Abstract

Green finance policy plays a pivotal role in motivating enterprises to engage in environmental governance. Utilizing data spanning from 2009 to 2024, this research applies the difference-in-differences (DID) method to explore how the Green Finance Reform and Innovation Pilot Zone (GFRIPZ) policy influences the ESG performance of A-share listed companies in China. The findings reveal that the policy significantly enhances corporate ESG performance through three primary channels: alleviating financing constraints, improving profitability, and increasing green innovation capability. Moreover, the policy’s impact exhibits notable heterogeneity across regions and company types. It exerts a positive effect on ESG performance in core cities and southern regions, while its influence is negative or insignificant in non-core cities and northern regions. For high-tech and non-heavily polluting enterprises, the impact is significantly positive; however, for non-high-tech and heavily polluting enterprises, the effect is positive but statistically non-significant.

1. Introduction

Amid intensifying global climate change and growing ecological pressures, the shift toward a green, low-carbon, and sustainable economy and society has become an international consensus and an urgent priority. As key participants in market-driven economic activities, the environmental, social, and governance (ESG) performance of corporations not only determines their long-term survival and reputational risks but also directly affects the resilience and development quality of the entire economic system. In recent years, corporate ESG performance has attracted considerable attention from global media, regulators, and academics [1,2]. Current research mainly focuses on the economic benefits of ESG investment, such as increasing corporate value [3], improving investment efficiency [4], and mitigating systemic risk [5]. Additionally, scholars have explored various factors influencing ESG, including internal drivers like executive incentive mechanisms [6] and board gender composition [7], as well as external factors such as legal regulations [8] and corporate culture [9].

Green finance has emerged as a vital market-based policy tool and resource allocation mechanism, with its significance becoming increasingly prominent. In 2017, China strategically launched the “Green Finance Reform and Innovation Pilot Zones (GFRIPZ)” across five provinces and eight districts. This initiative represents a major institutional experiment to integrate environmental and climate objectives into the financial system. Existing studies on the GFRIPZ policy have primarily adopted macro and micro perspectives. From a macro viewpoint, research indicates that the GFRIPZ policy plays a significant role in attracting foreign investment, maintaining macro-financial stability, and promoting economic growth [10,11,12,13], while also contributing to reducing carbon emissions and improving energy efficiency [14,15,16,17]. From a micro perspective, emerging studies suggest a positive correlation between green finance policy and corporate green innovation or environmental performance [18,19,20]. Nevertheless, despite these contributions, the existing literature has three key limitations that this study aims to address.

From a theoretical perspective, there is a lack of an integrated framework that synthesizes how green finance policy simultaneously operates through multiple interrelated channels—such as alleviating financing constraints, improving profitability, and enhancing green innovation—to influence the comprehensive ESG performance of corporations. Previous studies often examine isolated mechanisms [21,22,23,24,25], ignoring their synergistic and sequential effects. While [26] explored the mediating roles of financing constraints and social responsibility awareness, and [27] found that the green finance pilot policy enhances ESG performance through similar channels, these studies do not fully integrate the three pathways into a coherent theoretical framework. Furthermore, most existing research relies on specific ESG rating systems such as Bloomberg’s ESG ratings [28,29] or the China Securities ESG evaluation system [30], which may limit the generalizability of findings across different institutional contexts.

From a practical perspective, although the policy effects are recognized, there is insufficient evidence regarding their heterogeneous impacts across regions and corporation types—information that is crucial for designing targeted and effective policy implementations. Although some studies have focused on heavily polluting corporations [31,32] or manufacturing corporations [20], comprehensive analyses of how policy effects vary based on geographical location, technological intensity, and pollution levels remain limited. This gap is particularly significant given China’s vast regional disparities and diverse corporate structure. Understanding these heterogeneous effects is essential for policymakers to design more precise and effective green finance instruments.

Regarding social justification, the role of green finance as a tool for achieving broader societal goals—such as promoting equitable green transition, enhancing systemic resilience, and aligning corporate conduct with national sustainable development strategies—remains underexplored in the context of ESG outcomes. While studies have examined the impact of China’s sustainable finance policy [33] and green finance’s role in promoting urban green development [2], the societal implications of how green finance policy shapes corporate ESG performance have not been systematically investigated. This represents a significant gap in understanding how financial system reforms can contribute to broader sustainability agendas.

This study leverages China’s GFRIPZ as a quasi-natural experiment to systematically investigate the policy’s impact on corporate ESG performance. Drawing on and extending theories of economic externalities, information asymmetry, signaling, and stakeholder engagement, we construct a Difference-in-Differences (DID) model using a panel dataset of Chinese A-share listed corporations from 2009 to 2024. Our research aims to make threefold contributions:

First, we develop and test a multi-mechanism transmission framework, clarifying how green finance policy enhances ESG performance by alleviating financing constraints, improving profitability, and strengthening green innovation capability. This enriches the theoretical understanding of policy-to-performance pathways by integrating insights from studies on green credit policy and innovation capabilities [34] into a comprehensive analytical framework.

Second, we provide detailed empirical evidence on the heterogeneous effects of the policy across core/non-core cities, northern/southern regions, and different corporate types (high-tech vs. non-high-tech, heavily polluting vs. non-heavily polluting). These findings offer actionable insights for policymakers to tailor and refine green finance instruments for greater efficacy and inclusivity, addressing the gaps identified in studies focusing on specific sectors or regions.

Third, by linking corporate ESG outcomes to the GFRIPZ policy, we highlight the critical role of financial system reform in advancing national sustainability agendas, fostering a just transition, and enhancing the non-financial governance of corporations. This underscores the societal value of green finance as a catalyst for aligning economic activities with ecological boundaries and social well-being, complementing existing research on green finance’s environmental impacts and economic benefits.

The remainder of this paper is structured as follows: Section 2 develops the research hypotheses. Section 3 outlines the research design, including the econometric model, variable definitions, and data. Section 4 presents the empirical results, including benchmark regression, robustness checks, mechanism tests, and heterogeneity analysis. Section 5 discusses the findings in relation to existing literature. Section 6 concludes the study with policy implications, limitations, and directions for future research.

2. Research Hypothesis

2.1. Green Finance Policy and Corporate ESG Performance

Based on externality theory, green finance policy drives corporations to integrate ESG practices into their operational decisions by internalizing environmental externalities. From the perspective of information asymmetry theory, ESG performance serves as a core signal for corporations to secure green finance support, incentivizing them to optimize ESG performance and convey compliance signals to the market. From the standpoint of stakeholder and incentive theory, ESG performance is key to meeting diverse stakeholder demands and obtaining policy incentives [24]. Research demonstrates that green finance policy accelerates corporate green transformation, with ESG performance serving as its core manifestation. Empirical studies further confirm that corporations covered by green finance policy exhibit significantly greater improvements in ESG scores compared to uncovered corporations. Accordingly, this paper proposes the first core hypothesis:

H1.

The implementation of green finance policy significantly enhances corporate ESG performance.

2.2. Mechanisms of Green Finance Policies to Improve Corporate ESG Performance

2.2.1. The Mechanism of Financing Constraints

ESG-related investments typically involve substantial capital requirements and extended payback periods, with less immediate returns. This contradicts the traditional logic of pursuing short-term returns, leading to significant financing barriers for most corporations. The core function of green finance policy is to channel financial resources toward green sectors. Through instruments such as green loans and green bonds, the policy provides corporations with lower-cost, more abundant capital, thereby alleviating financing constraints. This, in turn, secures funding for ESG-related investments (e.g., purchasing environmental protection equipment or implementing pollution control measures), preventing corporations from abandoning long-term ESG practices due to short-term capital pressures and driving improvements in ESG performance. Hence, we propose the second hypothesis:

H2.

Green finance policy enhances corporate ESG performance by alleviating financing constraints.

2.2.2. The Mechanism of Profitability

Green finance policy can help corporations secure green product premiums and environmental subsidies, directly boosting profitability. Conversely, the policy compels corporations to phase out high-pollution production capacity, drive technological upgrades and equipment renewal, and reduce environmental penalties and energy consumption costs, thereby indirectly improving profit quality. This approach reduces both the unit energy consumption cost of products and raw material wastage during production, while also lowering compliance costs stemming from environmental violations and associated fines. Enhanced profitability provides corporations with greater capital to invest in ESG initiatives, creating an intrinsic motivation for ESG implementation. This fosters a virtuous cycle, “profit growth → increased ESG investment → improved ESG performance,” ultimately driving corporate value growth. Thus, we propose the third hypothesis:

H3.

Green finance policy enhances corporate ESG performance by improving profitability.

2.2.3. The Mechanism of Green Innovation Capability

Green finance policy effectively alleviates the initial funding constraints of corporate green R&D by providing low-cost financing, offering stable financial support for technological innovation, and significantly lowering the entry barriers for corporations to pursue green innovation. The outcomes of green innovation, such as green patents and clean production technologies, directly align with core environmental (E) metrics within ESG frameworks, powerfully driving improvements in corporate environmental performance. Moreover, the impact of green innovation extends beyond the environmental dimension. The application of green technologies helps improve production conditions and work environments, enhancing employee health and safety—aligning with the social dimension (S) focus on employee rights. The promotion of green products better safeguards consumer health and safety, further resonating with relevant evaluation requirements under the social dimension (S). Simultaneously, the technological upgrades and management optimizations driven by green innovation enhance operational efficiency and increase transparency in information disclosure. This manifests within the governance dimension (G) as more effective governance structures and standardized operational management practices. Therefore, we propose the fourth hypothesis:

H4.

Green finance policy enhances corporate ESG performance by increasing green innovation capability.

3. Research Design

3.1. Econometric Model

To systematically examine the impact of green finance policy on corporate ESG performance, this study constructs a multidimensional fixed-effects model based on the multi-period DID approach. This model effectively identifies changes in corporate ESG performance before and after policy implementation, controlling for time trends and corporation-specific characteristics to reveal the net policy effect. The benchmark model specification is as follows:

where denotes the ESG score of corporation i in year t. is a dummy variable that equals 1 if the region where the corporation is located has implemented the green finance policy and 0 otherwise. denotes the set of control variables. , and represent corporation, year, and industry fixed effects, respectively. is the random disturbance term. The sign and significance of the core coefficient are used to test whether green finance policy significantly enhances corporate ESG performance.

3.2. Variable Definition

3.2.1. Explained Variable

Corporate ESG performance is measured using the SynTao Green Finance ESG score (https://www.chindices.com/esg-ratings.html (accessed on 25 January 2026)), one of China’s most representative and authoritative third-party quantitative ESG evaluation systems. The SynTao ESG score system evaluates corporate performance across three dimensions—Environment, Social, and Governance—based on publicly disclosed information from listed corporations and accessible materials such as social responsibility reports, sustainability reports, and annual reports. It generates a composite score through a standardized weighting system. The environmental dimension primarily reflects a corporation’s performance in energy conservation, emissions reduction, resource utilization efficiency, pollution control, and green innovation. The social dimension focuses on employee rights protection, product safety, community relations, and supply chain management. The governance dimension evaluates a corporation’s governance standards in areas such as equity structure, board independence, transparency of information disclosure, and regulatory compliance. The rating scale typically ranges from 0 to 100 points, with higher scores indicating stronger corporate sustainability performance. This reflects a corporation’s ability to balance economic benefits with social responsibility and ecological conservation. The SynTao ESG score system comprehensively reflects corporate non-financial performance and long-term value creation capabilities, serving as the core metric for assessing green transformation and sustainability levels in this study.

3.2.2. Explanatory Variable

Green finance policy centers on “embedding environmental and climate objectives into financial resource allocation.” By institutionally integrating corporate environmental performance into investment and financing decisions, it reshapes capital flows to support green transformation and reduce pollution and carbon emissions. In 2017, the State Council decided to establish “Green Finance Reform and Innovation Pilot Zones” in eight locations across five provinces nationwide. This marked China’s green finance entering a new development phase combining top-down policy design with bottom-up regional exploration. The pilot zones were rolled out incrementally each year. By the end of 2018, the State Council had initiated pilot programs in five provinces: Zhejiang, Guangdong, Jiangxi, Guizhou, and Xinjiang. Each pilot province focused on distinct aspects of green finance development. Building upon the implementation of the Belt and Road Initiative, the Xinjiang Uygur Autonomous Region positioned itself to strengthen financial support for modern agriculture and clean energy through green finance development. Guizhou Province, leveraging its big data technology implementation, focuses on supporting ecological conservation and poverty alleviation projects and infrastructure through green finance. Guangdong Province positions itself for green finance cooperation within the Guangdong-Hong Kong-Macao Greater Bay Area, aiming to develop a green finance market. Jiangxi Province focuses on building a green finance system composed of diversified green financial products. Zhejiang Province aims to support the transformation and upgrading of traditional industrial structures through innovation in green finance systems, mechanisms, and products. Beyond these pilot provinces, other regions have yet to deploy large-scale green finance policy. Consequently, the introduction of government-led regional green finance pilot zone policy represents a pioneering effort. Furthermore, the analysis indicates that both the policies themselves and the selection of pilot provinces exhibit significant exogenous characteristics, exerting substantial influence on reshaping the “trinity” of credit allocation, environmental disclosure, and regulatory accountability within regions—leveraging capital and governance.

In this study, the core explanatory variable is the interaction term treat × post. Here, treat denotes the treatment group dummy variable, identifying whether a corporation is located within a GFRIPZ. A corporation is assigned a value of 1 if its registered location falls within the first batch of pilot regions designated by the State Council in 2017 (including Zhejiang, Jiangxi, Guangdong, Guizhou, and Xinjiang) and 0 otherwise. Post denotes the time dummy variable, reflecting temporal changes before and after policy implementation. It takes a value of 1 when the year is greater than or equal to the policy implementation year and 0 otherwise. The interaction term treat × post equals 1 when the corporation is located in a pilot region and the period is after policy implementation, indicating the corporation is actually affected by the green finance policy; it equals 0 otherwise. Constructed at the corporation-year level, this variable simultaneously captures time effects and regional effects. It thereby measures the average difference in changes between corporations in pilot regions and those in non-pilot regions regarding ESG performance following the implementation of green finance policy. The regression coefficient measures the policy impact: a significantly positive coefficient indicates that green finance policy promotes sustainable corporate operations or enhances green performance; a significantly negative coefficient suggests that the policy curbs high-energy consumption and high-emission behaviors by tightening financing constraints or restricting capital inflows to high-pollution sectors, thereby reflecting its environmental governance effects.

3.2.3. Data Source and Descriptive Statistics

This study examines the impact of green finance policy on corporate sustainability by selecting Chinese A-share listed corporations on the Shanghai and Shenzhen stock exchanges from 2009 to 2024 as research samples. Corporate ESG performance serves as the dependent variable. The sample period encompasses both the implementation phase of the GFRIPZ policy and its subsequent impact phase, enabling a comprehensive reflection of the dynamic evolution of policy effects. The data originate primarily from multiple authoritative databases. Corporate ESG score data come from SynTao Green Finance’s ESG rating system. Financial and corporate governance data come from the CSMAR database and the Wind Financial Terminal. The list of green finance pilot cities and years of policy implementation is based on the ‘Overall Plan for GFRIPZ’ issued by the People’s Bank of China and the Ministry of Ecology and Environment, along with other relevant government documents.

To ensure the reliability and representativeness of the data, the following screening procedures were implemented: (1) Financial listed corporations were excluded to avoid estimation biases caused by industry-specific attributes. (2) ST and *ST corporations were removed to eliminate interference from abnormally performing corporations. (3) Samples with missing key variables were discarded. (4) Double-tailed trimming was applied to continuous variables at the 1st and 99th percentiles to mitigate the impact of extreme values. This process yielded a final dataset comprising 53,298 corporation-year observations from 2009 to 2024. All data underwent standardization and consistency checks. Overall, the sample selection for this study balanced temporal coverage and industry distribution, providing a robust data foundation for analyzing the impact of green finance policy on corporate ESG performance. Variable definitions and descriptive statistics are provided in Table 1.

Table 1.

Variable Definition.

4. Empirical Analysis Results

4.1. Benchmark Regression Results Analysis

Table 2 presents the benchmark regression results. Column (1) includes only the core explanatory variable and fixed effects. Column (2) adds corporate financial characteristics, while Column (3) further incorporates corporate governance and structural variables, progressively enhancing the model’s explanatory power. All models control for corporation, industry, and year fixed effects and employ robust standard errors to address potential heteroskedasticity.

Table 2.

Benchmark Regression Results.

The coefficient on DID is significantly positive in all three specifications, stabilizing around 0.15. This indicates that, after controlling for other factors, the implementation of green finance policy significantly improved corporate ESG performance, supporting H1. The result reflects the positive incentive effect of policy guidance and institutional pressure on corporate ESG behavior, aligning with theoretical expectations. It demonstrates that green finance policy not only channels capital toward green sectors but also motivates corporations to actively fulfill social responsibilities and enhance governance structures.

Regarding financial characteristics, the coefficient on Lev is significantly negative, suggesting that corporations with higher leverage may face greater debt repayment pressure, thereby reducing investment in long-term strategic activities such as ESG. The coefficient on ROA is significantly positive, indicating that profitable corporations possess greater resources and intrinsic motivation to pursue ESG initiatives to build sustainable competitive advantage. The coefficient on CashFlow is negative or insignificant, implying that the promotional effect of cash flow adequacy alone on ESG may be constrained by other financial factors. Inv is significantly positive, likely reflecting a direct correlation with corporate investments in fixed assets and environmental protection equipment. Rec shows an insignificant influence, suggesting that working capital management efficiency has limited direct impact on ESG.

Concerning corporate governance and structural characteristics, the coefficient on Intangible is significantly positive, underscoring the importance of technological innovation and knowledge capital accumulation for corporations pursuing green development and social responsibility. Top10 is significantly positive, indicating that concentrated equity structures facilitate shareholder alignment on long-term ESG investment strategies. Balance2 exhibits a significant negative coefficient, implying that corporations with asset allocations favoring liquidity may prioritize short-term profitability over ESG investments. ListAge shows a significant negative correlation, suggesting that mature corporations may face greater challenges in ESG transformation due to organizational inertia or overreliance on traditional pathways.

The overall goodness-of-fit (R2) is around 0.54, and all F-statistics are significant, confirming the model’s sound design and overall validity. Through stepwise regression, the significance and magnitude of the DID coefficients remained stable after sequentially incorporating control variables. This demonstrates the robustness of the benchmark regression results, providing strong support for the proposition that green finance policy can significantly enhance corporate ESG performance.

4.2. Robustness Test

Endogeneity Test

Given the potential non-randomness in the selection of pilot zones, this section addresses endogeneity concerns by employing a lagged-period DID variable as an instrumental variable (IV) in a two-stage least squares (2SLS) estimation. The lagged DID is theoretically correlated with the current policy status, but after controlling for fixed effects, it is unlikely to directly influence current corporate ESG decisions, thereby satisfying the relevance and exogeneity assumptions of a valid instrumental variable.

The results of the endogeneity test are presented in Table 3. Diagnostic tests confirm the validity of the instrumental variable. The Kleibergen-Paap rk LM statistic rejects the null hypothesis of under-identification at the 1% level, indicating that the model is well-identified. Furthermore, the Kleibergen-Paap rk Wald F-statistic far exceeds the Stock-Yogo critical value for the 10% significance level, allowing us to reject the weak instrument hypothesis.

Table 3.

Regression Results Using the Instrumental Variables Method (2SLS).

In the first-stage regression, the instrumental variable L.DID exhibits a strong and statistically significant positive correlation with the endogenous variable DID. This confirms that the lagged policy variable effectively predicts the current policy status, satisfying the relevance condition. The second-stage regression results show that the coefficient on DID remains significantly positive at the 1% level. This indicates that, after controlling for potential endogeneity, the green finance policy continues to exert a significant positive impact on corporate ESG performance. The implementation of the policy markedly enhances the overall ESG performance of corporations. These results validate the robustness of the instrumental variables approach and further strengthen the conclusion that green finance policy can significantly promote corporate sustainable development.

Results of other robustness tests, such as the Parallel Trend Test and Placebo Test, are presented in the Appendix A.

4.3. Mechanism Analysis

To verify whether the hypothesized mechanisms based on financing constraints, profitability, and green innovation capability hold, we construct a mediation model, as specified in Equations (2) and (3). Following the methodology in [35], we examine the underlying channels through which green finance policy influences corporate ESG performance.

where represents the respective mediating variables: financing constraints (measured by the SA index), profitability (measured by NetProfit), and green innovation capability (denoted by Patent). If both and are statistically significant, this indicates that the green finance policy indirectly enhances corporate ESG performance by influencing these mediating variables. The interpretations of the remaining variables are consistent with those in the benchmark regression. The results of the mechanism analysis are presented in Table 4.

Table 4.

Mechanism Analysis Results.

4.3.1. Financing Constraints

This study employs the SA index to measure corporate financing constraints for the mechanism test. The SA index is calculated based on firm size and age. Since the SA index typically yields negative values, we use its absolute value for analysis, where a higher value indicates a greater degree of financing constraints.

The results are presented in columns (1) and (2) of Table 4. The mechanism test shows that in the regression with the SA Index as the dependent variable, the coefficient on DID is −0.025 and significant at the 5% level. This suggests that the implementation of the green finance policy significantly alleviates corporate financing constraints and improves the external financing environment. When ESG is used as the dependent variable in the subsequent regression, the coefficient on DID is 0.146, significant at the 1% level and consistent in direction with the benchmark regression results. This indicates that, after controlling for the mediating role of financing constraints, the direct policy effect remains significant. The results imply that green finance policy further promotes corporate ESG performance by reducing financing constraints, with financing constraints playing a significant mediating role in this process. Therefore, research hypothesis H2 is supported.

4.3.2. Profitability

This study uses NetProfit as a measure of corporate profitability for the mechanism test. A higher NetProfit indicates stronger corporate profitability. The results are presented in columns (3) and (4) of Table 4. The mechanism test indicates that the coefficient on DID in the regression with NetProfit as the dependent variable is 0.031, significant at the 1% level, suggesting that the implementation of green finance policy significantly enhances corporate profitability. In the subsequent regression with ESG as the dependent variable, the coefficient on DID is 0.148, significant at the 5% level and consistent in direction with the benchmark results. This demonstrates that green finance policy indirectly promotes ESG performance by improving corporate profitability, with profitability playing a significant mediating role in this transmission mechanism. Thus, research hypothesis H3 is validated.

4.3.3. Green Innovation Capability

Drawing on the methodology of [25] and considering data availability and indicator relevance, this section adopts the “total number of green patent applications filed by corporations” as the core proxy variable for green innovation capability. Following the approach of [34], this variable is transformed using the natural logarithm. Green patents include green invention patents, green utility model patents, and other categories as classified by the China National Intellectual Property Administration.

The mechanism test results in columns (5) and (6) of Table 4 show that the coefficient on DID in the regression with Patent as the dependent variable is 0.149, significant at the 5% level, suggesting that the implementation of green finance policy significantly enhances corporate green innovation capabilities. In the subsequent regression with ESG as the dependent variable, the coefficient on DID is 0.141, significant at the 5% level and consistent in direction with the benchmark results. This indicates that green finance policy indirectly promotes ESG performance by improving corporate green innovation capabilities, with green innovation capability playing a significant mediating role in this process. Therefore, research hypothesis H4 is validated.

4.4. Heterogeneity Analysis

To examine whether the impact of green finance policy varies across different corporate characteristics and regional contexts, we conduct heterogeneity analyses based on geographical location, technological intensity, and pollution levels. The results are presented in Table 5.

Table 5.

Heterogeneity Analysis Results.

4.4.1. Region Heterogeneity Analysis

To assess geographical variations in policy effectiveness, the sample is divided into subgroups based on urban hierarchy and geographical location. Columns (1) to (4) of Table 5 present the regression results for core cities versus non-core cities and for northern versus southern regions.

The results reveal significant regional disparities in policy impact. For corporations located in core cities, the coefficient on DID is 0.112 and significant at the 10% level, indicating a positive effect of green finance policy on ESG performance. In contrast, for corporations in non-core cities, the DID coefficient is negative and statistically insignificant. This disparity may be attributed to the advantages of core cities in financial resource allocation, policy responsiveness, and institutional implementation capacity, which enable green finance policy to more effectively guide sustainable corporate behavior. Non-core cities, with their less developed financial markets and limited policy transmission channels, may not have fully realized the intended policy effects.

In terms of geographical location, the policy exerts a significantly positive effect on corporations in southern regions. Conversely, for corporations in northern regions, the DID coefficient is negative and statistically insignificant. A plausible explanation is that southern regions possess more developed financial systems, higher levels of marketization, and more active green investment environments. These factors enhance the transmission efficiency of green finance policy, thereby more effectively incentivizing corporations to fulfill their environmental, social, and governance responsibilities. In contrast, northern regions, characterized by more traditional industrial structures and green finance markets still in the developmental stage, have been unable to fully leverage the incentive effects of such policy.

4.4.2. High-Tech Heterogeneity Analysis

Columns (5) and (6) of Table 5 present the results of the heterogeneity analysis based on whether a corporation is classified as high-tech. The findings indicate that green finance policy significantly and positively enhances the ESG performance of high-tech corporations. In contrast, the impact on non-high-tech corporations is positive but statistically insignificant. This suggests that the incentive effect of green finance policy is more pronounced for corporations with high innovation capabilities and technological intensity. Under policy constraints and capital guidance, such corporations are more inclined to convert green finance resources into sustainable development investments. The results demonstrate the differentiated impact of the policy, indicating that the synergistic interaction between technological innovation and capital support is a crucial pathway for achieving the objectives of green finance policy.

4.4.3. Heavy Polluting Corporations Heterogeneity Analysis

The results of the heterogeneity analysis based on pollution levels are shown in columns (7) and (8) of Table 5. The impact of green finance policy differs significantly between heavily polluting and non-heavily polluting corporations. For non-heavily polluting corporations, the DID coefficient is 0.167 and significant at the 1% level, indicating that the policy implementation significantly promotes their ESG performance. However, for heavily polluting corporations, the effect is positive but statistically insignificant. A possible explanation is that green finance policy incentives yield more pronounced effects in corporations with lower pollution levels and more optimized industrial structures. In contrast, heavily polluting corporations face constraints such as high remediation costs, technological transition barriers, and policy compliance pressures, resulting in relatively lower conversion efficiency of green finance resources. Consequently, the policy’s promotional effect on their ESG performance is diminished.

5. Discussion

This study leverages the GFRIPZ policy as a quasi-natural experiment to empirically examine its impact on corporate ESG performance. The findings indicate that the GFRIPZ policy significantly enhances ESG performance, primarily by alleviating financing constraints, improving profitability, and strengthening green innovation capability. This result enriches the existing literature and provides nuanced evidence and mechanism-based explanations.

In contrast to previous research, the results of this study both align with and extend current academic perspectives. Similarly to the authors of [18,19], who found that green finance policy positively influences corporate environmental performance, this study further reveals that such impacts significantly enhance a corporation’s overall ESG score. This suggests that green finance, as a policy tool, exerts a more comprehensive effect on corporate sustainability than previously understood.

The heterogeneity findings of this study also offer new insights. Unlike some previous research that emphasized the uniform effect of policy across different regions and corporations (e.g., [27]), our results indicate significant disparities in policy effectiveness between the northern and southern regions, as well as between high-tech and traditional polluting corporations. This is particularly relevant for understanding the real-world application of green finance policy, as it reveals how regional economic development levels, corporate structures, and environmental governance capacities may moderate policy outcomes.

Most importantly, this study validates the theoretical framework that green finance policy can promote corporate ESG performance through multiple channels, including financing, profitability, and innovation. This multi-mechanism perspective deepens the current theoretical understanding. Compared to earlier studies that primarily focused on single mechanisms such as financing constraints (e.g., [24]) or technological innovation (e.g., [25]), our analysis demonstrates that these mechanisms operate interactively, with each playing a crucial role in corporate decision-making.

In summary, this study not only confirms the positive role of green finance policy in promoting corporate ESG performance but also reveals the complexity and variability of their impact mechanisms. These findings provide theoretical support for the further refinement of green finance policy and practical guidance for corporate sustainable development strategies.

6. Conclusions and Future Research

This study examines the effects of the GFRIPZ policy on corporate ESG performance, focusing on the corporate dimension. Utilizing panel data from A-share listed corporations from 2009 to 2024 and employing a DID approach, we discovered that the GFRIPZ policy resulted in a significant improvement in corporate ESG performance. This enhancement reflects the positive incentive effect of market-oriented policy instruments, primarily realized through three channels: alleviating financing constraints, improving corporate profitability, and strengthening green innovation capabilities.

This conclusion aligns with and extends the findings of existing literature. Consistent with the authors of [18,19], who verified the positive impact of green finance policy on corporate environmental performance, our study further demonstrates that such policy exerts a comprehensive boosting effect on the overall ESG performance of corporations, rather than being limited to a single environmental dimension. This supplements the research gap in prior studies that focused more on partial sustainability indicators [20,26] and confirms that green finance policy can systematically optimize corporations’ environmental, social, and governance behaviors. Compared with [27], which emphasized the uniform effect of green finance policy, our heterogeneity analysis further reveals that the policy’s impact varies across regions and corporate types—an outcome that enriches the understanding of the contextual boundary conditions of green finance policy effects [31,32]. Additionally, our identification of three parallel transmission mechanisms (financing constraints, profitability, and green innovation capability) responds to the call of [24,25] for exploring multi-path policy impacts and integrates fragmented mechanism studies into a coherent analytical framework, deepening the theoretical explanation of how green finance policy shapes corporate sustainable development.

This study has several limitations that warrant further investigation. First, while we focus on ESG composite scores, future research could disaggregate the effects across environmental (E), social (S), and governance (G) dimensions to uncover nuanced policy impacts [36,37,38]. Second, the study primarily relies on listed corporation data; extending the analysis to small and medium-sized enterprises (SMEs) and unlisted firms would provide a more comprehensive view of policy outreach. Third, regarding instrumental variable selection, this study employs one-period-lagged DID. Future research could explore alternative instrumental variables to test model validity.

In summary, green finance represents a powerful lever for aligning corporate behavior with sustainable development objectives. Continued policy innovation, empirical evaluation, and multi-stakeholder engagement will be essential to fully realize its potential in fostering an inclusive, resilient, and green economy.

Author Contributions

Methodology, B.Z. (Bowen Zhu); Software, B.Z. (Bowen Zhu); Formal analysis, J.L., B.Z. (Bicheng Zhang) and A.Y.; Investigation, B.Z. (Bicheng Zhang) and A.Y.; Writing—original draft, J.L.; Writing—review & editing, J.L. and A.Y.; Supervision, A.Y. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The original contributions presented in this study are included in the article. Further inquiries can be directed to the corresponding author.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

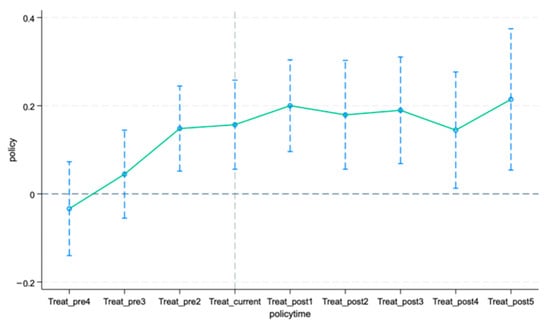

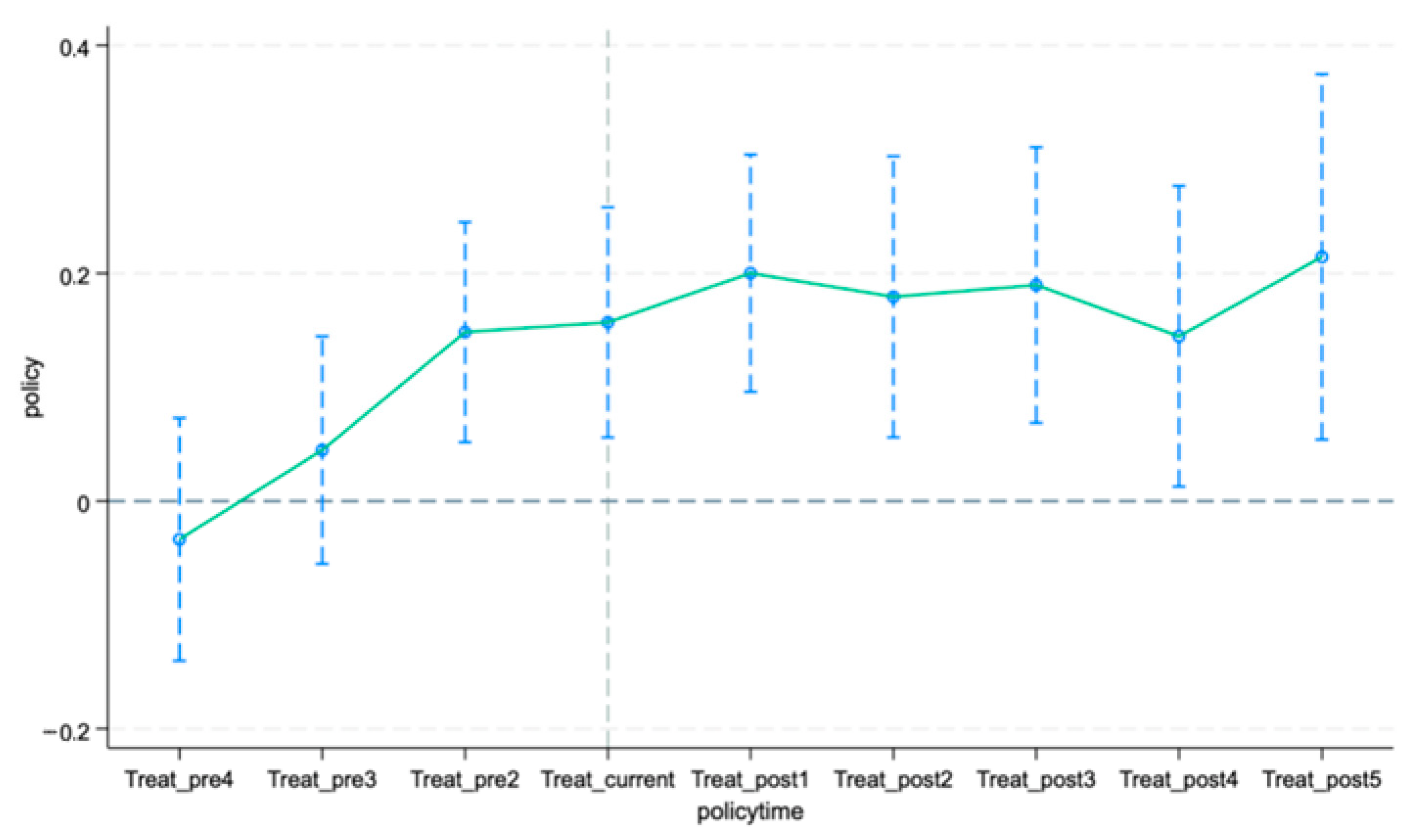

Appendix A.1. Parallel Trend Test

The results of the parallel trend test are presented in Figure A1. Prior to policy implementation, the interaction term coefficients for all periods did not significantly deviate from zero and exhibited limited fluctuation. This indicates that the ESG performance trends in the treatment and control groups were largely consistent before the policy introduction, thereby satisfying the parallel trend assumption required for the DID model. During and after the policy implementation period, the coefficients display an overall upward trajectory. From the Treat_current to Treat_post5 stages, the coefficients remain positive and statistically significant for most periods, indicating a marked improvement in corporate ESG performance after the policy took effect. The policy’s impact gradually materialized over time and demonstrated a degree of sustainability. In terms of trend patterns, improvements in ESG performance peaked during the policy implementation phase. Although slight fluctuations occurred afterward, the positive effect persisted. This suggests that the green finance policy exerts a steady and cumulative positive influence on corporate sustainable governance, thereby validating the reliability of the benchmark regression results and the sustained temporal impact of the policy.

Figure A1.

Parallel Trend Test Results.

Figure A1.

Parallel Trend Test Results.

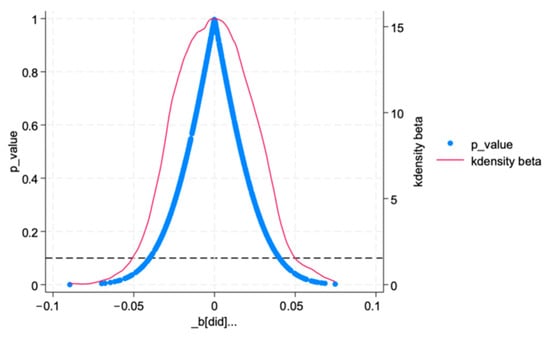

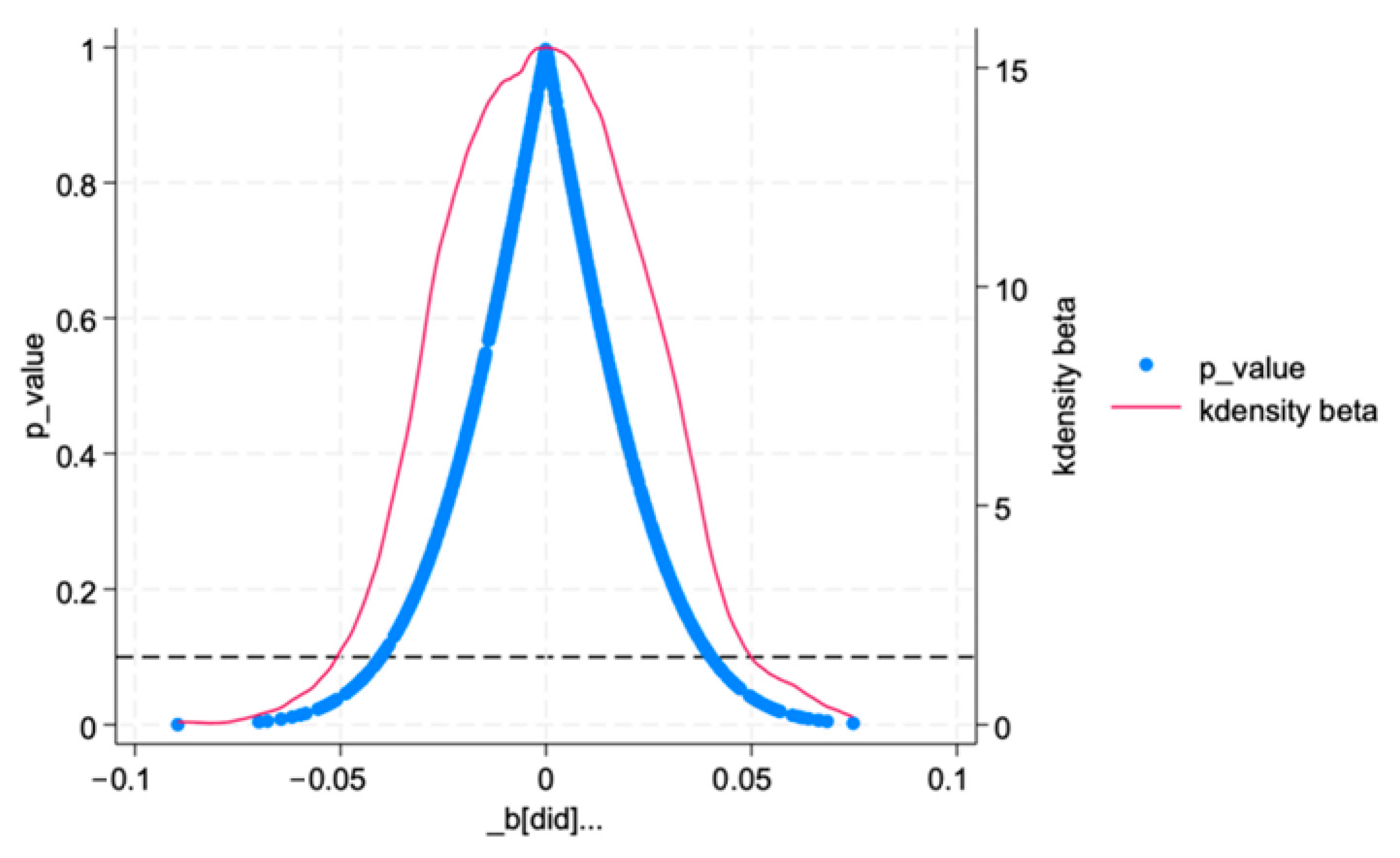

Appendix A.2. Placebo Test

Figure A2 presents the results of the placebo test. The coefficient distribution generated from 1000 random permutations exhibits a broadly symmetric, approximately normal shape. The density peak of the coefficients is concentrated near zero, and the true estimated coefficient from the main regression shows almost no overlap with the distribution of simulated coefficients. This indicates that the main model’s results are not driven by random factors. The corresponding p-values remain consistently below the conventional significance level of 0.05, further validating the statistical robustness of the estimated policy effect. Overall, the placebo test results support the identification validity of the DID model, confirming that the positive effect of the green finance policy on corporate ESG performance is genuine and not attributable to sample selection or random errors.

Figure A2.

Placebo Test Results.

Figure A2.

Placebo Test Results.

Appendix A.3. Core Variable Substitution

Table A1 presents the robustness test results using alternative measures of the dependent variable. After substituting the ESG composite score with the ESG median score, the coefficient on DID remains significantly positive at the 5% level, indicating that the estimated policy effect holds robustly across different ESG measurement approaches. This result further validates that the green finance policy significantly promotes corporate sustainability performance. Specifically, the implementation of the green finance policy markedly enhances corporate ESG performance, an effect that is independent of the specific ESG metric used, demonstrating the robustness of the primary conclusion.

Table A1.

Robustness Test Results: Core Variable Substitution.

Table A1.

Robustness Test Results: Core Variable Substitution.

| (1) | (2) | |

|---|---|---|

| ESG Median | ESG | |

| DID | 0.145 ** | 0.156 *** |

| (2.474) | (2.779) | |

| Lev | −0.649 *** | −0.611 *** |

| (−13.026) | (−12.973) | |

| ROA | 0.480 *** | 0.430 *** |

| (6.509) | (6.263) | |

| CashFlow | −0.118 * | −0.100 |

| (−1.694) | (−1.541) | |

| Inv | 0.541 *** | 0.505 *** |

| (5.988) | (5.914) | |

| Rec | 0.095 | 0.085 |

| (0.830) | (0.788) | |

| Intangible | 0.007 ** | 0.007 *** |

| (2.477) | (2.578) | |

| Top10 | 0.334 *** | 0.291 *** |

| (4.255) | (3.888) | |

| Balance2 | −0.068 *** | −0.066 *** |

| (−3.621) | (−3.687) | |

| ListAge | −0.055 *** | −0.070 *** |

| (−3.042) | (−4.017) | |

| _cons | 4.100 *** | 4.147 *** |

| (46.102) | (48.995) | |

| N | 53,298 | 53,298 |

| Corporation FE | Yes | Yes |

| Year FE | Yes | Yes |

| Industry FE | Yes | Yes |

| R2 | 0.505 | 0.540 |

| F | 44.000 | 44.034 |

Note: 1. T-values in parentheses; 2. * p < 0.10, ** p < 0.05, *** p < 0.01.

Appendix A.4. Partial Sample Exclusion

Table A2 presents the robustness test results based on partial sample exclusion. Under three different sample specifications—excluding observations from the first two years of the sample period, excluding observations from the last two years, and using the full sample—the DID regression coefficients are 0.127, 0.137, and 0.156, respectively. All coefficients are statistically significant at the 5% or 1% level and consistently move in a positive direction. This indicates that the positive impact of the green finance policy on corporate ESG performance remains robust across different sample scopes. The implementation of this policy has indeed effectively enhanced the level of corporate sustainable governance.

Table A2.

Robustness Test Results: Partial Sample Exclusion.

Table A2.

Robustness Test Results: Partial Sample Exclusion.

| (1) | (2) | (3) | |

|---|---|---|---|

| ESG : First Two Year Exclusion | ESG : Last Two Year Exclusion | ESG : No Exclusion | |

| DID | 0.127 ** | 0.137 *** | 0.156 *** |

| (2.212) | (2.652) | (2.779) | |

| Lev | −0.713 *** | −0.506 *** | −0.611 *** |

| (−12.766) | (−10.926) | (−12.973) | |

| ROA | 0.341 *** | 0.398 *** | 0.430 *** |

| (4.778) | (5.834) | (6.263) | |

| CashFlow | −0.049 | −0.192 *** | −0.100 |

| (−0.670) | (−2.887) | (−1.541) | |

| Inv | 0.611 *** | 0.359 *** | 0.505 *** |

| (6.208) | (4.263) | (5.914) | |

| Rec | 0.119 | 0.127 | 0.085 |

| (1.042) | (1.163) | (0.788) | |

| Intangible | 0.006 * | 0.007 *** | 0.007 *** |

| (1.697) | (2.598) | (2.578) | |

| Top10 | 0.275 *** | 0.121 | 0.291 *** |

| (3.278) | (1.629) | (3.888) | |

| Balance2 | −0.061 *** | −0.056 *** | −0.066 *** |

| (−3.157) | (−3.157) | (−3.687) | |

| ListAge | −0.047 ** | −0.122 *** | −0.070 *** |

| (−2.394) | (−6.856) | (−4.017) | |

| _cons | 4.160 *** | 4.299 *** | 4.147 *** |

| (40.639) | (49.573) | (48.995) | |

| N | 47,479 | 42,773 | 53,298 |

| Corporation FE | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes |

| Industry FE | Yes | Yes | Yes |

| R2 | 0.557 | 0.581 | 0.540 |

| F | 34.509 | 37.695 | 44.034 |

Note: 1. T-values in parentheses; 2. * p < 0.10, ** p < 0.05, *** p < 0.01.

References

- Li, J.; Lian, G.; Xu, A. How do ESG affect the spillover of green innovation among peer firms? Mechanism discussion and performance study. J. Bus. Res. 2023, 158, 113648. [Google Scholar] [CrossRef]

- Zhang, H.; Wang, Y.; Li, R.; Si, H.; Liu, W. Can green finance promote urban green development? Evidence from green finance reform and innovation pilot zone in China. Environ. Sci. Pollut. Res. 2023, 30, 12041–12058. [Google Scholar] [CrossRef] [PubMed]

- Wu, S.; Li, X.; Du, X.; Li, Z. The impact of ESG performance on firm value: The moderating role of ownership structure. Sustainability 2022, 14, 14507. [Google Scholar] [CrossRef]

- Wang, W.; Yu, Y.; Li, X. ESG performance, auditing quality, and investment efficiency: Empirical evidence from China. Front. Psychol. 2022, 13, 948674. [Google Scholar] [CrossRef]

- Curcio, D.; Gianfrancesco, I.; Onorato, G.; Vioto, D. Do ESG scores affect financial systemic risk? Evidence from European banks and insurers. Res. Int. Bus. Financ. 2024, 69, 102251. [Google Scholar] [CrossRef]

- Jang, G.Y.; Kang, H.G.; Kim, W. Corporate executives’ incentives and ESG performance. Financ. Res. Lett. 2022, 49, 103187. [Google Scholar] [CrossRef]

- Dyck, A.; Lins, K.V.; Roth, L.; Towner, M.; Wagner, H.F. Renewable governance: Good for the environment? J. Account. Res. 2023, 61, 279–327. [Google Scholar] [CrossRef]

- Liang, H.; Renneboog, L. On the foundations of corporate social responsibility. J. Financ. 2017, 72, 853–910. [Google Scholar] [CrossRef]

- Bai, F.; Shang, M.; Huang, Y. Corporate culture and ESG performance: Empirical evidence from China. J. Clean. Prod. 2024, 437, 140732. [Google Scholar] [CrossRef]

- Dikau, S.; Volz, U. Central bank mandates, sustainability objectives and the promotion of green finance. Ecol. Econ. 2021, 184, 107022. [Google Scholar] [CrossRef]

- Lee, C.C.; Lee, C.C. How does green finance affect green total factor productivity? Evid. China Energy Econ. 2022, 107, 105863. [Google Scholar] [CrossRef]

- Deng, X.; Li, W.; Ren, X. More sustainable, more productive: Evidence from ESG ratings and total factor productivity among listed Chinese firms. Financ. Res. Lett. 2023, 51, 103439. [Google Scholar] [CrossRef]

- Chang, Y.; Wang, S. China’s pilot free trade zone and green high quality development: An empirical study from the perspective of green finance. Environ. Sci. Pollut. Res. 2023, 30, 88918–88935. [Google Scholar] [CrossRef] [PubMed]

- Xia, L.F.; Liu, Y.J.; Yang, X. The response of green finance toward the sustainable environment: The role of renewable energy development and institutional quality. Environ. Sci. Pollut. Res. 2023, 30, 59249–59261. [Google Scholar] [CrossRef]

- Ran, C.; Zhang, Y. The driving force of carbon emissions reduction in China: Does green finance work. J. Clean. Prod. 2023, 421, 138502. [Google Scholar] [CrossRef]

- Cheng, Z.; Kai, Z.; Zhu, S. Does green finance regulation improve renewable energy utilization? Evidence from energy consumption efficiency. Renew. Energy 2023, 208, 63–75. [Google Scholar] [CrossRef]

- Zhang, Z.; Wang, J.; Feng, C.; Chen, X. Do pilot zones for green finance reform and innovation promote energy savings? Evidence from China. Energy Econ. 2023, 124, 106763. [Google Scholar] [CrossRef]

- Wang, X.S.; Elahi, E.; Khalid, Z. Do Green Finance Policy Foster Environmental, Social, and Governance Performance of Corporate? Int. J. Environ. Res. Public Health 2022, 19, 14920. [Google Scholar] [CrossRef]

- Xue, Q.H.; Wang, H.M.; Bai, C.Q. Local green finance policy and corporate ESG performance. Int. Rev. Financ. 2023, 23, 721–749. [Google Scholar] [CrossRef]

- Sun, X.L.; Zhou, C.; Gan, Z.J. Green Finance Policy and ESG Performance: Evidence from Chinese Manufacturing Firms. Sustainability 2023, 15, 6781. [Google Scholar] [CrossRef]

- Ma, D.; He, Y.H.; Zeng, L.G. Can green finance improve the ESG performance? Evidence from green credit policy in China. Energy Econ. 2024, 137, 107772. [Google Scholar] [CrossRef]

- Wu, Y.J.; Hou, L.R.; Yuan, Y.; Ma, S.L.; Zeng, H.J. Green credit policy’s influence on construction firm ESG performance: A difference in differences estimation. J. Asian Archit. Build. Eng. 2025. [Google Scholar] [CrossRef]

- Fang, Y.A.; Zhong, S.; Jin, D.Z. How does the green credit policy affect corporate ESG performance? empirical evidence from China. Environ. Dev. Sustain. 2025. [Google Scholar] [CrossRef]

- Ma, J. On Building China’s Green Financial System. Financ. Forum 2015, 20, 18–27. [Google Scholar]

- Liu, J.H.; Wang, X.H.; Yan, L. Can Green Finance Pilot Policy Force Polluting Enterprises to Make Green Innovation: Based on the Empirical Evidence of Green Finance Reform and Innovation Pilot Zones. Stat. Res. 2024, 41, 98–110. [Google Scholar]

- Zhang, Y.Y.; Zhang, N.N. Green finance policy and corporate environmental, social, and governance performance. Financ. Res. Lett. 2025, 81, 107421. [Google Scholar] [CrossRef]

- Zhu, H.Q.; Li, X.F. Can green finance improve corporate ESG performance? Empirical evidence from Chinese A-share listed companies. Asia-Pac. J. Account. Econ. 2025, 32, 590–607. [Google Scholar] [CrossRef]

- Liu, C.H.; Cui, P.; Zhao, H.X.; Zhang, Z.Z.; Zhu, Y.S.; Liu, H.J. Green Finance, Economic Policy Uncertainty, and Corporate ESG Performance. Sustainability 2024, 16, 10141. [Google Scholar] [CrossRef]

- Ye, X.Y.; Tian, X.Y. Green finance and ESG performance: A quasi-natural experiment on the influence of green financing pilot zones. Res. Int. Bus. Financ. 2025, 73, 102647. [Google Scholar] [CrossRef]

- Gao, D.; Zhou, X.T.; Wan, J. Unlocking sustainability potential: The impact of green finance reform on corporate ESG performance. Corp. Soc. Responsib. Environ. Manag. 2024, 31, 4211–4226. [Google Scholar] [CrossRef]

- Qian, S.T.; Yu, W.Z. Green finance and environmental, social, and governance performance. Int. Rev. Econ. Financ. 2024, 89, 1185–1202. [Google Scholar] [CrossRef]

- Sun, Y.Y.; Wang, D.M. Green finance and ESG performance of enterprises: Evidence from Green Finance Reform and Innovation Pilot Zone. Appl. Econ. 2025, 57, 11204–11218. [Google Scholar] [CrossRef]

- Li, W.Q.; Zheng, X.P.; Zheng, A.Y. ESG Responsibility and Green Total Factor Productivity in Manufacturing Enterprises: Me diating Effects of Financing Constraints and Innovation Capabilities. SME Manag. Technol. 2025, 10, 53–55. [Google Scholar]

- Li, H.Y.; Gao, X.; Zhang, X.M.; Zhai, K.Y.; Ling, Y.T.; Cao, M.Q. The impacts of China’s sustainable financing policy on environmental, social and corporate governance (ESG) performance. Environ. Dev. Sustain. 2025. [Google Scholar] [CrossRef]

- Jiang, T. Mediating effects and moderating effects in empirical research of causal inference. China Ind. Econ. 2022, 5, 100–120. [Google Scholar]

- Benuzzi, M.; Ferriani, F.; Gazzani, A. Chasing ESG performance: How methodologies shape sustainability inference. Bus. Strategy Environ. 2025, 34, 112–129. [Google Scholar]

- Luo, D. ESG and aggregate disagreement. J. Empir. Financ. 2024, 72, 101–119. [Google Scholar] [CrossRef]

- Passas, I.; Vortelinos, D.I.; Lemonakis, C.; Dragomir, V.D.; Garefalakis, S. Impact of Environmental, Social, and Governance (ESG) Scores on International Credit Ratings: A Sectoral and Geographical Analysis. Sustainability 2025, 17, 9755. [Google Scholar]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2026 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license.