Abstract

New high-order weak schemes are proposed and simplified to solve stochastic differential equations with Markovian switching driven by pure jumps (PJ-SDEwMs). Using Malliavin calculus theory, it is rigorously proven that the new numerical schemes can achieve a high-order convergence rate. Some numerical experiments are provided to show the efficiency and accuracy.

MSC:

65C30; 60H35

1. Introduction

Let be a complete probability space with a filtration generated by a Poisson process. In this paper, we mainly study the second-order weak schemes of the following Equations (PJ-SDEwMs) on the probability space :

with initial value where is Markov chain, is a compensated Poisson measure, and is equipped with its Borel field E. The drift coefficient is denoted by , and the jump diffusion coefficient is represented by .

Recently, the study of SDEs with Markovian switching driven by pure jumps has attracted increasing interest. PJ-SDEwMs can be seen as a generalization of the SDEs with jump. It is also possible to think of it as a generalization of SDEs with Markovian switching, of course. It is not only used in finance but also has a wide range of applications in control systems, bio-mathematics, chemistry and mechanics (see [1,2,3]). The authors [4] study mode coupling in a multimode step-index microstructured polymer optical fibers for potential sensing and communication applications. Ji and Chizeck [5] focused on the control problem for systems with continuous-time Markovian jump parameters. Mao [6] discussed the exponential stability for general nonlinear SDEwMs. Similar to SDEs with jump, it is difficult to obtain an explicit solution for SDEwMs. Therefore, we need effective schemes which are accurate and computationally convenient to approximate the true solutions. Yuan and Mao [7] discovered the convergence of the Euler–Maruyama scheme, which is used to obtain the stationary distribution of SDEwMs in [8]. Mao and Yuan [9] gave the systematic presentation of the theory of SDEs with Markovian switching. Then, the existence and uniqueness of solutions for neutral SDEwMs were proven in [10] under non-Lipschitz conditions, and Euler approximate solutions were provided for solving SDEwMs. Common numerical schemes for solving SDEs with jumps or SDEwMs include Euler–Maruyama scheme [7,9,11,12], Milstein scheme [13,14], and jump-adapted scheme [15,16]. The authors of [17] studied the balanced implicit numerical methods for solving SDEs driven by Poisson jumps. Zhou and Mamon [18] expanded three short-rate models, integrating the switching of economic regimes via a discrete-time finite-state Markov chain.

A high-order model incorporating drift and volatility modulation by a discrete-time weak Markov chain is introduced in [19]. Yang, Yin and Li [20] utilized stochastic approximation techniques to analyze the stability of numerical solutions for jump diffusions with Markovian switching. Furthermore, the authors [21] study the convergence of SDEs differential equations containing delay and Markovian switching, and an Euler scheme for solving SDEwMs under non-Lipschitz conditions is given in [22]. Given the application requirements in finance and related fields, there is an increasing interest in studying high-order numerical schemes for solving SDEs. For instance, Fan [23] developed a strong approximation order 1.5 scheme for solutions of SDEwMs. Liu and Li [24] proved the convergence of the weak stochastic Taylor scheme with an appropriate order. In [25], a new weak scheme for solving SDEwMs driven by Brownian motion was proposed and achieved the convergence rate of second-order. Additionally, the numerical results of several weak schemes are presented, with a focus on the second-order weak stochastic Taylor scheme and the extrapolation of the Euler scheme. We refer to the high-order numerical methods of solving SDEs in [24,25,26,27] to propose novel numerical schemes of pure jump SDEs, which can achieve a weak second-order convergence rate.

The primary contributions of this paper can be succinctly highlighted as follows:

- For PJ-SDEwMs with mark-dependent jump coefficient , we first propose Scheme 1 using Wagner–Platen expansion. However, Scheme 1 contains multiple stochastic integrals, which are not easily computed. Thus, to avoid the use of some double integrals, we propose another new Scheme 2, by employing the trapezoidal rule to approximate the following multiple stochastic integralsFurthermore, we can use the definition of compound Poisson process to computewhich has no high-accuracy based on the truncation approximation.

- Especially, for PJ-SDEwMs with mark-independent jump coefficient , we propose Scheme 3 by using the trapezoidal rule and duality formula, which does not involve multiple stochastic integrals. Moreover, Scheme 3 is not a special case of Scheme 2. Using Malliavin calculus theory, it is strictly proven that Scheme 3 has a local weak order-3.0 convergence rate. The greatest state difference and the upper bound of the state value are connected to the convergence rate.

- The convergence and stability results of Schemes 2 and 3 are validated through numerical experiments, which are also compared with the Euler scheme to verify its effectiveness and accuracy. Scheme 3 is simpler and faster than Scheme 2 in the case of mark-independent PJ-SDEwMs.

The following is a list of some notations to be used later: In Section 2, we give the introduction of fundamental concepts, encompassing the Markov Chain, Itô-Taylor expansion, and Malliavin stochastic calculus which include duality formula and chain rule. Section 3 presents our novel weak second-order numerical schemes, accompanied by a rigorous proof establishing their local weak convergence order of 3.0. In Section 4, we give the practical application of our proposed new schemes, where we present some numerical examples to validate the effectiveness and accuracy of them. The paper concludes with Section 5, providing a succinct summary of our work.

The following notations are listed for future reference:

- ⧫

- is the set of continuously differential functions with uniformly bounded partial derivatives and for and The notation is similarly defined.

- ⧫

- is the set of functions which have at most polynomial growth.

- ⧫

- C is a generic constant depending only on the upper bounds of derivatives of , g and the largest state difference.

2. Preliminaries and Notation

2.1. Markov Chain

On the probability space we assume that is a right-continuous Markov chain and takes values in a finite state space with generator

where and, for . Let be the mark set equipped with its Borel field Now, on we consider a given intensity measure of the form with kernel function for all and for , and suppose that the total intensity Moreover, with for and for which the intervals have length , that is

and so on (see [9]).

2.2. Wagner–Platen expansion

First, we give Itô’s isometry for jump martingale and multi-dimensional Itô formula for PJ-SDEwMs (see [9,27]).

Lemma 1

(Itô’s isometry for jump martingale, see [27]). If is -adapted stochastic process, then

Lemma 2

(Itô formula, see [9]). If , for any , we have

with the operators

with and

A higher order of PJ-SDEwMs can be obtained via the Wagner–Platen expansion. However, there are a few more definitions and notations that must be introduced before we can discuss the order of approximation. When for , we designate a row vector as a multi-index of length . Then, the set of all multi-indices is denoted by

where v is the multi-index of length zero . Assume that is the hierarchical set, and is the corresponding remainder set. Given a multi-index with , we write and for the multi-index obtained by eliminating the last component and the first component of , respectively. Let us define recursively the Itô coefficient functions by

Furthermore, let the multiple Itô integral be defined by

For and we assume

For example if

2.3. Malliavin Stochastic Calculus

Suppose the operator is the Malliavin derivative of Poisson process at . A random variable U is Malliavin differentiable if and only if . Here, the stochastic Sobolev spaces consist of all measurable with the norm

where the Malliavin derivative is defined as

with especially for .

Lemma 3

(Duality formula, see [28]). Assume and for , we obtain the duality formula

Lemma 4

(Chain rule, see [28]). Let , then and

Let and ϕ be a real continuous function on and . Then,

Lemma 5

(See [28]). For and the stochastic process we have

and

where is the indicator function defined by for and for

3. Main Results

First, we consider a regular time uniform discretization: with for . For a basic depiction, we consider and which is the k-th component of . Using the classical Wagner–Platen expansion, we can derive the following Scheme 1 for solving SDEwMs with mark-dependent jump coefficient.

Scheme 1

(Wagner–Platen expansion). Given the initial condition . For , we solve with its k-th component by

From the Wagner–Platen expansion and trapezoidal rule we obtain

where the truncation error

with Here, we write for and for . Then, by Equation (12), we propose the following second-order new scheme.

Scheme 2.

Given the initial condition . For , we solve with its k-th component by

with .

Remark 1.

If the jump coefficient function , we generate the compound Poisson process

and the multiple stochastic integral in Scheme 2 can be computed by

where the pairs of k-th jump time and marks are independent uniformly distributed in the planar region , and For the Lebesgue–Stieltjes stochastic integral we can use trapezoidal rule to approximate it, that is

In the special case of a mark-independent jump coefficient , we use the following discrete-time approximation

with the truncation error

Based on Equation (16), we propose the following simplified scheme for solving mark-independent PJ-SDEwMs.

Scheme 3.

Given the initial condition . For , we solve with its k-th component by

where and

Remark 2.

Here, is a kernel function, which may be symmetric, i.e., ;or non-symmetric, i.e.,

or singular, i.e.

Local Weak Convergence Theorems

In this section, using Malliavin stochastic analysis and the Wagner–Platen expansion, we rigorously prove and obtain the local weak order-3.0 convergence of Schemes 1–3.

Theorem 1.

(Local weak convergence) Suppose that and satisfy Equation (12) and Scheme 1, respectively. If the functions and then

where is a generic constant, which can vary from line to line.

Proof of Theorem 1.

Theorem 2.

Suppose that and satisfy Equation (12) and Scheme 2, respectively. If the functions and then

where is a generic constant, which can vary from line to line.

Proof of Theorem 2.

Using the multi-dimensional Taylor formula, for ease of proof, we assume

where

Assume is the k-th component of explicit solution . Then, it follows from the Itô–Taylor expansion that

which by the fact yields

It follows from the definition of the operator that

By the duality formula in Lemma 3 and from Equations (29) and (30), we deduce

where

By taking Malliavin derivative with respect to we obtain

for and Furthermore, the chain rule (10) gives

Then, it follows from Taylor formula and Lemma 5 that

where and

By the duality formula, we have

Now by Lemma 3, from Equations (33)–(35), we have

which by using the fact

yields

Note that

and we deduce from Lemma 3 that

which gives

Using the duality formula in Lemma 3, we conclude that

Combining the inequalities (37)–(40), we obtain

For , applying the Itô isometry Formula (4), we have

For , we obtain

By the inequalities (42) and (43), we deduce

From the inequalities (41) and (44), we finally obtain

□

Theorem 3.

Assume that and , respectively, satisfy Equation (16) and Scheme 3. If the functions and then

where is a generic constant, which could change line by line.

Proof of Theorem 3.

Using multi-dimensional Taylor formula, to make the proof easier, we have

where

Assume is the k-th component of explicit solution . Then, from the Itô–Taylor expansion, we can obtain

which yields

By the duality formula in Lemma 3 and from Equation (49), we deduce

where

For by using Malliavin derivative in relation to , we get

which by combining chain rule (10) gives

where the functions and do not depending only on t and e. Furthermore, from Lemma 3, using the notation , we have

which by using the fact

gives . Similarly, note that

we deduce

Using Itô’s formula, we can obtain , note also that

by the duality formula we have

Applying the duality formula in Lemma 3, we have

Combining Equation (50), and inequality (57), we have

For , by using the Itô isometry Formula (4), we obtain

For , we obtain

Combining inequalities (59) and (60), we have

From inequalities (58) and (61), we finally obtain

□

4. Numerical Experiments

Assume that the state space Markov chain is in , and the transition probability matrix is

We choose as the sample size for our numerical experiments, where is the total number of sample pathways. We can measure the average errors of local weak convergence and the errors of global weak convergence as follows:

where , are . We let . Let represent numerical solution and represent explicit solutions at the time , where .

Now, we give three numerical examples, including mark-dependent PJ-SDEwMs, mark-independent PJ-SDEwMs (Ornstein-Uhlenbeck type) and PJ-SDEwMs (geometrical type).

Example 1.

We consider the following mark-dependent PJ-SDEwMs:

where is a constant and the Markov chain is in . The group coefficients g are given by We use the Itô formula to obtain the explicit solution of Equation (62) which is

Assume and and the pairs () are independent uniformly distributed in the square Assume the kernel function , we have for

Then, for solving the PJ-SDEwMs (62), we have Scheme 2 with the form

which by the computation of compound Poisson process (see [27]) and the trapezoidal rule gives

where

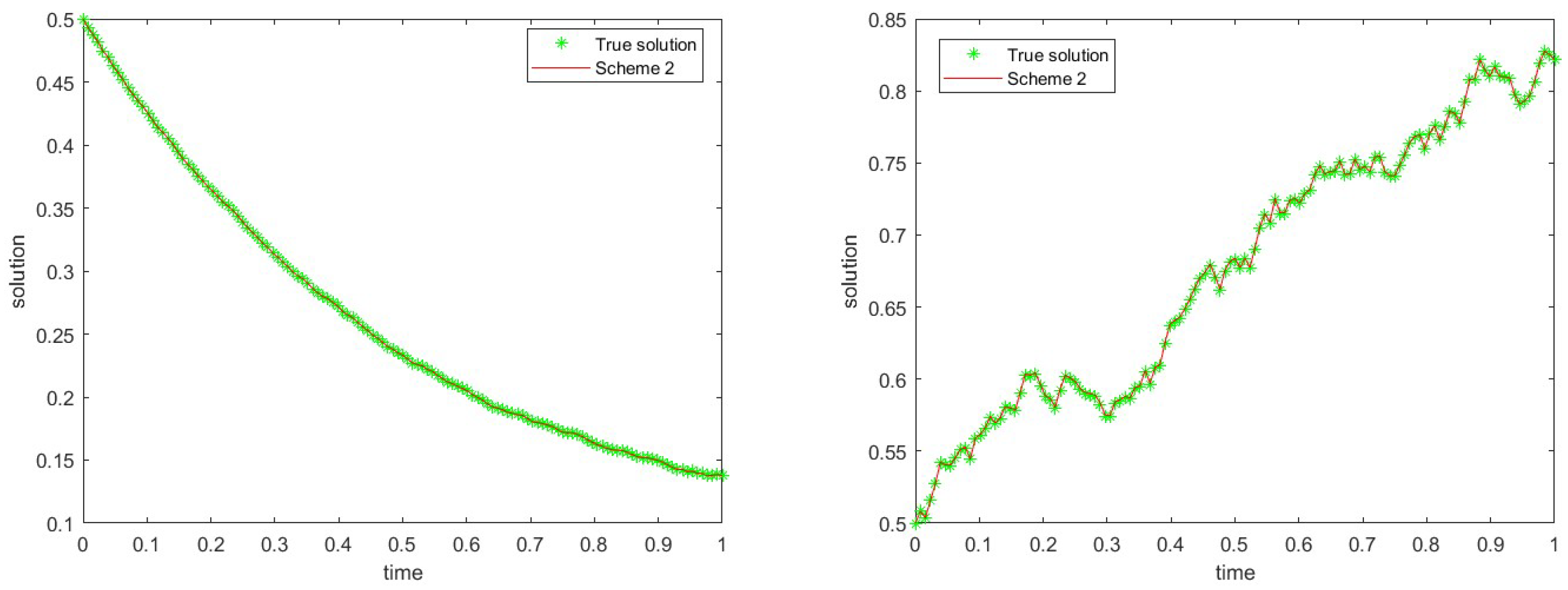

We use CR to represent the rate of convergence over the time step . To evaluate the performance of Scheme 2, we calculate their global errors and average local errors. It is gratifying to find that the global convergence rate (Glo.CR) has order 2.0, while the average local convergence rate (Avg.local CR) has order 3.0. This means that Scheme 2 has excellent convergence properties and shows the great accuracy in numerical calculations (see Table 1). At the same time, we draw trajectories of numerical and analytical solutions in Figure 1. By comparing different state values, it was found that regardless of how the state values change, the simulation efficacy demonstrated by Scheme 2 remains highly favorable.

Table 1.

The results of convergence rates and errors for Scheme 2 in Example 1.

Figure 1.

(Left) True solution and numerical solution when . (Right) True solution and numerical solution when .

Example 2.

Consider the Ornstein–Uhlenbeck (O-U) PJ-SDEwMs as follows:

where is a constant and the Markov chain is in and the group coefficients g are given by and It is evident that Equation (63) possesses an explicit solution:

According to the evaluation results presented in Table 2, a detailed analysis was conducted regarding the performance of Schemes 2 and 3. The evaluation included the calculation of their global error and average local error. Interestingly, both Schemes 2 and 3 demonstrated a second-order convergence rate during the global convergence process, indicating a relatively rapid approach towards the optimal solution. Furthermore, in terms of local convergence performance, both schemes exhibited a higher level of convergence with a third-order average convergence rate. This finding suggests that both Schemes 2 and 3 exhibit favorable performance. In Table 3, we compare the global errors and convergence rate of the Euler scheme, Schemes 2 and 3. It is obvious that Scheme 3 makes it simpler and more convenient for us to calculate in comparison to Scheme 2. Equally gratifying is that Scheme 3 greatly reduces the computing time. Scheme 3 takes 3.597104 seconds, while Scheme 2 takes 10.024912 seconds.

Table 2.

The results of convergence rates and errors for Scheme 3 in Example 2.

Table 3.

The results of global convergence rates and errors for three schemes in Example 2.

Example 3.

We consider the following PJ-SDEwMs with mark-independent jump coefficient:

where the Markov chain is in , and represents a compensated Poisson measure in one dimension. Assuming that and are independent, with the group coefficients f and g provided by

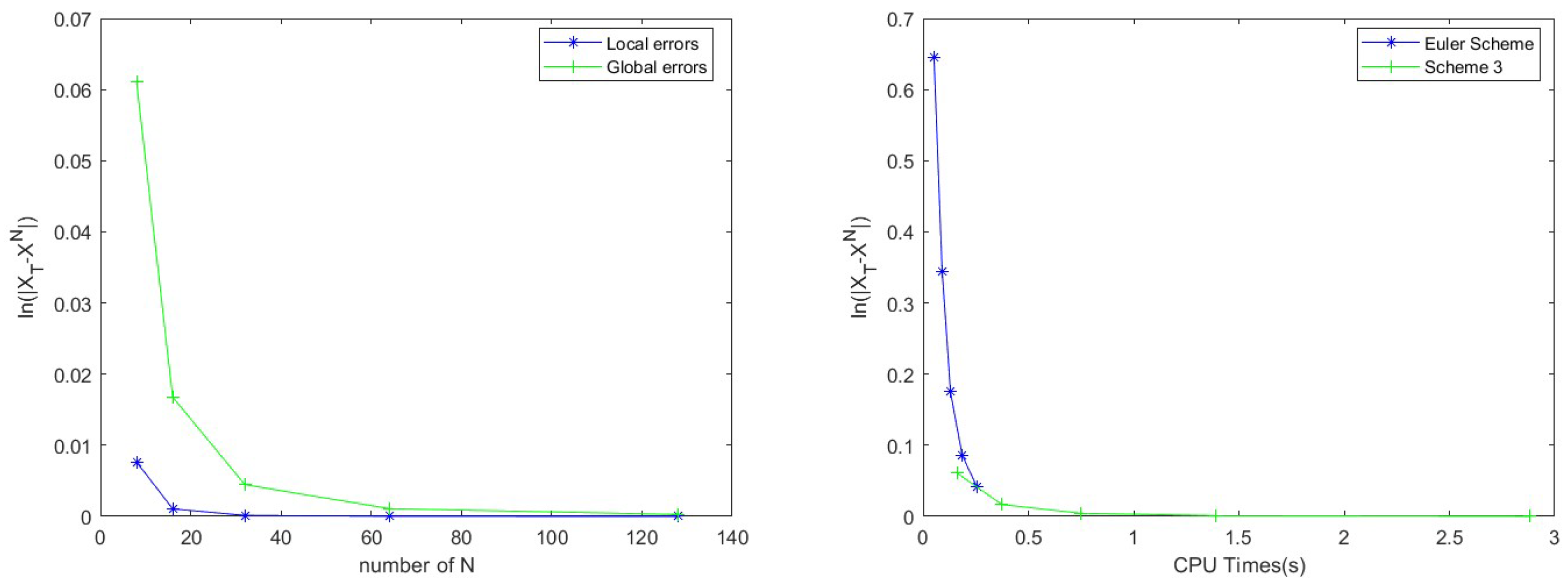

We utilize the Itô formula to derive the explicit solution for Equation (64) as

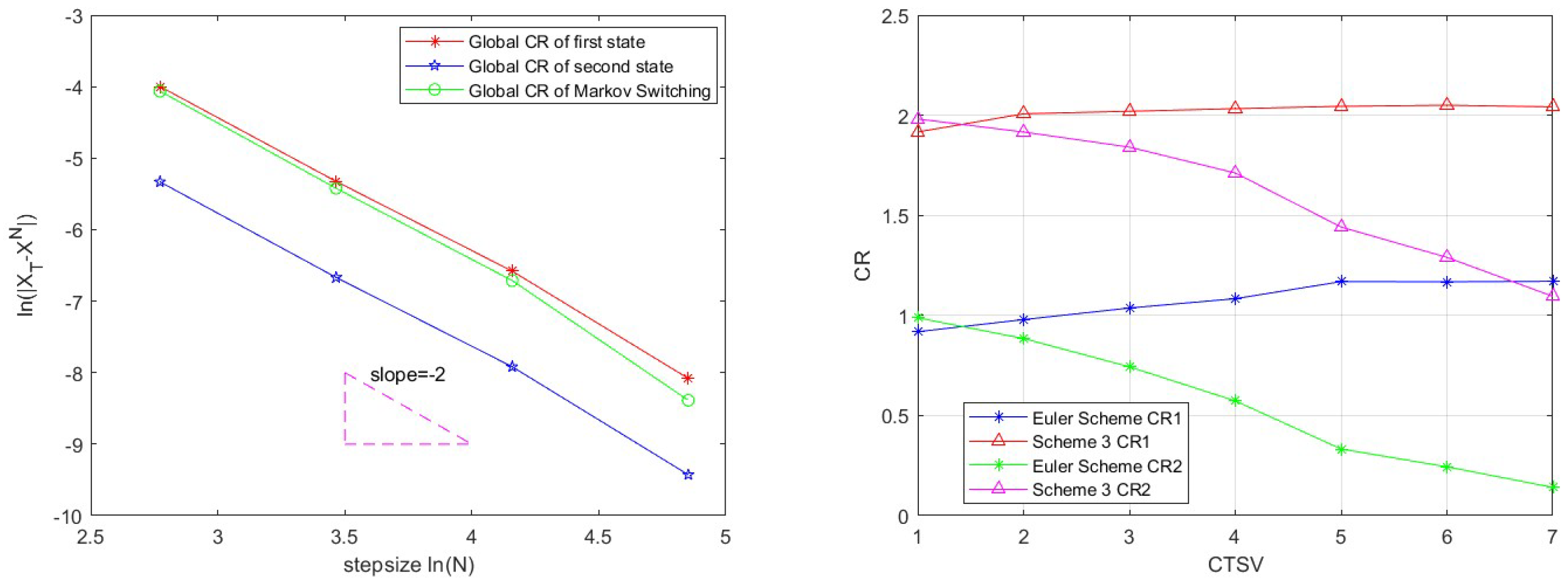

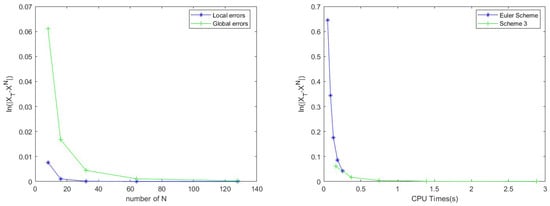

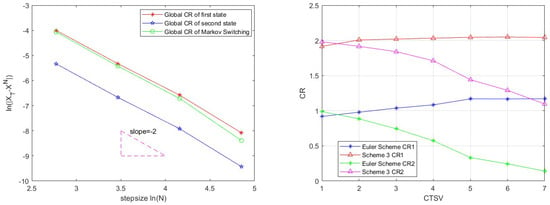

The time with is set in Table 4, and we use Scheme 3 to solve the PJ-SDEwMs (64). Scheme 3 has the second-order global convergence rate (Glo.CR) and the third-order average local convergence rate (Avg.local CR). In Table 5 and Table 6, we compare the Euler Scheme with Scheme 3 with different state values. For clearer display, we draw two pictures (errors of the new scheme and CPU times) according to the two tables in Figure 1. In Figure 2 (left), we clearly demonstrate that there are differences in global errors between individual states and transition states. For a more intuitive presentation, Figure 3 (right) illustrates the fluctuation of convergence rates as the number of times changes, showcasing the process of convergence rate variation with the change in state value times (CTSV). These visualizations allow us to gain a clearer understanding of the impact of state changes on convergence rates. The observation enhances our comprehension of the dynamic nature of the system.

Table 4.

The results of convergence rates and errors for Scheme 3 in Example 3.

Table 5.

Global convergence rates of multiple groups of different state values for two schemes with .

Table 6.

Global convergence rates of multiple groups of different state values in two schemes with .

Figure 2.

(Left) The results of the global errors and the average local errors for Scheme 3 in Example 3. (Right) The correlations for global errors and CPU time of all schemes.

Figure 3.

(Left) The convergence rates of different states. (Right) The correlations for global convergence rates and the variation of state values.

5. Discussion

In this work, we mainly study stochastic differential equations with Markovian switching driven by pure jumps (PJ-SDEwMs) and give three numerical schemes. In general, PJ-SDEwMs contains mark-dependent jump coefficient , which we can solve using Schemes 1 and 2. Compared to the Itô-Taylor expansion scheme (Scheme 1), Scheme 2 is easier to calculate by using the trapezoidal rule to approximate the following multiple stochastic integrals:

In particular, PJ-SDEwMs contains mark-independent jump coefficient , we can compute it in Schemes 2 and 3. Because multidimensional random integrals are avoided, Scheme 3 is simpler and more convenient (Example 2 demonstrates this very well). In addition, by using Malliavin calculus theory, we strictly proved that the proposed new schemes have local weak order-3.0 convergence rates. However, through Example 3, we find that as the upper bound of the state values gradually increases, the simulation effect of Scheme 3 is still good, but the convergence rates will gradually decrease.

6. Conclusions

In this paper, we propose three new weak second-order numerical schemes to solve stochastic differential equations with Markovian switching driven by pure jumps. By using the Malliavin stochastic analysis method, the new schemes are strictly analyzed theoretically, and the second-order convergence rate is proven. Finally, the correctness and effectiveness of the second-order schemes are verified by three numerical experiments. In addition, we find that as the upper bound of the state values increases, the global convergence rate of Scheme 3 gradually decreases to the first-order. Besides, the maximum state difference and the variation of Markov chains have a certain impact on the convergence rate.

Author Contributions

Conceptualization, Y.L.; methodology, Y.L.; software, Q.X. and Y.X; validation, Y.L., Y.X., Q.X. and Y.Z.; formal analysis, Y.L. and Y.X; investigation, Y.L., Y.X., Q.X. and Y.Z.; resources, Y.L.; data curation, Y.L., Y.X., Q.X. and Y.Z.; writing—original draft preparation, Y.L. and Y.X.; writing—review and editing, Y.L., Y.X., Q.X. and Y.Z.; visualization, Y.X.; supervision, Y.L.; project administration, Y.L.; funding acquisition, Y.L. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

No new data were created or analyzed in this study. Data sharing is not applicable to this article.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Jang, J. Jump diffusion processes and their applications in insurance and finance. Math. Econ. 2007, 41, 62–70. [Google Scholar] [CrossRef]

- Geman, H. Pure jump Levy processes for asset price modeling. J. Bank. Financ. 2002, 26, 1297–1316. [Google Scholar] [CrossRef]

- He, H.; Qi, W.; Kao, Y. HMM-based adaptive attack-resilient control for Markov jump system and application to an aircraft model. Appl. Math. Comput. 2021, 392, 125–668. [Google Scholar]

- Savović, S.; Li, L.Q.; Savović, I.; Djordjevich, A.; Min, R. Treatment of Mode Coupling in Step-Index Multimode Microstructured Polymer Optical Fibers by the Langevin Equation. Polymers 2022, 14, 1243. [Google Scholar]

- Ji, Y.; Chizeck, H.J. Controllability, stabilizability and continuous-time Markovian jump linear quadratic control. IEEE Trans. Automat. Control. 1990, 35, 777–788. [Google Scholar] [CrossRef]

- Mao, X. Stability of stochastic differential equations with Markovian switching. Stoch. Process.Their Appl. 1999, 79, 45–67. [Google Scholar] [CrossRef]

- Yuan, C.; Mao, X. Convergence of the Euler–Maruyama method for stochastic differential equations with Markovian switching. Math. Comput. Simul. 2004, 64, 223–235. [Google Scholar] [CrossRef]

- Mao, X.; Yuan, C.; Yin, G. Numerical method for stationary distribution of stochastic differential equations with Markovian switching. J. Comput. Appl. Math. 2005, 174, 1–27. [Google Scholar] [CrossRef]

- Mao, X.; Yuan, C. Stochastic Differential Equations with Markovian Switching; Imperial College Press: London, UK, 2006. [Google Scholar]

- Mao, W.; Mao, X. On the approximations of solutions to neutral SDEs with Markovian switching and jumps under non-Lipschitz conditions. Appl. Math. Comput. 2014, 230, 104–119. [Google Scholar] [CrossRef]

- Li, M.; Huang, C.; Chen, Z. Compensated projected Euler–Maruyama method for stochastic differential equations with superlinear jumps. Appl. Math. Comput. 2021, 393, 125–760. [Google Scholar] [CrossRef]

- Yin, B.; Ma, Z. Convergence of the semi-implicit Euler method for neutral stochastic delay differential equations with phase semi-Markovian switching. Appl. Math. Model. 2011, 35, 2094–2109. [Google Scholar] [CrossRef]

- Ren, Q.; Tian, H. Compensated θ-Milstein methods for stochastic differential equations with Poisson jumps. Appl. Numer. Math. 2020, 150, 27–37. [Google Scholar] [CrossRef]

- Chaman, K.; Tejinder, K. On explicit tamed Milstein-type scheme for stochastic differential equation with Markovian switching. J. Comput. Appl. Math. 2020, 377, 112917. [Google Scholar]

- Kohatsu-Higa, A.; Tankov, P. Jump-adapted discretization schemes for Lévy-driven SDEs. Stoch. Process. Their Appl. 2010, 120, 2258–2285. [Google Scholar] [CrossRef]

- Mikulevicius, R. On the rate of convergence of simple and jump-adapted weak Euler schemes for Lévy driven SDEs. Math. Naclir. 2012, 122, 2730–2757. [Google Scholar] [CrossRef]

- Hu, L.; Gan, S. Convergence and stability of the balanced methods for stochastic differential equations with jumps. Int. J. Comput. Math. 2011, 88, 2089–2108. [Google Scholar] [CrossRef]

- Zhou, N.; Mamon, R. An accessible implementation of interest rate models with Markov-switching. Expert Syst. Appl. 2012, 39, 4679–4689. [Google Scholar] [CrossRef]

- Siu, T.; Ching, W.; Fung, E.; Ng, M.; Li, X. A high-order Markov-switching model for risk measurement. Comput. Math. Appl. 2009, 58, 1–10. [Google Scholar] [CrossRef][Green Version]

- Yang, Z.; Yin, G.; Li, H. Stability of numerical methods for jump diffusions and Markovian switching jump diffusions. J. Comput. Appl. Math. 2015, 275, 197–212. [Google Scholar] [CrossRef]

- Li, R.H.; Chang, Z. Convergence of numerical solution to stochastic delay differential equation with poisson jump and Markovian switching. Appl. Math. Comput. 2007, 184, 451–463. [Google Scholar]

- Chen, Y.; Xiao, A.; Wang, W. Numerical solutions of SDEs with Markovian switching and jumps under non-Lipschitz conditions. J. Comput. Appl. Math. 2019, 360, 41–54. [Google Scholar] [CrossRef]

- Fan, Z. Convergence of numerical solutions to stochastic differential equations with Markovian switching. Appl. Math. Comput. 2017, 315, 176–187. [Google Scholar] [CrossRef]

- Liu, X.; Li, C. Weak approximations and extrapolations of stochastic differential equations with jumps. SIAM J. Numer. Anal. 2000, 37, 1747–1767. [Google Scholar] [CrossRef]

- Li, Y.; Wang, Y.; Feng, T.; Xin, Y. A High Order Accurate and Effective Scheme for Solving Markovian Switching Stochastic Models. Mathematics 2021, 9, 588. [Google Scholar] [CrossRef]

- Buckwar, E.; Riedler, M.G. Runge–Kutta methods for jump-diffusion differential equations. J. Comput. Appl. Math. 2011, 236, 1155–1182. [Google Scholar] [CrossRef]

- Platen, E.; Bruti-Liberati, N. Numerical Solutions of Stochastic Differential Equations with Jump in Finance; Springer: Berlin/Heidelberg, Germany, 2010. [Google Scholar]

- Giulia, D.N.; Bernt, Ø.; Frank, P. Malliavin Calculus for Lévy Processes with Applications to Finance; Springer: Berlin/Heidelberg, Germany, 2008. [Google Scholar]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).