportation, and consumption, all of which contribute to greenhouse gas emissions. Studies have shown that trade openness is associated with higher emissions, particularly in countries that specialise in carbon-intensive industries and rely on fossil fuel-based energy sources (Balogh and Mizik 2023; Meng et al. 2023). Additionally, trade can lead to the phenomenon of carbon leakage, where emissions are displaced from countries with stringent environmental regulations to those with lax standards (Olasehinde-Williams and Akadiri 2024). However, trade also presents opportunities for emissions reduction through the adoption of cleaner technologies, the dissemination of best practices, and the integration of environmental clauses into trade agreements (Brandi et al. 2020; Honma 2015). Balancing the economic benefits of trade with environmental considerations is a key challenge for policymakers seeking to address climate change effectively. Table 1 summarises various relevant literature by providing information on the countries that are the focus of the research, the methodologies used, and the research results.

Table 1.

Summary of the relevant literature review.

Finally, these conflicting outcomes underscore the intricacies of assessing the nexus between economic activities and climate change impacts. While some studies highlight the predominant role of economic growth in driving climate change, others indicate a lack of clear long-term relationships between energy use and growth. Such divergent findings underscore the need for comprehensive and context-specific analyses to elucidate the complex dynamics at play and inform effective policy interventions aimed at mitigating climate change impacts.

3. Data and Model Specification

3.1. Data Sources

This research aims to examine macroeconomic variables that can influence climate change in ASEAN countries. We chose five countries, namely Indonesia, Malaysia, the Philippines, Singapore, and Thailand, because they are the founders of ASEAN, have relatively stable economic growth, and provide relatively accessible data compared to other countries. Additionally, ASEAN was historically founded in 1967 by these five countries and later developed with the participation of surrounding nations. In this study, we used data covering a relatively long period, from 1970 to 2022. These data span from the early days of independence and development in Southeast Asia to the modern era. The five countries were chosen because they have consistently available data within the specified time period. Meanwhile, data for other ASEAN countries are not available due to several reasons, including limited data resources and infrastructure, accessibility problems, reporting delays, confidentiality policies, and lack of regional collaboration.

This study used several macroeconomic variables: CO2 emissions as a proxy of climate change variable (), measured in kilotons, resulting from the burning of fossil fuels and the production of cement; the gross domestic product per capita, calculated as gross national income at constant 2015 US prices divided by population (); and urbanisation (), capturing the phenomenon of rural-to-urban migration, which often signifies economic development in developing countries. Urbanisation data is presented as annual growth percentages in these countries. Energy intensity is measured using primary energy before its conversion into other forms of fuel for end-use purposes. It is calculated by adding indigenous production and imports, subtracting exports, and the supply of fuel to ships and aircraft involved in international transportation, then divided by GDP per capita. Foreign direct investment (FDI) is calculated as the percentage of total capital entering a country divided by gross domestic product (). Inflation is the annual percentage change in the average consumer’s cost of purchasing a basket of goods and services (). Trade is quantified by the proportion of exports and imports relative to GDP ().

Our data is sourced from the International Energy Agency (IEA) (IEA 2023), and World Development Indicators (WDI) (World Bank 2021). To minimise the occurrence of data abnormalities and heteroscedasticity, all data was transformed into natural logarithmic form. Table 2 presents the descriptive statistics of the variables in this study.

Table 2.

Descriptive statistics.

3.2. Model Specifications

The methodology employed in this research is grounded in the STIRPAT (Stochastic Impacts by Regression on Population, Affluence, and Technology) framework. The STIRPAT method offers a systematic approach to examining the impacts of emissions as pollutants and is widely used in environmental studies. In this study, urbanisation () is used as a proxy for population dynamics, the influence variable is operationalised using gross domestic product per capita (), and energy use () serves as a proxy for technological advancement and utilisation. Climate change impacts are assessed through CO2 emissions () data. The model can be represented as follows:

and it allows for an in-depth analysis of how urbanisation, economic growth, and energy consumption influence climate change in ASEAN countries.

Then we added several macroeconomic variables such as , (Essandoh et al. 2020), and (Bilal et al. 2022) creating Model 2. The equation is as follows:

In this study, we also calculated Model 2a based on Equation (2) by excluding Singapore from the analysis sample. Our assumption rests on Singapore being the most developed country with the highest GDP per capita and a relatively small area in the Southeast Asia region (Raihan and Tuspekova 2022).

Before carrying out the ARDL panel analysis, we performed several preliminary tests. First, we conducted cross-sectional dependence tests, including Breusch-Pagan LM, Pesaran Scaled LM, and Pesaran CD. Second, we carried out panel unit root tests using the Levin, Lin and Chu and Im, Pesaran, and Shin methods on all variables. In these tests, all dependent variables must be stationary at the first difference level, while independent variables can be stationary at level I(0) or first difference I(1) (Pesaran 2007). Third, we performed a Kao cointegration panel analysis to determine whether the model used is cointegrated among the variables (Kao 1999).

Following these preliminary tests, we conducted autoregressive distributed lag (ARDL) panel analysis to evaluate the long-run and short-run relationships between the variables. Standard ARDL models with distinct impacts may produce biased estimators due to potential correlations between the mean-difference of independent variables and the white noise component. To address these concerns, we applied the mean group (MG) and pooled mean group (PMG) ARDL methods (Sarkodie and Strezov 2018).

The MG estimator is based on country-specific regressions (i) in a time series and calculates the average coefficient. As described by Pesaran et al. (1999), the MG estimator allows for heterogeneity among individual variables in each cross-section and averages the estimated parameters. Moreover, the data from cross-sections can be grouped to accommodate different intercepts (Asafu-Adjaye et al. 2016).

The PMG technique combines averaging and pooled coefficients, providing different intercepts, error variances, and short-run coefficients across groups. However, the PMG estimator constrains long-run coefficients to be identical across groups (Pesaran et al. 1999). The PMG estimator has several advantages: first, it can analyse data whether it is I(0) or I(1) (as in the present study). Second, it can exclude short-run causality even without cointegration in the model. Third, if the variables are in logarithmic form, long-run coefficients represent elasticity.

The Hausman test is used to determine the ideal model between the MG and PMG estimators. The null hypothesis for the Hausman test is that the PMG estimator is preferred, assuming both PMG and MG are consistent, but MG is inefficient. Conversely, the alternative hypothesis is that PMG is inconsistent. If the p-value of the Hausman test is greater than 5%, the PMG estimator is chosen; if the p-value is less than 5%, the MG estimator is used, or vice versa.

The Autoregressive Distributed Lag (ARDL) symmetry method to examine the relationship between macroeconomics and climate change over short and long run. The panel ARDL can assess co-integration in a single equation model (Pesaran et al. 2004). Therefore, we converted Equation (2) into an ARDL panel format (p, q1, q2, q3, q4, q5, q6) as follows:

where Δ represents the first difference form of variables, t denotes yearly periods, and i denotes countries. is the fixed effects coefficient and are scalars and lagged coefficients of the independent variables. represents the error terms as white noise and varies among countries and over time.

4. Empirical Results

The utilisation of panel data allows for a comprehensive assessment of the dynamics shaping climate change within the context of diverse macroeconomic conditions across these Southeast Asian nations. By employing unit root panel tests, we ascertain the stationarity properties of the variables under consideration, laying the foundation for robust statistical analysis. Through this rigorous methodological framework, our study aims to contribute to the understanding of the complex interactions between macroeconomic dynamics and energy-related climate change in Southeast Asia, providing valuable insights for policymakers and stakeholders striving to promote sustainable development and mitigate the impacts of climate change in the region.

Before conducting the ARDL panel analysis, we performed cross-sectional dependence (CSD) tests, panel unit root tests, and cointegration tests. We used three types of cross-sectional correlation tests: Breusch-Pagan LM, Pesaran Scaled LM, and Pesaran CD, as shown in Table 3. The null hypothesis for these tests is that there is no cross-sectional correlation (Pesaran et al. 2004). Table 3 indicates that the variables , , , , , , and significantly reject the null hypothesis, meaning that all variables do not exhibit cross-sectional correlation. Thus, we conclude that the diagnostic CSD test confirms the stability of the model used, and the possibility of spurious regression is eliminated. Next, we performed panel unit root tests using Levin, Lin, and Chu (LLC) and Im, Pesaran, and Shin (IPS) methods in Table 4. The LLC estimation results show that the variables and are not stationary at I(0). However, the variables , , , , and are stationary at I(0). We then carried out a first difference level unit root test, which showed that all variables are stationary and do not contain a unit root. The IPS unit root test at level I(0) indicates that only and are stationary. Different results at the first difference level show that all variables are stationary. The results of the panel unit root tests, as shown in Table 4, meet the requirements for further analysis. Overall, these panel unit root tests provide valuable insights into the stationarity properties of the variables under examination, facilitating robust statistical analysis and interpretation of the relationships between macroeconomic factors and energy-induced climate in Southeast Asia.

Table 3.

Cross-sectional dependence tests results.

Table 4.

Panel unit root tests.

The next analysis is the Kao panel cointegration test using trend and intercept. The null hypothesis for this test is the absence of cointegration in the model. Table 5 shows that there is cointegration between and , , , , , and . This test rejects the null hypothesis and accepts the alternative hypothesis, indicating that there is cointegration between these variables. With this confirmation of cointegration, we are confident in proceeding with the ARDL panel analysis to estimate both long-run and short-run relationships.

Table 5.

Kao cointegration tests (panel).

This study investigates the interplay between macroeconomic variables and energy utilisation to climate change across five key economies in Southeast Asia: Indonesia, Malaysia, the Philippines, Singapore, and Thailand. We aim to understand how urbanisation, economic growth, energy intensity, foreign direct investment, inflation, and trade impact climate change in these countries. The analysis spans from 1970 to 2022, providing a comprehensive view of the factors influencing climate change in the region over an extensive period. By employing ARDL panel analysis, we seek to elucidate the dynamic relationships between these variables, thereby offering insights that can inform policy and strategic decisions aimed at mitigating environmental impacts while fostering economic development.

Table 6 presents the results of the macroeconomic and climate change nexus in the ARDL panel, segmented into PMG and MG analyses. In this analysis, we divided the study into three models. Model 1 is based on Equation (1), Model 2 is based on Equation (2), and Model 2a is also based on Equation (2) but with the exclusion of Singapore from the sample. This segmentation allows us to observe the impacts of macroeconomic variables on climate change both inclusively and exclusively of Singapore, providing a nuanced understanding of how these relationships vary with and without the most developed country in Southeast Asia.

Table 6.

Panel ARDL results.

Model 1 investigates the determinants of climate change, focusing on the effects of urbanisation, GDP, and energy intensity using both the Pooled Mean Group (PMG) and Mean Group (MG) estimators, with the Hausman test employed to determine the preferred model. In this model, the PMG estimator shows a positive significant long-run relationship between urbanisation and climate change (β = 0.375, p < 0.05). Economic growth also has a significant positive impact on climate change (β = 0.483, p < 0.001), while the relationship between energy consumption and climate change is positive but not significant (β = 0.400, p > 0.05). In the short run, economic growth significantly affects climate change (β = 0.949, p < 0.001), as does energy intensity (β = 0.584, p < 0.001). The error correction term (ECT) is negative but not significant (β = −0.134, p > 0.05), suggesting a slower adjustment to long-run equilibrium.

On the other hand, the MG estimator for Model 1 indicates urbanisation has a negative and significant impact, indicating that as urbanisation increases, climate change decrease (β = −0.075, p > 0.05). Economic growth significantly and positively impacts climate change (β = 1.122, p < 0.001), and there is also a significant positive relationship between energy intensity and climate change (β = 0.370, p < 0.001). In the short run, both economic growth (β = 0.821, p < 0.001) and energy consumption (β = 0.556, p < 0.001) have significant positive effects on climate change. The ECT is significant and negative (β = −0.289, p < 0.001), indicating a faster adjustment to long-run equilibrium.

The Hausman test results (Chi-square = 13.85, p = 0.0031) suggest that the MG estimator is preferred over the PMG estimator. These findings highlight notable differences between the PMG and MG estimations. The PMG model suggests a significant positive impact of urbanisation on climate change, while the MG model shows an insignificant negative effect. Both estimators indicate a significant positive relationship between GDP and climate change, but they differ on the significance of energy intensity’s impact. In the short run, both models agree on the significant positive effects of GDP and energy consumption on climate change, with the MG model indicating a significant faster adjustment to long-run equilibrium. In conclusion, the Hausman test favours the MG estimator, suggesting that this model provides a better fit for the data. The findings underscore the critical roles of economic growth and energy consumption in driving climate change, with significant policy implications. While urbanisation’s impact is less clear, addressing these factors is crucial in managing climate change effectively.

The findings from Model 2 of the panel ARDL analysis, employing the MG estimator, reveal nuanced relationships between climate change and various determinants. The PMG estimator suggests a marginally significant negative association between urbanisation and climate change (β = −0.113, p < 0.10), while the MG estimator indicates a stronger negative relationship (β = −0.283, p < 0.001). In contrast, GDP exhibits positive relationships with climate change, with only the MG estimation being statistically significant (β = 0.923, p < 0.001). Energy consumption shows a positive but nonsignificant relationship in the PMG model (β = 0.721, p > 0.05), whereas the MG model reveals a significant positive association (β = 0.092, p < 0.05). Other variables such as FDI, inflation, and trade display mixed results across the estimators. The significant negative coefficients for the Error Correction Term (ECT) indicate a prompt adjustment to long-run equilibrium following short-term shocks. Both estimators also show negative constant terms, with the MG model demonstrating a significant negative coefficient (β = −1.766, p < 0.01). The Hausman test strongly favours the MG estimator over the PMG estimator (Chi-square = 59.77, p < 0.0001), highlighting its superiority in explaining the data. These results emphasise the importance of considering urbanisation, GDP, and energy intensity in understanding climate change dynamics and informing policies for environmental sustainability.

In Model 2a of the panel ARDL analysis, employing both the PMG and MG estimators, notable findings emerge regarding the relationship between climate change and its determinants with all sample except Singapore. The PMG estimator indicates a statistically significant negative association between urbanisation and climate change (β = −0.187, p < 0.01), while the MG estimator shows an even stronger negative relationship (β = −0.382, p < 0.001). GDP displays a significant positive relationship with climate change in both estimations, with slightly higher coefficients in the MG model (β = 0.839, p < 0.001; β = 0.967, p < 0.001). Energy intensity exhibits conflicting results, with the PMG model indicating a negative but nonsignificant relationship (β = −0.273, p > 0.05), whereas the MG model suggests a positive albeit weak association (β = 0.001, p < 0.05). Other variables such as FDI, inflation, and trade show mixed results across the estimators. The ECT coefficients are significantly negative in both estimators, indicating prompt adjustments to long-run equilibrium following short-term shocks. The constant terms in both models are also negative, with the MG model showing a significant negative coefficient (β = −1.262, p < 0.05). The Hausman test results indicate no significant difference between the two estimators (Chi-square = 5.86, p > 0.05), suggesting that either estimator could be suitable for explaining the data. These results underscore the importance of considering urbanisation, GDP, and energy intensity in understanding dynamics and formulating effective environmental policies.

The results of the panel ARDL analysis across three models reveal significant insights into the relationship between the dependent variable, climate change, and various independent variables. In Model 1, the MG estimator indicates a statistically significant negative relationship between urbanisation and climate change (β = −0.075, p < 0.05), while GDP displays a significant positive association (β = 1.122, p < 0.001). Energy intensity also exhibits a significant positive relationship with climate change (β = 0.370, p < 0.001). However, in Model 2, the magnitude of the coefficients changes notably. urbanisation now demonstrates a stronger negative relationship (β = −0.283, p < 0.001), while GDP per capita maintains its positive association (β = 0.923, p < 0.001). Surprisingly, energy intensity shows a significant but weak positive relationship (β = 0.092, p < 0.05), and FDI, inflation, and trade exhibit no significant associations.

Model 2a further refines these relationships, with urbanisation showing a substantial negative coefficient (β = −0.382, p < 0.001) and GDP per capita retaining its positive relationship (β = 0.967, p < 0.001). Notably, energy intensity’s coefficient becomes almost negligible (β = 0.001, p < 0.05), indicating a weak positive relationship with CO2 emissions. The ECT coefficients in all models are significantly negative, suggesting prompt adjustments to long-run equilibrium following short-term shocks. The constant terms vary across models but generally exhibit negative coefficients, with Model 2a showing the most significant negative coefficient (β = −1.262, p < 0.05). These results underscore the complex interplay between urbanisation, GDP per capita, and energy intensity in influencing climate change. Then, we compare based on the Hausman tests in Table 6. All the three models within the ARDL panel analysis framework, each examining the relationship between macroeconomic variables and climate change using the Mean Group (MG) estimator. Model 1 is based on Equation (1), Model 2 on Equation (2), and Model 2a on Equation (2) but excludes Singapore from the sample.

The MG analysis across the three models reveals some consistency and variation in the impact of various macroeconomic variables on climate change. One of the key consistencies is seen with GDP per capita. In all three models, GDP per capita consistently shows a strong positive impact on climate change. Specifically, GDP per capita has coefficients of 1.122 (p < 0.01) in Model 1, 0.923 (p < 0.01) in Model 2, and 0.967 (p < 0.01) in Model 2a. This indicates that higher economic output per person is associated with increased climate change across the models, underscoring the role of economic growth in driving climate change.

Energy intensity also shows a generally positive relationship with climate change in all three models, although the strength of this impact varies. The coefficients for energy intensity are 0.370 (p < 0.01) in Model 1, 0.092 (p < 0.1) in Model 2, and 0.001 (p < 0.1) in Model 2a. This consistency suggests that increased energy consumption is a significant driver of climate change. Additionally, the ECT is significant and negative in all models. The coefficients are −0.289 (p < 0.01) in Model 1, −0.402 (p < 0.01) in Model 2, and −0.300 (p < 0.01) in Model 2a. This indicates that deviations from the long-run equilibrium are corrected relatively quickly, the system tends to return to equilibrium after a shock and implying a stable long-term relationship between the variables.

However, there are notable differences in the results as well. Urbanisation shows a variable impact across the models. In Model 1, urbanisation has a coefficient of −0.075 (p < 0.05), indicating a negative but statistically significant impact on CO2 emissions. In Model 2, the coefficient is −0.283 (p < 0.01), and in Model 2a, it is −0.382 (p < 0.01). This suggests that the exclusion of Singapore in Model 2a may strengthen the perceived negative relationship between urbanisation and emissions.

Inflation demonstrates a significant negative impact in Models 2 and 3. The coefficients are −0.016 (p < 0.01) in Model 2 and −0.021 (p < 0.01) in Model 2a, indicating that higher inflation rates might reduce CO2 emissions. However, inflation is not included in Model 1, so no comparison can be made for this variable across all three models. Trade openness shows a significant positive relationship with climate change in Models 2 and 2a, with coefficients of 0.005 (p < 0.05) and 0.007 (p < 0.01), respectively, suggesting that higher levels of trade are associated with increased emissions. This variable is not included in Model 1, either.

The FDI is not included in Model 1 but shows a positive and statistically insignificant impact in Models 2 and 2a, with coefficients of 0.021 and 0.033, respectively. This indicates that FDI does not have a consistent significant impact on climate change in the analysed models.

Overall, GDP per capita, energy use, and the error correction term show consistent results across all three models, urbanisation, inflation, and trade openness exhibit variability in their impacts depending on the model specification. The exclusion of Singapore in Model 2a appears to accentuate the negative impact of urbanisation on CO2 emissions. This suggests that the inclusion or exclusion of certain countries can influence the observed relationships between macroeconomic variables and CO2 emissions.

5. Conclusions and Discussion

In this study, we examine the macroeconomic trends of Southeast Asian countries considering their impact on climate change, particularly in the context of their adherence to the Kyoto Protocol and commitment to sustainable development goals. Our analysis focuses on three key macroeconomic variables: urbanisation, GDP per capita and energy intensity, FDI, inflation, and trade aiming to ascertain their influence on climate change dynamics.

The MG analysis across the three models reveals both consistencies and variations in the impact of various macroeconomic variables on climate change. First, urbanisation exerts a negative impact on exacerbating climate change. This phenomenon underscores an advantaging of the population influx from rural to urban areas in Southeast Asian countries. Termed traditional urbanisation, this trend primarily aims at fulfilling job demands in urban centres but frequently results in resource depletion, traffic congestion, and environmental deterioration. This unbridled urbanisation underscores the pressing need for policymakers to prioritise the development of robust urban infrastructure and comprehensive urban planning strategies. By doing so, they can effectively address the burgeoning urban population and mitigate the adverse environmental impacts associated with rapid urbanisation. Implementing sustainable urban development initiatives, such as green infrastructure, public transportation systems, and renewable energy integration, can help foster resilient and environmentally conscious urban communities in Southeast Asia. Thus, policymakers must focus on proactive measures to promote sustainable urbanisation and combat climate change in the region.

Urbanisation plays a pivotal role in shaping the economic and social landscape of countries, with new-type urbanisation emerging as a critical driver of China’s developmental trajectory, as highlighted by Wang et al. (2015). Distinguished by its human-centric approach, new-type urbanisation aims to address pressing issues in economic and social development while prioritising sustainability and quality of life. Unlike traditional urbanisation, which primarily focuses on increasing urbanisation rates, new-type urbanisation emphasises augmenting urban population density—the number of individuals per unit area—as a key metric of progress. The significance of urban population density lies in its correlation with the efficient utilisation of urban resources, a hallmark characteristic of new-type urbanisation. As population density increases, so does the potential for resource optimisation, thereby enhancing economic productivity and social well-being. However, the rapid growth of urban populations poses challenges to the carrying capacity of ecosystems, necessitating a paradigm shift towards sustainable urban development practices. Despite the laudable goals of new-type urbanisation, the findings from the mean MG analysis reveal a surprising lack of significant correlation between the urbanisation variable and climate change. Initially, urbanisation indicates a slight negative impact on climate change, which becomes more pronounced when excluding Singapore from the analysis. This could be due to Singapore’s unique urbanisation patterns and stringent environmental regulations, which differ significantly from other ASEAN countries. This suggests that tailored urbanisation policies promoting sustainable practices, such as green infrastructure and public transportation, could help mitigate emissions. The studies with similar results are Martínez-Zarzoso et al. (2007), and Martínez-Zarzoso and Maruotti (2011).

Second, the strong positive impact of GDP per capita on climate change in all three models. This finding indicates that higher economic output per person is consistently associated with increased the climate. This underscores the role of economic growth in driving emissions and highlights the significant challenge of balancing economic growth with environmental sustainability. As Southeast Asia experiences rapid economic development, characterised by increased industrial activities, urbanisation, and higher energy intensity, it is imperative for policymakers to adopt sustainable growth strategies that decouple economic growth from climate change impacts.

The analysis findings challenge the prevailing notion that developing countries significantly contribute to climate change during their developmental phases. In transitional economies, the misallocation of resources often leads to their inefficient utilisation, resulting in heightened pollution as a negative byproduct of production processes. Additionally, a notable hallmark of transitional economies is their heavy reliance on energy derived predominantly from fossil fuel combustion. It is only in the latter stages of their transformation that we observe a gradual uptick in the proportion of renewable energy sources integrated into their energy mix. However, the empirical insights gleaned from our analysis in Southeast Asia diverge from this narrative. Despite experiencing economic growth, these countries have managed to curtail pollution levels. This suggests a decoupling of economic growth from climate change, possibly attributable to factors such as the adoption of more efficient technologies, bolstered environmental regulations, and investments in renewable energy infrastructure. Moreover, the impact of this variable supports the findings of Paul and Bhattacharya (2004), which indicate that economic activity, as proxied by GDP, has a positive effect on climate change.

Third, the energy intensity also shows a generally positive relationship with the climate change across the models, though the strength of this impact varies. This consistency suggests that increased energy consumption is a significant driver of the climate change. This underscores the critical importance of addressing inefficient energy practices as a key strategy to mitigate the adverse impacts of climate change. Recognising the urgency of the situation, it becomes imperative to prioritise efforts aimed at enhancing energy efficiency and promoting the adoption of renewable energy sources. The results of the impact of energy intensity on climate change support the research of Menyah and Wolde-Rufael (2010), and Pao et al. (2011).

Considering this imperative, countries in Southern Asia can spearhead efforts towards sustainable development by transitioning towards renewable energy-based machinery and infrastructure in their economic activities. By harnessing the power of renewable resources such as solar, wind, and hydroelectric energy, these nations can significantly reduce their carbon footprint while simultaneously fostering economic growth. However, combating rising pollution requires a multifaceted approach that addresses not only energy inefficiency but also the equitable distribution of resources and the promotion of renewable energy adoption. Sustainable development efforts must be guided by an overarching commitment to environmental stewardship, social equity, and economic prosperity.

Moreover, raising ecological consciousness among stakeholders is paramount in driving meaningful change towards sustainability. This entails enhancing public awareness about the importance of environmental conservation, fostering a deeper understanding of the interconnectedness between human activities and ecosystem health, and promoting sustainable lifestyles and consumption patterns. Additionally, investing in new technologies and innovation plays a pivotal role in addressing climate change challenges. By leveraging advancements in clean energy technologies, sustainable agriculture practices, and eco-friendly manufacturing processes, countries can accelerate their transition towards a low-carbon and resilient future. In conclusion, the fight against climate change necessitates concerted efforts from all sectors of society. By prioritising energy efficiency, promoting renewable energy adoption, addressing resource distribution disparities, raising ecological consciousness, and investing in innovative technologies, Southeast Asian countries can pave the way towards a more sustainable and prosperous future for generations to come.

Inflation demonstrates a significant negative impact on climate change in some models. This relationship suggests that higher inflation rates might reduce the climate change. One possible explanation is that higher prices reduce consumer demand, leading to a decrease in production activities that typically generate emissions. This indicates that inflation can indirectly influence environmental outcomes by altering consumption and production patterns. Although inflation control is not a direct tool for environmental policy, understanding its relationship with climate change can be valuable for designing comprehensive economic strategies. For instance, policymakers can leverage this knowledge to craft policies that simultaneously aim for macroeconomic stability and environmental sustainability (Antal and Van den Bergh 2013). During periods of inflation, the government can prioritise investments in energy-efficient technologies and green infrastructure. By doing so, even if economic activities slow down due to higher prices, the impact on climate change could be mitigated through increased efficiency and reduced reliance on fossil fuels.

Furthermore, this relationship highlights the interconnectedness of economic and environmental policies. As countries strive to control inflation, they must consider the potential environmental benefits of reduced economic activity and adjust their policies accordingly. For instance, a country experiencing high inflation might implement measures to stabilise prices while simultaneously promoting renewable energy sources and sustainable practices in industry and transportation. In discussing the policy implications, it is essential to recognise that while inflation control can have environmental benefits, it should not be relied upon as the primary means of reducing the climate change. Instead, it should complement other targeted environmental policies, such as carbon pricing, regulations on industrial emissions, and incentives for clean energy adoption. By integrating economic and environmental policies, governments can achieve a more holistic approach to sustainable development.

Additionally, the negative impact of inflation on climate change may vary depending on the structure of the economy and the specific sectors driving inflation. Policymakers should conduct sector-specific analyses to understand how inflation affects emissions in different industries. For example, inflation in the energy sector might lead to higher prices for fossil fuels, encouraging a shift toward renewable energy sources. Conversely, inflation in the agricultural sector could have different implications for emissions.

In conclusion, while inflation control is not a direct environmental policy tool, its significant negative impact on climate change in some models provides valuable insights for policymakers. By understanding this relationship, governments can design comprehensive economic policies that contribute to both macroeconomic stability and environmental sustainability. Integrating inflation control with targeted environmental measures can help achieve a balanced approach to sustainable development, ensuring that economic growth does not come at the expense of environmental health. The results of this research on the impact of inflation strengthen the findings of Xu et al. (2023), which indicate that inflation affects certain economic conditions.

Trade openness exhibits a positive relationship with climate change in certain models. This finding suggests that higher levels of trade are associated with increased emissions, potentially due to the intensified industrial activity and transportation demands accompanying trade expansion. As developing countries with promising economies, their industries expand to meet the growing demand for goods and services, typically resulting in an increase in manufacturing and production activities. This finding is also in line with Idowu et al. (2023), which indicates that energy consumption from the industrialisation process has a positive impact on increasing carbon emissions.

This observation underscores the need for policymakers to address the environmental implications of trade liberalisation. One potential explanation for the positive relationship between trade openness and climate change is the phenomenon of pollution havens. In pursuit of comparative advantage and cost savings, industries may relocate to countries with lax environmental regulations, leading to increased emissions in those regions. Moreover, trade can amplify consumption patterns, resulting in higher demand for goods and services, which in turn drives up emissions from production processes and transportation.

To address the climate change consequences of trade openness, policymakers should adopt measures to promote cleaner technologies and impose stricter on climate change reducing efforts within trade agreements. By incorporating environmental clauses into trade negotiations, governments can encourage trading partners to adopt sustainable practices and mitigate the environmental impact of trade activities. Additionally, investing in research and development of eco-friendly technologies can enhance competitiveness while reducing emissions associated with trade-related activities.

Furthermore, discussions surrounding trade and environmental sustainability should consider the concept of carbon leakage. While stricter environmental regulations in one country may lead to emissions reductions domestically, industries may relocate to regions with weaker regulations, resulting in a mere shift in emissions rather than an absolute decrease (Savona and Ciarli 2019). Policymakers must address this challenge through coordinated international efforts to harmonise environmental standards and prevent carbon leakage.

The positive relationship between trade openness and climate change underscores the need for proactive environmental policies in the context of trade liberalisation. By integrating environmental considerations into trade agreements and promoting sustainable practices, policymakers can ensure that trade expansion contributes to economic growth without compromising environmental integrity. Collaboration at the international level is crucial to address the global nature of environmental challenges associated with trade, ultimately fostering a more sustainable and equitable global trading system.

The FDI yielded mixed results regarding its impact on climate change across the models. While FDI has the potential to stimulate economic growth, its environmental repercussions hinge on various factors, including the nature of investments and industrial sectors involved. The lack of consistent significance in the impact of FDI on climate change underscores the complexity of this relationship. It suggests that the environmental effects of FDI may vary depending on factors such as the sector in which investments are made and the technological advancements accompanying them. This variability highlights the importance of context-specific analyses and the need to consider the heterogeneity of FDI inflows in environmental policymaking.

Moreover, the inconclusive findings regarding FDI’s influence on climate change emphasise the necessity of adopting a nuanced approach to attract foreign investments. Policymakers should prioritise investments that align with sustainable development goals and promote environmentally friendly practices. By incentivising green FDI and implementing stringent environmental regulations, countries can leverage foreign investments to drive economic growth while minimising ecological harm which can impact to climate change. Research by Apergis et al. (2023) supports the results of this study by finding that FDI flows from OECD countries do not impact carbon emissions and environmental damage in BRICS countries.

Additionally, the absence of a consistent relationship between FDI and climate change underscores the need for further research to elucidate the underlying mechanisms driving this association. Future studies could explore how factors such as technology transfer, sectoral composition, and environmental regulations influence the environmental impact of FDI. By gaining a deeper understanding of these dynamics, policymakers can devise more effective strategies to harness the potential benefits of FDI while mitigating its adverse environmental consequences.

In conclusion, while GDP per capita, energy intensity, and the error correction term show consistent results across all three models, urbanisation, inflation, and trade openness exhibit variability in their impacts depending on the model specification. The exclusion of Singapore in the analysis appears to accentuate the negative impact of urbanisation on climate change. This suggests that the inclusion or exclusion of certain countries can influence the observed relationships between macroeconomic variables and climate change. Policymakers in ASEAN countries should adopt a multifaceted approach that promotes sustainable economic growth, increases energy efficiency, leverages cleaner technologies, and incorporates environmental considerations into trade and investment policies. By doing so, they can achieve a balance between economic development and environmental sustainability, ultimately contributing to the global effort to combat climate change.

Author Contributions

Conceptualisation: A.S. (Agung Suwandaru); Methodology: A.S. (Agung Suwandaru); Software: W.S.; Formal Analysis: W.S.; Investigation: Y.F.; Resources: A.S. (Ahmed Shawdari); Data Curation: A.S. (Ahmed Shawdari); Writing—original draft preparation: A.S. (Agung Suwandaru); Writing—review and editing: W.S. and A.S. (Ahmed Shawdari); Project Administration: Y.F. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Informed Consent Statement

Not applicable.

Data Availability Statement

Data is available upon request.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Ahmad, Wasim, Rishman Jot Kaur Chahal, and Shirin Rais. 2022. Understanding the impact of the coronavirus outbreak on the economic integration of ASEAN countries. Asia and the Global Economy 2: 100040. [Google Scholar] [CrossRef]

- Andersson, Malin, Julian Morgan, and Claudio Baccianti. 2020. Climate change and the macro economy. ECB Occasional Paper 2020: 2020243. [Google Scholar] [CrossRef]

- Antal, Miklós, and Jeroen C. J. M. Van den Bergh. 2013. Macroeconomics, financial crisis and the environment: Strategies for a sustainability transition. Environmental Innovation and Societal Transitions 6: 47–66. [Google Scholar] [CrossRef]

- Apergis, Nicholas, and James E. Payne. 2010. Renewable energy consumption and economic growth: Evidence from a panel of OECD countries. Energy Policy 38: 656–60. [Google Scholar] [CrossRef]

- Apergis, Nicholas, Mehmet Pinar, and Emre Unlu. 2023. How do foreign direct investment flows affect carbon emissions in BRICS countries? Revisiting the pollution haven hypothesis using bilateral FDI flows from OECD to BRICS countries. Environmental Science and Pollution Research 30: 14680–92. [Google Scholar] [CrossRef]

- Asafu-Adjaye, John, Dominic Byrne, and Maximiliano Alvarez. 2016. Economic growth, fossil fuel and non-fossil consumption: A Pooled Mean Group analysis using proxies for capital. Energy Economics 60: 345–56. [Google Scholar] [CrossRef]

- ASEAN Secretariat. 2021. ASEAN State of Climate Change Report. Jakarta: ASEAN Secretariat. [Google Scholar]

- Atici, Cemal. 2022. Reconciling the flexibility mechanisms of climate policies towards the inclusiveness of developing countries: Commitments and prospects. Environment, Development and Sustainability 24: 9048–67. [Google Scholar] [CrossRef]

- Balogh, Jeremiás Máté, and Tamás Mizik. 2023. Global impacts of climate policy and trade agreements on greenhouse gas emissions. Agriculture 13: 424. [Google Scholar] [CrossRef]

- Bassi, Andrea M., Joel S. Yudken, and Matthias Ruth. 2009. Climate policy impacts on the competitiveness of energy-intensive manufacturing sectors. Energy Policy 37: 3052–60. [Google Scholar] [CrossRef]

- Bennink, Hans. 2023. Prospects of green financing in democratic societies. Green Finance 5: 154–94. [Google Scholar] [CrossRef]

- Bilal, Irfan Khan, Duojiao Tan, Waseem Azam, and Syed Tauseef Hassan. 2022. Alternate energy sources and environmental quality: The impact of inflation dynamics. Gondwana Research 106: 51–63. [Google Scholar] [CrossRef]

- Bistline, John, Neil Mehrotra, and Catherine Wolfram. 2023. Economic Implications of the Climate Provisions of the Inflation Reduction Act. Brookings Papers on Economic Activity 2023: 77–182. [Google Scholar] [CrossRef]

- Brandi, Clara, Jakob Schwab, Axel Berger, and Jean-Frédéric Morin. 2020. Do environmental provisions in trade agreements make exports from developing countries greener? World Development 129: 104899. [Google Scholar] [CrossRef]

- Bukša, Tomislav, Juraj Bukša, and Ivana Kosovac. 2022. Effects of foreign direct investment on the economy and environment. Journal of Process Management and New Technologies 10: 22–39. [Google Scholar] [CrossRef]

- Burck, Jan, Franziska Marten, Christoph Bals, and Niklas Höhne. 2014. The Climate Change Performance Index: Results 2015. Berlin: Germanwatch Berlin. [Google Scholar]

- Chang, Rongping, Bei Wang, Yan Zhang, and Lingxue Zhao. 2022. Foreign direct investment and air pollution: Re-estimating the “pollution haven hypothesis” in China. Sustainability 14: 13759. [Google Scholar] [CrossRef]

- Chen, Lifeng, Fuxuan Guo, and Lingyan Huang. 2023. Impact of foreign direct investment on green innovation: Evidence from China’s provincial panel data. Sustainability 15: 3318. [Google Scholar] [CrossRef]

- Cole, Matthew A., and Eric Neumayer. 2004. Examining the impact of demographic factors on air pollution. Population and Environment 26: 5–21. [Google Scholar] [CrossRef]

- Dissanayake, Sumali, Renuka Mahadevan, and John Asafu-Adjaye. 2020. Evaluating the efficiency of carbon emissions policies in a large emitting developing country. Energy Policy 136: 111080. [Google Scholar] [CrossRef]

- Essandoh, Obed Kwame, Moinul Islam, and Makoto Kakinaka. 2020. Linking international trade and foreign direct investment to CO2 emissions: Any differences between developed and developing countries? Science of The Total Environment 712: 136437. [Google Scholar] [CrossRef]

- Fong, Letisha S., Alberto Salvo, and David Taylor. 2020. Evidence of the environmental Kuznets curve for atmospheric pollutant emissions in Southeast Asia and implications for sustainable development: A spatial econometric approach. Sustainable Development 28: 1441–56. [Google Scholar] [CrossRef]

- Gerden, Tomaž. 2018. The adoption of the kyoto protocol of the united nations framework convention on climate change. Contributions to Contemporary History 58: 315–31. [Google Scholar] [CrossRef]

- Goodwin, Neva, Jonathan M Harris, Julie A Nelson, Pratistha Joshi Rajkarnikar, Brian Roach, and Mariano Torras. 2022. Macroeconomics in Context. London: Routledge. [Google Scholar]

- Honma, Satoshi. 2015. Does international trade improve environmental efficiency? An application of a super slacks-based measure of efficiency. Journal of Economic Structures 4: 13. [Google Scholar] [CrossRef]

- Idowu, Ayodele, Obaika Micheal Ohikhuare, and Munem Ahmad Chowdhury. 2023. Does industrialization trigger carbon emissions through energy consumption? Evidence from OPEC countries and high industrialised countries. Quantitative Finance and Economics 7: 165–86. [Google Scholar] [CrossRef]

- IEA, ed. 2023. World Energy Outlook 2022. Paris: IEA. [Google Scholar]

- Kao, Chihwa. 1999. Spurious regression and residual-based tests for cointegration in panel data. Journal of Econometrics 90: 1–44. [Google Scholar] [CrossRef]

- Konradt, Maximilian, and Beatrice Weder di Mauro. 2023. Carbon taxation and greenflation: Evidence from Europe and Canada. Journal of the European Economic Association 21: 2518–46. [Google Scholar] [CrossRef]

- Li, Cunpu, Xuetong Zhang, and Jing He. 2023. Impact of Climate Change on Inflation in 26 Selected Countries. Sustainability 15: 13108. [Google Scholar] [CrossRef]

- Martínez-Zarzoso, Inmaculada, and Antonello Maruotti. 2011. The impact of urbanization on CO2 emissions: Evidence from developing countries. Ecological Economics 70: 1344–53. [Google Scholar] [CrossRef]

- Martínez-Zarzoso, Inmaculada, Aurelia Bengochea-Morancho, and Rafael Morales-Lage. 2007. The impact of population on CO2 emissions: Evidence from European countries. Environmental and Resource Economics 38: 497–512. [Google Scholar] [CrossRef]

- Meng, Jing, Jingwen Huo, Zengkai Zhang, Yu Liu, Zhifu Mi, Dabo Guan, and Kuishuang Feng. 2023. The narrowing gap in developed and developing country emission intensities reduces global trade’s carbon leakage. Nature Communications 14: 3775. [Google Scholar] [CrossRef]

- Menyah, Kojo, and Yemane Wolde-Rufael. 2010. Energy consumption, pollutant emissions and economic growth in South Africa. Energy Economics 32: 1374–82. [Google Scholar] [CrossRef]

- Mitić, Petar, Olja Munitlak Ivanović, and Aleksandar Zdravković. 2017. A Cointegration Analysis of Real GDP and CO2 Emissions in Transitional Countries. Sustainability 9: 568. [Google Scholar] [CrossRef]

- Mohd Nor, Muhammad Anwar, Mohd Nor Mamat, Siti Fatahiyah Mahamood, and Muhammad Munir Mohd Nor. 2020. ASEAN as an Inclusive Community: Identifying and Overcoming the Challenges. In Charting a Sustainable Future of ASEAN in Business and Social Sciences: Paper presented at the 3rd International Conference on the Future of ASEAN (ICoFA) 2019—Volume 1, Perlis Branch, Malaysia, 4–6 October 2019. Singapore: Springer. [Google Scholar]

- Napp, Tamaryn A., Ajay Gambhir, Thomas P. Hills, Nicholas Florin, and Paul S. Fennell. 2014. A review of the technologies, economics and policy instruments for decarbonising energy-intensive manufacturing industries. Renewable and Sustainable Energy Reviews 30: 616–40. [Google Scholar] [CrossRef]

- Nasir, Muhammad Ali, Toan Luu Duc Huynh, and Huong Thi Xuan Tram. 2019. Role of financial development, economic growth & foreign direct investment in driving climate change: A case of emerging ASEAN. Journal of Environmental Management 242: 131–41. [Google Scholar] [PubMed]

- Olasehinde-Williams, Godwin, and Seyi Saint Akadiri. 2024. Environmental policy stringency and carbon leakages: A case for carbon border adjustment mechanism in the European Union. Environment, Development and Sustainability, 1–22. [Google Scholar] [CrossRef]

- Pao, Hsiao-Tien, Hsiao-Cheng Yu, and Yeou-Herng Yang. 2011. Modeling the CO2 emissions, energy use, and economic growth in Russia. Energy 36: 5094–100. [Google Scholar] [CrossRef]

- Parry, Martin, Nigel Arnell, Tony McMichael, Robert Nicholls, Pim Martens, Sari Kovats, Matthew Livermore, Cynthia Rosenzweig, Ana Iglesias, and Gunther Fischer. 2001. Millions at risk: Defining critical climate change threats and targets. Global Environmental Change 11: 181–83. [Google Scholar] [CrossRef]

- Pastpipatkul, Pathairat, Kunchon Wattanakul, and Chutikan Khumchui. 2022. Relationship Among International Trade, Financial Development, and Economic Growth: The Case of ASEAN. Paper presented at the International Conference of the Thailand Econometrics Society, Chiang Mai, Thailand, January 1–2. [Google Scholar]

- Paul, Shyamal, and Rabindra Nath Bhattacharya. 2004. CO2 emission from energy use in India: A decomposition analysis. Energy Policy 32: 585–93. [Google Scholar] [CrossRef]

- Pereira, Joy Jacqueline, and Rajib Shaw. 2022. Southeast Asia: An Outlook on Climate Change. In Climate Change Adaptation in Southeast Asia. Singapore: Springer, pp. 1–24. [Google Scholar]

- Pesaran, M. Hashem. 2007. A simple panel unit root test in the presence of cross-section dependence. Journal of Applied Econometrics 22: 265–312. [Google Scholar] [CrossRef]

- Pesaran, M. Hashem, Til Schuermann, and Scott M. Weiner. 2004. Modeling Regional Interdependencies Using a Global Error-Correcting Macroeconometric Model. Journal of Business & Economic Statistics 22: 129–62. [Google Scholar] [CrossRef]

- Pesaran, M. Hashem, Yongcheol Shin, and Ron P. Smith. 1999. Pooled mean group estimation of dynamic heterogeneous panels. Journal of the American Statistical Association 94: 621–34. [Google Scholar] [CrossRef]

- Philip, Lucy Davou, Kamil Sertoglu, Seyi Saint Akadiri, and Godwin Olasehinde-Williams. 2021. Foreign direct investment amidst global economic downturn: Is there a time-varying implication for environmental sustainability targets? Environmental Science and Pollution Research 28: 21359–68. [Google Scholar] [CrossRef] [PubMed]

- Poumanyvong, Phetkeo, and Shinji Kaneko. 2010. Does urbanization lead to less energy use and lower CO2 emissions? A cross-country analysis. Ecological Economics 70: 434–44. [Google Scholar] [CrossRef]

- Raihan, Asif, and Almagul Tuspekova. 2022. The nexus between economic growth, energy use, urbanization, tourism, and carbon dioxide emissions: New insights from Singapore. Sustainability Analytics and Modeling 2: 100009. [Google Scholar] [CrossRef]

- Saboori, Behnaz, and Jamalludin Sulaiman. 2013. CO2 emissions, energy consumption and economic growth in Association of Southeast Asian Nations (ASEAN) countries: A cointegration approach. Energy 55: 813–22. [Google Scholar] [CrossRef]

- Saboori, Behnaz, Lokman Zaibet, and Houcine Boughanmi. 2022. Export diversification, energy consumption, economic growth and environmental degradation: Evidence from Oman. International Journal of Ambient Energy 43: 8486–504. [Google Scholar] [CrossRef]

- Sarkodie, Samuel Asumadu, and Vladimir Strezov. 2018. Empirical study of the environmental Kuznets curve and environmental sustainability curve hypothesis for Australia, China, Ghana and USA. Journal of Cleaner Production 201: 98–110. [Google Scholar] [CrossRef]

- Savona, Maria, and Tommaso Ciarli. 2019. Structural changes and sustainability. A selected review of the empirical evidence. Ecological Economics 159: 244–60. [Google Scholar] [CrossRef]

- Shahbaz, Muhammad, Qazi Muhammad Adnan Hye, Aviral Kumar Tiwari, and Nuno Carlos Leitão. 2013. Economic growth, energy consumption, financial development, international trade and CO2 emissions in Indonesia. Renewable and Sustainable Energy Reviews 25: 109–21. [Google Scholar] [CrossRef]

- Sharma, Susan Sunila. 2011. Determinants of carbon dioxide emissions: Empirical evidence from 69 countries. Applied Energy 88: 376–82. [Google Scholar] [CrossRef]

- Soussane, Jihad Ait, Dalal Mansouri, Mohamed Yassine Fakhouri, and Zahra Mansouri. 2023. Does climate change constitute a financial risk to foreign direct investment? An empirical analysis on 200 countries from 1970 to 2020. Weather, Climate, and Society 15: 31–43. [Google Scholar] [CrossRef]

- Tran, Trang My. 2022. International environmental agreement and trade in environmental goods: The case of Kyoto Protocol. Environmental and Resource Economics 83: 341–79. [Google Scholar] [CrossRef]