Abstract

The emergence of online brokerage platforms, mobile banking applications, and commission-free trading has altered the investment landscape, renewing commercial and scholarly interest in retail investors. In light of these changes, the present study aims to provide a structural overview of the current state of research on the behaviour of retail investors. Based on a dataset of 386 articles sourced from the Web of Science database, this study employs a composite bibliometric approach of a co-word and co-citation analysis as well as a network analysis to determine preceding scientific discourses, current research themes, and potential avenues for future research. The co-word analysis identifies seven distinct research themes: (1) implications for financial performance; (2) information behaviour; (3) behavioural biases and investor characteristics; (4) investor attention; (5) attitudes towards financial risks; (6) socially responsible investing; and (7) complex financial retail instruments. Incorporating applicable research on individual investors, private investors, and household investors from referenced articles, the co-citation analysis reveals nine preceding scientific discourses. Additionally, the network analyses highlight the concepts and publications currently shaping and likely to influence future research in this field. The present study contributes to the academic discourse by mapping the intellectual landscape of retail investor behaviour, suggesting avenues for future research, and offering valuable insights for navigating this dynamic field.

1. Introduction

At the turn of the millennium, the investment behaviour of private investors was often considered a contrarian indicator by many institutional investors. Research at the time suggested that active investment choices eroded the assets of retail investors (e.g., Frazzini & Lamont, 2008). This belief was rooted in the traditional financial view that deviations from the efficient-market hypothesis were partially due to the unsophisticated actions of retail investors (A. Kumar & Lee, 2006). Although some authors have argued that retail investors are capable of making profitable (Dorn et al., 2008) and informed trading decisions (Kaniel et al., 2012), the prevailing studies typically used retail investors as a comparative benchmark (e.g., Locke & Mann, 2005) or focused on the supposed irrationality of their actions (e.g., Hvidkjaer, 2008; Henker & Henker, 2010). Given the small share of trades executed by retail investors on major stock exchanges in Western markets (e.g., less than 2% of total trades on the New York Stock Exchange, Evans, 2010) and “requiems” for the American retail investor during the global financial crisis (Evans, 2009), research on the behaviour of retail investors remained a niche subject in the early 2010s.

Despite low adoption rates in the beginning of the last decade, online banking has transformed financial service delivery by offering private clients continuous access, control, and reduced wait times (Al-Somali et al., 2009; Montazemi & Qahri-Saremi, 2015). In parallel, the rise in online stock trading has increased stock market participation by enabling individuals to trade independently with lower costs and enhanced accessibility (Oertzen & Odekerken-Schröder, 2019; S. U. Khan et al., 2020). This financial transformation has been further accelerated by innovation (Henderson & Pearson, 2011) and the emergence of mobile brokerage and cryptocurrency exchange platforms (Barber et al., 2022), which have fuelled speculative trading in increasingly complex financial products (Basu & Dulleck, 2020). Commission-free trading as well as the circumstances during the COVID-19 pandemic accelerated this trend and led to an influx of younger, less experienced retail investors into the stock market (e.g., Ülkü et al., 2023; Johnson et al., 2024). Events such as the GameStop trading frenzy (Hasso et al., 2022) or the integration of unregulated financial instruments like Bitcoin into traditional brokerage applications (Hasso et al., 2019) underscore the evolving role of retail investors in the financial market. Political institutions have recognised this development, which resulted in plans to amend the legislative structure for retail investments by the U.S. Securities and Exchange Commission (Lizárraga, 2023) and the European Commission (FISMA, 2023).

With regard to the increasing importance of retail investors’ actions for global equity markets and the inconsistent findings on their investment behaviour in earlier research, the aim of this bibliometric study is to provide a structural overview of the research themes on retail investor behaviour. In this manner, the present study should help researchers and practitioners find their way in this complex field and point out potential avenues for future research. Another motivation for this study is to consolidate the existing literature on individual investors and retail investors where feasible. While research on retail investor behaviour inherently pertains to individual investors, findings from studies on the behaviour of individual investors may not universally apply to retail investors. Early influential publications highlighted distinct market behaviours associated with different brokerage types (e.g., Odean, 1998; Barber & Odean, 2000). Therefore, an inclusion of the literature on individual investors must be carefully evaluated to determine its suitability for the context of retail investors.

A bibliometric analysis is an effective method for structuring the thematic research field of retail investor behaviour. As a widely accepted method in business economics, many researchers have previously used co-citation analyses to structure the discourses (e.g., Goyal & Kumar, 2021; Khatib et al., 2022; Ansari et al., 2022) or co-word analyses to find thematic clusters (e.g., Paule-Vianez et al., 2020; Alqudah et al., 2023; Coronel-Pangol et al., 2023) in a particular research field. The present study uses a co-word analysis to identify the current research themes based on keywords of scientific articles that investigate the behaviour of retail investors. Furthermore, a co-citation analysis is applied to uncover the preceding scientific discourses from the references of the scientific articles. Due to the above-mentioned terminological inconsistencies, these preceding scientific discourses encompass studies on individual, private, and retail investors. Thus, the composite bibliometric approach of a co-word and co-citation analysis offers a comprehensive research overview while ensuring the applicability of the referenced studies to the field of retail investor behaviour. Quantitative network analysis measures are used to detect the most relevant keywords for every research theme and the most relevant cited publications for every preceding scientific discourse, which reveals the current state of research interest and potential avenues for future research.

Against this background, the present study contributes to research on retail investor behaviour in several ways. It is among the first reviews to apply bibliometric methods in the context of retail investors, and the first publication to structure the existing literature based on keywords and the referenced articles in a composite approach. Distinctively, it provides a detailed overview of the retail investor terminology, which most of the existing studies take for granted or do not define adequately. By uncovering the most relevant discourses and publications on individual investor behaviour that are applicable to retail investors, this study clarifies the often interchangeable terminology. Lastly, it outlines several avenues for future research, offering guidance for prospective researchers eager to explore the complexities of this dynamic and increasingly significant field.

This article is structured as follows. First, the evolution of the retail investor terminology is presented. This is followed by a detailed description of the composite bibliometric approach. Next, a descriptive summary of the existing literature on retail investor behaviour is provided. The subsequent chapter delves into both historical and contemporary research trajectories concerning retail investor behaviour. After that, the results of the network analyses are presented. Based on co-citation, co-word, and network analyses, potential avenues for future research are discussed. This article concludes with a summary of the key findings.

2. The Evolution of the Retail Investor Terminology

Brokerage companies traditionally distinguished two customer segments for their services: the “institutional market” and the “retail market”. The latter encompassed all private individuals who invested in securities through professional brokers (van Banning, 1978). Although this segregation of investor segments was common practice in the financial industry (McDaniel, 1984), the term was rarely mentioned in scientific financial publications of the 1980s (e.g., Rubinstein & Leland, 1981; Marr & Spivey, 1989; Figlewski, 1989).

In their study on initial public offering (IPO) proceeds under alternative regulatory environments, Benveniste and Wilhelm (1990) are the first authors to include the term “retail investor” in the abstract of an article. They define retail investors as small-scale atomistic investors who participate in IPOs through retail brokers. In their model, retail investors can possess heterogeneous levels of market knowledge and behave in a risk-neutral manner. Contrarily, Brennan (1993) defines retail investors as individuals who do not possess expert knowledge of financial markets. According to him, the evaluation of financial products poses a major difficulty for this type of investor. Search costs are therefore likely to be of greater significance for small retail investors than for large institutional investors. In one of the first scientific publications to use the term in its title, Hass (1998) describes retail investors as members of the general public who have a limited net worth and are largely financially unsophisticated. Thus, retail investors have historically been considered less informed and having a limited understanding of stock fundamentals, which can potentially result in irrational financial behaviour and decisions based on sentiment (K. Chan & Kwok, 2005).

Despite the fact that this characterisation of retail investors could have been applied to all private investors at the time, it is the terminological origin that distinguished retail investors from other types of investors. Traditionally, only full-service retail brokers offered personalised advice and comprehensive financial services, while discount brokers did not provide advisory services and worked on a commission basis, which allowed discount brokers to charge lower rates (Saunders & Smirlock, 1987). Although large retail brokerage companies dominated the market for brokerage services (Bakos et al., 2005), the specific characteristics of self-directed investments in securities through discount brokers led to several impactful publications on individual investor behaviour (e.g., Odean, 1998; Barber & Odean, 2000). In these publications, the term “retail investor” is differentiated from the terms “household investor” and “individual investor” based on the choice of brokerage type. This differentiation accounted for the potential influence of retail brokers on the trading practices of their clients (Odean, 1998). It took several years before the distinction between private investors at retail and discount brokerages was somewhat softened by the same authors. Barber and Odean (2008) found that these investors exhibit similar net buying behaviours, while Barber et al. (2009) discovered that their mean monthly contemporaneous percentage of buys correlations are similar as well. However, datasets from discount brokerages of the previous century may still differ in certain aspects from those of retail brokerages.

Technological progress and shifts in consumer preferences have made this clear distinction between retail investors and discount broker users redundant to a certain extent. The introduction of online brokers, which enabled individual investors to execute transactions in real time and reduced the commissions per trade, increased the competition among brokerage companies (Konana et al., 2000). In turn, discount brokers such as Charles Schwab extended their range of services to include affordable financial advice and stock market information, moving into the realm of traditional retail brokers (Song et al., 2007). Similarly, retail brokers implemented more self-service options on their websites, reducing the cost for their services. As a consequence, researchers began utilising discount brokerage data to analyse the trades of retail investors (e.g., Ivković & Weisbenner, 2005; A. Kumar & Lee, 2006; Dorn et al., 2008) and used the terms individual investor and retail investor interchangeably (e.g., Foucault et al., 2011). The emergence of fintech brokerage companies changed the structure of the financial services industry yet again (You et al., 2023). Commission-free trading, as introduced by the fintech broker Robinhood (Barber et al., 2022), was adopted by traditional brokers in October 2019 (Johnson et al., 2024). At the same time, brokerage companies’ mobile applications have evolved into one-stop-shop financial applications that offer retail investors access to a wider selection of financial products (Ozik et al., 2021; You et al., 2023). Robo-advisors (Bhatia et al., 2021) and social trading platforms (Heimer, 2016) are facilitating access to relevant market information for private investors.

Hence, the investment environment in the 2020s no longer justifies a distinction between retail investors and other types of individual investors. With regard to the existing definitions and the current investment reality, retail investors are defined in this article as non-professional individual investors who generally invest small amounts in securities or funds for personal purposes through brokerage companies.

3. Methodology

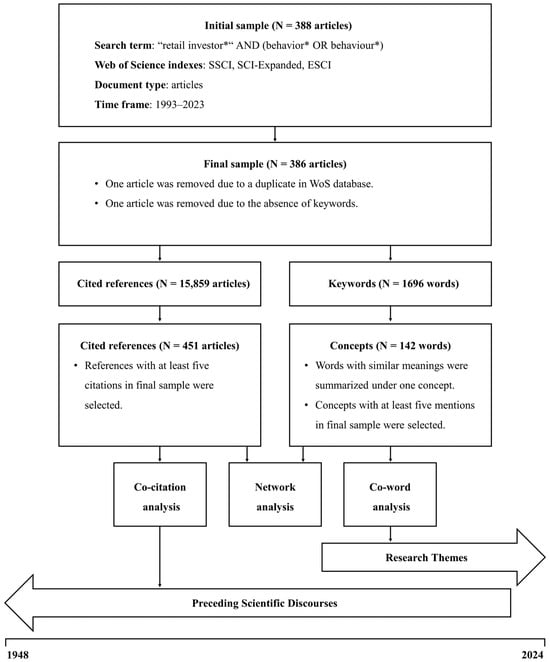

A bibliometric analysis applies quantitative statistical methods to aggregated bibliographic data for the evaluation of the scientific research literature (Pritchard, 1969; Broadus, 1987). The research objective is to uncover previously unknown patterns in the dataset, which are manifested in the connections between research disciplines, research fields, keywords, authors, and individual articles (Zupic & Čater, 2015). Due to the growth in scientific publications and the availability of bibliometric data through scientific databases such as Scopus and Web of Science, bibliometric analysis has become a widely used research method in the field of business economics (e.g., Castillo-Vergara et al., 2018; D. Zhang et al., 2019). While a co-citation analysis depicts past trajectories, and bibliographic coupling depicts present trajectories of a research field, a co-word analysis can be used to predict future research trajectories (Donthu et al., 2021). In order to provide a structural overview of the past, present, and future trajectories of research on retail investor behaviour, the present study employs a composite bibliometric approach that integrates a co-word and co-citation analysis. A co-word analysis is used to identify the underlying themes and avenues for future research regarding retail investor behaviour. Considering the retail investor terminology, a co-citation analysis is used to detect the intellectual foundations of the different research themes. This step is necessary, as the terms retail investor and individual investor have been used almost synonymously in the last decade. However, since not all study results on individual investor behaviour may universally apply to retail investors, the cited references of the retail investor studies should be suitable to identify those articles that provide applicable insights. In a network analysis of the corresponding keywords and the cited references, the thematic network is mapped visually and quantified using proven scientometric parameters (Rost et al., 2017). The steps required to pre-process the initial sample and the analysis methods are displayed in Figure 1 and are described in the following chapters.

Figure 1.

Overview of the methodological steps.

3.1. Sample Selection Process

An initial sample is obtained from the Clarivate Web of Science (WoS) platform. The WoS platform was chosen for its extensive citation data and recognised reputation in bibliometric studies (Zhu & Liu, 2020), making it an established database in evaluative bibliometrics (Leydesdorff & Bornmann, 2016). A Boolean operator (“AND”) is used to search for peer-reviewed articles that encompass research on retail investors and behavioural aspects. Each block of the search term is marked with an asterisk at the end of the word to prevent a potential limitation in scope (Figure 1). In order to ensure the inclusion of various facets of behavioural research linked to research on retail investors, the topic search is conducted in the Social Sciences Citation Index (SSCI), Science Citation Index Expanded (SCI-EXPANDED), and Emerging Sources Citation Index (ESCI). No restrictions with regard to publication years or WoS research areas are applied to the data retrieval, as the combination of words in the search term is primarily used in the realm of business economics. The initial sample consists of 388 articles, which were extracted on 20 November 2023.

3.2. Data Pre-Processing

All articles of the initial sample are screened manually in order to subsequently correct an incorrect allocation in the data retrieval process. The topic search in WoS identifies articles based on the title, abstract, author keywords, and KeyWords Plus. While the title, abstract, and author keywords are defined by the authors of an article, the KeyWords Plus are formulated by Clarivate’s algorithm (Garfield & Sher, 1993). In exceptional cases, this can lead to incorrect outcomes in WoS search results. The manual screening revealed that all articles belonged to the original area of interest, but one article was listed twice in the SSCI. As a result, the duplicate is eliminated from the initial sample. The co-word analysis and the co-word network analysis in this study use author keywords and KeyWords Plus in a merged concept format. While author keywords are topic-specific words that the authors themselves have selected to represent the content of their articles (Lu et al., 2020), KeyWords Plus are automatically generated words from the titles of references which are cited in the articles (Garfield & Sher, 1993). Despite having a broader description of the content of an article, previous studies have shown that KeyWords Plus offers similar qualities for co-word analysis as author keywords (J. Zhang et al., 2016). Due to the absence of author keywords in 42 articles in the initial sample, merging author keywords and KeyWords Plus will enable the assignment of almost all articles to a research theme in the co-word analysis. Only one article did not contain author keywords or KeyWords Plus and was removed from the initial sample. Thus, the final sample consists of 386 articles with 1696 distinct words that were mentioned 4491 times in the dataset.

3.3. Analysis Methods

The composite bibliometric approach involves a conceptual integration of co-word and co-citation analysis. The inclusion of KeyWords Plus in the creation of concepts ensures that a link to the cited references is established early on in the identification of research themes through the co-word analysis. Subsequently, the preceding scientific discourses revealed by the co-citation analysis can then be associated with the research themes by examining the citing literature. This approach effectively connects historical references with the concepts prevalent in current scholarly publications and thus offers a way to analyse the evolution of academic thought and identify emerging trends in the field. In the present study, KHCoder, UCINET, and SPSS are used for the co-word analysis; BibExcel and UCINET for the co-citation analysis; and UCINET and Gephi for the network analysis.

3.3.1. Co-Word Analysis

A co-word analysis is based on the assumption that co-occurrences of words reflect a thematic relationship between them (Donthu et al., 2021). If two or more words are frequently used together in the titles, abstracts, or keywords of articles, those words might be representative of a research theme (van Eck & Waltman, 2014). Analyses of the frequency distribution with the software KHCoder 3.0 revealed the presence of synonyms, plural forms, and abbreviations among the distinct words. Concepts are formed, which can comprise several distinct words (e.g., “INITIAL PUBLIC OFFERINGS” = “initial public offerings” and “ipo”). The formation is limited to word stems in order to differentiate between potentially different applications in the research themes (e.g., “DECISION” and “DECISION MAKING” might not be used in the same context). Consequently, the distinct words were transformed into 1452 concepts. In order to include only the most representative concepts, concepts with at least five mentions in the dataset are selected for further analyses. Concepts that were included in the search term as well as non-informative concepts (e.g., THEORY) are eliminated, since those concepts might lead to trivial results (Block & Fisch, 2020). Hence, 142 concepts, accounting for 58.61% of all mentions, constitute the final sample for the co-word analysis.

To analyse the co-occurrences of the 142 concepts in the merged keywords of the 386 articles, a binary concept occurrence matrix is created with KHCoder 3.0. The resulting matrix contains a one in each cell of a row in which a concept is present in the merged keywords of the respective article. Based on the binary keyword occurrence matrix, a concept co-occurrence matrix is created with the software UCINET 6.636 (Borgatti et al., 2002). The diagonal of the concept co-occurrence matrix (i.e., the total number of occurrences of a concept) is replaced by the highest number of co-occurrences with another concept. An exploratory factor analysis (EFA) is conducted with IBM SPSS Statistics 28 to identify the thematic relationships. By grouping the concepts into factors based on factor loadings, the EFA characterises the research themes in the sample (H. Sun & Teichert, 2024). A principal component analysis and a varimax rotation with Kaiser normalisation are used to extract the research themes. In addition to high factor loadings of the concepts, representative articles are also used to describe the factors. The representativeness of an article is determined by an especially high absolute and relative number of relevant concepts for a respective factor.

3.3.2. Co-Citation Analysis

A co-citation analysis assumes that high co-citation frequencies are an indicator of the relevance of articles for scientific discourses (Small, 1977). In other words, if a considerable number of authors frequently cite two (or more) articles together, these articles are considered to make an important contribution to a research field. Thus, a co-citation analysis can be used to investigate the intellectual structure of an academic field and its underlying themes (e.g., White & Griffith, 1981; Z. Liu et al., 2015). In total, the final sample contained 15,859 unique references. To include the most relevant articles, only articles with at least 5 co-citations are selected for further analysis, which reduces the reference sample to 451 articles. Equivalent to the co-word analysis, a binary citation matrix and a symmetric co-citation matrix are created for further analysis (e.g., Small, 1973; McCain, 1990). On the basis of a principal component analysis and a varimax rotation with Kaiser normalisation, as well as the research themes extracted from the co-word analysis, the referenced articles are assigned to preceding scientific discourses which represent the intellectual foundations of the research field (Donthu et al., 2021).

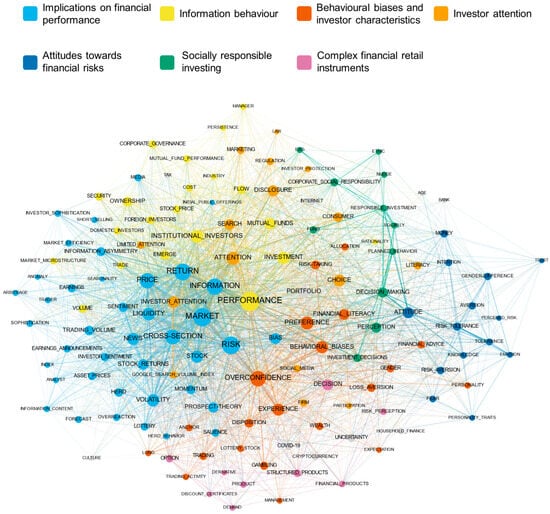

3.3.3. Network Analysis

A network analysis is a commonly applied method in bibliometrics to visualise the linkages and structures of research networks (e.g., Kuntner & Teichert, 2016; Wörfel, 2021). The visualisation of the concept co-occurrence and co-citation matrices with Gephi (version 0.10.1) facilitates interpretations of the roles within and between different research themes and the preceding scientific discourses (Bastian et al., 2009; Zuschke, 2020). Using Fruchterman–Reingold and Force Atlas 2 layout algorithms sequentially in Gephi provides enough space between larger nodes while maintaining the original properties of the network, which are based on geodesic distances (i.e., number of ties). The node size reflects the total number of co-occurrences, the thickness of lines represents the number of co-occurrences between two concepts, and the colour displays factor affiliation.

On the node level, a core–periphery analysis reveals the concepts that are central to the topic and relate to overarching research themes (Borgatti & Everett, 2000). In addition, a core–periphery analysis of the co-citation network is used to identify the most influential cited articles from the preceding scientific discourses. The densities within and between the different research themes and preceding scientific discourses of the respective networks are calculated with UCINET 6.636. Dividing the number of existing ties between nodes by the sum of all possible ties, the density scores of a dichotomised concept co-occurrence matrix display the (inter-)connectedness of themes (Hanneman & Riddle, 2005). Moreover, a density analysis is similarly applied to the co-citation matrix to assess the extent of (inter-)connectedness among the most cited references.

4. Descriptive Summary of Literature on Retail Investor Behaviour

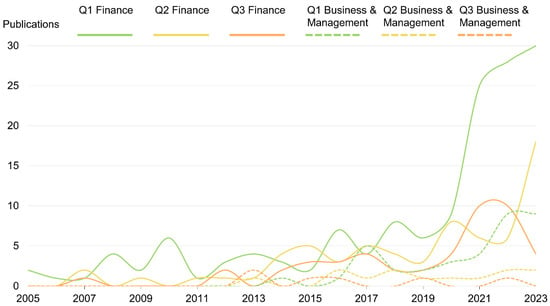

The expansion of research on retail investor behaviour is illustrated in Figure 2, which depicts the number of published articles by year, field of research, and SCImago quartile. The field of finance includes journals categorised under “Business Finance” and “Economics” in the WoS, while the field of business and management encompasses journals within the “Business”, “Management”, and “Operations Research & Management Science” categories. Despite being limited to three SCImago quartiles, Figure 1 includes 330 of the 386 articles in the final sample. Notably, early publications in Q1 journals from the field of finance initiated the examination of the topic in the first decade of the 21st century. In contrast, other journals began publishing on this topic only around the beginning of the last decade. Despite a noticeable uptick in publications between 2015 and 2017, the dissemination of research on retail investor behaviour began in the year 2020, with more than 60 percent of all publications appearing from that year onwards. In recent years, high-quality journals in the field of business and management, such as the Journal of Business Ethics, Journal of Business Research, and Management Science, have made notable contributions, potentially broadening the perspective and range of research on retail investor behaviour.

Figure 2.

Journal and publication timeline.

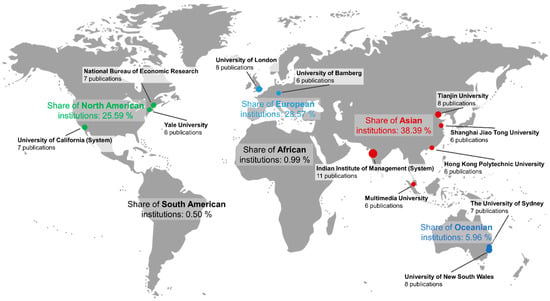

Figure 3 highlights the international scope of the topic by showing the share of all contributing institutions per continent, along with the most influential institutions having more than five affiliated publications. The Indian Institute of Management (IIM System) stands out with 11 affiliations, leading in the number of articles produced. Researchers from Yale University display the highest citation index, averaging 108.5 citations per publication, among the most influential institutions. The figure also uncovers a geographic imbalance in contributions, with Asian institutions being the most prominent in this area of research, while those from Africa and South America are the least represented. Consequently, this imbalance may result in the perspectives of retail investors from Africa and South America being underrepresented in the research.

Figure 3.

Research contribution by continent and most influential institutions.

The diversity of the research field is reflected in the overview of the most frequently cited articles on retail investor behaviour (see Table 1). Early publications investigated the general stock trading behaviour of retail investors with regard to theories from behavioural sciences and in comparison to institutional investors (Locke & Mann, 2005; Graham & Kumar, 2006; Gopi & Ramayah, 2007). In addition, the analysis of stock returns from small retail investments was a frequently investigated topic in the initial phase of the research field (Hvidkjaer, 2008; Brandt et al., 2010; Kelley & Tetlock, 2013). Frazzini and Lamont’s (2008) seminal work on future stock return predictions based on mutual fund flows connects the literature on stock returns with research on investor sentiment, which itself has become an important area in research on retail investor behaviour (Cornelli et al., 2006). A more recent topic among the most frequently cited articles is the study of investor attention in the stock market (Dimpfl & Jank, 2016; Wen et al., 2019).

Table 1.

Most frequently cited articles on retail investor behaviour.

A core–periphery analysis of the co-citation matrix is used to identify the most influential articles from the cited references. Table A1 in Appendix A lists the 55 core articles identified. The seminal work by Barber and Odean (2008) stands out as the most influential article based on its total number of citations in the references of the final sample. Interestingly, the second most cited article is by Barber and Odean (2000), which specifically distinguishes between household investors and retail investors based on the brokerage type used, focusing only on the behaviour of discount clients. Even though an investigation of the time period of citation in the final sample reveals that the share of articles which cite studies that make a distinction regarding brokerage types decreases over the years (which might be due to the dissemination of research on retail investors), contemporary research on retail investors continue to use these articles as sources. However, the majority of core articles do not explicitly define the type of investor they address. They either use the terms “individual investor” and “retail investor” interchangeably or consistently adhere to a single term throughout the text.

5. Past and Present Trajectories of Research on Retail Investor Behaviour

A composite bibliometric approach is used to explore the past and present trajectories of research on retail investor behaviour. Firstly, a co-word analysis is employed to identify predominant thematic research areas of articles that explicitly use the term “retail investor”. Secondly, a co-citation analysis of the referenced articles, which can be applied to research on retail investors but does not necessarily use the retail investor terminology, uncovers the intellectual foundations of the thematic research areas. In order to reflect the chronological order of the publications, the results of the co-citation analysis are reported first in the following sub-sections, even though the affiliations of the preceding scientific discourses and the research themes are all based on the results of the co-word analysis.

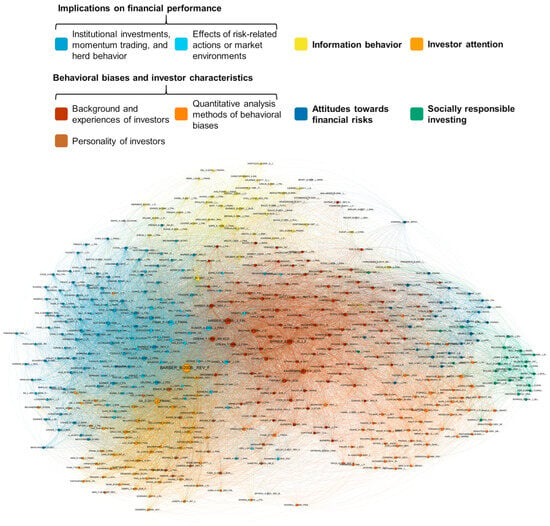

The performance of a principal component analysis and varimax rotation with Kaiser normalisation reveals the existence of seven distinct factors that explain 52.34% of the total variance in the final sample of 142 concepts. The highest factor loadings of concepts (fl > 0.7) and the most representative articles are used to characterise the predominant thematic research areas of the factors. All articles of a respective factor are qualitatively analysed to describe the research paradigm and thematic relationships.

A principal component analysis and varimax rotation with Kaiser normalisation of the symmetric co-citation matrix yielded nine preceding scientific discourses, which together explain 51.42% of the variance in the references sample of 451 articles. The referenced articles with the highest factor loadings (fl > 0.7) and the research theme affiliation of the referencing articles from the final sample are used to characterise the predominant research area(s) of the preceding scientific discourses.

5.1. Implications on Financial Performance

The first research theme consists of articles which focus on the impact of retail investor behaviour on financial performance. With 120 assigned articles and an explained variance of 14.40%, the first research theme can be considered the most influential branch of research regarding retail investor behaviour. A descriptive analysis of the research methodologies uncovers that the empirical analyses in these articles are supported by a comprehensive set of data sources, including trading records of retail investors and datasets on market indices and stock price volatility across global financial markets. In addition, measurements capturing significant market occurrences, information on retail investor sentiment during key events, and the Google search volume index collectively provide a multifaceted perspective on market dynamics and financial performance. The empirical foundation is further enriched by insights derived from online surveys, econometric experiments, and social media interactions.

The methodologies employed in the articles of this factor are predominantly quantitative, utilising statistical analysis techniques such as cross-sectional, panel, and time series regression models. To explore causal relationships, methods such as Granger causality and a mediation analysis are used, supplemented by structural equation modelling. Advanced machine learning and predictive analytics, exemplified by random forest classifiers, offer robust quantitative analytical frameworks. In addition, behavioural and decision-oriented models, including technology acceptance models, contribute to a deeper understanding of economic behaviours and their impact on financial performance.

5.1.1. Preceding Scientific Discourses on Implications for Financial Performance

Two distinct preceding scientific discourses can be identified as the theoretical basis for the first research theme. The first preceding scientific discourse comprises referenced articles that investigate institutional investments, momentum trading, and herd behaviour. In contrast to trading on information, it is unlikely for individual investors to make a profit from noise trading (Black, 1986). Rather, rational speculative investors can profit when purchasing ahead of noise trader demand (de Long et al., 1990). Positive feedback investment strategies applied by institutional investors can lead to net positive trading following past intraday excess stock returns (Griffin et al., 2003). Hence, institutional investors act as momentum traders when expanding their portfolio and as contrarian traders when liquidating their position (Badrinath & Wahal, 2002). This type of trading behaviour is particularly pronounced among institutional investors who invest in foreign markets (Froot et al., 2001; Richards, 2005). For mutual funds, momentum trading leads to significantly better fund performance. However, despite the prevalence of positive feedback investment strategies, there is only weak evidence that institutional herding results from momentum trading (Grinblatt et al., 1995). Instead, lag institutional demand and lag returns are positively correlated with institutional herding (Nofsinger & Sias, 1999). Thus, institutional investors mimic their own and other institutional investors’ trading behaviour and herd as a result of the interpretation of information from lagged trades (Sias, 2004). Empirical studies on the effects of risk-related actions or market environments on stock returns (Fama & MacBeth, 1973) are frequently cited in the second distinct preceding scientific discourse. The analyses include the impact of periodic market closures on trading policies of individual investors (Hong & Wang, 2000), the influence of conditional skewness on expected returns (Harvey & Siddique, 2000), and the role of the 52-week high for momentum investing (George & Hwang, 2004). Based on the notion of cumulative decision weights of the cumulative prospect theory (Tversky & Kahneman, 1992), positively skewed stocks can be overpriced, as individual investors prefer lottery-like investments (Barberis & Huang, 2008). Stocks that have lottery-like features attract retail investors with a strong gambling tendency (Han & Kumar, 2013). Correlated trading in stocks with lottery-like features by investors with stronger gambling tendencies can generate excess return comovement (A. Kumar et al., 2016). The demand for lottery-like stocks can be a driver for the beta anomaly, which in turn leads to low abnormal returns (Bali et al., 2017).

5.1.2. Research Theme 1: Implications on Financial Performance

Financial markets with a high proportion of retail investors frequently serve as a research object for the analysis of deviations from the efficient-market hypothesis (W. Li & Wang, 2010; Haritha & Rishad, 2020). Correlated trades of retail investors can be the result of a prevailing market expectation that the prices move in a specific direction (Schmeling, 2009). On the basis of daily transaction records of more than 37,000 clients of a German discount broker, Dorn et al. (2008) find that comovement among speculative market order trades is 20% to 50% higher in comparison to non-speculative market order trades of retail investors, and that those speculative market order trades lead returns in comparison to other types of trading. Using small-sized buyer-initiated trades from the years 1994 to 2004 in U.S. markets, Y. C. Chan (2014) argues that bullish retail investor behaviour can lead to the overpricing of shares in initial public offerings and future price reversals. For a more recent database (2005 to 2009), Hu and Wang (2013) find that cross-sectional stock returns are affected by the correlated trading of retail investors and that buy–sell imbalance is a reverse indicator to predict future returns. Based on the buy–sell imbalance of retail investors, Kim et al. (2017) find a negative mean–variance relation for high-sentiment stocks and a positive mean–variance relation for low-sentiment stocks. In addition, stocks with a low retail investor concentration exhibit a strong risk–return trade-off. Intraday price anomalies can also be attributed to the (short-term) sentiment of retail investors. In line with the findings for institutional investors from the preceding scientific discourses on financial performance (Griffin et al., 2003), stocks with high-attention days exhibit a stronger net buying behaviour at the opening of the next trading day, which leads to high opening prices and positive returns during the overnight period (Berkman et al., 2012). On the contrary, stocks that receive less investor attention and recently recorded large daily losses will exhibit lower future returns as retail investors underreact to the high left-tail risk and overprice these stocks (Atilgan et al., 2020). Potential triggers for an increase in retail investor attention can be unanticipated price shocks for commodities (Qadan & Nama, 2018) or monetary policy announcements, especially if the announcement contains unfavourable information for investors (Gong & Dai, 2017).

In uncertain market conditions, retail investors rely on financial blogs to access information that can guide their investments, especially when information asymmetry is high or the market experiences prolonged price declines (Rickett, 2016). As a consequence, buy recommendations on financial blogs can lead to abnormal trading volumes and abnormal returns (Rickett & Datta, 2018). Furthermore, the purchasing behaviour of established institutional investors can serve as an investment guide for retail investors. Despite the fact that closed-end funds are transparent entities, announcements of director purchases lead to significant positive abnormal price returns, and the trading volume of retail investors increases around the day of the purchase but bounces over the following 15 days back to pre-purchase levels (Andriosopoulos et al., 2015). While information on the purchasing behaviour of key market actors increases trading volume, post-trade trader anonymity does not have an effect on the trading behaviour of retail investors (Meling, 2021). Thus, retail investors seem to mimic the behaviour of institutional investors, a phenomenon observed in the preceding scientific discourses on financial performance (see Sias, 2004). However, retail investors can fall victim to manipulated institutional information when the stock market is monitored too closely. Using big buy or big sell orders from institutional investors as trading signals, retail investors trade on potentially manipulated information (upwards/downwards), which ultimately leads to negative returns (C. Liu et al., 2021). Consequently, short-term reversals in stock markets can be attributed to the noise trading of retail investors, who react strongly to trading signals (Chui et al., 2022). During negative stock market bubbles (i.e., market crashes), the contrarian behaviour of retail investors can lead to negative feedback trading, which results in positive returns during the rebound (Ülkü et al., 2023). Another potential trading signal of individual stocks is a temporary extreme positive performance. Due to judgment biases in the processing of positive information, retail investors overvalue stocks with high maximum daily returns (MAX) in a given month, which leads to low returns in the subsequent month (Baars & Mohrschladt, 2021). While the MAX effect is negatively related to price anchors (e.g., the maximum stock price over the preceding year), investor attention is the main determinant for retail investors’ skewness preference in the evaluation of the 52-week high price (Z. M. Wang & Lien, 2023).

5.2. Information Behaviour

The second research theme contains articles that describe the information sourcing and interpretation of available market data by retail investors. Most of the articles in this research theme use institutional investors as an illustrative example to distinguish their information behaviour from the information behaviour of retail investors. In total, 52 articles can be assigned to this research theme, which explains a combined 8.16% of the variance.

A descriptive analysis of the research methodologies uncovers that the empirical analyses in these articles are supported by a diverse array of data sources, including market and trading data covering multiple years. Surveys targeting both retail and institutional investors, alongside big data analytics, further enrich the empirical foundation. Behavioural and decision-making studies offer in-depth insights through analyses of popular trading apps like Robinhood. Corporate and regulatory analyses provide data on investor holdings during global financial crises and responses to policy changes. In addition, financial product analyses incorporate data on IPO auctions and mutual fund flows, serving as indicators of investor sentiment.

The articles within the second research theme predominantly utilise quantitative statistical analysis techniques, including cross-sectional regressions and random effect panel data models. To analyse differences among groups, analyses of variance and discriminant function analyses are frequently utilised. Consistent with empirical studies in other research themes, structural equation modelling is employed to explore causal relationships within the data. Furthermore, the Fama–MacBeth approach and staggered difference-in-differences design provide robust frameworks for a detailed examination of how retail investors interact with and interpret market data.

5.2.1. Preceding Scientific Discourse on Information Behaviour

The distinct preceding scientific discourse of the second research theme is centred around research on mutual funds, as individual investors’ mutual fund investments can be based on different types of information sources (Alexander et al., 1998). Information on mutual fund risk can be derived from managerial incentives (Brown et al., 1996; Chevalier & Ellison, 1997). Funds with high fees, as well as advertised funds, attract inflows from individual investors even though they do not necessarily perform better (Sirri & Tufano, 1998; Jain & Wu, 2000). One potential explanation is the increasing participation of novice investors, which exhibit high search costs and therefore rely on financial advisory services, media attention, or advertisements (Hortaçsu & Syverson, 2004; Barber et al., 2005). In order to redeem participation costs, new investors rely on a relative mutual fund’s past performance when making investment decisions (Ivković & Weisbenner, 2009). The flow-performance relationship is dependent on different levels of participation costs (Huang et al., 2007), although past performance is not predictive of future returns or indicative of the skills of active fund managers (Berk & Green, 2004).

5.2.2. Research Theme 2: Information Behaviour

While individual characteristics of institutional analysts do not have an impact on the information sources and communication channels used, the institutional resources significantly influence the information behaviour of institutional analysts (Baldwin & Rice, 1997). Moreover, local institutional analysts display a home bias regarding the interpretation of information (S. Lai & Teo, 2008). Institutional analysts can therefore be subject to similar behavioural biases as retail investors (Shao & Wang, 2021). Investigating the information content of mutual fund ratings for retail investors, Faff et al. (2007) find that newly upgraded funds attract investments and newly downgraded funds deter investors. Thus, retail investors do rely on analysts’ recommendations when investing in mutual funds. In addition, information on previous returns serves retail investors as guidance for the investment in mutual funds, even when top past performing mutual funds might have an unfavourable expense ratio (Navone, 2012). Another source of information for retail investors can be the publicly available data on stocks held by mutual funds. S. Yao and Zhang (2022) find that the number of overweighing mutual funds for a target stock is a significant indicator for the short-term performance of this specific stock.

Despite the increasing availability of financial information for retail investors, information asymmetry continues to be an important topic for research on retail investors. Whereas small retail investors are likely to be noise traders, institutional investors generally make more informed investments, as their trades forecast returns more accurately (Kuo et al., 2015). In line with this argument, H. L. Chen et al. (2015) find that correlated trades of small retail investors are inversely associated with future stock returns. For large retail investors, the correlated trades positively predicted future returns. Moreover, large retail investors tend to trade shortly before earnings announcements and price changes, thus exhibiting a very similar trading behaviour to the behaviour of local institutions (e.g., Chiu et al., 2021). Brokers, analysts, and fund managers, who can often be considered large individual investors themselves, engage in similar behaviour when trading for their own accounts, outperforming retail investors over short periods of up to a month (Berkman et al., 2023). Having different payoff functions, investments in options, and futures can reflect different information about the expected future returns of companies. In the context of aggregated stock returns, Bae and Dixon (2018) show that institutional investors use futures and options to trade on different types of information than retail investors. Investigating the information content of investor groups’ transactions in different commodity futures, Iwatsubo and Watkins (2020) find that domestic retail investors have the greatest influence over the efficient price in the Japanese gasoline futures market. As the underlying commodity is a domestic grade of finished regular gasoline, local information is crucial for trading on this particular futures market.

Similarly, the investment in small-cap stocks in emerging markets requires local knowledge of how these companies operate and what factors in the societal environment might affect the business. Consequently, domestic retail investors invest a large proportion of their investment capital in small-cap stocks and focus on business sectors that operate locally (Chhimwal et al., 2021). Mostly utilising contrarian investment strategies, retail investors tend to base their trading behaviour in emerging markets on the past trading activities of institutional investors (Koesrindartoto et al., 2020). The contrarian behaviour is even more pronounced for stocks that have lost in the past, causing retail investors’ portfolios to lose value, as past losing stocks are underperforming in comparison to past winners in the short run (Chhimwal & Bapat, 2021).

5.3. Behavioural Biases and Investor Characteristics

The third research theme comprises articles that examine investor characteristics and behavioural biases which can influence the behaviour of retail investors. In contrast to the articles of the first research theme, the research focus lies on the characteristics and behavioural biases themselves, rather than the analysis of the effects on performance. With 65 assigned articles and an explained variance of 7.64%, the investigation of behavioural biases and investor characteristics contributes to research on retail investor behaviour far beyond the scope of the first research theme.

A descriptive analysis of the research methodologies uncovers that the empirical analyses in these articles are centred on survey and experimental data. In addition, market and trading data from significant market events, such as market drops or the COVID-19 pandemic, are frequently utilised. Expert interviews provide practical insights that contrast the behavioural biases of retail investors with the rational actions of institutional investors. Consequently, the data sources include both grouped and individual analyses, facilitating a comprehensive understanding of investor characteristics and behavioural biases.

The methodologies used in the articles of the third research theme are predominantly quantitative, employing a variety of statistical analysis techniques. These include cross-sectional regressions, time series regression analysis, and structural equation modelling with tools like SmartPLS for PLS-SEM. Causal analysis methods, such as multiple mediation tests, multinomial logit, and covariance-based SEM, are applied to explore complex relationships and behavioural biases. In addition to quantitative techniques, qualitative approaches are also utilised, including case-based decision theory, which provides valuable insights into how past experiences influence investor behaviour and decision-making processes.

5.3.1. Preceding Scientific Discourses on Behavioural Biases and Investor Characteristics

Three distinct preceding scientific discourses can be identified as the theoretical basis for the research theme “Behavioural biases and investor characteristics”. The first preceding scientific discourse comprises referenced articles that investigate the personal background and experiences of individual investors. Accordingly, overconfidence bias is associated with gender (Barber & Odean, 2001) and early successful investment experiences (Gervais & Odean, 2001), which in turn can lead to an increase in trading frequency (Glaser & Weber, 2007; Grinblatt & Keloharju, 2009). In addition, prior investment experiences can lead to loss aversion (Barberis et al., 2001), which can result in a withdrawal from the stock market (Seru et al., 2010). Therefore, the subjective evaluation of these experiences (Kaustia & Knüpfer, 2008) as well as the personal environment of the investors (Malmendier & Nagel, 2011) must be taken into consideration. The referenced articles of the second preceding scientific discourse study the importance of the investor’s personality in investment decisions. Differences in asset allocation and market participation are attributed to gender traits (Sunden & Surette, 1998; Jianakoplos & Bernasek, 1998) or the Big Five personality traits (Durand et al., 2008; Conlin et al., 2015). The latter also has an impact on information acquisition, which in turn can influence the trading behaviour of individual investors (Abreu & Mendes, 2012; Tauni et al., 2015). As a consequence, research on financial advisors identified the importance of the investor’s personality (Tauni et al., 2017) as well as the advisor’s personality (Tauni et al., 2018) for stock trading decisions. The third preceding scientific discourse contains referenced articles about methodologies or systematic reviews concerning specific behavioural biases. Among the articles with the highest factor loadings are guidelines for structural equation modelling (Fornell & Larcker, 1981; Henseler et al., 2015; Hair et al., 2019), questionnaire construction (Ajzen, 2002), as well as introductory articles on other behavioural research methods (Podsakoff et al., 2003; Faul et al., 2009). Systematic reviews on the effects of financial literacy and demographic variables on behavioural biases (Baker et al., 2019) or conceptual (Sahi et al., 2013) and summarising (Prosad et al., 2015; S. Kumar & Goyal, 2015; Zahera & Bansal, 2018) articles on behavioural biases in general combine the other two preceding scientific discourses of this research theme. The review articles on the theory of planned behaviour (Ajzen, 1991; Armitage & Conner, 2001) are also frequently cited in articles of the research theme “Socially responsible investing”.

5.3.2. Research Theme 3: Behavioural Biases and Investor Characteristics

Investigating the behavioural origins of cognitive biases in the financial market, Tarim (2016) argued that situated cognition can serve as an explanation for the objectively irrational market behaviour of retail investors. In line with the findings by Barberis et al. (2001) from the preceding scientific discourse on the personal background of individual investors, exaggerated extrapolation of past perceived portfolio returns can induce optimism, overconfidence, and a risky attitude among retail investors. These cognitive biases act as mediators for trading intentions, risky shareholding, and the willingness to take risks (M. T. I. Khan et al., 2017). Additionally, overconfidence partially mediates the impact of representative heuristics on investment decisions, as overconfident retail investors tend to overreact to new information regarding their investment targets (Parveen et al., 2020). Self-perceived confident retail investors believe that their investment capabilities are superior to other investors, thus placing too much importance on information that confirms their own perception (Chandra et al., 2017). As established in the preceding scientific discourses (Glaser & Weber, 2007; Grinblatt & Keloharju, 2009), this can, in turn, lead to an increased trading frequency.

Two potentially more powerful predictors of investment decision making are regret aversion and loss aversion (Bihari et al., 2023). Hence, the investment choices of retail investors are not solely influenced by desirable future outcomes, but also by the aversion to subjectively undesirable future outcomes. Interestingly, the prevailing market environment has an impact on the effect of aversion behaviour on trading behaviour. In an analysis of retail millennial investors during the COVID-19 pandemic, Talwar et al. (2021) find that in the presence of an external stressor, loss aversion has no significant impact on trading behaviour. In contrast, information on local firm bankruptcies has an effect on the risk-taking behaviour of retail investors. The extrapolation from local experiences (i.e., nearby firm bankruptcies) to expectations about the aggregate stock market can lead to increased trading behaviour, as retail investors try to reduce the share of potentially risky investments in their portfolio (Laudenbach et al., 2021).

While risk reduction can be a motive for increased trading of individual stocks, the gambling motive can prompt retail investors to invest in complex financial instruments. Based on real trading data of Portuguese individual investors, Abreu (2019) finds that the gambling motive is a distinguishing characteristic of retail investors in warrants. Moreover, overconfident and disposition-prone young male investors are more likely to invest and trade in warrants. Reflecting the findings by Barber and Odean (2001) and Jianakoplos and Bernasek (1998) of the preceding scientific discourses on the personality and the personal background of individual investors, the disposition proneness of retail investors can be attributed to gender, loss aversion, trading experience, and sophistication in trading (Ahn, 2022). In addition, mental accounting has an impact on the disposition effect (Frydman et al., 2018). Whereas cognitive biases and investor characteristics are inherent to the investor, X. Zhang et al. (2022) find evidence that the market environment and market entry timing influence the size of the disposition effect. Retail investors who enter the stock market in periods of low market returns, low investor sentiment, high market volatility, or high economic policy uncertainty exhibit a stronger disposition effect.

In a study on the relationship between personality traits and susceptibility to behavioural biases, venturesomeness was negatively correlated with susceptibility to overconfidence, mental accounting, and the sunk cost fallacy. Neither impulsivity nor empathy had a significant correlation with behavioural biases (Rzeszutek, 2015). While venturesomeness is generally associated with gender and age, other observable investor characteristics (such as educational status or income) are frequently investigated in the articles of the third research theme (Chandra et al., 2017). Retail investors with a higher household income tend to trade more in volume and value and are more likely to invest in lottery-like stocks (Bui et al., 2022). Birth cohorts, identified by average GDP growth rates during investors’ teenage years and shared social and cultural experiences, display a similar speculative investment preference in the stock market. Retail investors who have experienced desirable macro-economic and social conditions during adolescence are more likely to invest in lottery-like stocks (Lepone et al., 2023).

5.4. Investor Attention

The articles of the fourth research theme focus on retail investor attention and subsequent reactions to information disclosures. In total, 53 articles are assigned to this research theme, which explain a combined 6.83% of the variance.

A descriptive analysis of the research methodologies uncovers that the empirical analyses in these articles draw on theoretical and analytical studies that explore frameworks in behavioural economics and the regulatory impacts in the post-Lehman Brothers era. Moreover, behavioural and decision-making studies investigate the link between Google search index volumes and trading behaviour across various investment products, using data from international stock markets and the cryptocurrency market. Internet-based experiments and perception surveys further assess investor reactions to information disclosures. Additional data sources, such as mutual fund disclosures and advertising-related search behaviours, shed light on how retail investors perceive and interpret information, highlighting the multifaceted nature of research on investor attention.

The methodologies employed in these articles are predominantly quantitative, utilising statistical analysis techniques such as multiple regressions, panel regression models, and Tobit regressions. Time series techniques, including autoregressive models, Granger causality, and wavelet coherence, are utilised to uncover temporal patterns and relationships within the datasets. A survival analysis offers insights by examining the timing and duration of events, highlighting factors that influence investor attention. Notably, some studies employ neuroscientific techniques to blend insights from behavioural finance with cognitive neuroscience, offering a novel perspective on investor attention and decision-making processes.

5.4.1. Preceding Scientific Discourse on Investor Attention

The role of advertising and the impact on stock returns are the predominant themes of the preceding scientific discourse, which serves as the intellectual foundation of the fourth research theme. Companies that have higher expenditures on advertising in the product market possess a greater number of retail and institutional investors as well as better liquidity of their common stock (Grullon et al., 2004). Even though product market advertisements are designed to attract consumer attention, increased advertising spending has a short-term impact on investor attention and abnormal stock returns (Lou, 2014; Madsen & Niessner, 2019). In contrast, stocks with no media coverage outperform stocks that are frequently featured on mass media outlets. One possible explanation for this result is that the media provide investors with company information that is comparable to that of financial analysts (Fang & Peress, 2009). The information demand of individual investors can be quantified via internet search volume (Drake et al., 2012), which has its methodological roots in epidemiology research (Ginsberg et al., 2009). Consequently, a Google search volume index is used to measure investors’ active attention and its implications for stock market activity (Aouadi et al., 2013). Increased investor attention is accompanied by positive weekly stock returns (Takeda & Wakao, 2014) and partial return reversals in the subsequent weeks (Ying et al., 2015). The impact of investor attention on future stock returns is affected by past index returns (Vozlyublennaia, 2014). Accordingly, market-wide attention-grabbing events induce individual investors to sell their positions when the market index is high and to moderately increase their stock holdings when the market index is low (Yuan, 2015).

5.4.2. Research Theme 4: Investor Attention

Retail investor attention is typically measured by internet search intensity, as supposedly uninformed retail investors tend to meet their information demand via search engines such as Google or Baidu (Da et al., 2011). Strong market movements can lead to an increase in search queries, which is followed by a higher volatility in the stock market (Dimpfl & Jank, 2016). Using daily company-specific Wikipedia searches, Behrendt et al. (2020) show that collective retail investor behaviour can be inferred from their search history on digital encyclopaedias. In the same vein, Google search queries can promote herd behaviour in the stock market, as retail investors rely on the available and free information from search engines and make similar trading decisions (Wanidwaranan & Padungsaksawasdi, 2022). This effect is more pronounced in bull markets and for companies with a small capitalisation (Hsieh et al., 2020). Increases in abnormal Google search volume for company-specific information can also predict the odd-lot trading of retail investors. While an increase in abnormal search volume leads to fewer odd-lot trades for stocks with a low price (below USD 11), an increase in odd-lot trades can be observed for stocks with a medium-to-high price (above USD 46) (Kupfer & Schmidt, 2021). For companies with a smaller capitalisation, abnormal trading volume is positively affected by Google search queries of the previous period, whereas excess return is negatively affected. However, if the increased retail investor attention is driven by a positive price shock, an increase in Google search volume is positively correlated with excess return and trading volume (H. H. Lai et al., 2022). In addition to strong market movements or price shocks, Yang et al. (2021) find that earnings announcements, management forecasts, financial analysts following, mergers and acquisition announcements, and dividend pay-outs have a positive effect on internet search intensity.

Potentially mitigating the information asymmetry problem between retail investors and (investment) managers, investor attention is negatively associated with stock price crash risk. Consequently, retail investors should gather information from the internet before investing in emerging markets, whereas institutional investors can use search indexes as an indicator of investment (Wen et al., 2019). Social media activity increases retail investor attention and amplifies the effect of other media channels on trading volume and stock prices (Rakowski et al., 2021). Moreover, institutional investors can turn to online forums or social networks in order to evaluate potential risks for their investments, as retail investor-driven flash bubbles can have their origins in digital information sharing. While coordinated flash bubbles such as the GameStop trading frenzy might be difficult to predict, the bubble behaviour of single short-squeeze incidents can transmit to other unrelated, heavily shorted stocks (Umar et al., 2021). Before the initial surge in price in flash bubbles, retail investors show an increase in individual commitment in financial discussions on digital platforms. For the GameStop trading frenzy, the initial committed retail investors occupied a central position in the discussions on Reddit (Lucchini et al., 2022).

In the cryptocurrency market, news on cryptocurrency returns from popular coins induces investor attention, which in turn can lead to price pressure at lower market phases (Subramaniam & Chakraborty, 2020). Warnings from official authorities can reduce the demand for cryptocurrencies among inexperienced retail investors. The impact of these warnings is strongest when authorities point out privacy issues, whereas information on CO2 emissions or deposit guarantees only affects subgroups of investors (Ebers & Thomsen, 2021). Thus, policymakers can use specific messages to protect retail investors in highly volatile, decentralised market environments. Moreover, regulations can be imposed on financial advertising or disclosure requirements to protect retail investors from behavioural exploitation (Brenncke, 2018). But while regulators and affected institutions act on the basis of informed, rational behaviour, retail investors react to the media coverage of the regulation rather than responding to the content of the regulation (Scheld & Stolper, 2023).

5.5. Attitudes Towards Financial Risks

The fifth research theme contains articles that investigate influencing factors of retail investors’ attitudes towards financial risks. With only 22 assigned articles, the factor explains 5.94% of the variance.

A descriptive analysis of the research methodologies reveals that the empirical analyses of the fifth research theme are centred almost entirely on survey and experimental data. These surveys often encompass large, diverse samples of retail investors, incorporating self-assessment data that enrich the analysis of influencing factors across international markets. Furthermore, mixed-methods approaches blend qualitative interviews with quantitative data on the utilisation of certain financial services, enhancing the understanding of actual retail investor behaviour.

The methodologies employed in these articles are predominantly quantitative, utilising exploratory techniques such as cluster and factor analysis to uncover underlying patterns within the data. Predictors of risk attitudes are examined through multiple linear regression, logit, and structural equation models. Additionally, risk-preference assessments are conducted, utilising structured surveys and experimental settings to evaluate how varying levels of risk aversion impact investment choices. Comparative tools, such as analysis of variance, are used to highlight distinctions across different retail investor groups. Advanced techniques, including artificial neural networks, offer a sophisticated approach to predictive modelling by simulating complex, nonlinear relationships within the data.

5.5.1. Preceding Scientific Discourse on Attitudes Towards Financial Risks

One preceding scientific discourse can be assigned to the research theme “Attitudes towards financial risks”. In the referenced articles with high factor loadings, the analysis of the factors influencing investors’ risk tolerance includes biopsychosocial features such as gender, age, or other demographic characteristics. Female-headed households show lower levels of risk tolerance than similar households with a male head or a married couple (Sung & Hanna, 1996). The effects of gender on risk taking can be explained to a considerable extent, but not completely, by differences in financial knowledge (Dwyer et al., 2002) or previous investment experiences (Brooks et al., 2019). Age has an inverse, nonlinear relationship with risk tolerance (Hallahan et al., 2004). Hence, the willingness to take financial risks declines with growing age (R. Yao et al., 2011). While early research postulated a general decline in relative risk aversion of households (Schooley & Worden, 1996), supposedly reversed by socio-economic factors such as retirement (Riley & Chow, 1992), more recent research confirmed a modest, negative effect of age on risk tolerance, which cannot be attributed to other observable characteristics that differ between younger and older individual investors (Brooks et al., 2018). In addition, the individual investor’s personality traits, socio-economic background, and family structure, alone or in combination with gender and age, have an impact on financial risk tolerance (Grable, 2000).

5.5.2. Research Theme 5: Attitudes Towards Financial Risks

In comparison to institutional investors and financial advisors, retail investors tend to be more risk-averse when investing in the stock market and adopt more passive investing behaviour as they get older (Lo et al., 2019). However, the relationship between age and risk tolerance does not increase linearly with increasing age and is moderated by bull and bear market phases (Arora & Mishra, 2023). In accordance with findings by Sung and Hanna (1996) and Grable (2000) from the preceding scientific discourse on attitudes towards financial risks, demographic characteristics such as gender, education, or occupation can be used to differentiate between retail investors’ financial risk tolerance profiles (Kannadhasan, 2015). Brooks and Williams (2021) show that the personality traits neuroticism, trait anger, intolerance of uncertainty, resilience, and financial self-efficacy have a significant impact on financial risk tolerance. In periods of high market volatility, only financial self-efficacy has significant explanatory power for retail investor behaviour, which in turn excludes financial risk tolerance as a reliable predictor of retail investor reactions to actual investment losses (Brooks & Williams, 2022). Investigating the link between emotions and attitudes to financial risk, Brooks et al. (2023) find that financial risk tolerance increases with positive emotions towards investments and towards life and decreases with negative emotions. Moreover, retail investors who have more positive emotions towards investments than towards life have a higher risk tolerance than retail investors who have equally positive or equally negative emotions towards investments and life. The positive emotional attachment towards an investment has a stronger impact on risk-aversion than the demographic characteristics of gender, age, income, or investment experience. Similarly, the association of money with feelings of security or power can mitigate or amplify a retail investor’s risk attitude, respectively (Lippi et al., 2021). Considering the influence of emotions and personality traits on financial risk tolerance, Mazzoli and Palmucci (2023) propose a psychometric-based framework for the assessment of bank clients’ risk profiles. Thus, financial advisors can adjust standard bank questionnaires accordingly in order to align clients’ asset allocation and financial planning choices with their risk preferences.

5.6. Socially Responsible Investing

The sixth research theme focuses on factors that influence investment in socially responsible financial products. In total, 32 articles are assigned to this research theme, which explain a combined 4.69% of the variance.

A descriptive analysis of the research methodologies shows that the empirical analyses within these articles predominantly rely on experimental and survey-based methods, as well as qualitative interviews. Surveys and structured questionnaires capture the insights of retail investors from diverse backgrounds across international financial markets. To deepen the understanding of investor attitudes towards sustainability, behavioural and decision-making studies implement qualitative techniques such as interviews. In addition, historical market data and regulatory developments are integrated with frameworks from behavioural economics and nudge theory.

The methodologies in the articles of the sixth research theme predominantly employ quantitative techniques to analyse socially responsible investment decisions. Exploratory methods, such as factor and cluster analysis, are employed to identify patterns and segment investors based on behavioural traits. Regression analyses, including multiple linear and logistic regressions, determine key predictors of preferences for socially responsible products. Advanced modelling techniques, such as structural equation modelling and partial least squares, reveal the interdependencies among investment factors, enabling the exploration of causal pathways. Panel regression models are used to investigate temporal dynamics, revealing how investment preferences change over time. Additionally, machine learning approaches, notably artificial neural networks, enhance predictive capabilities, offering a deeper understanding of sustainable investment behaviours.

5.6.1. Preceding Scientific Discourse on Socially Responsible Investing

The last preceding scientific discourse forms the intellectual basis for the research theme “Socially responsible investing”. With only the prospect of a strong connection of socially responsible investing (SRI) with corporate social responsibility (Sparkes & Cowton, 2004), the main research interest has been on the motives of individual investors to engage in SRI. In contrast to conventional investing, moral considerations as well as attitudes towards the social aims of companies are the driving forces behind SRI for some investors (Williams, 2007; Hofmann et al., 2008). These investors may receive a psychic return from SRI, and every SRI decision is based on a trade-off between financial and psychic returns (Beal et al., 2005). Socially responsible investors are therefore not merely driven by pro-social attitudes, but also by financial considerations about their investments (Nilsson, 2008). However, several existing studies imply that SRI investors are willing to accept suboptimal financial returns in order to invest according to their pro-social attitudes (Renneboog et al., 2008a). Based on the respective relevance of the return trade-off, three SRI investor segments can be distinguished: SRI investors with a financial return focus, SRI investors with a social responsibility focus, and SRI investors that value both when engaging in SRI (Nilsson, 2009). Even though risk-adjusted returns do not differ between SRI and conventional funds (Renneboog et al., 2008b), socially responsible investors expect to earn lower returns and pay higher management fees on SRI funds (Riedl & Smeets, 2017). As lower return expectations generally inhibit investments, funds with a socially responsible objective need to provide potential investors with additional information that demonstrates the funds’ social aims (Barreda-Tarrazona et al., 2011).

5.6.2. Research Theme 6: Socially Responsible Investing

Socially responsible investing provides retail investors with the opportunity to align their investments with their ethical values (Pilaj, 2017). Consequently, social values as well as environmental and governance concerns have an impact on SRI decisions (Diouf et al., 2016). Investigating Indian retail investors’ investment behaviour towards socially responsible financial products, Garg et al. (2022) find that biospheric values and perceived financial performance are significant predictors of attitudes and intentions towards SRI. For the investment in renewable energy, social norms significantly influence retail investors’ attitudes. Moreover, evaluations of policy measures and subsidies and confidence in environmental non-governmental organisations affect investment attitudes (Gamel et al., 2017). As an immediate antecedent for the intention to invest in companies with socially responsible initiatives, retail investors’ trust is positively influenced by personal attitude, subjective norms, and perceived behavioural control (K. H. Chan et al., 2022). Additionally, personal attitude towards SRI significantly mediates the relationship between knowledge about SRI and the intention to invest in SRI (Mehta et al., 2021). Being a responsible consumer increases awareness towards SRI and the likelihood to invest in socially responsible financial products (Jonwall et al., 2022; Brunen & Laubach, 2022).