Abstract

As a key engine driving China’s green financial transformation, the Green Financial Reform and Innovation Pilot Zones have demonstrated significant achievements in enhancing the capacity of financial services to support green real economies, preventing and mitigating green financial risks, and bolstering national and urban economic resilience. On this basis, a spatial Markov chain model is applied to further analyze the economic toughness of prefecture-level cities. This study treats the establishment of these pilot zones as a quasi-natural experiment, using panel data from 269 prefecture-level cities in China from 2013 to 2023 and employing a multi-period difference-in-differences (DID) model to empirically examine the impact of green financial reform on urban economic resilience and its underlying mechanisms. The results reveal that the establishment of these pilot zones significantly enhances urban economic resilience. Specifically, green financial reforms primarily improve urban economic resilience by increasing credit accessibility and capital allocation efficiency in the pilot cities. Furthermore, the policy effects are more pronounced in large cities and resource-dependent cities compared to small and medium-sized cities and non-resource-dependent cities, with stronger impacts observed in southern and coastal regions than in northern inland areas. Additionally, the policy effects are significantly greater in environmentally prioritized cities than in non-prioritized cities. By integrating green financial reforms and urban economic resilience into a unified analytical framework, this study provides valuable insights for policymakers to refine green financial strategies and design resilience-enhancing policies.

1. Introduction

In recent years, various natural disasters and man-made disasters have frequently occurred around the world. Urban problems such as high temperatures, earthquakes, political instability, environmental pollution, and traffic congestion have become increasingly serious []. The term “resilience” originates from physics, where it describes the ability of a material to absorb energy when it is deformed elastically and release that energy upon unloading []. This foundational idea has since been adapted into the social sciences and economics, where resilience generally refers to the capacity of a system to absorb shocks, reorganize, and retain essentially the same function, structure, identity, and feedback []. In the context of economics, resilience has gained prominence as a concept to assess how well regional or national economies withstand, recover from, and adapt to external disruptions such as financial crises, natural disasters, and geopolitical instability. China has paid attention to the importance of building resilient cities. The 14th Five-Year Plan historically incorporates “resilient cities” into national planning and clearly puts forward the goal of building resilient cities. The report of the 20th National Congress of the Communist Party of China emphasized the implementation of urban renewal actions, strengthening urban infrastructure construction, and creating livable, resilient, and smart cities. This also points out the direction for promoting the construction of resilient cities []. Under dual pressures from both domestic and international fronts, China’s macroeconomic resilience has continued to strengthen. Leveraging the advantages of a mega-sized market, the potential for household consumption upgrading, and coordinated policies to stimulate consumption, the economy has maintained a generally stable growth trajectory.

Resilience is interpreted in terms of how well a system adapts its structure and function in response to shocks. More specifically, economic resilience entails not only the ability to return to a prior growth trajectory (engineering resilience) but also the capacity to adapt, transform, and develop in response to long-term structural changes (evolutionary resilience). The concept has therefore evolved beyond a mere recovery function to one that emphasizes adaptability, transformation, and learning in the face of cumulative stressors []. Being resilient can help mitigate external shocks such as financial crises and pandemics. In 2025, the General Secretary Xi Jinping emphasized at the Central Economic Work Conference that China’s economy has maintained overall stability with steady progress. With the continued implementation and effectiveness of a series of precise and robust policies, the momentum for economic growth in the coming year will further consolidate, and economic performance is expected to achieve a higher-quality and more dynamic recovery. Currently, how to further tap into the potential of economic resilience and leverage it to propel China’s economy forward steadily amid a complex international environment and domestic structural adjustments has become a focal point of discussion among scholars across various fields. Against the backdrop of advancing interest rate liberalization and the transformation and upgrading of real-economy enterprises, the resilience of green finance has steadily improved []. Economic resilience, acting as the stabilizer of the system, constructs a multi-level feedback system through multiple buffer layers and dynamic adjustment mechanisms []. Under the national advocacy for green development strategies, governments at all levels have successively introduced specialized green finance policies, significantly promoting the deep integration of green finance with the green industries of the real economy [].

As a “guiding beacon” for policy practice, China’s Green Finance Reform and Innovation Pilot Zones were first established in June 2017 in cities such as Huzhou, Quzhou, and Ganzhou []. These pilot zones have significantly enhanced urban economic resilience through institutional innovation and the synergy of financial instruments: on one hand, they guide capital flows into strategic emerging industries in environmental protection through tools such as credit and bonds, fostering new growth drivers with regional characteristics; on the other hand, they promote the optimization of resource allocation efficiency in traditional industries [].

Driven by the continuous improvement of the green finance policy system and the accelerated flow of financial resources to green industries, a virtuous interaction has formed between institutional supply at the national level and practical exploration at the micro level []. Notably, although existing studies have explored the micro-level corporate effects and regional development efficacy of green finance from multiple dimensions, the transmission mechanisms of policy effects at the prefecture-level city level remain under-researched, particularly lacking correlation analysis with urban economic resilience as a systemic indicator []. In other words, existing studies have yet to systematically explore how green finance reform pilot zones enhance urban resilience. Do these policy effects exhibit heterogeneous performance under different city sizes, resource endowments, and geographical conditions? For instance, large cities may amplify policy leverage effects due to their complex industrial structures, while resource-based cities may need to explore differentiated transformation paths. Therefore, this paper attempts to use a multi-period difference-in-differences (DID) model to reveal the impact of Green Finance Reform and Innovation Pilot Zone policies on urban economic resilience, focusing on the dynamic mechanisms involved, thereby providing empirical evidence for the design of regionally differentiated policy tools []. Furthermore, clarifying the role of green finance in promoting economic resilience addresses a critical gap at the intersection of environmental finance and regional economic policy. As green finance evolves from a niche policy tool into a central pillar of national development strategies, its potential to serve as a buffer against external economic shocks becomes increasingly relevant []. Given the escalating challenges posed by climate change, energy transitions, and geopolitical volatility, investigating how green financial reforms contribute to regional economic stability is not only timely but also essential for informing adaptive and forward-looking policy frameworks []. This approach not only responds to the national green development strategy’s demand for refined policy evaluation but also complements a new paradigm for studying the relationship between green finance reform and urban economic resilience at the meso level [].

The marginal contributions of this paper are reflected in three aspects: First, in terms of research perspective, it breaks through the limitations of existing literature on the micro-level effects of green finance policies, constructing a meso-level analytical framework for policy evaluation at the prefecture-level city scale []. It is the first to systematically link green finance reform with urban economic resilience and reveal its mechanisms through a multi-period DID model, filling a theoretical gap in meso-level policy effect research. Second, in terms of research dimensions, unlike existing macro-level analyses based on provincial data, this study focuses on the complexity of urban economic systems and the characteristics of policy implementation units []. It integrates multiple transmission pathways, such as credit accessibility and resource allocation efficiency, to construct a comprehensive urban resilience evaluation framework, revealing the micro-level mechanisms through which green finance policies strengthen urban resilience by optimizing credit structures and improving factor allocation efficiency. Third, in terms of data timeliness, it moves beyond the reliance on early-stage policy data in existing studies, constructing a long-term panel dataset with the latest data to capture the dynamic evolution of policy effects. It identifies the phased characteristics of pilot zone policies, from initial green credit scale expansion to later-stage technological innovation and risk management deepening, providing empirical evidence for dynamic policy optimization.

2. Theoretical Analysis and Research Hypotheses

2.1. The Impact of Green Finance Reform Policies on Urban Economic Resilience

As a key initiative of China’s ecological civilization system reform, in 2017, the People’s Bank of China and six other ministries launched the first batch of Green Finance Reform and Innovation Pilot Zones in regions such as Zhejiang, Jiangxi, Guangdong, Guizhou, and Xinjiang [,]. This established a two-way innovation mechanism combining “top-down” policy guidance and “bottom-up” practical exploration. These pilot zones were entrusted with a dual strategic mission: serving as “testing grounds” to verify the effectiveness of green finance policies and as “demonstration zones” to generate replicable experiences [,].

The introduction of this policy represents a significant manifestation of green finance reform and innovation, aiming to steer financial resources toward green and innovative industries, promote sustainable economic development, and strengthen financial support for green sectors in the real economy, thereby preventing finance from “diverting from green to speculative activities.” []. This policy enhances urban economic resilience across multiple dimensions, including resistance and recovery capacity, adaptation and adjustment capacity, and innovation and transformation capacity [].

By optimizing financial resource allocation, driving technological innovation, and facilitating green industrial transformation, the green finance reform policy significantly strengthens urban economic resilience. It directs financial resources toward green sectors, alleviates corporate financing constraints, reduces financing costs, and effectively supports technological upgrades and production capacity adjustments—thereby improving the economy’s resistance and recovery capabilities. Meanwhile, the growth of green industries boosts local tax revenues, improves fiscal conditions, and provides governments with more resources to respond to crises. Additionally, the policy generates numerous green jobs, stimulates green consumption among residents, and forms an endogenous buffering mechanism of “industry-employment-consumption.” Through the coordination of green finance and fiscal policies, as well as cross-regional risk-sharing mechanisms, the policy further enhances the economy’s adaptation and adjustment capacity, offering systemic support for cities to withstand external shocks.

In terms of boosting urban economic innovation and transformation capacity, green finance reform also plays a prominent role. Muhammad Umar et al. (2023) explored that green finance has a positive impact on economic development in China as a whole and in the regions of eastern, central, and western China []. The policy also incentivizes enterprises to increase green R&D investment, attracts and cultivates green-tech talent, enhances urban green innovation capabilities, and vigorously drives the transition toward a green, low-carbon economy, thereby improving economic innovation and transformation capacity [].

Based on the above analysis, Research Hypothesis H1 is proposed:

H1.

The green finance reform and innovation policy helps enhance urban economic resilience.

2.2. The Effect of Green Finance Reform and Innovation Policies on Urban Economic Resilience

Existing research indicates that implementing a green finance policy can further enhance the impact of green finance development []. There are positive outcomes of application being achieved through the application of pressure on companies to respond positively to stakeholders who display a desire to invest in green activities [,]. On one hand, green finance reform and innovation expand credit coverage by introducing innovative collateral mechanisms and developing environmental risk hedging instruments, effectively reducing financial institutions’ risk assessment costs for green projects. On the other hand, its unique environmental benefit evaluation system directs capital toward low-carbon transition sectors, significantly enhancing the positive environmental externalities of capital allocation. This dual mechanism strengthens urban economic resilience by improving financial resource availability and optimizing investment efficiency in sustainable development.

2.2.1. Green Finance Reform and Innovation Policies Are Conducive to Enhancing the Availability of Credit, Thereby Enhancing the Resilience of Urban Economies

The green finance reform and innovation have effectively expanded the supply scale of green financial products and services by reshaping the incentive mechanisms in financial markets, significantly mitigating information asymmetry risks and institutional discrimination faced by green enterprises in credit markets []. This institutional remediation enables more green enterprises to overcome financing constraints and obtain credit support commensurate with their development needs, thereby achieving substantial improvement in credit accessibility at the corporate level. Higher credit allocation efficiency facilitates banks in making rational credit evaluation decisions and providing effective financial support, alleviating the substantial capital demands during the initial stages of entrepreneurship, thereby boosting urban dynamism []. Finance is a critical enabler to accelerate climate action. However, access to finance is unequal, making finance a barrier in developing countries. According to the research by Shuyu Han et al. (2022), debt financing is an important mechanism for the green finance reform and innovation pilot policy to promote corporate green innovation [,]. What’s more, Huwei, Wen (2021) examined how the implementation of the green credit can affect the green production efficiency of enterprises through the financing scale effect and financing cost effect []. The sustainable fiscal revenue generated by governments through green finance significantly enhances their resource allocation capacity in responding to environmental shocks. This not only ensures the continuity of public services but also provides policy buffer space for the recovery of commodity markets. Improved credit accessibility incentivizes enterprises to increase investment in green technology R&D, driving the green transformation of traditional industries and fostering emerging green industries. This injects innovation and transformation momentum into the urban economic system from the supply side. Based on this, Research Hypothesis H2 is proposed:

H2.

The green finance reform and innovation policy can enhance urban economic resilience by improving credit accessibility.

2.2.2. Green Finance Reform and Innovation Policies Are Conducive to Improving the Efficiency of Capital Allocation, Thereby Enhancing the Resilience of Urban Economy

The green finance reform and innovation systematically lower market entry barriers for green industries by optimizing the green capital market environment and improving the financial supply structure. This institutional transformation has not only generated significant effects at the enterprise level. Existing research shows that the establishment of green finance reform and innovation pilot zones effectively enhances corporate resilience by alleviating financing constraints, promoting bank-enterprise relationship coupling, and optimizing resource allocation []. Hong Yi (2023) found that the implementation of green finance policies can significantly facilitate the enhancement of resource utilization efficiency []. More profoundly, this micro-level mechanism provides a critical entry point for explaining macroeconomic phenomena. When capital flows more smoothly to green and efficient enterprises and projects under the guidance of green finance, the improvement in capital allocation efficiency not only enables individual enterprises to obtain timely financing and maintain production but also strengthens the resistance and recovery capacity of urban economic systems at the macro level. Qiaoli, Chang et al. (2024) found that there is an urgent need to optimize the allocation of productive resources and enhance the resilience of ecosystems to adapt swiftly to new equilibrium states after disturbances, thereby ensuring the smooth functioning of basic living spaces and urban economic activities []. Furthermore, the role of green finance policies in high-quality urban economic development. They found that green finance policies significantly improve urban economic quality by optimizing resource allocation and promoting industrial upgrading []. These policies not only reduce urban energy intensity but also incentivize enterprises to pursue green technology innovation and advance industrial structure optimization []. Through the effective transmission of micro-level mechanisms at the enterprise level to the meso-level, we can further deduce the intrinsic relationship between the improvement in capital allocation efficiency driven by green finance policies and urban economic resilience [,]. Based on this, Research Hypothesis H3 is proposed:

H3.

The green finance reform and innovation policy can enhance urban economic resilience by improving capital allocation efficiency.

3. Model Design

3.1. Setting of the Econometric Model

3.1.1. Setting of the DID Model

The Green Finance Reform and Innovation Pilot Zone policy, characterized by its exogeneity (as a centrally mandated deployment) and non-uniform promotion features, provides a quasi-natural experimental design framework for identifying the causal effects of green finance policies on regional economic resilience. This study takes the first batch of pilot zones established under the General Plan for Green Finance Reform and Innovation Pilot Zones jointly issued by seven ministries, including the People’s Bank of China—specifically seven cities in Zhejiang; Jiangxi; Guangdong; Guizhou; and Xinjiang provinces—as the baseline treatment group (with Changji Prefecture in Xinjiang excluded due to severe missing key indicators from 2016 to 2020). A multi-period difference-in-differences (DID) model is constructed for policy evaluation:

where: : City index, : Year index; : Dependent variable (economic resilience), : Explanatory variable (green finance reform policy implementation). : Set of control variables, : Time-fixed effects, : Individual-fixed effects, : Random error term, : Core coefficient of interest measuring the net effect of green finance pilot zone policies on urban economic resilience.

3.1.2. Setting of the Mediation Mechanism Model

This study has verified that green finance reform and innovation policies significantly enhance urban economic resilience. To further elucidate the roles of credit availability and resource allocation efficiency in the process through which green finance reform policies influence urban economic resilience, this paper adopts an empirical approach inspired by Weicheng Xu et al. Given the evident causal inference deficiencies in the traditional “three-stage” mediation mechanism test, we construct a “four-stage” mediation mechanism model to examine the transmission mechanism of how green finance reform policies affect urban economic resilience []. Additionally, Sobel tests and Bootstrap tests are employed to enhance the completeness and credibility of the mechanism analysis. The specific mediation mechanism model is structured as follows:

Among them, the explained variable is the mediating variable.

As mentioned in the manuscript, the “four-stage” mediation mechanism model is constructed to address the limitations of causal inference in the traditional “three-stage” mediation test []. Its core is to systematically verify whether a mediating variable (e.g., credit accessibility, capital allocation efficiency) plays a role in the causal path from the independent variable (green financial reform policy) to the dependent variable (urban economic resilience). The four stages typically include

Testing the total effect of the independent variable on the dependent variable.

Testing the effect of the independent variable on the mediating variable.

Testing the effect of the mediating variable on the dependent variable (controlling for the independent variable).

Testing the direct effect of the independent variable on the dependent variable after including the mediating variable to determine whether the mediation is partial or complete.

This model strengthens the rigor of causal inference by clarifying the step-by-step logical relationship between variables.

3.2. Variable Selection

3.2.1. Dependent Variable: Economic Resilience (ER)

The construction of a multi-dimensional evaluation system comprehensively quantifies the relationship between green finance and economic resilience, providing robust support for studying the impact of green finance on high-quality urban economic development. Understanding the spread of shocks across urban spaces, among businesses and urban amenities, is crucial for resilient urban planning policies, which aim to mitigate disruptions and to improve the recovery speed and quality of businesses and organizations in cities []. To systematically assess urban economic resilience, this study synthesizes existing research and selects indicators across three dimensions: Resistance and Recovery Capacity; Adaptation and Adjustment Capacity; Innovation and Transformation Capacity, with the specific indicator construction detailed in Table 1. The resulting evaluation system comprises 3 primary indicators and 18 secondary indicators. Given the substantial number of selected evaluation indicators and potential inter-indicator correlations, Principal Component Analysis (PCA) was employed to calculate indicator weights. Prior to PCA, Bartlett’s Test and the KMO Test were conducted to validate data suitability: KMO Value: 0.899 (indicating strong shared variance among variables, confirming appropriateness for factor/PCA analysis). Bartlett’s Test: Rejected the null hypothesis of “no significant correlations among variables” (p < 0.001), confirming significant inter-variable correlations. These results confirm that the data meet the prerequisite assumptions for PCA, ensuring methodological validity.

Table 1.

Comprehensive Evaluation Index System of Urban Economic Resilience.

3.2.2. Explanatory Variable: Green Finance Reform and Innovation Policy (Treat × Time)

The establishment of Green Finance Reform and Innovation Pilot Zones represents a strategic initiative in China’s deepening of green financial reforms. As a major institutional innovation at the national level, it marks a critical transition from top-level design to regional implementation in building localized green financial systems. Consequently, this study utilizes the institutional innovations within these pilot zones as a policy vehicle to characterize the implementation effects of green finance reform policies. Specifically, the Green Finance Reform and Innovation Pilot Zone policy implemented in June 2017 serves as the proxy for green finance reform efforts.

The establishment of Green Finance Reform and Innovation Pilot Zones represents a strategic initiative in China’s efforts to deepen green financial reforms. As a major institutional innovation at the national level, it signifies a critical transition in the development of China’s regional green financial systems—from top-level design to practical regional implementation. Given this context, this study selects the Green Finance Reform Pilot Zones as a policy vehicle, leveraging their institutional innovations to characterize the implementation effects of green finance reform policies. To operationalize the policy intervention, we utilize the Green Finance Reform and Innovation Pilot Zones established in June 2017 as a proxy for the green finance reform policy. The variable indicates whether the ii-th prefecture-level city was designated as a pilot zone in year tt. Cities are categorized into two groups: Treatment Group ( = 1): Cities designated as pilot zones during the sample period. Control Group ( = 0): Cities not designated as pilot zones.

3.2.3. Control Variables

This study incorporates the following control variables to account for potential confounding factors: (1) Economic Agglomeration (), measured as the logarithm of the ratio of the number of industrial enterprises above designated size to administrative land area (units/km2) []. (2) Informatization Level (), represented by the logarithm of the ratio of international internet users to registered population (users/person) []. (3) Infrastructure Development (), captured by the logarithm of the ratio of total freight volume to registered population (tons/person) []. (4) Openness to Foreign Investment (), quantified as the logarithm of per capita foreign direct investment (yuan/person) []. (5) Human Capital (), derived from the logarithm of the ratio of college/university enrollment to registered population [] (6) Government Intervention (), expressed as the logarithm of the ratio of local general budget expenditure to GDP []. (7) Population Density (), calculated as the logarithm of the ratio of total population to administrative land area (persons/km2), and (8) Pollution Intensity (), defined as the logarithm of the ratio of annual average PM2.5 concentration (μg/m3) to GDP (100 million yuan). All variables are log-transformed to mitigate heteroscedasticity and ensure comparability [].

3.2.4. Mediating Variables

Credit accessibility is theoretically grounded in the “financial development theory,” which posits that green financial reforms can alleviate financing constraints for green projects and urban economic activities by expanding credit channels, thereby enhancing cities’ ability to resist and recover from shocks (i.e., economic resilience). Capital allocation efficiency is supported by the “resource allocation theory,” as green finance guides capital flows from low-efficiency sectors to high-value-added green industries, optimizing resource allocation structures and improving long-term adaptive and transformative capacities of urban economies. These two mechanisms collectively bridge the causal path from green financial policies to urban economic resilience, reflecting both short-term financial support and long-term structural optimization.

This study incorporates two mediating variables to examine the transmission mechanisms of green finance policies: Credit Accessibility (), measured as the per capita loan balance per unit area in prefecture-level cities, and resource allocation efficiency () to estimate factor market distortion. Higher values indicate lower market distortion and improved allocation efficiency. Both variables are integrated to assess how green finance reforms influence economic resilience through credit availability and resource optimization.

Within this framework, is proxied by regional gross domestic product (GDP), while capital stock () is proxied by the average annual balance of net fixed assets, and labor input () is represented by the average number of employed workers in urban non-private sectors. Capital price () is set at 10%, combining a 5% depreciation rate and 5% real interest rate, whereas labor price () is derived from the total wage bill of urban non-private employees. Capital output elasticity () and labor output elasticity () are obtained through regression analysis of the production function, with calculated by comparing the dispersion of firm-level marginal productivities to these estimated elasticities. This approach captures how efficiently resources are allocated across cities, linking policy effects to economic resilience through credit availability and market efficiency.

This study measures the degree of resource misallocation in each city using the ratio of the city’s value to the maximum value among all cities in the given year, serving as a proxy variable for resource allocation efficiency. Furthermore, resource allocation efficiency () is defined as the inverse measure of resource misallocation. Consequently, this study operationalizes resource allocation efficiency () as the reciprocal of the resource misallocation degree.

3.3. Data Sources

This study utilizes panel data from 269 prefecture-level cities in mainland China spanning 2013 to 2023. The raw data for variables are sourced from the China City Statistical Yearbook, provincial and municipal statistical yearbooks, and partially supplemented by manual collection from official local government websites to address missing values. Remaining gaps are filled using interpolation methods. To control for price effects, all monetary variables are adjusted to 2013 constant prices (base period). Descriptive statistics for the key variables are summarized in Table 2.

Table 2.

Descriptive Statistics of Key Variables.

3.4. Rationality and Scientificity of the Urban Economic Resilience Evaluation System

3.4.1. Theoretical Basis: Alignment with the Core Connotation of Economic Resilience

The evaluation system is rooted in the theoretical definition of economic resilience, which refers to a system’s capacity to absorb shocks, recover, adapt, and transform. The three primary indicators correspond to the key dimensions of this connotation:

Resistance and Recovery Capacity Index: This dimension focuses on the short-term response to shocks. Indicators such as per capita GDP, GDP growth rate, and residents’ disposable income directly measure the economic foundation for withstanding and recovering from disruptions. Social security indicators quantify the “buffer capacity” of the social system—sound social security reduces the vulnerability of residents during crises; which is consistent with the “shock absorption” function of resilience.

Adaptation and Adjustment Capacity Index: This reflects the system’s ability to adjust resource allocation amid shocks. The fiscal self-sufficiency rate and per capita fiscal expenditure measure the government’s regulatory capacity to stabilize the economy through fiscal policies, while commodity market activity and per capita household consumption expenditure reflect market vitality, which is critical for maintaining functional stability during adjustments.

Innovation and Transformation Capacity Index: This captures long-term evolutionary resilience. Indicators such as per capita patent grants, proportion of R&D personnel, and industrial upgrading index reflect the potential for technological progress and structural transformation, aligning with the “evolutionary resilience” framework that emphasizes adaptation and transformation.

3.4.2. Comprehensive and Systematic Indicator Selection

The system integrates 18 secondary indicators covering five dimensions: economic performance, social security, fiscal regulation, innovation input, and industrial structure. This multi-dimensional design avoids one-sidedness from single-indicator evaluation:

It includes both objective economic metrics (e.g., GDP growth rate) and social support indicators (e.g., medical beds per capita), reflecting the systemic nature of urban economic resilience—resilience is not solely determined by economic scale but also by social stability and institutional adaptability.

It balances short-term recovery and long-term development, capturing the dynamic nature of resilience as a combination of “engineering resilience” and “evolutionary resilience”.

3.4.3. Scientificity of the Measurement Method

Principal Component Analysis (PCA) is adopted to determine indicator weights, ensuring objectivity:

Pre-test validation: Bartlett’s Test (p < 0.001) confirms significant correlations among variables, and the KMO value (0.899) exceeds the threshold of 0.7, indicating strong suitability for PCA. These tests validate that the data meet the methodological prerequisites.

Reduction of subjectivity: PCA extracts common factors to determine weights, avoiding artificial bias in subjective weighting methods (e.g., expert scoring). This ensures that the composite index of economic resilience is derived from data-driven relationships among indicators.

3.4.4. Reliability of Data Sources

All indicators are constructed using data from authoritative sources: the China City Statistical Yearbook, provincial/municipal statistical yearbooks, and official government websites. These sources ensure data comparability across 269 prefecture-level cities from 2013 to 2023, and missing values are supplemented through interpolation and manual collection, maintaining data integrity.

In summary, the evaluation system is theoretically grounded, comprehensive in indicator coverage, methodologically rigorous, and data-reliable, thus ensuring its rationality and scientificity in measuring urban economic resilience.

4. Empirical Tests and Result Analysis

4.1. Baseline Regression Results

4.1.1. Parallel Trend Test

In this study, to ensure the comparability of economic resilience between the treatment and control group cities prior to the establishment of the Green Financial Reform and Innovation Pilot Zones, we systematically conducted a parallel trend assumption test following the research paradigm of Yilin Wang while employing a multi-period difference-in-differences (DID) model for empirical analysis []. To effectively mitigate multicollinearity issues in the model, the baseline year of policy implementation (2017) was designated as the reference point for the event study approach.

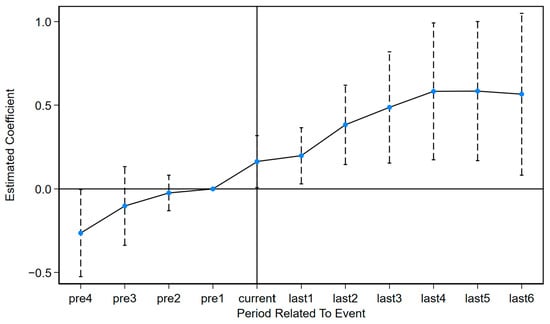

As shown in Figure 1, in the five years preceding policy implementation (Period = −5 to −1), the estimated coefficients fluctuated closely around zero. This distribution pattern verifies that the economic resilience of the treatment and control group cities followed statistically indistinguishable evolutionary paths prior to the policy intervention, satisfying the parallel trend assumption of the difference-in-differences (DID) model. The coefficient estimate for the year of policy implementation (Period = 0) was 0.32, indicating an initial signal of policy effectiveness, but it failed to pass the significance test. This aligns with the characteristics of China’s green financial policy transmission mechanism, where adaptive behaviors such as financial institutions restructuring their operations and enterprises adjusting production models require approximately one year to respond. Starting from the second-year post-implementation (Period = 1), the estimated coefficients exceeded the significance threshold (β = 0.65, p < 0.05) and exhibited a sustained upward trajectory. By the sixth observation period (Period = 6), the policy effect intensity reached its peak (β = 1.84, p < 0.01), nearly tripling compared to the initial phase. These results demonstrate that green financial reforms exert a cumulative and enduring impact on economic resilience.

Figure 1.

Parallel Trend Test Results.

4.1.2. Baseline Regression

This study employs a multi-period difference-in-differences (DID) model with prefecture-level city clustered standard errors to conduct baseline regression analysis. By utilizing a two-way fixed effects model to control for city-specific heterogeneity and temporal trends, we systematically evaluate the impact of green financial reform and innovation policies on urban economic resilience. The core empirical results in Table 3 show that in the baseline model without control variables, the estimated coefficient of the green financial policy variable is significantly positive at the 1% significance level, indicating that the policy significantly enhances urban economic resilience. This preliminarily validates Hypothesis 1.

Table 3.

Baseline Regression Result.

To mitigate potential regression bias caused by omitted variables, Column (2) in Table 3 presents the results after incorporating control variables into the multi-period DID model. The findings reveal that the coefficients of the green financial reform policy’s impact on urban economic resilience remain significantly positive regardless of the inclusion of control variables. This further validates the robust enhancing effect of the establishment of Green Financial Reform and Innovation Pilot Zones on urban economic resilience.

The baseline regression results further indicate that economic agglomeration (), digitalization (), infrastructure (), government intervention (), and population density (POP) all significantly enhance urban economic resilience, whereas openness () and human capital (HUM) exhibit statistically insignificant effects. The potential explanations are as follows: (1) Economic Agglomeration (). Economic agglomeration inherently reflects the concentrated manifestation of local market advantages. A higher level of economic agglomeration provides cities with scaled resource support to withstand external shocks, thereby strengthening their capacity for production recovery. (2) Digitalization (). Digitalization injects dual momentum into urban economic resilience by enabling the development of the digital economy and the digital transformation of industries. On one hand, the growth of the digital economy facilitates intelligent risk warning and response mechanisms, enhancing a city’s ability to resist economic shocks. On the other hand, industrial digitization accelerates the upgrading of traditional industries and the cultivation of emerging sectors, solidifying the industrial foundation for economic resilience. (3) Infrastructure (). As a critical pillar of regional economic systems, infrastructure enhances urban economic resilience by improving the efficiency of commodity circulation and market transaction vitality. This optimization of resource allocation efficiency elevates market operational capacity, systematically strengthening the risk resistance of urban economies against internal and external shocks. (4) Government Intervention (). Government intervention significantly boosts urban economic resilience through institutional environment optimization. By refining regulatory frameworks and policy incentives, governments enhance systemic stability and adaptive capacity. (5) Population Density (). High population density reduces labor costs for enterprises via the labor pool effect, while diversified consumer demands support industrial pluralism, forming a buffer layer against economic shocks. (6) Environmental Regulation Pressure. High pollution intensity triggers stricter environmental policy constraints, increasing corporate compliance costs and pressure for technological upgrades. These factors may suppress innovation investments and weaken risk resilience in heavily polluting industries.

4.2. The Role of Green Financial Instruments

When examining the impact of green finance policies on urban economic resilience, it is crucially important to delve into their operational mechanisms. Taking Wenzhou as an example, the city’s innovative green financial products have significantly enhanced local economic resilience. For instance, Industrial Bank’s Wenzhou Branch launched the “Photovoltaic Loan” product, which addresses financing needs for distributed photovoltaic projects in industries, commerce, and residential rooftops. By leveraging carbon emission reduction support tools to lower financing costs for clients, it has accelerated the growth of the photovoltaic industry. Additionally, tailored green financing credit schemes with preferential interest rates were provided for Wenzhou’s new energy manufacturing base, injecting robust momentum into industrial development. This innovative practice demonstrates how green financial instruments enhance urban economic resilience across multiple dimensions.

A nuanced and interdependent yet potentially conflicting relationship exists between financial accessibility and capital allocation efficiency. On one hand, diversified green financial products improve financial accessibility, enabling broader access to funding—whether for capacity expansion in renewable energy enterprises or daily operations of SMEs. On the other hand, precision in allocating capital to green industries and projects substantially elevates capital allocation efficiency, preventing capital misallocation. However, this process requires careful balancing: overemphasizing one aspect may disrupt equilibrium. For example, excessive expansion of green credit to boost accessibility without adequate risk assessment may reduce allocation efficiency, leading to non-performing loans.

Different green financial tools diversely contribute to urban economic resilience: Green credit provides direct funding to enterprises, catalyzing green project initiation and operations. Green bonds broaden financing channels, attracting more social capital into green industries. Carbon finance instruments incentivize emission reductions through market mechanisms, accelerating industrial green transitions. Deep analysis of these mechanisms will inform optimized green finance policies, strengthen urban economic resilience, and foster better equilibrium between economic growth and environmental protection.

4.3. Considering Policy Overlapping Effects

Urban economic resilience encompasses multiple dimensions of a city’s economy. Therefore, in addition to green financial reform and innovation policies, other national-level policies—such as the New-type Urbanization Policy (); the National Integration of Industry and Education City Pilot Policy (); and the Urban Medical Consortium City Pilot Policy ()—also exert significant impacts on urban economic development and; consequently; urban economic resilience. To examine these overlapping policy effects, this study incorporates three additional policy variables—; ; and —into the econometric model. The regression results are presented in Table 4.

Table 4.

Regression Results Considering Policy Superposition.

After accounting for these overlapping policy effects, the regression coefficient of the green financial reform and innovation policy exhibits slight fluctuations but remains significantly positive, passing the 5% significance level test. This confirms that the enhancing effect of green financial reforms on urban economic resilience is robust and not overestimated.

4.4. Robustness Test

4.4.1. Sample Selection Bias

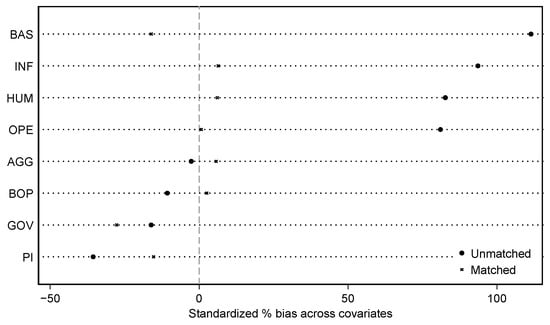

To address the potential selection bias caused by sample self-selection, this study employs a kernel matching-based PSM-DID model for causal inference []. Figure 2 displays the standardized bias plot of the control variables, clearly indicating that the absolute values of control variable biases are significantly reduced after propensity score matching, remaining within 10%. This suggests that sample selection bias has been effectively mitigated, allowing for the application of the Difference-in-Differences (DID) model regression to the matched groups. The results are presented in column (1) of Table 5. The regression results show that the coefficient for the green finance reform and innovation policy is 0.454, significant at the 5% level, thereby confirming the robustness of the findings presented in this paper.

Figure 2.

Results of the Placebo Test.

Table 5.

Results of the Robustness Test.

4.4.2. Placebo Test

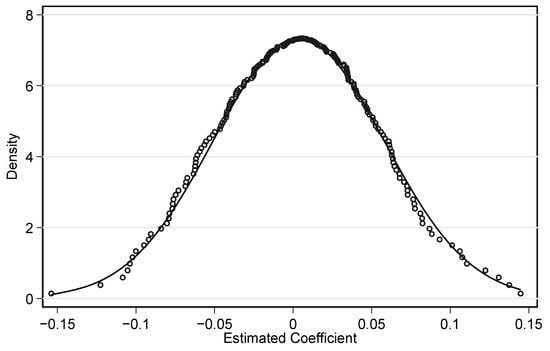

Although the preceding quasi-natural experiment controlled for numerous variables and accounted for multiple overlapping policy effects, unobserved city-specific characteristics might still influence the outcomes of the green finance reform and innovation policy. To address concerns that the estimated policy effects could be driven by unobservable time-varying confounders, a placebo test was conducted by artificially altering the treatment variable assignment. Following this, the study implemented the placebo test through randomized assignment of treatment and control groups. If the regression coefficients from the randomized treatment cluster around zero, it would indicate the absence of unobserved factors affecting the conclusions.

The simulated estimates are densely distributed within the interval [−0.15, 0.15] (mean = 0.007, standard deviation = 0.086). The kernel density curve exhibits a symmetric structure peaking at zero, closely overlapping with the fitted normal distribution line (Kolmogorov–Smirnov test, p = 0.412), consistent with the expected pattern under the null hypothesis. As shown in Figure 3, the randomized treatment coefficients follow a normal distribution centered at zero, which is significantly distinct from the actual policy coefficient of 0.516. This confirms that the enhancement of urban economic resilience by the green finance reform pilot zones is genuine and statistically robust.

Figure 3.

Standardized Deviation Diagram of Control Variables.

4.4.3. The Problem of Omitted Variables

In this paper, by substituting the control variables lagged by one period into the regression model, the endogeneity problem caused by the selection bias in the process of selecting pilot cities for green finance reform pilot zones is eliminated. The regression results are shown in column (2) of Table 6. It can be seen from this that the value of the regression coefficient is close to that of the benchmark regression, and it passes the significance level test at 1%, which once again confirms the robustness of the conclusions of this paper.

Table 6.

Results of the Tests of the Transmission Mechanism.

4.4.4. Replacing the Explained Variable

The principal component analysis method and the entropy method are currently the two most commonly used objective weighting methods. To ensure the robustness of the research conclusions, this paper further uses the entropy method to recalculate the urban economic resilience and substitutes it into the regression model. The results in column (3) of Table 6 show that the recalculated regression coefficient is still significantly positive at the 1% confidence level. This indicates that the role of financial reform and innovation policies in enhancing urban economic resilience truly exists.

5. Tests of the Transmission Mechanism and Heterogeneity Analysis

5.1. Testing the Transmission Mechanism

Columns (4)–(6) of Table 6 present the test results with the reverse measurement of the degree of resource misallocation () as the transmission mechanism. The results in column (4) show that the impact coefficient of the green finance reform and innovation policy () on the reverse measurement of the degree of resource misallocation () is significantly positive at the 1% level, indicating that the green finance reform and innovation policy significantly enhances the efficiency of resource allocation. The results in columns (5) and (6) show that the impact coefficients of the reverse measurement of the degree of resource misallocation () on the urban economic resilience are both significantly negative and pass the significance level test at 1%, indicating that enhancing the efficiency of resource allocation helps to improve the urban economic resilience. At the same time, the regression coefficient of the green finance reform and innovation policy in column (6) is smaller compared with that in the benchmark test, indicating that the efficiency of resource allocation plays a partial mediating effect in the process of the green finance reform and innovation policy affecting the urban economic resilience. The results of the Sobel test and the Bootstrap test show that the above results are valid; that is, the green finance reform and innovation policy can improve the urban economic resilience by enhancing the efficiency of resource allocation, and Research Hypothesis 3 is verified.

5.2. Heterogeneity Analysis

5.2.1. Classification According to Urban Scale

According to the “Notice on Adjusting the Standards for Dividing Urban Scales” issued by the State Council, this paper takes the permanent population of the urban area of “1 million people” as the dividing line to divide the cities in China into large cities and small and medium-sized cities. The results in columns (1) and (2) of Table 7 show that there are certain differences in the urban scale regarding the effect of the green finance reform and innovation policy on enhancing urban economic resilience.

Table 7.

Results of the Heterogeneity Analysis According to Urban Scale and Resource Endowment.

The coefficient of the green finance reform and innovation policy () is 0.467 in large cities, which is significant at the 5% level, and 0.460 in small and medium-sized cities, which is significant at the 10% level. This indicates that the green finance reform and innovation policy also have a positive effect on enhancing the economic resilience of small and medium-sized cities, but the significance is slightly lower than that in large cities. Large cities have stronger financial capabilities and a higher degree of maturity of the financial market and are able to allocate green funds efficiently. In contrast, the participation of financial institutions in small and medium-sized cities is relatively low, and the popularization of green financial tools is insufficient, resulting in low efficiency in the implementation of policies. These results highlight the key role of financial maturity and institutional capacity in shaping the effectiveness of green finance policies. Large cities typically possess more diversified financial ecosystems, better access to green financial instruments, and more skilled labor for environmental project management. This allows them to respond more efficiently to green policy stimuli. In contrast, small and medium-sized cities often lack such structural advantages, which constrains the transmission efficiency of green finance into tangible economic resilience improvements. Therefore, policy implementation should consider capacity-building initiatives tailored to these less-developed financial environments.

5.2.2. Classification According to Urban Resource Endowments

According to the “National Sustainable Development Plan for Resource-based Cities (2013–2020)”, this paper divides the cities covered in the plan into resource-based cities and non-resource-based cities. The results in columns (3) and (4) of Table 8 show that there are significant regional differences in the effect of the green finance reform and innovation policy on enhancing urban economic resilience.

Table 8.

Results of the Heterogeneity Analysis According to Inland-Coastal Areas and Environmental Regulation.

The variable coefficient is 0.740, which is significant at the 1% significance level, indicating that this policy has a significant positive effect on enhancing the economic resilience of resource-based cities. For non-resource-based cities, the variable ’s coefficient is 0.389 and fails to pass the significance test, indicating that the effect of the green finance reform and innovation policy on enhancing the economic resilience of non-resource-based cities has not reached a significant level. Resource-based cities face more urgent transformation pressures, and the policy directly alleviates their structural contradictions through green investment and releases growth potential. The insignificant policy effect in non-resource-based cities may be due to their diversified economic structures, resulting in a lower marginal utility of green finance, or the insufficient matching between policy tools and local demands.

5.2.3. Classification According to Urban Geographical Location

This paper divides 269 cities into inland areas and coastal areas. The results in columns (1) and (2) of Table 8 show that there are significant differences in the effect of the green finance reform and innovation policy on enhancing urban economic resilience between inland areas and coastal areas.

The coefficient of the variable in inland areas is 0.298 and fails to pass the significance test, indicating that the policy has an insignificant effect on enhancing the economic resilience of inland cities. For coastal areas, the variable coefficient is 0.472, which is significant at the 1% significance level, indicating that the green finance reform and innovation policy has a significant positive effect on enhancing the economic resilience of coastal cities. Therefore, the policy effect in coastal areas is better than that in inland areas. The evident east-west policy disparity mirrors long-standing spatial imbalances in infrastructure, institutional quality, and financial penetration. Coastal cities are generally more market-oriented, with better access to international capital, advanced financial markets, and stronger administrative capacity to coordinate green development initiatives. Inland cities, by contrast, often face constraints such as limited fiscal space and lower investor confidence, which can dampen the effectiveness of green financial instruments. Addressing these systemic gaps is critical to ensuring policy equity and avoiding regional divergence in resilience-building capacity.

5.2.4. Classification According to Urban Environmental Regulation

According to the “National Environmental Protection Eleventh Five-Year Plan” issued by the State Council in 2007, this paper divides 269 prefecture-level cities into key environmental protection cities and non-key environmental protection cities. The results in columns (3) and (4) of Table 8 show that there are significant differences in the effect of the green finance reform and innovation policy on enhancing economic resilience between key environmental protection cities and non-key environmental protection cities.

The coefficient of the variable in key environmental protection cities is 0.589, which is significant at the 1% significance level, indicating that the policy has a significant positive effect on enhancing the economic resilience of key environmental protection cities. For non-key environmental protection cities, the variable coefficient is 0.0418 and fails to pass the significance test, indicating that the green finance reform and innovation policy has an insignificant effect on the economic resilience of non-key environmental protection cities. The findings suggest that cities with stronger environmental regulation foundations are more responsive to green finance policy interventions. This may stem from their better-developed monitoring systems and stronger institutional alignment with sustainable development goals. Non-key environmental protection cities may lack the administrative experience or political incentives to prioritize green transformation, reducing their ability to effectively absorb and utilize green capital. Strengthening environmental governance frameworks in these regions could thus act as a catalyst for improving their economic resilience through green finance.

6. Further Analysis: The Dynamic Evolutionary Trend of the Economic Resilience of Prefecture-Level Cities

6.1. Kernel Density Estimation

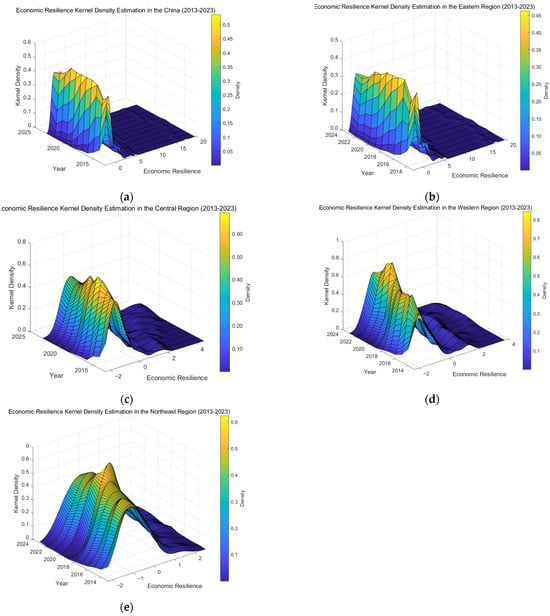

In order to supplement the prior heterogeneity analysis, this section provides a dynamic and temporal perspective on how economic resilience has evolved across prefecture-level cities and major regions over time. To explore the dynamic characteristics of economic resilience in China’s prefecture-level cities, we employ kernel density estimation to analyze the distributional features—such as position; shape; and extensibility—of high-quality economic development at both the national level and across the four major regions. This approach allows us to capture not only the static effects of policy but also the evolving patterns of economic resilience, thereby revealing the long-term impacts and regional trajectories shaped by structural and policy-level interventions. The results are illustrated in Figure 4:

Figure 4.

This is a figure of the Dynamic Development of Economic Resilience Nationally and in the four major regions. (a) Description of whole nation; (b) Description of eastern nation; (c) Description of central nation; (d) Description of western nation; (e) Description of northeastern nation.

Figure 4a shows the dynamic evolution trend of the national economic resilience from 2013 to 2023. The height of the main peak presents the evolutionary characteristics of “fluctuating upward, briefly falling back, and then rising steadily again”. From 2013 to 2016, the height of the main peak was generally low, indicating that the distribution of the economic resilience levels of various provinces was relatively dispersed, and there were large regional development differences; after 2017, the height of the “main peak” (economic resilience peak) increased rapidly, and the density in the high-resilience interval gradually increased, which is related to the promotion of the resilience of some regions by the establishment of policies for green financial reform and innovation. From 2021 to 2022, the height of the main peak briefly decreased, possibly affected by external shocks (such as the pandemic); from 2022 to 2023, the height of the main peak rebounded again and tended to be stable. At the same time, the width of the main peak continued to shrink, indicating that the differences in economic resilience among various provinces narrowed, and regional synergy was enhanced.

Figure 4b–e respectively describe the dynamic evolution trends of the economic resilience in the eastern region, central region, western region, and northeastern region. In Figure 4b, the single-peak distribution in the eastern region is right-skewed. The main peak of economic resilience is concentrated in the interval of 0–5, and the density peak is 0.4–0.5. The tail extends to the high-resilience interval (15–20), indicating that the eastern region is mainly characterized by medium-high resilience as a whole, but there are a small number of areas with ultra-high resilience. It can be largely attributed to its advanced industrial structure, stronger financial markets, and the early uptake of green finance policies. Post-2017, the region leveraged its institutional capacity and innovation ecosystem to effectively internalize the structural reforms promoted by the green finance reform and innovation pilot program. This enabled a smoother transition toward high-quality growth even amid national shocks. In Figure 4c, the single-peak distribution in the central region is right-skewed. The main peak of economic resilience is concentrated in the interval from −2 to 0.5, and the density peak is 0.4–0.5. The tail extends to the medium-resilience interval (1–2), indicating that the central region is mainly characterized by medium-low resilience as a whole, but there are areas with medium resilience. It reflects partial spillovers from national policy efforts—such as infrastructure investment and industrial upgrading—as part of broader supply-side structural reforms. However, due to relatively weaker baseline institutional capacity, the uptake and transformation effects of green finance have been more limited compared to the east, resulting in slower convergence. In Figure 4c, the single peak in the western region is right-skewed. The main peak is located in the low-resilience interval (−2–0), but the tail extends to the medium-resilience interval (0–2), reflecting that the overall resilience is low and fragile. The noticeable decline in density within the low-resilience interval after 2017 coincides with the targeted inclusion of several western cities in national green finance reform pilots. This region benefited from concentrated fiscal and industrial support under the 13th and 14th Five-Year Plans, particularly in energy transition and environmental remediation. However, due to geographical constraints and underdeveloped financial systems, the overall pace of convergence remains slower. After 2017, the density in the low-resilience interval decreased, which benefited from the policy and economic support in the pilot areas. In Figure 4e, the distribution in the northeastern region is a broad peak. The economic resilience is scattered in the interval from −2 to 1. The peak is flat and has a large span, indicating that there are extremely large differences in resilience within the region. It can be seen that the difficulties in the transformation of traditional industrial cities coexist with the improvement of the resilience of emerging cities. In addition, after 2017, the density in the low-resilience interval (0.4–0.5) did not significantly decrease, suggesting that the effect of the revitalization policies is limited. Despite revitalization plans and macroeconomic policy support, the COVID-19 pandemic further disrupted already fragile regional dynamics. Weak industrial diversification, combined with a slower response to green finance initiatives, has contributed to the region’s continued vulnerability and divergence in resilience levels.

Overall, the high-quality economic development in the four major regions presents the characteristics of “general convergence and local differentiation”. The narrowing of absolute differences and the shrinkage of the width of the main peak are the general trends. The eastern region maintains its leading position, relying on its innovation advantages. Due to the limitations of resource endowments, there is still a polarization in the western region, and the transformation pressure in the northeastern region has not been completely resolved. These regional variations underscore the heterogeneous capacities of different macro-regions to absorb policy interventions and external shocks, shaped by long-term structural, institutional, and financial disparities.

6.2. Markov Chain Analysis

The Markov model is based on the time series change relationship to obtain a matrix with the probability of transferring the variable between different states as the element and then explores the trend of the variable in a time series []. In order to further reflect the internal flow direction and position transfer characteristics of high-quality economic development, this paper introduces the Markov transition probability matrix for analysis, and the results are shown in Table 9. The elements on the diagonal are always larger than those off the diagonal. Among them, the probabilities that provinces at the low level, medium-low level, medium-high level, and high level maintain their original levels after one year are 76.44%, 73.81%, 84.97%, and 97.07%, respectively. This indicates that there is a relatively stable situation among different levels of the high-quality economic development index, and there is a phenomenon of “club convergence”.

Table 9.

Markov Transition Probability Matrix of China’s Economic Resilience from 2013 to 2023.

6.3. Spatial Markov Chain Analysis

The spatial lag model further reveals the differential impacts of spatial dependence among regions. The results in Table 10 show that under the condition of low-resilience neighbors (spatial lag type I), the stability of high-resilience regions (IV) remains at 100%, but the stability of medium-low-resilience regions (II→II) drops to 67.06%, indicating that a low-resilience environment will intensify the risk of fluctuations in adjacent medium-low-resilience regions. Medium-high-resilience neighbors (spatial lag type III) significantly promote the upgrading of low-resilience regions. The self-maintenance probability (I→I) drops to 53.85%, while the probability of upgrading to the medium-low-resilience level (I→II) increases to 24.89%. High-resilience neighbors (spatial lag type IV) generate a “siphon effect” on low-resilience regions, causing the self-maintenance probability (I→I) to decline to 66.67%; at the same time, the upgrading probability of medium-high-resilience regions (III→IV) increases from 9.97% in the traditional model to 15.15%, indicating that the demonstration effect of high-resilience neighbors can broaden the upgrading path.

Table 10.

Spatial Markov Transition Probability Matrix of China’s Economic Resilience from 2013 to 2023.

In conclusion, the evolution of economic resilience is driven by both local path dependence and spatial spillover effects. High-resilience regions have strong stability, but low-resilience regions are more likely to break through the “lock-in” under the influence of adjacent medium-high-resilience environments. It is necessary to be vigilant against the siphon effect of high-resilience regions on surrounding resources. At the same time, positive spillovers should be strengthened through cross-regional collaborative policies to promote an overall leap in the level of resilience.

7. Research Conclusions and Policy Implications

7.1. Research Conclusions

This study focuses on the impact mechanism of green finance reform and innovation policies on urban economic resilience. Using the panel data of 269 prefecture-level cities in China from 2013 to 2023 as a sample, a multi-period difference-in-differences model is applied to empirically test the relationship between green finance reform and innovation and urban economic resilience, verifying the role of green finance reform and innovation policies in enhancing urban economic resilience. In addition, enhancing credit availability and improving capital allocation efficiency are two paths through which the above effects are generated. Furthermore, there are significant differences in the effects of green finance reform and innovation policies in terms of urban scale, resource endowment, geographical location, and environmental regulation. In terms of urban scale, the policy effect of green finance reform and innovation policies in large cities is higher than that in small and medium-sized cities; in terms of urban resource endowment, the policy effect of these policies in resource-based cities is better than that in non-resource-based cities; in terms of geographical location, the policy effect of these policies in southern cities and coastal cities is stronger than that in northern and inland cities. In terms of environmental regulation, the policy effect in key environmental protection cities is significantly higher than that in non-key cities.

Although existing studies have revealed that green financial reforms can enhance urban economic resilience, there are still the following research gaps that warrant focused exploration in the future. First, existing studies, based on data from 2013 to 2023, have not fully captured the long-term dynamic evolution of policies. Future research could focus on whether there is a “threshold effect” in the marginal effect changes of green financial policies on urban economic resilience. Second, digital technologies such as big data and blockchain have provided new tools for the precise implementation of green finance, but existing studies have not systematically explored their integration with urban resilience. Future research may pay attention to the mechanisms through which digital technologies empower green finance and the impact of the digital divide. Third, China’s green financial reforms have unique characteristics, but research on international experiences remains insufficient. Future studies could investigate the differences in the correlation between green finance and resilience in global value chains under different institutional contexts.

7.2. Research Limitations

Despite the contributions of this study to exploring the relationship between green financial reform and urban economic resilience, several limitations should be acknowledged:

7.2.1. Incomplete Exploration of Long-Term Dynamic Effects and Threshold Characteristics

This study verifies the positive impact of green financial reform on urban economic resilience using panel data from 2013 to 2023. However, the long-term dynamic evolutionary characteristics of the policy, such as potential “threshold effects” or “diminishing marginal effects” in its marginal impacts, remain underexamined. The effectiveness of green financial policies may exhibit nonlinear patterns influenced by implementation duration, policy intensity, or urban economic fundamentals. The current analysis fails to capture such dynamic processes, limiting a comprehensive understanding of the policy’s long-term mechanisms.

7.2.2. Limitations in Variable Measurement and Potential Confounding Factors

Although urban economic resilience is measured using principal component analysis (PCA) and the entropy method integrating 18 secondary indicators, indicator selection may involve subjectivity. For instance, dimensions such as social capital and emergency management efficiency, which potentially affect resilience, are not included, leading to an incomplete characterization of economic resilience. Additionally, despite controlling for some endogeneity through multi-period DID, PSM-DID, and other methods, unobserved heterogeneous characteristics at the urban level (e.g., micro-level differences in local government governance capacity) may still interfere with the results.

7.2.3. Lack of International Comparative Perspective Restricting Generalizability

Focusing on 269 prefecture-level cities in China, this study emphasizes the institutional particularities of China’s green financial reform but neglects comparative analyses of the relationship between green finance and urban economic resilience across different countries or institutional contexts (e.g., developed vs. developing economies, varying financial regulatory systems). Given that green finance development is heavily influenced by institutional environments and market maturity, the absence of international comparisons limits the generalizability of conclusions to other economic systems.

7.3. Policy Implications

Existing research suggests that green innovation is a core element in addressing environmental governance issues, and it is accompanied by the development of digital technologies and green finance, as well as economic activities such as the digital economy and green bonds []. Based on the above research conclusions, the findings of this paper have the following practical implications for the formulation of green finance reform policies in China and policies related to enhancing China’s economic resilience.

First, given that green finance reform and innovation policies can enhance urban economic resilience, it is advisable to gradually extend the successful experiences and policy measures of the green finance reform and innovation pilot zones to more cities, especially small and medium-sized cities, non-resource-based cities, northern cities, and inland cities, so as to boost the overall economic resilience. Differentiated green finance policies should be formulated. For example, for small and medium-sized cities, incentive measures can be introduced to encourage financial institutions to increase credit support for green projects, and at the same time, financial subsidies or tax preferences can be provided to reduce the financing costs of enterprises. Streamlined green financial instruments suitable for such cities should be promoted, piloting tools like “green micro-loans” and “green bill discounting” to simplify approval procedures and lower financing barriers for green projects of small and medium-sized enterprises (SMEs); for non-resource-based cities, the focus should be on guiding financial resources to flow into emerging green industries and cultivating new economic growth points; Concurrently, initiatives like issuing green consumption vouchers and subsidizing green building standard retrofits should be implemented to stimulate green demand among residents. This consumer pressure will drive industries towards low-carbon transformation, fostering a virtuous “consumption—industry—finance” cycle; for northern and inland cities, green finance development plans that are in line with local industrial characteristics can be formulated. These plans should support industries like green agriculture and ecological restoration. Bundled products combining green agricultural insurance and credit should be developed to mitigate the impact of natural risks on these industries. For instance, in heavy industrial cities in the north, the green transformation of traditional industries can be promoted, and in inland cities, the development of industries such as green agriculture and eco-tourism can be supported. In key environmental protection cities, the coupling mechanism between green finance, carbon trading, ecological compensation, and other policies should be deepened, and a risk compensation fund for green projects should be explored and established; for non-key cities, the focus should be on breaking through institutional barriers. Urban environmental improvement indicators can be tied to central fiscal transfer payments and eligibility for green finance pilot programs, with additional policy inclinations granted to non-priority cities that achieve rapid improvements in environmental performance. Through measures such as establishing a cross-regional trading mechanism for green financial products and implementing a green finance talent support program, the policy response capacity can be gradually cultivated. At the same time, the regulatory authorities should establish a dynamic adjustment mechanism and update the list of key cities in a timely manner according to the improvement of urban environmental performance to form policy incentives that are compatible.

Second, financial institutions should further optimize the allocation of credit resources in accordance with the orientation of green finance reform and innovation policies. In large cities and resource-based cities, the intensity of credit investment in green industries and projects should be increased, and at the same time, the capital allocation efficiency should be improved to ensure that funds flow to the green projects with the greatest potential and economic benefits. For small and medium-sized cities, non-resource-based cities, and northern and inland cities, financial institutions can establish a long-term mechanism to enhance credit availability, and local governments should take an active role in promoting the development of green finance reform and innovation pilot zones. On the one hand, a green finance incentive system should be constructed, and a special green finance reward fund should be established to reward financial institutions that actively carry out green credit and green bond businesses, encouraging them to increase financial support for green industries; the mandatory environmental information disclosure system for green financing enterprises should be improved, and the disclosure standards should be unified, so that financial institutions can more accurately assess the environmental risks and development potential of enterprises, reduce information asymmetry, alleviate the difficulties and high costs of financing for green enterprises, and improve the availability of green credit. Governments should strongly support the development of digital technologies [].

Third, differentiated incentives should be implemented. In view of the significant differences in the scale of green credit in China between different regions. It is recommended to construct a “trinity” policy optimization framework to improve resource allocation efficiency []. Secondly, the synergy between green finance and industrial policies should be strengthened, and differentiated industrial transformation support tools should be designed for resource-based cities and non-resource-based cities. Thirdly, a cross-regional green finance coordination mechanism should be established. Through building a regional green finance information platform, promoting the technology transfer from large cities to small and medium-sized cities, facilitating industrial cooperation between resource-based cities and non-resource-based cities, and strengthening the innovation leadership of southern coastal areas over northern inland areas, policy coordination, information sharing, and resource integration can be achieved. This mechanism aims to break down regional policy barriers, form a virtuous cycle of “technology spillover-industrial linkage-innovation diffusion”, promote the optimized allocation of green financial resources on a larger spatial scale, and provide solutions for enhancing urban economic resilience. Finally, encourage innovative pilots and risk compensation. Establish a virtuous cycle mechanism of “trial-and-error, error tolerance, and scaling up”. To address implementation challenges across different city types, design phased pilot programs and risk-sharing instruments, injecting sustained momentum into enhancing urban economic resilience.

Author Contributions