Abstract

As a systematic project, corporate green innovation involves technological, organizational, and environmental dimensions. Therefore, its effective functioning is contingent on guidance from internal leadership. STEM represents an integration of science, technology, engineering, and mathematics education. A STEM CEO is a chief executive officer holding a degree in science, engineering, agriculture, or medicine. However, research on the impact of STEM CEOs on green innovation is limited. Using data from Chinese listed manufacturing firms from 2010 to 2023, panel fixed effects models reveal that STEM CEOs positively influence corporate green innovation. Further analysis indicates that alleviating financing constraints, fostering external collaboration, increasing R&D investment, and improving the efficiency of innovation resource allocation are key pathways through which STEM CEOs enhance green innovation output. Furthermore, this impact is positively moderated by the level of green finance development and the intensity of market competition. Finally, heterogeneity tests demonstrate that these positive effects are more pronounced for firms with high public environmental concern, in non-heavily polluting industries, with strong ESG performance, and in highly competitive industries. These findings underscore the role of STEM leaders in enhancing the output of green innovation systems, offering actionable insights into the interaction between STEM CEOs and the external environment.

1. Introduction

Although global economic progress has accelerated in recent decades, it has been accompanied by severe environmental pollution. Consequently, fostering green innovation has become a crucial imperative for China’s ecological preservation and sustainable economic trajectory. The 2024 Report on Statistical Analysis of Green and Low-Carbon Patents notes that enterprises rank among the top five applicants for global green patents, underscoring their central role as drivers of green innovation. Corporate green innovation is a systematic project that involves technological, organizational, environmental, and other aspects [1]. For individual firms, enhancing the operational efficiency and output of the green innovation system is not only a matter of environmental responsibility but also a vital strategy for securing long-term competitive advantages. However, the dual externalities of green innovation present challenges for its effective operation. Many studies have shown that the external environment influences both the capability and efficiency of corporate green innovation [2].

Given green innovation’s reliance on knowledge and resources, the fundamental factor determining whether enterprises can achieve success and sustain long-term advantages lies in internal leadership [3]. The CEO plays a pivotal role in shaping organizational strategies and priorities, significantly influencing corporate green innovation outcomes [4]. This has prompted both scholars and practitioners to explore the impact of CEO background on green innovation. Quan et al. [5] reported that foreign CEOs, who possess stronger environmental ethics and greater comprehensive competence, are more likely to drive corporate green innovation. Hu and Shi [6] revealed that CEOs with green backgrounds can attract green talent, thereby promoting green innovation.

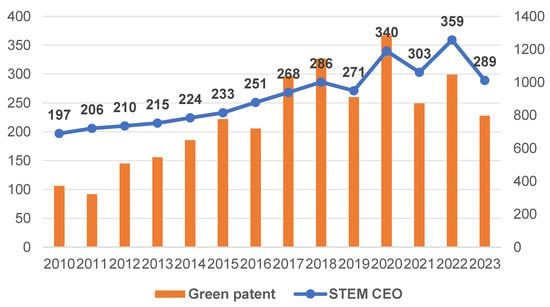

However, the role of a CEO’s educational background remains underexplored. STEM education represents the integration of science, technology, engineering, and mathematics education. STEM education—emphasizing interdisciplinary literacy, innovation, and social responsibility—aims to nurture talent capable of applying scientific and mathematical knowledge to environmentally sustainable practices [7]. According to the U.S. Department of Homeland Security (DHS) STEM Designated Degree Program List, STEM majors include Science, Engineering, Agriculture, and Medicine. The STEMM Opportunities Alliance identifies STEM talent as a key driver of national innovation and sustainability. Scientific foundations provide the theoretical underpinnings for green R&D, while an engineering mindset drives the practical implementation of green solutions. Furthermore, training in agronomy and medicine instills a systems perspective, a long-term orientation, and a deep respect for nature. This unique combination of disciplines enables STEM professionals to internalize green sustainable development, transforming it from a mere slogan into a core corporate strategy [8]. Figure 1 indicates that the total number of green patents among Chinese manufacturing firms increased alongside the growth in the total number of STEM talents from 2010 to 2023. Therefore, STEM talents are critical for the R&D of green technologies, and firms require such talents to propel green innovation.

Figure 1.

Trend chart of the number of green patents and STEM CEOs in Chinese manufacturing enterprises from 2010 to 2022.

A STEM CEO, defined as a leader with a university degree in a STEM field, significantly influences organizational decisions and outcomes, including traditional innovation [9] and corporate social responsibility [10]. However, little research has investigated their impact on environmental innovation. Furthermore, existing studies have primarily examined their overall impact [11], neglecting their interplay with the external environment. From the perspective of the resource-based view, the development level of external green finance and the intensity of market competition influence a firm’s resource base. Under such conditions, the relationship between STEM CEOs and corporate green innovation may be altered. Consequently, this study systematically addresses two key questions: (1) Can STEM CEOs foster the emergence of corporate green innovation outcomes, and what is the potential mechanism? (2) How does the external environment influence the relationship between STEM CEOs and green innovation?

To address these questions, this study develops a systematic theoretical framework based on upper echelons theory, integrating STEM CEOs, firm-level financing constraints, external collaborations, R&D investment, innovation resource allocation efficiency, and external environmental-level green finance and market competition. We analyse data from Chinese listed manufacturing firms from 2010 to 2023, panel fixed effects models show that STEM CEOs foster the emergence of corporate green innovation outcomes, particularly substantive green innovation, with green finance and market competition amplifying this effect. Additional analyses suggest that alleviating financing constraints, fostering external collaboration, increasing R&D investment, and improving the efficiency of innovation resource allocation are key pathways through which STEM CEOs enhance green innovation output. Heterogeneity tests further reveal that the positive effects are more pronounced for firms with high public environmental concern, in non-heavily polluting industries, with strong ESG performance, and in highly competitive industries.

This study makes several theoretical contributions. First, while prior research predominantly addresses non-environmental strategies [10,11,12], the influence of STEM CEOs on corporate environmental innovation remains underexplored. By applying upper echelons theory, it enriches strategic leadership literature by exploring STEM CEOs’ impact on green innovation. This study elucidates the dynamic pathways through which STEM CEOs influence green innovation from the dimensions of external resource acquisition and internal resource allocation, thereby expanding the theoretical understanding of the driving factors behind green innovation. Second, this study innovatively defines STEM disciplines by cross-referencing China’s Academic Classification Catalogue with the DHS STEM Designated Degree Program List. This approach establishes a contextualized delineation of STEM specialization within China’s institutional framework, offering a transferable methodology for constructing STEM databases in other emerging economies. Furthermore, we categorize green innovation into substantive and strategic types for a comprehensive assessment. Third, by analyzing the interaction effects between CEO characteristics and the external environment, this study provides new insights into the boundary conditions of the relationship between STEM CEOs and green innovation, thereby revealing the systemic interactivity.

2. Literature Review

2.1. Theoretical Advances

The upper echelons theory provides the theoretical foundation for constructing our conceptual framework. “Upper echelons” refers to the top management team of a company, typically consisting of three levels: the board of directors, the CEO, and the executive team. Upper echelons theory posits that senior managers are boundedly rational, meaning that their cognitive and decision-making abilities are limited when facing complex external environments and internal governance issues [13]. As a result, the psychological and cognitive traits of senior managers often drive their strategic decision-making processes [14]. Since the psychological characteristics of managers are difficult to quantify, upper echelons theory suggests the use of demographic characteristics such as the gender, age, cultural background, and educational background of senior managers as proxy variables for their psychological and cognitive traits. Thus, the upper echelons theory provides a quantitative analytical framework for studying corporate behavior from the perspective of senior managers. From this theoretical perspective, the CEO, as a key decision-maker, is the primary force driving organizational management updates within the company [6]. Scholars have started to focus on the impact of CEO characteristics on corporate green innovation decisions. Ren et al. [15], on the basis of upper echelons theory, reported that a CEO’s hometown identity has a positive effect on green innovation.

Furthermore, by integrating signaling theory, social network theory, the resource-based view, and dynamic capability theory, this study constructs an analytical framework for the underlying channels. Signaling theory is divided into signal-sending theory and signal-screening theory. Signal-sending theory refers to the process where the information-advantaged party releases certain signals to guide the less-informed party toward making decisions favorable to the advantaged party under conditions of limited information. Signal-screening theory, on the other hand, refers to the process by which the less-informed party selects and receives information [16]. Corporate executives, as information-advantaged parties, can send signals regarding their own competence, thereby influencing investor decisions [17]. Social network theory posits that network members can obtain necessary social resources through network relationships, thus enhancing the firm’s ability to acquire and utilize resources. Network relationships serve as a form of capital and resource for the company and, like other corporate resources, can improve its operational performance [18]. The resource-based view posits that for resources to become a firm’s core competitiveness, they must simultaneously possess value, rarity, inimitability, and non-substitutability [19]. Existing research primarily focuses on the relationship between resource attributes and firm performance. Grant [20] indicates that firms with a strong knowledge base, represented by R&D capabilities and intellectual property, are more likely to achieve breakthrough innovation. Dynamic capability theory points out that dynamic capabilities refer to the ability to integrate, acquire, and reconfigure a firm’s internal and external resources to adapt to rapidly changing environments [21]. Wang et al. [22] demonstrates that dynamic capabilities can reconfigure technology and knowledge, thereby influencing a firm’s green innovation synergy through resource restructuring and changes in resource allocation patterns.

The STEM education background of CEOs influences their cognition and capabilities, thereby affecting environmental decision-making. By integrating upper echelons theory with signaling theory, social network theory, the resource-based view, and dynamic capabilities theory, this study elucidates the potential channels through which this influence occurs. Specifically, a STEM background shapes corporate green innovation decisions by molding the signals of competence conveyed by the CEO, the social capital available to the firm, the allocation of R&D resources, and the firm’s ability to integrate and reconfigure resources.

2.2. Antecedent Variables of Green Innovation

To reduce environmental burdens, green innovation involves the development and enhancement of technologies, processes, and products in an environmentally sustainable manner. Previous research has categorized green innovation into two types: substantive green innovation and strategic green innovation [23]. Substantive innovation prioritizes the quality of innovation, aiming to achieve technological breakthroughs, secure competitive advantages, and enhance environmental performance. Strategic green innovation emphasizes the speed and quantity of innovation, which is chiefly directed at fulfilling external requirements or obtaining short-term gains, without necessarily generating substantive environmental benefits. Scholars have extensively investigated the factors influencing green innovation, considering both external and internal determinants within firms.

External factors such as institutional and market environments significantly influence corporate green innovation. Studies have shown that institutional pressures, government subsidies, and credit policies can propel firms towards green innovation [24,25,26]. Green innovation is inseparable from financial support. Consequently, green finance policies play a vital role in driving green innovation through funding support, tax incentives, and market signaling mechanisms [27,28]. As demand evolves, scholars increasingly focus on market environments. Fierce market competition drives firms towards conservative strategies to secure short-term benefits rather than risk investing in long-term green innovation [29]. Conversely, some studies have suggested that market competition can pressure firms to pursue green innovation to gain or maintain market share [30].

From a firm-level perspective, researchers have explored how internal resources, organizational structure, and managerial characteristics affect green innovation. Internal resources represent a firm’s core competencies. Studies have revealed that R&D investment is a key determinant of corporate innovation capacity, with greater funding and personnel linked to higher levels of green innovation. Conversely, stringent financial constraints and reliance on a single financing source hinder a firm’s green innovation capacity [31,32]. Organizational structure influences a firm’s resource allocation and decision-making efficiency. Previous works on this topic have documented positive effects of management [33] and governance systems [34] on environmental innovation. As core actors within the organization, top management shapes the achievement of green objectives. Recent studies have shown that CEO demographic characteristics, such as age and gender [35,36], can influence corporate green innovation performance. Some research has examined the impact of psychological traits, such as CEO narcissism, hometown identity, and environmental awareness, on green innovation [15,37,38]. Recently, scholars have begun examining the role of CEO experience in green innovation. Huang et al. [39] found that CEOs with marketing experience can enhance green innovation in manufacturing by emphasizing stakeholder needs.

A CEO’s professional background refers to their educational experience, shaping their preferences and behaviors, which in turn affects corporate green innovation. However, recent studies have primarily focused on the demographic characteristics and psychological traits of CEOs rather than their educational backgrounds. Moreover, existing studies primarily focus on the direct linear relationship between CEO characteristics and green innovation, failing to differentiate between distinct types. This paper examines the impact of CEOs’ STEM backgrounds on different types of green innovation.

2.3. The Governance Effects of STEM CEOs

Individuals with STEM backgrounds are adept at designing environmentally sustainable machines and systems [7], aligning with the key characteristics of green development talent. Research indicates that STEM graduates are highly valued for their technological creativity and sustainability mindset [40,41]. Consequently, scholars are increasingly interested in the impact of STEM backgrounds on business performance.

A STEM CEO is a chief executive officer with a university degree (bachelor’s, master’s, or doctoral) in science, engineering, agriculture, or medicine [11]. STEM CEOs are valued for their analytical and data-driven decision-making, which often leads to strategically sound and operationally efficient capital allocation decisions [42]. Scholars have found that STEM CEOs can significantly influence corporate strategies and market responses. They are more likely to understand technical advice and favor R&D strategies that drive digital transformation and sustainability [11,43]. Furthermore, STEM CEOs can send positive signals to the market, enhancing investor confidence in corporate strategies and securing tangible financial support for R&D activities [44].

Recently, scholars have begun focusing on the impact of STEM CEOs on corporate social responsibility (CSR). STEM CEOs typically uphold high ethical standards and demonstrate strong environmental awareness [45]. They recognize the importance of assuming social responsibility and protecting the public interest for long-term firm development [10,46]. Some studies suggest that firms with STEM CEOs tend to have higher CSR and ESG ratings [12,47].

While previous studies on STEM CEOs and corporate governance have concentrated on non-environmental strategies and CSR [11,12], they often overlook the effects on firms’ environmental innovation. Therefore, it is vital to examine the relationship between STEM CEOs and corporate green innovation. This study not only enriches the theoretical research on STEM CEOs, but also helps explain the specific capabilities required for leaders to enable green innovation in a firm.

3. Theoretical Analysis and Hypothesis Development

3.1. STEM CEOs and Green Innovation

Upper echelons theory suggests that CEOs’ educational backgrounds shape their knowledge base, behavioral tendencies, and cognitive abilities, influencing organizational strategy choices and performance [48,49]. Existing research indicates that a CEO’s educational background can affect the firm’s management style, risk-taking, and innovation strategy [48,50,51]. CEOs with a STEM educational background can reshape corporate development philosophies and mitigate the risk of innovation failure, thereby promoting green innovation. First, the problem-solving and critical thinking skills cultivated through coursework in science, engineering, agriculture, and medicine foster risk-taking and innovative capabilities among STEM CEOs [42]. They are inclined to embrace challenges, driving green innovation initiatives throughout the organization [9,11]. Second, STEM CEOs’ cognitive search emphasizes distant solutions [7], focusing not only on short-term gains but also on fulfilling corporate social responsibilities [10]. Science and engineering education equips them with the concepts and expertise necessary for green production and management [38]. Both the ethical norms in medicine and the ecological concerns in agriculture heighten their understanding of the adverse effects of pollution and motivate the integration of environmental protection into strategic goals. As key decision-makers, CEOs directly influence management dynamics, guiding teams to emphasize corporate green development and increasing environmental awareness. Such environmental awareness leads them to view green innovation as a market opportunity, prompting them to adopt targeted strategies to increase corporate reputation and competitiveness. Third, STEM CEOs’ structured risk assessment and technological foresight help organizations identify critical innovation risk, reducing the probability of green innovation failure [42]. Their foundational knowledge in science and engineering equips them to assess the feasibility and risks of emerging green technologies [42]. This technical insight mitigates information asymmetry, enabling them to make more informed R&D investment decisions.

Hu et al. [23] classify green innovation into two types: substantive green innovation and strategic green innovation. Substantive green innovation typically involves breakthroughs in core technologies and their application, significantly reducing pollution emissions or enhancing resource utilization efficiency. This type of innovation drives continuous improvements in technological advancement and environmental performance, effectively promoting long-term economic growth for firms. Conversely, strategic green innovation is perceived as a short-term marketing instrument. While effective for complying with immediate regulatory and market pressures, these approaches lack the foresight necessary to accommodate future standards, consequently jeopardizing long-term profitability. STEM CEOs prioritize organizational long-term interests and possess a deeper understanding of market rules. They are more likely to adopt substantive green innovation to achieve long-term corporate development.

Based on these aspects, we propose the first hypothesis (H1):

H1a.

STEM CEOs promote corporate green innovation.

H1b.

STEM CEOs are more effective in promoting corporate substantive green innovation compared to strategic green innovation.

3.2. Potential Channels of STEM CEOs and Corporate Green Innovation

Based on the characteristics of STEM CEOs, this paper selects two theoretical dimensions—external resource acquisition and internal resource allocation—to further examine how STEM CEOs influence corporate green innovation.

From the perspective of external resource acquisition, STEM CEOs can drive corporate green innovation by alleviating financing constraints and fostering external collaboration. First, signaling theory suggests that individual market behaviors convey unobservable information, which influences trust [17]. On one hand, a CEO’s background in science, engineering, agriculture, or medicine serves as a high-quality signal [52]. It sends positive information to external investors regarding the CEO’s technological acumen and project management capabilities. This reduces information asymmetry between external investors and the firm, thereby alleviating financing constraints. On the other hand, the commitment of STEM CEOs to environmental issues is reflected in their managerial decisions [53], which signal a dedication to environmental protection and attract green investors. Existing research indicates that fund availability is crucial for green innovation [54]. Information asymmetry and regulatory costs can exacerbate financing constraints, limit resource acquisition, and thus lead to failures in green innovation. Therefore, CEOs with STEM backgrounds can alleviate information asymmetry and attract external investors, thereby solving corporate financing challenges and promoting corporate green innovation.

Additionally, social network theory posits that an individual’s social connections serve as a critical channel for obtaining information and resources [55]. The STEM educational background of CEOs fosters high-quality social networks, which facilitates access to external innovation resources and information [56]. Simultaneously, CEOs with backgrounds in science, technology, agriculture, and medicine can leverage their past learning experiences and expertise to foster collaboration, provide technical assistance, and establish partnerships between different participants through certification and trust mechanisms [57]. This capability facilitates the formation of R&D alliances with external partners, thereby expanding opportunities for external collaboration [58]. Existing research demonstrates that broader external collaboration enables firms to more easily undertake green innovation activities [59]. Therefore, the STEM educational background of a CEO often connects the firm to a high-quality network of social capital. This helps secure external collaboration opportunities and, through such collaboration, empowers corporate green innovation.

From the perspective of internal resource allocation, STEM CEOs can drive corporate green innovation by increasing R&D investment and enhancing the allocation efficiency of innovation resources. First, the resource-based view posits that differentiated resource allocation is the source of competitive advantage, and the structure of R&D resource allocation is a key determinant of corporate innovation [60,61,62]. On one hand, CEOs with STEM backgrounds exhibit a stronger long-term orientation and greater risk tolerance. To achieve tangible environmental improvements and gain stakeholder recognition, they are willing to commit substantial R&D resources to develop new products and explore new markets. On the other hand, STEM CEOs integrate green elements into operations and stimulate employee creativity through incentive mechanisms, thereby enhancing R&D efficiency [63]. Existing research indicates that increased R&D investment broadens the scope for “trial and error”, thus improving environmental innovation performance [31]. Therefore, STEM CEOs can influence corporate green innovation output by altering R&D investments.

Furthermore, according to dynamic capability theory, the efficiency of innovation resource allocation essentially reflects a comprehensive corporate capacity for integrating and reconfiguring resources [22,64]. On one hand, STEM CEOs possess extensive professional networks [65], enabling their firms to flexibly integrate internal and external innovation resources by facilitating collaborative R&D and establishing industrial alliances. On the other hand, their education in science equips STEM CEOs with a strong quantitative mindset and data analysis skills [42]. This allows them to rapidly assess project feasibility based on real-time R&D data and to make decisive dynamic adjustments to resource allocation. This approach reduces the risk of mismatch and achieves highly efficient resource supply-demand matching [66]. Existing research indicates that highly efficient innovation resource allocation channels more high-quality resources into innovation activities, thereby promoting corporate green innovation [67]. Consequently, STEM CEOs enhance the firm’s ability to “integrate-reconfigure-deploy” innovation resources, improve the efficiency of innovation resource allocation, and thus drive corporate green innovation.

Thus, the following hypotheses are suggested.

H2.

STEM CEOs can promote corporate green innovation by alleviating financing constraints.

H3.

STEM CEOs can promote corporate green innovation by fostering external collaboration.

H4.

STEM CEOs can promote corporate green innovation by increasing R&D investment.

H5.

STEM CEOs can promote corporate green innovation by enhancing the efficiency of innovation resource allocation.

3.3. The Moderating Effect of the External Environment

Existing studies have highlighted that the interplay between personal characteristics and the external environment influences CEOs’ impact on green innovation [39]. Among various external factors, the development of green finance and the intensity of market competition reshape a firm’s resource base. Subsequently, we analyze how the relationship between STEM CEOs and green innovation evolves under different resource conditions.

Compared with conventional finance, green finance emphasizes financial support for environmental protection and pollution reduction, and is more supportive of green investment projects [68,69]. Bai et al. [70] found that green finance can provide enterprises with necessary funding and policy support, thereby promoting strategic green innovation. This implies that STEM CEOs can not only leverage their specialized knowledge and networks to attract traditional investment, but also supplement these efforts through green financing products, thereby channeling green capital specifically towards R&D activities [28]. Furthermore, an elevated level of green finance signals a nation’s commitment to the development of green and low-carbon industries [71]. STEM CEOs can quickly recognize the advantages of green finance. They can leverage relevant policies to secure additional financial resources for firms, thereby promoting green innovation.

Market competition intensity, which is defined as the degree of competition faced by focal firms within their industry, amplifies the vulnerability of corporate market share and exacerbates inefficiency in resource utilization. Existing research suggests that the intensification of market competition drives companies to continuously seek new growth opportunities, with green innovation being one of the key highlights [72]. Market competition enhances STEM CEOs’ risk-taking [73,74,75]. When confronted with the threat of bankruptcy inherent in competitive markets, STEM CEOs are motivated to pursue green innovation to improve economic performance while safeguarding market reputation. Concurrently, intense competition pressures firms, compelling STEM CEOs to identify weaknesses and develop green technologies to meet rising consumer demand for eco-friendly offerings, thereby gaining market advantage. Moreover, heightened competitive intensity exacerbates the resource burden on firms [29]. Under resource pressure, STEM CEOs increasingly prioritize corporate sustainability, proactively conducting quantitative analyses of the cost-benefit ratio of green innovation. They lead their organizations in leveraging green innovation to reduce environmental costs and enhance resource utilization efficiency.

Thus, Hypotheses 6 (H6) and 7 (H7) are proposed:

H6.

The level of development of green finance has a positive moderating effect on the relationship between STEM CEOs and green innovation.

H7.

The intensity of market competition has a positive moderating effect on the relationship between STEM CEOs and green innovation.

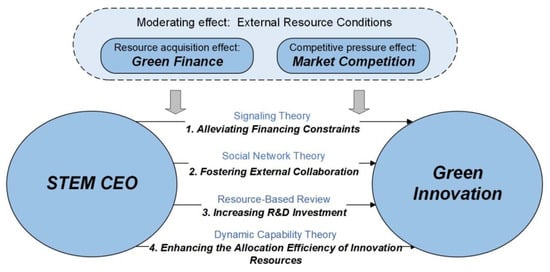

The theoretical framework is illustrated in Figure 2:

Figure 2.

Theoretical framework.

3.4. Theoretical Framework Explanation

According to upper echelons theory, executives’ value orientations and cognitive abilities significantly influence corporate decision-making processes and strategy implementation [14]. In the context of STEM CEOs, upper echelons theory provides profound insights into how executives’ specific backgrounds and expertise influence the advancement of green innovation. To further elucidate how STEM executives influence corporate green innovation, this study integrates signaling theory [76], social network theory [55], the resource-based view [62], and dynamic capabilities theory [77] to examine how STEM CEOs can empower corporate green innovation systems through resources, collaboration, innovation, and coordination. In addition, CEO characteristics interact with the external environment [39]. This study explores how the impact of STEM CEOs on corporate green innovation varies under different external resource conditions.

4. Research Design

4.1. Sample and Data

The initial unbalanced panel data for this study comprised A-share listed manufacturing companies on the Shanghai and Shenzhen Stock Exchanges in China from 2010 to 2023. Data on green finance were derived from the Wind Database, the National Bureau of Statistics, carbon emission exchanges, and the annual reports of listed commercial banks. Other data were sourced from the China Research Data Service Platform (CNRDS) and China Stock Market and Accounting Research Database (CSMAR). Missing data regarding CEOs’ educational backgrounds were manually completed using annual reports disclosed on the Juchao Information Network and executive biographies in prospectuses.

Following the methodology of previous studies [39], several criteria were applied to refine the sample: (1) firms labelled as ST/*ST/PT were excluded; (2) insolvent firms were removed; (3) firms with multiple CEOs in the same year were excluded; (4) firms lacking CEO professional background information in the database, and where such information could not be obtained manually, were removed; and (5) samples with missing main values were discarded. This process resulted in 10,317 firm-year observations. To mitigate the impact of outliers, a 1% winsorization was applied to all continuous variables.

4.2. Variable Measurement

4.2.1. Dependent Variable

Green innovation is measured by the number of green patent applications. Specifically, patents are filtered according to International Patent Classification (IPC) codes from the Green Patent List published by the World Intellectual Property Organization (WIPO). Since design patents are not classified by IPC, only invention and utility model patents are considered. Following previous research [78], the natural logarithm of one plus the total number of green patent applications is used to measure green innovation (Gpatent). Additionally, green innovation is categorized into substantive green innovation and strategic green innovation [3]. Substantive green innovation (Ginvent) is calculated as the natural logarithm of one plus the number of green invention patents, while strategic green innovation (Gutility) is computed as the natural logarithm of one plus the number of green utility model patents.

4.2.2. Independent Variable

A CEO’s STEM background (STEM) is identified based on their degree and field of study [9,43]. As per the classification used by Kong et al. [11] and aligned with the Chinese Academic Classification Catalog, STEM majors include science, engineering, agriculture, and medicine. If a CEO holds a degree in any of these fields (bachelor’s, master’s, or doctoral), STEM is assigned a value of 1; otherwise, it is 0.

4.2.3. Channel Variables

According to Yu et al. [79], the study measures levels of financing constraints (FC) using FC index. The larger the value of the FC index, the stronger firms’ financing constraints.

Second, we employ the number of joint patent applications between firms and various heterogeneous partners (i.e., other companies, universities, and research institutions) as a proxy for external collaboration (EC) [80].

Third, following Zhang et al. [31], the study measures the intensity of research and development investment (RD) is measured by the proportion of R&D expenditure to operating income.

Lastly, according to Feng et al. [81], this study employs a sensitivity measure of corporate R&D input to output. For innovation input, firms’ innovation investment behavior is captured by R&D expenditures scaled by beginning-of-period total assets. For innovation output, it is characterized by the number of patent applications per unit of R&D investment. The efficiency of innovation resource allocation (IE) is calculated as the ratio of ln (1 + patent applications) to ln (1 + R&D expenditures).

4.2.4. Moderating Variable

Green finance supports environmental initiatives by offering financing, operational support, and risk management services. According to Liu and Liu [28], this study adopts the entropy weight method to construct a green finance index (GF) from seven dimensions, including green credit, green bonds, green investment, green insurance, green funds, green equity and carbon finance, as shown in Table 1.

Table 1.

Evaluation index system of green finance.

Second, we employ the Herfindahl-Hirschman Index (HHI) to measure market competition [29]. A higher HHI signifies less market competition for the firm, whereas a lower HHI signifies greater market competition. Therefore, this study employs “1-HHI” to reflect the intensity of market competition (MC).

4.2.5. Control Variables

Hsieh et al. [9] used control variables such as the current ratio and sales growth rate, while Huang et al. [39] included firm size, firm age, and CEO duality. Based on these, several control variables were included: firm size (Size), firm age (Age), book-to-market ratio (BM), current ratio (Liquid), sales growth (Growth), shareholding ratio of the top ten shareholders (Top), CEO duality (Duality), and the chairman’s STEM background (STEM_Chairman). The definitions of these variables are summarized in Table 2.

Table 2.

Variable definitions.

4.3. Model Construction

This study applies a double fixed-effects model to examine the impact of STEM CEOs on green innovation. The baseline regression takes the form of Equation (1):

where Greeni,t denotes the green innovation performance of firm i in year t, including overall green innovation (Gpatent), substantive green innovation (Ginvent) and strategic green innovation (Gutility); STEMi,t is set to 1 if the CEO has a STEM background, otherwise it is 0; Controlsi,t represents a set of control variables; Year and Industry account for time and industry fixed effects, respectively; and εi,t represents random error terms.

To empirically examine H2, H3, H4, and H5, this study constructed Equations (2) and (3) as follows:

where Channeli,t represents financing constraints (FC), external collaboration (EC), R&D investment (RD), and the efficiency of innovation resource allocation (IE), other variables are defined similarly to Equation (1).

To test H6 and H7, we also constructed Equations (4) and (5):

where GFi,t represents the level of green financial development, MCi,t refers to market competition, and the other variables are defined similarly to Equation (1). Firm-level clustering is employed in the regression models to control for the correlation of error terms more effectively.

5. Empirical Results and Analysis

5.1. Descriptive Statistics

Table 3 presents descriptive statistics for the main variables. To enhance precision and readability while avoiding the loss of key information, this study employs three quantiles [39,79]. The average value of green innovation (Gpatent) among listed companies is 0.320, with a maximum of 2.708, a minimum of 0.000, and a standard deviation of 0.634. This indicates a significant variation in the level of green innovation among Chinese companies, with an overall low level of green innovation and considerable room for improvement. After distinguishing between types of green innovation, there are significant differences between companies in terms of substantive green innovation (Ginvent) and strategic green innovation (Gutility), suggesting that the green innovation performance of Chinese companies requires further enhancement. The average value of having a STEM CEO (STEM) is 0.354, meaning that between 2010 and 2023, approximately 35.4% of the sample companies had a CEO with a STEM educational background. All control variables fall within reasonable limits.

Table 3.

Descriptive statistics.

Table 4 provides the CEO’s professional background and the mean difference test for two subsamples (STEM = 0 vs. STEM = 1). In Panel A, this distribution indicates a preference for business-educated or STEM CEOs in manufacturing firms. Panel B shows significant mean difference in green innovation between subsamples. The mean overall green innovation (Gpatent) of firms with STEM-background CEOs is 0.517, whereas it is 0.212 for those without. This evidence suggests that STEM CEOs may positively influence green innovation.

Table 4.

CEOs’ professional backgrounds and descriptive statistics for separate subsamples divided by STEM background.

To avoid the problem of spurious regression, this study employs the ADF-Fisher test. The results in Table 5 show that the panel data reject the null hypothesis of a unit root, suggesting that the data are stationary.

Table 5.

ADF-Fisher Test.

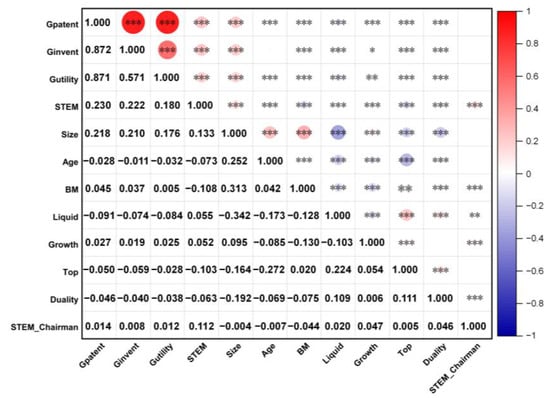

Figure 3 illustrates Pearson correlation coefficients for key variables, showing a correlation coefficient of 0.230 between STEM and Gpatent, significantly positive at the 1% level. This finding indicates a substantial positive impact of STEM CEOs on corporate green innovation. The correlation coefficient between STEM and Ginvent is greater than that between STEM and Gutility. This indicates that the positive effect of STEM CEOs on substantive green innovation is likely more pronounced than their effect on strategic green innovation. Furthermore, all correlation coefficients have absolute values less than 0.500, suggesting that there are no severe multicollinearity issues. Finally, Table 6 shows the results for the multicollinearity test. Variance inflation factors (VIFs) calculated for all regression variables show a maximum value of 1.41, well below the threshold of 5, confirming that multicollinearity is not a concern.

Figure 3.

Heatmap for correlation analysis. Note: *, **, and *** indicate significance at the 1%, 5%, and 10% levels, respectively.

Table 6.

VIF results.

5.2. Baseline Results

Table 7 presents the main regression results. The coefficients for STEM CEO (STEM) are significantly positive at the 1% level for Gpatent, Ginvent, and Gutility, with values of 0.210, 0.151, and 0.121, respectively. In terms of economic significance, a one-standard-deviation increase in the proportion of STEM CEOs is associated with an average increase of 0.312 in green innovation performance, an average increase of 0.380 in substantive green innovation performance, and an average increase of 0.297 in strategic green innovation performance, all of which are economically significant. Comparing the coefficients for the three types of innovation reveals that while STEM CEOs enhance overall green innovation, their impact is more pronounced on substantive green innovation than on strategic green innovation. These findings confirm that STEM CEOs positively influence corporate green innovation, supporting H1. Existing research suggests that CEOs with foreign, marketing, or green backgrounds all promote corporate green innovation [5,6,39]. This study incorporates the CEO’s STEM educational background into the upper echelons theory framework, thereby expanding the study of factors influencing green innovation.

Table 7.

Baseline regression results.

5.3. Robustness Test

5.3.1. Tobit Model and Alternative Green Innovation Variables

In practice, many firms do not submit green patent applications, leading to a substantial portion of the dependent variable’s observations being zero. To address this data distribution characteristic, the study employs a Tobit model for robustness testing. The regression results are shown in Columns (1), (2), and (3) of Table 8. The coefficients for STEM are all significantly positive at the 1% level, confirming the robustness of the findings.

Table 8.

Tobit model and alternative measure of green innovation regression results.

Furthermore, following Su et al. [3], the study redefines the dependent variables by using the natural logarithm of the total number of granted green patents (eGpatent) after adding 1, the number of green invention patents granted (eGinvent) after adding 1, and the number of granted green utility models (eGutility) after adding 1. The results of these regression models are presented in Columns (4), (5), and (6) of Table 8. Again, the coefficient for STEM is positive and statistically significant at the 1% level, indicating that the main findings are robust.

5.3.2. Lagged Independent Variable

Given the time required for firms to develop green innovations [82], lagged independent variables were used to validate the findings. In this study, the independent variable (STEM) and its corresponding control variables were lagged by one period. Columns (1), (2), and (3) of Table 9 present the regression results with a one-period lag (L1.STEM), while Columns (4), (5), and (6) display the results with a two-period lag (L2.STEM). Across all six columns, the findings consistently show that the lagged STEM variables are significantly positive at the 1% level. These results confirm that the main findings are robust.

Table 9.

Lagged independent variable regression.

5.3.3. Propensity Score Matching (PSM) and Entropy Balancing Matching (EBM)

In this study, propensity score matching was used to address endogeneity issues. Specifically, each firm in the experimental group (STEM = 1) was matched with a firm in the control group (STEM = 0) using a 1:1 nearest neighbor matching method. Based on the results of the balance test, after matching, the standardized differences for all control variables were within 5%, indicating no significant differences between the experimental and control groups for these variables.

After matching, regression analysis was performed on the matched samples using the regression model. The results in columns (1), (2), and (3) of Table 10 indicate that the coefficient of STEM remains significantly positive at the 1% significance level, confirming the robustness of the research findings.

Table 10.

PSM and EBM results.

To mitigate the differences in covariates between the treatment group (with STEM CEOs) and the control group (without STEM CEOs), this study employs the entropy balancing technique following Hainmueller [83]. The result indicates that, prior to entropy balancing, significant differences existed in the means, variances, and skewness of the covariates between the two groups. These differences were eliminated after the matching procedure, confirming the effectiveness of the approach. Furthermore, the study re-estimated the baseline regression using the matched sample. The results in columns (4), (5), and (6) of Table 10 indicate that the coefficient remains significantly positive, consistent with the initial findings, which reinforces the robustness of the conclusions.

5.3.4. The 2SLS Approach

To address the potential endogeneity issues from reverse causality, where firms with high levels of green innovation might be more inclined to hire CEOs with STEM backgrounds, a two-stage least squares (2SLS) estimation was used.

In this study, the number of STEM graduates in the CEO’s registered residence is selected as the instrumental variable (Tool). This specific variable is chosen as the instrumental variable for the following reasons. First, the number of STEM graduates from the CEO’s registered residence location generally serves as an indicator of the abundance of STEM education resources the CEO was exposed to during their formative years. An individual who grows up in a region rich in STEM education resources is more likely to be exposed to high-quality STEM education and influenced by the surrounding environment to choose a STEM major in college, thereby increasing the possibility that CEOs recruited by enterprises have a STEM background. Second, a greater concentration of STEM graduates in the registered residence location fosters a more robust STEM learning atmosphere. This increases the likelihood that the CEO was exposed to role models such as engineers and scientists during their youth, thereby making them more inclined to choose a STEM major and ultimately raising the likelihood of a firm-appointed CEO possessing a STEM background. Therefore, the instrumental variable (Tool) is correlated with the endogenous variable (STEM), satisfying the relevance condition. Furthermore, the number of STEM graduates in a CEO’s registered residence is unlikely to affect corporate green innovation through other channels.

Table 11 reports the results of the 2SLS instrumental regressions. Column (1) shows the results of the first-stage regression, where the coefficient of the instrumental variable (Tool) is 0.081 and significantly positive at the 1% level. The Kleibergen–Paap rk LM statistic is 112.51, significant at the 1% level, indicating rejection of the underidentification hypothesis. The Kleibergen–Paap rk Wald F statistic is 112.51, exceeding the critical value of 16.38, suggesting no weak identification problem. Columns (2), (3), and (4) present the second-stage regression results, where the coefficients of STEM CEOs are significantly positive at the 1% or 5% level. These findings demonstrate that, even after addressing potential endogeneity issues, STEM CEOs significantly enhance firms’ green innovation efforts.

Table 11.

Instrumental variable two-stage regression.

5.4. Potential Channels

Subsequently, this study delves into the pathway of its influence, employing the stepwise regression method to verify the mediating roles of financing constraints (FC), external cooperation (EC), R&D investment (RD), and innovation resource allocation efficiency (IE). Panel G of Table 12 presents that the coefficients of the relevant variables exhibit significance at the 1% or 5% level, confirming the mediating effect of financing constraints. STEM CEOs can promote green innovation by alleviating financing constraints through reducing information asymmetry and attracting investors. Panel H of Table 12 presents that the coefficients of the relevant variables exhibit significance at the 1% level, confirming the mediating effect of external cooperation. STEM CEOs can leverage their social networks to expand external collaboration opportunities, thereby driving corporate green innovation. Panel I of Table 12 presents that the coefficients of the relevant variables exhibit significance at the 1% or 5% level, confirming the mediating effect of R&D investment. STEM CEOs demonstrate stronger long-term orientation and greater risk-taking capacity, and are willing to increase R&D investment to enhance green innovation output. Panel J of Table 12 presents that the coefficients of the relevant variables exhibit significance at the 1% level, confirming the mediating effect of innovation resource allocation efficiency. STEM CEOs can enhance the firm’s capacity to integrate and coordinate resources, improve the efficiency of innovation resource allocation, and thereby drive green innovation. Thus, H2, H3, H4, and H5 are verified.

Table 12.

Channel Effects Regression Results.

To compare the relative importance of the underlying pathways, this study conducted a path analysis. The results indicated that the external collaboration mechanism accounted for the greatest proportion of the mediating effect, suggesting that expanding external collaboration is one of the most critical pathways through which STEM CEOs promote corporate green innovation. Chen et al. [84] also emphasized the importance of external collaboration as a potential channel. This study combines the upper echelons theory with signaling theory, social network theory, resource-based view, and dynamic capabilities theory to elucidate the “black box” of how STEM CEOs incentivize green innovation.

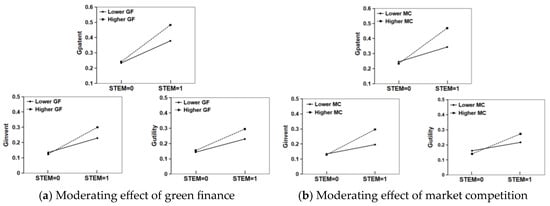

5.5. Moderating Effects

This study further explores the moderating effects of green finance and market competition on the relationship between STEM CEOs and green innovation. First, the impact of green finance (GF) is analyzed. Columns (1), (2), and (3) of Table 13 show that the coefficients for the interaction term STEM×GF are 0.797, 0.675, and 0.450, respectively, each significantly positive at the 1% or 5% level. H6 is verified.

Table 13.

Moderating effects.

Second, this study investigates the influence of market competition (MC) on the relationship between STEM CEOs and green innovation. Columns (4), (5), and (6) of Table 13 present these results. The coefficients for the interaction term STEM×MC are 1.291, 0.987, and 0.721, each significantly positive at the 1% or 5% level. H7 is verified. The interaction plots illustrating these effects are shown in Figure 4. Previous studies have emphasized the direct impact of green finance and market competition on green innovation [29,70]. This study views green finance and market competition as external resource conditions and discusses their moderating roles. It reveals that green innovation is not determined by a single factor, but rather is the result of the synergistic interaction between executive characteristics and external resource conditions.

Figure 4.

The moderating effect.

5.6. Heterogeneity Analyses

5.6.1. Heterogeneity Analysis by Public Environmental Concern

Public environmental concern refers to the degree of public attention and importance placed on environmental conditions and issues, reflecting the perceived significance and urgency of environmental topics among the general populace. The level of public environmental concern can influence the stakeholder pressure and market opportunities that firms face. Under different challenges and opportunities, the impact of STEM CEOs on corporate green innovation may vary. In this study, the annual Baidu haze search index is used to measure the degree of public environmental concern [85]. Based on the median value of public environmental concern, the sample is stratified into high and low environmental concern groups to examine whether public environmental concern influences the impact of STEM CEOs on corporate green innovation. The results in Table 14 indicate that under conditions of high public environmental concern, STEM CEOs exert a positive impact on corporate green innovation. However, under conditions of low public environmental concern, the effect of STEM CEOs on corporate green innovation is not significant.

Table 14.

Heterogeneity analysis based on public environmental concern.

This phenomenon may be explained by the following reasons. First, heightened public environmental concern leads to increased pressure on firms from various stakeholders, including consumers, investors, and the media. Such pressure manifests as elevated expectations for corporate environmental performance and intensifies the fragility of corporate reputation [39]. This intensifies STEM CEOs’ negative perceptions of pollution, thus motivating them to pursue green innovation to maintain corporate reputation and avoid negative publicity. Second, public environmental concern serves an oversight role, motivating corporate executives to fulfill their responsibilities [86]. Driven by a sense of social responsibility and environmental protection fostered through STEM education, STEM CEOs are willing to promote green innovation to earn stakeholder recognition. Finally, growing public demand for green products under high environmental concern creates new market opportunities [87], which in turn motivates STEM CEOs to pursue green innovation in order to capture the market.

5.6.2. Heterogeneity Analysis by Industry

Considering the distinct characteristics of different industries, the resources available to firms for pursuing green innovation vary. In this study, manufacturing firms are classified into heavily polluting and non-heavily polluting industries to examine the influence of STEM CEOs on firm green innovation within these industry types. The results in Table 15 indicate that STEM CEOs significantly positively impact firm green innovation in both heavily polluting and non-heavily polluting industries, with all results passing the Fisher Permutation test. Moreover, a comparison of variable correlations reveals that the positive impact of STEM CEOs on green innovation is more pronounced in non-heavily polluting firms.

Table 15.

Heterogeneity analysis based on industry.

This phenomenon can be attributed to the following reasons. On one hand, non-heavily polluting firms face fewer credit constraints and typically enjoy a stronger social reputation than their heavily polluting counterparts, making it easier for them to access external financing [88] and reducing the risks associated with green transformation. On the other hand, firms in non-heavily polluting industries tend to have greater asset flexibility and access to more human capital resources dedicated to green innovation [89], providing a robust platform for CEOs to effectively leverage their STEM backgrounds.

5.6.3. Heterogeneity Analysis by ESG Performance

ESG ratings are tools for measuring corporate performance in the areas of environment (E), social responsibility (S), and corporate governance (G). ESG performance influences aspects such as financing costs, corporate culture, risk exposure, and investment efficiency. Under different cultural and resource contexts, the impact of STEM CEOs on green innovation may vary. In this study, the Hua Zheng ESG database is used to measure a firm’s ESG performance. Based on the median ESG rating, the sample is divided into high-ESG and low-ESG groups to examine whether the ESG rating influences the impact of STEM CEOs on corporate green innovation. The results in Table 16 indicate that STEM CEOs significantly positively impact corporate green innovation in both high- and low-ESG firms, with all results passing the Fisher Permutation test. Moreover, a comparison of variable correlations reveals that the positive impact of STEM CEOs on green innovation is more pronounced in high-ESG firms.

Table 16.

Heterogeneity analysis based on ESG performance.

This phenomenon can be attributed to the following reasons. From an internal perspective, firms with high ESG ratings typically possess a corporate culture that emphasizes sustainability, resulting in a strong internal consensus regarding green innovation. Consequently, STEM CEOs encounter less internal political resistance when implementing new technologies and projects. From an external perspective, high-ESG firms benefit from a strong brand image and enjoy more favorable financing conditions, which alleviate their financing constraints [90] and, in turn, reduce the external pressure on STEM CEOs when promoting corporate green innovation. Additionally, the technical expertise of a STEM CEO, aligned with the firm’s established green strategy, sends a strong positive signal to the market, thereby boosting R&D morale and attracting external partnerships.

5.6.4. Heterogeneity Analysis by Industry Competition

The industrial competitive environment is a crucial factor influencing firms’ innovative behaviors [91]. Given the variations in competitive pressure, the impact of STEM CEOs on corporate green innovation may differ. This study employs industry concentration to measure the intensity of industrial competition. A higher industry concentration ratio indicates lower competitive intensity. The study splits the sample into high- and low-competition groups based on the median industry concentration to examine whether industry competition influences the effect of STEM CEOs on green innovation. The results in Table 17 indicate that STEM CEOs exert a positive impact on corporate green innovation in a high-competition environment, whereas their impact on corporate green innovation is not significant in a low-competition environment.

Table 17.

Heterogeneity analysis based on industrial competition.

This phenomenon may be explained by the following reasons. Intense industry competition spurs firms to enhance their innovation efficiency in order to escape the fierce rivalry with other industry players [92]. In highly competitive environments, green innovation can serve as a key strategic tool for firms to seek differentiation and break away from homogeneous competition. Leveraging their technical expertise, STEM CEOs are more adept at identifying the potential for product enhancement, new market opportunities, or cost savings offered by green technologies. Under competitive pressure, they are more likely to perceive green innovation as a proactive competitive weapon rather than a burden. In contrast, within less competitive environments, firms lack a strong impetus for change. Reliance on existing, successful business models dampens the motivation for STEM CEOs to drive corporate green innovation.

6. Discuss

Against the backdrop of global climate change, green innovation has emerged as a crucial strategy for firms pursuing sustainable development. This study explores how a CEO’s STEM background influences corporate green innovation through the potential mechanism and boundary conditions, aiming to elucidate the “black box” of internal motivation within corporate green innovation systems to better fulfill environmental governance responsibilities.

First, the findings emphasize the positive impact of STEM CEOs on corporate environmental strategies. While prior research has acknowledged the contributions of STEM CEOs to general innovation and corporate social responsibility [9,47], their specific influence on environmental innovation has been largely overlooked. This study provides theoretical insights into how STEM CEOs drive green innovation.

Second, it identifies alleviating financing constraints, promoting external collaboration, increasing R&D investment, and improving the efficiency of innovation resource allocation as potential pathways guiding this effect. This is consistent with the findings of previous scholars. Kong et al. [11] found that STEM CEOs promote R&D investment by increasing capital commitment and expanding the R&D workforce. Yang and Du [52] confirmed that a CEO’s background can send positive signals to the outside world, thereby reducing financing costs. Wang and Li [57] emphasized the role of collaboration, finding that CEOs can leverage their professional experience to build partnerships between different participants through certification and trust mechanisms, thus promoting green innovation. This aligns with our path analysis results, highlighting the importance of collaboration in enabling green innovation.

Again, this study confirms the positive moderating effect of the external environment, responding to the recent academic calls for exploring the interaction between CEO characteristics and contextual factors [93]. Specifically, green finance positively moderates the relationship between STEM CEOs and green innovation, which is consistent with research that holds a positive view of green finance policies. Chen et al. [69] argue that the concept of green finance aligns with green innovation and can bring more financial resources to enterprises, driving green innovation. This finding provides theoretical support for the implementation of green finance policies. However, this study shows that market competition positively moderates the relationship between STEM CEOs and green innovation, which contradicts arguments that intense market competition may divert resources and negatively affect green innovation [29,94]. We analyze the underlying reasons for this result. When operating under significant resource constraints, the strategic focus of enterprises shifts from pursuing potentially green innovations to maintaining market stability and short-term financial returns, as the latter ensures immediate survival. Therefore, healthy market competition contributes to enhancing environmental awareness within companies. However, excessive competition may suppress green innovation. This finding provides compelling theoretical support for market-oriented policy-making.

Finally, this study incorporates firm characteristics into the research framework of green innovation, specifically examining the impact of public environmental concern, pollution intensity, ESG performance, and industry competitiveness on the main conclusions. It combines public environmental concern with the perspective of stakeholder pressure, pollution intensity with the perspective of resource endowment, ESG performance with the perspective of internal governance, and industry competition with the perspective of competitive pressure. This is consistent with existing research. Zhang and Wang [95] found that the positive effect of CEOs on green innovation is more pronounced in non-heavily polluting industries. In conclusion, this study critically examines the differences in the impact of STEM CEOs on corporate green innovation when considering firm characteristics, thereby expanding the upper echelon theory.

7. Summary and Conclusions

7.1. Research Conclusion

This study contributes to upper echelons theory by innovatively incorporating STEM CEOs into the research framework of this theory. Moreover, it expands the application of STEM education in the field of environmental protection, which is conducive to enriching the relevant research on green innovation. The results demonstrate the significant impact of STEM CEOs on green innovation in Chinese manufacturing firms, particularly enhancing substantive green innovation. The positive relationship proves robust across various econometric tests. The effect is amplified in environments with higher levels of green financial development and more market competition. The alleviation of financing constraints, promotion of external collaboration, increased R&D investment, and improved efficiency in innovation resource allocation are identified as key mediating mechanisms. Heterogeneity analysis reveals that these positive effects are more pronounced for firms with high public environmental concern, in non-heavily polluting industries, with strong ESG performance, and in highly competitive industries.

7.2. Limitations and Future Research Opportunities

First, this study focuses solely on the influence of CEOs’ STEM backgrounds on green innovation. Future research could explore the impact of the broader executive team’s STEM background [96]. Second, while this study examined institutional and market moderators, the relationship between STEM CEOs and green innovation is likely influenced by other contextual factors. Subsequent research could explore moderators from technological and cultural dimensions. Finally, as this research is based on Chinese data, the generalizability of our findings to other emerging economies warrants further investigation.

7.3. Recommendations

First, the results indicate the positive impact of STEM CEOs on enhancing corporate green innovation. For enterprises, it is advisable to improve the CEO selection mechanism and prioritize candidates with a STEM background, thus injecting intrinsic momentum into green innovation. Concurrently, companies should promote STEM-related professional development within their existing leadership, integrate green technologies and STEM knowledge into the training system, require employees across departments to regularly participate in relevant training, and establish assessment mechanisms. In addition, green innovation achievements should be incorporated into the executive performance evaluation system, with incentive mechanisms linked to technological outcomes. For the government, on one hand, policies should be implemented to encourage universities and research institutions to strengthen their STEM discipline, cultivate more professionals with STEM backgrounds, and ensure a sufficient talent pool for corporate green innovation. On the other hand, the government should enhance publicity and awareness of STEM education, leveraging various channels such as the media, science museums, and open days to raise public understanding and attention to the STEM fields.

Second, this study emphasizes the importance of alleviating financing constraints, enhancing external collaboration, increasing R&D investment, and improving the efficiency of innovation resource allocation in promoting green innovation. The government should develop platforms for industry–academia–research cooperation, offering opportunities for enterprises, universities, and research institutions to exchange and collaborate, while providing financial support or tax incentives for cooperative projects. Simultaneously, the government should increase subsidies for green innovation R&D investment in manufacturing enterprises, improve tax incentive policies, and guide innovation resources toward green innovation sectors. Enterprises should proactively respond to policy directives. On one hand, they should actively apply for and utilize government-established green innovation subsidies and tax incentives to broaden financing channels. On the other hand, they should actively seek collaboration opportunities with universities, research institutions, and other enterprises to jointly conduct green technology R&D. Furthermore, enterprises should increase investment in green R&D, optimize internal research structures, establish dedicated teams for breakthrough research in green technologies, and improve mechanisms for allocating innovation resources to enhance resource utilization efficiency.

Third, the managers and government should closely monitor the moderating role of green finance and market competition. Given that the impact of STEM CEOs is context dependent, enterprises must closely monitor market dynamics and green finance policies, establishing a dynamic monitoring mechanism to strategically recalibrate their innovation initiatives and avoid missing the innovation window due to strategic delays. The government should advance the development of green financing and regulate the market environment. This includes strengthening policy frameworks to ensure capital is effectively allocated to green R&D activities. Furthermore, it is essential to enforce anti-monopoly regulations and refine market access policies to sustain a competitive landscape, thereby preventing excessive market concentration from stifling innovation.

Finally, by analyzing the heterogeneity of corporate public environmental concern, pollution levels, ESG performance, and industry competition, this study provides valuable insights for the management decisions of STEM CEOs. In terms of public environmental concern, enterprises should establish a transparent and regular information disclosure mechanism for green innovation, actively release relevant data, and respond to public concerns in order to enhance their reputation. Governments should develop and improve the environmental information disclosure system for enterprises to ensure the authenticity and comparability of data, thereby reducing the cost of public information access and increasing public attention to environmental issues. In addition, governments should broaden channels for public participation, encourage and support environmental organizations, the media, and citizens to conduct environmental supervision in accordance with the law, and create social pressure through public opinion, thereby compelling corporate executives to place greater emphasis on green innovation. In terms of pollution levels, targeted incentives should be provided to non-heavily polluting industries. The government can establish special funds and offer tax incentives to support green technology R&D in non-heavily polluting industries. For heavily polluting industries, both regulatory constraints and guidance should be emphasized. While strictly enforcing environmental protection standards, the government should also offer guidance on technological transformation pathways and provide financial support, thereby creating a broader innovation platform for STEM CEOs. In terms of ESG development, both enterprises and the government should place emphasis on ESG management and establish a sound ESG performance evaluation system. With respect to industry competition, enterprises should adopt a correct competitive mindset, considering green innovation as an important means to enhance corporate competitiveness. Moreover, the government can strengthen market supervision and maintain a fair competitive industrial order by setting industry standards and regulating industry access.

Author Contributions

Conceptualization, Y.X. and Y.J.; methodology, Y.J.; software, Y.J. and R.M.; validation, Y.X., Y.J., and R.M.; formal analysis, Y.X. and Y.J.; investigation, Y.X. and Y.J.; resources, Y.X. and Y.J.; data curation, Y.X. and Y.J.; writing—original draft preparation, Y.J.; writing—review and editing, Y.X., Y.J., and R.M.; visualization, Y.X. and Y.J.; supervision, Y.X. and Y.J.; project administration, Y.X. and Y.J.; funding acquisition, Y.X. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by China’s Anhui Provincial Science and Technology Innovation Strategy and Soft Science Research Special Project, grant number BJ2040150069.

Data Availability Statement

Data are contained within the article.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Wang, Z.; Zhang, X.; Song, X.; Huang, J. Unlocking AI’s Radical Innovation Potential: The Contingent Roles of Digital Foundation and Government Subsidy. Systems-Basel 2025, 13, 702. [Google Scholar] [CrossRef]

- Cheng, Y.; Du, K.; Yao, X. Stringent environmental regulation and inconsistent green innovation behavior: Evidence from air pollution prevention and control action plan in China. Energy Econ. 2023, 120, 106571. [Google Scholar] [CrossRef]

- Su, Y.; Liu, Z.; Liang, S. Does CEO information technology background promote substantive green innovation or strategic green innovation? Technol. Anal. Strateg. Manag. 2023, 37, 253–266. [Google Scholar] [CrossRef]

- Zhao, S.; Zhang, B.; Shao, D.; Wang, S. Can Top Management Teams’ Academic Experience Promote Green Innovation Output: Evidence from Chinese Enterprises. Sustainability 2021, 13, 11453. [Google Scholar] [CrossRef]

- Quan, X.; Ke, Y.; Qian, Y.; Zhang, Y. CEO Foreign Experience and Green Innovation: Evidence from China. J. Bus. Ethics 2023, 182, 535–557. [Google Scholar] [CrossRef]

- Hu, W.; Shi, S. CEO green background and enterprise green innovation. Int. Rev. Econ. Financ. 2025, 97, 103765. [Google Scholar] [CrossRef]

- Zollman, A. Learning for STEM Literacy: STEM Literacy for Learning. Sch. Sci. Math. 2012, 112, 12–19. [Google Scholar] [CrossRef]

- Kelley, T.R.; Knowles, J.G. A conceptual framework for integrated STEM education. Int. J. STEM Educ. 2016, 3, 11. [Google Scholar] [CrossRef]

- Hsieh, T.-S.; Kim, J.-B.; Wang, R.R.; Wang, Z. Educate to innovate: STEM directors and corporate innovation. J. Bus. Res. 2022, 138, 229–238. [Google Scholar] [CrossRef]

- Cho, C.H.; Jung, J.H.; Kwak, B.; Lee, J.; Yoo, C.-Y. Professors on the Board: Do They Contribute to Society Outside the Classroom? J. Bus. Ethics 2017, 141, 393–409. [Google Scholar] [CrossRef]

- Kong, D.; Liu, B.; Zhu, L. Stem CEOs and firm digitalization. Financ. Res. Lett. 2023, 58, 104573. [Google Scholar] [CrossRef]

- Garcia-Blandon, J.; Argilés-Bosch, J.M.; Ravenda, D. Exploring the relationship between ceo characteristics and performance. J. Bus. Econ. Manag. 2019, 20, 1064–1082. [Google Scholar] [CrossRef]

- Simon, H.A. A Behavioral Model of Rational Choice. Q. J. Econ. 1955, 69, 99–118. [Google Scholar] [CrossRef]

- Hambrick, D.C.; Mason, P.A. Upper echelons: The organization as a reflection of its top managers. Acad. Manag. Rev. 1984, 9, 193–206. [Google Scholar] [CrossRef]

- Ren, S.; Wang, Y.; Hu, Y.; Yan, J. CEO hometown identity and firm green innovation. Bus. Strateg. Environ. 2021, 30, 756–774. [Google Scholar] [CrossRef]

- Ross, S.A. The Determination of Financial Structure: The Incentive-Signalling Approach. Bell J. Econ. 1977, 8, 23–40. [Google Scholar] [CrossRef]

- Connelly, B.L.; Certo, S.T.; Ireland, R.D.; Reutzel, C.R. Signaling Theory: A Review and Assessment. J. Manag. 2011, 37, 39–67. [Google Scholar] [CrossRef]

- Reagans, R.; Zuckerman, E.W. Networks, Diversity, and Productivity: The Social Capital of Corporate R&D Teams. Organ. Sci. 2001, 12, 502–517. [Google Scholar] [CrossRef]

- Barney, J. Firm Resources and Sustained Competitive Advantage. J. Manag. 1991, 17, 99–120. [Google Scholar] [CrossRef]

- Grant, R.M. Toward a Knowledge-Based Theory of the Firm. Strateg. Manag. J. 1996, 17, 109–122. [Google Scholar] [CrossRef]

- Teece, D.J. Explicating Dynamic Capabilities: The Nature and Microfoundations of (Sustainable) Enterprise Performance. Strateg. Manag. J. 2007, 28, 1319–1350. [Google Scholar] [CrossRef]

- Wang, M.; Yu, X.; Hong, X.; Yang, X. Can digital finance promote green innovation collaboration in enterprises? Glob. Financ. J. 2025, 65, 101109. [Google Scholar] [CrossRef]

- Hu, Y.; Jin, S.; Ni, J.; Peng, K.; Zhang, L. Strategic or substantive green innovation: How do non-green firms respond to green credit policy? Econ. Model. 2023, 126, 106451. [Google Scholar] [CrossRef]

- Zhou, P.; Song, F.M.; Huang, X. Environmental regulations and firms’ green innovations: Transforming pressure into incentives. Int. Rev. Financ. Anal. 2023, 86, 102504. [Google Scholar] [CrossRef]

- Liu, J.; Zhao, M.; Wang, Y. Impacts of government subsidies and environmental regulations on green process innovation: A nonlinear approach. Technol. Soc. 2020, 63, 101417. [Google Scholar] [CrossRef]

- Qiao, N.; Xu, B. Green credit policy, media pressure, and corporate green innovation. Int. Rev. Econ. Financ. 2025, 98, 103921. [Google Scholar] [CrossRef]

- Yu, C.-H.; Wu, X.; Zhang, D.; Chen, S.; Zhao, J. Demand for green finance: Resolving financing constraints on green innovation in China. Energy Policy 2021, 153, 112255. [Google Scholar] [CrossRef]

- Liu, X.; Liu, D. How green finance drives new-quality productivity from the perspective of Chinese modernization. Financ. Res. Lett. 2025, 82, 107496. [Google Scholar] [CrossRef]

- Ji, H.; Yu, Z.; Tian, G.; Wang, D.; Wen, Y. Market competition, environmental, social and corporate governance investment, and enterprise green innovation performance. Financ. Res. Lett. 2025, 77, 107057. [Google Scholar] [CrossRef]

- Zhu, Z.; Huang, Y.; Hu, C.; Yan, Y. The green effects of competition: Administrative monopoly regulation and green innovation. Financ. Res. Lett. 2024, 64, 105488. [Google Scholar] [CrossRef]

- Zhang, Z.; Wu, Y.; Wang, H. Corporate financial fragility, R&D investment, and corporate green innovation: Evidence from China. Financ. Res. Lett. 2024, 62, 105190. [Google Scholar] [CrossRef]

- Wu, R. Innovation or imitation? The impacts of financial factors on green and general research and development. Int. Rev. Econ. Financ. 2023, 88, 1068–1086. [Google Scholar] [CrossRef]

- Abbas, J.; Khan, S.M. Green knowledge management and organizational green culture: An interaction for organizational green innovation and green performance. J. Knowl. Manag. 2023, 27, 1852–1870. [Google Scholar] [CrossRef]