Abstract

To ensure stability and transparency in the European logistics sector, in May 2017, the European Commission presented several proposals to change the regulation of the market—in particular, market access, driving and rest periods, and business trips. In the development of this package, several unfavourable decisions were made that go against Lithuanian transport companies, which will have a significant impact on the companies’ finances, as the frequent return of trucks will lead to additional fuel costs and is also in contradiction with the concept of green logistics. Thus, it is essential to study the Mobility Package’s pros and cons and compare researchers’ views. Accordingly, the subject of this article is the impact of the Mobility Package on Lithuanian logistics companies. This article employs various methods, including an analysis of the scientific literature and legislation, statistical data analysis, PEST analysis, and qualitative research based on expert interviews. The results allow us to identify that the content of the Mobility Package is driven by the goal of ensuring equivalent working conditions throughout the EU, which in this case is the most important object of the legal changes. Also, based on the results obtained, it can be stated that Lithuanian logistics companies that want to remain in the market have several solutions they can employ to achieve that goal, and to support their efforts, a competitiveness improvement model for Lithuanian logistics companies has been developed.

1. Introduction

The transportation of goods is essential in all types of businesses and thus affects the growth of social and economic well-being. Road transport is a sector that currently dominates the structure of goods transport throughout the European Union (EU). Nevertheless, the sector has faced operational challenges due to the unpredictable outbreak of COVID-19 worldwide in the period of 2019–2021. Strict import and export restrictions, reductions in production volumes, or even temporary closures of factories and warehouses have had an impact on the activities of companies. Furthermore, due to the rapidly increasing number and turnover of companies in this sector, another negative trend is also becoming apparent—the number of harmful gases emitted to the environment and the emergence of unequal conditions of operation and competition across the European continent. For the above reasons, the EU is considering a number of changes and bans in the transport sector, which may have a very significant impact on the operations of transport companies and their future development opportunities. One of the major changes is the Mobility Package presented in 2017, which is supposedly aimed at ensuring drivers’ rights. However, the desire to ensure drivers’ rights also has a negative implication—legal changes will have an undeniable impact on the activities and development of logistics companies. First of all, the Mobility Package will undoubtedly ensure stability and transparency in the European logistics sector. The European Commission presented several proposals to change the regulation of the market—in particular, market access, driving and rest periods, and business trips. However, in the development of this package, a number of unfavourable decisions were made that go against Lithuanian transport companies, which will have a significant impact on the companies’ finances, as the frequent return of trucks will lead to additional fuel costs and is also in contradiction with the concept of green logistics. Thus, it is essential to study the Mobility Package’s pros and cons and compare researchers’ views. Firstly, the package will impact environmental issues and the development of sustainability principles, as the forced return of trucks to companies’ headquarters will lead to a significant increase in the emission of gases. Secondly, the implementation of these legal provisions will highlight the inequality of peripheral countries in relation to large European countries.

With all that said, the Mobility Package and the regulations and directives it describes are relatively new legal documents, and their content is still subject to discussion and change; therefore, there are no scientific sources for the direct impacts of these legal acts on logistics companies; only hypothetical scenarios are described. Accordingly, the aim of the article is to assess the impact of the Mobility Package on logistics companies based on the example of Lithuania. This study is implemented by analysing the changes in the legal environment and the presumed impact on the development of logistics companies in the context of the European Union Mobility Package.

The methods used in this article include an analysis of the scientific literature and legal acts, statistical data analysis, a PEST study, and qualitative research based on expert interviews.

The article is structured into several parts: an introduction, an analysis of the scientific literature and legal acts, a section on the methods and methodology, results and discussion sections, and conclusions.

2. Literature Analysis

Logistics is a crucial economic factor that allows companies to trade and increase their competitiveness and prosperity by providing goods and services, which are the basis of economic life []. Transport and logistics also contribute to European society, on which they can have both positive and negative impacts.

The share of road transport in the transportation field has remained stable over the years—at around 72%. It is estimated that five million people are currently employed by transport companies, and they generate almost 400 billion EUR in revenue in Europe by providing various transport and logistics services []. Moreover, rapidly growing and developing consumer demand means the transport sector occupies a particularly important place in the context of the European continent []. Yet, an economic recession was felt in this sector a few years ago due to the COVID-19 pandemic, which decreased the size of the transport sector—and, in particular, road transport—by almost 4% []. Despite the pandemic, which was felt by the whole world, the transport sector is now gaining momentum and recovering quite quickly since modern society is unthinkable without the uninterrupted movement of goods, which is ensured by transport companies. The Mobility Package was proposed in 2017, with the aim of improving and harmonising safety and social justice objectives and promoting the sustainability and economical operating of European road transport. The Mobility Package [,,] will limit the access of trade union carriers to certain segments of the transport market, reduce their competitiveness in Europe, and undoubtedly create very serious obstacles to the movement of goods within the European Union. The changes to drivers’ work and rest periods have also received a number of negative opinions, as they oblige the driver to take a weekly rest every 4 weeks in the country of establishment of the company [,]. There are countries where Lithuanian carriers have almost no conditions for implementing the Mobility Package solutions, and its establishment will significantly affect the competitiveness of Lithuanian companies in Europe, which is why there is great dissatisfaction.

The road freight transport sector plays a crucial role in the European logistics market and is an important component of modern economic systems, providing services that connect producers, traders, and consumers. This was particularly evident during the COVID-19 crisis, when some goods became unavailable and an increasing number of consumers shopped online and had their goods delivered directly to their homes []. The logistics sector was severely affected during the pandemic [] by (1) reduced demand; (2) changes in supply chains; (3) operational challenges []; and (4) health and safety concerns [].

During the global pandemic, passenger transport significantly reduced, and the main role of this sector is to ensure that freight and essential workers can continue to move []. To control the spread of the pandemic, many countries around the world imposed internal transit restrictions and closed border crossings. Such action led to major disruptions to trade and supply chains worldwide.

The main objective of European Union law is to implement a common and single-purpose transport policy to expand and promote the modernisation of EU transport networks and infrastructure. In order to ensure harmoniously functioning cross-border networks of transport modes, the Maastricht Treaty was adopted in 1992 []. This treaty established European transport networks and opened up internal transport markets, to promote entrepreneurship and competitiveness between countries []. The European Union’s transport policy and its existence ensure the smooth movement of goods and services within the territories of European Union countries.

The transport and logistics sector is one of the most important factors in the economy of each country and internationally. In the case of Lithuania, it is defined as a part of the economic and social sphere, the most important task of which is to meet the needs of society and economic objects by transporting goods or transporting passengers [].

In order to ensure a higher standard of living and competitiveness in relation to Western Europe, Lithuania must promote continuous productivity growth in the country []. To ensure the stability of the financial and legal environment, it is necessary to adhere to prudent policies and promote labour market flexibility. Nevertheless, the Lithuanian transport and logistics sector has recently been facing factors that reduce competitiveness and entrepreneurship. The level of competitiveness of Lithuanian transport market participants is suffering significant losses in order to remain competitive in the environment with Western European carriers []. Global increase in prices, more precisely, of fuel, are one of the reasons. This trend is observed not only in Lithuania but also throughout Europe, so companies, due to increased company costs and wanting to compete among other business entities, are increasing the prices of their services. However, the implementation of the provisions of the EU Mobility Package and the changes to the legal environment planned by the Government of the Republic of Lithuania may not only significantly affect the competitiveness and costs of the sector but also pose a threat to the further development of logistics companies.

Lithuanian logistics companies are faced with the problem of employing citizens from third countries. Employment quotas for non-EU citizens have been introduced, and the number of these employees is limited. Thus, the shortage of labour also contributes to the challenge of companies remaining competitive. The EU Mobility Package regulations that will come into force will also contribute to the challenges listed above, reducing the financial efficiency and development of transport companies. The changes introduced by the EC and the Mobility Package will have a significant impact on their economic activity. The forced return of vehicles to the country of operation, changes to weekly rest for drivers, and changes to the posting and remuneration of truck drivers will certainly not grant peripheral countries a competitive advantage [].

The European transport and logistics sector is one of the main parts of the European market. This sector is constantly improving and developing; therefore, currently more than 45 per cent of all transport in the EU is carried out precisely by freight tractors []. Without a doubt, this phenomenon has both positive and negative consequences for the entire European continent and its free market. With increasing consumer demand, the creation of new companies contributes to the development of European trade, as new jobs are created, thereby ensuring a better quality of life. Also, unhindered transport activity in the EU is one of the main indicators that provides economic stability and market development. Logistics activity in the territory of Europe is gaining great momentum and opens up opportunities to achieve new economic heights not only for each company but also for the entire EU. However, the rapidly developing transport industry also has its negative side. Thousands of company truck fleets and “empty” distance driving strongly contradict the EU’s beliefs regarding CO2 clean standards and the idea of a climate-neutral economy. Also, with the creation of new road transport companies and increased competition, doubts arise as to whether all social guarantees for workers are ensured. Companies interested in continuous profit-making and development often violate the rights of truck drivers by “forcing” them to work under working conditions that do not comply with the established procedure. In addition, there is a global tax evasion by transport companies when they are established in one country and carry out full-fledged activities in other countries, thus seeking to increase their income [].

With the introduction and legalisation of the regulations and directives set forth in the Mobility Package, the aim is to solve many emerging problems and support transparent business conduct in the European transport sector. The Mobility Package addresses the following aspects of the transport industry []: harmonising and simplifying common rules, ensuring their better and more consistent implementation across all EU Member States, supporting social fairness and fair competition, improving the environmental performance of road transport operations, and stimulating innovation. These are the main objectives of the new legislative package []. There have been three Mobility Package releases in total: the first two were published in the spring and autumn of 2017, and the third was published in May 2018. However, after the publication of the Mobility Package provisions, two different positions emerged among the countries engaged in transport activities in the European Union. Major EU countries, such as France, Belgium, the Netherlands, and Germany, supported the published Mobility Package provisions and encouraged other countries to contribute to their support []. These changes are beneficial for Western European countries because, once the Mobility Package regulations come into force, their competitors in Eastern Europe face a huge threat of bankruptcy and an increase in operating costs, which is why it is expected that this will help to push competitors out of the market. It is Eastern European countries that have expressed dissatisfaction with the new EU policy. Along with Lithuania, eight other peripheral countries are defined as the less developed countries within the world economic system. These are countries with low raw material dependence on exports and technology. They are countries with lower levels of industrialisation and higher levels of poverty compared to more advanced countries, usually with less economic influence, less industrial development, or less influence on world affairs. Latvia, Estonia, Poland, Romania, Bulgaria, Hungary, Cyprus, and Malta also supported the revision of the regulations, but this was not enough for the EC to begin considering the revision of the regulations and directives. The Mobility Package has had a significant impact not only on Lithuania but also on the Polish and Romanian economies and business environments.

The framework of this regulation has created many challenges for both Poland and Romania, which, like Lithuania, have a large number of transport companies and drivers. It has improved working conditions and promoted fairer competition. This legislation has strengthened the sector and increased confidence in local companies.

However, on the problematic side, the logistics and transport sector has faced increased operating costs and administrative difficulties, which have affected profitability and competitiveness in the international market.

The 1st Mobility Package consisted of the following areas: access of hauliers to the road haulage market and the possibility of pursuing the profession; freight transport for hire; road charging and electronic tolling; driving and rest time rules; posting of drivers; CO2 monitoring; and reporting of heavy-duty vehicles [].

The 2nd and 3rd Mobility Packages were supplemented with the following changes: Clean Vehicles Directive, Combined Transport Directive, digitalisation of freight transport documents, and implementation of intelligent vehicle technologies.

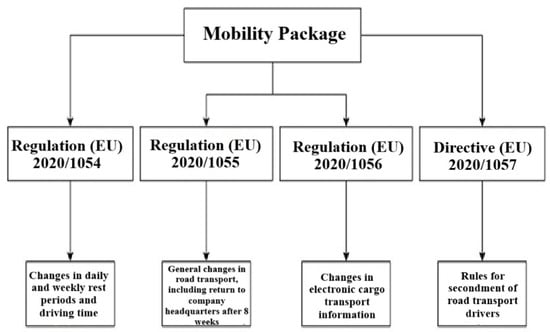

From the information provided, it can be concluded that the EC’s aim to regulate the road transport sector is aimed specifically at ensuring social guarantees for truck drivers, maintaining sustainable competition between European countries, and reducing environmental pollution. According to the European Transport Workers’ Federation, the need for the Mobility Package arose due to the unequal working conditions and wages of truck drivers from different countries working in one market. Another important reason is the implementation of cabotage and illegal competition, as companies exploit the existing situation in the European road transport market by establishing operations in countries with weaker economic conditions, resulting in lower wages being paid. However, Lesiak [] points out that completely eliminating cabotage restrictions would be an “ecological” step, as it would reduce the share of “empty” mileage in the transport sector throughout Europe []. According to Załoga [], road cabotage has a positive impact on the transport market, but it causes dissatisfaction among local companies in countries such as Germany or France, which seek to protect their national markets. It is also intended that by requiring truck drivers to return to the country of establishment no later than every 8 weeks, illegal business models will be stopped []. The provisions and rules of the Mobility Package consist of three regulations and one directive (see Figure 1), which contain amendments and additions to the previous regulations for the road transport sector and introduce new requirements.

Figure 1.

Regulations and directives forming part of the Mobility Package (Source: compiled by the authors).

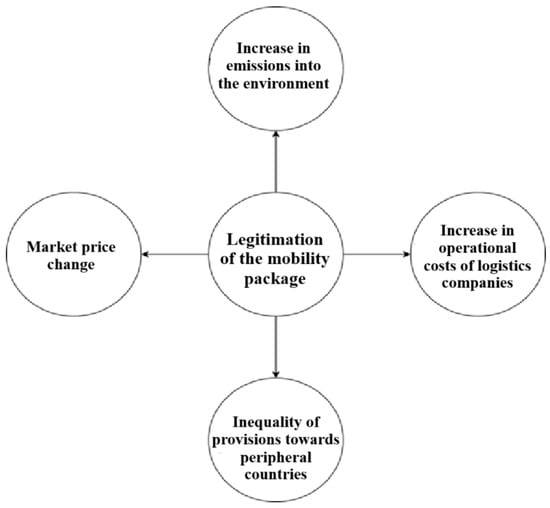

To ensure the stability and transparency of the European logistics sector, the European Commission in May 2017 submitted several proposals introducing changes related to market regulation—in particular market access, driving and rest periods, and the regulation of business trips. The content of the Mobility Package is based on the fact that the driver in this case is the most important object of legal changes, for whom it is intended to ensure equivalent working conditions throughout the EU. However, the desire to ensure drivers’ rights also has another effect—legal changes will have an undeniable impact on the activities and development of logistics companies. First of all, they will undoubtedly affect environmental problems since the forced return of trucks to the company’s registered office will significantly increase the amount of gas emissions. Secondly, the implementation of these legal provisions will highlight the inequality of peripheral countries in relation to large European countries, since certain provisions of the Mobility Package will be much easier to implement for countries such as France, Germany, and Belgium than for Romania, Lithuania, and Latvia. In addition, these regulations will affect the change in market prices, since companies, faced with an undeniable increase in operating costs, will be forced to increase the prices of their services, which will lead to an increase in the final prices of goods due to increased transportation costs. Even a small increase in costs can increase corporate insolvency throughout the European Union, so it is important to anticipate possible problems in this process and identify ways to solve them (see Figure 2).

Figure 2.

Problems posed by the legalisation of the Mobility Package for logistics companies (Source: compiled by the authors).

Based on the data and the opinions of other authors, it can be assumed that the development scenarios of the Lithuanian transport industry after the introduction of the socioeconomic Mobility Package are as follows:

An increase in prices due to a decrease in the supply of transport services. This means that companies will be able to increase prices evenly to create a positive balance with the costs incurred. In this scenario, most existing companies will continue to operate in the market, and their long-term position in the industry will depend on their profits. At the same time, increasing transport costs will lead to an increase in product prices.

There will be a significant surge in freight transport prices, leading to a rise in expenses. In this case, the activities of many companies may become unprofitable in a short time, and in the long term, they may disappear from the market altogether.

Based on various data and the opinions of other authors, it can be stated that such drastic market regulation by the European Union will not only increase the prices of transport services and freight but will also affect the competitiveness of companies or even cause the withdrawal of business entities from the market. That is why there was a need to assess the impact of the Mobility Package on Lithuanian logistics companies through a consistent study and to propose a model for solving the problems raised.

3. Materials and Methods

The regulations and directive of the Mobility Package established by the European Commission caused a considerable wave of indignation in Europe among logistics companies. Due to the novelty of the aforementioned legal acts, the direct impact of these changes on transport companies has not yet been proven; however, after analysing various data and press releases, it can be concluded that the new changes pose a risk to the development of logistics businesses in Europe and especially in Lithuania while also harming the Lithuanian economy.

The study aims to examine the impact of the Mobility Package on logistics companies.

The aim of the empirical study is to determine the impact of the Mobility Package on the activities of Lithuanian logistics companies and, after analysing the results obtained, to create a model that will ensure the competitiveness and development of companies’ activities after the legalisation of the Mobility Package.

The empirical study aims to achieve the following research objectives:

- By conducting a PEST analysis, examine the establishment of the Mobility Package based on four factors: political, economic, social, and technological.

- Apply a qualitative research method to confirm or refute the conclusions formulated during the PEST analysis.

- After summarising the research results, present a model and action plan for improving the activities and development of logistics companies.

This empirical study employed various research methods:

- PEST analysis. A PEST (political, economic, social, and technological) analysis is a preliminary method with the main function of identifying the environment in which a company or project operates and providing data and information that will allow the organisation to make predictions about new situations and circumstances []. The factors analysed in PEST analysis are usually measured and evaluated independently. When performing a PEST analysis, it is necessary to understand which factors to examine and what each one means []: Political; Economic []; Social; Technological.

- Qualitative research—expert interviews. Expert interviews are a qualitative research method used to collect detailed insights, opinions, and knowledge from individuals who specialise in a certain field []. Expert interviews are most often used in journalism and various scientific or academic research in order to obtain important information and analyse certain questions or problems from the perspective of a selected expert. During the interview, an expert may be asked to share their knowledge, experience, and opinion or answer specific questions []. In order to ensure a qualitative expert interview works, it is very important to properly formulate and prepare questions to avoid superficial and inappropriate answers. It is also important to prepare for the topic under consideration and have a good understanding of the question area in order to clarify the most important aspects []. This study used semi-structured expert interviews, which were conducted online. The purpose of this survey is the systematic organisation of knowledge obtained from people, called experts, and a certain structural division or interpretation of data using various mathematical and logical methods, such as presenting data in diagrams or even ranking. It should be noted that the purpose of a qualitative research sample is not to interview the largest possible number of people, but on the contrary—the purpose of qualitative research is high-quality and accurate answers and reasoning of respondents, in this case, experts. In older scientific sources, Augustinaitis and Rudzkienė [] have mentioned that the number of experts is connected by a rapidly decreasing nonlinear relationship. This means that the assessments and answers of even a small group of experts are equivalent to the assessments and decisions of a large group of experts. Therefore, based on these facts, the opinions of 20 experts are equivalent to the reasoning of 8 experts; 10 experts were selected for this study. Since the selected respondents, or more precisely, experts, are the main source in forming the final conclusions of this study and proposals for solving the problem, certain requirements were imposed on the experts to ensure that their answers were significant, accurate, and useful. The following requirements were imposed on the experts: Work activity must be in the transport and logistics sector; work experience in the transport and logistics sector for at least 5 years; advantage—higher education; work in the logistics field in a managerial position. The expert interviews aimed to comply with these requirements in order to ensure the reliability and novelty of the research results, and based on the summarised opinions of 10 experts, a solution to the problem in question was identified, conclusions drawn, and a proposed business model formed for companies that want to remain competitive and continue their business activities despite political and economic restrictions. A questionnaire consisting of 17 questions was compiled for the expert study. The questionnaire begins with general topics related to the current state of the logistics and transport sector and then goes in-depth into the fundamental research problem and its solutions. The first two questions of the questionnaire aim to find out the respondents’ opinions on the current state of the logistics and transport sector and the problems that have arisen. The second question lists the current problems of the sector: the concept of green logistics, the shortage of employees, the legalisation of the Mobility Package, increased costs and expenses, and the increased tax burden on Lithuanian logistics companies. This question aims to find out which of the listed problems are currently the most relevant for logistics companies in Lithuania and cause the most trouble. The following five questions are specifically related to the legalisation of the Mobility Package regulations. These questions aim to find out what the managers of logistics and transport sector companies think about the legalised Mobility Package regulations and ask them to name the operational risks that have arisen. These questions also allowed us to understand whether logistics companies are already feeling increased company costs due to compliance with the regulations and whether additional operational processes have emerged in companies. Since press releases are full of statements that the legalisation of the Mobility Package contradicts the concept of green logistics, which is encouraged to be followed throughout Europe, the eighth question allowed us to confirm or deny that the Mobility Package regulations are not fully aligned with green logistics and promote emissions on a European scale. After the finalisation of the Mobility Package regulations, peripheral countries, such as Lithuania, Latvia, Romania, etc., rushed to oppose it, claiming that the implementation of the regulations, namely the return of drivers and trucks to the company’s home country, would lead to the bankruptcy of companies; therefore, the ninth and tenth questions aim to find out the expert opinion on this. Questions eleven to fourteen discuss the Mobility Package regulation, which obliges drivers to return to their company headquarters every four weeks and tow trucks every eight. The aim is to find out whether companies are already fully obliged to comply with this regulation or are still finding ways to avoid it. In addition, these questions allow us to understand whether most Lithuanian logistics companies are already thinking about alternative solutions to this problem, such as, for example, relocating their operations to another country with a more favourable economic and political climate. The last questions aim to investigate which solutions are currently most attractive to Lithuanian logistics companies that want to continue to operate and operate competitively in Europe. The following solutions to the problem are discussed: increasing the number of third-country nationals in the company to save money, transferring all company activities together with the office to another country whose economic and political environment is more favourable for carrying out activities, searching for new markets, e.g., working with the Uzbek market with full and partial loads, while using intermodality opportunities in Lithuania, and registering a new company in Germany and hiring your company’s drivers on a rental basis, thus reducing the return of drivers and vehicles to the German headquarters. The opinions of experts allow us to finally understand how the majority of logistics companies plan to solve the problems arising from the implementation of the Mobility Package and offer an effective model for improving the activities and development of Lithuanian logistics companies that seek to continue to work competitively and efficiently in Europe.

4. Results

4.1. PEST Analysis

To better understand the logistics environment in the Lithuanian market, it was necessary to perform a PEST analysis. A PEST analysis investigates the impact of political, economic, social, technological, environmental, and legal factors on a company and provides a detailed analysis of operational challenges. A PEST analysis was conducted on the example of logistics companies in Lithuania (Table 1).

Table 1.

PEST analysis.

The political and legal environment play a crucial role. When analysing the legal environment, it is important to mention that the political situation in the country and Europe directly affects transport companies in Lithuania. The adopted Mobility Package creates many obstacles to the successful development of transport business in Lithuania. In addition, various restrictions of state institutions, such as the non-granting of quotas for the employment of third-country drivers, encourage companies to seek business solutions in neighbouring countries. The war in the neighbouring country—Ukraine—has become a topical issue these days. The imposition of sanctions and restrictions has led to the suspension of activities with CIS countries.

Economic environment. Since transport activities are carried out internationally, they are strongly dependent on economic developments in Europe. Inflation, changing interest rates, and investments make business development difficult. In addition, the Ministry of Social Security and Labour does not allocate additional quotas for the employment of third-country nationals; plus, there are difficulties and shortages of labour, which encourage carriers to consider transferring their activities to foreign countries. Due to the ongoing war and sanctions against Russia, fuel costs for transport companies have doubled—companies are forced to increase service prices in order to operate profitably.

Socio-cultural environment. In order to remain a competitive company, it is important to retain professional employees; however, there is a significant migration of specialists to other European countries from Lithuania. The low standard of living and education is no less important a factor in the logistics industry because, in order to work and coordinate a logistics company, higher education is required. Lithuania is in 15th place in terms of higher education of adults aged 25–64. In addition, wages in Lithuania are relatively low for highly educated people, so hiring a good employee is a considerable challenge these days, and there is a noticeable shortage of specialists. Also, the company’s activities are affected by the bad habits of drivers, or more precisely, alcohol consumption. Drivers on long-distance trips throughout Europe are prone to alcohol consumption, which is why breathalysers are installed in company trucks. Currently, citizens of Tajikistan and Kyrgyzstan are gradually entering the European transport market.

Technological environment. Information technology solutions are essential in logistics due to the complexity and dynamism of supply chains. Visibility tools such as parcel tracking and truck tracking, including routing and mapping algorithms, have a significant impact on the logistics market. Administrative innovations are also one of the most popular technological trends in the logistics industry. By applying information systems, companies optimise accounting processes. However, in order to expand, companies should use a common internal system that helps different departments exchange and manage information.

Thus, after conducting a PEST analysis, it can be stated that external factors have a significant impact on the development of a company’s activities and profit generation.

4.2. Data Analysis of the Expert Survey

After compiling an expert interview questionnaire, the survey results were obtained and analysed. In the presented questionnaire, experts were asked not only open-ended questions in which they could express their thoughts or suggestions but also in certain questions they were asked to list the factors in order of importance. The results are summarised in diagrams; the value of ten experts is 100%, so the analysis is more accurate.

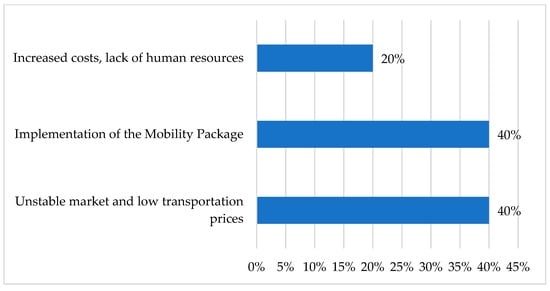

In order to assess the general situation of the Lithuanian logistics transport sector at the moment, experts were asked to share their thoughts and list the difficulties that the Lithuanian logistics and transport sector is currently facing (Figure 3). This question was of an open-ended type; however, most of the answers were very similar. We found that 40% of the experts, i.e., four experts, mentioned the main problems in the sector at the moment being an unstable market and low transport prices, which lead to a loss of potential income. According to the experts, the seasonality factor is no longer an indicator due to the falling freight flow and its prices in Europe, where most Lithuanian companies operate. The same number of experts also mentioned the implementation of the Mobility Package regulations. Lithuania, as a Northern European country, is usually quite far from the centres where it carries out transport activities, since its main activities are in Central and Western Europe, which is why some regulations, for example, the mandatory regular return of trucks and drivers to the company’s headquarters, cause certain additional logistical difficulties. We found that 20% of the experts also believe that increased costs and a lack of human resources are currently two of the main problems in the sector.

Figure 3.

The most important difficulties faced by Lithuanian logistics companies in the transport sector (Source: compiled by the authors).

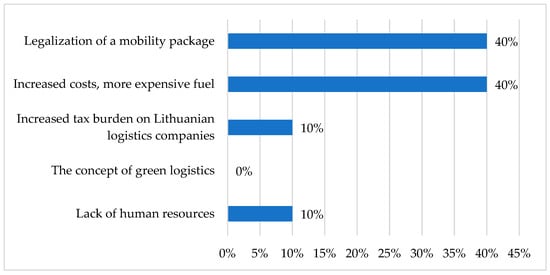

To identify the main problems in the sector that cause the most difficulties for the company’s operations, experts were asked to present factors in order from the most important to the least relevant (Figure 4). As can be seen from the diagram presented, the main problems were identified as increased costs and expenses, increased fuel prices, and the legalisation of the Mobility Package regulations. These two factors each received 40% of the experts’ votes. They identified the lack of human resources and the increased tax burden in Lithuania as less important problems, and none of the experts chose the concept promoted by green logistics, as they believe that there are currently more pressing problems in the logistics sector.

Figure 4.

Distribution of expert opinions when assessing the most relevant problem in the transport sector (Source: compiled by the authors).

The survey further assessed the topic of the Mobility Package and the enacted regulations (Figure 5). All experts answered with 100% accuracy that the Mobility Package proposed by the European Commission in 2017 and already in force is assessed negatively. According to the experts, the Mobility Package is a provision that creates additional requirements for Lithuanian transport companies, which, due to the geographical location of the country, are quite difficult to comply with regularly. These legal requirements create only two choices for Lithuanian transport companies, but the result is still the same: either to apply to them and honestly comply with all the provisions, which incur additional costs for the company (hotel reservations for rest, return of drivers and trucks to the country of registration, and renewal of the truck fleet) or not to comply with them and drive around Europe and collect fines for each violation, the amounts of which are currently in the thousands.

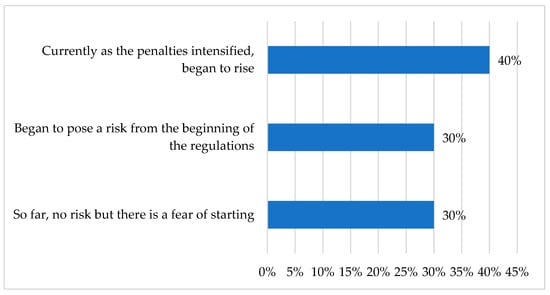

Figure 5.

Risk assessment of the Mobility Package regulations (Source: compiled by the authors).

Since only heads of companies or departments were selected for the expert survey, they were asked to state whether the enacted Mobility Package regulations already pose a risk to the company’s development and competitiveness. We found that 30% of experts responded that they do not pose any risk yet, but there is a fear that they will soon begin to. According to the experts, so far, control and inspections of tow trucks are quite rare, so the fines received do not have a significant impact on the company’s development or growth, but if inspections become much more frequent and stricter, without any doubt, the company will suffer quite large financial losses, and reduced profitability will significantly slow the entire company’s development process. Also, three experts mentioned that the enacted regulations—namely, the rule on the return of tow trucks and drivers—began to pose a risk from the very beginning of their entry into force because companies were immediately obliged to adapt and shorten the terms of all drivers to a period of 4 weeks, which led to additional costs since it is necessary to organise more frequent driver changes in Europe or return them to Lithuania together with the tow truck. The remaining four experts said that now, with the increase in fines for non-compliance with regulations, there is a risk because for small and medium-sized enterprises, which cannot influence the market itself, this is a difficult provision to implement, and a single fine is felt more strongly than for larger companies.

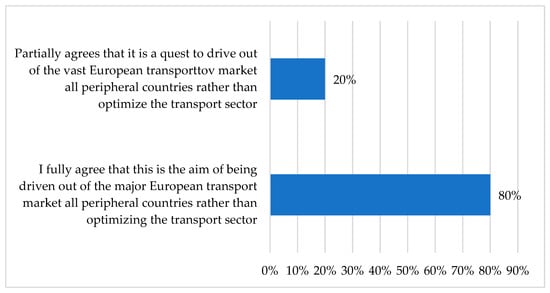

As soon as the European Commission announced the planned Mobility Package regulations in 2017, the opinions of the countries were divided into two parts: peripheral countries, such as Lithuania, Latvia, Romania, Hungary, etc., spoke out against it, claiming that the regulations would be much more difficult to implement than for countries such as France, Belgium, and Germany and stated that these regulations were not equal for all European countries. However, Central and Western European countries supported the Mobility Package proposed by the European Commission and unanimously said that this package was intended to equalise the rights of all countries participating in the European transport sector. When asked for the opinion of experts on this topic, 80% of those surveyed said that they fully agreed with the idea that the legalisation of the Mobility Package is simply an attempt to drive all peripheral countries out of the European transport market, rather than to optimise and equalise rights in the sector (Figure 6). According to most experts, not only will it not drive out peripheral countries but also large companies from peripheral countries will establish branches in Germany, France, and Italy in order to comply with the Mobility Package, which will bring in cheap labour on a rental basis, and will dump the market within their countries, which will create even greater competition for carriers from those countries. It should not be forgotten that Eastern European carriers currently carry out 95% of all international transport. Western carrier companies carry out transport mainly within their own countries, and the consequences of the Mobility Package for them will be such that they will lose even their internal market if foreign countries establish branches and register their trucks in their countries.

Figure 6.

Distribution of expert opinions on the issue of equality of the Mobility Package regulations (Source: compiled by the authors).

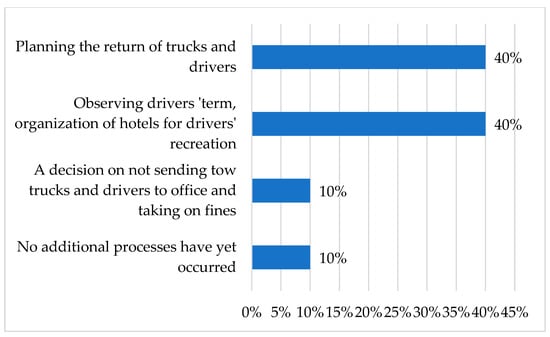

The Mobility Package regulations have already been enacted, so companies must either comply with them by introducing new processes in the company’s activities or not comply and accept full responsibility for the fines received. This was exactly the opinion of two out of ten experts, who stated that no additional processes have yet appeared in the company because the Mobility Package regulations have not yet been complied with and a decision had been made not to send trucks and drivers to the company’s headquarters (Figure 7). The remaining eight experts stated that to avoid large fines in the thousands or reduce them to a minimum, it was necessary to integrate additional processes into the company’s activities. These processes included monitoring the tenure of trucks and drivers and organising their return so as not to exceed the allowed number of weeks. In addition, 40% of experts also stated that, after the introduction of the Mobility Package regulations, a decision was made to organise a mandatory 45 h rest in hotels for drivers.

Figure 7.

Assessment of additional processes (Source: compiled by the authors).

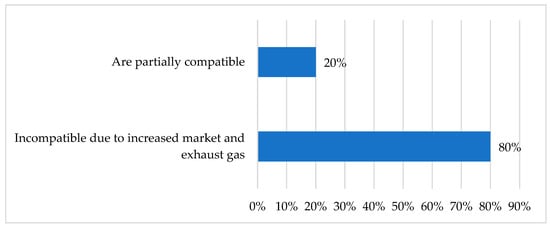

After the enactment of the Mobility Package regulation, which obliges the company to return a truck to the country of its registered office every 8 weeks and the driver every 4 weeks, peripheral countries rebelled, claiming that these decisions contradict the popular concept of green logistics, which states that companies should reduce empty kilometres and save the environment by reducing harmful emissions. We found that 80% of experts agree with the idea that the provisions of the Mobility Package are incompatible with green logistics and argue that by honestly complying with the stipulated conditions and sending trucks to the country of registration quite often, the average number of kilometres covered by the truck would increase, which would lead to higher CO2 emissions (Figure 8). However, 20% of experts believe that frequent return of each truck to Lithuania will ensure the maintenance of the trucks in service stations and eliminate defects that may affect the environment. In addition, drivers, especially in winter, when taking weekend breaks, no longer have to heat the trucks with the engines running. This reduces air pollution and provides more comfortable conditions for drivers in hotels.

Figure 8.

Compatibility of the Mobility Package regulations and the green logistics concept (Source: compiled by the authors).

Of our experts, 100% agree and believe that due to the strict regulations introduced by the Mobility Package, smaller and medium-sized companies will be on the verge of bankruptcy, while larger ones will occupy the majority of the market and survive (Figure 9). Experts also argue that larger companies will be able to adapt and develop optimal solutions, but small companies are currently quite severely affected by the poor market situation, and the Mobility Package will further increase the costs incurred by companies, so companies that do not have the financial reserves to overcome this period will likely be on the verge of bankruptcy. It is believed that the salvation of large companies will be the fact that Lithuania, after all, is a connection between Northern Europe and Central and Western Europe, which is why the transport sector accounts for the largest share of the country’s GDP, so the existing infrastructure will be needed in any case.

Figure 9.

Percentage of possible bankruptcy of logistics companies in the transport sector (Source: compiled by the authors).

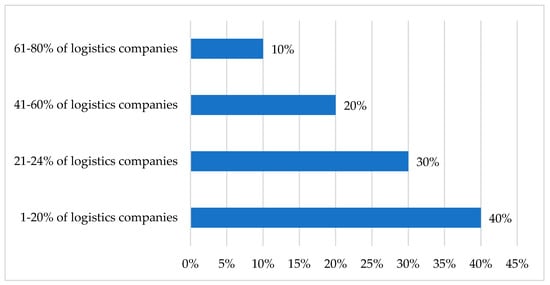

Thus, four experts believe that due to the current changes in the transport sector, and more precisely, because of the Mobility Package regulations, 1–20% of logistics companies will reach the bankruptcy threshold, while three experts say that it will be 21–40% of logistics companies. This distribution indicates that experts expect Lithuanian logistics companies to adapt and overcome changes in the transport sector. However, as many as 30% of experts believe that more than 40% of Lithuanian logistics companies will find themselves on the verge of bankruptcy (see Figure 9).

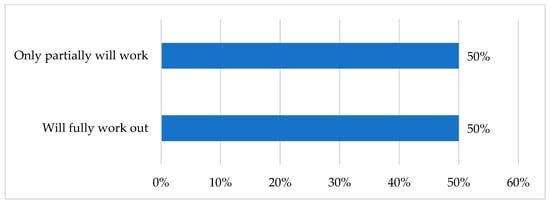

Between 2020 and 2021, numerous scientific reports and articles in the press indicated that the sole solution for peripheral countries seeking to successfully comply with the Mobility Package regulations and continue expanding their activities was to open subsidiary companies or branches in neighbouring countries, such as Poland or Germany. On this issue, expert opinions were divided into two equal parts. In our study, 50% of experts said that this was so far one of the solutions that could work very well in the future. The other half of experts believed that it would work only partially and for a short time (see Figure 10). Experts said that many companies expected to avoid the consequences of the Mobility Package in this way and move their branches to Poland, but not so long ago the Polish government increased taxes on logistics companies. After these changes, the new tax rates exceeded the Lithuanian ones, and, unfortunately, operating in a neighbouring country is currently the same as accepting the consequences of the Mobility Package. Other experts said that the choice of import/export to these countries is greater and more profitable. The proposed that returning the tow truck will take less time and will not incur as much of a loss; in fact, it may even be profitable.

Figure 10.

Assessment of the opening of subsidiaries or branches in neighbouring countries (Source: compiled by the authors).

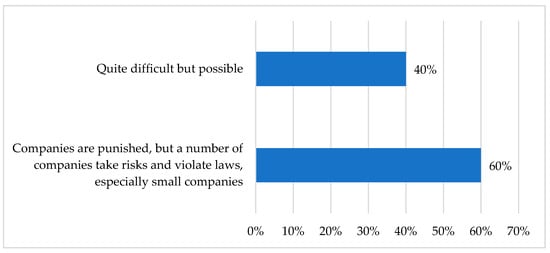

The main regulation of the Mobility Package which scares Lithuanian logistics companies is the obligation to return the driver to the company’s headquarters every 4 weeks and the tractor every 8 weeks. It is impossible for peripheral countries to comply with these provisions during this period because freight flows to Lithuania are minimal and very poorly paid; therefore, returning tractors and drivers would only cause losses to the company. In this study, 40% of experts agreed that complying with this regulation during this period would be quite difficult, but they proposed that could be possible only because companies have long-standing contracts with customers, meaning companies are provided with freight flows, making planning in this process somewhat easier (see Figure 11). However, 60% of those surveyed said that very small and medium-sized companies assumed responsibility and risk by not complying with this regulation, although they were punished. For small and medium-sized businesses, returning trucks and drivers for less than cost was described as currently tantamount to a straight path to bankruptcy, so companies chose to take the risk.

Figure 11.

Compliance with the Mobility Package regulation obliging drivers and tow trucks to return to the company’s headquarters (Source: compiled by the authors).

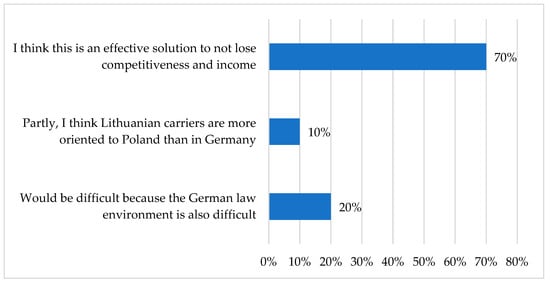

Due to the Mobility Package regulation, which obliges them to return to the company’s registered office, Lithuanian logistics companies have to make decisions. One of them could be—if the main activity of the company is carried out not in Lithuania but in Europe—France, the Benelux countries, Spain, etc.—registering the company in Germany and employing its existing drivers in the newly registered company on a rental basis. This principle will avoid empty mileage of returning the truck and driver to Lithuania since the company’s registered office will be kept in Germany. As many as 70% of experts agreed that this decision would be justified in order not to lose income and competitiveness (Figure 12). When planning to implement this, it is be appropriate to thoroughly analyse the geographical location and market in which the company operates and establish the company’s registered office in the centre of the activity. This links up not only to the arrival of trucks to the country of registration but also to the change of drivers, as the drivers being replaced can gather in one specific place on the weekend and all get collected in one transport. Several experts said that it was justified since it avoids additional costs and reduces losses when trucks have to be returned every 8 weeks, which is financially unprofitable. Some companies already have strategies on how to execute all this officially without violations and avoid additional losses due to this provision of the Mobility Package. In this study, 20% of those surveyed said that it would be very difficult to work since Member States regulate work on a rental basis differently. As the laws contradict each other, it would be easy for competitors to ruin such a company. Also, one expert said that Lithuanian carriers are more orientated towards Poland than towards Germany.

Figure 12.

Assessment of company registration in Germany and hiring existing drivers on a rental basis (Source: compiled by the authors).

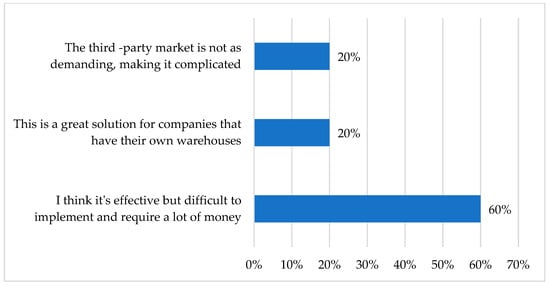

One future business model to comply with the Mobility Package regulations could involve finding new customers in third-country markets while utilising intermodal opportunities in Lithuania. This means that a full trailer would be collected with partial loads from Germany or Italy, and transported to Lithuanian warehouses, where the tractor would be reloaded and returned to Europe, and the partial load would continue to travel via intermodal routes to third countries. For this model to be successful and run smoothly, companies need to establish relationships with new customers. In this study, 60% of experts expressed the belief that this would be an effective business model, but complex and requiring significant investment (Figure 13). Meanwhile, 20% of experts said that it would be easy to implement for companies that have their own warehouses. Some experts expressed their belief that this solution would be too complicated. Again, the conclusion is that for large logistics companies, all solutions are possible, but small companies do not have much choice in solving this problem.

Figure 13.

Evaluation of the search for new customers in third-country markets and the use of intermodality in Lithuania (Source: compiled by the authors).

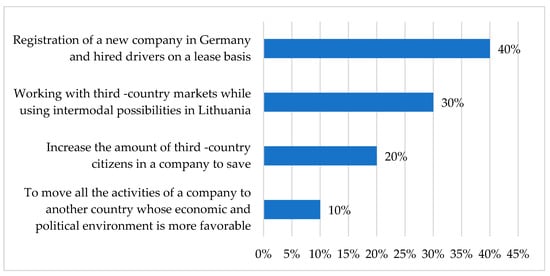

To find optimal solutions to the problem, experts were asked what measures, in their opinion, Lithuanian logistics companies should take if they want to continue to operate competitively and successfully despite the introduced Mobility Package regulations (Figure 14). There were no unanimous answers on this issue; 40% of experts expressed a firm belief that registering a company in Germany and hiring drivers on a rental basis would pay off the fastest and would be the smoothest solution. Another 30% of experts expressed their belief that it is necessary to take a risk and try to establish relations with third-country markets, using the opportunities of intermodality. The rest said that it is possible to try to transfer all company operations to Poland or Germany or increase the number of third-country nationals in the company in order to save money.

Figure 14.

Assessment of measures that would ensure competitiveness and economic growth of the country (Source: compiled by the authors).

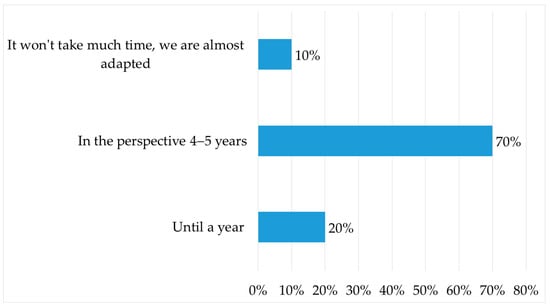

After assessing the possible solutions and business models, it is necessary to predict how much time Lithuania, as a peripheral country whose main activities are carried out in Central and Western Europe, will need to adapt to all the necessary changes in the Mobility Package and remain competitive in the European transport sector. Seventy per cent of experts believe that positive changes in the activities organised by Lithuanian logistics will require 4 to 5 years for the Mobility Package to become a regular law regulating transport policy, allowing companies to continue operating successfully and generating profit not only for themselves but also for the country (see Figure 15). Two experts believe that Lithuanian logistics companies can adapt to the changes within a year, and one claims that it will not take much time, as businesses have almost adapted.

Figure 15.

Time perspective assessment of when Lithuania will adapt to the changes in the Mobility Package (Source: compiled by the authors).

In summary, it can be stated that Lithuanian logistics companies that want to continue to operate successfully not only in Lithuania but also in Europe, to be competitive and have opportunities to develop their activities, are faced with difficulties due to increased company costs and the implementation of the Mobility Package regulations. The research results indicate that the Lithuanian logistics sector is currently developing new business strategies, and it is looking for ways to save money that would help companies avoid bankruptcy and successfully develop their business. The established Mobility Package and its regulations, or more precisely, the weekly rest of drivers in hotels and the forced return of drivers and trucks to the company’s headquarters, have greatly intimidated the Lithuanian logistics sector.

Based on the opinions and proposals expressed by experts, it can be stated that Lithuanian logistics companies that want to remain on the market have several solutions. One of the methods that almost all logistics and transport companies are trying to use is the employment of third-country nationals. But this solution is limited because state quotas have an annual limit and are often used up by mid-year. The second solution discussed by experts is the establishment of a subsidiary or division in Germany, hiring their own drivers on a lease basis. And the third solution, which is the future vision of many companies, is the search and opening of new markets, using Lithuanian warehouses to develop intermodality.

5. Discussion

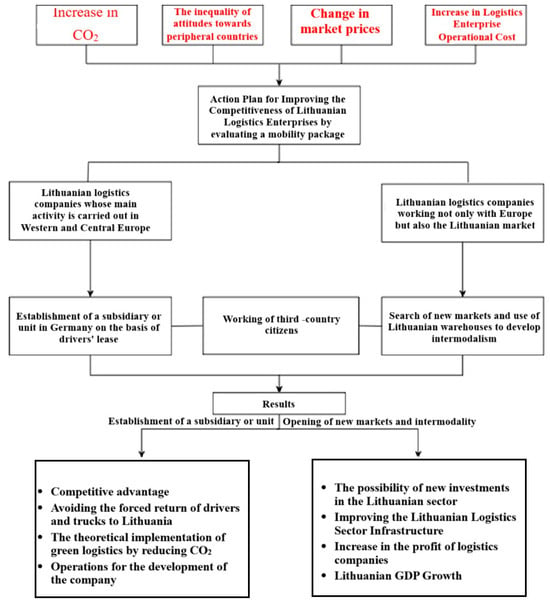

The Lithuanian logistics and transport sector, after the Mobility Package regulations approved by the European Commission, is facing several challenges to remain competitive and have all the opportunities to operate and develop logistics businesses. Many companies, forced to comply with the established regulations, incur additional costs, are encouraged to increase CO2 emissions when returning a tractor to the company’s headquarters, and feel inequality in the regulations compared to Western European countries. Companies, to continue to successfully carry out their activities and remain competitive, must find solutions. Figure 16 below suggests a model for improving the competitiveness of companies.

Figure 16.

Model of an action plan for improving the competitiveness of Lithuanian logistics companies (Source: compiled by the authors).

Based on the presented model, it can be seen that companies have the option to utilize solutions to improve their competitiveness according to their activities and the location of their implementation on the European continent. This means that for companies whose main activities are carried out in Europe and whose company’s administrative office is located in Lithuania, the most effective solutions differ from those for companies whose main transport market is not only Europe but also Lithuania. However, one solution is favourable for the entire transport sector—the employment of third-country nationals. The only downside to this solution is that employment quotas are limited; therefore, it is expected that over time, the Lithuanian state will consider the current situation in the logistics and transport sector and increase the quotas allowed.

The Mobility Package regulation, which requires the return of the driver and the tractor to the company’s headquarters, is a considerable challenge for Lithuanian logistics companies, whose main activities and customers are in Western Europe. Therefore, companies wishing to avoid additional costs of returning the driver and the tractor to the company’s headquarters could establish subsidiaries or branches closer to their operations, i.e., in Germany. Then, the existing drivers would be hired by the new unit on a rental basis, so the return would only be required to Germany, not Lithuania. This would undoubtedly facilitate and improve the activities of companies since the probability of a profitable return to the unit in Germany is ten times higher than trying to return the driver with the tractor to Lithuania. In addition, beyond saving costs or increasing profits, logistics companies would also contribute to the concept of green logistics since an increase in CO2 emissions would be avoided when driving long distances from Western Europe to Lithuania and back.

Establishing a branch in Germany or another country does not provide an effective solution for companies operating in the Lithuanian market. Until now, such companies have not faced operational problems or cargo shortages, since before the Russia–Ukraine war, most of the cargo from Europe to Russia was transported via Lithuania. As a result, such companies had constant cargo flows from Germany or Italy to Lithuania, and thus their supply chains were secured. After the introduction of sanctions, a significant decrease in cargo has been noticeable; therefore, companies that want to continue to successfully operate and maintain their constant cargo flows from Europe to Lithuania and back must look for new markets. As an example, these could be third-country markets, for example, Uzbekistan. At the beginning of the Russia–Ukraine war, a large demand for cargo was observed on routes from Germany and Italy to Lithuania. However, in the middle of the war, these flows were stopped due to the sanctions introduced. The renewal of these profitable flows can be achieved by establishing relations with new markets such as Uzbekistan. This could be the transportation of full or partial loads from Europe to Lithuanian warehouses, using intermodality, since the cargo collected from Lithuanian warehouses would already be sent further to third countries, and trucks would have regular flows between Lithuania and Europe. With such a solution, Lithuania would be perfectly utilised as a transit country due to its territorial location, and all the required regulations of the Mobility Package would be implemented without any losses.

Theoretical model solutions would benefit the sector and the Lithuanian economy by improving company competitiveness. First, companies would not flee the Lithuanian market en masse but would open branches, which means that the state would still collect corporate taxes. Second, companies, feeling that their activities were not unprofitable but profitable, would expand their activities, which would also have a positive impact on Lithuania’s GDP. Lithuanian companies, having established relations with new markets, would be likely to attract new investments to the country, which would improve Lithuania’s transport infrastructure. In addition, it would contribute to the green logistics concept, and trucks would not drive long distances empty, which would save CO2 emissions to the environment.

The impact of the Mobility Package on Lithuanian logistics companies.

Since it is not yet possible to determine the exact impact of the Mobility Package on Lithuanian logistics companies, an analysis of literature sources and an expert study were used. After analysing the latest literature and press releases and using the opinions of pre-selected experts, it can be stated that Lithuanian logistics companies are currently going through a truly difficult period. First of all, this is a complex legal situation both in Lithuania and in Europe, and secondly, the current market situation and price changes further complicate the situation of Lithuanian logistics. It can be concluded that the impact of the Mobility Package regulations would not be felt so strongly if the economic situation in Europe were more favourable and companies did not face sudden increases in costs and expenses; therefore, the implementation of the Mobility Package regulations, and especially the return of trucks and drivers, currently seems very unprofitable for companies.

We can also assess the further impact on Lithuanian logistics companies and the country’s economy by taking the example of the country’s large logistics companies. According to mass media reports and data from major representatives of the Lithuanian transport sector, such as Linava, the Girteka Group decided to relocate part of its company several years ago due to the Mobility Package, and it operates about 9.2 thousand tractors and 9.8 thousand semi-trailers in Europe and Scandinavia, delivers 776 thousand full loads annually, and employs 23 thousand employees. In addition to the Girteka Group, Linava announced that currently more than 800 other transport and logistics companies conduct their activities outside Lithuania, having established branches or subsidiaries, which have registered more than 8000 trucks abroad. Considering that the transport and logistics sector generates about 12–13% of the country’s GDP, this means that when businesses relocate their operations to other countries due to unfavourable economic and legal circumstances, the state budget does not collect part of the taxes and therefore loses a large part of its income. Therefore, when looking to the future, it can be stated that if companies follow the example of larger logistics companies and relocate their operations or establish branches in other countries, the Lithuanian budget will suffer significantly.

On the other hand, it is worth noting that Lithuania, compared to Germany or Poland, is a small country, and therefore the freight flows to and from it are quite small, which also results in significantly lower freight transport prices than in Germany or Poland. Therefore, returning the vehicle together with the driver to Lithuania is economically unprofitable for transport companies. The cost of freight transport from Germany to Poland ranges from 1.30 to 1.80 EUR/km (depending on the transport distance), while the cost of transport from these countries to Lithuania is about 1 EUR/km.

In addition to the economic impact of the Mobility Package on Lithuanian logistics companies, an environmental aspect is also highlighted due to the exhaust gases. From the perspective of the Mobility Package, the forced return of the truck to the company’s headquarters every 8 weeks will not only increase the company’s fuel costs but will also contribute to an increase in the amount of CO2 particles in the atmosphere since the truck will have to travel additional distances.

The European Commission has published a study stating that the obligation to return a truck will lead to inefficiency in the transport system and increase empty trips, environmental pollution, and congestion. According to the Commission’s assessment, the requirement to return trucks to the country of establishment alone will increase the number of empty trips by 1.9 million per year. It is also calculated that the truck emits 58.6 g of CO2 per tonne-kilometre in the environment (European Automobile Manufacturers Association, 2020). As a result, carbon dioxide emissions will increase by 2.9 million tonnes, and nitrogen oxide and particulate matter pollution will increase by 619 and 221 tonnes per year, respectively. In addition, according to the International Transport Union, the mandatory return of tractors will increase the mileage of heavy transport by up to 75 per cent and CO2 emissions by up to 100 thousand tonnes per year. Lithuanian carriers and drivers will be forced to allocate incomparably greater financial and time resources to the implementation of the requirement than companies located closer to the centre of the EU. A trip to Lithuania from Western and Southern Europe can take about a week (including traffic restrictions, weekly rest, holidays, etc.), while, for example, a Czech from Germany can return in a few hours. These aspects justify the model of an action plan for improving the competitiveness of Lithuanian logistics companies. Therefore, using the previously presented theoretical model, which proposes opening a company branch in Germany and hiring drivers on a rental basis, we can say that a truck, for example, would only need to return to Berlin, which would not be as difficult in the current market compared to returning to Lithuania. Considering the above information, it can be said that the Mobility Package regulation, which obliges the return of the truck to the company’s headquarters, is currently being discussed and reviewed. Due to a complaint filed by peripheral countries, which states that this regulation is not equivalent to all European countries and that it is impossible to implement it without losses in peripheral countries, the European Court of Justice proposes to revoke this regulation. The revocation of this regulation would be a huge win for peripheral countries and, at the same time, for Lithuania. Lithuanian transport and logistics companies would not need to invest in opening fictitious branches in other countries unless the company seeks to expand in Europe and would also avoid huge additional CO2 emissions and empty kilometres. This would be an opportunity for the Lithuanian transport sector to recover in this difficult market and develop the sector not only in Lithuania but also on a European scale.

In conclusion, it can be stated that the proposed model for improving the competitiveness of a company would have positive benefits not only for the sector and companies but also for the Lithuanian economy, as it would increase the country’s GDP and encourage new investments from foreign markets. However, the withdrawal of one of the main regulations of the Mobility Package is currently being considered, one which has a negative economic impact on Lithuanian logistics companies.

6. Conclusions

To anticipate possible problems of the Mobility Package regulations and find ways to solve them, several studies were performed: chiefly, PEST and expert interviews. According to experts, the Lithuanian logistics and transport sector is currently facing several main problems, i.e., an unstable market and low transportation prices, the implementation of the Mobility Package regulations and increased costs, and a lack of human resources. After analysing the extant studies, it was found that Lithuanian logistics companies that want to continue to operate successfully not only in Lithuania but also in Europe, be competitive, and have opportunities to develop their activities are faced with difficulties due to increased company costs and the implementation of the Mobility Package regulations. The results of the studies clearly indicate that the Lithuanian logistics sector is currently developing new business strategies, as well as looking for ways to save money that will help companies avoid bankruptcy and successfully develop their business. The established Mobility Package and its regulations, or more precisely, the weekly rest of drivers in hotels and the forced return of drivers and trucks to the company’s headquarters, have greatly intimidated the Lithuanian logistics sector.

One of the methods that almost all logistics and transport companies are trying to use is the employment of third-country nationals. But this solution is limited because state quotas have an annual limit and are often used up by mid-year. The second solution, which was discussed by experts, is the establishment of a subsidiary or division in Germany, hiring its own drivers on a lease basis. And the third solution, which is the future vision of many companies, is the search for and opening of new markets, using Lithuanian warehouses to develop intermodality. Regardless, of these solutions, the Mobility Package rules hurt the economy now and will do so in the future. The European Court of Justice’s consideration of revoking one of the main rules shows that the European Commission made a hasty choice without considering the possible effects on not just smaller countries like Lithuania, but all of Europe.

The Mobility Package encourages logistics companies to adopt fairer, safer, and smarter practices. While some rules raise environmental concerns, the overall impact helps ensure the long-term sustainability of the industry. It can be argued that success depends on companies adapting to innovation and digital transformation. More studies might look into how the Mobility Package affects GDP and economic measures in the transport and logistics industry, including specific areas like Western and Central Europe (which is seen as a transition area between Eastern and Western Europe or as the border of Western Europe). Central Europe includes countries such as Germany, Poland, Austria, the Czech Republic, Slovakia, Hungary, Switzerland, and parts of Slovenia, Croatia, and Romania. The region is characterised by the influences of Western and Eastern Europe and is therefore important in European politics, economics, and so on.

The limitations of this study are related to the lack of clear statistics and calculations of the impact of the Mobility Package on peripheral countries, despite the fact that some companies have established subsidiaries or re-registered in Poland.

Author Contributions

Conceptualisation, K.Č., M.V. and A.J.; methodology, K.Č., M.V., A.P. and A.J.; validation, K.Č., M.V. and A.J.; formal analysis, K.Č., M.V., A.P. and A.J.; investigation, K.Č., M.V. and A.J.; resources, K.Č., M.V. and A.J.; data curation, M.V. and A.P.; writing—original draft preparation, K.Č., M.V., A.P. and A.J.; writing—review and editing, K.Č., A.P. and A.J.; visualisation, K.Č. and M.V.; supervision, A.P. and A.J.; project administration, A.J.; funding acquisition, A.J. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

The study was conducted in accordance with the Declaration of Helsinki, and approved by the Institutional Ethics Committee of Vilnius Gediminas technical university (approval code: 20240725, dated 25 July 2024).

Informed Consent Statement

Informed consent for participation was obtained from all subjects involved in the study.

Data Availability Statement

The original contributions presented in this study are included in the article. Further inquiries can be directed to the corresponding author.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- The Innovation Response. 2021 Activity Report. Available online: https://www.eib.org/files/publications/eib_activity_report_2021_en.pdf (accessed on 20 June 2025).

- Suproń, B. Influence of the mobility package on the functioning of the Polish road transport of goods sector. Pr. Nauk. Uniw. Ekon. We Wrocławiu. 2020, 64, 92–106. [Google Scholar] [CrossRef]

- Nowakowska-Grunt, J.; Strzelczyk, M. The current situation and the directions of changes in road freight transport in the European Union. Transp. Res. Procedia. 2019, 39, 350–359. [Google Scholar] [CrossRef]

- Road Freight Transport Statistics—Statistics Explained. Available online: https://ec.europa.eu/eurostat/statistics-explained/index.php?title=Road_freight_transport_statistics (accessed on 20 June 2025).

- Klaus, P. Mobility Package—Impact on the European road transport system. FAU Friedrich-Alexander Universität Erlangen-Nunberg, Fraunhöfer. 24 October 2019. Available online: https://www.researchgate.net/publication/336774978_MOBILITY_PACKAGE-_IMPACT_ON_THE_EUROPEAN_ROAD_TRANSPORT_SYSTEM (accessed on 20 June 2025).

- Gheoculescu, A.V. The EU Mobility Package for Transport. Bull. Transilv. Univ. Braşov Ser. VII Soc. Sci. Law 2022, 15, 95–102. Available online: https://www.researchgate.net/publication/370907366_The_EU_Mobility_Package_for_Transport (accessed on 20 June 2025). [CrossRef]

- Vaškys, A.; Ginavičienė, J.; Romeikienė, J. Balancing Transport Regulation and Sustainability: The Mobility Package’s Environmental Impact. Environ. Technol. Resour. 2025, 1, 555–561. [Google Scholar] [CrossRef]

- Breemersch, T. The Impact of the 1st Mobility Package on European Road Freight Transport, with Special Focus on Peripheral Countries. Report for: The Lithuanian National Road Carriers’ Association LINAVA & UNTRR—Uniunea Nationala a Transportato-rilor Rutieri din Romania. 30 September 2019. Transport Mobility Leuven TML. Available online: https://www.untrr.ro/media/wysiwyg/1st_Mobility_Package_-_TML_Report_for_LINAVA_UNTRR_v4.pdf (accessed on 20 June 2025).

- Čižiūnienė, K.; Viduto, M.; Zinkevičiūtė, V. The Impact of the European Union Mobility Package on the Performance of Road Freight Transport Companies: A Case Study of Lithuania; Current issues of the management of socio-economic systems in terms of globalization challenges: Scientific monograph; University of Security Management in Košice: Košice, Slovakia, 2023; pp. 229–310. ISBN 9788081850646. [Google Scholar]

- Kotzeva, M. Eurostat Regional Yearbook: 2022 Edition; Publications Office of the European Union: Luxembourg, 2022; Available online: https://www.drugsandalcohol.ie/37936/1/Eurostat_regional_yearbook_2022.pdf (accessed on 20 June 2025).

- Świtała, M.; Łukasiewicz, A. Road freight transport companies facing the COVID-19 pandemic. Gospod. Mater. Logistyka. 2021, 5, 8–16. [Google Scholar] [CrossRef]

- Mack, E.A.; Agrawal, S.; Wang, S. The impacts of the COVID-19 pandemic on transportation employment: A comparative analysis. Transp. Res. Interdiscip. Perspect. 2021, 12, 100470. [Google Scholar] [CrossRef] [PubMed]

- Loske, D. The impact of COVID-19 on transport volume and freight capacity dynamics: An empirical analysis in German food retail logistics. Transp. Res. Interdiscip. Perspect. 2020, 6, 100165. [Google Scholar] [CrossRef]

- Lakshmi, B.M. Impact of COVID 19 on the Transport Industry. Generic 2020, 12, 1327–1334. [Google Scholar]

- European Commission, Directorate-General for Communication. Trade: Free Trade Is a Source of Economic Growth, Publications Office. 2016. Available online: https://data.europa.eu/doi/10.2775/42184 (accessed on 20 June 2025).

- Raczkowski, K.; Schneider, F.; Laroche, F. The Impact of Regulation of the Road Transport Sector on Entrepreneurship and Economic Growth in the European Union; Motor Transport Institute: Warsaw, Poland, 2017; Volume 8. [Google Scholar]

- Report on the Performance of the Fitness Check of Legal Regulation in the Field of Transport and the Assessment of the Regulatory Burden on Economic Entities. Ministry of Economy and Innovation. Available online: https://eimin.lrv.lt/uploads/eimin/documents/files/Keliu%20transporto%20teisinio%20reguliavimo%20patikra%202019-04-01.pdf (accessed on 20 June 2025).

- International Monetary Fund. European Dept. IMF Country Report No. 19/252 Republic of Lithuania (Issue 19). 2019. Available online: https://www.elibrary.imf.org/view/journals/002/2019/252/002.2019.issue-252-en.xml (accessed on 20 June 2025).

- Baltic Institute for Research and Development. Economic Analysis of the Competitiveness of the Lithuanian Road Freight Transport Sector. Report Prepared for the Meeting of the Tripartite Council of the Republic of Lithuania, 2019. November 19. Vilnius, Lithuania. 2019. Available online: https://cdn-trans.info/uploads/2020/01/ebd570060385fd50df0e082c59a.pdf (accessed on 20 June 2025).

- Poulsen, A. The Road to a Minimum Winning Coalition? A Study of Coalition Building During the Negotiations of the Mobility Package. Master’s Thesis, Lund University, Lund, Sweden, 2021. Available online: https://www.lunduniversity.lu.se/lup/publication/9045113 (accessed on 20 June 2025).

- Rolbiecki, R.; Książkiewicz, D. Performance of Polish road carriers in relation to regulations according to the remuneration of seconded workers. Transp. Econ. Logist. 2019, 77, 115–124. [Google Scholar] [CrossRef]

- IRU Annual Report 2021. Available online: https://www.iru.org/resources/iru-library/iru-annual-report-2021 (accessed on 20 June 2025).

- Lesiak, P. Wpływ koncepcji zrównoważonego rozwoju na konkurencyjność polskich przedsiębiorstw transportowych. Transp. Samoch. 2010, 1, 33–42. Available online: http://yadda.icm.edu.pl/baztech/element/bwmeta1.element.baztech-a2906657-d3ef-420c-aa77-e7caf1d3197d (accessed on 20 June 2025).

- Załoga, E. Kabotaż drogowy a reguły rynku wewnętrznego Unii Europejskiej. Zesz. Nauk. Uniw. Gdańskiego Ekon. Transp. Logistyka. 2017, 64, 201–211. [Google Scholar]

- ITF Workers’ Federation. 2019. Available online: www.itfseafarers.org (accessed on 20 June 2025).

- Elomda, B.M.; Hefny, H.A.; Hassan, H.A. An extension of fuzzy decisi on maps for multi-criteria decision-making. Egypt. Inform. J. 2013, 14, 147–155. [Google Scholar] [CrossRef]

- Kotzeva Çitilci, T.; Akbalik, M. The Importance of PESTEL Analysis for Environmental Scanning Process. In Handbook of Research on Decision-Making Techniques in Financial Marketing; IGI Global Scientific Publishing: Hershey, PA, USA, 2020; pp. 336–357. [Google Scholar] [CrossRef]

- Fosher, H. Understanding the Marketing and Management of Trails Using Pestel Analysis. Master’s Thesis, University of New Hampshire, Durham, UK, 2018. [Google Scholar]