Identification of Various Execution Modes and Their Respective Risks for Public–Private Partnership (PPP) Infrastructure Projects

Abstract

1. Introduction

2. Literature Survey

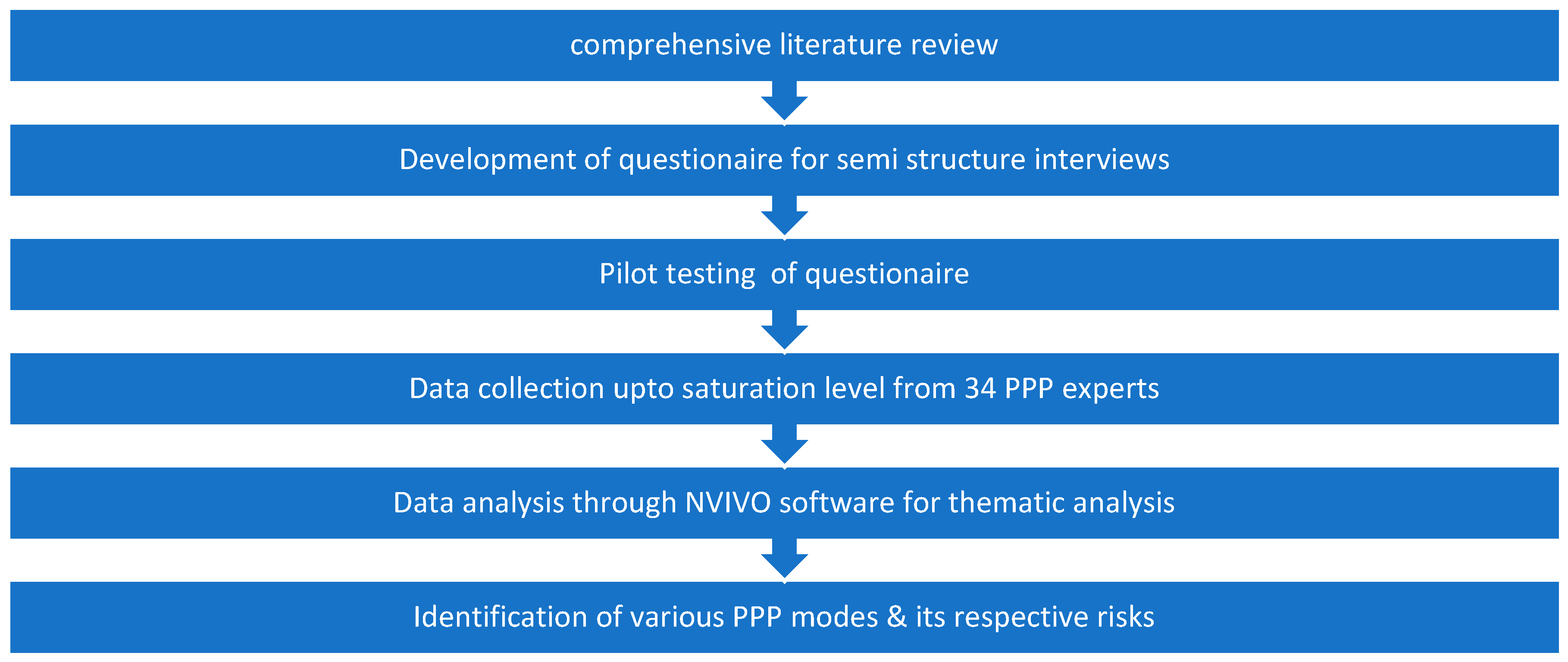

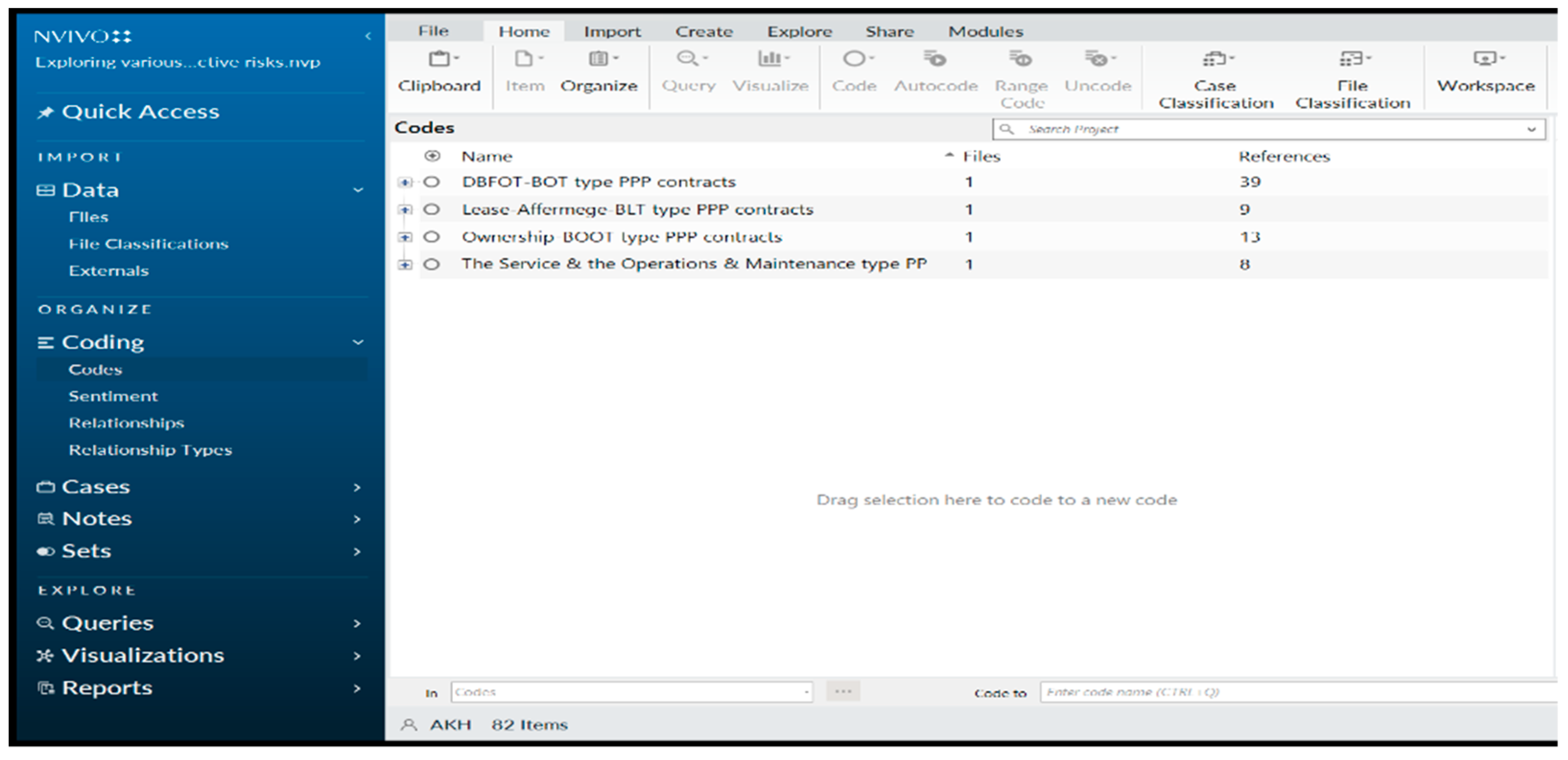

3. Research Methodology

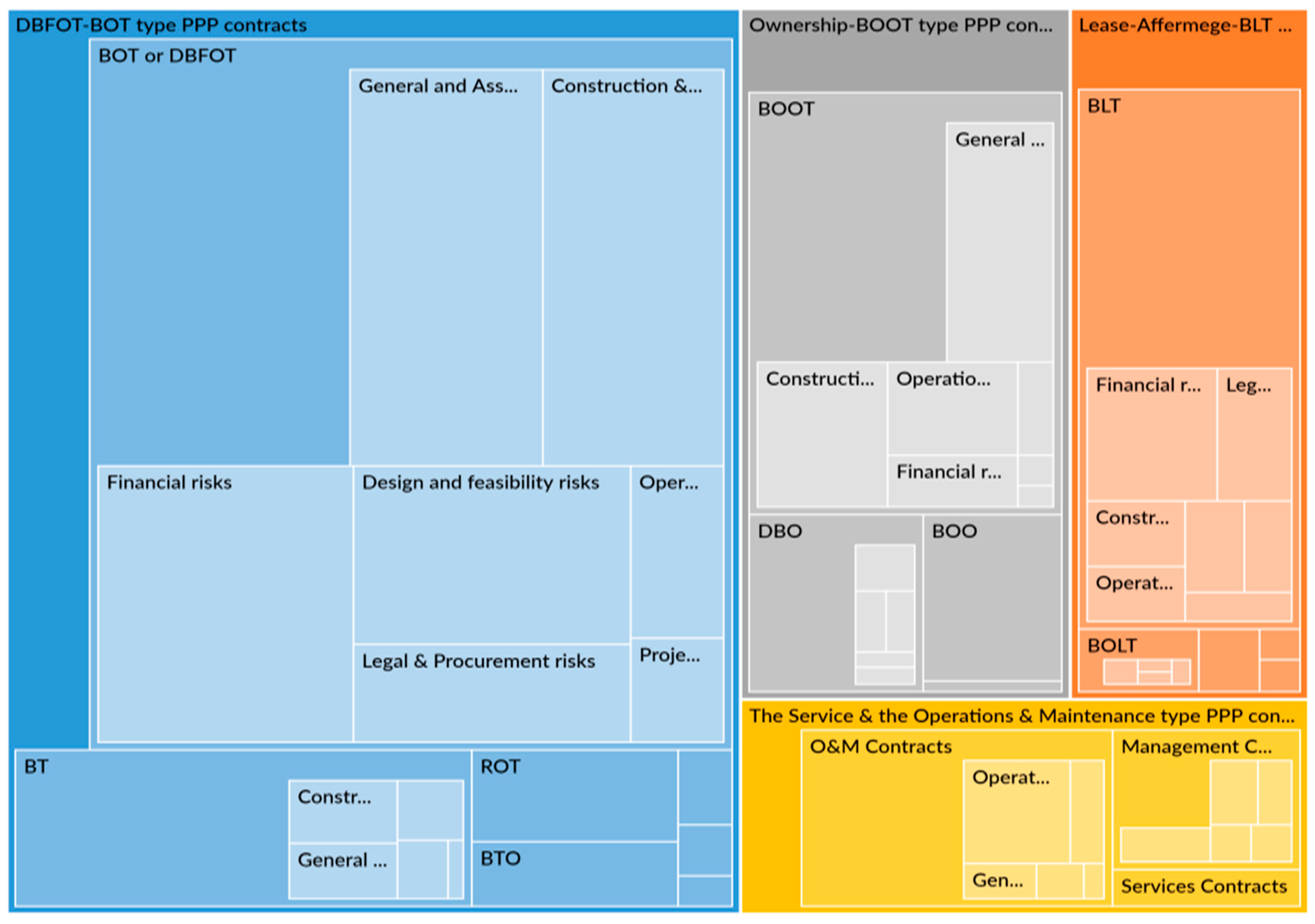

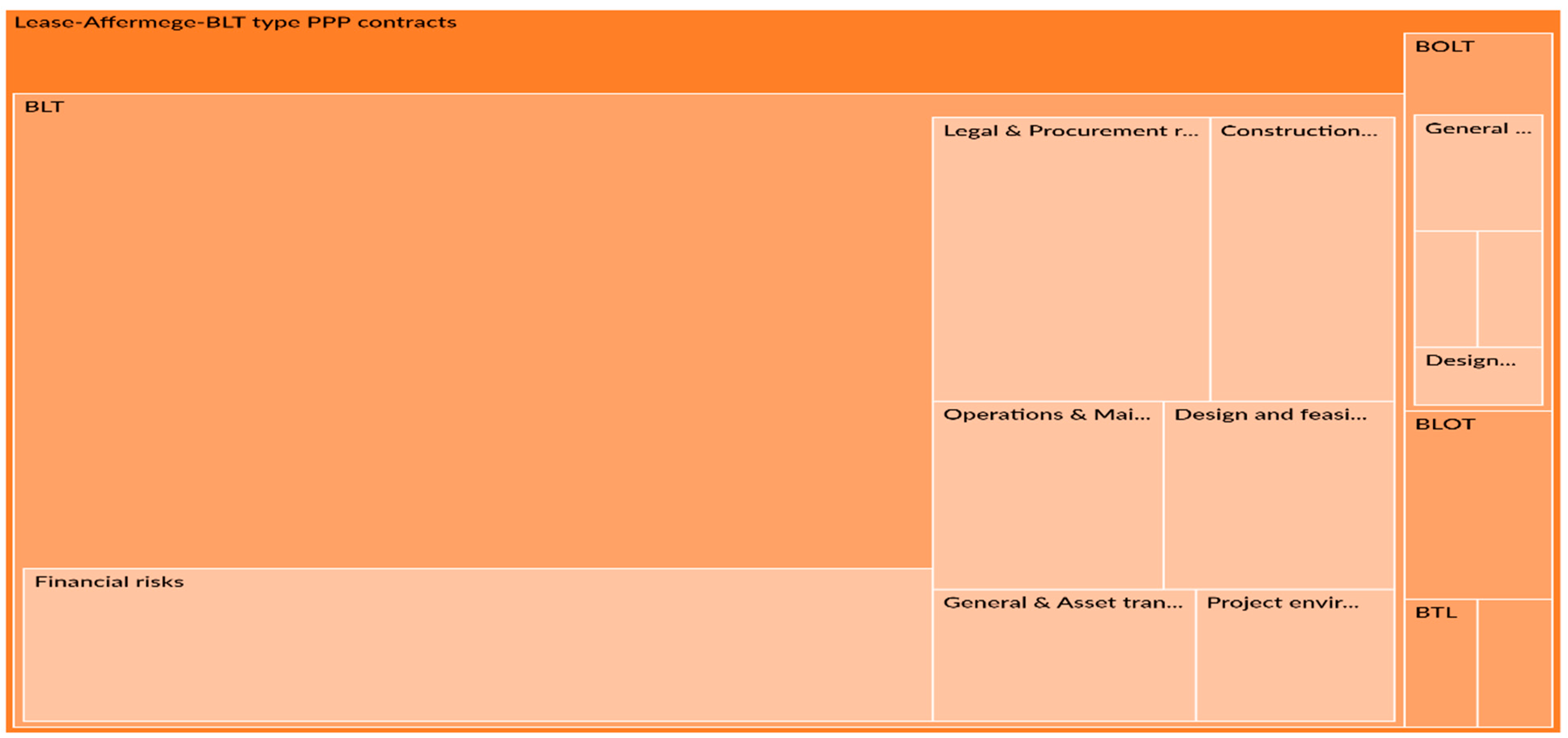

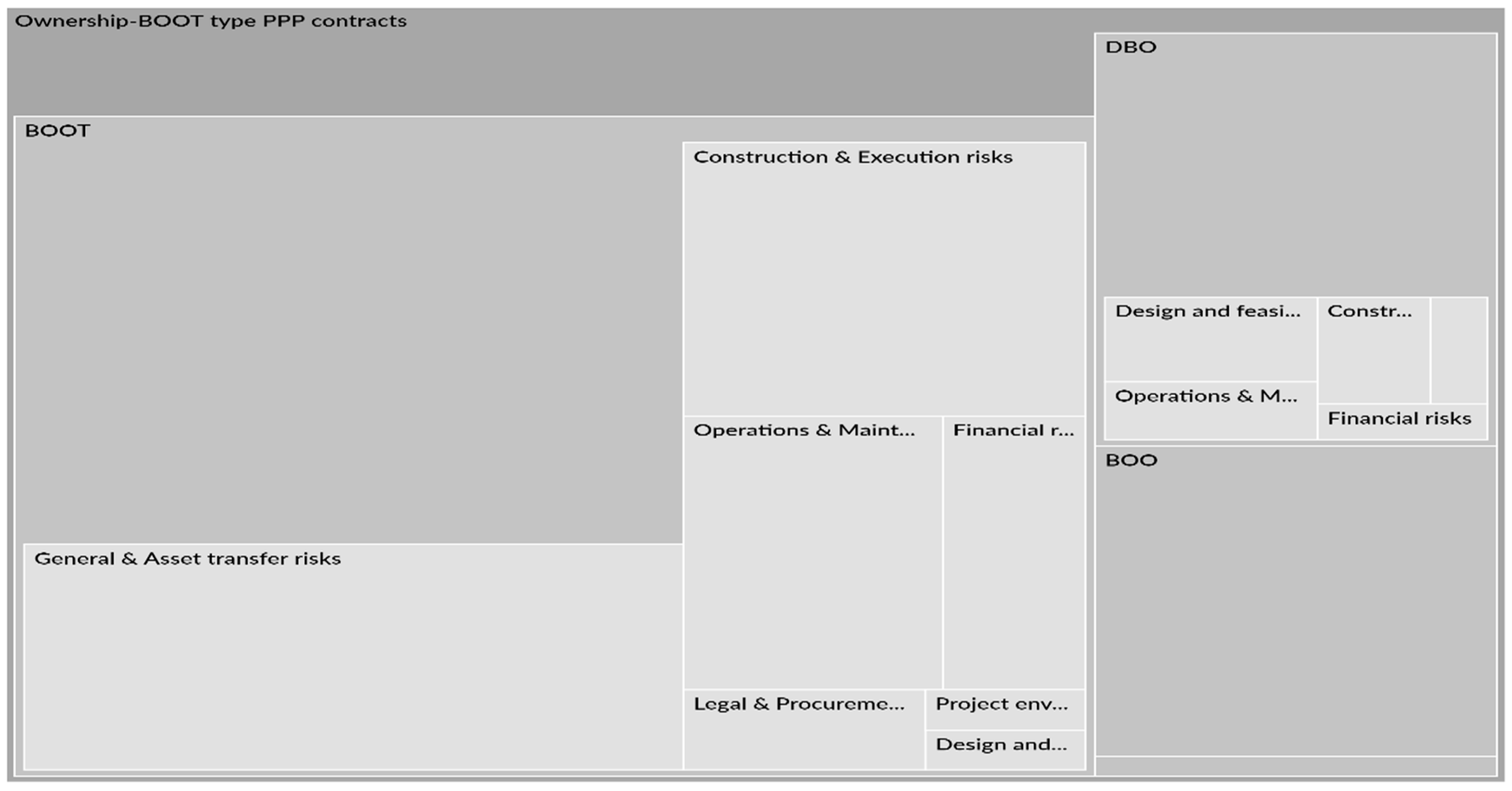

4. Research Results and Discussion

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

Abbreviations

| PPP | Public–Private Partnership | PFI | Private Finance Initiative |

| BOT | Build, Operate, and Transfer | BBO | Build–Buy–Operate |

| BTO | Build, Transfer, and Operate | ROT | Rehabilitate/Renovate, Operate, and Transfer |

| DBOM | Design, Build, Operate, and Maintain | BLOT | Build, Lease, Operate, and Transfer |

| DBFOT | Design, Build, Finance, Operate, and Transfer | BOO | Build–Own–operate |

| DBFOM | Design, Build, Finance, Operate, and Maintain | BOOT | Build, Own, Operate, and Transfer |

| DBOO | Design, Build, Own, and Operate | BOOM | Build, Own, Operate, and Maintain |

| DCMF | Design, Construct, Manage, and Finance | ROOT | Rehabilitate, Own, Operate, and Transfer |

| O&M | Operations and Maintenance | DOT | Develop, Operate, and Transfer |

| DBO | Design–Build–Own | SC | Service Contract |

| BLT | Build, Lease, and Transfer | MC | Management Contract |

| BOOTT | Build, Own, Operate, Train, and Transfer | BOLT | Build, Own, Lease, and Transfer |

| CAO | Contract, Add, and Operate | SWOT | Strength, Weakness, Opportunity, Threat |

| PPIAF | Public Private Infrastructure Advisory Facility | DBOFT | Design, Build, Operate, Finance, and Transfer |

| TOT | Transfer–Operate–Transfer | LOT | Lease, Operate, and Transfer |

| DOOT | Develop, Own, Operate, and Transfer | DBB | Design, Bid, and Build |

| BLO | Build, Lease, and Own | LUF | Land Use Fee |

| BT | Build–Transfer | BOR | Build, Operate, and Renewal |

| AP | Availability Payment | PVR | Present Value of Revenues |

| BLMT | Build, Lease, Maintain, and Transfer | DB | Design–Build |

| DBFM | Design, Build, Finance, and Maintain | BBO | Build, Buy, and Operate |

| DBL | Design, Build, and Lease | ||

Appendix A. Questions Related to the Interview Protocol

| First Part (Introduction) |

|

| Second Part (PPP Modes) |

|

| Third Part (Associated risks) |

|

Appendix B. Identified Risks in Four (04) Different Categories along with Definitions

| Risks | PPP Modalities | |||||

| DBFOT/BOT Type PPP Contracts | Lease/Affermage/BLT Type PPP Contracts | Ownership/BOOT Type PPP Contracts | The Services and the O&M Type PPP Contracts | |||

| (a) | Planning, design, and feasibility risks | Efficiency enhancement | ||||

| 1 | Improper design and technical study Definition: Poor design team responsible for carrying out the technical studies | Unavailability of Investor | ||||

| 2 | Land acquisition and compensation Definition: Difficulties faced by both client and consultant regarding route alignment for land acquisition and subsequently stay orders from the owners of the land during the compensation phase | Productivity Risks | ||||

| 3 | Required initial approvals for a feasibility study Definition: Unnecessary delay in approvals from the concerned agencies at the initial stages of the project | Social Challenges | ||||

| 4 | Improper preliminary survey Definition: Poor survey team responsible for reconnaissance survey | Reputation Risks | ||||

| 5 | Inherent risks to conceiving PPP projects Definition: Incompetency or lack of experience in adopting the PPP modality, especially in developing countries | Performance Risk | ||||

| 6 | Multilateral agencies and stakeholders’ involvement Definition: PPPs have many stakeholders and agencies as compared to the traditional approach of executing projects | |||||

| 7 | Poor cost estimation Definition: Poor quantification of project items, including soil contamination and other construction items at the time of the planning stage | |||||

| (b) | Financial risks | |||||

| 8 | Macroeconomic variables Definition: This includes inflation, GDP, Government fiscal policies, national income, international trade, and interest rate, etc. | |||||

| 9 | Availability of finance Definition: Adequate funds are available to the contractor during the construction of the PPP project phase | |||||

| 10 | Fulfillment of commitments with financial institutes Definition: This includes debt repayment to the financial institutes in an efficient manner as committed during financial closure | |||||

| 11 | Revenue shortfall Definition: Shortfall in revenues, user levies, and availability-based payments | |||||

| 12 | Financial rate of returns on investment Definition: Internal rate of return (IRR), return on investment (ROI), payback period, and net present value (NPV), etc., are the indicator of the risk. | |||||

| 13 | Financial insolvency of the host government Definition: The host government could not remain financially stable and became bank corrupt | |||||

| (c) | Legal and procurement risks | |||||

| 14 | Ownership of assets Definition: Concessionaire is fully responsible for projects assets | |||||

| 15 | Change in Law Definition: Post-bid changes in any existing law by the government that affects any of the project objectives | |||||

| 16 | Insolvency of the public or private sector Definition: Insolvency of either public or private sector | |||||

| 17 | Third-party reliability Definition: Any unexpected disagreement arising from the third party regarding the fulfillment of contractual obligations | |||||

| 18 | Institutional nature arrangement Definition: Poor institutional nature arrangement for execution of PPP Projects | |||||

| 19 | Encumbrances of land Definition: Illegal encumbrances cause litigation and invoke legal repercussions | |||||

| 20 | Legally weak partnership or strategic alliance Definition: PPPs are all about partnerships between the public and private sectors, which should be legally and contractually strong for durable intra-consortium counterparty | |||||

| 21 | Inefficient procurement process Definition: The procurement process should be efficient, economical, effective, and transparent, which brings value for money | |||||

| 22 | Tenant risks Definition: Risks related to the leaseholder for efficient operations | |||||

| 23 | Lack of flexibility in contracts Definition: PPPs are complex contractual arrangements; therefore, they should be flexible enough to safeguard the interests of both parties | |||||

| 24 | Market demand for assets Definition: The project’s assets are market-driven for desired revenue collection | |||||

| 25 | Legal aspects of the property Definition: lessor should lease the land to the lessee, which is legally protected against all types of litigations | |||||

| 26 | Expropriation Definition: risks of taking property or assets by the state from the owner | |||||

| (d) | Construction and execution risks | |||||

| 27 | Poor quality Definition: Maintaining the desired quality standards on the project during the construction and execution phase | |||||

| 28 | Unproven engineering techniques Definition: Using untested technology and inadequate engineering exposure for the construction and execution of the infrastructure projects | |||||

| 29 | Unforeseen construction cost overruns Definition: Construction cost overrun resulting from poor planning and measurements of the quantities | |||||

| 30 | Availability of land for use Definition: encumbrance free right of way is available for construction | |||||

| 31 | Scope creep Definition: extensive change orders during the construction phase | |||||

| 32 | Inadequate health and safety measures Definition: Non-adoption of required health and safety requirements as per standards | |||||

| 33 | Delay in a construction period Definition: Noncompliance with construction timelines adequately | |||||

| 34 | Availability of labor and material Definition: Shortage of resources due to inadequate supply chain management of the organizations | |||||

| 35 | Protection of geological and historical objects Definition: Sometimes slight variations are required during the construction phase for the protection of geological and historical objects | |||||

| 36 | Shifting of utilities Definition: Shifting of utilities like power lines, gas lines, and other underground cables | |||||

| (e) | Operations and maintenance risks | |||||

| 37 | Operation and maintenance Definition: Concessionaire is responsible for the operation and maintenance of the project | Operation and maintenance Definition: Public sector is responsible for operations, and Concessionaire is responsible for maintenance activities | Operation and maintenance Definition: Concessionaire is responsible for the operation and maintenance of the project | |||

| 38 | Demand and revenue shortfall Definition: Revenue collection is less than the forecasted demand | |||||

| 40 | Frequency of maintenance Definition: Major maintenance involves high cost; therefore, the frequency of maintenance matters | |||||

| 41 | The uncertainty in rent prices Definition: Uncertainty lies with the lessee to cope with the decrease in rent prices | Operational Technology | ||||

| Operational Efficiency risks | ||||||

| 42 | Toll slippages Definition: Week operational measures and control | |||||

| (f) | General and project environment risks | |||||

| 43 | Corruption Definition: Kickbacks, unjust rewards, and corrupt officials | |||||

| 44 | Political instability Definition: Regime change and other political chaos in the country | |||||

| 45 | Environmental permits Definition: Permits required from the environmental protection agencies for project approvals | |||||

| 46 | Ground and weather conditions Definition: Unexpected or poor ground or weather conditions | |||||

| 47 | Lack of R&D in the PPP regime Definition: Poor R&D in the field of PPP domain | |||||

| 48 | Natural disasters or force majeure events Definition: The circumstances which are out of the control of any stakeholder reach | |||||

| 49 | Transfer of technology Definition: International bidders are the source of the transfer of technology | |||||

| 50 | Inherent risks Definition: Limited competencies and experience available for the execution of PPP projects, especially in developing countries | |||||

| (g) | Completion and transfer of assets risks | |||||

| 51 | Project transfer risks Definition: Transferring the project assets to the public sector as per requirements | |||||

| 52 | Residual value risks Definition: Unable to transfer the assets in normal working condition | |||||

| 53 | Depreciation of asset Definition: Devaluation of the asset at the time of transferring of assets | |||||

| 54 | Completion of project Definition: Non-fulfilment of the contractual requirement regarding the completion of the project | |||||

| 55 | Asset obsolescence Definition: due to long concessions of PPP, the project’s assets or technology may be obsoleted | |||||

| 56 | Asset maintenance Definition: due to ownership of assets, asset maintenance is the prime responsibility of the private sector to properly handover | |||||

| [42,44,58,63,64,65,66,67,68,69,70,71,72,73,74,75,76,77,78,79,80,81,82,83,84,85,86,87,88,89,90,91,92,93,94,95,96,97,98,99,100,101,102,103,104,105,106,107,108,109,110,111,112,113,114,115,116,117,118,119,120,121,122,123] | ||||||

References

- Ke, Y.; Wang, S.; Chan, A.P. Risk Misallocation in Public–Private Partnership Projects in China. Int. Public Manag. J. 2013, 4, 438–460. [Google Scholar] [CrossRef]

- Hou, X. Can Public–Private Partnership Wastewater Treatment Projects Help Reduce Urban Sewage Disposal? Empirical Evidence from 267 Cities in China. Int. J. Environ. Res. Public Health 2022, 19, 7298. [Google Scholar] [CrossRef]

- Liu, J.; Guo, Y.; Martek, I.; Chen, C.; Tian, J. A Phase-Oriented Evaluation Framework for China’s PPP Projects. Eng. Constr. Arch. Manag. 2022, 29, 3737–3753. [Google Scholar] [CrossRef]

- Chen, C.; Man, C. Are Good Governance Principles Institutionalised with Policy Transfer? An Examination of Public–Private Partnerships Policy Promotion in China. Aust. J. Soc. Issues 2020, 55, 162–181. [Google Scholar] [CrossRef]

- Wang, Y.; Cui, P.; Liu, J. Analysis of the Risk-Sharing Ratio in PPP Projects Based on Government Minimum Revenue Guarantees. Int. J. Proj. Manag. 2018, 36, 899–909. [Google Scholar] [CrossRef]

- Fleta-Asín, J.; Muñoz, F. Renewable Energy Public–Private Partnerships in Developing Countries: Determinants of Private Investment. Sustain. Dev. 2021, 29, 653–670. [Google Scholar] [CrossRef]

- Chowdhury, A.N.; Chen, P.-H.; Tiong, R.L. Analysing the Structure of Public–Private Partnership Projects Using Network Theory. Constr. Manag. Econ. 2011, 29, 247–260. [Google Scholar] [CrossRef]

- Ng, S.T.; Wong, J.M.W.; Wong, K.K.W. A public private people partnerships (P4) process framework for infrastructure development in Hong Kong. Cities 2013, 31, 370–381. [Google Scholar] [CrossRef]

- Xu, Y.; Yeung, J.F.; Chan, A.P.; Chan, D.W.; Wang, S.Q.; Ke, Y. Developing a Risk Assessment Model for PPP Projects in China —A Fuzzy Synthetic Evaluation Approach. Autom. Constr. 2010, 19, 929–943. [Google Scholar] [CrossRef]

- Du, J.; Wang, W.; Gao, X.; Hu, M.; Jiang, H. Sustainable Operations: A Systematic Operational Performance Evaluation Framework for Public–Private Partnership Transportation Infrastructure Projects. Sustainability 2023, 15, 7951. [Google Scholar] [CrossRef]

- Public Private Partnership, Legal Resource Center (PPP LRC). Available online: https://ppp.worldbank.org/public-private-partnership/about-ppplrc-ppp-legal-resource-center (accessed on 3 March 2020).

- Dabarera, G.K.M.; Perera, B.A.K.S.; Rodrigo, M.N.N. Suitability of Public-Private-Partnership Procurement Method for Road Projects in Sri Lanka. Built Environ. Proj. Asset Manag. 2019, 9, 199–213. [Google Scholar] [CrossRef]

- Lee, J.; Kim, K.; Oh, J. Build-Transfer-Operate with Risk Sharing Approach for Railway Public-Private-Partnership Project in Korea. Asian Transp. Stud. 2022, 8, 100061. [Google Scholar] [CrossRef]

- Coll—A Guide to the Project Management Body of Knowledge (PMBOK® Guide)-Project Management Institute (2017).Pdf, n.d.). Available online: https://www.works.gov.bh/English/ourstrategy/Project%20Management/Documents/Other%20PM%20Resources/PMBOKGuideFourthEdition_protected.pdf (accessed on 3 March 2020).

- Williamson, O.E. Transaction-Cost Economics: The Governance of Contractual Relations. J. Law Econ. 1979, 22, 233–261. [Google Scholar] [CrossRef]

- Tallaki, M.; Bracci, E. Risk Allocation, Transfer and Management in Public–Private Partnership and Private Finance Initiatives: A Systematic Literature Review. Int. J. Public Sect. Manag. 2021, 34, 709–731. [Google Scholar] [CrossRef]

- Shankar Nayak, B. Reification and Praxis of Public Private Partnerships in History. Soc. Bus. Rev. 2019, 14, 63–70. [Google Scholar] [CrossRef]

- Ameyaw, C.; Adjei-Kumi, T.; Owusu-Manu, D.-G. Exploring Value for Money (VfM) Assessment Methods of Public-Private Partnership Projects in Ghana: A Theoretical Framework. J. Financ. Manag. Prop. Constr. 2015, 20, 268–285. [Google Scholar] [CrossRef]

- Panda, D.K. Public Private Partnerships and Value Creation: The Role of Relationship Dynamics. Int. J. Organ. Anal. 2016, 24, 162–183. [Google Scholar] [CrossRef]

- Abednego, M.P.; Ogunlana, S.O. Good project governance for proper risk allocation in public–private partnerships in Indonesia. Int. J. Proj. Manag. 2006, 24, 622–634. [Google Scholar] [CrossRef]

- Medda, F. A Game Theory Approach for the Allocation of Risks in Transport Public Private Partnerships. Int. J. Proj. Manag. 2007, 25, 213–218. [Google Scholar] [CrossRef]

- Cui, C.; Liu, Y.; Hope, A.; Wang, J. Review of studies on the Public–Private Partnerships (PPP) for Infrastructure Projects. Int. J. Proj. Manag. 2018, 36, 773–794. [Google Scholar] [CrossRef]

- Alonso-Conde, A.B.; Brown, C.; Rojo-Suarez, J. Public Private Partnerships: Incentives, Risk Transfer and Real Options. Rev. Financ. Econ. 2007, 16, 335–349. [Google Scholar] [CrossRef]

- Wang, Y.; Gao, H.O.; Liu, J. Incentive Game of Investor Speculation in PPP Highway Projects Based on the Government Minimum Revenue Guarantee. Transp. Res. Part A Policy Pract. 2019, 125, 20–34. [Google Scholar] [CrossRef]

- Bing, L.; Akintoye, A.; Edwards, P.J.; Hardcastle, C. The Allocation of Risk in PPP/PFI Construction Projects in the UK. Int. J. Proj. Manag. 2005, 23, 25–35. [Google Scholar] [CrossRef]

- Babatunde, S.O.; Perera, S.; Zhou, L.; Udeaja, C. Barriers to Public Private Partnership Projects in Developing Countries: A Case of Nigeria. Eng. Constr. Archit. Manag. 2015, 22, 669–691. [Google Scholar] [CrossRef]

- Wang, H.; Liu, Y.; Xiong, W.; Song, J. The Moderating Role of Governance Environment on the Relationship between Risk Allocation and Private Investment in PPP Markets: Evidence from Developing Countries. Int. J. Proj. Manag. 2019, 37, 117–130. [Google Scholar] [CrossRef]

- Public Private Infrastructure Advisory Facility (PPIAF) May. 2012. Available online: https://documents1.worldbank.org/curated/en/144651468335680152/pdf/Public-Private-Infrastructure-Advisory-Facility-PPIAF-annual-report-2012.pdf (accessed on 3 March 2020).

- Tan, J.; Zhao, J.Z. The Rise of Public–Private Partnerships in China: An Effective Financing Approach for Infrastructure Investment? Public Adm. Rev. 2019, 79, 514–518. [Google Scholar] [CrossRef]

- Batjargal, T.; Zhang, M. Review on the Public-Private Partnership. Manag. Stud. 2022, 10, 597–612. [Google Scholar] [CrossRef]

- Hu, Y.; Chiu, Y.; Yen, G.; Ken, Y. Incorporation of the DEMATEL into evaluations of CSR performance in BOT projects. Syst. Res. Behav. Sci. 2022, 40, 266–281. [Google Scholar] [CrossRef]

- Algarni, A.M.; Arditi, D.; Polat, G. Build-Operate-Transfer in Infrastructure Projects in the United States. J. Constr. Eng. Manag. 2007, 133, 728–735. [Google Scholar] [CrossRef]

- Hakim, S.; Clark, R.M.; Blackstone, E.A. (Eds.) Handbook on Public Private Partnerships in Transportation, Vol II: Roads, Bridges, and Parking. Competitive Government: Public Private Partnerships; Springer International Publishing: Cham, Switzerland, 2022. [Google Scholar]

- Akintoye, A. Policy Management and Finance of Public-Private Partnership; Blackwell Publishing Ltd.: Hoboken, NJ, USA, 2008. [Google Scholar] [CrossRef]

- Kim, K.; Jung, M.W.; Park, M.; Koh, Y.E.; Kim, J.O. Public-Private Partnership Systems in the Republic of Korea, the Philippines and Indonesia Asian Development Bank ADB Economic Working Paper Series; Korea Development Institute: Sejong-si, Republic of Korea, 2018; pp. 2–17. [CrossRef]

- Ahmad, Z.; Mubin, S.; Masood, R.; Ullah, F.; Khalfan, M. Developing a Performance Evaluation Framework for Public Private Partnership Projects. Buildings 2022, 12, 1563. [Google Scholar] [CrossRef]

- Kim, K.-S.; Jung, M.-W.; Park, M.-S.; Koh, Y.-E.; Kim, J.-O. Public Private Partnership Systems in the Republic of Korea, the Philippines, and Indonesia; ADB Economics Working Paper Series; Asian Development Bank: Manila, Philippines, 2018. [Google Scholar]

- Mladenovic, G.; Queiroz, C. Assessing the Financial Feasibility of Availability Payment PPP Projects. In T&DI Congress 2014; American Society of Civil Engineers: Orlando, FL, USA, 2014; pp. 602–611. [Google Scholar]

- Xenidis, Y.; Angelides, D. The Financial Risks in Build-operate-transfer Projects. Constr. Manag. Econ. 2005, 23, 431–441. [Google Scholar] [CrossRef]

- Liao, C.-L. Private Participation for Infrastructure Projects. In Construction Congress VI; American Society of Civil Engineers: Orlando, FL, USA, 2000; pp. 857–867. [Google Scholar]

- Shukla, N.; Panchal, R.; Shah, N. Built-Own-Lease-Transfer (BOLT): A Public Private Partnership Model That Bridges Gap of Infrastructure in Urban Areas. Int. J. Civ. Eng. Res. 2014, 5, 135–144. [Google Scholar]

- Marcus, J.; Gameson, R.; Rowlinson, S. Critical Success Factors of the BOOT Procurement System: Reflections from the Stadium Australia Case Study. Eng. Constr. Archit. Manag. 2002, 9, 352–361. [Google Scholar]

- Public-Private Partnership Reference Guide. PPP Referenc eGuide Version31 (worldbank.org). 2020, pp. 17–160. Available online: https://ppp.worldbank.org/public-private-partnership/sites/ppp.worldbank.org/files/documents/PPP%20Reference%20Guide%20Version%203.pdf (accessed on 3 March 2020).

- Phang, S.-Y. Urban Rail Transit PPPs: Survey and Risk Assessment of Recent Strategies. Transp. Policy 2007, 14, 214–231. [Google Scholar] [CrossRef]

- Huang, Y.; Xu, W.; Li, C. Information Integration Framework for a Public–Private Partnership System of an Urban Railway Transit Project (Part B: An Empirical Application). J. Ind. Inf. Integr. 2022, 25, 100245. [Google Scholar] [CrossRef]

- Zhang, W.; Bai, Y.; Huang, Y. Risk Management for Build-Transfer Plus Land Usage Fee Reimbursement Delivery Method in China. In Construction Research Congress 2014; American Society of Civil Engineers: Atlanta, GA, USA, 2014; pp. 1871–1880. [Google Scholar] [CrossRef]

- Touran, A.; Gransberg, D.D.; Molenaar, K.R.; Ghavamifar, K. Selection of Project Delivery Method in Transit: Drivers and Objectives. J. Manag. Eng. 2011, 27, 21–27. [Google Scholar] [CrossRef]

- Liu, T.; Wang, Y.; Wilkinson, S. Identifying Critical Factors Affecting the Effectiveness And Efficiency of Tendering Processes in Public–Private Partnerships (PPPs): A Comparative Analysis of Australia and China. Int. J. Proj. Manag. 2016, 34, 701–716. [Google Scholar] [CrossRef]

- Cruz, C.O.; Marques, R.C. Flexible Contracts to Cope with Uncertainty in Public–Private Partnerships. Int. J. Proj. Manag. 2013, 31, 473–483. [Google Scholar] [CrossRef]

- Ke, Y.; Wang, S.; Chan, A.P.; Lam, P.T. Preferred Risk Allocation in China’s Public–Private Partnership (PPP) Projects. Int. J. Proj. Manag. 2010, 28, 482–492. [Google Scholar] [CrossRef]

- Rasheed, N.; Shahzad, W.; Khalfan, M.; Rotimi, J.O.B. Risk Identification, Assessment, and Allocation in PPP Projects: A Systematic Review. Buildings 2022, 12, 1109. [Google Scholar] [CrossRef]

- Holmes, N.; Lingard, H.; Yesilyurt, Z.; De Munk, F. An Exploratory Study of Meanings of Risk Control for Long Term and Acute Effect Occupational Health and Safety Risks in Small Business Construction Firms. J. Saf. Res. 2000, 30, 251–261. [Google Scholar] [CrossRef]

- Sami Ur Rehman, M.; Shafiq, M.T.; Afzal, M. Impact of COVID-19 on Project Performance in the UAE Construction Industry. J. Eng. Des. Technol. 2022, 20, 245–266. [Google Scholar] [CrossRef]

- Zheng, X.; Wang, S.; Yang, Y. Determinants of the Severity of Contract Enforcement in Chinese PPP Projects: From Public Sector’s Perspective. J. Environ. Public Health 2022, 2022, 5149478. [Google Scholar] [CrossRef]

- Saunders, B.; Sim, J.; Kingstone, T.; Baker, S.; Waterfield, J.; Bartlam, B.; Burroughs, H.; Jinks, C. Saturation in Qualitative Research: Exploring Its Conceptualization and Operationalization. Qual. Quant. 2018, 52, 1893–1907. [Google Scholar] [CrossRef]

- Byrne, D. A worked example of Braun and Clarke’s approach to reflexive thematic analysis. Qual. Quant. 2022, 56, 1391–1412. [Google Scholar] [CrossRef]

- Stafford, A.; Stapleton, P. The impact of hybridity on PPP governance and related accountability mechanisms: The case of UK education PPPs. Account. Audit. Account. J. 2022, 35, 950–980. [Google Scholar] [CrossRef]

- Bao, F.; Martek, I.; Chen, C.; Wu, Q.; Chan, A.P.C. Critical Risks Inherent to the Transfer Phase of Public–Private Partnership Water Projects in China. J. Manag. Eng. 2022, 38, 04022006. [Google Scholar] [CrossRef]

- Li, J.; Zou, P.X.W. Fuzzy AHP-Based Risk Assessment Methodology for PPP Projects. J. Constr. Eng. Manag. 2011, 137, 1205–1209. [Google Scholar] [CrossRef]

- Ning, L.; Abbasi, K.R.; Hussain, K.; Alvarado, R.; Ramzan, M. Analyzing the Role of Green Innovation and Public-Private Partnerships in Achieving Sustainable Development Goals: A Novel Policy Framework. Environ. Sci. Pollut. Res. 2023, 25, 1–17. [Google Scholar] [CrossRef]

- Ke, Y.; Wang, S.; Chan, A.P.; Cheung, E. Understanding the risks in China’s PPP projects: Ranking of their probability and consequence. Eng. Constr. Arch. Manag. 2011, 18, 481–496. [Google Scholar] [CrossRef]

- Malek, M.S.; Gundaliya, P.J. Negative factors in implementing public–private partnership in Indian road projects. Int. J. Constr. Manag. 2023, 2, 234–242. [Google Scholar] [CrossRef]

- Zhang, W.R.; Wang, S.Q.; Tiong, R.L.K.; Ting, S.K.; Ashley, D. Risk Management of Shanghai’s Privately Financed Yan’an Donglu Tunnels. Eng. Constr. Archit. Manag. 1998, 5, 399–409. [Google Scholar] [CrossRef]

- Ullah, S.; Mufti, N.A.; Saleem, M.Q.; Hussain, A.; Lodhi, R.N.; Asad, R. Identification of Factors Affecting Risk Appetite of Organizations in Selection of Mega Construction Projects. Buildings 2021, 12, 2. [Google Scholar] [CrossRef]

- Mubin, S.; Ghaffar, A. Bot contracts: Applicability in pakistan for infrastructure development. Pak. J. Eng. Appl. Sci. 2008, 3. Available online: https://www.semanticscholar.org/paper/BOT-Contracts%3A-Applicability-in-Pakistan-for-Mubin-Ghaffar/9d548661ac1d2e333d8e9bf6b659c472ec70a8a9 (accessed on 16 May 2023).

- Aldrete, R.; Bujanda, A.; Valdez, G.A. Valuing Public-Sector Revenue Risk Exposure in Transportation Public–Private Partnerships. Transp. Res. Rec. J. Transp. Res. Board 2012, 2297, 88–96. [Google Scholar] [CrossRef]

- Liou, F.-M.; Huang, C.-P. Automated Approach to Negotiations of BOT Contracts with the Consideration of Project Risk. J. Constr. Eng. Manag. 2008, 134, 18–24. [Google Scholar] [CrossRef]

- Singh, L.B.; Kalidindi, S.N. Traffic revenue risk management through Annuity Model of PPP road projects in India. Int. J. Proj. Manag. 2006, 24, 605–613. [Google Scholar] [CrossRef]

- Brandão, L.E.; Bastian-Pinto, C.; Gomes, L.L.; Labes, M. Government Supports in Public–Private Partnership Contracts: Metro Line 4 of the São Paulo Subway System. J. Infrastruct. Syst. 2012, 18, 218–225. [Google Scholar] [CrossRef]

- Burke, R.; Demirag, I. Risk management by SPV partners in toll road public private partnerships. Public Manag. Rev. 2019, 21, 711–731. [Google Scholar] [CrossRef]

- Carbonara, N.; Costantino, N.; Gunnigan, L.; Pellegrino, R. Risk Management in Motorway PPP Projects: Empirical-based Guidelines. Transp. Rev. 2015, 35, 162–182. [Google Scholar] [CrossRef]

- Carbonara, N.; Costantino, N.; Pellegrino, R. Revenue Guarantee in Public-Private Partnerships: A Fair Risk Allocation Model. Constr. Manag. Econ. 2014, 32, 403–415. [Google Scholar] [CrossRef]

- Chan, A.P.C.; Yung, E.H.K.; Lam, P.T.I.; Tam, C.M.; Cheung, S.O. Application of Delphi Method in Selection of Procurement Systems for Construction Projects. Constr. Manag. Econ. 2001, 19, 699–718. [Google Scholar] [CrossRef]

- Chang, L.-M.; Chen, P.-H. BOT Financial Model: Taiwan High Speed Rail Case. J. Constr. Eng. Manag. 2001, 127, 214–222. [Google Scholar] [CrossRef]

- Daito, N.; Chen, Z.; Gifford, J.L.; Porter, T.; Gudgel, J.E. Implementing Public Private Partnerships during Challenging Economic Times: Case Study of the 495 Express Lanes on the Virginia Portion of the Washington Capital Beltway Project (USA). Case Stud. Transp. Policy 2013, 1, 35–45. [Google Scholar] [CrossRef]

- De Schepper, S.; Dooms, M.; Haezendonck, E. Stakeholder Dynamics and Responsibilities in Public–Private Partnerships: A Mixed Experience. Int. J. Proj. Manag. 2014, 32, 1210–1222. [Google Scholar] [CrossRef]

- Rostiyanti, S.F.; Pangeran, M.H. Framework for Risk Allocation in PPP Infrastructure Development; Research Gate, Conference Paper. 2012, pp. 2–15. Available online: https://www.researchgate.net/publication/329371111_Framework_for_Risk_Allocation_In_PPP_Infrastructure_Development (accessed on 16 May 2023).

- Guasch, J.L.; Straub, S. Renegotiation of Infrastructure Concessions: An Overview. Ann. Public Coop. Econ. 2006, 77, 479–493. [Google Scholar] [CrossRef]

- Hwang, B.-G.; Zhao, X.; Gay, M.J.S. Public Private Partnership Projects in Singapore: Factors, Critical Risks and Preferred Risk Allocation from the Perspective of Contractors. Int. J. Proj. Manag. 2013, 31, 424–433. [Google Scholar] [CrossRef]

- Jokar, E.; Aminnejad, B.; Lork, A. Assessing and Prioritizing Risks in Public-Private Partnership (PPP) Projects Using the Integration of Fuzzy Multi-Criteria Decision-Making Methods. Oper. Res. Perspect. 2021, 8, 100190. [Google Scholar] [CrossRef]

- Ke, Y.; Wang, S.; Chan, A.P. Risk Allocation in Public-Private Partnership Infrastructure Projects: Comparative Study. J. Infrastruct. Syst. 2010, 16, 343–351. [Google Scholar] [CrossRef]

- Kumar, L.; Jindal, A.; Velaga, N.R. Financial Risk Assessment and Modelling of PPP Based Indian Highway Infrastructure Projects. Transp. Policy 2018, 62, 2–11. [Google Scholar] [CrossRef]

- Kuo, Y.-C.; Lu, S.-T. Using Fuzzy Multiple Criteria Decision Making Approach to Enhance Risk Assessment for Metropolitan Construction Projects. Int. J. Proj. Manag. 2013, 31, 602–614. [Google Scholar] [CrossRef]

- Sastoque, L.M.; Arboleda, C.A.; Ponz, J.L. A Proposal for Risk Allocation in Social Infrastructure Projects Applying PPP in Colombia. Procedia Eng. 2016, 145, 1354–1361. [Google Scholar] [CrossRef]

- Sheppard, G.; Beck, M. The Evolution of Public–Private Partnership in Ireland: A Sustainable Pathway? Int. Rev. Adm. Sci. 2018, 84, 579–595. [Google Scholar] [CrossRef]

- Tang, L.; Shen, Q.; Skitmore, M.; Cheng, E.W.L. Ranked Critical Factors in PPP Briefings. J. Manag. Eng. 2013, 29, 164–171. [Google Scholar] [CrossRef]

- Wu, Y.; Li, L.; Xu, R.; Chen, K.; Hu, Y.; Lin, X. Risk assessment in straw-based power generation public-private partnership projects in China: A fuzzy synthetic evaluation analysis. J. Clean. Prod. 2017, 161, 977–990. [Google Scholar] [CrossRef]

- Wu, Y.; Zhang, T.; Chen, K.; Yi, L. A Risk Assessment Framework of Seawater Pumped Hydro Storage Project in China under Three Typical Public-Private Partnership Management Modes. J. Energy Storage 2020, 32, 101753. [Google Scholar] [CrossRef]

- Xu, Y.; Chan, A.P.C.; Yeung, J.F.Y. Developing a Fuzzy Risk Allocation Model for PPP Projects in China. J. Constr. Eng. Manag. 2010, 136, 894–903. [Google Scholar] [CrossRef]

- Yurdakul, H.; Kamaşak, R.; Öztürk, T.Y. Macroeconomic Drivers of Public Private Partnership (PPP) Projects in Low Income and Developing Countries: A Panel Data Analysis. Borsa Istanb. Rev. 2021, 22, S2214845021000028. [Google Scholar] [CrossRef]

- Zangoueinezhad, A.; Azar, A. How Public-Private Partnership Projects Impact Infrastructure Industry for Economic Growth. Int. J. Soc. Econ. 2014, 41, 994–1010. [Google Scholar] [CrossRef]

- Zavadskas, E.K.; Turskis, Z. Multiple Criteria Decision Making (Mcdm) Methods In Economics: An Overview/Daugiatiksliai Sprendimų Priėmimo Metodai Ekonomikoje: Apžvalga. Technol. Econ. Dev. Econ. 2011, 17, 397–427. [Google Scholar] [CrossRef]

- Alireza, V.; Mohammadreza, Y.; Zin, R.M.; Yahaya, N.; Noor, N.M. An enhanced multi-objective optimization approach for risk allocation in public–private partnership projects: A case study of Malaysia. Can. J. Civ. Eng. 2014, 41, 164–177. [Google Scholar] [CrossRef]

- Casady, C.B.; Baxter, D. Pandemics, Public-Private Partnerships (PPPs), and Force Majeure|COVID-19 Expectations and Implications. Constr. Manag. Econ. 2020, 38, 1077–1085. [Google Scholar] [CrossRef]

- Chen, H.; Zhang, L.; Wu, X. Performance risk assessment in public–private partnership projects based on adaptive fuzzy cognitive map. Appl. Soft Comput. 2020, 93, 106413. [Google Scholar] [CrossRef]

- Forum on Public–Private Partnerships for Global Health and Safety; Board on Global Health; Health and Medicine Division; National Academies of Sciences, Engineering, and Medicine. Public–Private Partnership Responses to COVID-19 and Future Pandemics: Proceedings of a Workshop—In Brief; Casola, L., Ed.; National Academies Press: Washington, DC, USA, 2020.

- Jin, X.-H.; Zhang, G. Modelling optimal risk allocation in PPP projects using artificial neural networks. Int. J. Proj. Manag. 2011, 29, 591–603. [Google Scholar] [CrossRef]

- Khazaeni, G.; Khanzadi, M.; Afshar, A. Optimum risk allocation model for construction contracts: Fuzzy TOPSIS approach. Can. J. Civ. Eng. 2012, 39, 789–800. [Google Scholar] [CrossRef]

- Ng, S.T.; Xie, J.; Cheung, Y.K.; Jefferies, M. A Simulation Model for Optimizing the Concession Period of Public–Private Partnerships Schemes. Int. J. Proj. Manag. 2007, 25, 791–798. [Google Scholar] [CrossRef]

- Tian, C.; Peng, J.-J.; Zhang, S.; Wang, J.-Q.; Goh, M. A Sustainability Evaluation Framework for WET-PPP Projects Based on a Picture Fuzzy Similarity-Based VIKOR Method. J. Clean. Prod. 2021, 289, 125130. [Google Scholar] [CrossRef]

- Akomea-Frimpong, I.; Jin, X.; Osei-Kyei, R. A Holistic Review of Research Studies on Financial Risk Management in Public–Private Partnership Projects. Eng. Constr. Arch. Manag. 2021, 28, 2549–2569. [Google Scholar] [CrossRef]

- Akomea-Frimpong, I.; Jin, X.; Osei-Kyei, R. Managing Financial Risks to Improve Financial Success of Public–Private Partnership Projects: A Theoretical Framework. J. Facil. Manag. 2022, 20, 629–651. [Google Scholar] [CrossRef]

- Bildfell, C. P3 Infrastructure Projects: A Recipe for Corruption or an Antidote? Public Work. Manag. Policy 2018, 23, 34–57. [Google Scholar] [CrossRef]

- Braun, V.; Clarke, V. Using Thematic Analysis in Psychology. Qual. Res. Psychol. 2006, 3, 77–101. [Google Scholar] [CrossRef]

- Dansoh, A.; Frimpong, S.; Ampratwum, G.; Oppong, G.D.; Osei-Kyei, R. Exploring the Role of Traditional Authorities in Managing the Public as Stakeholders on PPP projects: A Case Study. Int. J. Constr. Manag. 2020, 20, 628–641. [Google Scholar] [CrossRef]

- Debela, G.Y. Critical Success Factors (CSFs) of Public–Private Partnership (PPP) Road Projects in Ethiopia. Int. J. Constr. Manag. 2022, 22, 489–500. [Google Scholar] [CrossRef]

- Dey, P.K.; Ogunlana, S.O. Selection and Application of Risk Management Tools and Techniques for Build-operate-transfer Projects. Ind. Manag. Data Syst. 2004, 104, 334–346. [Google Scholar] [CrossRef]

- Engel, E.; Fischer, R.; Galetovic, A. When and How to Use Public-Private Partnerships in Infrastructure: Lessons from the International Experience; National Bureau of Economic Research: Cambridge, MA, USA, 2020. [Google Scholar] [CrossRef]

- Henjewele, C.; Sun, M.; Fewings, P. Analysis of factors affecting value for money in UK PFI projects. J. Financ. Manag. Prop. Constr. 2012, 17, 9–28. [Google Scholar] [CrossRef]

- Khahro, S.H.; Ali, T.H.; Hassan, S.; Zainun, N.Y.; Javed, Y.; Memon, S.A. Risk Severity Matrix for Sustainable Public-Private Partnership Projects in Developing Countries. Sustainability 2021, 13, 3292. [Google Scholar] [CrossRef]

- Kim, K.; Kim, J.; Yook, D. Analysis of Features Affecting Contracted Rate of Return of Korean PPP Projects. Sustainability 2021, 13, 3311. [Google Scholar] [CrossRef]

- Mazher, K.M.; Chan, A.P.C.; Choudhry, R.M.; Zahoor, H.; Edwards, D.J.; Ghaithan, A.M.; Mohammed, A.; Aziz, M. Identifying Measures of Effective Risk Management for Public–Private Partnership Infrastructure Projects in Developing Countries. Sustainability 2022, 14, 14149. [Google Scholar] [CrossRef]

- Nguyen, D.A.; Garvin, M.J.; Gonzalez, E.E. Risk Allocation in U.S. Public-Private Partnership Highway Project Contracts. J. Constr. Eng. Manag. 2018, 144, 04018017. [Google Scholar] [CrossRef]

- Page, S.N.; Ankner, W.; Jones, C.; Fetterman, R. The Risks and Rewards of Private Equity in Infrastructure. Public Work. Manag. Policy 2008, 13, 100–113. [Google Scholar] [CrossRef]

- Ramli, N.H.; Adnan, H.; Baharuddin, H.E.A.; Bakhary, N.A.; Rashid, Z.Z.A. Financial Risk in managing Public-Private Partnership (PPP) Project. IOP Conf. Ser. Earth Environ. Sci. 2022, 1067, 012074. [Google Scholar] [CrossRef]

- Schaufelberger, J.E.; Wipadapisut, I. Alternate Financing Strategies for Build-Operate-Transfer Projects. J. Constr. Eng. Manag. 2003, 129, 205–213. [Google Scholar] [CrossRef]

- Feng, Y.; Guo, X.; Wei, B.; Chen, B. A Fuzzy Analytic Hierarchy Process for Risk Evaluation of Urban Rail Transit PPP Projects. Edited by Dalin Zhang, Sabah Mohammed, and Alessandro Calvi. J. Intell. Fuzzy Syst. 2021, 41, 5117–5128. [Google Scholar] [CrossRef]

- Wang, H.; Chen, B.; Xiong, W.; Wu, G. Commercial Investment in Public–Private Partnerships: The Impact of Contract Characteristics. Policy Politics 2018, 46, 589–606. [Google Scholar] [CrossRef]

- Wang, Y.; Zhao, Z.J. Evaluating the Effectiveness of Public–Private Partnerships in Highway Development: The Case of Virginia. Transp. Res. Rec. J. Transp. Res. Board 2018, 2672, 43–53. [Google Scholar] [CrossRef]

- Zhang, J.; Li, J.; Xu, S.; Zuo, J. PPP Concession Contract/Guidelines: A Comparative Analysis. In Proceedings of the 20th International Symposium on Advancement of Construction Management and Real Estate; Wu, Y., Zheng, S., Luo, J., Wang, W., Mo, Z., Shan, L., Eds.; Springer: Singapore, 2017; pp. 1279–1292. [Google Scholar]

- Zhang, S.; Li, J.; Li, Y.; Zhang, X. Revenue Risk Allocation Mechanism in Public-Private Partnership Projects: Swing Option Approach. J. Constr. Eng. Manag. 2021, 147, 04020153. [Google Scholar] [CrossRef]

- Zheng, X.; Liu, Y.; Sun, R.; Tian, J.; Yu, Q. Understanding the Decisive Causes of PPP Project Disputes in China. Buildings 2021, 11, 646. [Google Scholar] [CrossRef]

- Holian, M.J. Public-Private Partnerships for Brownfield Redevelopment: Economic Development, Regulatory Reform, and the Private Sector Role in Urban Environmental Management. In Environmental Management; 2006; pp. 1–8. Available online: https://www.cdfa.net/cdfa/cdfaweb.nsf/ord/nemwi-p3brownfields-614.html/$file/brownfield%20public%20private.pdf (accessed on 16 May 2023).

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Akhtar, M.; Mufti, N.A.; Mubin, S.; Saleem, M.Q.; Zahoor, S.; Ullah, S. Identification of Various Execution Modes and Their Respective Risks for Public–Private Partnership (PPP) Infrastructure Projects. Buildings 2023, 13, 1889. https://doi.org/10.3390/buildings13081889

Akhtar M, Mufti NA, Mubin S, Saleem MQ, Zahoor S, Ullah S. Identification of Various Execution Modes and Their Respective Risks for Public–Private Partnership (PPP) Infrastructure Projects. Buildings. 2023; 13(8):1889. https://doi.org/10.3390/buildings13081889

Chicago/Turabian StyleAkhtar, Muhammad, Nadeem Ahmad Mufti, Sajjad Mubin, Muhammad Qaiser Saleem, Sadaf Zahoor, and Sanna Ullah. 2023. "Identification of Various Execution Modes and Their Respective Risks for Public–Private Partnership (PPP) Infrastructure Projects" Buildings 13, no. 8: 1889. https://doi.org/10.3390/buildings13081889

APA StyleAkhtar, M., Mufti, N. A., Mubin, S., Saleem, M. Q., Zahoor, S., & Ullah, S. (2023). Identification of Various Execution Modes and Their Respective Risks for Public–Private Partnership (PPP) Infrastructure Projects. Buildings, 13(8), 1889. https://doi.org/10.3390/buildings13081889