Measurement and Spatio-Temporal Evolution Analysis of the Business Environment in the Guangdong–Hong Kong–Macao Greater Bay Area

Abstract

1. Introduction

2. Literature Review

2.1. The Connotation of Business Environment

2.2. Evaluation Indicators for Business Environment

2.3. The Measurement of Business Environment

3. Construction and Measurement Methods of Business Environment Development Indicators

3.1. Theoretical Foundation

3.2. Indicators System Design

3.3. Data Sources

3.4. Research Methodology

3.4.1. The Entropy Method

- (1)

- Theoretical foundation of the entropy method

- (2)

- The calculation steps of the entropy method

3.4.2. Kernel Density Estimation

3.4.3. Spatial Autocorrelation Analysis

3.4.4. The Markov Chain Analysis

4. The Measurement and Analysis of the Business Environment Development Level

4.1. The Development Level of the Business Environment in the Greater Bay Area

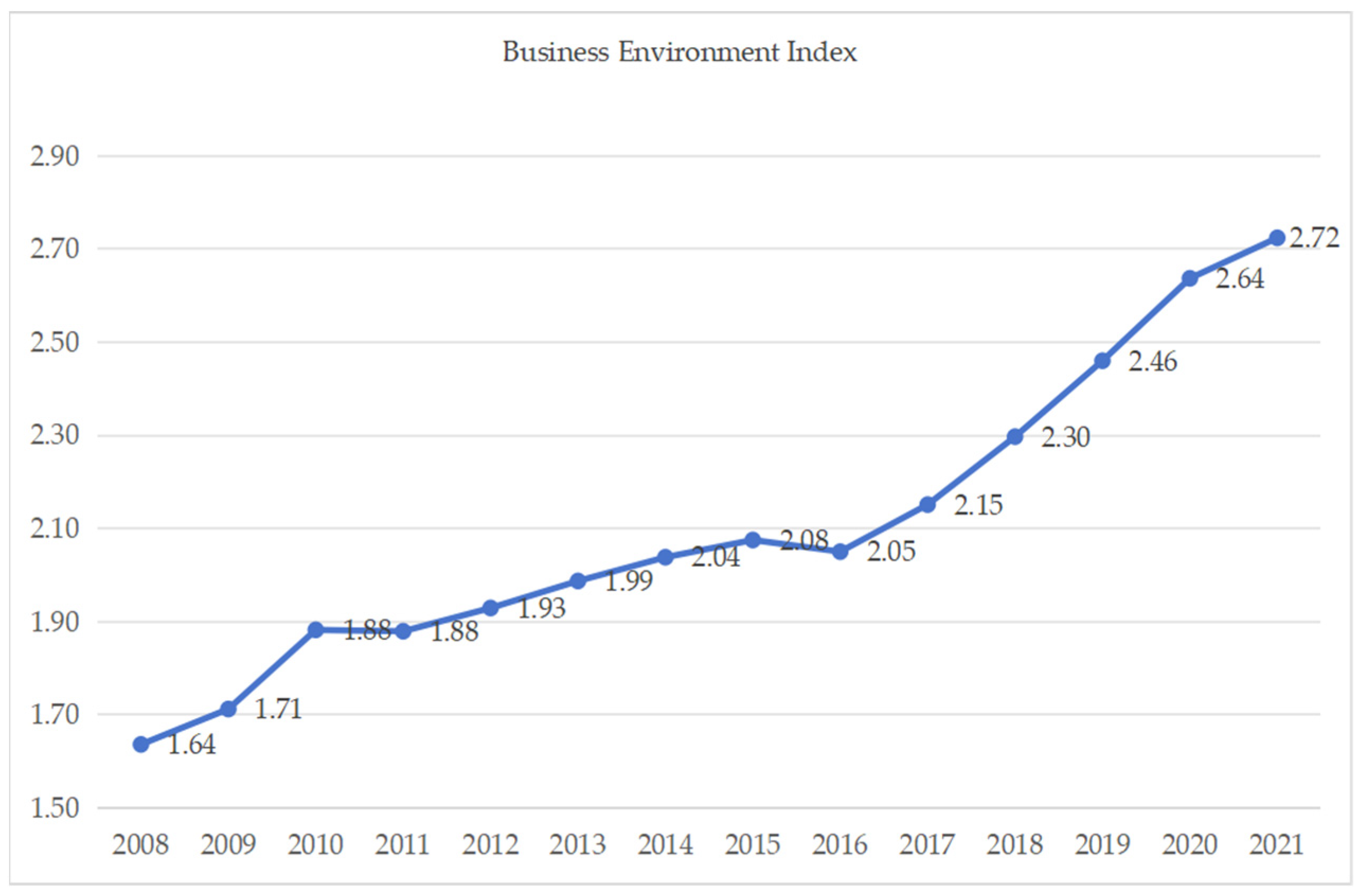

4.1.1. Comprehensive Development Level

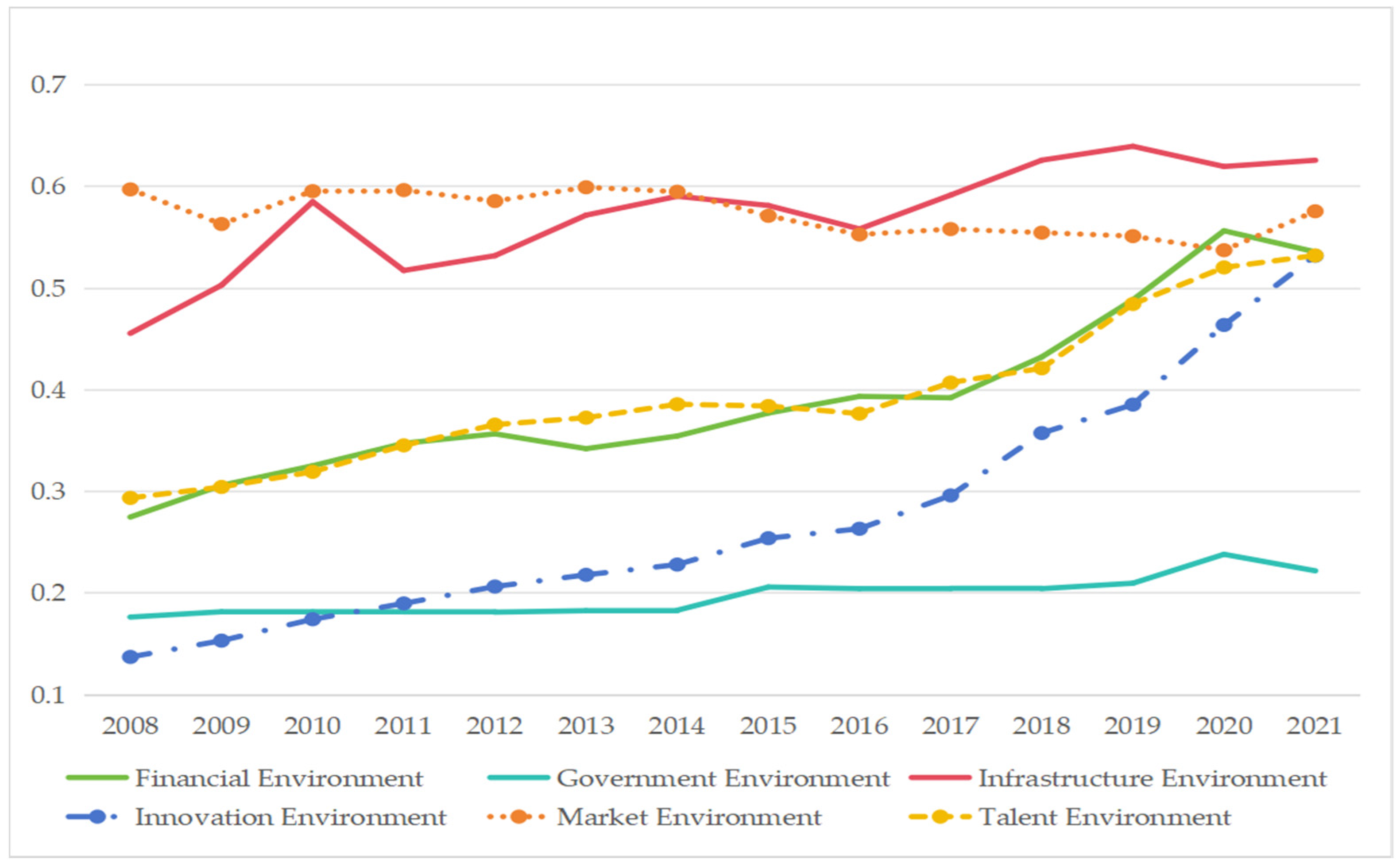

4.1.2. Development Levels of Six Sub-Environment Dimensions

4.2. Timing Evolution Analysis

4.2.1. The Overall Level of Business Environment Across Different Cities

4.2.2. Development Levels of Six Sub-Environment Dimensions Across Different Cities

4.3. Temporal Evolution Analysis of the Business Environment

4.4. Spatial Correlation Evolution Analysis

4.4.1. Spatial Evolution Analysis

4.4.2. Spatial Correlation Analysis

- (1)

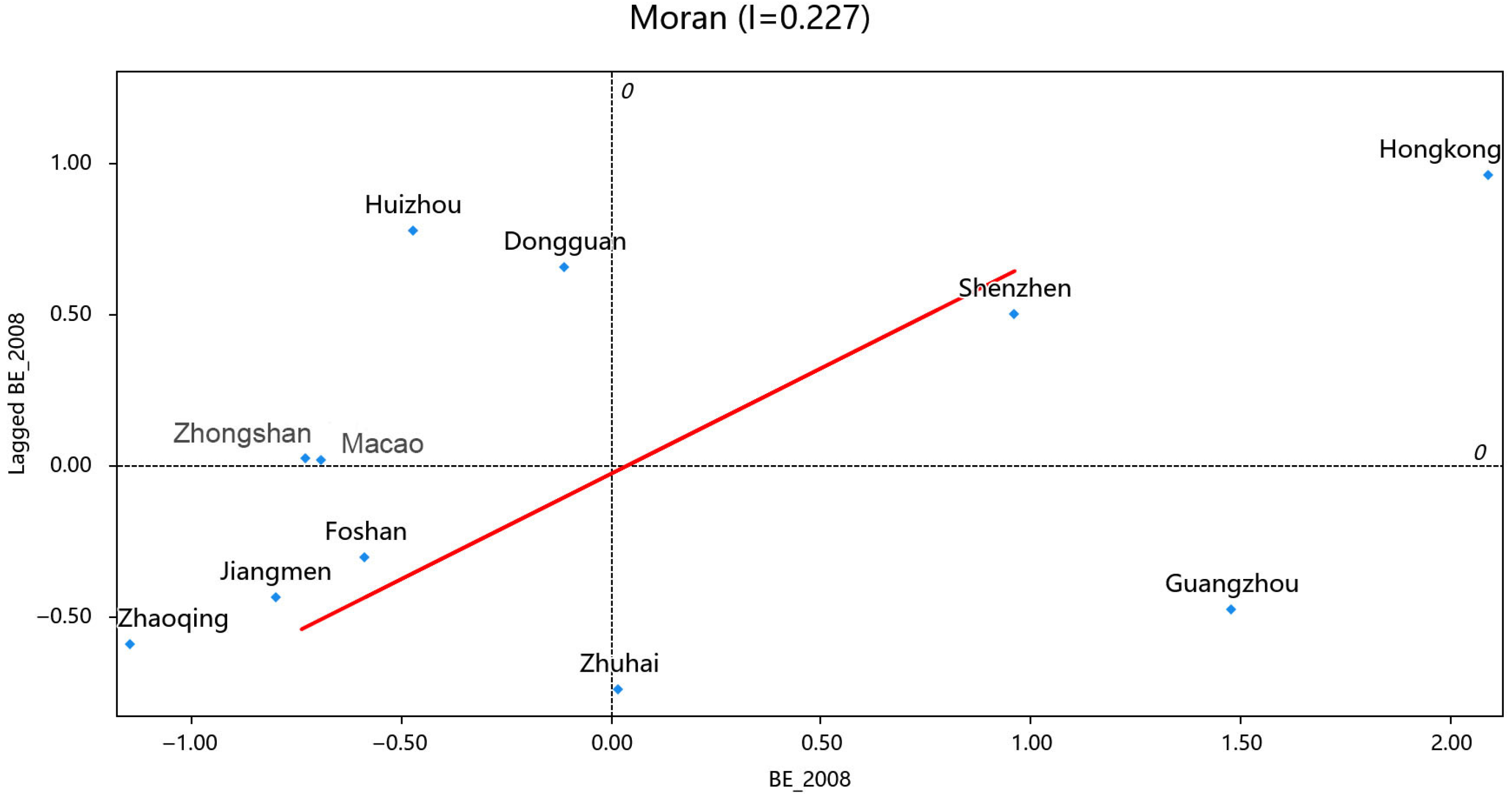

- Global Spatial Correlation analysis

- (2)

- Spatial Correlation Analysis

4.4.3. Markov Analysis of the Business Environment

4.5. Regression Analysis of Spatial Econometric Model

4.5.1. Descriptive Statistical Analysis

4.5.2. Correlation Statistical Analysis

4.5.3. The Regression Results of Spatial Model

5. Research Conclusions and Policy Recommendations

5.1. Research Conclusions

5.2. Policy Recommendations

5.2.1. Adopt Measures to Local Conditions and Strengthen Cooperation with Core Cities

5.2.2. Strengthen Strategies for Optimizing the Business Environment to Improve Policy Operability

5.2.3. Learning from GBA’s Business Environment to Enhance Policy Transferability

5.3. Limations and Future Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Dong, Z.; Wei, X.; Tang, C. Institutional soft environment and economic development. Manag. World 2012, 4, 9–20. [Google Scholar] [CrossRef]

- Haidar, J.I. The impact of business regulatory reforms on economic growth. J. Jap. Int. Econ. 2012, 26, 285–307. [Google Scholar] [CrossRef]

- Lai, X.J. Measures, Effects, and Prospects of Improving and Optimizing the Business Environment—Analysis Based on the World Bank’s: Doing Business Report. Macro-Econ. Manag. 2020, 4, 20–26. [Google Scholar] [CrossRef]

- Li, X.J.; Luo, Z.W. Optimization of China’s Business Environment in the New Era: Review of the 13th Five-Year Plan Period and Prospect of 14th Five-Year Plan Period. Reform 2020, 8, 46–57. [Google Scholar]

- He, D.X.; Wang, J. Ease of Doing Business and High-Quality Development: Index and Empirical Research. J. Shanghai Int. Bus. Econ. 2020, 6, 51–62. [Google Scholar] [CrossRef]

- Yang, J.D.; Yang, Q.J. Creating a Favorable Business Environment to Drive Industrial Transformation and Upgrading. Natl. Gov. 2018, 44, 18–23. [Google Scholar] [CrossRef]

- Li, Z.J.; Zhang, S.G.; Li, Y.F.; Shan, S. The Environmental Evaluation of Doing Business in Chinese cities and related Suggestions. Jiangsu Soc. Sci. 2019, 2, 30–42. [Google Scholar] [CrossRef]

- Li, Z.J. Evaluation and comparative study of the business environment in key urban agglomerations in China. J. Beijing Tech. Bus. Univ. Soc. Sci. 2021, 36, 17–28. [Google Scholar]

- Li, K.; Xu, B.L. Financing constraints, debt capacity, and corporate performance. Econ. Res. 2011, 5, 61–73. [Google Scholar]

- Liu, G.Q. Analysis of the incentive effects of tax incentives and fiscal subsidy policies: An empirical study based on the perspective of information asymmetry. Manag. World 2016, 10, 62–71. [Google Scholar] [CrossRef]

- Wu, C.P.; Tang, J. The enforcement of intellectual property protection, technological innovation, and corporate performance: Evidence from Chinese listed companies. Econ. Res. 2016, 51, 125–139. [Google Scholar]

- Xu, H.L.; Wang, H.C. Will the simplification and decentralization reform improve enterprise export performance?—A quasi-natural experiment based on the delegation of export tax rebate approval rights. Econ. Res. 2018, 53, 157–170. [Google Scholar]

- Du, Y.Z.; Liu, Q.C.; Cheng, J.Q. What kind of ecosystem for doing business will contribute to city-level high entrepreneurial activity? A research based on institutional configurations. Manag. World 2020, 36, 141–155. [Google Scholar] [CrossRef]

- Erdi, H.; Bambang, R. The Influence of the External and Internal Business Environment on the Marketing Strategy and Their Impact on the Marketing Performance. Eur. J. Bus. Manag. 2021, 13, 2222–2839. [Google Scholar] [CrossRef]

- Svilane, I.; Kallkis, H. External Factors of Business Environment and Family Business: Theoretical Review. Bus. IT. 2023, 2, 1–16. [Google Scholar] [CrossRef]

- Campbell, D.J.; Craig, T. Organisations and the Business Environment; Elsevier Butterworth-Heinemann: London, UK, 2005; pp. 3–25. [Google Scholar]

- Jayasuriya, D. Improvements in the world bank’s ease of doing business rankings: Do they translate into greater foreign direct investment inflows? World Bank Policy Res. Work. Pap. 2011, 5787, 1–18. [Google Scholar]

- Eifert, B. Do regulatory reforms stimulate investment and growth? Evidence from the doing business data. SSRN Electron. J. 2009, 140–159. [Google Scholar] [CrossRef]

- Carlin, W.; Schaffer, M.E. Understanding the business environment in South Asia: Evidence from firm-level surveys. Soc. Sci. Electron. Publ. 2012, 6160, 1–88. [Google Scholar]

- Dong, B.; Li, R.Y. Research on the construction of a rule-of-law and international business environment in China: An analysis based on Business Environment Report. Bus. Econ. Rev. 2016, 13, 141–143. [Google Scholar] [CrossRef]

- Lou, C.W.; Zhang, G.Y. Research on the Construction of Business Environment Assessment Framework Based on the Subjective Perception of Market Entities. A Review of Business Environment Assessment Model of the World Bank. Contemp. Econ. Manag. 2018, 40, 60–68. [Google Scholar] [CrossRef]

- Ma, X.D.; Wang, Y.S. New Policy of attracting foreign investment in the new era: From providing preferential policies to improving business environment. J. Party Sch. CPC. 2018, 22, 112–121. [Google Scholar] [CrossRef]

- Wang, X.L.; Fan, G.; Ma, G.R. Report on the Provincial Business Environment Index in China; Social Sciences Academic Press: Beijing, China, 2017; pp. 25–38. [Google Scholar]

- Li, C.; Shi, W.P. A Study of the World Bank’s “Paying Taxes” indicator system. Xiamen Univ. J. Philos. Soc. Sci. 2020, 5, 118–130. [Google Scholar] [CrossRef]

- Qian, Y.W. Research on the Path of the Construction of Rule-of-Law Business Environment in China: Taking Jiangsu Province’s Experience as a Research Sample. Shanghai Univ. Financ. Econ. J. 2020, 22, 1–10. [Google Scholar] [CrossRef]

- Novak, K.; Bridwell, L. The Future of Healthcare in Africa. J. Am. Soc. Compet. 2019, 17, 431–437. [Google Scholar]

- Ren, T. Assessment Report on the Business Environment of Chinese Cities: Methods and Data; Enterprise Management Press: Beijing, China, 2017; pp. 55–57. [Google Scholar]

- Cui, H.; Wu, Z.X. The intrinsic logic and construction of a rule-of-law business environment. Liaoning Econ. 2018, 9, 58–59. [Google Scholar] [CrossRef]

- Peng, D.Y.; Chen, B.; Liu, Z.J. Construction and application of a regional business environment evaluation index system: A case study of the Yangtze River Economic Belt. Financ. Econ. 2019, 5, 49–55. [Google Scholar] [CrossRef]

- Qiu, K.Q.; Chen, J.; Lu, Y.Q. Measurement of the comprehensive development level of the business environment in China. Econ. Tech. Econ. Res. 2022, 39, 121–143. [Google Scholar] [CrossRef]

- Li, H.; Cao, L. Measurement of high-quality economic development in the middle reaches of the Yangtze River urban agglomeration. Stat. Decision. 2021, 37, 101–105. [Google Scholar] [CrossRef]

- Sun, P.; Chen, S.Y. Evaluation of the business and administrative environment based on principal component analysis: A case study of 14 cities in Liaoning Province. Northeast Univ. J. Soc. Sci. 2019, 21, 51–56. [Google Scholar] [CrossRef]

- Li, M.L.; Liu, X.M. Research on optimization of business environment based on Benchmarking and analytic hierarchy process: Taking District in Chongqing as an Example. Sus. Dev. 2019, 10, 90–100. [Google Scholar] [CrossRef]

- Lin, S.Y. A Study on enterprise satisfaction evaluation as against international first-class business environments: A case study of the city of Hangzhou. Zhejiang Univ. J. Hum. Soc. Sci. 2021, 51, 75–90. [Google Scholar] [CrossRef]

- Li, Z.J. Evaluation of Business Environment in Chinese Cities; China Development Press: Beijing, China, 2019; pp. 20–30. [Google Scholar]

- Zhang, S.B.; Zhao, K.X.; Zhang, Z.X. Business environment in Chinese provinces: Quantitative assessment and horizontal comparison. Luo Jia Manag. Rev. 2023, 1, 32–52. [Google Scholar]

- Xia, H.X.; Tan, Q.M.; Bai, J.H. Business environment, Enterprise rent-seeking, and market innovation: Evidence from the China enterprise survey. Econ. Res. 2019, 54, 84–98. [Google Scholar]

- Chen, T.Y.; Wang, Y.; Zhao, X.S. Business environment, corporate confidence, and high-quality development: Empirical evidence from the China Enterprise Comprehensive Survey in 2018. Macro Qual. Res. 2020, 8, 110–128. [Google Scholar] [CrossRef]

- Cui, X.S. Empirical study on the effect of business environment on economic development along the “Belt and Road” initiative area: Based on the analysis of World Bank business environment indicator system. Beijing Gong Shang Univ. J. Soc. Sci. 2020, 35, 37–48. [Google Scholar]

- Tansley, A.G. The Use and Abuse of Vegetational Concepts and Terms. Ecology 1935, 16, 284–307. [Google Scholar] [CrossRef]

- Moore, J.F. Predators and prey: A new ecology of competition. Harv. Bus. Rev. 1993, 71, 75–86. [Google Scholar]

- Dunn, K. The Entrepreneurship Ecosystem. MIT Tech. Rev. 2005, 9, 1–10. [Google Scholar]

- Cohen, B. Sustainable valley entrepreneurial ecosystems. Bus. Strat. Environ. 2006, 15, 1–14. [Google Scholar] [CrossRef]

- Adner, R.; Kapoor, R. Value creation in innovation ecosystems: How the structure of technological interdependence affects firm performance in new technology generations. Strat. Manag. J. 2010, 31, 306–333. [Google Scholar] [CrossRef]

- Isenberg, D.J. How to start an entrepreneurial revolution. Harv. Bus. Rev. 2010, 88, 40–50. [Google Scholar]

- Vogel, R.; Güttel, W.H. The dynamic capability view in strategic management: A bibliometric review. Int. J. Manag. Rev. 2013, 15, 426–446. [Google Scholar] [CrossRef]

- Li, J. Research on the formation mechanism of regional entrepreneurial environment from the perspective of entrepreneurial ecosystems. Suzhou Univ. J. Philos. Soc. Sci. 2019, 40, 90–98. [Google Scholar] [CrossRef]

- Cai, L.; Peng, X.Q.; Nambisan, S.; Wang, L. A review and outlook on research in entrepreneurial ecosystems. Jilin Univ. Soc. Sci. J. 2016, 56, 5–16. [Google Scholar] [CrossRef]

- Yang, C.K.; Jiang, C.H. Measurement of international cities’ business environment and enlightenments on Beijing and Shanghai. Econ. Syst. Reform. 2019, 4, 34–41. [Google Scholar]

- Wang, Y.D.; Ma, Y.X.; Qiao, G.H. Can Government auditing optimize regional business environments? Evidence from provincial panel data from 2008 to 2016. Audit Res. 2021, 1, 31–39. [Google Scholar] [CrossRef]

- Ciftci, M.; Cready, W.M. Scale effects of R&D as reflected in earnings and returns. J. Account. Econ. 2011, 52, 62–80. [Google Scholar] [CrossRef]

- Lin, Y.F. Theoretical Foundations and Development Directions of New Structural Economics. Econ. Rev. 2017, 3, 4–16. [Google Scholar] [CrossRef]

- Zhou, D.M.; Chen, X.L.; Yang, J.; Lu, R.Y. Review and outlook on entrepreneurship research. Manag. World 2020, 36, 206–225. [Google Scholar] [CrossRef]

- Zhang, Y.L.; Gong, Q.; Rong, Z. Technological innovation, equity financing, and financial structure transformation. Manag. World 2016, 11, 65–80. [Google Scholar] [CrossRef]

- Yu, H.; Zhou, L.; Yang, L.H. Study on the impact of Zhejiang financial business environment on foreign investment. Economics 2022, 5, 155–159. [Google Scholar] [CrossRef]

- Shannon, C. A mathematical theory of communication. Bell Syst. Tech. J. 1948, 27, 379–422. [Google Scholar] [CrossRef]

- Yang, K.F.; Wang, L.L.; Qiu, N.Q. Business environment construction, subjective governance performance evaluation, and spillover effects: Empirical evidence from 29 provinces in China. J. Public Admin. 2023, 20, 106–120. [Google Scholar] [CrossRef]

- Cunha-Zeri, G.; Guidolini, J.F.; Branco, E.A.; Ometto, J.P. How sustainable is nitrogen management in Brazil? A sustainability assessment using the Entropy Weight Method. J. Environ. Manag. 2022, 316, 115330. [Google Scholar] [CrossRef] [PubMed]

- Phillips, S.J.; Dudík, M. Modeling of species distributions with Maxent: New extensions and a comprehensive evaluation. Ecography 2008, 31, 161–175. [Google Scholar] [CrossRef]

- Zhang, Y.; Zhang, Y.; Zhang, H.; Zhang, Y. Evaluation on new first-tier smart cities in China based on entropy method and TOPSIS. Ecol. Indic. 2022, 145, 109616. [Google Scholar] [CrossRef]

- Alao, M.A.; Ayodele, T.R.; Ogunjuyigbe, A.S.O.; Popoola, O.M. Multi-criteria decision based waste to energy technology selection using entropy-weighted TOPSIS technique: The case study of Lagos. Niger. Energy 2020, 201, 117675. [Google Scholar] [CrossRef]

- Xin, C.C.; Chen, Z.Y. Dynamics, regional disparities, and convergence of the supply level of basic public services in China. Quant. Econ. Tech. Econ. Res. 2019, 36, 52–71. [Google Scholar] [CrossRef]

- Moran, P.A.P. Notes on continuous stochastic phenomena. Biometrika 1950, 37, 17–23. [Google Scholar] [CrossRef]

- Anselin, L. Local indicators of spatial association-LISA. Geogr. Anal. 1995, 27, 93–115. [Google Scholar] [CrossRef]

| Indicator | Symbol | Specific Indicators | Measurement Methods |

|---|---|---|---|

| Business environment | BE | BE development level | The index is constructed from six environmental components, weighted by the entropy method |

| Innovation environment | TE | R&D spending intensity | The R&D expenditure/GDP |

| Technological innovation | Three types of patent grants | ||

| Market environment | ME | Market size | Aggregate retail sales of consumer products/GDP |

| The degree of reliance on foreign trade | Aggregate imports and exports/GDP | ||

| The actual use of foreign capital share | The total amount of foreign capital utilized/GDP | ||

| Level of economic development | Per capita GDP | ||

| Talent environment | RE | Education expenditure intensity | Education expenditure/general government expenditure |

| Level of education | Number of university students | ||

| Personnel of education employment | |||

| Financial environment | FE | The ratio of financial deepening | Deposit–loan ratio of financial institutions/GDP |

| The level of finance | Number of employees in the financial industry | ||

| Government environment | GE | Government service efficiency | Local general public finance expenditure/GDP |

| Tax burden level | Local general public finance revenue/GDP | ||

| Infrastructure environment | IE | Per capita road length | Total road length/resident population |

| Port handling capacity | Port cargo throughput | ||

| Level of infrastructure investment | Infrastructure investment/fixed asset investment | ||

| Per capita Internet level | Mobile Internet users per 10,000 people |

| Sub-Dimension | Specific Indicators | Information Entropy | Information Utility Value | Weight Coefficient |

|---|---|---|---|---|

| Innovation environment | R&D expenditure intensity | 0.9591 | 0.0409 | 2.90% |

| Number of patents granted | 0.8338 | 0.1662 | 11.80% | |

| Market environment | Retail sales of consumer goods | 0.9829 | 0.0171 | 1.21% |

| Total imports and exports | 0.9158 | 0.0842 | 5.98% | |

| Utilization of foreign capital | 0.8619 | 0.1381 | 9.80% | |

| Per capital GDP | 0.9138 | 0.0862 | 6.12% | |

| Talent environment | Education expenditure intensity | 0.9879 | 0.0121 | 0.86% |

| Number of university students | 0.8178 | 0.1822 | 12.93% | |

| Education employment personnel | 0.9120 | 0.0880 | 6.25% | |

| Financial environment | Financial deepening ratio | 0.9258 | 0.0742 | 5.27% |

| Number of employees in the financial industry | 0.8236 | 0.1764 | 12.52% | |

| Government environment | Degree of government intervention | 0.9593 | 0.0407 | 2.89% |

| Level of tax burden | 0.9870 | 0.0130 | 0.92% | |

| Infrastructure environment | Per capital road length | 0.9222 | 0.0778 | 5.52% |

| Port throughput | 0.9029 | 0.0971 | 6.89% | |

| Infrastructure investment | 0.9697 | 0.0303 | 2.15% | |

| Number of mobile Internet users | 0.9157 | 0.0843 | 5.98% |

| Year | Shen Zhen | Guang Zhou | Zhu Hai | Fo Shan | Hui Zhou | Dong Guan | Zhong Shan | Jiang Men | Zhao Qing | Hong Kong | Macao |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 2008 | 0.232 | 0.277 | 0.150 | 0.098 | 0.108 | 0.139 | 0.085 | 0.079 | 0.049 | 0.330 | 0.089 |

| 2009 | 0.240 | 0.298 | 0.151 | 0.109 | 0.113 | 0.135 | 0.087 | 0.096 | 0.054 | 0.343 | 0.086 |

| 2010 | 0.260 | 0.346 | 0.198 | 0.117 | 0.108 | 0.144 | 0.093 | 0.100 | 0.058 | 0.375 | 0.085 |

| 2011 | 0.277 | 0.336 | 0.165 | 0.119 | 0.102 | 0.151 | 0.093 | 0.092 | 0.058 | 0.394 | 0.090 |

| 2012 | 0.276 | 0.357 | 0.158 | 0.121 | 0.107 | 0.157 | 0.094 | 0.103 | 0.060 | 0.398 | 0.097 |

| 2013 | 0.266 | 0.346 | 0.178 | 0.128 | 0.114 | 0.166 | 0.100 | 0.109 | 0.065 | 0.414 | 0.102 |

| 2014 | 0.271 | 0.365 | 0.180 | 0.133 | 0.111 | 0.170 | 0.103 | 0.108 | 0.068 | 0.418 | 0.110 |

| 2015 | 0.276 | 0.382 | 0.182 | 0.130 | 0.110 | 0.178 | 0.104 | 0.109 | 0.070 | 0.415 | 0.118 |

| 2016 | 0.274 | 0.393 | 0.170 | 0.127 | 0.109 | 0.174 | 0.106 | 0.104 | 0.074 | 0.398 | 0.121 |

| 2017 | 0.290 | 0.409 | 0.164 | 0.141 | 0.114 | 0.176 | 0.116 | 0.108 | 0.082 | 0.429 | 0.123 |

| 2018 | 0.351 | 0.460 | 0.165 | 0.142 | 0.117 | 0.191 | 0.123 | 0.115 | 0.081 | 0.425 | 0.128 |

| 2019 | 0.392 | 0.496 | 0.179 | 0.166 | 0.136 | 0.207 | 0.120 | 0.112 | 0.082 | 0.435 | 0.133 |

| 2020 | 0.435 | 0.521 | 0.169 | 0.172 | 0.137 | 0.220 | 0.132 | 0.122 | 0.091 | 0.451 | 0.186 |

| 2021 | 0.460 | 0.545 | 0.173 | 0.183 | 0.145 | 0.232 | 0.132 | 0.126 | 0.083 | 0.469 | 0.176 |

| City | BEDI | IE | ME | TE | FE | GE | IE | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| S | R | S | R | S | R | S | R | S | R | S | R | S | R | |

| Shenzhen | 4.30 | 3 | 0.86 | 1 | 0.70 | 4 | 0.45 | 3 | 0.95 | 2 | 0.21 | 3 | 1.144 | 2 |

| Guangzhou | 5.53 | 2 | 0.52 | 2 | 0.44 | 7 | 1.99 | 1 | 0.66 | 3 | 0.18 | 7 | 1.749 | 1 |

| Zhuhai | 2.38 | 4 | 0.22 | 6 | 0.79 | 3 | 0.25 | 7 | 0.20 | 6 | 0.23 | 2 | 0.691 | 5 |

| Foshan | 1.89 | 6 | 0.36 | 4 | 0.35 | 10 | 0.37 | 4 | 0.22 | 5 | 0.16 | 9 | 0.435 | 6 |

| Huizhou | 1.63 | 8 | 0.20 | 7 | 0.50 | 6 | 0.22 | 9 | 0.09 | 10 | 0.20 | 4 | 0.427 | 7 |

| Dongguan | 2.44 | 5 | 0.38 | 3 | 0.60 | 5 | 0.30 | 5 | 0.19 | 7 | 0.16 | 10 | 0.822 | 4 |

| Zhongshan | 1.49 | 9 | 0.29 | 5 | 0.42 | 8 | 0.19 | 10 | 0.13 | 6 | 0.19 | 6 | 0.276 | 10 |

| Jiangmen | 1.48 | 10 | 0.17 | 8 | 0.37 | 9 | 0.22 | 8 | 0.12 | 9 | 0.19 | 5 | 0.407 | 8 |

| Zhaoqing | 0.98 | 11 | 0.08 | 9 | 0.20 | 11 | 0.22 | 6 | 0.04 | 11 | 0.14 | 11 | 0.226 | 11 |

| Hong Kong | 5.69 | 1 | 0.07 | 10 | 2.20 | 1 | 0.46 | 2 | 1.95 | 1 | 0.23 | 1 | 0.836 | 3 |

| Macao | 1.64 | 7 | 0.010 | 11 | 0.85 | 2 | 0.09 | 11 | 0.25 | 4 | 0.16 | 8 | 0.286 | 9 |

| Variable | Moran Index | E(I) | Z(I) | p-Value |

|---|---|---|---|---|

| 2008 | 0.227 | −0.100 | 1.365 | 0.086 |

| 2009 | 0.187 | −0.100 | 1.202 | 0.115 |

| 2010 | 0.074 | −0.100 | 0.716 | 0.237 |

| 2011 | 0.183 | −0.100 | 1.182 | 0.119 |

| 2012 | 0.171 | −0.100 | 1.130 | 0.129 |

| 2013 | 0.154 | −0.100 | 1.078 | 0.140 |

| 2014 | 0.133 | −0.100 | 0.987 | 0.162 |

| 2015 | 0.122 | −0.100 | 0.929 | 0.177 |

| 2016 | 0.113 | −0.100 | 0.894 | 0.186 |

| 2017 | 0.133 | −0.100 | 0.980 | 0.163 |

| 2018 | 0.152 | −0.100 | 1.038 | 0.150 |

| 2019 | 0.157 | −0.100 | 1.055 | 0.146 |

| 2020 | 0.169 | −0.100 | 1.096 | 0.136 |

| 2021 | 0.181 | −0.100 | 1.147 | 0.126 |

| Low | Medium-Low | Medium-High | High | n | |

| Low | 0.8205 | 0.1795 | 0.0000 | 0.0000 | 39 |

| Medium-Low | 0.0571 | 0.8286 | 0.1143 | 0.0000 | 35 |

| Medium-High | 0.0000 | 0.0294 | 0.9118 | 0.0588 | 34 |

| High | 0.0000 | 0.0000 | 0.0286 | 0.9714 | 35 |

| Variable Name | Variable Symbols | Calculation Method |

|---|---|---|

| The level of technological innovation | TIL | R&D investment intensity/population size |

| The degree of opening up | OPD | Total retail sales of consumer goods/GDP |

| The level of financial development | FDL | Natural logarithm of financial industry employees |

| The degree of government intervention | GED | Government fiscal expenditure/GDP |

| The level of infrastructure investment | IEI | Infrastructure investment/Fixed asset investment |

| The level of labor force | LF | Natural logarithm of the employed people |

| The educational level | EL | Education investment intensity/population size |

| Variable | Mean | SD | Min | Max | Obs |

|---|---|---|---|---|---|

| BE | 0.191 | 0.121 | 0.049 | 0.545 | 154 |

| TIL | 0.195 | 0.176 | 0.005 | 0.951 | 154 |

| OPD | 0.344 | 0.081 | 0.122 | 0.492 | 154 |

| FDL | 10.20 | 1.070 | 8.810 | 12.53 | 154 |

| GED | 0.119 | 0.081 | 0.048 | 0.399 | 154 |

| IEI | 0.229 | 0.075 | 0.089 | 0.429 | 154 |

| LF | 15.16 | 0.636 | 13.80 | 16.34 | 154 |

| ELF | 0.418 | 0.557 | 0.017 | 2.472 | 154 |

| Variable | BE | TIL | OPD | FDL | GED | IEI | LF | EL |

|---|---|---|---|---|---|---|---|---|

| BE | 1.000 | |||||||

| TIL | 0.692 *** | 1.000 | ||||||

| OPD | 0.086 | 0.092 | 1.000 | |||||

| FDL | −0.039 | −0.057 | −0.360 *** | 1.000 | ||||

| GED | −0.090 | −0.093 | −0.519 *** | 0.089 | 1.000 | |||

| IEI | 0.310 *** | 0.227 *** | 0.423 *** | −0.042 | −0.340 *** | 1.000 | ||

| LF | 0.537 *** | 0.415 *** | −0.119 | −0.012 | −0.017 | 0.179 ** | 1.000 | |

| EL | 0.214 *** | 0.109 | 0.032 | 0.039 | 0.009 | −0.028 | 0.163 ** | 1.000 |

| (1) | (2) | (5) | (6) | (7) | |

|---|---|---|---|---|---|

| Variables | Main | WX | Direct | Indirect | Total |

| TIL | 0.420 *** (7.78) | 0.275 *** (3.21) | 0.421 *** (6.67) | 0.037 (0.62) | 0.458 *** (6.36) |

| OPD | 0.191 ** (2.36) | 0.073 (0.52) | 0.223 ** (2.42) | −0.131 (−1.23) | 0.092 (0.87) |

| FDL | −0.005 (1.08) | −0.002 (−0.22) | −0.006 (−1.21) | 0.001 (0.10) | −0.005 (−0.90) |

| GED | −0.027 (−0.41) | 0.006 (0.006) | −0.025 (−0.32) | 0.011 (0.15) | −0.015 (−0.17) |

| IEI | 0.286 *** (3.72) | 0.053 (0.48) | 0.310 *** (3.81) | −0.074 (−0.72) | 0.237 ** (2.09) |

| LF | 0.054 *** (4.76) | 0.083 *** (4.63) | 0.041 *** (3.11) | 0.046 *** (3.51) | 0.087 *** (5.49) |

| EL | 0.037 ** (2.15) | −0.049 (−1.12) | 0.052 ** (2.46) | −0.061 (−1.51) | −0.010 (−0.32) |

| rho | 0.538 *** (5.85) | ||||

| 0.003 | |||||

| N | 154 | ||||

| R2 | 0.717 | ||||

| Log-L | 223.636 | ||||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhao, F.; Wei, Q. Measurement and Spatio-Temporal Evolution Analysis of the Business Environment in the Guangdong–Hong Kong–Macao Greater Bay Area. Sustainability 2025, 17, 7426. https://doi.org/10.3390/su17167426

Zhao F, Wei Q. Measurement and Spatio-Temporal Evolution Analysis of the Business Environment in the Guangdong–Hong Kong–Macao Greater Bay Area. Sustainability. 2025; 17(16):7426. https://doi.org/10.3390/su17167426

Chicago/Turabian StyleZhao, Fang, and Qiang Wei. 2025. "Measurement and Spatio-Temporal Evolution Analysis of the Business Environment in the Guangdong–Hong Kong–Macao Greater Bay Area" Sustainability 17, no. 16: 7426. https://doi.org/10.3390/su17167426

APA StyleZhao, F., & Wei, Q. (2025). Measurement and Spatio-Temporal Evolution Analysis of the Business Environment in the Guangdong–Hong Kong–Macao Greater Bay Area. Sustainability, 17(16), 7426. https://doi.org/10.3390/su17167426