Abstract

Against the backdrop of global sustainable development goals, the resilience of manufacturing enterprises has become a critical topic. It serves as an important benchmark for assessing ability to coordinate environmental responsibilities and economic benefits. It also plays a pivotal role in driving the green transformation of industries and sustainable social development. To examine the relationship between environmental, social, and governance (ESG) performance and corporate resilience, as well as their underlying mechanisms, this study develops a research model incorporating moderating and mediating effects. Using a sample of manufacturing listed companies in China’s Shanghai and Shenzhen A-share markets covering the period 2011–2023, the study systematically investigates the impact of ESG performance on corporate resilience. The results indicate that ESG performance significantly enhances corporate resilience, and this conclusion remains valid under various robustness tests. Further mechanism analysis reveals that ESG performance effectively promotes corporate resilience by improving resource allocation efficiency, with analyst attention exerting a positive moderating effect in this process. Heterogeneity analysis reveals that the promoting effect of ESG performance on corporate resilience is more significant in technology-intensive and labor-intensive industries, high environmental sensitivity industries, markets with intense competition, and firms with low resource slack. This study not only expands the theoretical explanatory framework in the fields of corporate sustainable development and organizational resilience but also provides policy and management implications for manufacturing firms to achieve green transformation and sustainable competitiveness through ESG practices in an uncertain environment.

1. Introduction

As the global economy accelerates its shift toward greening and low-carbon transition, sustainable development has gradually become a core agenda in economic and social governance for countries worldwide. Driven by policy goals such as “carbon peaking” and “carbon neutrality,” environmentally friendly practices and efficient resource utilization are recognized as critical pathways to achieving high-quality growth and long-term competitive advantages. As the core entities of economic activities, enterprises’ tangible efforts in environmental protection, social responsibility, and corporate governance directly influence the implementation process of sustainable development strategies. Against this backdrop, Environmental, Social, and Governance (ESG) has evolved into a core framework for measuring enterprises’ sustainable capabilities and long-term value, and has been integrated into investment and risk assessment systems by a growing number of investors and financial institutions [1].

Corporate resilience, a crucial capability for addressing external uncertainties, encompasses two dimensions: at the survival level, it includes the shock resistance capacity to withstand disruptions and maintain basic operations; at the development level, it involves the adaptability to achieve long-term growth through strategic adjustments and resource reorganization [2,3]. However, Chinese enterprises have lagged in the initiation of ESG practices; while they have made incremental progress in recent years—driven by policy guidance and supported by the capital market—gaps still exist in areas such as optimizing environmental management systems, deepening the fulfillment of social responsibilities, and enhancing governance effectiveness [4]. This scenario exposes manufacturing enterprises to heightened complexities amid energy transition, supply chain realignment, and the reshaping of the global competitive landscape. Therefore, exploring how to enhance corporate resilience through effective ESG practices, and further achieve green transformation and sustainable competitive advantages in an uncertain environment, has become a critical research issue that urgently demands in-depth investigation.

From a theoretical perspective, the impact of ESG performance on corporate resilience does not exhibit a unidirectional deterministic nature. On the one hand, strong ESG performance facilitates the optimization of corporate governance structures, mitigates agency problems, and strengthens transparency and reputation capital [5], thereby enhancing the capacity to address uncertain risks. Meanwhile, proactive ESG engagement improves access to external funding and eases financing constraints during the corporate growth phase [6]. On the other hand, ESG-related investments might consume limited operational resources, imposing specific pressure on short-term financial performance and financing capabilities [7]. Furthermore, if management executes ESG strategies driven by self-serving motives—such as reputation preservation or information obfuscation—it could weaken governance effectiveness and reduce resource allocation efficiency [8].

Existing international studies have generally verified the correlation between ESG performance and corporate resilience [9]. However, most remain at the outcome level, lacking the characterization of micro-mechanisms regarding “how ESG performance is transformed into resilience,” and there is even fewer large-sample empirical analysis targeting emerging market firms. In contrast, domestic studies mostly adopt macro perspectives such as government-business relations and social capital [10,11], while paying insufficient attention to internal transmission paths that rely on firms’ micro-operational efficiency. Meanwhile, differences across countries in terms of economic development level, institutional quality, and legal origin will affect corporate ESG practices and firm performance [12], this thus renders the question of “how Chinese manufacturing firms enhance resilience through ESG practices” a critical research gap that has not been covered by international studies and requires further exploration in domestic research. In fact, corporate resilience stems not only from external buffering mechanisms but also, more importantly, depends on the agility and optimization capability of dynamic internal resource allocation [13]. According to the dynamic capability theory, firms integrate, build, and restructure internal and external resources to respond to rapidly changing environments, which constitutes the core foundation of resilience. Within this framework, sound ESG performance helps improve firms’ efficiency in resource identification, acquisition, and restructuring by optimizing the accuracy of investment decisions, reducing financing costs, and enhancing the coordination of operational processes [14]. Additionally, as a key market information intermediary, analyst attention may also provide support for the transformation of ESG practices into long-term resilience through its external supervision and signal transmission functions [15].

Notably, this dual mechanism of “internal resource allocation + external information supervision” has not yet been systematically identified in existing domestic and international studies. Although existing studies have verified the correlation between ESG performance and performance, risk, or resilience, there remains a lack of sufficient theoretical and empirical characterization of its microscopic operation process and mechanistic impacts. The extent to which this mechanism affects the relationship between ESG performance and corporate resilience remains an important area requiring further research.

Against this backdrop, this study focuses on the following research questions:

- (1)

- Does sound ESG performance exert a positive effect on corporate resilience?

- (2)

- Does resource allocation efficiency play a mediating role between ESG performance and corporate resilience?

- (3)

- How does analyst attention moderate the relationship between ESG performance and corporate resilience?

To address the above questions, this study develops a dual-path mechanism framework of “internal resource allocation efficiency + external information supervision.” Using a sample of manufacturing listed companies in China’s Shanghai and Shenzhen A-share markets from 2011 to 2023, this study integrates Huazheng ESG Ratings to construct a localized evaluation system, employs a two-way fixed effects model to control for endogeneity, and introduces mediation effect and moderation effect models to identify the underlying mechanisms.

The contributions of this study primarily manifest in three aspects: First, it provides micro-level empirical evidence based on manufacturing listed companies in China’s Shanghai and Shenzhen A-share markets, incorporates corporate resilience into the analytical framework of ESG’s economic consequences, and expands the applicable boundaries of existing international ESG research under the institutional context of emerging markets. Second, it identifies “resource allocation efficiency” as a key mediating pathway and complements the mechanistic chain through which ESG performance influences long-term corporate stability from both theoretical and empirical perspectives. Third, it incorporates analyst attention into the analytical model, reveals the moderating role of external information mechanisms in the transformation of ESG performance into corporate resilience, and enriches the research perspective on the interactive influence between institutional and market forces.

2. Theoretical Analysis and Research Hypothesis

2.1. Literature Review

2.1.1. Economic Effects of ESG

As a key indicator for measuring corporate sustainable development, ESG performance has attracted widespread attention in academic and practical circles regarding its impact on corporate economic performance. Existing studies demonstrate that ESG performance may not only generate a value-added effect on corporate value but also impose potential costs.

From a positive perspective, based on stakeholder theory, the resource-based view, and signaling theory, ESG practices can optimize resource allocation, reduce capital costs [16], and enhance market competitiveness and corporate reputation [17], thereby improving investor confidence and long-term corporate value. Studies have shown that high-quality ESG investment can strengthen enterprises’ ability to respond to external uncertainties by improving internal governance coordination and the efficiency of strategic resource reserves, thus providing an institutional and resource foundation for corporate resilience.

On the other hand, neoclassical economic theory suggests that the externality and public good nature of ESG investment may prevent enterprises from fully internalizing their benefits. Excessive investment or formalized implementation may reduce resource utilization efficiency and weaken financial performance and market confidence in the short term [18,19]. For instance, Ananzeh, H. et al. used the annual reports of listed companies in Jordan and found that ownership concentration has a negative impact on the quality of corporate social responsibility disclosure [20]. Meanwhile, a case study by Kim et al. on the U.S. electric power industry revealed that enterprises evade regulatory pressure through false emission reduction reports rather than achieving actual emission reductions [21]. In the Chinese context, peer imitation in ESG information disclosure may exacerbate resource misallocation [22]. Additionally, some empirical studies have found that the relationship between ESG and financial performance exhibits a non-linear characteristic; for example, in the banking industry, ESG performance can significantly reduce the cost of equity capital but has a limited impact on the cost of debt [23,24].

We find that there has long been a theoretical tension between the “value-added theory” and “cost theory” in research on the economic consequences of ESG. The former emphasizes the strategic benefits it brings, such as reputation and financing advantages, while the latter focuses on its resource crowding-out effect and agency costs. In other words, this debate largely confines the value of ESG performance within the framework of static financial indicators.

2.1.2. The Definition and Measurement of Corporate Resilience

The concept of “resilience” originally originated in ecology [25] and was later introduced into the field of organizational management to describe enterprises’ ability to recover and achieve sustainable development after responding to unexpected events. From a static perspective, resilience is manifested as enterprises’ ability to maintain stable operations or minimize losses when withstanding negative shocks [26]. From a dynamic perspective, corporate resilience emphasizes an organization’s impact resistance capability and recovery speed during the evolution of crises [27]. It is evident that whether adhering to the “capability theory” or “process theory,” resilience is universally recognized as a key factor enabling enterprises to withstand shocks, rebound and recover, and ultimately achieve overtaking.

An analysis of domestic and international literature reveals that the construction of corporate resilience relies on the joint driving force of internal and external factors. The internal driving path mainly focuses on the integration and operation efficiency of enterprises’ internal resources, including managers’ risk identification and strategic decision-making capabilities [28,29], the flexibility of organizational structure, and the reservation and allocation efficiency of strategic resources [30]; all of these constitute the core foundation for enterprises to cope with external shocks. The external driving path emphasizes enterprises’ interaction with the external environment and the establishment of support networks. Strong supply chain relationships, support from strategic alliance partners [31], and trust and reciprocal relationships established with key stakeholders form a crucial external buffer system [32], which can provide support in terms of key resources, information, and market access, especially when enterprises suffer major shocks. Therefore, exploring the construction path of resilience not only helps enhance enterprises’ ability to respond to external shocks but also serves as the key to achieving sustainable competitive advantages and high-quality development.

Since the connotation of corporate resilience involves interdisciplinary integration, the academic community has not yet formed an authoritative consensus on the definition of its core dimensions, and measurement methods exhibit diversification characteristics. Corporate resilience can be captured either through direct scales to measure organizational capabilities or through indirect indicators to reflect financial and market stability. Examples of direct measurement methods include the scale of learning capability, adaptability, and network capability proposed by Şengül et al. [33], as well as the three-dimensional model of anticipation capability, response capability, and adaptability targeting the context of Chinese enterprises [34]; these methods focus on enterprises’ prediction capability before crises and dynamic adjustment capability during crises. Indirect measurement methods, on the other hand, indirectly reflect resilience through market or financial indicators, such as stock return volatility, sales revenue growth, or cumulative growth of net sales [35,36,37]. Xu [38] further comprehensively depicts corporate growth and financial stability based on the evaluation of the sustainability of long-term performance.

Exploration of the driving factors of corporate resilience has been quite extensive, yet its deep-seated mechanism remains a “black box.” Existing studies have successfully identified many key internal and external driving factors, but most stop at the confirmation of “correlation.” In other words, we know these factors are “important,” but we know little about “how they are important”—especially regarding the microscopic transmission mechanism of how internal capabilities and external networks interact synergistically. This lack of research on the “process” limits the understanding of the essence of resilience construction.

2.2. Research Hypotheses

2.2.1. ESG Performance, Corporate Resilience

As a key vehicle for implementing sustainable development strategies, the role of corporate ESG performance in enhancing resilience has become one of the core topics in academic research. From the environmental dimension, unlike formalized environmental disclosure statements, high-quality environmental practices should be reflected in the systematic establishment and operation of environmental management systems such as ISO 14001 [39], with benchmarking against the environmental performance levels of industry-leading enterprises [40]. Such environmental governance arrangements, based on institutionalized and auditable standards, enable enterprises to establish systematic environmental monitoring, early warning, and correction mechanisms. This allows enterprises to identify changes in the external environment earlier, trigger resource adjustments at the process level, and ultimately enhance their robustness in responding to shocks and operational viability [41,42]. Furthermore, a green development orientation and improved environmental performance can also optimize enterprises’ external evaluations and financing conditions during crises [43], providing additional resource buffers for resilience. In terms of social responsibility, active fulfillment of social responsibilities reduces compliance costs, enhances employee cohesion, thereby strengthening enterprises’ ability to cope with risks, while stabilizing performance and consolidating stakeholder support. Improvements in governance structures enhance financial security and investor trust, effectively mitigating the negative impact of managers’ risk preferences on resilience [44]. Additionally, optimizing shareholder networks facilitates information flow and risk prevention, boosting enterprises’ adaptability [45].

Overall, sound ESG practices comprehensively enhance corporate resilience by strengthening market competitiveness, reducing financing costs, improving reputation, and enhancing risk management capabilities. Based on the above analysis, this study proposes the following hypothesis:

Hypothesis H1:

Sound ESG performance can improve the level of corporate resilience.

2.2.2. ESG Performance, Resource Allocation Efficiency, and Corporate Resilience

Resource allocation efficiency refers to how enterprises effectively utilize, allocate, and manage their available resources. Efficient resource allocation not only enables the optimal combination of factors in normal operations but also allows for rapid adjustment of resource flows when shocks occur; it also serves as an important theoretical basis for governments to formulate sustainable development policies [46].

Scholars at home and abroad have developed different methodological traditions regarding its measurement. In international research, total factor productivity is widely regarded as a key indicator for measuring resource allocation efficiency, as it can capture output growth driven by technological and management efficiency that goes beyond factor inputs. Regarding its calculation, structural methods aimed at addressing endogeneity have become mainstream. For instance, the Levinsohn–Petrin (LP) method proposed by Levinsohn & Petrin [47]—which introduces intermediate inputs as proxy variables—has been widely applied in manufacturing research to characterize enterprises’ efficiency levels. In empirical studies within the Chinese context, scholars have also adopted total factor productivity as a core indicator, while conducting applicability tests and optimizations of international methods [48]. A comparative study by Lu & Lian [49] points out that compared with methods such as the Olley–Pakes (OP) method, the LP method is better suited to the sample characteristics of Chinese manufacturing enterprises, thereby effectively mitigating sample selection bias. However, few studies have integrated TFP into the overall relational framework between ESG performance and corporate resilience [50], resulting in the “internal black box” of ESG-to-resilience transformation remaining unopened.

ESG performance can enhance corporate resource allocation efficiency through two key pathways, thereby laying the foundation for resilience building. First, ESG performance reduces the risk of resource misallocation by improving the information environment. Sound ESG practices rely on a well-developed corporate governance structure, and improved governance can significantly reduce internal and external information asymmetry: On one hand, transparent ESG information disclosure helps enterprises expand financing channels and technological cooperation pathways, strengthening their control over key resources such as capital, human resources, and knowledge [51]; on the other hand, the mitigation of information asymmetry reduces managerial agency problems and inter-departmental resource waste, driving limited resources to concentrate on high-value operational links [52] and preventing non-core businesses from occupying resources needed for resilience building. Second, ESG performance optimizes resource utilization efficiency through strategic synergy [53]. Enterprises’ integrated practices in environmental, social, and governance dimensions jointly contribute to the improvement of total factor productivity [54], providing multi-dimensional support for the optimization of resource allocation efficiency.

The improvement of resource allocation efficiency further enhances corporate resilience through the dual mechanisms of normal-state accumulation and shock response. At the normal operation level, efficient resource allocation helps enterprises accumulate slack resources and core capabilities: On one hand, the concentration of resources in high-value links can improve profitability, reserving funds and technologies for resilience building; on the other hand, optimized factor collaboration efficiency enhances organizational flexibility, laying a procedural foundation for subsequent shock response. At the shock response level, the value of resource allocation efficiency becomes more prominent: Relying on the dynamic resource integration capabilities fostered by ESG practices, enterprises can quickly restructure production factors and adjust strategic directions [55]; meanwhile, they can obtain resource supplements through the stakeholder trust networks established by ESG [56], reducing operational losses caused by shocks. This transmission chain of “ESG performance → resource allocation efficiency → corporate resilience” is essentially a process in which ESG performance transforms “sustainable advantages” into “risk resistance capabilities” through internal governance optimization. Based on this, the following hypothesis is proposed:

Hypothesis H2:

ESG performance enhances corporate resilience by improving resource allocation efficiency.

2.2.3. ESG Performance, Analyst Attention, and Corporate Resilience

As a core information intermediary and external supervision force in the capital market, the impact of analyst attention on corporate behavior is mainly realized through the “information transmission effect” and “external supervision effect”—both of which can strengthen the promoting role of ESG performance in corporate resilience. Existing studies mostly measure the level of analyst attention using either the “number of analyst teams following the firm” or the “number of research reports published” [57,58]. Among these, the number of following analysts has become the mainstream choice for characterizing analyst attention due to its data accessibility and indicator objectivity; it not only reflects the market’s attention to the firm but also indicates the intensity of external supervision.

The information transmission effect of analyst attention can amplify the “signal value” of ESG performance, providing external trust support for corporate resilience building. Based on the information intermediary theory, analysts transform corporate ESG information into market-understandable signals through in-depth research—especially sound ESG performance, which is emphasized and interpreted by analysts and transmitted to investors [59]. This process can significantly reduce information asymmetry between firms and the capital market: On one hand, investors’ recognition of ESG performance enhances their expectations of the firm’s long-term stable operations, improving the availability of external financing and providing financial support for the optimization of resource allocation efficiency and resilience building; on the other hand, the wide dissemination of ESG signals strengthens corporate reputation capital, further consolidating cooperative relationships with stakeholders such as suppliers and customers, and improving the external buffer system for resilience [60]. Conversely, in the absence of analyst attention, the positive signals of ESG performance may be overlooked by the market, and its promoting effect on resilience will be weakened due to poor information transmission.

The external supervision effect of analyst attention can inhibit the “formalization tendency” of ESG practices, ensuring that ESG resources are truly transformed into a driving force for resilience improvement. Based on the effective supervision hypothesis, the continuous follow-up of analysts imposes constraints on firms, promoting the transformation of ESG strategies from “textual disclosure” to “substantive implementation” [61]. Under the joint action of the supervision mechanism and signal amplification mechanism of analyst attention, firms are more likely to achieve alignment between “words” and “deeds” in ESG strategy execution and resource allocation, thereby strengthening the positive promoting effect of ESG performance on corporate resilience [62]. Meanwhile, by in-depth interpretation of corporate ESG information, analysts can not only evaluate firms’ performance in the environmental, social, and governance dimensions but also identify potential operational risks and timely transmit negative information to the market—further alleviating information asymmetry between firms and stakeholders and ultimately enhancing the positive impact of ESG performance on corporate resilience. Thus, the following hypothesis is proposed:

Hypothesis H3:

Analyst attention plays a positive moderating role in the relationship between ESG performance and corporate resilience.

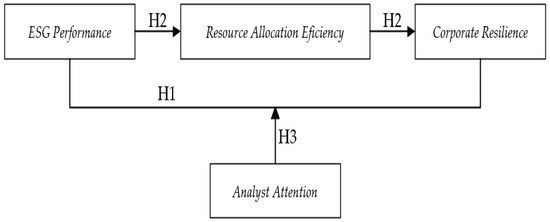

The proposed conceptual framework is presented in Figure 1.

Figure 1.

Theoretical analysis framework.

3. Research Design

3.1. Sample Selection and Data Sources

This study utilizes Shanghai and Shenzhen A-share listed manufacturing firms as its research sample, with panel data spanning 2011 to 2023 employed for regression analysis. ESG data are sourced from the Wind Database, while other corporate financial information is obtained from the CSMAR Database. This study finally obtained 26,147 observation samples. The specific process of sample screening is illustrated in Figure 2.

Figure 2.

Sample screening process diagram.

3.2. Variable Description

3.2.1. Dependent Variable: Corporate Resilience (Res)

Since corporate resilience is a complex and latent concept, direct measurement often fails to comprehensively and accurately capture its essence. Thus, this study adopts an indirect measurement method and, by referring to the measurement approach proposed by Ortiz [55], divides corporate resilience into a two-dimensional construct encompassing low financial volatility and high growth capacity. Specifically, the standard deviation of monthly stock returns within one year is used to measure shock resistance capacity, while cumulative operating revenue growth over three years is employed to gauge performance growth capacity. Given that the entropy weight method is more objective than other weighting methods and avoids data information loss, this study refers to the research methodology of Chen et al. [63] and ultimately calculates the comprehensive corporate resilience score using the entropy weight method to reflect the overall resilience performance of enterprises during the sample period.

3.2.2. Independent Variable: Corporate ESG Performance (ESG)

The CSI ESG Ratings are adopted to construct the ESG performance variable (ESG), for two main reasons: first, the CSI ESG Ratings are tailored to the Chinese context, and second, they feature broad coverage, complete indicators, and timely updates. The ratings are categorized into 9 levels, ranging from AAA (highest) to C (lowest). Correspondingly, the CSI ESG comprehensive ratings are assigned values from 9 (AAA) to 1 (C) in descending order.

3.2.3. Mediating Variable: Resource Allocation Efficiency (TFP)

Within the context of this study, total factor productivity (TFP) is selected as the proxy indicator for resource allocation efficiency, primarily based on the following considerations: First, given the operational characteristic of manufacturing industries centered on physical production, changes in TFP can largely capture the optimization effect of resource flow toward high-productivity segments—this aligns with the logic of our focus on “the supporting role of dynamic resource allocation in corporate resilience.” Second, compared with single-dimensional indicators such as the capital-labor ratio and investment efficiency, TFP better comprehensively reflects the differences in enterprises’ efficiency in integrating multiple factors; moreover, a relatively mature consensus on its measurement methods has been formed in manufacturing research.

To mitigate methodological bias in productivity estimation, based on the argument regarding sample selection bias by Lu et al. [49], the baseline regression adopts the Levinsohn–Petrin method to estimate TFP.

3.2.4. Moderating Variable: Analyst Attention (Ana)

This study draws on the empirical methodology proposed by Maoret et al. [64] and measures analyst attention using the number of analyst teams following the target firm. Specifically, it takes the natural logarithm of this number after adding 1. The selection of this indicator is based on two considerations: on the one hand, it is suitable for the large-sample context of listed companies, and its data can be directly obtained from mainstream databases such as Wind and CSMAR, which ensures data completeness and objectivity; on the other hand, this indicator has been widely applied in domestic research on corporate ESG and corporate governance, which facilitates comparisons with existing literature.

3.2.5. Control Variables

With reference to Zhao et al. [65], control variables are selected to account for corporate financial characteristics and governance attributes, including:

- Financial characteristics: Return on Assets (ROA), Cash Flow (CF), Leverage Ratio (LEV), and Firm Size (SIZE).

- Governance attributes: Board Size (BOARD), Proportion of Independent Directors (INDE), Largest Shareholder’s Ownership Ratio (TOP1), and Ownership Nature (SOE).

Definitions of all variables are detailed in Table 1.

Table 1.

Variable Definitions.

3.3. Model Speciffcation

To test the total effect of ESG on corporate resilience, the following model is constructed:

where X represents the set of control variables, α are the parameters to be estimated, denotes firm fixed effects, denotes year fixed effects, and is the error term. Notably, corporate resilience exhibits significant heterogeneity across firms and years. To mitigate the bias in causal inference caused by omitted variables, the empirical model incorporates firm fixed effects and year fixed effects for control. ESG performance is the core explanatory variable of interest in this model. If the coefficient of this variable is positive, it indicates that ESG performance contributes to enhancing corporate resilience; conversely, a negative coefficient suggests that ESG performance reduces corporate resilience.

To test Hypothesis H2, which involves the mediating effect of resource allocation efficiency, this study follows the approach of Wen et al. [66] and constructs Model 2 based on Model 1 as follows:

To test Hypothesis H3, which examines the moderating effect of analyst attention, we construct the following model:

4. Empirical Results

4.1. Descriptive Statistics

Results in Table 2 show the following: For corporate resilience, the mean is 0.527 and the median is 0.624, where the larger the value, the higher the firm’s resilience level. For ESG performance, the mean is 4.149, with P75 and P25 being 5 and 3.75, respectively, indicating that the overall ESG performance of the sample firms is at a moderate level. For resource allocation efficiency, the mean is 8.479, reflecting a relatively high overall productivity level of the firms. For analyst attention, the mean is 6.83 and the median is 2, suggesting significant differences in the number of analysts following different firms in the sample. The remaining control variables also fall within an acceptable range.

Table 2.

Descriptive statistics.

4.2. Regression Analysis

4.2.1. Regression Results of ESG and Corporate Resilience

Table 3 presents the regression results of the benchmark model using the fixed-effects approach. In Columns (1) and (2), the coefficient of the core explanatory variable ESG is significantly positive (β = 0.003, p < 0.01), indicating that ESG exerts a robust promoting effect on corporate resilience. This provides preliminary support for Hypothesis H1.

Table 3.

Results of baseline regression.

4.2.2. Regression Results of the Mediating Effect

Table 4 reports the regression results for Models (2) and (3). Column (1) shows that ESG is positively correlated with TFP (β = 0.011, p < 0.05). Column (2) indicates that TFP is significantly positive with Res (β = 0.003, p < 0.01). Column (3) includes both ESG and TFP in the regression, and both variables continue to exert a significant positive impact on Res at the 1% level. These results confirm that resource allocation efficiency plays a partial mediating role in the relationship between ESG performance and corporate resilience, thereby validating Hypothesis H2.

Table 4.

Regression Results of the Mediating Effect.

4.2.3. Regression Results of the Moderating Effect

Table 5 presents the regression results for Model (4). Column (1) shows that ESG is significantly positive with Ana (β = 0.536, p < 0.01), indicating that improved ESG performance attracts more analyst attention. In Column (2), the coefficient of ESG remains significantly positive, the coefficient of Ana is significantly negative, and the coefficient of the interaction term ESG × Ana is significantly positive (β = 0.000, p < 0.01). These results validate Hypothesis 3, confirming that analyst attention exerts a positive moderating effect on the relationship between ESG performance and corporate resilience through external supervision and signal amplification mechanisms.

Table 5.

Regression Results of the Moderating Effect.

4.3. Robustness Tests

4.3.1. Instrumental Variable Method

To address endogeneity issues caused by potential reverse causality, this study selects the average ESG rating of other listed companies in the same year and province as the focal firm (excluding the firm itself) as the instrumental variable (ESG_IV), and employs the two-stage least squares (2SLS) method for estimation. On the one hand, due to regional policy environments and institutional isomorphism pressures, ESG performance of firms in the same province tends to exhibit significant consistency, satisfying the relevance condition of instrumental variables. On the other hand, the regional average ESG performance of other firms primarily reflects macro-environmental information and theoretically lacks a direct transmission mechanism to affect the micro-level organizational resilience of individual firms, meeting the exogeneity condition of instrumental variables.

The regression results are reported in Columns (1) and (2) of Table 6. The coefficient of ESG_IV on ESG is significantly positive (β = 0.188, p < 0.01). Meanwhile, the Kleibergen-Paap F-statistic for the instrumental variable is 484.07, which is much higher than the critical value of 16.38 at the 10% significance level in the Stock-Yogo weak identification test. This indicates no weak instrumental variable issue, thus verifying the appropriateness of the instrumental variable selection.

Table 6.

Regression Results of Robustness Tests.

4.3.2. Lagged One-Period Independent Variable

The benchmark regression results suggest that ESG performance has a significant positive impact on corporate resilience. However, this result may be confounded by reverse causality; i.e., corporate resilience itself may promote ESG performance. To eliminate this potential interference, this study conducts a robustness test using the lagged one-period ESG indicator (L.ESG). As shown in Column (3) of Table 6, the coefficient of L.ESG on Res is significant at the 5% level, confirming that the impact of ESG on Res is not affected by reverse causality.

4.3.3. Propensity Score Matching

To mitigate estimation biases caused by sample selection bias, this study uses the propensity score matching method for robustness testing. Based on the average ESG score (4.11), the sample is divided into high-ESG and low-ESG groups, and 1:1 nearest-neighbor matching is performed using all control variables as covariates. Column (4) of Table 6 shows that after matching, the coefficient of ESG on Res remains significantly positive at the 1% level, which is consistent with the benchmark regression results. This further supports the robustness of the study’s findings.

4.4. Heterogeneity Analysis

Building on the established positive correlation between ESG performance and corporate resilience, this study further analyzes heterogeneity across four dimensions: factor intensity, environmental sensitivity, competitive intensity, and resource slack level.

4.4.1. Heterogeneity Analysis by Factor Intensity

Considering that differences in factor endowments across industries may lead to variations in enterprises’ resource integration paths and governance response capabilities during ESG strategy implementation, which in turn affects corporate resilience, this study follows the approach proposed by Lu [67]. It classifies all firms into three industry types—labor-intensive, capital-intensive, and technology-intensive—using cluster analysis based on two indicators: the proportion of fixed assets and the proportion of R&D expenditures. The regression results, reported in Columns (1)–(3) of Table 5, show that ESG performance in technology-intensive industries significantly enhances corporate resilience (β = 0.003, p < 0.01); meanwhile, ESG performance in labor-intensive enterprises also exhibits a strong positive correlation with corporate resilience (β = 0.004, p < 0.01). In contrast, the regression coefficient of ESG performance on corporate resilience in capital-intensive enterprises is statistically insignificant at conventional significance levels.

This heterogeneous result may stem from differences in organizational structures and governance mechanisms caused by varying factor endowments. On one hand, technology-intensive enterprises typically possess higher R&D capabilities and organizational flexibility; ESG strategies help them establish an innovation-oriented resource allocation logic, enabling faster adaptation to external shocks. On the other hand, labor-intensive enterprises are closely linked to ESG in terms of workforce stability and social responsibility fulfillment—higher ESG levels help maintain employee relationships and enhance reputational capital, thereby strengthening corporate resilience. In contrast, capital-intensive enterprises are highly dependent on fixed asset operations; ESG investments may, in the short term, crowd out funds for critical equipment maintenance. When shocks are coupled with production capacity fluctuations, this may instead exacerbate cost burdens and weaken the resilience-enhancing effect of ESG performance.

4.4.2. Heterogeneity Analysis of Industry Environmental Sensitivity

Differences in environmental sensitivity across industries lead to heterogeneous regulatory pressure and social expectations, which may result in heterogeneous impacts of ESG performance on corporate resilience. Based on China’s Guidelines for the Classification of Listed Companies’ Industries and Catalogue for the Classification and Management of Environmental Protection Verification for Listed Companies, this study classifies sample firms into high environmental sensitivity industry firms and low environmental sensitivity industry firms, depending on whether they belong to heavily polluting industries. The regression results, reported in Columns (4) and (5) of Table 5, show that ESG performance of firms in high environmental sensitivity industries significantly enhances corporate resilience (β = 0.004, p < 0.05), while the regression coefficient of ESG performance on resilience for firms in low environmental sensitivity industries is statistically insignificant at conventional significance levels.

This phenomenon may be attributed to the fact that, under regulatory pressure, ESG investments of heavily polluting firms mostly focus on environmental technology upgrading and compliance management. These investments not only reduce the risk of environmental violations but also improve production stability, ultimately significantly enhancing resilience in response to external shocks. Meanwhile, stakeholders pay less attention to the ESG performance of firms in low environmental sensitivity industries, making it difficult for these firms to obtain additional policy, capital, or social support for their ESG investments.

4.4.3. Heterogeneity Analysis by Industry Competition Intensity

As shown in Columns (6) and (7) of Table 7, significant differences emerge: In firms with high industry competition, ESG performance makes a significant contribution to improving corporate resilience (β = 0.002, p < 0.01); in firms with low industry competition, this impact is statistically insignificant. This phenomenon may result from the external incentive effect of competitive pressure on corporate strategic behavior. In high-competition industries, firms face greater survival pressure; ESG practices, as tools for reputation building and stakeholder management, help firms establish differentiated advantages in homogeneous markets and enhance risk resistance through improved governance and resource allocation. In low-competition industries, however, high entry barriers and strong market stability reduce firms’ urgency for strategic transformation; ESG often manifests as compliance-oriented behavior, leading to a relatively limited resilience-enhancing effect.

Table 7.

Regression Results of Heterogeneity Analysis.

4.4.4. Heterogeneity Analysis by Resource Slack Level

The level of internal resource slack plays a key role in mitigating risks and stabilizing operations. To examine the impact of firms’ resource bases on the governance effect of ESG, this study uses the ratio of cash and cash equivalents to total assets to measure resource slack and divides the manufacturing sample into groups with high and low resource slack based on the mean value.

As shown in Columns (8) and (9) of Table 7, the impact of ESG performance on corporate resilience is more significant in firms with low resource slack (β = 0.004, p < 0.01) compared to those with high resource slack. Empirical results indicate that firms with low resource slack rely more on external governance tools and institutional arrangements to improve shock resistance, making ESG strategies more effective in terms of governance incentives and practicality. On the one hand, ESG practices help optimize resource allocation efficiency and alleviate financing constraints, thereby enhancing firms’ adaptability under resource constraints. On the other hand, firms with sufficient resources already have a certain resilience foundation, leading to lower marginal dependence on ESG strategies and relatively weak willingness for governance constraints and resource integration. In an environment with fluctuating resource slack, firms should take key measures—such as strengthening the synergy between ESG and external governance tools, optimizing early warning and allocation mechanisms for resource slack, and innovating flexible ESG implementation models—to enhance the stability of shock resistance across different resource conditions.

5. Discussion

Although existing studies have initially explored the correlation between ESG and corporate resilience, they mostly remain at the macro level or focus on outcome verification [10,11,12]; research on the underlying mediating mechanisms and contextual boundaries remains insufficient [27], especially lacking systematic evidence based on the manufacturing sector in emerging markets. To address this research gap, this study adopts a dual-path analytical framework of “internal resource allocation efficiency + external information supervision” and systematically examines the impact mechanism of ESG performance on corporate resilience through empirical tests on 26,147 samples of Chinese manufacturing listed companies from 2011 to 2023. The research findings are as follows:

First, this study confirms the significant promoting effect of ESG performance on corporate resilience. This finding echoes the conclusion of Wang et al., which is based on an international sample [9], but extends the evidence to China—a typical emerging market—thereby enhancing the generalizability of research on ESG’s economic consequences across different institutional contexts. More theoretically, unlike previous studies that mostly emphasize ESG enhances resilience through “buffering mechanisms” such as external reputational capital, legitimacy improvement, or relationship network construction [4,31,55], the mechanism analysis in this study reveals that the optimization of internal governance pathways is equally crucial. This indicates that for Chinese manufacturing enterprises, the resilience gains from ESG not only stem from its “shield” function in responding to external pressures but also from its “engine” function in driving the improvement of internal operational efficiency and forging core dynamic capabilities [27]. This finding provides new empirical support for the application of the resource-based view and dynamic capability theory in ESG research in emerging markets, expanding the explanatory dimensions of the sources of corporate resilience.

Second, the mediation effect tests successfully uncover the key “black box” of “resource allocation efficiency.” This implies that the value of ESG practices lies not only in creating short-term reputation but also in systematically improving enterprises’ resource utilization and dynamic reorganization capabilities by optimizing the information environment and investment decisions [6,68]. This finding deepens the research of Deng et al. on the relationship between ESG and total factor productivity [50], ultimately extending its impact to corporate resilience—a more comprehensive strategic goal. Compared with views that mainly attribute resilience improvement to external resource support [31,69], the results of this study highlight the fundamental role of internal resource allocation efficiency as a core governance mechanism, complementing the micro-mechanism chain through which ESG influences long-term corporate stability.

Third, the moderation effect of analyst attention is significant, indicating that sound ESG performance requires effective information intermediaries to be fully transformed into market recognition and resilience improvement. This is consistent with the research logic of El Ghoul et al., which argues that institutional investor attention can improve corporate financing conditions [15], collectively emphasizing the critical role of the external information environment in the realization of ESG value. This study finds that analyst attention not only performs an external supervision function to inhibit the “formalization tendency” of ESG [61,62] but also acts as a signal amplifier: by reducing information asymmetry, it helps enterprises convert ESG advantages into more stable competitive advantages [59,60]. This enriches the research perspective on the interactive influence between institutional and market forces, suggesting that future research should pay more attention to the contextual dependence of ESG value creation.

6. Conclusions

This study provides important insights into the association, mediating mechanism, moderating mechanism, and heterogeneity between ESG performance and corporate resilience among Chinese manufacturing enterprises. The findings indicate that ESG performance significantly enhances corporate resilience, with resource allocation efficiency playing a partial mediating role between them; analyst attention positively moderates this relationship. Notably, this effect is more prominent in technology-intensive and labor-intensive industries, sectors with high environmental sensitivity, highly competitive markets, and enterprises with low resource slack, while it is insignificant in capital-intensive industries, sectors with low environmental sensitivity, and low-competition markets.

From a theoretical perspective, tailored to the characteristic of manufacturing enterprises being dominated by physical production, this study constructs a dual-path analytical framework of “internal resource allocation efficiency + external analyst supervision.” By integrating the mediating chain of “ESG performance–resource allocation efficiency–corporate resilience” with the moderating role of analyst attention, this study unlocks the “black box” of ESG transformation into corporate resilience. Furthermore, it deepens the mechanistic interpretation by incorporating differences in factor intensity within the manufacturing sector, thereby providing a new analytical perspective for micro-theoretical research on the relationship between ESG performance and corporate resilience in the manufacturing industry of emerging markets. Second, this study not only aims to provide empirical evidence to support developing countries in promoting and effectively implementing ESG principles but also offers policy insights for developed countries to address global issues and advance corporate low-carbon transitions. Although based on Chinese data, the findings are particularly relevant for emerging economies at similar development stages that face comparable institutional transitions and market conditions.

From a practical perspective, the results of this study offer important implications for manufacturing enterprises seeking to enhance resilience through ESG strategies in an uncertain environment. First, policymakers can optimize ESG support policies based on the characteristics of manufacturing enterprises with different factor intensities. For instance, they may focus on coordinated subsidies for ESG and green R&D in technology-intensive enterprises and strengthen guidance on linking ESG with employee rights protection in labor-intensive enterprises, avoiding one-size-fits-all policies and providing adaptive institutional support for enterprises’ sustainable practices. Second, enterprises can integrate ESG practices into core production and operation processes rather than merely stopping at the disclosure level. Meanwhile, enterprises should enhance organizational adaptability based on their own resource characteristics to avoid blind investments. Additionally, investors can incorporate the correlation between ESG performance and corporate operational resilience into their decision-making references, prioritizing manufacturing enterprises with outstanding ESG implementation outcomes. This will drive green finance to tilt toward substantive resilience improvement, forming a tripartite linkage to advance ESG practices.

Despite systematically examining the mechanism through which ESG performance influences the resilience of manufacturing enterprises and providing empirical evidence, this study still has limitations and room for further expansion. First, the analysis is conducted using samples of Chinese listed manufacturing enterprises, so the applicability of the conclusions is mainly confined to China’s domestic institutional system and industrial ecosystem. Significant differences in policy frameworks, market operation mechanisms, and development stages across countries mean that the cross-context generalization value of the conclusions requires further verification. Future research can expand the sample scope to other emerging markets in Asia and economies along the Belt and Road Initiative, leveraging cross-economy comparative analysis to enhance the generalizability and international adaptability of the findings. Second, the research objects are limited to listed enterprises with relatively large scales and mature governance structures. Small and medium-sized enterprises or non-listed enterprises may exhibit distinct characteristics in terms of resource endowments, governance models, and the depth of ESG implementation; thus, future studies need to expand the sample scope to improve the generalizability of the conclusions. Third, the measurement of resource allocation efficiency and analyst attention in this study mainly relies on existing quantitative indicators. While these indicators can capture key characteristics, they overlook specific differences in resource allocation efficiency and the coverage features of analyst attention and fail to fully reflect the complexity of corporate dynamic capabilities and external supervision mechanisms. Future research can further integrate emerging variables such as digital transformation, green innovation, and industrial chain collaboration to explore broader research paths for the interaction between ESG and corporate resilience, providing more extensive and robust empirical evidence for global sustainable development governance.

Author Contributions

H.L.: conceptualization, methodology, software, data curation, writing—original draft preparation. W.F.: conceptualization, methodology, software, data curation, writing—original draft preparation. C.L.: conceptualization, supervision, methodology, resources, funding acquisition, writing—review and editing. All authors have read and agreed to the published version of the manuscript.

Funding

This study was supported by the Scientific Research Fund Project of Yunnan Provincial Education Department, Grant Number 2024J0704, Project Manager, Chaohong Li. Project Name, Research on ESG Information Disclosure of Enterprises in Yunnan Province Under the Background of Digital Transformation.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

ESG performance data are mainly sourced from the Wind Database, while data on corporate resilience and resource allocation efficiency are obtained through organized analysis from the China Stock Market & Accounting Research (CSMAR) Database. Data for other variables in the study are also derived from the CSMAR Database. Link to the CSMAR offfcial website: https://data.csmar.com/, accessed on 3 April 2025.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Rose, A.; Liao, S.Y. Modeling Regional Economic Resilience to Disasters: A Computable General Equilibrium Analysis of Water Service Disruptions. J. Reg. Sci. 2005, 45, 75–112. [Google Scholar] [CrossRef]

- El Nayal, O.; Slangen, A.; van Oosterhout, J.; van Essen, M. Towards a democratic new normal? Investor reactions to interim-regime dominance during violent events. J. Manag. Stud. 2020, 57, 505–536. [Google Scholar] [CrossRef]

- Grøgaard, B.; Colman, H.L.; Stensaker, I.G. Legitimizing, leveraging, and launching: Developing dynamic capabilities in the MNE. J. Int. Bus. Stud. 2022, 53, 636–656. [Google Scholar] [CrossRef]

- Bai, F.; Shang, M.; Huang, Y. Corporate Culture and ESG Performance: Empirical Evidence from China. J. Clean. Prod. 2024, 437, 140732. [Google Scholar] [CrossRef]

- Meng, T.; Yahya, M.H.D.H.; Ashhari, Z.M.; Yu, D. ESG Performance, Investor Attention, and Company Reputation: Threshold Model Analysis Based on Panel Data from Listed Companies in China. Heliyon 2023, 9, e20974. [Google Scholar] [CrossRef]

- Chava, S.; Livdan, D.; Purnanandam, A. Do Shareholder Rights Affect the Cost of Bank Loans? Rev. Financ. Stud. 2009, 22, 2973–3004. [Google Scholar] [CrossRef]

- Landi, G.; Sciarelli, M. Towards a More Ethical Market: The Impact of ESG Rating on Corporate Financial Performance. Soc. Responsib. J. 2019, 15, 11–27. [Google Scholar] [CrossRef]

- Liu, Y.X.; Qi, H.J. Does Managerial Overconfidence Affect Investment Efficiency?—A Discussion on the External Governance Effect of the Margin Trading and Short Selling System. Account. Res. 2019, 43–49. Available online: https://kns.cnki.net/kcms2/article/abstract?v=3-fZNjprSazqsWvXQZb2h92bSm0khar3YrMp5qeRxIG2OFS9jp97o_gnpa88xze-eZAtlI9Bg5L2-l2iUXRcGS9yryj6AxkxIAwwuXB0aNfwUD_3Xm_fZ2nms7F866OLyWi0hcOKTwNb0bTMErIr9kQKPgRvNj06Yl9ZScmyvvlUvj-H-2250Q==&uniplatform=NZKPT&language=CHS (accessed on 5 April 2025).

- Wang, H.; Jiao, S.; Ma, C. The impact of ESG responsibility performance on corporate resilience. Int. Rev. Econ. Financ. 2024, 93, 1115–1129. [Google Scholar] [CrossRef]

- Chen, J.J.; Ding, H.Y.; Zhang, X.M. Does ESG performance affect customer relationship stability? Secur. Mark. Her. 2023, 13–23. Available online: https://link.cnki.net/urlid/44.1343.F.20230313.2041.002 (accessed on 5 April 2025).

- Jha, A.; Cox, J. Corporate social responsibility and social capital. J. Bank. Financ. 2015, 60, 252–270. [Google Scholar] [CrossRef]

- Pinheiro, A.B.; dos Santos, J.I.A.S.; Cherobim, A.P.M.S.; Segatto, A.P. What drives environmental, social and governance (ESG) performance? The role of institutional quality. Manag. Environ. Qual. Int. J. 2024, 35, 427–444. [Google Scholar] [CrossRef]

- Liang, L.; Li, Y. How does government support promote digital economy development in China? The mediating role of regional innovation ecosystem resilience. Technol. Forecast. Soc. Change 2023, 188, 1–9. [Google Scholar] [CrossRef]

- Wang, K.; Yu, S.; Mei, M.; Yang, X.; Peng, G.; Lv, B. ESG performance and corporate resilience: An empirical analysis based on the capital allocation efficiency perspective. Sustainability 2023, 15, 16145. [Google Scholar] [CrossRef]

- El Ghoul, S.; Guedhami, O.; Mansi, S.A.; Yoon, H.J. Institutional investor attention, agency conflicts, and the cost of debt. Manag. Sci. 2023, 69, 5596–5617. [Google Scholar] [CrossRef]

- Wong, W.C.; Batten, J.A.; Mohamed-Arshad, S.B.; Nordin, S.; Adzis, A.A. Does ESG Certification Add Firm Value? Financ. Res. Lett. 2021, 39, 101593. [Google Scholar] [CrossRef]

- Fang, X.M.; Hu, D. Corporate ESG Performance and Innovation—Evidence from A-Share Listed Companies. Econ. Res. J. 2023, 58, 91–106. [Google Scholar]

- Wang, X.H.; Luan, X.Y.; Zhang, S.P. Corporate R&D Investment, ESG Performance and Market Value—The Moderating Effect of Enterprise Digital Level. Stud. Sci. Sci. 2023, 41, 896. [Google Scholar]

- Wang, H.; Jiao, S.; Sun, G. Investor Interaction and the Valuation of Listed Companies. Res. Int. Bus. Financ. 2024, 67, 102144. [Google Scholar] [CrossRef]

- Ananzeh, H.; Al Shbail, M.O.; Al Amosh, H.; Khatib, S.F.; Abualoush, S.H. Political connection, ownership concentration, and corporate social responsibility disclosure quality (CSRD): Empirical evidence from Jordan. Int. J. Discl. Gov. 2022, 20, 83. [Google Scholar] [CrossRef]

- Kim, E.H.; Lyon, T.P. Greenwash vs. brownwash: Exaggeration and undue modesty in corporate sustainability disclosure. Organ. Sci. 2015, 26, 705–723. [Google Scholar] [CrossRef]

- Lu, X.Y.; Pan, H.Y.; Xin, F. Motivations and governance mechanisms of corporate greenwashing based on peer mimicry in ESG information disclosure. Chin. J. Popul. Resour. Environ. 2025, 35, 116–128. [Google Scholar]

- Atan, R.; Alam, M.M.; Said, J.; Zamri, M. The Impacts of Environmental, Social, and Governance Factors on Firm Performance: Panel Study of Malaysian Companies. Manag. Environ. Qual. Int. J. 2018, 29, 182–194. [Google Scholar] [CrossRef]

- Azmi, W.; Hassan, M.K.; Houston, R.; Karim, M.S. ESG Activities and Banking Performance: International Evidence from Emerging Economies. J. Int. Financ. Mark. Inst. Money 2021, 70, 101277. [Google Scholar] [CrossRef]

- Duchek, S. Organizational Resilience: A Capability-Based Conceptualization. Bus. Res. 2020, 13, 215–246. [Google Scholar] [CrossRef]

- Sahebjamnia, N.; Torabi, S.A.; Mansouri, S.A. Building Organizational Resilience in the Face of Multiple Disruptions. Int. J. Prod. Econ. 2018, 197, 63–83. [Google Scholar] [CrossRef]

- Liu, J.Q.; Xu, Y.L. ESG Performance and Corporate Resilience. J. Audit Econ. 2024, 39, 54–64. [Google Scholar]

- Hu, D.M.; Zhao, L.; Chen, W.Z. A Study on the Relationship Between Top Management Team Crisis Attention and Organizational Resilience Based on System Dynamics. Soft Sci. 2024, 38, 103–110. [Google Scholar]

- Hillmann, J.; Guenther, E. Organizational resilience: A valuable construct for management research? Int. J. Manag. Rev. 2021, 23, 7–44. [Google Scholar] [CrossRef]

- Qiao, P.H.; Zhang, Y.; Xu, W.B. The Impact of Leader Resilience on Exploratory Innovation in High-Tech Enterprises—A Discussion on the Moderating Role of Expectation Gap. Soft Sci. 2022, 36, 131–137. [Google Scholar]

- Lv, W.; Wei, Y.; Li, X.; Lin, L. What Dimension of CSR Matters to Organizational Resilience? Evidence from China. Sustainability 2019, 11, 1561. [Google Scholar] [CrossRef]

- Yan, X.; Espinosa-Cristia, J.F.; Kumari, K.; Cioca, L.I. Relationship between Corporate Social Responsibility, Organizational Trust, and Corporate Reputation for Sustainable Performance. Sustainability 2022, 14, 8737. [Google Scholar] [CrossRef]

- Şengül, H.; Marşan, D.; Gün, T. Survey assessment of organizational resilience potential of a group of Seveso organizations in Turkey. Proc. Inst. Mech. Eng. Part O J. Risk Reliab. 2019, 233, 470–486. [Google Scholar]

- Feng, W.N.; Chen, H. The impact of ambidextrous innovation on the resilience of high-tech enterprises: The moderating role of knowledge scope and knowledge balance. Sci. Res. Manag. 2022, 43, 117–135. [Google Scholar]

- Nguyen, H.T.; Pham, M.H.; Truong, C. Leadership in a pandemic: Do more able managers keep firms out of trouble? J. Behav. Exp. Financ. 2023, 37, 100781. [Google Scholar] [CrossRef] [PubMed]

- Hu, H.F.; Song, X.X.; Dou, B. Value of digitalization during crises: Evidence from corporate resilience. Finance Trade Econ. 2022, 43, 134–148. [Google Scholar] [CrossRef]

- Wang, H.H.; Li, Y.J.; Gong, Y.Y. Technological diversification, continuous innovation, and corporate resilience: The moderating role of dual networks. Sci. Technol. Prog. Policy 2025, 42, 50–61. [Google Scholar]

- Xu, R.; Li, X.F. Does Flexible Tax Administration Enhance Corporate Resilience? A Quasi-Natural Experiment Based on Tax Credit Rating. J. Zhongnan Univ. Econ. Law 2025, 55–69. [Google Scholar] [CrossRef]

- Darnall, N. Why firms mandate ISO 14001 certification. Bus. Soc. 2006, 45, 354–381. [Google Scholar] [CrossRef]

- Watson, K.; Klingenberg, B.; Polito, T.; Geurts, T.G. Impact of environmental management system implementation on financial performance: A comparison of two corporate strategies. Manag. Environ. Qual. Int. J. 2004, 15, 622–628. [Google Scholar] [CrossRef]

- Saeed, S.; Cek, K. Integrating corporate sustainability reporting and environmental management systems into environmental performance management: An audit perspective. Appl. Econ. 2024, 1–16. [Google Scholar] [CrossRef]

- DesJardine, M.; Bansal, P.; Yang, Y. Bouncing Back: Building Resilience through Social and Environmental Practices in the Context of the 2008 Global Financial Crisis. J. Manag. 2019, 45, 1434–1460. [Google Scholar] [CrossRef]

- Arvidsson, S.; Dumay, J. Corporate ESG Reporting Quantity, Quality and Performance: Where to Now for Environmental Policy and Practice? Bus. Strateg. Environ. 2022, 31, 1091–1110. [Google Scholar] [CrossRef]

- Buyl, T.; Boone, C.; Wade, J.B. CEO Narcissism, Risk-Taking, and Resilience: An Empirical Analysis in US Commercial Banks. J. Manag. 2019, 45, 1372–1400. [Google Scholar] [CrossRef]

- Luo, D.L.; Zhai, Y.R. How Does Shareholder Relationship Network Affect Corporate Resilience?—An Empirical Study Based on A-Share Listed Companies. J. Financ. Regul. Res. 2023, 73–92. [Google Scholar] [CrossRef]

- Xue, T.H.; Xiao, W.; Tang, N. Labor cost and total factor productivity against the background of population aging: From the perspective of enterprise ownership type. J. Zhejiang Univ. (Hum. Soc. Sci.) 2023, 53, 71–84. [Google Scholar]

- Levinsohn, J.; Petrin, A. Estimating production functions using inputs to control for unobservables. Rev. Econ. Stud. 2003, 70, 317–341. [Google Scholar] [CrossRef]

- Nie, H.H.; Jia, R.X. Productivity and resource misallocation of Chinese manufacturing enterprises. World Econ. 2011, 34, 27–42. [Google Scholar] [CrossRef]

- Lu, X.D.; Lian, Y.J. Estimation of total factor productivity of Chinese industrial enterprises: 1999–2007. China Econ. Q. 2012, 11, 541–558. [Google Scholar]

- Deng, X.; Li, W.; Ren, X. More sustainable, more productive: Evidence from ESG ratings and total factor productivity among listed Chinese firms. Financ. Res. Lett. 2023, 51, 103439. [Google Scholar] [CrossRef]

- Zhang, Z.N.; Xia, Y.J.; Zhang, X.M. Empowering or disempowering: ESG performance and corporate labor investment efficiency. Foreign Econ. Manag. 2024, 46, 69–85. [Google Scholar]

- Lü, Z.; Huang, Y.C.; Chen, C.M.; Wan, A.W. Corporate ESG performance, organizational resilience and innovation efficiency: The moderating role of corporate digitalization. Mod. Manag. Sci. 2024, 127–137. Available online: https://kns.cnki.net/kcms2/article/abstract?v=3-fZNjprSazmNpZZa3JHkrmW-ZzXx7Ce2zyBtx9MZDlsP_lqx7dSVmJzeWtFmERxzH96hvqOsFItYcvtDsYuIlQvzPbI-mOcS0OU9IYxvVaQcn6_ckm_TC4S_7Lz8UD0YkwCpgpVd9v0Xpna-KtYu2G_Eb3XtuVbV2MrkdGo3NmGul2m7UZXcQ==&uniplatform=NZKPT&language=CHS (accessed on 5 April 2025).

- He, F.; Du, H.; Yu, B. Corporate ESG performance and manager misconduct: Evidence from China. Int. Rev. Financ. Anal. 2022, 82, 102201. [Google Scholar] [CrossRef]

- Zhao, T.J.; Xiao, X.; Zhang, B.S. Dynamic impact of corporate social responsibility on capital allocation efficiency—An empirical study from the perspective of corporate governance. J. Shanxi Univ. Financ. Econ. 2018, 40, 66–80. [Google Scholar] [CrossRef]

- Ortiz-de-Mandojana, N.; Bansal, P. The long-term benefits of organizational resilience through sustainable business practices. Strateg. Manag. J. 2016, 37, 1615–1631. [Google Scholar] [CrossRef]

- Zong, H.J.; Li, Z. Minimum wage standards, labor market segmentation and resource allocation efficiency. Ind. Econ. Res. 2020, 74–89. [Google Scholar] [CrossRef]

- Zhu, H.J.; He, X.J.; Tao, L. Can securities analysts in China improve the efficiency of the capital market? Evidence from stock price synchronicity and stock price information content. J. Financ. Res. 2007, 110–121. Available online: https://kns.cnki.net/kcms2/article/abstract?v=3-fZNjprSayD1ZUhyktO6CFjjDW726jy3zm2FtxtLPYkooXBijfD_Izt-wMdCtY-fIwwLpsU7q6gv_tMEMBpdOsemvhIIWBSeKaCkcavr90SbpVkiiaSenKC1lzJaHV2sMdK5Zv-HbhqesZAk_diBpy7VgKDxQR2UlOF-R5j_noDYZ998FMibQ==&uniplatform=NZKPT&language=CHS (accessed on 5 April 2025).

- Kasznik, R.; McNichols, M.F. Does meeting earnings expectations matter? Evidence from analyst forecast revisions and share prices. J. Account. Res. 2002, 40, 727–759. [Google Scholar] [CrossRef]

- Wu, H.; Zhang, K.; Li, R. ESG Score, Analyst Coverage and Corporate Resilience. Financ. Res. Lett. 2024, 62, 105248. [Google Scholar] [CrossRef]

- Zhu, L.; Chen, Q.; Yang, S.; Yi, Z. The role of analysts in negative information production and disclosure: Evidence from short selling deregulation in an emerging market. Int. Rev. Econ. Financ. 2021, 73, 391–406. [Google Scholar] [CrossRef]

- Chen, T.; Harford, J.; Lin, C. Do analysts matter for governance? Evidence from natural experiments. J. Financ. Econ. 2015, 115, 383–410. [Google Scholar] [CrossRef]

- Zhang, C.; Wu, X. Analyst Coverage and Corporate ESG Performance. Sustainability 2023, 15, 12763. [Google Scholar] [CrossRef]

- Chen, Q.; Li, M.H. Can ESG Ratings Improve Corporate Resilience?—A Quasi-Natural Experiment Based on ESG Rating Events. R&D Manag. 2024, 36, 132–145. [Google Scholar]

- Maoret, M.; Moreira, S.; Sabanci, H. Closing the Gender Pay Gap: Analyst Coverage, Stakeholder Attention, and Gender Differences in Executive Compensation. Organ. Stud. 2024, 45, 495–521. [Google Scholar] [CrossRef]

- Zhao, H.X.; Zhang, Y.F. The Impact of Digital Transformation on Corporate Resilience and Its Mechanism. Innov. Technol. 2024, 24, 71–82. [Google Scholar] [CrossRef]

- Wen, Z.L.; Zhang, L.; Hou, J.T.; Liu, H.Y. Procedures for Testing Mediating Effects and Their Applications. Acta Psychol. Sin. 2004, 36, 614–620. [Google Scholar]

- Lu, T.; Dang, Y. Corporate Governance and Technological Innovation: A Cross-Industry Comparison. Econ. Res. J. 2014, 49, 115–128. [Google Scholar]

- Markovic, S.; Bagherzadeh, M. How does breadth of external stakeholder co-creation influence innovation performance? Analyzing the mediating roles of knowledge sharing and product innovation. J. Bus. Res. 2018, 88, 173–186. [Google Scholar] [CrossRef]

- Barasa, E.; Mbau, R.; Gilson, L. What is resilience and how can it be nurtured? A systematic review of empirical literature on organizational resilience. Int. J. Health Policy Manag. 2018, 7, 491. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).