Abstract

The conversion of ecological product value is vital for reconciling economic growth with environmental sustainability. As a financial innovation that combines digital technology with inclusive finance, digital finance has emerged as a key driver of this process. Drawing on Chinese provincial panel data from 2011 to 2020, this study shows that digital finance significantly enhances the conversion efficiency of ecological product value (CEEPV), and the results remain robust after addressing endogeneity and sensitivity concerns. The analysis reveals that the depth of use and the level of digitalization of digital finance strongly promote CEEPV, while coverage breadth has no significant effect. Mechanism tests indicate that digital finance improves CEEPV mainly through alleviating rural financing constraints, fostering entrepreneurship, encouraging green innovation, enhancing agricultural social services, and supporting rural e-commerce. In addition, traditional finance and financial regulation complement digital finance in strengthening CEEPV. Heterogeneity analysis further shows that the positive effect of digital finance is concentrated in provinces with higher levels of marketization and urbanization. Overall, the findings underscore the importance of accelerating digital finance development and implementing region-specific policies to maximize its potential in advancing ecological product value realization.

1. Introduction

The United Nations Environment Programme (UNEP) defines ecological products as the integrated outcomes of ecosystems and human activities, encompassing a wide range of goods and services that contribute directly to human well-being [1]. Ecological product value (EPV) is a broad and multifaceted concept covering provisioning, regulating, supporting, and cultural services of ecosystems. Yet rapid urbanization and industrialization have intensified ecological degradation and reduced EPV, creating mounting risks for sustainable development worldwide [2,3]. Promoting the realization of EPV has therefore become a crucial pathway to reconcile economic growth with ecological conservation.

From the perspective of welfare economics, the realization of EPV lies in internalizing the positive externalities of ecosystems into measurable economic benefits. While ecological compensation mechanisms can offset ecological opportunity costs, the effectiveness of EPV realization also depends on how efficiently ecological resources are converted into tangible economic and ecological outcomes. To capture this efficiency dimension, scholars have begun to focus on the conversion efficiency of ecological product value (CEEPV), which measures the input–output performance of ecological resources integrated into production systems [4]. CEEPV is not only an indicator of ecological value realization but also reflects the effectiveness of ecological capital allocation and its implications for equity, regional development, and sustainability.

China provides a particularly compelling context for examining CEEPV. Many provinces are endowed with rich ecological resources, yet the conversion of such resources into sustainable economic benefits is constrained by information asymmetry, financing bottlenecks, and limited market access [5]. These challenges are especially pronounced in rural areas, which hold a large share of ecological resources but lack adequate financial and institutional support. This explains the strong connection between CEEPV and rural regions: improving efficiency in these areas not only drives ecological protection and poverty alleviation but also contributes to rural revitalization and the broader green transition.

In this regard, digital finance—an emerging financial innovation integrating digital technologies with inclusive financial services—has created new opportunities for overcoming the traditional barriers to EPV realization. With its features of efficiency, accessibility, and inclusiveness, digital finance can reduce transaction costs, ease financing constraints, and expand market access for ecological industries. Existing studies have explored its impacts on rural financing [6], green productivity [7], entrepreneurship [8], and innovation [9]. However, systematic investigations into how digital finance affects the CEEPV remain limited.

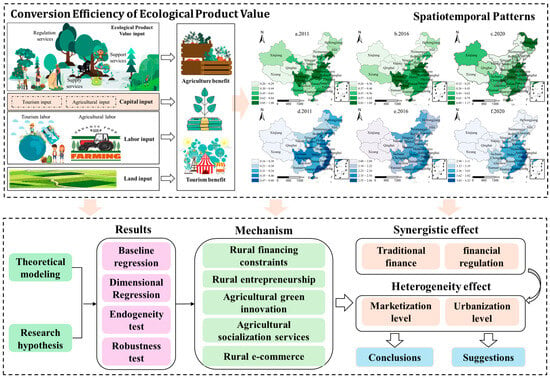

Against this backdrop, the present study sets out to achieve four interrelated objectives, using the conceptual framework and research design shown in Figure 1. First, it seeks to construct a provincial-level indicator system for the CEEPV and to measure its spatiotemporal evolution across China during the period 2011–2020. Second, it aims to examine the overall impact of digital finance on CEEPV, with particular attention to the differentiated effects of its three dimensions—coverage breadth, usage depth, and digitalization level. Third, the study endeavors to identify and empirically test the transmission mechanisms through which digital finance enhances CEEPV, focusing on rural financing, entrepreneurial activity, agricultural green innovation, agricultural socialization services, and rural e-commerce. Finally, the analysis extends to exploring the heterogeneity and synergistic effects of digital finance, emphasizing its interactions with traditional finance, regulatory frameworks, and varying levels of marketization and urbanization across regions.

Figure 1.

Conceptual framework and research design illustrating the analytical pathway used to examine the relationship between digital finance and CEEPV in China.

Compared to the existing literature, this research provides a useful complement to previous studies. Firstly, much of the existing research on the realization of EPV remains theoretical or case-based [10,11], with relatively limited empirical evidence. By systematically examining EPV from the perspective of conversion efficiency, this paper integrates economic benefits (direct market value) with ecological benefits (indirect market value) to develop a comprehensive framework for evaluating CEEPV. This approach not only refines the analytical scope of EPV but also provides a more operational framework for assessing the sustainable development of ecosystem services.

Secondly, while prior studies have investigated the impacts of digital finance on environmental quality, green growth, and innovation [12,13], fewer have focused explicitly on the efficiency dimension of ecological value realization. By linking digital finance to CEEPV, our study extends this line of inquiry and highlights a mechanism that integrates ecological protection with economic development. We further contribute by empirically testing multiple transmission pathways—such as rural financing, entrepreneurship, and green innovation—thereby strengthening the causal explanation of how digital finance affects ecological value realization.

Finally, although existing work has examined the interactions among digital finance, traditional finance, and financial regulation [14,15,16], this study considers these relationships specifically from the perspective of CEEPV. Our results indicate that digital finance, traditional finance, and financial regulation reinforce each other in enhancing ecological product value conversion. This nuanced perspective provides practical insights for policymakers and practitioners seeking to design coordinated strategies that combine financial innovation with regulatory and institutional support.

2. Literature Review and Research Hypothesis

2.1. Literature Review

The concept of ecological products, derived from ecological services and introduced by Ehrlich and Ehrlich (1981) [17], refers to the welfare that humans derive from ecosystem functions. Costanza et al. (1997) [2] further clarified that ecological products are obtained either directly or indirectly from ecosystem functions. The Millennium Ecosystem Assessment [18] categorized these benefits into four groups: provisioning, regulating, supporting, and cultural services. Realizing the EPV requires the implementation of government or market mechanisms to transform ecological products into production factors that are integrated into the market economy. EPV accounting are crucial areas of research in the realization of EPV. Currently, the main methods for EPV accounting include the equivalent factor method [19,20], the market value method [19], the function pricing method [21], and the “eco-yuan” approach [22].

Existing research on the realization of ecological product value has made some progress, primarily focusing on theoretical discussions and case analyses, while studies that measure the realization of ecological product value remain limited. Notably, Kong et al. (2023) [4] employed input factors such as forest ecological product value, forest land, material capital, and labor, with forestry added value as the output factor, to assess the efficiency of ecological product value conversion in Lishui, Zhejiang Province. Their findings indicate that the development of the digital economy can enhance the conversion efficiency of forest ecological product value. Similarly, Sun et al. (2024) [19] assessed the EPV in 77 urban-rural integration development pilot zones by combining the market value method with the equivalent factor method, and empirically examined the impact of ecological product value realization on urban-rural integration development. While these studies have made preliminary strides in measuring and converting ecological product value, there is an urgent need for breakthroughs in understanding the mechanisms underlying ecological product value realization.

With the advancement of information technology, digital finance has emerged as a significant field of study. Existing research has explored the economic effects of digital finance from both macroeconomic and micro-individual perspectives, emphasizing its inclusive financial characteristics, such as alleviating information asymmetry, providing precise financial services, expanding coverage, and managing risk [12]. However, research on the impact of digital finance on the realization of EPV remains in its early stages. This includes studies investigating the effects of digital finance on the financing constraints of rural areas [6,23], rural entrepreneurship [23], agricultural green innovation [24,25], agricultural socialization services [26,27], and rural e-commerce [28]. The connection between digital finance and CEEPV, particularly its underlying mechanisms, remains an area in need of further exploration.

2.2. Direct Impact Mechanism

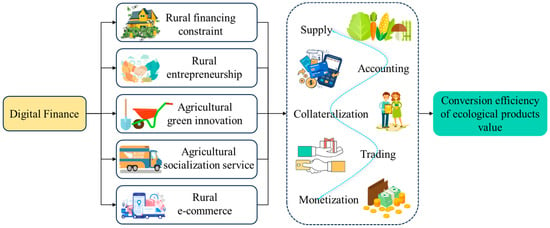

Through design features such as lower transaction costs, broader service coverage, higher service efficiency, and improved user convenience, digital finance can facilitate the conversion of EPV across all five stages: supply, accounting, collateralization, trading, and monetization (Figure 2).

Figure 2.

The influence mechanism of digital finance on CEEPV.

On the supply side, digital platforms like online lending, crowdfunding, and micro-funding are expanding financing channels. These are especially beneficial for small ecological enterprises and rural initiatives, helping them secure startup capital or scale up operations more easily [29]. Compared to traditional finance, digital finance reduces intermediary costs, making funding more accessible and affordable [15].

In accounting, the use of big data and AI allows for more accurate valuation of both the market and social value of ecological products, helping lenders and investors make smarter decisions [30]. Blockchain technology further improves transparency and trust by making transactions traceable and verifiable—critical for credible ecological value assessments [12].

When it comes to collateralization, digital platforms offer flexibility by recognizing digital and nontraditional assets as collateral. This is a game changer for ecological enterprises that often lack conventional assets but hold valuable environmental capital. Digitization also speeds up the process and cuts down costs [15].

For trading, digital finance provides user-friendly online platforms that connect producers directly with consumers, cutting out intermediaries and improving efficiency [6]. Mobile payments and digital currencies enable cross-border transactions, broadening the market reach of ecological products [28].

In terms of monetization, digital tools allow ecological assets to be digitized or tokenized, making them more liquid and easier to trade in broader markets [29]. Additionally, platforms now offer diverse financial products tailored to ecological sectors, expanding monetization channels.

A practical illustration is the case of Guizhou’s Chishui bamboo industry, listed among the national “Typical Cases of Ecological Product Value Realization.” Supported by digital finance, local cooperatives accessed credit to expand ecological bamboo cultivation and leveraged e-commerce platforms for branding and online sales. This demonstrates how digital finance reduces transaction costs and broadens market access, thereby facilitating the conversion of ecological resources into sustainable economic value.

Hypothesis 1:

Digital finance can significantly enhance CEEPV.

2.3. Indirect Impact Mechanism

Underdeveloped regions often possess rich natural resources and ecological environments, giving them great potential to convert EPV into economic gains while preserving ecological sustainability. However, realizing this potential is constrained by limited investment, lack of technology, poor infrastructure, and restricted market access. Digital finance can play a transformative role in addressing these barriers by expanding access to credit, reducing transaction costs, and integrating ecological industries into broader markets. Specifically, digital finance influences CEEPV through five indirect mechanisms: rural financing, entrepreneurship, green innovation, agricultural socialization services, and rural e-commerce. A representative case is the Anji white tea industry in Zhejiang Province, also included in the China’s “Typical Cases of Ecological Product Value Realization.” Digital finance products provided loans for ecological tea farming, while online platforms enabled direct trading and branding. This integration of finance and e-commerce not only expanded the market reach of ecological products but also significantly improved their conversion efficiency, exemplifying the indirect mechanism of rural e-commerce.

Rural financing constraints: Traditional financial institutions often fail to meet the financing needs of farmers and agricultural enterprises in remote areas. Digital finance, through mobile and internet platforms, has expanded access to financial services in such regions [31]. Moreover, by leveraging big data and AI, these platforms can better assess creditworthiness and reduce information asymmetry, thus lowering risks and easing borrowing processes [6]. This improved access to finance enhances investment in agriculture and ecological product production, increasing the efficient use of ecological resources [23,32]. In addition, Wang (2023) [33] notes that digital finance encourages long-term investment in sustainable rural development, thereby improving the CEEPV.

H2a:

Digital finance enhances CEEPV by alleviating rural financing constraints.

Rural entrepreneurship: Digital finance also supports entrepreneurial activity in rural areas. Platforms provide farmers with market insights, access to technology, and financing channels [8,23], allowing them to engage in ecological industries. This reduces entry barriers and encourages innovation. Farmers can thus participate more actively in ecological product supply chains, boosting supply and monetization [24]. As a result, digital finance promotes rural entrepreneurship, enhances the structure and efficiency of ecological industry chains, and elevates CEEPV [4,5,34].

H2b:

Digital finance enhances CEEPV by promoting rural entrepreneurial activity.

Agricultural green innovation: Green agriculture often struggles with high costs and long investment cycles. Digital finance helps mitigate these risks by supporting collaborative R&D, and easing access to capital [25]. This enables innovation in green farming technologies and encourages their adoption at scale. Through platforms that connect tech firms with farmers, digital finance supports the development and dissemination of sustainable farming practices [24]. These innovations improve resource efficiency and increase EPV, further boosting CEEPV [35].

H2c:

Digital finance enhances CEEPV by fostering agricultural green innovation.

Agricultural socialization services: Digital finance platforms improve coordination and information flow along the agricultural value chain. Farmers, processors, and distributors can exchange real-time information and integrate resources more effectively [26,27]. This strengthens agricultural socialization services, which improve specialization, enhance supply chain efficiency, and optimize resource allocation. Ultimately, this leads to greater EPV and improved CEEPV [32,34].

H2d:

Digital finance enhances CEEPV by improving agricultural socialization services.

Rural E-commerce: Rural e-commerce development often faces financing and data limitations. Digital finance reduces these barriers, enabling better matching between sellers and consumers of ecological products [28]. E-commerce platforms support efficient promotion, transaction, and delivery of ecological goods. This not only raises EPV but also significantly boosts CEEPV by shortening supply chains, reducing intermediary costs, and expanding market reach [5,36]. The improved visibility and accessibility of ecological products increase their value and market performance.

H2e:

Digital finance enhances CEEPV by supporting rural e-commerce development.

3. Research Design

3.1. Methods

3.1.1. Conversion Efficiency of Ecological Products Value

Wang et al. (2021b) [5] proposed the concept of the “fourth industry of ecological products,” defining it as an industrial form focused on ecological resources and associated with the realization of EPV. This industry involves production, development, operation, and trading of ecological products. Ecological products can directly enter the socio-economic production system as production factors, and their cyclical process involves converting their form and value through ecological technologies, thereby entering the ecological market and becoming ecological commodities and material wealth via transactions. This process ultimately promotes economic growth and enhances human well-being [4,5]. The value conversion mechanism of ecological products is a key mechanism that drives the realization of EPV under market economic conditions. It specifically includes two aspects: the value realization pathway and value conversion efficiency [4]. The CEEPV refers to the efficiency of input factors obtained by incorporating the EPV as ecological capital inputs into an extended production function [10].

The Cobb–Douglas function is the most used model for studying input-output efficiency. Land, material capital, and labor are traditional input factors. As an important concept in modern ecological economic growth theory, the EPV is also included in the economic growth factor system [5]. The conversion of EPV involves using ecological products as input factors, combined with material capital, labor, and other social capital inputs to create direct market value (economic benefits) and indirect market value (ecological benefits). The process of converting the EPV can be defined as production activities centered on the EPV. The quantitative relationship between input and output at a certain technical level can be described using the Cobb–Douglas production function [4]:

Taking the logarithm of Equation (2) yields Equation (3):

In Equations (2) and (3), Yit, Nit, Kit, Rit, Eit, and Ait represent the total output, land input, material capital input, labor input, EPV, and other inputs of the i-th province in the t-th year, respectively. α, β, γ, δ, and μ, respectively, denote the output elasticity of land input, material capital input, labor input, EPV, and other inputs. λit is the constant term.

The equivalent factor method has a broad range of applications, capable of assessing diverse types of ecosystem services such as forests, wetlands, and grasslands. The unit area EPV equivalence table devised by Shi et al. (2022) [37] for China has been employed to calculate the EPV of 31 provinces. The computing method for EPV is delineated in Equation (3):

In Equation (3), EPV signifies the ecological product value (RMB), and one equivalent factor of the standard unit EPV is defined as one-seventh of the economic value of the average annual grain yield of one hm2 farmland. Si denotes the area (hm2) of the i-th type of land use, P is grain crops value (RMB/kg), Q embodies the sowing area of grain crops (kg/ha), αij is the equivalent factor of the j-th ecosystem service of the i-th type of land use.

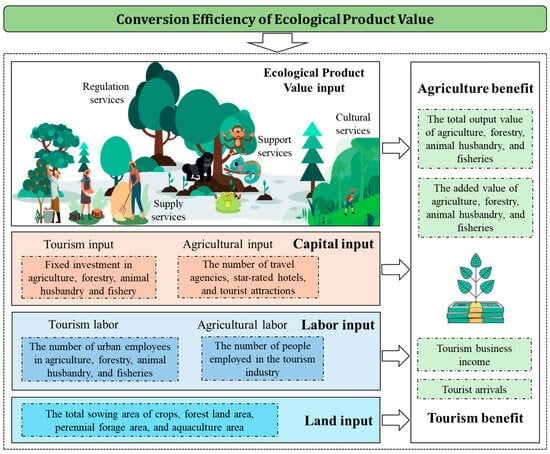

The conversion of EPV involves ecological resources, combined with material capital, land, labor, and other social capital inputs to create economic benefits. It is primarily driven by commercial ecological products such as eco-agricultural products, eco-tourism services, etc., and its value can be converted through market mechanisms. This study constructs an indicator system as depicted in Figure 3 from two aspects: input and output [38,39,40,41]. It then calculates the CEEPV using the Scale Efficiency Measure of Super-efficiency Model (SE—SBM Model) and Malmquist index.

Figure 3.

Indicator system of CEEPV.

3.1.2. Model Specification

We establish the two-way fixed effects model to examine the influence of digital finance on CEEPV. The two-way fixed-effects model has clear advantages: it controls for unobservable regional heterogeneity and time effects, thereby reducing omitted variable bias and improving the reliability of causal inference [42]. The model tests the overall relationship between financial digitalization and CEEPV. In subsequent sections, the model is further extended to investigate potential mechanisms and heterogeneity across different levels of socio-economic level and institutional conditions. The equation are as follows:

In Equation (4), CEEPVit represents the conversion efficiency of ecological products value in region i in year t; Digfiit is the digital finance level in region i in year t; Controlit refers to the set of control variables affecting CEEPV; αi represents the fixed effects of the region, λt is the fixed effects of the year, and εit is the random disturbance term. β1 measures the overall effect of digital finance on CEEPV.

3.2. Variables

3.2.1. Digital Finance

The China Digital Inclusive Finance Index, jointly developed by the Digital Finance Research Center of Peking University and Ant Financial Group, serves as a tool to describe the development of digital finance in China. This index provides valuable material for studying the status of digital finance development in China and its economic effects [12]. The Digital Inclusive Finance Index is compiled based on the big data of Ant Financials’ transaction accounts, offering significant research value and credibility [43]. Table 1 presents a detailed indicators system of digital finance, showing that the index includes three primary dimensions: coverage breadth (Digfi_CB), usage depth (Digfi_UD), and the level of digital support services (Digfi_DL).

Table 1.

Digital finance indicator system.

3.2.2. Mechanism Variables

To investigate the mechanism by which digital finance influences CEEPV, based on the theoretical analysis, rural financing constraints (Afin), rural entrepreneurial activity (Ajob), agricultural green innovation (Atech), agricultural socialization services (Aser), and rural e-commerce (Ecom) are selected as mechanism variables [6,25,27]. They are represented by the proportion of agricultural loans to the total output value of agriculture, forestry, animal husbandry, and fisheries; the proportion of the number of individual rural employees and private enterprise employees to the rural population; the logarithm of the number of applications for green agricultural invention patents; the proportion of the added value of agricultural services to the total output value of agriculture, forestry, animal husbandry, and fisheries; and the logarithm of the number of Taobao villages, respectively.

3.2.3. Control Variables

Referring to existing literature and the specific issues of this research [4,9,13], the following variables are controlled: Economic development level (lnpgdp) is measured by per capita Gross Domestic Product (GDP) and log transformed. Industrial structure (ind) is represented by the proportion of added value of the secondary and tertiary industries in GDP. Regional innovation level (Inn) is measured by the number of patent applications per 10,000 people and log transformed. Rural human capital (Capit) is measured by the average years of education of rural residents. Agricultural modernization (Amod) is measured by the ratio of total agricultural machinery power to total crop sowing area. The descriptive statistical results of related variables are shown in Table 2. To exclude extreme outliers, we winsorize the control variables at the 0.5 and 99.5 percentiles.

Table 2.

Descriptive statistical results.

3.3. Data Source

This study utilized the annual China Land Cover Dataset (CLCD), published by Wuhan University, to calculate the EPV. The dataset has produced continuous 30 m land use classification results for almost 30 years. The data from Chinese 31 provinces (cities) spanning the years 2011 to 2020 were selected as the foundational sample (Hong Kong, Macao, and Taiwan were excluded from the empirical analysis due to the unavailability of data). The socioeconomic data mainly comes from the “China Statistical Yearbook” and “China Rural Statistical Yearbook” from 2010 to 2021 and the statistical bureau websites of each province. The digital inclusive financial index is sourced from the “Beijing University Digital Inclusive Financial Index (2011–2020)” published by the Internet Finance Research Center of Peking University. The data on the number of applications for agricultural green invention patents come from the National Intellectual Property Administration, and the data on Taobao villages come from the list of Taobao villages publicly released by the Alibaba Research Institute (http://www.aliresearch.com/cn/index, accessed on 14 January 2023) from 2009 to 2020, including the geographic coordinates and attribute data of Taobao village points. The linear interpolation method was employed to compensate for missing data.

4. Empirical Results and Analysis

4.1. Spatiotemporal Evolution Characteristics of CEEPV and Digital Finance Level

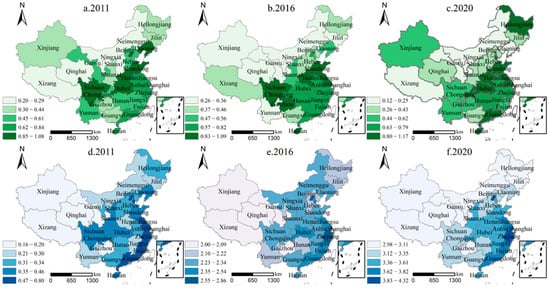

From 2011 to 2020, the CEEPV experienced significant spatial expansion and intensification (Figure 4a–c). In 2011, high-efficiency areas were scattered and mainly concentrated in coastal cities. By 2016, these areas expanded outward, forming more continuous clusters along major economic corridors. In 2020, high-efficiency zones further consolidated and spread, reflecting stronger policy support, technological innovation, and regional integration efforts. Despite overall improvement, notable regional disparities persist, particularly between core economic zones and ecologically sensitive or underdeveloped regions. The evolution highlights a transition from isolated high-efficiency points to broader spatial diffusion, emphasizing the need for targeted regional strategies.

Figure 4.

Spatiotemporal evolution pattern of CEEPV (a–c) and digital finance level (d–f).

Digital finance in China evolved from highly concentrated hotspots in coastal megacities to broader regional diffusion (Figure 4d–f). In 2011, development was limited to major coastal cities. By 2016, digital finance expanded along key urban corridors and into inland provincial capitals. By 2020, a more widespread and integrated pattern emerged, although significant disparities persisted between urban centers and peripheral regions. This evolution reflects the combined effects of infrastructure expansion, policy initiatives, and market-driven innovation.

4.2. Benchmark Regression

We utilize both a fixed-effect model and a random-effects model to study the impact of digital finance on CEEPV. The sturdiness of regression outcomes is assessed by progressively incorporating control variables. As shown in Table 3, the coefficients of Digfi are all significantly positive at a 5% level. Column (3), which controls for individual and time fixed effects, is considered the baseline result in this study. We found that a one unit increase in the digital finance index boosts the CEEPV by 0.249. This implies that digital finance significantly promotes CEEPV. Digital finance, through financing insurance services, big data, intelligent algorithms, financial market pricing, mortgage bonds, and smart contract transactions aids in the supply, accounting, collateralization, trading, and monetization of ecological products, consequently improving CEEPV. The results of control variables suggest that optimizing the industrial structure and enhancing human capital can improve CEEPV, whereas the impact of economic development, regional innovation level, and the agricultural mechanization on CEEPV is uncertain. This could be because the enhancement of economic development level, innovation ability, and agricultural mechanization can both positively and negatively affect CEEPV, resulting in insignificant outcomes.

Table 3.

Results of benchmark regression.

4.3. Dimensional Regression

The digital inclusive finance index, synthesized from three subindices measuring coverage breadth, usage depth, and digitalization level, allows us to further scrutinize the dimensions of digital finance that have ameliorated CEEPV. As shown in Table 4, the coefficient of coverage breadth, that is Digfi_CB, is positive, but it did not achieve statistical significance. This is related to the connotation of this index. The coverage breadth is determined by the ownership rate of Alipay accounts, but ownership rate does not equate to usage rate. Indeed, middle-aged and elderly users do not frequently use online financial management and investment services; therefore, coverage breadth does not significantly influence CEEPV. As digital finance has not strayed from the essence of finance, digital literacy and financial knowledge remain important prerequisites for utilizing digital finance services. The usage depth index, Digfi_UD, significantly boosts CEEPV. Usage depth represents the users’ activity level in engaging in investment, credit, and consumption via digital finance platforms, directly mirroring their initiative to use their idle funds to promote CEEPV. This indicates that a range of digital finance tools and products effectively caters to the needs of investors in the ecological industry chain, significantly promoting CEEPV. The impact of digitalization level, Digfi_DL, on CEEPV is significantly positive, implying that digital services have enhanced the convenience of financial services and reduced acquisition costs, thereby improving CEEPV. This suggests that policymakers should not only concentrate on the coverage breadth but also tackle the “financial knowledge gap” and “digital gap” between urban and rural areas, enhancing the usage depth and digitalization levels.

Table 4.

Results of dimensional regression.

4.4. Endogeneity and Robust Test

4.4.1. Endogeneity Test

While this study makes every effort to control for relevant variables, the possibility of endogeneity cannot be entirely ruled out. To address this issue, an instrumental variable (IV) approach is adopted. One key instrument is the spherical distance (Dist) between each province’s capital and Hangzhou, calculated using Geographic Information System (GIS) tools. This choice is based on the fact that the Digital Inclusive Finance Index is constructed using operational data from Alibaba Group, whose origins and early expansion are rooted in Hangzhou. As major internet companies tend to diffuse outward from this hub, proximity to Hangzhou is strongly correlated with a province’s level of digital finance development. Importantly, the distance to Hangzhou is unrelated to CEEPV, satisfying the exogeneity condition of a valid instrument. A second instrument is the historical volume of postal and telecommunications services, which is closely related to the long-term development of digital finance infrastructure. Specifically, the per capita volume from 1984 (Postal) is used, which meets the relevance criterion (as a proxy for digital connectivity) and the exclusion restriction, given its minimal direct impact on today’s ecological product value conversion efficiency. To enhance the robustness of the endogeneity tests, this study also uses lagged digital finance (LDigfi) as an additional instrument. Since both Dist and Postal are time-invariant, they cannot directly be used in standard two-stage least squares (2SLS) estimation. To resolve this, the study introduces interaction terms by multiplying the instrumental variables with the national average level of digital finance (excluding the province in question). This produces time-varying instruments that retain validity while allowing for consistent estimation within a panel data framework.

The results of the instrumental variable regression are presented in Table 5. First, the regression coefficients of Digfi in the first stage of all three sets of regressions are significant at the 1% level. For the under-identification test, the Kleibergen–Paap rk LM statistic results reject the null hypothesis at the 1% level, meeting the relevance requirement of the instrumental variables. For the weak-identification test, the Kleibergen–Paap Wald rk F statistic is significantly greater than the 10% critical value (16.38), indicating that there is no weak instrumental variable problem. Finally, in the second stage, the digital financial inclusion index is significant at the 10% level for all three sets of results, demonstrating that digital financial inclusion can still significantly enhance CEEPV after mitigating endogeneity issues. This is consistent with the baseline regression results, confirming the robustness of the core conclusions of this paper.

Table 5.

Results of endogeneity test.

4.4.2. Robustness Test

To verify the robustness of the benchmark regression results, we employed the following testing methods: To exclude extreme outliers, we minorized the digital inclusive finance index at the 0.1 and 99.9 percentiles and fitted the regression using a panel two-way fixed-effects model. Infrastructure and social consumption levels also significantly influence CEEPV. This study introduced control variables such as transportation infrastructure, measured by per capita road mileage of the rural population, and the consumer price index, gauging the impact of regional consumption levels. These potential omitted variables, namely transportation infrastructure and social consumption level, were integrated into the regression to test the robustness of the conclusion. Digital inclusive finance may need time to impact CEEPV. Therefore, we lagged all explanatory variables by one order and rear the regression. As shown in Table 6, the robustness tests collectively indicate that the parameter estimates and significance of the core explanatory variables did not undergo significant alterations, affirming the robustness of the conclusions of this study.

Table 6.

Results of robustness test.

5. Further Analysis

5.1. Mechanism Identification

5.1.1. Rural Financing Constraints

This research study confirms that the development of digital finance significantly enhances the CEEPV. However, the specific mechanisms through which digital finance achieves this improvement require further elaboration.

We tested the mechanisms related to rural financing constraints. Column (1) of Table 7 indicates that digital finance significantly increases the availability of credit resources for agriculture, rural areas, and farmers, thereby alleviating rural financing constraints [6,31]. Alleviating these constraints enhances access to funding for farmers and agricultural enterprises, which in turn boosts agricultural investment and ecological product production, ultimately contributing to improvements in CEEPV [23,32]. The results of dimension-specific regressions are presented in Columns (2) to (4) of Table 7. Both the coverage breadth and usage depth of digital finance significantly alleviate rural financing constraints, whereas the digitalization level does not have a substantial impact on these constraints. This suggests that digital finance mitigates rural financing constraints primarily through expanding its coverage breadth and usage depth. While digital services facilitate access to rural financial services, fundamentally addressing the challenges of access to and affordability of financing in rural areas requires improvements in the breadth and depth of coverage.

Table 7.

Mechanisms test for rural financing constraints and rural entrepreneurial activity.

5.1.2. Rural Entrepreneurship

We evaluated whether digital finance could enhance CEEPV by stimulating rural entrepreneurial activity. Column (5) of Table 7 shows that digital finance significantly increases the proportion of rural entrepreneurs and stimulates entrepreneurship activities [8,23]. This suggests that digital finance has facilitated entrepreneurship among farmers in the ecological product sector, optimizing the ecological product supply chain and advancing the marketization and industrialization of ecological products within regions, thereby improving CEEPV [4,5,34]. The results of the dimensional regressions are presented in Columns (6) to (8) of Table 7, where coverage breadth, usage depth, and digitalization level all have a significantly positive impact on rural entrepreneurial activities. This indicates that digital finance alleviates agricultural financing constraints by expanding its coverage breadth and usage depth in rural regions, encouraging more individuals to engage in entrepreneurial activities within the ecological industry chain. Additionally, digital finance provides farmers with abundant information resources and market access channels through digital services, thereby fostering more effective entrepreneurial activities. This contributes to enhancing the innovation and competitiveness of ecological products, further improving CEEPV [5,19].

5.1.3. Agricultural Green Innovation

We further explored how digital finance contributes to enhancing CEEPV by promoting agricultural green innovation. As shown in Column (1) of Table 8, the impact of digital finance on agricultural green innovation is significantly positive. This indicates that the growth of digital finance substantially strengthens research and development efforts related to agricultural technology, thereby fostering green innovation within the agricultural sector [24,25]. Agricultural green technologies can effectively increase resource use efficiency during the agricultural production process, contributing to EPV and significantly enhancing CEEPV [24,35]. The dimension-specific regression results presented in Columns (2) to (4) reveal that the usage depth and digitalization level of digital finance significantly promote agricultural green innovation, whereas coverage breadth does not show a significant effect. This outcome can be attributed to the nature of investments in green production technology, which often requires long-term and stable financing support due to their extended payback periods and the high risks involved. Such support can be effectively provided when investors fully utilize various service functions of digital finance, such as loans and insurance, thereby securing stable financial backing for green technology research and development. Moreover, digital finance facilitates the sharing of technology and collaboration between agricultural technology companies and farmers through digitalization services, leading to more sustainable and environmentally friendly agricultural production practices [4]. This, in turn, contributes to the advancement of green innovation, ultimately improving CEEPV.

Table 8.

Mechanisms test for agricultural green innovation and agricultural socialization services.

5.1.4. Agricultural Socialization Services

The current study also explores how digital finance enhances CEEPV by supporting agricultural socialization services. As shown in Columns (5) to (8) of Table 8, digital finance significantly contributes to the promotion of agricultural socialization services. All three dimensions—coverage breadth, usage depth, and digitalization level—have a significantly positive impact on these services. This indicates that coverage breadth and usage depth help expand a financial service network in rural areas, thereby fostering the development of agricultural socialization services [26,27]. Moreover, digitalization services facilitate information sharing and collaborative operations across all segments of the agricultural industrial chain, providing more efficient support for the ecological product supply chain [30]. Agricultural socialization services play a crucial role in optimizing information sharing and resource integration at each stage of agricultural production, which, in turn, enhances the efficiency of the ecological product supply chain. This increased efficiency helps to elevate the EPV, ultimately leading to improved CEEPV [26,27,34].

5.1.5. Rural E-Commerce

In the digital era, e-commerce is thriving in rural areas of China, leading to the rise of professional e-commerce villages, such as Taobao villages. This study assesses the role of digital finance in enhancing CEEPV by fostering the growth of rural e-commerce. As shown in Table 9, digital finance significantly increases the number of Taobao villages, thus supporting the expansion of rural e-commerce [44,45]. The dimensional regression results indicate that usage depth and digitalization level have a significantly positive impact on the development of rural e-commerce, whereas the impact of coverage breadth is not significant. This outcome can be attributed to the underdeveloped state of the rural e-commerce industrial chain, which faces challenges that cannot be overcome by coverage breadth alone. Instead, a variety of loan products and insurance services provided through digital finance offer essential financial support for the growth of rural e-commerce. Moreover, the success of rural e-commerce is also reliant on regional digital infrastructure, which supports seamless operations and market access. The growth of rural e-commerce contributes to shortening the supply chain of ecological products, allowing farmers to connect more directly with markets and reducing transaction costs associated with intermediaries. This improved market efficiency facilitates the enhancement of ecological product value (EPV), thereby leading to an increase in CEEPV [5,36].

Table 9.

Mechanisms test for rural e-commerce.

5.2. Synergistic Effect Analysis

The development of digital finance is deeply rooted in the foundation laid by traditional financial services, and its sustained growth is closely dependent on the presence of effective financial regulation [15]. This study investigates whether traditional finance and regulatory strength interact synergistically with digital finance to enhance the CEEPV. Using grouped regression analysis, the study adopts the median levels of traditional finance and regulatory intensity as benchmarks for classification.

Results from Columns (1) and (2) of Table 10 reveal that in regions with weak traditional financial development, digital finance does not significantly affect CEEPV. However, in areas with stronger traditional finance, the impact is statistically significant at the 10% level, indicating a positive synergy between digital and traditional financial systems. In these more developed regions, factors such as comprehensive financial infrastructure, higher financial literacy, and a more supportive business climate contribute to this effect. In addition, technology incubators, venture capital, and support for ecological industries provide further momentum to digital finance initiatives in agriculture and tourism. Meanwhile, Columns (3) and (4) show that in regions with weak financial regulation, digital finance exerts a negative influence on CEEPV at the 10% level. In contrast, in regions with stronger regulation, the impact becomes significantly positive at the 5% level. These findings underscore the importance of regulatory oversight [14]. Weak regulation may expose digital finance to systemic risks, leading to instability and inefficiencies that reduce ecological value outcomes. Conversely, robust regulatory frameworks enhance financial discipline, reduce risk, and ensure that digital finance contributes effectively to ecological sustainability.

Table 10.

Heterogeneity analysis based on traditional finance and financial regulation.

In conclusion, the evidence highlights a dual synergy: one between digital and traditional financial systems, and another between digital finance and effective financial regulation. Together, they enhance the capacity of digital finance to promote CEEPV. Without this structural support, digital finance may fail to reach its full potential—or worse, introduce new financial risks. Carefully designed regulatory policies are thus essential to safeguard and optimize the role of digital finance in ecological value transformation.

5.3. Heterogeneity Analysis

The external environment—shaped by marketization, urbanization, and economic development—plays a vital role in determining how effectively digital finance can enhance the conversion efficiency of ecological product value (CEEPV). This study examines whether the impact of digital finance on CEEPV varies across different regional development contexts. To measure this, we used the marketization index developed by Fan et al. (2019) [46] and the urbanization ratio (urban population divided by total population) to divide the sample into high and low groups for both marketization and urbanization. A grouped regression analysis was then performed.

As seen in Columns (1) and (2) of Table 11, digital finance has no significant impact on CEEPV in regions with low levels of marketization. However, in highly marketized regions, the impact is significantly positive. This suggests that market-oriented economies provide the necessary conditions for digital finance to function effectively. In such regions, pricing mechanisms are more transparent, supply and demand are more efficiently reflected through market signals, and competition is stronger [45]. These factors lead to better resource allocation, higher efficiency, and improved incentives for ecological product providers to innovate and enhance service quality—all of which contribute to improved CEEPV.

Table 11.

Heterogeneity analysis based on levels of marketization and urbanization.

Similarly, Columns (3) and (4) show that in low-urbanization regions, the impact of digital finance on CEEPV is not significant. In contrast, in high-urbanization regions, digital finance has a significantly positive effect. This is because urbanization supports scale-oriented agriculture, improving the availability of ecological products [44]. It also drives improvements in digital infrastructure, enabling better monitoring, assessment, and trading of ecological goods. Moreover, urbanized regions often experience higher environmental awareness and governance standards, further amplifying the role digital finance can play in promoting ecological sustainability [47].

6. Discussion

6.1. Interpretation of Our Findings

The empirical results provide strong evidence that digital finance significantly enhances the conversion efficiency of ecological product value (CEEPV). This finding supports Hypothesis 1 and aligns with prior studies that emphasize the positive role of digital finance in promoting green growth and resource efficiency [7,12]. By improving access to financial services, reducing transaction costs, and enabling new market connections, digital finance contributes to translating ecological resources into tangible economic and ecological benefits.

The dimensional analysis further reveals that usage depth and digitalization level are the primary drivers of this effect, while coverage breadth is not statistically significant. This partially validates the expectation that broader access to financial services would matter for ecological outcomes, but also suggests that simply expanding coverage without improving service quality or digital intensity is insufficient. This nuance is consistent with evidence from rural financial studies, where accessibility alone does not guarantee efficiency gains unless accompanied by depth and innovation in financial services [6].

The mechanism analysis confirms Hypotheses H2a–H2e, showing that rural financing, entrepreneurship, green innovation, agricultural socialization services, and rural e-commerce are crucial channels linking digital finance to CEEPV. These results echo existing research that highlights digital finance’s role in alleviating financing constraints [32], fostering rural entrepreneurship [8], and supporting agricultural modernization [24]. At the same time, the evidence from this study adds nuance by quantifying their relative contributions to ecological value realization, thus bridging the gap between theoretical claims and empirical validation.

The synergistic role of traditional finance and regulatory frameworks further strengthens the case for an integrated financial ecosystem. This supports findings by Li and Huang (2020) [15] and Wang et al. (2021a) [16] that traditional and digital financial systems are not substitutes but complements, with regulation providing stability and traditional finance offering credibility to digital innovations. The implication is that policy design should not treat digital finance in isolation but embed it within a coordinated financial and regulatory environment.

Finally, the heterogeneity analysis reveals that digital finance promotes CEEPV predominantly in provinces with higher levels of marketization and urbanization. This suggests that a conducive institutional and infrastructural environment is a prerequisite for digital finance to translate into ecological efficiency gains. The finding partially contrasts with studies that emphasize the universal benefits of digital finance, but it resonates with evidence that institutional quality and infrastructure are critical moderators in sustainable finance outcomes [10]. From a regional perspective, this highlights the importance of tailoring digital finance policies: while developed regions can focus on deepening digitalization and service quality, less-developed areas may require simultaneous improvements in infrastructure, governance, and market institutions to fully leverage the ecological benefits of digital finance.

In summary, digital finance is shown not only to enhance CEEPV but also to rely on specific mechanisms and enabling conditions. This underscores the need for differentiated, context-sensitive policies to maximize the ecological and economic value of digital finance.

6.2. Policy Suggestions

To boost the ecological products industry, digital finance should be integrated across all stages—from production to trading and monetization. This will enhance the value of ecological products, streamline the entire supply chain, and support better development, marketing, and sales. Using internet tools, e-commerce, and new business models can help build strong branding and “tri-commerce” systems for wider reach. Investing in rural digital infrastructure is also key. Expanding network access and promoting digital finance in these areas will improve information sharing, cooperation, and service delivery. Government support is essential. Policies like tax breaks, R&D subsidies, and start-up funds can encourage rural innovation and entrepreneurship. Financial and tech institutions should be motivated to develop new solutions for ecological products. Traditional banks should partner with digital finance platforms to modernize their services. Finally, establishing rural financial regulators can ensure a safe and stable financing environment. Strong partnerships between financial institutions and ecological businesses will help grow the industry and make it more competitive.

6.3. Limitations and Future Prospect

Despite these contributions, this study is not without limitations. First, the empirical analysis relies on provincial-level panel data, which may obscure firm-level or household-level heterogeneity in the relationship between digital finance and CEEPV. Future work could incorporate micro-level survey or transaction data to capture more nuanced behavioral responses. Second, while the fixed-effects regression framework allows us to address unobserved heterogeneity, it may not fully reflect the dynamic and nonlinear nature of the mechanisms involved. The adoption of more advanced tools—such as spatial econometric models, structural equation modeling, or machine-learning-based approaches—could provide deeper insights. Third, the present analysis is limited by data availability, excluding variables such as environmental regulation intensity, local governance capacity, and digital literacy, which may also shape the impact of digital finance. Future research should integrate these dimensions to enhance explanatory power. Finally, although this study is situated in the Chinese context, comparative analyses across developing and developed countries would help to evaluate the generalizability of the findings and refine policy recommendations in a broader global setting.

7. Conclusions

This study demonstrates that digital finance significantly improves the CEEPV in China. The effect is primarily driven by usage depth and digitalization level, while coverage breadth shows no significant impact. Mechanism tests reveal that digital finance enhances CEEPV by alleviating rural financing constraints, promoting entrepreneurship, fostering green innovation, strengthening agricultural services, and supporting rural e-commerce. In addition, digital and traditional finance, together with financial regulation, play complementary roles. The positive impact is most evident in provinces with higher marketization and greater urbanization, underscoring the importance of institutional and infrastructural conditions. These findings contribute to understanding how digital finance can be leveraged to advance the realization of EPV and guide region-specific policy design for sustainable development.

Author Contributions

W.D.: Writing—original draft, Writing—review and editing; Y.L.: Conceptualization, Language proofreading, Project administration, Funding acquisition; S.L.: Methodology, Data curation. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the National Key Research and Development Project for Science and Technology under grant number 2022yfd1600603.

Data Availability Statement

All data and materials are available upon request.

Conflicts of Interest

The authors declare no conflicts of interest.

Abbreviations

The following abbreviations are used in this manuscript:

| CEEPV | Conversion efficiency of ecological product value |

| EPV | Ecological product value |

References

- Ben, F.; Li, Z.; Sun, J.; Wang, H.; Zhao, X. Ecological product value accounting and analyst behavior. Int. Rev. Financ. Anal. 2024, 94, 103273. [Google Scholar] [CrossRef]

- Costanza, R.; d’Arge, R.; De Groot, R.; Farber, S.; Grasso, M.; Hannon, B.; Limburg, K.; Naeem, S.; O’Neill, R.V.; Paruelo, J.; et al. The value of the world’s ecosystem services and natural capital. Nature 1997, 387, 253–260. [Google Scholar] [CrossRef]

- Wood, S.L.; Jones, S.K.; Johnson, J.A.; Brauman, K.A.; Chaplin-Kramer, R.; Fremier, A.; Girvetz, E.; Gordon, L.J.; Kappel, C.V.; Mandle, L.; et al. Distilling the role of ecosystem services in the Sustainable Development Goals. Ecosyst. Serv. 2018, 29, 70–82. [Google Scholar] [CrossRef]

- Kong, F.B.; Cheng, W.J.; Xu, C.Y. Whether the development of digital economy can improve the value conversion efficiency of forest ecological products: An empirical analysis based on Lishui City, Zhejiang Province. Chin. Rural Econ. 2023, 5, 163–184. (In Chinese) [Google Scholar]

- Wang, J.; Yu, F.; Ma, G.; Peng, F.; Zhou, X.; Wu, C.; Yang, W.; Wang, C.; Cao, D.; Jiang, H.; et al. Gross economic-ecological product as an integrated measure for ecological service and economic products. Resour. Conserv. Recycl. 2021, 171, 105566. [Google Scholar] [CrossRef]

- Xu, Y.; Peng, Z.; Sun, Z.; Zhan, H.; Li, S. Does digital finance lessen credit rationing? —Evidence from Chinese farmers. Res. Int. Bus. Finance 2022, 62, 101712. [Google Scholar] [CrossRef]

- Gao, Q.; Cheng, C.; Sun, G.; Li, J. The impact of digital inclusive finance on agricultural green total factor productivity: Evidence from China. Front. Ecol. Evol. 2022, 10, 905644. [Google Scholar] [CrossRef]

- Xie, W.; Wang, T.; Zhao, X. Does digital inclusive finance promote coastal rural entrepreneurship? J. Coast. Res. 2020, 103, 240–245. [Google Scholar] [CrossRef]

- Lin, B.; Ma, R. How does digital finance influence green technology innovation in China? Evidence from the financing constraints perspective. J. Environ. Manag. 2022, 320, 115833. [Google Scholar] [CrossRef]

- Cheng, W.J.; Kong, F.B.; Xu, C.Y. Study on the Conversion Efficiency of Forest Regulating EPV in the National Pilot Areas. Issues For. Econ. 2022, 42, 354–362. (In Chinese) [Google Scholar]

- Wang, J.N.; Wang, Z.K.; Liu, Z.K.; Ma, G.X.; Wang, X.H.; Zhao, Y.H.; Cheng, L.W.; Fang, Y.W. Framework research of theory and its practice of the fourth industry of ecological products. Chin. J. Environ. Manag. 2021, 13, 5–13. (In Chinese) [Google Scholar]

- Razzaq, A.; Yang, X. Digital finance and green growth in China: Appraising inclusive digital finance using web crawler technology and big data. Technol. Forecast. Soc. Change 2023, 188, 122262. [Google Scholar] [CrossRef]

- Razzaq, A.; Sharif, A.; Ozturk, I.; Skare, M. Asymmetric influence of digital finance, and renewable energy technology innovation on green growth in China. Renew. Energy 2023, 202, 310–319. [Google Scholar] [CrossRef]

- Cao, S.; Nie, L.; Sun, H.; Sun, W.; Taghizadeh-Hesary, F. Digital finance, green technological innovation and energy-environmental performance: Evidence from China’s regional economies. J. Clean. Prod. 2021, 327, 129458. [Google Scholar] [CrossRef]

- Li, S.; Huang, Y. Do cryptocurrencies increase the systemic risk of the global financial market? China World Econ. 2020, 28, 122–143. [Google Scholar] [CrossRef]

- Wang, Z.; Chen, Y.M.; Zhang, M. Traditional Financial Supply and Digital Finance Development: Supplement or Substitute? Based on the Perspective of Regional System Differences. Bus. Manag. J. 2021, 43, 5–23. [Google Scholar] [CrossRef]

- Ehrlich, P.R.; Ehrlich, A.H. The causes and consequences of the disappearance of species. Q. Rev. Biol. 1981, 1, 82–85. [Google Scholar]

- Assessment, M.E. Ecosystems and Human Well-Being; Island Press: Washington, DC, USA, 2005; Volume 5, p. 563. [Google Scholar]

- Sun, Y.H.; Zhang, D.X.; Liang, Y.H.; Ding, J. Value Realization of Ecological Products and Integrated Urban-rural Development: An Empirical Study Based on Urban-rural Integrated Development Pilot Zones. Stat. Res. 2024, 41, 87–99. (In Chinese) [Google Scholar]

- Xie, G.; Zhang, C.; Zhen, L.; Zhang, L. Dynamic changes in the value of China’s ecosystem services. Ecosyst. Serv. 2017, 26, 146–154. [Google Scholar] [CrossRef]

- Ouyang, Z.Y.; Zhu, C.Q.; Yang, G.B.; Xu, W.H.; Zheng, H.; Zhang, Y.; Xiao, Y. Gross ecosystem product: Concept, accounting framework and case study. Acta Ecol. Sin. 2013, 33, 6747–6761. [Google Scholar] [CrossRef]

- Liu, G.Y.; Yang, Z.F. Energy Analysis Theory and Practice: Ecological Economic Accounting and Urban Green Management; Science Press: Beijing, China, 2018; Volume 2018, pp. 1–415. [Google Scholar]

- Zhao, P.; Zhang, W.; Cai, W.; Liu, T. The impact of digital finance use on sustainable agricultural practices adoption among smallholder farmers: An evidence from rural China. Environ. Sci. Pollut. Res. 2022, 29, 39281–39294. [Google Scholar] [CrossRef]

- Liang, C.A.; Du, G.; Cui, Z.; Faye, B. Does digital inclusive finance enhance the creation of county enterprises? Taking Henan Province as a case study. Sustainability 2022, 14, 14542. [Google Scholar] [CrossRef]

- Yu, L.; Zhao, D.; Xue, Z.; Gao, Y. Research on the use of digital finance and the adoption of green control techniques by family farms in China. Technol. Soc. 2020, 62, 101323. [Google Scholar] [CrossRef]

- Ge, H.; Li, B.; Tang, D.; Xu, H.; Boamah, V. Research on digital inclusive finance promoting the integration of rural three-industry. Int. J. Environ. Res. Public Health 2022, 19, 3363. [Google Scholar] [CrossRef]

- Liu, X.; Wang, X.; Yu, W. Opportunity or Challenge? Research on the Influence of Digital Finance on Digital Transformation of Agribusiness. Sustainability 2023, 15, 1072. [Google Scholar] [CrossRef]

- Harish, A.R.; Liu, X.L.; Li, M.; Zhong, R.Y.; Huang, G.Q. Blockchain-enabled digital assets tokenization for cyber-physical traceability in E-commerce logistics financing. Comput. Ind. 2023, 150, 103956. [Google Scholar] [CrossRef]

- Berger, S.C.; Gleisner, F. Emergence of financial intermediaries in electronic markets: The case of online P2P lending. Bus. Res. J. 2009, 2, 39–65. [Google Scholar] [CrossRef]

- Song, H.; Li, M.; Yu, K. Big data analytics in digital platforms: How do financial service providers customise supply chain finance? Int. J. Oper. Prod. Manag. 2021, 41, 410–435. [Google Scholar] [CrossRef]

- Karaivanov, A. Financial constraints and occupational choice in Thai villages. J. Dev. Econ. 2012, 97, 201–220. [Google Scholar] [CrossRef]

- Song, M.; Du, J. Mechanisms for realizing the ecological products value: Green finance intervention and support. Int. J. Prod. Econ. 2024, 271, 109210. [Google Scholar] [CrossRef]

- Wang, J. Digital inclusive finance and rural revitalization. Finance Res. Lett. 2023, 57, 104157. [Google Scholar] [CrossRef]

- Li, L.; Fan, Z.; Xiong, K.; Shen, H.; Guo, Q.; Dan, W.; Li, R. Current situation and prospects of the studies of ecological industries and ecological products in eco-fragile areas. Environ. Res. 2021, 201, 111613. [Google Scholar] [CrossRef]

- Zhang, L.; Yang, W. Modelling of coordinated development between marine agglomeration industry ecological industry chain and natural environment. Int. J. Heavy Veh. Syst. 2022, 29, 565–578. [Google Scholar]

- Tang, W.; Zhu, J. Informality and rural industry: Rethinking the impacts of E-Commerce on rural development in China. J. Rural Stud. 2020, 75, 20–29. [Google Scholar] [CrossRef]

- Shi, J.; Li, S.; Song, Y.; Zhou, N.; Guo, K.; Bai, J. How socioeconomic factors affect ecosystem service value: Evidence from China. Ecol. Indic. 2022, 145, 109589. [Google Scholar] [CrossRef]

- Guo, H.; Xia, Y.; Jin, J.; Pan, C. The impact of climate change on the efficiency of agricultural production in the world’s main agricultural regions. Environ. Impact Assess. Rev. 2022, 97, 106891. [Google Scholar] [CrossRef]

- Li, Z.; Liu, H. How tourism industry agglomeration improves tourism economic efficiency? Tour. Econ. 2022, 28, 1724–1748. [Google Scholar] [CrossRef]

- Wu, X.; Liang, X. Tourism development level and tourism eco-efficiency: Exploring the role of environmental regulations in sustainable development. Sustain. Dev. 2023, 31, 2863–2873. [Google Scholar] [CrossRef]

- Sun, G.; Liu, Y.; Qian, Q.; He, Y.; Shi, Y.; Zhu, Y. Environmental regulation and tourism industry development: Evidence from China. Environ. Sci. Pollut. Res. 2023, 30, 81531–81549. [Google Scholar] [CrossRef]

- Liu, Y.; Deng, W.; Wen, H.; Li, S. Promoting green technology innovation through policy synergy: Evidence from the dual pilot policy of low-carbon city and innovative city. Econ. Anal. Policy 2024, 84, 957–977. [Google Scholar] [CrossRef]

- Zhang, X.; Wan, G.H.; Zhang, J.J.; He, Z.Y. Digital economy, inclusive finance, and inclusive growth. Econ. Res. J. 2019, 54, 71–86. [Google Scholar]

- Abadía, J.J.P.; Walther, C.; Osman, A.; Smarsly, K. A systematic survey of Internet of Things frameworks for smart city applications. Sustain. Cities Soc. 2022, 83, 103949. [Google Scholar] [CrossRef]

- Hou, F.; Tang, W.; Wang, H.; Xiong, H. Economic policy uncertainty, marketization level and firm-level inefficient investment: Evidence from Chinese listed firms in energy and power industries. Energy Econ. 2021, 100, 105353. [Google Scholar] [CrossRef]

- Fan, G.; Ma, G.; Wang, X. Institutional reform and economic growth of China: 40-year progress toward marketization. Acta Oeconomica 2019, 69, 7–20. [Google Scholar] [CrossRef]

- Feng, Y.; Yuan, H.; Liu, Y.; Zhang, S. Does new-type urbanization policy promote green energy efficiency? Evidence from a quasi-natural experiment in China. Energy Econ. 2023, 124, 106752. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).