Abstract

In financial time series analysis, symmetric and asymmetric GARCH models have become essential models for measuring the characteristics of economic volatility. In this article, we propose the consistency and asymptotic normality properties of the self-weighted quasi-maximum likelihood estimation without assuming the existence of the second moment for the moving average model with a class of GARCH error. Numerical simulation shows that the parameter estimation performs well; empirical analysis shows that the self-weighted quasi-maximum likelihood estimation of the moving average model with a class of GARCH error can improve the data fitting effect and prediction ability.

1. Introduction

With the progress and development of multivariate time series theory and technology, to accurately describe the dynamic time-varying characteristics of the volatility of financial time series data, Engle [1] proposed an ARCH model for the volatility of the UK inflation rate, and Bollerslev [2] extended it to a GARCH model. On this basis, many experts and scholars at home and abroad have done much research on the GARCH model in combination with the asymmetry and long memory of volatility. For example, given that the impact of positive and negative news on stock market volatility is asymmetric, Nelson [3] proposed the exponential GARCH (EGARCH) model; Glosten, Jagannathan, and Runkle [4] proposed the asymmetric GARCH (GJR) model; H. Viet Long and Bin Jebreen et al. [5] employed the generalized autoregressive conditional heteroskedasticity (GARCH) model for risk management as their main contribution. However, in the traditional GARCH model, the conditional heteroscedasticity is a function of the unobservable lag residuals square sequence, which makes the parameter estimation of this model complex. Li and Zhang et al. [6] combined the ideas of a factor model and a symmetric GARCH model to describe the dynamics of a high-dimensional conditional covariance matrix. Therefore, Baillie [7] described the population characteristics of various long memory processes in FIGARCH. The conditional variance of the process implies a slow hyperbolic decay rate for the influence of lagged squared innovations. Ling [8] proposed the DAR(p) model based on the ARCH model. In this way, a better estimate of the parameters can be obtained. Moreover, Ling [9] proposed the consistency and asymptotic properties of self-weighted quasi-maximum likelihood estimation in the presence of fractional moments for the ARMA-GARCH model. Then, Zhu and Ling [10] proposed the strong coincidence and asymptotic properties of global self-weighted quasi-maximal exponential likelihood estimation for the ARMA-GARCH model in the presence of fractional moments. Many models with GARCH also have some properties of similar analysis. For example, Pan and Chen et al. [11] discussed the asymptotic properties of WLAD estimation for the ARFIMA model under stationary and non-stationary conditions. For long-memory and heteroscedastic models, Ramírez-Parietti and Contreras-Reyes et al. [12] computed cross-sample entropy measures for synchrony level, which involved ARMA, ARFIMA, ARMA-GARCH, and FIGARCH processes.

Based on the classical ARCH model, Ling [13] proposed the DAR model to make the parameter estimation of the DAR model become easier to estimate and proved the consistency and asymptotic properties of the QMLE estimation without assuming the existence of the second-order moment of the sequence. Then Zhu and Zhang et al. [14] proposed a class of MA-GARCH models (the DAR(p) model p tends to infinity), proving that Ling has done similar work without assuming the existence of second-order moments. However, when there are extreme data, the parameter weights estimated by QMLE are all 1, which has a specific error. Thus, Ling [9] proved that the self-weighted QMLE estimation of the RAMA-GARCH model is consistent and asymptotic in the presence of fractional moments. The purpose is to use weights to reduce leverage points and make estimates more precise and more efficient.

In this paper, to reduce the error, we perform a self-weighted QMLE estimation based on Zhu and Zhang et al. [14] Giving different weights to different values makes our estimates more robust, proving some properties of the forecast. The rest of the article is organized as follows. Section 2 introduces the consistency and asymptotic properties of estimation; Section 3 presents the numerical simulation of self-weighted QMLE estimation. Section 4 gives a real example; Section 5 concludes the article. The proof is in Appendix A.

2. Self-Weighted QMLE

A class of MA-GARCH model can be written as

where and when , and are independent of each other. Denote , and , and . Denote , , , , , where .

Compared to traditional MA-GARCH model, the previous in (3) is instead denoted by . A class of MA-GARCH model is easier to predict than the traditional MA-GARCH model.

Remark 1.

With simple iteration, the model can be transformed into:

From this, we can see that, compared with the DAR(p) model proposed by Ling [14], the above formula is equivalent to the order p of the conditional mean, and the conditional variance tends to infinity. Then, we refer to Zhu [15] to obtain the parameter space of the above models (1)–(3).

We introduce the following conditions:

- A1:

- is an interior point in , and is stationary, ergodic, and identifiable.

- A2:

- is independent and identically distributed with a mean of 0 and a variance of 1.

- A3:

- has a nondegenerate distribution with .

- A4:

- and is a measurable, positive, and bounded function on with , and , .

Given the observations and the initial values , we can rewrite the parametric models (1)–(3) as

According to Yoshida’s [16] research on the asymptotic properties of the likelihood estimators of various nonlinear stochastic processes, for convenience, the weighted log-quasi-likelihood function (ignoring a constant) can be written as follows:

Remark 2.

This is important because it ensures that the maximum value of the log of the probability occurs at the same point as the original probability function. The quasi-score function and the quasi-information matrix are given in the Appendix A. Equation (A11) in the Appendix A.1 shows that

It is possible to obtain an estimator such that it is asymptotic normal if we can downweight .

We look for the minimizer, , of on ; that is,

We first give two lemmas.

Lemma 1.

Let , where . Then there exists a constant ρ and a neighborhood of such that:

- ;

- ;

- .

Lemma 2.

Let . Then there exists a constant ρ and a neighborhood of , and . Then:

We now can state our main results as follows.

Theorem 1.

If Assumptions A1–A4 hold, then

- where

3. Simulation

In this section, on the basis of a class of MA-GRACH model, we compared SQMLE with QMLE. In the simulation, we studied the cases when has , , and . Then we took the sequences that are generated by a class of MA-GARCH models, where . We needed to select a weight . It seemed reasonable to use the following weight analog Ling [17] and Huber [18] influence function:

where , c is the 95th quantile of the sequence . This weight satisfies assumption A4. Then, For the models (1)–(3), we compared the parameter estimation methods of Zhu and Zhang, etc. [14]. We set the sample size at and used 1000 replications.

From Table 1, when , we can see that all estimators in Table 1 have minimal biases, and the SD and AD of self-weighted QMLE are close. As the sample size n increases, the values of SD and AD both decrease. At the same time, we compare the two estimation methods, the quasi-maximum likelihood estimation(QMLE) and the self-weighted quasi-maximum likelihood estimation (SQMLE), in Table 1. With the increase in n, the bias, AD, and SD shows different trends. The quasi-maximum likelihood estimation and the self-weighted quasi-maximum likelihood estimation values were getting closer and closer. Still, the quasi-maximum likelihood estimation’s bias, AD, and SD are always slightly smaller than the bias, AD, and SD of the self-weighted quasi-maximum likelihood estimate. When this happens, it is reasonable to be pointed out by Ling [9]. Therefore, the simulation results illustrate that self-weighted quasi-maximum likelihood estimates are applicable.

Table 1.

Estimators for the models (1)–(3) when .

When , , respectively, we can see that both Table 2 and Table 3 have similar simulation effects to Table 3. Therefore, the self-weighted quasi-maximum likelihood estimation for a class of MA-GARCH model is valid.

Table 2.

Estimators for the models (1)–(3) when .

Table 3.

Estimators for the models (1)–(3) when .

There are many other weights, such as and , that satisfies assumption A4. However, our simulation results that are not reported in this paper show that the self-weighted quasi-maximum likelihood estimated is much more efficient than that based on these weights.

4. A Real Example

In this section, we empirically analyzed the models (1)–(3) by using two real data sets. We used the SQMLE to compare the goodness of fit and prediction effect for a class of MA-GARCH model and traditional MA-GARCH model.

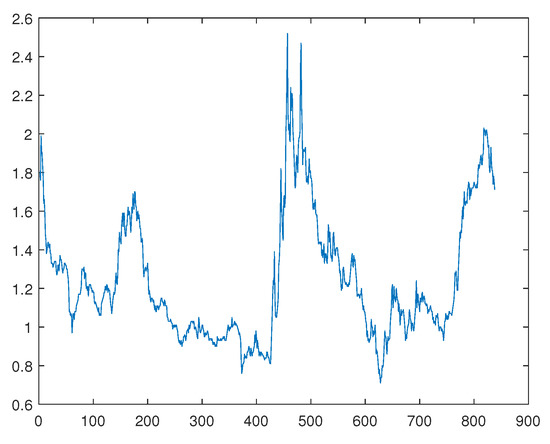

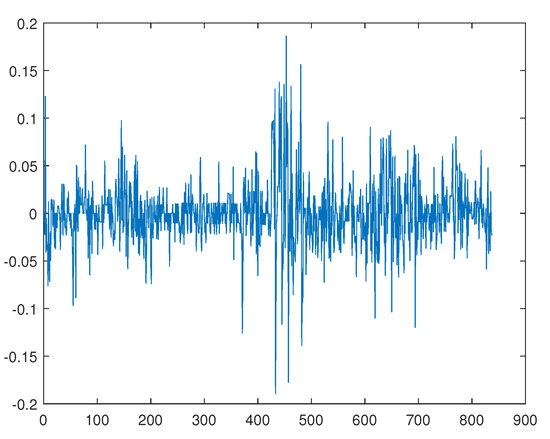

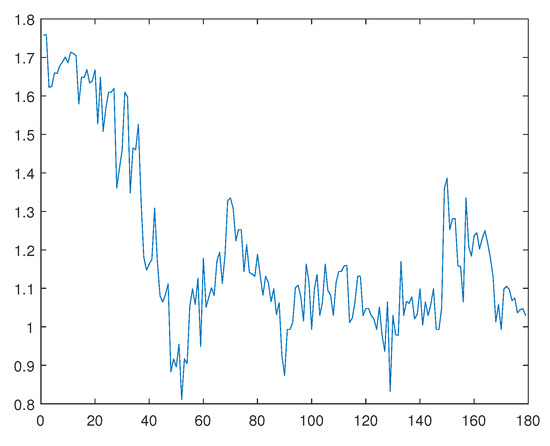

Firstly, we studied the opening price of ST Daji (000564) from 1 January 2018 to 1 January 2022, which has, in total, 837 observations. Let be the logarithms of the opening price of ST Daji (000564) in Figure 1, and , is plotted in Figure 2. Ling [8] makes a self-weighted quasi-maximum likelihood estimate for ARMA-GARCH.

Figure 1.

be the logarithms of the opening price of ST Daji (000564).

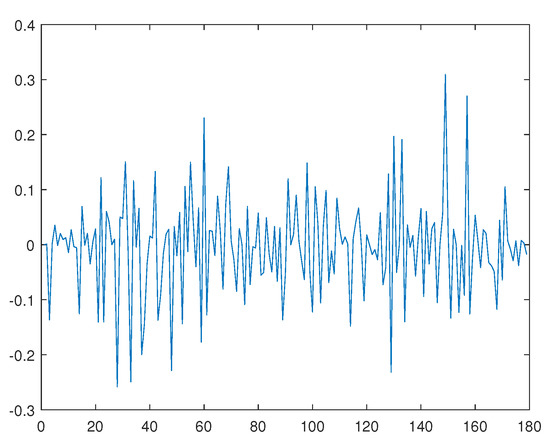

Figure 2.

Time series diagram of -.

The ARMA(0,1)-GARCH(0,1) (MA-GARCH) model was adopted to fit by Ling [8], and the result is

where the standard errors are in parentheses.

Similarly, we used models (1)–(3) to fit , and the result is

where the standard errors are in parentheses (obtained from Theorem 1).

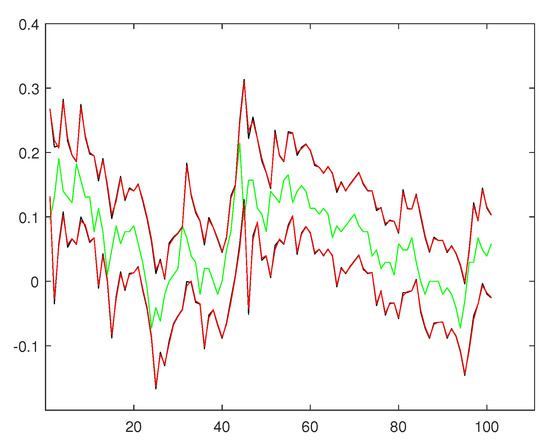

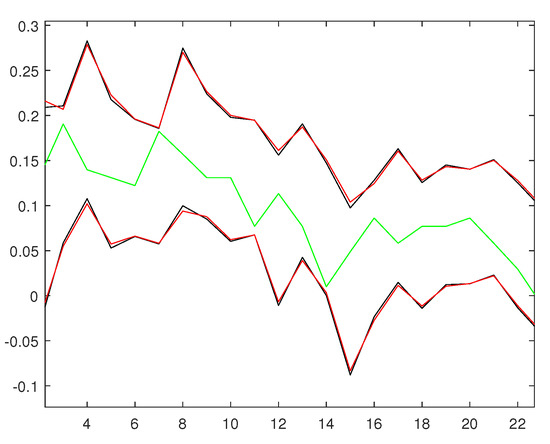

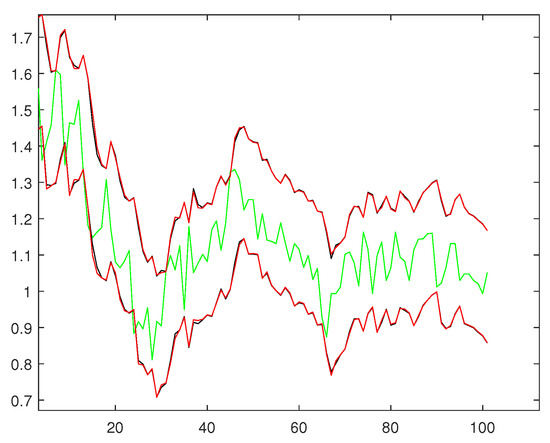

We compared the root-mean-squared error (RMSE) for the one-step-ahead forecast and log-likelihood value for models (8) and (9) and models (10) and (11), respectively. The results are shown in Table 4. In addition, for the data of the data set from 24 March 2021 to 19 August 2021, we give a 95 percent confidence interval of sequence , as shown in Figure 3 below. Figure 4 is a partial enlargement of Figure 3. As can be seen from Table 4, the RMSE value of models (10) and (11) is smaller than that of models (8) and (9), and the log-likelihood value of models (10) and (11) is bigger than that of models (8) and (9). Thus, the goodness of fit of models (10) and (11) is better than models (8) and (9). In addition, as can be seen from Figure 3, at almost all points, models (10) and (11) have a narrower confidence interval than models (8) and (9), and we can see that all points fall within the confidence interval. This shows that under this data, models (10) and (11) are better than models (8) and (9) in terms of goodness of fit and predictive ability. Therefore, in this paper, we consider models (10) and (11) to be better than models (10) and (11) to a certain extent.

Table 4.

Comparison of the fitting effect of models (8) and (9) and models (10) and (11).

Figure 3.

Time series diagram of the data (green line) and 95% forecasting confidence intervals based on models (8) and (9) (red line) and models (10) and (11) (black line), respectively.

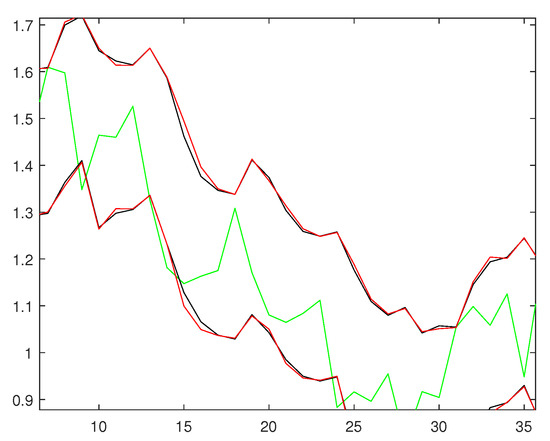

Figure 4.

Part of Figure 3 is enlarged.

Secondly, we studied the 21-day China Interbank Offered Rate from 2 November 2015 to 8 March 2016, which has 178 observations. Let be the logarithms of the 21-day China Interbank Offered Rate in Figure 5, and , is plotted in Figure 6. Ling [8] makes a self-weighted quasi-maximum likelihood estimate for ARMA-GARCH.

Figure 5.

, the logarithms of the 21-day China Interbank Offered Rate.

Figure 6.

Time series diagram of -.

ARMA(0,1)-GARCH(0,1) (MA-GARCH) model was adopted to fit by Ling [8], and the result is

where the standard errors are in parentheses.

Similarly, we used models (1)–(3) to fit , and the result is

where the standard errors are in parentheses (From Theorem 1 we get).

From Table 5, we can see that the RMSE and the log-likelihood values of models (12) and (13) and models (14) and (15) are equal. In addition, we give a 95 percent confidence interval of sequence , as shown in Figure 7 below. Figure 8 is a partial enlargement of Figure 7. From Figure 7, we can see that models (14) and (15) hasve a narrower confidence interval than models (12) and (13), and we can see that all points fall within the confidence interval. This shows that for this data, models (14) and (15) are better than models (12) and (13) in terms of predictive ability. Therefore, in this paper, we consider models (14) and (15) better than models (12) and (13) to a certain extent.

Table 5.

Comparison of the fitting effect of models (12) and (13) and models (14) and (15).

Figure 7.

Time series diagram of the data (green line) and 95% forecasting confidence intervals based on models (12) and (13) (red line) and models (14) and (15) (black line), respectively.

Figure 8.

Part of Figure 7 is enlarged.

5. Conclusions

With the motivation to study the DAP(p) model with p going to ∞, in this article, we propose a class of MA-GARCH model based on Zhu and Zhang et al. [14] The consistency and asymptotic normality properties of the self-weighted quasi-maximum likelihood estimation of a class of MA-GARCH models are established. Through simulation, we found that the the self-weighted quasi-maximum likelihood estimation of a class of MA-GARCH models is feasible. Empirical results show that a class of a MA-GARCH model is better than the MA-GARCH model in terms of goodness of fit and predictive ability. This implies that the model we considered has some applicability to the field of MA-GARCH models.

Author Contributions

Methology and Simulation, D.X.; Guide and Supervision, X.L.; Solfware, R.L. All authors have read and agreed to the published version of manuscript.

Funding

The work is partially supported by National Natural Science Foundation of China under grant no.12161009, The Science and technology project of Guangxi under grant no.2021AC06001, and Scientific Research Foundation of Development Institute of Zhujiang-Xijiang Economic Zone under grant no. ZX2020013.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The empirical data comes from ST Daji (000546) shared on the Shenzhen Stock Exchange; the empirical data comes from the choice financial date terminal.

Conflicts of Interest

The authors declare no conflict of interest.

Abbreviations

The following abbreviations are used in this manuscript:

| MDPI | Multidisciplinary Digital Publishing Institute |

| DOAJ | Directory of open access journals |

| TLA | Three letter acronym |

| LD | Linear dichroism |

Appendix A

Appendix A.1

Proof of Lemma 1.

(i):

(ii):

for some and .

(iii):

for some and , and . □

Proof of Lemma 2.

(i): From the models (1)–(3), we can deduce that .

(ii): From models (1)–(3), one iteratively obtains

Then

because , so

where .

(iii): The proof of (iii) is similar to that of (ii).

(vi): Because , so, . □

Appendix A.2

Proof of Theorem 1.

(i): First, the space is compact, and is an interior point in . Second, is continuous in and is a measurable function of for all . Third, by Lemmas 1 and 2, it follows that

By (A1)–(A3), we can show that

Therefore, by (A4) and (A5), we have

By ergodic theorem, we have

By Theorem 3.1 in Ling and McAleer (2003a) [19], it follows that

Because , thus,

.

Therefore, , where

.

Considering the function when , it reaches a minimum at . Thus, for A, A reaches the minimum if and only if . For B, , B reaches the minimum if and only . Thus, we can claim that is uniformly minimized at .

Next, we use the method in Theorem 4.1.1 in Amemiya [20]. Let V be any open neighborhood of . Then is the compact set, and exists as a minimum in .

We order

and let be the event A.

Thus, ,.

Because , thus,

and because , then, by (A2), we have

By (A8) and (A9), we have

By (A6) and (A10), we have

So

Thus, , and then .

And because , we have .

(ii): We further give the quasi-score function and the quasi-information matrix as follows.

Take the derivative of :

Then

Therefore,

By ergodic and Theorem 3.1 in Ling and McAleer(2003) [19], it follows that

if and only if .

By the double expectation property, it follows that

Then,

Similarly, we can show that holds.

Because

Therefore,

Thus, ,

Because , then

where ,

Then,

Because is bounded, by Assumptions A3 and A4, it follows that

By the central limit theorem for a martingale different sequence, we have

By Theorem 4.1.3 in Amemiya (1985) [20], it follows that

□

References

- Engle, R.F. Autoregressive conditional heteroscdeasticity with estimates of the variance of united kingdom inflation. Econometrica 1982, 50, 897–1007. [Google Scholar] [CrossRef]

- Bollerslve, T. Generalized autoregressive condition heteroskedasticity. J. Econom. 1986, 31, 307–327. [Google Scholar] [CrossRef]

- Nelson, D.B. Conditional heteroskedasticity in asset returns: A new approach. Econometrica 1991, 59, 347–870. [Google Scholar] [CrossRef]

- Glosten, L.R.; Jagannathan, R.; Runkle, D.E. On the relationship between the expected value and the valatility of the nominal excess return on stocks. J. Financ. 1993, 48, 1779–1801. [Google Scholar] [CrossRef]

- Long, H.V.; Jebreen, H.B.; Dassios, I.; Baleanu, D. On the Statistical GARCH Model for Managing the Risk by Employing a Fat-Tailed Distribution in Finance. Symmetry 2020, 12, 1698. [Google Scholar] [CrossRef]

- Li, X.; Zhang, X.; Li, Y. High-Dimensional Conditional Covariance Matrices Estimation Using a Factor-GARCH Model. Symmetry 2022, 14, 158. [Google Scholar] [CrossRef]

- Baillie, R.T. Long memory processes and fractional integration in econometrics. J. Econom. 1996, 73, 5–59. [Google Scholar] [CrossRef]

- Ling, S. Estimation and testing stationarity for double autoregressive models. J. R. Stat. Soc. 2004, 66, 63–78. [Google Scholar] [CrossRef]

- Ling, S. Self-weighted and local quasi-maximum likelihood estimators for ARMA-GARCH/IGARCH model. J. Econom. 2007, 140, 849–873. [Google Scholar] [CrossRef]

- Zhu, K.; Ling, S. Global self-weighted and local quasi-maximum exponential likelihood estimators forARMA-GARCH/IGARCH models. Ann. Stat. 2011, 39, 2131–2163. [Google Scholar] [CrossRef]

- Pan, B.; Chen, M.; Wang, Y.; Xia, W. Weighted least absolute deviations estimation for ARFIMA time with finite or infinite variance. J. Korean Stat. Soc. 2015, 44, 1–11. [Google Scholar] [CrossRef]

- Ramírez-Parietti, I.; Contreras-Reyes, J.E.; Idrovo-Aguirre, B.J. Cross-sample entropy estimation for time series analysis: A nonparametric approach. Nonlinear Dyn. 2021, 105, 2485–2508. [Google Scholar] [CrossRef]

- Ling, S. A double AR(p) model: Structure and estimation. Stat. Sin. 2007, 17, 161–175. [Google Scholar]

- Zhu, H.; Zhang, X.; Liang, X.; Li, Y. Moving Average Model with an Alternative GARCH-type Error. J. Syst. Sci. Inf. 2018, 6, 165–177. [Google Scholar] [CrossRef]

- Zhu, K.; Ling, S. Quasi-maximum exponential likelihood for a double AR(p) model. Stat. Sin. 2013, 23, 251–270. [Google Scholar]

- Yoshida, N. Quasi-likelihood analysis and its applications. Stat. Inference Stoch. Process. 2022, 25, 43–60. [Google Scholar] [CrossRef]

- Ling, S. Self-weighted least absolute deviation estimation for infinite variance autoragressive models. R. Stat. Soc. 2005, 67, 381–389. [Google Scholar] [CrossRef]

- Huber, P.J. Robust Statistical Procedures; Society for Industrial and Applied Mathematics: Philadelphia, PA, USA, 1997. [Google Scholar]

- Ling, S.; McAleer, M. Asymptotic theory for a new vector ARMA-GARCH model. Econom. Theory 2003, 19, 280–310. [Google Scholar] [CrossRef]

- Amemiya, T. Advanced Econometrics; Harvard University Press: Cambridge, MA, USA, 1985. [Google Scholar]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).