Abstract

Developed countries have the resources/technologies to combat pollution even at the expense of economic growth. Developing countries are in a less fortunate position. Foreign Direct Investment (FDI) can be a tool for developed countries to transfer polluting industries, which increases pollution in host countries. However, as FDI might reduce pollution by reducing energy consumption, the pollutant effect might also be influenced. Therefore, this study examines the mediating effect of energy consumption on the impact of FDI on pollution, and the role of FDI to attain Green Growth via energy transition. The main findings indicate that FDI impacts pollution through energy consumption and that energy transition plays a vital role in reducing this mediating effect. Developing countries appear to use non-renewable energy to fill energy demand. In both groups of countries, FDI is a driver of Green Growth. However, developing countries require larger efforts to achieve Green Growth through the energy transition.

1. Introduction

The climate change debate is at the core of most international discussions and agreements. The United Nations Conference of the Parties (COP) on Climate Change is the most current international agreement on climate action. The COP allows countries to debate and set their climate targets. However, what happens if countries do not meet those targets? The debate and the imposition of targets are both critical, but they are only effective when the targets are met. The absence of penalties may discourage countries from undermining economic growth at the expense of environmental protection. This is especially true in developing countries, which have lower wealth.

FDI is one of the primary sources of economic growth in developing countries. This study concerns one of the strategies adopted by developing countries to attract FDI: Reducing environmental regulations to attract investment. By following this strategy, developing countries gain a comparative advantage in polluting goods and industries. Although developed countries are leading climate action, they are still the most polluting countries. To reach climate targets and avoid tighter environmental restrictions, developed countries may choose to relocate their polluting industries. This phenomenon is known in the literature on the FDI–Environment nexus as the Pollution Haven Hypothesis (PHH). This relocation goes against the efforts of the COP, as it only results in a transfer of the territorial source of emissions, not a pollution reduction.

The FDI–Environment nexus focuses on analysing the environmental impact of FDI in recipient countries, but the findings are controversial. While some scholars have noticed a pollutant effect of FDI, the reverse effect was also found: FDI might reduce pollution due to the transfer of cleaner/more efficient energy processes that can reduce energy consumption (). This is generally defined in the literature as the Pollution Halo Hypothesis (PHlH).

This latter hypothesis prompted some reasoning: As FDI could reduce pollution by reducing energy consumption, could FDI be increasing pollution by the indirect effect of FDI increasing energy consumption? Therefore, more than just analysing the impact of FDI on the level of CO2 emissions, the main objective of this paper is to examine whether the pollutant effect is mediated by the increased energy consumption from non-renewable sources. In addition, this study also aims to assess whether the energy transition from the fossil-fuel-based energy mix to the renewables-based energy mix could soften the potential mediating effect.

This study innovates in four ways: (i) By filling a gap in the literature supporting the transfer of polluting industries only based on the polluting effect of FDI in host countries; (ii) by scrutinizing the environmental impact of FDI in both developed and developing countries, which allows a comparison between the effects of investment; (iii) by understanding, through a moderated mediation model, whether policies directed toward the energy transition might influence the mediating effect of energy consumption on the impact of FDI on Carbon Dioxide (CO2) emissions; and (iv) by analysing the role of the energy transition in mitigating the harmful effect of FDI, thus leading to Green Growth (economic growth that also considers environmental depletion).

The central questions of this study are: (i) Does FDI increase pollution due to the fossil fuel-based energy mix of the host countries? (ii) What is the role of FDI and the energy transition for countries achieving Green Growth? (iii) Does the energy transition soften the PHH? To answer these central questions, this study analyses a group of 19 developed and 20 developing countries through a Structural Equation Model (SEM). This model examines the mediating effects of energy consumption and energy transition on the impact of FDI on CO2 emissions and Green Growth, respectively. Furthermore, a dynamic game with incomplete information is carried out to clarify whether the imposition of penalties on international commitments to climate action could be crucial for countries to achieve climate targets. The main findings show that developing countries have been using non-renewable energy to meet the increased energy demand provoked by increased FDI. Therefore, pollution has been driven by FDI in developing countries. On the contrary, FDI encourages the energy transition and reduces pollution in developed countries. The moderated mediation model uncovers the potential role of the energy transition to reduce the mediating effect of energy consumption in both groups of countries. FDI seems to be a driver of Green Growth in both developed and developing countries. However, developing countries are required to make larger efforts to make the energy transition an ally to meet Green Growth. Encouraging foreign and/or private investment in renewable energy infrastructure appears crucial.

2. Literature Review

Attracting FDI is a global strategy adopted to increase income in both developed and developing countries (). However, as economic growth has expanded, the environment has degraded. All strategies adopted by both developed and developing countries have one main concern: Their impact on economic growth.

Climate action policies might require, for example, investment in Research and Development (R&D) to increase countries’ technology absorptive capacity for greener technologies, as announced by (). As stated by (), the absorptive capacity of countries can be defined as the ability of countries to identify, assimilate, and exploit knowledge from their environment. Briefly, this capacity reflects the capacity of countries to learn fast (). This is especially relevant in developing countries that commonly have a lower technology-absorptive capacity, thus representing higher adjustment costs hindering the potential benefits of FDI.

Investment in renewable energy infrastructure also appears crucial on the path to climate action, as increased renewable energy consumption is directly associated with reduced environmental degradation (e.g., ; ). Moreover, as suggested by (), energy efficiency plays a vital role in climate action to reduce CO2 emissions levels. As stated by (), it can prevent environmental degradation without lowering the production level of the economy. However, countries must be willing to potentially undermine economic growth to preserve the environment, which might be more difficult for countries with less wealth or those that generally have fewer resources to allocate to climate action ().

The environmental impacts of FDI are analysed through two main hypotheses: The Pollution Haven and the Pollution Halo. The PHH postulates that the transfer of polluting industries occurs from countries with strict environmental regulations to countries with lower environmental restrictions (e.g., ; ; ). This transfer can lead developing countries to relax their environmental restrictions further to attract FDI and thus increase income. The PHlH states that FDI can reduce pollution by transferring green technologies that consume less energy (e.g., ; ; ). The latter hypothesis might disclose that the environmental impact of FDI can be influenced by the impact of FDI on energy consumption.

The results of the FDI–Environment nexus are controversial, perhaps because the transfer of polluting industries has been supported only based on the polluting effect of FDI in recipient countries, without profoundly analysing what is at the origin of this effect. In fact, FDI could increase the output of countries, which could demand higher energy, as stated by (). As is known, the energy consumption of non-renewable sources can harm the environment. Therefore, this effect might stem from the increased consumption of non-renewable energy. Based on the above-mentioned information, the first hypothesis is formulated as follows:

H1:

Energy consumption mediates/influences the impact of FDI on the pollution level of the host country.

Some literature focuses on the impact of FDI on energy consumption, also considering its sources as, for example, (), who analysed nine countries with the highest score on the Climate Change Performance Index. The author found mixed effects of FDI on renewable and non-renewable energy consumption in these countries. For example, FDI negatively affects renewable energy consumption in Morocco, thus contributing to environmental pollution. In contrast, in Portugal, FDI increases renewable energy consumption and has no impact on CO2 emissions. Furthermore, () found that FDI reduces CO2 emissions in India by reducing non-renewable energy consumption in the long run. In this regard, the second hypothesis has been developed:

H2:

Energy transition can reduce the pollutant effect of FDI provoked by increased energy consumption, thus softening PHH.

With this in mind, the energy transition from fossil fuels to renewable energy might be crucial to reduce the pollutant effect of FDI and avoid the relocation of polluting industries. Indeed, renewable energy consumption may be more effective for economic growth than energy consumption from non-renewable sources (). Through the energy transition, countries might increase their income while preserving the environment. This is commonly known as Green Growth (e.g., ). The development of green technologies appears to be able to reduce pollution and preserve natural resources ().

However, developing countries are generally dependent on technologies and innovations that evolved in developed countries. The exhaustive exploitation of natural resources in developing countries is a reality that must be prevented (see, e.g., ). Therefore, developed countries might play a relevant role in preventing this exploitation, perhaps through FDI in renewable energy. As stated by (), FDI can support renewable energy projects and ensure countries’ ecological energy security. Therefore, foreign investors play a vital role in improving worldwide environmental conditions.

As suggested by (), investment in innovation ought to be accompanied by investment in infrastructure (for instance, in renewable energy infrastructure aimed at energy transition). In fact, FDI can be an ally in accelerating the development of the renewable energy sector (). Briefly, efforts are required to incorporate renewable energy consumption and FDI inflows (to benefit from technology know-how transfer), as announced by (), in both developed and developing countries. Thus, the last hypothesis is proposed as follows:

H3:

Energy transition mediates/influences the impact of FDI on Green Growth.

This study thus fills a gap in the literature by going further into the analysis of the environmental impact of FDI, considering the potential role of energy consumption in predicting this impact in both developed and developing countries. In addition, this study analyses the role of the energy transition for countries aiming to achieve Green Growth, which should be a global goal. Furthermore, this study provides an analysis of how FDI could lead countries to achieve the goal of Green Growth more easily. Therefore, this study analyses a group of 19 developed countries and a group of 20 developing ones from 1995 to 2018. The SEM is used to analyse the mediating mediated effects. The main findings expose that the pollutant effect of FDI is mediated by energy consumption in both developed and developing countries. The energy transition plays a vital role as a moderator in reducing the mediating effect of energy consumption. FDI is a driver of Green Growth. However, developing countries ought to make larger efforts to ensure the energy transition drives Green Growth.

3. Data

This study aims to analyse the role of energy consumption and the energy transition to predict the impact of FDI on CO2 emissions and Green Growth, respectively. A group of 19 European Union countries is under analysis, namely: Austria, Belgium, Bulgaria, Cyprus, the Czech Republic, Denmark, Estonia, Finland, France, Germany, Hungary, Ireland, Italy, Portugal, the Slovak Republic, Slovenia, Spain, Sweden, and the United Kingdom; and a group of 20 developing countries: Argentina, Bangladesh, Brazil, Cambodia, China, Colombia, Costa Rica, Guatemala, India, Indonesia, Malaysia, Mexico, Nicaragua, Pakistan, Peru, Philippines, the Russian Federation, Sri Lanka, Thailand, and Vietnam from 1995 to 2018. The European Union countries were chosen mainly because they are under similar policy guidance, especially on climate action. The group of developing countries was selected according to the World Bank’s PPI database; these countries have received investment in energy infrastructure, which is crucial to the energy transition. Table 1 gives the description and source of the variables used in this study.

Table 1.

The variable’s description, sources, and descriptive statistics.

The inward FDI stock measures FDI stock-in, and CO2 emissions are used as a proxy for pollution. The energy transition is measured through the Clean Energy Transition as in (). Green Growth could be measured through several methods (see ). According to the System for Integrated Environmental and Economic Accounting released by the United Nations Statistics Division (which laid the fundamental framework for green accounting), Green Growth must consider natural resource depletion and environmental pollution. Thus, such as in (), Green Growth is measured using the following Equation (1):

All variables are converted into per capita and then into natural logarithms.

4. Methodology

4.1. Mediation Model

The SEM was used to analyse the indirect effect of energy consumption on the impact of FDI on CO2 emissions (Model I), and the indirect effect of the energy transition on the impact of FDI on Green Growth (Model II). This model allowed both direct and indirect effects to be analysed ().

The main motivation for the Model I analysis was the PHlH, which holds that FDI might reduce pollution by reducing energy consumption (e.g., ). The rationale behind this analysis is that FDI could increase pollution by boosting consumption from non-renewable sources. Therefore, it appears relevant to analyse whether the impact of FDI on CO2 emissions is indirectly affected by the impact of FDI on energy consumption. To reach this, energy consumption was used as a mediator variable.

Both developed and developing countries aim to attract FDI to increase economic growth. However, the literature has exposed the detrimental effects of FDI on the environment. Therefore, countries must consider the urgency of climate change by shifting the goal from purely economic growth to a goal of Green Growth (economic growth that also considers environmental depletion). Therefore, since FDI can boost the output of economies (), support sustainable renewable sources (), and contribute to accelerating renewable energy development (), FDI appears to have the potential to help countries achieve Green Growth more easily through the energy transition. Given that, the energy transition was used as a mediator variable in Model 2.

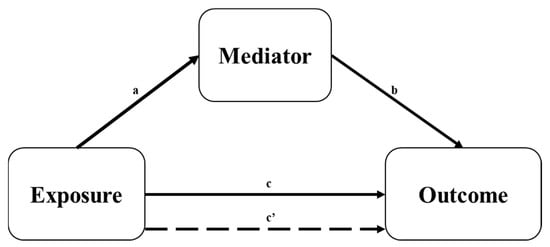

Figure 1 presents the general path diagram from the SEM results where the direct and indirect effects are shown.

Figure 1.

Path diagram of mediation test.

Six equations are derived from Figure 1. Equations (2)–(4) are from Model 1, where the exposure variable is FDI, the outcome variable is CO2 emissions, and the mediator variable is energy consumption.

The intercept is denoted as i in all equations, and the error term is ε. The overall effect of the exposure variable on the outcome variable is outlined by c in Equation (2). The impact of the exposure variable on the mediator variable is given in Equation (3). The direct impact of the exposure variable on the outcome variable is expressed by c′, and the indirect effect of the mediator variable on the outcome variable is given by b in Equation (4). Equations (5)–(7) are from Model 2.

The SEM was performed with 1000 bootstrap repetitions. Then, the Sobel test was carried out to check the robustness of the findings (). To establish a mediated relationship, a few conditions are required, according to (): (i) The independent variable must significantly affect the mediator and the dependent variable; and (ii) the mediator ought to have a significant effect on the dependent variable.

4.2. Moderated Mediation Model

This study intends to analyse the mediating effect of energy consumption on the impact of FDI on CO2 emissions. The potential role of the energy transition to influence this mediating impact is under analysis as well. Thus, a moderated mediation model was conducted to examine if the mediating effect of energy consumption varies according to the value of a moderator (energy transition). Such as suggested by (), this analysis was based on the Moderated Mediation Index (MMI) and the Condition Indirect Effects (CIE).

5. Empirical Findings

5.1. Mediation Model Results

The presence of collinearity and multicollinearity is tested through the correlation matrix and VIF statistics, revealing that these phenomena are not a concern. The results are not presented to preserve space but are available upon request to the authors. Table 2 shows the direct, indirect, and total effects, and the () test. The latter is performed based on the () approach to test for mediation using the Ratio of Indirect to Total effect.

Table 2.

Direct, indirect, and total effects, and Sobel test results.

The Sobel test reveals that 2969% of the effect of FDI on CO2 emissions is mediated by energy consumption in developed countries. In developing ones, the amount mediated is approximately 31%. Regarding Model II, the effect of FDI on Green Growth is approximately 13% mediated by energy transition in developed countries and 15% in developing countries. FDI has a statistically significant impact on CO2 emissions via energy consumption in both developed and developing countries, which verifies H1. The mediating effect of the energy transition on the impact of FDI on Green Growth uncovers that energy transition can be an ally to ensure FDI drives Green Growth, thus H3 is verified.

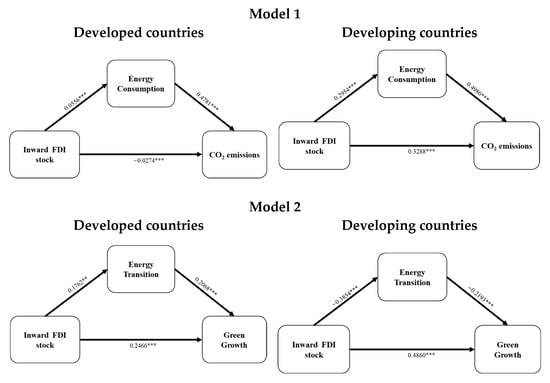

Focusing on Figure 2 and Model I, FDI stock-in reduces CO2 emissions in developed countries, such as found by (), (), and (), thus supporting the PHlH. Notwithstanding, it increases energy consumption. This might suggest that although FDI increases energy consumption in developed countries (which increases pollution), these countries also appear to be receiving green technologies and energy-efficient processes that can mitigate the pollutant effect of increased energy consumption, as suggested by (). The authors also state that increased FDI seems to be able to improve the manufacturing sector and the use of cleaner technologies.

Figure 2.

Path diagram of SEM. Notes: ***, and ** mean statistical significance at 1% and 5% levels. Source: Own elaboration.

Focusing on developing countries, FDI boosts pollution as found by, for example, (), (), and (), thus supporting the PHH and the transfer of polluting industries. However, this effect appears to be a consequence of increased energy consumption from fossil fuels. These findings seem to be consistent with (), who stated that there is a prerequisite of green technology knowledge in host countries for FDI to increase environmental sustainability. Commonly, developed countries have higher levels of human capital and green technologies, while developing countries appear to be more dependent on the technologies that evolved from developed countries. As suggested by (), developing countries should assimilate advanced technologies (perhaps brought in by FDI) to improve energy efficiency, as this could reduce the polluting effect of FDI.

Relative to Model II, FDI stock-in appears to be a driver of the energy transition in developed countries, as found by (), suggesting that FDI can increase renewable energy consumption in developed countries. This may occur due to self-sufficient firms producing their energy through solar photovoltaic systems, for example. Regarding developing countries, FDI stock-in appears to be a barrier to the energy transition. FDI stock-in can increase the production level of countries, which might increase energy demand. As stated by (), FDI can increase the output of the economy due to a higher level of industrial production, which, in turn, can mean more energy required. To meet this demand, countries use the energy they have available. Therefore, the negative effect of FDI on energy transition in developing countries might suggest that the energy used to meet this demand is from non-renewable sources, which also explains the effect of energy transition in reducing Green Growth. This effect might also suggest a lack of renewable energy infrastructures to fill demand in developing countries. The energy transition is only effective in promoting Green Growth in developed countries. () concluded that to achieve innovation-led sustainable growth, investments in innovation must be accompanied by investments in sustainable infrastructure (in this case, in the form of clean energy production). Therefore, investment in sustainable infrastructure appears vital to driving Green Growth in developing countries.

FDI stock-in is a driver of Green Growth in both developed and developing countries. This outcome is unexpected and deserves further discussion. FDI stock-in can increase Green Growth by increasing economic growth and/or reducing environmental depletion. As the energy transition reduces Green Growth in developing countries, it appears that FDI increases it by stimulating both economic growth and environmental depletion, perhaps by increasing overall energy consumption, which, in these countries, mostly comes from fossil fuels. Another explanation could be that by investing in renewable energy infrastructure, developing countries may no longer have the required wealth to invest in concerns such as corruption control and poverty reduction, which could shrink Green Growth. In developed countries, the impact suggests that FDI reduces environmental depletion. In developed countries, FDI appears to improve environmental conditions.

5.2. Moderated Mediation Model Results

As the impact of FDI on CO2 emissions in both developed and developing countries is mediated by energy consumption, the moderated mediation model was used, aiming to provide evidence on the role of the energy transition on this mediating effect. Table 3 shows the moderated mediation effects based on the MMI and CIE. The latter was generated with a Standard Deviation of the proposed moderator below the mean (CIE low), at the mean (CIE mean), and above the mean (CIE high).

Table 3.

Moderated mediating effects.

Under the null hypothesis of no evidence of moderated mediating effect, the MMI confidence interval demonstrates that there is evidence of moderated mediation effects on both developed and developing countries. This index exposes the effect of the interaction between FDI and energy transition on the mediating effect of energy consumption. In both developed and developing countries, the interaction reveals a reduction of the mediating effects.

Since there is evidence of a moderated mediation effect, the CIE can be analysed. Focusing on developed countries, one observes that the mediating effect of energy consumption on the impact of FDI on CO2 emissions, under the conditions of a low energy transition, was 0.021%. Under the condition of a high energy transition, the impact is reduced and becomes non-statistically significant.

Therefore, as the energy transition level of developed countries increases, the mediating effect of energy consumption changes from statistically significant to non-statistically significant, with the potential to reduce the mediating effect. This effect might suggest that besides investing in energy transition, developed countries should also invest in energy efficiency. In fact, energy efficiency could reduce the pressure on the energy grid, and contribute to reducing emissions, as concluded by (), and, as suggested by (), energy efficiency is capable of reducing emissions without reducing production. Thus, the potential negative impact of reducing energy consumption on economic growth is avoided.

Moreover, as is well known, the intermittent generation by renewable energies could ensure countries use non-renewable energy sources to meet increased energy demand. This effect might also suggest that through the energy transition, the mediating effect reduces their significance, perhaps because some policies for energy transition (e.g., ending energy from coal) may require time to implement and produce the expected result of a pollution reduction.

Focusing on developing countries, as the energy transition increases, there is a potential reduction in the mediating effect of energy consumption, and the effect changes from statistically significant to non-statistically significant. The absence of statistical significance might reveal a lack of renewable energy infrastructure or can evidence that developing countries should increase their efforts toward the energy transition. According to the International Renewable Energy Agency (IRENA), developed countries have, on average, almost twice as many policies as developing countries. This suggests that developing countries should enhance and increase their efforts toward energy transition policies. Once again, due to the lower available resources of developing countries to allocate to climate action, attracting foreign investment to the renewable energy sector is recommended.

As concluded by (), FDI in renewable energy can reduce pollution. Therefore, attracting greenfield foreign investment in renewable energy might play a relevant role in avoiding the undesirable effect of FDI increasing environmental degradation. However, investment in human capital to increase knowledge in green technologies is recommended as it might accelerate the beneficial effect of FDI (). This is also announced by (), who stated that policies aimed at increasing education budget, green energy use, and attracting FDI with green technology are required to improve environmental quality, especially in developing countries. Moreover, energy transition is only effective in reducing pollution after a certain level of electrification. Developing countries may not yet be at the required level of electrification of the economy to fully benefit from the energy transition.

From the moderated mediation model, one observes that in both developed and developing countries, policymakers need to widen the remit of their policies beyond just FDI if their objective is to avoid further environmental degradation. Policies must include strict environmental regulations and encourage both energy efficiency and energy transition to avoid the potential polluting effect of FDI and thus soft the PHH. Keeping all this in mind, energy transition appears to have the potential to reduce the mediating effect of energy consumption. Thus, H2 is verified.

It is worth noting that developing countries have several human concerns to address (besides climate change), such as poverty, corruption, and energy poverty. Indeed, corruption is one of the main concerns when it comes to investing in developing countries, whether it is the hypothesis of a Helping Hand or a Grabbing Hand. The former hypothesis is known as a hand that speeds up bureaucratic processes, and the latter hypothesis is a hand that requires indirect taxes/bribes (). Therefore, developed countries play a critical role in controlling investment flows from developed to developing countries. The volume of emissions embodied in developed countries’ trade is much higher in imports than in exports (), mainly because developed countries attempt to reduce their total direct emissions (to reach climate goals) by importing goods with higher levels of embodied emissions (). Therefore, policymakers of developed countries should impose requirements related to the level of CO2 emissions embodied in imports from developing countries to developed countries.

In addition, policymakers of developed countries (where the firm’s headquarters are located) must control the purpose of the investment, for instance, by controlling the ecological footprint of the firm or the intensity of CO2 emissions, and therefore assessing whether the investment is to avoid the stricter environmental regulations. Moreover, the transfer (through FDI) of cleaner technologies evolved by developed countries, including those related to renewable energy production, should be encouraged, perhaps by providing tax benefits in the source country. In this way, developed countries might assist developing countries in achieving economic growth while preserving the environment.

6. Conclusions

This study aims to fill a gap in the literature that currently considers the transfer of polluting industries solely based on the pollutant effect of FDI. The current literature assumes that increased CO2 emissions are caused by rising energy consumption mainly from non-renewable energy sources. Thus, this study examines the mediating effect of energy consumption on the impact of FDI on CO2 emissions. This study also intends to understand the role of energy transition in reducing the mediating effect of energy consumption on the impact of FDI on CO2 emissions. In addition, the potential role of the energy transition to help FDI drive Green Growth is also under analysis. This study examines a group of 19 developed countries and a group of 20 developing countries and compares them. This comparison is crucial to analyse how the transfer of polluting industries affects each group. The SEM scrutinizes the mediating effects of energy consumption and energy transition on the effect of FDI on CO2 emissions and Green Growth, respectively.

The main findings reveal that FDI reduces CO2 emissions in developed countries (supporting the PHlH) and increases them in developing ones (supporting the PHH). However, the indirect effect reveals the impacts of FDI are influenced by energy consumption. FDI might raise the production level of countries, which might boost energy demand. The pollutant effect suggests that the energy used to meet this demand mainly comes from fossil fuels, perhaps due to the intermittency of renewable energy and the lack of renewable energy infrastructure (mainly in developing countries). Therefore, policymakers (mainly from developed countries) could adopt strategies that target energy efficiency. For example, governments can provide tax benefits to industries that invest in R&D for energy efficiency, mainly from the industry sector. In addition, governments should strengthen monetary incentives (such as scholarships) to encourage advanced education. Developing countries should also promote advanced education to improve the absorptive capacity of domestic workers on advanced techniques from multinationals and adopt them in domestic industries as well.

Energy transition plays a vital role in reducing the mediating effect of energy consumption in both developed and developing countries. However, the results for developed countries reveal that an energy transition alone may not be enough to mitigate the pollutant effect of increased energy consumption, perhaps due to the intermittency of renewables. Therefore, energy efficiency and the energy transition must go hand in hand. In developing countries, the absence of statistical significance in the CIE under the condition of high energy transition might suggest a lack of renewable energy infrastructure. Attracting investment (both domestically and abroad) in this sector is recommended. This can occur perhaps by providing tax benefits and simplifying the bureaucratic process for investment directed at the energy sector. Developing countries need this investment in renewable energy so that they can direct their available wealth towards internal concerns such as poverty reduction and corruption control.

FDI increases the energy transition in developed countries and reduces it in developing ones. Thus, developing countries appear to be using fossil-fuel energy to meet the increased energy demand provoked by FDI. Since energy transition increases Green Growth in developed countries and reduces it in developing countries, FDI appears to increase Green Growth in developed countries by reducing environmental depletion. When environmental depletion is observed in developing countries and Green Growth is limited, an explanation could be that developing countries may no longer have the wealth to invest in concerns such as corruption control and poverty reduction because they have been investing in renewable energy infrastructure.

Developed countries’ policymakers play a key role in controlling investment flows from developed to developing countries and, consequently, in climate action by developing countries. Policymakers must assess whether investment from developed countries to developing countries is made to avoid stricter environmental regulation in the country of origin (where the firm’s headquarters are located), perhaps by assessing the firm’s carbon footprint. It is also relevant to impose some requirements related to the level of CO2 emissions incorporated in imports from developing to developed countries. In addition, the transfer of cleaner technologies through FDI (including those related to renewable energy production) from developed to developing countries should be encouraged, perhaps through the provision of tax benefits in the source country following this type of investment. Developed countries play a vital role in assisting developing countries in achieving Green Growth.

Policymakers should not attempt to prevent polluting FDI by only applying stricter environmental regulation, as this could inhibit all types of investment. Mainly in developing countries, attracting investment in renewable energy infrastructure and the electrification of the economy could be key to shifting the negative effect of energy transition inti Green Growth. In developed countries, the energy transition and energy efficiency ought to go together as a package. Energy transition and innovation could reduce pollution in developed countries, assisting them to reach their climate targets. In the future, developed countries might no longer need to transfer polluting industries. International agreements such as the COP must implement penalties on countries that do not comply with the agreed treaty. Without severe consequences, countries will always make decisions that maximise their profits.

The relatively small number of countries under analysis is one of the limitations of this work. For future research, it could be interesting to analyse the countries in groups; for example, developing countries such as the Association of Southeast Asian Nations (ASEAN) and Brazil, Russia, India, China, and South Africa (BRICS). Moreover, the econometric procedure is quite simple because this study is developed mainly with the view of new lines of research on the FDI–Environment nexus, pointing out that energy consumption (and its sources) should always be considered when analysing the environmental impact of FDI.

Author Contributions

Conceptualization, R.V.C., A.C.M. and T.L.A.; methodology, R.V.C.; software, R.V.C.; validation, A.C.M. and T.L.A.; formal analysis, R.V.C. and A.C.M.; investigation, R.V.C.; resources, R.V.C.; data curation, R.V.C.; writing—original draft preparation, R.V.C.; writing—review and editing, A.C.M. and T.L.A.; visualization, R.V.C., A.C.M. and T.L.A.; supervision, A.C.M. and T.L.A.; project administration, A.C.M.; funding acquisition, A.C.M. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by NECE-UBI-Research Unit in Business Science and Economics, Portugal, Project no. UIDB/04630/2020, and the PhD fellowship (2021.04776.BD), both sponsored by the FCT—Portuguese Foundation for the Development of Science and Technology, Ministry of Science, Technology and Higher Education, Portugal.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Publicly available datasets were used in this study. These data can be found here: https://unctadstat.unctad.org/wds/ReportFolders/reportFolders.aspx?sCS_ChosenLang=en (accessed on 8 February 2022); https://www.iea.org/data-and-statistics (accessed on 8 February 2022); and https://data.worldbank.org/indicator/ (accessed on 8 February 2022).

Acknowledgments

The authors would like to acknowledge the financial support of the NECE-UBI-Research Unit in Business Science and Economics, Portugal, Project no. UIDB/04630/2020, and the PhD fellowship (2021.04776.BD), both sponsored by the FCT—Portuguese Foundation for the Development of Science and Technology, Ministry of Science, Technology and Higher Education, Portugal. A short version of this paper was presented in the 5th edition of ICEE—Energy & Environment: Bringing together Economics and Engineering.

Conflicts of Interest

The authors declare no competing interest.

References

- Adom, Philip Kofi, Eric Evans Osei Opoku, and Isabel Kit-Ming Yan. 2019. Energy demand–FDI nexus in Africa: Do FDIs induce dichotomous paths? Energy Economics 81: 928–41. [Google Scholar] [CrossRef]

- Afonso, Tiago Lopes, António Cardoso Marques, and José Alberto Fuinhas. 2021. Does energy efficiency and trade openness matter for energy transition? Empirical evidence for countries in the Organization for Economic Co-operation and Development. Environment, Development and Sustainability 23: 13569–89. [Google Scholar] [CrossRef]

- Atahau, Apriani Dorkas Rambu, Imanuel Madea Sakti, Andrian Dolfriandra Huruta, and Min Sun Kim. 2021. Gender and renewable energy integration: The mediating role of green-microfinance. Journal of Cleaner Production 318: 128536. [Google Scholar] [CrossRef]

- Balsalobre-Lorente, Daniel, Korhan K. Gokmenoglu, Nigar Taspinar, and José María Cantos-Cantos. 2019. An approach to the pollution haven and pollution halo hypotheses in MINT countries. Environmental Science and Pollution Research 26: 23010–26. [Google Scholar] [CrossRef]

- Baron, Reuben M., and David A. Kenny. 1986. The moderator-mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. Journal of Personality and Social Psychology 51: 1173. [Google Scholar] [CrossRef] [PubMed]

- Buhari, Doğan, Daniel Balsalobre-Lorente, and Muhammad Ali Nasir. 2020. European commitment to COP21 and the role of energy consumption, FDI, trade and economic complexity in sustaining economic growth. Journal of Environmental Management 273: 111146. [Google Scholar] [CrossRef]

- Caglar, Abdullah Emre. 2020. The importance of renewable energy consumption and FDI inflows in reducing environmental degradation: Bootstrap ARDL bound test in selected 9 countries. Journal of Cleaner Production 264: 121663. [Google Scholar] [CrossRef]

- Cai, Xiang, Xiahui Che, Bangzhu Zhu, Juan Zhao, and Rui Xie. 2018. Will developing countries become pollution havens for developed countries? An empirical investigation in the Belt and Road. Journal of Cleaner Production 198: 624–32. [Google Scholar] [CrossRef]

- Castellani, Davide, Giovanni Marin, Sandro Montresor, and Antonello Zanfei. 2022. Greenfield foreign direct investments and regional environmental technologies. Research Policy 51: 104405. [Google Scholar] [CrossRef]

- Cheng, Zhonghua, Xiang Li, and Meixiao Wang. 2021. Resource curse and green economic growth. Resources Policy 74: 102325. [Google Scholar] [CrossRef]

- De Pascale, Gianluigi, Ruggiero Sardaro, Nicola Faccilongo, and Francesco Contò. 2020. What is the influence of FDI and international people flows on environment and growth in OECD countries? A panel study. Environmental Impact Assessment Review 84: 106434. [Google Scholar] [CrossRef]

- Demena, Binyam Afewerk, and Sylvanus Kwaku Afesorgbor. 2019. The effect of FDI on environmental emissions: Evidence from a meta-analysis. Energy Policy 138: 111192. [Google Scholar] [CrossRef]

- Gaspar, Jorge dos Santos, António Cardoso Marques, and José Alberto Fuinhas. 2017. The traditional energy-growth nexus: A comparison between sustainable development and economic growth approaches. Ecological Indicators 75: 286–96. [Google Scholar] [CrossRef]

- Gossel, Sean Joss. 2018. FDI, democracy and corruption in Sub-Saharan Africa. Journal of Policy Modeling 40: 647–62. [Google Scholar] [CrossRef]

- Hayes, Andrew F. 2015. An Index and Test of Linear Moderated Mediation. Multivariate Behavioral Research 50: 1–22. [Google Scholar] [CrossRef] [PubMed]

- International Energy Agency. n.d.a. Carbon Dioxide Emissions in Million Tonnes. Available online: https://www.iea.org/data-and-statistics/data-browser/?country=WORLD&fuel=CO2%20emissions&indicator=CO2BySource (accessed on 8 February 2022).

- International Energy Agency. n.d.b. Renewable Energy Supply. Available online: https://www.iea.org/data-and-statistics/data-browser/?country=WORLD&fuel=Energy%20supply&indicator=TESbySource (accessed on 8 February 2022).

- International Energy Agency. n.d.c. Fossil Fuel Energy Supply. Available online: https://www.iea.org/data-and-statistics/data-browser/?country=WORLD&fuel=Energy%20supply&indicator=TESbySource (accessed on 8 February 2022).

- International Energy Agency. n.d.d. Total Energy Consumption in Kilotonnes of Oil Equivalent. Available online: https://www.iea.org/data-and-statistics/data-browser/?country=WORLD&fuel=Energy%20consumption&indicator=TFCShareBySector (accessed on 8 February 2022).

- Muhammad, Bashir, and Sher Khan. 2019. Effect of bilateral FDI, energy consumption, CO2 emission and capital on economic growth of Asia countries. Energy Reports 5: 1305–15. [Google Scholar] [CrossRef]

- Nepal, Rabindra, Nirash Paija, Bhawna Tyagi, and Charles Harvie. 2021. Energy security, economic growth and environmental sustainability in India: Does FDI and trade openness play a role? Journal of Environmental Management 281: 111886. [Google Scholar] [CrossRef]

- Qamruzzaman, Md. 2022. Nexus between renewable energy, foreign direct investment, and agro-productivity: The mediating role of carbon emission. Renewable Energy 184: 526–40. [Google Scholar] [CrossRef]

- Sarkodie, Samuel Asumadu, and Vladimir Strezov. 2019. Effect of foreign direct investments, economic development and energy consumption on greenhouse gas emissions in developing countries. Science of the Total Environment 646: 862–71. [Google Scholar] [CrossRef] [PubMed]

- Singhania, Monica, and Neha Saini. 2021. Demystifying pollution haven hypothesis: Role of FDI. Journal of Business Research 123: 516–28. [Google Scholar] [CrossRef]

- Sobel, Michael E. 1982. Asymptotic Confidence Intervals for Indirect Effects in Structural Equation Models. Sociological Methodology 13: 290. [Google Scholar] [CrossRef]

- Stern, Nicholas, and Anna Valero. 2021. Innovation, growth and the transition to net-zero emissions. Research Policy 50: 104293. [Google Scholar] [CrossRef]

- Sultana, Nasrin, and Ekaterina Turkina. 2020. Foreign direct investment, technological advancement, and absorptive capacity: A network analysis. International Business Review 29: 101668. [Google Scholar] [CrossRef]

- Sun, Xiang, Zhong Ba Ping, Zhan Feng Dong, Ke Liang Chen, Xiao Dong Zhu, Larry B. Li, Xing Yu Tan, Bo Kuan Zhu, Xin Liu, Chang Chang Zhou, and et al. 2021. Resources and environmental costs of China’s rapid economic growth: From the latest theoretic SEEA framework to modeling practice. Journal of Cleaner Production 315: 128126. [Google Scholar] [CrossRef]

- United Nations Conference on Trade and Development. n.d. Inward Foreign Direct Investment stock in Millions at Constant United States Dollar. Available online: https://unctadstat.unctad.org/wds/ReportFolders/reportFolders.aspx?sCS_ChosenLang=en (accessed on 8 February 2022).

- Wang, Zhen, Cai Li, Qiaoling Liu, Beibei Niu, Sha Peng, Liangchun Deng, Ping Kang, and Xiaoling Zhang. 2019. Pollution haven hypothesis of domestic trade in China: A perspective of SO2 emissions. Science of the Total Environment 663: 198–205. [Google Scholar] [CrossRef]

- Weimin, Zhu, Muhammad Zubair Chishti, Abdul Rehman, and Manzoor Ahmad. 2021. A pathway toward future sustainability: Assessing the influence of innovation shocks on CO2 emissions in developing economies. Environment, Development and Sustainability 24: 4786–809. [Google Scholar] [CrossRef]

- World Development Indicators. n.d.a. Gross Domestic Product in Constant 2015 United States Dollar Prices. Available online: https://data.worldbank.org/indicator/NY.GDP.MKTP.KD (accessed on 8 February 2022).

- World Development Indicators. n.d.b. Mineral Depletion as a Share of Gross National Income. Available online: https://data.worldbank.org/indicator/NY.ADJ.DMIN.GN.ZS (accessed on 8 February 2022).

- World Development Indicators. n.d.c. Carbon Dioxide Damage as a Share of GROSS National Income. Available online: https://data.worldbank.org/indicator/NY.ADJ.DCO2.GN.ZS (accessed on 8 February 2022).

- World Development Indicators. n.d.d. Gross National Income in Constant 2015 United States Dollar Prices. Available online: https://data.worldbank.org/indicator/NY.GNP.MKTP.KD (accessed on 8 February 2022).

- Xu, Chang, Wenqi Zhao, Mengzhen Zhang, and Baodong Cheng. 2021. Pollution haven or halo? The role of the energy transition in the impact of FDI on SO2 emissions. Science of the Total Environment 763: 143002. [Google Scholar] [CrossRef] [PubMed]

- Yasmeen, Rizwana, Cui Zhaohui, Hassan Wasi Ul Shah, Muhammad Abdul Kamal, and Anwar Khan. 2021. Exploring the role of biomass energy consumption, ecological footprint through FDI and technological innovation in B&R economies: A simultaneous equation approach. Energy 244: 122703. [Google Scholar] [CrossRef]

- Yilanci, Veli, Seref Bozoklu, and Muhammed Sehid Gorus. 2020. Are BRICS countries pollution havens? Evidence from a bootstrap ARDL bounds testing approach with a Fourier function. Sustainable Cities and Society 55: 102035. [Google Scholar] [CrossRef]

- Yin, Yexing, Xinruo Xiong, and Jamal Hussain. 2021. The role of physical and human capital in FDI-pollution-growth nexus in countries with different income groups: A simultaneity modeling analysis. Environmental Impact Assessment Review 91: 106664. [Google Scholar] [CrossRef]

- Zafar, Muhammad Wasif, Quande Qin, Muhammad Nasir Malik, and Syed Anees Haider Zaidi. 2020. Foreign direct investment and education as determinants of environmental quality: The importance of post Paris Agreement (COP21). Journal of Environmental Management 270: 110827. [Google Scholar] [CrossRef] [PubMed]

- Zaidi, Saida, and Kais Saidi. 2018. Environmental pollution, health expenditure and economic growth in the Sub-Saharan Africa countries: Panel ARDL approach. Sustainable Cities and Society 41: 833–40. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).