Abstract

This study tests the connectionbetween corporate governance structures and firm value, incorporating financial distress as a mediating mechanism among construction companies listed in ASEAN markets. Utilizing a sample of 58 firms drawn from an initial population of 169 companies over the 2018–2021 period, this study measures governance mechanisms through managerial ownership, institutional ownership, independent commissioners, audit committees, and litigation risk. Firm value is proxied by Tobin’s Q, while financial distress is assessed utilizing the Altman Z-Score. Panel data regression is employed to test the direct connections, and the Sobel test is used to evaluate the mediating role of financial distress. The outcome describes that managerial ownership and audit committees have a favorable effect on firm value, whereas independent commissioners and litigation risk exert a negative influence. Institutional ownership shows no significant association with firm value. Moreover, none of the governance mechanisms significantly affect financial distress, although financial distress itself has a detrimental impact on firm value. The mediation analysis describes that financial distress mediates only the connection between institutional ownership and firm value. These outcomes help clarify prior inconsistencies in the literature and underscore the importance of strengthening managerial ownership and audit committees, optimizing the role of independent commissioners, and mitigating litigation risk to sustain firm value.

1. Introduction

Corporate governance has become a central theme in accounting and finance literature because of its crucial role in mitigating agency conflicts, enhancing transparency, and strengthening managerial accountability. Well-designed governance mechanisms are widely believed to decrease information asymmetry and, ultimately, improve firm value. Muranda (2006) contends that inadequate governance exacerbated financial distress and increased the likelihood of business failure within the Zimbabwean banking system. This demonstrates that corporate governance serves not only as a monitoring tool but also as a crucial foundation for sustaining long-term business viability.

Muranda (2006) argues that inadequate governance intensified financial distress and increased the likelihood of business failure within the Zimbabwean banking system. This outcome underscores that corporate governance functions not only as a monitoring mechanism but also as a fundamental foundation for ensuring long-term business sustainability. However, this connection is not uniform across countries. Ramdani and Witteloostuijn (2010) report that board independence and CEO duality have differing effects on firm performance in Indonesia, Malaysia, South Korea, and Thailand. These divergent outcomes suggest that institutional and regulatory contexts play a critical role in forming the effectiveness of governance mechanisms in creating firm value.

The construction sector in the ASEAN region faces particularly complex challenges. Its capital-intensive and high-risk nature, combinedwith a strong dependence on government fiscal policy, makes the industry especially vulnerable to financial distress. Amalia (2019) finds that construction firms listed on the Indonesia Stock Exchange during the 2014–2018 period exhibited a pronounced vulnerability to financial distress, which directly affected their market value. A comparable pattern is observed in Vietnam, where Truong (2022) shows—utilizing an endogenous switching regression approach—that corporate governance significantly mitigates the risk of financial distress.

The major crisis that struck China’s Evergrande Group further underscores the urgency of this research. Once among the world’s largest construction and property conglomerates, the company suffered a severe liquidity crisis driven by weak governance, excessive debt accumulation, and inadequate risk management. The impact not only sharply diminished the firm’s valuebut also generated systemic risks for the regional economy. The Evergrande case illustrates how failures in corporate governance and financial risk management can lead to severe consequences, particularly in the construction sector, which exhibits similar structural characteristics across ASEAN countries.

The connection between governance and firm value tends to be indirect, with the firm’s financial condition acting as a mediating factor. This perspective is supported by empirical evidence, comprising the outcomes of Andari and Rahyuda (2021), which describe that financial distress may mediate the connection between financial performance and firm value. Fich and Slezak (2008) demonstrate that effective governance can help financially distressed firms decrease the risk of bankruptcy. However, empirical evidence in this area remains mixed. For example, Thanatawee (2014) finds a favorable connection between institutional ownership and firm value in Thailand, whereas outcome by other countries do not consistently support this association.

The inconsistencies observed across prior studies point to a significant gap in the existing literature. Agency theory posits that corporate governance is essential for mitigating conflicts of interest among managers and shareholders, whereas stewardship theory emphasizes managers’ roles as trustworthy stewards who act in the best interests of shareholders when overseeing the firm. Both theories suggest that governance has the potential to influence firm value; however, its effectiveness largely depends on the firm’s financial condition. Consequently, financial distress may serve as a mediating factor that helps explain variations in the governance–firm value connection across different contexts.

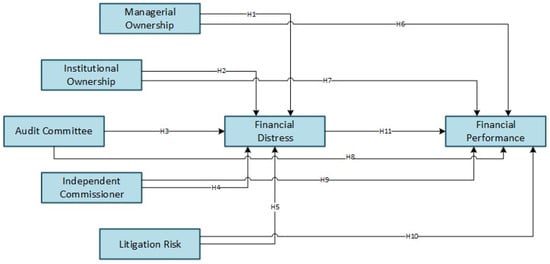

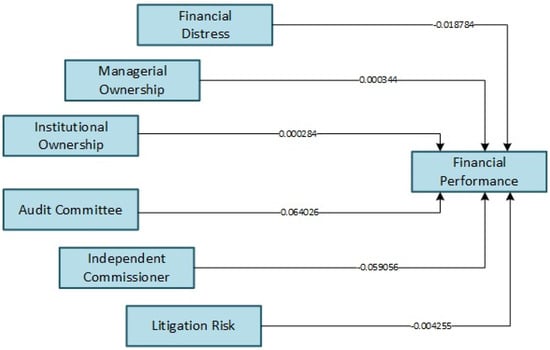

This study aims to analyze the impact of governance structures on the value of construction firms in the ASEAN region, with financial distress acting as a mediating variable. Figure 1 presents the conceptual framework that illustrates the hypothesized relationships between corporate governance structures, financial distress, and firm value. The governance structures tested in this study include managerial ownership, institutional ownership, independent commissioners, audit committees, and litigation risk, which together represent key elements of corporate governance frameworks. This research seeks to give theoretically by enriching the existing literature on corporate governance, financial distress, and firm value. In addition, the study offers practical insights for regulators, corporate managers, and investors in the construction sector by highlighting ways to strengthen governance mechanisms and anticipate potential financial difficulties. Ultimately, the outcomes are expected to assist firms in building long-term resilience and sustaining corporate value in an increasingly competitive market environment.

Figure 1.

Framework of Thought.

Research on the connection between corporate governance structure and firm value remains inconclusive, as existing outcomes fail to offer definitive conclusions. While some studies report a significant favorable effect (Ly & Duc, 2018; Mahubessy, 2021), others reveal outcomes that vary across institutional and regulatory contexts (Ramdani & Witteloostuijn, 2010). This lack of consensus is particularly relevant in the ASEAN construction sector, which faces a high risk of financial distress (Amalia, 2019; Truong, 2022).

In emerging markets, an expanding body of empirical evidence suggests that corporate governance mechanisms play a critical role in determining firm value and strengthening resilience under financial pressure. Alofaysan et al. (2024) document that sustainable governance practices, when integrated by corporate sustainability initiatives, enhance firm value efficiency among Saudi listed companies. Similarly, Anas et al. (2023) find that stronger governance structures are associated with superior firm performance in India during the COVID-19 crisis. Board characteristics also play a crucial role; Khan et al. (2024) report that gender-diverse boards decrease the likelihood of financial distress, particularly when monitoring effectiveness is not undermined by CEO duality. At the same time, ownership structure interacts with governance quality in mitigating agency problems. Almaharmeh et al. (2024) demonstrate that family ownership, when combined with strong governance quality, curbs aggressive tax avoidance in Jordan. Similarly, Senan (2024) emphasizes the mediating role of corporate governance in reinforcing the favorable connection between internal audit quality and financial reporting quality in Yemeni banks. Collectively, these studies describe that ownership structure, board independence, and other governance mechanisms can affect both firm value and financial distress. However, the existing evidence remains fragmented and largely country-specific, underscoring the need for further investigation in alternative institutional contexts, such as ASEAN construction firms that operate under high litigation risk and volatile financial conditions.

By financial distress positioned as a mediating variable, this study addresses the central research question: how does governance structure affect corporate value through financial distress? This question is grounded in prior empirical outcomes and established theoretical frameworks. To answer it, the study tests sixteen hypotheses encompassing the direct effect of governance structure on firm value, the influence of governance structure on financial distress, the impact of financial distress on firm value, and the mediating role of financial distress in these connections.

This study aims to (1) test the effect of governance structure on corporate value, (2) analyze the connection among governance structure and financial distress, (3) assess the impact of financial distress on firm value, and (4) investigate the mediating role of financial distress in the connection among governance structure and firm value inside of construction companies in the ASEAN region.

This article is organized into five sections to systematically address the research objectives. Section 1 introduces the study by outlining its context, defining the research problem, and stating the objectives. Section 2 reviews the relevant literature and presents the development of the study’s hypotheses. Section 3 describes the research methodology, comprising the research design, sample selection, variable measurement, and analytical techniques. Section 4 reports and discusses the empirical outcomes. Finally, Section 5 presents the conclusions, highlights the study’s findings, acknowledges its limitations, and offers directions for future research.

2. Materials and Methods

Interest alignment mechanisms are considered effective tools for harmonizing the objectives of shareholders and managers, and managerial ownership is widely viewed as a key means of achieving such alignment. Previous studies have demonstrated that managerial ownership plays a significant role in forming a firm’s asset value. Suastini et al. (2016) argue that higher levels of managerial share ownership can decrease agency conflicts and, in turn, improve overall business performance. Consequently, the initial hypothesis is put forward:

H1.

Managerial ownership has an effect on firm value.

There is a widespread belief that institutional investors are better equipped than individual investors to exercise effective managerial oversight. Masry (2016) found that, in the Egyptian context, institutional ownership has a favorable impact on firm performance. However, evidencefrom ASEAN countries remains mixed. While Thanatawee (2014) reported a favorable connection in Thailand, Ramdani and Witteloostuijn (2010) documented contrastingoutcomes in other institutional settings. The second hypothesis has been formulated:

H2.

Institutional ownership has an effect on firm value.

Independent commissioners are appointed to enhance the effectiveness of oversight and to limit managerial influence. According to Khosa (2017), their presence is favorably associated with firm value. However, other studies have identified a negative effect, particularly in situations where independence is largely symbolic rather than substantive. Therefore, a third hypothesis is proposed:

H3.

Independent commissioners have an impact on company value.

Audit committees play a crucial role in safeguarding the integrity and reliability of financial reporting. Klein (2002) finds that audit committee independence is associated with decreased earnings management, while Choi et al. (2014) show that the presence of an audit committee enhances shareholder welfare in Korean firms. Accordingly, the fourth hypothesis is proposed:

H4.

The audit committee has an impact on company value.

One potential external factor that may influence managerial behavior is exposure to legal risk. Nguyen et al. (2018) show that shareholder legal rights can affect firms’ cash flow policies, while Koh et al. (2014) find that litigation risk influences both corporate social performance and market value. Accordingly, the fifth hypothesis is proposed:

H5.

Litigation risk affects firm value.

Current research tests the extent to which managerial ownership can decrease the likelihood of a firm experiencing financial distress. The underlying rationale is that greater managerial share ownership aligns managers’ interests with the long-term success of the company, increasing their commitment to sustaining its performance. Suastini et al. (2016) suggest that higher managerial ownership can decrease agency conflicts and improve managerial efficiency, thereby lowering the likelihood of financial distress. In contrast, low levels of managerial ownership may increase the tendency for opportunistic behavior, which can heighten the risk of financial difficulties. Based on this reasoning, the following hypothesis is proposed:

H6.

Managerial ownership has an effect on financial distress.

Institutional ownership functions as a strong external monitoring mechanism, as institutional investors possess the resources, experience, and expertise needed to assess corporate risks, comprising the potential for financial distress. Masry (2016) finds that institutional investors have the ability to curb earnings management practices that may lead to financial distress. Similarly, Miglani et al. (2015) provide evidence from Australia showing that stronger governance—particularly through institutional ownership—is associated with a lower likelihood of distress. Accordingly, the seventh hypothesis is proposed:

H7.

Institutional ownership has an effect on financial distress.

Independent commissioners are entrusted with overseeing management and protecting shareholders’ interests. Their strong independence allows the board to restrain opportunistic managerial behavior and encourage more prudent strategic decision-making, thereby decreasing the risk of financial distress. Manzaneque et al. (2016) show that, in Spain, effective corporate governance—comprising the involvement of independent commissioners—can decrease the likelihood of financial distress. However, when independence exists merely as a formality, its effectiveness may be weakened. In light of these considerations, the following hypothesis is proposed:

H8.

Independent commissioners have an influence on financial distress.

Ensuring compliance with regulations and maintaining the quality of financial reporting are key responsibilities of the audit committee. An effective audit committee can limit excessive earnings management, enhance the credibility of financial statements, and strengthen internal control systems. Klein (2002) finds that audit committee independence can help prevent accounting manipulation practices. Similarly, Truong (2022) emphasizes the importance of sound corporate governance—comprising the role of audit committees—in alleviating financial distress in Vietnam. Accordingly, the ninth hypothesis is formulated:

H9.

The audit committee has an impact on financial distress.

One external factor that can affect a company’s financial condition is exposure to potential legal action. An increased likelihood of additional costs and operational challenges for the firm is associated with a higher risk of litigation. Koh et al. (2014) find that firms exposed to high litigation risk often experience financial pressure due to increased compliance costs and reputational damage. Conversely, the threat of litigation may encourage management to adopt a more cautious and disciplined approach, potentially decreasing financial strain. In light of these considerations, the tenth hypothesis is proposed:

H10.

Litigation risk has an impact on financial distress.

Financial distress erodes investor confidence and adversely affects market value. Altman (1968) introduced the Z-score as an early warning tool for forecasting bankruptcy, while Fich and Slezak (2008) argue that strong governance mechanisms can help protect firms from bankruptcy arising from financial distress. Based on this reasoning, the eleventh hypothesis is proposed:

H11.

Financial distress has an effect on company value.

In the presence of financial difficulties, managerial ownership is found to influence firm value both directly and indirectly. As managers’ shareholdings increase, they have stronger incentives to avoid high-risk decisions that could lead to adverse outcomes. Consequently, managers tend to have a greater personal stake in the firm’s performance compared to other shareholders. Prior literature argues that managerial ownership can reduce agency conflicts and enhance firm performance by aligning the interests of managers and shareholders (Jensen & Meckling, 1976; McConnell & Servaes, 1990; Demsetz & Lehn, 1985). Moreover, when a company faces financial difficulties, managerial ownership may serve as an important mechanism for mitigating declines in firm value. Accordingly, the following hypothesis is proposed:

H12.

Financial distress mediates the effect of managerial ownership on firm value.

Institutional ownership functions as an effective monitoring mechanism that can discourage opportunistic managerial behavior. Institutional investors typically emphasize long-term stability, thereby decreasing the likelihood of financial distress. Masry (2016) suggests that institutional ownership can enhance the effectiveness of managerial oversight. As financial distress declines, firm value tends to increase. Within this context, financial distress may serve as a significant mediating factor. Accordingly, the following hypothesis is proposed:

H13.

Financial distress mediates the effect of institutional ownership on firm value.

Independent commissioners perform several vital functions, most notably maintaining independent judgment and enhancing the overall quality of corporate oversight. Their presence may help curb excessive managerial behavior, thereby decreasing the likelihood of financial distress. Manzaneque et al. (2016) demonstrate that effective governance, particularly through board independence, is associated with a lower risk of distress. Accordingly, independent commissioners may influence firm value by financial distress, acting as a mediating variable in this connection. Based on this reasoning, the following hypothesis is proposed:

H14.

Financial distress mediates the influence of independent commissioners on firm value.

The audit committee is responsible for ensuring the accuracy of the organization’s financial reporting, compliance with regulatory requirements, and the effective functioning of internal control systems. The presence of a strong audit committee is associated with a reduction in earnings management practices, which are frequently a source of concern for stakeholders (Klein, 2002; Truong, 2022). By proactively implementing strategies to address potential challenges, a firm can preserve its value and potentially strengthen investor perception. The subsequent formulation presents the fifteenth hypothesis, detailed as follows:

H15.

Financial distress mediates the influence of the audit committee on firm value.

When a firm is exposed to potential litigation, its financial condition may come under pressure due to rising costs. Koh et al. (2014) note that companies facing elevated litigation risk are more likely to experience financial distress, which can ultimately lead to a decline in firm value. Conversely, the threat of legal action may, under certain conditions, encourage management to adopt a more disciplined approach, thereby potentially decreasing the likelihood of financial distress. Accordingly, financial distress is viewed as a mechanism that mediates the connection between litigation risk and firm value. Based on this reasoning, the following hypothesis is proposed:

H16.

Financial distress mediates the effect of litigation risk on firm value.

This study adopts a causal research design using a quantitative approach to test the connections among the variables proposed in the hypotheses. The analysis focuses on construction companies listed on ASEAN stock exchanges during the 2018–2021 period. The study seeks to explain the connection between corporate governance structures and firm value, with financial distress serving as a mediating variable.

The study population consisted of all construction companies previously listed on the ASEAN stock exchanges, totaling 169 firms based on initial records. Applying selection criteria focused on the availability of complete and audited financial statements decreased the eligible sample to 134 companies. Further screening based on the completeness of data for the research variables resulted in 77 companies. After identifying and excluding 19 outliers, the final sample comprised 58 companies included in the analysis. Data analysis was conducted in several stages:

- Descriptive statistical measures were used to summarize the characteristics of the data, comprising the mean, median, minimum, maximum, and standard deviation for each research variable. (Ghozali, 2018).

- Panel Data Regression Analysis was utilized to investigate the influence of independent variables on both mediating and dependent variables. The Chow, Hausman, and LM tests were conducted to identify the most appropriate specification among the common effects, fixed effects, and random effects models. The outcome describes that the random effects model is best suited for analyzing financial distress, whereas the fixed effects model is more appropriate for examining firm value.

- The Sobel test was employed to evaluate the mediating role of financial distress in the connection between corporate governance structure and firm value. (Ghozali, 2018).

- The t-test is employed in hypothesis testing to evaluate the significance of both direct and indirect connections among variables within the empirical model.

3. Result

This study uses a sample of construction companies listed on ASEAN stock exchanges in 2022. Of the 77 firms with complete data, an outlier identification process was conducted to exclude companies exhibiting extreme characteristics or performance that could potentially distort the analysis outcome. Through this process, 19 companies were identified as outliers and subsequently excluded from the analysis. As a result, the final sample comprised 58 construction companies, which was deemed more representative for the study. Table 1 presents the distribution of ASEAN construction companies included in the sample across countries

Table 1.

ASEAN Construction Company Subjects.

3.1. F-Statistic Test or Chow Test

The Chow test was applied to both the financial distress and firm value models to determine the most appropriate specification among the common effects and fixed effects models. This test is designed to detect differences across time periods, which suggests that the fixed effects model is more appropriate than the common effects model. The outcome of the Chow tests for both models is presented in Table 2 and Table 3, respectively.

Table 2.

Chow Test for Financial Distress Model.

Table 3.

Chow Test for Firm Value Model.

The Chow test was performed to determine the more appropriate specification among the common effects and fixed effects models. The outcome for the financial distress model shows a probability value of 0.0000,which is below the 0.05 significance threshold (Cross-section F = 15.231875; Chi-square = 420.940244). These outcomes support the conclusion that the fixed effects model is appropriate. The Chow test for the firm value model yields a probability value of 0.0000, which is below the 0.05 significance level (Cross-section F = 958.159322; Chi-square = 1342.624069), confirming that the fixed effects model is the most suitable specification.

3.2. Hausman Test

The Hausman test is used to determine the appropriate specification—fixed effects or random effects—for the financial distress and firm value models. By examining whether systematic differences exist in the estimated coefficients, the test assesses the validity of the random-effects assumption relative to the fixed-effects alternative. The outcome of the Hausman tests for each model is reported in the Table 4 and Table 5.

Table 4.

Hausman Test for Financial Distress Model.

Table 5.

Hausman Test for Firm Value Model.

The Hausman test was conducted to contrast the suitability of fixed effects and random effects models. Since the probability value for the financial distress model is 0.1613, exceeding the 0.05 significance level (Chi-Sq = 7.908719), the random effects model is identified as the most appropriate specification. For the firm value model, the probability value is 0.0052,which is below the 0.05 significance threshold (Chi-Sq = 18.441696), indicating that the fixed effects model is the most appropriate specification. Accordingly, this study applies a random effects model to analyze financial distress and a fixed effects model to test firm value.

3.3. Classical Multicollinearity Assumption Test

A multicollinearity test was conducted to verify the absence of strong linear connections among the independent variables in both the financial distress and firm value models. This assessment is essential to ensure the reliability of coefficient estimates and to prevent distortions in the regression outcome caused by intercorrelations among explanatory variables. The outcome of the multicollinearity tests for each model is presented in Table 6 and Table 7.

Table 6.

Multicollinearity Test for Financial Distress Model.

Table 7.

Multicollinearity Test for Firm Value Model.

A multicollinearity assessment was conducted to ensure that no strong linear connections existed among the independent variables included in the model. The outcome for the financial distress model, presented in Table 6, shows that the correlations among the independent variables are all below the critical threshold of 0.90.

In the firm value model (Table 7), the correlation coefficients among the independent variables are all below 0.90. The strongest correlation is observed between managerial ownership and independent commissioners, with a value of −0.514. This describes that the connections among the independent variables are not sufficiently strong to pose multicollinearity concerns.

3.4. Panel Data Linear Regression Analysis

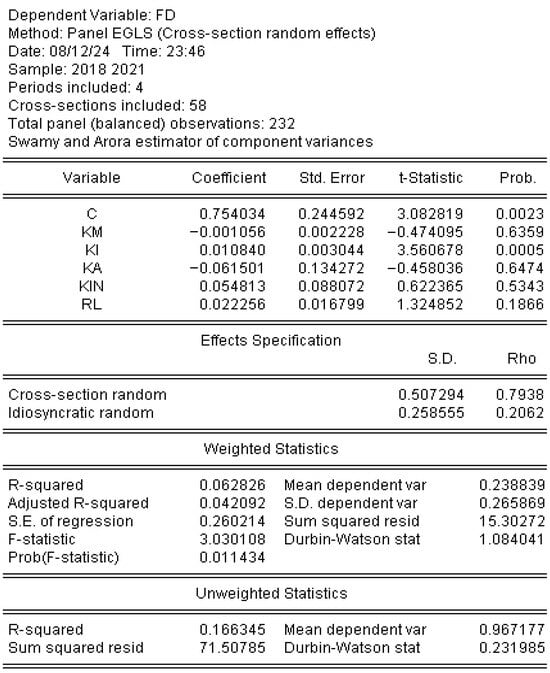

In the subsequent phase, following the completion of the classical assumption tests and model selection procedures, regression estimation is carried out to evaluate the impact of the independent variables on the level of financial distress. The Hausman test suggests that the random effects model is the most appropriate specification; therefore, this study employs the Panel EGLS (Cross-Section Random Effects) approach. Figure 2 presents the outcome of the panel data regression analysis for the financial distress model.

Figure 2.

Linear Regression Data Panel for Financial Distress Model. Source: processed data.

The linear regression equation applied in this study is expressed based on the outcome presented in Table 8.

FD = 0.754034 − 0.001056 (KM) + 0.010840 (KI) − 0.061501 (KA) + 0.054813 (KIN) +

0.022256 (RL)

0.022256 (RL)

Table 8.

Hypothesis Test.

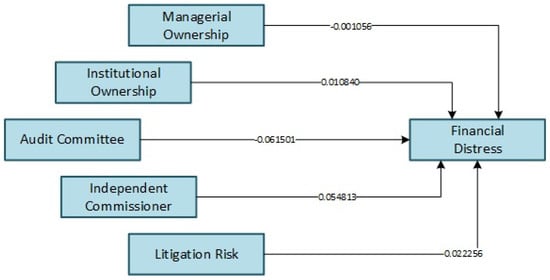

Figure 3 illustrates the financial distress research model employed in this study, showing the relationships between corporate governance mechanisms and financial distress. The R-squared value of 0.062826 indicates that only 6.28% of the variation in financial distress is explained by the independent variables included in the model, with the remaining varianceattributed to external factors beyond the model’s scope. Nevertheless, the F-statistic of 3.030138 and a corresponding probability of 0.011434 confirm that the model is simultaneously significant at the 5% confidence level. Consequently, although the model is statistically significant overall, none of the corporate governance mechanisms—comprising institutional ownership—exhibits a significant individual effect on financial distress. This outcome suggests that, within ASEAN construction companies, financial distress is largely driven by external conditions and broader ownership structures, while internal governance mechanisms play a limited role in decreasing distress risk. Figure 4 presents the linear panel regression results for the firm value model.

Figure 3.

Financial Distress Research Model.

Figure 4.

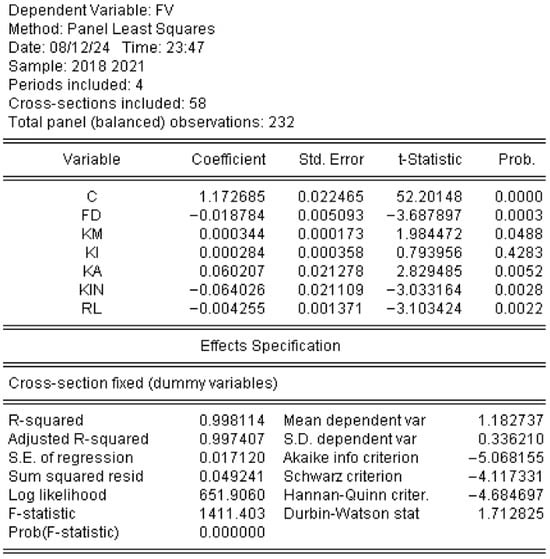

Linear Regression Data Panel for the Firm Value Model. Source: processed data.

The test outcome presented in Table 8 describes that the linear regression equation employed in this study can be expressed as follows:

NP = 1.172685 − 0.018784 (FD) + 0.000344 (KM) + 0.000284 (KI) + 0.064026 (KA) − 0.059056 (KIN) − 0.004255 (RL)

Figure 5 illustrates the firm value research model based on the estimated regression coefficients. The model explains 99.81% of the variation in firm value, as described by an R-squared value of 0.998141. This outcome suggests that the independent variables included in the analysis account for nearly all the observed variation in firm value within the sample. Furthermore, the F-statistic of 1411.403 by a probability of 0.000000 confirms that the model is statistically significant at the 1% confidence level.

Figure 5.

Firm Value Research Model.

The regression analysis shows that managerial ownership and audit committee ownership favorably influence firm value, whereas independent commissioners, litigation risk, and financial distress have a negative effect on firm value. In contrast, institutional ownership does not appear to have a significant impact on corporate value.

3.5. Regression Significance Test (F Test)

- N value by F table Financial Distress at α = 5%, k = 5, dk = nk = 232 − 5 = 227 is 2.25381876

- N value by the F table of Company Value at α = 5%, k = 6, dk = nk = 232 − 6 = 226 is 2.13884697

The F-test outcome describes that both the financial distress and firm value regression models are statistically significant when evaluated jointly. Specifically, the financial distress model records an F-statistic of 3.030138 by a corresponding probability of 0.011434, which is below the 0.05 significance level and exceeds the critical F-table value of 2.2538. The firm value model yields an F-statistic of 1411.403 by a significance probability of 0.000000, which is well below the 0.05 threshold and exceeds the critical F-table value of 2.1388. This describes that the model is statistically significant overall, confirming that governance variables collectively influence both financial distress and firm value.

3.6. Significance Test of Regression Coefficient (t-Test)

Based on Fugure 3 the Financial Distress Model shows that the calculated t-values for managerial ownership, institutional ownership, audit committee, independent commissioner, and litigation risk are −0.474095, 3.560676, −0.458036, 0.622365, and 1.324852, respectively. The corresponding significance levels are 0.6359, 0.0005, 0.6474, 0.5343, and 0.1866. Meanwhile, the critical t-value at a 5% significance level (α = 0.05), by degrees of freedom calculated as dk = n − k − 1 = 232 − 5 − 1 = 226, is 1.97051624.

Based on Figure 4 the Company Value Model shows that financial distress has a coefficient of −3.687897, managerial ownership 1.984472, institutional ownership 0.793956, audit committee 2.829485, independent commissioner −3.033164, and litigation risk −3.103424. The corresponding significance levels are 0.0003, 0.0488, 0.4283, 0.0052, 0.0028, and 0.0022, respectively. Meanwhile, the critical t-value at a 5% significance level (α = 0.05) by degrees of freedom calculated as dk = n − k − 1 = 232 − 6 − 1 = 225 is 1.97056339.

4. Discussion

Overall, the study finds that corporate governance enhances firm value primarily through direct mechanisms—namely, managerial ownership, audit committees, independent commissioners, and litigation risk—while financial distress serves as a significant mediating factor only in the connection between institutional ownership and firm value.

The study’s outcomes describe that management ownership (H1) significantly enhances a corporation’s value (p = 0.0488). This outcome is consistent with agency theory, which posits that higher managerial share ownership can decrease potential conflicts of interest among managers and shareholders, thereby enhancing firm value. The role of managerial ownership as a key mechanism for aligning the interests of owners and managers is further supported by the earlier study of S. W. Hidayat and Pesudo (2019).

In contrast, institutional ownership (H2) was found to have no significant effect on firm value (p = 0.4283). This outcome differs from the outcomes of T. Hidayat et al. (2021) and Pitri (2021), who reported a favorable connection between institutional ownership and firm value. This discrepancy may be explained by the distinctive characteristics of the ASEAN construction sector, where limited managerial control by institutional investors constrains their ability to influence corporate value.

The outcomes reveal that independent commissioners have a significant negative effect on firm value (p = 0.0028). This outcome lends further support to the conclusions of Laily (2019) and T. Hidayat et al. (2021), who argue that the presence of independent commissioners does not automatically translate into higher corporate value. In practice, an excessive emphasis on board independence may constrain managerial decision-making and ultimately weaken a firm’s competitiveness.

Audit committees (H4) were found to have a significant favorable effect on firm value (p = 0.0052), outperforming the role of independent commissioners. This outcome is consistent with the outcomes of Istia’adah (2016) and further supported by Valensia and Khairani (2019), who report that the presence of an effective audit committee enhances the quality of financial reporting and strengthens investor confidence.

Litigation risk (H5) is found to have a significant negative effect on firm value (p = 0.0022). The outcome suggests that greater exposure to legal risk is associated with a decline in a firm’s market valuation. This outcome is consistent with Koh et al. (2014), who report that elevated litigation risk increases compliance costs and adversely affects corporate reputation.

The outcome offers no empirical support for hypotheses H6–H10, indicating that the tested governance mechanisms do not directly account for financial distress in ASEAN construction companies. Specifically, the analysis finds no evidence of a direct connection among managerial ownership, institutional ownership, independent commissioners, audit committees, or litigation risk and the financial difficulties experienced by firms in this sector. The outcomes of Miglani et al. (2015) in Australia and Manzaneque et al. (2016) in Spain, which report a significant effect of corporate governance on financial distress, stand in contrast to the outcome of the present study. This divergence may be attributed to the capital-intensive characteristics of the construction industry, which make firms particularly sensitive to external influences such as project cycles, regulatory environments, and broader macroeconomic conditions.

The outcomes of this study confirm that financial distress has a significant negative effect on firm value (p = 0.0003). Heightened levels of distress erode investor confidence and directly undermine market valuation. Notably, substantial variation in distress levels is observed among construction firms across ASEAN countries. For example, Acset Indonusa Tbk (Indonesia) records a minimum value of −5.392970, reflecting severe financial distress, whereas Quang Nam Transportation JSC (Vietnam) demonstrates a value of 9.365255, indicating strong financial health. These outcomes underscore the critical importance of financial stability in sustaining firm value.

The Sobel test outcome reveals that financial distress acts as a significant mediating variable in the connection between institutional ownership and firm value (H13, p = 0.012). This suggests that institutional investors can influence corporate value by mitigating financial distress. These outcomes are consistent with those of Andari and Rahyuda (2021), who identified financial distress as a key mediator in explaining the link between financial performance and firm value.

In contrast, the outcomes show that financial distress does not function as a mediating variable in other connections, comprising managerial ownership (H12), independent commissioners (H14), audit committees (H15), and litigation risk (H16). This suggests that not all governance mechanisms influence firm value through financial distress; rather, many operate primarily through direct effects.

The analysis of the outcomes suggests that the effectiveness of corporate governance is closely shaped by industry conditions and the firm’s financial context. The evidence shows that managerial ownership and audit committees significantly contribute to enhancing firm value in ASEAN construction companies. In contrast, the presence of independent commissioners and heightened litigation risk is associated with a significant decline in firm value. Conversely, financial distress is generally associatedwith a decline in firm value; however, its role as a mediating variable is significant only in the connection between institutional ownership and firm value. By highlighting this distinction, the study helps reconcile inconsistencies in prior research and suggests that, within the ASEAN construction industry, governance mechanisms are more effective when operating through direct channels rather than through the mediation of financial distress.

5. Conclusions

This study investigates the connection between corporate governance structures and firm value among construction companies in ASEAN, with financial distress considered as a mediating variable. The outcome reveals that managerial ownership and audit committee ownership have a favorable effect on firm value, while the presence of independent commissioners and litigation risk negatively impacts firm value. In contrast, institutional ownership does not exhibit a significant influence on corporate value.

Inside a challenging financial environment, none of thetested governance mechanisms—managerial ownership, institutional ownership, independent commissioners, audit committees, or litigation risk—exerted a significant influence on the level of financial distress. In contrast, financial distress was found to substantially decrease firm value, underscoring its adverse effect on investor confidence and overall market perception.

Additionally, the Sobel test outcome describes that financial distress acts as a significant mediating variable in the connection between institutional ownership and firm value, while no mediating effects are observed for the other variables. These outcomes suggest that, within the ASEAN construction sector, governance mechanisms generally enhance firm value through direct pathways, with financial distress playing a mediating role only in the context of institutional ownership.

Author Contributions

Conceptualization, A.F., N.N.A., H.S. and T.F.; methodology, A.F. and T.F.; formal analysis, A.F.; investigation, A.F.; data curation, A.F.; writing—original draft preparation, A.F.; writing—review and editing, N.N.A., H.S. and T.F.; supervision, N.N.A., H.S. and T.F.; project administration, A.F. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data used in this study were obtained from publicly available annual reports and financial statement databases of construction companies listed on ASEAN stock exchanges. Additional details are available from the corresponding author upon reasonable request.

Acknowledgments

The authors would like to thank their respective institutions for the support provided during the completion of this research.

Conflicts of Interest

The authors declare no conflicts of interest.

Abbreviations

The following abbreviations are used in this manuscript:

| ASEAN | Association of Southeast Asian Nations |

| CG | Corporate Governance |

| MO | Managerial Ownership |

| IO | Institutional Ownership |

| IC | Independent Commissioner |

| AC | Audit Committee |

| LR | Litigation Risk |

| FD | Financial Distress |

| FV | Firm Value |

| TQ | Tobin’s Q |

| ZS | Altman Z-Score |

References

- Almaharmeh, M. I., Shehadeh, A., Alkayed, H., Aladwan, M., & Iskandrani, M. (2024). Family ownership, corporate governance quality and tax avoidance: Evidence by an emerging market—The case of Jordan. Journal of Risk and Financial Management, 17(2), 86. [Google Scholar] [CrossRef]

- Alofaysan, H., Jarboui, S., & Binsuwadan, J. (2024). Corporate sustainability, sustainable governance, and firm value efficiency: Evidence by Saudi listed companies. Sustainability, 16, 5436. [Google Scholar] [CrossRef]

- Altman, E. I. (1968). Financial ratios, discriminant analysis and the prediction of corporate bankruptcy. The Journal of Finance, 23(4), 589–609. [Google Scholar] [CrossRef]

- Amalia, F. (2019). Analisis perbandingan financial distress pada perusahaan konstruksi di bursa efek indonesia tahun 2014–2018. E-Jurnal Ekonomi Dan Sosial, 10(1), 11. [Google Scholar]

- Anas, M., Gulzar, I., Tabash, M. I., Ahmad, G., Yazdani, W., & Alam, M. F. (2023). Investigating the Nexus among corporate governance and firm performance in India: Evidence by COVID-19. Journal of Risk and Financial Management, 16(7), 307. [Google Scholar] [CrossRef]

- Andari, N. M. M., & Rahyuda, H. (2021). The role of financial distress as mediator among financial performance and firm value. Russian Journal of Agricultural and Socio-Economic Sciences, 119(11), 55–64. [Google Scholar] [CrossRef]

- Choi, Y. K., Han, S. H., & Lee, S. (2014). Audit committees, corporate governance, and shareholder wealth: Evidence by Korea. Journal of Accounting and Public Policy, 33(5), 470–489. [Google Scholar] [CrossRef]

- Demsetz, H., & Lehn, K. (1985). The structure of corporate ownership: Causes and consequences. Journal of Political Economy, 93(6), 1155–1177. [Google Scholar] [CrossRef]

- Fich, E. M., & Slezak, S. L. (2008). Can corporate governance save distressed firms by bankruptcy? An empirical analysis. Review of Quantitative Finance and Accounting, 30(2), 225–251. [Google Scholar]

- Ghozali, I. (2018). Aplikasi analisis Multivariate dengan program SPSS-Imam Ghozali-2018. Badan Penerbit Universitas Diponegoro. [Google Scholar]

- Hidayat, S. W., & Pesudo, D. A. A. (2019). Pengaruh perencanaan pajak dan kepemilikan manajerial terhadap nilai perusahaan dengan transparansi perusahaan sebagai variabel moderasi. International Journal of Social Science and Business, 3(4), 367–376. [Google Scholar] [CrossRef]

- Hidayat, T., Triwibowo, E., & Vebrina Marpaung, N. (2021). Pengaruh good corporate governance Dan Kinerja Keuangan Terhadap Nilai Perusahaan. Jurnal Akuntansi Bisnis Pelita Bangsa, 6(01), 1–18. [Google Scholar] [CrossRef]

- Istia’adah, U. (2016). Faktor-Faktor Yang Mempengaruhi Nilai Perusahaan Pada Perusahaan Manufaktur. Nominal, Barometer Riset Akuntansi Dan Manajemen, 4(2). [Google Scholar]

- Jensen, M. C., & Meckling, W. H. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3(4), 305–360. [Google Scholar] [CrossRef]

- Khan, M. T., Ahmad, W., Khan, S. N., Antohi, V. M., Fortea, C., & Zlati, M. L. (2024). Is the Nexus among Gender diversity and firm financial distress moderated by CEO duality? Economies, 12(9), 240. [Google Scholar] [CrossRef]

- Khosa, A. (2017). Independent directors and firm value of group-affiliated firms. International Journal of Accounting & Information Management, 25(2), 217–236. [Google Scholar] [CrossRef]

- Klein, A. (2002). Economic determinants of audit committee independence. The Accounting Review, 77(2), 435–452. [Google Scholar] [CrossRef]

- Koh, P. S., Qian, C., & Wang, H. (2014). Firm litigation risk and the insurance value of corporate social performance. Strategic Management Journal, 35(10), 1464–1482. [Google Scholar]

- Laily, Y. N. (2019). Analisis pengaruh dewan komisaris, komisaris independen, dan komite audit terhadap nilai perusahaan yang dimoderasi oleh struktur modal pada perusahaan manufaktur yang terdaftar di bursa efek indonesia periode 2015–2017. Universitas Muhammadiyah Surakarta. [Google Scholar]

- Ly, T. T. H., & Duc, N. K. (2018). Corporate governance, pyramid ownership, and firm value: Evidence by Vietnam. Journal of Asian Business and Economic Studies, 25(1), 85–102. [Google Scholar] [CrossRef]

- Mahubessy, V. J. (2021). Good corporate governance, Kepailitan dan Nilai Perusahaan Pertambangan yang Terdaftar di Bursa Efek Indonesia. E-Jurnal Akuntansi, 31(1), 142. [Google Scholar] [CrossRef]

- Manzaneque, M., Priego, A. M., & Merino, E. (2016). Corporate governance effect on financial distress likelihood: Evidence by Spain. Revista de Contabilidad, 19(1), 111–121. [Google Scholar] [CrossRef]

- Masry, M. (2016). The impact of institutional ownership on the performance of companies listed in the Egyptian stock market. Journal of Economics and Finance (IOSR-JEF), 7(1), 5–15. [Google Scholar]

- McConnell, J. J., & Servaes, H. (1990). Additional evidence on equity ownership and corporate value. Journal of Financial Economics, 27(2), 595–612. [Google Scholar] [CrossRef]

- Miglani, S., Ahmed, K., & Henry, D. (2015). Voluntary corporate governance structure and financial distress: Evidence by Australia. Journal of Contemporary Accounting & Economics, 11(1), 18–30. [Google Scholar] [CrossRef]

- Muranda, Z. (2006). Financial distress and corporate governance in Zimbabwean banks. Corporate Governance: The International Journal of Business in Society, 6(5), 643–654. [Google Scholar] [CrossRef]

- Nguyen, H. T., Phan, H. V., & Sun, L. (2018). Shareholder litigation rights and corporate cash holdings: Evidence by universal demand laws. Journal of Corporate Finance, 52, 192–213. [Google Scholar] [CrossRef]

- Pitri, S. D. (2021). Pengaruh Kepemilikan Keluarga Dan corporate governance Terhadap Nilai Perusahaan. Prosiding Seminar Nasional Ekonomi Bisns & Akuntansi, 1, 176–185. [Google Scholar]

- Ramdani, D., & Witteloostuijn, A. V. (2010). The impact of board independence and CEO duality on firm performance: A quantile regression analysis for Indonesia, Malaysia, South Korea and Thailand. British Journal of Management, 21(3), 607–627. [Google Scholar] [CrossRef]

- Senan, N. A. M. (2024). The moderating role of corporate governance on the associations of internal audit and its quality by the financial reporting quality: The case of Yemeni banks. Journal of Risk and Financial Management, 17(3), 124. [Google Scholar] [CrossRef]

- Suastini, N. M., Purbawangsa, I. B. A., & Rahyuda, H. (2016). Pengaruh Kepemilikan Manejerial dan Pertumbuhan Perusahaan terhadap Nilai Perusahaan Pada Perusahaan Manufaktur Di Bursa Efek Indonesia. E-Jurnal Ekonomi Dan Bisnis Universitas Udayana, 5(1), 143–172. [Google Scholar]

- Thanatawee, Y. (2014). Institutional ownership and firm value in Thailand. Asian Journal of Business and Accounting, 7(2), 1–22. [Google Scholar]

- Truong, K. D. (2022). Corporate governance and financial distress: An endogenous switching regression model approach in vietnam. Cogent Economics & Finance, 10(1), 2111812. [Google Scholar] [CrossRef]

- Valensia, K., & Khairani, S. (2019). Pengaruh profitabilitas, financial distress, dewan komisaris independen dan komite audit terhadap nilai perusahaan dimediasi oleh tax avoidance. Jurnal Akuntansi Faculty of Economics & Business, Universitas Bengkulu, 9(1), 47–62. [Google Scholar]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2026 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license.