Abstract

Physical climate risks significantly raise financing costs for China’s local government debt, with compound extremes posing a particularly severe threat. Analyzing 19,761 Local Government Financing Vehicle (LGFV) bonds from 2014 to 2023, this study uses extreme temperature and precipitation days to proxy for climate risk. Results show that the individual risks and the compound risk comprised of the two significantly increase bond issuance spreads. Crucially, the economic impact is dramatically amplified when risks compound, as with “heavy rainfall accompanied by extreme heat”, reflecting investor pricing of non-linear climate impacts. For a typical bond, a 1% increase in extreme temperature days raises interest costs by approximately CNY 6840. These conclusions withstand a series of robustness checks, including the reconstruction of climate threats using a regional exposure index. Mechanism tests confirm that heightened local fiscal risks and deteriorating debt sustainability are key transmission channels. The study underscores the urgent need to integrate physical climate risk into public financial management to safeguard sustainable development.

1. Introduction

Climate change is no longer a future threat but a present crisis, with extreme weather events, such as the 2022 Yangtze River Basin drought that caused CNY 50 billion in direct economic losses, which are inflicting severe damage and raising financial risks [,]. The World Economic Forum’s (WEF) Global Risks Report 2025 [] identifies climate and environmental risks as top long-term threats, and financial authorities worldwide, including the People’s Bank of China, have integrated climate analysis into their regulatory frameworks []. While financial markets have begun pricing these physical climate risks into sovereign and corporate debt, a critical gap remains in understanding their impact on sub-sovereign public finance, particularly through the channel of compound extreme events. This study investigates how compound physical climate risks, particularly those arising from the interaction of extreme temperature and precipitation, affect the financing costs of China’s Local Government Financing Vehicle (LGFV) bonds.

Existing research has established that climate risks can elevate municipal bond yields. International studies primarily examine the relationship between climate risks and municipal bonds. Painter [] pioneered this field, demonstrating that regions exposed to sea-level rise face significantly higher underwriting fees and yields for long-term municipal bonds, though short-term bonds show no significant climate risk premium. Chen and Chu [] found that climate risks exacerbate fiscal imbalances and increase default probabilities for local governments. Acharya et al. [] revealed that heat stress raises municipal bond credit spreads by increasing energy costs and reducing labor productivity in high-risk sectors, with lower-rated, longer-term, and revenue-dependent bonds being more sensitive. Goldsmith-Pinkham et al. [] showed that sea-level rise elevates credit spreads, particularly for long-term bonds, reflecting pricing of future climate uncertainty and imposing economic costs on exposed governments.

In China, research on climate risks and local government financing costs primarily focuses on LGFV bonds, a unique financing instrument heavily reliant on land revenue and implicit government guarantees. Recent years have seen rapid LGFV bond expansion alongside lingering concerns over implicit debt risks. Climate change may further elevate financing costs by damaging infrastructure and increasing maintenance expenditures. For instance, Guo et al. [] found that both physical and transition climate risks raise LGFV bond issuance costs. Zhang et al. [] constructed a climate risk index using principal component analysis (PCA) and linked its increase to wider LGFV bond spreads, particularly in regions with stringent environmental regulations, high climate risk awareness, or advanced green finance development. Focusing on specific risks, Song and Wang [] identified that each additional day above 32 °C raises LGFV bond spreads by 2.48 basis points, attributing this to production losses and fiscal deficits. Gu and Qiu [] examined drought risks, showing they increase credit spreads and yields by heightening investor climate concerns and fiscal pressures, especially in agriculturally intensive or less-developed regions.

Despite establishing a “physical–transition” dual-risk framework, the existing literature has three limitations: First, conceptual oversimplification, often equating climate risks with single hazard types. Second, fragmented analyses focus on isolated hazards like sea-level rise or extreme heat, as exemplified by Song and Wang [], whose study exclusively focused on extreme heat, and Gu and Qiu [], in their examination of drought as a single factor. While these studies have significantly advanced our understanding of individual climate hazards, their isolated approaches inherently overlook the non-linear impacts arising from compound extreme events, particularly the critical interaction between extreme precipitation and temperature. Third, a mechanistic disconnection persists; there is a lack of systematic examination of how compound climate shocks, such as the synergistic interaction between extreme precipitation and temperature, transmit their impacts.

Our research addresses this gap by pioneering an explicit focus on compound physical climate risks in public finance. Based on a comprehensive sample of 19,761 LGFV bonds from 2014 to 2023, we demonstrate that the financing cost impact of compound extremes is significantly greater than the sum of their individual parts. We further elucidate the underlying mechanisms, namely, heightened local fiscal risk and deteriorating debt sustainability, and explore critical heterogeneity. We find that bonds with shorter terms, lower credit ratings, and those issued in China’s eastern region are more sensitive. By quantifying this “climate–fiscal–financial” nexus within China’s distinctive institutional context, our findings offer a granular, large-scale empirical template. This provides crucial insights not only for Chinese policymakers but also for municipalities and national governments globally grappling with the urgent task of financing climate-resilient infrastructure.

2. Theoretical Analysis and Hypotheses

Consistent with risk premium theory, the pricing of financial assets reflects not only the discounted value of future cash flows but also incorporates additional compensation above the risk-free rate to account for investor exposure to uncertainty and risk, a premium typically manifested in elevated risk spreads. As a non-diversifiable systemic risk factor, physical climate risks represent an inescapable threat to the broader economic system. The rising frequency and severity of extreme weather events directly undermine regional economic stability while amplifying market apprehensions regarding local governments’ debt servicing capacity.

For LGFV bonds, whose creditworthiness hinges crucially on local fiscal credibility, heightened exposure to physical climate risks within a jurisdiction elevates investors’ perceived uncertainty about issuers’ repayment capacity, thereby increasing implied default probabilities. Ji et al. [] demonstrate that these bonds (primarily financing infrastructure and public utilities) embed climate risks directly into their credit spreads: intensified extreme weather raises default expectations, compelling investors to demand higher risk premiums. Crucially, even absent actual defaults, risk-averse investors systematically require elevated expected returns to offset potential losses, translating into wider issuance spreads between bond yields and risk-free rates and an effective increase in financing costs. In other words, climate risk heightens market sensitivity to local government credit risk. Even a slight change in the probability of future losses may trigger an upward adjustment in risk premium requirements, thereby increasing financing pressure on debt issuers. Furthermore, the compound risk impacts formed by different types of extreme weather events, characterized by their concurrent, cascading, and systemic destructive features, exert multidimensional erosion on the repayment foundation of LGFV bonds. Simultaneously, through the “expectation channel” that severely deteriorates the information environment and reinforces long-term recession expectations, they profoundly undermine market confidence. Collectively, these effects drive a surge in risk premiums, ultimately leading to a substantial widening of LGFV bond issuance spreads. Accordingly, this paper proposes the following hypotheses:

H1a.

An increase in physical climate risk leads to higher financing costs of LGFV bonds in the affected region.

H1b.

Compound risks will produce a synergistic effect, significantly amplifying the impact of individual climate risks on the financing costs of LGFV bonds.

In public finance theory, escalating climate risks pose dual fiscal pressures on local governments, creating a precarious asymmetry between revenue and expenditure dynamics. On the expenditure front, heightened frequency and intensity of extreme weather events compel governments to allocate substantial resources to post-disaster reconstruction, infrastructure reinforcement, and enhancement of public services (e.g., healthcare, emergency response, and social protection), thereby inflating fiscal outlays. Conversely, on the revenue side, climate risks erode the tax base by suppressing corporate productivity, disrupting supply chains, and dampening regional economic vitality, resulting in diminished fiscal inflows. This “rigid expenditure growth versus elastic revenue contraction” imbalance exacerbates fiscal deficits and budgetary strain, necessitating delicate policy trade-offs between risk mitigation and resource allocation to preserve fiscal sustainability. Stroebel and Wurgler [] found that physical climate risks caused by extreme weather events can directly lead to economic losses for regional businesses, such as infrastructure damage, supply chain disruptions, and productivity declines. This damage poses significant challenges to urban development and creates unavoidable fiscal pressures for governments. Bachner and Bednar-Friedl [] concluded that extreme climate events can also disrupt production processes, reducing aggregate output and tax revenues, thereby further straining local government finances.

Existing research also confirms that local fiscal risks influence LGFV bond financing costs. Zhong and Lu [] found that an increase in per capita central government fiscal transfers leads to higher LGFV bond issuance by local financing platforms, suggesting that stronger fiscal capacity provides a solid foundation for LGFV bond issuance. Additionally, Zhong et al. [] argue that local fiscal revenue levels are a factor in the “implicit guarantee” of LGFV bonds. The higher the fiscal risk of a local government, the lower investors’ expectations of its ability and willingness to bail out LGFVs, leading to increased default risk expectations for LGFV bonds. Accordingly, this paper proposes the following hypothesis:

H2.

Physical climate risk directly increases fiscal pressure on the government, thereby amplifying the default risk of LGFV bonds, which in turn translates into higher financing costs for these bonds.

According to fiscal decentralization theory, local governments enjoy a degree of fiscal autonomy but are also constrained by central government macro-control and legal regulations. For instance, Article 35 of China’s new Budget Law explicitly requires local budgets to “balance revenues and expenditures” and prohibits deficits, allowing local governments to issue bonds only within limits approved by the State Council and strictly for public welfare capital expenditures. This demonstrates tight constraints on local government debt behavior.

However, as climate risks intensify, frequent extreme weather events and natural disasters accelerate infrastructure aging, damage, and renewal needs, forcing local governments to increase spending on disaster prevention and public construction. In such cases, conventional budget revenues are often insufficient to cover surging expenditures, leaving most local governments reliant on bond issuance to ensure liquidity for emergency spending and basic public services.

While bond financing can temporarily alleviate fiscal pressure, it leads to accumulating government debt, gradually increasing the debt burden. Over time, debt levels may exceed repayment capacity, adversely affecting fiscal sustainability and creditworthiness in the long run. Liu et al. [] analyzed the relationship between regional implicit debt levels and LGFV bond spreads by constructing a local government implicit debt burden ratio indicator. Their study found that regions with heavier implicit debt burdens typically require higher risk premiums for LGFV bond issuance. Thus, government debt financing burdens can widen LGFV bond spreads by increasing default risks. Accordingly, this paper proposes the following hypothesis:

H3.

Physical climate risks elevate regional governments’ debt financing burdens, which in turn increases LGFV bond financing costs.

These theoretical mechanisms may exhibit heterogeneity across different bond types and regions. The empirical analysis of these heterogeneous characteristics will be discussed in detail in Section 4.4.

3. Empirical Design

3.1. Sample and Data

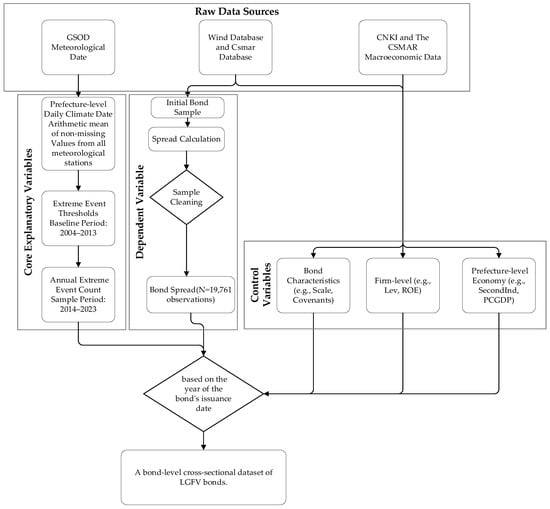

This study constructs an unbalanced panel dataset of Chinese LGFV bonds issued from 2014 to 2023 and applies the following sample-cleaning steps. First, because green bonds are earmarked for climate-adaptation projects and would therefore understate the adverse impact of climate risk on conventional bonds, all green bonds issued during the sample period are excluded. Second, the spreads of bonds with maturities of less than one year are driven mainly by liquidity premia and short-term market fluctuations rather than by climate risk, so these short-term bonds are also dropped. Third, to mitigate the influence of outliers and missing observations on the regression results, we discard any bond with missing variables and winsorize all continuous variables at the 1st and 99th percentiles. The final processed dataset consists of 19,761 LGFV bond observations across 272 prefecture-level cities from 2014 to 2023. The bond data, including issuance details and yield spreads, as well as ChinaBond Treasury yield curves and LGFV financial statements, are sourced from the Wind Database. Daily extreme temperature and precipitation records are obtained from the Global Surface Summary of the Day (GSOD) meteorological dataset, while prefecture-level city macroeconomic indicators are compiled from the China City Statistical Yearbook (CNKI Database) and the CSMAR Database. Detailed procedures for data collection and processing are provided in Appendix A.1 and Appendix B.1.

3.2. Variable Definitions and Descriptions

This paper adopts the issuance spread (Spread) of LGFV bonds as the dependent variable in empirical analysis, serving as a proxy for their financing cost. Following methodologies established by Chen et al. [] and Qiu et al. [], we address practical constraints in obtaining perfectly matched treasury bond yields with identical maturities and issuance timestamps through linear interpolation to derive corresponding treasury rates. The issuance spread is calculated as the difference between the LGFV bonds’ yield-to-maturity at issuance and the interpolated ChinaBond Treasury yield with equivalent maturity. For robustness checks, we implement the approach of Liang et al. [] by adopting the 5-year ChinaBond Treasury yield as a benchmark rate to recompute LGFV bond spreads.

This study selects extreme temperature (Extre_temp) and extreme precipitation (Extre_precip) at the prefecture level as core explanatory variables to represent physical climate risks, following the methodologies of Pan et al. [] and Ren et al. [], considering both the representativeness of climate physical risks and data availability. Furthermore, this study introduces an interaction term between the two to measure the compound impact (Comp_Risk) of extreme temperature and extreme precipitation. Taking extreme temperature as an example, the calculation method involves extracting daily temperature data for Chinese cities from GSOD for the period 2004–2023. To elaborate, in order to construct a climate data sample at the prefecture-level city level, we calculated the average of non-null values from all meteorological stations within each prefecture-level city using the data collected by GSOD. The baseline climate period is defined as 2004–2013, during which the extreme high and low temperatures for the same calendar date across different years are sorted in ascending order, with the 90th percentile and 10th percentile values set as the extreme high-temperature and low-temperature thresholds, respectively. The sample climate period is defined as 2014–2023. For each day during this period, if the temperature exceeds the high-temperature threshold or falls below the low-temperature threshold established during the baseline period, it is counted as an extreme temperature day. The annual count of extreme temperature days for each prefecture-level city is then aggregated. Similarly, for extreme precipitation, daily precipitation data for the same calendar date across different years during the baseline period are sorted, and the 99th percentile 10-year average is set as the extreme precipitation threshold. Days in the sample period with precipitation exceeding this threshold are counted as extreme precipitation days, and the annual count for each prefecture-level city is aggregated.

Following Guo et al. [] and Zhang et al. [], control variables are selected at three levels: bond, firm, and prefecture. Bond-level controls include issuance size (Scale), special covenants (Covenants), and guarantee status (Guarantee). Firm-level controls include leverage ratio (Lev), return on equity (ROE), and total asset turnover (Turnover). Prefecture-level controls include GDP growth (Growth), industrial structure (SecondInd), and per capita GDP (PCGDP).

This study examines the mechanism through which local fiscal risks and debt financing burdens influence the impact of physical climate risks on LGFV bond financing costs. Drawing on the research of Huang and Mao [], the fiscal deficit ratio (Deficit) is selected as a mediating variable to represent local fiscal risks. Following Rao et al. [] and Huang et al. [], local government debt scale (Debt) is selected as a mediating variable to represent local debt financing burdens. Detailed variable definitions are provided in Table 1.

Table 1.

Variable descriptions.

3.3. Empirical Model

This study employs a two-way fixed-effects regression model with robust standard errors to examine the impact of physical climate risks on the financing costs of LGFV bonds, incorporating both province and year fixed effects. In the model, denotes the issuance spread of bond i issued by LGFV company n in city c during year t; represents extreme temperature in city c during year t; denotes extreme precipitation days in city c during year t; stands for control variables at the bond, firm, and city levels; and denote province fixed effects and year fixed effects, respectively; and is the stochastic error term. The baseline empirical model is specified as follows:

where

3.4. Descriptive Statistics

Table 2 presents the descriptive statistics of key variables in this study. The issuance spread (Spread) of LGFV bonds shows a mean value of 2.494%, with minimum and maximum values of 0.580% and 5.289%, respectively, indicating significant spatial variation in risk premiums across different regions. Both extreme temperature (Extre_temp) and extreme precipitation (Extre_precip) demonstrate notable heterogeneity in climate risk exposure among cities, as evidenced by their respective mean, minimum, and maximum values.

Table 2.

Descriptive statistics of main variables.

Among bond-level characteristics, the issuance size (Scale) spans 3.219 log-points from its minimum to its maximum, implying marked regional divergence in debt-issuance behavior. The mean value of 0.696 for bond covenants (Covenants) indicates that approximately 70% of bonds incorporate risk-mitigation clauses, while the low guarantee ratio (Guarantee) of 0.198 reveals insufficient credit enhancement measures in the LGFV bond market. Financial indicators show that the sample LGFVs maintain an average leverage ratio (Lev) of 56.83% with a polarized distribution and a meager mean ROE of 1.89% with significant left-skewness, confirming the dual challenges of weak profitability and excessive debt burdens common among these entities.

At the macroeconomic level, the median secondary industry share (SecondInd) of 40.59% exceeds its mean value, reflecting the industrial-dominant economic structure in over half of the sampled cities. Mediating variables reveal concerning fiscal conditions: the average fiscal deficit ratio (Deficit) reaches 6.66% with observed peaks at 59.85%, while the debt ratio (Debt) averages 56.36% but exceeds 200% in some regions, highlighting severe fiscal imbalances in certain localities. These control variables collectively demonstrate substantial variations in issuance scales, credit enhancement practices, and local government debt situations across different LGFV bonds, consistent with China’s characteristic regional economic disparities.

4. Empirical Analysis

4.1. Regression Results

The baseline regression results for the number of extreme temperature days and extreme precipitation days in relation to the issuance spread of LGFV bonds are presented in Table 3 below. The core explanatory variable in Columns (1) and (2) is the number of extreme temperature days, while that in Columns (3) and (4) is the number of extreme precipitation days. The core explanatory variable in Columns (5) and (6) is the interaction term (Comp_Risk) between the number of extreme temperature days and the number of extreme precipitation days. Additionally, Columns (1), (3), and (5) present the regression results with only the core variables included, while Columns (2), (4), and (6) show the regression results after incorporating control variables at three levels: bond, company, and prefecture-level city.

Table 3.

The impact of climate risks on LGFV bond spreads: from single to compound risks.

The results show that regardless of whether a series of control variables are incorporated into the regression or not, the regression coefficients of the number of extreme temperature days or extreme precipitation days on the issuance spread of LGFV bonds are all significant at the 1% significance level. Moreover, after incorporating the control variables, the R-squared increases significantly. These results show that for every 1% increase in the number of extreme temperature days, the issuance spread of LGFV bonds rises by 0.228 bp; for every 1% increase in the number of extreme precipitation days, the issuance spread increases by 0.126 bp. To quantify the economic significance of these effects, we estimate the additional interest costs for a typical LGFV bond with the median issuance size of CNY 600 million and a 5-year maturity. A 1% increase in extreme temperature days generates approximately CNY 6840 in additional interest costs, while a similar increase in extreme precipitation days adds about CNY 3780 in costs. The rise in physical climate risks leads investors to demand a higher risk premium for LGFV bonds, i.e., an increase in the financing cost of LGFV bonds. Therefore, Hypothesis H1a is verified.

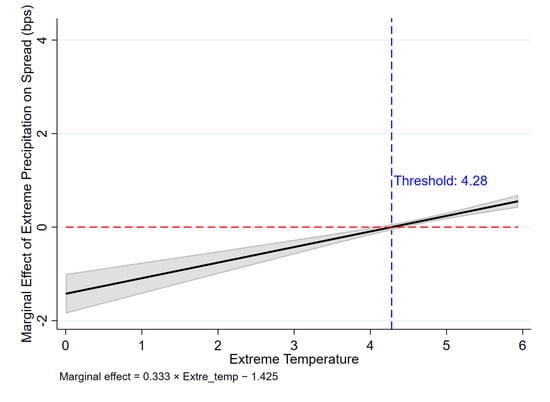

The coefficient of the interaction term (Comp_Risk) is significantly positive at the 1% significance level. This suggests that when the two extreme climate events occur simultaneously, their negative impact on the issuance cost of LGFV bonds is far greater than the sum of their independent effects. The synergistic effect (coefficient of 0.333 bp) further adds approximately CNY 9990 in costs for the median bond issuance. Furthermore, an analysis of the marginal effect of extreme precipitation on spreads (see Appendix B.2 for details) reveals that extreme precipitation only increases the issuance cost after the number of extreme temperature days reaches a certain threshold. This reflects that investors are not particularly concerned about “rain during cool weather”; instead, the type of compound extreme event that is more likely to cause anxiety and prompt them to demand a high-risk premium is “heavy rainfall accompanied by extreme heat”. Heavy rainfall following extreme high temperatures is more prone to triggering floods; the alternation of hot droughts and heavy rains is extremely destructive to agriculture and infrastructure, and can cause the most catastrophic, non-linear physical damage and operational disruptions. The above results verify Hypothesis H1b. Additionally, the control variables generally demonstrate expected effects on bond issuance spreads.

4.2. Endogeneity Treatment

Although the baseline regressions already include controls for variables likely to confound the link between physical climate risk and the cost of LGFV bonds, as well as two-way fixed effects at the province and year levels, unobserved factors may still correlate with the regressors, extreme temperature or extreme precipitation, and the error term, giving rise to endogeneity. Instrumental variable (IV) estimation is a standard remedy: by introducing instruments that are correlated with the endogenous variables but orthogonal to the error term, the exogenous variation in the regressors can be isolated, yielding consistent and more accurate estimates. We therefore adopt this strategy.

For extreme temperature, following Auffhammer and Mansur [], we use the natural logarithm of altitude (Altitude) as an instrument. High-altitude regions are systematically cooler, satisfying the relevance condition, while altitude is plausibly exogenous to bond characteristics or regional development, satisfying the exclusion restriction.

For extreme precipitation, we use the ten-year mean annual precipitation (MAP_10y) of each city. According to the IPCC (2021) report Climate Change 2021: The Physical Science Basis [], areas with higher long-run annual precipitation experience more active hydrological cycles and, consequently, a greater likelihood of extreme rainfall events. Mean annual precipitation is largely determined by atmospheric circulation and topography and can thus be treated as exogenous.

Table 4 presents the test results of the IV method. Columns (1) and (2) show the regression results obtained using altitude (Altitude) as the instrumental variable. The regression coefficient of altitude on the number of extreme temperature days in the first stage is significant at the 1% level, indicating that the relevance requirement is satisfied. In the second-stage regression, the positive effect of the number of extreme temperature days on the issuance spread of LGFV bonds is also significant at the 1% level.

Table 4.

Instrumental variable (IV) regression results.

Consistent with the test results in the first two columns, Columns (3) and (4) report the regression results obtained using the 10-year average precipitation (MAP_10y) of prefecture-level cities as the instrumental variable. The regression coefficient of the 10-year average precipitation on the number of extreme precipitation days in the first stage is significant at the 1% level, meeting the relevance requirement. The coefficient of the number of extreme precipitation days on the issuance spread of LGFV bonds in the second stage is also significant.

Additionally, referring to the method proposed by Ebbes et al. [], the instrumental variable for the interaction term of endogenous variables is constructed by taking the interaction (Comp_IV) of the instrumental variables corresponding to the endogenous variables. Columns (5) and (6) present the regression results using the interaction term of the instrumental variables, altitude (Altitude) and the 10-year average precipitation (MAP_10y) of prefecture-level cities. Here, we report only the first-stage results for the compound risk; the complete two-stage regression outputs are provided in Appendix A.3. The regression coefficient of the interaction term of instrumental variables on compound risk (Comp_Risk) in the first stage is significant at the 1% level, satisfying the relevance requirement. In the second-stage regression, compound risk (Comp_Risk) still shows a significantly positive effect on the issuance spread of LGFV bonds at the 1% level.

The above results indicate that even after considering potential omitted variables and endogeneity issues, physical climate risks still have a significant impact on the financing costs of LGFV bonds. Specifically, the increase in physical climate risks will make investors demand higher risk premiums, thereby leading to an increase in the financing costs of LGFV bonds. This result further verifies Hypothesis H1.

Furthermore, to ensure the exogeneity of the instrumental variable for extreme precipitation days, this study additionally selects the global annual El Niño index as an instrumental variable for this variable. The ENSO (El Niño–Southern Oscillation) phenomenon is widely recognized as one of the primary climatic forces that drive significant changes in global extreme precipitation patterns. Through large-scale ocean–atmosphere interactions, it exogenously influences the probability and intensity of extreme precipitation events in China; this ensures a strong correlation between the instrumental variable and the endogenous variable. Specifically, we introduce an El Niño-based instrument following Wang [], where the El Niño index interacts with firm geographic coordinates: Nino_index = (Longitude/Latitude) × Nino/1000, and Nino represents the annualized weighted El Niño index (NinoZ), which is calculated as the area-weighted average of the Nino1 + 2, Nino3, and Nino4 indices corresponding to their respective three oceanic regions (referring to the National Climate Centre (NCC): https://cmdp.ncc-cma.net/pred/cn_enso.php?product=cn_enso_nino_indices (accessed on 10 March 2025)). For the detailed methodology, please refer to Appendix A.1. Detailed regression results using this alternative instrument are presented in Appendix A.4 and Appendix A.5, where the positive effect of extreme precipitation and compound risk on bond spreads remains statistically significant, further supporting the robustness of our findings.

4.3. Robustness Checks

4.3.1. Redefining the Baseline Period for Extreme Temperature and Extreme Precipitation

In the main specification we use a 10-year rolling window to calculate extreme thresholds, partly because the meteorological series for some cities are short. However, global warming has accelerated climate change, so thresholds calculated over 2004–2013 may understate actual climate risk. To ensure that the choice of baseline does not mask climate signals, we redefine the baseline period as 1994–2013 and recompute the numbers of extreme temperature and extreme precipitation days accordingly.

Table 5 presents the regression results for the recalculated extreme temperature (Extre_temp1) and extreme precipitation days (Extre_precip1) and their derived compound risks, all of which exhibit statistically significant coefficients at the 1% level, which confirms that the effect of physical climate risks in terms of increasing the financing costs of LGFV bonds is robust.

Table 5.

Robustness check: alternative measures of extreme weather variables.

4.3.2. Alternative Measure of Issuance Spread

This study conducts robustness checks by adopting an alternative measure of issuance spreads, where the yield-to-maturity of LGFV bonds at issuance is recalculated against the contemporaneous 5-year ChinaBond Treasury yield. This approach follows Wang and Gao’s [] methodology, which demonstrates that the average duration of corporate bonds approximates five years. Using 5-year Treasury yields better captures risk premiums associated with long-term economic expectations while mitigating distortions from short-term market volatility. Table 6 presents regression results for extreme temperature and precipitation days against the redefined spread measure (Spread1). The coefficients of core explanatory variables remain statistically significant at the 1% level, reaffirming both the explanatory power of baseline results and the robustness of our primary conclusions.

Table 6.

Robustness check: alternative measure of bond issuance spread.

4.3.3. Excluding Regions with Atypical Temperature Characteristics

Because climatic conditions differ markedly across China, we re-estimate the model after dropping regions whose extreme temperature events rarely translate into material damages. For example, extreme heat in the northeast and on the Tibetan Plateau, or extreme cold in parts of the South, seldom disrupt local economic activity or infrastructure. Following Pan et al. [], we therefore exclude Guangdong, Guangxi, Hainan, Heilongjiang, Jilin, Liaoning, Tibet, Qinghai, Yunnan, and Guizhou from the sample to reduce noise. Table 7 presents regression results after excluding these special cases. The coefficients of core climate variables remain statistically significant at the 1% level, robustly confirming that physical climate risks elevate LGFV bond financing costs.

Table 7.

Robustness check: excluding regions with atypical temperature.

4.3.4. Incorporating Risk Exposure Index

To further verify the robustness of the baseline results, this study uses the entropy method to construct a comprehensive physical climate risk exposure index (Score) at the prefecture-level city, which includes three dimensions: population exposure, economic and asset exposure, and agricultural and production exposure. See Appendix A.2 for detailed indicator definitions and data sources. This index is then interacted with the number of extreme temperature days, the number of extreme precipitation days, and the compound risk variable to form more precise core variables of physical climate risk: Temp_Risk, Precip_Risk, and Comp_Risk3. These variables allow for a more accurate assessment of the impacts caused by regional physical climate risks. The specific model construction is as follows:

where

Table 8 presents the regression results after variable reconstruction. After incorporating the regional physical climate risk exposure index, the impact of physical climate risks, Temp_Risk and Precip_Risk, and compound risk, Comp_Risk3, on the financing costs of LGFV bonds still remains positively significant. Furthermore, the higher the level of regional physical climate risk exposure, the greater the negative impact caused by extreme climates.

Table 8.

Robustness check: incorporating risk exposure index into core variables.

4.3.5. Additional Robustness Tests

We provide further robustness checks in the online Appendix A, including (1) constructing the compound risk variable using different pre-issuance windows (60, 90, and 180 days) (see Appendix A.6); (2) controlling for province × year fixed effects and issuer fixed effects (see Appendix A.7); and (3) employing two-way clustered standard errors at the province and year levels (see Appendix A.7). All these tests support our core findings.

4.4. Heterogeneity Analysis

4.4.1. Maturity-Based Heterogeneity

This study examines the heterogeneous impact of physical climate risks on the issuance spreads of LGFV bonds by distinguishing between bond tenures (short-term vs. long-term). Considering the issuance structure of China’s bond market and the maturity distribution characteristics of the sample, the 3-year tenure is chosen as the cutoff point for the heterogeneity analysis of bond tenures.

As shown in Table 9, Columns (1) and (2) present the results of grouped regressions for extreme temperature, while Columns (3) and (4) report those for extreme precipitation. For short-term bonds, the coefficients of both extreme temperature days and extreme precipitation days are significant at the 1% level; for long-term bonds, however, the coefficient of extreme temperature is insignificant, and although the coefficient of extreme precipitation remains significant, its magnitude decreases to 0.071. The results in Columns (5) and (6) indicate that short-term bonds are also more sensitive to compound risk compared to long-term bonds.

Table 9.

Heterogeneity analysis by bond maturity.

These findings suggest that the positive effect of physical climate risks on the financing costs of LGFV bonds exhibits significant tenure heterogeneity, with short-term bonds being significantly more sensitive to physical climate risks than long-term bonds. This result may arise because investors in short-term bonds pay more attention to short-term cash flow fluctuations and default risks induced by physical climate risks, whereas long-term bonds may absorb part of the risks through term premiums, or because investors have lower pricing sensitivity to the immediate default risks of long-term bonds, leading to a reduced marginal impact of physical climate risks.

4.4.2. Credit-Rating-Based Heterogeneity

This study further conducts a heterogeneity test based on the issuer’s credit ratings. International rating agencies typically regard AA and above as high ratings. Considering the comparability of the divided samples, AA+ is used as the cutoff for classifying issuer credit ratings.

As shown in Table 10, Columns (1) and (2) present the grouped regression results for extreme temperature, while Columns (3) and (4) show those for extreme precipitation. Columns (5) and (6) report the grouped regression results for compound risk. In the low-rated sample, the coefficients of both extreme temperature and extreme precipitation are significant at the 1% level. In the high-rated sample, the coefficient of extreme temperature decreases to 0.048 and becomes insignificant; although the coefficient of extreme precipitation remains significant, its magnitude reduces to 0.123; and the impact of compound risk also relatively decreases.

Table 10.

Heterogeneity analysis by issuer credit rating.

The regression results indicate that the impact of physical climate risks on the financing costs of LGFV bonds exhibits a significant rating stratification effect, with low-rated bonds being significantly more sensitive to physical climate risks than high-rated bonds. A possible reason is that enterprises with low credit ratings, due to weaker financial resilience and insufficient risk buffer capacity, are more vulnerable to the marginal impact of climate shocks. In contrast, enterprises with high credit ratings can effectively mitigate the negative impact of physical climate risks through their robust debt-servicing capacity and risk management mechanisms.

4.4.3. Region-Based Heterogeneity

Finally, we assess whether the pricing effect of climate risk on bond spreads differs across regions. Following Liu and Wakasi [], and aiming to keep subsamples reasonably balanced, we adopt the National Bureau of Statistics’ definition of eastern, central, and western regions to divide the sample into eastern and central–western groups. As shown in Table 11, Columns (1) and (2) present the grouped regression results for extreme temperature, Columns (3) and (4) present the results for extreme precipitation, and Columns (5) and (6) present the results for compound risk.

Table 11.

Heterogeneity analysis by geographic region.

The regression results indicate that the pricing effect of physical climate risks exhibits significant regional divergence, with LGFV bonds in eastern China being far more sensitive to physical climate risks than those in central and western regions. In the eastern region sample, the coefficients of extreme temperature, extreme precipitation, and compound risk are all significant at the 1% level. In the central and western regions sample, the coefficient of extreme temperature decreases to 0.171 and is only significant at the 5% level, while the coefficients of extreme precipitation and compound risk are insignificant.

This suggests that the amplifying effect of physical climate risks on the financing costs of LGFV bonds is more pronounced in eastern China, whereas central and western regions are constrained by differences in regional economic structures and asymmetry in climate-adaptation capacities.

5. Further Investigation

Building on the theoretical discussion, our analysis suggests that physical climate risk influences the financing cost of LGFV bonds primarily through two channels: local fiscal risk and the burden of local government debt financing. To test these hypotheses empirically, this study adopts the mediation effect analysis framework proposed by Imai et al. [] and employs the non-parametric bootstrap method (with 1000 replications) to estimate the indirect effects of extreme temperatures, extreme precipitation, and their compound risk on the financing costs of LGFV bonds through the channels of fiscal risk and debt burden. The model is specified as follows:

where the risk variables include physical climate risks (Extre_temp and Extre_precip) and the compound risk (Comp_Risk) formed by their interaction term; measures the effect of climate risk on the mediator variable; represents the effect of the mediator variable on bond issuance spreads after controlling for climate risk; is the direct effect of climate risk on bond issuance spreads after controlling for the mediator variable; and is the indirect effect, representing the pathway through which climate risk affects bond issuance spreads via the mediator variable, M.

5.1. Local Fiscal Risk Transmission Channel

The local fiscal risk channel takes the “local fiscal deficit ratio” as the mediating variable. The transmission effects of the three types of climate risks are presented in the section “A. Via Fiscal Deficit Channel” in Table 12. A key characteristic of this channel is that the coefficient is stable around 0.045 across all models, meaning that a 1% increase in the local fiscal deficit ratio leads to a 0.045% increase in bond spreads, reflecting the consistent sensitivity of the market to local fiscal risks.

Table 12.

Decomposition of mediation effects: transmission through fiscal and debt channels.

Starting with extreme precipitation, the coefficient of 0.266 reveals that a 1% increase in actual extreme precipitation days raises the local fiscal deficit ratio by 0.266 bp. This reflects how disaster-induced spending hikes and revenue declines worsen fiscal health. The indirect fiscal effect, 0.012, accounts for only 9.426% of the total effect, and 0.126 indicates that the fiscal deficit channel is an important transmission mechanism. The direct effect, = 0.114, dominates at 90.57%; the market may primarily price precipitation risks through other paths, such as direct asset losses or fluctuations in economic output, rather than relying solely on fiscal deterioration as the transmission channel.

Compound risk, measured as the logarithmic interaction of extreme temperature and precipitation, exhibits a far stronger fiscal impact, with an coefficient of 1.846. This indicates that compound risk still exhibits a synergistic effect in increasing the fiscal deficit, a non-linear amplification driven by cascading disaster effects that exceed the sum of individual risk impacts. This robust fiscal sensitivity translates to a more impactful indirect effect, 0.082, which explains 24.54% of the total effect, 0.333, more than double that of extreme precipitation, confirming the fiscal channel as the primary transmission path for compound risk.

Extreme temperature presents a counterintuitive fiscal pattern, with an coefficient of −1.023. Specifically, a 1% increase in the number of actual extreme temperature days results in a 1.023 bp decrease in the local fiscal deficit ratio, likely due to adaptive policies or economic adjustments. This translates to a negative indirect effect, −0.046, that offsets 20.35% of the total effect, 0.228. However, the direct effect remains dominant; = 0.274 accounts for 120.35% of the total effect after offsetting the negative indirect impact, showing the market still prices temperature risks heavily through other channels like long-term economic restructuring costs or agricultural productivity losses.

5.2. Local Government Debt Financing Burden Transmission Channel

The local government debt financing burden channel takes “LGFV interest-bearing debt scale/GDP” as the mediating variable. The transmission effects of the three types of climate risks are presented in the section “B. Via Debt Burden Channel” in Table 12. A key characteristic of this channel is that the β coefficient is stable around 0.22 across all models, meaning that a 1% increase in the debt scale leads to a 0.22% increase in bond spreads, reflecting the stable sensitivity of the market to local government debt risks.

For extreme precipitation, the coefficient of 0.051 shows that a 1% increase in actual precipitation days boosts debt by 0.051 bp, as local governments rely on debt to cover disaster reconstruction costs beyond regular fiscal capacity. The indirect debt effect, 0.011, accounts for 8.80% of the total effect, 0.126, slightly less than the fiscal channel’s 9.43%. Once again, the direct effect ( = 0.115) leads at 91.20%, reinforcing that physical damage and economic disruptions remain the main drivers of spread pricing for precipitation risk.

Extreme temperature, by contrast, exerts a more pronounced impact on debt: its coefficient of 0.166 is over three times that of extreme precipitation, meaning that a 1-unit log increase in temperature days raises debt by 0.166 units, likely due to funding of adaptive infrastructure (e.g., high-temperature protection projects) or energy system upgrades. This debt sensitivity translates to a meaningful indirect effect, 0.039, which explains 17.25% of the total effect, 0.228. Unlike the fiscal channel, which had a negative offset, the debt channel fills this gap, becoming a key transmission path for temperature risk. The direct effect, 0.189, still contributes 82.75%, but its reduced share relative to the fiscal channel highlights the debt channel’s complementary role.

Compound risk’s debt impact falls between extreme temperature and precipitation, with an coefficient of 0.148: a 1-unit increase in the temperature–precipitation interaction raises debt by 0.148 units, reflecting the need for debt to cover multi-crisis rescue costs. The indirect debt effect, 0.028, accounts for 8.33% of the total effect, 0.333, complementing the fiscal channel’s 24.54% contribution. The direct effect, 0.305, still leads at 91.67%, but its persistence indicates that other factors, such as systemic risk or expectations of future fiscal pressure, remain part of compound risk pricing, even after accounting for both fiscal and debt channels.

5.3. Comparison of the Two Channels and Key Conclusions

Across the two channels, clear patterns emerge regarding how climate risks transmit to bond spreads, shaped by both risk type and transmission mechanism.

First, channel importance varies sharply by risk. In the fiscal channel, compound risk dominates with a 24.54% indirect effect share, followed by extreme precipitation (9.43%), while extreme temperature acts as a fiscal buffer (−20.35% offset). In the debt channel, extreme temperature takes the lead (17.25% indirect effect), with compound risk (8.33%) and extreme precipitation (8.80%) trailing. This variation underscores that each risk type interacts differently with fiscal and debt systems, requiring tailored assessment rather than one-size-fits-all analysis.

Second, direct effects remain universally dominant: all coefficients are positive and account for over 75% of the total effects. This highlights that while fiscal and debt channels matter, non-channel mechanisms, like direct physical damage or revised economic expectations, are still critical to spread pricing, suggesting room for further research into unmeasured transmission paths.

Collectively, these results provide evidence for Hypotheses H2 and H3.

6. Conclusion

6.1. Principal Findings

Our empirical analysis of China’s Local Government Financing Vehicle (LGFV) bonds from 2014 to 2023 yields four principal findings.

First, physical climate risks significantly increase LGFV bond issuance spreads. This effect is particularly pronounced for compound risks arising from the interaction of extreme temperature and precipitation. This conclusion remains valid after controlling for micro- and macro-level influencing factors and performing a series of robustness tests. Second, physical climate risks amplify local fiscal risks by intensifying the structural contradiction between fluctuating fiscal revenues and rigid emergency expenditures, thereby driving up LGFV bond financing costs. However, the effects of different risks are heterogeneous, so response measures must also be adapted to local conditions. Third, physical climate risks aggravate local governments’ debt financing burdens, magnifying the climate risk premium in LGFV bond financing costs through the pathway of deteriorating debt sustainability. Fourth, the impact of physical climate risks on LGFV bond financing costs exhibits multidimensional heterogeneity: short-term bonds demonstrate higher vulnerability due to greater liquidity and higher sensitivity to physical climate risks; lower-rated bonds show heightened sensitivity owing to weaker risk buffer capacity; and eastern regions display more pronounced pricing effects because of their higher economic concentration and greater asset exposure.

6.2. Policy Implications

Our findings, while contextualized in China, reveal a “climate–fiscal–financial” nexus with global relevance. The mechanism, whereby climate shocks erode public finances and amplify debt burdens, is critical for sub-national governments worldwide, particularly in rapidly urbanizing economies. Accordingly, we propose the following:

Integrate climate risk into public financial management. Governments should systematically incorporate physical climate risk assessments into fiscal planning and debt sustainability frameworks. Mandating robust climate risk disclosures for municipal financing vehicles is essential to improve market transparency and price risk accurately.

Develop climate-adaptive financial instruments. To fund resilient infrastructure and hedge against fiscal losses, policymakers should promote specialized green credit products, climate catastrophe insurance, and the issuance of “climate-resilience bonds”. The prudent use of weather derivatives can further help manage short-term liquidity risks.

Strengthen equitable global standards. The international community must foster cooperation to develop global climate risk disclosure standards. These standards must be equitable and responsive to the distinct challenges faced by developing economies.

Effectively managing these climate-induced fiscal pressures is indispensable for achieving key UN Sustainable Development Goals (SDGs), particularly those related to sustainable cities (SDG 11) and climate action (SDG 13).

6.3. Future Research Agenda

Building on the limitations of this study, we propose the following promising directions for future research: first, analyzing climate transition risks by examining how policy changes and technological shifts affect the debt sustainability of local government financing vehicles; second, investigating differences in financing costs between the primary and secondary markets to reveal how different markets price climate risk; third, decomposing risk premiums by breaking down credit spreads into default risk and liquidity premium components to identify which element is more significantly affected by climate risk. These directions will help establish a more comprehensive analytical framework for climate financial risks.

Author Contributions

C.T.: Conceptualization, Data curation, Formal analysis, Software, Methodology, Resources, Validation, Writing—original draft. G.C.: Conceptualization, Data curation, Software, Methodology, Validation, Writing—original draft (translation), Writing—review and editing. J.G.: Conceptualization, Methodology, Project administration, Supervision, Validation, Writing—review and editing. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Data are readily available upon request from the corresponding author.

Conflicts of Interest

The authors declare no conflicts of interest.

Abbreviations

The following abbreviations are used in this manuscript:

| LGFV | Local Government Financing Vehicle |

| IPCC | Intergovernmental Panel on Climate Change |

| WEF | The World Economic Forum |

| GSOD | Global Surface Summary of the Day |

Appendix A

Appendix A.1

Table A1.

Data sources and description.

Table A1.

Data sources and description.

| Data Category | Source | URL/Database Platform | Key Variables | Access Date |

|---|---|---|---|---|

| LGFV Bond and Corporate Data | Wind, CSMAR | Wind; CSMAR | Firm-level fundamentals; bond characteristics | March 2025 |

| Meteorological Data | GSOD, NOAA | GSOD; NOAA | Daily temperature, daily precipitation; El Niño index (Nino1 + 2, Nino3, and Nino4) | March 2025; September 2025 |

| Prefecture-Level Macroeconomic Data | CSMAR, CNKI, CNRDS | CSMAR; CNKI; CNRDS | Prefecture-level economic factors; prefecture-level data on assets, population, and infrastructure | 2024–2025 (continuously accessed during the research period) |

Note: This study leverages multi-source proprietary and public data to construct a comprehensive panel dataset. The LGFV bond issuance details, corporate financial statements, and prefecture-level macroeconomic indicators were programmatically extracted through official subscription-based platforms (Wind and CSMAR). Meteorological records, including daily temperature and precipitation observations from the Global Surface Summary of the Day (GSOD) maintained by NOAA, were obtained in bulk for climate variable construction. The underlying El Niño index data, essential for computing the instrumental variable, were sourced from the National Oceanic and Atmospheric Administration (NOAA). Following the operational methodology of China’s National Climate Center, a weighted El Niño index (NinoZ) was computed as the area-weighted average of the standard Nino1 + 2, Nino3, and Nino4 indices. All datasets underwent rigorous cleaning and temporal alignment, with continuous data collection and validation occurring throughout the 2024–2025 research period to ensure consistency for empirical analysis. The specific access dates for the final regression datasets are documented above.

Appendix A.2

Table A2.

Indicators for constructing the regional climate risk exposure index.

Table A2.

Indicators for constructing the regional climate risk exposure index.

| First-Level Indicators | Second-Level Indicators | Third-Level Indicators | Unit | Indicator Direction |

|---|---|---|---|---|

| Population Exposure | Population Scale | Population Density | people/km2 | Positive |

| Vulnerable Population | Number of Elderly People in High-Risk Areas | people | Positive | |

| Economic and Asset Exposure | Macroeconomy | Regional Gross Domestic Product | 10,000 yuan | Positive |

| Key Infrastructure | Built-Up Area | km2 | Positive | |

| Road Network Density | km/km2 | Positive | ||

| Centralized Treatment Rate of Sewage Treatment Plants | % | Negative | ||

| Drainage Pipe Density in Built-Up Areas | km/km2 | Negative | ||

| Water Supply Pipe Density in Built-Up Areas | km/km2 | Negative | ||

| Agricultural and Production Exposure | Agricultural Production | Total Sown Area of Crops | 1000 hectares | Positive |

Note: The data for the above indicators are sourced from the China City Statistical Yearbook (CNKI) and Chinese Research Data Services Platform. This table outlines the multi-tiered indicator system for constructing the Climate Risk Exposure Index via the Entropy Weight Method (EWM). The EWM is an objective weighting technique that assigns higher weights to indicators with greater dispersion across observations, as they are deemed to carry more information for differentiation. The index construction process was as follows: Standardization: All third-level indicators were normalized to a [0, 1] scale using the min–max method. The direction of impact (Positive/Negative) specified in the table was strictly adhered to during this process. For positive indicators, a higher original value signifies a greater potential for damage and loss when exposed to extreme climate events. Thus, it leads to a higher standardized value and a higher exposure score. For negative indicators, a higher original value represents a stronger city’s resilience and capacity to mitigate the impacts of extreme climate events. Thus, the transformation is reversed so that it reduces the final exposure score. Weight Calculation: The entropy weight for each third-level indicator was calculated objectively based on its data variability. The weights for second-level and first-level indicators were determined by summing the weights of their constituent lower-level indicators. Composite Score: The final exposure index for each city-year observation is the weighted sum of all standardized third-level indicators, using the entropy-derived weights. This data-driven approach ensures that the index reflects the actual disparities in climate risk exposure across different cities and years.

Appendix A.3

Table A3.

Two-stage least squares results for compound risk.

Table A3.

Two-stage least squares results for compound risk.

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| First Stage | First Stage | First Stage | Second Stage | |

| Variable | Extre_Temp | Extre_Precip | Comp_Risk | Spread |

| Comp_Risk | 4.692 *** | |||

| (5.315) | ||||

| Extre_temp | −3.696 *** | |||

| (−2.890) | ||||

| Extre_precip | −21.234 *** | |||

| (−5.247) | ||||

| altitude | 0.045 *** | 0.015 | 0.103 * | |

| (13.139) | (1.279) | (1.802) | ||

| MAP_10y | −0.088 *** | 0.407 *** | 1.761 *** | |

| (−21.071) | (30.612) | (29.046) | ||

| Comp_IV | −0.019 *** | −0.009 *** | −0.063 *** | |

| (−19.172) | (−2.843) | (−4.239) | ||

| Controls | Yes | Yes | Yes | Yes |

| Prov FE | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes |

| Observations | 19,761 | 19,761 | 19,761 | 19,761 |

| First-stage F | 192.290 *** | 2311.790 *** | 2177.23 *** | |

| Kleibergen–Paap rk LM | 78.390 *** | |||

Note: This table presents the two-stage least squares (2SLS) results addressing endogeneity of compound risk. Columns (1)–(3) report first-stage regressions for extreme temperature, extreme precipitation, and their compound risk, respectively. Column (4) shows the second-stage results, where compound risk significantly increases bond issuance spreads. The first-stage F-statistics for all endogenous variables are significant at the 1% level, providing strong evidence against weak instruments. This indicates that our instruments, Altitude, ten-year mean annual precipitation (MAP_10y), and their interaction (Comp_IV), are jointly highly significant in explaining variations in the endogenous regressors. The Kleibergen–Paap rk LM statistic (78.390), also significant at the 1% level, rejects the null hypothesis of underidentification. *** and * denote significance at the 1% and 10% levels, respectively; t-statistics based on robust standard errors are reported in parentheses.

Appendix A.4

Table A4.

Two-stage least squares results for extreme precipitation instrumented with the El Niño index.

Table A4.

Two-stage least squares results for extreme precipitation instrumented with the El Niño index.

| (1) | (2) | |

|---|---|---|

| First Stage | Second Stage | |

| Variable | Extre_Precip | Spread |

| Extre_precip | 0.127 *** | |

| (5.160) | ||

| MAP_10y | 0.432 *** | |

| (74.906) | ||

| Oino_index | 68.912 *** | |

| (4.021) | ||

| Controls | Yes | Yes |

| Prov FE | Yes | Yes |

| Year FE | Yes | Yes |

| Observations | 19,739 | 19,739 |

| First-stage F | 3302.980 *** | |

| Kleibergen–Paap rk LM | 3144.182 *** | |

Note: This table presents two-stage least squares (2SLS) results that augment the identification strategy for extreme precipitation by incorporating the El Niño index alongside the 10-year mean precipitation (MAP_10y) as instruments. Column (1) reports the first-stage regression showing strong predictive power of both instruments, while column (2) presents the second-stage results confirming the significant positive effect of extreme precipitation on bond issuance spreads. The first-stage F-statistic of 3302.980, significant at the 1% level, far exceeds conventional weak instrument thresholds, demonstrating the exceptional strength of our expanded instrument set. The Kleibergen–Paap rk LM statistic (3144.182), also significant at the 1% level, firmly rejects the null hypothesis of underidentification. The significant second-stage coefficient of 0.127 reinforces the robustness of the precipitation risk effect on LGFV financing costs. *** denotes significance at the 1% level; t-statistics based on robust standard errors are reported in parentheses.

Appendix A.5

Table A5.

Two-stage least squares results for compound risk instrumented with the El Niño index.

Table A5.

Two-stage least squares results for compound risk instrumented with the El Niño index.

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| First Stage | First Stage | First Stage | Second Stage | |

| Variables | Extre_Temp | Extre_Precip | Comp_Risk | Spread |

| Comp_Risk | 4.230 *** | |||

| (6.634) | ||||

| Extre_temp | −4.261 *** | |||

| (−4.706) | ||||

| Extre_precip | −19.201 *** | |||

| (−6.569) | ||||

| altitude_MAP | −0.022 *** | −0.016 *** | −0.100 *** | |

| (−19.430) | (−4.725) | (−6.321) | ||

| altitude_Oino | 3.244 *** | 7.420 *** | 38.553 *** | |

| (8.204) | (5.738) | (6.514) | ||

| altitude | 0.057 *** | 0.041 *** | 0.232 *** | |

| (14.302) | (3.204) | (3.938) | ||

| MAP_10y | −0.095 *** | 0.384 *** | 1.648 *** | |

| (−20.771) | (28.442) | (26.774) | ||

| Oino_index | −16.022 *** | 89.334 *** | 430.328 *** | |

| (−2.820) | (5.188) | (5.387) | ||

| Controls | Yes | Yes | Yes | Yes |

| Prov FE | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes |

| Observations | 19,739 | 19,739 | 19,739 | 19,739 |

| First-stage F | 107.58 *** | 105.92 *** | 105.43 *** | |

| Kleibergen–Paap rk LM | 21.044 *** | |||

Note: This table presents extended two-stage least squares (2SLS) results that augment the identification strategy beyond the single instrument (MAP_10y) by incorporating the El Niño index as an additional instrument for compound risk. Columns (1)–(3) report the first-stage regressions for extreme temperature, extreme precipitation, and their compound risk, respectively, while column (4) presents the corresponding second-stage results. Columns (1)–(3) report first-stage regressions for extreme temperature, extreme precipitation, and their compound risk, respectively. Column (4) shows the second-stage results where compound risk maintains a statistically significant positive effect on bond issuance spreads at the 1% level. The first-stage F-statistics for all three endogenous variables are significant at the 1% level (107.58, 105.92, and 105.43, respectively), comfortably exceeding conventional weak instrument thresholds and confirming the joint strength of our instrument set. The Kleibergen–Paap rk LM statistic (21.044) rejects the null hypothesis of underidentification at the 1% level, further supporting instrument validity. All interactions with the El Niño index show strong predictive power in the first-stage regressions. *** denotes significance at the 1% level; t-statistics based on robust standard errors are reported in parentheses.

Appendix A.6

In a further robustness check, this paper employs multiple pre-issuance windows, specifically 1–60 days, 1–90 days, and 1–180 days before the bond issuance date, to construct a set of continuous variables, CompRisk_Window60, CompRisk_Window90, and CompRisk_Window180, measuring compound risk. Each variable represents the total number of days within the respective window on which both extreme precipitation and extreme temperature occur concurrently. The regression results in Table A6 indicate that the bond issuance spread remains statistically significantly sensitive to these compounded climate risk measures across all extended windows considered.

Table A6.

Robustness check: constructing compound risk using the pre-issuance window.

Table A6.

Robustness check: constructing compound risk using the pre-issuance window.

| (1) | (2) | (3) | |

|---|---|---|---|

| Variable | Spread | Spread | Spread |

| CompRisk_Window60 | 0.068 ** | ||

| (2.526) | |||

| CompRisk_Window90 | 0.155 *** | ||

| (4.751) | |||

| CompRisk_Window180 | 0.547 *** | ||

| (11.250) | |||

| Controls | Yes | Yes | Yes |

| Prov FE | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes |

| Observations | 19,659 | 19,659 | 19,659 |

| R-squared | 0.369 | 0.370 | 0.373 |

Note: This table reports robustness checks using alternative pre-issuance windows to construct the compound risk variable. The dependent variable is bond issuance spread. All specifications include province and year fixed effects and the full set of control variables. The compound risk variable is redefined as the total number of days within specific pre-issuance windows where both extreme temperature and extreme precipitation occurred concurrently. Column (1) uses a 60-day window (CompRisk_Window60); Column (2) uses a 90-day window (CompRisk_Window90); Column (3) uses a 180-day window (CompRisk_Window180). The positive and statistically significant coefficients across all columns confirm that bond issuance spreads remain sensitive to compound risks measured over various extended pre-issuance periods. *** and ** denote significance at the 1% and 5% levels, respectively; t-statistics based on robust standard errors are reported in parentheses.

Appendix A.7

Although the baseline model controls for year and province fixed effects, there may still be some omitted variables that vary with both time and province. To rule out such interference, this study conducts a more stringent test by introducing the interaction of province and year fixed effects (Prov × year FE) into the model. This specification controls for all confounding factors that vary with both province and time, such as time-varying provincial macroeconomic shocks and policy changes. In addition, to eliminate the impact of persistent differences in credit quality among issuers, this study controls for issuer fixed effects. Furthermore, to ensure that standard errors accurately capture weather sequence correlation and spatial correlation, this study performs two-way clustering of standard errors along the province and year dimensions. After controlling for the aforementioned factors, the compound impact of extreme climates remains significantly positive.

Table A7.

Additional robustness checks.

Table A7.

Additional robustness checks.

| (1) | (2) | (3) | (4) | (5) | |

|---|---|---|---|---|---|

| Variable | Spread | Spread | Spread | Spread | Spread |

| Comp_Risk | 0.095 * | 0.122 *** | 0.333 * | ||

| (1.862) | (3.020) | (2.005) | |||

| Extre_temp | 0.108 *** | −0.334 | −0.440 ** | −1.425 * | |

| (6.962) | (−1.417) | (−2.347) | (−1.896) | ||

| Extre_precip | 0.686 *** | 0.569 *** | −0.448 *** | −0.195 | |

| (9.111) | (5.735) | (−5.927) | (−0.502) | ||

| Controls | Yes | Yes | Yes | Yes | Yes |

| Prov FE | Yes | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes | Yes |

| Prov × Year FE | Yes | Yes | Yes | ||

| Company FE | Yes | ||||

| Prov_Year cluster | Yes | ||||

| Observations | 19,753 | 19,753 | 19,753 | 19,285 | 19,761 |

| R-squared | 0.460 | 0.459 | 0.462 | 0.725 | 0.373 |

Note: This table presents a series of robustness checks employing increasingly stringent identification strategies to confirm the stability of the core finding that compound risk elevates LGFV bond issuance spreads. Columns (1)–(3) report results for extreme temperature, extreme precipitation, and compound risk, respectively, using province-by-year fixed effects to control for time-varying provincial confounders. Column (4) further adds issuer fixed effects to the compound risk specification to account for time-invariant heterogeneity across bond issuers. Column (5) employs two-way clustering of standard errors at the province and year levels. The coefficient on compound risk remains positive and statistically significant across all specifications, confirming the robustness of our main finding. t-statistics are reported in parentheses. *** p < 0.01, ** p < 0.05, * p < 0.1.

Appendix A.8

Table A8.

Causal mediation analysis: decomposition of climate risk effects through fiscal channels.

Table A8.

Causal mediation analysis: decomposition of climate risk effects through fiscal channels.

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| Compound Risk | Extreme Temperature | Extreme Precipitation | ||||

| Coefficient | 99% Conf. Interval | Coefficient | 99% Conf. Interval | Coefficient | 99% Conf. Interval | |

| Total Effect | 0.333 *** | [0.218, 0.439] | 0.228 *** | [0.093, 0.393] | 0.126 *** | [0.088, 0.165] |

| Indirect Effect—Deficit | 0.082 *** | [0.059, 0.109] | −0.046 *** | [−0.082, −0.012] | 0.012 *** | [0.004, 0.018] |

| Indirect Effect—Debt | 0.028 *** | [0.016, 0.041] | 0.039 *** | [0.026, 0.057] | 0.011 *** | [0.007, 0.015] |

| Direct Effect—Deficit | 0.251 *** | [0.139, 0.358] | 0.275 *** | [0.135, 0.445] | 0.114 *** | [0.076, 0.153] |

| Direct Effect—Debt | 0.305 *** | [0.191, 0.414] | 0.189 *** | [0.052, 0.355] | 0.115 *** | [0.077, 0.153] |

| Prop—Deficit | 24.544 *** | [16.010, 38.204] | −20.350 *** | [−66.298, −4.749] | 9.427 *** | [3.422, 16.266] |

| Prop—Debt | 8.327 *** | [4.423, 14.480] | 17.252 *** | [8.702, 47.180] | 8.797 *** | [5.315, 14.454] |

| —Deficit | 1.846 *** | [1.330, 2.390] | −1.023 *** | [−1.821, −0.260] | 0.266 *** | [0.099, 0.405] |

| —Debt | 0.148 *** | [0.121, 0.176] | 0.166 *** | [0.127, 0.202] | 0.051 *** | [0.043, 0.059] |

| —Deficit | 0.044 *** | [0.039, 0.050] | 0.045 *** | [0.041, 0.050] | 0.045 *** | [0.039, 0.050] |

| —Debt | 0.188 *** | [0.111, 0.262] | 0.237 *** | [0.165, 0.315] | 0.217 *** | [0.142, 0.295] |

Note: This table presents the complete results of the causal mediation analysis, decomposing the total effect of three types of climate risks, Compound Risk, Extreme Temperature, and Extreme Precipitation, on LGFV bond issuance spreads into indirect effects (transmitted through fiscal deficit and debt channels) and direct effects. The analysis is based on 1000 bootstrap repetitions, with 99% confidence intervals reported in brackets. All point estimates are statistically significant at the 1% level. *** denotes significance at the 1% level. The indirect effects (Indirect Effect—Deficit/Debt) represent the portion of the total climate impact mediated by the respective fiscal channel, while the direct effects (Direct Effect—Deficit/Debt) represent the remaining impact after accounting for the mediators. The proportions (Prop—Deficit/Debt) indicate the percentage of the total effect explained by each channel. Coefficients represent the effect of climate risks on the mediators (deficit/debt), while coefficients β (beta) represent the effect of the mediators on bond spreads after controlling for climate risks.

Appendix B

Appendix B.1

Figure A1.

Data-flow diagram. The diagram illustrates the process of organizing the baseline regression sample for this study, showcasing the collection and integration of the dependent, independent, and control variables.

Appendix B.2

Figure A2.

The marginal effect of extreme precipitation on bond spreads, conditional on extreme temperature. This figure depicts the non-linear impact of extreme temperature on bond issuance spreads. The horizontal axis represents the variable extreme temperature (Extre_temp), while the vertical axis shows the marginal effect of extreme precipitation (Extre_precip) on bond issuance spreads. The marginal effect, defined as 0.333 × Extre_temp − 1.425, measures the change in spreads (in basis points) resulting from a 1% increase in extreme precipitation days, conditional on a given level of extreme temperature. The gray shaded area represents the 95% confidence interval around the marginal effect estimate. A distinct regime shift occurs at the extreme temperature threshold (Extre_temp ≈ 4.28, marked by the blue dashed line), which corresponds to approximately 71.8 actual extreme temperature days per year. Below this threshold, the impact of extreme precipitation on issuance spreads is negligible or even negative; above it, the marginal effect turns positive and increases steadily. This pattern indicates that once the annual number of extreme temperature days exceeds about 72 days, the market significantly reprices physical climate risks, leading to a sharp rise in bond financing costs. For instance, when Extre_temp reaches 5, a 1% increase in extreme precipitation days raises the spread by approximately 0.24 basis points, and this process exhibits non-linear dynamics, with extreme temperatures significantly amplifying the precipitation effect.

References

- China Focus: Super Typhoon Yagi Strikes South China, Leaving 4 Dead, 95 Injured. Available online: https://english.news.cn/20240907/b0174a4a321a46dcaa5d5c142f941d93/c.html (accessed on 10 March 2025).

- Yangtze River Basin Experiences Its Most Severe Drought in 61 Years: Prepare for a “Protracted and Severe Drought”. Available online: https://www.toutiao.com/article/7135222613776925225/?upstream_biz=doubao&source=m_redirect (accessed on 10 March 2025).

- Global Risks Report 2025. Available online: https://reports.weforum.org/docs/WEF_Global_Risks_Report_2025.pdf (accessed on 10 March 2025).

- PBOC: Climate Change Factors to Play Role in Policy. Available online: https://www.chinadaily.com.cn/a/202103/21/WS6056c1d0a31024ad0bab07a8.html (accessed on 10 March 2025).

- Painter, M. An inconvenient cost: The effects of climate change on municipal bonds. J. Financ. Econ. 2020, 135, 468–482. [Google Scholar] [CrossRef]

- Chen, B.; Chu, L. Decoupling the double jeopardy of climate risk and fiscal risk: A perspective of infrastructure investment. Clim. Risk Manag. 2022, 37, 100448. [Google Scholar] [CrossRef]

- Acharya, V.V.; Johnson, T.; Sundaresan, S.; Tomunen, T. Is Physical Climate Risk Priced? Evidence from Regional Variation in Exposure to Heat Stress; National Bureau of Economic Research Working Paper Series; National Bureau of Economic Research: Cambridge, MA, USA, 2022; No. 30445. [Google Scholar]

- Goldsmith-Pinkham, P.; Gustafson, M.T.; Lewis, R.C.; Schwert, M. Sea-Level Rise Exposure and Municipal Bond Yields. Rev. Financ. Stud. 2023, 36, 4588–4635. [Google Scholar] [CrossRef]

- Guo, K.; Bian, Y.; Zhang, D.; Ji, Q. The Impact of Climate-Related Risk on Local Government Financing Costs. J. Environ. Econ. 2023, 8, 108–131. [Google Scholar]

- Zhang, Y.; Liang, D.; Yang, J. The Effect of Climate Risk on Credit Spreads: The Case of China’s Quasi-Municipal Bonds. SSRN 4566626. 2023. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4566626 (accessed on 25 March 2025).

- Song, Y.; Wang, C. Pricing effects of extreme high temperature: Evidence from municipal corporate bonds in China. Econ. Lett. 2024, 243, 111933. [Google Scholar] [CrossRef]

- Gu, N.; Qiu, Q. Climate risk, environmental action and issuance pricing of local government bond. China Soft Sci. 2025, 1, 157–174. [Google Scholar]

- Ji, Y.; Wu, S.; Xiong, P. When Cities Soak: The Impact of Torrential Rain on Urban Investment (Chengtou) Bonds. China Econ. Q. 2025, 25, 512–527. [Google Scholar]

- Stroebel, J.; Wurgler, J. What do you think about climate finance? J. Financ. Econ. 2021, 142, 487–498. [Google Scholar] [CrossRef]

- Bachner, G.; Bednar-Friedl, B. The effects of climate change impacts on public budgets and implications of fiscal counterbalancing instruments. Environ. Model. Assess. 2019, 24, 121–142. [Google Scholar] [CrossRef]

- Zhong, H.; Lu, M. How Does the Fiscal Transfer Affect the Local Government Debt? J. Financ. Res. 2015, 9, 1–16. [Google Scholar]

- Zhong, N.; Chen, S.; Ma, H.; Wang, S. The Evolvement of Debt Risk of Local Government Financing Platforms: Based on Measuring the Expectation of “Implicit Guarantee”. China Ind. Econ. 2021, 4, 5–23. [Google Scholar]

- Liu, X.; Lv, Y.; Yu, F. Local Government Implicit Debt and the Pricing of Chengtou Bonds. J. Financ. Res. 2021, 12, 170–188. [Google Scholar]

- Chen, G.; Lian, L.; Zhu, S. Multiple Credit Rating and Bond Financing Cost: Evidence from Chinese Bond Market. J. Financ. Res. 2021, 2, 94–113. [Google Scholar]

- Qiu, Z.; Wang, Z.; Wang, Z. Local Government Debt Replacement Plan and New Implicit Debt: Based on Issuance Scale and Pricing of Chengtou Bonds. China Ind. Econ. 2022, 4, 42–60. [Google Scholar]

- Liang, S.; Wen, W.; Jiang, Y. Local Government Debt and Bond Credit Spreads. China Ind. Econ. 2024, 3, 157–174. [Google Scholar]