Abstract

Metaverse research has as its main focus the technology, neglecting the human factor and, implicitly, how the metaverse user perceives this technology, with its strengths and risks. The main objective of our research is to assess the impact that the metaverse has on accountants and how they perceive the advantages and disadvantages of using digital technologies, including the metaverse, and, as a secondary objective, to identify the factors that lead accountants to accept or reject the conduct of activities in the virtual world. We used an integrated theoretical framework combining the Theory of Planned Behavior (TPB) and the Technology Acceptance Model 3 (TAM 3). Data collected online from a sample of 597 accountants were analyzed using structural equation modeling with partial least squares (PLS-SEM) for evaluating the multiple causal relationships between items of variables. Our findings prove that digital technology does not represent a barrier for members of the accounting community to work in virtual space. However, the deficiency of accounting standards tailored to the specifics of digital technologies does not promote transparency or ensure a high level of safety for members of the accounting community in virtual space.

1. Introduction

According to the latest AICPA 2021 Trends report [1] the number of students specializing in accounting has decreased between 2019 and 2023 (for example, in the 2019–2020 academic year, there was a 2.8% decrease in accounting bachelor’s graduates, an 8.4% decrease in accounting master’s graduates, and a 17% decrease in new CPA Exam candidates). This trend will have a direct and immediate impact on several interested parties; at the forefront are the accounting firms that will face difficulty in hiring specialized accountants, and thus, existing accountants will be subjected to more significant pressures to fulfill the tasks which must fall to them, and secondarily are the companies from the business environment that will no longer benefit from accounting experts. In this context, digital technology can be considered an adjunct to the accounting profession, but digital technology can only partially replace accounting expertise because this profession includes multiple skills, including analytical and critical thinking. Accountants, in order to master and use digital technology effectively, must understand the role and importance of the metaverse in ensuring the accuracy of accounting records, especially virtual transactions.

Brink et al. [1] conducted a survey, and they observed that a career in accounting is associated, on the one hand, with carrying out activities that are monotonous and less interesting than activities carried out in other fields of activity, and on the other hand, with a greater volume of work required to become an accountant compared to other professions, offering fewer opportunities for professional career development. Severini et al. [2], using their social accounting matrix (SAM), disaggregated the labor factor (for example, by formal educational attainment, digital skills, and gender) and observed differences between highly educated and skilled working males (i.e., security and investigation activities and wholesale trade) and females (education and household activities).

In 1992, Neal Stephenson published the science fiction novel Snow Crash [3], in which the term metaverse was used to describe a computer-generated universe that managed an urban environment from an immersive virtual world populated by avatars, thus foreshadowing a tool based on virtual reality as a substitute for the Internet. Zalan and Barbesino [4] (p. 2) mention that as early as 1938, French dramatist Antonin Artaud employed virtual reality (VR) in his essay, and 30 years later, in 1968, the computer scientist Ivan Sutherland improved this concept in the relationship of computer simulation with stereoscopic vision technology. With the evolution of technologies and artificial intelligence, this connection to an artificial world has transformed from a perceptible reality to virtuality.

The structure of the word METAVERSE is a combination of the term META, which in Latin means above and in English has several meanings that emphasize the perception of reality by individuals, such as transcending, beyond, reflexive, introspective, recursive, reflective, analytical, critical, nuanced, or complex [5], and VERSE, which signifies universe.

The COVID-19 pandemic, through the movement restrictions and self-isolation imposed on people, created the premise for developing the metaverse as a manifestation of AI. The development of the metaverse continued, and the post-COVID-19 period sparked the interest of researchers in various fields who studied how to merge the interactive experience of the real world with the experiences of the virtual world using artificial intelligence (AI). In the post-COVID-19 era, many people have not given up some habits acquired during the pandemic, and one of them is to use virtual reality more and more to interact with other people, express their emotions, and carry out their work professionally.

The metaverse as an AI manifestation, taking into account the experiences lived during the pandemic, creates a sense of security for users and offers them the possibility of detaching from the real environment and translating experiences from real life into virtual life by putting a personal stamp on these experiences. Furthermore, users are suspicious of data security and privacy in the metaverse environment [6,7].

The arguments in favor of the metaverse and which we can consider to be the result of the pandemic are the following: independence of movement in the virtual world, flexibility of work schedules, control of emotions, and the translation of some elements from real life into the virtual world, which translates into an augmented reality. Arguments against the excessive use of the metaverse include creating a dependency on the virtual world and losing contact with the real world, security issues, and suspicions regarding data privacy.

Our research focused on the Clarivate Web of Science (WoS) database core collection due to its vast collection of peer-reviewed publications and the possibility of easy data mining based on selected keywords. The data collection was performed in October 2023 using the main terms of our research, “Metaverse” and “Accounting,” with a selection of English publications. Because “Metaverse” is a new term, the selected period was 2015–2023, and we used this period in all variations of our searches. The resulting data were visualized using VosViewer (Visualization of Similarities) [8].

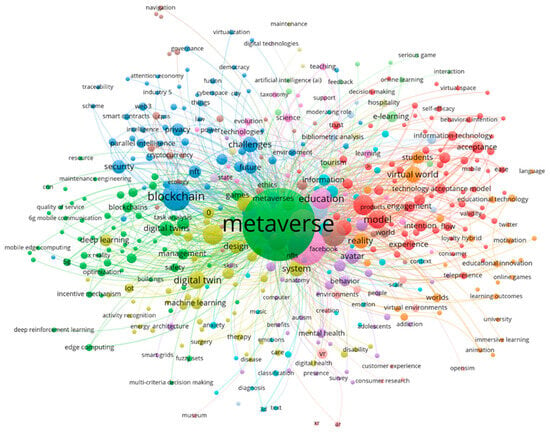

The search for “metavers*” produced 1717 results, including 1208 articles, 343 proceeding papers, 138 review articles, and 32 book chapters, gathering 444 keywords organized in 14 clusters (Figure 1).

Figure 1.

VosViewer visualization of “metavers*” search results from WoS core collection. Source: Authors using the VosViewer platform.

Dwivedi et al. [9] (p. 16) conducted a comprehensive analysis of the potential of the metaverse from a multi-perspective approach from experts and defined the metaverse “as a fully immersive three-dimensional environment able to integrate either physical or virtual worlds…”.

Our research starts from the idea that accountants must be aware and motivated to use AI, but for this, we must identify the factors that contribute to accountants plunging into the metaverse and the factors that represent a barrier to the decision-making process in virtual space [10]. In this framework, our research fills the gap in both accounting and metaverse literature and practice related to the accounting community because we adopted a complementary approach from accountants to the metaverse virtual environment. Our research represents one of the first studies placing accountants’ intention and perceived behavioral control as analysis factors concerning their acceptance of the metaverse environment. This research extends the existing TPB and TAM3 theories by introducing gender and age as moderators between the main variables of the construct. Incorporating the gender and age constructs is helpful concerning the difference between Millennials and Generation Z and as predictors for Generation Alpha. Therefore, our research argues for empirical studies concerning metaverse adoption by the accounting community.

2. Literature Review: The Relationship between the Metaverse and the Accounting Community

2.1. Metaverse: A Controversial Technology for Improving the Professional Lives of the Accounting Community

The accounting profession represents a field that involves measuring, processing, analyzing, interpreting, and communicating financial information about economic entities. Therefore, accountants are vital in helping organizations manage their financial resources, make informed business decisions, and meet legal and regulatory requirements [11].

The digitization of the accounting profession refers to integrating technology and digital tools into various accounting processes and practices, encompassing software applications, automation, data analytics, cloud computing, and other technological advances to streamline accounting tasks, improve accuracy, increase efficiency, and provide real-time financial information [12]. Cloud-based accounting software allows accountants and organizations to access financial data, perform accounting tasks, and generate financial reports from any location with an Internet connection because these platforms offer features such as online invoicing, expense tracking, bank reconciliation, and integration with other business systems. Cloud accounting software enables real-time collaboration and data synchronization, reducing the need for manual data entry and improving data accuracy.

Digitization automates routine accounting tasks such as data entry, invoice processing, and bank reconciliation through robotic process automation (RPA) and artificial intelligence (AI). Automation reduces manual errors, speeds up processes, and frees up time for accountants to focus on more strategic and analytical activities. Digital tools and software allow accountants to analyze large volumes of financial data quickly. Data analysis techniques, including trend analysis, predictive modeling, and anomaly detection, help identify patterns, insights, and potential risks. Moreover, business intelligence tools provide visualizations and dashboards that improve decision making by presenting financial data clearly and meaningfully. In this context, a challenge for today’s accountants is to use the virtual experience offered by the metaverse with all the advantages derived from this experience.

Ferri et al. [13] analyzed the factors that influence auditors to use digital technologies and blockchain, and they observed that performance expectation, social influence, and expectation of auditors’ efforts about the implementation and use of this technology influence auditors’ intention to use blockchain.

The metaverse provides users with a timeless virtual experience, where the distinction between the real and virtual worlds is imperceptible, transforming the real work environment into a virtual work environment where users experience various sensations and emotions. In metaverses, virtual communities can be built and developed. Thus, users become an integrated part of this community without restricting their freedom to be members of several virtual communities simultaneously, and this is considered an advantage of the metaverse because it allows the user to be accepted and leave specific virtual communities without constraints and predetermined contractual or pre-contractual relationships.

As a result of previous scientific arguments, we elaborated the following hypothesis.

H1:

The interaction of the accountants in the metaverse directly influences their intention to work in this environment (IM -> IWM).

2.2. Metaverse: A Point of Contact for the Accounting Community with Virtuality

The challenges launched by digital technologies for accounting took accounting communities by surprise because they were not prepared with accounting methods to assess the virtual and uncertain potential of some assets (i.e., the accurate market value of cryptocurrencies [14] due to the large fluctuations it registers in a short period cannot be determined for accounting purposes at any time). This challenge demonstrates that many fields of activity still need to be fully prepared to move from the real world to the virtual world and that successive steps are needed to prepare the human resources in parallel and the methods and techniques specific to the field.

The metaverse in accounting implies the emergence of new approaches and paradigms regarding the elements and instruments of traditional accounting, considering their intangible nature [15]. Starting from the metaverse’s challenges for accounting and research in the field, we noticed a gap in research and practice regarding the behavior of the human factor (the accountant). Therefore, using the TPB, we identified the factors contributing to strengthening the relationship between the real and virtual worlds (the metaverse) in the accounting field. The lack of standardization and regulation of the activities carried out in virtual economies allows companies to resort to unethical practices and not accurately report the assets, virtual transactions, and income obtained in the virtual space [16].

Our analysis oriented us to formulate the following hypothesis:

H2:

The interaction of the accountants in the metaverse directly influences the perceived utility of working in this environment (IM -> PUM).

2.3. The Opportunities and Vulnerabilities of the Metaverse Perceived by the Accounting Community

In the metaverse, immersive and interconnected digital spaces favor easy interaction between users in virtual reality as organizations seek to gain a competitive advantage by reducing costs, attracting and retaining talent, creating flexible career plans, and promoting sustainable business. Therefore, the metaverse represents an opportunity to implement organizational change and effectively manage its transformation.

How managers manage the metaverse has profound implications for the organization’s employees and other stakeholders (i.e., customers and suppliers), which is a challenge that needs to be managed considering both the strengths and risks those digital technologies generate, and reduces the potential for using the metaverse [17].

Gil-Cordero et al. [18] conducted valuable research on the factors that determined the intentions of 182 Spanish small and medium-sized enterprises (SMEs) to adopt the metaverse and observed that the intention of business behavior is influenced by business satisfaction, which has the potential to reduce uncertainty in a virtual environment. Therefore, the relationship between intention and uncertainty in the metaverse can be mediated by satisfaction.

Researchers underline the relationship between intention and perceived behavioral control, especially in virtual environments [19,20].

Dwivedi et al. [9] affirm that vulnerabilities in the virtual world are negatively reflected in the perception of users in the physical world. In this context, the safety and security of the metaverse are elements that influence the perceived behavioral control in the metaverse and considerably reduce the intention of accountants to work in this environment.

Therefore, we elaborated the following hypothesis:

H3:

The intention of accountants to work in the metaverse directly influences the perceived behavioral control in this environment (IWM -> PBCM).

2.4. The Perceived Utility of the Metaverse by the Accounting Community

Accounting in the metaverse becomes increasingly complicated because, in some cases, it is difficult to determine income distribution in transactions where the parties involved are not clearly stated or when the transaction involves intermediaries. In the metaverse, it is not easy to account for income, even if there are standards for some activities (The Accounting Standards Codification (ASC) 606) [21]. Tafon et al. [22], analyzing the critical success factors of the implementation of The Accounting Standards Codification (ASC) 606, observed that organizations report the values of virtual assets differently, which complicates actual values but also the moment when the user obtains control over the asset. These particularities generated by virtual transactions represent a challenge for accounting that requires adapting accounting standards.

H4:

The perceived utility of working in the metaverse directly influences the intention of accountants to work in this environment (PUM -> IWM).

H5:

The perceived utility of working in the metaverse directly influences the perceived behavioral control in this environment (PUM -> PBCM).

2.5. The Gender and Age of the Accountants as Moderators of Activity in the Metaverse

The literature is not rich in studies related to the impact of gender and age of accountants on acceptance of the metaverse environment by the accounting community. Kokina and Davenport [23] started from the premise that the experience at the beginning of an accounting career influences the acceptance of artificial intelligence as an integrated tool of new entry-level accountants’ activity. Accountants over 50 years old are afraid that new technology will become their enemy and the friend of younger accountants who will replace them [24].

McKinsey’s report [25] evaluated the emergence of the metaverse and the metaverse’s value-creation potential and total investment landscape and observed differences in metaverse activities between genders. Considering the gap in the literature and practice, we elaborated the following hypotheses:

H6:

Gender moderates the relationship between the intention of accountants to work in the metaverse and the perceived utility of working in this environment (Gender x IWM -> PUM).

H7:

Age moderates the relationship between the interaction of the accountants in the metaverse and their intention to work in this environment (Age x IM -> IWM).

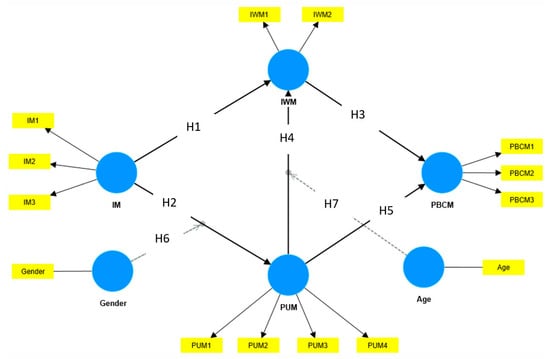

As a result of the literature, we elaborated the Metaverse Accountants’ Behavior (MAB) research model (Figure 2).

Figure 2.

The theoretical Metaverse Accountants’ Behavior (MAB) model. Source: Authors.

In the Table 1, we present a logical evolution of the position of intention from TPB [26] and TAM3 [27] up to the MAB model.

Table 1.

The evolution of the factors influencing users’ behavior from the real world to virtual reality.

3. Methodology

We used an integrated theoretical framework combining the Theory of Planned Behavior (TPB) and the Technology Acceptance Model 3 (TAM 3) [28]. Our research was directed at members of the accounting community to assess how virtual reality in the metaverse is attractive to accountants. The developed questionnaire was administered online between 15 April and 30 June 2023. Of the 618 questionnaires received, 597 were valid with all answers completed. The questionnaire was pretested on 82 accountants to eliminate items that were irrelevant to the research objective and keep items that were important to the accounting community.

Of the 597 final respondents, 266 (44.6%) were male and 331 (53.4%) were female. In terms of age, the majority group is represented by accountants from the 18–30 years segment (47.9%), followed by the age groups between 31 and 40 years (27.3%), between 41 and 50 years (9.7%), respondents aged between 51 and 60 years (8.9%) and respondents over 60 years (6.2%).

Instruments were developed from the existing literature using a five-point Likert scale (1 = strongly disagree; 5 = strongly agree). Items measuring the intention of accountants to work in the metaverse (IWM) were adapted from Ferri et al. [13] and Anderson et al. [29] (IWM1: I am so familiar with virtual reality that I want to work on metaverse rather than real life; IWM2: I intend to use virtual reality for my accounting activities); items for perceived behavioral control in the metaverse (PBCM) were adapted from Albayati et al. [30] (PBCM1: I am confident that I can get involved in carrying out accounting activities in the metaverse; PBCM2: I can control the quality of accounting activities in the metaverse; and PBCM3: I can engage in accounting activities in the metaverse); items for the perceived utility of working in the metaverse (PUM) were adapted from Anderson et al. [29] (PUM1: Metaverse improves the results of my activity; PUM2: Carrying out the activity in the metaverse determines the faster completion of my tasks; PUM3: Working in the metaverse increases my productivity; and PUM4: The metaverse enhances my effectiveness on the job); and the items for Interaction in the Metaverse (IM) are our creation (IM1: I am sure that working in the metaverse develops teamwork skills; IM2: I am confident that working in the metaverse develops my communication skills in the virtual environment; and IM3: Metaverse facilitates supportive interactions between users).

Many researchers [31,32,33] have analyzed and compared the Partial Least Squares Structural Equation Modeling (PLS-SEM) and Covariance-Based Structural Equation Modeling (CB-SEM) methods, underlining the similarities and differences between both methods. Therefore, for our exploratory research, considering our composite-based model and relying on bootstrapping to obtain estimates of the standard errors of our model parameters, we have employed PLS-SEM by utilizing SmartPLS (version 4.0).

4. Results

We evaluated the internal consistency reliability, convergent validity, and discriminant validity of the constructs and VIF (Table 2).

Table 2.

Statistical values of the variables.

We observed that the value of the loadings ranged from 0.739 to 0.927, more significant than the threshold value of 0.700, and the values of Cronbach’s alpha and composite reliability (CR) all exceeded 0.70, indicating sufficient construct reliability [32]. The average variance extracted (AVE) values are between 0.703 and 0.809. Consequently, the convergent validity is building up.

The next stage was dedicated to the evaluation of the discriminant validity. We analyzed the heterotrait–monotrait ratio of correlations (HTMT), and we observed that we have no problems related to discriminant validity because the highest value of the HTMT is 0.282 below the threshold (0.85) recommended by Henseler et al. [34].

The standardized root mean residual (SRMR) was 0.052, lower than the stipulated criterion of 0.08, and the normed fit index (NFI) was 0.910, above the value recommended 0.9; these two indicators prove a good model fit [34].

The model does not show multicollinearity issues because the variance inflation factor (VIF) values were less than 3.3 [35].

Table 3 shows the validation or invalidations of hypotheses, the relationships between gender and perceived utility of working in the metaverse, and the relationships between age and accountants’ intention to work in the metaverse.

Table 3.

Hypotheses testing and other direct relationships.

Analyzing Table 3, we observe that only H1 and H6 are not validated.

5. Discussion

The accounting profession is subject to continuous challenges generated by legislative changes imposed by the evolution of digital technology at the national and international levels. In this context, metaverses create real opportunities for accountants to transform their profession into one that is dynamic and full of surprises that accountants experience in virtual reality.

How accountants capitalize on metaverse opportunities and overcome metaverse challenges depends on the level of metaverse development and aspects such as realism, ubiquity, interoperability, and scalability [36].

Our findings prove that the interaction of the accountants in the metaverse does not influence their intention to work in this environment (H1 is not approved). Therefore, the intention of accountants to use virtual reality to accomplish their tasks is not influenced by the presence of other people because they are familiar with virtual reality and consider that working in the metaverse develops both teamwork skills and individual communication skills in the virtual environment [37]. Moreover, Al-Gnbri [38] is concerned with the possibility that in the metaverse, the lack of direct interaction between accountants may lead to a degradation of the accounting profession, and regardless of the level of technology development, it will not be possible to replace the feelings and emotions of the real world.

Park and Kim [39] underline the importance of the interaction of users in the metaverse by mentioning that user participation in this environment is increased by providing a third-person view rather than a first-person spectator mode. Therefore, the role of the non-player character (NPC) is changing continuously to increase the realism of actions and contribute to developing the intelligent behavior of accountants to meet the other users’ expectations [40].

As a relevant consequence of the findings related to hypothesis 1, the interaction of the accountants in the metaverse underlines the perceived utility of working in this environment. In this framework, the accountants affirm that virtual reality positively impacts their activities, increasing productivity and determining the faster completion of tasks (H2 is approved).

Respondents mentioned that technical difficulties are not a relevant factor for the acceptance of the metaverse because, thanks to their computer skills, they can overcome these problems quickly. Instead, the lack of accounting standards specific to the virtual space, security, and data are complex challenges to overcome in virtual space. Therefore, respondents noted a need to develop digital impact assessment tools that underpin accounting practices conducted in the metaverse, especially in the accounting industry (H3 is approved). Our findings are also supported by Abumalloh et al. [41], who observed that users consider the metaverse vulnerable to security threats. For this reason, it is necessary to employ strong security measures to diminish the risks associated with implementing the metaverse.

The relationship between personal and professional skills development contributes to improving the accountants’ intention to work in the metaverse based on the perceived utility of working in this environment and the possibility of reproducing some aspects of real life in a virtual space (H4 is approved).

The respondents fear that their actions in the metaverse may have consequences in the real world, and privacy is one of the respondents’ most significant concerns related to the metaverse (H5 is approved). Our findings agree with Clark [42], which is considered an advantage of the second life is the possibility of the users finding solutions to some problems in real time through interactive activities. Therefore, accounting firms can use the metaverse to acquire new clients and communicate with existing ones in real time by creating an immersive and engaging virtual office in parallel with developing accounting standards tailored to the specifics of digital technologies and ensuring transparency in the virtual space by holding all stakeholders accountable.

Our findings align with the findings of Kyung and Ji [43], who concluded that perceived usefulness had a significant impact on the intention of accountants to work in a metaverse environment. An [44] also observed that perceived usefulness is one factor that positively influences the acceptance of technology.

Gender and age were two variables that we employed to analyze some relationships with other variables, and we arrived at the following conclusions. Gender does not moderate the relationship between the intention of accountants to work in the metaverse and the perceived utility of working in this environment (H6 is not approved). This finding has many explanations. One explanation is the low differences between the gender of the respondents (8.8% more male than female), and the other is related to a continuous diminution in the difference between males and females related to acceptance of technology [45].

Instead, age moderates the relationship between the interaction of the accountants in the metaverse and their intention to work in this environment (H7 is approved). This finding is motivated by the presence of 449 accountants between 18 and 40 years old, preponderantly from Generation Z (47.9%).

We identified two other direct relationships. Gender directly influences the perceived utility of working in the metaverse, and age directly influences the intention of accountants to work in the metaverse.

Our findings confirm the findings of Pan and Seow [46] on how reviewing articles published between 2004 and 2014 based on IT skills among accounting professionals concluded that accountants should prove advanced knowledge of digital tools in the future. Moreover, accountants should acquire digital skills at university, so curricula should contain courses dedicated to accountants considering the particularities of this profession [47,48]. The financial accounting metaverse is an area that requires increased attention because, very shortly, most transactions will move into the metaverse and launch many challenges for accountants.

The theoretical implications of our research consist of how several theories have been brought together to create a model for evaluating metaverse users from a professional point of view, a model that will be improved as new challenges arise from the virtual world and new opportunities in the real world. Through our research, we have contributed to the development of both the accounting literature and the metaverse literature through an approach from the point of view of the accounting community. Some authors [24,38] believe that the relationships between the members of the accounting community, especially in the virtual environment, are subject to transformations that are not in favor of the accounting profession because one of the particularities that give it attractiveness of this profession is face-to-face communication through which real-world emotions are highlighted. Our analysis led to the exploration of the following thematic areas that are insufficiently debated in the literature: (1) the optimistic future of accounting in the virtual world of the metaverse; (2) the impact of the challenges related to the ethics and security of the metaverse on the perceived behavioral control of the accounting community in this environment; (3) there is a considerable reduction in gender differences in the metaverse environment because gender influences the perceived utility of working in this environment but does not moderate the relationship between the intention of accountants to work in the metaverse and the perceived utility of working in this environment; and (4) age remains a variable that constantly influences both the relationship between the interaction of the accountants in the metaverse and their intention to work in this environment.

In the virtual world, digital technology is an ingredient that transforms the accounting profession from monotonous to one that has to face multiple challenges that make the accountant a professional with informational skills. These skills will give the accountant greater professional flexibility and more opportunities for career development. Pandey and Gilmour [49] noted that transactions in the metaverse have no regulatory framework and are subject to multiple jurisdictions, making it difficult to account for and tax revenues from these virtual transactions.

The practical implications of the research consist of how to interpret the results because most of the highlighted aspects are faced not only by users from the accounting industry but also by users of metaverses from other organizations, such as public organizations, financial organizations, organizations from the tourism industry, and those in the field of health [50].

Moreover, virtual spaces enhance the feeling of face-to-face assistance with a high degree of immersion. However, on the other hand, it can lead to creating a feeling of insecurity, especially for introverted users or those who are very attentive to details, because any deficiency manifested in the virtual space, either related to technology or related to communication and information, can generate an aversion of users towards metaverses, which will translate into the isolation of users from the virtual community in which the deficiency occurred. Our recommendation is to develop accounting standards tailored to the specifics of digital technologies and to ensure transparency in the virtual space by holding all stakeholders accountable. A breach in the management of virtual assets can lead to an undervaluation of the metaverse generated by the lack of confidence of investors and other stakeholders in the real potential of digital technologies.

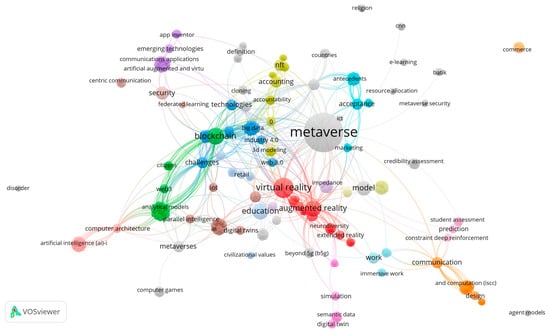

Finally, the novelty of our approach was confirmed by the results obtained by our search on the combination of the two terms, “metavers*” AND “account*”, for the same period, 2015–2023. Only 59 papers were found, including 47 articles, seven proceeding papers, five review articles, and only one book chapter, with 389 keywords (Figure 3).

Figure 3.

VosViewer visualization of “metavers*” AND “account*” search results from WoS core collection. Source: Authors using the VosViewer platform.

By sorting these 389 keywords based on the number of occurrences and total link strength, we observe that “metaverse” is in the top position, “accounting” is in the 16th position, and “accountability” is only in the 235th position. We have chosen the Web of Science (WoS) Core Collection as a tool for identifying relevant sources because this platform is considered to be an essential search platform for analytical information used in research activity in various scientific fields because it includes the set of data which they use to query the database [51].

In the articles identified through our research, the potential of the metaverse to redefine, together with blockchain and virtual reality, the design of activities in numerous fields, including accounting, with positive effects on the efficiency of the results obtained is emphasized [52,53,54]. Along with the growth of globalization, the appearance of more efficient and reliable systems of evidence throughout the supply–production–sale chain is required, considering the increasing demands for responsibility and transparency [55]. Current research increasingly highlights the positive impact that the metaverse could have on the economy, public services, access to information and education, financial accounting services, entertainment, and creativity [56].

6. Conclusions

The metaverse is being perceived more and more as a strategic opportunity for sustainable business. Organizations are forced to adapt to new changes imposed by generative AI and integration into a virtual reality that is increasingly present in people’s daily lives. Therefore, the metaverse is a three-dimensional virtual space that allows users to connect and interact professionally and personally, their lives falling into an undefined paradigm in time but, above all, space. Physical and intellectual experiences tend to become captive in a virtual reality that converges to stratify organizations and individuals by levels of understanding and influence according to their ability to drop into the metaverse [57].

Managerial actions must be oriented towards transposing reality into the virtual world to develop the most effective strategies that place the organization on a higher level than other companies. The metaverse eases the decision-making process by providing real-time data to managers, reducing their cognitive pressure, and creating a sense of security. Through collaborative and interoperable technologies, the metaverse offers organizations a virtual space that leads to a decongestion of physical space, offering greater freedom of movement to employees.

An accountant can create an avatar in the metaverse expressing their personality and facilitating communication and collaboration with colleagues at various levels. The moment they connect to virtual reality, the accountants disconnect entirely from their real environment and can experience emotional intelligence and freedom of movement in the virtual space, creating a feeling of safety and unconditional acceptance for the user [58].

Future research will be oriented to digital twins as an integral part of the metaverse because they can replicate reality continuously and in real time, leading to increased productivity by connecting activities from the real environment, in the mirror, to the virtual environment in different headquarters of the same organization, which stimulates the creation and development of virtual teams. Ferrigno et al. [59] (p. 351) identified four elements of value creation in the metaverse, as follows: “(1) value creation enablers, (2) digital resources for value creation, (3) motives for value creation and (4) value creation practices.” Our future research will be oriented toward verifying the relationship between value creation and sustainable development in the metaverse environment. Virtual reality will be, more and more, part of our daily life, both professionally and personally. Therefore, it is necessary not only to adapt the existing acceptance models of technology but also to create a new acceptance model of technology based on the particularities of every profession (i.e., accountants, engineers, medics, lawyers, etc.). Future research will be oriented toward developing a universal acceptance model and customizing existing models so that users feel comfortable in the metaverse.

Author Contributions

Conceptualization, A.B.-S. and N.P.; methodology, A.B.-S.; software, A.B.-S.; validation, A.B.-S., N.P. and N.G.P.; formal analysis, N.P.; investigation, A.B.-S., N.P. and N.G.P.; data curation, A.B.-S.; writing—original draft preparation, A.B.-S., N.P. and N.G.P.; writing—review and editing, A.B.-S., N.P. and N.G.P.; visualization, A.B.-S.; supervision, A.B.-S.; project administration, A.B.-S. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

The data will be available on request to the corresponding author.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Brink, W.; Eaton, T.V.; Heitger, D. How Students View the Accounting Profession. Journal of Accountancy. 2023. Available online: https://www.journalofaccountancy.com/issues/2023/jun/how-students-view-the-accounting-profession.html (accessed on 10 July 2023).

- Severini, F.; Pretaroli, R.; Socci, C.; Zotti, J.; Infantino, G. The suggested structure of final demand shock for sectoral labour digital skills. Econ. Syst. Res. 2020, 32, 502–520. [Google Scholar] [CrossRef]

- Stephenson, N. Snow Crash; Bantam Books: New York, NY, USA, 1992. [Google Scholar]

- Zalan, T.; Barbesino, P. Making the metaverse real. Digit. Bus. 2023, 3, 100059. [Google Scholar] [CrossRef]

- Thesaurus.net. Available online: https://www.thesaurus.net/meta (accessed on 12 July 2023).

- Chen, Z. Metaverse office: Exploring future teleworking model. Kybernetes 2023. [Google Scholar] [CrossRef]

- Kerdvibulvech, C. Digital Human Emotion Modeling Application Using Metaverse Technology in the Post-COVID-19 Era. In Digital Human Modeling and Applications in Health, Safety, Ergonomics and Risk Management. HCII 2023. Lecture Notes in Computer Science; Duffy, V.G., Ed.; Springer: Cham, Switzerland, 2023; Volume 14029. [Google Scholar] [CrossRef]

- Van Eck, N.J.; Waltman, L. VOSviewer Manual. Manual for VOSviewer Version 1.6.10. 2019. Available online: https://www.vosviewer.com/documentation/Manual_VOSviewer_1.6.10.pdf (accessed on 15 October 2023).

- Dwivedi, Y.K.; Hughes, L.; Baabdullah, A.M.; Ribeiro-Navarrete, S.; Giannakis, M.; Al-Debei, M.M.; Dennehy, D.; Metri, B.; Buhalis, D.; Cheung, C.M.; et al. Metaverse beyond the hype: Multidisciplinary perspectives on emerging challenges, opportunities, and agenda for research, practice and policy. Int. J. Inf. Manag. 2022, 66, 102542. [Google Scholar] [CrossRef]

- Vogel, S. How Virtual Reality Can Help Accountants with CPD. Institute of Chartered Accountants in England and Wales. 2021. Available online: https://www.icaew.com/insights/viewpoints-on-the-news/2020/aug-2020/how-virtual-reality-can-help-accountants-with-cpd (accessed on 12 June 2023).

- Burlea-Schiopoiu, A.; Remme, J. The Dangers of Dispersal of Responsibilities. Amfiteatru Econ. 2017, 19, 464–476. [Google Scholar]

- Alshaikh, M.A. The Impact of Accounting Information on Stock Returns–Integrative Literature Review. Asia-Pac. J. Manag. Technol. 2022, 3, 13–20. [Google Scholar] [CrossRef]

- Ferri, L.; Spanò, R.; Ginesti, G.; Theodosopoulos, G. Ascertaining auditors’ intentions to use blockchain technology: Evidence from the Big 4 accountancy firms in Italy. Meditari Account. Res. 2021, 29, 1063–1087. [Google Scholar] [CrossRef]

- Ruan, K. Digital Asset Valuation and Cyber Risk Measurement: Principles of Cybernomics; Academic Press: London, UK, 2019. [Google Scholar]

- Zadorozhnyi, Z.M.; Muravskyi, V.; Humenna-Derij, M.; Zarudna, N. Innovative Accounting and Audit of the Metaverse Resources, Marketing and Management of Innovations. 2022. Available online: https://dev-mmi.sumdu.edu.ua/wp-content/uploads/2023/01/A653-2022-02_Zadorozhnyi_et_al.pdf (accessed on 12 July 2023).

- Deloitte. The Metaverse: Accounting Considerations Related to Nonfungible Tokens. 2022. Available online: https://dart.deloitte.com/USDART/home/publications/deloitte/accounting-spotlight/2022/metaverse-accounting-considerations (accessed on 16 July 2023).

- Burlea-Schiopoiu, A.; Borcan, I.; Dragan, C.O. The Impact of the COVID-19 Crisis on the Digital Transformation of Organizations. Electronics 2023, 12, 1205. [Google Scholar] [CrossRef]

- Gil-Cordero, E.; Maldonado-López, B.; Ledesma-Chaves, P.; García-Guzmán, A. Do small- and medium-sized companies intend to use the Metaverse as part of their strategy? A behavioral intention analysis. Int. J. Entrep. Behav. Res. 2023. [Google Scholar] [CrossRef]

- Aburbeian, A.M.; Owda, A.Y.; Owda, M. A Technology Acceptance Model Survey of the Metaverse Prospects. AI 2022, 3, 285–302. [Google Scholar] [CrossRef]

- Gansser, O.A.; Reich, C.S. A new acceptance model for artificial intelligence with extensions to UTAUT2: An empirical study in three segments of application. Technol. Soc. 2021, 65, 101535. [Google Scholar] [CrossRef]

- Stripe. The ASC 606 How-To Guide: Revenue Recognition in Five Steps. Last Updated 26 April 2023. Available online: https://stripe.com/en-ro/resources/more/asc-606-how-to-guide (accessed on 11 June 2023).

- Tafon, C.; Sullivan, G.; Self, S.; Sullivan, A. Implementation Critical Success Factors and Accounting Standard Codification Topic 606 Implementation Dynamics: A Correlational Study. J. Account. Financ. 2022, 22, 1–34. [Google Scholar] [CrossRef]

- Kokina, J.; Davenport, T.H. The Emergence of Artificial Intelligence: How Automation is Changing Auditing. J. Emerg. Technol. Account. 2017, 14, 115–122. [Google Scholar] [CrossRef]

- Kruskopf, S.; Lobbas, C.; Meinander, H.; Söderling, K.; Martikainen, M.; Lehner, O. Digital Accounting and the Human Factor: Theory and Practice. ACRN J. Financ. Risk Perspect. 2020, 9, 78–89. [Google Scholar] [CrossRef]

- McKinsey. Value Creation in the Metaverse. The Real Business of the Virtual World. 2020. Available online: https://www.mckinsey.com/~/media/mckinsey/business%20functions/marketing%20and%20sales/our%20insights/value%20creation%20in%20the%20metaverse/Value-creation-in-the-metaverse.pdf (accessed on 12 July 2023).

- Ajzen, I. The theory of planned behavior. Org. Behav. Hum. Decis. Process. 1991, 50, 179–211. [Google Scholar] [CrossRef]

- Venkatesh, V.; Bala, H. Technology Acceptance Model 3 and a Research Agenda on Interventions. Decis. Sci. 2008, 39, 273–315. [Google Scholar] [CrossRef]

- Davis, F.D. Perceived Usefulness, Perceived Ease of Use, and User Acceptance of Information Technology. MIS Q. 1989, 13, 319–340. [Google Scholar] [CrossRef]

- Anderson, C.S.; Al-Gahtani, S.; Hubona, G. The Value of TAM Antecedents in Global IS Development and Research. J. Organ. End User Comput. 2011, 23, 18–37. [Google Scholar] [CrossRef]

- Albayati, H.; Alistarbadi, N.; Rho, J.J. Assessing engagement decisions in NFT Metaverse based on the Theory of Planned Behavior (TPB). Telemat. Inform. Rep. 2023, 10, 100045. [Google Scholar] [CrossRef]

- Dash, G.; Paul, J. CB-SEM vs PLS-SEM methods for research in social sciences and technology forecasting. Technol. Forecast. Soc. Chang. 2021, 173, 121092. [Google Scholar] [CrossRef]

- Hair, J.F.; Hult, G.T.M.; Ringle, C.; Sarstedt, M. A Primer on Partial Least Squares Structural Equation Modeling (PLS-SEM), 3rd ed.; Sage: Thousand Oaks, CA, USA, 2022. [Google Scholar]

- Rigdon, E.E.; Sarstedt, M.; Ringle, C.M. On Comparing Results from CB-SEM and PLS-SEM: Five Perspectives and Five Recommendations. ZFP–J. Res. Manag. 2017, 39, 4–16. [Google Scholar] [CrossRef]

- Henseler, J.; Ringle, C.M.; Sarstedt, M. A new criterion for assessing discriminant validity in variance-based structural equation modeling. J. Acad. Mark. Sci. 2015, 43, 115–135. [Google Scholar] [CrossRef]

- Kock, N.; Lynn, G.S. Stevens Institute of Technology Lateral Collinearity and Misleading Results in Variance-Based SEM: An Illustration and Recommendations. J. Assoc. Inf. Syst. 2012, 13, 546–580. [Google Scholar] [CrossRef]

- Dionisio, J.D.N.; Burns, W.G., III; Gilbert, R. 3D Virtual worlds and the metaverse: Current status and future possibilities. ACM Comput. Surv. 2013, 45, 1–38. [Google Scholar] [CrossRef]

- Burlea-Schiopoiu, A. Success Factors for an Information Systems Projects Team Creating New Context. In Proceedings of the 11th International-Business-Information-Management-Association Conference. Innovation and Knowledge Management in Twin Track Economies: Challenges & Solutions, Cairo, Egypt, 4–6 January 2009; Volume 1–3, pp. 936–941. [Google Scholar]

- Al-Gnbri, M.K.A. Accounting and auditing in the metaverse world from a virtual reality perspective: A future research. J. Metaverse 2022, 2, 29–41. [Google Scholar]

- Park, S.-M.; Kim, Y.-G. A Metaverse: Taxonomy, Components, Applications, and Open Challenges. IEEE Access 2022, 10, 4209–4251. [Google Scholar] [CrossRef]

- Lee, L.-H.; Braud, T.; Zhou, P.; Wang, L.; Xu, D.; Lin, Z.; Kumar, A.; Bermejo, C.; Hui, P. All One Needs to Know about Metaverse: A Complete Survey on Technological Singularity, Virtual Ecosystem, and Research Agenda. arXiv 2021, arXiv:2110.05352. [Google Scholar] [CrossRef]

- Abumalloh, R.A.; Nilashi, M.; Ooi, K.B.; Wei-Han, G.; Cham, T.-H.; Dwivedi, Y.K.; Hughes, L. The adoption of metaverse in the retail industry and its impact on sustainable competitive advantage: Moderating impact of sustainability commitment. Ann. Oper. Res. 2023, 1–42. [Google Scholar] [CrossRef]

- Clark, M.A. Genome Island: A virtual science environment in second life. Innov. J. Online Educ. 2009, 5, 1–6. [Google Scholar]

- Kyung, P.S.; Ji, K.Y. A Study on the intentions of early users of metaverse platforms using the Technology Acceptance Model. J. Digit. Converg. 2021, 19, 275–285. [Google Scholar]

- An, J. Technology acceptance and influencing factor of anatomy learning using augmented reality: Usability based on the technology acceptance model. J. Korea Converg. Soc. 2019, 10, 487–494. [Google Scholar] [CrossRef]

- Awang, Y.; Taib, A.; Shuhidan, S.M.; Zakaria, Z.N.Z.; Ifada, L.M.; Sulistyowati, S. Mapping between Digital Competencies and Digitalization of the Accounting Profession among Postgraduate Accounting Students. Asian J. Univ. Educ. 2023, 19, 83–94. [Google Scholar] [CrossRef]

- Pan, G.; Seow, P.-S. Preparing accounting graduates for digital revolution: A critical review of information technology competencies and skills development. J. Educ. Bus. 2016, 91, 166–175. [Google Scholar] [CrossRef]

- Gonçalves, M.J.A.; da Silva, A.C.F.; Ferreira, C.G. The Future of Accounting: How Will Digital Transformation Impact the Sector? Informatics 2022, 9, 19. [Google Scholar] [CrossRef]

- Quattrone, P. Management accounting goes digital: Will the move make it wiser? Manag. Account. Res. 2016, 31, 118–122. [Google Scholar] [CrossRef]

- Pandey, D.; Gilmour, P. Accounting meets metaverse: Navigating the intersection between the real and virtual worlds. J. Financ. Rep. Account. 2023. [Google Scholar] [CrossRef]

- Grossi, G.; Biancone, P.P.; Secinaro, S.; Brescia, V. Dialogic accounting through popular reporting and digital platforms. Meditari Account. Res. 2021, 29, 75–93. [Google Scholar] [CrossRef]

- Li, K.; Rollins, J.; Yan, E. Web of Science use in published research and review papers 1997–2017: A selective, dynamic, cross-domain, content-based analysis. Scientometrics 2017, 115, 1–20. [Google Scholar] [CrossRef]

- Allam, Z.; Sharifi, A.; Bibri, S.E.; Jones, D.S.; Krogstie, J. The Metaverse as a Virtual Form of Smart Cities: Opportunities and Challenges for Environmental, Economic, and Social Sustainability in Urban Futures. Smart Cities 2022, 5, 771–801. [Google Scholar] [CrossRef]

- Nakavachara, V.; Saengchote, K. Does unit of account affect willingness to pay? Evidence from metaverse LAND transactions. Finance Res. Lett. 2022, 49, 103089. [Google Scholar] [CrossRef]

- Spanò, R.; Massaro, M.; Ferri, L.; Dumay, J.; Schmitz, J. Blockchain in accounting, accountability and assurance: An overview. Account. Audit. Account. J. 2022, 35, 1493–1506. [Google Scholar] [CrossRef]

- Ellahi, R.M.; Wood, L.C.; Bekhit, A.E.-D.A. Blockchain-Based Frameworks for Food Traceability: A Systematic Review. Foods 2023, 12, 3026. [Google Scholar] [CrossRef] [PubMed]

- Naqvi, N. Metaverse for Public Good: Embracing the Societal Impact of Metaverse Economies. J. Br. Blockchain Assoc. 2023, 6, 1–17. [Google Scholar] [CrossRef] [PubMed]

- Damar, M. Metaverse shape of your life for future: A bibliometric snapshot. J. Metaverse 2021, 1, 1–8. [Google Scholar] [CrossRef]

- Al-Emran, M. Beyond technology acceptance: Development and evaluation of technology-environmental, economic, and social sustainability theory. Technol. Soc. 2023, 75, 102383. [Google Scholar] [CrossRef]

- Ferrigno, G.; Di Paola, N.; Oguntegbe, K.F.; Kraus, S. Value creation in the metaverse age: A thematic analysis of press releases. Int. J. Entrep. Behav. Res. 2023, 29, 337–363. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).