ESG Rating Divergence and Stock Price Crash Risk

Abstract

1. Introduction

- It reveals the mechanism by which ESG rating divergence exacerbates stock price crash risk through the dual paths of information asymmetry and external monitoring, and provides empirical evidence for enhancing market information transparency and strengthening the external monitoring mechanism.

- While the existing literature on the “information effect” of ESG rating divergence focuses on the domestic single-market environment and lacks cross-system comparison between international rating systems and local practices, this paper selects data from six authoritative rating agencies at home and abroad to explore whether there is an “information effect” of ESG rating divergence from a global perspective, which effectively bridges the gap in the existing literature in the dimension of internationalization.

- Heterogeneity analysis across property rights, marketization level, and industry pollution degree indicates that ESG rating divergence’s impact on stock price crash risk is more pronounced in non-state-owned firms, low-marketization level firms and firms in high-pollution industries, echoing the capital market’s differentiated regulation and regulators’ protection priorities.

2. Literature Review and Research Hypotheses

2.1. Literature Review

2.2. Research Hypothesis

3. Research Design

3.1. Sample Selection and Data Sources

3.2. Variable Definition

3.2.1. ESG Rating Divergence

3.2.2. Stock Price Crash Risk

3.2.3. Control Variables

3.3. Empirical Modeling

4. Empirical Results and Analysis

4.1. Descriptive Statistics

4.2. Baseline Regression

4.3. Robustness Tests

4.3.1. Endogeneity Tests

- Instrumental variable regression

- 2.

- Propensity score matching (PSM)

- 3.

- Lagged independent variables

4.3.2. Replacement of Key Variable Measures

4.3.3. Double Cluster Analysis

4.3.4. Reducing the Sample Interval

5. Further Tests

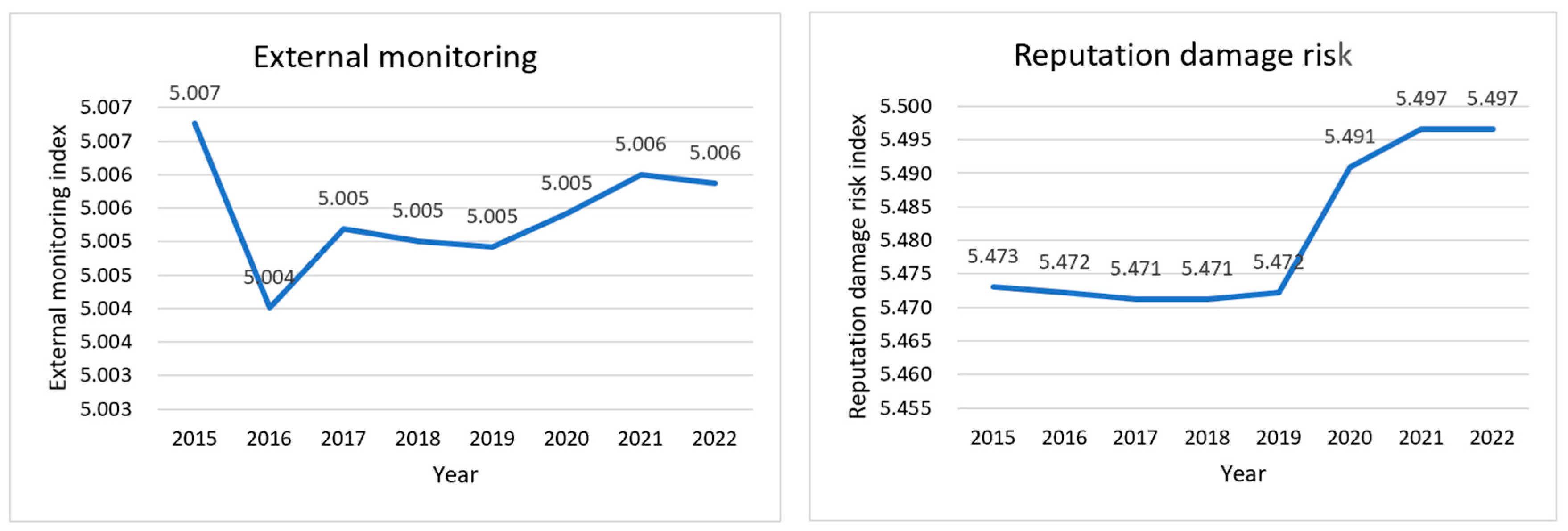

5.1. Mechanism Analysis

5.2. Heterogeneity Analysis

5.2.1. Heterogeneity Test Based on the Nature of Property Rights

5.2.2. Heterogeneity Test Based on the Level of Marketization

5.2.3. Heterogeneity Test Based on Industry Pollution Level

5.3. Dimensionality Test

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

| (1) | (2) | |

|---|---|---|

| NCSKEW | DUVOL | |

| L.NCSKEW | 0.037 ** | |

| (1.97) | ||

| L.DUVOL | 0.051 ** | |

| (2.30) | ||

| L.ESGdif6 | 0.406 *** | 0.246 *** |

| (3.74) | (3.33) | |

| Size | −0.153 | 0.042 |

| (−0.64) | (0.33) | |

| Lev | 0.057 | −1.436 |

| (0.02) | (−1.00) | |

| ROA | −2.565 | −3.677 ** |

| (−0.92) | (−2.21) | |

| Board | 0.570 | 0.063 |

| (0.36) | (0.05) | |

| Balance1 | −2.452 | −2.471 ** |

| (−1.56) | (−2.13) | |

| Big4 | 0.149 | −0.509 |

| (0.06) | (−0.33) | |

| Ret | −32.457 *** | −17.773 *** |

| (−6.96) | (−5.33) | |

| Sigma | −5.012 | −5.954 * |

| (−1.07) | (−1.88) | |

| INST | 0.200 | 0.009 |

| (0.11) | (0.01) | |

| Growth | 1.614 *** | 1.307 *** |

| (5.73) | (6.87) | |

| _cons | 2.514 | 0.390 |

| (0.51) | (0.16) | |

| N | 15,052 | 15,052 |

| IND | YES | YES |

| YEAR | YES | YES |

| R-Squared | 0.0147 | 0.0119 |

References

- Alhazmi, A. H. J., Islam, S., & Prokofieva, M. (2024). The impact of changing external auditors, auditor tenure, and audit firm type on the quality of financial reports on the Saudi stock exchange. Journal of Risk and Financial Management, 17(9), 407. [Google Scholar] [CrossRef]

- Alruwaili, W. S. (2025). ESG, CSR strategy, and board-specific skills: Further evaluation across the GCC region. Corporate Social Responsibility and Environmental Management, 32(4), 4570–4585. [Google Scholar] [CrossRef]

- Alruwaili, W. S., Ahmed, A. D., & Joshi, M. (2023a). IFRS adoption, firms’ investment efficiency and financial reporting quality: A new empirical assessment of moderating effects from Saudi listed firms. International Journal of Accounting & Information Management, 31(2), 376–411. [Google Scholar] [CrossRef]

- Alruwaili, W. S., Ahmed, A. D., & Joshi, M. (2023b). IFRS innovation, governance practices and firm performance: A new empirical assessment of moderating effects across GCC region. Equilibrium. Quarterly Journal of Economics and Economic Policy, 18(3), 615–659. [Google Scholar] [CrossRef]

- Alshdaifat, S. M., Abdul Hamid, M. A., Ab Aziz, N. H., Saidin, S. F., & Alhasnawi, M. Y. (2025). Corporate governance effectiveness and firm performance in global crisis: Evidence from GCC countries. Corporate Governance: The International Journal of Business in Society, 25(3), 455–470. [Google Scholar] [CrossRef]

- Arouri, M., Gomes, M., & Pukthuanthong, K. (2019). Corporate social responsibility and M&A uncertainty. Journal of Corporate Finance, 56, 176–198. [Google Scholar] [CrossRef]

- Austin, P. C. (2011). An introduction to propensity score methods for reducing the effects of confounding in observational studies. Multivariate Behavioral Research, 46(3), 399–424. [Google Scholar] [CrossRef]

- Avramov, D., Cheng, S., Lioui, A., & Tarelli, A. (2022). Sustainable investing with ESG rating uncertainty. Journal of Financial Economics, 145(2), 642–664. [Google Scholar] [CrossRef]

- Berg, F., Koelbel, J. F., Pavlova, A., & Rigobon, R. (2022). ESG confusion and stock returns: Tackling the problem of noise. National Bureau of Economic Research. [Google Scholar] [CrossRef]

- Chen, G., Firth, M., Gao, D. N., & Rui, O. M. (2005). Is China’s securities regulatory agency a toothless tiger? Evidence from enforcement actions. Journal of Accounting and Public Policy, 24(6), 451–488. [Google Scholar] [CrossRef]

- Gao, S., Zhao, X., Chen, Z., & Zhang, H. (2025). ESG rating divergence and audit efficiency: From the perspective of audit dela. Communication of Finance and Accounting, 46(7), 39–43. [Google Scholar] [CrossRef]

- Garrido, M. M., Kelley, A. S., Paris, J., Roza, K., Meier, D. E., Morrison, R. S., & Aldridge, M. D. (2014). Methods for constructing and assessing propensity scores. Health Services Research, 49(5), 1701–1720. [Google Scholar] [CrossRef] [PubMed]

- Guan, K., & Zhang, R. (2019). Corporate reputation and earnings management: Efficient contract theory or rent-seeking theory. Accounting Research, 40(1), 59–64. [Google Scholar] [CrossRef]

- Guo, Y., Su, C., & Zhang, Y. (2019). Does corporate social responsibility disclosure improve the company’s market performance? Systems Engineering-Theory & Practice, 39(4), 881–892. [Google Scholar]

- He, T., Li, Y., Wang, Z., & Tan, Z. (2023). Do divergent ESG ratings improve firms’ voluntary disclosure? Accounting and Economics Research, 37(3), 54–70. [Google Scholar] [CrossRef]

- Huang, J., & Zhou, C. N. (2012). Empirical research on the lmpact of ownership structure and management behavior on the environmental disclosure: Evidence from heavy polluting industries listed in shanghai stock exchange. China Soft Science, 27(1), 133–143. [Google Scholar] [CrossRef]

- Hutton, A. P., Marcus, A. J., & Tehranian, H. (2009). Opaque financial reports, R2, and crash risk. Journal of Financial Economics, 94(1), 67–86. [Google Scholar] [CrossRef]

- Ioannou, I., & Serafeim, G. (2015). The impact of corporate social responsibility on investment recommendations: Analysts’ perceptions and shifting institutional logics. Strategic Management Journal, 36(7), 1053–1081. [Google Scholar] [CrossRef]

- ISO. (2024). Non-financial environmental, social and governance (ESG) reporting and disclosure. Guidelines for organizations Publisher; International Organization for Standardization (ISO). [Google Scholar]

- Jiang, T. (2022). Mediating effects and moderating effects in causal inference. China Industrial Economics, 40(5), 100–120. [Google Scholar] [CrossRef]

- Kim, J.-B., Li, L., Yu, Z., & Zhang, H. (2019). Local versus non-local effects of Chinese media and post-earnings announcement drift. Journal of Banking & Finance, 106, 82–92. [Google Scholar] [CrossRef]

- Kim, J.-B., Li, Y., & Zhang, L. (2011a). CFOs versus CEOs: Equity incentives and crashes. Journal of Financial Economics, 101(3), 713–730. [Google Scholar] [CrossRef]

- Kim, J.-B., Li, Y., & Zhang, L. (2011b). Corporate tax avoidance and stock price crash risk: Firm-level analysis. Journal of financial Economics, 100(3), 639–662. [Google Scholar] [CrossRef]

- Kothari, S. P., Leone, A. J., & Wasley, C. E. (2005). Performance matched discretionary accrual measures. Journal of Accounting and Economics, 39(1), 163–197. [Google Scholar] [CrossRef]

- Lamont, M. (2012). Toward a comparative sociology of valuation and evaluation. Annual Review of Sociology, 38(1), 201–221. [Google Scholar] [CrossRef]

- Li, J., He, C., Liao, D., & He, M. (2018). Opinion leadership, limited attention and overreaction. Economic Research Journal, (3), 126–141. [Google Scholar]

- Li, P., & Wang, J. (2025). The impact of ESG rating divergence on audit opinion decisions. Statistics & Decision, 41(8), 177–182. [Google Scholar] [CrossRef]

- Li, Q., & Chen, L. (2024). Impact research of ESG ratings uncertainty on corporate green innovation. Chinese Journal of Management, 21(12), 1820–1829. [Google Scholar] [CrossRef]

- Li, R., Xu, J., & Xu, G. (2024). The impact of ESG rating divergence on investor sentiment. Financial Theory & Practice, 46(10), 91–103. Available online: https://link.cnki.net/urlid/41.1078.F.20241118.1338.016 (accessed on 2 July 2025).

- Li, X., Liang, R., & Li, Y. (2023). Does ESG affect stock liquidity?—A dual perspective based on ESG rating and rating divergence. Studies of International Finance, 40(11), 75–86. [Google Scholar] [CrossRef]

- Liu, X., Yang, Q., & Hu, J. (2023). ESG rating divergence and stock price synchronicity. China Soft Science, 8, 108–120. [Google Scholar]

- Muck, M., & Schmidl, T. (2024). Comparing ESG score weighting approaches and stock performance differentiation. Finance Research Letters, 67(Pt B), 105924. [Google Scholar] [CrossRef]

- Petersen, M. A. (2008). Estimating standard errors in finance panel data sets: Comparing approaches. The Review of Financial Studies, 22(1), 435–480. [Google Scholar] [CrossRef]

- Piotroski, J. D., Wong, T., & Zhang, T. (2015). Political incentives to suppress negative information: Evidence from Chinese listed firms. Journal of Accounting Research, 53(2), 405–459. [Google Scholar] [CrossRef]

- Quan, X., Xiao, B., & Wu, S. (2016). Can lnvestor relations management stabilize the stock market? Journal of Management World, 32(1), 139–152+188. [Google Scholar] [CrossRef]

- Rong, D., Wang, L., & Liu, L. (2025). Impact of digital transformation on corporate greenwashingin different media environment. R&D Management, 37(2), 1–12. [Google Scholar] [CrossRef]

- Shao, Y., Zhang, G., & Zhang, Y. (2025). ESG rating divergence and stock price crash risk: Noise effect or information effect? Journal of Audit & Economics, 40(1), 84–94. [Google Scholar]

- Song, X., & Hu, J. (2017). Corporate social responsibility disclosure and stockPrice crash risk: Based on information effect and reputation insurance effect. Journal of Financial Research, 60(4), 161–175. Available online: https://kns.cnki.net/kcms2/article/abstract?v=9oehDy4zW5YmZAFdrYwOXOQFuo7Z6PWBs4TBfOhnQEM24bxslHxGy_HTppdUJ74r_SISF_GMGZ9YZOBjazMU2Kmqrqe4D_VndJk-3LmUp38UjuR9aAyb6Qd8nHFVZkfrVqprOXvetYvq4aoQ2iGVyDXVXaYwq92MB1kQxOW9KhIs4nInoLwi6OPAk6lh7mTy&uniplatform=NZKPT&language=CHS (accessed on 2 July 2025).

- Tang, G., Wu, Y., Tian, M., & Xiang, R. (2025). Investor macro-information attention and stock price crash risk: A perspective based on information transmission. Systems Engineering-Theory & Practice, 45(3), 816–834. Available online: https://link.cnki.net/urlid/11.2267.N.20250106.1743.020 (accessed on 2 July 2025).

- Wang, J., Wang, S., Dong, M., & Wang, H. (2024). ESG rating disagreement and stock returns: Evidence from China. International Review of Financial Analysis, 91, 103043. [Google Scholar] [CrossRef]

- Yang, Z., & Wang, S. (2021). Systemie financial risk contagion of global stock market under public health emergency: Empirical evidence from COVID-19 epidemic. Economic Research Journal, 56(8), 22–38. [Google Scholar]

- Zhang, Y., Meng, X., & Wang, X. (2024). Study on the influence mechanisms and management strategies of media attention on the risk of stock price crash. Journal of Financial Development Research, 43(8), 34–43. [Google Scholar] [CrossRef]

- Zhao, Y., Sun, Y., Feng, T., & Liu, Y. (2024). How does supplier ESG rating divergence affect corporate operational resilience. China Industrial Economics, 11, 174–192. [Google Scholar] [CrossRef]

- Zhou, Z., Gu, W., & San, Z. (2023). ESG rating divergence and analysts’ earnings forecast accuracy. China Soft Science, 10, 164–176. [Google Scholar]

- Zhu, P. (2020). Negative reputation and corporate financing: Empirical studies on listed companies. Finance & Trade Economics, 41(4), 50–65. [Google Scholar] [CrossRef]

| Variable | Variable Definitions |

|---|---|

| NCSKEW | Negative return skewness factor |

| DUVOL | Ratio of upward and downward fluctuations in returns |

| ESGdif6 | Standard deviation of ESG ratings from six rating agencies: Bloomberg, SynTao Green Finance, FTSE Russell, Sino-Securities Index, Susallwave, and Wind |

| Size | Fixed Assets/Total Assets |

| Lev | EBITDA/average total assets |

| ROA | Natural logarithm of the number of board members |

| Board | Number of independent directors/number of board members |

| Top1 | Number of shares held by the largest shareholder/total number of shares |

| Big4 | (Current Year − Year of Establishment + 1) take the natural logarithm |

| Ret | (Market value of outstanding shares + number of non-outstanding shares x net assets per share + book value of liabilities)/Total assets |

| Sigma | Growth in operating income/total operating income of the previous year |

| INST | 1 if the enterprise is audited by a Big 4 accounting firm, 0 otherwise |

| Growth | Net cash flow from operating activities/total assets of the enterprise |

| Balance1 | Degree of equity balance |

| Industry | Industry fixed effects |

| Year | Time fixed effects |

| Variable | N | Mean | Min | Max | P50 | SD |

|---|---|---|---|---|---|---|

| NCSKEW | 25,688 | −0.321 | −2.397 | 1.655 | −0.280 | 0.737 |

| DUVOL | 25,688 | −0.206 | −1.356 | 1.006 | −0.208 | 0.483 |

| ESGdif6 | 25,688 | 0.960 | 0.000 | 2.828 | 1.000 | 0.720 |

| Size | 25,688 | 22.340 | 20.020 | 26.390 | 22.150 | 1.301 |

| Lev | 25,688 | 0.420 | 0.061 | 0.905 | 0.411 | 0.201 |

| ROA | 25,688 | 0.038 | −0.263 | 0.228 | 0.038 | 0.071 |

| Board | 25,688 | 2.106 | 1.609 | 2.639 | 2.197 | 0.196 |

| Balance1 | 25,688 | 0.381 | 0.013 | 0.994 | 0.307 | 0.284 |

| Big4 | 25,688 | 0.061 | 0.000 | 1.000 | 0.000 | 0.239 |

| Ret | 25,688 | 0.002 | −0.015 | 0.035 | 0.001 | 0.010 |

| Sigma | 25,688 | 0.067 | 0.026 | 0.158 | 0.061 | 0.027 |

| INST | 25,688 | 0.424 | 0.003 | 0.908 | 0.435 | 0.247 |

| Growth | 25,688 | 0.158 | −0.579 | 2.292 | 0.099 | 0.390 |

| (1) | (2) | |

|---|---|---|

| NCSKEW | DUVOL | |

| L.ESGdif6 | 0.024 *** | 0.015 *** |

| (3.50) | (3.39) | |

| Size | −0.045 *** | −0.036 *** |

| (−8.41) | (−10.47) | |

| Lev | 0.080 ** | 0.075 *** |

| (2.51) | (3.64) | |

| ROA | 0.211 ** | 0.085 |

| (2.55) | (1.59) | |

| Board | −0.070 *** | −0.041 ** |

| (−2.68) | (−2.42) | |

| Balance1 | 0.060 *** | 0.038 *** |

| (3.49) | (3.42) | |

| Big4 | −0.006 | −0.005 |

| (−0.30) | (−0.34) | |

| Ret | −15.593 *** | −11.180 *** |

| (−21.29) | (−23.54) | |

| Sigma | −7.802 *** | −4.816 *** |

| (−28.32) | (−26.95) | |

| INST | 0.096 *** | 0.059 *** |

| (4.16) | (3.92) | |

| Growth | 0.100 *** | 0.053 *** |

| (7.12) | (5.81) | |

| _cons | 1.175 *** | 0.896 *** |

| (10.00) | (11.76) | |

| N | 25,688 | 25,688 |

| IND | YES | YES |

| YEAR | YES | YES |

| R-Squared | 0.096 | 0.098 |

| (1) | (2) | (3) | |

|---|---|---|---|

| ESGdif6 | NCSKEW | DUVOL | |

| Esgdiss_IV | 0.972 *** | ||

| (100.91) | |||

| L.ESGdif6 | 0.044 *** | 0.032 *** | |

| (4.65) | (5.17) | ||

| Size | 0.073 *** | −0.032 *** | −0.028 *** |

| (19.59) | (−6.43) | (−8.65) | |

| Lev | 0.048 ** | 0.025 | 0.030 |

| (2.18) | (0.86) | (1.62) | |

| ROA | −0.302 *** | −0.055 | −0.055 |

| (−5.41) | (−0.73) | (−1.12) | |

| Board | −0.030 * | −0.048 ** | −0.028 * |

| (−1.70) | (−2.00) | (−1.82) | |

| Balance1 | −0.022 * | 0.015 | 0.011 |

| (−1.92) | (0.96) | (1.05) | |

| Big4 | 0.006 | −0.018 | −0.013 |

| (0.42) | (−0.92) | (−0.96) | |

| Ret | 1.801 *** | −7.979 *** | −6.909 *** |

| (3.34) | (−13.16) | (−17.44) | |

| Sigma | −0.740 *** | −5.282 *** | −3.142 *** |

| (−3.89) | (−23.45) | (−21.35) | |

| INST | 0.037 ** | 0.089 *** | 0.054 *** |

| (2.38) | (4.28) | (4.00) | |

| Growth | −0.037 *** | 0.054 *** | 0.024 *** |

| (−4.14) | (4.47) | (3.09) | |

| _cons | −1.503 *** | 0.842 *** | 0.691 *** |

| (−17.89) | (7.83) | (9.84) | |

| N | 25,688 | 25,688 | 25,688 |

| IND | YES | YES | YES |

| YEAR | YES | YES | YES |

| R-Squared | 0.488 | 0.066 | 0.073 |

| (1) | (2) | |

|---|---|---|

| NCSKEW | DUVOL | |

| L.ESGdif6 | 0.021 *** | 0.013 ** |

| (2.65) | (2.52) | |

| Size | −0.041 *** | −0.034 *** |

| (−6.64) | (−8.40) | |

| Lev | 0.131 *** | 0.116 *** |

| (3.49) | (4.73) | |

| ROA | 0.220 ** | 0.079 |

| (2.19) | (1.20) | |

| Board | −0.084 *** | −0.047 ** |

| (−2.82) | (−2.38) | |

| Balance1 | 0.064 *** | 0.041 *** |

| (3.17) | (3.11) | |

| Big4 | −0.009 | −0.006 |

| (−0.39) | (−0.39) | |

| Ret | −14.955 *** | −10.804 *** |

| (−17.47) | (−19.29) | |

| Sigma | −7.127 *** | −4.433 *** |

| (−22.29) | (−21.18) | |

| INST | 0.099 *** | 0.064 *** |

| (3.60) | (3.55) | |

| Growth | 0.104 *** | 0.053 *** |

| (6.49) | (5.03) | |

| _cons | 1.039 *** | 0.801 *** |

| (7.57) | (8.92) | |

| N | 15,002 | 15,002 |

| IND | YES | YES |

| YEAR | YES | YES |

| R-Squared | 0.085 | 0.087 |

| (1) | (2) | |

|---|---|---|

| NCSKEW | DUVOL | |

| L2.ESGdif6 | 0.038 *** | 0.025 *** |

| (5.13) | (5.26) | |

| Size | −0.034 *** | −0.030 *** |

| (−5.79) | (−7.94) | |

| Lev | 0.043 | 0.057 ** |

| (1.22) | (2.55) | |

| ROA | 0.154 * | 0.069 |

| (1.72) | (1.20) | |

| Board | −0.059 ** | −0.037 ** |

| (−2.04) | (−2.00) | |

| Balance1 | 0.065 *** | 0.043 *** |

| (3.41) | (3.49) | |

| Big4 | 0.005 | 0.001 |

| (0.21) | (0.04) | |

| Ret | −17.593 *** | −12.617 *** |

| (−22.29) | (−24.80) | |

| Sigma | −7.295 *** | −4.378 *** |

| (−24.02) | (−22.36) | |

| INST | 0.085 *** | 0.051 *** |

| (3.23) | (3.03) | |

| Growth | 0.121 *** | 0.067 *** |

| (7.71) | (6.56) | |

| _cons | 0.918 *** | 0.751 *** |

| (7.04) | (8.94) | |

| N | 25,688 | 25,688 |

| IND | YES | YES |

| YEAR | YES | YES |

| R-Squared | 0.106 | 0.108 |

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| Replacement of Key Variable Measures | Double Cluster Analysis | Reducing the Sample Interval | ||||

| NCSKEW | DUVOL | NCSKEW | DUVOL | NCSKEW | DUVOL | |

| L.ESGdif4 | 0.030 *** | 0.021 *** | ||||

| (4.63) | (4.92) | |||||

| L.ESGdif6 | 0.024 *** | 0.015 *** | 0.030 ** | 0.028 *** | ||

| (2.93) | (3.26) | (2.56) | (3.70) | |||

| Size | −0.045 *** | −0.036 *** | −0.045 *** | −0.036 *** | −0.045 *** | −0.034 *** |

| (−8.50) | (−10.63) | (−6.24) | (−8.22) | (−5.55) | (−6.50) | |

| Lev | 0.083 *** | 0.077 *** | 0.080 ** | 0.075 *** | 0.073 | 0.079 *** |

| (2.61) | (3.76) | (2.62) | (3.85) | (1.56) | (2.59) | |

| ROA | 0.230 *** | 0.100 * | 0.211 * | 0.085 | 0.415 *** | 0.303 *** |

| (2.78) | (1.86) | (1.95) | (1.35) | (3.31) | (3.73) | |

| Board | −0.067 ** | −0.039 ** | −0.070 ** | −0.041 ** | −0.059 | −0.035 |

| (−2.57) | (−2.30) | (−2.03) | (−2.24) | (−1.57) | (−1.43) | |

| Balance1 | 0.058 *** | 0.037 *** | 0.060 *** | 0.038 *** | 0.086 *** | 0.052 *** |

| (3.36) | (3.29) | (2.72) | (2.97) | (3.37) | (3.18) | |

| Big4 | −0.009 | −0.007 | −0.006 | −0.005 | −0.006 | −0.011 |

| (−0.42) | (−0.47) | (−0.29) | (−0.29) | (−0.20) | (−0.53) | |

| Ret | −15.872 *** | −11.406 *** | −15.593 *** | −11.180 *** | −23.071 *** | −16.383 *** |

| (−21.54) | (−23.87) | (−15.36) | (−17.91) | (−20.82) | (−22.81) | |

| Sigma | −7.803 *** | −4.815 *** | −7.802 *** | −4.816 *** | −8.089 *** | −5.180 *** |

| (−28.34) | (−26.96) | (−16.02) | (−18.90) | (−19.00) | (−18.77) | |

| INST | 0.100 *** | 0.062 *** | 0.096 *** | 0.059 *** | 0.133 *** | 0.078 *** |

| (4.31) | (4.09) | (4.67) | (4.36) | (3.94) | (3.59) | |

| Growth | 0.102 *** | 0.054 *** | 0.100 *** | 0.053 *** | 0.065 *** | 0.032 ** |

| (7.21) | (5.94) | (7.80) | (6.25) | (3.19) | (2.45) | |

| _cons | 1.169 *** | 0.895 *** | 1.175 *** | 0.896 *** | 1.114 *** | 0.813 *** |

| (9.98) | (11.79) | (7.38) | (8.85) | (6.18) | (6.96) | |

| N | 25,688 | 25,688 | 25,688 | 25,688 | 10,084 | 10,084 |

| IND | YES | YES | YES | YES | YES | YES |

| YEAR | YES | YES | YES | YES | YES | YES |

| R-Squared | 0.096 | 0.099 | 0.096 | 0.098 | 0.102 | 0.109 |

| (1) | (2) | |

|---|---|---|

| External Monitoring | Reputation Damage Risk | |

| Media | Rep | |

| L.ESGdif6 | −0.049 *** | 0.125 *** |

| (−5.89) | (7.77) | |

| Size | 0.420 *** | 1.212 *** |

| (67.01) | (107.69) | |

| Lev | −0.336 *** | −1.755 *** |

| (−8.96) | (−25.91) | |

| ROA | 0.794 *** | 23.213 *** |

| (7.90) | (133.47) | |

| Board | 0.041 | 1.258 *** |

| (1.34) | (23.72) | |

| Balance1 | 0.060 *** | 0.074 ** |

| (2.91) | (2.10) | |

| Big4 | 0.426 *** | 1.587 *** |

| (17.40) | (37.72) | |

| Ret | −1.537 * | 15.132 *** |

| (−1.94) | (9.33) | |

| Sigma | 14.492 *** | −5.281 *** |

| (49.42) | (−9.06) | |

| INST | −0.057 ** | 0.629 *** |

| (−2.07) | (13.15) | |

| Growth | −0.024 | 0.174 *** |

| (−1.60) | (6.67) | |

| _cons | −5.360 *** | −24.719 *** |

| (−38.49) | (−97.09) | |

| N | 25,688 | 25,688 |

| IND | YES | YES |

| YEAR | YES | YES |

| R-Squared | 0.327 | 0.765 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| State-Owned Enterprises | Non-State-Owned Enterprises | State-Owned Enterprises | Non-State-Owned Enterprises | |

| NCSKEW | NCSKEW | DUVOL | DUVOL | |

| L.ESGdif6 | 0.011 | 0.072 *** | 0.002 | 0.044 *** |

| (0.96) | (4.98) | (0.30) | (4.70) | |

| Size | −0.017 * | −0.049 *** | −0.023 *** | −0.040 *** |

| (−1.76) | (−4.50) | (−4.30) | (−5.58) | |

| Lev | 0.067 | 0.018 | 0.112 *** | 0.054 |

| (1.11) | (0.27) | (3.51) | (1.23) | |

| ROA | 0.178 | −0.035 | 0.087 | 0.036 |

| (1.25) | (−0.17) | (1.11) | (0.26) | |

| Board | −0.055 | −0.035 | −0.011 | −0.046 |

| (−1.16) | (−0.68) | (−0.44) | (−1.34) | |

| Balance1 | 0.074 ** | 0.046 | 0.056 *** | 0.026 |

| (2.35) | (1.27) | (3.29) | (1.10) | |

| Big4 | −0.016 | 0.009 | 0.024 | 0.002 |

| (−0.41) | (0.27) | (1.09) | (0.08) | |

| Ret | −17.263 *** | −19.966 *** | −9.972 *** | −13.575 *** |

| (−14.47) | (−12.20) | (−14.79) | (−12.66) | |

| Sigma | −5.776 *** | −7.343 *** | −4.093 *** | −4.691 *** |

| (−11.92) | (−12.65) | (−15.61) | (−12.33) | |

| INST | 0.138 *** | 0.055 | 0.078 *** | 0.015 |

| (3.29) | (0.85) | (3.58) | (0.35) | |

| Growth | 0.110 *** | 0.146 *** | 0.039 *** | 0.078 *** |

| (4.47) | (4.92) | (2.98) | (4.03) | |

| _cons | 0.448 ** | 1.188 *** | 0.471 *** | 1.003 *** |

| (2.02) | (4.98) | (3.93) | (6.43) | |

| N | 9731 | 15,957 | 9731 | 15,957 |

| IND | YES | YES | YES | YES |

| YEAR | YES | YES | YES | YES |

| p-value | 0.002 | 0.027 | ||

| R-Squared | 0.050 | 0.056 | 0.060 | 0.061 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| High- Marketization | Low- Marketization | High- Marketization | Low- Marketization | |

| NCSKEW | NCSKEW | DUVOL | DUVOL | |

| L.ESGdif6 | 0.018 | 0.025 ** | 0.012 * | 0.035 *** |

| (1.55) | (2.29) | (−1.78) | (4.31) | |

| Size | −0.045 *** | −0.038 *** | 0.025 *** | −0.034 *** |

| (−4.70) | (−4.79) | (−4.70) | (−6.36) | |

| Lev | 0.141 ** | 0.126 ** | −0.011 | 0.131 *** |

| (2.48) | (2.53) | (−0.35) | (3.98) | |

| ROA | −0.039 | 0.443 *** | −0.193 ** | 0.217 ** |

| (−0.26) | (3.25) | (−2.35) | (2.42) | |

| Board | −0.126 *** | −0.054 | −0.015 | −0.043 |

| (−2.77) | (−1.36) | (−0.61) | (−1.63) | |

| Balance1 | 0.100 *** | 0.035 | 0.011 | 0.026 |

| (3.34) | (1.30) | (0.66) | (1.43) | |

| Big4 | 0.008 | −0.020 | −0.010 | −0.018 |

| (0.24) | (−0.64) | (−0.51) | (−0.89) | |

| Ret | −13.819 *** | −16.057 *** | −5.220 *** | −11.364 *** |

| (−11.09) | (−13.68) | (−8.37) | (−14.72) | |

| Sigma | −7.305 *** | −6.941 *** | −2.701 *** | −4.271 *** |

| (−15.40) | (−16.07) | (−11.51) | (−15.03) | |

| INST | 0.134 *** | 0.073 * | 0.047 ** | 0.056 ** |

| (3.34) | (1.92) | (2.19) | (2.22) | |

| Growth | 0.120 *** | 0.091 *** | 0.030 ** | 0.046 *** |

| (4.95) | (4.23) | (2.44) | (3.26) | |

| _cons | 1.200 *** | 0.929 *** | 0.579 *** | 0.782 *** |

| (5.70) | (5.12) | (4.97) | (6.55) | |

| N | 12,753 | 12,935 | 12,753 | 12,935 |

| IND | YES | YES | YES | YES |

| YEAR | YES | YES | YES | YES |

| p-value | 0.000 | 0.004 | ||

| R-Squared | 0.080 | 0.091 | 0.058 | 0.091 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| Heavily Polluting Industries | Non-Heavily Polluting Industries | Heavily Polluting Industries | Non-Heavily Polluting Industries | |

| NCSKEW | NCSKEW | DUVOL | DUVOL | |

| L.ESGdif6 | 0.044 ** | 0.030 * | 0.023 ** | 0.020 * |

| (2.45) | (1.90) | (1.97) | (1.93) | |

| Size | −0.050 *** | −0.052 *** | −0.039 *** | −0.041 *** |

| (−4.05) | (−4.17) | (−4.74) | (−5.00) | |

| Lev | 0.119 | 0.170 ** | 0.088 * | 0.137 *** |

| (1.53) | (2.15) | (1.73) | (2.63) | |

| ROA | 0.629 *** | 0.168 | 0.211 | 0.062 |

| (2.65) | (0.77) | (1.36) | (0.43) | |

| Board | −0.130 ** | −0.050 | −0.076 ** | −0.061 |

| (−2.22) | (−0.80) | (−1.98) | (−1.47) | |

| Balance1 | 0.062 | 0.116 *** | 0.044 * | 0.067 ** |

| (1.56) | (2.77) | (1.70) | (2.43) | |

| Big4 | −0.097 ** | 0.072 | −0.083 *** | 0.049 * |

| (−2.40) | (1.62) | (−3.16) | (1.66) | |

| Ret | −15.871 *** | −12.383 *** | −11.445 *** | −8.977 *** |

| (−7.92) | (−7.32) | (−8.71) | (−8.09) | |

| Sigma | −7.795 *** | −6.890 *** | −4.912 *** | −4.425 *** |

| (−11.39) | (−10.62) | (−10.96) | (−10.40) | |

| INST | 0.135 ** | 0.040 | 0.102** | 0.043 |

| (2.23) | (0.70) | (2.57) | (1.14) | |

| Growth | 0.084 ** | 0.157 *** | 0.048 ** | 0.092 *** |

| (2.54) | (5.11) | (2.22) | (4.56) | |

| _cons | 1.353 *** | 1.166 *** | 0.990 *** | 0.961 *** |

| (4.85) | (4.26) | (5.41) | (5.35) | |

| N | 18,502 | 7186 | 18,502 | 7186 |

| IND | YES | YES | YES | YES |

| YEAR | YES | YES | YES | YES |

| p-value | 0.000 | 0.003 | ||

| R-Squared | 0.094 | 0.076 | 0.098 | 0.080 |

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| Environmental | Social | Corporate Governance | ||||

| NCSKEW | DUVOL | NCSKEW | DUVOL | NCSKEW | DUVOL | |

| L.ESGdif6 | 0.056 ** | 0.026 * | 0.035 *** | 0.017 *** | 0.060 ** | 0.051 *** |

| (2.40) | (1.90) | (3.04) | (2.64) | (2.09) | (2.66) | |

| Size | −0.036 * | −0.034 *** | −0.034 *** | −0.034 *** | −0.043 ** | −0.040 *** |

| (−1.89) | (−3.11) | (−3.69) | (−6.64) | (−2.07) | (−2.83) | |

| Lev | 0.107 | 0.119* | 0.060 | 0.128 *** | −0.024 | 0.143 |

| (0.94) | (1.82) | (1.01) | (4.02) | (−0.18) | (1.63) | |

| ROA | 0.712 ** | 0.407 ** | 0.203 | 0.099 | 0.402 | 0.330 |

| (2.30) | (2.20) | (1.33) | (1.16) | (1.05) | (1.29) | |

| Board | −0.129 | −0.109 ** | −0.071 | −0.042 * | −0.044 | −0.071 |

| (−1.49) | (−2.16) | (−1.58) | (−1.70) | (−0.43) | (−1.04) | |

| Balance1 | 0.041 | −0.009 | 0.106 *** | 0.057 *** | 0.056 | 0.038 |

| (0.71) | (−0.27) | (3.51) | (3.42) | (0.84) | (0.84) | |

| Big4 | −0.028 | −0.038 | −0.008 | −0.010 | 0.059 | 0.022 |

| (−0.38) | (−0.87) | (−0.24) | (−0.54) | (0.61) | (0.34) | |

| Ret | −18.109 *** | −11.330 *** | −18.891 *** | −10.404 *** | −15.903 *** | −11.295 *** |

| (−7.73) | (−7.81) | (−15.28) | (−14.77) | (−5.65) | (−5.99) | |

| Sigma | −7.266 *** | −4.519 *** | −6.241 *** | −4.952 *** | −6.878 *** | −4.177 *** |

| (−7.82) | (−8.09) | (−12.95) | (−18.51) | (−6.30) | (−5.71) | |

| INST | −0.057 | 0.024 | 0.081* | 0.062 *** | 0.051 | 0.062 |

| (−0.68) | (0.50) | (1.90) | (2.72) | (0.52) | (0.94) | |

| Growth | 0.113 ** | 0.049 * | 0.148 *** | 0.065 *** | 0.127 ** | 0.047 |

| (2.15) | (1.74) | (5.99) | (4.73) | (2.49) | (1.36) | |

| _cons | 1.128 *** | 0.956 *** | 0.860 *** | 0.805 *** | 1.062 ** | 0.946 *** |

| (2.67) | (3.97) | (4.13) | (7.04) | (2.32) | (3.08) | |

| N | 25,688 | 25,688 | 25,688 | 25,688 | 25,688 | 25,688 |

| IND | YES | YES | YES | YES | YES | YES |

| YEAR | YES | YES | YES | YES | YES | YES |

| R-Squared | 0.118 | 0.097 | 0.096 | 0.092 | 0.107 | 0.102 |

| F | 21.461 | 22.504 | 65.582 | 85.901 | 13.826 | 12.972 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhang, C.; Hsu, W.-L. ESG Rating Divergence and Stock Price Crash Risk. Int. J. Financial Stud. 2025, 13, 147. https://doi.org/10.3390/ijfs13030147

Zhang C, Hsu W-L. ESG Rating Divergence and Stock Price Crash Risk. International Journal of Financial Studies. 2025; 13(3):147. https://doi.org/10.3390/ijfs13030147

Chicago/Turabian StyleZhang, Chuting, and Wei-Ling Hsu. 2025. "ESG Rating Divergence and Stock Price Crash Risk" International Journal of Financial Studies 13, no. 3: 147. https://doi.org/10.3390/ijfs13030147

APA StyleZhang, C., & Hsu, W.-L. (2025). ESG Rating Divergence and Stock Price Crash Risk. International Journal of Financial Studies, 13(3), 147. https://doi.org/10.3390/ijfs13030147