1. Introduction

Value Added Tax (VAT) is an indirect tax levied on all merchandises and amenities manufactured or rendered in a country except for supplies and facilities that are VAT relieved. VAT is a levy on the number of products and provisions that the end user ultimately endures, and its collection is designed and made possible at each phase of the manufacturing and delivery sequence. It implies that VAT is a consumption tax collected from individuals who only suffer a little incidence of taxation that allows the persons who pays VAT not to bear the entire cost of the charge [

1]. Following the enactment of Value Added Tax Act (VATA) 1993, VAT was introduced in Nigeria as specified in No. 102 of the VATA 1993 to replace the sales tax that was then the consumption tax supported by the Federal Government Decree No. 7 of 1986. Since the introduction of VAT in 1993, the Nigerian VAT rate remained at 5% and is one of the lowest globally. President Obasanjo’s Administration considered a VAT increment from 5% to 10%, but the proposal was turned down by the Late President Yar’Adua’s administration due to stiff resistance from the Nigerian people.

Section 34 of the Finance Act of 2020 increased the VAT rate from 5% to 7.5%, which is one of the major changes in Nigerian VAT administration. President Buhari signed the Finance Bill of 2019 into law on 13 January 2020, and the Finance Act 2020 became effective from 1 February 2020. However,

Table A1 in

Appendix A shows that VAT is not applicable in countries such as Bermuda, Cayman Islands, Gibraltar, Greenland, Guernsey, Channel Islands, Hong Kong SAR, Kuwait, Libya, Macau SAR, Oman, Qatar, Turks and Caicos Islands, and the United States [

2]. In

Table A2 in

Appendix B, Nigeria falls within the countries with the lowest VAT rate, which ranges from 2.5% to 9%. These countries include Bahrain 5%, Fiji 9%, Japan 8%, Jersey, Channel Islands 5%, Liechtenstein 7.7%, Nigeria 7.5%, Panama 7%, Saudi Arabia 5%, Singapore 7%, Sri Lanka 8%, Switzerland 7.7%, Taiwan 5%, Thailand 7%, Timor-Leste 2.5%, and the United Arab Emirates 5% [

2]. Countries with the highest VAT rate that is noteworthy and ranges between 20 and 27 per cent include Albania 20%, Argentina 21%, Slovenia 22%, Poland 23%, Finland 24%, Denmark 25%, and Hungary 27%, among others [

2].

It is worthy of note that VAT imposition on all goods and services does not include exempted goods, which are not subject to VAT as specified in No. 102 of VATA 1993 include everything medicinal in addition to pharmacological goods, essential foodstuff, books and learning resources, infant foods, and nourishment. The exemption includes domestically manufactured agrarian and veterinary medication, agricultural equipment and agribusiness conveyance tools, all exports, plants and machines traded in for usage in the export handling sector. The VATA 1993 also excludes plant and equipment acquired for operation of gas in downstream gasoline processes, tractors, and cultivators and agronomic apparatuses bought for agricultural tenacities from VAT payment. The relieved services include medicinal services, services rendered by community banks, the People’s Bank and secured loan organizations, shows and concerts produced by enlightening institutes as part of education, and all exported facilities [

3,

4]. The zero-rated goods and services specified by the VATA 2007 (as amended) include non-oil exports, merchandises and services procured by ambassadors, and privileges obtained for use in philanthropic sponsored schemes.

The new Finance Act 2020 has improved the goods and services exempted from VAT by extending the list of essential food items that are free from VAT. The additional items included in the list of necessary food items that are VAT free comprise seasonings (honey), dough, mueslis, catering apply oil, gastronomic parsleys, fish, flour and thickener, and berries (fresh or dried). The list also includes animal protein sources, milk, nuts, throbs, tubers, saline, spuds, H

2O, domestically produced sterile bath sheets, swabs, or wipes. The additional services exempted for VAT under the new Finance Act 2020 consist of services rendered by microfinance banks, training involving kindergarten, and other levels of schooling. Section 38 of the Finance Act 2020 exempts businesses with a turnover that is less than N25 million from payment of VAT. Nigeria’s VAT revenue sharing formula is 85% to the states and local governments, while the federal government has only a 15% share. From the 85% share, 50% is allocated to the state, governments, while the local governments’ share is 35%. The idea behind this sharing preference to states and local governments is to enable them to carry out their social responsibilities and economic obligations to the citizens, which invariably includes the new minimum wage the state governors committed themselves to satisfy [

5].

The Finance Act 2020 [

6] also clarifies that VAT record should be on a cash basis and no longer had invoice based, which is on an accrual basis. The reason is that a taxpayer can only recover input VAT against output VAT that is collected. This treatment agrees with the prudence concept of accounting, which encourages revenue recognition and financial planning based on income earned and not revenue expected.

However, the debate on the influence of incidental levies (VAT and CED) on the fiscal progress of a nation has been ongoing among scholars, using different models, parameters, and tools of measurement coupled with varying analysis outcomes. For instance, [

7] found significant positive input of VAT on Romanian economic growth using GDP, while [

8] used the Romanian national income to assess VAT contribution to economic growth and also found it significantly positive. Simionescu and Albu [

9] tested the effect of VAT on the monetary progression of CEE-5 and a significant favorable impression of VAT on GDP was established, but [

10] found that VAT contributions to Kenya’s GDP was inconsequentially positive. Ikeokwu and Micah [

11] found the impact of CED and VAT on Nigeria’s Per Capita Income (PCI) materially positive, while [

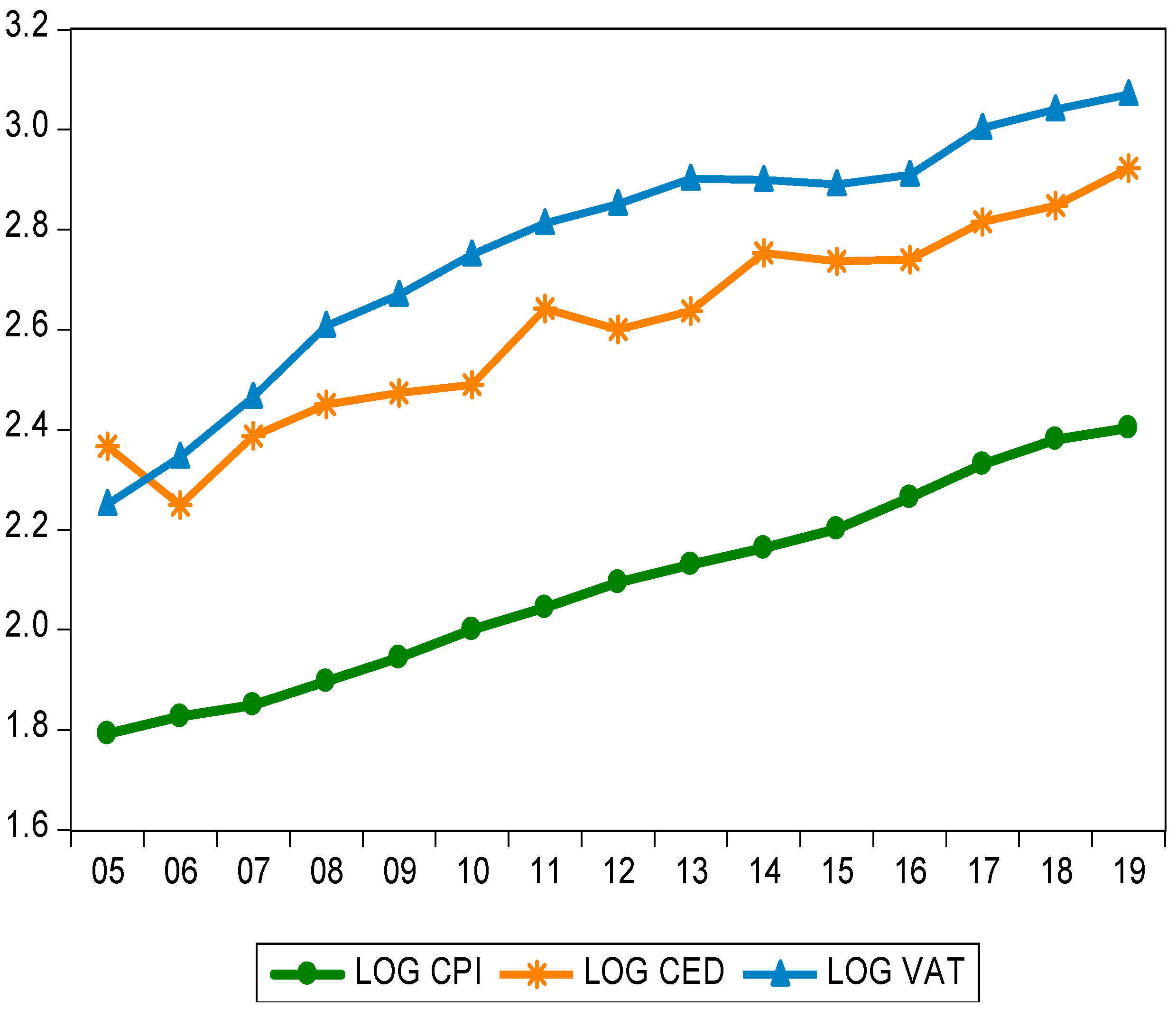

12] revealed that VAT and CED had an insignificant negative impact on Nigeria’s monetary evolution. These differences prompted the current enquiry, which focused on the impact of VAT and CED on consumption in Nigeria. This study uses the consumer price index (CPI) as a proxy for consumption. CPI represents consumption expenses, which measure the average variation in costs over time that consumers pay for a basket of goods and services. It covers the period from 2005 to 2019 and tries to make a substantial difference by using consumption patterns as the response variable, assessing how people’s consumption levels in Nigeria respond to VAT and CED charges imposed on goods and services.

Nevertheless, it is worthy to note that tax revenue in an unindustrialized state such as Nigeria is fraught with tax avoidance and evasions due to a high rate of underground economic activities [

13] of which VAT is not an exemption. Majorly, the informal economy forms a significant aspect of Nigeria’s economy. It remains a wonder how VAT revenues accruing from such shadow economic activities will get to the government. That is, it is probable VAT charges are not obtainable in the informal sector where every business is undercover without proper disclosure to the relevant authorities [

14]. Where companies do not register officially due to underground economy, it will be difficult to account for VAT revenue. Individuals who get involved in the informal sector evade all manner of tax payment [

15], which consequently and negatively affects government public service delivery [

16]. According to [

17], VAT is the leading source of global tax proceeds, but it is confronted with the challenges of tax avoidance due to shadow economic activities and corruption among business participants. However, this study examines the effect of indirect taxes on consumption. Consumption of certain goods and services could be discouraged through indirect taxes such as customs and excise duties, while VAT is such an indirect tax that does not discourage consumption of goods and services because its payment is not felt by an individual at any stage in the consumption chain, but the challenge is its remittance to the government, which sometimes is hindered due to frequent tax evasion.

5. Conclusions and Recommendation

This research determines the incidental assessments aftermath on consumption in Nigeria. One of the objectives of this study is to keep in line with the open innovation concept and trends in businesses, which includes amendment in the associated indirect taxes. Chesbrough [

34] explained that open innovation is “a paradigm that assumes that firms can and should use external ideas as well as internal ideas, and internal and external paths to market as the firms look to advance their technology”. In order to pursue the open innovation goal of using external and internal ideas to improve business operations in Nigeria, Section 38 of the Finance Act 2020 relieves businesses with a revenue that is less than N25 million from the payment of VAT. It is important to understand that consumers react to changes in prices of goods and services either directly or indirect. The reaction could result in affirmative, sometimes undesirable, but it is subject to the value each consumer attaches to the products or services being consumed. In this study, we discovered that VAT impacts positively on consumption, but its influence is very immaterial to reckon with. However, VAT’s insignificant influence on consumption could be likened to low patronage of some goods and services due to VAT imposition on them. Another scenario could be due to informal economic activities hindering the collection of VAT revenue and the nonchalant behavior of some companies and individuals who fail to remit VAT revenues to the appropriate government revenue authorities.

Businesses operating underground and failing to remit VAT revenues is one of the challenges of open innovation, which has made it difficult for SMEs to be transformed despite government’s efforts to improve their operations. On the contrary, CED has a substantial positive impact on consumption. That means instead of CED imposition discouraging the consumption of imported goods and services and other harmful materials, their consumption is on the increase. From the foregoing, the research recommends that governments endeavor to reduce the prices of products and services attracting value added tax charges. The reduction in the prices of these consumable products will enhance their consumption despite the VAT charges levied on them. This study is also proposing the initiation of other mechanisms by the designated authorities to depress the intake of unsafe foodstuffs in the country. Import of such products should be totally banned and a strict check should be put in place against smugglers of these prohibited goods and services.

The underlying forces propelling the improvement culture openly adopted by the government to modernize VAT and CED administration in Nigeria is a function of prevailing economic realities, while keeping in line with universal best practices. This study highlights several innovative outcomes occasioned by changes in VAT and CED policies in Nigeria. The fundamental reason behind the open innovation culture promoted by this study is to ensure that the public is abreast with the changes that have occurred in recent times in VAT and CED administration in the country. The knowledge this study is providing will help to improve and sustain entrepreneurship operations, especially in VAT remittances to the government. It will also help to give the public the enlightenment to inhibit the consumption of items with extraordinary CED charges on them. The government will also ensure that open innovation engineering on tax policies do not cripple economic activities or adversely affect private sector operations in the country. The adoption of modernization principles should not also discourage foreign direct inflows in Nigeria. The government should ensure that VAT and CED practices encourage international business participation and investment to boost the economic growth of the nation.