Key Challenges and Opportunities for an Effective Supply Chain System in the Catalyst Recycling Market–A Case Study of Poland

Abstract

1. Introduction

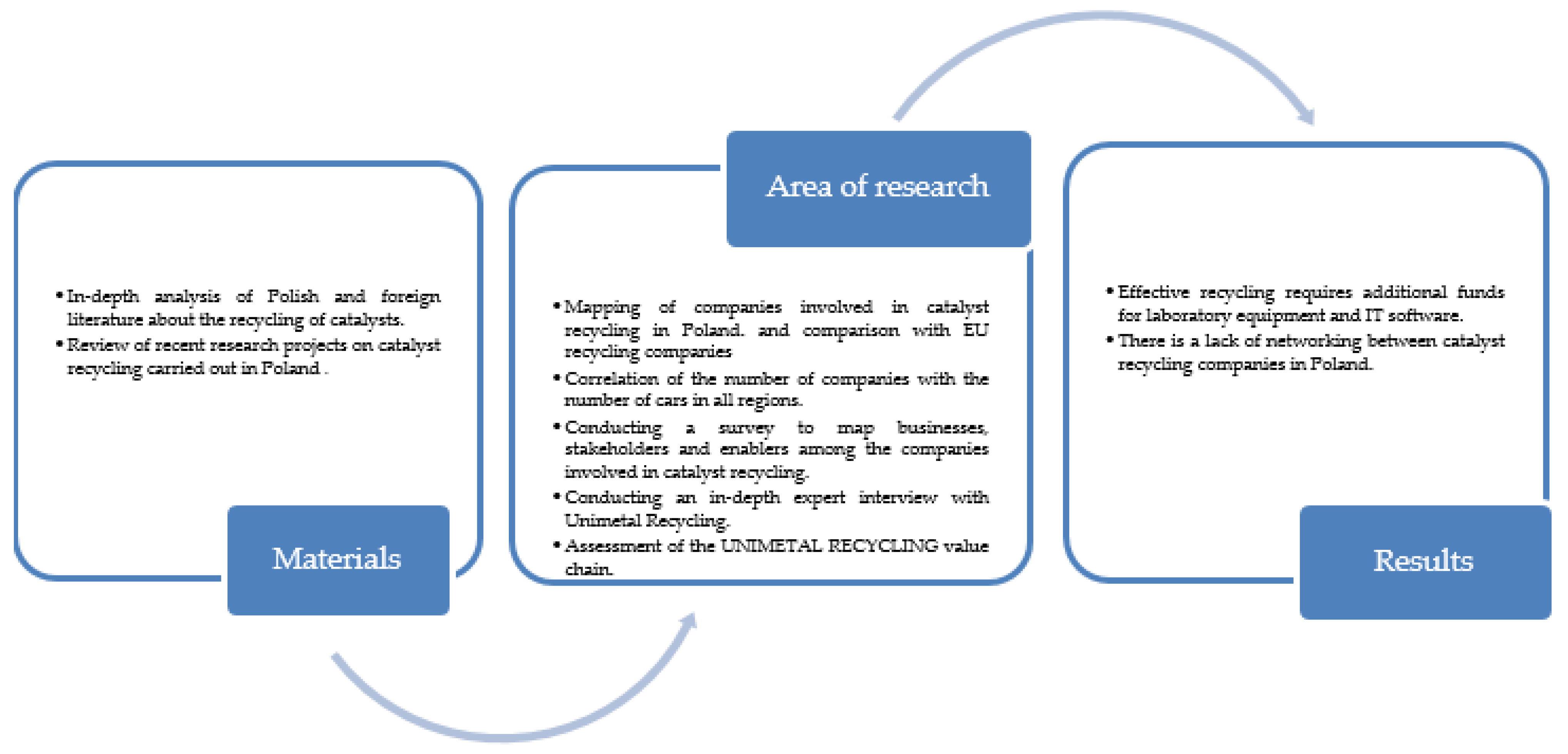

2. Materials and Methods

2.1. Materials

2.2. Area of Research

- 80% have awareness of developments in the field of replacement/modernisation of catalysts in vehicles,

- 70% pointed out that the demand for replacement catalysts is rather average or limited,

- 90% indicated equity as the company financing model, and the remaining 10% pointed to EU funds and other types of subsidies.

2.3. Methodology

- Inbound logistics—involving networking with suppliers and all the activities required to receive, analyse and recycle catalysts.

- Operations—these are all activities related to the preparation of the catalyst for recovery of PGMs.

- Outbound logistics—include all the activities required to collect and store data about the catalyst available on the market.

- Marketing and sales—activities to inform customers about products and services, induce buyers to purchase them and facilitate their purchase.

- Service—includes all the activities required to keep the process of recycling of the catalyst working effectively for the customer after he/she has decided to sell it.

- Secondary activities are:

- Procurement—the acquisition of inputs, or resources, for the company based on their own IT software.

- Human resource management—consists of all activities involved in recruiting, hiring, training, developing, compensating (UMR provides corporate social responsibility).

- Technological development—pertains to the equipment, hardware, software, procedures and technical knowledge which is used in the technology for recycling the catalyst but also in the laboratory during the analysis of the catalyst and also the software specially prepared by UMR.

- Infrastructure—serves the company’s needs and ties its various parts together and consists of functions and departments.

2.4. The Importance of Transparency in Catalyst Analysis—Case Study of Unimetal Recycling

3. Results and Discussion

- Difficult access to identify the entities in the whole supply chain in Poland. There are a lot of micro companies which collect waste, including catalysts, which are not promoting their activities on the Internet (do not have webpage) as they work in internal and informal networks.

- Collecting of data about waste was time consuming as they were reported to the voivodeship database. Nowadays, a central database available in Poland.

- The time and permission for new investment, even in recycling technology, is time consuming, due to environmental procedure, including public consultations.

- The results of cooperation between science and recycling companies are not widely published.

4. Conclusions

- Most studies and expert appraisals predict that future demand for these critical metals will increase, which will result in a shortage of supply of these metals if there is no recycling from major secondary sources.

- The main drivers for the development of the design of the recycling network are legal regulations and economic conditions, but also the declining amount of primary sources of these suppliers.

- In Poland, the recycling system for catalysts is still developing, but there is a significant trend to an increase mainly due to EU policy on the circular economy.

- Review of projects showed that they mostly focus on the improvement of catalyst quality or the development of new recycling technology; none of them focus on innovation and cooperation in the whole supply chain. There is no official network or association in Poland, but some companies are members of the Waste Recycling and Management Cluster—Key National Cluster of Poland.

- The results of the survey showed that companies are not considering cooperation with other companies and research organisations, although 40% would be interested in a strategic alliance.

- Because of frequent technological and legal changes, the market is not transparent and the price for used catalysts varies significantly. Moreover, some catalysts are offered on the “black market”.

- It is important for the companies to have a transparent method of analysing the catalysts that determines the value of the product in a clear and equitable way, however, it requires significant investment.

- As catalytic converters contain mainly a compound of the three metals Pt, Pd and Rh; the manufacture of catalysts for automobiles is the largest sector of demand for and consumption of PGMs.

- If the COVID-19 pandemic affected the PGM supply from primary and secondary resources as well as demand in 2020, the estimates show that there was only a short-term impact connected with temporary plant closures.

- It is possible that financial stress due to the COVID-19 crisis will motivate car companies to take a fresh look at opportunities to reduce the cost of their exhaust after treatment systems.

- Effective system could be implemented by creating a network between suppliers and customers with the use of good laboratory equipment with dedicated IT applications.

- Such good cooperation in the value chain also creates a demand for joint R&D projects and close cooperation with universities and enables an increase in economic and resource efficiency.

- In Poland, the development of catalyst recycling is going in the right direction, especially when we compare it to the largest companies in the world, although not every company can take advantage of this situation.

- The development of catalyst recycling in Poland fits perfectly into the topic of circular economy. Such activities can be supported by the European Commission in various R&D projects in the future.

- There is growth potential in the market for very specialised companies in a semi-competitive market with the dominance of large international companies.

Supplementary Materials

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Ding, Y.; Zhang, S.; Liu, B.; Zheng, H.; Chang, C.C.; Ekberg, C. Recovery of precious metals from electronic waste and spent catalysts: A review. Resour. Conserv. Recycl. 2019, 141, 284–298. [Google Scholar] [CrossRef]

- Resano, M.; Flóres, M.; Oeralt, I.; Margui, E. Determination of palladium, platinum and rhodium in used automobile catalysts and active pharmaceutical ingredients using high-resolution continuum source graphite furnace atomic absorption spectrometry and direct solid sample analysis. Spectrochim. Acta Part B At. Spectrosc. 2015, 105, 38–46. [Google Scholar] [CrossRef]

- Olejnik, T.P.; Sobiecka, E. Utilitarian Technological Solutions to Reduce CO2 Emission in the Aspect of Sustainable Development. Probl. Sustain. Dev. 2017, 12, 173–179. [Google Scholar]

- Knobloch, V.; Zimmermann, T.; Gößling-Reisemann, S. From criticality to vulnerability of resource supply: The case of the automobile industry. Resour. Conserv. Recycl. 2018, 138, 272–282. [Google Scholar] [CrossRef]

- Trinh, H.; Lee, J.; Suh, Y.; Lee, J. A review on the recycling processes of spent auto-catalysts: Towards the development of sustainable metallurgy. Waste Manag. 2020, 114, 148–165. [Google Scholar] [CrossRef]

- Ding, Y.; Zheng, H.; Zhang, S.; Liu, B.; Wu, B.; Jian, Z. Highly efficient recovery of platinum, palladium, and rhodium from spent automotive catalysts via iron melting collection. Resour. Conserv. Recycl. 2020, 155, 104644. [Google Scholar] [CrossRef]

- Asimellis, G.; Michos, N.; Fasaki, I.; Kompitsas, M. Platinum group metals bulk analysis in automobile catalyst recycling material by laser-induced breakdown spectroscopy. Spectrochim. Acta Part B At. Spectrosc. 2008, 63, 1338–1343. [Google Scholar] [CrossRef]

- Wei, X.; Liu, C.; Cao, H.; Ning, P.; Jin, W.; Yang, Z.; Wang, H.; Sun, Z. Understanding the features of PGMs in spent ternary automobile catalysts for development of cleaner recovery technology. J. Clean. Prod. 2019, 239, 118031. [Google Scholar] [CrossRef]

- Zhang, S.; Ding, Y.; Liu, B.; Chang, C.C. Supply and demand of some critical metals and present status of their recycling in WEEE. Waste Manag. 2017, 65, 113–127. [Google Scholar] [CrossRef]

- Molnár, A.; Papp, A. Catalyst recycling—A survey of recent progress and current status. Coord. Chem. Rev. 2017, 349, 1–65. [Google Scholar] [CrossRef]

- Cowley, A.; Bloxham, L.; Brown, S.; Cole, L.; Cowley, A.; Fujita, M.; Girardot, N.; Jiang, J.; Raithatha, R.; Ryan, M.; et al. The Pgm Market Report. 2020. Available online: http://www.platinum.matthey.com/services/market-research/pgm-market-reports (accessed on 22 September 2020).

- Habib, K.; Sprecher, B.; Young, S.B. COVID-19 impacts on metal supply: How does 2020 differ from previous supply chain disruptions? Resour. Conserv. Recycl. 2021, 165, 105229. [Google Scholar] [CrossRef]

- Tsai, W. Promoting the Circular Economy via Waste-to-Power (WTP) in Taiwan. Resources 2019, 8, 95. [Google Scholar] [CrossRef]

- Wilburn, D.; Bleiwas, D. Platinum-Group Metals—World Supply and Demand. 2005. Available online: https://www.researchgate.net/publication/267298042_Platinum-Group_Metals-World_Supply_and_Demand (accessed on 23 September 2020).

- Saternus, M.; Fornalczyk, A.; Gąsior, W.; Dębski, A.; Terlicka, S. Modifications and Improvements to the Collector Metal Method Using an mhd Pump for Recovering Platinum from Used Car Catalysts. Catalysts 2020, 10, 8080. [Google Scholar] [CrossRef]

- Prasetyo, E.; Anderson, C. Platinum Group Elements Recovery from Used Catalytic Converters by Acidic Fusion and Leaching. Metals 2020, 10, 485. [Google Scholar] [CrossRef]

- Yakoumis, I.; Moschovi, A.; Panou, M.; Panias, D. Single-Step Hydrometallurgical Method for the Platinum Group Metals Leaching from Commercial Spent Automotive Catalysts. J. Sustain. Metall. 2020, 6, 259–268. [Google Scholar] [CrossRef]

- Hakan, M.M. A new approach to recover platinum-group metals from spent catalytic converters via iron matte. Resour. Conserv. Recycl. 2020, 159, 104891. [Google Scholar] [CrossRef]

- Loutatidou, S.; Sanchez, B.F.; Festa, E.; Akil, N. Value Chain Stakeholders Analysis. PGMs Recovery Using Secondary Raw Materials. Report from the Platirus Project. 2016. [Google Scholar]

- Trębacz, H.; Michno, P. The evaluation of Platinum Group Metals (PGMs) and their recovery from car catalytic converters. Environment 2017, 9, 133–147. [Google Scholar]

- Karagoz, S.; Aydin, N.; Simic, V. End-of-life vehicle management: A comprehensive review. J. Mater. Cycles Waste Manag. 2020, 22, 416–442. [Google Scholar] [CrossRef]

- DIRECTIVE 2000/53/EC of the European Parliament and of the Council of 18 September2000 on End-of Life Vehicles. Available online: https://eur-lex.europa.eu/LexUriServ/LexUriServ.do?uri=CONSLEG:2000L0053:20050701:EN:PDF (accessed on 23 September 2020).

- Eskina, V.; Dalnova, O.; Filatova, D.; Baranovskaya, V.; Karpov, Y. Direct precise determination of Pd, Pt and Rh in spent automobile catalysts solution by high-resolution continuum source graphite furnace atomic absorption spectrometry. Spectrochim. Acta Part B At. Spectrosc. 2020, 165, 105874. [Google Scholar] [CrossRef]

- Lee, J.; Raju, B.; Kumar, B.; Kumar, J.; Park, H.; Reddy, B. Solvent extraction separation and recovery of palladium and platinum from chloride leach liquors of spent automobile catalyst. Sep. Purif. Technol. 2010, 73, 213–218. [Google Scholar] [CrossRef]

- Zhang, L.; Song, Q.; Liu, Y.; Xu, Z. An integrated capture of copper scrap and electrodeposition process to enrich and prepare pure palladium for recycling of spent catalyst from automobile. Waste Manag. 2020, 108, 172–182. [Google Scholar] [CrossRef] [PubMed]

- Puig, A.; Alvarado, J. Evaluation of four sample treatments for determination of platinum in automotive catalytic converters by graphite furnace atomic absorption spectrometry. Spectrochim. Acta Part B At. Spectrosc. 2006, 61, 1050–1053. [Google Scholar] [CrossRef]

- Torrejos, R.; Nisola, G.; Min, S.; Han, J.; Lee, S.; Chung, W. Highly selective extraction of palladium from spent automotive catalyst acid leachate using novel alkylated dioxa-dithiacrown ether derivatives. J. Ind. Eng. Chem. 2020, 89, 428–435. [Google Scholar] [CrossRef]

- Ilyas, S.; Srivastava, R.; Kim, H.; Cheema, H. Hydrometallurgical recycling of palladium and platinum from exhausted diesel oxidation catalysts. Sep. Purif. Technol. 2020, 248, 117029. [Google Scholar] [CrossRef]

- Ferella, F. A review on management and recycling of spent selective catalytic reduction catalysts. J. Clean. Prod. 2020, 246, 118990. [Google Scholar] [CrossRef]

- Ciuła, J.; Gaska, K.; Generowicz, A.; Hajduga, G. Energy from Landfill Gas as An Example of Circular Economy. In Proceedings of the First Conference of the International Water Association IWA for Young Scientist in Poland “Water, Wastewater and Energy in Smart Cities”, Cracow, Poland, 12–13 September 2017. [Google Scholar] [CrossRef]

- Karhu, M.; Bachér, M.; Yli-Rantala, E.; Huttunen Saarivirta, E.; Cordones, P.; Martel Martin, S.; Sanz, M.C. Report on the Economic Assessment of Substitution Trajectories. 2019. Available online: http://scrreen.eu/wp-content/uploads/2019/06/SCRREEN-D5.3-Report-on-the-economic-assessment-of-substitution-trajectories.pdf (accessed on 28 September 2020).

- Król, J.; Ocłoń, P. Economic analysis of heat and electricity production in combined heat and power plant equipped with steam and water boilers and natural gas engines. Energy Convers. Manag. 2018, 176, 11–29. [Google Scholar] [CrossRef]

- Trinh, H.; Lee, J.; Srivastava, R.; Kim, S. Total recycling of all the components from spent auto-catalyst by NaOH roasting-assisted hydrometallurgical route. J. Hazard. Mater. 2019, 379, 120772. [Google Scholar] [CrossRef]

- Xun, D.; Hao, H.; Sun, X.; Liu, Z.; Zhao, F. End-of-life recycling rates of platinum group metals in the automotive industry: Insight into regional disparities. J. Clean. Prod. 2020, 266, 121942. [Google Scholar] [CrossRef]

- Che, J.; Yu, J.; Kevin, R.S. End-of-life vehicle recycling and international cooperation between Japan, China and Korea: Present and future scenario analysis. J. Environ. Sci. 2011, 23, S162–S166. [Google Scholar] [CrossRef]

- LBMA PALLADIUM. Available online: https://www.lme.com/Metals/Precious-metals/Palladium (accessed on 23 September 2020).

- GUS. Available online: https://bdl.stat.gov.pl/BDL/dane/podgrup/wykres (accessed on 23 September 2020).

- Moztota, B. Structuring Strategic Design Management: Michael Porter’s Value Chain. Des. Manag. Rev. 2010, 9, 2. [Google Scholar] [CrossRef]

- Magangement Technology Policy. Available online: https://www.ifm.eng.cam.ac.uk/research/dstools/value-chain-/ (accessed on 23 September 2020).

- Umicore Investor Presentation. Available online: https://www.umicore.com/storage/group/investor-presentation-october.pdf (accessed on 30 September 2020).

- Amund, N.L.; Hagelüken, C.H.; Wäger, P. Improving supply security of critical metals: Current developments andresearch in the EU. Sustain. Mater. Technol. 2018, 15, 9–18. [Google Scholar]

- Espinoza, L.T.; Schrijvers, D.; Chen, W.; Dewulf, J.; Eggert, R.; Goddin, J.; Habib, K.; Hagelüken, C.; Hurd, A.J.; Kleijn, R.; et al. Greater circularity leads to lower criticality, and other links betweencriticality and the circular economy. Resour. Conserv. Recycl. 2020, 159, 104718. [Google Scholar] [CrossRef]

- Bahaloo-Horeh, N.; Mousavi, S.M. Comprehensive characterization and environmental risk assessment of end-of-life automotive catalytic converters to arrange a sustainable roadmap for future recycling practices. J. Hazard. Mater. 2020, 400, 123186. [Google Scholar] [CrossRef] [PubMed]

| Company Name | Date of Registration | Legal Form | Source | |

|---|---|---|---|---|

| 1 | An-mar | 2007-01-15 | trading business | panoramafirm.pl |

| 2 | Skup katalizatorów PUH Platinum | 2008-12-18 | general partnership | https://www.platinum-katalizatory.pl/ |

| 3 | JAMAR | 2010-08-11 | limited partnership | https://katalizatory-skup.pl/ |

| 4 | Elemental Holding S.A. | 2011-01-13 | joint-stock company | https://elemental.biz/ |

| 5 | DS Auto Sp. z o.o | 2011-01-28 | limited partnership | https://katalizatorychrzanow.pl/ |

| 6 | PLATINIUM Metal Recycling Company | 2011-12-07 | limited partnership | https://catalystrecycling.pl/ |

| 7 | Skup katalizatorów TOMKAT | 2014-02-06 | limited liability company | http://www.tomkat-lublin.pl |

| 8 | Unimetal Recycling Sp z o.o. | 2014-05-09 | limited partnership | https://unimetalrecycling.pl |

| 9 | KAT-RECYKLING SP Z O.O. | 2015-10-22 | limited partnership | https://www.kat-recykling.pl/ |

| 10 | KATEX Lichorad Łukasz | 2017-10-25 | limited partnership | https://indexfirm.pl |

| Company Name | Scope | Range | Source | |

|---|---|---|---|---|

| 1 | Umicore | It is a global materials technology and recycling group. It focuses on application areas where its expertise in materials science, chemistry and metallurgy makes a real difference. Its activities are organised in three business groups: 1. Catalysis, 2. Energy and Surface Technologies and 3. Recycling. | Worldwide | https://www.umicore.com/ |

| 2 | Elemental Holding | Elemental Holding S.A. invests in entities dealing with urban mining and recycling. Companies belonging to the ELEMENTAL Group operate within the framework of four business lines: recycling of spent automotive catalysts (SAC), recycling of waste electrical and electronic equipment (WEEE), recycling of printed circuit boards (PCB), recycling of non-ferrous metal scrap (non- ferrous). | Worldwide | https://elemental.biz/en/ |

| 3 | Johnson Matthey | They are organised into four sectors, aligned to the needs of customers and the global challenges. They are structured internally into the groups of Clean Air, Efficient Natural Resources, Health, New Markets. | Worldwide | www.matthey.com |

| 4 | Remondis PMR B.V. | It is divided into three main areas—recycling, services and water—and the individual companies within the REMONDIS Group have been organised to reflect this structure. However, it is not always possible to draw a clear-cut line between recycling, services and water so that the three often overlap. Many of REMONDIS companies, therefore, provide services from two or even all three areas. | Worldwide | https://www.remondis-katalysator-recycling.de/en/ |

| 5 | MAIREC Edelmetallgesellschaft mbH | The company recycles automotive catalysts, industrial catalysts, electronic scrap, sweeps and concentrates and other industrial waste. | Germany | https://www.mairec.com/ |

| 6 | MONOLITHOS | In addition to recycling, the company deals with the production of catalysts. | Greece | https://www.monolithos-catalysts.gr/en/ |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Generowicz, N.; Kulczycka, J.; Partyka, M.; Saługa, K. Key Challenges and Opportunities for an Effective Supply Chain System in the Catalyst Recycling Market–A Case Study of Poland. Resources 2021, 10, 13. https://doi.org/10.3390/resources10020013

Generowicz N, Kulczycka J, Partyka M, Saługa K. Key Challenges and Opportunities for an Effective Supply Chain System in the Catalyst Recycling Market–A Case Study of Poland. Resources. 2021; 10(2):13. https://doi.org/10.3390/resources10020013

Chicago/Turabian StyleGenerowicz, Natalia, Joanna Kulczycka, Monika Partyka, and Kamil Saługa. 2021. "Key Challenges and Opportunities for an Effective Supply Chain System in the Catalyst Recycling Market–A Case Study of Poland" Resources 10, no. 2: 13. https://doi.org/10.3390/resources10020013

APA StyleGenerowicz, N., Kulczycka, J., Partyka, M., & Saługa, K. (2021). Key Challenges and Opportunities for an Effective Supply Chain System in the Catalyst Recycling Market–A Case Study of Poland. Resources, 10(2), 13. https://doi.org/10.3390/resources10020013