Domestic vs. External Economic Sectors and the Political Process: Insights from Greece

Abstract

1. Introduction

2. Methodology

2.1. Study Area

2.2. Logical Framework and Scope of the Study

2.3. Variables and Indicators

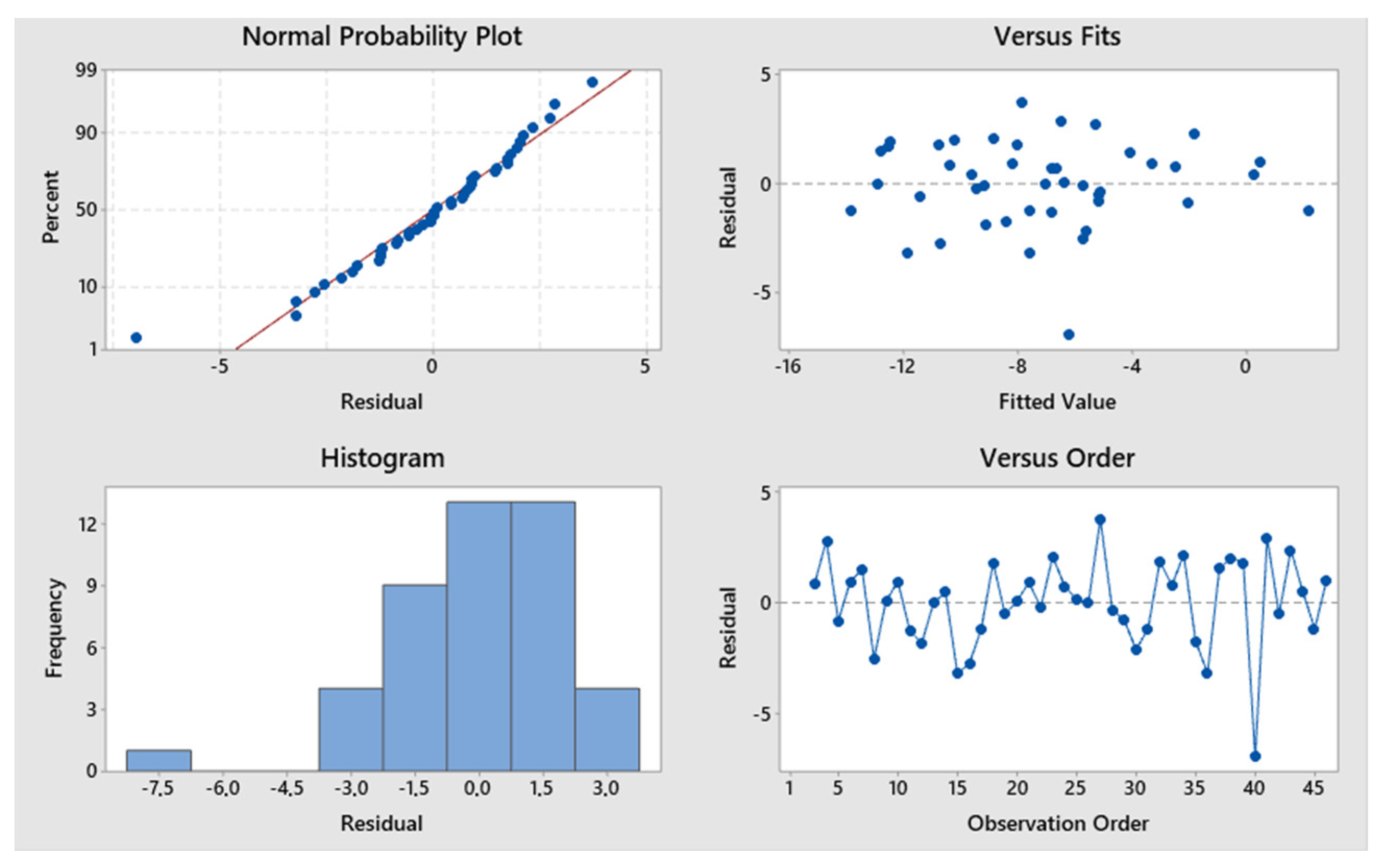

2.4. Statistical Analysis

3. Results and Discussion

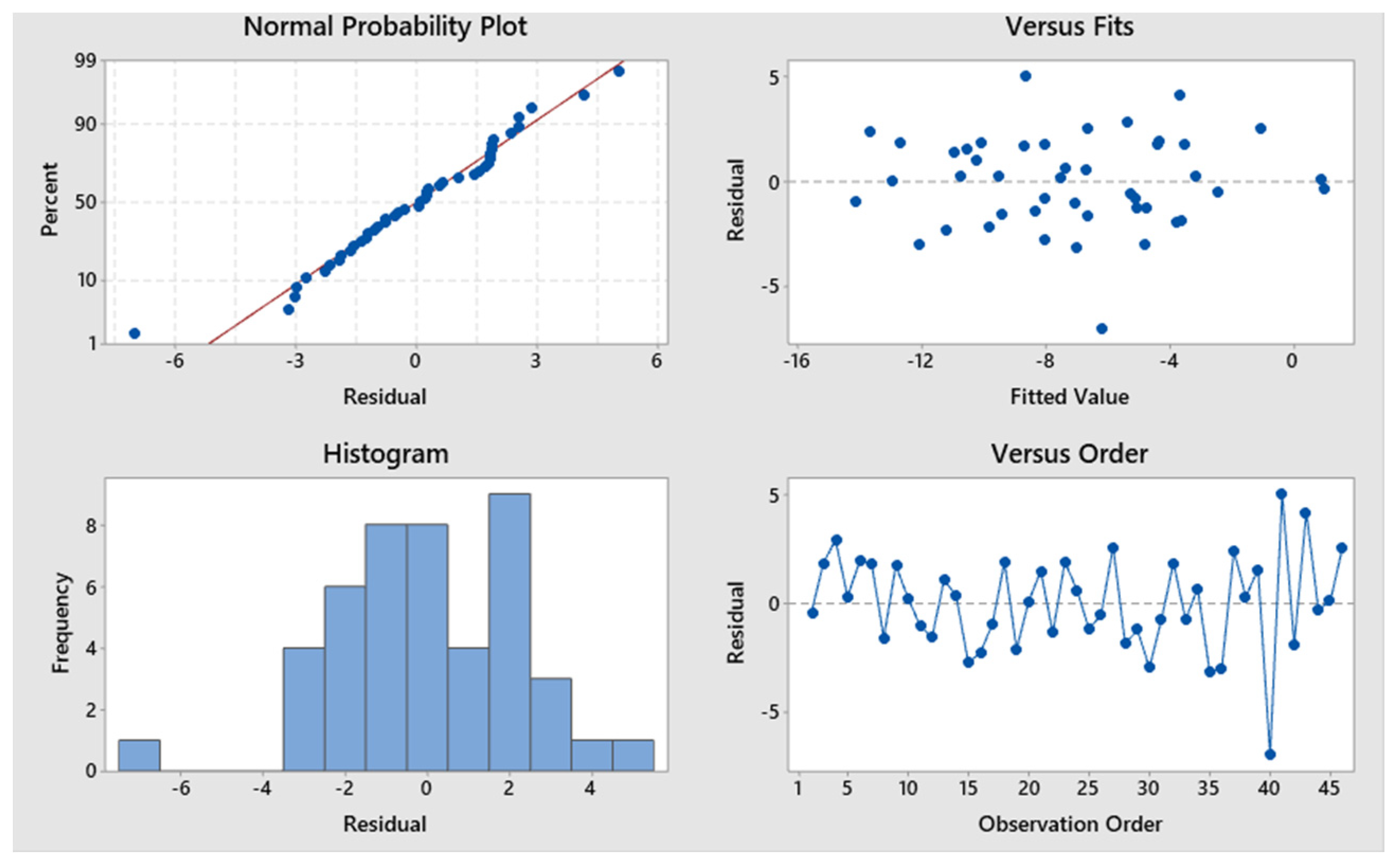

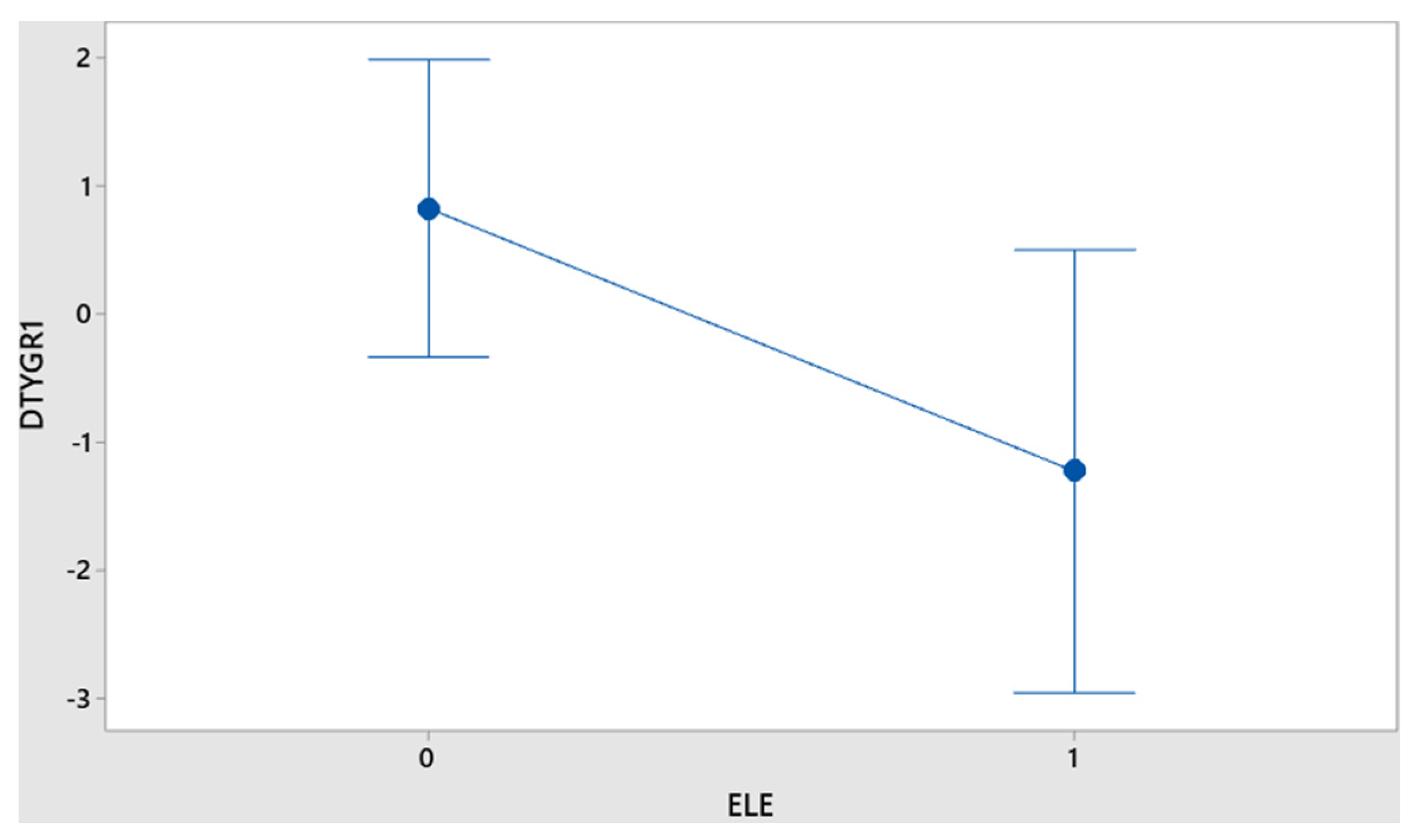

3.1. Outcomes of Model 1

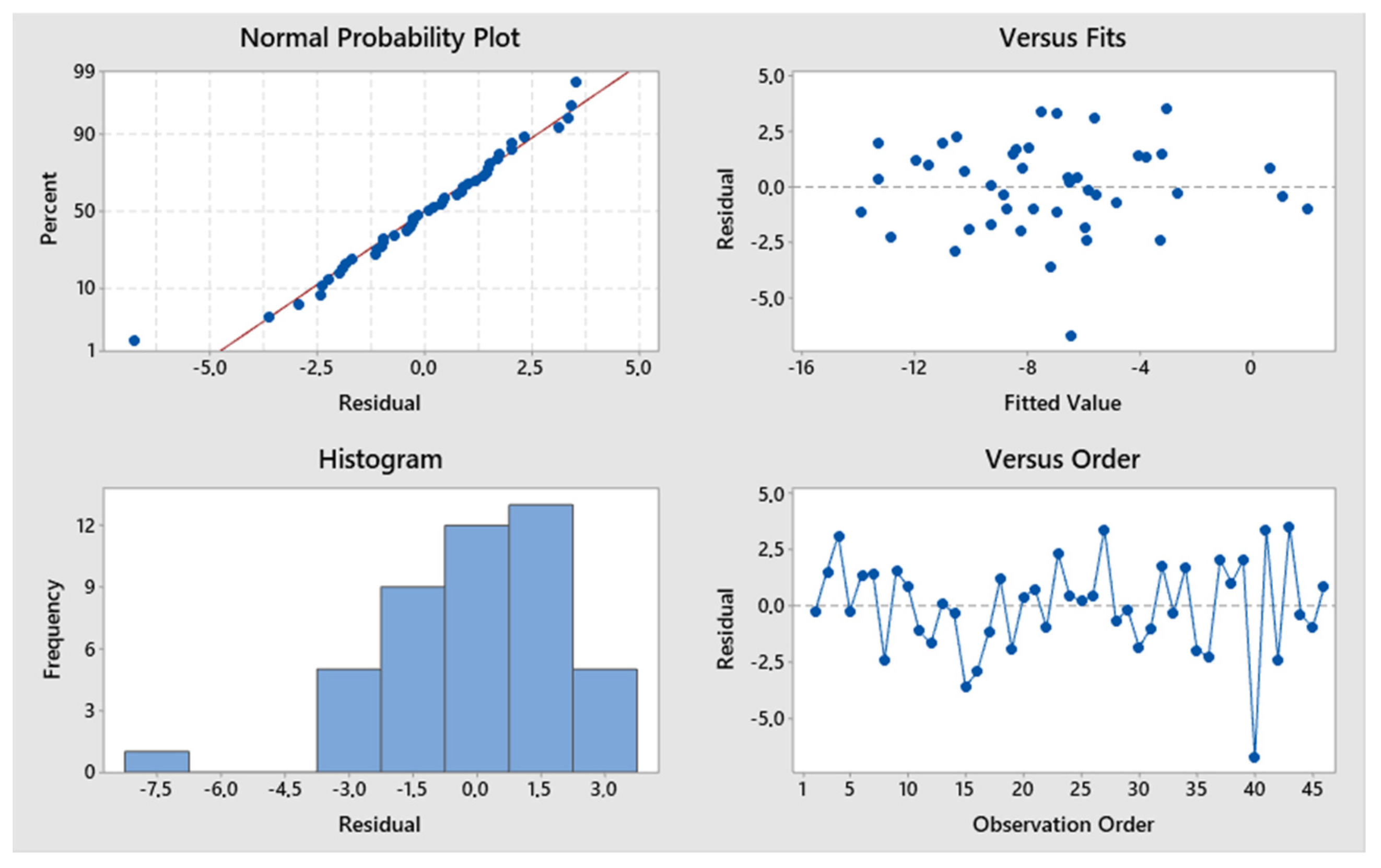

3.2. Outcomes of Model 2

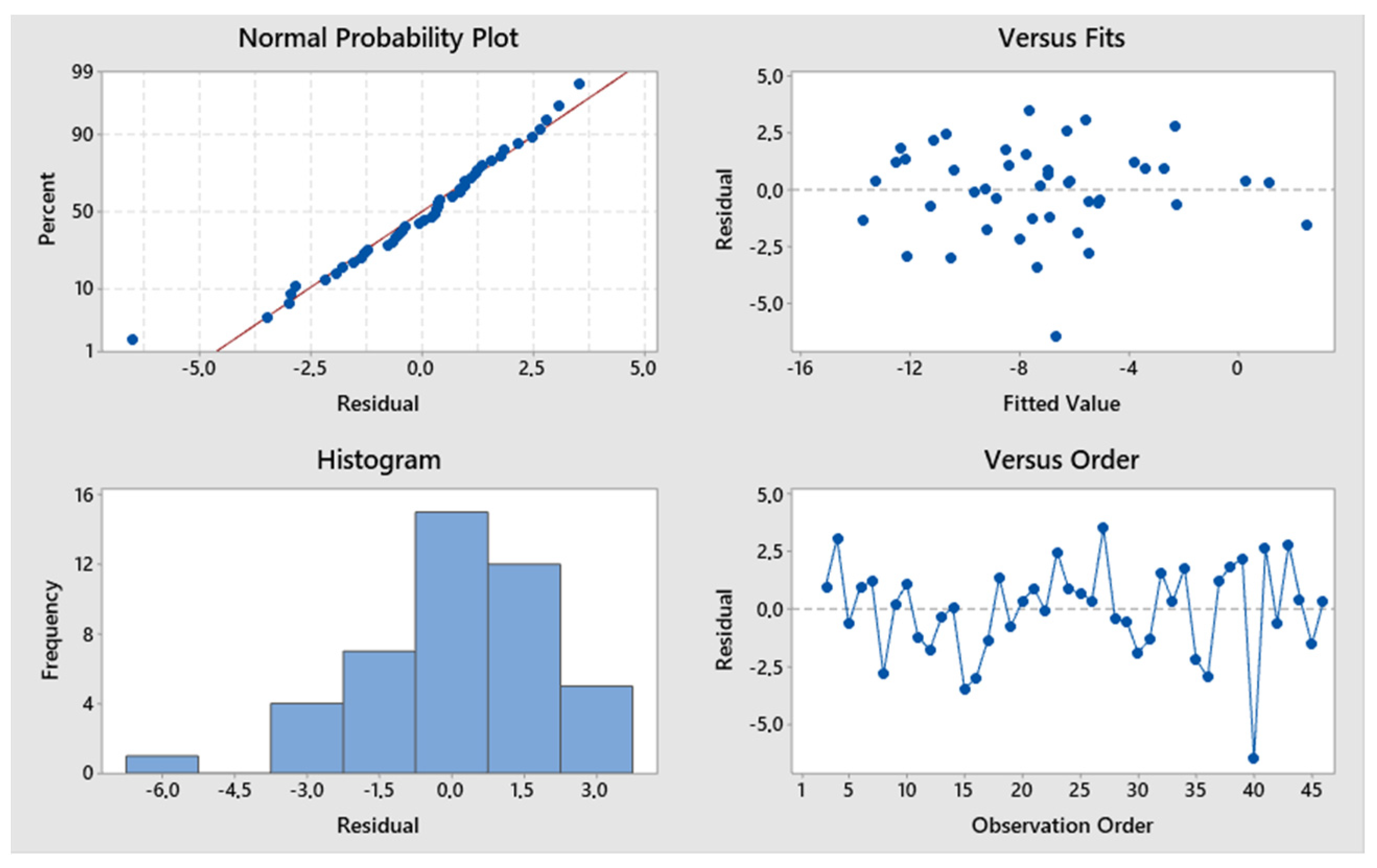

3.3. Outcomes of Model 3

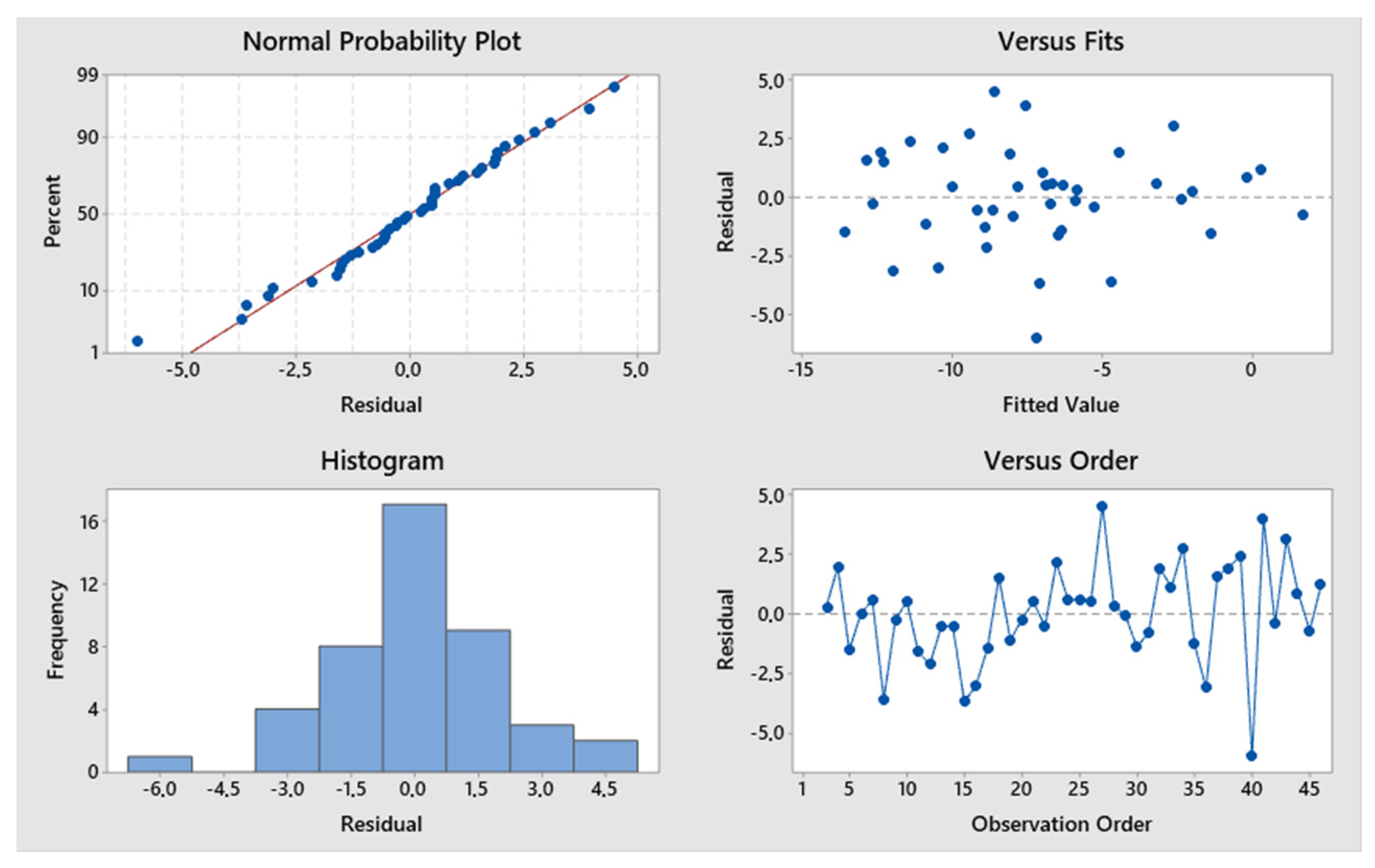

3.4. Outcomes of Model 4

3.5. Outcomes of Model 5

3.6. Discussing the Outcomes of Econometric Models (1 to 5)

4. Concluding Remarks

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

| 1 | See Eurostat, online data code: GOV_10DD_EDPT1, update: 22 February 2022. |

| 2 | See Downs (1957); Nordhaus (1975); Rogoff and Sibert (1988); Rogoff (1990); Alesina and Perotti (1995); Persson and Tabellini (2000); Eslava (2011); De Haan (2013); Bonfiglioli and Gancia (2013). More recent contributions include the empirical studies by Dubois (2016); Mandon and Cazals (2019); Bohn (2019); Garcia and Hayo (2021); Gootjes et al. (2021). |

| 3 | Another factor that may influence the occurrence of political budget cycles is uncertainty regarding the outcome of the forthcoming elections, given that if governments are very confident of their re-election possibilities, they have limited motivation or no motivation at all to resort to them (Schultz 1995; Alt and Rose 2007; Hanusch and Magleby 2014; Eibl and Lynge-Mangueira 2017). |

References

- Afonso, António, Florence Huart, João Tovar Jalles, and Piotr Stanek. 2022. Twin deficits revisited: A role for fiscal institutions? Journal of International Money and Finance 121: 102506. [Google Scholar] [CrossRef]

- Afonso, António, Sotirios Zartaloudis, and Yannis Papadopoulos. 2015. How party linkages shape austerity politics: Clientelism and fiscal adjustment in Greece and Portugal during the eurozone crisis. Journal of European Public Policy 22: 315–34. [Google Scholar] [CrossRef][Green Version]

- Aidt, Toke S., Francisco José Veiga, and Linda Gonçalves Veiga. 2011. Election results and opportunistic policies: A new test of the rational political business cycle model. Public Choice 148: 21–44. [Google Scholar] [CrossRef]

- Alesina, Alberto. 1987. Macroeconomic policy in a two-party system as a repeated game. Quarterly Journal of Economics 102: 651–78. [Google Scholar] [CrossRef]

- Alesina, Alberto. 1988. Credibility and policy convergence in a two-party system with rational voters. American Economic Review 78: 796–805. [Google Scholar]

- Alesina, Alberto, and Roberto Perotti. 1995. The political economy of budget deficits. International Monetary Fund Staff Papers 42: 1–31. [Google Scholar] [CrossRef]

- Algieri, Bernardina. 2013. An empirical analysis of the nexus between external balance and government budget balance: The case of the GIIPS countries. Economic Systems 37: 233–53. [Google Scholar] [CrossRef]

- Alt, James E., and Shanna S. Rose. 2007. Context-conditional political business cycles. In Oxford Handbook of Comparative Politics. Edited by Carles Boix and Susan C. Stokes. Oxford: Oxford University Press, pp. 845–67. [Google Scholar]

- Andrikopoulos, Andreas, Ioannis Loizides, and Kyprianos Prodromidis. 2004. Fiscal policy and political business cycles in the EU. European Journal of Political Economy 20: 125–52. [Google Scholar] [CrossRef]

- Badinger, Harald, Aurélien Fichet de Clairfontaine, and Wolf Heinrich Reuter. 2017. Fiscal rules and twin deficits: The link between fiscal and external balances. World Economy 40: 21–35. [Google Scholar] [CrossRef]

- Benassi, Federico, Alessia Naccarato, Ricardo Iglesias-Pascual, Luca Salvati, and Salvatore Strozza. 2022. Measuring residential segregation in multi-ethnic and unequal European cities. International Migration. [Google Scholar] [CrossRef]

- Block, Steven. A. 2002. Political business cycles, democratization, and economic reform: The case of Africa. Journal of Development Economics 67: 205–28. [Google Scholar] [CrossRef]

- Bohn, Frank. 2019. Political budget cycles, incumbency advantage, and propaganda. Economics and Politics 31: 43–70. [Google Scholar] [CrossRef]

- Bonfiglioli, Alessandra, and Gino Gancia. 2013. Uncertainty, electoral incentives and political myopia. The Economic Journal 123: 373–400. [Google Scholar] [CrossRef]

- Brender, Adi, and Allan Drazen. 2005. Political budget cycles in new versus established democracies. Journal of Monetary Economics 52: 1271–95. [Google Scholar] [CrossRef]

- Brender, Adi, and Allan Drazen. 2008. How do budget deficits and economic growth affect reelection prospects? Evidence from a large panel of countries. American Economic Review 98: 2203–20. [Google Scholar] [CrossRef]

- Cavallo, Michele. 2005. Understanding the Twin Deficits: New Approaches, New Results. FRBSF Economic Letter. San Francisco: Federal Reserve Bank of San Francisco. [Google Scholar]

- Chang, Eric C. C. 2008. Electoral incentives and budgetary spending: Rethinking the role of political institutions. The Journal of Politics 70: 1086–97. [Google Scholar] [CrossRef]

- Chortareas, Georgios, Vassilis E. Logothetis, and Andreas A. Papandreou. 2018. Elections and opportunistic budgetary policies in Greece. Managerial and Decision Economics 40: 854–62. [Google Scholar] [CrossRef]

- Christodoulakis, Nicos. 2019. Greece and the Euro Area: The Cost of Weak Institutions. CGK Working Paper No. 2019-05. Medford: The Fletcher School, Tufts University, May. [Google Scholar]

- Ciommi, Mariateresa, Francesco M. Chelli, and Luca Salvati. 2019. Integrating parametric and non-parametric multivariate analysis of urban growth and commuting patterns in a European metropolitan area. Quality & Quantity 53: 957–79. [Google Scholar]

- Ciommi, Mariateresa, Francesco M. Chelli, Margherita Carlucci, and Luca Salvati. 2018. Urban growth and demographic dynamics in southern Europe: Toward a new statistical approach to regional science. Sustainability 10: 2765. [Google Scholar] [CrossRef]

- Corsetti, Giancarlo, and Gernot J. Müller. 2006. Twin deficits: Squaring theory, evidence and common sense. Economic Policy 21: 598–638. [Google Scholar] [CrossRef]

- De Haan, Jakob. 2013. Democracy, elections and government budget deficits. German Economic Review 15: 131–42. [Google Scholar] [CrossRef]

- De Haan, Jakob, and Jeroen Klomp. 2013. Political budget cycles and election outcomes. Public Choice 157: 245–67. [Google Scholar]

- Di Feliciantonio, Cesare, and Luca Salvati. 2015. ‘Southern’ Alternatives of Urban Diffusion: Investigating Settlement Characteristics and Socio-Economic Patterns in Three Mediterranean Regions. Tijdschrift voor Economische en Sociale Geografie 106: 453–70. [Google Scholar] [CrossRef]

- Di Feliciantonio, Cesare, Luca Salvati, Efthymia Sarantakou, and Kostas Rontos. 2018. Class diversification, economic growth and urban sprawl: Evidences from a pre-crisis European city. Quality & Quantity 52: 1501–22. [Google Scholar]

- Downs, Anthony. 1957. An Economic Theory of Democracy. New York: Harper & Row. [Google Scholar]

- Dubois, Eric. 2016. Political business cycles 40 years after Nordhaus. Public Choice 166: 235–59. [Google Scholar] [CrossRef]

- Eibl, Ferdinand, and Halfdan Lynge-Mangueira. 2017. Electoral confidence and political budget cycles in non-OECD countries. Studies in Comparative International Development 52: 45–63. [Google Scholar] [CrossRef]

- Eslava, Marcela. 2011. The political economy of fiscal deficits: A survey. Journal of Economic Surveys 25: 645–73. [Google Scholar] [CrossRef]

- Forte, Francesco, and Cosimo Magazzino. 2013. Twin deficits in the European countries. International Advances in Economic Research 19: 289–310. [Google Scholar] [CrossRef]

- Garcia, Israel, and Bernd Hayo. 2021. Political budget cycles revisited: Testing the signaling process. European Journal of Political Economy 69: 1–18. [Google Scholar] [CrossRef]

- Gavalas, Vasilis S., Kostas Rontos, and Luca Salvati. 2014. Who becomes an unwed mother in Greece? Sociodemographic and geographical aspects of an emerging phenomenon. Population, Space and Place 20: 250–63. [Google Scholar] [CrossRef]

- Gkartzios, Menelaos. 2013. ‘Leaving Athens’: Narratives of counterurbanisation in times of crisis. Journal of Rural Studies 32: 158–67. [Google Scholar] [CrossRef]

- Gootjes, Bram, Jakob de Haan, and Richard Jong-A-Pin. 2021. Do fiscal rules constrain political budget cycles? Public Choice 188: 1–30. [Google Scholar] [CrossRef]

- Hanusch, Marek, and Daniel B. Magleby. 2014. Popularity, polarization, and political budget cycles. Public Choice 159: 457–67. [Google Scholar] [CrossRef]

- Kalou, Sofia, and Suzanna-Maria Paleologou. 2012. The twin deficits hypothesis: Revisiting an EMU country. Journal of Policy Modeling 34: 230–41. [Google Scholar] [CrossRef]

- Katrakilidis, Constantinos P., and Emmanouil Trachanas. 2011. Has the accession of Greece in the EU influenced the dynamics of the country’s “twin deficits”? An empirical investigation. European Research Studies Journal 14: 45–54. [Google Scholar]

- Katsimi, Margarita, and Vassilis Sarantides. 2012. Do elections affect the composition of fiscal policy in developed, established democracies? Public Choice 151: 352–62. [Google Scholar] [CrossRef]

- Kim, Soyoung, and Nouriel Roubini. 2008. Twin deficit or twin divergence? Fiscal policy, current account, and real exchange rate in the U.S. Journal of International Economics 74: 362–83. [Google Scholar] [CrossRef]

- Klomp, Jeroen, and Jakob de Haan. 2013. Do political budget cycles really exist? Applied Economics 45: 329–41. [Google Scholar] [CrossRef]

- Kosteletou, Nikolina E. 2013. Financial integration, euro and the twin deficits of southern eurozone countries. Panoeconomicus 60: 161–78. [Google Scholar] [CrossRef]

- Lamonica, Giuseppe R., Maria C. Recchioni, Francesco M. Chelli, and Luca Salvati. 2020. The efficiency of the cross-entropy method when estimating the technical coefficients of input–output tables. Spatial Economic Analysis 15: 62–91. [Google Scholar] [CrossRef]

- Magazzino, Cosimo. 2012. Fiscal policy, consumption and current account in the European countries. Economics Bulletin 32: 1330–44. [Google Scholar]

- Mandon, Pierre, and Antoine Cazals. 2019. Political budget cycles: Manipulation by leaders versus manipulation by researchers? Evidence from a meta-regression analysis. Journal of Economic Surveys 33: 274–308. [Google Scholar] [CrossRef]

- Miller, Stephen M., and Frank S. Russek. 1989. Are the twin deficits really related? Contemporary Economic Policy 7: 91–115. [Google Scholar] [CrossRef]

- Mitsopoulos, Michaele, and Theodore Pelagidis. 2011. Understanding the Crisis in Greece: From Boom to Bust. Basingstoke: Palgrave Macmillan. [Google Scholar]

- Nordhaus, William D. 1975. The political business cycle. Review of Economic Studies 42: 169–90. [Google Scholar] [CrossRef]

- Panori, Anastasia, Yannis Psycharis, and Dimitris Ballas. 2019. Spatial segregation and migration in the city of Athens: Investigating the evolution of urban socio-spatial immigrant structures. Population, Space and Place 25: e2209. [Google Scholar] [CrossRef]

- Panousis, Konstantinos P., and Minoas Koukouritakis. 2020. Twin deficits: Evidence from Portugal, Italy, Spain and Greece. Intereconomics 55: 332–38. [Google Scholar] [CrossRef]

- Pantelidis, Panagiotis, Emmanouil Trachanas, and Athanasios L. Athanasenas. 2009. On the dynamics of the Greek twin deficits: Empirical evidence over the period 1960–2007. International Journal of Economic Sciences and Applied Research 2: 9–32. [Google Scholar]

- Papadogonas, Theodore, and Yannis Stournaras. 2006. Twin deficits and financial integration in EU member-states. Journal of Policy Modeling 28: 595–602. [Google Scholar] [CrossRef]

- Paparas, Dimitrios, Christian Richter, and Hairong Mu. 2016. An econometric analysis of the twin deficits hypothesis in Greece during the period 1960–2014. Applied Economics Quarterly 62: 341–60. [Google Scholar] [CrossRef]

- Persson, Torsten, and Guido Tabellini. 2000. Political Economics: Explaining Economic Policy. Cambridge: The MIT Press. [Google Scholar]

- Persson, Torsten, and Guido Tabellini. 2005. The Economic Effects of Constitutions. Cambridge: The MIT Press. [Google Scholar]

- Petrakos, George, Kostantinos Rontos, Chara Vavoura, and Ioannis Vavouras. 2021a. The mechanism of political budget cycles in Greece. Paper presented at 2020 International Conference on Applied Economics (ICOAE 2020): Advances in Longitudinal Data Methods in Applied Economic Research, Virtual, July 2–3; Springer Proceedings in Business and Economics. Edited by Nicholas Tsounis and Aspasia Vlachei. Berlin and Heidelberg: Springer, pp. 123–33. [Google Scholar]

- Petrakos, George, Konstantinos Rontos, Chara Vavoura, and Ioannis Vavouras. 2021b. The destabilizing effects of political budget cycles: The case of Greece. Paper presented at the International Conference on Applied Economics (ICOAE): Advances in Quantitative Economic Research, Heraklion Crete, Greece, June 30; Springer Proceedings in Business and Economics. Berlin: Springer. [Google Scholar]

- Petrakos, George, Konstantinos Rontos, Chara Vavoura, Luca Salvati, and Ioannis Vavouras. 2021c. Political budget cycles and the effects of the Excessive Deficit Procedure: The case of Greece. Regional Statistics 11: 1–20. [Google Scholar] [CrossRef]

- Petrakos, George, Konstantinos Rontos, Chara Vavoura, Luca Salvati, and Ioannis Vavouras. 2021d. Toward a political budget cycle? Unveiling long-term latent paths in Greece. Quality and Quantity. [Google Scholar] [CrossRef]

- Philips, Andrew Q. 2016. Seeing the forest through the trees: A meta-analysis of political budget cycles. Public Choice 168: 313–41. [Google Scholar] [CrossRef]

- Piersanti, Giovanni. 2000. Current account dynamics and expected future budget deficits: Some international evidence. Journal of international Money and Finance 19: 255–71. [Google Scholar] [CrossRef]

- Rogoff, Kenneth. 1990. Equilibrium political budget cycles. American Economic Review 80: 21–36. [Google Scholar]

- Rogoff, Kenneth, and Anne Sibert. 1988. Elections and macro-economic policy cycles. Review of Economic Studies 55: 1–16. [Google Scholar] [CrossRef]

- Rontos, Kostas, Efstathios Grigoriadis, Adele Sateriano, Maria Syrmali, Ioannis Vavouras, and Luca Salvati. 2016. Lost in protest, found in segregation: Divided cities in the light of the 2015 “Oχι” referendum in Greece. City, Culture and Society 7: 139–48. [Google Scholar] [CrossRef]

- Rontos, Kostas, Ioannis Vavouras, Maria Teresa Ciommi, and Luca Salvati. 2019. Two faces of the same coin? A comparative, global approach to corruption and socioeconomic development. Quality & Quantity 53: 1875–94. [Google Scholar]

- Salvati, Luca. 2016. The dark side of the crisis: Disparities in per capita income (2000–12) and the urban-rural gradient in Greece. Tijdschrift voor Economische en Sociale Geografie 107: 628–41. [Google Scholar] [CrossRef]

- Salvati, Luca. 2018. Population growth and the economic crisis: Understanding latent patterns of change in Greece, 2002–16. Letters in Spatial and Resource Sciences 11: 105–26. [Google Scholar] [CrossRef]

- Salvati, Luca. 2019. Bridging the divide: Demographic dynamics and urban–rural polarities during economic expansion and recession in Greece. Population, Space and Place 25: e2267. [Google Scholar] [CrossRef]

- Salvati, Luca. 2022. Exploring long-term urban cycles with multivariate time-series analysis. Environment and Planning B: Urban Analytics and City Science 49: 1212–27. [Google Scholar] [CrossRef]

- Salvati, Luca, and Federico Benassi. 2021. Rise (and decline) of European migrants in Greece: Exploring spatial determinants of residential mobility (1988–2017), with special focus on older ages. Journal of International Migration and Integration 22: 599–613. [Google Scholar] [CrossRef]

- Salvia, Rosanna, Gianluca Egidi, Luca Salvati, Jesús Rodrigo-Comino, and Giovanni Quaranta. 2020. In-between ‘Smart’urban growth and ‘Sluggish’rural development? reframing population dynamics in Greece, 1940–2019. Sustainability 12: 6165. [Google Scholar] [CrossRef]

- Schultz, Kenneth A. 1995. The politics of the political business cycle. British Journal of Political Science 25: 79–99. [Google Scholar] [CrossRef]

- Shi, Min, and Jakob Svensson. 2003. Political budget cycles: A review of recent developments. Nordic Journal of Political Economy 29: 69–76. [Google Scholar]

- Shi, Min, and Jakob Svensson. 2006. Political budget cycles: Do they differ across countries and why? Journal of Public Economics 90: 1367–89. [Google Scholar] [CrossRef]

- Streb, Jorge M., and Gustavo Torrens. 2013. Making rules credible: Divided government and political budget cycles. Public Choice 156: 703–22. [Google Scholar] [CrossRef]

- Tomao, Antonio, Giovanni Quaranta, Rosanna Salvia, Sabato Vinci, and Luca Salvati. 2021. Revisiting the ‘southern mood’? Post-crisis Mediterranean urbanities between economic downturns and land-use change. Land Use Policy 111: 105740. [Google Scholar] [CrossRef]

- Trantidis, Aris. 2016. Clientelism and Economic Policy: Greece and the Crisis. Advances in European Politics (Book 126). London: Routledge. [Google Scholar]

- Vamvoukas, George A. 1999. The twin deficits phenomenon: Evidence from Greece. Applied Economics 31: 1093–100. [Google Scholar] [CrossRef]

- Veiga, Francisco José, Linda Gonçalves Veiga, and Atsuyoshi Morozumi. 2017. Political budget cycles and media freedom. Electoral Studies 45: 88–99. [Google Scholar] [CrossRef]

- Vinci, Sabato, Francesca Bartolacci, Rosanna Salvia, and Luca Salvati. 2022. Housing markets, the great crisis, and metropolitan gradients: Insights from Greece, 2000–14. Socio-Economic Planning Sciences 80: 101171. [Google Scholar] [CrossRef]

| Model | Dependent Variable | Predictors |

|---|---|---|

| 1 | Actual Budget Balance | ABB-1, TYGR, UNR, ELE |

| 2 | Actual Budget Balance | ABB-1, TYGR, EXPO, IMPO, ELE |

| 3 | Actual Budget Balance | ABB-1, ABB-2, TYGR, EXPO, IMPO, ELE |

| 4 | Actual Budget Balance | ABB-1, ABB-2, TYGR, BAGS, ELE |

| 5 | Actual Budget Balance | ABB-1, ABB-2, TYGR, BAGS, UNR, ELE |

| Variable | Coefficient | Standard Error | t-Value | p-Value | VIF |

|---|---|---|---|---|---|

| Constant | −3.18 | 1.170 | −2.71 | 0.010 | - |

| Budget Balance, previous year | 0.75 | 0.098 | 8.02 | 0.000 | 1.22 |

| GDP growth | 0.22 | 0.122 | 1.81 | 0.078 | 1.52 |

| Unemployment | 0.16 | 0.057 | 2.83 | 0.007 | 1.26 |

| Election year | −1.84 | 0.755 | −2.44 | 0.019 | 1.02 |

| Variable | Coefficient | Standard Error | t-Value | p-Value | VIF |

|---|---|---|---|---|---|

| Constant | −3.710 | 2.360 | −1.57 | 0.125 | - |

| Budget Balance, previous year | 0.531 | 0.108 | 4.93 | 0.000 | 1.86 |

| GDP growth | 0.335 | 0.122 | 2.74 | 0.009 | 1.77 |

| Exports | 0.444 | 0.122 | 3.63 | 0.001 | 5.97 |

| Imports | −0.312 | 0.140 | −2.24 | 0.031 | 4.66 |

| Election year | −1.733 | 0.708 | −2.45 | 0.019 | 1.03 |

| Variable | Coefficient | Standard Error | t-Value | p-Value | VIF |

|---|---|---|---|---|---|

| Constant | −3.100 | 2.410 | −1.28 | 0.207 | - |

| Budget Balance, previous year | 0.365 | 0.144 | 2.53 | 0.016 | 3.29 |

| Budget Balance, two years before | 0.228 | 0.130 | 1.76 | 0.087 | 2.52 |

| GDP growth | 0.313 | 0.121 | 2.58 | 0.014 | 1.71 |

| Exports | 0.458 | 0.121 | 3.78 | 0.001 | 5.88 |

| Imports | −0.326 | 0.138 | −2.36 | 0.023 | 4.51 |

| Election year | −1.767 | 0.701 | −2.52 | 0.016 | 1.03 |

| Variable | Coefficient | Standard Error | t-Value | p-Value | VIF |

|---|---|---|---|---|---|

| Constant | 1.003 | 0.979 | 1.02 | 0.312 | - |

| Budget Balance, previous year | 0.426 | 0.145 | 2.93 | 0.006 | 3.12 |

| Budget Balance, two years before | 0.224 | 0.134 | 1.68 | 0.102 | 2.52 |

| GDP growth | 0.236 | 0.118 | 2.01 | 0.052 | 1.51 |

| Balance of goods and services | 0.449 | 0.125 | 3.60 | 0.001 | 1.52 |

| Election year | −1.724 | 0.723 | −2.39 | 0.022 | 1.03 |

| Variable | Coefficient | Standard Error | t-Value | p-Value | VIF |

|---|---|---|---|---|---|

| Constant | −0.920 | 1.450 | −0.63 | 0.532 | - |

| Budget Balance, previous year | 0.417 | 0.141 | 2.95 | 0.005 | 3.12 |

| Budget Balance, two years before | 0.290 | 0.136 | 2.14 | 0.039 | 2.73 |

| GDP growth | 0.274 | 0.117 | 2.35 | 0.024 | 1.56 |

| Balance of goods and services | 0.304 | 0.147 | 2.06 | 0.046 | 2.23 |

| Unemployment rate | 0.117 | 0.067 | 1.75 | 0.089 | 1.96 |

| Election year | −1.744 | 0.704 | −2.48 | 0.018 | 1.03 |

| Year | No. Years | Mean | Standard Deviation | 95% Confidence Interval |

|---|---|---|---|---|

| No election | 31 | 0.823 | 3.620 | (−0.338; 1.983) |

| Election | 14 | −1.229 | 1.929 | (−2.956; 0.499) |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Petrakos, G.; Rontos, K.; Salvati, L.; Vavoura, C.; Vavouras, I. Domestic vs. External Economic Sectors and the Political Process: Insights from Greece. Economies 2022, 10, 198. https://doi.org/10.3390/economies10080198

Petrakos G, Rontos K, Salvati L, Vavoura C, Vavouras I. Domestic vs. External Economic Sectors and the Political Process: Insights from Greece. Economies. 2022; 10(8):198. https://doi.org/10.3390/economies10080198

Chicago/Turabian StylePetrakos, George, Kostas Rontos, Luca Salvati, Chara Vavoura, and Ioannis Vavouras. 2022. "Domestic vs. External Economic Sectors and the Political Process: Insights from Greece" Economies 10, no. 8: 198. https://doi.org/10.3390/economies10080198

APA StylePetrakos, G., Rontos, K., Salvati, L., Vavoura, C., & Vavouras, I. (2022). Domestic vs. External Economic Sectors and the Political Process: Insights from Greece. Economies, 10(8), 198. https://doi.org/10.3390/economies10080198