Decision Rules for Corporate Investment †

Abstract

1. Introduction

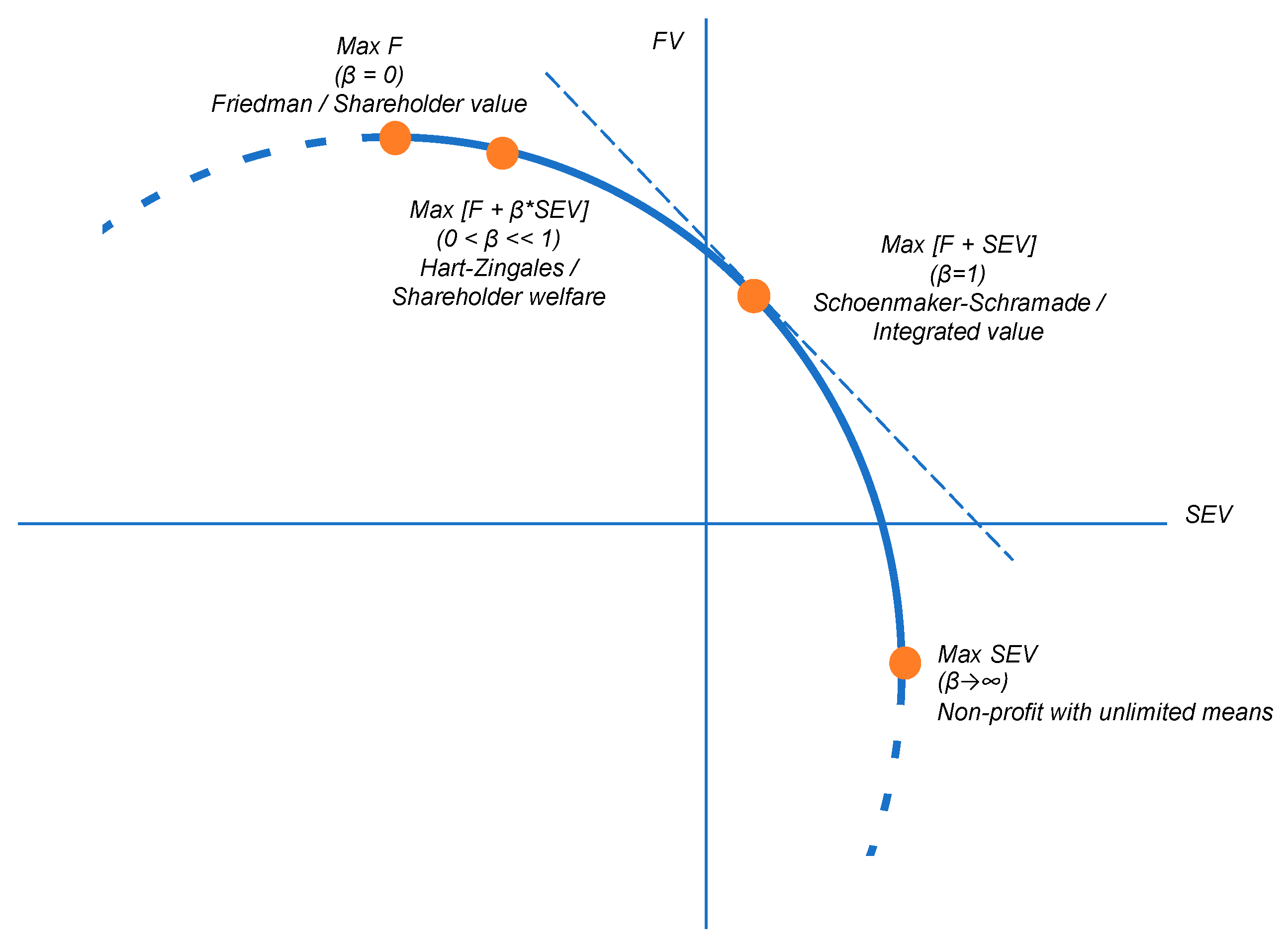

2. The Objective of the Company

2.1. Literature Review

2.2. Setting the Objective of the Company

2.3. Corporate Governance

3. Modelling the Value Frontier

3.1. Impact Measurement and Valuation

- Materiality assessment: determine important factors;

- Quantification: express these factors in their own units (Q);

- Monetary valuation: express these factors in monetary terms with shadow prices (SP).

- Greenhouse gas emissions, including carbon emissions;

- Labour practices, including discrimination and inclusion;

- Business ethics, including corruption and fraud.

3.2. Value Frontier

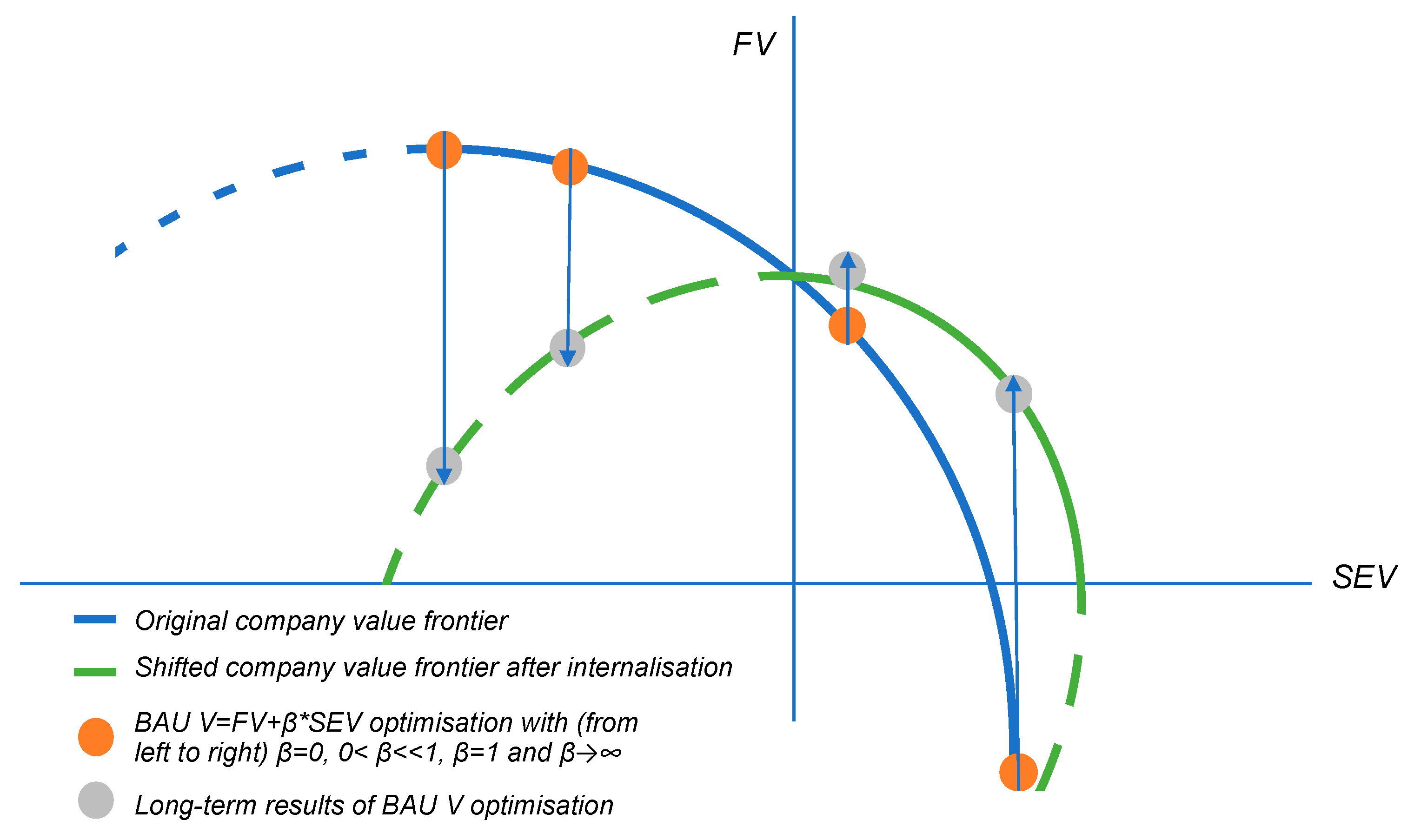

3.3. Dynamics of the Value Frontier

4. Investment Decision Rules

4.1. Investments and Re-Evaluation of the Company’s Objective

4.2. Decision Rule for Major Investments

4.3. Decision Rule for Annual Investments

5. Results and Extension

5.1. Numerical Examples

5.2. Extensions of the Decision Model

6. Conclusions

Author Contributions

Funding

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

| 1 | The IFRS created an International Sustainability Standards Board, which has issued two IFRS Sustainability Disclosure Standards. |

| 2 | See Chapter 19 of Schoenmaker and Schramade (2023). |

| 3 | |

| 4 | See Schoenmaker and Schramade (2023) for an expanded set of social factors (covering labour practices, combatting poverty and interaction with local communities) and environmental factors (covering pollution and use of scarce resources). |

| 5 | The non-profit with limited means would maximise SEV under the constraint FV ≥ 0. This is at the point where the company value frontier crosses the SEV-axis on the right, which means that F = 0. |

| 6 | Carbon prices enter the valuation twice—for calculating FV and EV. The ETS carbon tax incentivises the company to change behaviour and switch to low-carbon technologies reducing the negative EV. In the case of the company reducing carbon emissions, FV improves (by avoiding costly carbon taxes) and EV improves (by reducing carbon emissions). This should not be seen as double counting. |

| 7 |

References

- Azar, José, Miguel Duro, Igor Kadach, and Gaizka Ormazabal. 2021. The big three and corporate carbon emissions around the world. Journal of Financial Economics 142: 674–96. [Google Scholar] [CrossRef]

- Barby, Clara, Richard Barker, Ronald Cohen, Robert Eccles, Christian Heller, Colin Mayer, Bruno Roche, George Serafeim, Judith Stroehle, Rupert Younger, and et al. 2021. Measuring Purpose: An Integrated Framework. Working Paper. Available online: https://ssrn.com/abstract=3771892 (accessed on 17 February 2024).

- Bebchuk, Lucian, and Roberto Tallarita. 2021. The Illusory Promise of Stakeholder Governance. Cornell Law Review 106: 91–178. [Google Scholar] [CrossRef]

- Chava, Sudheer. 2014. Environmental externalities and cost of capital. Management Science 60: 2223–47. [Google Scholar] [CrossRef]

- Cone Communications. 2017. 2017 Cone Communications—CSR Study. Boston: Cone Communications. [Google Scholar]

- Cornell, Bradford, and Alan C. Shapiro. 2021. Corporate stakeholders, corporate valuation and ESG. European Financial Management 27: 196–207. [Google Scholar] [CrossRef]

- Dasgupta, Partha. 2021. The Economics of Biodiversity: The Dasgupta Review. London: HM Treasury. [Google Scholar]

- De Adelhart Toorop, Reinier, Jennifer Kuiper, Valeriu Hartanto, and Adrian de Groot Ruiz. 2019. Framework for Impact Statements, Beta Version. Amsterdam: Impact Institute. [Google Scholar]

- Deegan, Craig. 2019. Legitimacy theory. Despite its enduring popularity and contribution, time is right for a necessary makeover. Accounting, Auditing and Accountability Journal 32: 2307–29. [Google Scholar]

- Demuijnck, Geert, and Björn Fasterling. 2016. The Social License to Operate. Journal of Business Ethics 136: 675–85. [Google Scholar] [CrossRef]

- Ding, Ashley, Dan Daugaard, and Martina K. Linnenluecke. 2020. The future trajectory for environmental finance: Planetary boundaries and environmental, social and governance analysis. Accounting & Finance 60: 3–14. [Google Scholar]

- Dixit, Avinash, and Robert Pindyck. 1994. Investment under Uncertainty. Princeton: Princeton University Press. [Google Scholar]

- Dyck, Alexander, Karl Lins, Lukas Roth, and Hannes Wagner. 2019. Do institutional investors drive corporate social responsibility? International evidence. Journal of Financial Economics 131: 693–714. [Google Scholar] [CrossRef]

- Dyllick, Thomas, and Katrin Muff. 2016. Clarifying the meaning of sustainable business: Introducing a typology from business-as-usual to true business sustainability. Organization & Environment 29: 156–74. [Google Scholar]

- Edmans, Alex. 2020. Grow the Pie: How Great Companies Deliver Both Purpose and Profit. Cambridge: Cambridge University Press. [Google Scholar]

- Freeman, R. Edward. 1984. Strategic Management. A Stakeholder Approach. Boston: Pitman. [Google Scholar]

- Friedman, Milton. 1970. The social responsibility of business is to increase its profits. New York Times Magazine, September 13. [Google Scholar]

- Gollier, Christian. 2012. Pricing the Planet’s Future. Princeton: Princeton University Press. [Google Scholar]

- Gomes, Mathieu, and Sylvain Marsat. 2018. Does CSR impact premiums in M&A transactions? Finance Research Letters 26: 71–80. [Google Scholar]

- Grol, Carol. 2020. Waarom greep Shell mis bij de verkoop van Eneco? (Why did Shell go wrong with the sale of Eneco?). Het Financieele Dagblad, January 7. [Google Scholar]

- Harclerode, Melissa A., Pankaj Lal, and Michael E. Miller. 2016. Quantifying global impacts to society from the consumption of natural resources during environmental remediation activities. Journal of Industrial Ecology 20: 410–22. [Google Scholar] [CrossRef]

- Hart, Oliver, and Luigi Zingales. 2017. Companies Should Maximize Shareholder Welfare Not Market Value. Journal of Law, Finance, and Accounting 2: 247–75. [Google Scholar] [CrossRef]

- Hart, Oliver, and Luigi Zingales. 2022. The New Corporate Governance. University of Chicago Business Law Review 1: 195–216. [Google Scholar]

- Husted, Bryan W., and José de Jesus Salazar. 2006. ‘Friedman seriously: Maximizing profits and social performance. Journal of Management Studies 43: 75–91. [Google Scholar] [CrossRef]

- Impact Economy Foundation (IEF). 2022. Impact-Weighted Accounts Framework. Amsterdam: Impact Economy Foundation. [Google Scholar]

- Impact Institute. 2020. Integrated Profit & Loss Assessment Methodology (IAM): Core. Version 1.0. Amsterdam: Impact Institute. [Google Scholar]

- Kaplan, Robert, and David Norton. 1996. The Balanced Scorecard: Translating Strategy into Action. Boston: Harvard Business School Press. [Google Scholar]

- Kim, Yeuseung. 2021. Certified corporate social responsibility? The current state of certified and decertified B Corps. Corporate Social Responsibility & Environmental Management 28: 1760–68. [Google Scholar]

- Krueger, Philipp, Daniel Metzger, and Jiaxin Wu. 2022. The Sustainability Wage Gap. Working Paper. Available online: https://ssrn.com/abstract=3672492 (accessed on 17 February 2024).

- Kuh, Thomas, Andre Shepley, Greg Bala, and Michael Flowers. 2020. Dynamic Materiality: Measuring What Matters. San Francisco: Truvalue Labs. [Google Scholar]

- Kurznack, Lars, Dirk Schoenmaker, and Willem Schramade. 2024. A Model of Long-Term Value Creation. Journal of Sustainable Finance & Investment, 1–19. [Google Scholar] [CrossRef]

- Mayer, Colin. 2018. Prosperity: Better Business Makes the Greater Good. Oxford: Oxford University Press. [Google Scholar]

- Räsänen, Pirjo, Eija Roine, Harri Sintonen, Virpi Semberg-Konttinen, Olli-Pekka Ryynänen, and Risto Roine. 2006. Use of quality-adjusted life years for the estimation of effectiveness of health care: A systematic literature review. International Journal of Technology Assessment in Health Care 22: 235–41. [Google Scholar] [CrossRef]

- Rawls, John. 1971. Theory of Justice. Cambridge: Harvard University Press. [Google Scholar]

- Richardson, Katherine, Will Steffen, Wolfgang Lucht, Jørgen Bendtsen, Sarah E. Cornell, Jonathan F. Donges, Markus Drüke, Ingo Fetzer, Govindasamy Bala, Werner von Bloh, and et al. 2023. Earth beyond six of nine planetary boundaries. Science Advances 9: 2458. [Google Scholar] [CrossRef]

- Schoenmaker, Dirk, and Willem Schramade. 2022. Valuing Companies in Transition. Sustainability Letters 1: 1–12. [Google Scholar] [CrossRef]

- Schoenmaker, Dirk, and Willem Schramade. 2023. Corporate Finance for Long-Term Value. Berlin and Heidelberg: Springer. [Google Scholar]

- Schoenmaker, Dirk, Willem Schramade, and Jaap Winter. 2023. Corporate Governance Beyond the Shareholder and Stakeholder Model. Erasmus Law Review 16: 27–35. [Google Scholar] [CrossRef]

- Serafeim, George, T. Robert Zochowski, and Jennifer Downing. 2019. Impact-Weighted Financial Accounts: The Missing Piece for an Impact Economy. White Paper. Boston: Harvard Business School. [Google Scholar]

- Sidgwick, Henry. 1907. The Methods of Ethics, 7th ed. London: Macmillan and Company. [Google Scholar]

- Stiglitz, Joseph E., Amartya Sen, and Jean-Paul Fitoussi. 2009. Report by the Commission on the Measurement of Economic Performance and Social Progress. Stiglitz Report. Paris. [Google Scholar]

- Tirole, Jean. 2001. Corporate Governance. Econometrica 69: 1–35. [Google Scholar] [CrossRef]

- Wilburn, Kathleen M., and Ralph Wilburn. 2011. Achieving social license to operate using stakeholder theory. Journal of International Business Ethics 4: 3–16. [Google Scholar]

| Value Dimension | Synergies |

|---|---|

| Financial value (FV) | 46 |

| Social value (SV) | −38 |

| Environmental value (EV) | −13 |

| Integrated present value (IPV) | −5 |

| Value Dimension | Present Value |

|---|---|

| Financial value (FV) | −4.2 |

| −9.9 |

| 5.8 |

| Environmental value (EV) | 14.7 |

| Integrated present value (IPV) | 10.6 |

| Investment details | |

| |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

de Adelhart Toorop, R.; Schoenmaker, D.; Schramade, W. Decision Rules for Corporate Investment. Int. J. Financial Stud. 2024, 12, 24. https://doi.org/10.3390/ijfs12010024

de Adelhart Toorop R, Schoenmaker D, Schramade W. Decision Rules for Corporate Investment. International Journal of Financial Studies. 2024; 12(1):24. https://doi.org/10.3390/ijfs12010024

Chicago/Turabian Stylede Adelhart Toorop, Reinier, Dirk Schoenmaker, and Willem Schramade. 2024. "Decision Rules for Corporate Investment" International Journal of Financial Studies 12, no. 1: 24. https://doi.org/10.3390/ijfs12010024

APA Stylede Adelhart Toorop, R., Schoenmaker, D., & Schramade, W. (2024). Decision Rules for Corporate Investment. International Journal of Financial Studies, 12(1), 24. https://doi.org/10.3390/ijfs12010024