Abstract

This paper discusses digital capability and its potential translation into sustainable organizational performance through the integration of sustainable management accounting and high-quality managerial decision-making. Even though previous studies acknowledge the importance of digital technologies and sustainability practices, the current literature mostly analyzes them separately, and no empirical models explain how digital capability can be translated into sustainability outcomes through internal decision-making and accounting processes. To fill this gap, this paper constructs and proves a Digital-Enabled Sustainability Management Accounting (DSMA) framework based on Dynamic Capabilities Theory, the Knowledge-Based View, and the Technology–Organization–Environment framework. Based on Survey data from 667 respondents in the financial services industry and Partial Least Squares Structural Equation Modeling (PLS-SEM), the results indicate that digital capability can significantly contribute to sustainability performance by increasing accounting integration and decision quality. Although technological readiness enhances such relations, it does so with only a low degree of influence, meaning it has a supportive rather than a transformative effect. The research is valuable because it contributes to sustainability theory, provides a solid empirical database that is understudied, and has practical implications for organizations striving to implement digitally enabled sustainability initiatives.

1. Introduction

The global business environment is undergoing rapid digital transformation, intensifying sustainability pressures and driving greater transparency and accountability. The emergence of digital technologies, such as artificial intelligence, analytics, cloud computing, and integrated information systems, has also had a radical impact on how organizations create, process, and use information to make strategic decisions [1,2]. At the same time, regulatory authorities, investors, and stakeholders are continually insisting on robust environmental, social, and governance (ESG) reporting and evidence-based progress towards the Sustainable Development Goals [3]. In turn, sustainability has become an issue no longer peripheral but a strategic priority integrated into the organizational system of planning and performance management [4,5]. One of the most important parts of this transition is accounting and control systems, which transform sustainability goals into decision-relevant information. Specifically, Sustainable Management Accounting (SMA) has become one of the leading tools that allow incorporating environmental and social data into the internal decision-making cycle [6,7]. However, even with rising investments in digital solutions and sustainability projects, a significant portion of organizations cannot translate these investments into sustainable, reliable performance, indicating that technology in itself cannot be used to achieve sustainable performance [8,9,10,11].

This research is grounded in three theoretical perspectives that complement one another. First, there is the Dynamic Capabilities Theory (DCT), which explains how organizations identify opportunities, acquire digital resources, and remodel internal processes to create long-lasting competitive and performance advantages in dynamic environments [12]. Under this, digital capability is a strategic dynamic capability that enables organizations [13] and policymakers pursuing sustainability and ESG objectives to capture, analyze, and redeploy information related to sustainability in a productive manner. This research provides insights for financial service organizations in Saudi Arabia and comparable institutional contexts pursuing sustainability and ESG objectives. Second, the Knowledge-Based View (KBV) emphasizes that organizational value creation requires the acquisition, integration, and application of knowledge, not technology itself [14]. In this light, SMA and managerial decision quality can be understood as knowledge-integration processes that convert digital information into the implementation of sustainability outcomes [2]. Third, the Technology–Organization–Environment (TOE) model emphasizes the impact of technological contexts and readiness on the effectiveness of organizations’ adoption and use of digital systems [15]. In this paper, technology readiness is therefore defined as a moderating variable that determines the intensity of the digital-enabled accounting and decision-making.

Previous studies have observed consistent improvements in information quality, operational efficiency, and responsiveness to strategies with digital [16,17,18]. Research involving SMA demonstrates its ability to enhance cost allocation in the environment, ESG reporting, and sustainability-oriented decision-making [19,20]. Likewise, studies of the quality of managerial decisions emphasize the importance of evidence-based decisions, predictive accuracy, and long-term sustainability, achieved through strategic planning [21,22]. In more recent work, the impact of technology readiness on facilitating digital transformation and sustainability projects has begun to be recognized [23,24]. Nevertheless, these bodies of research are largely independent of one another and tend to focus on individual technologies, distinct accounting practices, or single facets of sustainability rather than on systems of organizational functioning. Although these gains have been made, several gaps remain. First, empirical studies that simultaneously investigate the concepts of digital capability, SMA integration, managerial decision quality, and sustainable organizational performance are limited [25]. Second, the quality of managerial decisions is hardly mediated as the central way in which digital and accounting capabilities can lead to sustainability outcomes, despite the theory indicating otherwise [26]. Third, the concept of technology readiness is often addressed. Still, its role as a moderator is largely unexamined empirically and conceptually vague, especially in digitally transforming and emerging-market settings [27]. Lastly, there are not yet any strong predictive studies of such integrated models using SEM-PLS.

Earlier research indicates that digital technologies improve the quality of information, operational efficiency, and strategic responsiveness. In contrast, managerial decision quality improves long-term organizational performance through evidence-based planning and forecasting [28,29,30,31,32]. Emerging studies also recognize the importance of technology preparedness in supporting digital transformation and sustainability projects [33]. But these streams of literature are mostly fragmented, and the digital capability, sustainability management accounting, managerial decision quality, and sustainability performance are usually studied separately. Consequently, few empirical studies have examined how digital capability can be translated into sustainability outcomes through internal accounting integration and managerial decision-making procedures, especially within a single explanatory framework [34]. In addition, the moderating effect of technology readiness has been more of a descriptive concept than an empirical construct, and it is therefore unclear how it affects the digitally enabled sustainability mechanisms [35].

Due to these gaps, organizations lack a clear understanding of how digital investments and sustainability accounting systems contribute to the quality of decisions and sustainable performance together. This poses a threat of companies excessively focusing on technological readiness and underleveraging digital capability and SMA as strategic and knowledge-based sustainability systems. This mismatch creates difficulties in developing theories and limits the practical utility of sustainability and digital transformation efforts [8,9].

To this extent, this research will set out to achieve the following:

- (1)

- Investigate the effects of digital capability on SMA integration, quality of managerial decision-making, and sustainable organizational performance.

- (2)

- Test the moderating positions of SMA integration and the quality of managerial decisions.

- (3)

- Examine the moderating effect of technology readiness.

- (4)

- Empirically confirm a Digital-enabled Sustainability Management Accounting (DSMA) model.

This paper employs a quantitative research design, drawing on survey data from the asset servicing sector. Structural Equation Modeling with Partial Least Squares (SEM-PLS), which is appropriate when the analysis is aimed at prediction, complex mediation-moderation connections, and extension of the theory, is used to test the proposed model [36,37]. The study is theoretical in its contribution to the research because it has combined the Dynamic Capabilities Theory, the Knowledge-Based View, and the TOE framework into a single sustainability accounting framework. It is methodologically sound because it offers strong SEM-PLS support of the multi-layered mediation/moderation framework. In practice, the results show that digital capability and decision quality have a stronger influence on sustainable performance than technology readiness alone, and they provide practical recommendations to managers and policymakers. Additionally, this study advances sustainability and digital transformation research by refining and empirically examining a Digital-Enabled Sustainability Management Accounting (DSMA) framework that clarifies how digital capability is operationalized through accounting integration and managerial decision quality to support sustainable organizational performance.

The research is significant because it digitally transforms economies and addresses broader sustainability and ESG goals. The findings can support organizational strategies and policy initiatives aimed at long-term, sustainable development by clarifying the roles of digital capability and SMA in sustainable performance [38,39,40].

2. Literature Review

The proposed Digital-enabled Sustainability Management Accounting (DSMA) framework builds on the conceptual and theoretical scope of current research by integrating existing studies on five interrelated topics: digital capability, sustainable management accounting integration, managerial decision quality, sustainable organizational performance, and technology readiness. Based on the Dynamic Capabilities Theory, the Knowledge-Based View, and the Technology–Organization–Environment framework, this section critically analyzes the interactions among digital technologies, accounting systems, and managerial knowledge processes to determine sustainability outcomes. Instead of conducting research on these constructs individually, the review identifies systematic, current dependencies among them, notes conceptual and empirical gaps in the available literature, and explains the need for an integrated, quantitative SEM-PLS model. In this way, the literature review lays a solid theoretical ground for the placement of digital capability as a central antecedent, SMA integration and the quality of managerial decisions as central mediating variables, and technology preparedness as a situational moderator of sustainable organizational performance.

2.1. Digital Capability

Digital capability describes an organization’s capacity to implement and integrate advanced digital technologies, including AI, analytics, big data infrastructure, and state-of-the-art information technology, to enhance precision, operational efficiency, and the strategic value of its operations. AI and analytics enhance financial operations, automate routine tasks, and assist with fraud detection, thereby improving the quality of operations [21,41]. The big data capability requires the availability of high-quality, trusted, and timely data to enable more precise measurement of trends and risks. Still, one of the limitations to the use of big data in companies is the issue of data security and privacy, as well as the lack of a uniform technological framework [21,42,43]. An effective IT infrastructure also underpins digital transformation by providing hardware, software, and network capacity to handle large volumes of data and execute sophisticated digital applications [21,44,45]. Cloud-based systems improve this ability by facilitating real-time processing and integration of accounting information systems without disruptions [46,47]. Similarly, accounting systems are going digital, aided by AI, blockchain, and cloud technologies, thereby enhancing transparency, reliability, and real-time financial reporting, but need to overcome the challenge of skill gaps, resistance to technological change, and regulatory compliance concerns [41,46,48]. In general, digital capability enhances organizational performance. It increases accuracy, transparency, and strategic insight, but companies still face infrastructure constraints, skill shortages, and government restrictions that limit their ability to fully utilize such technologies [21,49,50].

About sustainability, research increasingly recognizes digital capabilities as a significant facilitator of integrated sustainability information. Digital capability enhances the combination of sustainable management accounting and sustainable organizational performance by improving the quality and utility of accounting information. Digital transformation enables the incorporation of sustainability-related information into accounting and managerial reporting, thereby improving sustainability-focused decision-making [51,52]. Digital technologies also strengthen the managerial accounting functions that convey the sustainable value throughout the organization [2,53]. Business analytics is also a digital accelerator, enhancing sustainability management and accounting and aiding corporations in increasing ESG performance and competitiveness [25]. In addition to integrating accounting, digital capability impacts organizational sustainability in several ways, such as fostering digital leadership, enabling digital cultures, and enhancing employees’ digital skills [54]. Digital leadership encourages green innovation, providing opportunities for digital transformation to lead to better sustainability performance [55]. Greater digital transformation is also beneficial for sustainable innovation capability, as adaptability to technological, organizational, and environmental changes becomes feasible [56]. Moreover, the element of digitalization enhances the integration of knowledge, leading to radical innovation and contributing to the long-term sustainable development of the system [57].

Digital capability also benefits managerial decision-making by enhancing how managers obtain, process, and use information. The use of AI and analytics will enhance the accuracy of forecasts, market responsiveness, and risk management, as well as aid strategic financial thinking [16,17]. These technologies make operational activities more efficient and enable managers to allocate their time to higher-priority decision-making, as they automate repetitive tasks [58,59]. High-quality big data enables the analysis of financial trends and risks, yet companies must address persistent issues, including data security and privacy [16,60]. Big data capability further increases organizational agility, thereby improving decision-making in a rapidly changing environment [61]. A strong IT infrastructure will guarantee efficient information flow to the management at the right time and location [62,63]. Digitalization of accounting systems enhances the timeliness and accuracy of accounting data, thereby strengthening the quality of strategic decisions [64,65]. It can be affirmed that AI keeps reshaping the accounting process, improving the quality of information and aiding in making ethical and strategic decisions [66,67].

Even though the literature shows a strong relationship between digital capability, decision-making quality, and sustainability potential, most studies focus on individual digital tools rather than digital capability. The studies are dominated by either qualitative or context-specific designs, with limited empirical models of SEM-PLS linking digital capability to sustainability management, accounting, and sustainable organizational performance. This paper addresses this gap by placing digital capability as a dynamic capability that conditions SMA integration, managerial decision quality, and sustainability outcomes into the DSMA model.

2.2. Sustainable Management Accounting and Integration

Sustainable management accounting plays a central role in improving sustainable organizational performance through its involvement in internal decision-making. Economic cost allocation practices, especially those based on Environmental Management Accounting, enable organizations to define better and assign environmental costs, thereby improving ESG performance and facilitating decisions that prioritize financial and environmental considerations [6,7]. Strategic management accounting practices enhance this advantage by providing managers with comprehensive sustainability-related information, which strengthens economic, environmental, and social performance [19]. Integrating sustainability KPIs into budgets ensures that environmental and social priorities are factored into strategic planning and performance assessment, aligning the organization’s activities with long-term sustainability objectives [4].

The Balanced Scorecard is one of the tools that strengthen this alignment, as it ensures the connection between sustainability indicators, internal processes, and organizational performance [68]. Likewise, Triple Bottom Line reporting, when incorporated into broader management frameworks, reinforces environmental and social performance, ensuring that sustainability concerns are incorporated into managerial decisions at all levels [8]. Modern management accounting and control systems also assist companies in capitalizing on sustainable innovations that enhance their competitiveness and performance at the international level [69]. Altogether, these practices can improve the quality of decisions, increase the ESG performance, enhance operational efficiency, and engage stakeholders further, which may strengthen sustainable organizational performance [5,7,20,70] Nevertheless, to be effective, it is necessary to deal with the issues of employee engagement, organizational maturity, and environmental factors [8].

Sustainable Management Accounting (SMA) in promoting Corporate Social Responsibility (CSR) is also relevant in integrating environmental and social concerns in managerial decision-making. SMA increases transparency and accountability, as sustainability accounting and reporting are more transparent in disclosing environmental, social, and economic issues, and enable stakeholders to assess corporate behavior [9] critically. Even though this openness is important for CSR credibility, sustainability disclosures are symbolic rather than substantive in some companies. SMA facilitates strategic decision-making by providing credible sustainability-related information, aligning resource allocation and long-term planning with CSR goals [71], while enhancing cost efficiency and environmental performance [19]. Secondly, SMA helps meet regulatory requirements, including the EU Directive 2014/95/EU, thereby aligning CSR practices with the requirements of mandatory reporting [9]. However, compliance is not the only assurance of true CSR commitment since most companies are concerned with the bare minimum. SMA also facilitates CSR-driven innovation to make products and processes greener, boosting competitive edge and societal value [72]. It also reinforces corporate governance by enhancing internal controls and stakeholder engagement [71]. The inclusion of environmental and social indicators in financial systems offers a better perspective on corporate impact [73], but their dissemination across departments remains uneven. Lastly, implementing Environmental Management Accounting Systems helps achieve a sustainable competitive advantage by improving economic, environmental, and social performance [74].

The literature demonstrates that EMA, sustainability KPIs, TBL reporting, and integrated systems have strong conceptual and practical advantages. However, most research focuses on individual techniques rather than SMA integration as an integrated entity and often ignores the interplay between digital capability and decision quality. Some of them are qualitative or sector-specific, which inhibits generalizability. Substantial quantitative, SEM-PLS modelling of SMA integration as an intervening process between digital capability and sustainable organizational performance is limited regarding digitally transforming and emerging-market organizations. Sustainability management accounting integration reflects the extent to which sustainability-related data are systematically embedded into accounting systems, performance metrics, and control mechanisms, thereby shaping the informational infrastructure available to managers. In this study, sustainable organizational performance is operationalized as an aggregate construct capturing multiple performance dimensions, without implying equal weighting or symmetrical contributions across environmental, social, financial, reputational, and trust-related outcomes.

2.3. The Quality of Managerial Decisions

Managerial decision quality captures the cognitive and behavioral dimension of managerial action, reflecting how available accounting and analytical information is evaluated, interpreted, and applied in strategic decision-making. The quality of managerial decisions, i.e., the use of evidence-based sustainable decisions, sound forecasting, good strategic planning, or proper utilization of sustainability data, is decisive in the determination of sustainable organizational performance. The fact is that when managers base their decisions on sustainability-based performance frameworks, including various forms of Sustainability Balanced Scorecards, they are better equipped to make environmental investment decisions because they consider eco-efficiency factors in their measurements [21]. Likewise, managers who think paradoxically and employ more extensive measurement systems are more likely to select sustainable suppliers and reinforce social and environmental performance. However, these cognitive abilities are not always available throughout organizations [41]. The accuracy of forecasting also supports sustainability, as organizational practices such as Total Quality Management increase employee involvement and discipline in the process, thereby enhancing sustainability [75]. But risk-based studies caution that prediction of failures, including predicting when international standards, are poorly followed, can bring about sustainability issues and may not be accompanied by a guarantee of long-term performance [42]. The quality of strategic planning also contributes to sustainability by making sure that the sustainability decision making is in line with the real-time data provided by the IoT and analytics, enhancing the timeliness and relevance of sustainability underlying actions [44,46]. Green-supportive cultures enhance the effectiveness of such strategic intentions at the organizational level, but they are not always effective at integrating them into the firm [76]. Sustainable data (especially big data analytics) can be used to make decisions more accurately and support green innovation strategies, enabling companies to resolve the dilemma of economic and environmental objectives [48]. It has also been indicated that when knowledge services and absorptive capacity are improved through Balanced Scorecard frameworks, financial and non-financial performance improves, but this time, firms need the internal ability to interpret and utilize sustainability data [22]. On the whole, the literature indicates that decision-making soundness has a significant positive impact on sustainable organizational performance. Yet, it seems to have long-standing constraints: the lack of uniformity in managerial capabilities, inadequate cultural fit, and lack of commitment in organizational climate frequently diminish the quality of the decisions made by managers, pointing to the fact that managerial decisions lead to sustainability only when complemented by effective systems, sound data, and supportive organizational climate.

The current literature acknowledges that decision quality is relevant to sustainability. Still, most studies treat decision quality as an outcome of tools (BSC, TQM, big data) rather than as an intermediate variable. Furthermore, the sustainability-specific aspects of decision quality (evidence-based sustainable decision-making, sustainable strategic planning, ESG forecasting) are seldom integrated into a single model. They are systematically linked to digital capability and its integration with SMA. This is addressed in the current research, which theorizes managerial decision quality as a primary mediator that enables the DSMA framework.

2.4. Sustainable Organizational Performance

Sustainable organizational performance is the capability of an organization to achieve long-term environmental, social, and financial results while maintaining a good reputation and earning the trust of stakeholders. In environmental terms, companies become more sustainable through green supply chain implementation, supplier training, and the application of Green HRM to normal operations. Yet, most organizations continue to fail to execute them, beyond symbolic programs [77,78,79]. Green innovation also enhances environmental performance, although its success in certain cases is determined by regulatory pressure and technological maturity, both of which many organizations in emerging [80,81]. CSR, inclusive workplaces, and stakeholder engagement influence social performance, but there is evidence that CSR is frequently reactive rather than proactive and does not have a real social impact [78,82,83]. When sustainability is part of strategy, financial performance improves, though converting sustainable financial benefits is difficult, particularly for firms that cannot effectively apply continuous-improvement skills [84,85]. CSR and sustainability reporting are strongly affecting reputation, but organizations tend to talk more than act, and the presence of greenwashing is an issue [86,87]. Stakeholder trust increases when responsible leadership and stakeholder-based frameworks are genuinely integrated into governance systems. Still, it can easily be lost when sustainability claims are not accompanied by internal systems and verifiable performance [88].

In the context of the current research, these findings reveal that sustainable performance depends heavily on reliable sustainability data, integrated accounting systems, and strong decision quality—all core components of your DSMA model. The literature repeatedly highlights gaps in measurement reliability, data integration, and internal capabilities, reinforcing why digital capability, SMA integration, and managerial decision quality are essential predictors of sustainable organizational performance in your study.

Even though the environmental, social, financial, reputational, and trust dimensions are well known, empirical evidence tends to focus on only one of them (e.g., environmental and financial) and uses inconsistent measures. These multidimensional outcomes are only loosely associated with digital-enabled Sustainable Management Accounting (SMA) and Managerial Decision Quality (MDQ) in a single structural model across the few studies. This paper operationalizes Sustainable Organizational Performance (SOP) as a multidimensional construct defined by Digital Capability (DC), SMA Integration (SMAI), and Managerial Decision Quality (MDQ) within a single SEM-PLS model. In this study, sustainable organizational performance is operationalized as an aggregate construct capturing multiple performance dimensions, without implying equal weighting or symmetrical contributions across environmental, social, financial, reputational, and trust-related outcomes.

2.5. Technology Readiness

Technology readiness is an influential moderating factor that enhances the transformation of SMA integration and managerial decision quality into sustainable organizational performance. As has been studied, the more technologically ready companies are, i.e., strong digital infrastructure, employees with high digital competence, and a supportive technological culture, the better positioned they are to implement sustainability-oriented accounting systems. As shown, the introduction of technology increases environmental, economic, and social performance [89,90,91,92], suggesting that sustainability KPIs, environmental costing, and integrated reporting become more efficient when supported by well-developed technological contexts. Conversely, low-technology-readiness firms tend to experience system incompatibility, inaccurate data, and resistance to digital tools, which limits the impact of SMA integration. Technology readiness also influences how well managers can make high-quality sustainability decisions with the help of SMA information. Research indicates that procedural rationality and systematic decision-making enhance satisfaction and performance [93,94]. In high-technology-readiness environments, managers will have access to real-time analytics, automated reporting, and accurate sustainability data, enabling evidence-based decision-making.

Nevertheless, in low-digital-maturity environments, managers rely on intuition or incomplete information, undermining the connection between SMA information and decision quality. In addition, technology readiness increases the effects of sustainability practices on organizational performance. According to recent findings, well-prepared companies are more capable of translating green dynamic capabilities into high-quality sustainability outcomes [95,96,97]. This means that the role of technology readiness is not merely an additional resource but rather one that amplifies and magnifies the performance effects of SMA integration and managerial decision quality.

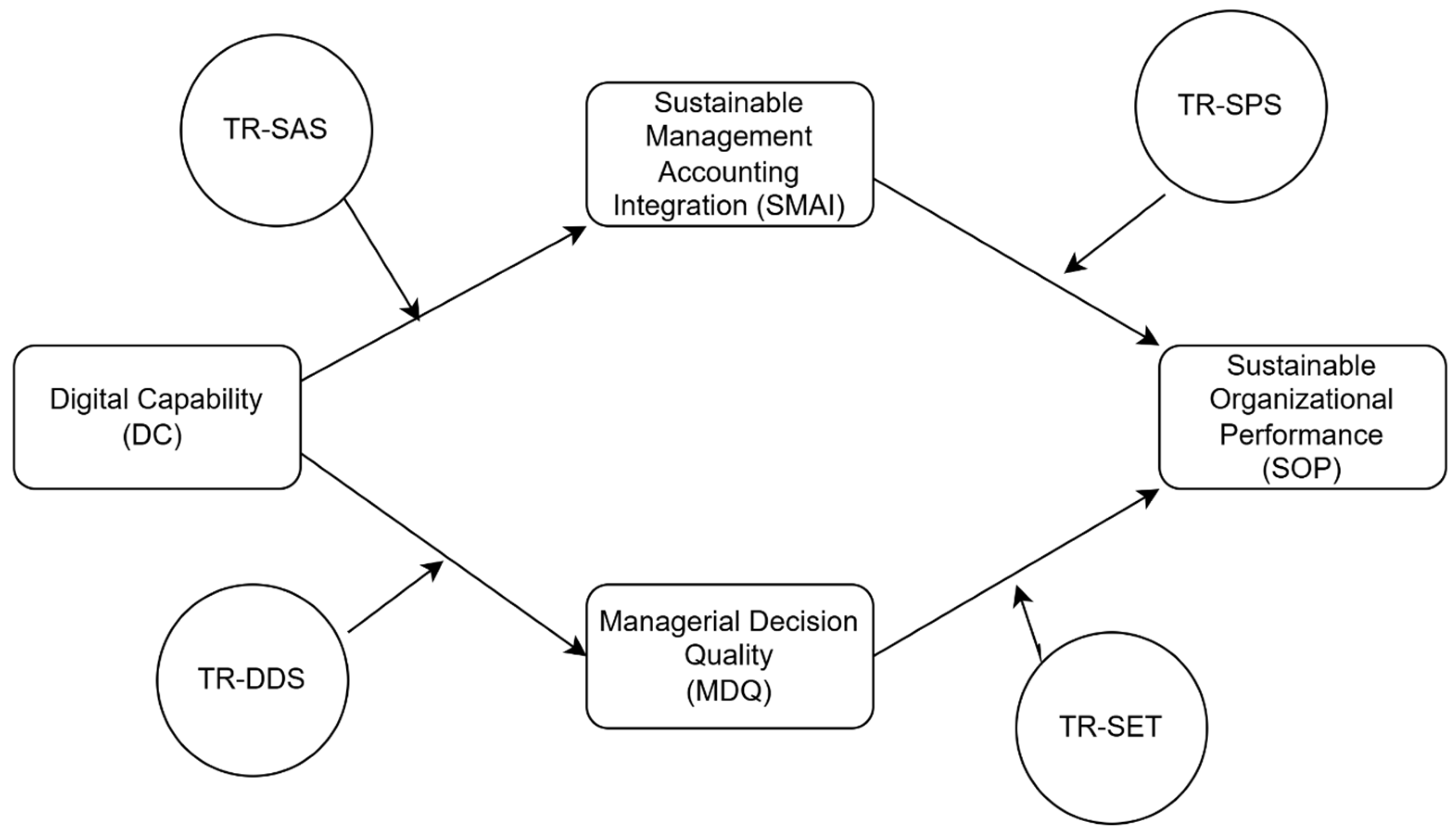

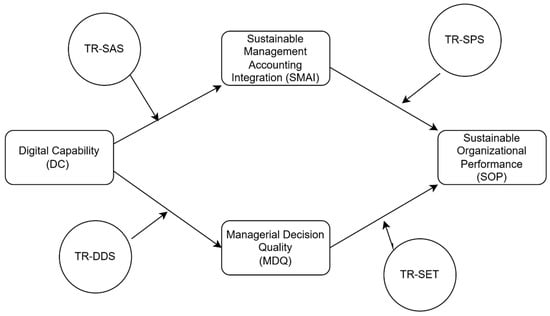

Comprehensively, technology readiness is an essential enabling factor. Very high readiness reinforces the links from SMA integration to managerial decision quality and onward to sustainable organizational performance, while low readiness may weaken or inhibit otherwise positive relations. Figure 1 illustrates the proposed research framework, in which digital capability influences sustainable organizational performance through sustainable management accounting integration and managerial decision quality. At the same time, technology-readiness dimensions serve as moderating mechanisms that condition these core relationships. Consistent with the Technology–Organization–Environment framework, the sub-dimensions of technology readiness employed in this study represent operational manifestations of the technological context rather than theoretically independent dimensions. Accordingly, these indicators capture variation in the availability and usability of digital tools supporting accounting and decision processes, without implying distinct causal mechanisms at the theoretical level.

Figure 1.

Framework of the Study.

Hence, from the above literature review, the following hypotheses are proposed:

H1.

Digital Capability positively influences Managerial Decision Quality.

H2.

Digital Capability positively influences Sustainability Management Accounting Integration.

H3.

Digital Capability positively influences Sustainable Organizational Performance.

H4.

Managerial Decision Quality positively influences Sustainable Organizational Performance.

H5.

Sustainability Management Accounting Integration positively influences Sustainable Organizational Performance.

H6.

Technology Readiness in Decision Support Systems positively moderates the relationship between Digital Capability and Managerial Decision Quality.

H7.

Technology Readiness in Sustainability Accounting Systems positively moderates the relationship between Digital Capability and Sustainability Management Accounting Integration.

H8.

Technology Readiness in Sustainability Performance Systems positively moderates the relationship between Sustainability Management Accounting Integration and Sustainable Organizational Performance.

H9.

Technology Readiness in Sustainability Execution Tools positively moderates the relationship between Managerial Decision Quality and Sustainable Organizational Performance.

Rather than treating Dynamic Capabilities Theory (DCT), the Knowledge-Based View (KBV), and the Technology–Organization–Environment (TOE) framework as parallel explanatory pillars, this study adopts a hierarchical and mechanism-oriented theoretical integration. DCT serves as the primary explanatory foundation, explaining how digital capability enables organizational reconfiguration toward sustainability outcomes. KBV complements this perspective by explaining how the integration of sustainability management accounting and managerial decision quality functions as a knowledge-integration mechanisms that translate digital capability into sustainable organizational performance. TOE is positioned as a contextual boundary framework that delineates the technological conditions under which these digital-enabled mechanisms are effective. Consistent with the TOE framework, technology readiness is not conceptualized as a direct driver of sustainability performance, but as an enabling contextual condition that moderates the effectiveness of digital capability-driven accounting and decision-making processes.

2.6. Theoretical Foundation

The current study is based on the Dynamic Capabilities Theory (DCT), which provides an understanding of how firms’ sensing, seizing, and reconfiguration of resources create performance advantages. Digital Capability (DC) is a dynamic capability that allows organizations to gather, synthesize, and restructure sustainability information [98]. Sustainable Management Accounting (SMA) serves as a mechanism for integrating digital information into budgeting, costing, and decision-making [25]. Complementing DCT, the Knowledge-Based View (KBV) substantiates the mediating role of SMA by stating that companies generate value when knowledge is captured, integrated, and applied using accounting systems [2]. Moreover, the Technology–Organization–Environment (TOE) framework explains why Technology Readiness (TR) should be a moderator, as technologically structured and digitally oriented firms can better convert digital capability into effective SMA practices [54,99]. The combination of these theories creates a comprehensive basis for the DSMA model presented in the paper. From a critical perspective, earlier research generally implements DCT, KBV, or TOE individually but seldom considers how to incorporate them into a unified sustainability accounting system. There is therefore a theoretical and empirical gap: no research to date integrates DCT (digital capability), KBV (SMA integration + decision quality), and TOE (technology readiness) to clarify the impact of digital-enabled SMA on sustainable organizational performance. The current study directly addresses this gap by integrating a DSMA model with SEM-PLS analysis.

3. Materials and Methods

3.1. Research Design

The research design used in this study is a qualitative, explanatory study that tests the cause-and-effect relationships in the Digital-Enabled Sustainability Management Accounting (DSMA) model. The model has combined Digital Capability, Sustainable Management Accounting (SMA) Integration, Managerial Decision Quality, Technology Readiness, and Sustainable Organizational Performance. PLS-SEM was employed in this study due to its emphasis on prediction and variance explanation, as well as its suitability for estimating mediation and moderation effects involving interaction terms. While the core structural relationships are theory-driven and could also be examined using covariance-based SEM, PLS-SEM is particularly appropriate for assessing predictive relevance, effect sizes, and explained variance in models that integrate mediation and contextual moderation.

3.2. Research Context and Sector Selection

The financial services sector serves as the location and participants in the study, with banks, insurance companies, fintech organizations, investment organizations, and regulatory bodies in Saudi Arabia. The industry is selected as one of the most digitized, with the prevalence of AI, analytics, integrated reporting systems, and high demand for sustainability and ESG reporting. Financial institutions depend heavily on digital systems for real-time reporting, risk evaluation, and sustainability disclosures, thereby enhancing the quality of managerial decisions, which makes them appropriate for studying the interaction between Digital Capability and SMA Integration and the quality of managerial decisions. The fact that the sector is strategically aligned with Vision 2030, which focuses on digital transformation and sustainability, also enhances its relevance as the study’s context.

3.3. Target Population

The target population is middle- and senior-level managerial employees who are directly engaged in financial reporting, digital transformation projects, sustainability accounting, or strategic decision-making. They are Finance Managers, Accounting Managers, Risk and Compliance Managers, Sustainability/ESG Officers, Internal Auditors, IT Managers involved with digital accounting systems, and Operations Managers, who manage planning and performance monitoring. These experts are chosen for their experience and can assess Digital Capability, SMA Integration, Managerial Decision Quality, and Sustainable Organizational Performance. The data gathered before the SEM-PLS analysis were systematically screened and cleaned to enhance their reliability and validity. Firstly, the questionnaires were sent to managerial-level respondents in the financial services industry. 1000 questionnaires were sent to the potential respondents. During data cleaning, answers with missing data, incomplete surveys, straight lining, or heterogeneous or inconsistent response patterns were filtered out. Following the application of these screening criteria, 667 valid and usable responses remained and were used in the further analysis. The original target sample was 840 responses, considered methodologically sufficient, though the final sample was 667. This sufficiency was also ensured by the post hoc power analysis, which revealed that the retained sample size was adequate to provide reasonable statistical power to test the proposed structural relations in the SEM-PLS model. The measurement instrument comprised 42 items, and therefore, the item-based rule was used, which suggests a minimum sample size of 20 respondents per indicator in complex models. In this regard, the sample size of 840 respondents (42 × 20) was the minimum [100]. The sample size is also validated by Post Hoc Analysis. The resulting valid sample size met this condition and thus provided sufficient statistical power, parameter estimation consistency, and the strength of the SEM-PLS findings. Refer to the Appendix B demographic profile.

3.4. Sampling Method and Sample Size

The purposive sampling method is used to ensure that only respondents with the relevant knowledge and engagement in digital systems, sustainability practices, and decision-making are included in the study. This would apply to specialized subject matter in which general employees might lack adequate knowledge of SMA Integration or sustainability decision-making.

The sample size is computed based on the maximum number of structural paths to any endogenous construct. It is set to a minimum of 10 times that number, given the SEM-PLS’s maximum power. Given the complexity of the DSMA model, a sample of 250–400 respondents would be sufficient to yield stable path estimates and predictive accuracy. This is also the same range as the recommended sample sizes for moderation and mediation studies.

3.5. Instrument Development

The survey instrument is constructed from validated measurement items from prior peer-reviewed research. Operationalization: Each construct is measured as a reflective latent variable on a 5-point Likert scale (refer to Appendix A). Digital Capability indicators include AI usage, analytics capability, big data quality, IT infrastructure, and digital integration. The practices that are reflected in the SMA Integration category include Environmental Management Accounting, sustainability KPIs, Triple Bottom Line reporting, and integrated sustainability systems. Managerial Decision Quality is gauged by evidence-based decisions, predictions, the quality of strategic planning, and the use of sustainability data. Technology Readiness items measure technological infrastructure, employees’ digital skills, system compatibility, and digital culture. Environmental, social, financial, reputation, and stakeholder trust indicators are part of Sustainable Organizational Performance. The instrument will be piloted with 20 to 30 managers in the financial sector to ensure it is content valid, clear, and reliable.

3.6. Data Collection Procedure

The information will be gathered through a computerized online questionnaire sent via e-mail notifications, LinkedIn business connections, and official communication with financial institutions. There will be a short introduction to the study that explains why it is being conducted, assures confidentiality, and highlights that it is voluntary. Participants will provide informed consent before completing the questionnaire. The technique guarantees effective management of geographically dispersed financial experts and reduces disruptions to their work schedules. Data collection will take 6–8 weeks to achieve a sufficient response rate.

3.7. Ethical Considerations

The research is conducted in accordance with ethical standards of research. Participants will be informed of the objectives of the study, their rights, and that participation will be voluntary. No personal data shall be collected. The information will be kept in a safe place and utilized only for academic purposes. The researcher’s review board will provide ethical approval before data collection.

3.8. Evaluation of Measurement Model

To ensure the reliability and validity of the constructs, the measurement model will be assessed first in SEM-PLS analysis. Reliability will be determined by Cronbach’s Alpha and Composite Reliability (CR), both of which will be greater than 0.70. Average Variance Extracted (AVE) will be used to confirm convergent validity, with a threshold of 0.50 or higher. The Fornell–Larcker criterion and the Heterotrait–Monotrait (HTMT) ratio will be used to test for discriminant validity. Multicollinearity will be measured by the Variance Inflation Factor (VIF), and all items will be less than 3.3. Given that all data were collected from a single respondent at a single point in time, the potential influence of common method bias (CMB) was assessed. Procedural remedies were applied during survey design, including respondent anonymity, careful item wording, and the separation of construct blocks. In addition, a statistical assessment was conducted using the full collinearity variance inflation factor (VIF) approach, with all VIF values falling below the recommended threshold of 3.3, suggesting that CMB is unlikely to be a serious concern. These results indicate that the observed relationships are not predominantly driven by common method variance.

3.9. Structural Model Assessment

The structural model shall be tested after validation of the measurement model to test hypothesized relationships. A bootstrapping process of 5000 subsamples will be used to calculate the path coefficients (β-values) and their statistical significance. R2 values will be taken to measure the model’s explanatory power, and f2 effect sizes will be taken to measure the impact of each predictor. Predictive relevance will be measured using Q2 values obtained on the blindfolding procedure. The most important model fit measures, like SRMR and NFI, will be provided. The bootstrapping method will be used to test the mediation effect of SMA Integration and Managerial Decision Quality. The moderating role of Technology Readiness will be analyzed using interaction terms developed in the SmartPLS package, which will allow assessing the strength of the predictive relationships reinforced by readiness and of those weakened.

3.10. Justification of Methodological Choices

The theoretical basis and empirical objective of the research are the reasons behind the methodological approach. SEM-PLS is best applied to predictive analysis, theory extension, and intricate structural models with moderators and mediators. The impact of purposive sampling is that it allows the sample to be composed of knowledgeable professionals who can provide high-quality data. The financial services industry is a fertile field where Digital Capability, SMA Integration, and Managerial Decision Quality are highly applicable, thereby enhancing context validity. The overall measurement strategy is also consistent with the major sustainability models.

4. Results

This analysis presents the empirical results of the research using the SEM-PLS method. The results are described in accordance with the two-step methodology: first, the estimation of the measurement model to assess reliability and validity, and second, the estimation of the structural model to test the proposed relationships, explanatory power, model fit, and moderating effects. Post hoc power analysis is also offered to estimate the statistical strength of the estimated paths. A combination of these analyses proves the empirical validity of the presented DSMA framework.

4.1. Model Evaluation

The measurement model in Table 1 shows high reliability and validity among all constructs. Cronbach’s alpha, rho A, and the measurement model show high reliability and validity across all constructs. The values of Cronbach’s alpha, rho A, and composite reliability (rho C) for Digital Capability, SMA Integration, Managerial Decision Quality, Sustainable Organizational Performance, and all Technology Readiness dimensions are above the recommended 0.70, indicating high internal consistency. Likewise, the AVEs for all constructs are greater than 0.50, indicating good convergent validity. The HTMT values indicate that the discriminant validity is acceptable, as the construct correlations are below the conservative threshold of 0.85, suggesting that the constructs are empirically distinct. Predictably, the results of the Digital Capability indicate moderately strong connections with SMA Integration (0.631) and Managerial Decision Quality (0.630), which substantiate the theoretical perspective that digital capability increases accounting integration and decision quality. Sustainable Organizational Performance also shows significant correlations with SMA Integration (0.632) and Managerial Decision Quality (0.612), validating the key roles of information integration and decision quality in generating sustainable outcomes. However, in comparison, the Technology Readiness interaction terms (e.g., TR-DDS × DC, TR-SAS × DC, TR-SPS × SMAI, TR-SET × MDQ) are weakly correlated with most constructs, consistent with their role as moderators rather than core predictors. In general, the table shows that the instrument is statistically strong, that the measures of constructs are valid and reliable, and that the data are properly organized to test the hypothesized relationships in the structural model.

Table 1.

Reliability, Validity and HTMT Matrix.

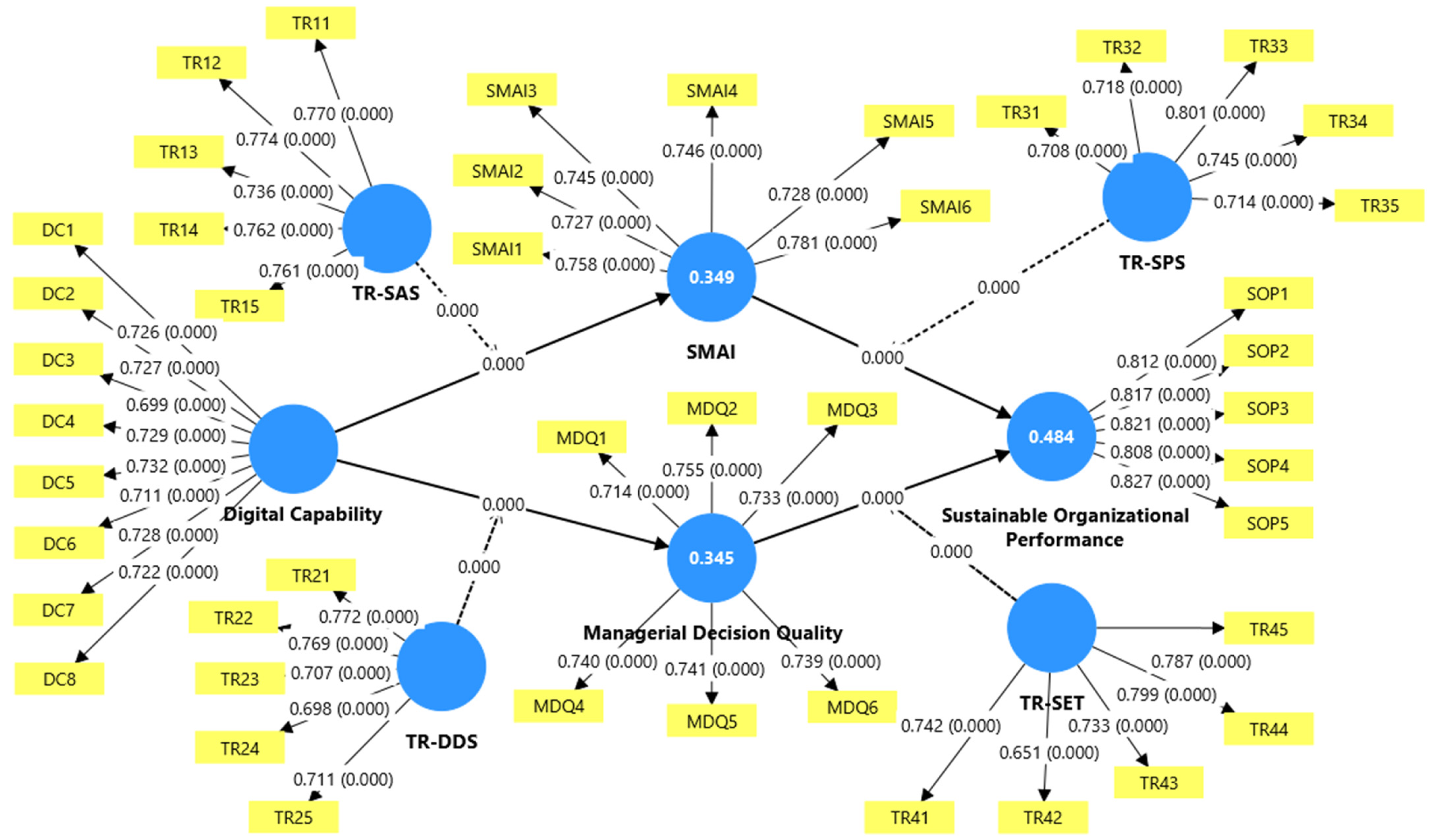

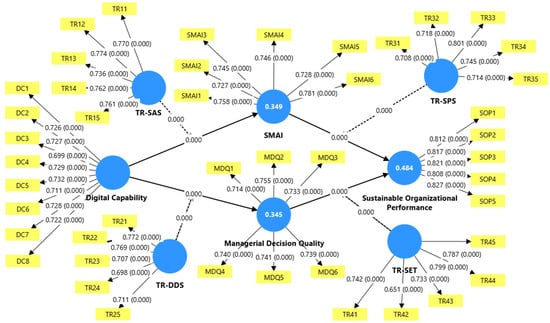

Table 2 and Figure 2 shows that the general structural model is quite robust and well-grounded statistically. The R2 values indicate that the model accounts for a significant percentage of variance across all important endogenous constructs, with Sustainable Organizational Performance showing strong explanatory power (0.484) and SMA Integration and Managerial Decision Quality showing moderate but satisfactory predictive power. Model fit indices also support a sound model: the SRMR values (0.041–0.052) are well below 0.08, and the NFI values are above 0.85, indicating that PLS-SEM is a good fit for the model. Multicollinearity diagnostics across the entire set of constructs, including the 4 Technology Readiness dimensions, indicate that VIF values are all below 3.3, indicating that the indicators are not affected by redundancy or inflationary artifacts. The validity of post hoc power analysis confirms that all main structural paths (DC → MDQ, DC → SMAI, SMAI → SOP, MDQ → SOP) have strong to moderate effect sizes and need comparatively small to medium sample sizes (indicating stability and statistical detectability). The moderation paths of technology Readiness have weaker effects, as expected with interaction terms, but are statistically significant, indicating that it still moderates at very small effect sizes. In general, acceptable model fit, high reliability, the absence of multicollinearity, and adequate statistical power indicate that the DSMA model is empirically sound and can be used in the context of sustainability research.

Table 2.

Combined Structural Model Evaluation: Explanatory Power, Fit Indices, and Multicollinearity Diagnostics.

Figure 2.

Measurement—Structural Model Evaluation.

Table 3 represents the post hoc test, which shows that the main structural directions in the model, in particular, the impact of Digital Capability on SMA Integration and Managerial Decision Quality, and their subsequent impact on Sustainable Organizational Performance, are robust and well-supported and only require rather small sample sizes to reach sufficient statistical power. This shows that the main theoretical relationships in the DSMA framework are consistent and significant. Conversely, the direct and moderating effects of Technology Readiness are considerably weaker. These directions are statistically significant, but the effect sizes indicate they are more subtle in the model. These influences are significantly larger in terms of sample sizes, and that indicates that Technology Readiness is a facilitating, but not a dominating, factor. In general, the analysis supports the main model’s strength and acknowledges that the moderating pathways play a more nuanced and context-specific role.

Table 3.

Post Hoc Power Analysis Table.

Table 4 presents the statistically supported relations, but a critical analysis of the findings reveals an evident asymmetry between direct and moderating effects. The direct relationships of the Digital Capability with Managerial Decision Quality (H1: β = 0.53, f2 = 0.428) and SMA Integration (H2: β = 0.533, f2 = 0.433) are not only significant but also substantively strong, which implies that the Digital Capability is considered a core strategic resource, not a peripheral enabler. Its direct impact on Sustainable Organizational Performance (H3: β = 0.408) once again confirms the fact that the digital capability alone should be viewed as a source of sustainability outcomes, which is consistent with the rationale of Dynamic Capabilities Theory, according to which sensing, seizing, and reconfiguring capabilities are the drivers of sustainability. Conversely, the relationship between Managerial Decision Quality (H4: β = 0.387, f2 = 0.25) and SMA Integration (H5: β = 0.38, f2 = 0.222) and sustainable performance, though significant, is not very strong and indicates that knowledge-based processes do not achieve digital investments into sustainable performance unless decision systems and accounting practices have been institutionalized. This observation aligns with the knowledge-based view, which argues that sustainability is not achieved solely through the use of technology but through interpreting and applying information. The effect sizes of the moderation of Technology Readiness are very small, despite being statistically significant (H6–H9: the f2 between 0.024 and 0.042). The small effect sizes associated with technology readiness moderation are theoretically consistent with its role as a contextual enabling condition rather than a primary explanatory driver. While statistically significant, these effects suggest that technological readiness marginally conditions, rather than substantively transforms, the relationship between digital capability, accounting integration, and decision quality. It means that technological readiness strengthens current relationships slightly and does not significantly alter the power of the main pathways. Critically, this implies that sustainability transformation requires technological readiness, but not only. Accordingly, the strong effects of digital capability should be interpreted at the organizational capability level rather than as evidence that individual digital technologies independently drive sustainability performance. Organizations can have digital infrastructure and staff, but without strong digital capability, decision quality, and SMA integration, technology readiness alone will yield low incremental value. Although the moderation effects of technology readiness are statistically significant, their small effect sizes are theoretically consistent with the TOE framework, which conceptualizes technological context as a conditioning factor rather than a transformative performance driver. This finding suggests that technology readiness supports—but does not substitute for—organizational digital capability and internal knowledge-conversion mechanisms.

Table 4.

Hypothesis Testing and Effect Size.

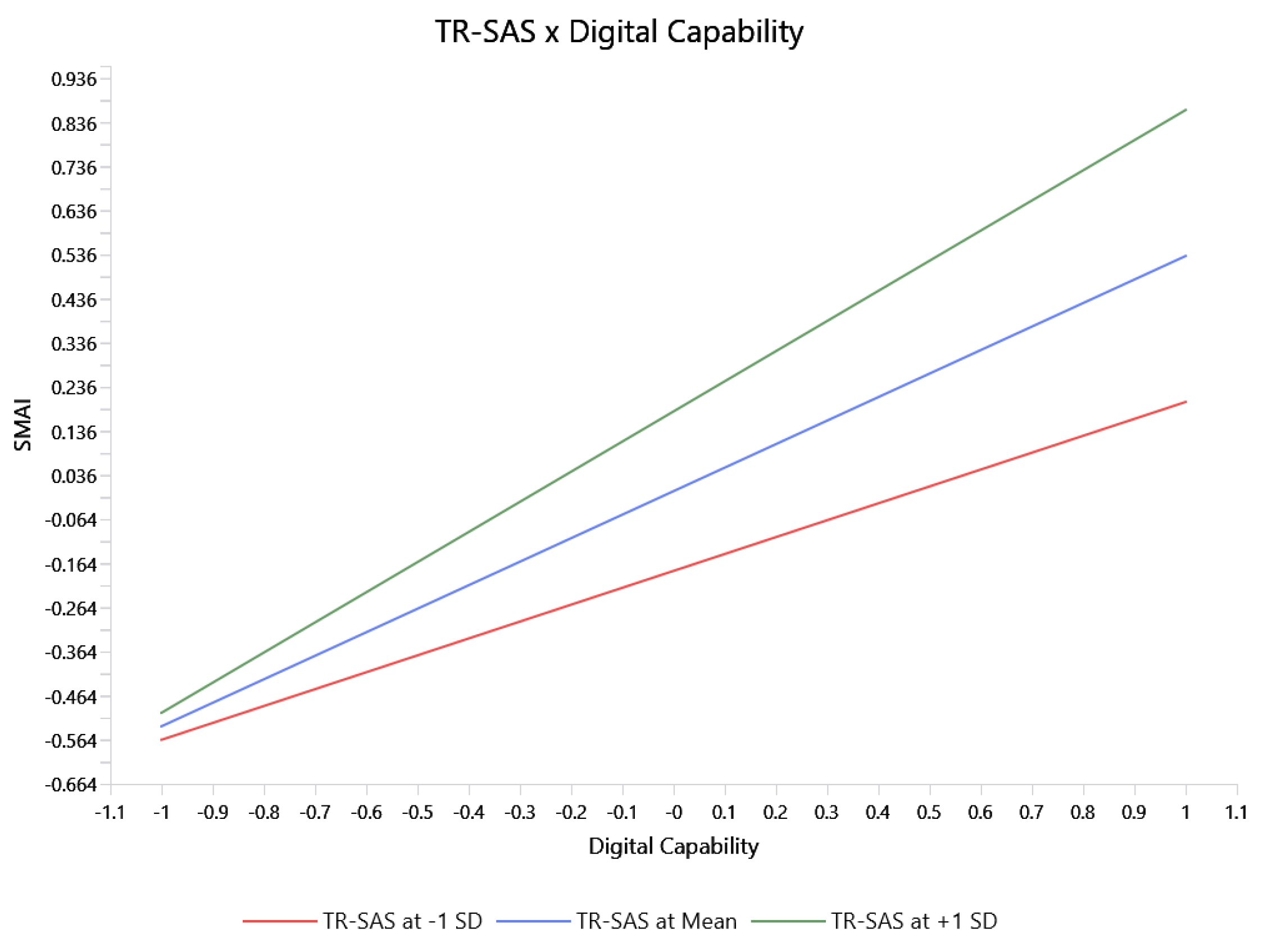

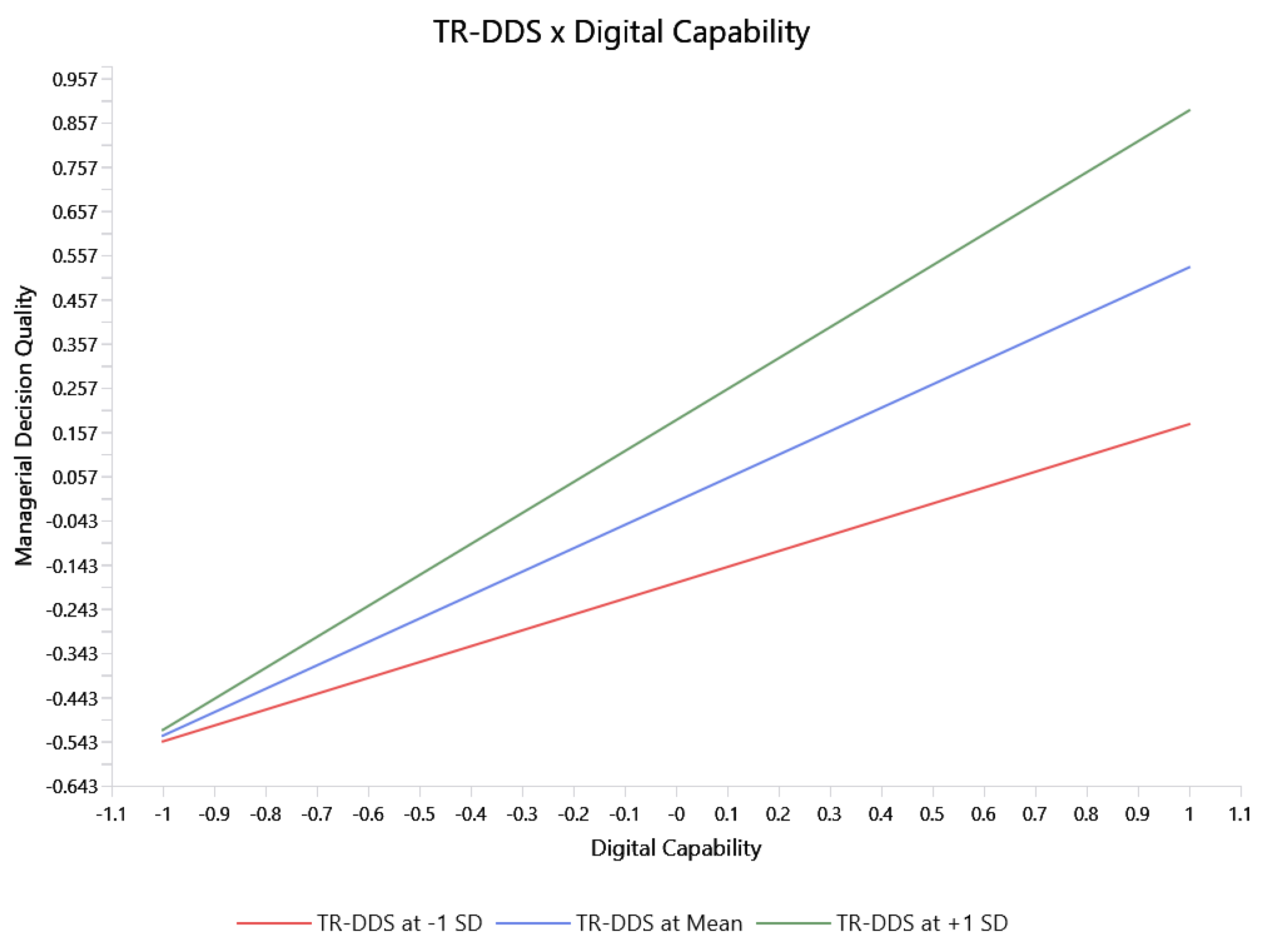

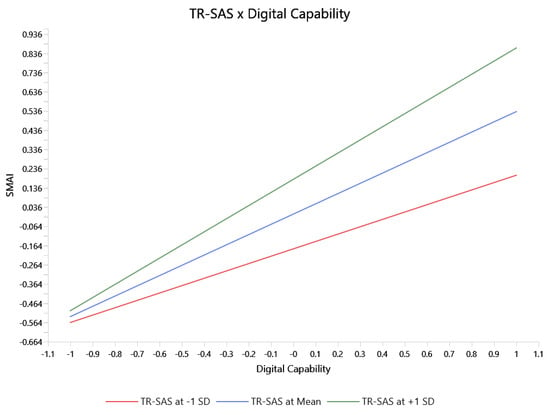

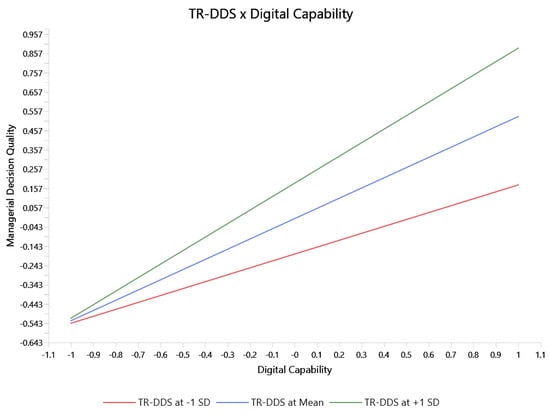

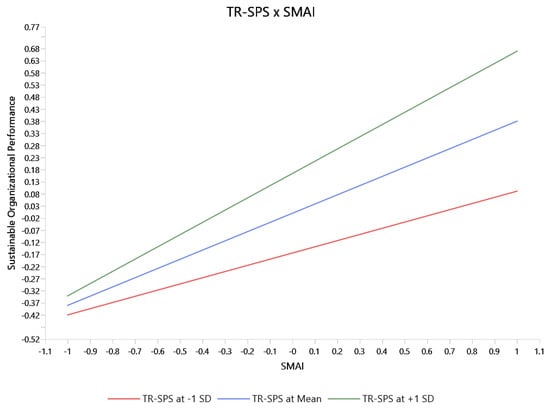

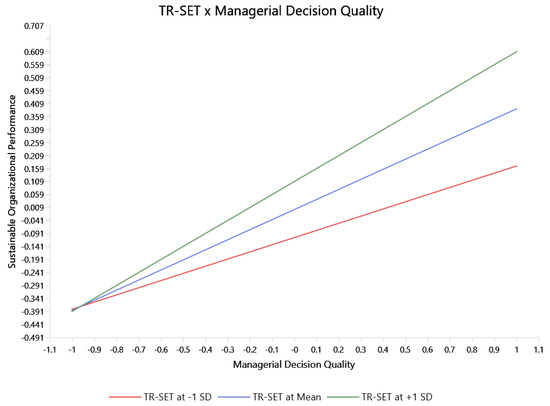

4.2. Moderation Effect

The moderation outcomes are more comprehensible using simple slope logic, which explains the extent to which a one-unit increase in one construct will have a significant impact at a given level of Technology Readiness. In the case of H6, the relationship between Digital Capability and TR-DDS involves a unit change in Digital Capability, with a slightly larger increase in Managerial Decision Quality when TR-DDS is high than when it is low. Though statistically significant, the slope difference is small: decision-support readiness contributes to, but does not significantly increase, the digital capability’s ability to improve decision quality. Equally, H7 shows that an increase of 1 unit in Digital Capability produces a comparatively greater change in SMA Integration in the presence of high TR-SAS. The more successful organizations in sustainability accounting systems gain more from digital capabilities. Yet, the relatively small slope change indicates that SMA integration is directly related to digital capability rather than readiness. In the case of H8, slope analysis indicates that SMA Integration has a positive but insignificant contribution to Sustainable Organizational Performance when TR-SPS is high, suggesting that sustainability performance systems enable organizations to translate SMA insights into actual performance outcomes. Once again, the moderation effect is minimal: the high readiness only has a slightly more positive effect on the slope than the low readiness. Lastly, H9 shows that a 1-unit improvement in Managerial Decision Quality produces a marginally greater effect on Sustainable Organizational Performance when TR-SET is high. This implies that execution readiness supports the decision-to-performance pathway and is not a fundamental redefinition of it. The slope trends in all four interactions are the same: Technology Readiness increases the slope by a small margin. It implies that although high TR conditions assist organizations in gaining greater value from digital capabilities, SMA assimilation, and high-quality choices, the fundamental improvements are driven by the fundamental constructs rather than the extent of preparedness. Technology readiness is rather a catalyst, helpful and supportive, but not transformative. Although the moderation effects of technology readiness are statistically significant, their small f2 and IPMA values indicate limited substantive influence. Accordingly, these findings should be interpreted as marginal boundary effects rather than evidence of strong theoretical or practical impact. These weak effects are likely sensitive to sample size and should therefore be interpreted with caution, particularly regarding their practical relevance.

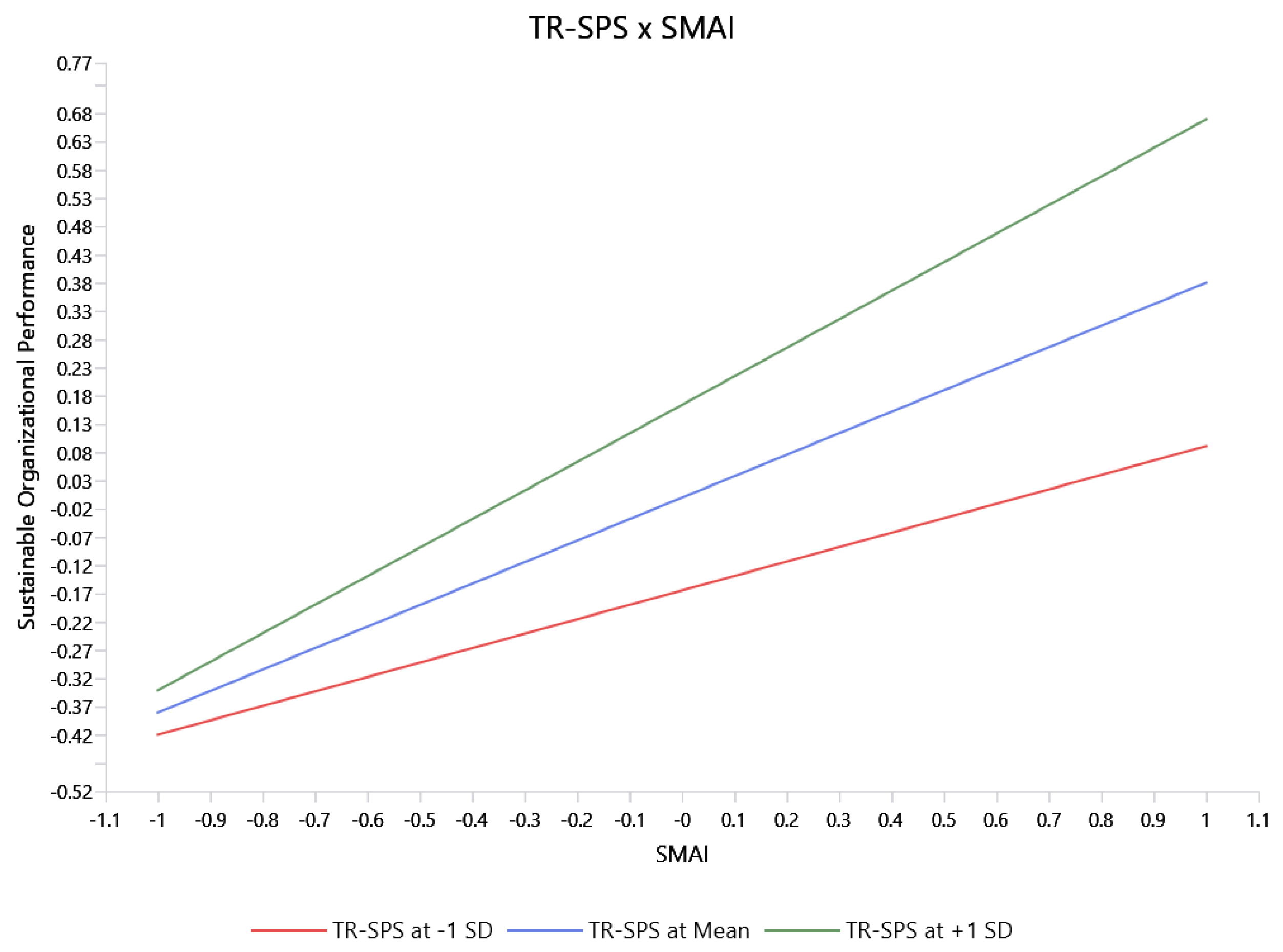

The model’s direct effects indicate that Digital Capability, SMA Integration, and Managerial Decision Quality have a strong and consistent positive impact on Sustainable Organizational Performance, as shown in Figure 3, Figure 4, Figure 5 and Figure 6. These routes are strong and indicative of the fundamental processes underlying the Knowledge-Based View and the Dynamic Capabilities Theory. Organizations can perform better when they can sense, process, and effectively utilize digital and sustainability-related information. Compared with the moderating effects of Technology Readiness, the moderating effects of Technology Readiness are relatively small. They are important, but they only enhance the existing relationships by a small margin. This is because, when technology readiness is high, it does not significantly increase the effects of digital capability, SMA integration, or the quality of decision-making; it only provides a small incremental effect. The real drivers of sustainability, in essence, are the direct effects, which indicate that Technology Readiness is a supportive, not a transformative, factor, only slightly enhancing the slopes.

Figure 3.

Moderating Effect of Technology Readiness (TR-SAS) on the Relationship between Digital Capability and SMA Integration.

Figure 4.

Moderating Effect of Technology Readiness (TR-DDS) on the Relationship between Digital Capability and Managerial Decision Quality.

Figure 5.

Moderating Effect of Technology Readiness (TR-SPS) on the Relationship between SMA Integration (SMAI) and Sustainable Organizational Performance.

Figure 6.

Moderating Effect of Technology Readiness (TR-SET) on the Relationship between Managerial Decision Quality and Sustainable Organizational Performance.

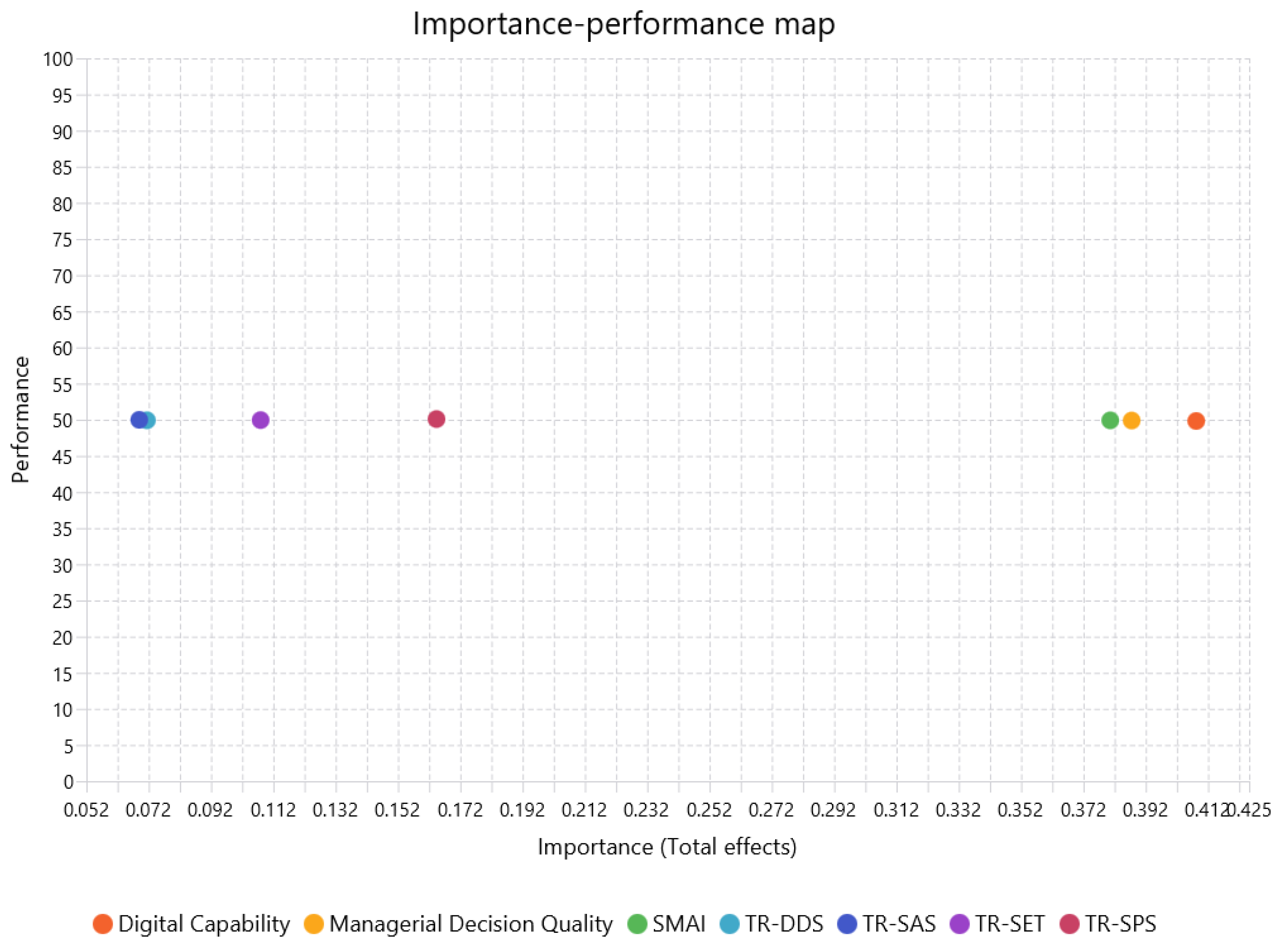

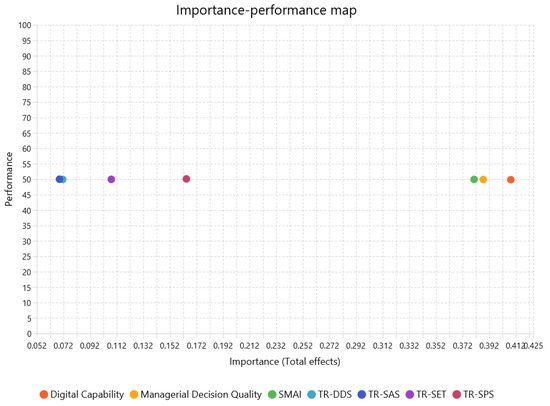

The IPMA analysis, as shown in Table 5, sheds light on the extent to which each construct is related to Sustainable Organizational Performance (SOP) and on how organizations are currently performing in these areas. A critical analysis of the findings reveals a steady trend: the constructs that yield the most significant results receive moderate scores on the performance scale. In contrast, the low-impact ones show slightly higher scores. Accordingly, the reported effects should be interpreted as influencing overall sustainability performance rather than uniformly affecting each underlying performance dimension. Digital Capability (Impact = 0.408, performance = 49.826) is the best driver of SOP, but the performance score is not extremely high. This illustrates a practical gap: although companies recognize the strategic value of digital solutions, artificial intelligence, analytics, and integrated reporting, these capabilities remain underdeveloped and inadequately implemented in practice. This practice of high impact and moderate performance indicates one of the core priorities: investments in digital transformation will yield the greatest returns in terms of sustainability. The same situation applies to Managerial Decision Quality (Impact = 0.387, performance = 49.891) and SMA Integration (Impact = 0.380, performance = 49.912). The impact of both constructs is high but moderate on performance. This implies that although managers use sustainability-related information and reporting systems, the quality, consistency, and depth of sustainability-oriented decision-making still require enhancement. Organizations have the underlying systems, but have not practiced their analytical skills, degree of integration, or even cultural reinforcement to capitalize on sustainability information.

Table 5.

IPMA Analysis.

In comparison, the Technology Readiness dimensions (TR-DDS, TR-SAS, TR-SET, TR-SPS) have extremely low impact scores (0.069–0.164) but higher performance (49.9–50.1). This trend is essential: even though organizations have been evolving moderately well in terms of digital competencies, system support, and technology culture, they do not have a substantial positive impact on the actual pathways through which sustainability performance must evolve. The firms are prepared, but this readiness is not reflected in substantive changes in SMA integration, decision quality, and sustainability outcomes. This also confirms the previous observation that technology preparation is more of a supportive, background role than a revolutionary force that propels sustainability. In general, the IPMA outcomes indicate that the most significant performance benefit will be achieved by enhancing digital capability, SMA integration, and managerial decision quality, rather than prioritizing technology preparedness growth. The analyzed organizations are mature in terms of technology but still lack well-developed digital integration and sustainability-focused decision-making systems. This disequilibrium shows an instrumental discrepancy between technology readiness and efficient digital-enabled sustainability management, as shown in Figure 7.

Figure 7.

IPMA Matrix.

5. Discussion

This study contributes to the sustainability and digital transformation literature by clarifying the mechanism through which digital capability is translated into sustainable organizational performance. Rather than proposing multiple parallel theoretical explanations, the study demonstrates how digital capability operates through the integration of sustainability management accounting and managerial decision quality as internal knowledge-conversion mechanisms, while empirically delimiting the contextual role of technology readiness.

The results of the study strongly support the view expressed in the literature: digital and knowledge-driven capabilities are the key drivers of sustainability, and technology readiness is a secondary supporting factor. Based on the Dynamic Capabilities Theory (DCT), the findings show that companies with high digital capability are better able to sense sustainability opportunities, process complex environmental and social information, and restructure internal processes to improve long-term performance. Similar conclusions are drawn in previous research on AI, analytics, big data, and cloud systems to increase transparency, accuracy, and financial and sustainability reporting [2,25,101]. Nevertheless, the literature also cautions that several companies encounter problems with skills deficits, privacy issues, and resistance to digital transformation [16,60,64]. The existing findings are consistent with both ends of this narrative: digital capability is perceived as impactful, but existing organizational preparedness and capacity limit its physical implementation.

Similarly, the findings confirm the Knowledge-Based View (KBV), which posits that sustainability performance depends on the quality with which organizations perceive, utilize, and implement sustainability-related knowledge in decision-making. The high impact of the SMA integration is based on earlier research findings that Environmental Management Accounting, sustainability KPIs, Triple Bottom Line reporting, and integrated control systems can enhance the environmental and social [6,19,68]. Similarly, strong sustainability indicators are also a determinant of evidence-based decision-making, as studies have found that sustainability models, predictive accuracy, and strategic planning are linked to enhanced ESG performance [21,44,46,102]. However, the literature also points out inherent limitations, including poor decision-making quality, a lack of organizational maturity, and low cultural fit, which prevent many companies from fully utilizing sustainability information [49,103]. These fears are indeed justified by the findings of this work: knowledge processes cannot be relied on by technological tools alone, and sustainability cannot be achieved through managerial judgment alone. A deeper revelation comes about upon considering the aspect of technology readiness. Though technology readiness is recognized as a significant facilitator of sustainability accounting and decision-making in the literature [94,104,105], the results show that the moderating impact is insignificant. This aligns with the TOE view [54], which holds that technology is a single component of a broader socio-organizational process. The findings suggest that even though organizations might have digital infrastructure and a technologically conducive culture, this readiness does not have a significant effect on the connections between digital capability and integration, or between integration and the decision between quality and sustainable performance. This observation confirms previous criticisms that readiness is insufficient without profound integration, data capabilities, and organizational commitment [9,72]. Firms might be technologically prepared, but that readiness has little effect without a powerful decision-making mechanism, effective SMA procedures, and genuine sustainability commitment.

The results of the IPMA process further develop this point of view by showing an incongruity between the effects and actual performance. Theory identifies critical constructs, which include digital capability, SMA integration, and the quality of decisions, that have high strategic impact but moderate performance, implying that these organizations have not exploited these capabilities to the fullest. It aligns with previous studies, indicating a lack of data integration, underdeveloped sustainability cultures, and incomplete managerial application of sustainability metrics [5,20,70,106]. Contrarily, technology readiness scales demonstrate greater performance yet lower influence, which supports the literature’s assumptions and shows that companies that use technological procurement do not transform it into an effective sustainability-related application [86,107,108]. Accordingly, the use of PLS-SEM should be interpreted as a methodological choice aligned with the study’s predictive orientation rather than as an indication that covariance-based SEM would be infeasible for testing the proposed relationships.

These findings should be interpreted within the institutional, regulatory, and technological context of Saudi Arabia’s financial services sector. However, they may offer theoretically informative insights for other knowledge-intensive industries undergoing digital and sustainability transitions. The discussion explains that the organization’s performance can sustainably remain knowledge-driven, but not technology-driven. The basic architecture includes digital capabilities and SMA integration, and the resulting decision quality supports the necessary long-term sustainability. Technology is not a catalyst, but an amplifier. These results combine and expand DCT, KBV, and TOE by demonstrating that sustainability performance is enhanced as digital capabilities and SMA procedures are incorporated into managerial cognition and decision-making, not only when organizations have advanced digital capabilities. For details, refer to Appendix C.

6. Conclusions

This paper shows that the three main factors that determine sustainable organizational performance are high digital capability, sound implementation of sustainable management accounting, and high-quality managerial decision-making. These findings affirm that organizations can achieve improved sustainability outcomes not only by using technology but also by integrating digital tools into accounting frameworks and converting sustainability data into informed managerial interventions. Although technology readiness is a supportive condition, its impact is not very significant, suggesting that readiness alone is not sufficient to be combined with relevant digital integration and knowledge use. The paper demonstrates that sustainability is achieved by combining strategic alignment of digital capabilities, accounting practices, and managerial judgment, and provides practical recommendations for how organizations can go beyond symbolic digitalization and achieve real sustainability impact. However, their close empirical association suggests a high degree of complementarity, consistent with the Knowledge-Based View and explaining the similarity in their estimated path coefficients. Given the sector- and country-specific nature of the sample, the conclusions of this study are not intended to represent universal organizational behavior, but rather to inform theory and practice within similar financial and institutional environments. Accordingly, the theoretical contribution of the DSMA framework lies not in displacing digital capability as the dominant driver of performance, but in clarifying the accounting and decision-making pathways through which digital capability is translated into sustainability outcomes.

Table 6 provides insight about future avenues of research and implication of the study.

Table 6.

Future Research Avenues and Implications of the Study.

Supplementary Materials

The following supporting information can be downloaded at: https://www.mdpi.com/article/10.3390/su18031349/s1.

Author Contributions

A.A.: Conceptualization, Methodology, Formal Analysis, Writing, Investigation, Data Curation, Supervision, Project Administration, Funding Acquisition, Writing, Review and Editing. T.H.: Methodology, Data Curation, Validation, Investigation, Writing, Review, and Editing. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

The study was conducted in accordance with the Declaration of Helsinki, and approved by the Department of Accounting and Finance Ethics Review Committee, College of Business, Jazan University (protocol code JU-CB-AF-ERC-2025-0417 and date of approval 5 August 2025).

Informed Consent Statement

Participation in this study was voluntary. Respondents were informed about the purpose of the research, assured of anonymity and confidentiality, and provided their informed consent before completing the survey.

Data Availability Statement

Data are submitted as a Supplementary File and are available for download.

Conflicts of Interest

The authors declare no conflicts of interest.

Abbreviations

The following abbreviations are used in this manuscript:

| Abbreviation | Full Form |

| AI | Artificial Intelligence |

| AVE | Average Variance Extracted |

| BSC | Balanced Scorecard |

| CSR | Corporate Social Responsibility |

| DC | Digital Capability |

| DCT | Dynamic Capabilities Theory |

| DSMA | Digital-enabled Sustainability Management Accounting |

| EMA | Environmental Management Accounting |

| ESG | Environmental, Social, and Governance |

| f2 | Effect Size (Cohen’s f-square) |

| HTMT | Heterotrait–Monotrait Ratio |

| IPMA | Importance–Performance Map Analysis |

| IT | Information Technology |

| KBV | Knowledge-Based View |

| KPI | Key Performance Indicator |

| MDQ | Managerial Decision Quality |

| NFI | Normed Fit Index |

| PLS-SEM | Partial Least Squares Structural Equation Modeling |

| R2 | Coefficient of Determination |

| SMA | Sustainable Management Accounting |

| SMAI | Sustainable Management Accounting Integration |

| SOP | Sustainable Organizational Performance |

| SRMR | Standardized Root Mean Square Residual |

| TBL | Triple Bottom Line |

| TOE | Technology–Organization–Environment Framework |

| TR | Technology Readiness |

| TR-DDS | Technology Readiness for Decision-Support Systems |

| TR-SAS | Technology Readiness for Sustainability Accounting Systems |

| TR-SET | Technology Readiness for Strategy Execution Technologies |

| TR-SPS | Technology Readiness for Sustainability Performance Systems |

| VIF | Variance Inflation Factor |

Appendix A. Questionnaire

Table A1.

Questionnaire.

Table A1.

Questionnaire.

| Construct | Code | Item Statement |

|---|---|---|

| Digital Capability (DC) | DC1 | Our organization effectively leverages digital technologies (e.g., AI and analytics) to enhance accounting and financial processes. |

| DC2 | Advanced data analytics are widely used to support managerial decision-making. | |

| DC3 | Our organization has access to high-quality and timely digital data for forecasting and risk analysis. | |

| DC4 | The existing IT infrastructure efficiently supports large-scale digital applications. | |

| DC5 | Cloud-based systems enable real-time integration of accounting information. | |

| DC6 | Digital systems improve the transparency and reliability of financial and sustainability reporting. | |

| DC7 | Employees possess the digital skills required to use advanced accounting and reporting systems. | |

| DC8 | The organization continuously invests in upgrading its digital technologies. | |

| Sustainable Management Accounting Integration (SMAI) | SMAI1 | Environmental Management Accounting practices are formally implemented in our organization. |

| SMAI2 | Sustainability KPIs are integrated into budgeting and performance planning. | |

| SMAI3 | Triple Bottom Line considerations guide internal accounting and reporting practices. | |

| SMAI4 | Sustainability information is systematically incorporated into managerial decision-making. | |

| SMAI5 | Our accounting system supports integrated financial and sustainability reporting. | |

| SMAI6 | Managers regularly use sustainability indicators to guide operational decisions. | |

| Managerial Decision Quality (MDQ) | MDQ1 | Managers make decisions based on reliable sustainability-related information. |

| MDQ2 | Forecasting tools enhance the accuracy of sustainability-oriented decisions. | |

| MDQ3 | Real-time digital and sustainability data support strategic planning. | |

| MDQ4 | Managers effectively balance financial and environmental considerations in decisions. | |

| MDQ5 | Digital analytics improve the quality of managerial judgments. | |

| MDQ6 | Decision-making processes in our organization are systematic and evidence-based. | |

| Sustainable Organizational Performance (SOP) | SOP1 | Our organization’s environmental performance has improved over time. |

| SOP2 | Our organization demonstrates strong social responsibility in its operations. | |

| SOP3 | Sustainability initiatives contribute positively to financial performance. | |

| SOP4 | The organization’s sustainability reputation has improved significantly. | |

| SOP5 | Stakeholders trust our organization’s sustainability commitments. | |

| Technology Readiness—Decision Support Systems (TR-DDS) | TRDDS1 | Our digital systems effectively support sustainability-related decision-making. |

| TRDDS2 | Managers have access to real-time digital dashboards for decision support. | |

| TRDDS3 | Digital decision-support tools are reliable and easy to use. | |

| TRDDS4 | Technology enhances the speed of sustainability-related decisions. | |

| TRDDS5 | Our organization encourages the use of digital decision-support systems. | |

| Technology Readiness—Sustainability Accounting Systems (TR-SAS) | TRSAS1 | Technology supports the integration of sustainability accounting practices. |

| TRSAS2 | Accounting systems are compatible with sustainability reporting requirements. | |

| TRSAS3 | Digital tools facilitate accurate measurement of sustainability costs. | |

| TRSAS4 | Employees are trained to use sustainability accounting systems. | |

| TRSAS5 | New sustainability accounting technologies are adopted efficiently. | |

| Technology Readiness—Sustainability Performance Systems (TR-SPS) | TRSPS1 | Digital systems support the monitoring of sustainability performance indicators. |

| TRSPS2 | Technology helps translate sustainability accounting data into performance outcomes. | |

| TRSPS3 | Sustainability performance metrics are tracked and evaluated digitally. | |

| TRSPS4 | Technology improves the implementation of sustainability initiatives. | |

| TRSPS5 | Digital tools amplify the impact of sustainability practices on performance. | |

| Technology Readiness—Strategy Execution Tools (TR-SET) | TRSET1 | Technology helps managers effectively execute sustainability-oriented strategies. |

| TRSET2 | Digital systems support the implementation of strategic sustainability decisions. | |

| TRSET3 | Technology improves coordination during the execution of sustainability strategies. | |

| TRSET4 | Managers use advanced digital tools to implement sustainability plans. | |

| TRSET5 | Technology increases the effectiveness of sustainability-focused managerial decisions. |

Appendix B. Respondents Profile

Table A2.

Respondents profile.

Table A2.

Respondents profile.

| Demographic Variable | Category | Percentage (%) |

|---|---|---|

| Gender | Male | 66.2 |

| Female | 33.8 | |

| Age Group | Below 30 years | 15.2 |

| 31–40 years | 37.6 | |

| 41–50 years | 31.4 | |

| Above 50 years | 15.8 | |

| Highest Education Level | Bachelor’s degree | 37.1 |

| Master’s degree | 47.9 | |

| Doctorate/Professional qualification | 15 | |

| Job Position | Finance/Accounting Managers | 32.9 |

| Sustainability/ESG Officers | 20.5 | |

| IT/Digital Systems Managers | 22.4 | |

| Senior/Strategic Management | 24.2 | |

| Years of Experience | Less than 5 years | 17.1 |

| 5–10 years | 43.8 | |

| More than 10 years | 39.1 | |

| Type of Organization | Banking | 40 |

| Insurance | 22.4 | |

| FinTech | 18.1 | |

| Investment/Financial Services | 19.5 | |

| Organization Size | Small/Medium | 38.6 |

| Large | 61.4 | |

| Country/Region | Saudi Arabia | 100 |

Appendix C. Total Effect

Table A3.

Total Effect.

Table A3.

Total Effect.

| Paths | Original Sample (O) | Sample Mean (M) | Standard Deviation (STDEV) | T Statistics (|O/STDEV|) | p Values |

|---|---|---|---|---|---|

| Digital Capability > Managerial Decision Quality | 0.530 | 0.530 | 0.027 | 19.338 | 0.000 |

| Digital Capability > SMAI | 0.533 | 0.534 | 0.026 | 20.126 | 0.000 |