The Role of IT Governance in the Integration of AI in Accounting and Auditing Operations

Abstract

1. Introduction

2. Literature Review and Hypotheses Development

2.1. The Saudi Context

2.2. The Impact of Artificial Intelligence on Accounting and Auditing

2.3. The Mediating Role of IT Governance on the Relationship between Artificial Intelligence and Accounting and Auditing

3. Research Design and Method

3.1. Sample and Tools of Analysis

3.2. Questionnaire Design and the Research Instrument

3.3. Statistical Setting

4. Empirical Results

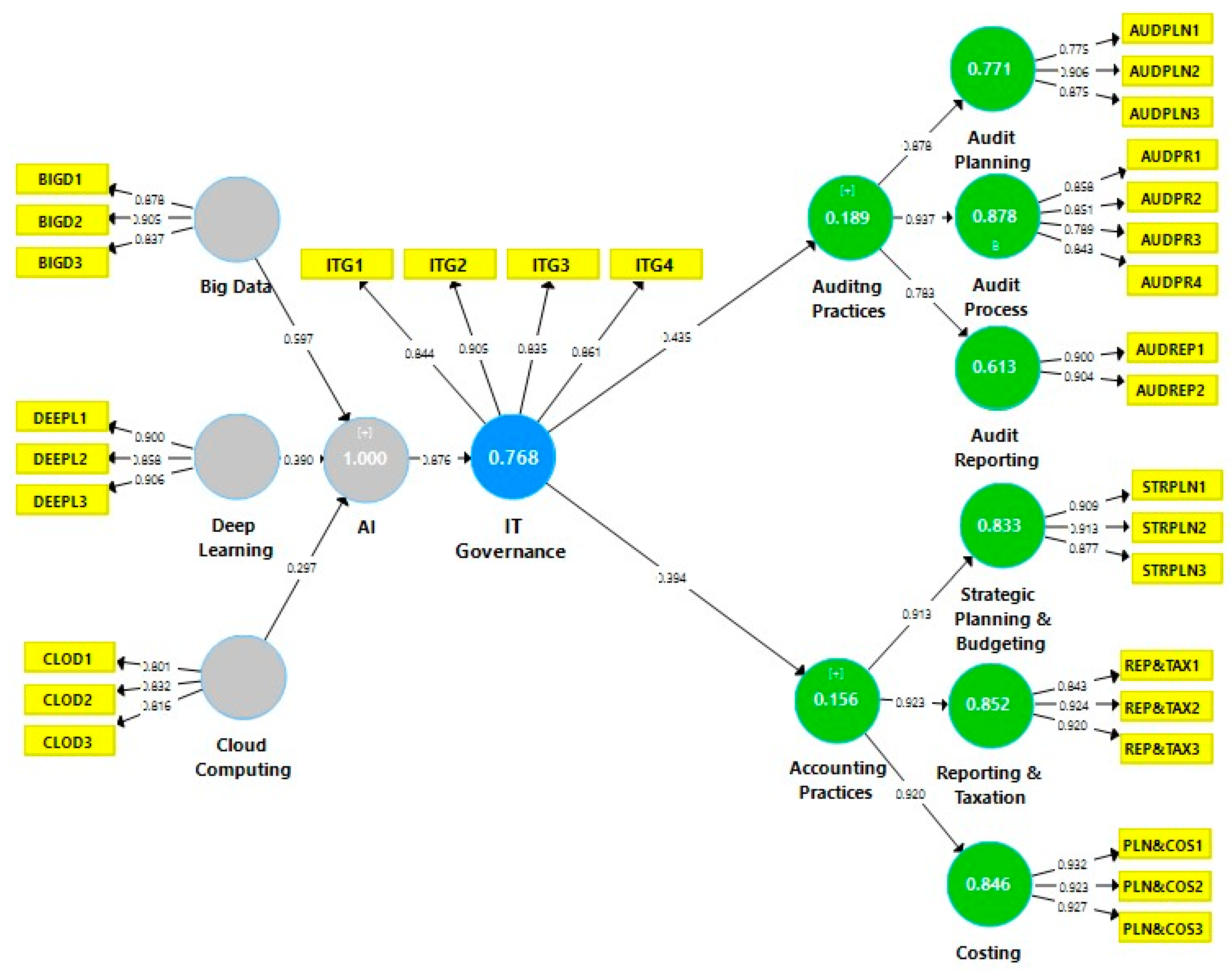

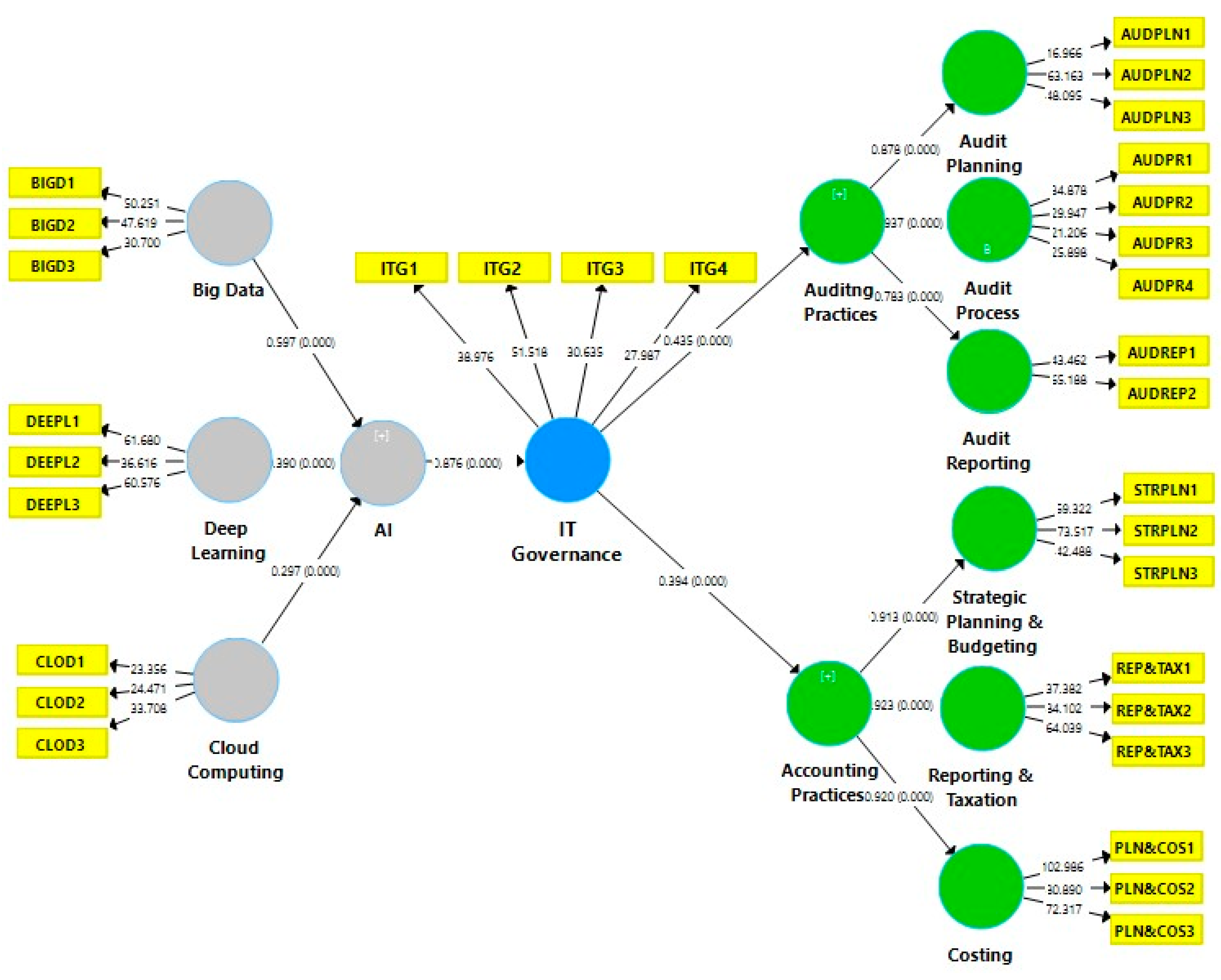

4.1. Model’s Measurement

Confirmatory Factor Analysis and Reliability Analysis

4.2. Direct Effect

4.3. Indirect Moderating Effect

5. Discussion and Implications

6. Conclusions

Funding

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Abdullah, Abdulwahid Ahmad Hashed, and Faozi A. Almaqtari. 2024. The impact of artificial intelligence and Industry 4.0 on transforming accounting and auditing practices. Journal of Open Innovation: Technology, Market, and Complexity 10: 100218. [Google Scholar] [CrossRef]

- Abu-Musa, Ahmad A. 2008. Information technology and its implications for internal auditing: An empirical study of Saudi organizations. Managerial Auditing Journal 23: 438–66. [Google Scholar] [CrossRef]

- Al Omari, Loai. 2016. IT Governance Evaluation: Adapting and Adopting the COBIT Framework for Public Sector Organisations. Doctoral dissertation, Queensland University of Technology, Brisbane, Australia. [Google Scholar]

- Alanazi, Fayez. 2023. Development of Smart Mobility Infrastructure in Saudi Arabia: A Benchmarking Approach. Sustainability 15: 3158. [Google Scholar] [CrossRef]

- Al-Baity, Heyam H. 2023. The artificial intelligence revolution in digital finance in Saudi Arabia: A comprehensive review and proposed framework. Sustainability 15: 13725. [Google Scholar] [CrossRef]

- AlGhazzawi, Nooradeen Adel. 2020. Adoption of Cloud Enterprise Resource Planning Systems (CERPs) in the Kingdom of Saudi Arabia. Doctoral dissertation, RMIT University, Melbourne, Australia. [Google Scholar]

- Al-Hattami, Hamood Mohammed. 2023. Understanding perceptions of academics toward technology acceptance in accounting education. Heliyon 9: e13141. [Google Scholar] [CrossRef] [PubMed]

- Al-Hattami, Hamood Mohammed, and Faozi A. Almaqtari. 2023. What determines digital accounting systems’ continuance intention? An empirical investigation in SMEs. Humanities and Social Sciences Communications 10: 1–13. [Google Scholar] [CrossRef]

- Al-Hattami, Hamood Mohammed, Faozi A. Almaqtari, Abdulwahid Ahmed Hashed Abdullah, and Ahmad Samed Al-Adwan. 2024. Digital accounting system and its effect on corporate governance: An empirical investigation. Strategic Change 33: 151–67. [Google Scholar] [CrossRef]

- Al-Htaybat, Khaldoon, Larissa von Alberti-Alhtaybat, and Zaidoon Alhatabat. 2018. Educating digital natives for the future: Accounting educators’ evaluation of the accounting curriculum. Accounting Education 27: 333–57. [Google Scholar] [CrossRef]

- Alhumoudi, Hamad, and Abdulrahman Juayr. 2023. Exploring the impact of artificial intelligence and digital transformation on auditing practices in Saudi Arabia: A cross-sectional study. Asian Journal of Finance and Accounting 15: 1–30. [Google Scholar] [CrossRef]

- Allami, Karrar Khalaf Jabbar, Faozi A. Almaqtari, Hamood Mohammed Al-Hattami, and Ritu Sapra. 2024. Factors associated with the intention to use information technology in audit in Iraq. Information Discovery and Delivery 52: 197–212. [Google Scholar] [CrossRef]

- Alles, Michael, and Glen L. Gray. 2016. Incorporating big data in audits: Identifying inhibitors and a research agenda to address those inhibitors. International Journal of Accounting Information Systems 22: 44–59. [Google Scholar] [CrossRef]

- Almaqtari, Faozi A. 2024. The moderating role of IT governance on the relationship between FinTech and sustainability performance. Journal of Open Innovation: Technology, Market, and Complexity 10: 100267. [Google Scholar] [CrossRef]

- Almaqtari, Faozi A., Najib HS Farhan, Ali T. Yahya, Borhan Omar Ahmad Al-Dalaien, and Mohd Shamim. 2022. The mediating effect of IT governance between corporate governance mechanisms, business continuity, and transparency and disclosure: An empirical study of COVID-19 Pandemic in Jordan. Information Security Journal 1: 1–19. [Google Scholar] [CrossRef]

- Almaqtari, Faozi A., Najib HS Farhan, Hamood Mohammed Al-Hattami, Tamer Elsheikh, and Borhan Omar Ahmad Al-dalaien. 2024. The Impact of Artificial Intelligence on Information Audit Usage: Evidence from Developing Countries. Journal of Open Innovation: Technology, Market, and Complexity 10: 100298. [Google Scholar] [CrossRef]

- Alotaibi, Nayef Shaie, and Awad Hajran Alshehri. 2023. Prospers and obstacles in using artificial intelligence in Saudi Arabia higher education institutions—The potential of AI-based learning outcomes. Sustainability 15: 10723. [Google Scholar] [CrossRef]

- Alreemy, Zyad, Victor Chang, Robert Walters, and Gary Wills. 2016. Critical success factors (CSFs) for information technology governance (ITG). International Journal of Information Management 36: 907–16. [Google Scholar] [CrossRef]

- Alzahrani, Reema Bakheet. 2024. An Overview of AI Data Protection in the Context of Saudi Arabia. International Journal for Scientific Research 3: 1–20. [Google Scholar] [CrossRef]

- Aqlan, Saleem Ahmed Ghaleb. 2021. The Role of Accounting Data and Information in Rationalization of Managerial Decisions in Private Industrial Units in the Republic of Yemen. Doctoral dissertation, Dr. Babasaheb Ambedkar Marathwada University, Aurangabad, India. [Google Scholar]

- Arnaboldi, Michela, Cristiano Busco, and Suresh Cuganesan. 2017. Accounting, accountability, social media and big data: Revolution or hype? Accounting, Auditing and Accountability Journal 30: 762–76. [Google Scholar] [CrossRef]

- Awwad, Bahaa, and Rim El Khoury. 2021. Information technology governance and bank performance: Evidence from Palestine. Journal of Decision Systems 33: 311–34. [Google Scholar] [CrossRef]

- Bradley, Joseph M., and Ralph T. Soule. 2018. Information Technology Governance through the Complex System Governance Lens. INCOSE International Symposium 28: 1237–49. [Google Scholar] [CrossRef]

- Brown-Liburd, Helen, and Miklos A. Vasarhelyi. 2015. Big data and audit evidence. Journal of Emerging Technologies in Accounting 12: 1–16. [Google Scholar] [CrossRef]

- Cabrera-Sánchez, Juan-Pedro, Ángel F. Villarejo-Ramos, Francisco Liébana-Cabanillas, and Aijaz A. Shaikh. 2021. Identifying relevant segments of AI applications adopters—Expanding the UTAUT2′s variables. Telematics and Informatics 58: 101529. [Google Scholar] [CrossRef]

- Caluwe, Laura, and Steven De Haes. 2019. Board Level IT Governance: A Scoping Review to Set the Research Agenda. Information Systems Management 36: 262–83. [Google Scholar] [CrossRef]

- Cath, Corinne. 2018. Governing artificial intelligence: Ethical, legal and technical opportunities and challenges. Philosophical Transactions of the Royal Society A: Mathematical, Physical and Engineering Sciences 376: 20180080. [Google Scholar] [CrossRef] [PubMed]

- Chen, Shu. 2021. The Impact of Artificial Intelligence and Data Fusion Technology on the Accounting Industry and Its Countermeasures. In ACM International Conference Proceeding Series. New York: Association for Computing Machinery, pp. 877–81. [Google Scholar] [CrossRef]

- Cockcroft, Sophie, and Mark Russell. 2018. Big Data Opportunities for Accounting and Finance Practice and Research. Australian Accounting Review 28: 323–33. [Google Scholar] [CrossRef]

- Damerji, Hassan, and Anwar Salimi. 2021. Mediating effect of use perceptions on technology readiness and adoption of artificial intelligence in accounting. Accounting Education 30: 107–30. [Google Scholar] [CrossRef]

- Deloitte. 2023. New Fundamentals for a Boundaryless World Middle East 2023 Human Capital Trends. Available online: https://www2.deloitte.com/content/dam/Deloitte/xe/Documents/human-capital/2023-Middle-East-Human-Capital-Trends-Report.pdf (accessed on 23 February 2024).

- Dhamija, Pavitra, and Surajit Bag. 2020. Role of artificial intelligence in operations environment: A review and bibliometric analysis. The TQM Journal 32: 869–96. [Google Scholar] [CrossRef]

- Di Vaio, Assunta, Rosa Palladino, Rohail Hassan, and Octavio Escobar. 2020. Artificial intelligence and business models in the sustainable development goals perspective: A systematic literature review. Journal of Business Research 121: 283–314. [Google Scholar] [CrossRef]

- Earley, Christine E. 2015. Data analytics in auditing: Opportunities and challenges. Business Horizons 58: 493–500. [Google Scholar] [CrossRef]

- Elazhary, Moustafa, Aleš Popovič, Paulo Henrique de Souza Bermejo, and Tiago Oliveira. 2022. How Information Technology Governance Influences Organizational Agility: The Role of Market Turbulence. Information Systems Management 40: 148–68. [Google Scholar] [CrossRef]

- Enholm, Ida Merete, Patrick Mikalef, Emmanouil Papagiannidis, and John Krogstie. 2022. Artificial intelligence and business value: A literature review. Information Systems Frontiers 24: 1709–34. [Google Scholar] [CrossRef]

- Erasmus, Wikus, and Carl Marnewick. 2021. An IT governance framework for IS portfolio management. International Journal of Managing Projects in Business 14: 721–42. [Google Scholar] [CrossRef]

- Faccia, Alessio, Mohamed Yousif Khamis Al Naqbi, and Saeed Ahmad Lootah. 2019. Integrated Cloud Financial Accounting Cycle. Paper presented at the 2019 3rd International Conference on Cloud and Big Data Computing, Oxford, UK, August 28–30; pp. 31–37. [Google Scholar] [CrossRef]

- Floridi, Luciano. 2018. Soft Ethics and the Governance of the Digital. Philosophy and Technology 31: 1–8. [Google Scholar] [CrossRef]

- Gomez, Javier. 2018. What should i wear today? An IoT–Based dress assistant for the E–Society. In Lecture Notes in Computer Science (Including Subseries Lecture Notes in Artificial Intelligence and Lecture Notes in Bioinformatics). LNCS; Cham: Springer, vol. 11195. [Google Scholar] [CrossRef]

- Gotthardt, Max, Dan Koivulaakso, Okyanus Paksoy, Cornelius Saramo, Minna Martikainen, and Othmar Lehner. 2020. Current state and challenges in the implementation of smart robotic process automation in accounting and auditing. ACRN Journal of Finance and Risk Perspectives 9: 90–102. [Google Scholar] [CrossRef]

- Groomer, S. Michael, and Uday S. Murthy. 2018. Continuous Auditing of Database Applications: An Embedded Audit Module Approach. In Continuous Auditing (Rutgers Studies in Accounting Analytics). Edited by David Y. Chan, Victoria Chiu and Miklos A. Vasarhelyi. Leeds: Emerald Publishing Limited, pp. 105–24. [Google Scholar] [CrossRef]

- Hamza, Randa Abd Elhamied Mohammed, Nasareldeen Hamed Ahmed, Abdelwhab Musa Elgali Mohamed, Mohamed Youcef Bennaceur, Ahmed Hesham Moawed Elhefni, and Mona M. Elshaabany. 2024. The Impact of Artificial Intelligence (AI) on the Accounting System of Saudi Companies. WSEAS Transactions on Business and Economics 21: 499–511. [Google Scholar] [CrossRef]

- Han, Hongdan, Radha K. Shiwakoti, Robin Jarvis, Chima Mordi, and David Botchie. 2023. Accounting and auditing with blockchain technology and artificial Intelligence: A literature review. International Journal of Accounting Information Systems 48: 100598. [Google Scholar] [CrossRef]

- Handoko, Bambang Leo, and Stephanie Liusman. 2021. Analysis of External Auditor Intentions in Adopting Artificial Intelligence as Fraud Detection with the Unified Theory of Acceptance and Use of Technology (UTAUT) Approach. Paper presented at the 2021 12th International Conference on E-business, Management and Economics, Beijing, China, July 17–19; pp. 96–103. [Google Scholar]

- Hardin-Ramanan, Sarita, Vanessa Chang, and Tomayess Issa. 2018. A Green Information Technology governance model for large Mauritian companies. Journal of Cleaner Production 198: 488–97. [Google Scholar] [CrossRef]

- Hooda, Nishtha, Seema Bawa, and Prashant Singh Rana. 2020. Optimizing Fraudulent Firm Prediction Using Ensemble Machine Learning: A Case Study of an External Audit. Applied Artificial Intelligence 34: 20–30. [Google Scholar] [CrossRef]

- Hu, Li-tze, and Peter M. Bentler. 1998. Fit indices in covariance structure modeling: Sensitivity to underparameterized model misspecification. Psychological Methods 3: 424–53. [Google Scholar] [CrossRef]

- Hu, Xiao, Rita Yi Man Li, Kalpina Kumari, Samira Ben Belgacem, Qinghua Fu, Mohammed Arshad Khan, and Abdulaziz A. Alkhuraydili. 2022. Relationship between green leaders’ emotional intelligence and employees’ green behavior: A PLS-SEM approach. Behavioral Sciences 13: 25. [Google Scholar] [CrossRef] [PubMed]

- Huerta, Esperanza, and Scott Jensen. 2017. An accounting information systems perspective on data analytics and big data. Journal of Information Systems 31: 101–14. [Google Scholar] [CrossRef]

- Issa, Hussein, Ting Sun, and Miklos A. Vasarhelyi. 2016. Research ideas for artificial intelligence in auditing: The formalization of audit and workforce supplementation. Journal of Emerging Technologies in Accounting 13: 1–20. [Google Scholar] [CrossRef]

- Jain, S. 2018. US $320 Billion by 2030? The Potential Impact of AI in the Middle East, PwC. Available online: https://www.pwc.com/m1/en/publications/potential-impact-artificial-intelligence-middle-east.html#:~:text=US%24320%20billion.-,In%20absolute%20terms%2C%20the%20largest%20gains%20are%20expected%20to%20accrue,to%2014%25%20of%202030%20GDP (accessed on 23 February 2024).

- Joshi, Anant, Laury Bollen, Harold Hassink, Steven De Haes, and Wim Van Grembergen. 2018. Explaining IT governance disclosure through the constructs of IT governance maturity and IT strategic role. Information and Management 55: 368–80. [Google Scholar] [CrossRef]

- Khan, Mohammed Arshad, Maysoon Khojah, and Vivek. 2022. Artificial intelligence and big data: The advent of new pedagogy in the adaptive e-learning system in the higher educational institutions of Saudi Arabia. Education Research International 2022: 1263555. [Google Scholar] [CrossRef]

- Kokina, Julia, and Thomas H. Davenport. 2017. The emergence of artificial intelligence: How automation is changing auditing. Journal of Emerging Technologies in Accounting 14: 115–22. [Google Scholar] [CrossRef]

- Kopalle, Praveen K., Manish Gangwar, Andreas Kaplan, Divya Ramachandran, Werner Reinartz, and Aric Rindfleisch. 2022. Examining artificial intelligence (AI) technologies in marketing via a global lens: Current trends and future research opportunities. International Journal of Research in Marketing 39: 522–40. [Google Scholar] [CrossRef]

- Kostka, Genia, Xuehua Zhang, and Kyoung Shin. 2020. Information, technology, and digitalization in China’s environmental governance. Journal of Environmental Planning and Management 63: 1–13. [Google Scholar] [CrossRef]

- Krichene, Aida, and Emna Baklouti. 2020. Internal audit quality: Perceptions of Tunisian internal auditors an explanatory research. Journal of Financial Reporting and Accounting 19: 28–54. [Google Scholar] [CrossRef]

- Lee, Cheah Saw, and Farzana Parveen Tajudeen. 2020. Usage and impact of artificial intelligence on accounting: Evidence from Malaysian organisations. Asian Journal of Business and Accounting 13: 213–39. [Google Scholar] [CrossRef]

- Li, Junying, Jirawan Deeprasert, Rita Yi Man Li, and Wei Lu. 2022. The Influence of Chinese Professional Basketball Organizations’(CPBOs’) Corporate Social Responsibility (CSR) Efforts on Their Clubs’ Sustainable Development. Sustainability 14: 12339. [Google Scholar] [CrossRef]

- Losbichler, Heimo, and Othmar M. Lehner. 2021. Limits of artificial intelligence in controlling and the ways forward: A call for future accounting research. Journal of Applied Accounting Research 22: 365–82. [Google Scholar] [CrossRef]

- Mikalef, Patrick, and Manjul Gupta. 2021. Artificial intelligence capability: Conceptualization, measurement calibration, and empirical study on its impact on organizational creativity and firm performance. Information and Management 58: 103434. [Google Scholar] [CrossRef]

- Molla, Alemayehu, Vanessa A. Cooper, and Siddhi Pittayachawan. 2009. IT and Eco-Sustainability: Developing and Validating a Green IT Readiness Model. ICIS 2009 Proceedings. vol. 141, pp. 1–21. Available online: http://aisel.aisnet.org/icis2009/141/ (accessed on 23 February 2024).

- Munoko, Ivy, Helen L. Brown-Liburd, and Miklos Vasarhelyi. 2020. The Ethical Implications of Using Artificial Intelligence in Auditing. Journal of Business Ethics 167: 209–34. [Google Scholar] [CrossRef]

- Nedbal, Dietmar, Werner Wetzlinger, Andreas Auinger, and Gerold Wagner. 2011. Sustainable IS Initialization through Outsourcing: A Theory-Based Approach. pp. 1–10. Available online: https://aisel.aisnet.org/amcis2011_submissions/255 (accessed on 23 February 2024).

- Noor, Nor Raihana Asmar Mohd, and Noorhayati Mansor. 2019. Exploring the Adaptation of Artificial Intelligence in Whistleblowing Practice of the Internal Auditors in Malaysia. Procedia Computer Science 163: 434–39. [Google Scholar] [CrossRef]

- O’Leary, Daniel E. 2009. Downloads and citations in Intelligent Systems in Accounting, Finance and Management. Intelligent Systems in Accounting, Finance and Management 16: 21–31. [Google Scholar] [CrossRef]

- Papagiannidis, Emmanouil, Ida Merete Enholm, Chirstian Dremel, Patrick Mikalef, and John Krogstie. 2023. Toward AI Governance: Identifying Best Practices and Potential Barriers and Outcomes. Information Systems Frontiers 25: 123–41. [Google Scholar] [CrossRef] [PubMed]

- Prakash, Gyan, and Kumar Ambedkar. 2022. Digitalization of manufacturing for implanting value, configuring circularity and achieving sustainability. Journal of Advances in Management Research 20: 116–39. [Google Scholar] [CrossRef]

- Rahman, Noorul Shaiful Fitri Abdul, Abdelsalam Adam Hamid, Taih-Cherng Lirn, Khalid Al Kalbani, and Bekir Sahin. 2022. The adoption of industry 4.0 practices by the logistics industry: A systematic review of the Gulf region. Cleaner Logistics and Supply Chain 5: 100085. [Google Scholar] [CrossRef]

- Razi, Muhammad A., and Haider H. Madani. 2013. An analysis of attributes that impact adoption of audit software. International Journal of Accounting and Information Management 21: 170–88. [Google Scholar] [CrossRef]

- Rubino, Michele, and Filippo Vitolla. 2014. Corporate governance and the information system: How a framework for IT governance supports ERM. Corporate Governance 14: 320–38. [Google Scholar] [CrossRef]

- Salijeni, George, Anna Samsonova-Taddei, and Stuart Turley. 2019. Big Data and changes in audit technology: Contemplating a research agenda. Accounting and Business Research 49: 95–119. [Google Scholar] [CrossRef]

- Savtschenko, Maximilian, Frederik Schulte, and Stefan Voß. 2017. It governance for cyber-physical systems: The case of industry 4.0. In Lecture Notes in Computer Science (Including Subseries Lecture Notes in Artificial Intelligence and Lecture Notes in Bioinformatics). LNCS; Cham: Springer, vol. 10288, pp. 667–76. [Google Scholar] [CrossRef]

- Schmidt, Nils-Holger, and Lutz Kolbe. 2011. Towards a Contingency Model for Green IT Governance. Available online: https://aisel.aisnet.org/ecis2011/105 (accessed on 7 February 2024).

- Schmitz, Jana, and Giulia Leoni. 2019. Accounting and Auditing at the Time of Blockchain Technology: A Research Agenda. Australian Accounting Review 29: 331–42. [Google Scholar] [CrossRef]

- Shaffer, Kathie J., Carol J. Gaumer, and Kiersten P. Bradley. 2020. Artificial intelligence products reshape accounting: Time to re-train. Development and Learning in Organizations 34: 41–43. [Google Scholar] [CrossRef]

- Simonsson, Mårten, Pontus Johnson, and Mathias Ekstedt. 2010. The effect of IT governance maturity on IT governance performance. Information Systems Management 27: 10–24. [Google Scholar] [CrossRef]

- Sledgianowski, Deb, Mohamed Gomaa, and Christine Tan. 2017. Toward integration of Big Data, technology and information systems competencies into the accounting curriculum. Journal of Accounting Education 38: 81–93. [Google Scholar] [CrossRef]

- Sofyani, Hafiez, Hosam Alden Riyadh, and Heru Fahlevi. 2020. Improving service quality, accountability and transparency of local government: The intervening role of information technology governance. Cogent Business and Management 7: 1735690. [Google Scholar] [CrossRef]

- Sun, Ting, and Miklos A. Vasarhelyi. 2018. Embracing textual data analytics in auditing with deep learning. International Journal of Digital Accounting Research 18: 49–67. [Google Scholar] [CrossRef] [PubMed]

- Sutton, Steve G., Matthew Holt, and Vicky Arnold. 2016. “The reports of my death are greatly exaggerated”—Artificial intelligence research in accounting. International Journal of Accounting Information Systems 22: 60–73. [Google Scholar] [CrossRef]

- Tallon, Paul P., Ronald V. Ramirez, and James E. Short. 2013. The information artifact in IT governance: Toward a theory of information governance. Journal of Management Information Systems 30: 141–78. [Google Scholar] [CrossRef]

- Teixeira, Josélia Elvira, and Ana Teresa Tavares-Lehmann. 2022. Industry 4.0: The future of manufacturing from the perspective of business and economics—A bibliometric literature review. Competitiveness Review 33: 458–82. [Google Scholar] [CrossRef]

- The Ministry of Finance. 2024. Budget Statement Fiscal Year 2024. Available online: https://www.mof.gov.sa/en/budget/2024/Documents/Bud-E%202024%20F4.pdf (accessed on 7 February 2024).

- Tiberius, Victor, and Stefanie Hirth. 2019. Impacts of digitization on auditing: A Delphi study for Germany. Journal of International Accounting, Auditing and Taxation 37: 100288. [Google Scholar] [CrossRef]

- Turel, Ofir, Peng Liu, and Chris Bart. 2017. Board-Level Information Technology Governance Effects on Organizational Performance: The Roles of Strategic Alignment and Authoritarian Governance Style. Information Systems Management 34: 117–36. [Google Scholar] [CrossRef]

- Vărzaru, Anca Antoaneta. 2022. Assessing Artificial Intelligence Technology Acceptance in Managerial Accounting. Electronics 11: 2256. [Google Scholar] [CrossRef]

- Vejseli, Sulejman, Daniel Proba, Alexander Rossmann, and Reinhard Jung. 2018. The agile strategies in IT governance: Towards a framework of agile IT governance in the banking industry. Paper presented at the Twenty-Sixth European Conference on Information Systems (ECIS2018), Portsmouth, UK, June 23–28; pp. 1–17. Available online: https://aisel.aisnet.org/ecis2018_rp/148 (accessed on 28 November 2018).

- Wamba-Taguimdje, Serge-Lopez, Samuel Fosso Wamba, Jean Robert Kala Kamdjoug, and Chris Emmanuel Tchatchouang Wanko. 2020. Influence of artificial intelligence (AI) on firm performance: The business value of AI-based transformation projects. Business Process Management Journal 26: 1893–924. [Google Scholar] [CrossRef]

- Wang, Tao. 2022. Board human capital diversity and corporate innovation: A longitudinal study. Corporate Governance: The International Journal of Business in Society 22: 680–701. [Google Scholar] [CrossRef]

- Warren, J. Donald, Kevin C. Moffitt, and Paul Byrnes. 2015. How big data will change accounting. Accounting Horizons 29: 397–407. [Google Scholar] [CrossRef]

- Wilkin, Carla L., Paul K. Couchman, Amrik Sohal, and Ambika Zutshi. 2016. Exploring differences between smaller and large organizations’ corporate governance of information technology. International Journal of Accounting Information Systems 22: 6–25. [Google Scholar] [CrossRef]

- Winfield, Alan F., Katina Michael, Jeremy Pitt, and Vanessa Evers. 2019. Machine ethics: The design and governance of ethical ai and autonomous systems. Proceedings of the IEEE 107: 509–17. [Google Scholar] [CrossRef]

- Xia, Huosong, Duqun Lu, Boqiang Lin, Jeretta Horn Nord, and Justin Zuopeng Zhang. 2022. Trust in Fintech: Risk, Governance, and Continuance Intention. Journal of Computer Information Systems 63: 648–62. [Google Scholar] [CrossRef]

- Yigitcanlar, Tan, Rita Yi Man Li, Prithvi Bhat Beeramoole, and Alexander Paz. 2023. Artificial intelligence in local government services: Public perceptions from Australia and Hong Kong. Government Information Quarterly 40: 101833. [Google Scholar] [CrossRef]

- Yoon, Sora. 2020. A study on the transformation of accounting based on new technologies: Evidence from Korea. Sustainability 12: 8669. [Google Scholar] [CrossRef]

- Yu, Songbo, Jaffar Abbas, Anca Draghici, Oriana Helena Negulescu, and Noor Ul Ain. 2022. Social Media Application as a New Paradigm for Business Communication: The Role of COVID-19 Knowledge, Social Distancing, and Preventive Attitudes. Frontiers in Psychology 13: 903082. [Google Scholar] [CrossRef] [PubMed]

- Zhang, Shiying, Zixuan Meng, Beibei Chen, Xiu Yang, and Xinran Zhao. 2021. Motivation, Social Emotion, and the Acceptance of Artificial Intelligence Virtual Assistants—Trust-Based Mediating Effects. Frontiers in Psychology 12: 728495. [Google Scholar] [CrossRef]

- Zhang, Yingying, Feng Xiong, Yi Xie, Xuan Fan, and Haifeng Gu. 2020. The impact of artificial intelligence and blockchain on the accounting profession. IEEE Access 8: 110461–477. [Google Scholar] [CrossRef]

| Constructs | Indicators | Symbol | Items | Synthesized Literature |

|---|---|---|---|---|

| AI | “Big Data” | BD | 3 | (Mikalef and Gupta 2021) |

| “Deep Learning” | DL | 3 | (Sun and Vasarhelyi 2018; Issa et al. 2016) | |

| “Cloud Computing” | CC | 3 | (Mikalef and Gupta 2021) | |

| IT Governance | IT Governance | ITG | 4 | (Almaqtari et al. 2024) |

| Auditing functions | Audit Preparation and Planning | ADPL | 4 | (Issa et al. 2016) |

| Audit Process | ADP | 3 | ||

| Audit Reporting | ADRP | 2 | ||

| Accounting operations | Costing | COS | 3 | (Aqlan 2021) |

| Reporting and Taxation | RT | 3 | ||

| Strategic Planning and Budgeting | STB | 3 |

| Items | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | CA | rho_A | CR | AVE |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| BD1 | 0.878 | 0.844 | 0.849 | 0.906 | 0.763 | |||||||||

| BD2 | 0.905 | |||||||||||||

| BD3 | 0.837 | |||||||||||||

| DL1 | 0.900 | 0.866 | 0.874 | 0.918 | 0.789 | |||||||||

| DL2 | 0.858 | |||||||||||||

| DL3 | 0.906 | |||||||||||||

| CC1 | 0.801 | 0.751 | 0.752 | 0.857 | 0.667 | |||||||||

| CC2 | 0.832 | |||||||||||||

| CC3 | 0.816 | |||||||||||||

| ITG1 | 0.844 | 0.884 | 0.888 | 0.920 | 0.743 | |||||||||

| ITG2 | 0.905 | |||||||||||||

| ITG3 | 0.835 | |||||||||||||

| ITG4 | 0.861 | |||||||||||||

| ADPL1 | 0.775 | 0.812 | 0.823 | 0.889 | 0.729 | |||||||||

| ADPL2 | 0.906 | |||||||||||||

| ADPL3 | 0.875 | |||||||||||||

| ADP1 | 0.858 | 0.858 | 0.875 | 0.903 | 0.699 | |||||||||

| ADP2 | 0.851 | |||||||||||||

| ADP3 | 0.789 | |||||||||||||

| ADP4 | 0.843 | |||||||||||||

| ADRP1 | 0.900 | 0.770 | 0.771 | 0.897 | 0.813 | |||||||||

| ADRP2 | 0.904 | |||||||||||||

| STB1 | 0.909 | 0.882 | 0.883 | 0.927 | 0.810 | |||||||||

| STB2 | 0.913 | |||||||||||||

| STB3 | 0.877 | |||||||||||||

| RT1 | 0.843 | 0.877 | 0.877 | 0.925 | 0.804 | |||||||||

| RT2 | 0.924 | |||||||||||||

| RT3 | 0.920 | |||||||||||||

| COS1 | 0.932 | 0.919 | 0.919 | 0.948 | 0.860 | |||||||||

| COS2 | 0.923 | |||||||||||||

| COS3 | 0.927 |

| Path | β | Standard Deviation | T Statistics | p Values |

|---|---|---|---|---|

| BD—AI | 0.673 | 0.053 | 12.704 | 0.000 |

| CC—AI | 0.329 | 0.035 | 9.481 | 0.000 |

| DL—AI | 0.391 | 0.028 | 14.077 | 0.000 |

| AI—ITG | 1.002 | 0.018 | 56.443 | 0.000 |

| ITG—Accounting Operations | 0.430 | 0.076 | 5.640 | 0.000 |

| ITG—Auditing functions | 0.485 | 0.086 | 5.670 | 0.000 |

| Auditing Functions—ADPL | 1.017 | 0.023 | 45.003 | 0.000 |

| Auditing Functions—ADP | 1.052 | 0.016 | 66.225 | 0.000 |

| Auditing Functions—ADRP | 0.937 | 0.038 | 24.895 | 0.000 |

| Accounting Operations—STB | 0.999 | 0.012 | 84.235 | 0.000 |

| Accounting Operations—RT | 1.014 | 0.014 | 73.817 | 0.000 |

| Accounting Operations—COS | 0.987 | 0.011 | 87.650 | 0.000 |

| Path | β | Standard Deviation | T Statistics | p Values |

|---|---|---|---|---|

| Panel (A): ITG—Big Data—Accounting and Auditing functions | ||||

| Big Data—AI—ITG | 0.675 | 0.060 | 11.291 | 0.000 |

| Big Data—AI—ITG—Auditing Functions | 0.327 | 0.053 | 6.160 | 0.000 |

| Big Data—AI—ITG—Auditing Functions—Audit Preparation and Planning | 0.333 | 0.056 | 5.931 | 0.000 |

| Big Data—AI—ITG—Auditing Functions—Audit Implementation and Workflow | 0.344 | 0.056 | 6.169 | 0.000 |

| Big Data—AI—ITG—Auditing Functions—Audit Findings Report | 0.306 | 0.053 | 5.803 | 0.000 |

| Big Data—AI—ITG—Accounting Operations | 0.290 | 0.047 | 6.182 | 0.000 |

| Big Data—AI—ITG—Accounting Operations—Strategic Planning and Budgeting | 0.290 | 0.048 | 6.076 | 0.000 |

| Big Data—AI—ITG—Accounting Operations—Reporting and Taxation | 0.294 | 0.049 | 6.051 | 0.000 |

| Big Data—AI—ITG—Accounting Operations—Costing | 0.287 | 0.047 | 6.087 | 0.000 |

| Panel (B): ITG—DL—Accounting and Auditing Functions | ||||

| Deep_Learning—AI—ITG | 0.392 | 0.030 | 13.208 | 0.000 |

| Deep_Learning—AI—ITG—Auditing Functions | 0.190 | 0.032 | 5.940 | 0.000 |

| Deep_Learning—AI—ITG—Auditing Functions—Audit Preparation and Planning | 0.193 | 0.034 | 5.764 | 0.000 |

| Deep_Learning—AI—ITG—Auditing Functions—Audit Implementation and Workflow | 0.200 | 0.033 | 5.988 | 0.000 |

| Deep_Learning—AI—ITG—Auditing Functions—Audit Findings Report | 0.178 | 0.032 | 5.649 | 0.000 |

| Deep_Learning—AI—ITG—Accounting Operations | 0.169 | 0.028 | 6.048 | 0.000 |

| Deep_Learning—AI—ITG—Accounting Operations—Strategic Planning and Budgeting | 0.168 | 0.028 | 5.914 | 0.000 |

| Deep_Learning—AI—ITG—Accounting Operations—Reporting &_Taxation | 0.171 | 0.029 | 5.904 | 0.000 |

| Deep_Learning—AI—ITG—Accounting Operations—Costing | 0.166 | 0.028 | 5.962 | 0.000 |

| Panel (C): ITG < CC—Accounting and Auditing Functions | ||||

| Cloud_Computing—AI—ITG | 0.330 | 0.035 | 9.528 | 0.000 |

| Cloud_Computing—AI—ITG—Auditing Functions | 0.160 | 0.037 | 4.335 | 0.000 |

| Cloud_Computing—AI—ITG—Auditing Functions—Audit Preparation and Planning | 0.162 | 0.038 | 4.295 | 0.000 |

| Cloud_Computing—AI—ITG—Auditing Functions—Audit Implementation and Workflow | 0.168 | 0.038 | 4.402 | 0.000 |

| Cloud_Computing—AI—ITG—Auditing Functions—Audit Findings Report | 0.150 | 0.036 | 4.134 | 0.000 |

| Cloud_Computing—AI—ITG—Accounting Operations | 0.142 | 0.035 | 4.109 | 0.000 |

| Cloud_Computing—AI—ITG—Accounting Operations—Strategic Planning and Budgeting | 0.142 | 0.035 | 4.047 | 0.000 |

| Cloud_Computing—AI—ITG—Accounting Operations—Reporting &_Taxation | 0.144 | 0.035 | 4.058 | 0.000 |

| Cloud_Computing—AI—ITG—Accounting Operations—Costing | 0.140 | 0.034 | 4.064 | 0.000 |

| Panel (D): ITG—AI—Accounting and Auditing Functions | ||||

| AI—ITG—Auditing Functions | 0.486 | 0.085 | 5.708 | 0.000 |

| AI—ITG—Auditing Functions—Audit Preparation and Planning | 0.494 | 0.089 | 5.572 | 0.000 |

| AI—ITG—Auditing Functions—Audit Implementation and Workflow | 0.511 | 0.088 | 5.787 | 0.000 |

| AI—ITG—Auditing Functions—Audit Findings Report | 0.455 | 0.085 | 5.367 | 0.000 |

| AI—ITG—Accounting Operations | 0.431 | 0.077 | 5.599 | 0.000 |

| AI—ITG—Accounting Operations—Strategic Planning and Budgeting | 0.431 | 0.079 | 5.479 | 0.000 |

| AI—ITG—Accounting Operations—Reporting and Taxation | 0.437 | 0.080 | 5.484 | 0.000 |

| AI—ITG—Accounting Operations—Costing | 0.426 | 0.077 | 5.513 | 0.000 |

| Panel (E): ITG—Accounting and Auditing Functions | ||||

| ITG—Auditing Functions—Audit Findings Report | 0.454 | 0.085 | 5.339 | 0.000 |

| ITG—Auditing Functions—Audit Implementation and Workflow | 0.510 | 0.089 | 5.750 | 0.000 |

| ITG—Auditing Functions—Audit Preparation and Planning | 0.493 | 0.089 | 5.551 | 0.000 |

| ITG—Accounting Operations—Strategic Planning and Budgeting | 0.430 | 0.078 | 5.525 | 0.000 |

| ITG—Accounting Operations—Reporting and Taxation | 0.436 | 0.079 | 5.532 | 0.000 |

| ITG—Accounting Operations—Costing | 0.425 | 0.076 | 5.561 | 0.000 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Almaqtari, F.A. The Role of IT Governance in the Integration of AI in Accounting and Auditing Operations. Economies 2024, 12, 199. https://doi.org/10.3390/economies12080199

Almaqtari FA. The Role of IT Governance in the Integration of AI in Accounting and Auditing Operations. Economies. 2024; 12(8):199. https://doi.org/10.3390/economies12080199

Chicago/Turabian StyleAlmaqtari, Faozi A. 2024. "The Role of IT Governance in the Integration of AI in Accounting and Auditing Operations" Economies 12, no. 8: 199. https://doi.org/10.3390/economies12080199

APA StyleAlmaqtari, F. A. (2024). The Role of IT Governance in the Integration of AI in Accounting and Auditing Operations. Economies, 12(8), 199. https://doi.org/10.3390/economies12080199