Abstract

The paper analyses development and drivers of accelerated growth of peer-to-peer (P2P) lending in Lithuania and its impact on the consumer credit market with a focus on related sustainability issues. Legislative discrepancies between the P2P and banking segments are analysed and their role in predetermining the different development trends within the segments is highlighted. The research is composed of several steps, where each step analyses a certain problem with the aim to compare the processes in both segments, and is using two different approaches based on macroeconomic data and legislative environment analysis. The applied setup of the research allows for distinguishing and quantitative evaluation of the impact on the segments caused by various internal and external factors, such as macroeconomics, technological advantages of P2P platforms, and discrepancies within business regulation. The obtained results could fill in the scientific literature gaps by providing quantitative evidence of the influence the analysed internal and external drivers have on the growth rate of the consumer credit market segments in Lithuania and how this could affect the performance of the whole market, including its sustainability. Conclusions made could be of interest to researchers and practitioners in other countries too, especially those which have similar legislation and regulations within the consumer credit market. Methods used: a scientific literature analysis and generalisation, comparative analysis, statistical data analysis, correlation–regression analysis, mathematical modelling.

1. Introduction

The main clients of the consumer credit market and generators of its turnover are households. An aggregate flow of household-related financial resources, which typically makes about 60% of the GDP of almost every country around the world, is extremely important for the economy and its financial sector and is often used as an essential variable for economic analysis (The World Bank 2022). The volume of this flow, which is made up of households’ own and borrowed resources, is not only subject to the current condition of the country’s economy or its fluctuations, but also depends on various overall shocks. From the beginning of the year 2020, when COVID-19 pandemic started, the world’s economy is facing new challenges (European Central Bank 2022). The unemployment rate was getting higher, an increasing number of household members have been losing jobs, and the ability to permanently generate necessary income was declining. In such a situation, in order to maintain balanced budgets, the affected households should adjust their consumption to the reduced income, but usually this does not happen in all the households and at least a part of them try to maintain the accustomed level of consumption and look for opportunities to borrow extra. Borrowing in traditional financial institutions, such as commercial banks, is quite strictly constrained by various formal and informal regulations, and such affected households may be denied loans. On the other hand, the financial services market has become particularly dynamic due to innovations and new IT technologies, which offer new borrowing possibilities. As a result, households can borrow not only from traditional financial institutions, but also from new and fast-growing alternative sources as peer-to-peer (P2P) platforms, which in literature can appear under alternative names, such as “fintech credits”, “crowdfunding credits”, or “marketplace lenders”, or the umbrella terms “internet finance” or “digital finance”. They all encompass “credit activity facilitated by platforms that match borrowers with lenders (investors)” (Claessens et al. 2018). Due to them, the borrowing aimed at compensating the shortage of funds in households has become much easier. Statistics show that borrowing through P2P platforms is steadily increasing, at least in some countries (Yeo and Jun 2020). According to CNBC (2021), P2P lending is gaining traction throughout the world, with the sector growing at a 17% annual pace, and is likely to increase in the future. Should the income level not recover in a relatively short period of time and reach the pre-COVID-19 level, an increased number of borrowers might face difficulties with repaying their loans. As a result, the volume of non-performing loans (NPL) might rise and negatively affect the whole consumer credit system. Therefore, analysis of trends within the consumer credit market, triggered by the emergence of peer-to-peer platforms, is much needed at this time.

Aspects related to the latest household borrowing issues are being analysed not only by scientists (Dorfleitner et al. 2021; Wright and Feng 2020; Bangham and Leslie 2020; Cloyne et al. 2020; Almenberg et al. 2020; Gilchrist and Mojon 2018; Faia and Paiella 2017; Fuster and Willen 2017; Zeng et al. 2017; de Roure et al. 2017), but also by financial and other institutions as well (OECD 2021; European Central Bank 2021; The World Bank 2021; Federal Reserve Bank of America 2021; Federal Reserve Bank of New York 2021; UK Parliament 2021; Bloomberg 2021; International Monetary Fund 2019, etc.). Numerous investigations analysing the impact of coronavirus pay attention to the potential threats that can appear after the pandemic. For example, Bangham and Leslie (2020) claim that “families in Great Britain are faced with the most severe economic contraction in more than 100 years”. Wright and Feng (2020) highlight that “fallout from the COVID-19 outbreak now threatens to intensify the financial risks arising from the increase in household borrowing.”

The above-mentioned studies, as well as many others, limit their research mainly to the traditional credit system and commercial banks, while new borrowing alternatives, such as relatively recently emerged P2P platforms and their growth trends, are still left out of the scope. Information on how the loan volume correlates with the macroeconomic indicators of the country, and especially with legal environment and regulations specifically in the P2P and traditional banking segments, is very limited.

The goal of this study is, therefore, to analyse the development and drivers of accelerated growth of P2P segment of the consumer credit market in Lithuania in comparison with its traditional segments. The interaction between the P2P and commercial bank segments under the country’s changing macroeconomic situation and the segment-specific regulations is being analysed and the respective correlation links revealed. The study should fill in the existing scientific literature gaps through identification of the factors that predetermine an accelerated growth of P2P segment and quantitative estimation of their impact on the overall performance of the whole consumer credit market and its segments. The results should be of interest to researchers and practitioners in other countries, first of all with similar legislation, because some of the identified trends may be similar in these countries too.

2. Review of Related Scientific Investigations on Peer-to-Peer Lending

Contemporary technologies bring modern trends to the financial services market and enable FinTech development. According to Mansilla-Fernández (2018), the segment is increasing in European countries, especially in more financially developed countries, such as Great Britain.

Fintech refers to the novel processes and products that become available for financial services thanks to digital technological advancement. The areas Fintech covers are: transactions execution (payments, clearing, and settlement); funds management (deposits, lending, capital raising, and investment management) and insurance (Navaretti et al. 2018). As a result of FinTech development, households have a much wider choice for financial services and their providers and can borrow not only from traditional financial institutions, such as commercial banks and credit unions, but also from such fast-growing alternative sources as peer-to-peer lending companies.

P2P concept analysis in the scientific literature. FinTech based online P2P lending, as a popular form of personal loans, has emerged in the credit market during the past decade (Wang et al. 2021). According to Babaei and Bamdad (2020), P2P lending has attracted many investors and borrowers since 2005. According to Huang (2018), “China’s online P2P lending market has undergone a period of explosive growth in the past few years to become the largest in the world”.

The P2P financial market helps investors and borrowers to invest in or obtain loans without a traditional financial intermediary. It transfers the traditional way of face-to-face personal loans through online services (Bachmann et al. 2011). Foo et al. (2017) described P2P lending as a fast-growing financial technology trend that can displace traditional retail banking.

Other researchers describe P2P lending very similarly—it is an electronic marketplace where individual lenders provide loans to individual borrowers. It is pervasive, convenient, efficient, and low-cost without the involvement of traditional financial institutions (Guo et al. 2016). Bauwens et al. (2019) claims that P2P is a social/relational dynamic through which peers can freely collaborate with each other and create value in the form of shared resources. Wang et al. (2021) proved that, differently from traditional banks, lenders provide loans to borrowers directly through P2P platforms, but P2P loans are unsecured personal loans, so credit rating of loans is vital in order to control default risk and improve profit for lenders and platforms as well.

The peer-to-peer-related topic is relatively new, but despite this, it is widely discussed around the world in finance and IT-related scientific literature. In this article, we define P2P lending as a financial term that means “individuals lending money to other individuals, without the intermediation of a financial institution” (Serrano-Cinca et al. 2015).

P2P lending and its impact on traditional banking. One of the most debatable questions related to the P2Ps is whether the P2P platforms will replace traditional banking in the future. For example, Dermine (2018) claims that “Fintech is disrupting banking markets”. Buchak et al. (2018) has proved that “commercial banks lose lending volume and take on riskier borrowers in response to peer-to-peer lending encroachment, while large bank loan volumes appear to be unaffected by the increase in competition.” Additionally, investment in FinTech companies is larger in countries with lower competition in the banking sector (Mansilla-Fernández 2018). According to Dermine (2018), on the credit side, Lending Club, Prosper, and SoFi in the US, the British Zopa and Funding Circle, the French Prźt d’Union, or Alibaba in China are competing with established banks in the unsecured consumer loan and small and medium-size enterprises (SME) markets. Moreover, Navaretti et al. (2018) demonstrated that “a substantial fraction (26.7%) of the peer-to-peer loan volume substitutes for small commercial bank personal loans. Competition will enhance efficiency, bring in new players, but banks will not disappear. If some do, they will be replaced by others, more efficient ones”. The idea that P2P platforms will not replace traditional banks is supported by Boot (2018) as well.

However, some researchers claim that P2P platforms are not competitors for commercial banks, because they serve a lower quality borrower segment that is underserved by other traditional financial institutions. For example, de Roure et al. (2017) has made an investigation in German consumer credit market and claimed that “when banks are faced with higher regulatory costs, the riskiest bank loans will migrate to P2P lenders first”. Tang (2019) agrees that P2P platforms attract those risky customers that traditional banks refuse to serve: “In that case, the borrower pool of P2P platforms is of worse quality than banks. Upon the shock to bank credit supply, the borrowers switching from banks to P2P platforms will improve the quality of the P2P borrower pool”. It is likely that P2P platforms tend to lend money to financially vulnerable individuals. de Roure et al. (2018) point out that “P2P lending is substituting the banking sector for high-risk consumer loans”. The majority of conclusions made in these studies are logically grounded, but usually not supported by quantitative evidence.

Regulations and legislation of the P2P lending segment. Efficient regulation of the financial services market combined with technological innovation make P2P platforms more competitive compared to commercial banks. According to Nemoto et al. (2019), “the regulation of P2P lending has evolved significantly in recent years globally, with mostly beneficial effects on the diversification of funding for individuals and corporations”. Fintech has a welfare-enhancing disruptive capability, but regulation needs to adapt so that the new technology delivers the promised benefits without endangering financial stability (Vives 2017).

Bofondi and Gobbi (2017), Vives (2017), point out that “an excessively light approach to the regulation of FinTech today may lead to similar consequences that financial market faced after 2008 crisis”. According to Farnish (2019), “legislation defines P2P lending as a new financial services activity from 2014 in Great Britain”. Ferrarini (2017) has proved that “a case-by-case regulatory approach should be implemented, essentially applying existing regulations on Fintechs, depending on the type of services they carry out”.

According to Huang (2018), “China has recently established a relatively complete regulatory regime for online lending, introducing a number of significant changes, such as the restriction on the business model that can be adopted by platforms, registration requirements, custodian requirements, information disclosure requirements and lending limits”. Nemoto et al. (2019) states that in some countries “P2P platforms have engaged in fraudulent behavior. On the other hand, stringent regulation in the United States has excessively impeded new entrants from providing competition to established platforms <...>. In our view, the United Kingdom can be suggested as an effective model to follow because of its tailormade and flexible regulation”. Most of the authors agree that P2P market regulation appears to be essential for the efficient functioning of the market, both to ensure investors against loss of funds and to clearly regulate the borrowing process.

Navaretti et al. (2018) claims that “the same regulatory framework is imposed on all institutions on the basis of the functions they perform, the playing field is levelled. Then the only competitive advantage is the one granted by technology and the organization of activities. The framework becomes one of pure competition with technological innovation”. Taking this as a guidance, and the Claessens et al. (2018) note that “the regulations can vary significantly depending on country”, we shall analyse the current regulatory framework in Lithuania from the point of view of its efficiency and sustainability of the whole consumer credit market and its segments.

3. Methodology of the Research and Credibility Issues

The research is composed of several steps, where each step analyses a certain problem with the aim to quantitatively evaluate and compare the development and performance of P2P and banking segments. Section 4 compares development trends and main performance indicators of the segments; Section 5 analyses the correlation of the indicators with macroeconomic determinants in both segments and compares their growth rates; Section 6 analyses drivers that stimulate an accelerated growth of the P2P segment compared to traditional banking and highlights the role of legislation.

The applied setup allows to distinguish the impact on the analysed segments from the side of various internal and external factors, such as macroeconomics, technological advantages of P2P platforms, and discrepancies of business regulation within the segments.

The correlation regression model used in the research deals with population data of the selected period of time instead of sample data and therefore is free from sampling errors. Moreover, analysis of correlation between the growth of lending volume in the market segments and the macroeconomic indicators was performed, taking into account their aggregate influence instead of one selected, e.g., GDP, wages, or unemployment rate, thus avoiding issues related to multi-collinearity. The reliability was tested by specific indicators, shown in Table 1. All the calculations were performed by using the SPSS program.

Table 1.

Results of the correlation—regression analysis.

The monthly statistics provided by the Bank of Lithuania on the whole consumer credit market, as well as on the main players within the P2P and banking segments provided by the institutions themselves, were used in the research.

Performed analysis is based on statistical data, which covers a 4-year period from 2016 to 2020:

- Consumer credits from two main traditional banks in the market: Swedbank and SEB, and two P2P platforms: Savy and Paskolu klubas;

- The selected key macroeconomic indicators, such as gross domestic product (GDP), wages, and unemployment rate;

- Forty-eight time series were used for each institution (two banks and two P2P platforms) and each indicator (GDP, wage, unemployment). A total of 192 data lines were used for the regression analysis (monthly data from January 2016 until January 2020).

Research limitations: the analysed number of issued loans and lending volume is linked only to main macroeconomic indicators. Other factors, such as the age, gender of the borrower, place of residence, the purpose of the loan, etc., were not investigated. These factors could be included in further research in the future. The analysis is based on limited time period data. At the time of research, not all necessary data was available for the year 2021; therefore, analysis includes data until 2020 only. The performed research is limited to Lithuania’s case and may lack the potential for in-depth comparative analysis with other countries, but this limitation was determined by the necessity to link the research results with the country-specific legislation.

4. Peer-to-Peer Lending in Lithuania: Development and Comparison with Traditional Segments of the Consumer Credit Market

According to The Central Bank of Lithuania (2019) to date, the following mutual lending platforms have been registered in Lithuania: Savy, (established in 2014), Neo Finance (est. 2014), Procentas (est. 2019), FinBee (est. 2016), Eurocredit, and Oz Finance (est. 2019).

The world’s first P2P platform to start operation in the year 2005 was Zopa (United Kingdom), later followed by Lending Club (USA, 2006) and Finansinspektionen (Sweden, 2007). The majority of platforms operating in other countries were started after the financial crisis of years 2008–2010 and at approximately the same time as in Lithuania—SocietyOne (Australia, 2012), Harmoney (New Zealand, 2014), Mintos (Latvia, 2015), and WeLab (China, 2016) (P2P Market Data 2021). Although, the first platform in Latvia was registered even a year later than in Lithuania, its platform Mintos together with Zopa (United Kingdom) are currently the two largest lending platforms on an international scale (P2P Market Data 2021).

The number of borrowers and investors in Lithuanian P2P platforms is permanently growing. According to P2P Market Data (2020), Lithuania had a total funding volume of €121.8 million in 2018, up from €61.3 million in 2017, which corresponds to the growth rate of 98.7%. This placed Lithuania’s crowdfunding market at that time in 15th position in Europe and 31st in the worldwide crowdfunding statistics.

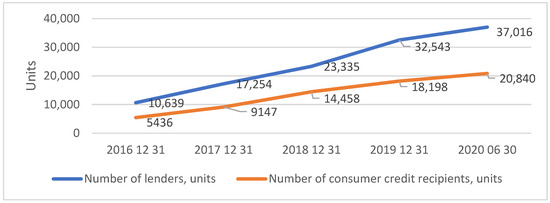

Figure 1 presents data on the number of lenders and the issued loans from 2016.

Figure 1.

Number of lenders and credit recipients of P2P platforms in Lithuania (created by authors based on data from Tarasevičienė 2019; The Central Bank of Lithuania 2020).

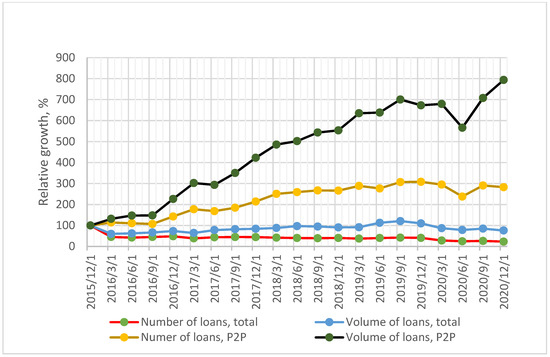

Figure 1 shows that during the period from 2016 until 2020, both the number of lenders and the number of credit recipients in P2P platforms have increased 4–5 times (Taujanskaitė and Karklytė 2021), while the number of loans and volume in P2P segment rose 2.5–3 times and 7–8 times, respectively (Figure 2).

Figure 2.

Relative growth of the total number (units) and volume (eur) of issued consumer loans of the whole market versus its P2P segment (created by authors based on data from The Central Bank of Lithuania 2021).

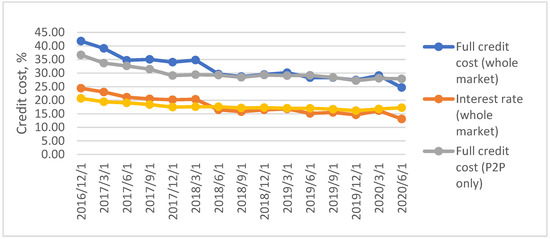

Interest rate and the total cost of loans have shown resemblance in the whole consumer credit market and its P2P segment soon after the emergence of peer-to-peer platforms (see Figure 3), which serves as an indicator of strong competition in the consumer credit market.

Figure 3.

Changes of interest rate and total cost of consumer credits in P2P and banking segments (created by authors based on data from The Central Bank of Lithuania 2021).

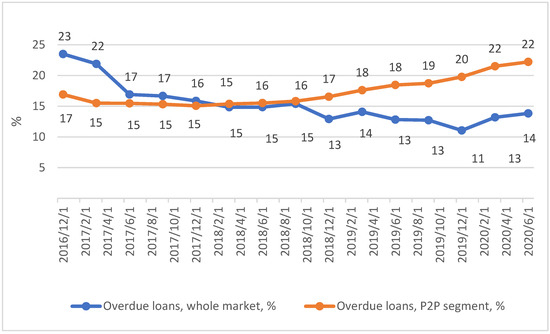

Although, the share of P2P lending in Lithuania is still relatively small compared to the whole consumer credit market and its monthly turnover makes between 5 to 10% by volume, its relative growth is exceptionally high; should this trend remain unchanged in the future, it may turn the P2Ps into a major market player soon. Besides more competition and increased efficiency, which is undoubtedly positive, this may also have a certain negative affect on the market. For example, a permanent growth of overdue loans’ share was observed in the P2P segment.

Figure 4 shows that in 2016, this share in the P2P segment made 17% and was significantly lower than average of the whole market. The latter at that time reached 23%. In 2020, the situation has radically changed—while this share in the whole market has dropped to some 13–14% from previous 23% in the P2P segment, on the contrary, it has increased to 22%. The causes, which drive the fast expansion of the segment and deterioration of its loan portfolio, could also affect the future development of P2P segment as well as the whole consumer credit market. The key question is if such a growth rate is only subject to internal factors, such as previously mentioned technological advantages and the related new business ideas, or there are also some overall factors, e.g., macroeconomics or specific business conditions due to regulations differing from those applied to the traditional banking. To verify this, we have analysed the correlation of growth trends within the P2P and traditional banking segments with the macroeconomic determinants as a first step.

Figure 4.

Change of overdue loan share in the P2P and banking segments, years 2016–2020 (created by authors based on data from The Central Bank of Lithuania 2021).

5. Growth Trends and Interaction between the P2P and Banking Segments

Macroeconomic factors, such as GDP, wages, and the unemployment rate, are likely to affect both segments of the consumer credit market; therefore, they have been selected as independent variables in the analysis. If GDP gets higher, salary should get higher too, the quality of living should rise, unemployment rate decrease, and HH probably will start to consume more, thus fuelling the borrowing. These economic indicators are interconnected and inseparable from the object of the research, and the change of each of them is likely to have an impact on borrowing.

Analysis was performed for two major business players from each of the segments: traditional banking, represented by Swedbank (2021) and the SEB bank (2021) and the P2P segment, represented by Savy (2021) and Paskolų klubas (PK, 2021). The two selected banks and the P2P platforms control more than half of the loan volume in own segments.

Datasets comprising of monthly data from 2016 until 2020 were used for each analysed institution and the macroeconomic indicators (GDP, wage, unemployment).

A relatively strong correlation was found between the selected macroeconomic indicators and the growth of volume indicators within the P2P platform and commercial bank segments. The correlation coefficients calculated were in the range from 0.650 to 0.863.

Results of the performed correlation–regression analysis are displayed in Table 1.

The received coefficients of correlation and determination of the final models were obtained large enough, the regressors that were left in the equations were statistically significant, the multicollinearity indicator was less than 2, and received data of residuals showed that the assumptions of model normality are satisfied.

The obtained correlation–regression equations are presented in Table 2.

Table 2.

Correlation regression equations.

Annual GDP is expressed in mln EUR, monthly wages after taxes in EUR, and unemployment rate in %. The equations produce monthly volume of loans issued by P2P platforms are expressed in EUR while the banking segment is expressed in thous. EUR.

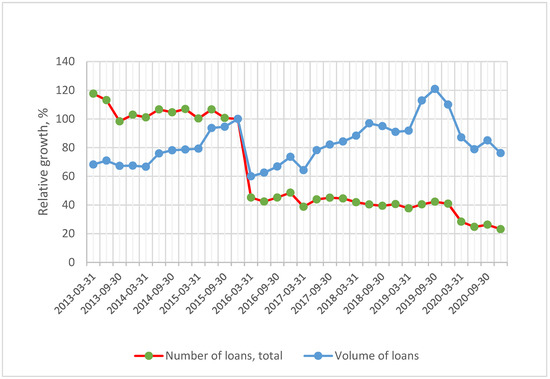

Analysis of growth trends within the segments of consumer credit market based on statistical data by The Central Bank of Lithuania (2021), has revealed that in some cases a very strong interaction exists between them. For example, at the end of 2015, the time when P2P lending platforms emerged, a sudden drop of volume and number of issued loans was registered in the banking segment (Figure 5). Some experts from The Central Bank of Lithuania link this drop with tightened regulations on consumer loans introduced in 2016 (The Central Bank of Lithuania 2016). Impact of this factor can hardly be disputed; nevertheless, this does not seem to have any visible effect on P2P lending (Figure 2).

Figure 5.

Relative changes in the number and volume of consumer loans in the banking segment, years 2013–2020 (created by authors based on data from The Central Bank of Lithuania 2021).

Performed correlation analysis using real statistical data on both market segments during the period of 2015–2020 has revealed a strong association between both segments. For example, Pearson coefficients found between the same properties in both segments, were:

- R = 0.904—between the total cost of credit

- R = 0.881—between interest rates

- R = 0.781—between the volume of loans

- R = −0.415—between the number of loans

- R = −0.805—between the number of loan recipients

- R = −0.785—between the loans overdue for more than 90 days

Thus, a strong positive correlation was found between the interest rates and total loan prices, which might be caused by competition in the market. The same applies to the volume of loans. A strong negative correlation was found between the number of loan recipients and poorly performing loans. This means that a sharp growth of the number of loan recipients in the P2P segment was associated with its decline in the banking segment. A similar relationship was found in the statistics of poorly performing loans. A moderate downhill (negative) linear relationship was registered between the number of issued loans in the segments.

Such relationships suggest that between the two market segments exists strong interaction, and processes in one of them affect the other. The slowdown of growth and even decline in the banking segment can, at least partly, be explained through pressure from the emerged P2P segment.

Relationship between the Macroeconomic Indicators and the Growth Rate of Loan Volume in the P2P and Banking Segments

Regression equations and their coefficients were used as a tool for analysis of the sensitivity (response) of loan volume within the consumer loan market segments to the deviation of independent macroeconomic indicators used as predictors in previous analysis (GDP, wages W, and unemployment rate UR). The response was calculated as an aggregate relative rise of loan volume within each of the segments in response to 1% deviation of all the predictors one by one:

where ΔVGDP—expresses the relative rise of loan volume in response to the deviation of GDP by 1% at a constant wages W and unemployment rate UR:

where:

ΔVΣ = (ΔVGDP2 + ΔVW2+ ΔVUR2)0.5

GDPn—the n-th value of GDP

KGDP—value of GDP coefficient in regression equation

Vn—the n-th value of loan volume calculated at constant values of macroeconomic predictors (GDPn, wages Wn and unemployment rate URn)

N—the number of observations.

Accordingly:

ΔVW—expresses relative rise of loan volume in response to the deviation of wages W by 1% at a constant GDP and unemployment rate UR:

ΔVUR—expresses relative rise of loan volume in response to the deviation of unemployment rate UR by 1% at a constant GDP and wages W:

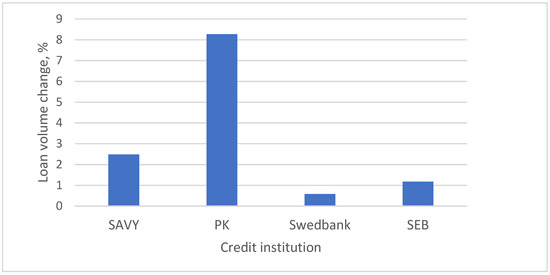

Performed analysis has revealed that P2P institutions appear to be much more sensitive to these changes compared to the banks. For example, the deviation of predictors by 1% has caused an aggregate change of loan volume in Swedbank by 0.58% and in SEB by 1.18%, while in P2P segment the changes were significantly higher, making 2.48% in Savy and even 8.27% in PK.

This closely correlates with the statistical data of both market segments (Figure 6), showing the fast growth of number and volume of loans in P2P segment in years 2016–2020, while the same indicators were flat or even declining (e.g., the number of loans) in the banking segment.

Figure 6.

Response of loan volume in P2P and banking segments to 1% deviation of macroeconomic predictors—GDP, wages W, and unemployment rate UR (created by authors).

The macroeconomic environment and its indicators used as predictors in the analysis are the same for both segments and should not cause any significant difference in growth rates unless there are certain segment-specific drivers capable of doing so. With the aim to identify them, we have made a review of certain internal and external factors, which may lead to accelerated growth of the P2P segment: (a) technological advantages of the P2P segment, known for being a strong driver of growth in this segment (Buchak et al. 2018), and (b) the discrepancies within legislation applicable to the segments. The latter aspect has not been paid much attention in the literature yet, especially in Lithuania. As admitted by Claessens et al. (2018), the regulations can vary significantly depending on country, therefore identification of aspects, which could be in favour of the development of any of the segments, is important.

With this, we will try to support two claims: (a) the technological and legislative factors together are the main drivers of accelerated growth of the P2P segment, and (b) the impact of each factor can be identified and distinguished, at least qualitatively.

6. Growth Trends and Interaction between the P2P and Banking Segments: The Drivers Stimulating an Accelerated Growth of P2P Lending

The drivers that stimulate the development of the consumer credit market segments can be divided into internal and external based on the character of their impact.

Internal drivers. Internal drivers that specifically stimulate the fast growth of the P2P segment of the consumer credit market mainly include technological advantages, first of all the IT-based, which enable: (a) direct and efficient communication between potential credit providers and recipients through an online platform; (b) transfer of relevant information on the borrower for assessing creditworthiness; (c) simple and easy-to-implement contract conclusion procedures; (d) reduction of operating cost due to simplified and minimized infrastructure of the platform, especially compared to the banks. These and some other advantages employed by P2Ps and other FinTech credit providers are well known and their role in stimulating the high growth rate of P2P segment has been justified (Navaretti et al. 2018; Siemionek-Ruskań and Fanea-Ivanovici 2021). Nevertheless, not all of the observed phenomena in the market, e.g., significant difference in the level of non-performing loans, could be justified by the influence of technological advantages only. It appears that quality of borrowers’ pools in the P2P and banking segments is significantly different for some reason(s) and results in a different level of overdue loans in them (see Figure 4). Obviously, the roots of this should be sought elsewhere as the influence of technological factors should not cause the migration of lower quality clients only from traditional banks over to P2P segment. Therefore, we will additionally compare business conditions set by specific regulations of each segment, which cannot be attributed to internal drivers.

External drivers. Besides the macroeconomic environment, which is identical for both segments and should not cause any significant difference in their growth rates, the other external drivers are first of all related to the legislation and regulations within the consumer credit market of Lithuania. In 2008, the European Parliament and Council have adopted the Directive 2008/48/EC (Directive 2008) that harmonises the laws, regulations, and administrative provisions of the EU Member States concerning credit agreements for consumers. The Directive sets principles, which legislations of all the EU member states should follow, but not the legislative documents themselves. The countries are to implement their own laws, which can be country-specific; consequently, there might also be certain differences among the legislations in different countries (EUR-Lex 2008), therefore a short look into related Lithuanian legislation is relevant. The Directive was transferred into Lithuanian national law by the Law on Consumer Credit in 2010 (LR Seimas 2010). Later, in 2015, the law was supplemented with Section 5, which expanded its scope by adding provisions related to mutual lending platforms (P2P). Mutual lending does not fall within the scope of Directive 2008/48/EC, but the Directive itself does not preclude its extension to national law either (LR Seimas 2020).

The aspects that are not covered by the Law on Consumer Credit fall under regulation by the General Contract Law and provisions of the Civil Code (Register of Legal Acts 2000), as well as the Law on Consumer Protection and some other legal acts aimed at consumer protection (LR Seimas 1994).

The Bank of Lithuania has adopted a number of documents applicable to the consumer credit market: the Responsible Lending Regulations of consumer credit recipients (LR Seimas 2011), which detail the creditworthiness assessment criteria established by the Law of Consumer Credit; the Rules for Calculating the Annual Percentage Rate of Charge for Consumer Credit (LR Seimas 2016), which set the rules for calculation of the annual rate of the total consumer credit price; and in 2013, the Rules for the Handling of Complaints received by financial market participants (LR Seimas 2013).

Moreover, some other documents adopted by the Bank of Lithuania regulate the market, namely the Rules for Providing Mandatory Information to Consumer Credit Providers and Mutual Lending Platform Operators to the Bank of Lithuania, (LR Seimas 2012), Consumer Credit Provision Guidelines (Infolex 2015) and the Guidelines for the Advertising of Financial Services (The Central Bank of Lithuania 2012).

These documents apply to all lending institutions/entities operating in the country; therefore, there are no major differences in terms of the lending process, irrespective of the segment the institution belongs to—the P2P or commercial banks. Only some minor differences do exist, such as limitations set by the Law on Consumer Credit (article 25.2), which limits to 500 EUR the total amount of credit in the P2P segment granted by a single lender to a single credit recipient, but this does not apply to total amount of the credit if it is granted by several lenders. This limitation does not apply to commercial banks.

On the other hand, there are significant differences in the requirements to credit institutions themselves belonging to different segments due to different laws, which regulate them. Commercial banks fall under the Law on Banks (LR Seimas 2004) and have to follow requirements related to risk provision and keep certain funds (Article 38, Section 6) needed to safeguard the depositors. The P2P platforms fall under the Law on Consumer Credit and are free from such requirements. Its Article 25.3 only puts certain limitations on the amount of P2P remuneration until the loan is fully repaid: “At least 50 per cent of the remuneration paid by the lender and/or the borrower to the operator of the platform shall be calculated in proportion to the contributions reimbursed to the lender by the borrower”. This requirement is exempted if the operator of the mutual lending platform provides each credit recipient with at least 12 percent of the total amount of the credit from own funds (Law on Consumer Credit). Thus, the main difference between the segments is that banks are obliged to bear all the lending-related risk and fully safeguard its depositors, while the maximum risk of the P2P platform is a 12 percent amount of its own funds and only in the case it has been used as a P2P contribution to the loan. Moreover, the authorized capital of the mutual lending platform operator must be at least 40,000 EUR (Law on Consumer Credit, article 25.3), while the value of the bank’s equity shares must be at least 5 million EUR [Law of Banks, article 44].

These legislation-related differences determine the specific setup of the lending process in the segments and, consequently, different attitude towards handling of this process.

Specific Setup of Lending and Borrowing Processes in Peer-to-Peer Platforms and the Outcomes Thereof

The differences in legislation result in different setup of peer-to-peer lending and borrowing processes compared to traditional banking. The banks usually act as special legal entities, which collect funds from depositors and afterwards lend them on their own to borrowers, generating income this way. The peer-to-peer (P2P) platforms, instead, only offer a specially arranged platform for direct business communication between the lenders and borrowers, earn from its use, but undertake very little or no responsibility at all for the deal made between the two parties independently from the platform. This means that in case of P2P lending, the funds’ transfer path from depositor over to borrower misses a special link—the banks—which among other duties undertake to provide guarantees against the lending-related risks. All the EU banks are obliged to book provisions for absorbing the losses in case the granted loans would become non-performing, but no such imperative requirements exist for P2Ps.

The banks, which bear full responsibility for every transaction, are forced to act in the market in a conservative way, while the P2P platforms, on the contrary, can be more liberal as almost all consequences for the transaction-related risk are on the lenders side. Although this is a simplified picture and currently P2P platforms voluntarily implement various measures aimed at better risk control, it puts some light on differences of the lending and borrowing process in banks and P2P platforms and the possible outcomes thereof.

To support this prediction, the statistics indicating the change of the level of overdue loans in both consumer loan market segments was analysed (see Figure 4). It can be seen that only at early stages of the P2P emergence, its share of overdue loans was lower than the market average but was growing fast and surpassed the average in 2018, and the growth rate remains higher since then, further increasing the gap. Such a trend fully supports the prediction about the different attitudes of the segments towards the borrowers—a more liberal attitude in the case of P2P and a stringent attitude in the case of banks. Another piece of evidence that becomes obvious is that not only technological factors, but also differences in regulations affect the lending process, stimulating a fast and somehow risky growth of P2P lending followed by higher share of non-performing loans. If growth of P2P lending remains significantly higher compared to the rest of the market and regulations shall be further favourable for it, some inevitable consequences may become urgent, such as certain sustainability threats, increased level of non-performing loans, and the related social and economic problems.

7. Scientific Discussion

In this research, an attempt was made to quantitatively evaluate and compare the development trends within P2P and traditional consumer credit market segments during the period since the emergence of P2Ps in Lithuania in 2016 until the end of 2020. The key parameters, such as growth rate of volume and the number of issued loans as well as parameters describing the quality of loan portfolios (non-performing loans), have been compared. The correlation links between those parameters and potential development drivers, such as macroeconomics, technological advantages, and, especially, the regulations and legislative environment, were established, including the corresponding quantitative indexes expressing the strength of these links. The obtained results show that correlation exists between the analysed drivers and performance indicators of both segments as well as between the segments themselves, and from this point of view they comply with those presented by Claessens et al. (2018) and some other authors too. Quantitative indicators presented in our research make it possible to go further than other authors do and compare the strength of the influence of analysed drivers. For example, the results suggest that discrepancies between the regulations of the segments appear to be the main factor to determine a much faster growth of the P2P segment compared to traditional. Furthermore, such legislation-induced fast growth can lead to performance problems not only within the P2P segment, but also in all the consumer credit market. The importance of legislation factors to the development of FinTech sector admit Vives (2017), Ferrarini (2017), Nemoto et al. (2019).

Rupeika-Apoga and Wendt (2021) claim that legislative system in Latvia is not very supportive of new developments in finance and disturbing the development of Fintech sector, but our results show that in the case of Lithuania, the situation is quite the opposite and legislation seems to be too liberal for the P2P segment, and this may be one of the reasons for this sector‘s extraordinary growth. The other claim that “a revision, modernization, and harmonization of regulation are essential to create a level playing field for all market participants: FinTech companies and traditional financial service providers <...>” fully matches with our conclusions.

The insight by Bofondi and Gobbi (2017) and Vives (2017) point out that “an excessively light approach to the regulation of FinTech today may lead to similar consequences that financial market faced after 2008 crisis” also correlates with our results.

When estimating future prospects for the P2P lending segment, there are several controversial aspects that attention should be paid to: (a) emergence of P2P lending can be estimated as positive and beneficial as brings to the consumer credit market more competition and stimulates the introduction of new technologies and novel business ideas; (b) the P2P and banking segments fall under different regulations, and loans provided by them cannot be considered full-scale substitutes as, contrary to banks, the P2P loans are not secured from lending-related risks and, therefore, might bring to the consumer credit market certain threats; (c) the solution could be either unification of regulations for all loan providers or clear distinguishing of the loans they offer in order to guarantee full awareness of borrowers and, especially, the lenders.

8. Conclusions

Analysis of statistical data on the consumer credit market of Lithuania has revealed that the growth rate of its peer-to-peer (P2P) segment was exceptionally high compared to the whole market, demonstrating a 700% increase in volume and to 300% in the number of issued loans in 2020 compared to 100% base of 2016. In contrast, the trends within the whole market were ambiguous—a moderate growth of volume to ~120% was followed by sharp decline in the number of loans, which in 2020 made only 40% compared to the 100% base of 2016.

Despite its sharp growth, the share of the P2P segment still makes only 5% to 10% of the whole market by volume, but if such a difference in growth rates shall remain, the P2P segment can turn into a major market player relatively soon.

The effect of the COVID-19 pandemic on the consumer credit market was ambiguous. A temporary ~20% decline in the number and volume of loans was observed in P2P segment in the second quarter of 2020, but recovery of third and fourth quarters fully compensated it. At the end of 2020, the number of loans was at its previous top height again, while volume has even reached record high of 800% compared to 2016. Contrary to P2P segment, the whole market, instead, has shrunk to ~25% by number and to ~75% by volume compared to the same base of 2016.

Interconnection between the trends in macroeconomics and the development of the consumer credit market and its P2P segment was confirmed by strong relevant correlation links; nevertheless, it has not been proven that macroeconomics could be the main driver of fast growth of P2P compared to the banking segment.

Review of factors that might stimulate an accelerated growth of the P2P segment has revealed that not only internal, such as technological advantages and novel business ideas induced by them, but also external, such as its specific treatment by legislation (regulations), determine favourable conditions for the development of this segment.

Specific treatment by regulations, first of all the exemptions from liabilities related to lending risks, is in favour of the more liberal attitude of the P2P segment towards borrowers and the requirements to them compared to the banking segment.

Analysis has evidently supported the prediction that P2P and banking segments act as competitors in the market and all their development indicators strongly correlate. For example, correlation between the number of issued loans is strongly negative—the rise in the P2P segment is followed by clear decline in the banking segment.

The growth of P2P lending can be associated with an increased level of non-performing loans and higher risk, especially for lenders; therefore, the P2P expansion could cause deterioration of performance of the consumer credit market, typically followed by undesirable financial and social consequences and real sustainability threats.

The observed growing share of overdue loans in the P2P segment and permanently increasing margin versus banking segment can only be explained by migration of “lower quality” borrowers over to P2P segment due to its more liberal attitude to them.

Discrepancies within legislation predetermine certain confusion with the products which P2P and banking segments provide, guided by their own specific laws. The assumption that loans from P2Ps and banks are substitutes is partly true only from the borrower’s point of view, while from lender’s point of view these products are different, as lenders in P2Ps are poorly secured from lending-related risks.

The quantitatively justified results of the research on the most influential factors that determine accelerated growth of the P2P segment and their impact on the overall performance of the consumer credit market and its segments add new information to the literature and can be of interest to researchers and practitioners in other countries, especially those having similar legislation and regulations within the consumer credit market.

Author Contributions

K.T. has worked with abstract, introduction, theoretical framework, methodology parts, and revised the whole paper; E.M. has worked with statistical data analysis, mathematical modelling, and revised the whole paper. Both authors have worked with the presentation and discussion of the final results. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Almenberg, Johan, Annamaria Lusardi, Jenny Säve-Söderbergh, and Roine Vestman. 2020. Attitudes toward debt and debt behavior. The Scandinavian Journal of Economics 123: 780–809. [Google Scholar] [CrossRef]

- Babaei, Golnoosh, and Shahrooz Bamdad. 2020. A multi-objective instance-based decision support system for investment recommendation in peer-to-peer lending. Expert Systems with Applications 113278: 150. [Google Scholar] [CrossRef]

- Bachmann, Alexander, Alexander Becker, Daniel Buerckner, Michael K. M. Hilker, Frank Kock, Mark Lehmann, Phillip Tiburtius, and Burkhardt Funk. 2011. Online peer-to-peer lending—A literature review. Journal of Internet Banking and Commerce 16: 1–18. [Google Scholar]

- Bangham, George, and Jack Leslie. 2020. Rainy Days: An Audit of Household Wealth and the Initial Effects of the Coronavirus Crisis on Saving and Spending in Great Britain. London: Resolution Foundation. Available online: https://www.resolutionfoundation.org/app/uploads/2020/06/Rainy-Days.pdf (accessed on 5 March 2021).

- Bauwens, Michel, Vasilis Kostakis, and Alex Pazaitis. 2019. Peer to Peer: The Commons Manifesto. London: University of Westminster Press. [Google Scholar] [CrossRef]

- Bloomberg. 2021. Mortgage Boom Drives Biggest Jump in Household Debt Since 2013. Available online: https://www.bloomberg.com/news/articles/2021-08-03/mortgage-boom-drives-biggest-jump-in-household-debt-since-2013 (accessed on 12 November 2021).

- Bofondi, Marcello, and Giorgio Gobbi. 2017. The big promise of FinTech. In European Economy: Banks, Regulation and the Real Sector. Fintech and Banking. Friends or Foes? Milano: Centro Studi Luca d’Agliano. [Google Scholar]

- Boot, Arnoud W. A. 2018. The Future of Banking: From Scale & Scope Economies to Fintech. Available online: https://european-economy.eu/2017-2/the-future-of-banking-from-scale-scope-economies-to-fintech/ (accessed on 15 April 2021).

- Buchak, Greg, Gregor Matvos, Tomasz Piskorski, and Amit Seru. 2018. Fintech, regulatory arbitrage, and the rise of shadow banks. Journal of Financial Economics 130: 453–83. [Google Scholar] [CrossRef]

- Claessens, Stijn, Grant Turner, Jon Frost, and Feng Zhu. 2018. Fintech credit markets around the world: Size, drivers and policy issues. BIS Quarterly Review 3: 29–49. [Google Scholar]

- Cloyne, James, Clodomiro Ferreira, and Paolo Surico. 2020. Monetary policy when households have debt: New evidence on the transmission mechanism. Review of Economic Studies 87: 102–29. [Google Scholar] [CrossRef]

- CNBC. 2021. Peer-to-Peer Lending: A Market Worth Your Attention. Available online: https://www.cnbctv18.com/finance/peer-to-peer-a-market-worth-your-attention-11496792.htm (accessed on 21 January 2022).

- de Roure, Calebe, Loriana Pelizzon, and Anjan V. Thakor. 2018. P2P Lenders versus Banks: Cream Skimming or Bottom Fishing? Available online: https://ssrn.com/abstract=3174632 (accessed on 16 September 2021).

- de Roure, Calebe, Loriana Pelizzon, and Paolo Tasca. 2017. How Does P2P Lending Fit into the Consumer Credit Market? Available online: https://ssrn.com/abstract=2848043 (accessed on 14 March 2021).

- Dermine, Jean. 2018. Digital Disruption and Bank Lending. In European Economy: Banks, Regulation and the Real Sector. Fintech and Banking. Friends or Foes? Milano: Centro Studi Luca d’Agliano. [Google Scholar]

- Directive. 2008. Directive 2008/48/EC of the European Parliament and of the Council on Credit Agreements for Consumers. Official Journal of the European Union. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:32008L0048&from=en (accessed on 22 January 2022).

- Dorfleitner, Gregor, Eva Maria Oswald, and Rongxin Zhang. 2021. From Credit Risk to Social Impact: On the Funding Determinants in Interest-Free Peer-to-Peer Lending. Journal of Business Ethics 170: 375–400. [Google Scholar] [CrossRef]

- EUR-Lex. 2008. Access to European Union Law. Available online: https://eur-lex.europa.eu/legal-content/LT/TXT/?uri=CELEX:32008L0048 (accessed on 22 January 2022).

- European Central Bank. 2021. Household Sector Report. Available online: https://sdw.ecb.europa.eu/reports.do?node=1000004952 (accessed on 16 January 2022).

- European Central Bank. 2022. Our Response to the Coronavirus Pandemic. Available online: https://www.ecb.europa.eu/home/search/coronavirus/html/index.en.html (accessed on 19 February 2022).

- Faia, Ester, and Monica Paiella. 2017. P2P Lending: Information Externalities, Social Networks and Loans’ Substitution (CEPR Discussion Paper, DP12235, 1-58). Available online: https://www.vwl.uni-mannheim.de/media/Lehrstuehle/vwl/DFG_1578/Publications/Faia_Paiella_2018.pdf (accessed on 19 February 2022).

- Farnish, Christine. 2019. P2P Lending and Regulation. Available online: https://thedocs.worldbank.org/en/doc/772361560127588574-0130022019/original/FinSACFintech20ChristineFarnish.pdf (accessed on 10 December 2021).

- Federal Reserve Bank of America. 2021. Household Debt Overview. Available online: https://www.federalreserve.gov/releases/z1/dataviz/household_debt/ (accessed on 10 January 2022).

- Federal Reserve Bank of New York. 2021. Household Debt and Credit Report. Available online: https://www.newyorkfed.org/microeconomics/hhdc (accessed on 10 January 2022).

- Ferrarini, Guido. 2017. Regulating FinTech: Crowdfunding and beyond. In European Economy: Banks, Regulation and the Real Sector. Fintech and Banking. Friends or Foes? Milano: Centro Studi Luca d’Agliano. [Google Scholar]

- Foo, Jessica, Lek-Heng Lim, and Ken Sze-Wai Wong. 2017. Macroeconomics and FinTech: Uncovering latent macroeconomic effects on peer-to-peer lending. arXiv arXiv:1710.11283. [Google Scholar]

- Fuster, Andreas, and Paul S. Willen. 2017. Payment size, negative equity, and mortgage default. American Economic Journal: Economic Policy 9: 167–91. [Google Scholar] [CrossRef]

- Gilchrist, Simon, and Benoit Mojon. 2018. Credit risk in the Euro area. The Economic Journal 128: 118–58. [Google Scholar] [CrossRef]

- Guo, Yanhong, Wenjun Zhou, Chunyu Luo, Chuanren Liu, and Hui Xiong. 2016. Instance-based credit risk assessment for investment decisions in P2P lending. European Journal of Operational Research 249: 417–26. [Google Scholar] [CrossRef]

- Huang, R. Hui. 2018. Online P2P Lending and Regulatory Responses in China: Opportunities and Challenges. European Business Organization Law Review 19: 63–92. Available online: https://ssrn.com/abstract=2991993 (accessed on 15 April 2022). [CrossRef]

- Infolex. 2015. Consumer Credit Provision Guidelines. Available online: http://www.infolex.lt/ta/511042 (accessed on 10 December 2021).

- International Monetary Fund. 2019. Household Debt, Consumption, and Monetary Policy in Australia. Available online: https://www.imf.org/en/Publications/WP/Issues/2019/04/05/Household-Debt-Consumption-and-Monetary-Policy-in-Australia-46685 (accessed on 5 March 2021).

- LR Seimas. 1994. Republic of Lithuania Law on Consumer Protection. Available online: https://e-seimas.lrs.lt/portal/legalAct/lt/TAD/TAIS.6020/asr (accessed on 10 December 2021).

- LR Seimas. 2004. Republic of Lithuania Law on Banks. Available online: https://e-seimas.lrs.lt/portal/legalAct/lt/TAD/TAIS.230458/asr (accessed on 10 December 2021).

- LR Seimas. 2010. Republic of Lithuania Law on Consumer Credit. Available online: https://e-seimas.lrs.lt/portal/legalAct/lt/TAD/b6921352bf7a11e5ac22dba8705b325b?jfwid=89x1tcj9p (accessed on 10 December 2021).

- LR Seimas. 2011. Responsible Lending Regulations of Consumer Credit Recipients. Available online: https://e-seimas.lrs.lt/portal/legalAct/lt/TAD/TAIS.405879/asr (accessed on 10 December 2021).

- LR Seimas. 2012. Rules for Providing Mandatory Information to Consumer Credit Providers and Mutual Lending Platform Operators to the Bank of Lithuania. Available online: https://e-seimas.lrs.lt/portal/legalAct/lt/TAD/TAIS.439434/awsbSnenvD (accessed on 10 December 2021).

- LR Seimas. 2013. Rules for the Handling of Complaints Received by Financial Market Participants. Available online: https://e-seimas.lrs.lt/portal/legalAct/lt/TAD/TAIS.450611/scCcmENBqF (accessed on 10 December 2021).

- LR Seimas. 2016. Rules for Calculating the Annual Percentage Rate of Charge for Consumer Credit. Available online: https://e-seimas.lrs.lt/portal/legalAct/lt/TAD/TAIS.438691/asr (accessed on 10 December 2021).

- LR Seimas. 2020. Republic of Lithuania Law on Consumer Credit (Current Consolidated Version). Available online: https://e-seimas.lrs.lt/portal/legalAct/lt/TAD/TAIS.390016/asr (accessed on 10 December 2021).

- Mansilla-Fernández, Jose Manuel. 2018. A bird eye (re)view of key readings. In Fintech and Banking: Friends or Foes. European Economy: BANKS, Regulation, and the Real Sector. Milano: Centro Studi Luca d’Agliano. [Google Scholar]

- Navaretti, Giorgio Barba, Giacomo Calzolari, and Alberto Franco Pozzolo. 2018. Fintech and banks. Friends or foes? In European Economy Banks, Regulation, and the Real Sector Fintech and Banking. Milano: Centro Studi Luca d’Agliano. [Google Scholar]

- Nemoto, N., D. Storey, and B. Huang. 2019. Optimal Regulation of P2P Lending for Small and Medium-Sized Enterprises. In ADBI Working Paper 912. Tokyo: Asian Development Bank Institute. Available online: https://www.adb.org/sites/default/files/publication/478611/adbi-wp912.pdf (accessed on 12 November 2021).

- OECD. 2021. Household Debt. Available online: https://data.oecd.org/hha/household-debt.htm (accessed on 12 January 2022).

- P2P Market Data. 2020. Crowdfunding Statistics Worldwide: Market Development, Country Volumes, and Industry Trends. Available online: https://p2pmarketdata.com/blog/crowdfunding-statistics-worldwide/ (accessed on 12 November 2021).

- P2P Market Data. 2021. Top 70 Financing Platforms by Funding Volumes. Available online: https://p2pmarketdata.com (accessed on 12 November 2021).

- Register of Legal Acts. 2000. Civil Code of the Republic of Lithuania. Available online: https://www.e-tar.lt/portal/lt/legalAct/TAR.8A39C83848CB (accessed on 10 December 2021).

- Rupeika-Apoga, Ramona, and Stefan Wendt. 2021. FinTech in Latvia: Status Quo, Current Developments, and Challenges Ahead. Risks 9: 181. [Google Scholar] [CrossRef]

- Serrano-Cinca, Carlos, Begona Gutiérrez-Nieto, and Luz López-Palacios. 2015. Determinants of Default in P2P Lending. PLoS ONE 10: e0139427. [Google Scholar] [CrossRef] [PubMed]

- Siemionek-Ruskań, Malgorzata, and Mina Fanea-Ivanovici. 2021. Peer-to-Peer Lending: Evolution and Trends. In Digitalization in Finance and Accounting. Edited by David Procházka. ACFA 2019. Springer Proceedings in Business and Economics. Cham: Springer. [Google Scholar] [CrossRef]

- Tang, Huan. 2019. Peer-to-Peer lenders versus banks: Substitutes or complements? Review of Financial Studies 32: 1900–38. [Google Scholar] [CrossRef]

- Tarasevičienė, Justina. 2019. Tarpusavio skolinimas: Ką reiktų žinoti investuojant ir skolinantis? Kas yra tarpusavio skolinimas? Vilnius: Lietuvos Bankas. Available online: https://www.lb.lt/uploads/documents/files/2019-10-02%20tarpusavio%20skolinimas_LB.pdf (accessed on 15 April 2021).

- Taujanskaitė, Kamilė, and Ieva Karklytė. 2021. Borrowing alternatives for households in Lithuania: Current situation, trends and challenges. Business, Management and Economics Engineering 19: 389–411. [Google Scholar] [CrossRef]

- The Central Bank of Lithuania. 2012. Guidelines for the Advertising of Financial Services. Available online: https://www.lb.lt/lt/teisesaktai?type=101 (accessed on 10 December 2021).

- The Central Bank of Lithuania. 2016. The Conditions for Granting Consumer Credit Have Been Significantly Reduced. Available online: https://www.lb.lt/lt/naujienos/sugrieztinus-vartojimo-kreditu-teikimo-salygas-ju-suteikta-gerokai-maziau (accessed on 10 December 2021).

- The Central Bank of Lithuania. 2019. Financial Market Participants—List of Mutual Lending Platform Operators. Available online: https://www.lb.lt/finansu-rinku-dalyviai?list=63 (accessed on 10 December 2021).

- The Central Bank of Lithuania. 2020. Mutual Lending Platform Operator Performance Review. Available online: https://www.lb.lt/uploads/publications/docs/26837_a473fa339f299946cb1226cb1d62400c.pdf (accessed on 10 December 2021).

- The Central Bank of Lithuania. 2021. Consumer Credit Statistics. Available online: https://www.lb.lt/lt/vkd-veiklos-rodikliai (accessed on 15 April 2021).

- The World Bank. 2021. Domestic Credit to Private Sector. Available online: https://data.worldbank.org/indicator/FS.AST.PRVT.GD.ZS (accessed on 10 December 2021).

- The World Bank. 2022. GDP by Countries. Available online: https://data.worldbank.org/indicator/NY.GDP.MKTP.CD (accessed on 10 December 2021).

- UK Parliament. 2021. Household Debt: Key Economic Indicators. Available online: https://commonslibrary.parliament.uk/research-briefings/sn02885/ (accessed on 10 December 2021).

- Vives, Xavier. 2017. The impact of FinTech on banking. In European Economy: Banks, Regulation and the Real Sector. Fintech and Banking. Friends or Foes? Milano: Centro Studi Luca d’Agliano. [Google Scholar]

- Wang, Haomin, Gang Kou, and Yi Peng. 2021. Multi-class misclassification cost matrix for credit ratings in peer-to-peer lending. Journal of the Operational Research Society 72: 923–34. [Google Scholar] [CrossRef]

- Wright, Logan, and Allen Feng. 2020. COVID-19 and China’s Household Debt Dilemma. Available online: https://rhg.com/research/china-household-debt/ (accessed on 12 April 2021).

- Yeo, Eunjung, and Jooyong Jun. 2020. Peer-to-Peer Lending and Bank Risks: A Closer Look. Sustainability 12: 6107. [Google Scholar] [CrossRef]

- Zeng, Xiangxiang, L. Liu, Stephen Leung, Jiangze Du, Xun Wang, and Tao Li. 2017. A decision support model for investment on P2P lending platform. PLoS ONE 12: e0184242. [Google Scholar] [CrossRef] [PubMed] [Green Version]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).