Abstract

This study describes a comprehensive bibliometric analysis of shadow banking and financial contagion dynamics from 1996 to 2022. Through a holistic approach, our study focuses on quantifying the impact and uncovering significant trends in scientific research related to these interconnected fields. Using advanced bibliometric methods, we explored the global network of publications, identifying key works, influential authors, and the evolution of research over time. The results of the bibliometric analysis have highlighted an annual growth rate of 22.05% in publications related to the topics of shadow banking and financial contagion, illustrating researchers’ interest and the dynamic nature of publications over time. Additionally, significant increases in scientific production have been recorded in recent years, reaching a total of 178 articles published in 2022. The most predominant keywords used in research include “systemic risks”, “risk assessment”, and “measuring systemic risk”. The thematic evolution has revealed that over time, the focus on fundamental concepts used in analyzing these two topics has shifted, considering technological advancements and disruptive events that have impacted the economic and financial system. Our findings provide a detailed insight into the progress, gaps, and future directions in understanding the complex interplay of shadow banking and financial contagion. Our study represents a valuable asset for researchers, practitioners, and policymakers with a keen interest in understanding the dynamics of these critical components within the global financial system.

1. Introduction

In the ever-evolving landscape of global finance, two critical phenomena have garnered increasing attention from both researchers and policymakers alike: shadow banking and financial contagion. These interconnected dynamics have the potential to shape the stability and resilience of financial systems worldwide. Shadow banking, with its complex web of non-traditional financial intermediaries and activities, poses a formidable challenge to traditional regulatory frameworks (Tobias and Ashcraft 2012). Simultaneously, financial contagion, the rapid spread of financial distress across markets and institutions, underscores the critical need to understand and quantify the potential risks associated with these shadowy channels (Kollmann and Malherbe 2013).

The shadow banking system, a complex entity, represents a crucial element within modern financial mechanisms (Landau 2019). It comprises a range of financial institutions and investment vehicles that operate outside the traditional framework of commercial banks, engaging in a diverse array of financial activities, including credit intermediation and risk management. This system, characterized by its lack of transparency and stringent regulations, has raised questions and concerns regarding systemic risk and financial stability.

In parallel, financial contagion, the phenomenon through which financial difficulties can rapidly spread throughout the entire financial system, underscores the importance of a precise understanding and quantification of the risks associated with this propagation.

In an interconnected global financial environment, events occurring in one region or within a specific market segment can have profound and extensive repercussions across the entire system, affecting not only financial institutions but also national and global economies.

Our study aims to bring to the forefront and analyze these complex aspects of the modern financial world. This research endeavor relies on the power of bibliometric analysis, which was conducted using the RStudio platform using the specialized Bibliometrix package. Through a systematic exploration of the specialized literature spanning a significant period of time, this study seeks to provide a detailed assessment from both quantitative and qualitative perspectives of these complex phenomena. Ultimately, our research aims to contribute to an in-depth understanding of the subtleties and interconnections that characterize the contemporary financial ecosystem.

In the context of bibliometric analysis, our study aims to investigate the dynamics and impact of the interaction between the financial contagion effect and shadow banking, exploring the main trends, significant contributions, and the evolution of academic interest in these areas over the last decade. Through this approach, we intend to identify influential authors, leading research institutions, frequently studied indicators, the evolving connections between shadow banking and financial contagion, emerging themes, and potential areas of overlap or development in the specialized literature. Additionally, we will analyze how the interaction between shadow banking and financial contagion influences the evolution of academic research and what unexplored or emerging directions can be identified for future investigations in this field.

Thus, by defining this comprehensive research question, we seek to offer a more profound perspective and insight into the specialized literature, which could act as a roadmap for exploration and research analysis within these scrutinized domains. Through the bibliometric analysis we conducted using RStudio, we encompassed various aspects, including the evolution of annual scientific production, the average number of citations per year, notable author collaborations, significant publication outlets, collaborative networks between countries, prolific authors within the field, and the most frequently occurring word groups in titles and abstracts. We harnessed a spectrum of visual tools, such as collaboration maps, three-field plots, collaboration networks, and WordClouds, to effectively identify and present pertinent data and information. These tools and methodologies have played a pivotal role in our analysis, enabling us to extract valuable insights and information from the vast reservoir of data available in the realm of shadow banking and financial contagion.

Our work is organized as follows: In Section 2, a review of the specialized literature on shadow banking and financial contagion is conducted. Additionally, a literature review on the topic of bibliometric analysis is carried out to highlight the originality of our study. Section 3 presents the bibliometric methodology used in our study and how the keywords were selected. In Section 4, the obtained results are presented and interpreted. The most relevant sources, the most influential authors, author affiliations, analysis of collaboration networks between countries, document analysis, and network analysis with the application of the factorial approach are examined. Section 5 discusses the implications and addresses the research question established in the introductory section. Our study concludes with Section 6, which covers the conclusions, limitations of our analysis, and future research directions.

2. An Overview of Shadow Banking and Financial Contagion

The interconnection between the concepts of shadow banking and financial contagion is significant in the context of the global financial system. Shadow banking activities involve financial intermediation by entities that are not traditional banks, such as mutual funds, hedge funds, and other non-bank financial institutions (Malatesta et al. 2016; Tobias and Ashcraft 2012). These entities often engage in complex operations and can create close connections among themselves, forming an interconnected network (Lu and Lau 2019).

Financial contagion refers to the rapid transmission of negative events from one part of the financial system to others, creating a domino effect (Kollmann and Malherbe 2013; Duda et al. 2022). In the case of shadow banking, this interconnection can amplify the risk of financial contagion. For example, a crisis or disruption in a non-bank financial institution within the shadow banking sector can have chain reactions on other interconnected entities, including traditional banks and financial markets.

The specific aspects of shadow banking activities, such as the extensive use of complex financial instruments and close ties between different parts of the financial system, can create an environment where negative events can spread rapidly. Therefore, understanding the interplay between shadow banking and financial contagion is crucial for assessing and managing risks within the global financial system.

2.1. Conceptual Dimensions of Shadow Banking

Shadow banking has been a central and widely debated topic in financial literature for more than ten years. The macroeconomic consequences and institutional significance of shadow banking have rendered it an intriguing subject of investigation for both researchers and business practitioners (Nath and Chowdhury 2021).

The concept of “shadow banking” originated from the discussions presented by economist Paul McCulley at the symposium held in Jackson Hole, Wyoming, in 2007, an event organized by the Federal Reserve Bank of Kansas City (IMF 2023). According to Adrian and Ashcraft’s (2016) approach, the shadow banking system is a network of specialized financial institutions that channel funding from savers to investors through various securitization and secured funding techniques. He believes that shadow banks are inherently fragile, akin to the commercial banking system, before the creation of the public safety net.

According to the European Parliament (2021), the shadow banking sector represents a form of intermediation similar to traditional banking, characterized by less restrictive regulatory standards compared with traditional banks. This sector includes money market funds and other funds using financial leverage, securities and derivatives dealers, securitizations, securities financing transactions, and derivatives, as well as emerging actors such as digital lenders and stablecoins.

Zarei et al. (2021) argue that the concept of shadow banking emerged as a result of the financial crisis of 2007–2009. Their study examines the impact of shadow banking on financial stability in the context of the 2007–2009 crisis. Based on data from 14 G20 countries between 2002 and 2018, the study categorizes countries into four groups based on the level of shadow banking activity and employs quantile regression. The results indicate that in countries with a strong presence of shadow banking, it negatively affects financial stability, with an increase of one unit in the shadow banking index, translating to a 1.6-unit increase in financial instability. In contrast, in countries where shadow banking is less pronounced, it does not have a significant impact on financial stability.

After the global economic crisis of the 2007–2009 period, research in the field of financial and banking market analysis has experienced a significant increase, highlighting the interest of researchers and specialists in this field, as well as the relevance and impact that these markets can have in generating economic and financial imbalances. For instance, Fève et al. (2022) emphasized in their study that shocks to both traditional and shadow banks were significant factors for the United States economy during the Great Recession and the Slow Recovery. Simultaneously, the study of Wu and Shen (2019) examines the risk associated with banks involved in shadow banking activities in the context of corporate governance. The results support the risk-taking hypothesis and suggest that effective governance could significantly reduce the impact of shadow banking activities on risk-taking for 59 Chinese banks during the period 2010–2016.

Huang (2018) tackles the concept of shadow banking integrated with off-balance-sheet finance modeling in a continuous macro-financial framework. The author’s approach highlighted that the shadow banking system is pro-cyclical and increases endogenous risk.

Kou et al. (2021) conducted a study in which they assessed FinTech-based investments in European banking services using an original approach that considers interval type-2 fuzzy decision-making trial and evaluation laboratory models, as well as Topsis. Additionally, they performed a sensitivity analysis by considering six distinct cases.

Understanding shadow banking activities and associated regulatory changes can be based on a specific money theory. Bouguelli (2020) proposes an alternative conception based on the theory of endogenous money, suggesting different regulations. His study offers another perspective on the purpose of the shadow banking system within the overall financial system.

Regarding the bibliometric review performed on shadow banking, Nath and Chowdhury (2021) conducted a study in which they performed a systematic literature review on shadow banking activities from 2008 to 2021. Their research provides an overview of the shadow banking sector, encompassing definitions, evolution, functions, and specific activities. Through bibliometric and content analyses, the authors identify four major trends in the literature and propose seven research questions for the future. The conclusions serve as a robust reference for researchers interested in advancing their understanding of shadow banking activities.

Other bibliometric research associates FinTech with shadow banking. For instance, Dissanayake et al. (2023) conducted a bibliometric analysis of FinTech research, providing insights into the landscape, trends, and influential factors. The analysis highlights the increasing research output in FinTech, identifying key contributors and emerging themes such as blockchain, digital payments, and regulation. This analysis serves as a guide for researchers and professionals, aiding in navigating the FinTech literature, identifying research gaps and promoting innovation in the financial industry. The association of shadow banking with FinTech is emphasized by Buchak et al. (2018). Their study highlights how FinTech companies, through technological innovations and operations outside traditional regulatory frameworks, have disrupted the financial industry and created new opportunities for regulatory arbitrage. The study explores the risks associated with the rise of shadow banks, including potential systemic risks, regulatory gaps, and consumer protection concerns. The article emphasizes the evolving regulatory landscape and the need for effective oversight to ensure financial stability and consumer welfare in the context of FinTech and shadow banking activities.

2.2. Conceptual Dimensions of Financial Contagion

The phenomenon of financial contagion has garnered the focus of experts and scholars in the field, particularly following the crisis in Thailand, when the devaluation of its currency had repercussions on other nations in Asia, influencing financial markets worldwide (Park and Song 2001; Baig and Goldfajn 1999). Pritsker’s research reinforces the notion that the intensity of the financial crises in Asia, coupled with the difficulty in finding macroeconomic justifications for their proliferation, has raised worries about potential irrational contagion and spurred demands for further regulatory measures in the financial markets (Pritsker 2001).

The concept of contagion originates from its medical use, denoting the spread or transmission of viruses throughout an organism, and later, analogous to the progression from a virus to an illness, the transmission of the condition to other individuals (Pernick 2002).

Allen and Gale (2000) characterize financial contagion as an equilibrium phenomenon in which banks engage in interregional claims as a hedge against liquidity preference shocks that are not perfectly correlated across regions. In the absence of aggregate uncertainty, an ideal risk distribution can be achieved. However, the system’s resilience is limited, and a minor liquidity preference shock in one region has the potential to trigger financial contagion, spreading throughout the entire economy. The risk of contagion is intimately connected to the completeness of the interregional claims structure, with more comprehensive structures exhibiting greater robustness to such shocks (Allen and Gale 2000).

Bae et al. (2003) present an innovative perspective on quantifying financial contagion in capital markets. In their research, they delve into the depth of the contagion phenomenon, its economic significance, and the influencing factors employing a multinomial logistic regression model. The findings of their study point to the possibility of forecasting contagion, which appears to be influenced by fluctuations in regional interest rates, changes in exchange rates, and the conditioned volatility of stock market performance. Although the results suggest that the impact of contagion is variable, they tend to indicate that market reactions are more pronounced during sharp declines than in situations of rapid growth; yet, the conclusions remain not entirely convergent.

It is clear that the Global Financial Crisis of 2007–2009 brought numerous unfavorable consequences and, at the same time, served as a crucial learning moment to identify the challenges that underpinned it and how systemic risks were formed. In his research, Baur (2012) investigates how the Global Financial Crisis spread from the financial sector to the real economy, analyzing ten sectors across 25 major stock markets, both developed and emerging. The study reveals that no country or sector was spared from the repercussions of the crisis, which limited the effectiveness of portfolio diversification strategies. However, it is noted that certain sectors, such as Healthcare, Telecommunications, and Technology, were less impacted by the crisis. Other research emphasizes that understanding and analyzing the complex financial networks among institutions can aid in addressing issues of stability and contagion risk. For instance, Summer (2013) argues that network models of interbank exposures facilitate the mapping of the complex web of financial connections between numerous institutions, tackling issues related to system stability and contagion risk.

Over time, various forms of financial contagion have been studied and defined based on multiple factors, such as the mode of propagation, movements in foreign exchange rates, the formed financial network, and so on. For instance, Masson (2006) considers the existence of contagion in financial markets. He models the movements of an exchange rate as a combination of country-specific events and common events affecting all markets, termed monsoon-type contagion. Additionally, due to the known linkages between countries and economies and the way the contagion effect can be transmitted through a network, Masson has classified this form as a spillover contagion effect.

The COVID-19 crisis, which began in 2019, has been another disruptive factor for economic and financial stability. In their research, Akhtaruzzaman et al. (2021) examine how financial contagion was mediated between China and the G7 countries through both financial and non-financial firms during this crisis. The study revealed that listed companies in these regions, both financial and non-financial, experienced a significant increase in the conditional correlations between their stock returns. Notably, financial firms showed a more pronounced increase in these correlations during the COVID-19 pandemic, thus highlighting the significant role they play in the propagation of financial contagion.

Regarding the originality of our bibliometric analysis, an investigation of the existing literature was conducted to highlight the novelty introduced by us. Seth and Panda (2018) conducted an empirical study with the aim of obtaining a comprehensive structure of research in the field of financial contagion. They identified 151 empirical studies, and the results of their analysis indicated that empirical studies on contagion have consistently increased in recent years. Another analysis conducted by Su et al. (2023) examines the risk of financial contagion in financial markets. They extracted articles using the Web of Science database for the period 2005–2021. Their results also indicate a significant increase in research on financial contagion, especially following the Global Financial Crisis. Another study focused on the bibliometric analysis of the concept of financial contagion, which, according to Kaur (2023), has experienced exponential growth over the past two decades due to the increased interdependence among financial markets in various countries. The author used the Scopus database to obtain the necessary information for the bibliometric analysis conducted. Another approach, belonging to Bajaj et al. (2022), conducts a comprehensive study on the evolution of academic literature related to the connections between sovereign credit risk and financial markets using a comprehensive bibliometric perspective.

3. Results

In this section, we present the results obtained from the bibliometric analysis of the interaction between the shadow banking system and the financial contagion phenomenon. The results illustrate the trends and patterns identified in the specialized literature, significant contributions of authors and institutions, relationships and interconnections between concepts, as well as other relevant aspects for a comprehensive understanding of these research domains. Our comprehensive analysis reveals essential information and provides a detailed overview of the evolution of research in the field of shadow banking and financial contagion.

In Table 1, the data are described, providing a detailed overview of the database and bibliometric research characteristics, offering insights into the volume, impact, and collaboration in the studied field.

Table 1.

Main information about data.

According to Table 1, the timespan covered by the bibliometric research starts in 1996 and extends until 2022, spanning a period of 26 years. The total number of sources used in our analysis for information extraction is 391, and the total number of relevant documents identified and analyzed is 1002. Regarding the annual growth rate of 22.05, it signifies the percentage by which the number of documents increased annually during the analysis period, reflecting the research dynamics in the shadow banking and financial contagion domain. The average age of relevant documents is 5.1 years, indicating the recentness of research in the specific field. Additionally, the average citation count is 21.09, indicating the relevance and impact of the research. Furthermore, 1756 relevant keywords plus were extracted, and 2403 author-specific keywords were used to describe the content of the documents. The average number of co-authors per document is 2.67, reflecting the level of collaboration in the research domain. Last but not least, the percentage of documents involving collaborations between authors from different countries is 33.73%, highlighting the international nature of the research.

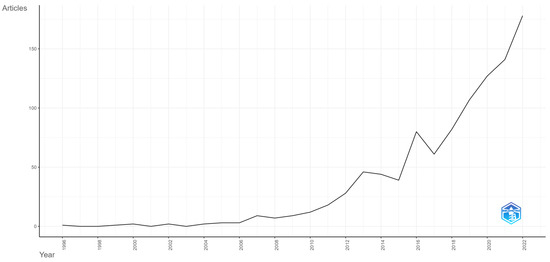

Figure 1 illustrates the annual evolution of scientific production in the research field based on the number of articles published each year. According to the results, we observe that during the period 1996–1999, scientific production was relatively low, with 1–2 articles per year. Starting from the 2000s, we notice a slight increase, and in the years 2004–2006, this becomes more significant, reaching three articles per year. The year 2007 was marked by a rapid and substantial growth in scientific production, reaching a peak in 2012 with 28 articles. From 2013 onward, there has been a continuous and accelerated increase in scientific production, with a notable peak in 2022, reaching 178 articles. These results indicate a strong upward trend in research, with a significant increase in scientific production in recent years, suggesting a heightened interest in the field of study.

Figure 1.

Annual research production.

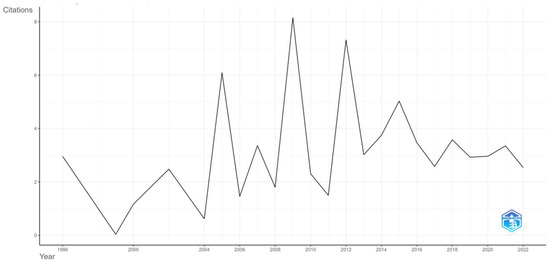

In Figure 2, the evolution of the average citations per year is depicted. We observe a significant fluctuation starting from the year 2008, with 2009 recording the highest number of citations of the analyzed period. This phenomenon can be justified by the heightened interest of researchers and experts in analyzing the effects of financial contagion and the shadow banking sector during the global economic crisis of 2007–2009.

Figure 2.

Average annual citations.

Table 2 provides an insight into the impact and durability of citations for articles published each year, demonstrating how they have been received and their ongoing relevance. The Mean Total Citations per Article (MTCpArt) represents the average total citations received by articles published in the analyzed year. For example, in 1996, an article received an average of 83 citations. The Number of Articles published in the analyzed year (N) indicates the total number of articles published in each year under scrutiny. For instance, in 2009, nine articles were published, with the highest number being in 2022 (178 articles). MTCpY represents the result of dividing the mean citations per article by the number of years since publication to the present. For instance, in 1996, the mean citations per article was 2.96, and in 2009, it was 8.15. CY represents the number of years an article is considered citable. For example, an article from 1996 is considered citable for 28 years, while for 2009, it is considered citable for 15 years.

Table 2.

Analysis of annual citations and temporal durability of published articles.

3.1. Analysis of Data Sources

In this subsection, we focus on the essential aspects of data analysis within the context of our bibliometric study. This crucial stage enables us to carefully observe and understand our data sources, revealing their origin and nature, as well as their fundamental contribution to underpinning our research in the field of shadow banking and financial contagion.

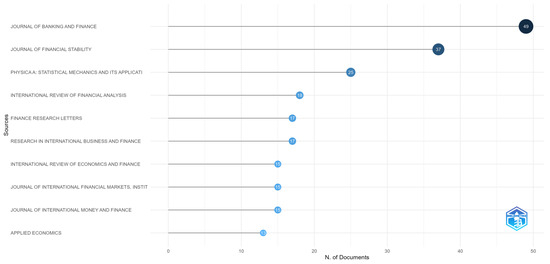

In Figure 3, the top 10 relevant sources are depicted, quantified by the number of articles contributing to various journals in the banking and financial domain, with a focus on the concepts of shadow banking and financial contagion. The Journal of Banking and Finance leads with the highest number of articles, totaling 49, and appears to be the most significant source, indicating its status as a key platform for scientific contributions related to this topic. Additionally, 37 articles have been identified from the Journal of Financial Stability, placing it second in the ranking of relevant sources. The journal Physica A: Statistical Mechanics and its Applications holds the third position with 25 articles, emphasizing statistical mechanics and its applications, potentially providing a unique perspective on the quantitative aspects of shadow banking. Occupying the 10th position in our ranking is the journal Applied Economics. This journal, with a focus on applied economics, can offer practical insights into the concrete implications of shadow banking.

Figure 3.

Top 10 relevant sources.

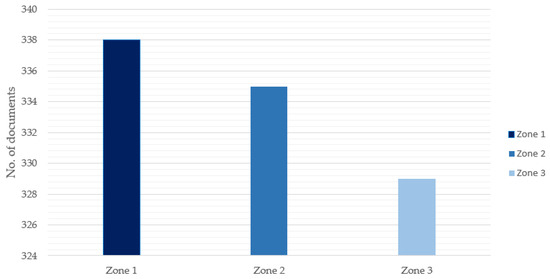

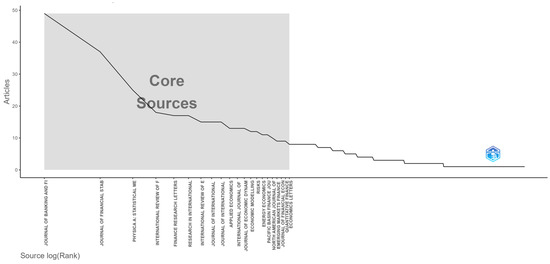

Bradford’s Law distribution is a method employed to assess the frequency distribution in scientific publications or literature within a specific field (Peritz 1990). This law suggests dividing sources into distinct zones, ensuring that the primary sources represent the majority of articles (Desai et al. 2018). In our analysis, it was categorized into three main zones. Zone 1 (core) encompasses a small number of sources but with high frequency, representing the central and essential nucleus of research in a domain. Zone 2 (intermediate) includes a larger number of sources but with lower frequencies than those in Zone 1. These sources are still considered important but not as central as those in the core zone. Zone 3 comprises a very large number of sources but with very low frequencies. These sources form a long tail and are considered peripheral or less relevant. The graphical representation in Figure 4 was created based on Bradford’s Law to illustrate this distribution. This distribution can assist researchers and specialists in identifying and focusing on key sources in Zone 1 to gain a deeper understanding of their field of study without having to sift through the immense volume of the peripheral literature (Nash-Stewart et al. 2012; Hjørland and Nicolaisen 2005).

Figure 4.

Bradford’s Law distribution in the literature on shadow banking and financial contagion.

In Figure 5, we observe the main sources based on the frequency of articles and their distribution across the three zones according to Bradford’s Law. The Journal of Banking and Finance ranks first, with a frequency of 49 articles, falling within Zone 1. In second place, there is the Journal of Financial Stability, with a frequency of 37 articles, also falling within Zone 1.

Figure 5.

Core sources by Bradford’s Law.

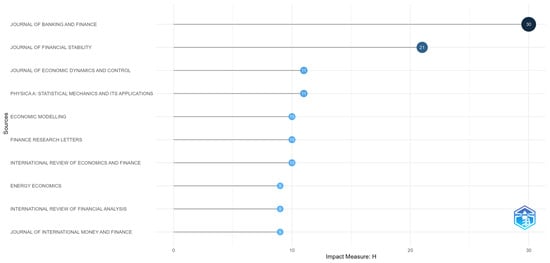

Figure 6 represents the local impact of the source according to the H-index. The H-index is a metric at the author level aimed at gauging both the productivity and citation influence of a scientist’s publications (Aria and Cuccurullo 2017). Once again, the Journal of Banking and Finance maintains its first position, with an H-index of 30, indicating a considerable influence.

Figure 6.

Sources’ local impact.

Table 3 provides an assessment of the impact and performance of the top 10 journals. We observe that the Journal of Banking and Finance has the highest G-index and the highest total number of citations (TC) at 3470. The M-index represents the average size of the group of authors contributing to the published articles (Zehra and Urooj 2022). NP represents the total number of publications of the journal, in the case of the Journal of Banking and Finance being 49, while PY represents the year the journal started publishing, in our case, 1996.

Table 3.

Indicators of impact and performance for sources.

These measures provide a detailed overview of the impact and performance of journals in the banking and financial field, assisting researchers and professionals in assessing their relevance and influence.

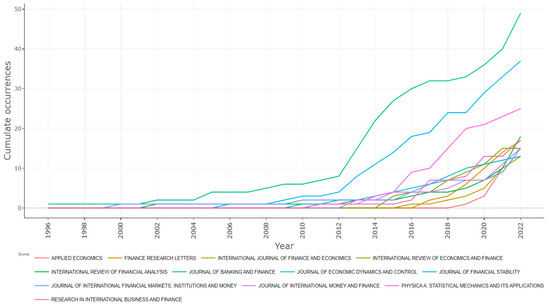

Figure 7 represents the assessment of the evolution of a source’s or publication’s production over time. This concept involves the quantitative analysis of the number of articles or documents published by a source within a specific time frame, allowing the observation of trends, changes in production, and significance over the years. Additionally, in this case, the Journal of Banking and Finance has the highest production. From the year 2012 onward, the number of research publications in this journal increased significantly.

Figure 7.

Temporal patterns in source publications.

3.2. Analysis of Authorship Patterns

This subsection focuses on the analysis of relevant authors based on the number of articles published, citation counts, and their impact on research. We delve into the contributions of authors within the scope of our study, examining their publication output, citation impact, and overall influence in the field. This analysis provides valuable insights into the key figures shaping the research landscape and contributing significantly to the body of knowledge.

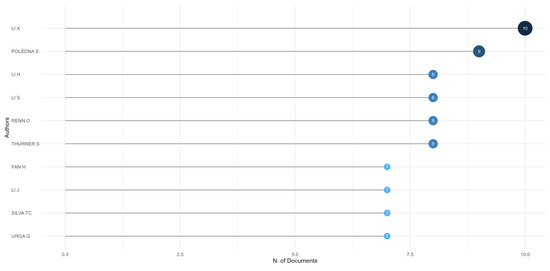

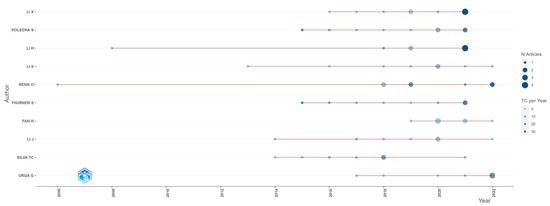

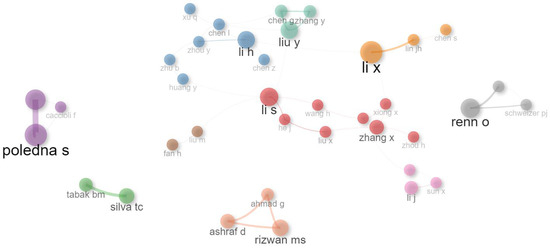

Regarding the most relevant authors based on the number of published documents (Figure 8), Li X has the highest count with ten, followed by Poledna with nine documents, and Li H, Li S, Renn O, and Thurner with eight published documents each.

Figure 8.

Top 10 influential authors.

Figure 9 illustrates how the number of published articles varies or evolves over time. This aspect provides us with a perspective on the activity and contribution of authors in a specific field or within a research theme over the years. For example, Poledna Sebastian published two articles in the year 2021 (Poledna et al. 2021; Pichler et al. 2021), with a total number of citations per year of 15.25. He published his first article on the analyzed topic in the year 2015. We also note that another author, Urga Giovanni, published three articles in 2022 (Cincinelli et al. 2022; Bellavite Pellegrini et al. 2022a, 2022b), with a total citations per year of 10.67.

Figure 9.

Temporal evolution of authors’ publications.

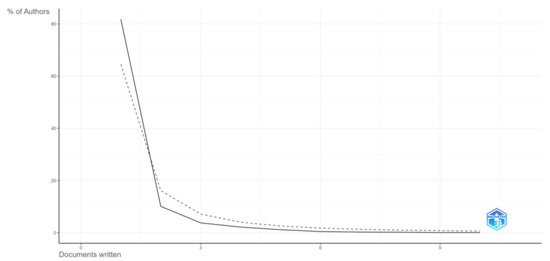

The graph in Figure 10 illustrates the distribution of author productivity in accordance with Lotka’s Law. This law describes an unequal distribution of author productivity in a scientific or literary domain (Sahu and Jena 2022). The graph can assist in identifying the rules governing author production and can highlight significant differences between prolific and less prolific authors. Lotka’s Law suggests that there is a small proportion of authors who produce a large number of articles, while the majority of authors have lower productivity.

Figure 10.

Exploring author productivity through Lotka’s Law.

In Table 4, the results of the unequal distribution of author productivity according to Lotka’s Law are presented. It is observed that the majority of documents are written by a small number of authors, with a significant proportion of 81.8% contributing only one document. As the number of documents written by an author increases, the number of authors contributing decreases sharply, indicating a strong concentration of productivity in a limited group of authors. For example, only 10.1% of authors contributed two documents, and this proportion decreases even further for authors with three or more documents. Thus, a significant difference is highlighted between authors with higher productivity and the majority of authors contributing fewer documents.

Table 4.

Distribution of author productivity according to Lotka’s Law.

3.3. Affiliations Insights

In this subsection, we analyze and present the affiliations of authors or institutions associated with the research papers included in our bibliometric analysis. This aspect is crucial for understanding the contributions and connections of authors in the studied field and for highlighting any relevant institutional relationships.

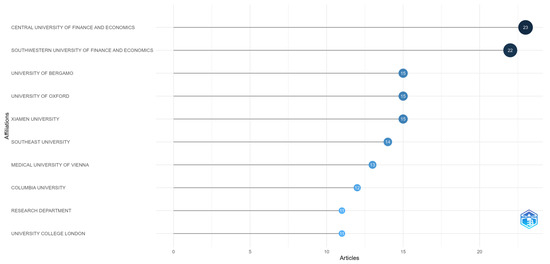

In Figure 11, we observe that the most relevant affiliation is the Central University of Finance and Economics, with a total of 23 affiliated articles. It is followed by the Southwestern University of Finance and Economics, with 22 articles, and by the University of Bergamo, the University of Oxford, and Xiamen University, each with 15 articles.

Figure 11.

Top 10 affiliations.

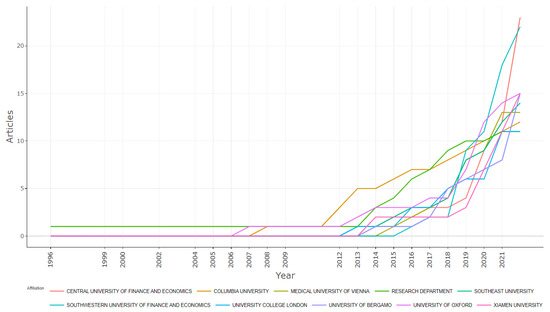

Regarding the analysis of production over time (Figure 12), we observe that the first research was conducted in 1996 at the Research Department. In 2022, this affiliation reached a total of 11 articles. The University of Oxford published its first article on the analyzed topic in 2007, reaching 15 articles by 2022. Also, Columbia University is among the top 10 in terms of production over time, with the first article published in 2008 and 12 articles by 2022. Another university at this top is the Central University of Finance and Economics, which published its first article on our topic in 2014, reaching 23 articles by 2022.

Figure 12.

Evolution of affiliation productivity.

3.4. Countries Insights

In this subsection, we delve into the geographic distribution of research contributions by analyzing the countries associated with the authors’ affiliations. Examining the countries involved in the research provides valuable insights into the global landscape of the studied field and highlights international collaborations and trends.

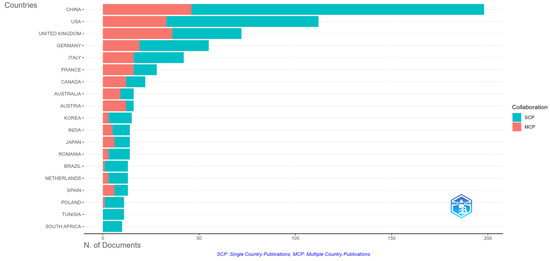

The graph in Figure 13 represents the distribution between single-country publications (SCPs) and multi-country publications (MCPs). SCPs and MCPs are the two categories of publications that make up the total publications for each country.

Figure 13.

Corresponding author’s countries.

For example, regarding China, according to the graph, the majority of publications, approximately 80%, are authored by individuals from a single country, while the rest are multi-country publications. Similarly, in the case of the USA, the majority of publications are SCPs, while in the United Kingdom, most publications are MCPs. Countries such as Germany, Italy, France, Canada, Australia, and Austria show diverse distributions between SCPs and MCPs, indicating varied collaboration between authors from these countries and elsewhere. Additionally, in countries like Korea, India, Japan, Romania, and Brazil, SCPs have a significant share, suggesting that the majority of publications are authored locally.

Regarding the scientific production analyzed at the country level (Table 5), China has the highest publication frequency, recording a total of 467 articles on the topic analyzed by us, followed by the USA with 330 documents and the United Kingdom with 200.

Table 5.

Countries’ scientific production.

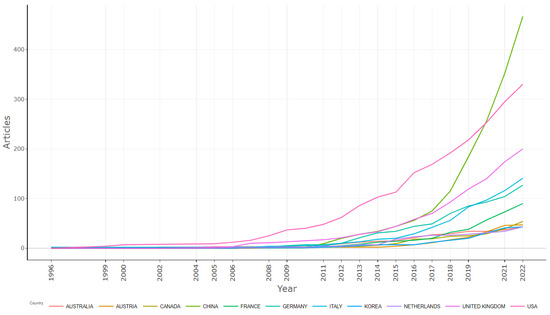

In Figure 14, the production over time at the country level is depicted, showcasing a top 10 list of countries. Although China is observed to have the highest number of articles at the end of the period (467 articles), experiencing substantial growth starting from 2017, its first article was written in 2007. In contrast, Germany published the first article on the analyzed topic in 1996, reaching a total of 127 documents by 2022. Italy also began publishing in 1996, with two documents, and its production over time started to increase from 2012, reaching 141 articles by 2022. The USA’s initial documents date back to 1999, with four articles, reaching 330 articles by 2022. Similarly, the United Kingdom stands out in this graph, reaching a total of 200 articles by the year 2022.

Figure 14.

Countries’ production over time.

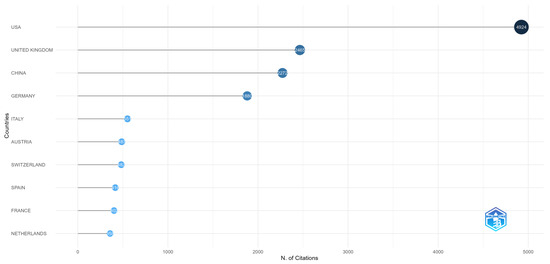

The graph from Figure 15 shows that, although China has the highest number of articles published over time, it ranks third in the list of the most cited countries. The United States is the most cited country, followed by the United Kingdom in second position.

Figure 15.

Most cited countries.

3.5. Documents Analysis

In this subsection, we focus on a detailed analysis of the documents that comprise the foundation of our bibliometric research. Documents are the fundamental elements of scholarly literature and serve as the primary sources of information in a research field. Through a careful examination of these documents, we unveil the essential characteristics of research in the shadow banking and financial contagion domains. We explore document types, the evolution of academic production over time, and their impact on the scholarly community. This document analysis will provide us with a better understanding of the research landscape within our field and help us identify trends and key developments in this area.

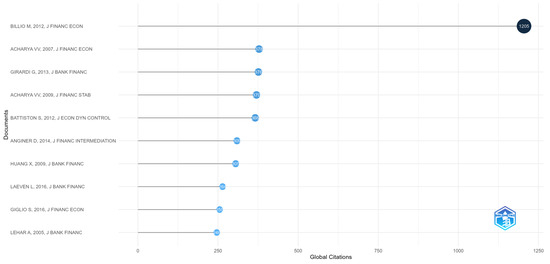

Regarding the analysis of relevant documents, Figure 16 illustrates the most cited documents globally. Billio et al. (2012) are among the top 10 in the first position, with 1205 total citations, followed by V. Acharya and Johnson (2007) with 378 total citations and Girardi and Tolga Ergün (2013) in the third position with 376 citations.

Figure 16.

Most global cited documents.

Table 6 complements Figure 16 with details such as the journal in which the document was published, the total number of citations received (TC), the average citations per year calculated based on the publication year (TCpY), and the normalized citations (NTC) that can reflect the document’s influence or relevance compared to others. Thus, the top three relevant and influential citations belong to Billio et al. (2012), Girardi and Tolga Ergün (2013), and Laeven et al. (2016).

Table 6.

Indicators of impact and performance for articles.

Table 7 presents the most recent publications related to shadow banking and financial contagion, ordered by the total number of citations, with the aim of identifying emerging themes or innovative research directions. These publications indicate ongoing interest and innovative approaches in research on shadow banking and financial contagion, addressing various aspects of systemic risk and contagion in diverse contexts, including geopolitical conflicts and pandemics.

Table 7.

Recent publications on shadow banking and financial contagion based on total citations.

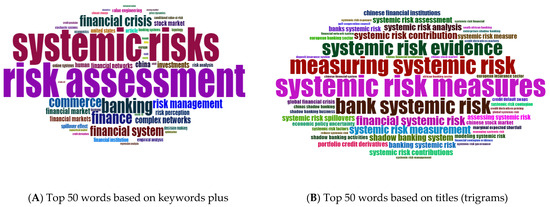

Figure 17 represents the word cloud created for the top 50 words based on keywords plus (A) and based on keywords from titles (B). In the case of keywords plus, terms such as “risk assessment”, “systemic risks”, and “banking” are among the most frequent, suggesting a focus on risk evaluation in the context of the banking system. Other significant words include “complex network”, “financial crisis”, “risk perception”, “spillover effect”, “conditional value-at-risk”, “regression analysis”, and “optimization”, indicating a diversity of aspects and research methods in the analyzed field. This word cloud can serve as a visual representation of the predominant themes and research directions in the conducted bibliometric analysis.

Figure 17.

Top 50 words based on keywords plus (A) and title keywords (B).

In the word cloud composed of title keywords, concepts such as “systemic risk measure”, “measuring system risk”, “systemic risk evidence”, “systemic risk spillover”, “shadow banking system”, “shadow banking risk”, “modeling systemic risk”, “marginal expected shortfall”, “economic policy uncertainty”, “China’s stock market”, and “credit default swaps” were identified. These suggest specific research directions and areas of interest in the analysis of the banking and financial system. Additionally, it is observed that these keywords cover diverse aspects, including measuring systemic risk, the impact of the banking system on the financial market, the risk of the shadow banking system, models for analyzing systemic risk, and specific concerns related to financial markets and instruments, such as credit default swaps and economic policy uncertainty. This context indicates the diversity and complexity of the field addressed in the bibliometric analysis.

Regarding the shadow banking sector, our results suggest that research is focused on aspects related to the shadow banking system, involving financial entities conducting banking activities but not subject to the same regulations as traditional banks. There is also evident concern about the risks associated with this shadow banking system, indicating that researchers are exploring possible threats and consequences of this phenomenon on financial stability. Also, keywords such as “systemic risk spillover” or “spillover effect” indicate an interest in how systemic risk spreads and can cause chain reactions throughout the entire financial system. This may include analyzing how events in one part of the market or financial sector can affect and contagion other segments, generating significant impacts.

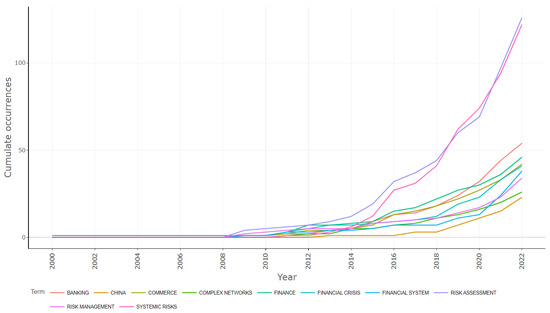

The analysis of word frequency over time from Figure 18 indicates the evolution of key terms’ usage in the analyzed documents over the years. Thus, it can be observed that the frequency of the key term “risk assessment” has significantly increased starting in 2009 and continued to grow consistently until 2022. This may indicate a growing concern and emphasis on risk assessment and management in the researched field. The term “systemic risks” began to be significantly used starting in 2009 and experienced continuous growth until 2022. The increasing usage of this term may reflect a growing interest in systemic risks and their impact on the financial domain. Key terms like “banking” and “finance” have been consistently used throughout all periods, indicating that research in the banking sector is a persistent theme. The key term “commerce” has a low and relatively constant presence, suggesting limited attention to commerce in the studied context. The usage of the term “financial crisis” significantly increased starting from 2008, indicating heightened attention toward financial crises following global events. This analysis provides insights into the evolution of key themes and concepts in the studied domain, highlighting changes in emphasis and trends over the years.

Figure 18.

Words’ frequency over time.

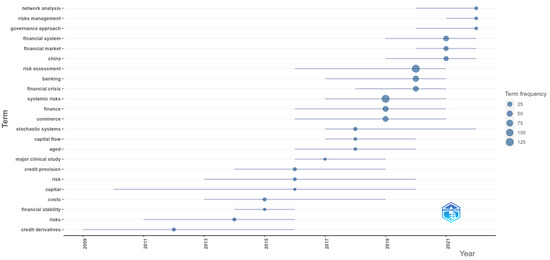

The analysis of word frequency over time in Figure 19 provides insight into the evolution of key themes in the studied field and can bring significant benefits in the context of our analysis. By examining the frequency of keywords over time, we can identify periods in which certain themes have become more relevant or have lost importance. Additionally, observing the increase or decrease in the frequency of specific keywords can suggest emerging directions or highlight topics that have been less explored in recent years. For instance, the concept of “credit derivatives” shows a significant presence starting from 2009, peaking in 2012, and maintaining a steady level until 2016. On the other hand, there was a notable interest between 2014 and 2019, with a peak in 2016 for “credit provision.” Similarly, “stochastic systems” demonstrate a growing interest over time, peaking in 2022, indicating an increasing focus on stochastic systems. There is a notable surge in interest in the “financial crisis”, with a peak in 2020, suggesting heightened attention to financial crises during that period.

Figure 19.

Trend topics.

3.6. Network and Factorial Approach

In this subsection, we delve into a comprehensive analysis of the network and factorial aspects of our bibliometric research. Networks play a crucial role in revealing the complex relationships between various elements within the research landscape. By exploring co-occurrence networks, thematic maps, thematic evolution, factorial analysis, collaboration networks, and a global map of countries’ collaboration, we aim to uncover the underlying structures and dynamics of the research field related to shadow banking and financial contagion. These analytical approaches provide valuable insights into the interconnections, trends, and influential factors that shape the scholarly discourse in this domain. Our examination of these network and factorial dimensions will contribute to a more comprehensive understanding of the complex interplay between key concepts and research entities in our study.

To analyze the interconnection and centrality of various keywords or concepts in the analyzed documents, a co-occurrence network was created from Figure 20. We observe that four clusters were formed: The first cluster (red) contains keywords related to systemic risk. The nodes include different terms related to systemic risk, financial stability, and network analysis. These words are interconnected and play a central role in the overall network. “Systemic risk” is the most central term, and other terms such as “shadow banking”, “financial contagion”, “interconnectedness”, and “financial crisis” are also significant. The second cluster (blue) contains keywords related to “risk management” and “credit derivatives”. The nodes include terms related to risk management, with this concept, along with “credit derivatives”, being central in this cluster. The third cluster (green) contains the keyword “systemic risks”, forming a distinct cluster, indicating a focus on understanding and analyzing systemic risks. The fourth cluster (purple) consists of keywords related to the contribution to systemic risk. The keywords in this cluster may explore factors contributing to systemic risk.

Figure 20.

Authors’ keywords co-occurrence network.

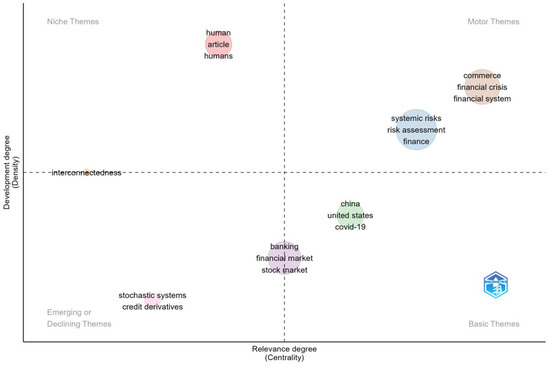

Another analysis we conducted is the construction of the thematic map in Figure 21.

Figure 21.

Thematic evolution over time based on keyword plus.

This provides a visual representation of the relationships and interconnections among keywords. It can assist in identifying and understanding key themes or predominant subjects within the analyzed set of documents. Consequently, seven clusters were formed: human, systemic risks, China, banking, interconnectedness, commerce, and stochastic systems. The first cluster focuses on terms related to human subjects, with the keyword “human” being the central term, indicating its importance in this cluster. The second cluster covers terms related to systemic risks and financial concepts, emphasizing topics such as risk assessment, systemic risks, financial networks, and risk analysis. The third cluster suggests a thematic focus on economic aspects related to China, including risk factors and economic development. The fourth cluster indicates a focus on topics such as banks, financial markets, and spillover effects in financial systems. The central term “interconnectedness” in cluster five highlights a focus on studying interconnections within financial systems. The sixth cluster suggests a thematic emphasis on subjects related to commerce, financial crisis, and financial systems. The last cluster emphasizes topics such as stochastic systems and credit derivatives.

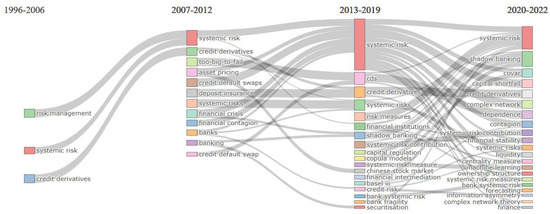

The thematic evolution shown in Figure 22 illustrates how the focus on different concepts has changed over time. We chose to split the dataset into four periods.

Figure 22.

The dynamics of research theme.

- ➢

- 1996–2006: This period is characterized by terms such as “risk management”, “systemic risk”, and “credit derivatives”. This suggests an initial focus on risk management within a growing financial system and on derivative financial products, which played a key role in the accumulation of systemic risks. In this phase, the literature began to lay the foundation for understanding the impact of credit derivatives on global financial stability.

- ➢

- 2007–2012: Terms such as “too big to fail”, “systemic risk”, “credit derivatives”, “financial contagion”, and “credit default swap” reflect the Global Financial Crisis and the responses to it. “Too big to fail” underscores the concern that some financial institutions have become so large that their failure could pose a systemic risk. “Financial contagion” and “credit default swap” are relevant for understanding how risks can spread through the financial system.

- ➢

- 2013–2019: Terms like “shadow banking”, “systemic risk measure”, “copula models”, “Chinese stock market”, “securitization”, and “Basel III” indicate a shift of attention toward emerging risks from the unconventional banking sector (“shadow banking”) and the need for more sophisticated models (such as copula models) for measuring and managing systemic risk. “Basel III” signals the implementation of new banking regulatory standards to strengthen the resilience of the banking sector.

- ➢

- 2020–2022: In this period, dominated by the COVID-19 pandemic and economic uncertainty, terms such as “shadow banking”, “covar”, “capital shortfall”, “financial stability”, “complex network”, “contagion”, “machine learning”, and “forecasting” indicate contemporary concerns. “CoVaR” (Conditional Value at Risk) and “capital shortfall” suggest analyses of vulnerabilities in the financial system, while “financial stability” and “complex network” show the need to understand and manage complex interdependencies. “Machine learning” and “forecasting” reflect the adoption of advanced technologies to anticipate and model future risks.

Dividing the data into these time intervals shows the evolution of research concerns from the theoretical foundation of derivative financial products and systemic risk to the analysis of the financial crisis and then to regulation and innovation in risk management, culminating in the use of technology and modeling to understand and manage risks in a changing global economic environment.

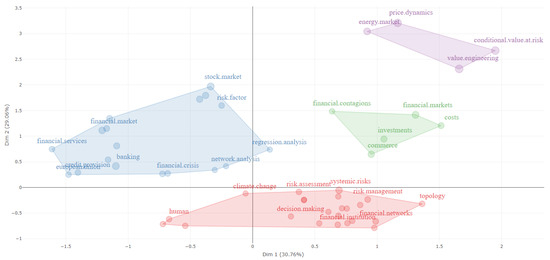

The factorial analysis in the context of our bibliometric analysis was used to identify the latent structures underlying the datasets. Each factor represents a dimension that captures a certain variation in the data. The factorial analysis in Figure 23 has placed the keywords in a two-dimensional space, represented by Dimension 1 and Dimension 2. The first dimension, according to the results, captures a variation from concepts related to markets and financial institutions toward analytical approaches and methods. The second dimension differentiates between terms oriented toward risk and those oriented toward the market or economic effects. To create a clearer perspective for understanding and interpreting the obtained results, based on the multiple correspondence analysis method, we formed four clusters, as can be seen in Figure 23. The first cluster (blue) includes terms such as “financial services”, “financial market”, “banking”, “financial crisis”, “network analysis”, “credit provision”, and “regression analysis”. The positioning of this cluster on the two dimensions suggests that it is related to the study of financial crises and systemic responses, with an emphasis on network analysis and impact assessment. This cluster could represent research on vulnerabilities and instability in financial systems, as well as regression models used to understand these phenomena. Cluster 2 (green) contains terms such as “financial contagions”, “financial market”, “costs”, “investments”, and “commerce”; this cluster is associated with market dynamics and macroeconomic impact, including how risks spread (contagion) and their effects on investments and costs. This cluster may reflect literature dealing with the interaction between financial markets and the broader economy, including how financial crises affect trade and investments. The third cluster (purple) encompasses “price dynamics”, “energy market”, “value engineering”, and “conditional value at risk”. Given its placement in the same quadrant as Cluster 2 but with a more technical and quantitative load, this group likely focuses on modeling and forecasting price dynamics, especially in the energy market, and applying advanced financial engineering techniques and risk measurements. The fourth cluster (red) includes terms such as “human” and “climate change”, suggesting a more contextual and possibly interdisciplinary approach, as well as concepts such as “risk assessment”, “systemic risks”, “risk management”, “financial networks”, “financial institutions”, and “topology”. This cluster focuses on risk management, systemic assessment, and understanding the structure of financial networks. The terms suggest a literature focused on methods of assessing and minimizing risks in financial institutions and systems. This distribution and grouping of terms reflect a variety of concerns in financial research, from the impact and management of crises to the macroeconomic influence of financial markets, to technical methods of modeling risks and price dynamics, and to more human and global aspects such as climate change and its impact on finance. The interpretation based on the four clusters and their positioning in the factorial space highlights the interconnectivity and complexity of the financial field and associated research.

Figure 23.

Factorial analysis.

Figure 24 illustrates the collaboration network, which is based on metrics that reflect the role and importance of each author within the network. For example, the author Li S has a high betweenness score, indicating that they may be a central figure in facilitating the collaboration between different authors or groups of authors. Additionally, among the influential authors, we observe Li S, Zhang X, and Liu Y.

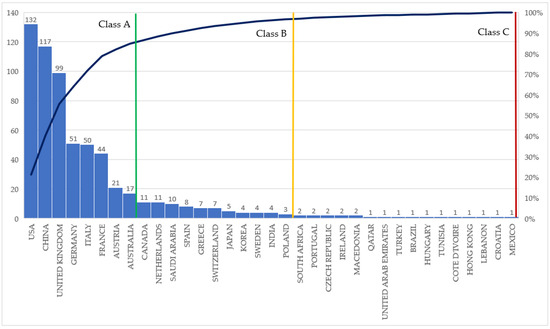

Figure 24.

Collaboration network.

In Figure 25, the map of international collaborations between countries is represented. From the representation, we observe that China has a significant volume of joint works or research projects together with the USA. A large number of collaborations may suggest a solid relationship in research or strong common interests in certain areas. Countries with a high number of collaborations, such as the United States, the United Kingdom, Germany, and China, can be seen as central hubs in the global research network. Regarding intercontinental collaborations, there is a noticeable collaboration between European countries with Asian or American ones. As for regional collaborations, we observe concentrations of partnerships between countries within the same region, such as Europe or East Asia, which may suggest partnerships based on geographical proximity or common regional interests. On the other hand, the graphical representation from Figure 26 is constructed based on the Pareto distribution, also known as the ABC Pareto analysis (Ionescu et al. 2024; Chen et al. 2008). Thus, Class A, consisting of the countries USA, China, United Kingdom, Germany, Italy, France, and Austria, represents 82% of the total existing collaborations. This class highlights the most frequent and strong collaborative relationships and can be considered the most influential or active collaborations in the network of countries writing articles on the topic we are analyzing. Class B captures only 15% of the total existing collaborations, signifying pairs of countries that collaborate less frequently than those in Class A. Countries such as Canada, Spain, Sweden, and Poland are found in this class. Although important, these countries are not as dominant as those in Class A. Class C signifies occasional or rare collaborations between countries, and we find collaborations between countries such as Portugal, Croatia, or Turkey.

Figure 25.

Countries’ collaboration world map.

Figure 26.

Data collection flow.

4. Materials and Methods

Bibliometric analysis entails statistically scrutinizing academic publications, which include articles, book chapters, and conference papers. This methodological approach proves especially valuable in uncovering patterns and trends across a wide range of research subjects (Derviş 2020). Lately, there has been a marked surge in the use of bibliometric analysis in the realm of business research, exemplified by the research undertaken by (Khan et al. 2021; Donthu et al. 2021).

In Donthu et al.’s study, to conduct a bibliometric analysis, it is necessary to consider the following steps: defining the objectives of bibliometric analysis, choosing appropriate analytical techniques, collecting the necessary data, visually representing them, and interpreting the results (Donthu et al. 2021). Additionally, Silva et al. (2022) present the following methodological workflow for conducting a bibliometric analysis: defining research questions, specifying the established keywords in the context of the bibliometric analysis, compiling bibliometric data by selecting the data source and exporting data based on inclusion and exclusion criteria, analyzing data using a bibliometric platform, applying visualization methods, and interpreting the results. We also used this comprehensive methodological workflow in our study.

Considering the primary goal of our study, which is to conduct a comprehensive bibliometric analysis to quantify the impact and uncover trends among the interconnected concepts of shadow banking and financial contagion, we opted to use the Scopus database for document extraction. This decision is grounded in the findings of Visser et al. (2021), which illustrate a significant overlap between the Scopus database and other databases, such as Web of Science, Crossref, and Microsoft Academic. For instance, there is an approximate 80% overlap between Scopus and WoS, with the Scopus database containing 27 million documents and WoS approximately 23 million documents.

The first step in conducting a bibliometric analysis is formulating research questions. In our study, we established ten research questions, as described in the introduction section. The next step in performing a bibliometric analysis is the selection of keywords. In this regard, we have chosen the following keywords: “shadow banking”, “financial contagion”, “systemic risk”, “nonlinear finance”, “opaque financial instruments”, “non-bank intermediaries”, “credit derivatives”, “parallel financial system”, “lack of regulation”, and “interconnectedness”. Through a review of the specialized literature, we observed that these terms represent essential elements for understanding the two analyzed concepts. These keywords were selected to ensure that our bibliometric analysis covers all relevant aspects of shadow banking and financial contagion. They reflect the central concepts and key topics in the specialized literature in the field, allowing us to accurately identify relevant studies and connections between these concepts. Their careful selection helps us gain a comprehensive perspective and extract meaningful information from the specialized literature in this research domain. In Table 8, a description of the key terms has been provided in order to offer a clearer understanding of their selection in our bibliometric analysis.

Table 8.

Rationale behind keyword choice.

The selection of keywords was made in accordance with the objectives and scope of our study. For instance, the term “nonlinear finance” was included because it represents an essential component for understanding the complex behavior of the financial system, with significant implications in the context of banking and financial contagion (Hui and Li 2008; K. Chen and Ying 2011; Arouri et al. 2011; Serletis and Xu 2019; Rottner 2023). In the process of selecting keywords, we considered identical or similar alternatives. The term “interconnectedness” was considered and is closely related to the concept of “connectedness,” but we decided to include “interconnectedness” to highlight the complex aspects of relationships between various financial entities and their impact on the overall financial system.

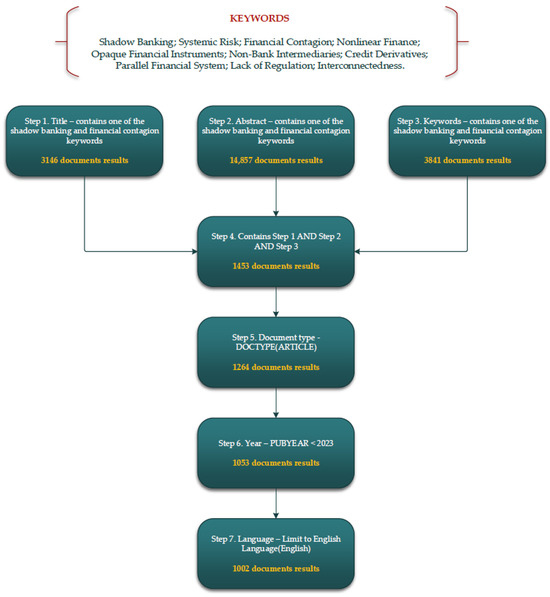

After the research questions and keywords were established, we queried the Scopus database to extract the necessary data. The steps we conducted are depicted in Figure 26. In the inclusion stage, we searched for all titles containing any of these established keywords, all abstracts, and all articles that have these key concepts in their keywords. After obtaining results from the three queries, we conducted another query to retrieve all documents containing these keywords in the titles, abstracts, and keywords. In the exclusion stage, we retained only articles and those published up to and including the year 2022, as the database for 2023 may still be incomplete. Another exclusion was limiting the extracted articles to those in the English language, as English is an internationally recognized language. As a result, there were a total of 1002 documents retrieved for the period 1996–2022.

In Figure 26, we depict the steps we followed in the data extraction phase. In the first step, where we extracted all titles containing the established keywords, there were a total of 3146 documents. Regarding the second step, all abstracts containing the keywords resulted in 14,857 documents, and in the third step, including all documents that had the keywords defined by the authors, there were 3841 documents. In the fourth step, all documents containing the key concepts in titles, abstracts, and keywords for our bibliometric analysis were included, resulting in 1453 documents. Following the exclusion steps at stages 5, 6, and 7, we ultimately obtained 1002 documents.

5. Discussion

In an era marked by economic and financial volatility, the theme of shadow banking and financial contagion is becoming increasingly crucial and relevant. In the current context, where financial markets are highly interconnected, and events in one corner of the world can have cascading effects on global economies, understanding the dynamics of these phenomena becomes essential for the stabilization and protection of the financial system.

In this context, a rigorous bibliometric analysis of research in the field becomes a valuable tool for quantifying the impact and identifying emerging trends. Moreover, our research has the potential to provide guidance for informed decisions in industry and policy-making, contributing to the development of more effective risk management strategies and the establishment of solid foundations for decision-making in financial institutions and governmental bodies.

When it comes to the predominant research trends concerning shadow banking and financial contagion in the past decade, the analysis of keywords using the generated word cloud underscored a prevailing focus on the significance of proficient management and evaluation of systemic risk. Consequently, key terms such as “risk assessment”, “systemic risk”, “measuring systemic risk”, and “systemic risk evidence” emerged prominently.

Exploring the identity of authors who have made significant contributions to the topic of financial contagion represented another facet of our inquiry. Through bibliometric analysis, it was discerned that Li X, Poledna S, Li H, Li S, and Renn O stand out as some of the most prolific contributors, ranking among the top 10 authors by volume of published work on this subject.

Another important aspect that we observed is highlighted by the thematic evolution analysis, revealing how the interest in financial contagion and shadow banking has changed over four distinct periods. In the 1996–2006 period, the emphasis on risk management and credit derivatives suggests an initial concern for evaluating and managing systemic risks in a growing financial system. The second period, 2007–2012, encompasses the context of the Global Financial Crisis, with a shift in interest toward aspects such as “too big to fail”, “systemic risk”, “credit derivatives”, “financial contagion”, and “credit default swap”. This period underscored concerns related to systemic risk, how risks can propagate within the financial system, and the necessity of managing these threats. In the 2013–2019 period, the interest shifted toward “shadow banking”, more advanced measures for systemic risk assessment, complex statistical models such as “copula models”, and stricter banking regulations represented by “Basel III”. This reflected a change in focus toward emerging risks in the unconventional banking sector and the need for more sophisticated models to evaluate and manage systemic risk. In the 2020–2022 period, marked by the COVID-19 pandemic and economic uncertainty, the interest has centered around topics such as “shadow banking”, “COVaR”, “capital shortfall”, “financial stability”, “complex network”, “contagion”, “machine learning”, and “forecasting”. This indicates contemporary concerns related to analyzing vulnerabilities in the financial system, managing the complexity of interdependencies, and adopting advanced technologies for anticipating and modeling future risks.

Another interesting analysis involved investigating the countries that have made a significant contribution to the specialized literature. The results of the analysis indicate that several countries have made a substantial contribution to the literature in the studied fields. China, the United States, and the United Kingdom stand out as among the most active and influential countries in the scientific production related to shadow banking and financial contagion. China has the highest publication frequency, with 467 articles, followed by the United States with 330 documents and the United Kingdom with 200. However, it is important to note that despite the large number of publications, China ranks third in terms of citations, with the United States taking the first position and the United Kingdom the second position in terms of citations. Other countries such as Germany, Italy, France, Canada, Australia, and Austria have also made significant contributions to the specialized literature, with diverse distributions between single-country publications and those produced in collaboration with authors from different countries.

Regarding the evolution of academic production in terms of volume and research quality related to the concept of shadow banking and financial contagion, the results show that academic production has undergone significant changes over time. In the period prior to the 2000s, production was relatively low, with only 1–2 articles per year. As time progressed, starting from the 2000s, we observed a gradual increase, and in the years 2004–2006, this increase became more substantial, reaching three articles per year. The year 2007 marked a rapid and significant growth in academic production, peaking in 2012 with 28 articles published. From 2013 onwards, there was continuous and accelerated growth in academic production, with a notable peak in 2022, when 178 articles were published. These results indicate a strong upward trend in research, with a significant increase in academic production in recent years, suggesting a heightened interest in the field of study. As for the journals in which these articles were published, the Journal of Banking and Finance and the Journal of Financial Stability are two of the most frequent and influential sources, with significant representation in Zones 1 of Bradford’s Law. Additionally, the Journal of Banking and Finance stands out with the highest H-index, indicating a significant influence in the field. These journals have been important outlets for the publication of research related to shadow banking and financial contagion.

Regarding the evolution of connections between shadow banking and financial contagion in recent years, we observe a significant increase in research production from affiliated research institutions such as the Central University of Finance and Economics, the Southwestern University of Finance and Economics, the University of Bergamo, the University of Oxford, and Xiamen University. Many of these affiliations began publishing more frequently in recent years, indicating a heightened interest in research related to shadow banking and financial contagion. This suggests a positive trend in the connections between these institutions and the field of study in the current context.

Our study also delves into identifying emerging themes or yet-to-be-explored topics within the realm of research on shadow banking and financial contagion. Thus, to address this perspective, we conducted a qualitative analysis of the most recent publications in our database. The results of this analysis suggest that emerging topics include the impact of geopolitical conflicts on systemic risk and financial contagion, as illustrated by the conflict between Russia and Ukraine. Additionally, the research we analyzed explores the relationship between shadow banks, systemic risk, and technological advancements in the financial industry, particularly within the FinTech sector. Furthermore, an emerging theme involves understanding how risk can spread from energy markets, such as the oil market, to global financial systems. Recent publications also delve into the influence of pandemics, such as COVID-19, on financial contagion and investor behavior. These emerging themes and unexplored topics underscore the diversity and complexity of research in the field of shadow banking and financial contagion, indicating promising directions for future studies.

Our study has the potential to serve as an interdisciplinary research opportunity, as we have observed interconnections between the two concepts of shadow banking and financial contagion. These interconnections are particularly evident in the identification of methods for managing and evaluating systemic risks. Hence, in addressing the overarching question, we emphasize the potential to identify intersecting and developmental research areas within both fields. This entails investigating how insights from shadow banking research can enhance our comprehension of financial contagion and vice versa. Through exploring these crossroads, scholars can discover novel strategies for mitigating systemic risks and bolstering financial stability.

Our results indicate that there are numerous areas of overlap and development in the research fields of shadow banking and financial contagion. Among the notable findings are the theoretical interconnections between the two concepts, which can serve as a basis for the development of common theoretical frameworks contributing to a deeper understanding of systemic risks. Additionally, our research has revealed that the approaches and methods used in both fields can complement each other. For example, complex statistical models employed for systemic risk assessment can also be applied in the context of shadow banking, contributing to a more comprehensive evaluation of financial risks. Our conclusions suggest that closer collaboration is necessary among researchers in the fields of shadow banking and financial contagion. This could lead to the development of interdisciplinary approaches addressing the complex challenges of financial stability.

6. Conclusions

Our study, based on a comprehensive bibliometric analysis, reveals the evolution of research in the areas of shadow banking and financial contagion in recent years. The results indicate a heightened interest and innovative approaches in these domains, as well as promising theoretical connections between them. Furthermore, the research underscores the need for closer collaboration among researchers in these fields to develop interdisciplinary approaches and address the complex challenges of financial stability. These findings contribute to a deeper understanding of systemic risk and financial contagion, providing a solid foundation for future studies and developments in the realms of shadow banking and financial contagion.

Regarding the implications stemming from our analysis, they suggest that the comprehensive development of financial policies at both national and international levels must continue to ensure effective financial stability management. Additionally, our study can serve as a framework to guide researchers and academicians interested in the fields of shadow banking and financial contagion.

Like any other research, our study may have certain limitations that need to be considered. The quality and completeness of the data used in our bibliometric analysis depend on the accuracy and availability of information in the selected databases. While we have used citation metrics as an indicator of research impact, it is important to consider that not all high-impact research may receive a large number of citations. Moreover, the number of citations can be influenced by various factors, including the publication date and the specific field of study. Additionally, while we have identified emerging themes and research directions, the real significance and impact of these research areas may vary and require further investigation. The conclusions and findings of our study may not be universally applicable, as the research landscape in the fields of shadow banking and financial contagion can vary depending on region, culture, or other contextual factors.

As for future research directions, our results highlight significant opportunities for interdisciplinary research between shadow banking and financial contagion. Future research can further explore how these two domains can collaborate to develop common theoretical frameworks and address systemic risks more comprehensively. Moreover, the results have highlighted a connection between shadow banking and technological advancements, particularly in the FinTech sector. Subsequent research can delve deeper into how financial technology can influence systemic risk and how shadow banks adapt to these technological changes. It has also been observed that major events such as geopolitical conflicts and pandemics can significantly impact both concepts. Therefore, a detailed analysis of how these events can influence global financial markets and the development of risk management strategies remain a challenge.

Author Contributions

Conceptualization, I.N., C.D., N.C. and Ș.I.; methodology, I.N. and C.D.; software, I.N.; validation, I.N., C.D., N.C. and Ș.I.; formal analysis, I.N. and C.D.; investigation, I.N. and C.D.; resources, I.N.; data curation, C.D. and Ș.I.; writing—original draft preparation, I.N.; writing—review and editing, I.N., C.D., N.C. and Ș.I.; visualization, I.N., C.D., N.C. and Ș.I.; supervision, I.N. and C.D. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Informed Consent Statement

Not applicable.

Data Availability Statement

Data are contained within the article.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Acharya, Viral V. 2009. A Theory of Systemic Risk and Design of Prudential Bank Regulation. Journal of Financial Stability 5: 224–55. [Google Scholar] [CrossRef]

- Acharya, Viral V., and Timothy C. Johnson. 2007. Insider Trading in Credit Derivatives☆. Journal of Financial Economics 84: 110–41. [Google Scholar] [CrossRef]

- Adrian, Tobias, and Adam B. Ashcraft. 2016. Shadow Banking: A Review of the Literature. In Banking Crises. Edited by Garett Jones. London: Palgrave Macmillan, pp. 282–315. [Google Scholar] [CrossRef]

- Ahmed, Rizwan, Sajid M. Chaudhry, Chamaiporn Kumpamool, and Chonlakan Benjasak. 2022. Tail Risk, Systemic Risk and Spillover Risk of Crude Oil and Precious Metals. Energy Economics 112: 106063. [Google Scholar] [CrossRef]

- Akhtaruzzaman, Md, Sabri Boubaker, and Ahmet Sensoy. 2021. Financial Contagion during COVID–19 Crisis. Finance Research Letters 38: 101604. [Google Scholar] [CrossRef]

- Allen, Franklin, and Douglas Gale. 2000. Financial Contagion. Journal of Political Economy 108: 1–33. [Google Scholar] [CrossRef]

- Alnassar, Walaa Ismael, and Othman Bin Chin. 2015. Why Banks Use Credit Derivatives? Review Paper. Procedia Economics and Finance 26: 566–74. [Google Scholar] [CrossRef]

- Anginer, Deniz, Asli Demirguc-Kunt, and Min Zhu. 2014. How Does Competition Affect Bank Systemic Risk? Journal of Financial Intermediation 23: 1–26. [Google Scholar] [CrossRef]

- Aramonte, Sirio, Andreas Schrimpf, and Hyun Song Shin. 2023. Non-Bank Financial Intermediaries and Financial Stability. BIS Working Paper, Bank for International Settlements 972. Available online: https://ideas.repec.org/p/bis/biswps/972.html (accessed on 28 December 2023).

- Aria, Massimo, and Corrado Cuccurullo. 2017. Bibliometrix: An R-Tool for Comprehensive Science Mapping Analysis. Journal of Informetrics 11: 959–75. [Google Scholar] [CrossRef]

- Arouri, Mohamed El Hedi, Fredj Jawadi, Wael Louhichi, and Duc Khuong Nguyen. 2011. Nonlinear Shift Contagion Modeling: Further Evidence from High Frequency Stock Data. In Nonlinear Financial Econometrics: Markov Switching Models, Persistence and Nonlinear Cointegration. Edited by Greg N. Gregoriou and Razvan Pascalau. London: Palgrave Macmillan UK, pp. 143–60. [Google Scholar] [CrossRef]

- Bae, Kee-Hong, G. Andrew Karolyi, and Reneé M. Stulz. 2003. A New Approach to Measuring Financial Contagion. Review of Financial Studies 16: 717–63. [Google Scholar] [CrossRef]

- Baig, Taimur, and Ilan Goldfajn. 1999. Financial Market Contagion in the Asian Crisis. IMF Staff Papers 46: 167–95. [Google Scholar] [CrossRef]