Abstract

Artificial intelligence (AI) technology is gradually integrating into the entire process of green supply chain management (GSCM), providing a systematic solution for enterprises to improve productivity and performance. This paper focuses on Chinese manufacturing enterprises, aiming to explore the multi-factor synergistic mechanism influencing differences in GSCM levels from a temporal perspective under the drive of AI. Based on 2019–2023 panel data of enterprises, this paper innovatively integrates the random forest algorithm with dynamic qualitative comparative analysis (QCA) to reveal the configurational effects of technological, organizational, and environmental factors in enterprises’ GSCM practices. The findings demonstrate that no single factor is a necessary condition for enterprises to implement GSCM; configurational analysis identifies two driving models: “AI technology innovation-driven (Configuration 1 and Configuration 2)” and “strategic resource-driven (Configuration 3)”; Configuration 1 combines research and development (R&D) investment and green awareness among executives with the enabling role of government subsidies; Configuration 2 couples R&D Investment with strong funding capacity, again facilitated by the presence of government subsidies; Configuration 3 combines AI technology adoption and green awareness among executives, supported by the necessary funding capacity and government subsidies. Additionally, inter-group analysis reveals no significant temporal effect among configurations but shows phased evolutionary characteristics. This paper has thoroughly explored the complex paths for enhancing GSCM of manufactory enterprises under the influence of AI. It is recommended that the government refine and strengthen targeted subsidy policies to better support the adoption and integration of AI in advancing GSCM within the manufacturing sector. Concurrently, manufacturers must align technology, organizational structure, and external factors, specifically through core AI technology improvements, enhanced executive green awareness, and the mobilization of government and external funding. These advancements have led to high-level GSCM within enterprises, allowing them to achieve high-quality and sustainable development.

1. Introduction

The rapid development of the global industrial economy, coupled with the continuous increase in energy consumption and the continuous increase in pollutant emissions, has triggered a series of severe ecological and environmental challenges, including global warming, biodiversity loss, and environmental pollution [1]. These issues not only pose serious threats to human health but also have an irreversible negative impact on sustainable economic growth and social stability [2]. To address increasingly severe environmental issues, governments around the world have successively introduced a series of policy measures to guide enterprises in transitioning their production and operations toward greener practices. China aims to promote green management in enterprises, advance “carbon peaking and carbon neutrality”, and foster a green, low-carbon economy. Growing public environmental awareness and the pursuit of sustainable development have increased consumer demand for eco-friendly products, creating a “green premium effect.” This market shift encourages enterprises to adopt green supply chain management (GSCM), integrating green practices across procurement, production, logistics, and sales to enhance both economic and environmental outcomes. As artificial intelligence (AI) technology becomes more embedded in enterprises, its capabilities in data processing, intelligent decision-making, and process optimization are being applied throughout GSCM process—from planning and execution to monitoring and optimization—offering systematic solutions to reduce costs, improve efficiency, and lower carbon emissions.

Previous research on GSCM mainly focuses on the discussion of its concept and the assessment of the implementation effect of GSCM practices from aspects such as performance and efficiency [3,4,5,6]. Some studies have also explored the antecedent factors that influence the implementation of corporate GSCM, including digital technology [7], digital transformation [8], green human resource [9], green intellectual capital [10], and government subsidies [11]. However, the existing literature lacks systematic research from a configurational perspective, overlooking the role of emerging technologies like AI in corporate GSCM practices. Moreover, it has not sufficiently explored the shaping mechanisms of GSCM in manufacturing enterprises under the interplay of multiple factors, indicating a substantial research gap. This view is supported by Tseng et al. [12], who demonstrated that corporate GSCM practices result from the interplay of internal and external factors. Therefore, examining individual factors alone may not effectively reveal the multifaceted driving paths influencing GSCM in manufacturing enterprises.

To address the research gaps, this study systematically investigates how manufacturing enterprises achieve GSCM excellence within AI-driven industrial systems. It focuses on three goals: analyzing Chinese A-share listed manufacturers using the Technology–Organization–Environment (TOE) framework; applying the random forest algorithm to identify key factors influencing GSCM performance; and employing dynamic qualitative comparative analysis (QCA) to explore the complex causal relationships among these factors. The findings aim to offer theoretical insights and practical guidance for enterprises adopting GSCM strategies amid AI transformation.

This paper makes substantial contributions to the existing literature. First, this study adopts a comprehensive TOE framework to systematically identify the potential influencing factors of GSCM covering the three dimensions of technology applications, organizational resources and external environment. The existing literature mostly analyzes various elements in isolation and fails to conduct systematic investigation under the integrated framework. Our research addresses this gap by innovatively applying the random forest algorithm as a pre-screening tool, quantitatively evaluating and sorting the relative importance of various factors to the performance of GSCM. The analysis identifies six core conditions demonstrating strong explanatory power for GSCM: AI technology adoption, R&D investment, high-level talent proportion, green awareness among executives, funding capacity and government subsidies. This methodology offers a significant theoretical contribution by integrating machine learning with the TOE framework to objectively identify critical factors. Consequently, it establishes a more rigorous foundation for understanding the complex drivers of GSCM. As such, it deepens our systematic understanding of GSCM implementation mechanisms and advances GSCM theory toward greater precision and scientific rigor.

Second, this study uses dynamic QCA to uncover complex causal patterns in how multiple factors interact to influence GSCM performance. It shows that improving corporate GSCM depends not on a single factor but on the synergistic alignment of core conditions, where certain factor combinations produce reinforcing effects. By identifying three equivalent pathways, that is, distinct configurations of antecedent conditions leading to high GSCM, this research moves beyond traditional regression’s “net-effect” logic [13,14]. The findings clarify the causal complexity of GSCM excellence, characterized by conjunctural causality and equifinality, and offer an analytical framework that better reflects the diverse, interactive success mechanisms in practice. Specifically, three core pathways emerge: the strategic resource-driven path (Configurations 1 and 2), where R&D investment and government subsidies are key despite lacking AI integration and high-level talent, and the AI technology innovation-driven path (Configuration 3), where AI technology adoption, executives’ green awareness, capital supply, and subsidies are central, though also lacking high-level talent. These results confirm the multiplicity and complexity of GSCM enhancement routes and reveal the limitations and complementarities among factor combinations across driving modes. This deepens theoretical understanding of differentiated path selection in corporate GSCM, showing that firms can achieve high performance through distinct yet equally effective configurations, each with unique strengths and constraints.

Third, this study advances from a static to a dynamic view by using dynamic QCA to track how GSCM improvement paths evolve over time. Unlike static QCA, the dynamic method that captures the changes in core variables in different periods, the green transformation of enterprises is a continuous adaptation process affected by technology, resources and dynamic pressure. This insight supports phased, adaptive green strategies and advances GSCM research toward understanding its evolutionary nature.

This paper is structured as follows. First, we review the relevant literature. Next, we present the theoretical framework and develop our research model. Then, we apply the random forest algorithm to identify key variables influencing GSCM performance, which serve as antecedents for configurational analysis. Afterward, we use fsQCA to reveal complex causal paths leading to high GSCM performance. Finally, we summarize key findings, discuss implications, and suggest future research directions.

2. Literature Review and Research Framework

2.1. Green Supply Chain Management

The research on GSCM originated in the 1990s [15]. With the rise in sustainable development concepts, green supply chains have gradually become a focal point for both enterprises and academia. Scholars have emphasized that environmental factors must be integrated into all aspects of supply chain operations, including product design, procurement, logistics, and distribution [16]. Later, Beamon [17] further enriched the concept of green supply chains, emphasizing the need to fully consider product recycling and reuse throughout the entire product lifecycle to maximize resource utilization and minimize environmental impact.

To achieve these objectives, GSCM has been proposed as a structured approach. The overarching goal of a green supply chain is to mitigate environmental damage while institutionalizing sustainability throughout the supply network. Operationally, GSCM entails the integration of environmental imperatives into conventional supply chain management [18]. Tseng et al. [12], through a synthesis of prevailing definitions, posit GSCM as a comprehensive strategy that embeds environmental management systems across the supply chain continuum. This strategy is predicated on robust collaboration with customers, suppliers, and logistics partners, leveraging knowledge sharing to augment environmental performance. A body of research corroborates that GSCM enhances corporate profitability and operational performance, yielding multifaceted advantages including cost efficiency, resource optimization, and resilience in sustainable development [19,20,21,22]. Scholarly work has largely concentrated on explicating the conceptual boundaries of green supply chains and evaluating the efficacy of GSCM practices. A significant gap remains, however, in understanding the determinants that facilitate or hinder corporate GSCM adoption.

2.2. TOE Framework

The TOE framework, originally developed by Tornatzky and Fleischer [23], provides a structured and integrative perspective for understanding the factors that influence an organization’s adoption and implementation of new technologies. The core premise is that technological innovation is shaped by the interplay among technological, organizational, and environmental contexts, not driven by a single dimension. These factors, configured in different combinations, collectively determine technological innovation and management. Specifically, the technical dimension includes all the internal and external technical backgrounds related to the enterprise, not only the technologies currently in use but also the technologies commonly available in the market [23,24]. The organizational dimension includes organizational characteristics and resources [25], reflecting the internal structure and processes of the enterprise. The environmental dimension describes the action domains related to the business, involving multiple entities such as industries, competitors, and the government [26,27].

The TOE theoretical framework has been widely applied in various research contexts, and its connotation has been continuously expanded. The framework has been successfully applied to multiple domains including the supply chain management [24,25,26], the digital transformation of small and medium-sized enterprises [27], the green innovation performance [28], the promotion of new energy technologies [29], and the diversification of enterprise services [30], fully verifying its cross-context explanatory power. This research takes the TOE theoretical framework as the logical basis. It incorporates the antecedents from technology, organization and environment into a single integrated research framework, and constructs a theoretical model for the driving path of corporate GSCM. It also explores the collaborative effects of different dimensions of antecedents and their combinations on corporate GSCM.

2.3. TOE Framework and Green Supply Chain Management

The implementation of GSCM is shaped by multiple factors across technological, organizational, and environmental dimensions, as framed by the TOE model. Technologically, digitalization and intelligent technologies drive innovations in GSCM. Research highlights the potential of AI technologies like generative AI and ChatGPT 5.1 to optimize supply chain decisions and resource efficiency [31,32], alongside the importance of green digital learning orientation [33] and digital transformation [8,34] in advancing corporate environmental practices. Digital supply chains [35] and green R&D investments [36] form the technological basis for enhancing GSCM performance. Organizationally, internal resources, capabilities, and strategies are crucial. Practices such as eco-design, green distribution, and green training constitute fundamental GSCM activities [37], while green human resource management [9,38] and green intellectual capital underpin environmental capabilities. Strategic factors such as green entrepreneurial orientation, green information systems, and management support provide essential leadership [39]. Environmentally, government subsidies [11] and regulations [40] incentivize GSCM, while customer ESG performance [41] and green marketing demand [42] drive market pull. Although the literature offers a comprehensive TOE-based framework, research gaps remain. Most studies focus on isolated factors with linear effects, lacking an integrated view of how technological, organizational, and environmental factors interact. This fragmentation limits understanding of synergistic mechanisms, particularly how technological factors influence GSCM through organizational capabilities and environmental moderation. Future research should explore these interactive and configurational pathways to deepen insights into GSCM implementation. Table 1 presents the extant research findings regarding the impact of the TOE framework on GSCM.

Table 1.

Literature Review on the influences of TOE Framework on GSCM.

2.4. Model Construction

The selection of the TOE framework as the core analytical tool in this study is based on two key considerations: First, GSCM is a systemic project covering the entire lifecycle, including raw material procurement, production and manufacturing, logistics and distribution, and waste disposal. Its construction and optimization require the collaborative participation of multiple stakeholders, such as upstream and downstream enterprises in the supply chain, government regulatory authorities, and industry associations. A single-dimensional analytical perspective is insufficient to capture its complex influence mechanisms, which necessitates a comprehensive and in-depth analysis of the influencing factors of GSCM from technological, organizational, and environmental dimensions [26,27]. Second, the TOE framework exhibits significant contextual adaptability, allowing flexible adjustment of the selection of antecedent variables according to specific research objectives and contexts, instead of adopting a one-size-fits-all fixed analytical paradigm. This characteristic endows it with broad applicability.

Furthermore, GSCM practices in Chinese manufacturing enterprises are developing rapidly, driven by policy and market pressures. Their effectiveness is influenced by internal factors (e.g., AI technology adoption, R&D investment, green awareness) and external variables (e.g., government subsidies, market competition, industrial policies), which intertwine to form a complex influence network [26]. The TOE framework provides a structured tool to classify these multi-level factors, clarifying their categories and functional boundaries to avoid analytical confusion. Therefore, by integrating the TOE framework with fsQCA, this study systematically identifies the core drivers of GSCM in Chinese manufacturing from technological, organizational, and environmental dimensions. It analyzes the configurational relationships among these factors to reveal multiple pathways for improving GSCM performance.

From a technological perspective, this study identifies the level of AI technology application and R&D investment as critical antecedents for enhancing corporate GSCM. Digital technologies facilitate the integration and sharing of knowledge and resources, thereby driving corporate green innovation and enabling the emergence of new supply chain models [43]. As a core component of next-generation digital technologies, AI demonstrates considerable potential in advancing green supply chain development. AI can be integrated into every stage of the supply chain. For example, Liu et al. [44] proposed an innovative framework incorporating AI and big data analytics to achieve material reduction, remanufacturing, reuse, and efficient recycling throughout the entire product lifecycle. Meanwhile, R&D investment serves as a key enabler of corporate green technological innovation [45]. Increased R&D expenditure encourages firms to develop and adopt technologies that improve production efficiency and reduce resource consumption. By consistently investing in green technologies, companies not only enhance their environmental competitiveness but also build a technical foundation for establishing green supply chains.

At the organizational level, this paper examines three critical factors influencing corporate GSCM: executives’ environmental awareness, high-level talent reserves, and corporate growth potential supported by financial resources. First, senior management’s commitment to sustainability is fundamental to the implementation of green supply chains. Studies show that managerial environmental consciousness drives eco-innovation, which in turn improves corporate environmental performance [46]. A profound understanding of sustainable development motivates executives to integrate green strategies into long-term planning, thereby accelerating supply chain transformation. Second, in the AI-driven era, enterprises must remain responsive to external changes and monitor feedback from suppliers and customers on digitalization, allowing them to identify growth opportunities amid transitions [47]. High-level talent reserves—particularly personnel with advanced education—exhibit stronger adaptive and learning capabilities. Such professionals promote supply chain optimization through technological and operational innovation, playing critical roles in enhancing green competitiveness across all supply chain segments. Third, corporate growth potential, reflected in sustained profitability and future growth prospects, serves as an important indicator of developmental capacity [48]. It helps firms secure external resources and gain competitive edges. Strong growth momentum encourages enterprises to expand their operational scale and diversify information channels, thereby increasing their sensitivity to green market demands. This enables more effective mobilization of internal and external resources for green transformation, ultimately strengthening green competitiveness. Moreover, GSCM implementation requires significant adjustments in technology R&D and equipment upgrades, which places high demands on capital supply capacity. However, financing constraints may limit corporate liquidity, potentially crowding out green innovation activities such as the development of green inventions and patents [49].

From an environmental perspective, this research highlights three key factors affecting corporate GSCM: market dynamics, government subsidies, and media attention. First, market competition is a major driver of technological innovation [50]. The widespread application of AI has further intensified market competition, pushing firms to consider the holistic impact of their supply chains. By strengthening collaboration with upstream and downstream partners, companies can improve product competitiveness while building green credentials to attract environmentally conscious consumers. In the AI era, heightened competition motivates enterprises to pursue green technological innovation and adopt GSCM practices. Second, government subsidies serve as important policy incentives. Research indicates that fiscal subsidies and tax incentives encourage manufacturers to adopt environmentally friendly technologies, optimize production processes, and reduce pollution [51]. Such support not only lowers implementation costs but also reinforces corporate social responsibility. Thus, government backing plays a crucial role in promoting GSCM. Finally, in the digital context, media attention significantly reinforces green supply chain initiatives. Using AI-enhanced dissemination channels, media outlets accelerate the spread of green supply chain concepts and raise public awareness of environmental protection, sustainable development, and corporate accountability. At the same time, ongoing public and media scrutiny creates a dual effect: positive coverage encourages firms to voluntarily disclose environmental governance information, strengthen green management, and transparently demonstrate supply chain achievements [52]; whereas negative exposure highlights deficiencies in their green transition, prompting self-regulatory improvements [53]. Together, these forces continuously stimulate GSCM innovation and upgrading.

This study selects nine antecedent conditions: AI technology adoption level, R&D investment, executives’ green awareness, high-level talent reserves, corporate growth potential, capital supply capacity, market competition, government subsidies, and media attention. A random forest model is used to identify the most critical factor configurations. Necessity analysis is conducted to assess whether individual conditions are essential for high GSCM performance. Finally, a dynamic qualitative comparative analysis (QCA) is applied to examine the interdependent matching effects among factors, revealing the complex causal mechanisms underlying GSCM in manufacturing enterprises. The findings provide valuable insights for future research and practice.

3. Methodology

3.1. Research Methods

3.1.1. Random Forest Model Based on Machine Learning

Random forest is an integrated learning algorithm that operates by constructing large number of decision trees during the training process. It could capture complex data relationships and summarize prediction results to improve the accuracy and generalization of overall predictions. Scholars have demonstrated that Random Forests can be effectively combined with fsQCA. The former is good at identifying a wide range of patterns from many variables, while the latter is more deeply exploring the causal path formed by key conditions [54]. In configuration studies, it is common to focus on the synergistic effects of only six factors. A common methodological challenge is the selection of critical factors from the numerous potential covariates. This study uses Random Forest to select key factors which solve this problem well. Based on Random Forest, six variables most related to corporate GSCM level are identified, which enhances the accuracy and interpretability of the selection of antecedent variables for configuration analysis [54].

3.1.2. Dynamic QCA Method

To explore the driving mechanism of enterprise GSCM implementation, this study followed a two-stage methodological approach. First, this study uses a random forest model to determine the independent variables most relevant to the corporate GSCM level. Then, building on the work of Du et al. [55], this study adopted QCA method proposed by Ragin [56] to investigate the driving path of Chinese manufacturing enterprises from the perspective of configuration. Unlike traditional regression analysis that focuses on the net effect of individual variables, QCA adopts a holistic approach to analyze configurational effects [56]. Traditional QCA methods can only be applied to single-year cross-sectional data, whereas the improvement of GSCM in manufacturing enterprises is a continuous and dynamic process over time. Cross-sectional data struggles to reflect its developmental patterns. Therefore, this study utilizes the dynamic QCA method based on panel data, as suggested by Garcia-Castro and Arino [57], to conduct subsequent research.

3.2. Data Sources

This study selects manufacturing listed companies on the Shanghai and Shenzhen stock exchanges from 2019 to 2023 as research subjects. The relevant data mainly come from the China Stock Market Accounting Research (CSMAR) database and the annual reports of enterprises. After excluding enterprises with ST or *ST labels and those with severely missing key variables. Finally, we obtain 6085 observations from 1217 Chinese A-share companies.

3.3. Variable Measurement

3.3.1. Result Variable

Corporate GSCM Level: The existing literature primarily employs three methods to measure GSCM. The first method uses objective indicators based on third-party disclosed data. For example, Li et al. [4] adopted the Corporate Information Transparency Index (CITI) published by the Institute of Public & Environmental Affairs (IPE) as a proxy variable for GSCM. This index assesses the extent to which Chinese domestic enterprises consider environmental impacts throughout the product life cycle and establishes an environmental compliance system covering both upstream and downstream supply chains. The second method involves questionnaire surveys, which collect corporate data by designing items related to green design, management, innovation, and other dimensions [5]. The third approach constructs comprehensive evaluation systems, such as using the entropy weight method to build a GSCM assessment framework from different dimensions [58,59]. While each approach has merits, the first two present significant limitations for large-scale, objective analysis of the broader manufacturing sector.

Among these methods, the objective indicator approach (CITI index) has a significant coverage deviation problem. The environmental information disclosure ability of small and medium-sized enterprises in China’s manufacturing industry is generally weak, and they rarely participate in the evaluation of CITI. For instance, in 2023, the CITI index evaluated only over 780 enterprises, while the total number of manufacturing firms in China far exceeds this figure. Therefore, using the objective index method to measure corporate GSCM levels would lead to the lack of samples, and it is difficult to support the universal conclusions about GSCM driving paths in Chinese manufacturing enterprises. Secondly, the questionnaire survey method is constrained by subjectivity and sample limitations. Although scale-based surveys can directly capture details of GSCM practices, including green purchasing and green logistics, the results depend on subjective corporate feedback and are susceptible to social desirability bias. Moreover, achieving high response rates and valid responses in large-scale surveys is challenging, which contradicts the needs of large-sample data analysis.

Given these limitations, following Xue et al. [58] and Wu et al. [59], we employ the entropy weighting method to measure corporate GSCM levels by establishing a comprehensive assessment system. All data is sourced from the CSMAR database, including indicators such as working capital turnover and inventory turnover. This ensures strong traceability and avoids subjective bias. Additionally, the use of financial data enables the coverage of enterprises across scales and sectors, ensuring broad sample representation. Furthermore, indicators in the assessment system represent the underlying capabilities that support GSCM implementation. For instance, efficient inventory turnover implies stronger coordination capability in reverse logistics. Similarly, asset utilization efficiency reflects the resource slack available for green technology upgrades. The specific measurement indicators for corporate GSCM levels are detailed in Table 2.

Table 2.

Measurement of corporate GSCM Level Based on Entropy Weighting Method.

3.3.2. Conditional Variables

- (1)

- Technical Dimension

AI Technology Adoption: Scholars have employed diverse methodologies to assess AI technology adoption, yet a consensus has not been reached. Previous studies have primarily utilized questionnaires [61] and conducted text analysis of annual reports [62,63,64,65] to assess the extent of AI technology implementation. Some academics measured AI technology adoption by calculating the logarithm of the ratio of the book value of machinery or industrial robots to the number of employees [66]. Among these measurement approaches, the penetration rate of industrial robots fails to comprehensively reflect the level of corporate AI, as current AI technologies have extended far beyond the scope of robotics. With the widespread adoption of AI technologies such as GPT and intelligent recognition, focusing solely on robotics would lead to a significant underestimation of AI technology adoption in many enterprises that have already achieved intelligent transformation. Questionnaire surveys also have obvious limitations, which is that enterprise managers are susceptible to the “halo effect” when answering questionnaires. This cognitive bias implies that managers’ answers may be influenced by the sequence of questions and the contextual framing of other items in the questionnaire. Furthermore, the amount of data recovered by the questionnaire survey is limited, and it is difficult to obtain large sample empirical data. For listed companies specifically, its annual report discloses the company’s main business information, business status and management’s strategic judgment on the future development direction, which provides important reference value for understanding the enterprise’s business strategy and decision-making. Importantly, annual reports describe the application of AI technologies within enterprises and disclose AI-related patents filed by listed companies, thereby offering a credible reflection of their actual AI technological capabilities. Given these advantages, this study adopts the text analysis approach for listed companies.

Aligned with Yao et al. [62], this study evaluates AI technology adoption by employing word frequency statistics and text analysis of annual reports from various listed companies. Since there is no space partition between Chinese characters, words and expressions are the smallest language unit that can be used independently, it is necessary to perform specialized word segmentation processing on the text of annual reports. Yao et al. [62] use the widely used Python 3.12 open source “jieba” Chinese word segmentation module to segment the text of listed companies’ annual reports. There are three difficulties in Chinese text analysis, i.e., the granularity of segmentation, ambiguous word recognition, and new word recognition. For example, “machine learning” is one of the core terms of AI, but the “jieba” module cuts it into two terms: “machine” and “learning”. In order to solve this problem, Yao et al. [38] add the generated AI dictionary (Figure 1) as a preset lexicon of proper nouns into the word division module of “jieba” and count the number of AI terms in the annual reports of listed companies. The natural logarithm of the number of AI keywords in the annual reports of listed companies plus one is used as the index of AI of enterprises.

Figure 1.

AI Dictionary.

R&D Investment: This study follows Yang et al. [67]’s approach by measuring R&D investment through the ratio of corporate R&D expenditures to operating revenue.

- (2)

- Organizational Dimension

Green Awareness of Executives: Following Li et al. [68], we measure this construct based on the frequency of keywords related to three dimensions in annual reports: green competitive advantage, corporate social responsibility, and external environmental pressure. The final value is the natural logarithm of the total keyword count.

High-level Talent Reserve: Measured as the percentage of employees with a bachelor’s degree or higher, in line with Guo et al. [69].

Enterprise Growth: Following Li et al. [48], this is measured by the annual revenue growth rate.

Funding Capacity: This is measured by the absolute value of the Size-Age index (SA index), where a higher value indicates weaker financing constraints and stronger funding capacity [70].

- (3)

- Environmental Dimension

Market Environment: Following established practices, the Herfindahl Index (HHI) is employed to gauge market competition intensity. A higher HHI value indicates stronger market monopolization and weaker industry competition.

Government Subsidies: Adopting the methodology of Feng et al. [45], the natural logarithm of government subsidy amounts recorded in the financial statements notes of the CSMAR database is used to quantify corporate subsidies.

Media Attention: Scholars commonly measure media exposure through news coverage volume. Following Chen et al. [71], this metric is calculated by adding 1 to the count of negative news reports about the company and then applying a natural logarithm transformation.

4. Empirical Results

4.1. Variable Selection Based on Random Forest Model

This study employs the TOE framework to identify driving variables of GSCM from technical, organizational, and environmental dimensions, initially including nine potential antecedent variables. Given that the driving mechanisms of GSCM exhibit nonlinear interactive characteristics (e.g., synergistic effects between policy incentives and technological innovation), Random Forest offers unique advantages in addressing such issues. Firstly, based on the ensemble learning logic of multiple decision trees, Random Forest does not require pre-specified linear assumptions among variables. It can capture the complex interaction effects between variables through node splitting rules to avoid missing combination characteristics that may synergistically drive GSCM. Secondly, through feature importance calculation methods such as Mean Decrease in Accuracy, it balances the contribution of variables across different dimensions, yielding more accurate results. Finally, the calculation of its characteristic importance is based on the aggregate results of multiple trees, which reduces the risk of overfitting of a single decision tree and enhances the robustness of the conclusion.

Compared with packaging methods such as Recursive Feature Elimination (RFE), Random Forest does not require additional iterative calculations for feature importance, resulting in lower computational costs. Moreover, it is less prone to local optima in the presence of multicollinearity, aligning better with the characteristics of panel data. In contrast, filter methods (e.g., Pearson correlation) can only assess univariate associations with the outcome. Random Forest surpasses them by capturing multivariate interactions, thus identifying synergistic variable sets that might otherwise be missed. Thus, the advantages of Random Forest in handling high-dimensional interactive data make it an ideal tool for screening antecedent conditions in this study.

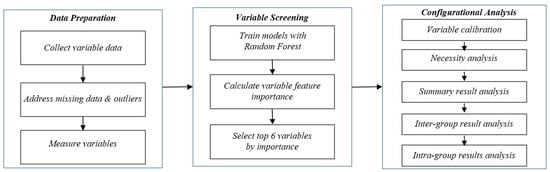

This study implements the Random Forest algorithm through the Random Forest package in R and screens the top six key variables based on the Mean Decrease in Accuracy method, laying the foundation for subsequent configuration analysis [72]. The data processing workflow of this study is illustrated in Figure 2.

Figure 2.

Data Processing Workflow.

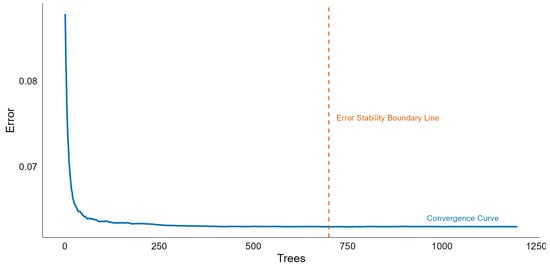

Firstly, the sample enterprise data was randomly divided into a training set and a test set at 70% and 30% ratios, respectively. In R programming, particular attention should be paid to setting the core parameters of the random forest model: ntree (number of decision trees) and mtry (number of candidate variables per node). Following the approach of scholar Zhang [73], this study calculated mtry using the formula (where P represents the total number of independent variables). Next, through error convergence curve analysis, we plotted the error variation with increasing decisiontree numbers to determine the optimal parameter values. As shown in Figure 3, when ntree > 700, the error stabilizes, indicating good model fit. To ensure model stability, we selected ntree = 1200. The final key parameters determined for the model are ntree = 1200 and mtry = 3.

Figure 3.

The trend of mean square error as the number of decision trees changes.

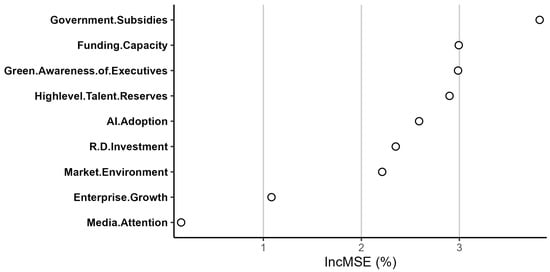

During the model training phase, the random forest algorithm establishes a mapping relationship between the independent variable (corporate GSCM level) and the target variable through fitting the training dataset. Subsequently, the model performs predictions using the test dataset. Finally, following the approach of scholar Zhang [73], the method of average reduction in accuracy is employed to calculate the importance scores of each variable. The measurement results are visually presented through a scatter plot (Figure 4), which intuitively demonstrates the impact intensity on the target variable.

Figure 4.

Scatter diagram of the importance of factors affecting GSCM level.

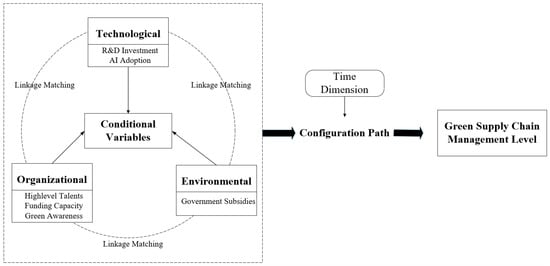

As shown in Figure 4, six core variables—AI Technology Adoption, R&D Investment, High-level Talent Reserves, Green Awareness of Executives, Funding Capacity, and Government Subsidies—significantly influence the target variable. In contrast, Market Environment, Enterprise Growth, and Media Attention show relatively weaker impacts. Therefore, this study selects these six variables with significant effects on corporate GSCM as the antecedents for configuration analysis. These variables are further categorized into three dimensions of the TOE framework: the technological dimension (AI technology adoption and R&D investment), the organizational dimension (High-level Talent Reserves, Green Executive Awareness, and Funding Capacity), and the environmental dimension (Government Subsidies). The theoretical model is illustrated in Figure 5. In the following sections, we will reveal the driving pathways of GSCM based on QCA and verify whether the “TOE synergy effect” exists.

Figure 5.

Theoretical model of factors affecting enterprise GSCM level.

4.2. Variable Calibration

In fsQCA, variable calibration refers to the process of assigning set membership to cases, and anchor points serve as key reference criteria for converting raw data into set membership scores. From the perspective of data adaptability, most indicators in our raw data have limited discriminability. Therefore, with reference to the approach adopted by Du et al. [55], we used the direct calibration method and selected the 75th, 50th, and 25th percentiles as the three calibration points for full membership, crossover point, and full non-membership, respectively. This was done to avoid calibration biases in the data caused by asymmetric anchor point settings, thereby reducing interference with the research results.

The variables are then calibrated into a [0, 1] interval dataset. Since crossover samples may yield 0.5 after calibration, this paper adjusts such values to 0.499 [74]. The descriptive statistics and calibration points for each variable are presented in Table 3.

Table 3.

Descriptive Statistics and Calibration Points.

4.3. Analysis of the Necessity of a Single Condition

Before conducting configuration analysis, it is essential to perform necessity analysis on individual conditions to determine whether they are necessary for the occurrence of the outcome. In traditional QCA methods, if a condition’s aggregated consistency level exceeds 0.9 and its aggregated coverage exceeds 0.5, it is considered a necessary condition for the outcome. Conversely, it is not deemed necessary. However, in dynamic QCA methods, judgments must be made by combining both the aggregated consistency and the consistency adjustment distance of individual conditions.

The necessity analysis results (Table 4) indicate that the aggregated consistency of all conditional variables is below 0.9, with most causal conditions showing adjustment distances under 0.2. The results show that the consistency adjustment distance of the four causal combinations exceeds 0.2, it is necessary to further analyze the necessity of conditional variables. Subsequent analysis (Table 5) reveals that the level of intergroup consistency across all scenarios is below 0.9, indicating that there is no single factor that constitutes a necessary condition for either high or low GSCM performance.

Table 4.

Necessity analysis.

Table 5.

Inter-group data with adjustment distance greater than 0.2.

4.4. Configuration Analysis

4.4.1. Summary Result Analysis

In conducting configuration analysis, this study sets the case frequency threshold at 5, the original consistency threshold at 0.8 [55], and the PRI consistency threshold at 0.5 [75]. The configuration analysis results for high-level GSCM demonstrated three distinct configurations as shown in Table 6. All three configurations exhibited individual and overall consistency values exceeding 0.75, with both intra-group consistency adjustment distances and inter-group consistency adjustment distances below 0.2. This indicates strong explanatory power in the aggregated results. The three configurations were further distilled into two models: the Strategic Resource-Driven Model and the AI Technology Innovation-Driven Model. Subsequent analysis will be conducted in detail based on Table 5.

Table 6.

Configuration analysis results of high GSCM level.

- (1)

- The Strategic Resource-driven path

This path, comprising Configuration 1 and 2, is characterized by R&D investment and government subsidies as core conditions, despite the absence of both AI technology and a high-level talent reserve. Enterprises with substantial R&D investment could carry out technological innovation and develop efficient production technologies to produce eco-friendly products continuously. This allows companies to mitigate the negative impact on the environment through process improvement and material substitution. Government subsidies offer the negative impact on the environment through process improvement and material substitution. The peculiarity of this path lies in its independence from AI technology and high-level talents. In Configuration 1, green transformation is driven primarily by executives’ strategic vision. Despite the limited adoption of AI technology, executives can accurately invest limited resources into the key links of the green supply chain by optimizing internal resource allocation and promoting cross-departmental collaboration. They may also form partnerships with universities and government agencies to overcome technical and talent constraints. In Configuration 2, the advantage of enterprises is the sufficient funds. Although lacking the adoption of AI technology, these enterprises can drive GSCM practices through flexible financial resource allocation.

The representative enterprise of this path is Gree Electric Appliances. As a leader in the traditional home appliance manufacturing industry, Gree has strong capital strength. It has implemented large-scale process transformation and equipment upgrading for a long time, and improved product performance through continuous R&D investments. Meanwhile, the company has secured policy support from local governments in energy conservation, emission reduction, and green production. Therefore, Gree Electric Appliances has formed a green transformation system that coordinates capital, R&D investment and government support. It does not rely on the in-depth adoption of AI technology or the internal high-end green management talent reserve, which is in line with the core characteristics of the strategic resource-driven path.

- (2)

- AI Technology Innovation-driven path

This path consists of configuration 3, in which a high level of AI technology adoption, executives’ green awareness, strong funding capacity, and government subsidies function as core conditions, despite the absence of a high-level talent reserve. Enterprises with high AI technology adoption have deeply integrated AI technology in the production process, enabling intelligent production that boosts efficiency and resource utilization. In competitive markets, high intelligence capability could help enterprises address challenges and improve competitiveness. Executives’ green awareness provides strategic guidance. Through accurate judgment of the green transformation of enterprises, it directly drives the decisions to adopt AI in GSCM based on assessments of green transformation needs. In addition, government subsidies provide additional financial support for enterprises, reducing the initial costs and risks of AI implementation. Therefore, although such enterprises are at a disadvantage in terms of talent reserve, they can still promote GSCM practices with the advantages of AI technology, the green strategy of executives, and sufficient capital investment.

Inspur Information Technology is a prime example of this path. As a leading technology firm, it has the ability to deeply embed AI technology in production and supply chain management. Moreover, Inspur Information Technology has sufficient capital and policy support to concentrate resources on the iterative upgrading of technology. While facing challenges in cultivating green talent, the company can improve its green competitiveness through strategic approaches like building technology platforms and optimizing algorithms. In this way, the technical strength and capital investment can be effectively combined to make up for the shortage of talents.

Overall, among the three configuration outcomes, Configuration 3 demonstrates the highest initial coverage rate, indicating that the AI-driven technological innovation pathway shows broad applicability in enhancing corporate GSCM. Further comparison between Configuration H1 and H2 reveals a potential substitution relationship between corporate executives ‘green awareness and capital availability in this model. Specifically, when other core conditions are met, companies can accelerate their green transition through strategic guidance from executives’ environmental consciousness or sufficient financial investment.

Additionally, combined with The TOE framework analysis, the TOE framework categorizes the influencing factors of new technology adoption into three dimensions: Technological, Organizational, and Environmental. Preliminary analysis of the three configuration paths derived in this study shows that enterprises in configuration path 1 are jointly influenced by factors such as technological dimension R&D Investment, organizational dimension Green Awareness of Executives, and environmental dimension Government Subsidies, leading to an improvement in their GSCM level. Enterprises in configuration path 2 are affected by factors such as technological dimension R&D Investment, organizational dimension Funding Capacity, and environmental dimension Government Subsidies, leading to an enhancement in their GSCM level. Meanwhile, the development of GSCM in enterprises represented by configuration path 3 is the result of the combined effects of factors such as technological dimension (AI Technology Adoption), organizational dimension (Green Awareness of Executives) and (Funding Capacity), and environmental dimension (Government Subsidies).

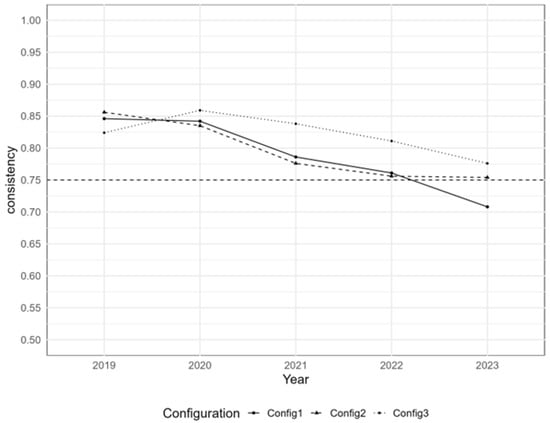

4.4.2. Inter-Group Result Analysis

The inter-group consistency adjustment distances for the three configurations in this study were all below 0.2, indicating no significant temporal effects. However, further analysis of inter-group consistency levels across configurations from 2019 to 2023 (Figure 6), it is found that their short-term fluctuations may be significantly associated with policy cycles, external shocks, and changes in the market environment.

Figure 6.

The trend of configuration consistency levels across groups.

Firstly, the national policy cycle has played a phased guiding role. During 2019–2020, the consistency levels of Configuration 1 and Configuration 2 showed a declining trend, while Configuration 3 exhibited an upward trend. This divergence may be closely related to the policy warming-up period before the launch of the “14th Five-Year Plan”. During this phase, the digital economy and AI were elevated to an unprecedented strategic height. For instance, the release of the draft “14th Five-Year Plan for Digital Economy Development” for public consultation consistently signaled a policy orientation toward integrating traditional industries with advanced digital technologies, creating unprecedented opportunities for enterprises with AI technology application capabilities. For enterprises represented by Configuration 3, their core approach to implementing GSCM is to rely on AI technology to realize the intelligence and greening of production processes, to promote their own green transformation. This path is highly in line with the direction of state-led industrial upgrading, so it can not only receive subsidies for green development but also benefit from additional policy and financial support specifically aimed at digital and intelligent transformation. The pulling effect of strong policy expectations has enhanced market recognition of the effectiveness of this pathway, leading to a rapid increase in its consistency level. In contrast, the traditional resource integration models relied upon by enterprises in Configurations 1 and 2 did not directly benefit from these policies in the short term, resulting in a decline in their consistency levels.

Simultaneously, the consistency levels of all three configurations showed a noticeable decline in 2020. However, this change was not random but concentrated in this specific year, indicating that it does not represent a benign deviation. The underlying reason is likely the outbreak of the COVID-19 pandemic in 2020, which caused systemic shocks to economic and social operations. Supply chain disruptions led to instability in raw material supplies, production halts weakened enterprises’ capacity for green technology research and development or adoption, and plummeting market demand further constrained resources for green transformation. Particularly for Configurations 1 and 2, which rely on long-term resource investments, the maintenance costs of their GSCM significantly increased due to external disturbances. Although Configuration 3 demonstrated relative resilience owing to its prior technological preparedness reducing labor dependency, its consistency level also declined under the impact of industry-wide downturn.

Furthermore, the inter-group consistency level of configuration 2 tends to stabilize in 2022, which is in stark contrast to the other two paths This suggests that the GSCM level of such enterprises is more stable. This stability may come from its dynamic adaptability to the external environment. In April 2022, the Chinese government promulgated the “Opinions on Accelerating the Construction of a National Unified Market,” which clearly pointed out that “promoting market competition from scale expansion to supply chain coordination and resilience improvement”. This policy reflects China’s determination to build a national unified market by improving the institutional and infrastructural construction. Against this backdrop, the core advantage of the enterprise represented by the configuration 2 lies in their long-term accumulated capital reserves and R&D capabilities. Relying on these advantages, such enterprises can effectively respond to fluctuations in market demand and adapt to the new development paradigm. Therefore, under the combined influence of government policies and market pressures, the GSCM model of these enterprises is more likely to be recognized by the market, leading to stabilized consistency levels.

4.4.3. Intra-Group Results Analysis

As shown in Table 5, the intra-group consistency adjustment distance in the three configurations is all below 0.2, indicating that there is no significant difference in the interpretation strength of each configuration between different types of enterprises. However, the intra-group consistency distances exceed the inter-group consistency adjustment distance, demonstrating that case effect of the configuration is stronger than the time effect. This finding highlights the importance of accounting for regional heterogeneity in GSCM implementation.

To analyze this, the study examines regional distribution patterns using intra-group coverage differences [76]. Enterprises were classified into three groups according to the location of the eastern, western and central regions. Since the intra-group coverage of the three configurations obtained in this paper did not pass the normal distribution test, the Kruskal–Wallis rank sum test was further adopted for analysis.

As shown in Table 7, the cases explained by the three configurations show no significant differences in regional distribution. However, in terms of the average coverage of regional configuration (Table 8), Configuration 1 and Configuration 3 primarily explain cases concentrated in central regions, while Configuration 2 explains cases predominantly distributed in western regions. This difference may stem from the following two factors. Firstly, as traditional industrial bases, central regions possess a complete industrial system and an active market environment, providing a diversified transformation path for enterprises. Specifically, enterprises represented by Configuration 1 face greater pressure for transformation and upgrading. This compels executives with green strategy awareness to invest government subsidies and other resources in R&D of green technologies and green production processes, driving GSCM through endogenous technological innovation. In contrast, enterprises aligned with Configuration 3 exhibit greater foresight. Executives of such enterprises not only have a sense of green strategy but also keenly capture the opportunities of digital technology, and improve the efficiency of supply chain operation by introducing mature AI technology, to achieve a high level of GSCM. Secondly. in western regions, it is easier for enterprises to obtain various kinds of financial support under the policy dividends like the Western Development Initiative… Enterprises represented by Configuration 2 primarily leverage their sound financial conditions and external government subsidies to fund R&D and address environmental issues, systematically advancing GSCM practices.

Table 7.

Kruskal–Wallis Rank Sum Test Results.

Table 8.

Average Regional Configuration Coverage.

4.4.4. Robustness Test

This study employs the robustness testing method of Zhang, Du et al. [55,77] by adjusting the consistency and frequency thresholds. When the consistency threshold was increased from 0.8 to 0.83 and the case frequency threshold from 5 to 6, the newly obtained configurations remained largely consistent with the original model. These findings validate the reliability of the conclusions presented in this paper.

5. Conclusions

5.1. Findings

This study employs a Random Forest model and a dynamic QCA approach to analyze data from 1217 Chinese manufacturing enterprises over the period 2019–2023. Using the TOE framework, it systematically investigates the multi-factor synergy mechanism of technology, organization, and environment on GSCM in Chinese manufacturing enterprises. The key findings are as follows:

The nine variables analyzed in this study (AI technology Adoption, R&D Investment, High-level Talent reserves, Enterprise Growth, Green Awareness of Executives, Funding Capacity, Market Environment, Government Subsidies, and Media Attention) all contribute to enhancing corporate GSCM. However, their impact magnitudes vary significantly. Specifically, technological dimensions (AI technology adoption and R&D investment), organizational dimensions (Green awareness of Executives, High-level Talent reserves, and Funding Capacity), and environmental dimensions (government subsidies) demonstrate substantial influence, collectively forming critical antecedents for improving corporate GSCM.

No single condition is necessary for achieving a high level of GSCM. Instead, it results from the confluence of multiple factors. Specifically, success depends on the interaction of technological capabilities, organizational capacities, and supportive environmental policies. Different combinations of these factors can lead to the same outcome, highlighting the equifinality of GSCM development paths.

This study identifies three distinct pathways to high-level GSCM, which can be categorized into two overarching models. The first is a strategic resource-driven model, applicable to non-technology-intensive enterprises facing talent shortages. This model shows that executive green awareness and strong funding capacity can act as functional substitutes when supported by core conditions like R&D investment and government subsidies. The second is an AI-driven innovation model, which demonstrates that even amid talent shortages, enterprises can achieve high-level GSCM by combining executive green leadership, capital investment, and a high level of AI adoption.

While the inter-group analysis revealed no significant temporal effects, distinct evolutionary trajectories were observed. In 2019, spurred by digital transformation policies, technology-driven enterprises saw a dramatic surge in GSCM capability, whereas the other two configurations declined. In 2020, all three configurations regressed, likely due to the systemic shock of the COVID-19 pandemic. After 2022, the evolutionary paths diverged more clearly. Enterprises following the strategic resource-driven model, leveraging their early planning and reserves, establish differentiated competitive advantages.

Analysis of regional distributions reveals distinct patterns: Configurations 1 and 3 primarily explain cases in central regions, while Configuration 2 is more prevalent in the west. This intra-group analysis confirms that regional heterogeneity shapes distinct GSCM practices. Consequently, policy interventions should be tailored to regional contexts to be effective.

5.2. Discussion

This section discusses the findings of this study in the context of the existing literature. Unlike prior research that has focused on the various effects of corporate GSCM, such as improving corporate financial performance [21,78], reducing energy consumption intensity [79], enhancing corporate environmental performance [80,81,82], and increasing corporate value [83], this paper explores the construction pathways of corporate GSCM driven by AI technologies. While direct empirical studies on this relationship are scarce, the existing theoretical literature provides indirect support for our findings.

Scholars have empirically tested that the application of AI technologies in manufacturing enterprises can reduce supply chain carbon emissions, thus promoting GSCM [84,85,86]. Rashid et al. [87] conducted an empirical study indicating that AI-driven big data analytics can improve green supply chain collaboration and achieve sustainable manufacturing. Wu et al. [59] pointed out that institutional investor ESG activism helps improve GSCM performance. Eltalhi et al. [88] emphasized that government support can provide key institutional guarantees for the implementation of GSCM for enterprises. Zhou et al. [89] pointed out in their study that the application of AI technologies can promote enterprises’ green transformation. Riad et al. [90] found that the adoption of AI technologies can improve the efficiency of supply chain operations and help enterprises efficiently build a green supply chain. Zhang et al. [91] explored the role of the Internet of Things technologies in improving corporate GSCM and further examined the outcomes of enterprises’ sustainable performance. Some existing studies have drawn conclusions inconsistent with those of this research; for example, Xu et al. [92] found that under high environmental uncertainty, enterprises’ digital transformation fails to effectively reduce carbon emissions.

However, these studies only examine the linear or nonlinear effects of individual factors on GSCM and cannot effectively reveal the multiple driving pathways influencing GSCM in manufacturing enterprises. This study delves into the multi-factor synergy mechanism underlying the differences in corporate GSCM levels driven by AI technologies and fully explores the complex pathways that drive the improvement of AI-enabled corporate GSCM levels from a configurational perspective, thereby contributing to the extant literature.

5.3. Theoretical Contribution

By exploring the complex paths for enhancing GSCM of manufactory enterprises under the influence of AI, this study expands the theoretical boundaries of GSCM. Existing research often overlooks the pivotal role of emerging technologies like AI when examining green supply chain drivers, resulting in a disconnect between theoretical frameworks and practical technological empowerment of green transformation. The paper incorporates AI technology applications into the GSCM framework as a precursor variable, deeply integrating with the TOE framework. Through clarifying the interaction between AI technology adoption and organizational/environmental dimensions, it extends the theoretical boundaries of GSCM and provides a collaborative-driven theoretical foundation for future research.

Methodologically, this study makes an innovative contribution by integrating the random forest algorithm with dynamic QCA. First, the random forest algorithm objectively identifies key drivers, overcoming the subjectivity and potential bias inherent in traditional QCA variable selection, thereby enhancing the robustness of the analysis. Second, dynamic QCA captures the temporal evolution of GSCM levels, addressing the static limitations of traditional QCA and offering an analytical approach that aligns with the dynamic nature of managerial practices. Together, this hybrid approach provides a more rigorous and dynamic methodological framework for investigating the driving mechanisms of GSCM.

5.4. Practical Contribution

To effectively promote GSCM, enterprises should not only seek simple one-size-fits-all solutions but also adopt a comprehensive and systematic way of thinking. Firstly, a high level of GSCM is not driven by a single factor; enterprises must foster coordination and cooperation across all supply chain segments. Secondly, enterprises should give priority to creating synergy between technology, organization and environment. Finally, enterprises should formulate targeted development strategies. Manufacturing enterprises should formulate targeted development strategies. Manufacturing enterprises need to make a clear assessment of their unique capabilities and resource endowments in order to select and implement GSCM improvement strategies suitable for their own characteristics.

Moreover, AI technology and innovative capacity is continuously evolving and playing a key role in improving the efficiency of enterprise management. Enterprises must enhance enterprises’ AI technology adoption depth and R&D capabilities. For companies that already have the advantages of AI technology, priority should be given to core green supply chain objectives such as improving production efficiency and optimizing resources. By deeply integrating AI into production process management and supply chain coordination, enterprises can not only achieve intelligent transformation but also achieve the goals of GSCM, such as cost reduction, efficiency improvement and carbon emission reduction. For enterprises with weak AI foundation, the implementation of GSCM can be promoted by increasing R&D investment, adopting emerging technologies, and improving resource utilization efficiency.

Additionally, the government should refine subsidy policies and build a dynamic adjustment mechanism for subsidies. Configuration analysis reveals that government subsidies constitute the core condition shared by all three configuration pathways and are the key elements to promoting enterprises to implement GSCM. Therefore, sustained increases in overall subsidy investments are essential, as enhanced funding directly boosts enterprises’ motivation for green transformation. Simultaneously, differentiated subsidy strategies should be implemented. For enterprises with weak technological foundations, subsidies should focus on AI infrastructure development to address technical gaps. For companies with advanced AI technology adoptions, subsidies should shift from individual enterprise support to guiding supply chain partners in collaborative green transformation, thereby promoting sustainable development across the entire industrial chain.

Beyond this, enterprises should focus on balancing technology investment and organizational capability building to develop a dynamically adaptable growth path. In the practice of GSCM, enterprises must avoid the misconception of prioritizing technological R&D over organizational development. Instead, they should take organizational capability building as the foundation and dynamically adjust the priority of technological R&D. When an enterprise’s internal capabilities are weak, it should first consolidate capital reserves to ensure the sustainability of resource input while widely recruiting outstanding talents and cultivating executives’ awareness of green management; this prevents AI technology investment from being ineffective due to insufficient organizational capabilities. When an enterprise’s internal capabilities are strong, its R&D investment in new technologies should be closely aligned with actual business needs, rather than blindly pursuing technology accumulation. This approach promotes the coordinated evolution of technology and organizational capabilities, thus optimizing the efficiency of global supply chain management.

In order to cope with the widespread shortage of talents, enterprises should use technical solutions to make up for the shortage of human resources. In all configurations, a common challenge is the shortage of high-level talents, which hinders the development of global supply chain management. We recommend adopting a dual strategy. In the short term, firms can implement standardized AI platforms to translate complex requirements into routine tasks and reduce dependence on professionals. For long-term resilience, companies must strengthen internal talent development by integrating AI skills and GSCM knowledge into training plans, thereby building sustainable core competencies. At the same time, green awareness must be enhanced at all organizational levels from managerial strategy to frontline execution. These multi-dimensional efforts can comprehensively promote GSCM practices.

Finally, GSCM strategies must adapt to external conditions and regional characteristics. Firstly, in order to enhance the ability to respond to sudden shocks like public health emergencies, enterprises need to establish a perfect emergency management and risk prevention mechanism. Secondly, considering the level of economic development and cultural differences in different regions, enterprises should adopt local strategies to meet specific needs instead of adopting a one-size-fits-all approach.

5.5. Limitations and Future Directions

This study has the following limitations: Firstly, due to data limitations, the dynamic QCA was conducted only using company samples from 2019 to 2023 after excluding seriously missing data and failed to include longer period data. Future research could expand the time range to study the multi-factor collaborative mechanism that affects variations in corporate GSCM. Secondly, the study used second-hand data to examine the driving effects of technology, organizational, and environmental factors at the corporate level. Future work could further refine this approach by exploring differentiated driving pathways across industries and enterprise types, thereby enhancing the generalizability of research conclusions. Finally, this study builds a measurement system for the GSCM level of enterprises based on the entropy power method, focusing more on reflecting the resource and capability basis of enterprise GSCM, rather than directly depicting its specific practical behavior. Future research could further combine enterprise environmental reports, social responsibility disclosure and other data to supplement the process indicators that directly measure GSCM practices (such as green product design and waste recovery rates), thereby enabling a more comprehensive evaluation of corporate GSCM performance.

Author Contributions

Conceptualization: Y.C. and L.H.; Data Curation: Y.C. and L.H.; Formal analysis: Y.C. and L.H.; Funding Acquisition: Y.C.; Investigation: L.H., Methodology: L.H.; Project Administration: Y.C. and L.H.; Resources: Y.C. and L.H.; Software: L.H.; Supervision: Y.C.; Validation: Y.C., L.H. and Z.Z.; Visualization: Y.C., L.H. and H.Z.; Writing—original draft: Y.C., L.H. and Z.Z.; Writing—review & editing: Y.C., L.H., Z.Z. and H.Z. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the National Social Science Foundation Project, grant number 24BGL125, Fundamental Research Funds for the Universities of Liaoning Province, grant number LJ112410143077, Project of the Department of Science and Technology of Liaoning Province, grant number 2025080034-JH4/101, Asian Research Centre of Liaoning University, grant number Y202313, Basic Scientific Research Project of Liaoning Provincial Department of Education, grant number LJ132510140001 and the Shenyang Aerospace University Talent Introduction Research Fund, grant number 22YB08.

Data Availability Statement

The original contributions presented in this study are included in the article material. Further inquiries can be directed to the corresponding author.

Conflicts of Interest

The authors declare no conflicts of interest. The funders had no role in the design of the study; in the collection, analyses, or interpretation of data; in the writing of the manuscript; or in the decision to publish the results.

References

- Liu, X.W.; Salman, W.; Hussain, M.; Sun, Y.; Kirikkaleli, D. China carbon neutrality target: Revisiting FDI-trade-innovation nexus with carbon emissions. J. Environ. Manag. 2021, 294, 113043. [Google Scholar] [CrossRef]

- Han, H. Theory of green purchase behavior (TGPB): A new theory for sustainable consumption of green hotel and green restaurant products. Bus. Strategy Environ. 2020, 29, 2815–2828. [Google Scholar] [CrossRef]

- Yao, F.M.; Yan, Y.L.; Li, Y.; Sun, J.Y. Green Design and Green Marketing Decisions of Supply Chain from the Perspective of Environmental Responsibility. Manag. Rev. 2024, 36, 255–265. (In Chinese) [Google Scholar] [CrossRef]

- Li, G.; Shao, S.; Zhang, L. Green supply chain behavior and business performance: Evidence from China. Technol. Forecast. Soc. Change 2019, 144, 445–455. [Google Scholar] [CrossRef]

- Xie, X.M.; Zhu, Q.W. Innovative Pivots or Conservative Shackles: How Can Green supply chain Management Practices SpurCorporate Performance? Chin. J. Manag. Sci. 2022, 30, 131–143. (In Chinese) [Google Scholar] [CrossRef]

- Ghaderi, Z.; Shakori, H.; Bagheri, F.; Hall, C.M.; Rather, R.A.; Moaven, Z. Green supply chain management, environmental costs and supply chain performance in the hotel industry: The mediating role of supply chain agility and resilience. Curr. Issues Tour. 2024, 27, 2101–2117. [Google Scholar] [CrossRef]

- Akhtar, F.; Huo, B.; Wang, Q. Embracing Green Supply Chain Collaboration through Technologies: The Bridging Role of Advanced Manufacturing Technology. J. Bus. Ind. Mark. 2023, 38, 2626–2642. [Google Scholar] [CrossRef]

- Li, T.; Donta, P.K. Predicting Green Supply Chain Impact with SNN-Stacking Model in Digital Transformation Context. J. Organ. End. User Comput. 2023, 35, 1–19. [Google Scholar] [CrossRef]

- Naseer, S.; Song, H.; Adu-Gyamfi, G.; Abbass, K.; Naseer, S. Impact of Green Supply Chain Management and Green Human Resource Management Practices on the Sustainable Performance of Manufacturing Firms in Pakistan. Environ. Sci. Pollut. Res. 2023, 30, 48021–48035. [Google Scholar] [CrossRef]

- Rouholamin, A.; Varposhti, S.; Alavian, A.; Talebi, S. Relationship between Green Intellectual Capital, Green Human Resource Management, Sustainable Supply Chain Management, and Sustainable Performance. J. Organ. Behav. Res. 2023, 8, 91–106. [Google Scholar] [CrossRef]

- Yi, S.; Wen, G. Game Model of Transnational Green Supply Chain Management Considering Government Subsidies. Ann. Oper. Res. 2023, 1–22. [Google Scholar] [CrossRef]

- Tseng, M.L.; Islam, M.S.; Karia, N.; Fauzi, F.A.; Afrin, S. A literature review on green supply chain management: Trends and future challenges. Resour. Conserv. Recycl. 2019, 141, 145–162. [Google Scholar] [CrossRef]

- Dubey, R.; Gunasekaran, A.; Samar Ali, S. Exploring the Relationship between Leadership, Operational Practices, Institutional Pressures and Environmental Performance: A Framework for Green Supply Chain. Int. J. Prod. Econ. 2015, 160, 120–132. [Google Scholar] [CrossRef]

- Luthra, S.; Garg, D.; Haleem, A. The Impacts of Critical Success Factors for Implementing Green Supply Chain Management towards Sustainability: An Empirical Investigation of Indian Automobile Industry. J. Clean. Prod. 2016, 121, 142–158. [Google Scholar] [CrossRef]

- Seuring, S.; Müller, M. From a literature review to a conceptual framework for sustainable supply chain management. J. Clean. Prod. 2008, 16, 1699–1710. [Google Scholar] [CrossRef]

- Sarkis, J. Manufacturing strategy and environmental consciousness. Technovation 1995, 15, 79–97. [Google Scholar] [CrossRef]

- Beamon, B.M. Designing the Green Supply Chain. Logist. Inf. Manag. 1999, 12, 332–342. [Google Scholar] [CrossRef]

- Sarkis, J. A boundaries and flows perspective of green supply chain management. Supply Chain. Manag. 2012, 17, 202–216. [Google Scholar] [CrossRef]

- Cousins, P.D.; Lawson, B.; Petersen, K.J.; Fugate, B. Investigating green supply chain management practices and performance The moderating roles of supply chain ecocentricity and traceability. Int. J. Oper. Prod. Manag. 2019, 39, 767–786. [Google Scholar] [CrossRef]

- Yu, Y.; Zhang, J.Z.; Cao, Y.; Kazancoglu, Y. Intelligent transformation of the manufacturing industry for Industry 4.0: Seizing financial benefits from supply chain relationship capital through enterprise green management. Technol. Forecast. Soc. Change 2021, 172, 120999. [Google Scholar] [CrossRef]

- Yi, Y.L.; Demirel, P. The impact of sustainability-oriented dynamic capabilities on firm growth: Investigating the green supply chain management and green political capabilities. Bus. Strategy Environ. 2023, 32, 5873–5888. [Google Scholar] [CrossRef]

- Awan, F.H.; Dunnan, L.; Jamil, K.; Mustafa, S.; Atif, M.; Gul, R.F.; Guangyu, Q. Mediating Role of Green Supply Chain Management Between Lean Manufacturing Practices and Sustainable Performance. Front. Psychol. 2022, 12, 810504. [Google Scholar] [CrossRef] [PubMed]

- Tornatizky, L.G.; Fleischer, M. Processes of Technological Innovation; Lexington Books: Lexington, KY, USA, 1990. [Google Scholar]

- Chittipaka, V.; Kumar, S.; Sivarajah, U.; Bowden, J.L.H.; Baral, M.M. Blockchain Technology for Supply Chains operating in emerging markets: An empirical examination of technology-organization-environment (TOE) framework. Ann. Oper. Res. 2023, 327, 465–492. [Google Scholar] [CrossRef]

- Li, W.; Xiao, X.; Yang, X.; Li, L. How Does Digital Transformation Impact Green Supply Chain Development? An Empirical Analysis Based on the TOE Theoretical Framework. Systems 2023, 11, 416. [Google Scholar] [CrossRef]

- Baral, M.M.; Chittipaka, V.; Pal, S.K.; Mukherjee, S.; Shyam, H.S. Investigating the factors of blockchain technology influencing food retail supply chain management: A study using TOE framework. Stat. Transit. 2023, 24, 129–146. [Google Scholar] [CrossRef]

- Abdurrahman, A.; Gustomo, A.; Prasetio, E.A. Impact of dynamic capabilities ondigital transformation and innovation to improve banking performance: A TOE framework study. J. Open Innov. Technol. Mark. Complex. 2024, 10, 100215. [Google Scholar] [CrossRef]

- Zhang, Y.; Sun, J.; Yang, Z.; Wang, Y. Critical success factors of green innovation: Technology, organization and environment readiness. J. Clean. Prod. 2020, 264, 121701. [Google Scholar] [CrossRef]

- Sun, Y.; Chen, J.; Kong, C.; Zheng, X.; Zhang, X. What factors influence the motivation of logistics enterprises to adopt green technology? An empirical study based on the TOE model. Br. Food J. 2025, 127, 4742–4766. [Google Scholar] [CrossRef]

- Lei, Y.; Guo, Y.; Zhang, Y.; Cheung, W. Information technology and service diversification: A cross-level study in different innovation environments. Infor. Manage-Amster 2021, 58, 103432. [Google Scholar] [CrossRef]

- Li, L.; Zhu, W.; Chen, L.; Liu, Y. Generative AI Usage and Sustainable Supply Chain Performance: A Practice-Based View. Transp. Res. E Logist. Transp. Rev. 2024, 192, 103761. [Google Scholar] [CrossRef]