An Empirical Investigation of Risk-Return Relations in Chinese Equity Markets: Evidence from Aggregate and Sectoral Data

Abstract

1. Introduction

2. Literature Review

3. A Basic Model in Empirical Analysis

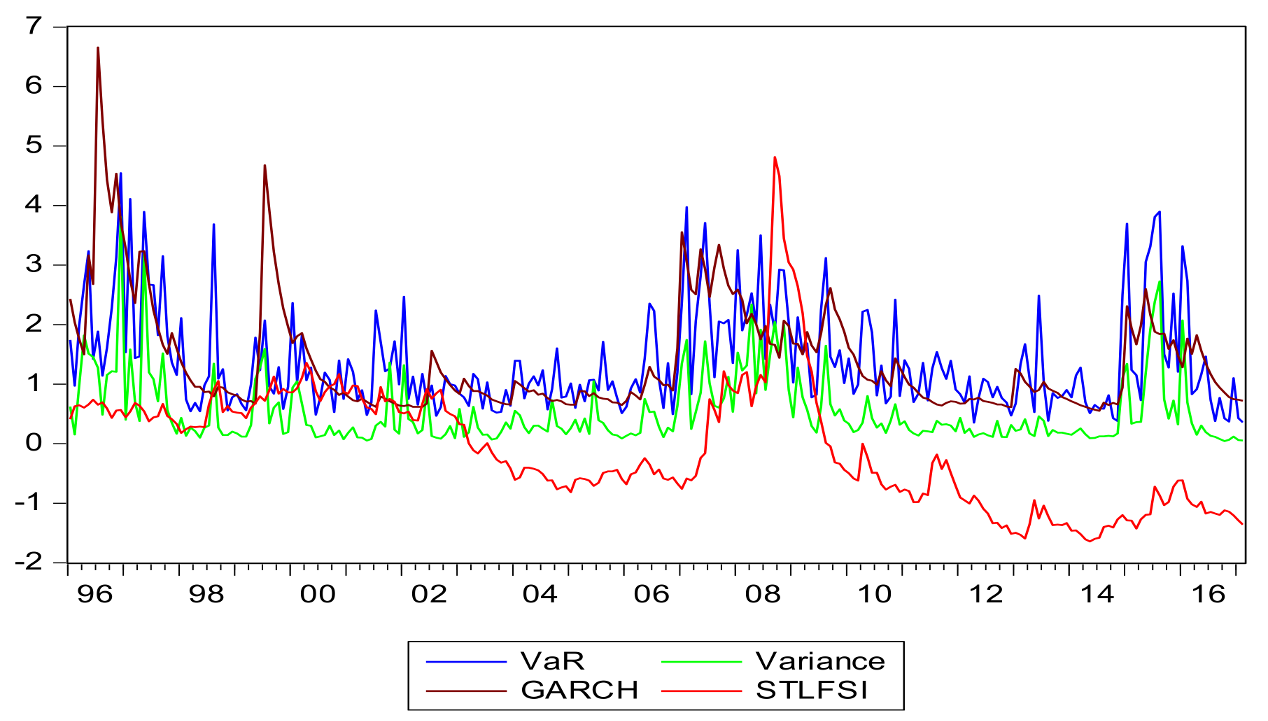

4. Selection of Variables

5. Data

6. Estimation Estimations

6.1. Summary of Statistics

6.2. Evidence from the Aggregate Market

6.3. Evidence from Sectoral Markets

6.4. Robustness Check

7. Conclusions

Author Contributions

Conflicts of Interest

References

- Acharya, Viral V., and Lasse Heje Pedersen. 2005. Asset pricing with liquidity risk. Journal of Financial Economics 77: 375–410. [Google Scholar] [CrossRef]

- Amihud, Yakov. 2002. Illiquidity and stock returns: Cross-section and time-series effects. Journal of Financial Markets 5: 31–56. [Google Scholar] [CrossRef]

- Amihud, Yakov, and Haim Mendelson. 1986. Asset pricing and the bid-ask spread. Journal of Financial Economics 17: 223–49. [Google Scholar] [CrossRef]

- Antoniou, Antonios, Gregory Koutmos, and Andreas Pericli. 2005. Index futures and positive feedback trading: Evidence from major stock exchanges. Journal of Empirical Finance 12: 219–38. [Google Scholar] [CrossRef]

- Bali, Turan G., and Nusret Cakici. 2010. World market risk, country-specific risk and expected returns in international stock markets. Journal of Banking and Finance 34: 1152–65. [Google Scholar] [CrossRef]

- Bali, Turan G., K. Ozgur Demirtas, and Haim Levy. 2009. Is there an intertemporal relation between downside risk and expected returns? Journal of Financial and Quantitative Analysis 44: 883–909. [Google Scholar] [CrossRef]

- Bali, Turan G., and Lin Peng. 2006. Is there a risk-return tradeoff? Evidence from high frequency data. Journal of Applied Econometrics 21: 1169–98. [Google Scholar] [CrossRef]

- Baillie, Richard T., and Ramon P. DeGennaro. 1990. Stock returns and volatility. Journal of Financial and Quantitative Analysis 25: 203–14. [Google Scholar] [CrossRef]

- Baker, Malcolm, and Jeffrey Wurgler. 2006. Investor sentiment and the cross-section of stock returns. Journal of Finance 61: 1645–80. [Google Scholar] [CrossRef]

- Baker, Malcolm, and Jeffrey Wurgler. 2007. Investor sentiment in the stock market. Journal of Economic Perspectives 21: 129–52. [Google Scholar] [CrossRef]

- Batten, Jonathan A., and Peter G. Szilagyi. 2016. The Internationalization of the RMB: New starts, Jumps and tipping points. Emerging Markets Review 28: 221–38. [Google Scholar] [CrossRef]

- Bekaert, Geert, Claude B. Erb, Campbell R. Harvey, and Tadas E. Viskanta. 1998. Distributional characteristics of emerging market returns and asset allocation. Journal of Portfolio Management 24: 102–16. [Google Scholar] [CrossRef]

- Bekaert, Geert, and Campbell R. Harvey. 1995. Time-varying world market integration. Journal of Finance 50: 403–44. [Google Scholar] [CrossRef]

- Bekaert, Geert, Campbell R. Harvey, and Christian Lundblad. 2007. Liquidity and expected returns: Lessons from emerging markets. Review of Financial Studies 20: 1783–831. [Google Scholar] [CrossRef]

- Bollerslev, Tim. 1986. Generalized autoregressive conditional heteroskedasticity. Journal of Econometrics 31: 307–27. [Google Scholar] [CrossRef]

- Bollerslev, Tim. 2010. Glossary to ARCH (GARCH) in Volatility and Time Series Econometrics: Essays in Honor of Robert Engle. Edited by Tim Bollerslev, Jeffrey Russell and Mark Watson. Oxford: Oxford University Press. [Google Scholar]

- Bollerslev, Tim, Ray Y. Chou, and Kenneth F. Kroner. 1992. ARCH modeling in finance: A review of theory and empirical evidence. Journal of Econometrics 52: 5–59. [Google Scholar] [CrossRef]

- Borst, Nicholas. 2017. Connecting China’s Stock Markets to the World. Federal Reserve Bank of San Francisco, January 4. Pacific Exchange Blog. Available online: http://www.frbsf.org/banking/asia-program/pacific-exchange-blog/china-stock-market-connect-shenzhen/ (accessed on 17 March 2018).

- Campbell, John Y., Andrew Wen-Chuan Lo, and Archie Craig MacKinlay. 1997. The Econometrics of Financial Markets. Princeton: Princeton University Press. [Google Scholar]

- Campbell, John Y., and Robert J. Shiller. 1988a. The dividend-price ratio and expectations of future dividends and discount factors. Review of Financial Studies 1: 195–227. [Google Scholar] [CrossRef]

- Campbell, John Y., and Robert J. Shiller. 1988b. Stock prices, earnings, and expected dividends. Journal of Finance 43: 661–76. [Google Scholar] [CrossRef]

- Chen, Nai-Fu, Richard Roll, and Stephen A. Ross. 1986. Economic forces and the stock market. Journal of Business 59: 383–403. [Google Scholar] [CrossRef]

- Chen, Xiaoyu, and Thomas C. Chiang. 2016a. Stock returns and economic forces—An empirical investigation of Chinese markets. Global Finance Journal 30: 45–65. [Google Scholar] [CrossRef]

- Chen, Cathy Yi-Hsuan, and Thomas C. Chiang. 2016b. Empirical analysis of the intertemporal relation between downside risk and expected returns: Evidence from time-varying transition probability models. European Financial Management 22: 749–96. [Google Scholar] [CrossRef]

- Cheng, Ai-Ru, and Mohammad R. Jahan-Parvar. 2014. Risk–return trade-off in the Pacific Basin equity markets. Emerging Markets Review 18: 123–40. [Google Scholar] [CrossRef]

- Chiang, Thomas C., and Jiandong Li. 2013. Modeling Asset Returns with Skewness, Kurtosis, and Outliers. In Handbook of Financial Econometrics and Statistics. Edited by John C. Lee and Cheng-Few Lee. New York: Springer Publishers, chp. 80. [Google Scholar]

- Chiang, Thomas C., and Shuh-Chyi Doong. 2001. Empirical Analysis of Stock Returns and Volatilities: Evidence from Seven Asian Stock Markets Based on TAR-GARCH Model. Review of Quantitative Finance and Accounting 17: 301–18. [Google Scholar] [CrossRef]

- Chiang, Thomas C., Huimin Li, and Dazhi Zheng. 2015b. The Intertemporal Return-Risk Relationship: Evidence from international Markets. Journal of International Financial Markets, Institutions and Money 39: 156–80. [Google Scholar] [CrossRef]

- Chiang, Thomas C., and Xiaoyu Chen. 2016a. Stock returns and economic fundamentals in an emerging market: An empirical investigation of domestic and global market forces. International Review of Economics and Finance 43: 107–20. [Google Scholar] [CrossRef]

- Chiang, Thomas C., and Xiaoyu Chen. 2016b. Empirical Analysis of Dynamic Linkages between China and International Stock Markets. Journal of Mathematical Finance 6: 189–212. [Google Scholar] [CrossRef]

- Chiang, Thomas C., Bang Nam Jeon, and Huimin Li. 2007. Dynamic correlation analysis of financial contagion: Evidence from Asian markets. Journal of International Money and Finance 26: 1206–28. [Google Scholar] [CrossRef]

- Chiang, Thomas C., and Dazhi Zheng. 2010. An empirical analysis of herd behavior in global stock markets. Journal of Banking and Finance 34: 1911–21. [Google Scholar] [CrossRef]

- Chiang, Thomas C., and Dazhi Zheng. 2015. Liquidity and stock returns: Evidence from international markets. Global Finance Journal 27: 73–97. [Google Scholar] [CrossRef]

- Cooper, S. Kerry, John C. Groth, and William E. Avera. 1985. Liquidity, exchange listing and common stock performance. Journal of Economics and Business 37: 19–33. [Google Scholar] [CrossRef]

- Cornish, E.A., and Ronald A. Fisher. 1937. Moments and Cumulants in the Specification of Distribution. Review of the International Statistical Institute 5: 307–20. [Google Scholar] [CrossRef]

- De Bondt, Werner F. M., and Richard Thaler. 1985. Does the stock market overreact? Journal of Finance 40: 793–805. [Google Scholar] [CrossRef]

- De Long, J. Bradford, Andrei Shleifer, Lawrence H. Summers, and Robert J. Waldmann. 1990. Positive feedback investment strategies and destabilizing rational speculation. Journal of Finance 45: 379–95. [Google Scholar] [CrossRef]

- De Santis, Giorgio, and Bruno Gerard. 1997. International asset pricing and portfolio diversification with time-varying risk. Journal of Finance 52: 1881–912. [Google Scholar] [CrossRef]

- Domowitz, Ian, Oliver Hansch, and Xiaoxin Wang. 2005. Liquidity commonality and return co-movement. Journal of Financial Markets 8: 351–76. [Google Scholar] [CrossRef]

- Elyasiani, Elyas, Shmuel Hauser, and Beni Lauterbach. 2000. Market response to liquidity improvements: Evidence from exchange listings. Financial Review 41: 1–14. [Google Scholar] [CrossRef]

- Engle, Robert F. 1982. Autoregressive conditional heteroskedasticity with estimates of variance of United Kingdom inflation. Econometrica 50: 987–1007. [Google Scholar] [CrossRef]

- Engle, Robert F. 1995. ARCH: Selected Readings. Oxford: Oxford University Press, UK. [Google Scholar]

- Engle, Robert F. 2009. Anticipating Correlations: A New Paradigm for Risk Management. Princeton: Princeton University Press USA. [Google Scholar]

- Fama, Eugene F., and Kenneth R. French. 1988. Dividend yields and expected stock returns. Journal of Financial Economics 22: 3–27. [Google Scholar] [CrossRef]

- Fama, Eugene F., and Kenneth R. French. 2015a. A five-factor asset pricing model. Journal of Financial Economics 116: 1–22. [Google Scholar] [CrossRef]

- Fama, Eugene F., and Kenneth R. French. 2015b. Dissecting Anomalies with a Five-Factor Model. Fama-Miller Working Paper. Available online: http://ssrn.com/abstract=2503174 (accessed on 15 December 2017).

- Federal Reserve Bank of St. Louis. 2014. What Is the St. Louis Fed Financial Stress Index? On the Economy. Available online: http://www.stlouisfed.org/on-the-economy/what-is-the-st-louis-fed-financial-stress-index/ (accessed on 30 June 2017).

- Forbes, Kristin J., and Roberto Rigobon. 2002. No contagion, only interdependence: Measuring stock market comovements. Journal of Finance 57: 2223–61. [Google Scholar] [CrossRef]

- French, Kenneth R., G. William Schwert, and Robert F. Stambaugh. 1987. Expected stock returns and volatility. Journal of Financial Economics 19: 3–29. [Google Scholar] [CrossRef]

- Gao, Yan, Chengjun Zhang, and Liyan Zhang. 2012. Comparison of GARCH models on different distributions. Journal of Computers 7: 1967–73. [Google Scholar] [CrossRef]

- Caporale, Guglielmo Maria, Faek Menla Ali, and Nicola Spagnolo. 2015. Oil price uncertainty and sectoral stock returns in China: A time-varying approach. China Economic Review 34: 311–21. [Google Scholar] [CrossRef]

- Ghysels, Eric, Pedro Santa-Clara, and Rossen Valkanov. 2005. There is a risk-return tradeoff after all. Journal of Financial Economics 76: 509–48. [Google Scholar] [CrossRef]

- Glosten, Lawrence R., Ravi Jagannathan, and David E. Runkle. 1993. On the relationship between GARCH and symmetric stable process: Finding the source of fat tails in data. Journal of Finance 48: 1779–802. [Google Scholar] [CrossRef]

- Govindaraj, Suresh, Joshua Livnat, Pavel G. Savor, and Chen Zhao. 2014. Large price changes and subsequent returns. Journal of Investment Management 12: 31–58. [Google Scholar] [CrossRef]

- Harvey, Campbell R., and Akhtar Siddique. 1999. Autoregressive Conditional Skewness. Journal of Financial and Quantitative Analysis 34: 465–87. [Google Scholar] [CrossRef]

- Harvey, Campbell R., John C. Liechty, Merrill W. Liechty, and Peter Muller. 2010. Portfolio selection with higher moments. Quantitative Finance 10: 469–85. [Google Scholar] [CrossRef]

- Karpoff, Jonathan M. 1987. The relation between price changes and trading volume: A survey. Journal of Financial and Quantitative Analysis 22: 109–26. [Google Scholar] [CrossRef]

- Lagarde, Christine. 2015. Press Release: IMF Executive Board Completes the 2015 Review of SDR Valuation. December 1. Available online: http://www.imf.org/en/news/articles/2015/09/14/01/49/pr15543 (accessed on 15 December 2017).

- Lesmond, David A. 2005. Liquidity of emerging markets. Journal of Financial Economics 77: 411–52. [Google Scholar] [CrossRef]

- Lettau, Martin, and Sydney Ludvigson. 2010. Measuring and modeling variation in the risk-return trade-off. In Handbook of Financial Econometrics. Edited by Yacine Aït-Sahalia, Lars Hansen and J. A. Scheinkman. Amsterdam: North Holland. [Google Scholar]

- Li, Hong. 2007. International linkages of the Chinese stock exchanges: A multivariate GARCH analysis. Applied Financial Economics 17: 285–97. [Google Scholar] [CrossRef]

- Merton, Robert C. 1973. An Intertemporal Capital Asset Pricing Model. Econometrica 41: 867–87. [Google Scholar] [CrossRef]

- Merton, Robert C. 1980. On estimating the expected return on the market. Journal of Financial Economics 8: 323–61. [Google Scholar] [CrossRef]

- Nelson, Daniel. 1991. Conditional heteroskedasticity in asset returns: A new approach. Econometrica 59: 347–70. [Google Scholar] [CrossRef]

- Pankratz, Alan. 1983. Forecasting with Univariate Box-Jenkins Models: Concepts and Cases. New York: John Wiley. [Google Scholar]

- Pastor, Ľuboš, and Robert F. Stambaugh. 2003. Liquidity risk and expected stock returns. Journal of Political Economy 111: 642–85. [Google Scholar] [CrossRef]

- Pericoli, Marcello, and Massimo Sbracia. 2003. A primer on financial contagion. Journal of Economic Surveys 17: 571–608. [Google Scholar] [CrossRef]

- Peiro, Amado. 1999. Skewness in financial returns. Journal of Banking and Finance 23: 847–62. [Google Scholar] [CrossRef]

- Rapach, David E., Jack K. Strauss, and Guofu Zhou. 2013. International stock return predictability: What is the role of the United States? Journal of Finance 68: 1633–22. [Google Scholar] [CrossRef]

- Rojas-Suarez, Liliana. 2014. Towards Strong and Stable Capital Markets in Emerging Market Economies. CGD Policy Paper 042. Washington: Center for Global Development, pp. 1–8. [Google Scholar]

- Scott, Robert C., and Philip A. Horvath. 1980. On the direction of preference for moments of higher order than the variance. Journal of Finance 35: 915–19. [Google Scholar] [CrossRef]

- Sentana, Enrique, and Sushil Wadhwani. 1992. Feedback traders and stock return autocorrelations: Evidence from a century of daily data. Economic Journal 102: 415–25. [Google Scholar] [CrossRef]

- Shi, Jian, Thomas C. Chiang, and Xiaoli Liang. 2012. Positive-feedback trading activity and momentum profits. Managerial Finance 38: 508–29. [Google Scholar] [CrossRef]

- Shiller, Robert J. 1981. Do stock prices move too much to be justified by subsequent changes in dividends? American Economic Review 71: 421–36. [Google Scholar]

| 1 | The research along this line has been popularized by the conditional variance (Baillie and DeGennaro 1990) using the generalized autoregressive conditional heteroscedasticity in mean (GARCH-M) model and its extensions to exponential GARCH (Nelson 1991) and threshold GARCH (Glosten et al. 1993). Bollerslev (2010) contains an encyclopedic type reference of ARCH acronyms used in the finance literature. |

| 2 | Chinese RMB constitutes 11% in the IMF’s basket of currencies. |

| 3 | Batten and Szilagyi (2016) provide a timely empirical analysis of the internationalization of the RMB. |

| 4 | Merton’s (1973) original article includes a hedging component that captures the investor’s motive to hedge future investment opportunities. However, a later article by Merton (1980) indicates that the hedging component can be negligible under certain conditions. Thus, the conditional expected excess return can be written as a linear relation of the market’s conditional variance. Some researchers, such as De Santis and Gerard (1997), Bali et al. (2009), Rapach et al. (2013), and Chiang et al. (2015b), prefer to include an additional covariance term between expected excess return and the stated variables to capture other risks besides market risk in their analyses of the CAPM. |

| 5 | In the empirical analysis, a conventional approach that follows an Engle type of model specification and is denoted by , which replaces (Engle 1982, 2009; Bollerslev 1986, 2010). Thus, this paper follows this same approach. |

| 6 | was considered as one of the control variables (Fama and French 1988; Campbell and Shiller 1988a) in the experiment stage. Due to its insignificance, this variable has been excluded. In addition, the higher moments of stock returns were removed from the list of control variables due to the inclusion of VaR, which is implied by the Cornish-Fisher expansion (1937). |

| 7 | Engle (1995, 2009), and Bollerslev (2010) provide different ARCH-type specifications and applications. |

| 8 | A kurtosis above 3 indicates “fat tails”, or leptokurtosis, relative to the normal, or Gaussian, distribution. Platykurtosis refers to a distribution that has a negative excess kurtosis with a relatively flatter peak rather than a normal distribution. |

| 9 | Engle (1995, 2009) and Bollerslev (2010) provide different ARCH-type specifications and applications. |

| 10 | The details of the variable list and the steps to constructing the index are given in the Appendix of National Economic Trends, January 2010; http://research.stlouisfed.org/publications/net/NETJan2010Appendix.pdf. |

| 11 | Baker and Wurgler (2006, 2007) use six different components to construct investment sentiment. Due to different market constraints and availability of data, investment sentiment will be different. |

| 12 | Both the ACF and PACF (partial ACF) for lagged one is 0.189. Comparing this value with the standard error 1/, where T (=observation) = 254, give the t-value = 0.189/0.063 = 3.00, which is significant at the 1% level. |

| 13 | We also estimate the effect by using illiquidity, which is negative and statistically significant. Since the results are similar, we do not report the estimated results here to save space. However, the result is available upon request. |

| 14 | We can use the Cornish-Fisher expansion (Cornish and Fisher 1937)

as a way to relate the -quantile of the probability distribution of stock return at time t, , to its corresponding skewness, and kurtosis, . The equation is: VaRt = 0.62 + 1.199 Vt − 0.387 + 0.069, = 0.90, where |

| 15 | The literature suggests that higher moments are important to explain stock returns (Scott and Horvath 1980; Harvey et al. 2010; Chiang and Li 2013). In an earlier version, we tested the model by including higher moments and the results reveal that the coefficients on the higher moments turn out to be statistically significant. However, the Akaike value turns out to be 5.22, which is higher than that of Model 3. The statistic also shows = 0.16, which is lower than that of Model 3. Therefore, we do not report the equation with higher moments. |

| 16 | Since the evidence shows that using stock return as a dependent variable produces a comparable result as that of excess return, we shall focus on the stock return. |

| 17 | The derivation of follows the same procedure as we derive the Chinese VaR. The is measured by the min of 21 daily stock returns of the world stock price index times (−1). |

| R | VaR | VARIANCE | GARCH* | SK | KU | MAX | |

|---|---|---|---|---|---|---|---|

| Mean | 0.3110 | 1.3685 | 0.5311 | 1.3966 | −0.05 | 1.3553 | 1.3417 |

| Median | 0.3654 | 1.0974 | 0.3038 | 0.9886 | −0.0569 | 0.8030 | 1.1395 |

| Maximum | 15.1544 | 4.5461 | 3.8087 | 6.6570 | 3.3171 | 13.2937 | 4.1020 |

| Minimum | −12.2664 | 0.3544 | 0.0450 | 0.5515 | −2.3038 | −1.5015 | 0.2958 |

| Std. Dev. | 3.6869 | 0.8477 | 0.5747 | 0.9294 | 0.9106 | 2.1117 | 0.7924 |

| Skewness | 0.1626 | 1.4227 | 2.2623 | 2.0613 | 0.3621 | 2.0003 | 1.3957 |

| Kurtosis | 5.0665 | 4.6027 | 9.4031 | 8.6485 | 3.7430 | 8.6109 | 4.6594 |

| Jonquiere | 46.316 | 112.86 | 650.56 | 517.54 | 11.392 | 502.56 | 111.61 |

| Q(12) | 19.44 | 299.28 | |||||

| (12) | 28.07 | ||||||

| Observations | 254 | 254 | 254 | 254 | 254 | 254 | 254 |

| Correlation | |||||

|---|---|---|---|---|---|

| t-Statistic | |||||

| 1 | |||||

| ----- | |||||

| 0.198 | 1 | ||||

| 2.37 | ----- | ||||

| 0.118 | −0.039 | 1 | |||

| 1.39 | −0.46 | ----- | |||

| 0.160 | −0.009 | 0.022 | 1 | ||

| 1.89 | −0.10 | 0.26 | ----- | ||

| 0.143 | 0.333 | −0.027 | 0.022 | 1 | |

| 1.69 | 4.13 | −0.31 | 0.26 | ----- | |

| Model | STLFSIt | STLFSIt−1 | Akaike | F1 | F2 | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | 0.320 | 88.842 | 2.101 | −1.085 | 1.139 | 1.417 | 0.250 | −0.282 | 0.858 | 11.22 | 11.22 | 5.30 | 0.02 | ||||

| 4.85 | 9.04 | 10.99 | −4.78 | 5.03 | 1.09 | 1.24 | −1.37 | 8.01 | 0.51 | 0.51 | |||||||

| 2 | −1.288 | 0.378 | 80.283 | 1.657 | −0.926 | 0.913 | 2.386 | 0.325 | −0.265 | 0.751 | 9.51 | 9.51 | 5.31 | 5.81 | 0.05 | ||

| −1.86 | 2.41 | 5.28 | 7.83 | −2.03 | 2.11 | 2.25 | 1.50 | −1.29 | 8.88 | 0.60 | 0.60 | 0.02 | |||||

| 3 | −1.347 | 1.145 | 2.367 | 70.535 | 1.577 | −0.460 | 0.706 | 1.543 | 0.378 | −0.286 | 0.752 | 13.54 | 13.54 | 5.07 | 609. | 304.7 | 0.18 |

| −1.56 | 4.46 | 24.69 | 7.30 | 7.55 | −2.32 | 3.34 | 2.56 | 3.38 | −3.01 | 23.70 | 0.33 | 0.33 | 0.00 | 0.00 | |||

| 4 | 3.174 | 0.199 | 2.831 | 264.47 | 8.216 | −5.707 | 5.249 | 9.186 | 0.858 | −0.494 | 0.668 | 10.78 | 10.78 | 7.20 | 7.88 | 0.16 | |

| 2.86 | 1.84 | 8.69 | 13.49 | 12.33 | −5.14 | 4.91 | 0.94 | 1.32 | −0.85 | 4.23 | 0.55 | 0.55 | 0.00 |

| Sectors | STLFSIt | STLFSIt−1 | Akaike | F1 | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Basic_M | −0.560 | 0.229 | 99.651 | 1.803 | −1.608 | 1.743 | 0.705 | 0.311 | −0.299 | 0.875 | 5.62 | 2.96 | 0.04 |

| −0.97 | 1.72 | 4.43 | 9.38 | −2.69 | 2.92 | 0.80 | 1.54 | −1.49 | 10.30 | 0.09 | |||

| Banks | −12.016 | 1.450 | 36.127 | 0.863 | −1.049 | 0.543 | 27.258 | 0.130 | 0.276 | 0.512 | 5.71 | 23.98 | 0.06 |

| −9.82 | 15.49 | 2.20 | 4.12 | −3.08 | 1.52 | 3.17 | 3.34 | 3.17 | 9.23 | 0.00 | |||

| Cons_Svs | −4.142 | 0.900 | 45.328 | 0.755 | −1.619 | 1.566 | 15.577 | 0.477 | −0.172 | 0.290 | 5.61 | 1.78 | 0.04 |

| −1.15 | 1.34 | 5.77 | 5.97 | −5.09 | 4.88 | 2.85 | 1.18 | −0.88 | 2.77 | 0.18 | |||

| Financial | −2.459 | 0.535 | 83.595 | 1.046 | −1.396 | 1.147 | 6.086 | 0.428 | −0.017 | 0.475 | 5.56 | 6.82 | 0.08 |

| −2.86 | 2.61 | 5.38 | 4.09 | −4.62 | 3.41 | 2.81 | 2.12 | −0.10 | 6.88 | 0.01 | |||

| Ind.Gs&S | −0.991 | 0.305 | 37.848 | 0.844 | −1.047 | 0.722 | 3.699 | 0.451 | −0.263 | 0.665 | 5.57 | 4.63 | 0.02 |

| −1.56 | 2.15 | 3.38 | 6.38 | −3.80 | 2.67 | 1.93 | 1.67 | −1.22 | 8.78 | 0.03 | |||

| Industrials | −1.522 | 0.322 | 64.621 | 0.543 | −1.213 | 0.777 | 3.533 | 0.440 | −0.420 | 0.697 | 5.76 | 4.35 | 0.02 |

| −2.20 | 2.09 | 3.72 | 1.65 | −2.11 | 1.35 | 1.80 | 1.65 | −1.57 | 6.35 | 0.04 | |||

| Oil&Gas | −0.671 | 0.159 | 55.241 | 2.597 | −1.175 | 1.386 | 3.061 | 0.751 | −0.811 | 0.840 | 5.49 | 2.50 | 0.02 |

| −1.19 | 1.58 | 8.78 | 52.34 | −4.13 | 4.81 | 1.68 | 1.27 | −1.25 | 24.92 | 0.11 | |||

| Real Estate | −18.948 | 3.420 | 59.969 | 0.901 | −1.695 | 1.812 | 21.987 | 0.006 | 0.040 | 0.267 | 5.89 | 13.38 | 0.00 |

| −4.14 | 3.66 | 2.52 | 3.95 | −3.24 | 3.42 | 4.62 | 0.92 | 2.07 | 3.75 | 0.00 | |||

| Retail | −1.511 | 0.453 | 119.98 | 0.959 | −0.520 | 0.403 | 1.243 | 0.329 | −0.205 | 0.713 | 5.67 | 2.90 | 0.03 |

| −1.56 | 1.70 | 3.24 | 1.48 | −0.62 | 1.01 | 1.63 | 3.04 | −1.84 | 9.04 | 0.09 | |||

| Utilities | 0.592 | 0.003 | 83.777 | 0.314 | −2.074 | 2.153 | 0.835 | 0.187 | −0.320 | 0.937 | 5.73 | 0.00 | 0.02 |

| 1.19 | 0.02 | 2.66 | 0.34 | −4.89 | 5.04 | 3.83 | 8.51 | −10.64 | 96.25 | 0.98 |

| Sectors | STLFSIt | STLFSIt−1 | Q(12) | Akaike | F1 | F2 | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Basic_M | −2.900 | 1.343 | 2.163 | 122.219 | 2.007 | −1.069 | 1.685 | 1.691 | 0.161 | −0.128 | 0.830 | 9.58 | 5.51 | 108.89 | 57.29 | 0.17 |

| −1.39 | 2.74 | 10.44 | 6.76 | 8.90 | −2.99 | 4.13 | 2.02 | 2.08 | −1.78 | 17.31 | 0.65 | 0.00 | 0.00 | |||

| Banks | −6.284 | 0.956 | 1.554 | 103.642 | 0.846 | −0.171 | −0.341 | 27.65 | 0.300 | 0.350 | 0.473 | 17.41 | 5.62 | 219.64 | 120.2 | 0.05 |

| −2.21 | 2.82 | 14.82 | 9.68 | 4.56 | −0.43 | −0.85 | 3.14 | 2.08 | 1.46 | 11.18 | 0.14 | 0.00 | 0.00 | |||

| Cons_Svs | −0.088 | 0.806 | 1.969 | 111.103 | 1.355 | 0.366 | −0.190 | 1.733 | 0.422 | −0.293 | 0.601 | 13.48 | 5.36 | 56.33 | 28.23 | 0.19 |

| −0.10 | 2.79 | 7.51 | 3.36 | 2.55 | 0.50 | −0.26 | 3.04 | 2.88 | −2.00 | 7.52 | 0.26 | 0.00 | 0.00 | |||

| Financial | −0.193 | 0.589 | 1.639 | 53.415 | 2.075 | −1.323 | 1.299 | 2.168 | 0.542 | −0.188 | 0.602 | 13.03 | 5.44 | 92.62 | 46.93 | 0.14 |

| −0.33 | 3.59 | 9.62 | 3.01 | 8.40 | −3.00 | 2.94 | 2.13 | 2.46 | −0.97 | 10.16 | 0.38 | 0.00 | 0.00 | |||

| Ind.Gs&S | −1.383 | 0.940 | 2.032 | 42.573 | 0.539 | −0.562 | 0.549 | 2.723 | 0.624 | −0.391 | 0.577 | 11.94 | 5.42 | 219.32 | 157.9 | 0.13 |

| −2.26 | 6.65 | 14.81 | 2.35 | 2.61 | −1.49 | 1.49 | 2.97 | 3.80 | −2.50 | 9.71 | 0.48 | 0.00 | 0.00 | |||

| Industrials | −1.971 | 0.945 | 2.129 | 67.970 | 0.490 | −1.064 | 0.461 | 1.548 | 0.280 | −0.261 | 0.796 | 13.22 | 5.63 | 114.06 | 57.16 | 0.09 |

| −1.97 | 3.38 | 10.68 | 3.17 | 1.56 | −1.95 | 0.83 | 2.77 | 2.20 | −1.91 | 19.57 | 0.35 | 0.00 | 0.00 | |||

| Oil&Gas | 0.110 | 0.721 | 2.176 | 15.497 | 1.678 | −0.258 | 0.022 | 2.157 | 0.481 | −0.268 | 0.500 | 14.11 | 5.20 | 72.75 | 36.71 | 0.13 |

| 0.12 | 2.37 | 8.53 | 0.53 | 3.47 | −0.41 | 0.03 | 3.59 | 2.86 | −1.36 | 4.62 | 0.29 | 0.00 | 0.00 | |||

| Real Estate | −4.328 | 1.468 | 1.818 | 78.107 | 0.704 | −0.831 | 0.739 | 1.796 | 0.137 | −0.111 | 0.831 | 10.41 | 5.71 | 53.87 | 28.10 | 0.10 |

| −1.77 | 2.60 | 7.34 | 2.76 | 1.60 | −1.69 | 1.27 | 1.98 | 2.05 | −1.66 | 18.55 | 0.58 | 0.00 | 0.00 | |||

| Retail | −1.035 | 0.770 | 1.443 | 109.601 | 1.014 | −0.728 | 0.931 | 1.363 | 0.288 | −0.191 | 0.727 | 12.42 | 5.62 | 19.24 | 9.95 | 0.08 |

| −0.86 | 2.18 | 4.39 | 3.11 | 1.85 | −0.87 | 1.15 | 1.64 | 2.71 | −1.80 | 10.03 | 0.41 | 0.00 | 0.00 | |||

| Utilities | 0.730 | 0.674 | 1.704 | 98.223 | 1.295 | −2.371 | 2.255 | 1.573 | 0.107 | −0.289 | 0.955 | 11.00 | 5.71 | 51.39 | 25.75 | 0.02 |

| 1.75 | 4.49 | 7.17 | 2.28 | 1.66 | −5.43 | 4.25 | 4.37 | 4.11 | −9.48 | 47.62 | 0.53 | 0.00 | 0.00 |

| Market | Q(12) | (12) | Akaike | F1 | F2 | F3 | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Market | −0.989 | 1.133 | 2.413 | 0.347 | 57.873 | 1.897 | 1.263 | 0.335 | −0.296 | 0.799 | 12.07 | 4.95 | 5.07 | 20.19 | 227.71 | 163.61 | 0.21 |

| −1.57 | 7.43 | 20.96 | 4.49 | 4.85 | 9.51 | 3.01 | 6.66 | −5.42 | 35.59 | 0.44 | 0.96 | 0.00 | 0.00 | 0.00 | |||

| Basic_M | −0.417 | 1.015 | 2.720 | 0.428 | 98.723 | 1.659 | 1.573 | 0.216 | −0.231 | 0.805 | 12.40 | 15.39 | 5.49 | 6.81 | 67.26 | 44.95 | 0.19 |

| −0.27 | 2.41 | 11.51 | 2.61 | 3.84 | 4.71 | 2.40 | 2.03 | −2.09 | 16.93 | 0.41 | 0.22 | 0.01 | 0.00 | 0.00 | |||

| Banks | −3.870 | 1.235 | 1.375 | 0.332 | 130.02 | 1.090 | 8.316 | 0.187 | −0.037 | 0.488 | 9.36 | 9.68 | 5.51 | 36.14 | 86.17 | 77.74 | 0.14 |

| −3.28 | 5.57 | 11.64 | 6.01 | 8.91 | 4.22 | 3.95 | 3.34 | −0.51 | 9.60 | 0.67 | 0.64 | 0.00 | 0.00 | 0.00 | |||

| Cons_Svs | −7.279 | 2.863 | 2.259 | 0.241 | 96.614 | 1.632 | 2.895 | 0.154 | −0.176 | 0.745 | 12.51 | 10.77 | 5.33 | 4.27 | 63.37 | 55.39 | 0.28 |

| −2.81 | 3.88 | 11.50 | 2.07 | 4.22 | 5.25 | 3.34 | 2.84 | −2.87 | 15.05 | 0.25 | 0.55 | 0.04 | 0.00 | 0.00 | |||

| Financial | −7.564 | 1.531 | 1.138 | 0.643 | 136.25 | 0.799 | 22.51 | 0.342 | −0.229 | 0.327 | 8.02 | 12.81 | 5.54 | 139.4 | 121.49 | 98.43 | 0.17 |

| −2.61 | 3.12 | 14.78 | 11.81 | 13.87 | 4.99 | 4.20 | 2.35 | −2.18 | 12.21 | 0.78 | 0.38 | 0.00 | 0.00 | 0.00 | |||

| Ind.Gs&S | −2.021 | 0.830 | 2.006 | 0.365 | 20.689 | 0.631 | 9.450 | 0.932 | −0.881 | 0.462 | 18.05 | 18.82 | 5.57 | 19.64 | 1071.5 | 717.23 | 0.13 |

| −1.24 | 2.52 | 46.29 | 4.43 | 2.48 | 9.64 | 3.21 | 1.87 | −1.90 | 11.22 | 0.11 | 0.09 | 0.00 | 0.00 | 0.00 | |||

| Industrials | −0.260 | 0.360 | 1.587 | 0.711 | 71.024 | 0.512 | 14.52 | 0.653 | −0.863 | 0.529 | 12.38 | 8.21 | 5.87 | 100.8 | 78.84 | 54.53 | 0.10 |

| −0.48 | 5.59 | −10.56 | −10.04 | 6.71 | 2.28 | 2.25 | 2.87 | −2.71 | 7.69 | 0.42 | 0.77 | 0.00 | 0.00 | 0.00 | |||

| Oil&Gas | −2.108 | 1.030 | 2.059 | 0.115 | 70.619 | 2.208 | 2.797 | 0.156 | −0.036 | 0.788 | 12.26 | 3.72 | 5.26 | 3.93 | 197.28 | 133.8 | 0.15 |

| −1.18 | 2.31 | 19.28 | 1.98 | 6.29 | 16.46 | 2.55 | 1.90 | −0.75 | 17.86 | 0.43 | 0.99 | 0.00 | 0.00 | 0.00 | |||

| Real Est. | −2.957 | 1.165 | 2.103 | 0.585 | 98.427 | 0.537 | 0.949 | 0.160 | −0.117 | 0.884 | 11.50 | 5.86 | 5.74 | 24.75 | 93.19 | 63.57 | 0.10 |

| −2.07 | 4.09 | 11.93 | 4.97 | 6.00 | 1.92 | 1.56 | 3.06 | −2.05 | 38.40 | 0.48 | 0.92 | 0.00 | 0.00 | 0.00 | |||

| Retail | −0.946 | 0.762 | 1.517 | 0.352 | 93.754 | 0.939 | 0.725 | 0.132 | −0.069 | 0.866 | 12.92 | 8.84 | 5.69 | 2.69 | 12.38 | 8.42 | 0.08 |

| −0.63 | 1.94 | 4.78 | 1.64 | 2.46 | 1.67 | 1.15 | 1.97 | −0.91 | 14.32 | 0.38 | 0.72 | 0.10 | 0.00 | 0.00 | |||

| Utilities | −3.160 | 1.153 | 1.830 | 0.253 | 85.819 | 1.415 | 1.684 | 0.104 | −0.117 | 0.887 | 13.93 | 6.07 | 5.28 | 9.00 | 268.40 | 179.93 | 0.10 |

| −2.14 | 3.90 | 22.20 | 3.00 | 8.02 | 11.16 | 3.36 | 3.02 | −2.84 | 88.17 | 0.31 | 0.91 | 0.00 | 0.00 | 0.00 |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chiang, T.C.; Zhang, Y. An Empirical Investigation of Risk-Return Relations in Chinese Equity Markets: Evidence from Aggregate and Sectoral Data. Int. J. Financial Stud. 2018, 6, 35. https://doi.org/10.3390/ijfs6020035

Chiang TC, Zhang Y. An Empirical Investigation of Risk-Return Relations in Chinese Equity Markets: Evidence from Aggregate and Sectoral Data. International Journal of Financial Studies. 2018; 6(2):35. https://doi.org/10.3390/ijfs6020035

Chicago/Turabian StyleChiang, Thomas C., and Yuanqing Zhang. 2018. "An Empirical Investigation of Risk-Return Relations in Chinese Equity Markets: Evidence from Aggregate and Sectoral Data" International Journal of Financial Studies 6, no. 2: 35. https://doi.org/10.3390/ijfs6020035

APA StyleChiang, T. C., & Zhang, Y. (2018). An Empirical Investigation of Risk-Return Relations in Chinese Equity Markets: Evidence from Aggregate and Sectoral Data. International Journal of Financial Studies, 6(2), 35. https://doi.org/10.3390/ijfs6020035