Abstract

The Latin American export in the manufacturing sector is 18% lower than the world average. Although between the 1980s and 1990s, the sophistication of exportable products increased by 13%, it is evident to see the low progress of the Latin American region to consolidate the change in its productivity and its dependence on oil extraction activities, minerals, and other raw materials. This article evaluates and quantifies the impact of human capital, globalization, and the role of the efficiency of institutions in the sophistication of production in Latin America compared to economies with greater complexity. This is conducted using panel data methodology with cointegration techniques, using data from 17 countries that belong to the continental part of Latin America and 10 countries with the greatest economic complexity according to the Atlas of Economic Complexity Index. These countries are classified by their income level, data compiled by the United Nations Development Program Indicators, the Harvard Growth Lab Atlas of Economic Complexity, the Swiss Economic Institute database, and the Heritage Foundation. The results indicate that there is a significant relationship between the explanatory variables and economic complexity. However, the nature of the relationships differs between the different income levels, finding the same trend in the cointegration analyses. It requires the adoption of public policies in the curricular and evaluative field of knowledge and skills as well as the fight against corruption in public and private sectors, motivating the improvement of bilateral relations with other countries in an economic, political, and social way.

1. Introduction

For a long time, economic progress has been analyzed through the amount of production a society can generate in a given time, becoming over time a very basic and inefficient measure when assessing the competitiveness of an economy. Hausmann et al. (2014) indicate that economic complexity is a measure of the amount of productive knowledge of a society, reflecting the variety of companies and occupations as well as how they are related to each other. Thus, expressing the capacity of their productive structures to determine the sophistication of the exportable offer. According to the World Economy Observatory, the volume of exports has grown by 2.50% in the world, and the main exporters of goods are China, the United States, Germany, and Japan, while the main exporters of services are the United States, the United Kingdom, and Germany. World exports are made up of 64.70% of manufactures, 17.80% of fuels, 9.50% of agricultural products, and 3.40% of products from extractive industries (Lenicov et al. 2015).

Additionally, the exports of Latin America and the Caribbean are made up of 47% of primary products and 53% of manufactured products, in which the 10 main exported products represent 31.90% of total annual exports. Exportable production is made up of 6% of petroleum oils and oils obtained from bituminous minerals, 5.65% of private vehicles, 3.8% of copper minerals, 3.50% of soybeans, 3.4% of vehicles for cargo transportation, 2.10% of processing machines, 2% of iron minerals, 2% of refined copper, 1.80% of communication devices, and 1.70% of derivatives of oilseeds and other solid waste. In this sense, Giordano et al. (2018) mention that the change in productive structures is fundamental; however, in the Latin American case, the quality of exported industrial and primary goods has a low level of sophistication, which is why it keeps the region lagging behind other economic regions. Surpassing only Africa, in Latin America, the sophistication of exportable products increased 13% between the 1980s and 1990s, unlike that of the Asian continent, which had a significant rebound in the 1960s, mainly in countries such as Japan and South Korea.

In the case of human capital, the United Nations Organization indicates that on average worldwide, life expectancy is 72.25 years, the expected years of schooling are 12.75 years and the middle years of schooling are 8.45 years. Countries in Europe, Central Asia, Latin America, East Asia, and the Pacific present values above the world average, while Sub-Saharan Africa, South Asia, and the United Arab Emirates are below average. According to the Economic Commission for Latin America and the Caribbean, Latin America and the Caribbean have net enrollment rates of 93.1% at the primary level, 76.90% at the secondary level, and 50.60% at the tertiary level.

Regarding the levels of integration, according to Weiß et al. (2018), the first places in integration are held by the member countries of the European Union and Switzerland due to their participation in the common European market and in various bilateral agreements. Other countries, such as Canada and Australia, stand out in 11th and 21st place, respectively, surpassing Italy in 23rd place, closely followed by the United States in 23rd place, and Japan in 33rd place. The emerging economies that stand out below the average positions are India, Argentina, Mexico, China, and Brazil. European countries such as the Netherlands, Belgium, and Ireland maintain great global integration of an economic and social nature.

Finally, the world average score for government transparency is 43 points. The Western European region is the best scoring, with 66 points. Despite this, there are still deficiencies in the fight against corruption due to a growing populist discourse that undermines the democratic institutions of the countries. Countries of Asia and the Pacific region, with 44 points, do not show significant progress in this institutional field due to the lack of anti-corruption laws and enforcement mechanisms; however, New Zealand and Singapore occupy the 2nd and 3rd place, respectively, in international transparency.

In the case of the region of the Americas with 44 points, the region does not have notable progress since it is being taken by populist leaders due to their arbitrariness with the institutions and being a civil society that is against freedom of expression, which are signs of a loss of capacity to exercise institutional control and discern conflicts of political and economic interests. Other regions that are below the threshold of 39 points, such as Eastern Europe, Central Asia, the United Arab Emirates, and Sub-Saharan Africa, are characterized as nations with fragile political will and marked institutional weaknesses that are incapable of sustaining the performance of functions with democratic values.

In this sense, the empirical evidence supports the benefits of maintaining a diversified and exclusive export not only for economic growth but also to mitigate social problems, such as income inequality, gender inequality, and environmental pollution. In this way, the importance of the analysis of the determinants and drivers of economic complexity in Latin American economies and the leading countries of sophistication of exported products is highlighted for a comparison of their characteristics and possible adaptations of public policies that make economic development viable, emphasizing the Latin American economies and their similarities/differences with economies with a developed and sustainable productive structure (Bahar et al. 2022; Lapatinas 2019; Morante et al. 2017; Nguyen et al. 2020; Sweet and Maggio 2015).

The work has as objectives, firstly, to analyze the characteristics over time of the complexity of the export basket, the level of human capital, the political–economic–social–cultural relationship and institutional performance, to estimate the effects of endogenous and exogenous factors on economic complexity, as well as whether there is a structural change in dependency, and to determine the existence of a long-term equilibrium relationship in the econometric model. We will also show a comparison with the ten most outstanding economies in the ranking of the economic complexity index of the Harvard Growth Lab in 2018, which are Japan, Germany, Singapore, Switzerland, Austria, Sweden, Slovenia, South Korea, Hungary, and the Czech Republic. These countries are characterized by being highly developed economies; the productive base of these economies is based on the export of goods and services with high added value and a great degree of production exclusivity, mainly oriented towards the technological progress and development of industries such as pharmaceutical, steel, automotive, and aeronautical, among other economic activities.

This research is based on the foundation of the Lego Theory of Economic Complexity proposed by Hidalgo and Hausmann (2009), indicating that the sophistication of exported products is the result of the accumulation of capabilities, knowledge, and skills integrated through networks, under the hypothesis that high levels of human capital significantly increase the complexity and economic diversification of a country, in addition to various endogenous and exogenous factors affecting the economic diversification of a country, and that there is a long-term equilibrium relationship between the human capital and economic complexity. In this research, the variables are implemented in a multidimensional way, understanding the contribution of human talent, the role of the government, and the political, economic, and social interrelations with other societies and their various types of social organization. The characteristics of human capital are not only limited to the educational level of the individuals but also expand to the productivity that they can contribute to the economic activity of their societies in the future, adding different dimensions, such as the state of health and the probability of survival of the human resource, and there is a long-term equilibrium relationship between human capital and economic complexity. Likewise, we consider the degree of global integration in the economic sphere, through trade and financing; in the political sphere, through the ability to establish joint economic policies in order to obtain the mutual benefit of their societies; and finally, in the social field, which integrates favorable conditions for cultural exchange. The determining role of the institutions is their ability to establish and enforce the rules of the social contract, resolving the conflicts of interest between its population and the factual powers.

There are various investigations that analyze the development of the quality of exports worldwide; however, the low levels of diversification and exclusivity of Latin American export production require a particular and collective analysis of the region’s production systems, in addition to allowing to contrast them with the data of consolidated productive structures, such as developed economies, to know the differences and similarities that can be found and thus promote the implementation of national and regional economic policies that increase the well-being of its inhabitants. In this way, it seeks to answer such questions as follows: What is the correlation and evolution of human capital in the economic complexity in Latin America, period 1996–2018? What incidence do human capital, globalization, and institutionality have on economic complexity by carrying out a theoretical regression for Latin America, period 1996–2018? Is there a cointegration relationship between human capital, globalization and institutionality, and economic complexity for Latin America compared to the countries with the greatest diversification, period 1996–2018?

This article is structured as follows. Section 2 presents relevant contributions from several authors regarding the topics under study. Section 3 describes the methodology used in the present work. Section 4 presents the results obtained in this study based on four variables applied in different countries. Section 5 presents various points based on the results presented in this work. Finally, Section 6 concludes the article.

2. Related Work

The analysis of economic complexity is relatively new, having a little more than a decade of development. Hidalgo and Hausmann (2009) argue about the possibility of establishing alternative ways of measuring the productive capacities of an economy, visualizing each capacity as a Lego piece; therefore, each product is interpreted as a Lego model. Thus, it is expected that each economy can produce certain goods and services if it has the necessary capacities to do so, considering characteristics such as the diversity and exclusivity of capacities that each economy has for the production of goods and services. In addition, Hidalgo (2021) indicates that measures of economic complexity are used to determine the effects of complexity on variables, such as inequality, human development, output volatility, productivity, health, and pollution, in addition to empirically formalizing the impact of various economic factors and social phenomena, such as technology, public policies, culture, and demography.

2.1. Impact of Economic Complexity on Socioeconomic Variables

In this way, the studies that analyze the effects produced by economic complexity in the other variables are initially presented in relation to the effects produced by complexity in income inequality. Hartmann et al. (2017) analyze the link between economic complexity and income inequality in the period from 1963 to 2008, disaggregating the analysis every ten years using data from 150 countries. They use the Gini index, the economic complexity index and the panel regressions with fixed effects to conclude a strong negative correlation between the variables, that is, an increase in economic complexity has decreased income inequality, highlighting the role of the institutional framework of every economy.

Likewise, Lee and Vu (2020) during the period from 1980 to 2014 with data from 96 countries, estimate that in high-income countries, complexity has a negative impact on inequality since countries with high economic sophistication have better income distribution, highlighting the role of secondary education. Bandeira Morais et al. (2018) make an analysis of the panel data in the period from 2002 to 2014 of 26 Federal States and 1 Federal District in Brazil, in the case of the Brazilian economy, and estimate a relationship between economic complexity and wage differences in the form of an inverted U, i.e., higher levels of complexity of production causes an increase in the salary difference between skilled and unskilled labor. However, from certain levels of complexity of production, it allows a more equitable distribution of income; thus, the authors encourage the Brazilian government at its different levels to concentrate its efforts on education and the development of human capital. Zhu et al. (2020) analyze the relationship between export structures and income inequality in the Chinese economy, the evidence suggesting an inverse relationship between the variables, being more significant in urban regions than in rural regions; thus, the authors believe that the government Chinese should reduce sectoral barriers between the urban and rural parts of the country by facilitating internal migration.

The effects on human development are presented by Lapatinas (2016), who estimates a positive correlation between the economic complexity index and social development but does not find a causal effect, arguing that economic complexity is a significant factor for economic growth. Le Caous and Huarng (2020) analyze the relationship between the economic complexity index and the human development index in 87 developing countries in the period from 1990 to 1997, using a hierarchical linear model, and conclude that human development increases with greater economic complexity. Additionally, Ferraz et al. (2018) determine the efficiency with which Latin American and Middle Eastern economies convert economic complexity into human development discovering that in all countries, except China, the Philippines, and Cuba, complexity and development were efficient, and economies such as Japan, South Korea, and Singapore showed favorable results in the long term; thus, the authors determine that economies with greater sophistication in their production and exports are more efficient in translating economic progress into human development.

In the cases of the volatility of production, i.e., the variability of the growth rate of the gross domestic product per capita, Güneri and Yalta (2021) detect the effects of economic complexity in 61 developing countries in the period from 1981 and 2015, using a generalized moments model, finding a negative relationship between the variables and concluding that greater economic sophistication reduces investment risks, increasing confidence and stabilizing the economy. Sweet and Maggio (2015) evaluate the effects of economic sophistication on the productivity of 70 countries from 1965 to 2009, indicating that there is a positive and significant relationship, attributing the improvement in productivity to the ability to adapt, replicate, and spread in the international production chains.

2.2. Determining Factors in Economic Complexity

Regarding the evaluation of the determinants of economic complexity, Sweet and Maggio (2015) analyze the relationship between economic complexity and the index of intellectual property rights in 110 countries from 1965 to 2005, through the model of generalized moments, where the results present a positive relationship in all the specifications, having an effect between 0.2340 and 0.0820 in the index of economic complexity. Lapatinas and Litina (2019), who studied the relationship between IQ and economic sophistication in 108 countries by continent, consider ethnic and linguistic diversity, index of democratic politics, and trade openness, using ordinary least squares estimates with Heteroskedasticity corrections, indicating that intelligence has a positive and significant effect in economies of high and low complexity, so the increase in IQ increases economic complexity. It also shows the existence of a positive and significant relationship with institutional quality, i.e., an increase in the index of democratic politics increases economic complexity by 0.13 points. Finally, it indicates a negative and non-significant relationship with economic openness, so the authors recommend the implementation of policies that increase collective intelligence by investing in education and innovation.

Subsequently, Lapatinas (2019) analyzes the effect of the internet on economic sophistication in 100 countries between developed and developing economies from 2004 to 2015, using the generalized method of moments estimators with robust standard errors and two-stage least squares, highlighting the estimates of the model of generalized moments. The results show that the use of the internet has a positive and significant impact on economic complexity, the role of the government has a significantly negative impact, and education shows negative and statistically insignificant effects, giving relevance to the important contribution of technological use to economic development.

Next, Lapatinas (2019) evaluate taxation on economic sophistication in 17 countries of the OECD (Organization for Economic Co-operation and Development) from 1970 to 2001, using the effective tax rates on labor and capital as independent variables and the economic complexity index as the dependent variable, using a model of two-stage least squares. The first stage shows the existence of a significant negative impact of the implicit tax on capital and labor, which deteriorate economic complexity by 0.11 and 0.06 points, respectively, while showing significantly positive effects on variables such as economic globalization, urbanization rate, and export price index, which improve economic complexity by 0.03, 0.02, and 2.58 points respectively, determining that the tax burden on capital restricts the innovation of the productive structure of an economy.

Bahar et al. (2022) analyze the relationship between nationality diversity and economic complexity in 100 countries from 1990 to 2000 using the ordinary least squares methodology, finding that countries with a greater diversity of native nationalities have a more complex economic structure. The authors attribute this result to the migration of people with high professional qualifications, who can increase economic complexity by 0.18 points for each specific increase in the diversity of nationalities.

Vu (2020) performs a global analysis of economic complexity and health outcomes, with data from 103 countries in the period from 1970 to 2015, using a bidirectional fixed effects methodology, showing that economic complexity has negative and statistically significant effects on infant mortality, mortality of children under five years old and neonatal mortality as well as showing a positive and significant relationship with life expectancy. The author attributes these results to the fact that economic complexity translates into an improvement in employment, which results in better health; in turn, better health can help to develop the productive structure of the economy toward the production of more sophisticated products.

Subsequently, Nguyen et al. (2020) investigate the influences of trade openness and the entry of foreign direct investment on the sophistication of exports, highlighting the role of human capital, internet use, and energy poverty in 40 developing countries from 2002 to 2017 through a generalized two-step system, concluding that economic openness has a significant relationship with economic complexity, while foreign direct investment negatively and significantly affects economic complexity, suggesting that investment in human capital, technology development, and energy poverty alleviate the effects of foreign direct investment inflows on economic complexity.

Ozsoy et al. (2021) study the effect of the number of applied patents, the foreign direct investment rate, and the institutional index, level of savings, and population on the sophistication of exports from 2002 to 2015 through a panel data analysis and the methodology model of generalized minimums. The authors conclude that the number of applied patents has a positive and statistically significant impact on the sophistication of products exported from developed and developing countries, while direct investment has a statistically significant impact, negative in developing economies and positive in developed economies.

In the same way, Vu (2021) analyzes institutional quality as a driver of economic complexity including other instrumental variables, with data from 115 countries, using the index of economic freedom and the index of economic complexity, through ordinary least squares regressions, obtaining a positive and significant impact by increasing one percentage point of economic freedom. The author concludes that the role of institutions is decisive in economic complexity throughout the world, mainly those that allow the development of the spirit of innovative business, encourage the accumulation of human capital and efficiently allocate human resources to productive activities.

Additionally, authors such as Antonietti and Franco (2021), Ozsoy et al. (2021), and Sadeghi et al. (2020) present studies that analyze the effect of foreign direct investment on economic complexity. In the first case, the authors deal with causality analysis, in which only a unidirectional causal link from foreign investment is recorded as being directed towards economic complexity, being a characteristic of developed countries, as long as the levels of education, GDP per capita, human development, and outsourcing of the economy are higher than the average in terms of countries in development. In the second case, the authors indicate that there is a statistically significant relationship between the second lag of direct foreign investment and the sophistication of imports, giving opposite results for developed and developing economies, while for developed economies, it has a positive effect for each percentage unit increase in foreign investment, while for developing economies, it shows a negative impact. In the third case, the authors indicate that economic complexity is a great attraction for foreign direct investment, which intensifies the local human capital.

3. Materials and Methods

This work uses a descriptive methodology by making an analysis of the variables involved in each country. The descriptive methodology describes the features of a population of a system under study, i.e., it focuses on describing the subject instead of explaining the reasons it happens (Vaismoradi et al. 2013). The econometric strategy to estimate the effect between economic complexity, human capital, institutionally, and globalization consists of a basic panel data regression model. The dependent variable is the economic complexity index and the independent variables are the human capital index of the country, the globalization index of the country, and the government integrity index . The basic model allows for verifying the degree of association and the direction of the relationship between the variables globally and by income level. Equation (1) formalizes the relationship between economic complexity, human capital, globalization, and institutionality:

To determine the estimation of the model with fixed or random effects, a robustness test was used against the efficiency of the estimators. According to Greene (2003), this test is based on the distance between the estimators of fixed effects and random effects estimators with degrees of freedom equal to the number of regressor variables over time. If the value of the distance is wide, it means that the random effects estimator is not consistent, and it is preferable to use the estimators of the fixed effects model, considering the following decision criteria, taking into account Equation (2):

- : and are not correlated, the random effects model, GLS is consistent and efficient, and the LSDV model is consistent and inefficient.

- : and are correlated, the random effects model, GLS is not consistent, and the LSDV model is consistent and inefficient.

To determine the existence of autocorrelation, it was evaluated using the Wooldridge test, which, according to Alejo et al. (2018), uses the residuals of regression in the first differences, which response to the models presented in Equations (3) and (4):

where is the first difference operator.

The variables used in this research are presented in Table 1:

Table 1.

Variables description.

- As a dependent variable, the economic complexity index measures the productive capacities and knowledge of each country, allowing more advanced production through the variety of exports and the degree of specialization of each exported product. On the one hand, it can take negative values when the productive structure of a country is simple, that is, it is based mainly on the export of raw materials, besides having an export basket that is not very diversified and too common with the rest of the countries in the foreign market. On the other hand, it can take positive and high values when exports have high added value, besides having a highly diversified basket of exportable products and exclusive production of goods and services in the international market.

- As an independent variable, the human capital index measures the number of future products that can be expected from children based on schooling through the combination of the quality and quantity of education.

- As a complementary variable, the globalization index measures globalization along the economic social political dimension of the countries of the world, i.e., the degree of economic integration in the world economy, the internationalization of personal contacts of its citizens, the access to the Internet, and the scope of its international political commitment.

- As a complementary variable, the government integrity index quantifies the capacity of the state to settle conflicts of interest and control systemic corruption through its institutions, where the score for this component is obtained by averaging the scores of factors such as the payment of bribes, transparency in government policies, absence of corruption, perception of corruption, and transparency of public administration.

4. Results

The countries are classified by their gross national income per capita (GNI) calculated in dollars of the United States of America according to the Atlas method (Serajuddin and Hamadeh 2020). The analysis is globalized by the following:

- High economic complexity countries that include economies with an economic complexity index for the year 2018 greater than 1.62.

- High-income countries that include economies with gross national income per capita greater than USD 12,535.

- Upper-middle-income countries that comprise economies of gross national income per capita between USD 4046 and USD 12,535.

- Lower-middle-income countries comprising economies with gross national income per capita between USD 1036 and USD 4046.

This classification is presented in Table 2.

Table 2.

Classification of Latin American countries by the Atlas method and countries of high economic complexity.

The continental part of Latin America is considered a field of study due to its cultural, climatic, and productive homogeneity, having in common the same economic, social, and political problems, in which we have Argentina, Bolivia, Brazil, Chile, Colombia, Costa Rica, Ecuador, El Salvador, Guatemala, Honduras, Mexico, Nicaragua, Panama, Paraguay, Peru, Uruguay, and Venezuela. In contrast, there are ten countries with the greatest diversification of their economies in 2018, which are Germany, Austria, the Czech Republic, South Korea, Slovenia, Hungary, Japan, Singapore, Sweden, and Switzerland. They are classified as extra-high-income countries.

Table 3 shows the statistics of the analyzed variables in Latin America with a total of 391 observations, from 17 economies, in a 23-year period.

Table 3.

Descriptive statistics Latin America.

- The economic complexity index shows an average of −0.19, according to the Harvard Growth Lab. This is due to the fact that the region’s export is based on low-complexity activities, such as agriculture and mineral extraction. Other economies, such as Costa Rica, El Salvador, Nicaragua, Guatemala, and Honduras, have advanced in the development of textiles and machinery. In addition, Argentina, Uruguay, and Mexico have developed a production of more moderate complexity in the automotive industry, electronics, and chemistry. Less variability within the Latin American economies indicates the slow progress in innovation and diversification of their production.

- The human capital index shows an average of 0.43, i.e., a child born in Latin America will have an average of 43% labor productivity in the future if adequate education and health services are guaranteed. According to the United Nations Development Reports (2021), there is no significant variation at a general level between countries, making Latin America a region with uniform human capital.

- The globalization index shows an average of 0.61, which indicates an average level of cooperation in economic, political, and social integration. In the same way as the human capital index, there is no significant variability; however, it is much lower over time within each country.

- The government integrity index shows an average of 0.36, which indicates that, according to The Foundation Heritage, the levels of ethics and the rule of law are moderately low. Likewise, it has little capacity to prevent and manage conflicts of interest and corruption. The low variability between the data results in the low-institutionality characteristic of the region, in addition to the fact that little or nothing has been done to correct it over the years.

Table 4 shows the statistics of the variables analyzed in the countries with high economic complexity such as Germany, Czech Republic, South Korea, Slovenia, Hungary, Japan, Singapore, Sweden, and Switzerland, with a total of 230 observations, from 10 economies, in the period of 23 years.

Table 4.

Descriptive statistics for countries with high economic complexity.

- The economic complexity index shows an average of 1.86 according to the Harvard Growth Lab. This is due to the fact that the export of the selected countries is based on activities of high and moderate complexity, such as the production of electrical and industrial machinery. Economies such as Germany, Japan, the Czech Republic, Slovenia, and Sweden have advanced in automotive production, in addition to the development of the pharmaceutical industry, electrical equipment, and travel and tourism products.

- The human capital index shows an average of 0.49, i.e., a child born in these economies will have an average of 49% labor productivity in the future if he/she is guaranteed adequate education and health service. According to the United Nations Development Reports (2021), there is no significant variation at a general level between the countries, making the economies of high economic complexity a group of countries with a uniform human capital.

- The globalization index shows an average of 0.81, which indicates a high level of cooperation in economic–political, and social integration. In the same way as the human capital index, there is no significant variability; however, it is decreased over time within each country.

- The government integrity index shows an average of 0.70, which indicates that the levels of ethics and rule of law are moderately high, which shows that they have a high capacity to prevent and manage conflicts of interest and corruption. The variability between the data makes the high level of institutionality characteristic of the group, in addition to the fact that it has varied little over the years.

The statistics offer a preliminary analysis of the characteristics of each group. In terms of human capital, on average there is no great difference, despite the great difference in economic complexity. However, there is a great difference between the level of institutionality and globalization of the groups of economies analyzed, being greater in the case of countries of high economic complexity, in which their high governmental integrity and high level of economic, social, and economic cooperation can be highlighted. In countries of high economic complexity, high levels of human capital, globalization, and government integrity, the little dispersion of the data implies that they can be treated as a homogeneous group in terms of public policies, while in the case of Latin America, despite having high levels of human capital, they have low levels of international integration and government transparency.

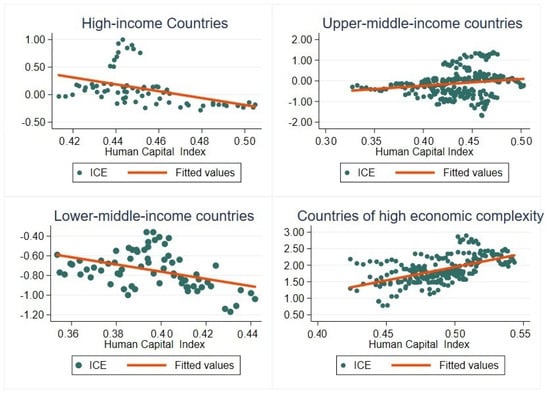

Figure 1 shows the correlation between economic complexity and human capital.

Figure 1.

Correlation between the economic complexity index and the human capital index in Latin American countries (by income levels) and countries with high economic complexity.

- In the case of high-income countries, indicates the existence of a negative and moderately low correlation, i.e., an increase in human capital reduces the complexity of exports, and the correlation is statistically significant at 1%.

- In the case of upper-middle-income countries, indicates the existence of a very low positive correlation, i.e., the increase in human capital increases economic complexity, although the correlation is not statistically significant.

- In the case of lower-middle-income countries, indicates the existence of a moderately low negative correlation, i.e., an increase in human capital reduces the complexity of exports, and the correlation is statistically significant at 1%

- In the case of countries with high economic complexity, indicates the existence of a positive and moderate correlation, i.e., an increase in human capital increases the complexity of exports, and the correlation is statistically significant at 1%.

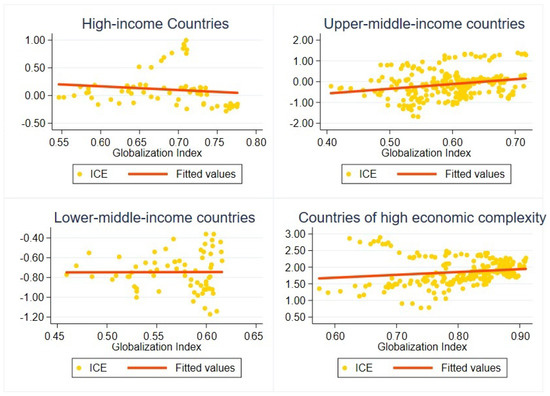

Figure 2 shows the correlation between economic complexity and the level of globalization.

Figure 2.

Correlation between the economic complexity index and the globalization index by income levels.

- In the case of high-income countries, indicates the existence of a negative and low correlation, i.e., an increase in the level of globalization reduces the complexity of exports, and the correlation is not statistically significant at 1%

- In the case of upper-middle-income countries, indicates the existence of a very low positive correlation, i.e., the increase in the level of globalization increases economic complexity, and the correlation is statistically significant at 1%

- In the case of lower-middle-income countries, indicates the non-existence of correlation, i.e., an increase or decrease in the level of globalization does not affect the complexity of exports.

- In the case of countries with high economic complexity, indicates the existence of a low positive correlation, i.e., the increase in the level of globalization increases the complexity of exports, and the correlation is not statistically significant at 1%.

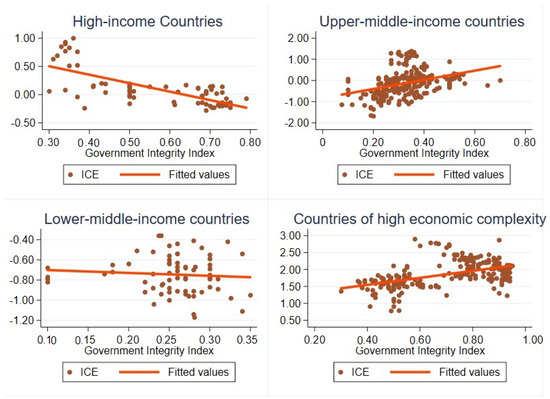

Figure 3 shows the correlation between economic complexity and government integrity.

Figure 3.

Correlation between the economic complexity index and the government integrity index by income levels.

- In the case of high-income countries, indicates the existence of a negative and moderately high correlation, i.e., an increase in government integrity reduces the complexity of exports, and the correlation is statistically significant at 1%.

- In the case of upper-middle-income countries, indicates the existence of a low positive correlation, i.e., the increase in government integrity increases economic complexity, and the correlation is statistically significant at 1%.

- In the case of lower-middle-income countries, indicates the existence of a low negative correlation, i.e., an increase in institutionality reduces the complexity of exports, and the correlation is not statistically significant at 1%.

- In the case of countries with high economic complexity, indicates the existence of a positive and moderate correlation, i.e., the increase in human capital increases the complexity of exports, and the correlation is statistically significant at 1%.

5. Discussion

In the correlation results between economic complexity and its factors, the figures obtained for upper-middle-income countries and countries with high economic complexity agree with those presented by Lapatinas (2019) since they show a positive correlation, using the IQ as a proxy variable for human capital. However, its coefficient is much higher, which means that IQ is more related to export sophistication than years of schooling and individual life expectancy, while it differs from the results obtained for high-income countries and in lower-middle-income countries, in which a negative correlation coefficient is shown; the correlation between economic complexity and the level of globalization for countries with high income and high economic complexity agrees with those obtained by Bahar et al. (2022), who obtain a positive relationship between economic complexity and the diversity of migrants as a proxy variable for global openness, which is far from the results obtained for high-income and lower-middle-income countries. Furthermore, the positive results of the positive correlation between economic complexity and institutional levels of countries with upper middle income and countries of high economic complexity agree with those shown by Sweet and Maggio (2015), who use the ability to obtain intellectual property rights and economic freedom as a proxy variable for institutionality, which differs with the results obtained for high-income countries and lower-middle-income countries.

In the first place, the evaluation of the determinants of the complexity of exported products, considering the positive effect of human capital in upper-middle-income countries in Latin America and countries with high economic complexity, is consistent with those shown by the authors who allude to factors related to human capital, such as intelligence (Lapatinas 2019) and life expectancy (Ozsoy et al. 2021) that can generate greater competitiveness. In addition, the authors suggest that public policies must be oriented towards the development of an intelligent group that allows reasoning, creating, and making decisions to solve problems, leaving aside the outdated system of conceiving education as the accumulation of schooling degrees. In this way, it would be stimulated to optimally take advantage of the diverse capacities of the human being in the different areas of science and in technical and technological activities. Furthermore, the evidence shows that better health helps to develop a productive structure, leading it to be more competitive. Nevertheless, it contradicts the results obtained in this research for high-income and lower-middle-income Latin American countries.

Next, the estimation of the positive effect of government integrity in upper-middle-income countries in Latin America and countries with high economic complexity are consistent with those shown by the authors who mention institutional factors, such as the right to intellectual property (Nguyen et al. 2020; Sweet and Maggio 2015), the labor and capital tax burden (Lapatinas 2019), economic freedom (Vu 2020) and democratic politics (Lapatinas 2019). They are elements that can boost exports of more sophisticated products since the ownership of the results of scientific research through patent rights allows productive economic agents to consider expectations of maximizing profits in the medium–long term and, therefore, through these means, to invest and develop more and better processes or products.

Due to the uncertainty that characterizes the Latin American markets, both rigid labor and capital tax legislation and excessive state intervention in market decisions scare off investment, causing companies or financial capital, in general, to choose economies with more flexible labor and tax legislation, which does not allow taking advantage of the capacities of the accumulated knowledge in that society, which ends up being applied in a rudimentary and inefficient way. For this reason, factors such as the rule of law (Ozsoy et al. 2021) are not determining factors for improving the competitiveness of production, i.e., the freedom of citizens produces competitiveness in the markets. It contradicts the results obtained in this research for high-income and lower-middle-income Latin American countries.

The estimation of the positive effect of globalization in high-income countries and low-middle-income countries in Latin America is consistent with those shown by the authors who mention factors such as trade openness (Lapatinas 2019; Nguyen et al. 2020), internet use (Lapatinas 2019), nationality diversity (Bahar et al. 2022), international financial development (Nguyen et al. 2020), and economic globalization (Lapatinas 2019), reflecting that economic, social, and cultural integration help to improve the competitiveness of production through economic openness. By competing in other markets, it is possible for economic agents to absorb knowledge and develop capacities required by the market and society, expanding distribution channels and taking advantage of sources of supplies of goods and services, and new sources of financing. Likewise, through the mobility of people, knowledge also moves to where it is required and can be used if there is no demand in its place of origin. It is an argument mentioned by Arif (2021), who analyzes the labor market and wages, pointing out that if qualified labor is not found in an adequate market, it can dilute the benefits of a complex export basket. In addition, the use of the Internet for communication and research as well as access to international financial markets contribute significantly to improving the export economic structure of a country.

In upper-middle income countries in Latin America and countries with high economic complexity, the positive effects of globalization are not decisive for economic complexity, which is supported by the results obtained by Antonietti and Franco (2021); Ozsoy et al. (2021); Sadeghi et al. (2020) that indicate that it depends on which markets the investment is directed. In the case of developing countries, the investment is inclined towards activities of exploitation of natural and mineral resources, deteriorating the competitive capacity of those economies; however, Nguyen et al. (2020) state that it is possible to mitigate the negative effects of foreign direct investment through public policies that condition this type of investment toward activities with greater knowledge intensity, in addition to investing in human capital, technology development, and eradicating the energy exclusion of rural areas.

Ozsoy et al. (2021) support the existence of structural changes in economic complexity. Their research suggests that at a certain level of income, the effects of foreign direct investment diverge, being positive for developed countries and negative for developing countries, while this research with reference to the great financial recession of 2008 shows a structural change over time for countries of high economic complexity since their economic agents are strongly linked and affected by the phenomena in the stock markets.

Human capital, globalization, and institutionality through governmental integrity have repercussions on the quality and added value of exported products. The capacity of the different economies in Latin America to transform knowledge and skills into wealth is very low, despite the similarities in the levels of human capital because the structural and economic differences are enormous. Corruption has become part of Latin American governments, which is a reason why financial and human capital are seeking to develop in other countries.

In this sense, this research presents the existence of a long-term relationship between economic complexity with human capital, globalization, and institutionality in Argentina, Brazil, Colombia, Costa Rica, Ecuador, Mexico, Guatemala, Paraguay, and Peru, for which the effects of the promotion of human capital, globalization, and government efficiency will be significant several years in the future. In addition, in the cases that partially agree with high-income countries and economies of high economic complexity, it will only present significant effects several years in the future for certain economies, opening the need for them to be studied individually. Lastly, they differ from the results obtained in lower-middle-income countries, which do not show a long-term relationship.

It is important to recognize the conditions that drive the economy in the medium and long term. The implementation of public and business policies would help maintain a good quality of life, in the case of a country, and maintain operations, in the case of companies, in a sustainable way, in order to not have to depend on changes in legal regulations that are too consecutive; these results are supported by those found by Nguyen et al. (2020), which show a long-term equilibrium relationship of economic complexity with international financial development, which is considered an aspect of economic globalization. In this sense, for the efficiency of international markets, and including what was mentioned by Arif (2021), the conditions are given for the use of accumulated knowledge in a society in the long term, projecting improvements in the prosperity of the economy for an extended period of time, which will be necessary to reconsider and innovate the processes since the markets are dynamic and often highly volatile (Güneri and Yalta 2021).

6. Conclusions

In this work, the theoretical basis proposed by Hidalgo and Hausmann (2009) is evaluated, and based on the results obtained, it is determined that the objective of evaluating the effect of human capital on the economic complexity of Latin America in the presence of factors is fulfilled through econometric techniques of cointegration panel data and threshold regressions for the period 1996–2018. At a general level, human capital, globalization, and institutionality are positive in the productive matrix of emerging economies, such as Latin America, and economies of high economic complexity.

The econometric estimates showed that human capital, globalization, and the role of the government are determining factors in the productive matrix of sophisticated export countries; however, in the case of Latin America, the dissonance of public policies does not allow to take advantage of resources, such as human talent and the natural wealth they possess, mainly due to the instability of their institutions.

At a general level, significant effects of the variables on economic complexity can be expected in the long term in the economies in Latin America and in some countries with high economic complexity, leaving the decisions made in the public policy subject to the nature of the effects shown by each group of countries. In Latin America, there are structural deficiencies regarding more developed economies. Likewise, public policies and private decisions have long-term effects on the complexity of export products.

Empirical and tacit knowledge can be transmitted within and between different economies, helping to improve competitiveness and regulating conflicts of interest between the state and power groups, which are factors that benefit the development of societies.

The results obtained manage to channel the characteristics of two groups of economies with more differences than similarities, which shows the gap in economic and social matters, noting that in Latin America, there are structural deficiencies with respect to more developed economies from the economic, social and cultural perspectives, the inequality being originated by decades of development and the late incorporation of the Latin American subcontinent to such events as the era of socioeconomic globalization and the industrial revolution.

Author Contributions

Conceptualization, B.R. and M.L.; methodology, M.L. and H.F.; validation, B.R. and H.F.; formal analysis, M.L. and H.F.; investigation, B.R., M.L. and H.F.; resources, M.L. and G.C.; data curation, B.R. and G.C.; writing—original draft preparation, B.R. and M.L.; writing—review and editing, H.F.; supervision, M.L. and G.C.; project administration, M.L. and G.C.; funding acquisition, M.L. and G.C. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Alejo, Javier, Gabriel Montes-Rojas, and Walter Sosa-Escudero. 2018. Testing for serial correlation in hierarchical linear models. Journal of Multivariate Analysis 165: 101–16. [Google Scholar] [CrossRef]

- Antonietti, Roberto, and Chiara Franco. 2021. From fdi to economic complexity: A panel granger causality analysis. Structural Change and Economic Dynamics 56: 225–39. [Google Scholar] [CrossRef]

- Arif, Imran. 2021. Productive knowledge, economic sophistication, and labor share. World Development 139: 105303. [Google Scholar] [CrossRef]

- Bahar, Dany, Hillel Rapoport, and Riccardo Turati. 2022. Birthplace diversity and economic complexity: Cross-country evidence. Research Policy 51: 103991. [Google Scholar] [CrossRef]

- Bandeira Morais, Margarida, J. Swart, and J. A. Jordaan. 2018. Economic complexity and inequality: Does productive structure affect regional wage differentials in Brazil? USE Working Paper Series 18: 1–19. [Google Scholar]

- Ferraz, Diogo, Herick Fernando Moralles, Jessica Suárez Campoli, Fabíola Cristina Ribeiro de Oliveira, and Daisy Aparecida do Nascimento Rebelatto. 2018. Economic complexity and human development: Dea performance measurement in asia and latin america. Gestão & Produção 25: 839–53. [Google Scholar]

- Giordano, Paolo, Rosario Campos, Cloe Ortiz de Mendívil, Kathia Michalczewsky, and Jesica De Angelis. 2018. Trade and Integration Monitor 2018: Flying to Quality: Export Sophistication as an Engine of Growth. New York: Inter-American Development Bank. [Google Scholar]

- Greene, William H. 2003. Econometric Analysis. Hoboken: Pearson Education India. [Google Scholar]

- Güneri, Barbaros, and A. Yasemin Yalta. 2021. Does economic complexity reduce output volatility in developing countries? Bulletin of Economic Research 73: 411–31. [Google Scholar] [CrossRef]

- Hartmann, Dominik, Miguel R. Guevara, Cristian Jara-Figueroa, Manuel Aristarán, and César A Hidalgo. 2017. Linking economic complexity, institutions, and income inequality. World Development 93: 75–93. [Google Scholar] [CrossRef]

- Harvad Growth Lab. Atlas of Economic Complexity. 2020. Atlas of Economic Complexity. Available online: https://atlas.cid.harvard.edu/what-is-the-atlas (accessed on 15 July 2023).

- Hausmann, Ricardo, César A. Hidalgo, Sebastián Bustos, Michele Coscia, and Alexander Simoes. 2014. The Atlas of Economic Complexity: Mapping Paths to Prosperity. Cambridge: MIT Press. [Google Scholar]

- Hidalgo, César A. 2021. Economic complexity theory and applications. Nature Reviews Physics 3: 92–113. [Google Scholar] [CrossRef]

- Hidalgo, César A., and Ricardo Hausmann. 2009. The building blocks of economic complexity. Proceedings of the National Academy of Sciences 106: 10570–75. [Google Scholar] [CrossRef]

- Lapatinas, Athanasios. 2016. Economic complexity and human development: A note. Economics Bulletin 36: 1441–52. [Google Scholar]

- Lapatinas, Athanasios. 2019. The effect of the internet on economic sophistication: An empirical analysis. Economics Letters 174: 35–38. [Google Scholar] [CrossRef]

- Lapatinas, Athanasios, and Anastasia Litina. 2019. Intelligence and economic sophistication. Empirical Economics 57: 1731–50. [Google Scholar] [CrossRef]

- Le Caous, Emilie, and Fenghueih Huarng. 2020. Economic complexity and the mediating effects of income inequality: Reaching sustainable development in developing countries. Sustainability 12: 2089. [Google Scholar] [CrossRef]

- Lee, Kang-Kook, and Trung V. Vu. 2020. Economic complexity, human capital and income inequality: A cross-country analysis. The Japanese Economic Review 71: 695–718. [Google Scholar] [CrossRef]

- Lenicov, Jorge, Anahi Viola, and Patricia Knoll. 2015. El Comercio Mundial. Principales Características y Tendencias. Available online: http://www.unsam.edu.ar/escuelas/economia/oem/pdf/Boletin-16.pdf (accessed on 15 July 2023).

- Morante Ana, Villamil Maria del Pilar, and Florez Hector. 2017. Framework for supporting the creation of marketing strategies. Information 20: 7371–7378. [Google Scholar]

- Nguyen, Canh Phuc, Christophe Schinckus, and Thanh Dinh Su. 2020. The drivers of economic complexity: International evidence from financial development and patents. International Economics 164: 140–50. [Google Scholar] [CrossRef]

- Ozsoy, Seren, Burcu Fazlioglu, and Sinan Esen. 2021. Do FDI and patents drive sophistication of exports? a panel data approach. Prague Economic Papers 2021: 216–44. [Google Scholar] [CrossRef]

- Sadeghi Pegah, Hamid Shahrestani, Kambiz Hojabr Kiani, and Taghi Torabi. 2020. Economic complexity, human capital, and fdi attraction: A cross country analysis. International Economics 164: 168–82. [Google Scholar] [CrossRef]

- Serajuddin, Umar, and Hamadeh Nada. 2020. New World Bank Country Classifications by Income Level: 2020–2021. Available online: https://blogs.worldbank.org/opendata/new-world-bank-country-classifications-income-level-2020-2021 (accessed on 15 July 2023).

- Sweet, Cassandra Mehlig, and Dalibor Sacha Eterovic Maggio. 2015. Do stronger intellectual property rights increase innovation? World Development 66: 665–77. [Google Scholar] [CrossRef]

- The Foundation Heritage. 2020. Index of Freedom Economics. Available online: https://www.heritage.org/index/ (accessed on 15 July 2023).

- United Nations Development Reports. 2021. Human Development Data. Available online: https://hdr.undp.org/data-center (accessed on 15 July 2023).

- Vaismoradi, Mojtaba, Hannele Turunen, and Terese Bondas. 2013. Content analysis and thematic analysis: Implications for conducting a qualitative descriptive study. Nursing & Health Sciences 15: 398–405. [Google Scholar]

- Vu, Trung V. 2020. Economic complexity and health outcomes: A global perspective. Social Science & Medicine 265: 113480. [Google Scholar]

- Vu, Trung V. 2021. Does Institutional Quality Foster Economic Complexity? The Fundamental Drivers of Productive Capabilities. Kiel: ZBW—Leibniz Information Centre for Economics. [Google Scholar] [CrossRef]

- Weiß, Johann, Andreas Sachs, and Heidrun Weinelt. 2018. 2018 Globalization Report: Who Benefits Most from Globalization? Gütersloh: Bertelsmann Stiftung. [Google Scholar]

- Zhu, Shengjun, Changda Yu, and Canfei He. 2020. Export structures, income inequality and urban-rural divide in china. Applied Geography 115: 102150. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).