1. Introduction

In recent decades, the business environment has been increasingly shaped by sustainability imperatives, regulatory transitions, and stakeholder pressures that fall under the umbrella of environmental, social, and governance (ESG) concerns [

1]. While ESG adoption has become a central feature of corporate strategy, an often-overlooked dimension is the uncertainty that surrounds ESG policies, disclosures, and regulatory expectations. Unlike conventional market risks that are quantifiable and relatively predictable, ESG uncertainty represents a complex and evolving challenge that complicates corporate decision-making [

2]. This uncertainty emerges from rapidly changing environmental regulations, shifting investor expectations, evolving social standards, and ambiguous governance frameworks. For firms, particularly those operating in emerging economies such as China, ESG uncertainty imposes additional layers of complexity in managing operational activities. Among the most critical of these activities is inventory management, which directly reflects the efficiency of working capital allocation and supply chain performance. Inventory lies at the nexus of financial prudence and operational agility as too much inventory inflates costs and risks obsolescence, while too little undermines the ability to meet demand [

3]. In a context where ESG standards are unclear, volatile, and inconsistently enforced, firms may face difficulties in aligning their inventory strategies with long-term sustainability goals while maintaining short-term operational efficiency. This paradox highlights the need to investigate the implications of ESG uncertainty for inventory management, an area that has been underexplored in the literature.

The motivation for this study stems from the dual recognition that ESG issues are reshaping corporate finance and that inventory management remains a cornerstone of firm-level efficiency and competitiveness. Previous research has predominantly examined ESG performance or disclosure quality as independent variables influencing firm outcomes, including financial performance, risk exposure, or innovation capacity [

1,

4,

5]. However, little attention has been directed toward ESG uncertainty which is inherently different from ESG performance. ESG uncertainty encapsulates the ambiguity, unpredictability, and inconsistency of ESG-related regulations, policies, and market pressures [

6]. This uncertainty can disrupt supply chains, increase costs of compliance, and deter firms from adopting efficient operational practices. At the same time, inventory management has traditionally been analyzed through the lenses of working capital efficiency, supply chain optimization, or cash conversion cycles [

7]. Therefore, integrating ESG uncertainty into this domain offers a fresh perspective, as it directly ties the sustainability debate to the core of corporate resource allocation. The primary objective of this study is therefore to empirically evaluate the effect of ESG uncertainty on inventory management.

To advance this inquiry, it is crucial to define the two central constructs, i.e., ESG uncertainty and inventory management. ESG uncertainty refers to the lack of clarity and predictability in the rules, standards, and pressures that govern corporate sustainability practices. It encompasses uncertainties in environmental regulation enforcement, shifting social expectations around labor and community relations, and evolving governance requirements [

6]. On the other hand, inventory management is operationalized as the efficiency with which firms handle their stock of goods, often measured through indicators such as inventory turnover ratios and days inventory outstanding. Efficient inventory management reduces costs, enhances liquidity, and strengthens competitive advantage [

8]. The interaction between these two constructs is theoretically compelling: heightened ESG uncertainty can encourage firms to adopt conservative strategies such as stockpiling inputs to hedge against supply disruptions or delaying lean inventory practices due to unclear compliance costs. By integrating these perspectives, this study positions ESG uncertainty as a determinant of inventory management outcomes, thereby bridging sustainability research with corporate finance and operational management.

The empirical analysis undertaken in this study is based on an extensive panel dataset of Chinese A-share listed firms spanning the years 2000 to 2024. China provides a particularly relevant context given its dynamic regulatory landscape, rapid industrial growth, and evolving ESG policies that often generate substantial uncertainty for corporations. By employing fixed effects, two-stage least squares (2SLS), and system GMM estimators, the analysis ensures robustness against endogeneity, heterogeneity, and simultaneity concerns. The findings reveal a consistent and significant negative relationship between ESG uncertainty and inventory management efficiency. Specifically, higher ESG uncertainty is associated with lower inventory turnover ratios, indicating that firms tend to hold excess inventory or fail to optimize stock levels under ambiguous ESG conditions. This result underscores the operational costs of sustainability-related ambiguities, suggesting that regulatory unpredictability and inconsistent ESG frameworks can weaken firms’ ability to maintain agile and efficient supply chains. The consistency of the findings across different econometric specifications strengthens their credibility and highlights the practical relevance of this issue for corporate managers and policymakers alike.

This study contributes to the theoretical literature by introducing ESG uncertainty, a relatively new construct in corporate finance and sustainability research into the domain of inventory management and working capital dynamics. While prior studies have examined how economic policy uncertainty (EPU) or climate policy uncertainty (CPU) shape firms’ inventory or supply chain strategies (e.g., [

9,

10,

11]), empirical attention to sustainability-driven uncertainty remains limited. Unlike EPU, which stems from macroeconomic and policy fluctuations, ESG uncertainty arises from evolving sustainability disclosure frameworks, inconsistent environmental regulations, and shifting stakeholder expectations, creating operational ambiguity for firms. Recent works such as Ed-Dafali et al. [

12] and Adardour et al. [

13] underscore that ESG practices and governance mechanisms increasingly influence firms’ risk-taking and investment behavior, yet their operational implication, particularly on inventory dynamics, remain underexplored. By empirically demonstrating that ESG uncertainty significantly disrupts inventory efficiency, this study advances theories of corporate risk management and resource dependence, revealing how non-financial uncertainty translates into tangible operational inefficiencies. Moreover, by situating ESG uncertainty within the broader discussion of sustainability governance and operational resilience, the study establishes a new conceptual and empirical bridge between the bodies of ESG and operations management literature, offering an actionable framework for firms operating in uncertain regulatory environments.

Empirically, the study adds to the growing body of literature on the Chinese market by providing one of the first large-scale analyses of ESG uncertainty and inventory management over a two-decade horizon. The methodological rigor achieved by applying fixed effect models alongside instrumental variable approaches such as 2SLS and dynamic estimators like system GMM ensures that the results are robust to concerns of omitted variables and endogeneity. This makes the study a valuable empirical reference for future scholarship exploring the intersections of sustainability, uncertainty, and corporate operational outcomes.

From a practical standpoint, the results hold important implications for corporate managers, regulators, and investors. For managers, the evidence underscores the importance of incorporating ESG uncertainty into operational planning and risk management frameworks. Some proactive strategies such as diversifying suppliers, adopting flexible procurement contracts, and leveraging digital supply chain technologies can mitigate the adverse effects of ESG-related ambiguities. For regulators, the findings highlight the unintended consequences of regulatory uncertainty: unclear or inconsistent ESG standards can slow firms’ progress toward efficiency and sustainability. Therefore, ensuring regulatory transparency and stability could thus enhance both environmental compliance and operational efficiency. For investors, understanding how ESG uncertainty translates into inventory inefficiencies provides an additional dimension for evaluating firm risk and resilience. In sum, this study emphasizes the need for alignment between sustainability objectives and operational realities, advocating for coherent policy frameworks and adaptive managerial strategies.

The remainder of the paper is structured as follows.

Section 2 reviews some existing theories, supporting the linkage between ESG uncertainty and inventory management,

Section 3 reviews the relevant empirical literature and

Section 4 outlines the methodological framework.

Section 5 presents the empirical results with robustness checks and interpretations.

Section 6 concludes by summarizing the key insights, outlining policy implications, and suggesting directions for future research.

2. Theoretical Review

The relationship between ESG uncertainty and inventory management can be theoretically grounded in several established frameworks within corporate finance, organizational behavior, and supply chain management. These theories help explain why firms adjust inventory practices in response to ambiguous sustainability conditions and how external pressures translate into operational inefficiencies. For instance, resource dependence theory (RDT) introduced by Pfeffer and Salanci [

14] argues that organizations are dependent on external resources controlled by the environment, and uncertainty in resource availability drives strategic responses. ESG uncertainty can be interpreted as a form of environmental turbulence where firms face ambiguous resource constraints due to evolving sustainability regulations, shifting investor expectations, and uncertain social standards. In such settings, firms may respond by stockpiling raw materials or maintaining higher inventory levels as a hedge against unpredictable supply chain disruptions or compliance costs. This behavior leads to reduced inventory turnover and inefficiencies, aligning with RDT’s assertion that firms adapt resource strategies when facing external uncertainty.

Similarly, institutional theory advanced by DiMaggio and Powell [

15] highlights how organizational behavior is shaped by institutional pressures, coercive, normative, and mimetic. Under ESG uncertainty, coercive pressures arise from governments and regulators imposing unclear or frequently changing sustainability rules, while normative pressures emerge from societal expectations and stakeholder demands. Mimetic pressures also play a role, as firms often imitate peer companies’ sustainability practices to maintain legitimacy. Within inventory management, these institutional pressures drive firms toward conservative and risk-averse strategies. For example, firms may maintain higher inventory buffers to ensure compliance with potential environmental audits or sudden governance requirements. The ambiguity of ESG standards therefore results in inefficiencies in inventory management, as firms prioritize legitimacy and compliance readiness over operational optimization. Institutional Theory thus explains the negative association between ESG uncertainty and inventory efficiency.

Real Options Theory, initially conceptualized by Myers [

16] and further developed by Dixit and Pindyck [

17], emphasizes managerial flexibility under uncertainty. Firms facing uncertain conditions perceive investments and operational strategies as “options” that can be exercised when more information becomes available. In the context of ESG uncertainty, firms may delay adopting lean inventory systems or sustainable supply chain practices due to ambiguous cost structures and unclear long-term benefits. Instead, they may hold excess inventory as a strategic option to preserve operational continuity until ESG frameworks stabilize. This cautious behavior reflects a trade-off between short-term inefficiency and long-term adaptability.

The trade-off theory of capital structure proposed by Kraus and Litzenberger [

18], posits that firms balance the tax advantages of debt against the costs of financial distress. When applied to inventory management, this theory suggests that firms facing ESG uncertainty experience higher risk perceptions from creditors and investors which raises their effective cost of capital. As a result, firms have greater incentives to optimize working capital and inventory efficiency to mitigate financing constraints. However, the paradox is that ESG uncertainty often increases operational risk, prompting managers to hold more inventory as a buffer. The theory thus provides insight into the dual pressures firms face: the financial need to minimize inventory holdings versus the operational need to increase them under ESG ambiguity. This tension explains why ESG uncertainty often translates into inefficiencies in inventory management despite financial incentives for leaner operations.

The dynamic capabilities theory formulated by Teece et al. [

19] emphasizes a firm’s ability to integrate, build, and reconfigure internal and external competencies in rapidly changing environments. ESG uncertainty is a prime example of such an environment as evolving regulations and stakeholder expectations require firms to adapt operational systems continuously. Inventory management under ESG uncertainty becomes a test of dynamic capabilities: firms with advanced sensing and reconfiguring abilities may leverage digital supply chains, predictive analytics, and supplier diversification to maintain turnover efficiency despite uncertainty. Conversely, firms with weaker dynamic capabilities may respond reactively, increasing inventory buffers and experiencing reduced efficiency. This framework highlights the heterogeneity of responses across firms and underscores why ESG uncertainty has a generally negative but uneven effect on inventory management.

Taken together, Resource Dependence Theory, Institutional Theory, Real Options Theory, and the Dynamic Capabilities framework collectively explain why ESG uncertainty uniquely affects inventory management. Unlike EPU, which primarily influences financial and investment choices, ESG uncertainty introduces multidimensional pressures, regulatory, normative, and stakeholder-driven that directly disrupt firms’ operational routines. Inventory management, being highly responsive to information asymmetry and supply chain volatility, becomes the most sensitive operational dimension under such uncertainty. Firms must continuously adjust procurement, production, and storage decisions to balance sustainability compliance with cost efficiency, reflecting both their dependence on external institutional expectations and their capacity to reconfigure resources dynamically.

3. Empirical Review and Hypothesis

The existing empirical research has increasingly explored ESG-related factors and their influence on firm performance and risk management, yet operational outcomes such as inventory management remain less examined. For instance, Darby et al. [

20] applied resource dependence theory to investigate how policy risk influences firms’ inventory strategies using 19,634 firm-year observations. The results showed that under high policy uncertainty and industry dynamism, firms increase inventory holdings as a buffer against potential disruptions. This highlights inventory as a strategic response to government-driven risks. The study supports the ESG uncertainty–inventory management linkage by illustrating how external policy environments shape firms’ supply chain decisions. Zeng et al. [

9] examined Chinese firms from 2007 to 2017 to explore how EPU shapes inventory decisions. They found that EPU reduces inventory holdings, especially in non-state-owned firms, while precautionary cash reserves increase as inventories decline. Financial constraints and governance strength further amplify this effect. Das [

21] investigated how sustainability initiatives across extended supply chains influence ESG performance in 201 Fortune Global 500 multinationals from 2011 to 2021. Using a fixed-effects model, they found that stronger supply chain policies, monitoring, and training improve ESG outcomes, particularly in the environmental dimension. Some country-level factors including socioeconomic models and ESG risks, further moderate these effects. This aligns with the ESG uncertainty–inventory management linkage by showing how supply chain sustainability practices shape firms’ operational and environmental performance.

Gao et al. [

22] examined the effects of green finance policies on ESG performance using Chinese A-share firms from 2007 to 2021, applying a continuous difference-in-differences approach around the 2016 policy shift. Their results showed that green finance significantly enhances ESG outcomes, with impacts shaped by supply chain finance and operational transparency. Further mechanism analysis revealed improvements via financing constraints, supply chain efficiency, and reduced managerial power, alongside regional heterogeneity. Yang et al. [

23] analyzed listed automotive firms from 2009 to 2022 to explore how ESG performance influences total-factor productivity (TFP) across supply chains. Using fixed-effects, mediation, and moderation models, they found that firms’ ESG practices significantly enhance downstream customers’ TFP by easing financing constraints. However, monopolistic power weakens this positive spillover effect. This supports the ESG uncertainty–inventory management linkage by showing how sustainability practices in one firm cascade through supply chains, shaping operational efficiency. Arouri et al. [

24] examined monthly data from 2008 to 2022 to assess how climate policy uncertainty (CPU) shapes the oil–stock return relationship in GCC countries. Using nonlinear analysis and seemingly related regressions, they found that CPU weakens the positive impact of oil price changes on stock returns, with stronger effects at higher uncertainty levels. Results showed consistent evidence across GCC countries except Qatar.

Lin and Li [

25] analyzed Chinese A-share firms from 2010 to 2022 to assess how supply chain resilience and ESG performance influence corporate growth. Using mediation and heterogeneity analysis, they found that resilience fosters growth through improved productivity, while ESG enhances growth by easing financing constraints and expanding funding channels. These effects varied by firm size, production intensity, CEO duality, and life cycle stage. Mir et al. [

10] analyzed 6150 firms across ten emerging economies from 2004 to 2020 to study how EPU affects inventory levels, using a two-step GMM approach. The results revealed an inverted U-shaped relationship, where moderate EPU encourages inventory buildup, but excessive uncertainty reduces it. Firms with fewer financial constraints were better able to expand inventories under high EPU. This strengthens the ESG uncertainty–inventory management linkage by showing how uncertainty-driven inventory strategies depend on firms’ financial flexibility. Namdar et al. [

11] investigated how policy uncertainty influences firms’ supply chain restructuring, focusing on onshoring/offshoring and diversification strategies. The empirical evidence showed that firms respond to upstream policy uncertainty by reducing onshore suppliers and expanding geographic diversification, while domestic uncertainty had limited effects except under very low levels. Furthermore, managers appeared more sensitive to upstream than domestic uncertainty in reshaping supply bases. This supports the ESG uncertainty–inventory management linkage by revealing how external policy risks drive firms’ sourcing and operational adjustments.

Sattar et al. [

26] employed XGBoost and RNNs to enhance demand forecasting, inventory policies, and risk mitigation in supply chains. They introduced new metrics, CAE and CAE-ESG, combining predictive accuracy with cost efficiency and sustainability benchmarks. The empirical findings showed XGBoost had the highest accuracy, while Random Forest offered stronger ESG-aligned efficiency. Wang et al. [

27] examined the nonlinear nexus between inventory leanness and ESG performance in Chinese manufacturing firms, applying instrumental variable techniques with two-stage least squares on panel data from 2012 to 2021. Their findings revealed an inverted U-shaped relationship, where moderate inventory reduction improved ESG outcomes, but excessive leanness reduced them, with market concentration and digital transformation mitigating adverse effects. This supports the linkage between ESG uncertainty and inventory management by showing how inventory strategies directly influence sustainability performance under varying institutional and technological contexts.

While existing research has explored the multifaceted relationship between ESG factors, policy uncertainty, and firm performance, the operational dimension of inventory management remains relatively underexamined. The reviewed studies collectively demonstrate that external risks such as policy uncertainty, climate-related risks, and sustainability pressures influence firms’ inventory strategies through mechanisms like financial constraints, supply chain resilience, and governance quality. At the same time, evidence shows that firms’ ESG initiatives can shape operational outcomes, not only enhancing supply chain efficiency but also creating nonlinear trade-offs between leanness and sustainability. However, despite these insights, the direct link between ESG uncertainty and inventory management is still fragmented, warranting empirical testing. Building on this gap, the present study develops the following hypothesis:

H1: ESG uncertainty has a significant negative impact on inventory management.

4. Data and Methods

4.1. Data and Sample

The empirical analysis of this study relies on a balanced panel dataset of Chinese A-share listed companies covering the period from 2010 to 2024. The initial sample consisted of 980 firms; however, after carefully screening for missing observations, extreme outliers, and the exclusion of financial sector firms, the final sample was reduced to 723 companies. This refined sample ensures the robustness and reliability of the results by mitigating potential biases arising from incomplete reporting and structural differences in financial firms. The choice of A-share listed companies is motivated by several considerations. First, A-share firms represent the largest and most liquid segment of China’s capital market, providing comprehensive insights into the corporate sector’s financial and operational behaviors. Second, these companies are subject to stringent disclosure requirements and regulatory oversight by the China Securities Regulatory Commission (CSRC), which enhances the reliability and comparability of their reported financial and non-financial data. Third, Chinese A-share firms have been at the forefront of ESG discussions as policymakers and investors increasingly emphasize sustainable development and corporate responsibility. This makes them particularly suitable for examining the implications of ESG uncertainty on inventory management.

The time span of 2010 to 2024 is also carefully selected to capture both the evolution of ESG frameworks in China and the changing dynamics of inventory management practices. This period includes major regulatory reforms, the rise of investor activism, and growing societal attention to sustainability issues. Additionally, the span provides sufficient longitudinal variation, enabling the use of econometric models. By spanning over a decade, the dataset reflects not only short-term fluctuations but also long-term adjustments in corporate strategies under conditions of ESG uncertainty. Overall, the final sample of 723 A-share listed firms over 15 years offers a representative and reliable foundation for analyzing the relationship between ESG uncertainty and inventory management. All financial and firm-level data were obtained from the China Stock Market and Accounting Research (CSMAR) database, which is widely recognized for its accuracy and comprehensiveness in Chinese capital market research. The data on ESG uncertainty were sourced from an online website, dedicated for uncertainty-related data (

https://www.policyuncertainty.com/sustainability_index.html) (accessed on 8 August 2025).

4.2. Research Models and Variables

The link between the variables can be established through following research models

Equation (1) demonstrates the fixed effect of ESG (ESG uncertainty) on INM (inventory management). This equation further includes the control variables like FRS (firm size), DBR (debt ratio), ENX (environmental expenditures), COC (cost of capital), and FRP (firm performance). Other symbols like

is denoting the firm fixed effects,

is for time fixed effect and is for

error term. Now, for 2SLS, Equation (1) can be further modified as

In Equation (2),

is the lag of ESG, indicating the use of instrumental variables. In parallel to 2SLS, the study also employs system GMM model. For system GMM model, Equation (2) can be re-structured as follows

Equation (3) displays the lagged effect of INM, termed as . In the above equations, is for firm and t is for time.

The dependent variable in this study is inventory management (INM) which is measured using the inventory turnover ratio, calculated as the cost of goods sold divided by the average inventory. This ratio is widely recognized as an indicator of how efficiently a firm manages its inventory and working capital. A higher turnover reflects efficient inventory utilization while a lower ratio suggests inefficiencies such as overstocking or poor demand forecasting [

28,

29]. Since ESG uncertainty can influence operational decisions, inventory management serves as a critical outcome variable to capture the firm-level implications of sustainability-related ambiguity. The key independent variable is ESG uncertainty (ESG), measured through the ESG uncertainty index. This index reflects the degree of ambiguity and inconsistency surrounding environmental, social, and governance frameworks, regulations, and expectations. Firms experiencing greater ESG uncertainty are more likely to face challenges in aligning operational and strategic practices with evolving sustainability requirements [

6]. As such, ESG uncertainty provides the central explanatory variable for understanding its impact on inventory management efficiency.

Several control variables are included to account for firm-specific characteristics that may also influence inventory management practices. Firm size (FRS) is measured as the natural logarithm of total assets. Larger firms are expected to enjoy economies of scale and better access to financial resources, which may enhance their inventory turnover efficiency compared to smaller firms. The debt ratio (DBR), calculated as total debt divided by total assets, is incorporated to capture the influence of financial leverage on inventory decisions. Firms with higher debt levels may face stricter financing constraints and thus adopt more conservative inventory strategies to mitigate risks associated with liquidity shortages. Environmental expenditures (ENX), measured as environmental expenditures divided by total revenue, are included to account for the impact of sustainability-related investments on operational outcomes. Higher environmental spending may reduce the resources available for inventory optimization, thereby affecting turnover ratios. At the same time, such expenditures could signal proactive environmental strategies that ultimately enhance efficiency. The cost of capital (COC), measured as interest expenses on debt divided by total debt, reflects the financing costs borne by the firm. A higher cost of capital raises the opportunity cost of holding excessive inventory, thereby encouraging firms to optimize inventory levels. Conversely, firms with lower financing costs may be less pressured to manage inventories stringently. Lastly, firm performance (FRP), measured as earnings before interest and taxes (EBIT) divided by total assets, is controlled for to capture the effect of profitability on inventory practices. Profitable firms may have greater flexibility to manage inventory strategically, while poorly performing firms may experience operational inefficiencies that reduce inventory turnover.

Table 1 shows the measurement of variables.

The study uses EBIT/Total Assets (EBIT/TA) as the primary performance control variable because it captures operating efficiency by reflecting a firm’s ability to generate earnings from its core operations relative to total resources. Unlike broader measures such as ROA or ROE, EBIT/TA focuses specifically on operational performance, which is directly relevant for inventory management decisions. Measures like CapEx or environmental performance capture investment intensity or sustainability outcomes rather than day-to-day operational efficiency, making EBIT/TA a more appropriate control for isolating the effect of ESG uncertainty on inventory practices.

While the ESG uncertainty variable is measured using a composite index capturing firm-level exposure to ESG-related regulatory and disclosure volatility, we acknowledge potential limitations in its scope and granularity. The index primarily reflects textual and frequency-based measures of ESG-related uncertainty, which may not fully capture firms’ internal sustainability risks or sector-specific regulatory nuances. To ensure validity, the measure was cross-checked against alternative proxies such as ESG disclosure dispersion and sentiment-based ESG risk metrics and yielded consistent directional results. Furthermore, the inclusion of lagged variables and dynamic specifications within the system GMM framework strengthens the causal interpretation by mitigating simultaneity bias and capturing the temporal persistence of inventory decisions. This dynamic approach ensures that short-term adjustments and long-term strategic responses to ESG uncertainty are both reflected in the estimation results, enhancing the robustness and interpretability of the findings.

4.3. Methodology

To empirically investigate the relationship between ESG uncertainty and inventory management, this study employed a rigorous econometric methodology supported by a series of pre-estimation diagnostic tests. These tests were necessary to ensure the appropriateness of the selected models and the reliability of the results. The first step was to determine whether the fixed effect model (FEM) or the random effect model (REM) was more suitable for the panel dataset. The Hausman test was conducted for this purpose, and the results are reported in

Table 2. The test produced a chi-square statistic of 512.008 with 11 degrees of freedom and a

p-value of 0.001, strongly rejecting the null hypothesis in favor of FEM. This implies that individual firm-specific effects are correlated with the explanatory variables, thereby justifying the use of a fixed effect estimator. By controlling for unobserved heterogeneity, the FEM ensures that firm-level characteristics such as managerial style, corporate culture, or sectoral attributes that remain constant over time do not bias the estimated relationships. The next diagnostic step was to check for heteroscedasticity, which, if present, could lead to inefficient and biased standard errors. As shown in

Table 3, the likelihood ratio (LR) test for heteroscedasticity yielded a chi-square value of 80.921 with 15 degrees of freedom and a

p-value of 0.051. These results confirm the existence of heteroscedasticity in the dataset. To address this issue, robust standard errors were employed in subsequent model estimations, ensuring that statistical inferences remain valid despite non-constant variance across observations.

Furthermore, the study accounted for potential endogeneity which can arise when explanatory variables are correlated with the error term, thereby biasing the estimates. Endogeneity may stem from reverse causality, measurement errors, or omitted variables, particularly in the context of ESG uncertainty and firm-level operational outcomes. To test for this, the Durbin–Wu–Hausman test was performed, as reported in

Table 4. Both the Durbin test (χ

2 = 16.912,

p = 0.018) and the Wu–Hausman test (χ

2 = 21.008,

p = 0.031) confirmed the presence of endogeneity. These findings necessitated the adoption of more advanced estimation techniques, namely the two-stage least squares (2SLS) and the system generalized method of moments (System GMM). The baseline estimations were conducted using the FEM, as indicated by the Hausman test results. FEM was chosen for its ability to control for time-invariant firm characteristics and provide unbiased estimations of the relationship between ESG uncertainty and inventory management. However, since FEM does not resolve endogeneity problems, it was complemented with instrumental variable techniques.

The two-stage least squares (2SLS) method was employed to address the endogeneity issue. By introducing valid instruments that are correlated with the endogenous explanatory variable (ESG uncertainty) but uncorrelated with the error term, 2SLS ensures consistent parameter estimation. This technique is particularly relevant in the current context where ESG uncertainty may be simultaneously influenced by firm-level operational outcomes, creating potential reverse causality. Finally, the study also applied the system GMM estimator, which is especially suitable for dynamic panel data models with potential endogeneity, heteroscedasticity, and autocorrelation. System GMM uses lagged levels and differences in endogenous variables as instruments, thereby enhancing efficiency and robustness. Its application in the current study is highly relevant because inventory management decisions are inherently dynamic, and past inventory levels may influence current adjustments. Moreover, System GMM allows for the simultaneous control of unobserved heterogeneity, endogeneity, and serial correlation, making it the most comprehensive approach for verifying the robustness of the findings.

In summary, the methodological approach of this study followed a systematic progression: the Hausman test identified FEM as the appropriate baseline model, the LR test highlighted heteroscedasticity, which was addressed using robust errors, and the Durbin–Wu–Hausman tests confirmed endogeneity, leading to the adoption of 2SLS and System GMM as advanced estimation techniques. Collectively, this combination of models ensures that the results are both consistent and reliable, providing robust evidence on the impact of ESG uncertainty on inventory management among Chinese A-share listed firms.

5. Empirical Results and Discussion

5.1. Descriptive Analysis

The descriptive statistics presented in

Table 5 provide an overview of the central tendencies and distributions of the study variables. The mean value of inventory management (INM) is 9.554, which indicates that, on average, Chinese A-share listed firms turn over their inventories roughly 9 to 10 times per year. This reflects a moderate level of inventory efficiency, suggesting that firms in the sample neither overstock excessively nor face significant shortages, though variations exist across companies. The average value of ESG uncertainty (ESG) is 21.914, implying that firms operate under a relatively high degree of ambiguity regarding ESG practices. This mean highlights the growing relevance of sustainability-related challenges in China’s corporate sector during the period under study. The relatively high ESG uncertainty suggests that firms must frequently adapt to evolving policies and market expectations which may influence their operational and inventory strategies. The mean of firm size (FRS) is 7.228, measured as the natural logarithm of total assets. This indicates that the sample firms are medium to large in scale, with substantial asset bases that potentially provide them with greater capacity to manage inventories effectively. Larger firms typically have more sophisticated inventory systems and resources to buffer against ESG-related uncertainties.

The mean debt ratio (DBR) stands at 0.269, showing that, on average, 26.9% of total assets are financed through debt. This level of leverage reflects a balanced approach, where firms neither rely excessively on debt financing nor operate with extremely conservative capital structures. The mean value of environmental expenditures (ENX) is 11.163, suggesting that, on average, firms allocate about 11% of their revenue toward environmental protection and sustainability-related activities. This relatively high share underscores the growing importance of sustainability investments in China’s corporate landscape, which may, however, compete with resources allocated to inventory efficiency. The mean cost of capital (COC) is 0.172, meaning that firms incur an average financing cost of approximately 17.2% relative to their debt levels. This indicates a significant financial burden, which may compel firms to optimize their inventory holdings to minimize the opportunity cost of tied-up capital. Finally, the mean firm performance (FRP) is 0.098, measured as EBIT relative to total assets. This suggests that the average return on assets is about 9.8%, reflecting moderate profitability across the sample. Firms with higher profitability are generally better positioned to manage inventories efficiently, while less profitable firms may struggle with operational inefficiencies.

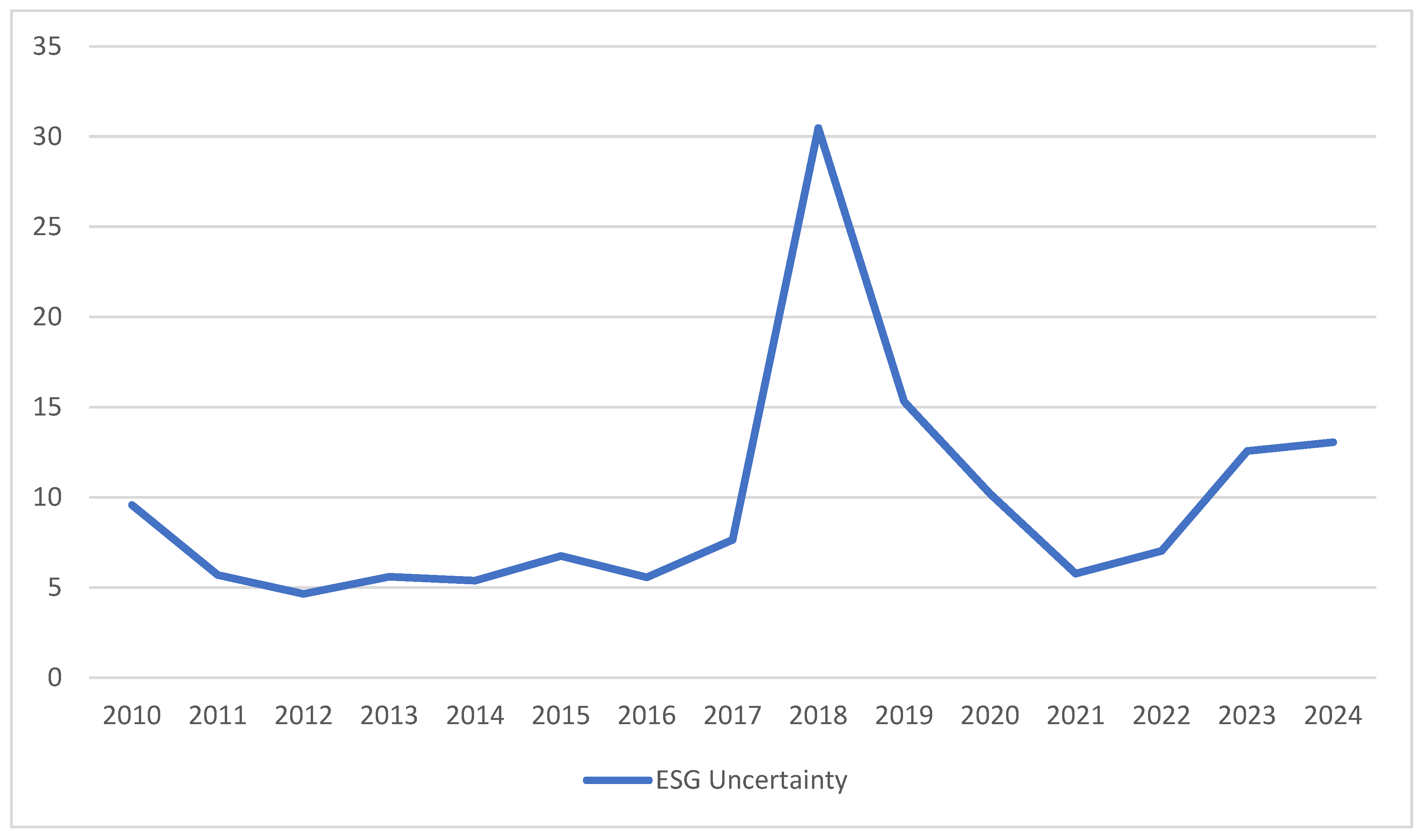

Figure 1 illustrates the trend of ESG uncertainty from 2010 to 2024. The figure shows that ESG uncertainty remained relatively low and stable until 2016, followed by a sharp surge in 2018, likely reflecting heightened regulatory debates and the introduction of new sustainability disclosure frameworks in China. After peaking in 2018, uncertainty declined as firms adapted to evolving ESG standards, though a moderate rise after 2022 indicates renewed policy discussions and tightening sustainability requirements. Overall, the trend reflects the evolving and dynamic nature of ESG regulation and its implications for firms’ operational decision-making.

5.2. Correlation Analysis

The correlation results presented in

Table 6 highlight the association of inventory management (INM) with other variables of the study. INM shows a weak negative correlation with ESG uncertainty (ESG) (−0.033), suggesting that higher levels of ESG uncertainty are marginally associated with lower inventory turnover, reflecting the possibility that sustainability-related ambiguity may hinder operational efficiency. A positive and relatively stronger correlation is observed between INM and firm size (FRS) (0.173), indicating that larger firms generally manage their inventories more effectively due to greater resources and advanced management systems. The relationship between INM and debt ratio (DBR) is slightly positive (0.017), implying that leverage has only a minimal effect on inventory practices in this sample. INM also shows a weak negative association with environmental expenditures (ENX) (−0.041) and cost of capital (COC) (−0.023), suggesting that higher sustainability spending and financing costs may slightly reduce inventory efficiency. Finally, INM and firm performance (FRP) are positively related (0.010), though the correlation is weak, indicating that more profitable firms only marginally improve their inventory turnover. Overall, the correlations confirm that ESG uncertainty exerts a small but negative influence on inventory management, while firm size appears to be the most relevant positive determinant.

5.3. Discussion on Results

The regression findings in

Table 7 underscore that ESG uncertainty exerts a strong and consistent negative effect on inventory management across all estimation techniques. This indicates that when firms face unpredictability in ESG reporting standards, compliance costs, or stakeholder expectations, their ability to manage inventory efficiently becomes constrained. ESG uncertainty can disrupt supply chains by forcing firms to make unplanned adjustments in sourcing, production, and logistics to meet evolving environmental or social requirements. Such disruptions echo Zeng et al. [

9], who found that policy uncertainty drives firms to reduce inventories and substitute them with precautionary cash holdings, thereby distorting normal inventory strategies. Similarly, Mir et al. [

10] reported an inverted U-shaped relationship between EPU and inventory levels, suggesting that excessive uncertainty undermines firms’ capacity to hold optimal inventory, particularly when financial constraints are binding. These findings collectively indicate that ESG uncertainty, distinct from broader policy uncertainty, introduces multidimensional pressures stemming from regulatory ambiguity, sustainability disclosure inconsistencies, and changing stakeholder expectations, all of which complicate operational decision-making.

From a theoretical perspective, Resource Dependence Theory and Dynamic Capabilities jointly explain this linkage: firms depend on external institutional environments for sustainability legitimacy, yet ESG-related unpredictability weakens their ability to reconfigure internal processes efficiently. Consequently, managerial focus shifts from optimizing operations to complying with uncertain sustainability mandates, leading to inefficiencies in procurement, production scheduling, and storage decisions. In some cases, firms may hold excessive inventories to buffer against ESG-related shocks, while others may cut inventories too aggressively to minimize perceived risks—both scenarios reflecting suboptimal resource use. Institutional Theory further supports this interpretation, as firms face coercive and normative pressures to align with ambiguous ESG expectations, which heightens operational rigidity and strategic conservatism.

The mechanisms through which ESG uncertainty disrupts inventory management can be understood across behavioral, institutional, and sectoral dimensions. Behaviorally, managers facing unpredictable ESG regulations tend to adopt risk-averse decision-making, often overstocking to hedge against supply chain disruptions or delaying procurement to avoid potential non-compliance, both of which distort inventory efficiency. Institutionally, weak enforcement consistency and fragmented policy signals in emerging markets like China amplify uncertainty, discouraging firms from investing in sustainable inventory technologies or long-term supplier relationships. Sectorally, industries with high environmental exposure such as manufacturing, energy, and chemicals experience more pronounced inventory disruptions, given their reliance on regulated inputs and sustainability reporting standards. Conversely, technology and service sectors, with relatively lower material dependency, show greater adaptive capacity. Together, these mechanisms highlight that ESG uncertainty operates not only through direct operational inefficiencies but also through behavioral conservatism, institutional fragility, and sectoral heterogeneity, thereby shaping firms’ overall inventory management dynamics.

Firm size (FRS) exhibits a negative association with inventory management, suggesting that larger firms—despite enjoying economies of scale, experience greater bureaucratic complexity and slower response times in adapting to ESG-related shifts. Under high ESG uncertainty, larger firms’ extensive supply networks and diversified product lines make them particularly exposed to coordination inefficiencies. This interaction implies that ESG uncertainty magnifies size-related organizational frictions, consistent with the Resource-Based View, where firm-specific capabilities determine adaptability under uncertainty. Conversely, debt ratio (DBR) positively affects inventory management, indicating that financially leveraged firms adopt tighter operational discipline. Debt obligations may compel managers to maintain inventory levels that ensure uninterrupted operations and stable cash flows. This is consistent with Trade-off Theory, where firms balance the benefits of debt financing with the need to avoid disruptions in revenue generation.

Environmental expenditure (ENX) negatively affects inventory management efficiency, reflecting the trade-off between sustainability investments and short-term operational performance. Firms allocating higher budgets to environmental initiatives may temporarily divert resources away from process optimization and digital inventory systems, resulting in transitional inefficiencies. This finding aligns with Institutional Theory, which posits that firms responding to external environmental pressures often incur short-term performance costs before realizing long-term efficiency gains.

The cost of capital (COC) shows a positive and significant relationship with inventory management, suggesting that higher financing costs impose financial discipline, encouraging managers to improve working capital efficiency. This mechanism can be interpreted through the Agency Theory, as higher financing costs reduce managerial discretion and increase accountability for resource utilization. Similarly, firm performance (FRP) positively influences inventory management efficiency, indicating that more profitable firms possess greater capacity to invest in predictive analytics, digital monitoring, and lean inventory systems. This aligns with the Dynamic Capabilities perspective, wherein superior-performing firms continuously upgrade operational competencies to maintain efficiency and resilience under ESG-related uncertainty.

Beyond statistical robustness supported by strong R2 values and valid GMM instruments, the results carry significant managerial implications. Managers should recognize ESG uncertainty not merely as a compliance challenge but as an operational risk that directly influences supply chain efficiency. Firms can mitigate these effects by integrating ESG risk monitoring into inventory systems, employing predictive analytics to anticipate supply disruptions, and establishing flexible procurement networks. Larger firms, in particular, should decentralize decision-making to enhance responsiveness under ESG volatility, while highly leveraged firms can leverage their financial discipline to align sustainability targets with operational goals. Policymakers, on the other hand, should focus on improving clarity and consistency in ESG disclosure requirements, as stable and transparent regulatory environments can enable firms to synchronize sustainability objectives with efficient inventory practices.

6. Conclusions and Policies

6.1. Conclusions of the Study

This study investigated the impact of ESG uncertainty on inventory management using panel data from Chinese A-share listed firms spanning 2010–2024. Employing various methods, the results consistently indicated that higher ESG uncertainty significantly undermines firms’ inventory management efficiency. Unpredictable changes in sustainability regulations, reporting standards, and stakeholder expectations were found to disrupt supply chain coordination, distort demand forecasting, and weaken inventory turnover. Beyond the core relationship, firm-level characteristics also shaped inventory outcomes. Larger firms and those with greater environmental expenditures exhibited lower inventory efficiency, likely due to operational complexity and resource reallocation toward sustainability initiatives. In contrast, higher debt ratios, cost of capital, and firm performance were associated with improved inventory outcomes, reflecting stronger financial discipline and operational oversight. Diagnostic tests confirmed the robustness of these findings. Theoretically, the study extends the literature by establishing ESG uncertainty as a distinct determinant of operational efficiency, bridging the gap between sustainability research and working capital management. By integrating insights from Resource Dependence, Institutional, and Dynamic Capabilities theories, the analysis highlights how non-financial uncertainty can alter firms’ operational decision-making and adaptive behavior. This contribution deepens understanding of the mechanisms through which ESG-related volatility translates into tangible supply chain and inventory inefficiencies.

6.2. Policy Implications

The findings highlight that ESG uncertainty poses a direct operational risk to inventory efficiency, requiring managers to adopt adaptive and resilience-oriented strategies. Firms should integrate sustainability considerations into their inventory and supply chain management systems rather than treating ESG as a separate compliance function. Specifically, flexible procurement policies, supplier diversification, and real-time monitoring systems can help buffer against ESG-related disruptions. Investment in predictive analytics and digital forecasting tools is equally important for improving demand estimation under regulatory or market uncertainty. Strengthening internal governance mechanisms to align ESG objectives with operational decisions can prevent both overstocking and understocking caused by sudden sustainability pressures. Moreover, firms should foster stronger coordination with supply chain partners to ensure information symmetry on ESG-related risks, allowing for collective adjustments rather than fragmented responses.

At the regulatory level, policymakers should focus on reducing ESG-related uncertainty by enhancing the clarity, consistency, and predictability of sustainability reporting frameworks. Frequent changes in ESG disclosure requirements or inconsistent enforcement create volatility that directly undermines operational decision-making. A harmonized national ESG taxonomy and standardized disclosure guidelines would enable firms to plan long-term inventory and production strategies more effectively. In addition, governments can provide incentives and support mechanisms such as green credit schemes, tax relief for sustainable practices, and access to digital supply chain infrastructure to encourage firms to integrate sustainability with operational efficiency.

Investors and financial institutions also play a critical role. Since the cost of capital and debt financing were found to positively influence inventory outcomes, financial actors can help stabilize corporate operations by linking lending conditions to predictable and transparent ESG performance metrics. This alignment between finance and sustainability would reduce uncertainty and promote disciplined inventory management. Similarly, suppliers and business partners should develop collaborative ESG risk-sharing mechanisms that promote cohesive adaptation across supply chains. Overall, these implications underscore that sustainability and operational efficiency should not be viewed as competing objectives. Reducing ESG uncertainty through coordinated policy, financial, and managerial actions can enable firms to enhance both resilience and competitiveness in a rapidly evolving sustainability landscape.

6.3. Limitations and Future Research

Despite offering valuable insights, this study has several limitations that warrant acknowledgment and open avenues for further exploration. First, the analysis focused solely on Chinese A-share listed companies, which may limit the external validity of the findings, as institutional structures, regulatory enforcement, and ESG disclosure standards vary significantly across countries. Future research could therefore conduct cross-country comparisons, especially between emerging and developed markets, to assess whether the relationship between ESG uncertainty and operational efficiency holds under different governance regimes and policy environments. Second, the measurement of ESG uncertainty was based on a composite index that, while robust and empirically tractable, may not fully capture firm-specific perceptions or qualitative aspects of ESG volatility. Incorporating alternative or multidimensional measures—such as text-based indicators, news sentiment analysis, or survey-based data could enhance construct validity and provide a more nuanced understanding of how firms interpret and respond to ESG turbulence. Third, this study concentrated on inventory management as the primary operational outcome. Expanding future analyses to include other dimensions, such as supply chain resilience, production adaptability, or working capital efficiency, would help establish a more comprehensive picture of how ESG uncertainty shapes corporate operations. Lastly, methodological extensions using mixed-method approaches—combining quantitative panel models with qualitative case studies—could offer deeper insights into managerial reasoning, organizational adaptation, and firm-level strategies under ESG uncertainty.