Abstract

In the grand context of the global convergence of the “dual-carbon” strategy and the digital economy, the underlying mechanisms by which corporate fintech impacts ESG performance remain a “black box” waiting to be explored. To this end, this study reveals the path by which corporate fintech unlocks ESG performance by constructing a theoretical framework that integrates resources, technology and governance. Based on data from Chinese A-share listed companies from 2011 to 2023, we found that corporate fintech can significantly improve ESG performance. Its core mechanism is to optimize resource allocation by alleviating financing constraints, promote green innovation-driven technological upgrades, and reduce agency costs to improve internal governance. Heterogeneity analysis further reveals that this effect is particularly prominent in companies with financial difficulties or high proportions of independent directors, and areas with weak institutional environments, highlighting the catalytic role of corporate fintech in specific situations. This study not only provides micro-mechanism evidence for digital technology to empower the sustainable development of enterprises but also offers important policy implications for emerging markets to leverage fintech to make up for institutional shortcomings and promote green transformation.

1. Introduction and Literature Review

Environmental, social and governance (ESG) has become the core dimension for measuring the long-term value of enterprises. However, its implementation process faces a fundamental paradox which is a key obstacle in the sustainable development of enterprises. That is, although improving ESG can bring long-term benefits [1,2], enterprises often struggle due to information asymmetry, high transaction costs and resource misallocation [3,4]. Meanwhile, the fintech revolution, centered on big data and artificial intelligence, essentially reshapes financial efficiency by reducing information costs and optimizing resource allocation. This naturally indicates that fintech may be the key to resolving the paradox of ESG development. However, the existing literature mainly conducts a preliminary analysis of the impact of external fintech on corporate ESG. Few studies delve into the core issue of how fintech unlocks ESG performance through micro-mechanisms from the internal corporate perspective. Thus, it can be seen that both theoretical and empirical evidence are insufficient [5]. This study aims to bridge this gap by systematically revealing the underlying logic of how fintech empowers sustainable corporate development based on the internal perspective of enterprises.

In academic research, the existing literature mainly focuses on the driving factors of ESG from the two perspectives of external environmental pressure and internal resource capabilities. The external perspective emphasizes the constraining and incentivizing effects of environmental regulations [6], media supervision [7], bank credit relationships [8] and institutional investor participation [9] in firms; the internal perspective focuses on corporate financial resources [10], the background and values of the executive team [11,12,13], and the application of emerging technologies such as artificial intelligence [14] on ESG decision-making. It is worth noting that ESG activities often face market failures and financing constraints due to their positive externalities [15,16,17]. Therefore, investigating technology-driven solutions to overcome resource constraints presents a critical direction for theoretical development.

At the same time, the rise of corporate fintech provides new perspectives for understanding corporate behavior. Most studies regard fintech as a regional external variable and find that it can improve the corporate financing environment by easing information asymmetry and reducing transaction costs [18,19,20], thereby promoting corporate innovation and investment efficiency [21]. As research deepens, scholars have further pointed out the positive role of fintech in supporting green credit [22], promoting sustainable development [23], and assisting carbon-neutral transformation [24], and observed its risk transmission relationship with sustainable assets during crises [25]. However, much of the existing literature examines fintech primarily as a macro-level variable measured at regional or industrial scales, while overlooking the heterogeneity across enterprises. Critical firm-specific factors, such as absorptive capacity, digital infrastructure, and strategic orientation, are often not accounted for. Consequently, macro-level findings may not accurately reflect the technology-enabled empowerment effects in enterprises.

With the emergence of interdisciplinary research on fintech and ESG, scholars have begun to identify the correlation between the two. Some studies have found that external fintech development can improve ESG performance by alleviating financing constraints [26,27], inhibiting corporate greenwashing behavior [28], and promoting green innovation [29]. Furthermore, relevant research also reveals that the impact of fintech on ESG is heterogeneous in different corporate lifecycle stages [30], ownership structures [14], and external institutional environments [5,31].

In summary, although existing research has laid the foundation for understanding ESG drivers and the economic consequences of fintech, there are still three key limitations. First, regarding driving factors, most scholars place firms in the position of passive recipients when they explored the impact of fintech on corporate ESG performance [4,29], treating fintech as an inclusive technological infrastructure or macro market environment. This overlooks the endogenous drivers for enterprises to actively adopt fintech in overcoming resource and capability constraints related to ESG. Second, considering measurement approaches, existing studies have primarily employed macro-level indicators [21,32], yet lack micro-level measurement of firm-specific fintech adoption, which makes it difficult to capture heterogeneous effects in how enterprises absorb and transform fintech. Third, in terms of mechanisms, current studies have largely focused on single pathways such as alleviating financing constraints [27] or mitigation of financial mismatch [29], with limited attention to synergistic effects among different mechanisms. To address these gaps, this paper constructs a firm-level measurement of fintech development and systematically explains the complete pathway through which fintech enhances corporate ESG performance from a synergistic perspective, integrating resources, technology, and governance.

To address these gaps, this paper mainly focuses on the three research questions as follows. The first is whether corporate adoption of financial technology (fintech) significantly enhances ESG performance. The second is how fintech can influence ESG outcomes through the collaborative triad of resources, technology, and governance. The third is how a scientifically robust framework can be developed to measure enterprise-level fintech application, thereby accurately assessing its internal maturity. To solve these problems, by integrating the ideas of Fazzari et al. [33] and Jensen and Meckling [34], this paper establishes a theoretical model to systematically analyze the transmission mechanism through which corporate fintech affects ESG performance in the framework integrating resources, technology and governance. Furthermore, to address the deficiencies in macro measurement, we construct a multidimensional measurement framework based on keyword and text analysis to quantify the development level of corporate fintech across six distinct dimensions. By utilizing panel data of Chinese A-share listed companies from 2011 to 2023, we empirically examine the impact of fintech application on corporate ESG performance and investigate the underlying mechanisms. It aims to advance micro-level and systematic research on corporate fintech and sustainable development. From a theoretical perspective, the paper seeks to provide systematic micro evidence and elucidate the causal mechanisms behind technology-driven ESG, thereby offering insights for companies and policymakers to foster substantive ESG practices.

The main contributions and innovative value are revealed as follows on this paper. First, at the measurement level, it breaks away from the macro-level focus prevalent in the existing literature [4,21,32] and develops an enterprise-level measurement of fintech development by integrating keyword and text analysis. This approach comprehensively reflects macro-environmental impacts and enterprise-level technological absorption, effectively remedying the disconnection between macro and micro perspectives in conventional measurement. Second, at the theoretical level, this study pioneers an integrative framework that synergizes resource, technological, and governance empowerment, unlike prior research that focused on single pathways such as financing or information [26,27,29]. This study proposes a mathematical model to characterize the decision-making process behind corporate green innovation. By integrating the dual role of fintech, including mitigating financing constraints and reducing agency costs, the model elucidates the micro-level black box through which fintech development influences ESG performance. Third, at the empirical level, leveraging an extended sample and richer data, this study not only examines the enabling effect of corporate fintech on ESG but also reveals the existence of enterprise-level heterogeneity, which offers more detailed evidence on the boundary conditions of technology empowerment.

The remaining structure of the paper is as follows: Section 2 presents the theoretical model and research hypothesis, building a mathematical model based on the manager’s utility function to explain how corporate fintech affects corporate ESG performance by ESG investment, green investment and agency costs; Section 3 details the research design, including the econometric model, main variables, and data sources used in this paper; Section 4 analyzes the empirical results based on the data from multiple dimensions, including benchmark regression, robustness tests, mechanism tests, and heterogeneity tests; and Section 5 concludes the findings and implications.

2. Theoretical Model and Research Hypotheses

To delve into the underlying mechanisms by which corporate fintech impacts ESG performance, this paper constructs a corporate optimization model. Drawing upon the ideas of Fazzari et al. [33] and Jensen and Meckling [34], we apply this model to characterize the decision-making process for corporate green innovation and systematically incorporate the dual effects of corporate fintech in alleviating financing constraints and reducing agency costs. On the one hand, this model treats corporate fintech as an exogenous impact that relaxes financing constraints and incentivizes corporate innovation by reducing the marginal cost of green investment. On the other hand, this model introduces the agency cost function and demonstrates that corporate fintech, as a novel internal supervision technology, can effectively reduce agency costs and enhance corporate resource allocation.

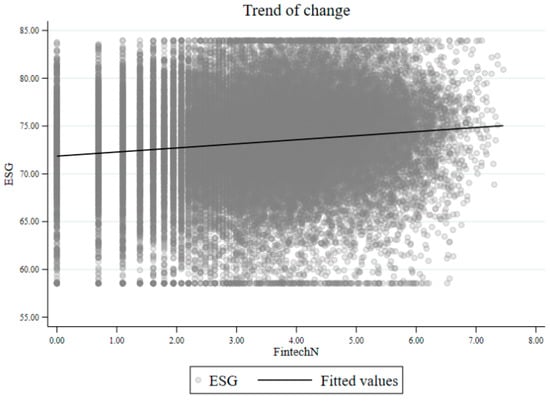

Furthermore, to explore the relationship between fintech and corporate ESG performance, this paper uses a scatter plot which indicates a clear positive trend, suggesting that firms operating in regions with more developed fintech tend to achieve higher ESG ratings. Building on this empirical baseline, we develop a theoretical model to reveal the logic behind this correlation. The model derives from the mechanism through which fintech enhances ESG performance from integrated resource, technology, and governance perspectives, with the comparative static analysis to test its key propositions (Figure 1).

Figure 1.

Trend of ESG with fintech.

2.1. Theoretical Mechanism Analysis

According to the financing constraint theory, information asymmetry between enterprises and financiers generates adverse selection and moral hazards, which elevates the cost of external capital. Fintech leverages tools such as big data credit assessment and blockchain-based recording to reduce the costs associated with information verification and contract enforcement, thus addressing the financing dilemma, especially for asset-light and weakly collateralized enterprises [35]. By accurately pricing the risk and return profile of green projects, fintech reduces financing premiums and facilitates the efficient allocation of capital toward sustainable initiatives. From a technological perspective, fintech not only exerts influence on the financing side but also directly optimizes the R&D process for green innovation through digital tools, thereby reducing efficiency losses by resource misallocation [36]. The mitigation of scale-driven diseconomies through improved resource allocation could directly counteract the rising marginal cost of corporate green innovation. At the governance level, the principal-agent theory suggests that the divergence of interests between shareholders and management can easily lead to agency conflicts. Fintech, however, can mitigate this conflict through information transparency and technological constraints. On the one hand, it leverages big data to enable real-time tracking of management decisions, enhancing information transparency; on the other hand, it embeds ESG performance into management incentive clauses through smart contracts, enabling automatic compliance [37]. This mechanism curbs management’s opportunistic pursuit of short-term gains by directly linking green innovation investment to their personal interests. This enhances the conversion efficiency of such investments into superior ESG performance, thereby forming a closed loop of investment, governance, and performance.

2.2. Basic Assumptions and Variable Definitions

We consider one representative enterprise whose goal is to maximize its net ESG value, denoted as V. The enterprise’s core decision-making variable is its level of green innovation investment, I, with that of fintech development to be represented by F. The key components of the model are defined as follows:

- (1)

- ESG output function expressed by . The relationship between green innovation investment (I) and ESG performance is captured by this function. Characterized by diminishing marginal returns, suggests that ESG performance improves with at a decreasing rate while the marginal benefit is highest at lower investment levels. Accordingly, this paper adopts the standard concave production technology () to capture how green investment enhances ESG performance with diminishing marginal returns. This setup yields a downward-sloping marginal revenue curve, which intersects uniquely with the marginal cost curve to determine the firm’s optimal green investment level. This equilibrium condition underpins our derivation of fintech’s impact mechanism. Specifically, we show that fintech shifts the optimal investment upward by lowering costs and improving efficiency, which lays the theoretical foundation subsequent hypothesis development and empirical tests.

- (2)

- Investment cost function presented by . This function represents the total cost of green innovation. The model is built on the hypothesis that fintech development in enterprises reduces the marginal cost of green investment, primarily through mechanisms like supply chain finance and green crowdfunding. Specifically, increasing green innovation input raises total costs as it consumes more specialized resources, while fintech could mitigate this rising marginal cost by enhancing resource allocation efficiency. Through easing capital constraints, it reduces financing premiums and opens access to lower-cost capital channels. Formally, we assume that and .

- (3)

- Agency cost factor measured by . This function depicts the efficiency loss arising from agency conflicts between shareholders and management. The principal-agent theory posits that information asymmetry between these parties inherently generates agency costs. Financial technology, however, can mitigate this asymmetry. By leveraging big data to enhance information transparency and utilizing smart contracts to strengthen oversight and enforcement, fintech lowers possibilities for managerial opportunism. Consequently, agency costs are expected to decline with the adoption of financial technology. We hypothesize that corporate adoption of fintech enhances internal monitoring and information transparency through technologies like big data analytics and smart contracts, thereby effectively curbing agency costs. In view of this, we assume that . The effective ESG output of a firm is therefore reduced by an efficiency factor of .

2.3. Enterprise Optimization Problem

Based on the above settings, the enterprise’s decision-making goal is to maximize its net ESG value by selecting the optimal level of green innovation investment, . The optimization problem can be formally expressed as

Equation (1) defines the net ESG value of an enterprise, which consists of two parts, that is, effective ESG output and investment cost . Notably, corporate fintech F acts on both the revenue and cost sides, as the core driver for our analysis.

2.4. Model Solving and Comparative Static Analysis

To find the optimal decision for the firm, we derive the first-order condition about for Equation (1):

The optimal level of green innovation investment should satisfy

Equation (3) shows that under optimal conditions, the effective marginal ESG benefits are equal to the marginal investment costs.

The core of the theoretical analysis lies in examining how the optimal investment level changes with the development of corporate fintech, F. We perform total differentials on the first-order condition (Equation (3)) with respect to F for comparative static analysis.

Let the formula be zero. According to the implicit function theorem, we can obtain

First, the numerator ∂G/∂F is calculated to obtain .

According to the model settings, and . Therefore, both terms are positive, which could prove the numerator to be positive. Then, we calculate the denominator ∂G/∂I to obtain

Similarly, according to the model settings, and . Therefore, the denominator is negative, satisfying the second-order condition, which ensures the uniqueness of the optimal solution. Thus, we can obtain

In summary, we obtain three propositions. Proposition 1: The improvement of corporate fintech development will systematically incentivize enterprises to achieve their optimal green innovation investment. With the increase in optimal green innovation investment, the ESG value of enterprises will be promoted. And this proposition clearly reveals the internal logic of corporate fintech promoting corporate ESG performance through the dual channels of revenue improvement and cost reduction. Proposition 2: In terms of cost-side effects, corporate fintech directly reduces the marginal cost of green investment (i.e., in the model) by easing financing constraints, making it feasible for green projects that were previously shelved due to high costs. Proposition 3: On the revenue side, corporate fintech reduces agency costs (i.e., in the model) by enhancing internal supervision and transparency, thus enhancing internal resource allocation and allowing each unit of green innovation investment to be more effectively converted into ESG performance. Under the synergy of these two forces, enterprises will rationally raise their investment when the net benefits from green innovation increase significantly, which ultimately achieves substantial improvements in ESG performance.

The above propositions draw the following hypotheses, laying a theoretical foundation for the subsequent empirical analysis.

Hypothesis 1 (H1):

Corporate fintech development is positively related to corporate ESG performance.

Furthermore, the model clearly defines the mediating role of the three mechanisms, leading to the following testable sub-hypotheses.

Hypothesis 2a (H2a):

The relief of financing constraints plays a mediating role in the relationship between corporate fintech and ESG performance.

Hypothesis 2b (H2b):

The reduction in agency costs performs the mediating functions between corporate fintech and ESG performance.

Hypothesis 2c (H2c):

The promotion of green innovation acts as the mediator between corporate fintech and ESG performance.

3. Research Design

3.1. Data and Samples

Based on the panel data of China’s A-share listed companies from 2011 to 2023, this paper empirically examines the positive effect of corporate fintech development on ESG performance. We choose the data of 2011 as the start to ensure data consistency and availability after the global financial crisis and take the data of 2023 as the cut-off for the latest complete data before the epidemic hits the economy on a large scale.

Regarding the data source for each variable, here are detailed explanations. (1) Corporate fintech development. The core explanatory variable is the level of fintech development at the listed company level. And the indicator data mainly comes from the annual reports of listed companies. (2) ESG rating. The explained variable, corporate-level ESG performance, which mainly comes from the Sino-Securities ESG rating. (3) Three major intermediary mechanisms, including resource, technology, and governance channels. The data mainly come from CSMAR database, CNRDS database, etc. (4) Other variables. The main sources include CSMAR database and annual reports of listed companies, etc.

To ensure the accuracy of the data, the following processes would be performed. (1) Exclude the financial industry, whose structure and reporting standards differs from those of general industries, and ST and *ST companies with abnormal financial conditions, as well as samples with missing key variables. (2) All continuous variables are winsorized at the 1% and 99% quantiles to mitigate the impact of extreme values.

3.2. Variable Definition

3.2.1. Explained Variable: ESG Performance (ESG)

The explained variable in this paper is corporate ESG performance. We use the ESG comprehensive score provided by the Sino-Securities ESG database, which evaluates companies from three dimensions, including environment (E), society (S) and governance (G). The higher the score, the better the ESG performance.

3.2.2. Explanatory Variables: Corporate Fintech Development (FintechN)

The core explanatory variable in this paper is corporate fintech. Following the approach of Liu J et al. [38], this variable could be measured by the natural logarithm of the occurrence frequency plus 1 of fintech related keywords in the annual reports of listed companies, with a total of 124 keywords covering six dimensions, including artificial intelligence, blockchain, cloud computing, big data, and online and mobile; more details are shown in Table 1. The higher the logarithmic value, the higher the fintech level of the company.

Table 1.

Fintech keywords.

3.2.3. Mediating Variables

To test three transmission channels within the theoretical framework of resources, technology, and governance, we selected the following mediating variables.

- (1)

- Resource channels are characterized by financing constraints (WW). Referring to Whited and Wu [39], we choose the WW index to measure the level of corporate financing constraints. The specific calculation formula is as follows:

In this Formula (4), CF is the ratio of corporate cash flow to total assets; DivPos represents a dummy variable for cash dividend payment, which takes 1 as its value if cash dividends are paid in the current period, otherwise taking 0 as its value; ISG presents industry average sales growth rate; SG expresses sales revenue growth rate, and other variables are defined the same as the control variables.

- (2)

- Technology channels are represented by green innovation (lngreen_inv). Referring to Lin et al. [40], we measure the enterprise’s green innovation capabilities by adding 1 to the natural logarithm of the total number of green invention patent applications filed by the enterprise in the current year. This indicator captures both the quantity and intensity of corporate green R&D activities.

- (3)

- Governance channels are explained by agency costs (AC). Referring to Jiang et al. [41], other receivables to main business revenue are chosen as the proxy variable for agency costs, reflecting the extent to which major shareholders or management harm the enterprise’s interests. In addition, this indicator is negatively correlated with the level of corporate governance. The higher the AC, the lower the level of corporate governance.

3.2.4. Control Variables

To isolate the net effect of corporate fintech development on ESG performance, a series of characteristic variables are under control to avoid impacts on ESG performance in corporate and governance level, following the practice of Mao Z et al. [42] and Xue Q et al. [43]. These variables include (1) enterprise size (SIZE), the natural logarithm of total assets. (2) Financial leverage (LEV), the ratio of total liabilities to total assets. (3) Return on total assets (ROA), the ratio of net profit to total assets. (4) Tobin Q (TobinQ), a comprehensive ratio of the market value of tradable stocks, net asset value per share of non-tradable shares, and book value of liabilities, divided by total assets. (5) Tangible assets ratio (TAR), the ratio of total assets minus intangible assets minus net goodwill to total assets. (6) Company age (ListAge), the natural logarithm of the company’s listing years. (7) Equity concentration (Top1), the shareholding ratio of the largest shareholder. (8) Board independence (Indep), the proportion of independent directors to the total number of board members.

3.3. Econometric Model

To examine the impact of corporate fintech on ESG, the benchmark effect model and the mediating effect model were adopted.

3.3.1. Benchmark Effect Model

To identify the direct impact of corporate fintech on ESG performance, we construct a two-way fixed effects model.

In this Formula (5), the subscript i represents the enterprise and t represents the year. represents the ESG performance of enterprise i in year t; represents the fintech level of enterprise i in year t; and other variables that affect the enterprise’s ESG rating are represented by Controls, that is, the set of control variables. and are company fixed effects and year fixed effects, respectively, and is the random error term. is the estimated coefficient of corporate fintech on ESG performance. When > 0, we hold the opinion that the enhancement of corporate fintech level can improve its ESG performance.

3.3.2. Mediating Effect Model

Following the classic three-step method of Baron and Kenny [44], we apply the Sobel test and Bootstrap test in the mediating effect of each mediating variable (WW, lngreen_inv, AC).

Step One: Examine the impact of corporate fintech on mediating variables.

We expect to be significantly negative for financing constraints (WW) and agency costs (AC), while significantly positive for green innovation (lngreen_inv). Step Two: Test the impact of mediating variables on ESG.

We expect to be significantly negative for financing constraints (WW) and agency costs (AC), while significantly positive for green innovation (lngreen_inv). Step Three: Test the significance of the mediating effect.

If the coefficients and are both statistically significant, it indicates that the mediating effect exists, with its effect magnitude to be . Furthermore, we will use Sobel test and Bootstrap method to evaluate the statistical significance of indirect effects.

4. Empirical Results and Analysis

4.1. Descriptive Statistics and Correlation Analysis

Table 2 reports the descriptive statistical results for all variables in this paper. The mean value of ESG is 73.305 and the standard deviation is 4.841, indicating significant differences in ESG performance among Chinese listed companies. The mean value of corporate fintech is 3.4 and the standard deviation is 1.449, reflecting significant disparities in the development of digital finance across different companies and years. The distribution of each control variable is basically consistent with the existing literature, and the winsorization process has effectively alleviated the impact of extreme values.

Table 2.

Descriptive statistics.

Table 3 reports the Pearson correlation coefficients among variables. The core explanatory variable, corporate fintech, is significantly positively correlated with ESG (correlation coefficient is 0.128, p < 0.01), which provides preliminary support for our main hypothesis. Furthermore, the correlation coefficients among variables in the regression model are less than 0.5, indicating that there is no severe collinearity problem among variables.

Table 3.

Correlation analysis.

Furthermore, this paper measured the variance inflation factor (VIF) among variables. The results are shown in Table 4. It was found that the variance inflation factors were all far below the threshold of 10, further proving that there is no serious multicollinearity problem among variables.

Table 4.

Variance inflation factors.

4.2. Benchmark Regression Results

Table 5 reports the benchmark regression results of corporate fintech on ESG performance. Column (1) only includes corporate fintech, and column (2) adds year and company fixed effects on this basis. It is found that regardless of whether fixed effects are added or not, the estimated coefficients of corporate fintech are significantly positive at the 1% level. In column (3), we add a series of company-level control variables, and column (4) further adds year and company fixed effects. The estimated coefficient of corporate fintech is still positive and significant. It can be seen from column (4) that for every one percentage point increase in the corporate fintech index, corporate ESG performance will increase by 0.11.

Table 5.

Benchmark regression.

The regression results of control variables show that the coefficients of enterprise SIZE (SIZE), return on assets (ROA), proportion of tangible assets (TAR) and independent directors’ ratio (Indep) are significantly positive. This may be due to several reasons as follows. First, large enterprises have sufficient resource reserves and stronger ESG investment capacity [45]. Second, the idle resources of highly profitable enterprises can support the improvement of ESG performance for a long time [46]. Third, tangible assets can reduce credit risks and help enterprises obtain low-cost funds to invest in ESG-related projects [47]. Fourthly, the supervision mechanism of independent directors promotes ESG practices [48]. Moreover, the coefficients on financial leverage (LEV), Tobin’s Q (TobinQ) and listing years (ListAge) are significantly negative. This pattern can be explained through three channels. First, high leverage imposes debt servicing pressure, which compels firms to prioritize short-term repayment over long-term ESG investments [49]. Second, a high Tobin’s Q might lead to managerial myopia or intensify agency conflicts while reflecting market valuation. Managers often curtail ESG expenditures that bear fruit only in the long run to sustain elevated valuations [34]. Third, longer-listed firms tend to develop organizational inertia and face diluted external monitoring, reducing their incentive to pursue non-mandatory, forward-looking ESG initiatives [50]. Finally, the coefficient on largest shareholder ownership (Top1) is not significant, possibly because its monitoring function has been replaced or overshadowed by more professional governance mechanisms such as board independence, institutional investors and analyst following [51]. Collectively, the regression results offer robust empirical support for Hypothesis 1, suggesting that corporate fintech development enhances enterprise ESG performance.

4.3. Robustness Check

4.3.1. Endogeneity Test

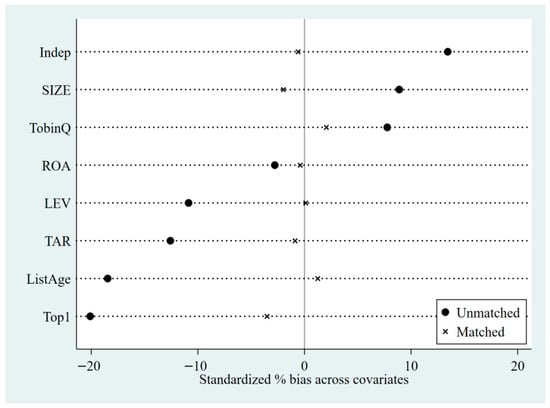

- Propensity Score Matching (PSM)

The development of corporate fintech is not only affected by external factors including market demand, macroeconomics and policies but also by internal factors such as organizational structure and technological innovation capabilities. Therefore, we utilize propensity score matching methods to mitigate the endogeneity problem. Specifically, we divide the sample into the experimental group and the control group based on the median level of corporate fintech. The matching process uses the variable of control in the benchmark regression model (4) as the selection criteria. Also, this paper chooses to perform matching with replacement at the matching ratio of 1 to 3, for lowering the impact of observable and unobservable confounding factors between the two groups. The balance test results before PSM regression are shown in Figure 2. It can be found that the absolute standard error of corporate characteristics decreases significantly before or after matching. After matching, all covariates were within the 10% threshold and passed the balance test. The PSM regression results are shown in Table 4. The estimated coefficient of corporate fintech is 0.138, significant at the 1% level, indicating that the benchmark regression results are still significant after mitigating the endogeneity problem.

Figure 2.

Balance test.

- 2.

- Instrumental Variable Method

The paper selects corporate fintech lagged by one period as an instrumental variable. Specifically, this variable can satisfy the characteristics of correlation and exogeneity. On the one hand, due to the continuity and path dependence of corporate fintech development, there is a strong correlation between the corporate fintech development level lagging by one period (t − 1) and the current corporate fintech level. On the other hand, before the current period, the fintech level of enterprises lagging by one period has been determined and will not be affected by the error term of the current period.

Table 6 shows the estimation results. The first-stage regression results are shown in column (2). The estimated coefficient for the one-period lagged fintech level (L.FintechN) is 0.150, which is significant at the level of 1%. Furthermore, the Wald F-statistic is significantly greater than the critical value for the weak instrument test at the 10% significance level, indicating the absence of a weak instrumental problem, which validates the relevance and effectiveness of the instrumental variable. The second-stage regression results, presented in column (3), continue to show a significantly positive coefficient for FintechN, the core explanatory variable. This finding is consistent with the regression estimates. Critically, the persistence of this positive causal link after addressing endogeneity through the instrumental variable approach further substantiates the robustness of our core conclusion regarding fintech’s role in enhancing corporate ESG performance.

Table 6.

PSM and instrumental variable method.

4.3.2. Substitute Core Variables

To further ensure the accuracy of the regression results, this paper uses the ESG comprehensive assignment (ESG_Value) and the number of fintech companies within the prefecture-level city (New_number) as substitute variables for the explained variables and core explanatory variables, respectively. Based on this, we re-regress to test the robustness of the benchmark regression results. To mitigate potential self-selection bias in the sample, we exclude listed companies located in the four direct-controlled municipalities, including Beijing, Tianjin, Shanghai, and Chongqing. Also, we conduct separate regressions for the 2020–2022 period to eliminate the impact of the COVID-19 pandemic on fintech. The test results are shown in Table 7. It can be found that the estimated coefficients of fintech are all positive and significant at the 1% level, further demonstrating the robustness of the benchmark regression.

Table 7.

Robustness test.

4.4. Mediation Effect Analysis

4.4.1. Financing Constraint Mechanism

The results of the resource channel test are reported in Part A of Table 8. In the first stage, the estimated coefficient of corporate fintech on the WW index (financing constraints) is −0.008 and significant at the 1% level, indicating that the development of corporate fintech can alleviate corporate financing constraints. In the second stage, the estimated coefficient of the WW index on ESG is significantly negative at the 1% level. The findings reveal that financing constraints act as a significant barrier to corporate ESG performance improvement. Conversely, alleviating these constraints facilitates stronger ESG performance. Although the positive association between corporate fintech adoption and ESG performance persists in this model, the estimated coefficient is smaller than that in the benchmark regression. Finally, the Sobel test confirms the presence of a significant mediation pathway, with an indirect effect of 0.003 accounting for 2.8% of the total observed effect. At the same time, the mediation effect also passed the Bootstrap test (extracting independent samples 1000 times). These findings verify Hypothesis 2a and confirm that alleviating financing constraints is one of the key paths for corporate fintech to improve ESG performance.

Table 8.

Mediation mechanism test.

4.4.2. Agency Cost Mechanism

The results for governance channels are reported in Part B of Table 8. Consistent with expectations, corporate fintech has significantly reduced corporate agency costs, conducive to mitigating the damage to the company’s interests by major shareholders or management. In addition, lower agency costs are strongly correlated with higher ESG scores. Its indirect effect size is 0.007, accounting for 6% of the total effect, and passed further Bootstrap test. This confirms Hypothesis 2b and reveals a novel path in which corporate fintech improves ESG performance by reducing agency costs.

4.4.3. Green Innovation Mechanism

Part C of Table 8 presents the results for the technology channel. Corporate fintech has a significant positive impact on green innovation, which in turn significantly improves ESG performance. The Sobel test confirmed the indirect effect to be statistically significant at the level of 1%. This effect, with a magnitude of 0.016, accounts for 17% of the total effect. And the Bootstrap test (with independent samples drawn 1000 times) also verified the validity of the mediation path. This provides strong support for Hypothesis 2c, proving that corporate fintech enhances corporate ESG performance by promoting their green innovation capabilities.

With all three mediating variables included in the model, the mediating effect remained significant, showing the regression results in column (7) of Table 8. It reveals that the coefficients of WW, Ingreen_inv, and AC are still significant at the 1% level, and the direct effect of FintechN (0.086 *) also remains significant. This further verifies that financing constraints, green technology innovation, and agency costs are all partial mediating variables through which financial technology affects corporate ESG performance, together constituting the transmission mechanism through which financial technology impacts corporate ESG performance.

4.5. Heterogeneity Test

4.5.1. Internal Heterogeneity Analysis

- Corporate financial status

The impact of corporate fintech on ESG performance can vary depending on a company’s financial status, specifically in terms of resource constraints and marginal returns. From the perspective of resource constraints, companies with poor financial status struggle to afford expensive ESG investments due to severe resource constraints [52]. The application of corporate fintech can help these companies optimize resource allocation to reduce corporate operating costs, thereby significantly improving corporate ESG ratings with obvious marginal benefits. Conversely, companies with better financial status already have sufficient resources to invest in ESG projects [53], possibly with a more mature ESG management system. For such companies, improvements in corporate fintech do not necessarily lead to significant marginal improvements in corporate ESG performance. In this regard, this paper performs regression analysis by dividing companies into two groups based on the median level of net profit margin of total assets of the company. The analysis results are shown in Table 9, which proves that corporate fintech has a more significant positive impact on the ESG performance of companies with poor financial conditions.

Table 9.

Enterprise-level heterogeneity analysis.

- 2.

- Corporate governance structure

The impact of corporate fintech on corporate ESG performance exhibits significant heterogeneity across companies with different governance structures. Specifically, the improvement of corporate ESG performance depends, to a certain extent, on the decision-making of independent directors. Corporate fintech can enhance the transparency and traceability of corporate information through technologies including big data analytics and blockchain [54], to reduce information asymmetry and moral hazard issues during project execution, thereby improving corporate ESG performance by better supervising corporate behavior. The extent to which fintech improves a company’s ESG performance depends on governance support, particularly from independent directors. A high proportion empowers them to fully harness fintech’s technical advantages in supervision and decision-making. Conversely, a low proportion results in insufficient support, hindering the full realization of fintech’s potential. On this basis, this paper divides companies into two groups based on the median proportion of independent directors to examine the impact of corporate fintech on their ESG performance improvement. It is found that in companies with a high proportion of independent directors, corporate fintech can better promote the improvement of corporate ESG performance.

4.5.2. External Heterogeneity Analysis

- Intensity of environmental regulation

When examining the impact of corporate fintech on ESG performance, there is significant heterogeneity in the intensity of external environmental regulations. In an environment with strong environmental regulations, corporate fintech could be transformed into a compliance tool, driving companies to meet their own compliance requirements, thus resulting in good ESG performance [55]. This leads to inapparent significant marginal benefits of corporate fintech for ESG performance. However, in areas with weak environmental regulations, companies lack mandatory compliance pressure and have weak environmental governance foundations [56]. In these regions, corporate fintech can optimize management processes and reduce information asymmetry, significantly improving ESG performance. In this regard, this paper divides the sample into two groups based on the frequency of environmental regulation-related words in each provincial government work report. The test results are shown in Table 10. It can be found that in the group with weak environmental regulations, the estimated coefficient of corporate FintechN is 0.176 and significant, while the other group of corporate fintech will not have a significant impact on corporate ESG ratings. This indicates that corporate fintech has a more significant effect on improving the ESG ratings of companies in areas with relatively weak environmental regulations.

Table 10.

External heterogeneity analysis.

- 2.

- Degree of marketization

When examining the impact of corporate fintech on ESG performance, there is also significant heterogeneity in the degree of marketization. In areas with a high degree of marketization, corporate ESG performance is generally higher, and the impact of corporate fintech on its ESG performance is not easily apparent. However, in areas with a low degree of marketization, the enabling effect of corporate fintech technology is more obvious and can effectively alleviate corporate financing constraints [57], thereby improving corporate ESG performance. In this regard, this paper divides the sample into two groups based on the median degree of marketization. The test results are shown in Table 10. It can be found that in the group with low marketization, the estimated coefficient of corporate FintechN is 0.160 and significant at the 1% level, while the other group of corporate fintech does not have a significant impact on ESG ratings, indicating that corporate fintech has a more positive effect on the ESG performance of companies in areas with low marketization.

5. Conclusions and Implications

Research on the impact of fintech on ESG performance has mainly focused on the macro-level, with limited exploration of fintech within enterprises, leaving the black box of the impact mechanisms far from being opened. How exactly does the improvement of fintech capabilities affect, and through what mechanisms does it reshape corporate ESG performance? This study is dedicated to uncovering this black box by constructing an integrated theoretical framework and mathematical model. The research found that (1) Corporate fintech can significantly improve corporate ESG performance. (2) Corporate fintech improves corporate ESG performance by alleviating financing constraints, promoting green innovation and lowering agency costs. (3) For companies with poor financial conditions and a high proportion of independent directors, or those in weak external regulations and having low degree of marketization, corporate fintech has a stronger positive effect on corporate ESG performance. This study goes beyond previous fragmented mechanism evidence, providing a holistic perspective for understanding how corporate fintech can serve as a comprehensive institutional catalyst to promote sustainable development.

This study reveals the positive causal relationship between corporate fintech and ESG performance. And more importantly, it helps open the black box of the impact mechanism through an integrated theoretical framework connecting technology empowerment, corporate governance, and sustainable development, with important theoretical, practical, and policy-guiding implications.

At the theoretical level, this study deepens the role of corporate fintech from macro-financial efficiency to micro-corporate behavior, bridging the research gap between corporate fintech and ESG performance. Corporate fintech has been confirmed to not be a simple external technology tool in this paper, but a core driving force for enterprises to reshape resource allocation by easing financing constraints, stimulate endogenous growth by promoting green innovation, and optimize governance structures by lowering agency costs. This provides a new perspective for understanding the intrinsic logic of sustainable value creation for enterprises in the era of digital economy.

At the practical level, this study provides clear action guidelines for enterprise managers. Enterprises should view fintech as a strategic investment, not merely a cost. Especially for companies in financial difficulties, fintech could help them break through financing bottlenecks, which transforms ESG from intangible concept into tangible competitive advantages. At the same time, board independence could significantly amplify the positive effect of fintech on ESG, which provides empirical basis for optimizing corporate governance structure. Boards with a higher proportion of independent directors may be better able to apply new technologies and strengthen oversight of management. This helps ensure that the value derived from fintech can be effectively channeled toward enhancing ESG performance, rather than being diverted to the self-interested rent-seeking behavior of management [58].

At the policy level, this study reveals that the positive effect of corporate fintech on ESG is more significant in areas with weaker institutional environments. When traditional institutional environments fail to support corporate sustainable development, fintech serves as an effective market supplementary mechanism, which uses digital tools to mitigate the resource misallocation and oversight deficiencies caused by institutional shortcomings, thus offering an alternative driver for enhancing ESG performance. Therefore, policymakers should shift their role from a single regulator to the ecological co-builders. In addition to strengthening top-level design, efforts should be focused on cultivating digital financial infrastructure and encouraging innovative corporate fintech applications, thus creating an inclusive and efficient institutional environment for enterprises to leverage technology for green transformation. This has important reference value for coordinating the balance between development and environmental protection in China and other emerging market countries.

Furthermore, regarding regulatory bodies in emerging markets, we recommend integrating fintech into sustainable development policy frameworks. In contexts of institutional underdevelopment, this integration can be fostered through public subsidies for ESG data monitoring platforms and the creation of dedicated mechanisms to bridge fintech and ESG data streams. Such steps would significantly enhance technology’s enabling role in sustainability. For enterprises, this paper recommends that corporate boards pursue the integrated development of fintech capabilities and governance structures. Specifically, companies should increase investment in fintech for ESG data monitoring and green financing, while optimizing governance mechanisms, such as by ensuring an appropriate proportion of independent directors, to enhance the enabling role of technology in ESG performance. At the investor level, we suggest that investors incorporate both the extent of a firm’s fintech adoption and the quality of its governance into their evaluation frameworks as key indicators, which allow them to better capture the sustainable returns generated through the synergy between fintech and governance.

However, despite the preliminary results of this study, further exploration is still needed. In terms of measurement, this paper uses the number of keyword frequencies disclosed in the annual report to measure the development level of fintech, which may have problems such as biased disclosure rather than actual adoption and variable omission. At the same time, for enterprises with different types of technology bias, it will bring new risks including data privacy and algorithmic discrimination while improving ESG performance, and it differs in its impact on different dimensions of ESG. In addition, the theoretical analysis in this paper rests on the assumption of a concave production function that may not hold universally, thus limiting the model’s generalizability. Furthermore, while the study draws on data from China to identify a core mechanism, where fintech enhances corporate ESG performance through resource allocation, technological innovation, and governance improvement, its findings are primarily applicable to emerging market economies. Notably, the magnitude of this effect and the dominant transmission channels may exhibit an inverse relationship with the stringency of data privacy regimes. Consequently, the conclusions may not extend to economies with more rigorous data protection frameworks, such as the European Union and the United States. These questions will be extremely valuable research directions in the future.

Supplementary Materials

The following supporting information can be downloaded at: https://www.mdpi.com/article/10.3390/su18031352/s1. Table S1: Fintech keywords.

Author Contributions

Conceptualization, H.Z. and J.K.; formal analysis, H.Z. and J.K.; investigation, P.X.; data curation, W.L.; writing—original draft preparation, H.Z., P.X., W.L. and J.K.; writing—review and editing, H.Z., P.X., W.L. and J.K.; visualization, P.X. and W.L. All authors have read and agreed to the published version of the manuscript.

Funding

This research was supported by National Social Science Fund of China “Research on the Division of Labor and Market Thought of Marx and Engels and Its Contemporary Value” (National Office of Philosophy and Social Sciences of China, NO. 22&ZD051); Key Scientific Research Project of Hunan Provincial Education Department “Research on Theory and Policy of New Quality Productivity Promoting Common Prosperity in Hunan” (Department of Education of Hunan Province, China, NO. 24A0445).

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data that support the findings of this study are available from the corresponding authors upon reasonable request.

Conflicts of Interest

All authors declare no conflicts of interest.

References

- Eccles, R.G.; Ioannou, I.; Serafeim, G. The impact of corporate sustainability on organizational processes and performance. Manag. Sci. 2014, 60, 2835–2857. [Google Scholar] [CrossRef]

- Fatemi, A.; Glaum, M.; Kaiser, S. ESG performance and firm value: The moderating role of disclosure. Glob. Financ. J. 2018, 38, 45–64. [Google Scholar] [CrossRef]

- Tang, H. The effect of ESG performance on corporate innovation in China: The mediating role of financial constraints and agency cost. Sustainability 2022, 14, 3769. [Google Scholar] [CrossRef]

- Wang, D.; Peng, K.; Tang, K.; Wu, Y. Does Fintech Development Enhance Corporate ESG Performance? Evidence from an Emerging Market. Sustainability 2022, 14, 16597. [Google Scholar] [CrossRef]

- Sun, X.; Wu, G. Leveraging FinTech for positive ESG outcomes through regional innovation: Insights from a knowledge capital perspective. Front. Public Health 2025, 13, 1641241. [Google Scholar] [CrossRef]

- Ahfeeth, A.M.J.; Çelebi, A. Environmental Fines and Corporate Sustainability: The Moderating Role of Governance, Firm Size, and Institutional Ownership. Sustainability 2025, 17, 9252. [Google Scholar] [CrossRef]

- Dyck, A.; Lins, K.V.; Roth, L.; Wagner, H.F. Do institutional investors drive corporate social responsibility? International evidence. J. Financ. Econ. 2019, 131, 693–714. [Google Scholar] [CrossRef]

- Zou, J.; Cheng, N.; Gao, L.; Gong, C.; Lu, X. Do bank-enterprise ESG disparities affect corporate ESG performance? Financ. Res. Lett. 2025, 72, 106571. [Google Scholar] [CrossRef]

- Riedl, A.; Smeets, P. Why do investors hold socially responsible mutual funds? J. Financ. 2017, 72, 2505–2550. [Google Scholar] [CrossRef]

- Borghesi, R.; Houston, J.F.; Naranjo, A. Corporate socially responsible investments: CEO altruism, reputation, and shareholder interests. J. Corp. Financ. 2014, 26, 164–181. [Google Scholar] [CrossRef]

- Cronqvist, H.; Yu, F. Shaped by their daughters: Executives, female socialization, and corporate social responsibility. J. Financ. Econ. 2017, 126, 543–562. [Google Scholar] [CrossRef]

- Chen, H.; Hao, Y.; Li, Y.; Alodat, A.Y. How does digital transformation moderate the link between ESG ratings and financial constraints? J. Bus. Econ. Manag. 2025, 26, 982–1006. [Google Scholar] [CrossRef]

- Yu, X.; Hu, Y.; Feng, S. The Bright Side of Executive Financial Background: A Perspective Based on Corporate ESG Performance. Environ. Res. Commun. 2025, 7, 075006. [Google Scholar] [CrossRef]

- Liu, Z.; Li, X. The impact of bank fintech on ESG greenwashing. Financ. Res. Lett. 2024, 62, 105199. [Google Scholar] [CrossRef]

- Heinkel, R.; Kraus, A.; Zechner, J. The effect of green investment on corporate behavior. J. Financ. Quant. Anal. 2001, 36, 431–449. [Google Scholar] [CrossRef]

- Bolton, P.; Kacperczyk, M. Do investors care about carbon risk? J. Financ. Econ. 2021, 142, 517–549. [Google Scholar] [CrossRef]

- Pástor, Ľ.; Stambaugh, R.F.; Taylor, L.A. Sustainable investing in equilibrium. J. Financ. Econ. 2021, 142, 550–571. [Google Scholar] [CrossRef]

- Buchak, G.; Matvos, G.; Piskorski, T.; Seru, A. Fintech, regulatory arbitrage, and the rise of shadow banks. J. Financ. Econ. 2018, 130, 453–483. [Google Scholar] [CrossRef]

- Chen, M.A.; Wu, Q.; Yang, B. How valuable is FinTech innovation? Rev. Financ. Stud. 2019, 32, 2062–2106. [Google Scholar] [CrossRef]

- Yao, T.; Song, L. Examining the differences in the impact of Fintech on the economic capital of commercial banks’ market risk: Evidence from a panel system GMM analysis. Appl. Econ. 2021, 53, 2647–2660. [Google Scholar] [CrossRef]

- Ding, N.; Gu, L.; Peng, Y. Fintech, financial constraints and innovation: Evidence from China. J. Corp. Financ. 2022, 73, 102194. [Google Scholar] [CrossRef]

- Liu, Q.; You, Y. Fintech and green credit development—Evidence from China. Sustainability 2023, 15, 5903. [Google Scholar] [CrossRef]

- Offiong, U.P.; Szopik-Depczyńska, K.; Ioppolo, G. FinTech innovations for sustainable development: A comprehensive literature review and future directions. Sustain. Dev. 2025, 33, 1459–1471. [Google Scholar] [CrossRef]

- Koemtzopoulos, D.; Zournatzidou, G.; Ragazou, K.; Sariannidis, N. Cryptocurrencies Transit to a Carbon Neutral Environment: From Fintech to Greentech Through Clean Energy and Eco-Efficiency Policies. Energies 2025, 18, 291. [Google Scholar] [CrossRef]

- Muhammad, S.; Huang, X. Tail Risk Spillovers between FinTech, Sustainability-Driven Investments and SME’s Stock Markets: Portfolio Implications. Singap. Econ. Rev. 2025, 70, 2439–2476. [Google Scholar] [CrossRef]

- Wanyan, R.; Zhao, T. The Dual Path of Fintech in Alleviating ESG Decoupling: A Dynamic Balance Between Short-Term and Long-Term Effects. Financ. Res. Lett. 2025, 86, 108443. [Google Scholar] [CrossRef]

- Huang, X.; Li, D.; Sun, M. Fintech and Corporate ESG Performance: An Empirical Analysis Based on the NEV Industry. Sustainability 2025, 17, 434. [Google Scholar] [CrossRef]

- Qian, S.; Yang, Z.; Fang, X. Bank Fintech and Corporate Green Transformation Quality Improvement: Based on Greenwashing Governance Perspective. Econ. Anal. Policy 2025, 87, 401–423. [Google Scholar] [CrossRef]

- Gao, D.; Tan, L.; Duan, K. Forging a path to sustainability: The impact of Fintech on corporate ESG performance. Eur. J. Financ. 2024, 1–19. [Google Scholar] [CrossRef]

- Hu, H.; Jia, Z.; Yang, S. Exploring FinTech, green finance, and ESG performance across corporate life-cycles. Int. Rev. Financ. Anal. 2025, 97, 103871. [Google Scholar] [CrossRef]

- Mertzanis, C.; Houcine, A.; Pavlopoulos, A.; Vetsikas, A.; Kampouris, I. Financial Technology and Environmental Performance: International Evidence. Int. J. Financ. Econ. 2025. [Google Scholar] [CrossRef]

- Zhan, W.; Jing, H. Does Fintech Development Reduce Corporate Earnings Management? Evidence from China. Sustainability 2022, 14, 16647. [Google Scholar] [CrossRef]

- Fazzari, S.; Hubbard, R.G.; Petersen, B.C. Financing Constraints and Corporate Investment; National Bureau of Economic Research: Cambridge, MA, USA, 1987. [Google Scholar] [CrossRef]

- Jensen, M.C.; Meckling, W.H. Theory of the Firm: Managerial Behavior, Agency Costs, and Ownership Structure. J. Financ. Econ. 1976, 3, 305–360. [Google Scholar] [CrossRef]

- Boumaiza, A. Advancing Sustainable Investment Efficiency and Transparency Through Blockchain-Driven Optimization. Sustainability 2025, 17, 2000. [Google Scholar] [CrossRef]

- Wang, C.; Yin, X.; Yu, F. The impact of FinTech on corporate green innovation: The case of Chinese listed enterprises. J. Environ. Manag. 2025, 392, 126605. [Google Scholar] [CrossRef]

- Chen, X.; Zhang, Z. Fintech development and corporate misconduct. Technol. Forecast. Soc. Change 2025, 213, 123988. [Google Scholar] [CrossRef]

- Liu, J.; Lv, X.; Zhang, G.; Zhang, M. Can fintech drive innovation in enterprise digital business models? Financ. Res. Lett. 2025, 78, 107237. [Google Scholar] [CrossRef]

- Whited, T.M.; Wu, G. Financial constraints risk. Rev. Financ. Stud. 2006, 19, 531–559. [Google Scholar] [CrossRef]

- Lin, J.; Cao, X.; Dong, X.; An, Y. Environmental regulations, supply chain relationships, and green technological innovation. J. Corp. Financ. 2024, 88, 102645. [Google Scholar] [CrossRef]

- Jiang, G.; Lee, C.M.; Yue, H. Tunneling through intercorporate loans: The China experience. J. Financ. Econ. 2010, 98, 1–20. [Google Scholar] [CrossRef]

- Mao, Z.; Wang, S.; Lin, Y.E. ESG, ESG rating divergence and earnings management: Evidence from China. Corp. Soc. Responsib. Environ. Manag. 2024, 31, 3328–3347. [Google Scholar] [CrossRef]

- Xue, Q.; Jin, Y.; Zhang, C. ESG rating results and corporate total factor productivity. Int. Rev. Financ. Anal. 2024, 95, 103381. [Google Scholar] [CrossRef]

- Baron, R.M.; Kenny, D.A. The moderator–mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. J. Personal. Soc. Psychol. 1986, 51, 1173. [Google Scholar] [CrossRef]

- Barney, J.B. Firm Resources and Sustained Competitive Advantage. J. Manag. 1991, 17, 3–10. [Google Scholar] [CrossRef]

- Waddock, S.A.; Graves, S.B. The corporate social performance–financial performance link. Strateg. Manag. J. 1997, 18, 303–319. [Google Scholar] [CrossRef]

- Goss, A.; Roberts, G.S. The impact of corporate social responsibility on the cost of bank loans. J. Bank. Financ. 2011, 35, 1794–1810. [Google Scholar] [CrossRef]

- Fama, E.F.; Jensen, M.C. Separation of Ownership and Control. J. Law Econ. 1983, 26, 301–325. [Google Scholar] [CrossRef]

- Thomas, D.; Josef, Z. Debt Maturity and the Dynamics of Leverage. Rev. Financ. Stud. 2021, 34, 5796–5840. [Google Scholar] [CrossRef]

- Xiang, C.; Chen, F.; Jones, P.; Xia, S. The effect of institutional investors’ distraction on firms’ corporate social responsibility engagement: Evidence from China. Rev. Manag. Sci. 2020, 15, 1645–1681. [Google Scholar] [CrossRef]

- Jo, H.; Harjoto, M.A. The Causal Effect of Corporate Governance on Corporate Social Responsibility. J. Bus. Ethics 2012, 106, 53–72. [Google Scholar] [CrossRef]

- Lee, M.S.; Thosuwanchot, N. The effect of financial constraints on strategic alliances: Agency perspective versus resource dependence perspective. J. Strategy Manag. 2025, 18, 410–429. [Google Scholar] [CrossRef]

- Zhang, D.; Lucey, B.M. Sustainable behaviors and firm performance: The role of financial constraints’ alleviation. Econ. Anal. Policy 2022, 74, 220–233. [Google Scholar] [CrossRef]

- Ge, W.; Yang, X.; Yang, X.; Pan, X.; Ran, Q. How does Fintech drive corporate climate information risk disclosure? New evidence from China’s A-share listed companies. Int. Rev. Financ. Anal. 2025, 103, 104210. [Google Scholar] [CrossRef]

- Babar, Z.N.; Wu, W. Advancing Green Finance through FinTech Innovations: A Conceptual Insight into Opportunities and Challenges. J. Excell. Manag. Sci. 2025, 4, 18–33. [Google Scholar] [CrossRef]

- Zhang, W.; Luo, Q.; Liu, S. Is government regulation a push for corporate environmental performance? Evidence from China. Econ. Anal. Policy 2022, 74, 105–121. [Google Scholar] [CrossRef]

- Wang, X. ESG Performance and Corporate Performance in China’s Manufacturing Firms: The Roles of Trade Credit Financing and Environmental Information Disclosure Quality. Sustainability 2025, 17, 9567. [Google Scholar] [CrossRef]

- Dressler, E.; Mugerman, Y. Doing the Right Thing? The Voting Power Effect and Institutional Shareholder Voting. J. Bus. Ethics 2023, 183, 1089–1112. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2026 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license.