Abstract

The article continues the study of the market model based on jump-telegraph processes. It is assumed that the price of a risky asset follows the stochastic exponential of a piecewise linear process, equipped with jumps that occur at the moments of a pattern change. In this case, the standard option pricing formula was derived previously, while exotic options for this model have not yet been explored. Within this framework, we are developing procedures for pricing binary barrier options. This article concerns the “cash-(at hit)-or-nothing” binary barrier option. The main tools of this analysis are methods developed for first-pass probabilities. Some known results related to the ruin probabilities follow directly from these settings.

1. Introduction

The stochastic approach to modelling nature and society is quite common and useful for understanding the world. In general, various types of Wiener/Levy processes are used for these purposes, which, it is also generally recognised, have a number of serious drawbacks. Among other things, these models are characterised by an infinite propagation velocity, which contradicts the generally accepted naive idea. Another disadvantage is the singularity and unlimited variation of paths. In this article, our goal is to develop a mathematical methodology and the application of such improvements that avoid these shortcomings. Our approach is based on the so-called telegraph processes.

In the traditional setting [1,2], the telegraph process describes the position at time of a particle, which moves on the line with constant velocities alternating at the random time epochs of an underlying Poisson process. Namely, , where is the (random) initial direction and is a counting Poisson process; and N are mutually independent.

Recently, various generalisations of this process have been proposed, also aimed at financial applications. First, the process X can be set as an inhomogeneous with different particle speeds and different rates of regime switching, which is reasonable since the symmetric case is very restrictive. Secondly, a purely jump component with deterministic [3] and independent random jumps [4] that occur when switching velocities is added to the telegraph process. At the same time, it is worth noting that the addition of jumps is necessary not only to better match the model to real markets but also for purely methodological reasons since the model of a continuous telegraph process leads to arbitrage opportunities.

To make the presentation more precise, consider a two-state Markov process , which is controlled by alternating switching rates and . Let be an inhomogeneous Poisson process counting switchings. Consider a sequence of mutually independent random variables independent of .

Consider a jump-telegraph process with constant alternating velocities and random jumps :

In this paper, we continue to explore the one-asset market model with dynamics of a risky asset price, which follows a stochastic exponential of :

This approach to market modelling substitutes a Wiener process in the classic Black–Scholes model with a telegraph process with jumps, which better fits the traditional view of price evolution.

This idea is now well understood. It should be noted that this model continues to develop in various directions, see a comprehensive review in [5], where the main attention is paid to option pricing within this model.

Note that the standard call option pricing formula has the same structure as the classic Black–Scholes formula. Meanwhile, exotic options are much less studied. This paper is focused on the “cash-(at hit)-or-nothing barrier binary option”, which involves the payment of a unit of capital when the level fixed in advance, is first reached.

2. Market Model and Measure Transform

Let be a Markov process with two states, defined on a complete probability space and switching at random times controlled by two alternating rates and .

In this setting, a piecewise linear stochastic process can be regarded as an asymmetric integrated telegraph process. The two pairs of parameters , , completely determine the distribution of For any , the distribution of is supported on with atoms at the extreme points:

and, for

Here,

and are modified Bessel functions, see, e.g., [5].

In search of a model without the disadvantages mentioned in the introduction, we will use the telegraph process instead of the Wiener process usually exploited for financial markets modelling. Note that simply replacing the Wiener process with a telegraph process of this form leads to arbitrage opportunities. This feature was not taken into account in the first attempts to construct such a generalisation of the Black–Scholes market model, where an integrated telegraph process was used instead of Brownian motion, see [6,7,8]. At the same time, these pioneering works are still interesting. For example, in article [7], stochastic order comparisons of price processes were presented, which later were not developed. Article [8] is devoted to some optimisation problems related to finding the optimal time to sell a stock, which also need to be developed.

Various ways have been suggested in the literature to avoid arbitrage, but the simplest and most natural is to add jumps after each speed switching. Here, we will focus on this issue.

Consider a compound Poisson process with independent random jumps of the amplitudes . Assume that the distributions and of the jump amplitudes change alternately as the market state switches.

We study a market model consisting of a single risky asset with a price which follows the ordinary stochastic equation

Integrating (3), we have a geometric jump-telegraph process of the form Here, is the stochastic (Doléans–Dade) exponential, so that where See, for example, [9].

For simplicity, let the interest rates and be constant in each market state, so that the bond price is a geometric telegraph process,

Thus, the discounted asset price, is again a geometric jump-telegraph process.

The martingale properties of such a model are characterised by the following well-known results.

Theorem 1.

Let be a jump-telegraph process.

- (a)

- The jump-telegraph process and its stochastic exponent are martingale if and only ifHere, and are the average amplitudes of the jumps associated with states 0 and 1, respectively,

- (b)

- For models (3)–(4), there is an equivalent martingale measure if and only if there exists a pair of positive measurable functions such thatUnder the new measure the Poisson rates are changed toand the jump amplitudes are distributed as

For the proof, see [4] (Theorem 2.2 and 3.1).

In particular, note that conditions (5) require that the average jump value be opposite to the current velocity direction.

Consider an option with a payoff that occurs at time . After the martingale measure is chosen, the price of this option is given by a pair

In this paper, we are focused on the so-called binary barrier options in which the payoff is either some fixed amount or nothing depending on the breakdown of the fixed threshold. See an overview of various binary barrier options and their pricing methods in [10].

3. Pricing “Cash-(At Hit)-or-Nothing Barrier Binary Option”

We are interested in pricing of the option in the simple case when the payoff is received at the moment the barrier x is breached. To be specific, let .

Consider an option of getting 1 when the asset price exceeds the threshold i.e., the option with a payoff function where is the indicator of event A. It is assumed that the payoff is received at time

when the stock price , reaches the barrier x for the first time. We assume that the interest rate r is strictly positive, since for the option price is always 1.

Let be the martingale measure. The option price is given by a pair (depending on the state of the market at underwriting) of bond-discounted payoff expectations with respect to the martingale measure

By definition, .

Note that the first time when the stock price reaches the threshold x coincides with the first passage time of through the threshold .

In what follows, we study the first passage time problem for the logarithm of the stock price. To get the answers for the market model (3) and (4), it suffices to modify the results obtained below by replacing .

3.1. “Bull Market” and Positive Threshold

We consider first the model with alternating positive trends and negative jump amplitudes. This means that the bull market is correcting down at the switch points. The latter means that the alternating distributions and of -corrections to the rising market prices

are supported on the interval .

Let denote the first passage time through the threshold by the jump-telegraph process Since both velocities are positive, note that this process breaches the barrier x by continuously moving between jumps.

By conditioning on the first velocity switching, the following identities in law are valid,

where is the holding time before the first jumping and Y is the first jump amplitude. Here, denotes the equality in distribution. We denote by the first passage time if the initial state is given.

Let the interest rate be positive.

Since a.s. for then . Further, since a.s., then as .

We hope that the use of some informal notations, when convolutions with a jump distribution and with a function are denoted in a similar way, will not cause misunderstandings.

The system of integral Equation (12) has a unique bounded solution [11]. To write this solution explicitly, note that is an eigenfunction of the convolution with measure

where

if the latter integral converges. Further,

We find a solution of (13) in the form

with indefinite coefficients and .

Substituting this function into (13), we obtain the following algebraic system:

which is equivalent to

From (16), it follows that are the positive roots of the algebraic equation

Notice that for a real positive the value is real, so if the interest rate is strictly positive, then

Therefore, since the function is decreasing, Equation (18) always has exactly two positive roots, , such that

Hence, the solution of system (13) is given by (14) with . The explicit form of coefficients and follows from Equations (16)–(18):

Example 1.

Consider the case ofand identically distributed exponential downward jumps with

and letNotice that the distribution of jumpgiven by (20), corresponds to the exponential distribution of the r.v.

Since

Equation (18) becomes

which splits into two quadratic equations that can be solved explicitly. The positive roots are

where and

Notice that in the symmetric case withand a zero interest ratewe have Since then (14) simplifies to

which coincides with known results, see [12].

The same follows for the Cramér–Lundberg model.

Further, by [13] (Formulas (2.2.5)–(18)), the inverse Laplace transform of the function

is given by

where denotes the modified Bessel function of the first order. Due to (21), the probability density function of takes the form

where is the Dirac delta-function, corresponding to movement without switching.

Generally speaking, the dynamics and of option prices are quite diverse. Some of numerical results based on (14), (18), and (19) for exponentially distributed downward jumps are shown in Figure 1, Figure 2 and Figure 3. Figure 2 shows two opposite behaviours of the option price. Panel (a) depicts the case when in state 0 the price experiences large and frequent jumps compared to small but rare ones (in state 1). In this case, Panel (b) shows the opposite case, where the risky asset price experiences large infrequent jumps (state 0) versus small but frequent jumps (state 1). In this case, .

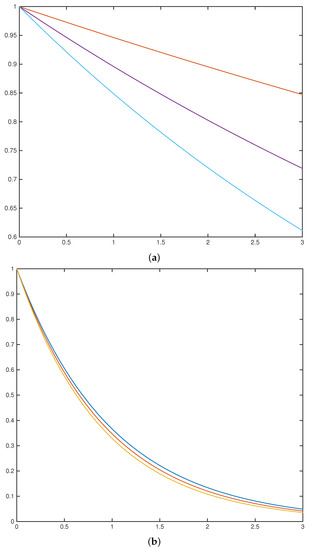

Figure 1.

The option price for the interest rates (from top to bottom): (a) in the symmetric case, (here ); (b) in the case .

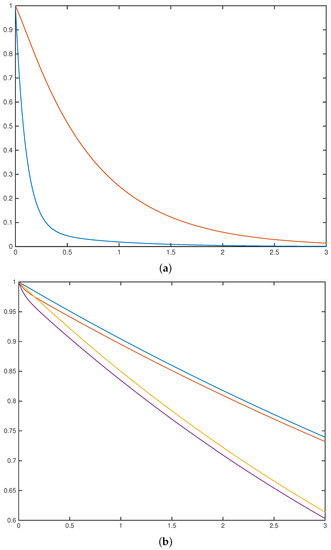

Figure 2.

The option price and in two “opposite” cases. (a): and Interest rate . Here, (b): , and Two pairs of the curves correspond to different interest rates, (top pair of curves) and (lower pair of curves). In both cases, .

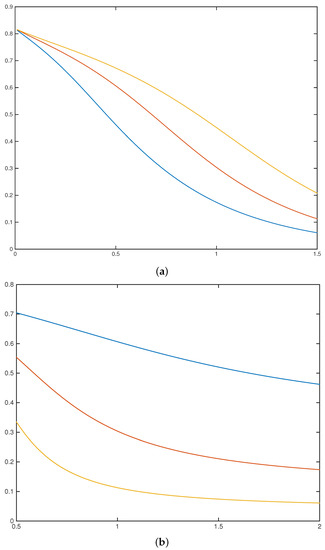

Figure 3.

The option price in the case (a): versus the switching rate for the different values (from bottom to top); (b): versus the mean jump amplitude, for different switching rates (from top to bottom).

Consider another simplified case where there are explicit formulae.

Example 2.

In the casethe Equation (18) has only one positive real root (and one negative one there are also a couple of conjugate imaginary roots). The solution is .

3.2. “Bull Market” and Negative Threshold

A process with positive trends breaches the threshold only by jumping. It cannot pass this level without switching, and the problem becomes much more difficult. Similarly to Section 3.1, we obtain the integral equations

where the cumulative distribution function

corresponds to the jump occurring in state i. The first terms of these equations appear under the condition of breakdown of the threshold after the first jump, the second terms correspond a small jump, not enough to immediately exercise the option.

In the case of exponentially distributed log-jumps, Equations (27) and (28) become slightly simpler. Indeed, let (negative) jumps have alternating distributions with the accumulated distribution function

see (20).

Note that

and changing the order of integration, we obtain

With additional symmetry assumptions , and these equations give the ruin probability. In this symmetric case, we have and, under the net profit condition the ruin probability is given explicitly:

which can be proved by plugging this expression into coinciding Equation (29). This repeats the known results, see, e.g., [12] (5.3.8).

3.3. “Bear Market” and the Cram ér–Lundberg Ruin Model

Let both trends be negative, and jumps positive. This case is symmetric to bullish market with negative corrections described in Section 3.1. In this case, the Laplace transform of is given by Formula (14) with the negative exponential rates given by the Equation (18).

4. Appendix: How to Choose a Martingale Measure

Since Equation (6) can has infinite number of solutions this model typically has infinitely many risk-neutral measures. In order to choose an appropriate martingale measure, we presume some additional restrictions.

- Jump risk is not priced. Note that the telegraph process and the accompanying Markov process can be considered as a source of systematic risk, while jump amplitudes can be classified as unsystematic. Under such assumptions, it is reasonable to assume that a change of the measure does not affect the distribution of jump amplitudes. This idea resembles the approach proposed by R.C.Merton [14].This corresponds to a constant solution of the Equation (6), which coincides with the new switching intensities, i.e., and .To choose a risk-neutral measure, we apply the measure transformation determined by the Radon–Nikodym derivative,where with deterministic constants and satisfying the martingale condition (5), i.e.,For the measure specified in this way, the distribution of jump amplitudes does not change, but the market regimes switch with changed rates which are determined byBy virtue of (31), it is clear that transformation (30) leads to a risk-neutral measure for this market model if and only ifWith this martingale measure, the switching rates and are given bySee [3,5] for details.

- Jump risk is insured. To choose another risk-neutral measure, we supply the market with an additional security, which magnifies its value by a fixed rate every time there is a change of the market state, i.e., letHere, the process is governed by the same Poisson process and it has deterministic jump values . This security can be considered as insurance that compensates losses and gains provoked by state changes and helps to hedge the option with a general payoff function . A market formed by three assets is still incomplete, but now we can use the following approach to make a reasonable choice of risk-neutral measure. First, we change the measure with respect to the switching intensities. Assume the magnification coefficients alter according to alternating market states, Applying the Radon–Nikodym derivative (30) to the asset we define the equivalent measure with switching intensities . We then make one more change of measure, conserving the form of the distribution of the jump values .

The following example illustrates this approach.

Example 3.

(Log-exponential distribution). Let jumps be distributed with the alternating probability density functions where see (20), which is equivalent to the negative exponential distribution of with the probability density function .

Consider a measure transformation that preserves the form of the jump distribution, which is defined by a solution to (6) of the form . By virtue of (6), the positive parameters and satisfy the equation

Since by virtue of (7), we have

therefore,

where the new switching intensities are determined at the first step: .

Sincewe have the condition for the insurance coefficients

which is sufficient for the existence of a risk-neutral measure.

The new distributions of jump amplitudes are

Funding

This research was supported by the Russian Science Foundation (RSF), project number 22-21-00148, https://rscf.ru/project/22-21-00148/ (accessed on 29 August 2022).

Acknowledgments

The author is grateful to the two referees for their careful reading the manuscript.

Conflicts of Interest

The author declares no conflict of interest.

References

- Goldstein, S. On diffusion by discontinuous movements and on the telegraph equation. Q. J. Mech. Appl. Math. 1951, 4, 129–156. [Google Scholar] [CrossRef]

- Kac, M. A stochastic model related to the telegrapher’s equation. Rocky Mt. J. Math. 1974, 4, 497–509, reprinted in Kac, M. Some Stochastic Problems in Physics and Mathematics; Colloquium lectures in the pure and applied sciences, No. 2, hectographed; Field Research Laboratory, Socony Mobil Oil Company: Dallas, TX, USA, 1956; pp. 102–122.. [Google Scholar] [CrossRef]

- Ratanov, N. A jump telegraph model for option pricing. Quant. Financ. 2007, 7, 575–583. [Google Scholar] [CrossRef]

- López, O.; Ratanov, N. Option pricing driven by a telegraph process with random jumps. J. Appl. Probab. 2012, 49, 838–849. [Google Scholar] [CrossRef]

- Ratanov, N.; Kolesnik, A.D. Telegraph Processes and Option Pricing, 2nd ed.; Springer: Heidelberg, Germany; New York, NY, USA; Dordrecht, The Netherlands; London, UK, 2022. [Google Scholar]

- Ratanov, N. Telegraph Processes and Option Pricing; 2nd Nordic-Russian Symposium on Stochastic Analysis; Springer: Beitostolen, Norway, 1999. [Google Scholar]

- Di Crescenzo, A.; Pellerey, F. On prices’ evolutions based on geometric telegrapher’s process. Appl. Stoch. Model. Bus. Ind. 2002, 18, 171–184. [Google Scholar] [CrossRef]

- Dalang, R.C.; Hongler, M.-O. The right time to sell a stock whose price is driven by Markovian noise. Ann. Appl. Probab. 2004, 14, 2176–2201. [Google Scholar] [CrossRef]

- Jeanblanc, M.; Yor, M.; Chesney, M. Mathematical Methods for Financial Markets; Springer: Dordrecht, The Netherlands; Heidelberg, Germany; London, UK; New York, NY, USA, 2009. [Google Scholar]

- Rubinstein, M.; Reiner, E. Unscrambling the binary code. Risk Mag. 1991, 4, 75–83. [Google Scholar]

- Linz, P. Analytical and Numerical Methods for Volterra Equations; SIAM: Philadelphia, PN, USA, 1985. [Google Scholar]

- Rolski, T.; Schmidli, H.; Schmidt, V.; Teugels, J. Stochastic Processes for Insurance and Finance; John Wiley & Sons: Hoboken, NJ, USA, 1999. [Google Scholar]

- Prudnikov, A.P.; Brychkov, Y.A.; Marichev, O.I. Integrals and Series, Vol. 5. Inverse Laplace Transforms; Gordon and Breach Science Publishers: Langhorne, PA, USA, 1992. [Google Scholar]

- Merton, R.C. Option pricing when underlying stock returns are discontinuous. J. Financ. Econom. 1976, 3, 125–144. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).