Abstract

This study examines the relationship between sustainable practices and corporate profitability in Colombian enterprises using data from 3572 responses to the FAEDPYME 2022 survey. Through Structural Equation Modeling, the research analyzes how environmental criteria and sustainability perceptions impact business performance, considering operational efficiency and corporate reputation as mediators. The results demonstrate that environmental supplier selection, energy efficiency management, and environmental certifications positively correlate with increased profitability. Conversely, plastic packaging management shows a negative relationship. The perception that sustainability enhances profitability strongly is associated with higher business performance. Both operational efficiency and corporate reputation serve as significant mediators in these relationships. The study confirms that the strategic implementation of specific sustainable practices is positively associated with enhanced corporate profitability. Furthermore, a managerial conviction that sustainability drives profitability appears to be a significant factor in achieving such positive financial outcomes.

1. Introduction

The imperative of sustainability has profoundly reshaped business management paradigms in recent decades. Mounting concerns over climate change, resource depletion, and heightened societal expectations are compelling organizations worldwide to adopt more environmentally and socially responsible practices. Amidst this transition, a critical and enduring question for businesses is the extent to which these sustainable practices translate into tangible financial benefits.

A substantial body of literature suggests that corporate sustainability can provide a range of advantages, including operational cost efficiencies, improved corporate reputation, enhanced customer loyalty, and the creation of lasting competitive advantages. The adoption of environmental criteria in supplier selection is widely recognized for its potential to bolster operational efficiency and mitigate supply chain vulnerabilities [1,2]. Similarly, efficient energy management practices are linked to reduced operational costs and can act as a catalyst for innovation [3,4,5], a view expanded by research arguing that environmental regulation could spur innovations that offset compliance costs [6]. The procurement of environmental certifications, such as ISO 14001, is also frequently associated with enhanced market perception and a tendency for certified companies to achieve superior financial performance [7,8,9,10]. Furthermore, the internal organizational perception of sustainability’s value can significantly influence employee motivation [11,12,13], the development of competitive advantages [14,15,16], corporate image [17,18,19], and customer satisfaction [20,21,22].

However, the implementation is not devoid of complexities. Certain sustainable practices may entail considerable upfront investments that could exert short-term pressure on profitability. The management of plastic packaging, for instance, may require initial capital outlays [23,24,25,26], and immediate financial windfalls from some environmental investments might be limited [27]. Similarly, sustainable water management can also involve initial costs [28,29,30], with financial benefits potentially materializing over a longer horizon [31]. This highlights a potential divergence between immediate financial outlays and long-term strategic advantages, forming a crucial point of debate within academic and business communities.

The primary objective of this research is to analyze the relationship between the adoption of specific sustainable practices and corporate profitability in the context of Colombian enterprises. To achieve this, the study employs a quantitative approach, utilizing Structural Equation Modeling (SEM) to test a series of hypotheses. The analysis is based on data from the 2022 FAEDPYME survey, which provides insights into how environmental criteria and sustainability perceptions, mediated by operational efficiency and corporate reputation, ultimately impact financial performance.

This research contributes to clarifying these nuanced relationships by empirically testing specific hypotheses in an emerging economy context. While numerous studies have explored the sustainability–profitability link, many rely on aggregate measures of corporate social responsibility. This study fills a gap by providing a disaggregated analysis, evaluating the distinct financial impacts of specific, operational-level environmental practices and managerial perceptions. The practical justification lies in offering actionable, evidence-based insights for firms in Colombia and similar Latin American contexts seeking to strategically embed sustainability into their operational and financial frameworks. The study’s relevance is further amplified by its alignment with key United Nations Sustainable Development Goals (SDGs), specifically SDG 8 (Decent Work and Economic Growth) and SDG 12 (Responsible Consumption and Production).

This article is structured as follows. Section 2 reviews relevant literature and develops the research hypotheses based on established theories. Section 3 details the research methodology, including the data source, variable measurement, and analytical strategy. Section 4 presents the results of the SEM analysis. Section 5 discusses the findings in the context of prior research and theoretical frameworks, and Section 6 concludes with the study’s main contributions, limitations, and directions for future research.

2. Literature Review and Hypothesis Development

This section provides the theoretical foundation for the study, drawing from established theories to build the conceptual model and justify the hypotheses.

2.1. Theoretical Framework

The relationship between sustainability practices and firm performance can be understood through several theoretical lenses. The Resource-Based View (RBV) suggests that firms can gain a competitive advantage by developing unique, valuable, and hard-to-imitate resources and capabilities. From this perspective, sustainable practices are not merely costs but can be strategic investments that build critical capabilities. For instance, developing green innovations, highly efficient processes, or a sustainable supply chain can lead to superior performance by reducing costs and differentiating the firm from its competitors.

Stakeholder Theory posits that to be successful in the long term, firms must create value for a wide range of stakeholders, not just shareholders. This includes employees, customers, suppliers, and the community. Engaging in sustainable practices helps manage these complex stakeholder relationships, which can enhance corporate reputation, build customer loyalty, attract and retain talent, and reduce regulatory and social risks, all of which can indirectly improve financial outcomes.

Finally, Institutional Theory explains that firms adopt certain practices to gain legitimacy and social acceptance within their institutional environment, which includes formal rules (regulations) and informal norms (societal expectations). Adopting widely recognized environmental standards, such as ISO 14001, signals conformity with these norms and expectations. This legitimacy can unlock access to new markets, improve relationships with regulators, and enhance the firm’s social license to operate.

Taken together, these theories suggest that the financial benefits of sustainability are not always direct or immediate. Instead, the impact on profitability is often mediated by the development of internal capabilities (as per RBV), the enhancement of intangible assets like corporate reputation (as per Stakeholder Theory), and the achievement of social legitimacy (as per Institutional Theory).

2.2. Hypothesis Development

Based on this theoretical framework and prior empirical evidence, we propose the following hypotheses to be tested within the context of Colombian enterprises.

The adoption of certain environmental criteria is widely recognized for its potential to create financial value. Practices such as improving supply chain sustainability can enhance operational efficiency and mitigate risks. Similarly, efficient energy management is directly linked to reduced operational costs and can act as a catalyst for innovation. Furthermore, obtaining environmental certifications can enhance market perception, improve operational discipline, and lead to better financial performance.

Conversely, some sustainability practices require significant initial investments that may not yield immediate financial returns. The management of plastic packaging, for example, can involve high upfront costs for new materials, and specialized water management technologies can be costly to implement. While these may offer long-term benefits, their immediate effect on profitability could be negative.

Therefore, we propose the following hypotheses:

H1:

The adoption of environmental criteria in supplier selection is positively associated with corporate profitability.

H2:

The implementation of environmental criteria in the management of plastic packaging and derivatives is negatively associated with corporate profitability.

H3:

The adoption of environmental criteria in process design is positively associated with corporate profitability.

H4:

The implementation of efficient energy management is positively associated with corporate profitability.

H5:

The adoption of environmental criteria in water management is negatively associated with corporate profitability.

H6:

The implementation of environmental criteria in waste management is positively associated with corporate profitability.

H7:

The attainment of environmental certifications is positively associated with corporate profitability.

The Role of Managerial Perceptions

Organizational theories emphasize that managerial attitudes and corporate culture are crucial for effective strategy implementation. A leadership team that genuinely believes sustainability is a driver of profitability is more likely to allocate the necessary resources and foster an environment where sustainability initiatives can succeed financially. This conviction can act as a catalyst, turning sustainability strategies into tangible financial outcomes. Therefore, we posit the following:

H8:

A managerial perception that sustainability initiatives increase corporate profitability is positively associated with actual corporate profitability.

3. Materials and Methods

The proposed methodology comprises four sections. The first addresses the quantitative, cross-sectional research design using Structural Equation Modeling (SEM) to test the formulated hypotheses. Then, the second section presents the sample of 3572 valid responses from Colombian enterprises across six geographical regions. Next, the third section explains the measurement approach for the dependent variable, independent variables, and mediating variables. Finally, the fourth section describes the SEM technique employed to evaluate the complex theoretical model and test the hypothesized relationships between variables.

3.1. Study Design

This investigation utilizes a quantitative, cross-sectional research design to formally test the hypotheses (H1–H8) derived from the theoretical review. Structural Equation Modeling (SEM) was employed to analyze primary data and examine the complex relationships between latent constructs (environmental criteria, sustainability perceptions), mediating variables (operational efficiency, corporate reputation), and the outcome variable (corporate profitability).

3.2. Sample and Data Collection

The data were sourced from the FAEDPYME (an acronym in Spanish for Foundation for the Strategic Analysis of Small and Medium-sized Enterprises) project, an international research initiative assessing key characteristics of SMEs across Ibero-American countries. The FAEDPYME survey captures a wide range of information related to business strategy, innovation, and sustainability practices.

The study sample was drawn from the 2022 survey, yielding 3572 valid responses from Colombian enterprises, a response rate of 77.65%. The data are self-reported by managers and measured on Likert-type scales, which is appropriate for capturing perceptions and practices. The geographical distribution of firms is as follows: Caribbean Coast (n = 326), Antioquia and Coffee Axis (n = 910), Cundinamarca and Boyacá (n = 719), Santanderes (n = 452), Amazonia-Orinoquía (n = 432), and Southwest (n = 717).

3.3. Measurement of Variables

The variables for this study were operationalized using items from the FAEDPYME 2022 survey (see Appendix A for full details).

- Dependent Variable: Corporate profitability (P) was measured with a single item assessing the firm’s profitability compared to its competitors.

- Independent variables (latent constructs):

- o

- Environmental Criteria (EC): Measured with seven indicators, including supplier selection, plastic packaging management, process design, energy management, water management, waste management, and environmental certifications.

- o

- Sustainability Perceptions (SP): Measured with five indicators regarding the belief that sustainability increases employee motivation, generates competitive advantages, improves corporate image, increases profitability, and enhances customer satisfaction.

- Mediating Variables: Operational efficiency (OE) and corporate reputation (CR) were measured as latent constructs using specific survey items selected to capture their mediating role as established in theoretical frameworks.

3.4. Analytical Strategy

To assess the hypothesized relationships, Covariance-Based SEM (CB-SEM) was employed using the lavaan package in R-4.5.1 for Windows [32]. CB-SEM was chosen because the primary goal of this research is to test and confirm a pre-defined theoretical model. Unlike PLS-SEM, which is better suited to exploratory research and prediction, CB-SEM provides a more rigorous framework for assessing the goodness-of-fit of the entire model and confirming hypothesized causal pathways, which aligns with our theory-testing objective.

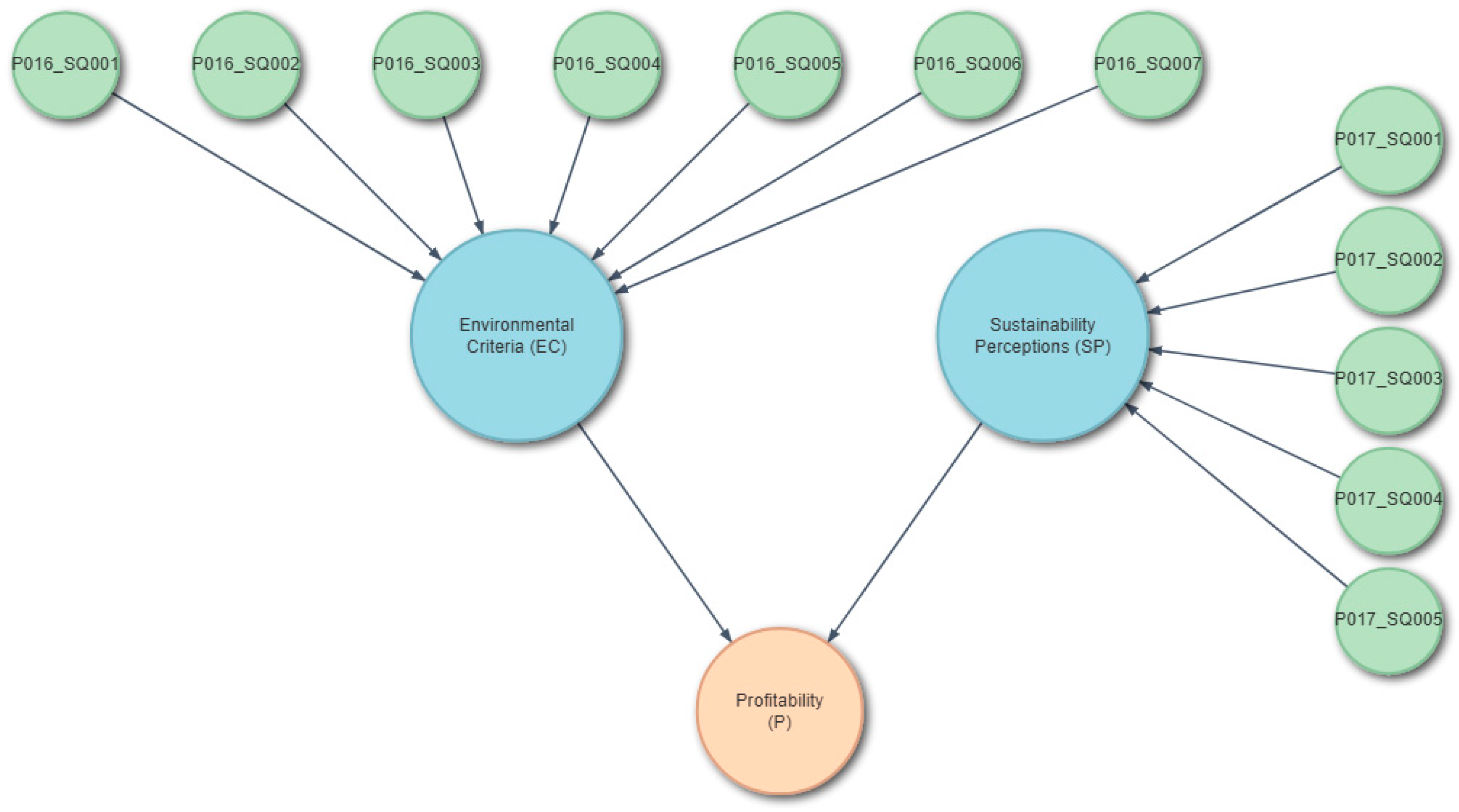

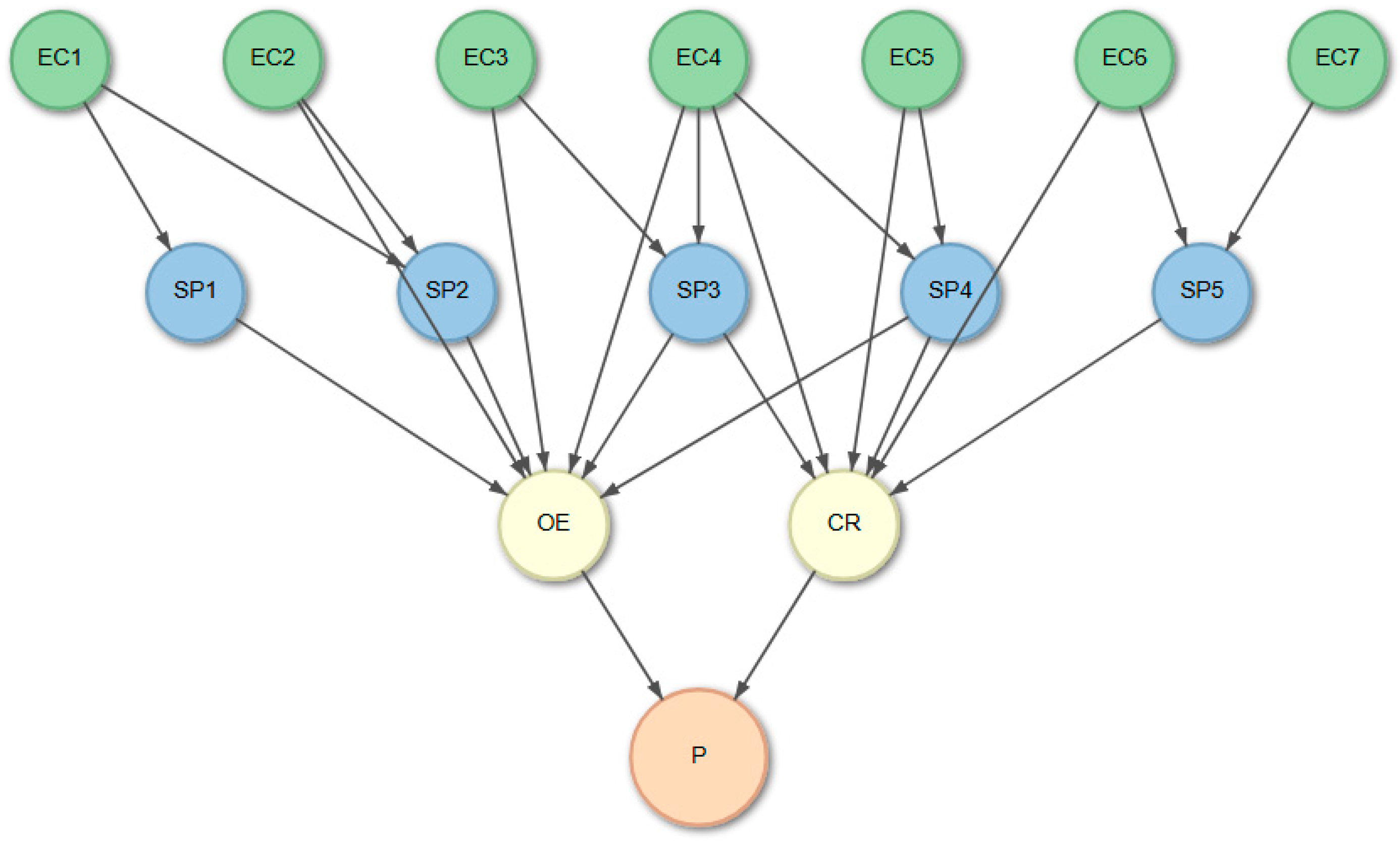

The analysis involved a two-step approach: first, Confirmatory Factor Analysis (CFA) was conducted to ensure the measurement model’s validity and reliability, verifying that the observed indicators properly represented their respective latent constructs. Second, after confirming the adequacy of the measurement model, the full structural model was estimated to test the hypothesized relationships. Methodological guidance for the application of SEM was drawn from established literature in the field [33,34,35]. The initial conceptual model and the enhanced model including mediators are shown in Figure 1 and Figure 2, respectively.

Figure 1.

Conceptual Model of Environmental Criteria, Perceptions of Sustainability, and Profitability. Source: Own elaboration. Variable codes: P016_SQ001 (Environmental criteria in supplier selection); P016_SQ002 (Management of plastic packaging and derivatives); P016_SQ003 (Environmental criteria in process design); P016_SQ004 (Environmental criteria for energy management); P016_SQ005 (Environmental criteria in water management); P016_SQ006 (Environmental criteria in waste management); P016_SQ007 (Environmental certifications); P017_SQ001 (Sustainability increases employee motivation); P017_SQ002 (Sustainability generates competitive advantages); P017_SQ003 (Adopting sustainable policies improves corporate image); P017_SQ004 (Sustainability increases corporate profitability); P017_SQ005 (Sustainability enhances customer satisfaction); OE, operational efficiency; CR, corporate reputation.

Figure 2.

Enhanced SEM Model with Operational Efficiency and Corporate Reputation as Mediators between Environmental Criteria, Sustainability Perceptions, and Profitability. Source: Own elaboration. Variable codes: EC1 (Environmental criteria in supplier selection); EC2 (Management of plastic packaging and derivatives); EC3 (Environmental criteria in process design); EC4 (Environmental criteria for energy management); EC5 (Environmental criteria in water management); EC6 (Environmental criteria in waste management); EC7 (Environmental certifications); SP1 (Sustainability increases employee motivation); SP2 (Sustainability generates competitive advantages); SP3 (Adopting sustainable policies improves corporate image); SP4 (Sustainability increases corporate profitability); SP5 (Sustainability enhances customer satisfaction); OE, operational efficiency; CR, corporate reputation; P, corporate profitability.

4. Results

The results section is divided into three subsections. The first subsection deals with the evaluation of the model fit. The second section discusses hypothesis tests and their direct effects. Finally, in the third section, the analysis of the mediation effects is presented.

4.1. Model Fit Assessment

The enhanced SEM model (Figure 2) was evaluated for its goodness-of-fit. The obtained fit indices were as follows: Comparative Fit Index (CFI) = 0.92, Tucker–Lewis Index (TLI) = 0.91, Root Mean Square Error of Approximation (RMSEA) = 0.05, and Standardized Root Mean Square Residual (SRMR) = 0.04. These indices meet established thresholds for good model fit, suggesting the model adequately represents the empirical relationships in the data.

4.2. Hypothesis Testing: Direct Effects

The results from the estimation of the structural model are detailed in Table 1. This table presents the direct outputs from the SEM analysis, including the standardized coefficients, standard errors, and p-values for each hypothesized path. A narrative summary of these findings is provided below.

Table 1.

Estimated Coefficients for Direct Effects on Corporate Profitability.

The analysis provided full support for hypotheses H1, H2, H4, H7, and H8. A positive and statistically significant relationship with profitability was found for environmental criteria in supplier selection (H1), efficient energy management (H4), and environmental certifications (H7). Conversely, a significant negative relationship was found for the management of plastic packaging (H2). The managerial belief that sustainability increases profitability was also strongly and positively associated with actual profitability (H8). Hypothesis H5 received marginal support, showing a negative relationship with profitability that was borderline significant. Finally, hypotheses H3 (process design) and H6 (waste management) were not supported, as their relationships with profitability were not statistically significant.

4.3. Mediation Effects Analysis

The SEM results also provided insights into the indirect effects mediated by operational efficiency (OE) and corporate reputation (CR):

Operational Efficiency (OE) as a Mediator: The analysis indicated a significant positive path from the latent construction of environmental criteria (EC) to operational efficiency (OE), and a subsequent significant positive path from OE to corporate profitability (P) (coefficient = 0.1325, p = 0.000). This suggests that the implementation of environmental criteria enhances operational efficiency, which, in turn, contributes positively to profitability.

Corporate Reputation (CR) as a Mediator: Similarly, a significant positive path was found from the latent construction of sustainability perceptions (SP) to corporate reputation (CR), and a further significant positive path from CR to corporate profitability (P) (coefficient = 0.1437, p = 0.000). This implies that favorable sustainability perceptions bolster corporate reputation, which subsequently leads to improved financial performance.

This confirms that both operational efficiency and corporate reputation are important mediators in the relationship between sustainability and financial performance.

5. Discussion

This empirical investigation reveals a multifaceted relationship between corporate sustainability and profitability within Colombian enterprises, one that is highly dependent on the specific practices adopted and prevailing managerial perceptions. The findings are discussed through the theoretical lenses of RBV, Stakeholder, and Institutional Theories.

The positive association between supplier selection, energy management, certifications, and profitability support the RBV, suggesting these practices function as valuable capabilities that create efficiencies and reduce costs. These results align with prior research that has found similar positive links [1,6,10,36]. This confirms that these practices are likely to contribute to profitability through mechanisms such as reduced operational costs, risk mitigation in the supply chain [1,2], and improved stakeholder trust associated with certifications [8,9].

Conversely, the negative short-term financial impact of plastic packaging and water management underscores the trade-offs firms face. These findings are consistent with literature suggesting that some environmental initiatives, particularly those requiring substantial upfront investment, may initially depress profitability [23,27], even if they offer long-term benefits such as regulatory compliance and enhanced brand value [24,25,31].

The lack of statistical significance for process design and waste management is also noteworthy. This does not necessarily imply these practices are without value. It could suggest their financial impact is not immediate or is fully mediated by operational efficiency, a pathway our model partially captures.

A particularly strong finding is the link between the managerial belief that sustainability is profitable and actual profitability. This highlights the critical role of strategic intent and a pro-sustainability corporate culture in effective implementation and translating strategies into financial success.

Finally, the significant mediating roles of operational efficiency and corporate reputation confirm theoretical expectations and prior empirical work [17,36], underscoring that sustainability should be integrated holistically into core business strategy to build both internal capabilities (efficiency) and external intangible assets (reputation).

On the Non-Significant Effects of Process Design and Waste Management

The lack of statistical significance for process design (H3) and waste management (H6) is noteworthy. This does not imply these practices are without value. Rather, it may suggest their financial impact is not immediate or is fully mediated by operational efficiency, a pathway our model partially captures. It is also possible that in the Colombian context, the initial costs of redesigning processes or implementing advanced waste management systems are high, offsetting any short-term financial gains that could be detected in a cross-sectional study.

6. Conclusions

This empirical investigation demonstrates that the relationship between corporate sustainability and profitability in Colombian enterprises is multifaceted, depending on the specific practice adopted and prevailing managerial perceptions. The study confirms that strategically implementing practices like environmental supplier selection, energy efficiency, and certifications is positively associated with enhanced corporate profitability. Furthermore, a managerial conviction that sustainability drives profitability appears to be a significant factor in achieving such positive financial outcomes.

However, the research also highlights that not all sustainability initiatives yield immediate financial gains. Practices such as plastic packaging management and intensive water management may impose short-term costs, necessitating a long-term strategic view. The study also highlights that the financial impact of some practices, like process design and waste management, may not be direct, as their relationship with profitability was not found to be statistically significant in this model. The significant mediating roles of operational efficiency and corporate reputation underscore the importance of integrating sustainability into core business processes and stakeholder engagement strategies to translate efforts into financial value.

Ultimately, this study reinforces the notion that sustainability, when strategically managed, is a source of competitive advantage and financial value, not merely a cost center. By offering a disaggregated analysis, the research provides actionable insights into business leaders navigating the complexities of sustainable development to improve both environmental and financial performance.

6.1. Summary of Key Findings per Hypothesis

To provide a direct link between the research questions and the outcomes, the conclusions for each tested hypothesis are summarized below.

Practices with Positive Financial Association: The findings support the hypothesis that environmental criteria in supplier selection (H1), efficient energy management (H4), and the attainment of environmental certifications (H7) are all positively and significantly associated with corporate profitability. This suggests that practices offering clear operational efficiencies, risk mitigation, or enhanced market legitimacy provide tangible financial benefits.

Practices with Negative Short-Term Financial Association: The study also confirms the hypotheses that plastic packaging management (H2) is negatively associated with profitability, while water management (H5) shows a marginally significant negative association. This indicates that practices requiring substantial upfront investment in new technologies or materials may impose net short-term costs, necessitating a long-term strategic perspective from managers.

Practices with Non-Significant Direct Association: The hypotheses linking process design (H3) and waste management (H6) directly to profitability were not supported in this model. This crucial finding suggests that the financial benefits of these practices are not automatic or direct; instead, their value may be realized over a longer period or be fully mediated through gains in operational efficiency, rather than impacting the bottom line directly.

The Role of Managerial Perception: Finally, the study strongly supports the hypothesis that a managerial belief that sustainability increases profitability (H8) is positively correlated with actual financial performance. This underscores that a pro-sustainability corporate culture and strategic intent are critical enablers for translating environmental initiatives into financial success.

6.2. Implications of the Study

Theoretically, this study contributes to literature by providing a disaggregated analysis that challenges a monolithic view of corporate sustainability, demonstrating that the financial impact varies significantly by practice. It validates key tenets of the Resource-Based View and Stakeholder Theory within an emerging economy context.

Practically, the findings offer a strategic roadmap for managers. They should prioritize “win–win” initiatives with clear and immediate returns (e.g., energy efficiency, supplier collaboration) while planning for the long-term value of practices that may incur short-term costs (e.g., packaging innovation). Above all, fostering a leadership mindset that genuinely champions the financial and strategic value of sustainability is paramount.

6.3. Limitations and Future Research

While this study provides valuable insights, the following limitations must be acknowledged to guide future research.

- Self-Reported Data and Perceptual Measures: A significant limitation is the reliance on self-reported, perceptual data for both the independent and dependent variables. This approach risks social desirability bias and may not accurately reflect true financial performance. Future research should aim to incorporate objective, audited financial metrics to strengthen the validity of findings.

- Geographical and Contextual Specificity: The study’s focus on Colombian enterprises may limit the generalizability of the findings to firms operating in different economic, regulatory, and market conditions. This suggests a need for comparative, cross-national research.

- Cross-Sectional Design: The study’s cross-sectional design precludes establishing causal relationships. A longitudinal analysis would provide stronger evidence of whether these practices lead to sustained financial benefits over time.

- Limited Mediating and Moderating Variables: The analysis does not extensively explore other potential mediators (e.g., innovation capacity) or moderators (e.g., firm size, industry sector). Incorporating these variables could yield a more nuanced understanding of the sustainability–profitability relationship.

- Lack of Qualitative Insights: The quantitative approach does not capture the “how” and “why” behind managerial decisions. Complementing the study with qualitative case studies could enrich the interpretation of results and uncover underlying strategic motivations.

Author Contributions

Conceptualization, J.A.R.-M. and J.A.A.-H.; methodology, J.A.R.-M.; software, J.A.A.-H.; validation, J.A.R.-M. and J.A.A.-H.; formal analysis, J.A.R.-M.; investigation, J.A.A.-H.; resources, J.A.A.-H.; data curation, A.F.R.A.; writing—original draft preparation, J.A.A.-H. and A.F.R.A.; writing—review and editing, J.A.R.-M.; visualization, A.F.R.A.; supervision, A.F.R.A.; project administration, A.F.R.A.; funding acquisition, A.F.R.A. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by Universidad Nacional de Trujillo and Universidad de Córdoba.

Institutional Review Board Statement

The study was conducted in accordance with the Ethics Committee of Tecnológico de Antioquia Institución Universitaria.

Informed Consent Statement

Informed consent was obtained from all subjects involved in the study.

Data Availability Statement

The data presented in this study are available on request from the corresponding author.

Conflicts of Interest

The authors declare no conflicts of interest.

Appendix A. Measurement Items

This appendix details the survey items from the FAEDPYME 2022 questionnaire used to measure the latent and observed variables in the study. All the perceptual items were measured on a Likert-type scale.

- Corporate Profitability (P)

This variable measures the firm’s self-perceived financial performance compared to that of its peers.

Scale: 1 (Much worse) to 5 (Much better), compared to the competition.

P019_SQ006: Assesses the firm’s profitability over the last year compared to its main competitors.

- Environmental Criteria (EC)

These items measure the importance that the firm places on applying environmental criteria across different operational areas.

Scale: 1 (Not important) to 5 (Very important).

P016_SQ001: Importance of applying environmental criteria in the selection of suppliers.

P016_SQ002: Importance of applying environmental criteria in the management of plastic packaging and derivatives.

P016_SQ003: Importance of applying environmental criteria in process design.

P016_SQ004: Importance of applying environmental criteria in energy management.

P016_SQ005: Importance of applying environmental criteria in water management.

P016_SQ006: Importance of applying environmental criteria in waste management.

P016_SQ007: Importance of obtaining environmental certifications.

- Sustainability Perceptions (SP)

These items assess the respondent’s level of agreement regarding the perceived benefits of adopting sustainable policies within the company.

Scale: 1 (Totally disagree) to 5 (Totally agree).

P017_SQ001: Agreement with the statement that sustainable policies increase employee motivation.

P017_SQ002: Agreement with the statement that sustainable policies generate competitive advantages.

P017_SQ003: Agreement with the statement that sustainable policies improve corporate image and reputation.

P017_SQ004: Agreement with the statement that sustainable policies increase corporate profitability.

P017_SQ005: Agreement with the statement that sustainable policies enhance customer satisfaction.

References

- Tachizawa, E.M.; Gimenez, C.; Sierra, V. Green supply chain management approaches: Drivers and performance implications. Int. J. Oper. Prod. Manag. 2015, 35, 1546–1566. [Google Scholar] [CrossRef]

- Villena, V.H.; Gioia, D.A. A more sustainable supply chain. Harv. Bus. Rev. 2020, 98, 84–93. [Google Scholar]

- Feng, Y.; Zhang, H.; Zhang, X. The impact of environmental regulation on firm innovation: Evidence from China. Energy Policy 2018, 118, 403–409. [Google Scholar] [CrossRef]

- Gielen, D.; Boshell, F.; Saygin, D.; Bazilian, M.D.; Wagner, N.; Gorini, R. The role of renewable energy in the global energy transformation. Energy Strategy Rev. 2019, 24, 38–50. [Google Scholar] [CrossRef]

- Chiaroni, D.; Chiesa, V.; Frattini, F.; Urbinati, A. Circular economy strategies in the energy industry: A cross-national analysis of drivers, barriers and practices. J. Clean. Prod. 2020, 276, 123215. [Google Scholar] [CrossRef]

- Porter, M.E.; van der Linde, C. Toward a new conception of the environment-competitiveness relationship. J. Econ. Perspect. 1995, 9, 97–118. [Google Scholar] [CrossRef]

- Nishitani, K.; Kaneko, S.; Fujii, H.; Komatsu, S. Are firms’ ISO 14001 certification and carbon emissions disclosure related to the CDP supply chain program? J. Environ. Manag. 2019, 234, 214–227. [Google Scholar] [CrossRef]

- Zobel, T.; Burström, F. ISO 14001 adoption and performance in SME manufacturing firms: A longitudinal analysis. Bus. Strategy Environ. 2018, 27, 101–115. [Google Scholar] [CrossRef]

- Heras-Saizarbitoria, I.; Dogui, K.; Boiral, O. Shedding light on ISO 14001 certification audits: A critical review. J. Clean. Prod. 2020, 243, 118547. [Google Scholar] [CrossRef]

- Darnall, N.; Henriques, I.; Sadorsky, P. Do environmental management systems improve business performance in an international setting? J. Int. Manag. 2008, 14, 364–376. [Google Scholar] [CrossRef]

- Glavas, A.; Kelley, K. The effects of perceived corporate social responsibility on employee attitudes. Bus. Ethics Q. 2014, 24, 165–202. [Google Scholar] [CrossRef]

- Rego, A.; Leal, S.; Cunha, M.P.; Faria, J.; Pinho, C. How the perceptions of five dimensions of corporate citizenship and their inter-inconsistencies predict affective commitment. J. Bus. Ethics 2010, 94, 107–127. [Google Scholar] [CrossRef]

- Kim, Y.J.; Kim, W.G.; Choi, H.M.; Phetvaroon, K. The effect of green human resource management on hotel employees’ eco-friendly behavior and environmental performance. Int. J. Hosp. Manag. 2019, 76, 83–93. [Google Scholar] [CrossRef]

- Porter, M.E.; Kramer, M.R. Strategy & society: The link between competitive advantage and corporate social responsibility. Harv. Bus. Rev. 2006, 84, 78–92. [Google Scholar] [PubMed]

- Haque, F.; Ntim, C.G. Environmental policy, sustainable development, governance mechanisms and environmental performance. Bus. Strategy Environ. 2018, 27, 415–435. [Google Scholar] [CrossRef]

- De Castro, G.M.; Salazar, E.M.A.; López, J.E.N.; Sáez, P.L. El papel del capital intelectual en la innovación tecnológica. Un aplicación a las empresas de servicios profesionales de España. Cuad. Econ. Dir. Empresa 2009, 12, 83–109. [Google Scholar] [CrossRef]

- Luo, X.; Bhattacharya, C.B. Corporate social responsibility, customer satisfaction, and market value. J. Mark. 2006, 70, 1–18. [Google Scholar] [CrossRef]

- Wang, Z.; Huo, B.; Tian, Y.; Zhu, W. The impact of supply chain quality integration on green supply chain management and environmental performance. J. Clean. Prod. 2020, 276, 124215. [Google Scholar] [CrossRef]

- Alshehhi, A.; Nobanee, H.; Khare, N. The impact of sustainability practices on corporate financial performance: Literature trends and future research potential. Sustainability 2018, 10, 494. [Google Scholar] [CrossRef]

- Lee, S.; Heo, C.Y. Corporate social responsibility and customer satisfaction among US publicly traded hotels and restaurants. Int. J. Hosp. Manag. 2009, 28, 635–637. [Google Scholar] [CrossRef]

- Hsu, K.T.; Chang, Y.Y.; Lin, H.L. The impact of corporate sustainability on brand equity and consumer behavior. J. Retail. Consum. Serv. 2019, 49, 349–360. [Google Scholar] [CrossRef]

- Groening, C.; Sarkis, J.; Zhu, Q. Green marketing consumer-level theory review: A compendium of applied theories and further research directions. J. Clean. Prod. 2018, 172, 1848–1866. [Google Scholar] [CrossRef]

- Singh, R.K.; Gupta, V.; Mondal, A. Sustainable packaging in supply chain management: A comprehensive review and framework. J. Clean. Prod. 2019, 236, 117631. [Google Scholar] [CrossRef]

- Vanapalli, K.R.; Samal, B.; Dubey, B.; Bhattacharya, J.; Medha, I. Strategies and perspectives for plastic waste management. Resour. Conserv. Recycl. 2021, 168, 105292. [Google Scholar] [CrossRef]

- Kumar, A.; Chandrakar, R. Integrating circular economy in business: The case of plastic waste management. Sustain. Prod. Consum. 2020, 23, 104–116. [Google Scholar] [CrossRef]

- Borland, H.; Bhatti, Y.; Lindgreen, A. Sustainability and sustainable development strategies in the UK plastic electronics industry. Corp. Soc. Responsib. Environ. Manag. 2019, 26, 805–818. [Google Scholar] [CrossRef]

- Tencati, A.; Pogutz, S.; Perrini, F. Sustainability and stakeholder management: The need for new corporate performance evaluation and reporting systems. Bus. Strategy Environ. 2004, 13, 296–308. [Google Scholar] [CrossRef]

- Ji, Y.; Ji, M.; Yang, G.; Dong, S. Water resource management and financial performance in high water-sensitive corporates. Corp. Soc. Responsib. Environ. Manag. 2023, 30, 2419–2434. [Google Scholar] [CrossRef]

- Damania, R.; Desbureaux, S.; Hyland, M.; Islam, A.; Moore, S.; Rodella, A.-S.; Russ, J.; Zaveri, E. Uncharted waters: The new economics of water scarcity and variability. Nat. Sustain. 2020, 3, 284–293. [Google Scholar]

- Gleick, P.H.; Palaniappan, M. Peak water limits to freshwater withdrawal and use. Proc. Natl. Acad. Sci. USA 2010, 107, 11155–11162. [Google Scholar] [CrossRef]

- Antonova, N.; Ruiz-Rosa, I.; Mendoza-Jimenez, J. Water resources in the hotel industry: A systematic literature review. Int. J. Contemp. Hosp. Manag. 2021, 33, 628–649. [Google Scholar] [CrossRef]

- Rosseel, Y. lavaan: An R package for structural equation modeling. J. Stat. Softw. 2012, 48, 1–36. [Google Scholar] [CrossRef]

- Byrne, B.M. Structural Equation Modeling with AMOS: Basic Concepts, Applications, and Programming, 3rd ed.; Routledge: New York, NY, USA, 2016. [Google Scholar]

- Hair, J.F.; Black, W.C.; Babin, B.J.; Anderson, R.E. Multivariate Data Analysis, 8th ed.; Cengage Learning: Boston, MA, USA, 2019. [Google Scholar]

- Kline, R.B. Principles and Practice of Structural Equation Modeling, 4th ed.; Guilford Press: New York, NY, USA, 2016. [Google Scholar]

- Sroufe, R.; Montabon, F. Sustainable supply chain management research: The role of big data analytics and artificial intelligence in the era of digitalization. J. Bus. Logist. 2019, 40, 203–212. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).