Abstract

Bitcoin is a complex phenomenon, whether in terms of the macro factors affecting its price or its role in the global energy infrastructure. However, extant literature pays too little attention to exploring the internal mechanisms of the protocol to be able to link them to how they affect the visible characteristics of Bitcoin. This paper uses secondary data from highly reputable Bitcoin-focused sources to systematically map the processes that enable Bitcoin to function as a peer-to-peer cash system. Novelty is achieved by applying the established and versatile “4I” organisational learning framework to provide a new lens through which to understand how the processes within Bitcoin enable and facilitate different types of changes to the protocol. Further insights are provided to organisational learning from Bitcoin, in relation to managing mission-critical changes to organisational systems. In addition, it presents an option for dealing with irreconcilable internal differences to “hard-fork” part of the organisation. While the scope of this paper is limited to secondary data, opportunities for further research, including primary data collection, are outlined to explore how Bitcoin knowledge disseminates within communities or companies.

1. Introduction

Since the 3 January 2009 and the mining of the “Genesis block”, Bitcoin (the network) has validated transactions and added blocks, on average, every 10 min for the past 15 years. While this process can be quickly described, a range of factors had prevented developers from achieving this earlier, with multiple, separately developed innovations having to be carefully integrated into a single protocol [1]. Satoshi Nakamoto’s [2] innovation also provided the first example of digital scarcity, where, unlike other digital artifacts, units in the system could not be duplicated. Van Wirdum [1] expertly plotted the history of the many innovations and failures that led to the emergence of Bitcoin, which, while detailed, give less attention to the intricacies of the protocol. As a result of Bitcoin’s complexity, those introduced to bitcoin (the asset) may quicker defer to mainstream media or poorly conducted “commentaries” that focus upon how many problems are being caused by Bitcoin or its use, rather than actually learning about it [3]. Rudd [4] provides illustrations of the multiple perspectives from which bitcoin research can be conducted, with Ibañez and Freier [5] providing extensive empirical evidence on Bitcoin’s actual, positive environmental impact. However, research has not been conducted to begin investigating the processes within Bitcoin and to provide theoretically underpinned insight into how aspects of the protocol enable peer-to-peer transactions.

Building upon a foundation of computer science, game theory and economics, the concepts embedded within the protocol can mean that without considerable time and effort, individuals have difficulty grasping what Bitcoin is. The benefits of Bitcoin are also difficult to conceptualise, particularly if individuals are not aware of the problems Bitcoin fixes [6], such as having assets seized or experiencing significant monetary debasement due to government policy. Individuals may also be averse to using Bitcoin due to its perceived negative impact on the environment, even when research suggests that this is not the case [5]. Fortunately, Nakamoto [2] provided a useful analogy for conceptualising the computational power expended to add new units as similar to the energy exerted by a gold miner to add more gold to the circulating supply. This analogy helps people to view bitcoin as “Gold 2.0”, due to its fixed supply and scarcity, but with improvements in terms of its auditability, divisibility and transportability, to name a few [7]. The expenditure of energy also provides an essential connection between the digital and physical worlds, where new digital units cannot be added to the system without expending physical resources to produce them.

Strolight [8] suggests that the Bitcoin network could be viewed as a brain, in terms of its ability to self-regulate, adapt, adjust and show great resilience. While providing valuable insight to those already knowledgeable, there are opportunities to critically analyse this view of the Bitcoin network as a black box of complexity. While valid and insightful, there are opportunities to give explicit attention to the internal processes within Bitcoin, with the hope of making the analysis more accessible to those not already familiar with the protocol. The current research aims to do this by using the theoretical lens of organisational learning to structure how the different aspects and elements of Bitcoin relate to one another and the external environment.

Organisational learning focuses upon the processes that organisations use to acquire new knowledge, develop new knowledge internally and change to reflect the requirements of their external environment [9]. However, unlike Strolight’s [8] work, organisational learning is not viewed as an extension of an individual (or indeed a brain). Instead, organisational learning draws attention to an organisation having resources and processes that enable learning through interactions between individuals, rather than an idealised view of an organisation absorbing knowledge and innovating spontaneously [10]. This more realistic view focuses analysis upon distinct stocks and flows of knowledge that in turn impact firm level outcomes [11]. While “Bitcoin is a lot more like an organism than it is like a company” [8], an organisational learning perspective may be able to provide an alternate framework to both structure and build new understanding about Bitcoin, but also about organisational learning.

The following paper uses the framework of organisational learning, developed by Crossan et al. [9], to build understanding of how different elements of Bitcoin relate to one another and develop overtime. This research does not attempt to explore the monetary implications of bitcoin or its potential value in the future, which has already been done on numerous occasions elsewhere [12,13]. The paper will, however, critically reflect on the processes present within the Bitcoin network to consider their implications upon academic understanding of organisational learning. The 4I Crossan et al.’s [9] model was selected due to its breadth in terms of the different aspects of organisational practices involved. The 4I framework has also had considerable impact as one of the most influential frameworks in the field of management research [14]. This will allow the following research question to be addressed:

Does organisational learning occur within the Bitcoin network, and if so, how?

The following section provides a very brief overview of the concept of organisational learning to outline the analytical framework for the research, before presenting the gap in the literature this research will focus upon. An outline of the data drawn from and how the data were analysed will be presented in a brief methodology section. This is followed by a section providing an overview of the processes that take place within the Bitcoin network. The discussions do not focus upon technical processes but use the data to provide a logical explanation of what happens during normal operations and improvement activities. The organisational learning framework is used to provide insight into how the different practices within the Bitcoin network relate to one another, and how there is potential to change (or indeed not change) the protocol in its entirety. The discussion and conclusion sections provide an outline of what has been understood about Bitcoin and organisational learning and identifies opportunities for further research.

2. Literature Review

Given the continual change of the modern business environment, it is essential for organisations to be able to adapt to meet the needs of their operating environment [15]. Importantly, this is not a passive process, where firms gradually adapt, but rather one where firms (but more specifically individuals within a firm) identify opportunities that help organisations to change themselves from within, through entrepreneurial endeavours and systematic adaptation [9]. This view is in stark contrast to more traditional views, where learning takes place through cumulative experience, with the costs of production reducing over time [16]. Such learning curve perspectives overlook the negative consequences of incremental learning that can create organisations that are resistant to change [17]. Tripsas and Gavetti [18] provide the examples of Polaroid and Kodak, which, while technically proficient, were unable to adapt to disruptive innovations that questioned thire established business models. To address this limitation, a more entrepreneurial view of organisational learning has been adopted.

Crossan et al. [9], building upon a range of highly influential models of organisational learning [19], proposed that organisational learning took place at three distinct levels: intuition at an individual level, through interpretation and integration at a group level, to institution at an organisational level (see [6] p. 532). They suggested that an individual may start by noticing or identifying an opportunity or issue that did not feel right, even to the point of them having difficulty articulating what they had noticed. By trying to understand the significance of what they had noticed, individuals would think about and potentially discuss ideas with colleagues to build a clearer picture and determine whether it was in fact something worth investigating further. Group level discussions can then be initiated to explore the insight, involving more people within the organisation, so the idea can be integrated into shared group understanding, associated with actions and initiatives driven by the initial idea. Through further sharing and refinement, products, procedures or even organisational strategies can be developed and implemented at an organisational level. Such institutionalised processes then form the foundation of the organisation and its operations, with the organisational systems informing and guiding groups that inform individual behaviour through the adherence to organisational procedures [20]. The resulting system provides organisations and academics alike, a framework that helps explain how firms not only adapt, but if necessary, undergo strategic renewal (well-illustrated by Crossan and Berdrow [21]).

While the 4I framework can be viewed as overly simplistic in explaining the complexity of organisational change processes, the framework has shown utility, being applied in multiple organisational contexts [14]. Organisational learning has also been applied within the more practical field of operational process improvement [22] and within small and medium-sized enterprises [20], showing its practical relevance and flexibility. Lawrence et al. [23] explored and enriched the framework by integrating factors of power and politics within the processes, which many organisations may need to consider when pursuing learning. The 4I framework thus has the potential to illustrate how individual ideas can be developed and absorbed into a wider community, which can then influence organisational systems, procedures and software. This is well demonstrated by Holmqvist [24], who explored how different forms of learning took place within a leading software company, drawing from Crossan et al.’s [9] work. Boh et al. [25] later explored the role of experience within software development, across multiple organisational levels, illustrating the relevance of the 4I framework within the context of software development.

From a Bitcoin perspective, the individual is represented by a user of the network. The protocol outlined by Nakamoto [2] represents the organisational processes and procedures, and the software operated by miners and validators (to be discussed later) link the software to the individuals. Bitcoin improvement proposals (BIP) (the process through which changes to the protocol are initiated [26]) then represent formalised processes that allow changes to be made to the protocol. A fascinating observation from the literature is the volume of literature related to BIPs. Out of eight pieces identified on the Scopus database (www.Scopus.com, accessed on 31 October 2023), seven were conference papers or lecture notes, and the other one was a journal article covering highly technical privacy and security-related topics [27]. Of particular note was Anceaume et al.’s [28] work, presented as a safety analysis of BIPs, but they neither mentioned nor discussed the processes of changing the Bitcoin protocol. Mueller et al. [29] did provide a detailed overview of “The Bitcoin Universe”, as well as paying some attention to the processes of Bitcoin improvement proposals, but mainly as a counter measure for the identified problems. The remaining five papers were computer science-related, so outside the scope of the current research.

In addition to there being limited academic literature exploring the nature of BIPs, there is limited crossover between research focused upon Bitcoin and that focused upon organisational learning. On Bitcoin whitepaper day in 2023 (31st October), on the Scopus academic database, there were 9785 sources that mentioned bitcoin in the title, abstract or keywords (TAK). On the same day, there were 13,210 sources that mentioned “organizational learning” in the TAK. Considering the relative ages of both concepts, academic interest in Bitcoin is considerably higher (1893 sources in 2022) than organisational learning (746 sources in 2022). Interestingly, even given the size of each field of research and the potential for an overlap, there was no research that mentioned both Bitcoin and organisational learning within the TAK. This suggests that currently, there is limited overlap between these two significant topics within academic research.

By expanding the search, of the 9785 papers mentioning bitcoin, four sources referred to organisational learning within the entire paper. The first, Xie et al. [30], explored how cohesion within a network could affect individuals’ ability to make price predictions, with organisational learning being referred to in terms of the transfer of knowledge within groups. Ilham et al. [31], the second source, focused upon how Bitcoin could support the collection of taxes, referring to a source focused on banking that included organisational learning as a mediating variable. The two more recent sources gave greater emphasis on blockchain (rather than bitcoin), with Akdogu and Simsir [32] exploring how mergers and acquisitions are affected by firms’ involvement with blockchain technologies. Mohapatra et al. [33] explored the role of blockchain within agri-food systems. In both cases, organisational learning appears in the title of cited sources but having limited impact on the research as a whole.

Conversely, within the 13,210 sources than mention organisational learning in the TAK there were only two sources that mentioned bitcoin within the rest of the paper, one an academic article, the second a related conference paper. The article [34] focused upon the adoption of blockchain technologies by Australian firms, with the organisational learning processes being one of the factors affecting technology adoption. Malik et al. [34] cited sources related to bitcoin within discussions of technology adoption but did not discuss this topic in detail. Malik et al. [35], the conference paper, provided foundations for the article by developing a theoretical model for blockchain adoption in Australian organisations. Organisational learning mechanisms and capabilities were considered an organisational factor that affected whether an organisation adopted blockchain technologies. In a similar way to the later work, Malik et al. [35] simply referred to Bitcoin as a widely known application of blockchain technology.

This search reveals there is no literature to present in terms of how organisational learning relates to the processes within the Bitcoin network. Given the social science foundation of organisational learning, compared to the computer science programming foundation of Bitcoin, this lack of overlap is not surprising. However, organisational learning provides a potentially useful theoretical lens [36] to help explain the processes within the Bitcoin network. In a similar way that process improvement has been able to make contributions to organisational learning theory [20], the Bitcoin network may be able to contribute in a similar manner. The use of a widely accepted academic framework also provides a means with which to introduce academics to Bitcoin. If possible, this research hopes to surprise the reader who is new to Bitcoin or organisational learning and help them question previously held beliefs [4,37].

The following section provides an outline of the research methodology that was employed within the research in terms of how the secondary data were selected and collected, and how the data was analysed to answer the research question.

3. Research Methodology

Given the foundations of Bitcoin within the computer science domain, a significant proportion of Bitcoin research is within the domain of computer science, engineering, economics and mathematics. As a result, while intangible, the processes within the Bitcoin network are objective and can be researched based on objective descriptions of the functions and interactions that take place in the network [2]. This research will thus be conducted from a positivist perspective, in the form of a theory-building case study, as described by Eisenhardt [37] and Yin [38]. However, while the Bitcoin protocol is itself a piece of software, the value is realised when individuals begin to adopt and use the asset and network. Consequently, rather than viewing the Bitcoin network from a wholly objective reality, given the need for individuals to understand and interact with the framework, individual perceptions of Bitcoin also need to be accounted for.

This results in more subjective interpretations of the internal processes of Bitcoin, in order for it to make sense to those outside computer science, engineering or economics. Due to the need to draw together multiple, independently written sources, describing social interactions that are part of BIPs, an interpretivist perspective [39], necessary for exploring and building an understanding of systems was utilised [40]. Apart from the Bitcoin white paper [2], which provided a clear foundation, there have been multiple interpretations of the original work since. This required triangulation of multiple data sources to ensure consistency of insight and the removal of bias that may be present in the data [41].

Data collection was informed by the authors’ broad understanding of Bitcoin, developed from audio and video media related to Bitcoin (YouTube and podcasts). For the sake of the research, the data set was formalised by beginning with Nakamoto’s [2] white paper, exploring the content of the Nakamoto Institute, identifying key literature, publicly available online resources associated with Bitcoin-focused organisations and Bitcoin-related media companies. Although these are not academic, peer-reviewed sources, given the fact that those involved with Bitcoin will be interacting with these sources, it is highly likely that any omissions or errors will be identified and updated (so effectively acting as peer review). Media outlets (for example Bitcoin Magazine) also provide opportunities for academics and practitioners to share thinking and views on Bitcoin that simply do not fall within the remit of academic journals. Although drawing from more academic literature may be viewed as increasing the quality of the dataset, there are risks associated with this that need acknowledging. At times, the literature is published where the authors appear to have clear motives for presenting the negative criminal [42] or environmental [43] impacts of Bitcoin. In such cases, there is a risk that not only the authors but also the reviewers are not sufficiently knowledgeable about Bitcoin to identify claims that are simply inaccurate, misleading or provably false. An interesting example of this is Mathy [44], who provided mathematical justification for their thesis of how to reduce energy usage of the Bitcoin network but completely misunderstood and misrepresented the process of proof of work in Bitcoin mining. The selected dataset aims to reflect current thinking on Bitcoin, compared to peer-reviewed research that can have a significant delay from when the research was conducted and when it was published; for example, Foley et al. [42] was originally received by the journal two years earlier than the 2019 publication date.

By triangulating data from multiple sources, related to the different elements of Bitcoin, it was possible to ensure the validity of the findings presented [38,41]. The data were analysed from the perspective of organisational learning, as defined by Crossan et al. [6]. By integrating a degree of pragmatism [4] to make connections between the two frameworks, the relationships between the various elements of the Bitcoin network, and the 4I framework of organisational learning could be better understood. From a foundation of the structure outlined within Nakamoto’s original work, although the BIP process was developed later, the extracts from the sources listed in Appendix A were used to provide a richer insight into how the different systems related to one another. The resulting structured data were used for within case analysis [37] of the functioning of the Bitcoin network, viewed from an organisational learning perspective. While the positivist perspective will be maintained in relation to an objective foundation of the software, the understanding of how the structure relates to organisational learning is drawn from a more pragmatic, interpretivist perspective [4] to link the data with how individuals view and interact with the system.

The following section provides an overview of the processes that take place both within normal peer-to-peer operations and processes for making changes to the protocol. While familiar to Bitcoin users, these generic discussions provide a foundation on which to progress to the discussion on how what happens within the Bitcoin network can be understood through the lens of organisational learning.

4. An Organisational Learning Perspective on the Bitcoin Network

4.1. Bitcoin: A Closed, Self-Regulating System

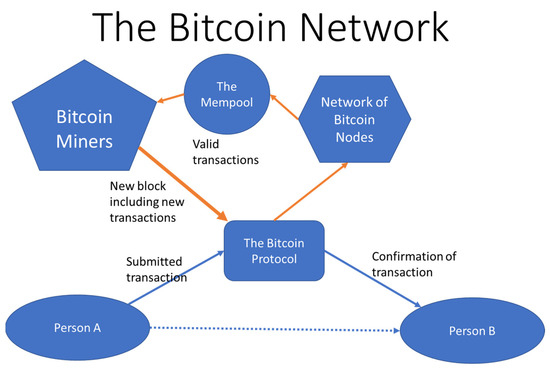

The initial challenge for Satoshi Nakamoto [2] was to present a system that enabled two people to transact a unit that they own, without third-party involvement, to issue the unit or validate the transaction (thus peer to peer). Firstly, it was necessary for an individual (person A) to own their bitcoin, which requires having access to the “private keys” necessary for spending/transferring from one set of private keys to another. Without access to the private keys, the bitcoin remain on the network to be viewed but cannot be moved (often referred to as “lost coins”). To make a transaction, person A must know the “public address” of the person they want to send their bitcoin to (person B). Person B then needs to hold the private keys associated with the public address if they want to be able to transfer (spend) the bitcoin in the future. Person A broadcasts and signs the transaction with their private keys to inform the network that the bitcoin have been transferred, to be accessible with a different set of private keys. Of note is that the bitcoin do not actually move; rather, the private keys through which they can be accessed changes.

Once submitted, the validator nodes confirm the original ownership was consistent with the previous transactions that had taken place on the network contained within the latest block of transactions. By linking each block of transactions to the previous block of transactions, the chain of transactions are a history for each bitcoin, back to when they originally entered the system. Once over 50% of the network validators reach consensus that the submitted transaction is valid, the transaction is placed in the “mempool” until it is added to a new block of transactions. Following this, “miners” expend energy by performing a “hash” function to identify a random number (or nonce, a number used only once) out of many possible answers. The computer (or group of computers) who guesses correctly “mines” the latest block, selecting which transactions from the mempool to add. This usually consists of choosing those transactions with the highest fees, so miners maximise revenue.

To initially incentivise miners to join the network and follow the rules of the protocol to ensure only valid transactions are processed, miners are provided with a block subsidy in addition to transaction fees. This is the mechanism that introduces new bitcoins into the system. To bootstrap the system and distribute bitcoin, initially this reward was large (even though the value of the reward in dollar terms was low). Overtime, the protocol releases fewer bitcoin through a process known as “the halving”, where the block reward reduces by a factor of 2 every 210,000 blocks, or approximately every 4 years. To prevent miners from processing transactions that are not consistent with the ledger, if a block is mined that was found to include invalid transactions, the network reverts to the last version of the “proof-of-work” chain that contained all valid transactions. Miners then begin mining and adding blocks to this older version, resulting in the miner that processed the invalid transactions having been rewarded bitcoin associated with a chain that is no longer valid. This system ensures that, without changing the protocol or emissions schedule, bitcoin miners are highly incentivised to both find the nonce to win the block reward, but also only process transactions that are consistent with the emission schedule.

Although the Bitcoin protocol can be viewed as a closed system, the ecosystem of miners and validators is extremely open, with miners and node operators able to freely join and leave the system without penalty. Anyone, globally, with equipment, a copy of the open-source software, an internet connection and power can mine or validate transactions. As part of this process, the software protocol does not change, meaning that without intervention other than the continued contribution of miners and validators, the Bitcoin network would continue to run (forever). The value of this is that two individuals in the world with smart phones, a Bitcoin wallet and internet access can transact value, without the approval of any third party. Furthermore, apart from knowing the other person’s public Bitcoin address, “keeping public keys anonymous…[can stop] linking the transaction to anyone” ([2] p. 6). Although Foley et al. [40] locate this characteristic within the domain of illegal transactions, there are many other situations where anonymity is essential for individual safety and well-being (See Canadian Trucker Protests [45]). Figure 1 provides a graphical representation of this process.

Figure 1.

The process of making a bitcoin transaction.

Notwithstanding that the network is closed, it is self-regulating, ensuring that if more miners (processing power) join the network, bitcoin are not mined too frequently. The protocol does this through a process of difficulty adjustment, where the size of integer the nonce could be located within increases, making it more difficulty to identify. With every 2016 blocks that are mined, the protocol determines whether blocks have been mined more or less often than every 10 min and changes the size of the nonce in order to return the difficulty back to the required block interval. To illustrate, in 2021, China banned bitcoin mining, reducing the overall hash rate by around 50%. This resulted in the time between blocks increasing to around 20 min. Following the allotted period, difficulty was adjusted downwards, making it easier for the remaining miners, returning the average block time to 10 min (and making it easier (and more profitable) for remaining miners to identify the nonce). The difficulty adjustment was one of Nakamoto’s key contributions to previous attempts at designing digital money [46], where the total supply was quickly distributed as more computers joined the network. The difficulty adjustment ensures that irrespective of the number of miners or developments in technology, miners are unable to increase the rate at which bitcoin are issued (unlike gold, for example).

4.2. Bitcoin: An Adaptive, Learning System?

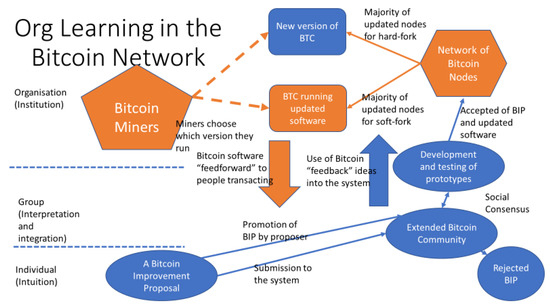

As the Bitcoin network began to be used, users were able to identify opportunities to make changes to the original code, or if problems arose in the network, make suggestions of ways to overcome them. Since the release of the Bitcoin protocol, there have been several issues identified, which were initially addressed by Satoshi Nakamoto, who issued new versions of the software to the small number of people running it. However, after Satoshi “moved onto other things”, changes have been developed and implemented through a process of Bitcoin Improvement Proposals (BIP). These can both include fixes to identified bugs and make improvements, such as the functionality of the protocol (Segwit, BIP142). They can also improve data efficiency to increase the number of transactions that can be processed (Taproot, BIP340-342).

Following Nakamoto’s departure, without a formal leader, it became a “Truly open system”, not only in terms of who can transact, validate and mine bitcoin, but also in terms of enabling anyone with an idea to propose a change to the protocol, “regardless of credentials or reputation”. Although ideas could originate from anyone, they were more likely to come from someone who had interacted with and deeply understood the processes taking place within the software. They tend to be those who are able to identify or intuit areas in which improvements could practically be made and provide sufficient benefits to warrant investigation. By working alone or with other developers, a BIP is submitted through a range of channels, allowing ideas to feedforward and be reviewed by the community and Bitcoin core developers. The proposal is initially interpreted and if appropriate, worked on to integrate the idea into a more formal proposal. If problems are found during the interpretation and integration stage, the proposal may be removed (if not needed or unfeasible) or deferred (if it is not yet possible to make the identified changes to the protocol).

The proposal is published, to be reviewed by the broader community, which includes Bitcoin developers, node operators, miners and even non-technical individuals who may simply hold the asset. The process allows a wider range of perspectives to be brought to proposals, to assess benefits and identify any drawbacks the proposed changes could lead to. The outcomes feedback to software developers, who refine and further develop changes before beginning to test new versions of the software and to develop plans to implement changes into the software. If problems are identified with the proposal or during the testing process, or if consensus cannot be reached by the network, the proposal is rejected and withdrawn or, if later BIPs are made, proposals may be made obsolete. If agreement can be reached within the community, with no significant drawbacks identified, Bitcoin Core software is updated. The community then chooses an activation path, which requires upgrading the software used by the majority of miners and node operators, to effectively institutionalise the change by running the updated version of the software. Figure 2 provides a graphical representation of the BIP process, mapped against the different concepts of organisational learning.

Figure 2.

Bitcoin improvement proposals as organisational learning.

The majority of changes are backwards compatible, ensuring nodes can continue to run older versions of the software (known as a “soft-fork”), so that even if nodes are not regularly attended to, they continue to validate transactions. If changes made to the protocol are such that they are not backwards compatible, what is known as a “hard-fork” occurs. In a similar way to miners processing invalid transactions, nodes and miners running old versions of the software cannot reach consensus with nodes and miners using newer versions of the software. The consequence is that these two sets of nodes and miners begin confirming transactions and adding blocks to different versions of the original chain. The creation of a new version of the original “proof-of-work” chain also results in a new version of the asset, one associated with each chain. In 2017, this took place when consensus could not be reached on a proposal to increase the block size, suggested by parties who believed smaller blocks limited transaction volume, which hampered wider adoption. Those on the opposing side argued that increasing block size would increase data requirement for node operators, reducing the ease with which nodes could be cheaply and easily operated, so negatively impacting decentralisation. The result of these two views of Bitcoin was a “hard-fork” that created Bitcoin Cash, the large block version of Bitcoin. This version continues to operate at the time of writing, only with a smaller market capitalisation, fewer validating nodes, fewer users and less profitable mining when compared to the original, smaller block, Bitcoin.

The process ensures that only changes that are accepted by most of the community and have received rigorous review and testing are ever implemented. For individuals who hold the assets or operate mining companies, the lack of rapid change is balanced against risk minimization, associated with fundamental changes to the protocol, which may introduce bugs. This means that even though any change can be submitted, such as changes to the emission schedule or the type of consensus algorithm, given the likely impact to asset and business value of miners, there is a near-zero chance that such changes would be accepted. As a side note, there is a frequently cited joke that people new to bitcoin will identify issues and announce, “I’m here to fix Bitcoin”. However, unless they provide insights that Satoshi or many other deep thinkers have not been able to identify, convince the Bitcoin community, miners and node operators the change will be net positive for Bitcoin, the asset and network, chances are, they will not change anything.

From an organisational learning perspective, the process of developing ideas and building consensus represents a rigorous process for making changes to organisational systems and processes (in this case the software), which ensures that any changes are carefully vetted. In comparison to an organisation making improvements that reflect a continually changing organisational environment, the Bitcoin network has a consistent purpose of enabling transactions while securing and maintaining a fixed supply asset. Therefore, Bitcoin’s lack of change over time is a significant benefit, which may not be appropriate for an organisation, where organisations need to adapt to changing customer preferences or competitor manoeuvring. In comparison, Bitcoin’s continual, incremental, systematic and deliberate improvements to the protocol create an increasingly robust foundation on which others can build upon. Over the course of Bitcoin’s existence, this slow, risk minimising approach has reduced the risk associated with “improvements” that result in negative, unintended consequences, further assuring owners it will continue to operate into the foreseeable future.

An example of the robustness of the protocol emerged in the first half of 2023, where the proof-of-work chain, community and protocol were tested by interest in ordinals (images) and BRC-20 tokens (assets on Bitcoin), greatly increasing transaction volume. Interestingly, these were unintended consequences of the Taproot upgrade. The impact was the competition for adding transactions to new blocks increased dramatically, significantly increasing transaction fees. The nature and resilience of the network resulted in this issue being resolved, as users delayed smaller transactions or used second layer solutions until interest in these developments reduced. Although this tested the network, nothing unexpected happened, other than identifying opportunities to make further improvements. While creating considerable discussions, the event had a positive unintended consequence of demonstrating that miners were able to receive considerable fees even after the block subsidies had finished (around 2140). The event also highlighted limitations in existing layer-two solutions, motivating further innovations or novel uses of existing technologies that are less affected by increases in fees.

5. Discussions

The above presentation of the Bitcoin network provides an overview of the main processes that take place within the network within normal operations, while also covering the process of Bitcoin Improvement Proposals. To answer the research question, the above exploration of the Bitcoin network assesses whether the processes that take place can be better understood from an organisational learning perspective, specifically, the conceptualisation presented by Crossan et al. [9]. Firstly, the evidence related to carrying out a transaction across the Bitcoin network is closed and self-regulating, meaning that, while the difficulty of the algorithm adapts to the amount of computational power on the network, the processes within the network do not change, or “learn”. However, Crossan et al.’s [9] framework provides insight into how the protocol represents the organisational level, informing how the group level miners and nodes operate when processing transactions submitted by individuals.

The more interesting insights arise from how the protocol itself develops and how interactions at individual and group levels inform the development of the protocol. The BIP system was developed to provide a mechanism for making changes to the protocol after Satoshi left the project. The process was developed to ensure that any changes introduced were carefully vetted by the community at large to prevent bugs or problems being introduced into the network. Starting from an individual’s idea to the formulation of a formal proposal, progressing through the development of ideas and solutions to be tested and approved through to the acceptance by the network, there are interesting similarities with the 4I framework [9]. While the coverage of successful upgrades, such as Segwit or Taproot, may provide an overly positive, idealised view of the process, the framework can also provide insights into upgrades that have been, to date, unsuccessful.

While there are many unsuccessful BIPs, BIP300 has received renewed attention recently, after originally being proposed in 2014. Although being presented as providing benefits to the protocol, in terms of increasing miner revenues and more effectively managing assets “on top of bitcoin”, the proposal has not gained widespread support. From an organisational learning perspective, the original proposal suggests the need to run tokens on top of Bitcoin to overcome the inherent limitations of the Bitcoin protocol. However, when presented with the limitations of the proposal, the author appeared unwilling to acknowledge the feedback and develop the proposal in order to build further support [47]. While some developers appreciated the benefits of the proposal [48], without the author being willing to accept feedback, building support may pose a challenge. In combination, unless the public opinion of the proposal improves dramatically, it is likely to remain an unrealised idea. An organisational learning perspective unpacks how critical it is for individuals to be able to interact, negotiate and persuade [23] those in the community to build social consensus and support for upgrading the software.

The processes that take place within the Bitcoin network also provide useful insights for organisational learning, in terms of the rigour and level of involvement in both the development of solutions and the processes for approving and implementing them. Although Bitcoin focuses more on refinement rather than exploratory forms of learning [49] to ensure network security, this provides insight into specific types of organisations pursuing development. Organisations operating in highly controlled environments (such as aerospace or nuclear) would likely benefit from improvements only becoming implemented once they had been extensively reviewed. This is unfortunately demonstrated by the expedited development of Boeing’s 737 Max, where system interactions were not identified during development, leading to fatalities [50]. Alternatively, the Bitcoin approach to improvements could be applied if fundamental changes to a business were being proposed, such as changes to organisational missions, values or strategies that need widespread consensus to become embedded into an organisation.

An interesting intersection between organisational learning and Bitcoin is the implementation of Bitcoin as an organisational strategy by Microstrategy [51]. By fundamentally changing parts of the business, Michael Saylor (the former CEO, who is now the Executive Chairman) used his control over the organisation to drive changes in Microstrategy’s treasury strategy (to hold Bitcoin on the balance sheet). In comparison to an organisational learning perspective, shareholders were provided with the opportunity to accept changes or sell their shares, rather than being supported to learn about and personally embrace the change. There are interesting similarities between the case of Microstrategy and work exploring improvement activities within SMEs, where an owner or director played an outsized role in the learning behaviours of an entire firm [20]. Reflecting the insight developed from analysing Bitcoin, larger organisations aiming to pursue change may benefit from balancing the significance of a development against the formality of the development process.

6. Conclusions

This research provides a new perspective from which to view a novel, complex digital network that has significant implications for how we view and utilise money [12]. The analysis of the Bitcoin network, as a process of organisational learning, provides several novel insights. Firstly, organisational learning is a widely accepted approach to analysing organisations, providing a new framework for understanding Bitcoin for those who may otherwise be unfamiliar with the protocol. Secondly, organisational learning helps to explain the importance of specific activities that take place within the Bitcoin network, justifying them from a perspective that has been applied within numerous organisational contexts [14]. Thirdly, the organisational learning perspective helps to understand the nature, form and scale of improvements that are made to the Bitcoin network, reflecting the ultimate freedom and control that is possible due to the open-source nature of the software. Fourthly, the framework helps develop a better understanding of social and learning processes within the Bitcoin network, such as factors that differentiate successful and unsuccessful proposals.

Even though BIPs tend to refine and reduce risks, more significant changes can still be proposed. Proposals aiming “to fix bitcoin” through altering block size or consensus mechanisms can be submitted, although they are unlikely to gain traction. The Bitcoin network had the opportunity to accept such trade-offs in the past, but ultimately rejected them, which resulted in a hard-fork. The market then chose whether the new chain represented an improvement over the original protocol. This leads to the final contribution that Bitcoin makes to organisational learning, as a mechanism for organisations to use when dealing with significant internal conflicts. Rather than attempting to work through internal issues, while technically complex, an organisation could undergo a “hard-fork” of the conflicting approaches to create two separate organisations. The market could then determine which “fork” of the organisation they valued most, compared to a business that continues to waste energy and resources on internal conflict.

More recent developmentsdemonstrate that improvements in the speed and transaction volumes do not need to take place on Bitcoin’s base layer. As already stated, Bitcoin walks a fine line between small blocks that allow the entire blockchain to be held on a small computer (making it easier to operate and decentralise nodes), but not so small to negatively impact the number of transactions that can be processed. The Lightning Network [52], amongst other innovations (Liquid, Fedimint etc.), have allowed many more, cheaper, quicker and more private transactions. However, these innovations only interact with the base chain when liquidity is added or removed from the protocol. As stated earlier, the limits of current solutions have been met during periods of high fees; however, such situations provide the necessary constraints that spur individuals to identify new, novel solutions [53]. Fortunately, organisational learning provides insight into the nature of layer 2 innovations that involve exploration, risk-taking and experimentation [49], which are built upon the base layer and engage in more exploratory forms of learning. Research shows that, while these different forms of learning may involve conflicting behaviours, balancing attention can provide a foundation for long-term, sustainable development [54].

This research provides an initial exploration of the role of organisational learning processes within the Bitcoin network, hopefully providing the reader with new insights. Complementing new insights for academics, this work aims to provide more insight for general readers into how Bitcoin (the network) works. Beginning to venture into the “bitcoin rabbit hole”, there is hope that readers will not disregard the asset as unbacked, only used by criminals [42] or negatively impacting the environment [43], even when evidence suggests otherwise [55]. There is also hope that accumulating some Bitcoin-related knowledge will prevent readers from emotional, reckless or gambling types of behaviour, driving Bitcoin purchases, rather than understanding why they hold the asset [56]. Finally, this work highlights the value of taking an academically rigorous, systematic approach to analysing Bitcoin, building understanding and appreciation of the network, away from focusing upon price or wider social implications. As outlined by Matthews [3], research into Bitcoin at times draws from questionable data sources, so lacks academic rigour, which this work aims to address.

For brevity and expediency, the research conducted was based on a range of publicly available resources from Bitcoin and Bitcoin-related news companies. While this has provided an overview, enabling the triangulation of multiple sources [41], there is room to increase the breadth and depth of the data contributing to discussions, while also relying less on the authors’ personal interpretation of the data. This research would benefit greatly from primary data collection from experts in the field, developers, writers, or individuals using bitcoin within their businesses, adding practical insight to discussions. Their views and critiques of an organisational learning perspective could provide clarity and alternative perspectives on the framework’s relevance. Further research could also explore how organisational learning informs or guides organisations or communities through the process of bitcoin acceptance and adoption. Herbert [6] provides insight into initiating discussions by identifying a problem Bitcoin solves, with Alvero [57] suggesting that identifying key individuals could promote wider adoption. Both articles offer insight into an individual’s initial touch points, with organisational learning providing a framework for the process of moving from individual learning to broader community-/organisation-level acceptance. Extending from how organisations adopt Bitcoin, broader learning theories, such as communities of practice [58], or the interaction between explicit and tacit knowledge [59] could be utilised to better understand the learning mechanisms that best support teaching other about Bitcoin. Both technical and non-technical practitioners involved in Bitcoin could provide valuable insight into how different groups understand and relate to Bitcoin.

The Bitcoin network is a system that enables the transaction of value between two individuals and undergoes organisational learning; however, the asset’s value should not be overlooked completely. The Bitcoin network operates with a fixed supply, enabling transactions between any two individuals with internet access, which, notwithstanding other applications (e.g., utilising stranded energy and load balancing [55]), has developed a monetary premium. Since 2009, the monetary value of each Bitcoin has risen from zero to nearly $70,000 per coin in 2021 [60]. Given the resilience and robustness of the protocol outlined in this paper, the likelihood of the protocol existing in the future is high, increasing confidence the asset will continue to have value in the future. As education increases, and more people learn the value of an asset with a fixed supply that enables transactions without engagement with (or approval of) a third party, it is logical that more people will want to hold some of their wealth in the asset. Taking a broader perspective, bitcoin provides the opportunity to save and transact, independent of national currencies that may be undergoing high levels of inflation and are at risk of seizure or being debased at the request of the IMF (see Zimbabwe, Egypt, Argentina and Lebanon, to name a few) [61]. Although there is a clear justification for Bitcoin to have value, some academics have difficulty understanding Bitcoin through accepted economic models. Cheah and Fry [10] stated, “the fundamental price of Bitcoin is zero” (p. 32). As a counterpoint to this view, Satoshi Nakamoto suggested a solution based on their view of the asset:

“It might make sense just to get some in case it catches on. If enough people think the same way, that becomes a self-fulfilling prophecy” [62].

This research shows that having “some in case” may not only be in reference to the value of the asset increasing, but also Bitcoin’s consistent monetary policy and ability to transact without third-party approval. “Just to get some in case” may not be about getting rich, but to protect yourself against monetary debasement and financial censorship.

Funding

This research received no external funding.

Data Availability Statement

No new data were created or analysed in this study. URLs for all source data are present within the reference list and Appendix A.

Acknowledgments

I would like to thank Murray Rudd and the editorial staff at Challenges for facilitating this special issue and for providing exceptional support through the process. I would also like to thank the three anonymous reviewers; their comments and suggestions tested my own understanding and provided the opportunity to greatly improve the original submission. Without your voluntary contributions, the process of peer-review would not exist, so thank you.

Conflicts of Interest

The author declares no conflicts of interest.

Appendix A

Table A1.

Case Database.

Table A1.

Case Database.

| Source Type | Title | URL | Resource | Resource URL |

|---|---|---|---|---|

| White Paper | Bitcoin: A peer-to-peer electronic cash system | http://nakamotoinstitute.org/bitcoin/ (Accessed on 15 November 2022) | n/a | |

| Website | Satoshi Nakamoto Institute | nakamotoinstitute.org (Accessed on 29 November 2022) | The complete Satoshi, Literature and Research | |

| Book | The Bitcoin Standard: The Decentralized Alternative to Central Banking | Publisher: John Wiley & Sons: Hoboken, NJ, USA, 2018. | n/a | |

| Book | The Blocksize War: The battle over who controls Bitcoin’s protocol rules (Biers 2021) | Publisher: Independently Published (14 March 2021) | n/a | |

| Website | Coin Telegraph | https://cointelegraph.com/bitcoin-for-beginners (Accessed on 25 November 2022) | What is Bitcoin, and how does it work? | https://cointelegraph.com/bitcoin-for-beginners/what-is-bitcoin-a-beginners-guide-to-the-worlds-first-cryptocurrency (Accessed on 25 November 2022) |

| Bitcoin halving: How it works and Why it matters? | https://cointelegraph.com/bitcoin-for-beginners/bitcoin-halving-how-does-the-halving-cycle-work-and-why-does-it-matter, (Accessed on 25 November 2022) | |||

| What is a Bitcoin node? A beginner’s guide on blockchain nodes | https://cointelegraph.com/bitcoin-for-beginners/what-is-a-bitcoin-node-a-beginners-guide-on-blockchain-nodes (Accessed on 25 November 2022) | |||

| Can Bitcoin’s hard cap of 21 million be changed? | https://cointelegraph.com/explained/can-bitcoins-hard-cap-of-21-million-be-changed (Accessed on 25 November 2022) | |||

| What are bitcoin improvement proposals? | https://cointelegraph.com/explained/what-are-bitcoin-improvement-proposals-bips-and-how-do-they-work, (Accessed on 25 November 2022) | |||

| Soft fork vs. hard fork: Differences explained | https://cointelegraph.com/blockchain-for-beginners/soft-fork-vs-hard-fork-differences-explained (Accessed on 25 November 2022) | |||

| Bitcoin network transactions and fees surge amid investor de-risking | https://cointelegraph.com/news/bitcoin-network-transactions-and-fees-surge-amid-investor-de-risking, (Accessed on 25 November 2022) | |||

| What is the Lightning Network in Bitcoin, and how does it work? | https://cointelegraph.com/bitcoin-for-beginners/what-is-the-lightning-network-in-bitcoin-and-how-does-it-work, (Accessed on 25 November 2022) | |||

| What are Bitcoin ordinals? | https://cointelegraph.com/explained/what-are-bitcoin-ordinals, (Accessed on 20 September 2023) | |||

| Bitcoin Ordinals’ total mintage fees increased 700% from April: Report | https://cointelegraph.com/news/bitcoin-ordinals-mintage-fees-paid-increase-700-since-april-report, (Accessed on 20 September 2023) | |||

| BIP-300 biff: Debates reignites over years-old Bitcoin Drivechain proposal | https://cointelegraph.com/news/bitcoin-bip300-drivechain-proposal-sparks-debate-and-alternate-solutions, (Accessed on 31 October 2023) | |||

| Website | River Financial | https://river.com/learn/ (Accessed on 25 November 2022) | What is Bitcoin | https://river.com/learn/what-is-bitcoin/ (Accessed on 25 November 2022) |

| How to send and receive bitcoin | https://river.com/learn/how-do-i-send-and-receive-bitcoin/, (Accessed on 25 November 2022) | |||

| What is bitcoin mining? | https://river.com/learn/what-is-bitcoin-mining/ (Accessed on 25 November 2022) | |||

| What is a Bitcoin improvement proposal | https://river.com/learn/what-is-a-bitcoin-improvement-proposal-bip/, (Accessed on 25 November 2022) | |||

| What is a Bitcoin node | https://river.com/learn/what-is-a-bitcoin-node/, (Accessed on 25 November 2022) | |||

| Can bitcoins hard cap of 21 million be changed | https://river.com/learn/can-bitcoins-hard-cap-of-21-million-be-changed/, (Accessed on 25 November 2022) | |||

| Mempool | https://river.com/learn/terms/m/mempool/ (Accessed on 25 November 2022) | |||

| Ordinals: A new NFT protocol on Bitcoin, hype or a distraction? | https://blog.river.com/ordinals-a-new-nft-protocol-on-bitcoin-hype-or-a-distraction/ (20 September 2023) | |||

| Website | Swan Bitcoin | https://www.swanbitcoin.com (Accessed on 25 November 2022) | What is Bitcoin? | https://www.swanbitcoin.com/what-is-bitcoin/ (Accessed on 25 November 2022) |

| Website | Club Swan | www.clubswan.com (Accessed on 25 November 2022) | Bitcoin’s 21 Million Cap Can be Changed, Except for | https://clubswan.com/blog/bitcoins-21-million-cap-can-be-changed-except-for/ (Accessed on 25 November 2022) |

| Website | Bitcoin Magazine | www.bitcoinmagazine.com (Accessed on 25 November 2022) | What is bitcoin | https://bitcoinmagazine.com/guides/what-is-bitcoin, (Accessed on 25 November 2022) |

| Mining | https://bitcoinmagazine.com/guides/what-is-bitcoin, (Accessed on 25 November 2022) | |||

| Nodes | https://bitcoinmagazine.com/guides/what-is-bitcoin (Accessed on 25 November 2022) | |||

| What is Nakamoto consensus? | https://bitcoinmagazine.com/guides/what-is-nakamoto-consensus-bitcoin, (Accessed on 25 November 2022) | |||

| With empty bitcoin mempools, it’s time to consolidate your UTXOs | https://bitcoinmagazine.com/business/what-empty-bitcoin-mempools-mean, (Accessed on 25 November 2022) | |||

| What is a bitcoin improvement proposal? | https://bitcoinmagazine.com/guides/what-is-a-bitcoin-improvement-proposal-bip, (Accessed on 25 November 2022) | |||

| What is Bitcoin Mining? The complete guide | https://bitcoinmagazine.com/guides/bitcoin-mining, (Accessed on 25 November 2022) | |||

| Why China’s Ban was the best thing for Bitcoin in 2021 | https://bitcoinmagazine.com/business/how-china-ban-improved-bitcoin-in-2021, (Accessed on 25 November 2022) | |||

| Inscriptions: Just a fad, or a real threat to bitcoin becoming decentralised money? | https://bitcoinmagazine.com/culture/the-implications-of-bitcoin-inscriptions, (Accessed on 20 September 2023) | |||

| High bitcoin fees from BRC-20 and Ordinals lead to controversy and challenges | https://bitcoinmagazine.com/technical/bitcoins-high-fees-create-controversy-and-challenges, (Accessed on 20 September 2023) | |||

| Drivechains are stupid, prove me wrong | https://bitcoinmagazine.com/technical/drivechains-are-stupid-prove-me-wrong, (Accessed on 20 September 2023) |

References

- Van Wirdum, A. The Genesis Book: The Story of the People and Projects That Inspired Bitcoin; Bitcoin Magazine Books, BTC Media: Nashville, TN, USA, 2024. [Google Scholar]

- Nakamoto, S. Bitcoin: A Peer-to-Peer Electronic Cash System Consulted. 2008. Available online: http://nakamotoinstitute.org/bitcoin/ (accessed on 15 November 2022).

- Matthews, R.L. ‘Don’t Trust, Verify’: Fixing the Problems with Academic Research on Bitcoin. Published by Bitcoin Magazine. 2023. Available online: https://bitcoinmagazine.com/culture/fixing-academic-research-on-bitcoin (accessed on 8 September 2023).

- Rudd, M. Bitcoin Is Full of Surprises. Challenges 2023, 14, 27. [Google Scholar] [CrossRef]

- Ibañez, J.I.; Freier, A. Bitcoin’s Carbon Footprint Revisited: Proof of Work Mining for Renewable Energy Expansion. Challenges 2023, 14, 35. [Google Scholar] [CrossRef]

- Herbert, A. An Orange Pill for Bitcoiners. Published by Bitcoin Magazine. 2023. Available online: https://bitcoinmagazine.com/culture/an-orange-pill-for-bitcoiners (accessed on 24 May 2023).

- Chawaga, P. Bitcoin as Digital Gold. 2019. Available online: https://bitcoinmagazine.com/markets/bitcoin-as-digital-gold (accessed on 7 November 2022).

- Strolight, T. The Bitcoin Brain with Tomer Strolight. What Bitcoin Did Podcast, P. McCormack. 2021. Available online: https://www.whatbitcoindid.com/podcast/the-bitcoin-brain (accessed on 25 November 2022).

- Crossan, M.M.; Lane, H.W.; White, R.E. An organizational learning framework: From intuition to institution. Acad. Manag. Rev. 1999, 24, 522–537. [Google Scholar] [CrossRef]

- Tsang, E. Organizational learning and the learning organization: A dichotomy between descriptive and prescriptive research. Hum. Relat. 1997, 50, 73–89. [Google Scholar] [CrossRef]

- Bontis, N.; Crossan, M.M.; Hulland, J. Managing an Organizational Learning System by Aligning Stocks and Flows. J. Manag. Stud. 2002, 39, 437–469. [Google Scholar] [CrossRef]

- Ammous, S. The Bitcoin Standard: The Decentralized Alternative to Central Banking; John Wiley & Sons: Hoboken, NJ, USA, 2018. [Google Scholar]

- Cheah, E.T.; Fry, J. Speculative bubbles in Bitcoin markets? An empirical investigation into the fundamental value of Bitcoin. Econ. Lett. 2015, 130, 32–36. [Google Scholar] [CrossRef]

- Crossan, M.M.; Maurer, C.C.; White, R.E. Reflections on the 2009 AMR decade award: Do we have a theory of organizational learning? Acad. Manag. Rev. 2011, 36, 446–460. [Google Scholar] [CrossRef]

- Garvin, D.A. Building a learning organization. Harv. Bus. Rev. 1993, 71, 78–91. [Google Scholar] [PubMed]

- Li, G.; Rajagopalan, S. Process Improvement, Quality, and Learning Effects. Manag. Sci. 1999, 44, 1517–1532. [Google Scholar] [CrossRef]

- Leonard-Barton, D. Core-capabilities and core rigidities: A paradox in managing new product development. Strateg. Manag. J. 1992, 13, 111–125. [Google Scholar] [CrossRef]

- Tripsas, M.; Gavetti, G. Capabilities, cognition, and inertia: Evidence from Digital Imaging. Strateg. Manag. J. 2000, 21, 1147–1161. [Google Scholar] [CrossRef]

- Crossan, M.; Lane, H.; White, R.E.; Djurfeldt, L. Organizational learning: Dimensions for a theory. Int. J. Organ. Anal. 1995, 3, 337–360. [Google Scholar] [CrossRef]

- Matthews, R.L.; MacCarthy, B.L.; Braziotis, C. Organisational learning in SMEs: A process improvement perspective. Int. J. Oper. Prod. Manag. 2017, 37, 970–1006. [Google Scholar] [CrossRef]

- Crossan, M.M.; Berdrow, I. Organizational learning and strategic renewal. Strateg. Manag. J. 2003, 24, 1087–1105. [Google Scholar] [CrossRef]

- Anand, G.; Ward, P.T.; Tatikonda, M.V.; Schilling, D.A. Dynamic capabilities through continuous improvement infrastructure. J. Oper. Manag. 2009, 27, 444–461. [Google Scholar] [CrossRef]

- Lawrence, T.B.; Mauws, M.K.; Dyck, B.; Kleysen, R.F. The politics of organizational learning: Integrating power into the 41 framework. Acad. Manag. Rev. 2005, 30, 180–191. [Google Scholar] [CrossRef]

- Holmqvist, M. Experiential Learning Processes of Exploitation and Exploration within and between Organizations: An Empirical Study of Product Development. Organ. Sci. 2004, 15, 70–81. [Google Scholar] [CrossRef]

- Boh, W.F.; Slaughter, S.A.; Espinosa, J.A. Learning from Experience in Software Development: A Multilevel Analysis. Manag. Sci. 2007, 53, 1315–1331. [Google Scholar]

- River Learn. What Is a Bitcoin Improvement Proposal? 2022. Available online: https://river.com/learn/what-is-a-bitcoin-improvement-proposal-bip/ (accessed on 4 November 2022).

- Chun, G.; Ziao, W.; Xiang, X.; Yu, Y. The Multi-User Constrained Pseudorandom Function Security of Generalized GGM Trees for MPC and Hierarchical Wallets. ACM Trans. Priv. Secur. 2023, 26, 37. [Google Scholar]

- Anceaume, E.; Lajoie-Mazane, T.; Ludumard, R.; Seriocola, B. Safety Analysis of Bitcoin Improvement Proposals. In Proceedings of the 2016 IEEE 15th International Symposium on Network Computing and Applications, Boston, MS, USA, 31 October–2 November 2016. [Google Scholar]

- Mueller, P.; Bergsträßer, S.; Rizk, A.; Steinmetz, R. The Bitcoin Universe: An Architectural Overview of the Bitcoin Blockchain; Lecture Notes in Informatics; Gesellschaft für Informatik: Bonn, Germany, 2018. [Google Scholar]

- Xie, P.; Chen, H.; Hu, Y.H. Signal or Noise in Social Media Discussions: The Role of Network Cohesion in Predicting the Bitcoin Market. J. Manag. Inf. Syst. 2020, 37, 933–956. [Google Scholar] [CrossRef]

- Ilham, R.N.; Ertina Fachrudin, K.A.; Silalahi, A.S.; Saputra, J. Comparative of the Supply Chain and Block Chains to Increase the Country Revenues via Virtual Tax Transactions and Replacing Future of Money. Int. J. Supply Chain. Manag. 2019, 8, 1066–1069. [Google Scholar]

- Akdogu, E.; Simsir, S.A. Are Blockchain and cryptocurrency M7As harder to close? Financ. Res. Lett. 2023, 52, 103600. [Google Scholar] [CrossRef]

- Mohapatra, S.; Sainath, B.; Anirudh, K.C.; Lalhminghlui, L.; Nithin, R.K.; Bhandari, G.; Nyika, J.; Sendhil, R. Application of blockchain technology in the agri-food system: A systematic bibliometric visualization analysis and policy imperatives. J. Agribus. Dev. Emerg. Econ. 2023, ahead-of-print. [Google Scholar] [CrossRef]

- Malik, S.; Chadhar, M.; Vatanasakdakul, S.; Chetty, M. Factors Affecting the Organizational Adoption of Blockchain Technology: Extending the Technology—Organization-Environment (TOE) Framework in the Australian Context. Sustainability 2021, 13, 9404. [Google Scholar] [CrossRef]

- Malik, S.; Chadhar, M.; Chetty, M.; Vatanasakdakul, S. An Exploratory Study of the Adoption of Blockchain Technology among Australian Organizations: A Theoretical Model. In Proceedings of the 17th European, Mediterranean and Middle Eastern Conference, Dubai, United Arab Emirates, 25–26 November 2020. [Google Scholar]

- Amundson, S.D. Relationships between theory-driven empirical research in operations management and other disciplines. J. Oper. Manag. 1998, 16, 341–359. [Google Scholar] [CrossRef]

- Eisenhardt, K.M. Building theory from case study research. Acad. Manag. Rev. 1989, 14, 532–550. [Google Scholar] [CrossRef]

- Yin, R.K. Case Study Research: Design and Methodology; Applied Social Research Methods Series; Sage Publications Inc.: Thousand Oaks, CA, USA, 2009. [Google Scholar]

- Radnor, H.A. Researching Your Professional Practice: Doing Interpretive Research, Doing Qualitative Research in Educational Settings; Open University Press: Buckingham, UK, 2001. [Google Scholar]

- Meredith, J. Building operations management theories through case and field research. J. Oper. Manag. 1998, 16, 441–454. [Google Scholar] [CrossRef]

- Jick, T. Mixing qualitative and quantitative methods: Triangulation in action. Adm. Sci. Q. 1979, 24, 602–611. [Google Scholar] [CrossRef]

- Foley, S.; Karlsen, J.R.; Putnins, T.J. Sex Drugs, and Bitcoin: How Much Illegal Activity is Financed through Cryptocurrencies? Rev. Financ. Stud. 2019, 32, 1798–1853. [Google Scholar] [CrossRef]

- Wendl, M.; Doan, M.H.; Sassen, R. The environmental impact of cryptocurrencies using proof of work and proof of stake consensus algorithms: A systematic review. J. Environ. Manag. 2023, 326, 116530. [Google Scholar] [CrossRef]

- Mathy, G. Eliminating Environmental Costs to Proof-of-Work-Based Cryptocurrencies: A Proposal. Easter Econ. J. 2023, 49, 206–220. [Google Scholar] [CrossRef]

- BBC. Trudeau Vows to Free Anti-Mandate Protesters’ Bank Accounts. Published by BBC News. 2022. Available online: https://www.bbc.co.uk/news/world-us-canada-60383385 (accessed on 20 November 2023).

- Back, A. Hashcash—A Denial of Service Counter-Measure. 2002. Available online: http://www.hashcash.org/papers/hashcash.pdf (accessed on 28 November 2023).

- Rochard, P.; Bitstein, M. Noded 85 on Drivechains. Published by Noded. Available online: https://soundcloud.com/noded-bitcoin-podcast/noded-85-on-drivechains?utm_source=twitter.com&utm_campaign=wtshare&utm_medium=widget&utm_content=https%253A%252F%252Fsoundcloud.com%252Fnoded-bitcoin-podcast%252Fnoded-85-on-drivechains (accessed on 6 November 2023).

- Linus, R.; Testnet, S. Chat_86—Everything on Bitcoin with Robin Lunus & Super Testnet. Published by Bitcoin Audible. 2023. Available online: https://fountain.fm/episode/HGZRh0juZ2D4X0mzIxbl (accessed on 20 November 2023).

- March, J.G. Exploration and exploitation in organizational learning. Organ. Sci. 1991, 2, 71–87. [Google Scholar] [CrossRef]

- Topham, G. Boeing Admits Full Responsibility for 737 Max Plane Crash in Ethiopia. Published by the Guardian. 2021. Available online: https://www.theguardian.com/business/2021/nov/11/boeing-full-responsibility-737-max-plane-crash-ethiopia-compensation (accessed on 21 November 2023).

- Pan, D.; Contiliano, T.; MicroStrategy’s Bitcoin Bet Is on Verge of Profitability Again. Published by Bloomberg. 2023. Available online: https://www.bloomberg.com/news/articles/2023-03-31/microstrategy-mstr-btc-bitcoin-bet-is-on-verge-of-profitability-again?leadSource=uverify%20wall (accessed on 7 June 2023).

- Cointelegraph. What Is the Lightning Network in Bitcoin, and How Does It Work? Published by Cointelegraph. 2022. Available online: https://cointelegraph.com/bitcoin-for-beginners/what-is-the-lightning-network-in-bitcoin-and-how-does-it-work (accessed on 29 November 2022).

- Matthews, R.L. Theory of Constraints and Bitcoin: Introducing a New Fulcrum. Challenges 2024, 15, 7. [Google Scholar] [CrossRef]

- Matthews, R.L.; Tan, K.H.; Marzec, P.E. Organisational ambidexterity within process improvement: An exploratory study of four project-oriented firms. J. Manuf. Technol. Manag. 2015, 26, 458–476. [Google Scholar] [CrossRef]

- Matthews, R.L. The Environmental Impact of Cryptocurrencies: A Clarification for Wendl et al. (2023); SSRN: Rochester, NY, USA, 2023; Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4494155, (accessed on 20 November 2023).

- Ryu, H.-S.; Ko, K.S. Understanding speculative investment behavior in the Bitcoin context from a dual-systems perspective. Ind. Manag. Data Syst. 2019, 119, 1431–1456. [Google Scholar] [CrossRef]

- Alvero, H. Orange Pilling Your Barber or Stylist: A Short Cut to Hyperbitcoinzation. Published by Bitcoin Magazine. 2023. Available online: https://bitcoinmagazine.com/culture/share-bitcoin-with-your-barber-or-stylist (accessed on 6 September 2023).

- Seely-Brown, J.; Duguid, P. Organizational learning and communities-of-practice: Toward a unified view of working, learning, and innovating. Organ. Sci. 1991, 2, 40–57. [Google Scholar] [CrossRef]

- Nonaka, I. A Dynamic Theory of Organizational Knowledge Creation. Organ. Sci. 1994, 5, 14–37. [Google Scholar] [CrossRef]

- Coin Market Cap. Today’s Cryptocurrency Prices by Market Cap. Published by Coin Market Cap. 2023. Available online: https://coinmarketcap.com/ (accessed on 24 March 2023).

- Gladstein, A. Structural Adjustment: How the IMF and World Bank Repress Poor Countries and Funnel Their Resources to Rich Ones. Published by Bitcoin Magazine. Available online: https://bitcoinmagazine.com/culture/imf-world-bank-repress-poor-countries (accessed on 24 November 2023).

- Nakamoto, S. Cryptography Mailing List, Bitcoin v0.1 Released, 2009-01-16. Published by the Nakamoto Institute. 2009. Available online: https://satoshi.nakamotoinstitute.org/emails/cryptography/17/#selection-103.0-107.9 (accessed on 29 November 2022).

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).