Abstract

By focusing on the tacit and explicit characteristics of informal and formal institutional distances, this study investigates the competitive advantage of foreign subsidiary firms from developed countries and emerging markets operating in Latin America. Following recent research on distances in international management, this study measured the size and direction of distances and computed formal institutional distances based on the world governance indicators from the World Bank, whereas informal institutional distances are calculated using the four original dimensions of Hofstede. Considering that culture is tacit, whereas formal institutions are explicit, it is argued that these differences affect the ability to convert experience dealing with cultural and formal institutional conditions in the home country into firm specific advantages (FSAs) in a foreign host country. These assumptions are tested quantitatively using data from the Orbis database, a sample that includes over 4200 firm-year observations covering 10 of the largest economies in Latin America. In a departure from previous studies investigating the implications of FID direction, it is shown that the effects in specific directions are different for foreign subsidiaries from developed countries and from emerging markets. The results reveal that emerging market firms are at an advantage when operating in less developed host countries, whereas foreign subsidiaries from developed countries can adjust more positively when operating in host countries with strong formal institutions. On the other hand, the effects of the different CD dimensions depend on the direction towards host countries with specific cultural profiles. These findings indicate that foreign subsidiaries from emerging markets have a clear advantage in dealing with institutional voids in Latin America (i.e., FID towards less developed host countries), whereas the effects of CD are the same for all firms. This suggests that the cultural profile of the host country is what really matters.

1. Introduction

In 1975, Jan Johanson and Finn Wiedersheim-Paul adopted the concept of psychic distance (Beckerman 1956; Linnemann 1966) to explain the internationalization behavior of firms. Since then, the concept of distance has become a central topic in international management (Ambos and Håkanson 2014). Distance represents the degree of dissimilarities between pairs of countries (e.g., home and host countries) and can be measured using different criteria. Psychic distance is a broad concept that represents the sum of factors preventing or disturbing the flow of information between the multinational firm and the foreign market (Johanson and Wiedersheim-Paul 1975). With the contributions of Hofstede (1980) and Kogut and Singh (1988), subsequent studies started to focus on the implications of Cultural Distance (CD). In 1996, Tatiana Kostova (1996) included the three pillars in the institutional framework (Scott 1995), which allowed for the comparison between countries in terms of cognitive, normative and regulatory institutional distances. According to Peng et al. (2009), the normative and regulatory dimensions are closely related to formal institutions as identified by North (1990).

Regardless of the dimension, distance-related studies focused on the disadvantage of foreign firms when compared to indigenous companies, hence a liability of foreignness (Zaheer 1995). The idea that distance represents a liability was widely accepted in the international business community, so much so that, in 2001, Oded Shenkar, in his seminal work, proposed replacing “distance” with the “friction” metaphor (Shenkar 2001; Shenkar et al. 2008), which relates to the higher transaction costs faced by foreign companies (Williamson 1975).

More recently, studies started to differentiate the effects of distances depending on the characteristics of the dimensions and the direction towards host countries with different profiles. For instance, by considering the direction of the distance, Cuervo-Cazurra and Genc (2011) argue that the effects of distance towards host countries with more supportive (i.e., strong) formal institutions are positive, whereas the distance towards less supportive host countries has a negative effect. When it comes to the implications of CD, as countries cannot be compared in terms of being better or worse, the effects of CD are always negative, regardless of the direction of the movement (Cuervo-Cazurra and Genc 2011).

Studies have found different, and sometimes contradictory, results; there is an ever-growing debate regarding the theoretical assumptions and methodological aspects in distance-related studies (Dow 2017; Verbeke et al. 2017; Shenkar et al. 2020). For example—conversely to Cuervo-Cazurra and Genc’s (2011) proposal in regard to the effects of formal institutional distance (FID)—by accounting for the direction of FID, Konara and Shirodkar (2018) have shown that distance towards host countries with less developed regulations have a more positive effect, whereas foreign subsidiary performance is negatively affected when FID is towards countries with stronger regulations.

When it comes to the effects of CD, the vast majority of empirical research highlights the negative effects of the construct (Beugelsdijk et al. 2018). However, recent studies have shown that the effects might be perceived differently (i.e., asymmetric effects) depending on the standpoint of the observer (Selmer et al. 2007; Magnani et al. 2018). Confirming these findings, the asymmetric effects of CD were verified quantitatively in recent studies (Correa da Cunha et al. 2020, 2022a; Stor 2021).

This study attempts to contribute to this discussion by investigating the effects of the direction of FID and CD on the financial performance of foreign subsidiary firms from developed countries and from emerging markets operating in Latin America. By addressing the tacit characteristics of culture and the explicit nature of formal institutions, it is argued that these distinct properties of the constructs impact the ability of firms translating the expertise in dealing with cultural and formal institutional conditions at home into a firm specific advantage when operating abroad. These assumptions are tested quantitatively using data from the Orbis database and includes over 1400 firms including 1200 foreign subsidiaries from developed countries and 200 from emerging markets. These firms operated in the 10 largest host countries in Latin America (according to GDP) over a period of 3 consecutive years ranging from 2013 to 2015. In the past few decades, Latin America has gone through profound political and economic reforms which created more favorable conditions to attract foreign firms into the region (Aguilera et al. 2017; Correa da Cunha et al. 2022b). These changes included the reduction in protectionist policies that were implemented during the import substitution industrialization (ISI). Foreign direct investment (FDI) into the region grew from USD 8.5 billion in 1990 to USD 104.7 billion in 1999. During the same period, GDP more than doubled and final consumption expenditure increased from USD 750 billion to USD 1.8 trillion. At the same time, inflation declined from nearly 22% in 1990 to less than 3.5% 1999 (World Bank 2021). Although there are huge opportunities for multinational companies in the region, in order to succeed, firms must adjust to the cultural and formal institutional conditions. The dynamic business environment combined with the diversity in national culture and formal institutional conditions make Latin America an ideal laboratory to build and test management theories (Aguinis et al. 2020).

This study advances the distance–profile conflation debate by arguing that distance is more suitable to discuss the effects of formal institutions, whereas the effects of informal institutions, such as the implications of cultural traits, are better represented by the host country profile effects. By considering the direction of CD and FID in comparing the effects on the financial performance of foreign subsidiaries from emerging markets, and from developed countries, the findings indicate that due to the tacit nature of culture, the effects towards host countries with specific cultural profiles tend to be the same for all firms, depending more on the direction than the size of CD. On the contrary, formal institutions are explicit, which allows foreign subsidiary firms to convert their knowledge in dealing with formal institutional conditions in the home country into firm specific advantages (FSAs) when operating in foreign host countries with similar characteristics. In addition to the theoretical implications, these findings are relevant to practice, as firms can identify the alternatives to enter and operate in host countries with different formal institutional and cultural characteristics.

2. Literature Review and Hypotheses

Culture is at the core of informal institutions (Peng et al. 2009). North (1990, p. 37) states that informal constraints “come from socially transmitted information and are a part of the heritage that we call culture”. Therefore, culture relates tacit knowledge (Mukerji 2014). Conversely, formal institutions are explicit as they represent “the rules of the game in a society or, more formally, are the humanly devised constraints that shape human interaction. They structure incentives in human exchange, whether political, social, or economic” (North 1990, p. 3). Well-developed and strong formal institutions “support the voluntary exchange underpinning an effective market mechanism” while weak formal institutions “fail to ensure effective markets or even undermine markets” (Meyer et al. 2009, p. 63). Strong formal institutions reduce transaction costs and provide better conditions for firms to operate (Cuervo-Cazurra and Genc 2011; Maseland 2013; Zaheer et al. 2012; Hernández and Nieto 2015; Konara and Shirodkar 2018), which result in superior financial performance.

2.1. Directional Cultural Distance (DCD) Hypothesis

Studies have indicated that some cultural characteristics might be associated to economic growth and institutional development (Gorodnichenko and Roland 2011; Klasing 2013; Maseland 2013) indicating that some cultures may provide better conditions for doing business (Zaheer et al. 2012). However, due to the tacit nature of culture, foreign firms from a different culture may not be able to take advantage of favorable cultural traits in the host country environment. In 1967, Michael Polanyi (1967) coined the term tacit knowledge. According to North (1990, p. 74), tacit knowledge “is acquired in part by practice and can only be partially communicated; different individuals have different innate abilities for acquiring tacit knowledge.” Mukerji (2014, p. 348) states that “tacit knowledge, or knowledge that is inarticulate or unarticulated, lies at the heart of all cultural life, and is exercised in dull and repetitive activities that constitute the heart of daily existence”.

Due to the tacit nature of culture, it is difficult to transfer abroad the expertise in dealing with cultural characteristics in the home country. Thus, as noted by Cuervo-Cazurra and Genc (2011), the implications of CD are always negative as it increases the costs of doing business in a foreign host country. In fact, the majority of research confirms the negative effects of CD (Beugelsdijk et al. 2018; Cuervo-Cazurra and Genc 2011; Stahl and Tung 2015).

However, a few recent studies indicate that cultural diversity create opportunities and advantages to firms (Vaccarini et al. 2017). Moreover, qualitative (Selmer et al. 2007; Magnani et al. 2018) and quantitative studies (Correa da Cunha et al. 2022a) have shown that the effects of CD can be asymmetric. Stor (2021) showed that the effects of CD depend on a configuration of different dimensions of the national culture. However, attempting to understand the overall effects of a combination of different dimensions of CD can be difficult as some dimensions might have a greater positive or negative influence which can offset the effects of other important dimensions (Correa da Cunha 2019; Hofstede et al. 2005). From a managerial perspective, in order to facilitate the identifications of actionable measures to accommodate the effects of CD, it is important to provide accurate and specific evidence of the impact of the dimensions of CD in specific directions. Therefore, as noted by Correa da Cunha et al. (2022a), the effects of CD depend not only on the ability of firms understanding the nuances (tacit knowledge) of the culture in a foreign host country, but also by being accepted and legitimized in that context.

The tacit nature of culture makes it is difficult to convert the expertise in dealing with the culture in the home country into a firm specific advantage (FSA) in a foreign host country. In fact, when adjusting to a foreign culture, the “perceived similarity can lead to carelessness and failure” (O’Grady and Lane 1996, p. 329). As a result, the effects of CD are likely to be associated with the direction towards host countries with specific profiles (e.g., masculine vs. feminine, individualistic vs. collectivist, high vs. low power distance and high vs. low uncertainty avoidance) (Correa da Cunha et al. 2020, 2022a). Therefore, foreign subsidiary firms from developed countries and emerging markets are likely to experience similar effects, despite the significantly different sizes of CD. In order to test these assumptions, we posit the following hypothesis:

Hypothesis 1 (H1).

The effects of CD on the financial performance of foreign subsidiaries from developed and emerging markets are the same depending on the direction towards host countries with specific cultural profiles.

2.2. Formal Institutional Distance (FID) Hypothesis

The implications of FID Cuervo-Cazurra and Genc (2011) argue that formal institutions can support business operations and reduce transaction costs. Therefore, according to the aforementioned authors, the financial performance of foreign subsidiary firms is positively associated with FID towards countries with stronger (i.e., more supportive) formal institutions. In that sense, when operating in a host country with stronger formal institutions, foreign subsidiary firms from emerging markets benefit more when compared to subsidiaries from developed countries as they are exposed to an environment where they can access superior resources not available at their home country. When the distance is in the opposite direction, developed country firms are at a disadvantage as they are used to having supportive institutions and may lack the expertise to operate in their absence (Cuervo-Cazurra and Genc 2011; Ramamurti and Singh 2009). According to Cuervo-Cazurra and Genc (2011, p. 450), “developing such capabilities requires an understanding of what is missing in the environment, and how to operate without those elements”. Emerging market firms, from birth are exposed to unreliable power, congested ports and roads, corrupt bureaucracies, political and regulatory uncertainties, weak educational institutions (Ramamurti and Singh 2009), and a range of other “institutional voids” (Palepu and Khanna 1998) which force these companies to develop creative strategies and capabilities to deal with such precarious conditions.

Important advancements have been made in regard to measuring and assessing the implications of the direction of formal institutional distance. As formal institutions can be compared in terms of better or worse (strong or weak), authors have used a dummy variable to account for the direction of FID towards host countries that score higher or lower in comparison to the home country (Chikhouni et al. 2017; Contractor et al. 2016; Correa da Cunha 2019; Hernández and Nieto 2015; Trąpczyński and Banalieva 2016). For example, Contractor et al. (2016) examined the moderating effect of the direction of various distance–dimensions on the link between MNCs’ intangible assets and subsidiary profitability. Correa da Cunha (2019) shows that FID towards less developed host countries positively moderates (i.e., increase the effects) the relationship between CD and profitability of foreign subsidiaries. Hernández and Nieto (2015) verified that regulatory distance towards more developed countries require higher resources’ commitment compared to entering countries with less developed regulatory quality. In their seminal paper, Konara and Shirodkar (2018) estimated the implications of the direction of FID based on a sample of 1936 firms over a period of 12 consecutive years ranging from 2002 to 2013, including 70 host countries and 66 home countries (including developed and emerging markets), and identified that FID towards less developed host countries have a more positive effect on performance compared to FID in the oposite direction. These findings contrast to the theoretical assumptions presented by Cuervo-Cazurra and Genc (2011) and prior research that show that countries with more developed formal institutions and effective enforcement mechanisms have lower transaction costs and are safer, allowing firms to commit resources that improve efficiency and increase performance (Ambos and Håkanson 2014; Hernández et al. 2018; Kraus et al. 2015).

Controversy still exists, and it is argued that due to the significant differences in their home country environments, foreign subsidiaries from emerging markets and from developed countries are likely to possess different capabilities to cope with formal institutions in the host country environment. While developed country firms are likely to adjust more positively when FID is towards more developed host countries, it can be argued that the opposite effect should be expected for the case of foreign subsidiaries from emerging markets as these firms will experience higher costs associated to learning how to conform to the more stringent regulations in such environment. Conversely, when FID is towards less developed host countries, foreign subsidiaries from emerging market are in advantage due to their expertise in dealing with institutional voids in their home countries (Palepu and Khanna 1998). This knowledge can be converted into a firm specific advantage when operating in host countries that present similar characteristics (Ramamurti and Singh 2009).

Based on these assumptions, it is argued that the effects of FIDs in opposite directions relate to the ability of foreign subsidiary firms from emerging markets and from developed countries to transfer their expertise in dealing with formal institutions in their home countries. Due to the explicit nature of formal institutions, it is possible for firms to convert their expertise into firm specific advantages (FSAs) when operating abroad. Based on these arguments, the following hypothesis is provided:

Hypothesis 2 (H2).

FID towards host countries with stronger formal institutions are positively associated with the financial performance of foreign subsidiaries from developed countries and negatively associated with the financial performance of foreign subsidiaries from emerging markets. Conversely, FID towards host countries with weaker formal institutions are negatively associated with the financial performance of foreign subsidiaries from developed countries and positively associated with the financial performance of foreign subsidiaries from emerging markets.

In addition to testing the implications of cultural and formal institutional factors, firms’ resources and industry characteristics are included as control variables in the analysis.

3. Data and Methodology

Subsidiary data were obtained from the Orbis database. Although the Orbis database has data for thousands of foreign subsidiaries operating in Latin America, the criteria adopted for the present study in order to perform a balanced panel model required only firms with complete data available for the period from 2013 to 2015 to be selected. Foreign subsidiaries were selected considering the majority of control (50.1%) concentrated in the home country of the firm which is different than the host country. Following the same individual subsidiary firms over a period of three consecutive years provides more robust estimates. This specific period was selected to minimize distortions caused by important events that influenced the financial performance of firms such as the commodity boom from 2002 to 2012 and the 2008 global financial crisis. Furthermore, from 2015 onwards, the huge corruption scheme exposed by Operation Car Wash had a tremendous impact on the economy of several countries in Latin America. Furthermore, the range of values for the World Governance Indicator during the period of the study provide a relevant assessment of how formal institutional conditions in the region change over time.

The final sample includes over 1400 foreign subsidiaries from which approximately 200 are from 22 different emerging markets; the remaining 1200 are from 22 different developed countries. It is important to note that due to the availability of data, the subsamples are unbalanced.

Developed countries and emerging markets are classified according to the World Economic Situation and Prospects (WESP) 2015 report from the United Nations. There are 10 host countries in our sample include Argentina, Brazil, Chile, Colombia, Ecuador, Mexico, Panama, Peru, Uruguay and Venezuela. In total, there are 168 combinations of different home and host countries.

3.1. Panel Data Method

This study uses panel data which combines cross-sections with time series according to (Baltagi and Raj 1992). By performing the tests using a balanced panel data permits evaluating the relationship between several variables by following the same individuals over a particular period of time.

3.2. Computing the Directional FID and CD

Following recent research that considers the direction of FID (Correa da Cunha 2019; Hernández and Nieto 2015; Konara and Shirodkar 2018) and Direction Cultural Distance (DCD) (Correa da Cunha 2019; Correa da Cunha et al. 2020, 2022a), this research computes distances in opposite directions using two separate and independent variables identified by “LH” (low score in the home country and high score in the host country) and “HL” (high score in the home country and low score in the host country). Thus, for each dimension of formal institutional distance (FID) and directional cultural distance (DCD) there are two specific variables, one measuring the distance in the LH and the other measuring the distance in the opposite HL direction. When the conditions HL or LH are satisfied, the specific variable receives the value calculated by the single component Kogut and Singh (1988) index. Otherwise, distance in that direction becomes 0 (zero).

Distances in the LH and HL directions are calculated as presented in the conditional Equations (1) and (2), respectively.

- Distance in LH Direction

In Equation (1), I = value for the dimension; i = distance dimension i; j = home country; u = host country, “V” stands for the variance of each dimension of the index.

- Distance in HL Direction

In Equation (2), I = value for the dimension; i = distance dimension i; j = home country; u = host country, “V” stands for the variance of each dimension of the index.

3.3. Dependent Variable

Financial Performance (Profit Margin): Following recent research that investigates the effects of CD on the financial performance of foreign subsidiary firms (Correa da Cunha et al. 2022a), financial performance is measured using profit margin. According to Vahlne and Johanson (2017, p. 1097), profit margin is a “relevant dimension of the firm’s resource position and of its performance”. Moreover, profit margin is less susceptible to distortions caused by investment or depreciation on firm’s assets (Geringer and Hebert 1989; Contractor et al. 2003). Additionally, it provides a more equitable alternative to comparing firms in different industries given the variance in using assets in different sectors. Furthermore, in the context of emerging markets, such as in host countries in Latin America, profit margin reflects management’s effectiveness at investing in projects that add value (Chopra and Mier 2017).

3.4. Independent Variables

Directional Cultural Distance (DCD): directional cultural distance (DCD) was calculated for each of the four dimensions of Hofstede (1980), which include power distance (PDI); individualism versus collectivism (IDV); masculinity versus femininity (MAS) and uncertainty avoidance (UAI). The fifth and six dimensions were not included because the data are not available for many countries in our sample and would reduce the number of firms included in the final sample.

Formal Institutional Distance (FID): In order to measure the institutional quality of a country, Kaufmann and Kraay (2008) developed the world governance indicators (WGI), which utilize more than 340 variables provided by approximately 32 different sources which are used to compute the six dimensions of the WGI. Additionally, the WGI dimensions are closely related to the normative and regulatory pillars and been extensively employed by different authors (Wernick et al. 2009; Gani 2007; Globerman and Shapiro 2003; Mengistu and Adhikary 2011; Stein and Daude 2001; Correa da Cunha 2019; Hernández et al. 2018) to represent the formal institutional framework of nations.

The WGI dimensions include voice and accountability (VA) which represents the freedom of speech and the participation of the society in selecting their government. Regulatory quality (RQ) indicates the quality of the laws formulated and implement by the government which promote the development of the society and the economy. Rule of law (RL) measures the perception of the quality related to contract enforcement and to what extent agents follow the rules of society. Political stability and absence of violence/terrorism (PE) account for the political stability and absence of violence in the country. Government effectiveness (GE) represents the effectiveness of the public services provided by the government. Control of corruption (CC) reflects to what extent corruption exists in the society. A score of between −2.5 (weak) and +2.5 (strong) is attributed to each of the six dimensions.

3.5. Control Variables

Industry annual growth (% Annual Growth): The data for the host country industry sector growth were collected from the Organization for Economic Co-operation and Development (OECD) website for each of the host countries and years. Codes from Orbis reported in NACE were matched to the ISIC used by the OECD to report the annual growth for each industry sector. Previous studies have shown that industry sector growth has a positive impact on firm profitability (Hay et al. 1991). Subsidiary Size: Subsidiary size was computed using the total assets for the subsidiary in each of the periods covered by this study. Larger firms have access to more resources which allow them to overcome market disruptions (Hannan and Freeman 1984). Additionally, larger corporations also have more resources which allow them to attract more qualified human capital, which in the case of a multinational company, includes hiring managers with international experience (Correa da Cunha et al. 2022a). These data were collected from the Orbis database. Industry Sector (Industry of Service): A dummy variable for the industry sector by considering if the firm is an industrial (1) or service firm (0). Companies were separated in service or industry based on the NACE code recorded in the Orbis database.

Developed or Emerging market (dummy): Due to the significant differences in their home country contexts, controlling for developed (1) or emerging market (0) home country is an important control variable when estimating the effects of cultural and formal institutional distances (Correa da Cunha 2019). Moreover, emerging market firms are experienced in dealing with the institutional voids and turbulence in this type of environment which might influence the effects of FID towards less developed host countries (Ficici et al. 2014).

Latin American home country (dummy): There are significant similarities in terms of national culture among Latin American countries when compared to other emerging markets from outside the region (Inglehart and Carballo 1997; Gupta et al. 2002). Therefore, when estimating the effects of cultural and formal institutional distances, it is important to control if the foreign subsidiary is from Latin America. Foreign subsidiaries from Latin America are identified by 1 and all others by 0.

3.6. Descriptive Statistics and Correlation Matrices

Table 1, Table 2 and Table 3 present the descriptive statistics; Table 4, Table 5, Table 6, Table 7 and Table 8 display the correlation among the variables included in empirical models developed for this study. Each table includes data related to the full sample and the two sub-samples included in the tests. The full sample includes foreign subsidiaries from developed countries and from emerging markets. In order to test the hypotheses and estimate the different effects on the foreign subsidiaries from emerging markets and from developed countries, two sub-samples were created. One sub-sample includes only foreign subsidiaries from developed countries while the other sub-sample includes only foreign subsidiaries from emerging markets.

Table 1.

Descriptive statistics—full sample.

Table 2.

Descriptive statistics—sub-sample including foreign subsidiaries from developed countries.

Table 3.

Descriptive statistics—sub-sample including foreign subsidiaries from emerging markets.

Table 4.

Correlation matrix for DCD Variables—full sample.

Table 5.

Correlation matrix for DCD variables—sub-sample including foreign subsidiaries from developed countries.

Table 6.

Correlation matrix for DCD variables—sub-sample including foreign subsidiaries from emerging markets.

Table 7.

Correlation Matrix for FID variables—sub-sample including foreign subsidiaries from developed countries.

Table 8.

Correlation matrix for FID variables—sub-sample including foreign subsidiaries from emerging markets.

4. Main Results and Discussion

4.1. Preliminary Tests

Before presenting and discussing the results, some preliminary issues must be discussed. First, regarding the risk of regressor endogeneity, it is assumed that the institutional variables are known (formal institutions) and are consequently exogenous.

In order to test for multicollinearity, the variance inflation index (VIF) is verified for all the variables included in the empirical arrangements. All values were lower than 2.0 which is well below 10.0 which is the maximum recommended by Neter et al. (1990).

In order to select the adequate estimation method to perform the tests, the Hausman was performed, and the test results pointed to the Random effects estimation method.

4.2. Main Results—Directional Cultural Distance (DCD)

Table 9 presents the results for the models intended to test the implications of CD calculated using the single dimension version of the Kogut and Singh (1988) metric and the results for DCD in the LH and HL directions.

Table 9.

Cultural distances—full, developed country and emerging market subsidiaries samples. Random-effects (GLS) estimates. Heteroskedasticity-corrected estimates. Dependent variable: profit margin.

The first consideration when analyzing the results in Table 9 is the improved explanatory capacity of the models when cultural distances are measured in specific directions using DCD. Furthermore, the results show that cultural distances measured using either CD or DCD have a much greater impact on the performance of foreign subsidiaries from emerging markets. Additionally, the results show that despite the cultural similarities that exist within the countries in Latin America (Hofstede 1980), the non-significant effect for the Latin America dummy indicate that firms from the region are not in advantage (i.e., do not perform better) when dealing with the effects of cultural differences when compared to foreign subsidiaries from other emerging markets outside the region.

In order to provide a more complete representation of the effects of DCD, the figures presented next display the results for the regression and the analysis including the mean score for the home countries included in the sample for each dimension and the effects of DCD in each direction.

4.2.1. DCD—Power Distance Index

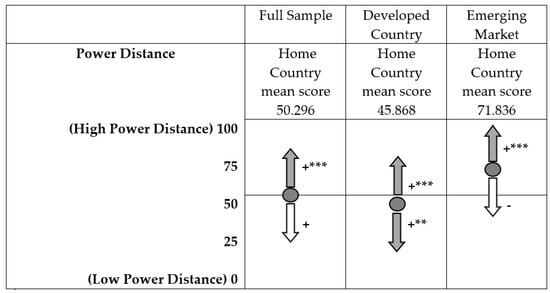

Figure 1 highlights the effects of DCD for the power distance index dimension.

Figure 1.

The effects of DCD—power distance index dimension. Notes:

DCD significant effects (gray arrow).

DCD significant effects (gray arrow).

DCD non-significant effects (white arrow).

DCD non-significant effects (white arrow).  Mean score for the home countries in the sample (position in the scale). ** p < 0.05; *** p < 0.01.

Mean score for the home countries in the sample (position in the scale). ** p < 0.05; *** p < 0.01.

DCD significant effects (gray arrow).

DCD significant effects (gray arrow).

DCD non-significant effects (white arrow).

DCD non-significant effects (white arrow).  Mean score for the home countries in the sample (position in the scale). ** p < 0.05; *** p < 0.01.

Mean score for the home countries in the sample (position in the scale). ** p < 0.05; *** p < 0.01.

The results show that developed country’s firms are able to take advantage of distances in terms of power distance in a way that, regardless of the direction, there is a statistically significant and positive effect on performance. These findings reveal the ability of developed country firms to accommodate differences in terms of power distances regardless of its direction in a positive manner. Thus, for this dimension of DCD, the effects in the opposite directions seem to have symmetric effects on the financial performance of foreign subsidiaries from developed countries.

On the other hand, foreign subsidiaries from an emerging market adjust more positively to host countries that score higher in terms of power distance. For this dimension of national culture, the results suggest that the similarity between a home and host country might in fact facilitate the adjustment to the culture in the foreign host country. Nevertheless, there is a consistent pattern regarding the signals for the significant effects, which support H1 in a sense that the effects on performance are the same regardless of the different DCD sizes.

4.2.2. DCD—Individualism vs. Collectivism

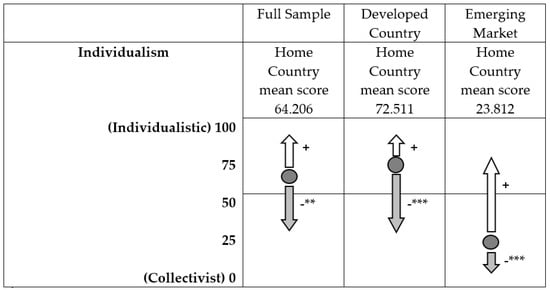

Figure 2 displays the effects of DCD for the individualism vs. collectivism dimension.

Figure 2.

The effects of DCD—individualism vs. collectivism dimension. Notes:

DCD significant effects (gray arrow).

DCD significant effects (gray arrow).

DCD non-significant effects (white arrow ).

DCD non-significant effects (white arrow ).  Mean score for the home countries in the sample (position in the scale). ** p < 0.05; *** p < 0.01.

Mean score for the home countries in the sample (position in the scale). ** p < 0.05; *** p < 0.01.

DCD significant effects (gray arrow).

DCD significant effects (gray arrow).

DCD non-significant effects (white arrow ).

DCD non-significant effects (white arrow ).  Mean score for the home countries in the sample (position in the scale). ** p < 0.05; *** p < 0.01.

Mean score for the home countries in the sample (position in the scale). ** p < 0.05; *** p < 0.01.

The findings reveal that DCD towards host countries that are more collectivist in comparison to the home country affect performance in a negative way. The graphical representation of the effects, Figure 2, shows that, despite fact that the mean score in the home country in the emerging market sample shows that these subsidiary firms come from collectivist societies, the effect on performance towards collectivist host countries is negative. Therefore, for the individualism vs. collectivism dimension, the results indicate that the negative effects can be attributed to the collectivist host country profile. Furthermore, although the effects towards more individualistic host countries are non-significant, these findings reveal that the effects for this dimension are asymmetric.

These results support hypothesis H1 as, despite differences in distance size, the effects on the financial performance of foreign subsidiaries from emerging markets and developed countries are the same.

4.2.3. DCD—Masculinity vs. Femininity Dimension

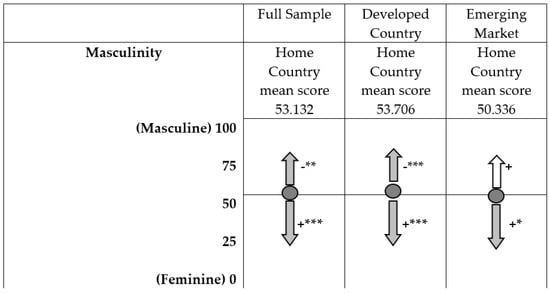

Figure 3 shows the effects of DCD for the masculinity vs. femininity dimension.

Figure 3.

The effects of DCD—masculinity vs. femininity dimension. Notes:

DCD significant effects (gray arrow).

DCD significant effects (gray arrow).

DCD non-significant effects (white arrow).

DCD non-significant effects (white arrow).  Mean score for the home countries in the sample (position in the scale). * p < 0.10; ** p < 0.05; *** p < 0.01.

Mean score for the home countries in the sample (position in the scale). * p < 0.10; ** p < 0.05; *** p < 0.01.

DCD significant effects (gray arrow).

DCD significant effects (gray arrow).

DCD non-significant effects (white arrow).

DCD non-significant effects (white arrow).  Mean score for the home countries in the sample (position in the scale). * p < 0.10; ** p < 0.05; *** p < 0.01.

Mean score for the home countries in the sample (position in the scale). * p < 0.10; ** p < 0.05; *** p < 0.01.

The findings in Figure 3 show that the effects of DCD towards more masculine host countries tend to affect performance negatively, whereas DCD towards more feminine host countries has a significant and positive effect on performance in all the subsamples. Therefore, these results indicate that the effects of the masculinity vs. femininity dimensions have an opposing symmetric effect on the financial performance of foreign subsidiary firms. These findings partially support hypothesis H1, as the statistically significant effects in all sub-samples reveal the same patterns.

4.2.4. DCD—Uncertainty Avoidance Dimension

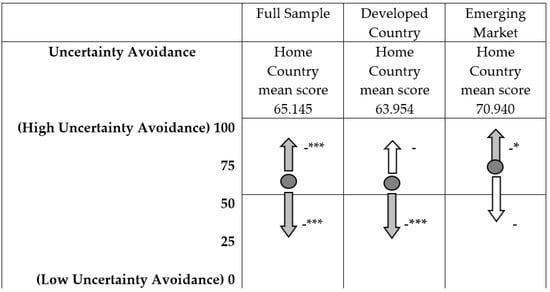

Figure 4 displays the effects of DCD for the uncertainty avoidance dimension.

Figure 4.

The effects of DCD—uncertainty avoidance dimension. Notes:

DCD significant effects (gray arrow).

DCD significant effects (gray arrow).

DCD non-significant effects (white arrow).

DCD non-significant effects (white arrow).  Mean score for the home countries in the sample (position in the scale). * p < 0.10; *** p < 0.01.

Mean score for the home countries in the sample (position in the scale). * p < 0.10; *** p < 0.01.

DCD significant effects (gray arrow).

DCD significant effects (gray arrow).

DCD non-significant effects (white arrow).

DCD non-significant effects (white arrow).  Mean score for the home countries in the sample (position in the scale). * p < 0.10; *** p < 0.01.

Mean score for the home countries in the sample (position in the scale). * p < 0.10; *** p < 0.01.

The effects of DCD in the uncertainty avoidance dimension suggest that, when home and host countries differ in terms of uncertainty avoidance, performance will be negatively affected. Therefore, this dimension of DCD seems to be the only one that conforms to the assumption that CD always has a negative effect, regardless of the direction (Cuervo-Cazurra and Genc 2011). For this dimension, hypothesis H1 is not supported, as the effects are significantly different across the subsamples. This indicates that emerging market and developed country firms have different abilities to cope with different degrees of uncertainty avoidance in the host country.

4.3. Main Results—Formal Institutional Distance (FID)

Next, the effects of FID were tested separately on a sub-sample including only foreign subsidiaries from developed countries and on a sub-sample including only foreign subsidiaries from emerging markets.

4.3.1. FID and the Financial Performance of Foreign Subsidiaries from Developed Countries

Table 10 presents the results for the implications of formal institutional distances for the sub-sample that includes foreign multinational subsidiaries from developed countries.

Table 10.

Formal institutional distances—foreign subsidiaries from developed countries. Random-effects (GLS) estimates. Heteroskedasticity-corrected estimates. Dependent variable: profit margin.

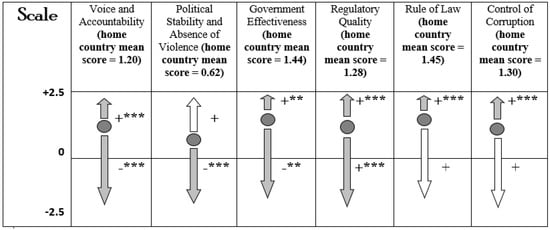

In Figure 5, the signal and statistical significance of the results presented in Table 10 are discussed based on the mean scores for the home country profiles. This representation of the findings allows for the discussion and verification of how similarities between home and host country profiles can help explain the effects of distances in specific directions.

Figure 5.

The effects of FID on the financial performance of foreign subsidiaries from developed countries. Notes:

FID significant effects (gray arrow).

FID significant effects (gray arrow).

FID non-significant effects (white arrow).

FID non-significant effects (white arrow).  Mean score for the home countries in the sample (position in the scale). ** p < 0.05; *** p < 0.01.

Mean score for the home countries in the sample (position in the scale). ** p < 0.05; *** p < 0.01.

FID significant effects (gray arrow).

FID significant effects (gray arrow).

FID non-significant effects (white arrow).

FID non-significant effects (white arrow).  Mean score for the home countries in the sample (position in the scale). ** p < 0.05; *** p < 0.01.

Mean score for the home countries in the sample (position in the scale). ** p < 0.05; *** p < 0.01.

Figure 5 shows that the performance of foreign multinational subsidiaries from developed country firms is affected in a positive manner when distances are towards more developed host countries. In addition, the results show that, when formal institutional distances are towards less developed countries, there is a negative effect, except for distances in terms of regulatory quality.

4.3.2. FID and the Financial Performance of Foreign Subsidiaries from Emerging Markets

Table 11 presents the results for formal institutional distances on the performance of subsidiaries from emerging markets.

Table 11.

The effects of FID on the financial performance of foreign subsidiaries from emerging markets. Random-effects (GLS) estimates. Heteroskedasticity-corrected estimates. Dependent variable: profit margin.

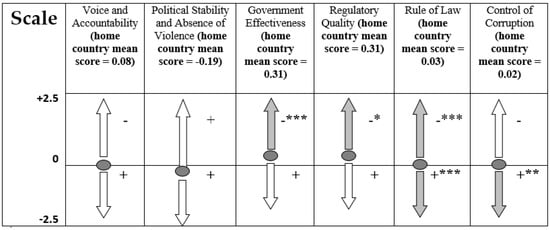

Figure 6 presents the signal and direction of formal institutional distances on the performance of emerging market firms in relation to the characteristics for the home country profiles in each dimension.

Figure 6.

The effects of FID on the financial performance of foreign subsidiaries from emerging markets. Notes:

FID significant effects (gray arrow).

FID significant effects (gray arrow).

FID non-significant effects (white arrow).

FID non-significant effects (white arrow).  Mean score for the home countries in the sample (position in the scale). * p < 0.10; ** p < 0.05; *** p < 0.01.

Mean score for the home countries in the sample (position in the scale). * p < 0.10; ** p < 0.05; *** p < 0.01.

FID significant effects (gray arrow).

FID significant effects (gray arrow).

FID non-significant effects (white arrow).

FID non-significant effects (white arrow).  Mean score for the home countries in the sample (position in the scale). * p < 0.10; ** p < 0.05; *** p < 0.01.

Mean score for the home countries in the sample (position in the scale). * p < 0.10; ** p < 0.05; *** p < 0.01.

The results show that the financial performance of foreign subsidiaries from emerging markets is affected negatively by FID towards host countries with stronger formal institutions and positively by FID towards host countries with weaker formal institutions. These findings support hypothesis H2, as emerging market firms can effectively convert their experience in dealing with institutional voids in their home countries (Ficici et al. 2014) into FSAs when operating in foreign host countries with similar characteristics. On the other hand, the negative and significant effect for FIDs towards host countries that score higher in terms of regulatory quality, government effectiveness and rule of law reveal that these firms are at a disadvantage when operating in more developed host countries. These findings support hypothesis H2, as each group of firms seem to be at an advantage when dealing with FIDs towards host countries that are similar to their home countries.

4.3.3. FID as a Competitive Advantage (or Disadvantage)

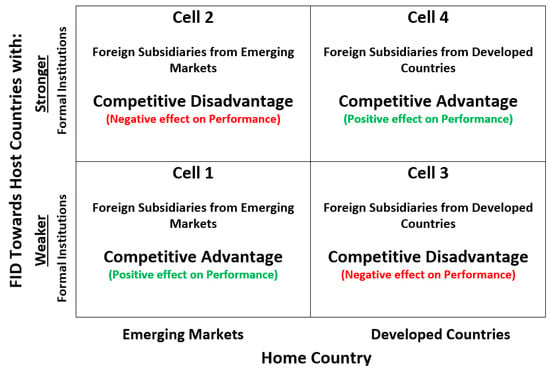

As noted on the main results for FIDs on the different sub-samples, emerging market and developed country firms are affected in different ways by FIDs. Figure 7 summarizes the main effects of FIDs on the financial performance of foreign subsidiaries from developed countries and from emerging markets.

Figure 7.

FIDs and the Competitive Advantages and Disadvantages of Foreign Subsidiaries from Developed Countries and from Emerging Markets.

Cell 1 indicates that foreign subsidiary firms from emerging markets have a competitive advantage when FIDs are towards host countries with weaker formal institutions. On the other hand, when FID is towards host countries with stronger formal institutions, the negative effects on the financial performance of foreign subsidiaries from emerging markets reveal a competitive disadvantage (Cell 2). Therefore, conversely to the findings proposed by Cuervo-Cazurra and Genc (2011), this suggests that, whereas emerging market firms can adjust more positively to the institutional voids in less developed host countries, these firms lack the expertise to take advantage of the strong formal institutions in more developed host countries.

In regard to the effects on the performance of foreign subsidiaries from developed countries, the results reveal that these firms are at an advantage when FIDs are towards host countries with stronger formal institutions (Cell 4). The opposite happens when foreign subsidiaries from developed countries operate in host countries with weaker formal institutions (Cell 3). The negative effects on performance indicate that foreign subsidiary firms from developed countries operating in Cell 3 face a competitive disadvantage. Interestingly, the positive effects for FID in the regulatory quality dimension in both directions indicate that foreign subsidiary firms from developed countries can adjust positively to host countries with more or less developed regulations.

4.4. Theoretical Contributions

By distinguishing between the foreign subsidiaries from developed countries and emerging markets, this study provides a more nuanced view which complements the previous studies that investigated the effects of FID in different directions (Hernández and Nieto 2015; Konara and Shirodkar 2018). The findings reveal that the effects of FID in specific directions depend on the characteristics of the home country. While Konara and Shirodkar (2018) have shown that FID towards less developed host countries have a more positive effect on performance, the findings in this study reveal that these effects are in fact different depending on whether the foreign subsidiary firms are from a developed or emerging market. The results indicate that emerging market firms are experienced in dealing with institutional voids in their home country (Ficici et al. 2014), and this expertise can be converted into a competitive advantage when operating in foreign host countries with similar conditions. Conversely, foreign subsidiaries from developed countries have a competitive advantage over foreign subsidiaries from emerging markets when operating in host countries with stronger formal institutions, as these firms know how to conform to the high demands in the more stringent host country environment.

By estimating the effects of CD using sub-samples with different characteristics, it is shown that, regardless of the different sizes of the distance, the effects towards host countries with specific profiles tend to be the same. These findings confirm the asymmetric effects of CD found in previous research (Selmer et al. 2007; Magnani et al. 2018; Correa da Cunha et al. 2022a) and provide specific indications of how the different dimensions of CD in specific directions affect the financial performance of foreign subsidiary firms. For instance, CD towards collectivist host countries tends to impact performance negatively, whereas distances towards individualistic host countries tend to have a more positive effect. The same pattern was found for the masculinity dimension, as a CD towards more feminine host countries has a positive effect on performance, whereas CD towards Masculine host countries has a negative effect on performance. In regard to the implications for the power distance dimension, firms seem to have the ability to adjust positively when operating in both high and low power distance settings. The contrary was verified for the implications of uncertainty avoidance, as CD in both directions (i.e., towards high and low UAI host countries) have a negative impact on the performance of foreign subsidiary firms.

Therefore, the effects of FID differ to the effects of CD. The different effects can be attributed to the different characteristics of the two constructs. Because formal institutions are explicit, it is easier for firms to understand the foreign environment and apply previous experience when dealing with specific situations. Culture, on the other hand, is tacit, which makes the nuances of culture more difficult to interpret in the foreign host country. There are no written rules expressing the cultural expectations and requirements for doing business in a foreign host country. The findings in this study indicate that making assumptions that cultural similarities will facilitate adjustments in a foreign country can be misleading, as outsiders will face greater challenges and costs before being legitimized and accepted in that context.

4.5. Practical Implications

From a managerial perspective, the results show that, while firms may find similar challenges when dealing with the implications of CD, foreign subsidiaries from emerging markets are at an advantage when operating in less developed host countries; however, foreign subsidiaries from developed countries are clearly at an advantage when in more developed host countries. By differentiating between emerging market and developed country firms, this study advances the knowledge about the implications of FIDs in specific directions. While developed country firms can effectively convert their expertise in dealing with formal institutions in the home country into an FSA when operating abroad, emerging market firms must learn how to operate in a more stringent host country in order to access the potential advantages available in a more supportive environment. In that sense, this study highlights the competitive advantage of emerging market firms in host countries with less supportive (i.e., weaker) formal institutions, whereas foreign subsidiaries from developed countries are clearly at an advantage when competing in host countries with more stringent formal institutional conditions.

4.6. Limitations and Directions for Future Research

This study has provided valuable insight; however, further opportunities for future research exist based on its limitations. While this study focused on host countries in the context of Latina America (i.e., emerging market region), future studies in different contexts could strengthen the findings and conclusions of this research. Moreover, as the different dimensions of formal and informal institutions are expected to interact, studies could investigate how different configurations of formal and informal institutional distances affect the financial performance of foreign subsidiary firms. Future research can further advance the knowledge of how formal and informal institutions affect the performance of foreign subsidiary firms by differentiating the effects of distance from the profile effects. Studies could also investigate how different characteristics of the firm, such as international experience, resources (i.e., firm size) and the degree of multinationality (DOI), can moderate the effects of CD and FID on firm performance.

5. Conclusions

This study advances the knowledge of how FID and CD affect the financial performance of foreign subsidiary firms by considering the tacit characteristics of culture and the explicit nature of formal institutions. Due to these distinct characteristics of the constructs, the findings reveal that firms can convert their knowledge in dealing with formal institutional conditions in the home country into firm specific advantages (FSAs) when operating in foreign host countries with similar characteristics. On the other hand, the results show that the effects of CD on the financial performance of foreign subsidiary firms depend more on the direction towards host countries with specific profiles. Being aware of the conditions under which the effects of CD and FID can be more positive or negative can help firms choose the optimal entry mode and managerial practices to accommodate these effects in a way that increases the performance and the competitiveness of foreign subsidiaries in different contexts.

Author Contributions

H.C.d.C.: writing—original draft, writing—review and editing, data curation, investigation, formal analysis, validation. M.A.: writing—review and editing, investigation, formal analysis, validation. J.M.V.: writing—original draft, writing—review and editing, investigation, formal analysis, validation. All authors have read and agreed to the published version of the manuscript.

Funding

There is no funding support for this research project.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data used in this article was accessed on 10 November 2021 and can be found at Geert Hofstede website: https://geerthofstede.com/research-and-vsm/dimension-data-matrix/ and the World Bank—World Governance Indicators website: at: http://info.worldbank.org/governance/wgi/ and subsidiary data was obtained from the Orbis database.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Aguilera, Ruth V., Luciano Ciravegna, Alvaro Cuervo-Cazurra, and Maria Alejandra Gonzalez-Perez. 2017. Multilatinas and the internationalization of Latin American firms. Journal of World Business 52: 447–60. [Google Scholar] [CrossRef] [Green Version]

- Aguinis, Herman, Isabel Villamor, Sergio G. Lazzarini, Roberto S. Vassolo, José Ernesto Amorós, and David G. Allen. 2020. Conducting management research in Latin America: Why and what’s in it for you? Journal of Management 46: 615–36. [Google Scholar] [CrossRef] [Green Version]

- Ambos, Björn, and Lars Håkanson. 2014. The concept of distance in international management research. Journal of International Management 20: 1–7. [Google Scholar] [CrossRef]

- Baltagi, Badi H., and Baldev Raj. 1992. A survey of recent theoretical developments in the econometrics of panel data. Empirical Economics 17: 85–109. [Google Scholar] [CrossRef]

- Beckerman, Wilfred. 1956. Distance and the pattern of intra-European trade. The Review of Economics and Statistics 38: 31–40. [Google Scholar] [CrossRef]

- Beugelsdijk, Sjoerd, Tatiana Kostova, Vincent E. Kunst, Ettore Spadafora, and Marc Van Essen. 2018. Cultural Distance and Firm Internationalization: A Meta-Analytical Review and Theoretical Implications. Journal of Management 44: 89–130. [Google Scholar] [CrossRef] [Green Version]

- Chikhouni, Abdulrahman, Gwyneth Edwards, and Mehdi Farashahi. 2017. Psychic distance and ownership in acquisitions: Direction matters. Journal of International Management 23: 32–42. [Google Scholar] [CrossRef]

- Chopra, Rohit, and Juan Mier. 2017. Profitability Trends in Emerging Markets Setting the Stage for Active Management. New York: Lazard Asset Management LLC. [Google Scholar]

- Contractor, Farok J., Sumit K. Kundu, and Chin-Chun Hsu. 2003. A three-stage theory of international expansion: The link between multinationality and performance in the service sector. Journal of International Business Studies 34: 5–18. [Google Scholar] [CrossRef]

- Contractor, Farok, Yong Yang, and Ajai S. Gaur. 2016. Firm-specific intangible assets and subsidiary profitability: The moderating role of distance, ownership strategy and subsidiary experience. Journal of World Business 51: 950–64. [Google Scholar] [CrossRef]

- Correa da Cunha, Henrique. 2019. Asymmetry and the moderating effects of for-mal institutional distance on the relationship between cultural distance and performance: The case of multinational foreign subsidiaries in Latin America. In The Direction of Cultural Distance and the Performance of Foreign Subsidiaries in Latin America Disser-Tations No. 61. Halmstad: Halmstad University Press. [Google Scholar]

- Correa da Cunha, Henrique, Carlyle Farrell, Svante Andersson, Mohamed Amal, and Dinora Eliete Floriani. 2020. The Direction of Cultural Distance and the Performance of Foreign Subsidiaries in Latin America. In Academy of Management Proceedings. Briarcliff Manor: Academy of Management, vol. 2020, p. 22159. [Google Scholar]

- Correa da Cunha, Henrique, Carlyle Farrell, Svante Andersson, Mohamed Amal, and Dinora Eliete Floriani. 2022a. Toward a more in-depth measurement of cultural distance: A re-evaluation of the underlying assumptions. International Journal of Cross Cultural Management 22: 157–88. [Google Scholar] [CrossRef]

- Correa da Cunha, Henrique, Vik Singh, and Shengkun Xie. 2022b. The Determinants of Outward Foreign Direct Investment from Latin America and the Caribbean: An Integrated Entropy-Based TOPSIS Multiple Regression Analysis Framework. Journal of Risk and Financial Management 15: 130. [Google Scholar] [CrossRef]

- Cuervo-Cazurra, Alvaro, and Mehmet Erdem Genc. 2011. Obligating, pressuring, and supporting dimensions of the environment and the non-market advantages of developing-country multinational companies. Journal of Management Studies 48: 441–55. [Google Scholar] [CrossRef]

- Dow, Douglas. 2017. Are we at a Turning Point for Distance Research in International Business Studies? In Distance in International Business: Concept, Cost and Value. Bingley: Emerald Publishing Limited, pp. 47–68. [Google Scholar]

- Ficici, Aysun, Lingling Wang, C. Bulent Aybar, and Bo Fan. 2014. The Correlation between the Internationalization Processes and Performance of Firms: The Case of Emerging Market Firms of the BRIC Countries. Journal of Economics and Political Economy 1: 4–25. [Google Scholar]

- Gani, Azmat. 2007. Governance and foreign direct investment links: Evidence from panel data estimations. Applied Economics Letters 14: 753–56. [Google Scholar] [CrossRef]

- Geringer, J. Michael, and Louis Hebert. 1989. Control and performance of international joint ventures. Journal of International Business Studies 20: 235–54. [Google Scholar] [CrossRef] [Green Version]

- Globerman, Steven, and Daniel Shapiro. 2003. Governance Infrastructure and US Foreign Direct Investment. Journal of International Business Studies 34: 19–39. [Google Scholar] [CrossRef]

- Gorodnichenko, Yuriy, and Gerard Roland. 2011. Which dimensions of culture matter for long-run growth? American Economic Review 101: 492–98. [Google Scholar] [CrossRef] [Green Version]

- Gupta, Vipin, Paul J. Hanges, and Peter Dorfman. 2002. Cultural clusters: Methodology and findings. Journal of World Business 37: 11–15. [Google Scholar] [CrossRef]

- Hannan, Michael T., and John Freeman. 1984. Structural inertia and organizational change. American Sociological Review 49: 149–64. [Google Scholar] [CrossRef]

- Hay, Donald A., Derek Morris, and Derek J. Morris. 1991. Industrial Economics and Organization: Theory and Evidence. Oxford: Oxford University Press. [Google Scholar]

- Hernández, Virginia, and María Jesús Nieto. 2015. The effect of the magnitude and direction of institutional distance on the choice of international entry modes. Journal of World Business 50: 122–32. [Google Scholar] [CrossRef]

- Hernández, Virginia, María Jesús Nieto, and Andrea Boellis. 2018. The asymmetric effect of institutional distance on international location: Family versus nonfamily firms. Global Strategy Journal 8: 22–45. [Google Scholar] [CrossRef]

- Hofstede, Geert. 1980. Culture and organizations. International Studies of Management & Organization 10: 15–41. [Google Scholar]

- Hofstede, Geert, Gert Jan Hofstede, and Michael Minkov. 2005. Cultures and Organizations: Software of the Mind. New York: Mcgraw-Hill, vol. 2. [Google Scholar]

- Inglehart, Ronald, and Marita Carballo. 1997. Does Latin America Exist? (And is There a Confucian Culture?): A Global Analysis of Cross-Cultural Differences1. PS: Political Science & Politics 30: 34–47. [Google Scholar]

- Johanson, Jan, and Finn Wiedersheim-Paul. 1975. The internationalization of the firm—Four Swedish cases 1. Journal of Management Studies 12: 305–23. [Google Scholar] [CrossRef]

- Kaufmann, Daniel, and Aart Kraay. 2008. Governance Indicators: Where Are We. Where Should We Be Going? The World Bank Research Observer 23: 1–30. [Google Scholar] [CrossRef] [Green Version]

- Klasing, Mariko. J. 2013. Cultural dimensions, collective values and their importance for institutions. Journal of Comparative Economics 41: 447–67. [Google Scholar] [CrossRef]

- Kogut, Bruce, and Harbir Singh. 1988. The effect of national culture on the choice of entry mode. Journal of International Business Studies 19: 411–32. [Google Scholar] [CrossRef]

- Konara, Palitha, and Vikrant Shirodkar. 2018. Regulatory institutional distance and MNCs’ subsidiary performance: Climbing up vs. climbing down the institutional ladder. Journal of International Management 24: 333–47. [Google Scholar] [CrossRef]

- Kostova, Tatiana. 1996. Success of the Transnational Transfer of Organizational Practices Within Multinational Companies. Minneapolis: University of Minnesota. [Google Scholar]

- Kraus, Sascha, Tina C. Ambos, Felix Eggers, and Beate Cesinger. 2015. Distance and perceptions of risk in internationalization decisions. Journal of Business Research 68: 1501–5. [Google Scholar] [CrossRef]

- Linnemann, Hans. 1966. An Econometric Study of International Trade Flows (No. 42). Amsterdam: North-Holland. [Google Scholar]

- Magnani, Giovanna, Antonella Zucchella, and Dinorá Eliete Floriani. 2018. The logic behind foreign market selection: Objective distance dimensions vs. strategic objectives and psychic distance. International Business Review 27: 1–20. [Google Scholar] [CrossRef] [Green Version]

- Maseland, Robbert. 2013. Parasitical cultures? The cultural origins of institutions and development. Journal of Economic Growth 18: 109–36. [Google Scholar] [CrossRef]

- Mengistu, Alemu Aye, and Bishnu Kumar Adhikary. 2011. Does good governance matter for FDI inflows? Evidence from Asian economies. Asia Pacific Business Review 17: 281–99. [Google Scholar] [CrossRef]

- Meyer, Klaus E., Saul Estrin, Sumon Kumar Bhaumik, and Mike W. Peng. 2009. Institutions, resources, and entry strategies in emerging economies. Strategic Management Journal 30: 61–80. [Google Scholar] [CrossRef] [Green Version]

- Mukerji, Chandra. 2014. The cultural power of tacit knowledge: Inarticulacy and Bourdieu’s habitus. American Journal of Cultural Sociology 2: 348–75. [Google Scholar] [CrossRef]

- Neter, John, William Wasserman, and Michael H. Kutner. 1990. Applied Statistical Models. Burr Ridge: Richard D. Irwin, Inc. [Google Scholar]

- North, Douglass C. 1990. Institutions, Institutional Change and Economic Performance. Cambridge: Cambridge University Press. [Google Scholar]

- O’grady, Shawna, and Henry W. Lane. 1996. The psychic distance paradox. Journal of International Business Studies 27: 309–33. [Google Scholar] [CrossRef]

- Palepu, Krishna G., and Tarun Khanna. 1998. Institutional voids and policy challenges in emerging markets. The Brown Journal of World Affairs 5: 71. [Google Scholar]

- Peng, Mike W., Sunny Li Sun, Brian Pinkham, and Hao Chen. 2009. The institution-based view as a third leg for a strategy tripod. Academy of Management Perspectives 23: 63–81. [Google Scholar] [CrossRef] [Green Version]

- Polanyi, Michael. 1967. The Tacit Dimension. Anchor: Garden City. [Google Scholar]

- Ramamurti, Ravi, and Jitendra V. Singh. 2009. Emerging Multinationals in Emerging Markets. Cambridge: Cambridge University Press. [Google Scholar]

- Scott, William Richard. 1995. Institutions and Organizations. Thousand Oaks: Sage, vol. 2. [Google Scholar]

- Selmer, Jan, Randy K. Chiu, and Oded Shenkar. 2007. Cultural distance asymmetry in expatriate adjustment. Cross Cultural Management: An International Journal 4: 150–60. [Google Scholar] [CrossRef]

- Shenkar, Oded. 2001. CD revisited: Towards a more rigorous conceptualization and measurement of cultural differences. Journal of International Business Studies 32: 519–35. [Google Scholar] [CrossRef]

- Shenkar, Oded, Yadong Luo, and Orly Yeheskel. 2008. From “distance” to “friction”: Substituting metaphors and redirecting intercultural research. Academy of Management Review 33: 905–23. [Google Scholar] [CrossRef]

- Shenkar, Oded, Stephen B. Tallman, Hao Wang, and Jie Wu. 2020. National culture and international business: A path forward. Journal of International Business Studies 53: 516–33. [Google Scholar] [CrossRef]

- Stahl, Günter K., and Rosalie L. Tung. 2015. Towards a more balanced treatment of culture in international business studies: The need for positive cross-cultural scholarship. Journal of International Business Studies 46: 391–414. [Google Scholar] [CrossRef]

- Stein, Ernesto, and Christian Daude. 2001. Institutions, integration and the location of foreign direct investment. In Global Forum on International Investment: New Horizons for Foreign Direct Investment. Paris: OECD Publications Services, pp. 101–30. [Google Scholar]

- Stor, Marzena. 2021. The configurations of HRM bundles in MNCs by their contributions to subsidiaries’ performance and cultural dimensions. International Journal of Cross Cultural Management 21: 123–66. [Google Scholar] [CrossRef]

- Trąpczyński, Piotr, and Elitsa R. Banalieva. 2016. Institutional difference, organizational experience, and foreign affiliate performance: Evidence from Polish firms. Journal of World Business 51: 826–42. [Google Scholar] [CrossRef]

- Vaccarini, Katiuscia, Francesca Spigarelli, Ernesto Tavoletti, and Christoph Lattemann. 2017. Cultural Distance in International Ventures: Exploring Perceptions of European and Chinese Managers. Berlin/Heidelberg: Springer. [Google Scholar]

- Vahlne, Jan-Erik, and Jan Johanson. 2017. From internationalization to evolution: The Uppsala model at 40 years. Journal of International Business Studies 48: 1087–102. [Google Scholar] [CrossRef]

- Verbeke, Alain, Rob van Tulder, and Jonas Puck. 2017. Distance in International Business Studies: Concept, Cost and Value. In Distance in International Business: Concept, Cost and Value. Bingley: Emerald Publishing Limited, pp. 17–43. [Google Scholar]

- Wernick, David A., Jerry Haar, and Shane Singh. 2009. Do governing institutions affect foreign direct investment inflows? New evidence from emerging economies. International Journal of Economics and Business Research 1: 317–32. [Google Scholar] [CrossRef]

- Williamson, Oliver E. 1975. Markets and Hierarchies: Analysis and Antitrust Implications: A Study in the Economics of Internal Organization. New York: Free Press. [Google Scholar]

- World Bank. 2021. World Bank Open Data. Free and Open Access to Global Development Data. Washington, DC: The World Bank Group, Available online: https://data.worldbank.org/ (accessed on 1 December 2021).

- Zaheer, Srilata. 1995. Overcoming the liability of foreignness. Academy of Management Journal 38: 341–63. [Google Scholar]

- Zaheer, Srilata, Margaret Spring Schomaker, and Lilach Nachum. 2012. Distance without direction: Restoring credibility to a much-loved construct. Journal of International Business Studies 43: 18–27. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).