Abstract

At present, net-zero emissions have become a widely accepted goal globally. For a giant carbon emitter like China, especially after just experiencing a high-energy consumption, high-emission, and low-efficiency extensive economic model, achieving the global net-zero emissions target by the middle of this century is particularly important. The implementation of environmental regulation policies is one of the inevitable choices for achieving carbon peak and carbon neutrality. Existing theoretical analysis shows that environmental regulation acts on pollution emissions through cost effects and technological innovation, but relevant studies mostly focus on macro effects and ignore the impact of enterprise heterogeneity. This study calculates the carbon emission data of listed enterprises in China from 2012 to 2021 and examines the impact of environmental regulation policies on the carbon emission intensity of enterprises and its transmission mechanism from both theoretical and empirical perspectives. At the same time, the heterogeneity effect of resource-based industry and non-resource-based industry is considered. The research results show that China’s environmental supervision has been increasing year by year, which can reduce the carbon emission intensity of enterprises by improving the level of environmental disclosure of enterprises, environmental management concepts, and resource allocation efficiency and accelerating the establishment of environmental systems of enterprises, but the effect of technological innovation has not been highlighted. Further heterogeneity also indicates that environmental regulation is more conducive to reducing the carbon emission intensity of non-resource-based enterprises, small enterprises, and non-state-owned enterprises. The conclusions of this paper provide a precise direction for the implementation of environmental regulation policies in China and the world.

1. Introduction

With the introduction of global Sustainable Development Goals, climate issues have gradually become the focus of policy and academic circles. As we all know, carbon emissions are an important cause of global warming, and reducing carbon emissions plays a very important role in protecting the health and living environment of humans. At the same time, reducing carbon emissions is also the core of maintaining sustainable and healthy economic development. According to new research from the Global Carbon Budget Science team, global emissions of fossil fuel carbon dioxide are expected to reach 36.8 billion tonnes in 2023, a record high. Even with the temporary impact of the pandemic, the problem of global carbon emissions is still serious, and the urgency of global emission reduction is self-evident.

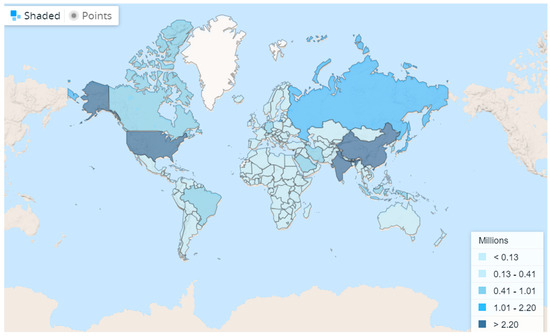

China, as the largest developing country and a major emitter of carbon, is urgently addressing the need for carbon reduction. As shown in Figure 1, the World Bank’s 2020 data on total carbon emissions by countries highlights China, the United States, and India as the world’s leading contributors to carbon emissions. To this end, China has implemented a series of carbon reduction measures in the past decade, such as vigorously developing clean energy and renewable energy and accelerating the green transformation of economic stock. As we all know, carbon emission has the characteristics of externality, and the government has to carry out mandatory intervention and regulation on its market failure. At present, China mainly adopts the command-and-control environmental regulation policy. For example, it formulates strict legal and administrative regulation policies and strictly sets enterprise carbon emission constraint indicators. Enterprises can be punished or even shut down if they emit too much. Of course, in addition to the command-and-control environmental regulation policy, there are also market incentive and public participation environmental regulation policies. However, the applicability of the latter two in China is relatively low. Therefore, command-and-control environmental regulation is selected as the research object in this study, with a focus on verifying the emission reduction effect of this policy. In particular, this paper will start from the perspective of enterprise carbon reduction because under the guidance of the policy of carbon neutrality and carbon peak, enterprises are the most micro subject of the implementation of the policy, and the emission reduction tasks and indicators undertaken are related to the success or failure of the national carbon emission reduction work.

Figure 1.

Global CO2 emissions by country in 2020 (million). Source: the World Bank (https://data.worldbank.org/, accessed on 1 November 2023).

In theory, the carbon reduction effect of environmental regulation involves a number of economic and environmental theories, including Porter’s hypothesis and pollution haven theory. Porter’s hypothesis was proposed by Professor Michael Porter of Harvard University. The core idea is that environmental regulation can promote innovation and improve the core competitiveness of enterprises, so as to achieve a win-win situation for the environment and the economy [1]. In terms of carbon reduction, Porter’s hypothesis emphasizes the incentive effect of environmental regulations on enterprises adopting greener and more efficient production technologies. By implementing environmental measures, enterprises innovate in product design, production processes, and energy use, thereby reducing carbon emissions. This conclusion has been substantiated by an extensive body of literature [2,3]. At the same time, some studies have found that in developing countries, with China as a representative, environmental regulations can foster enterprise innovation only in regions characterized by severe corruption [4,5]. Similarly, the pollution haven theory states that enterprises may move production activities to areas with less stringent environmental regulations to circumvent stringent environmental regulations [6,7]. Therefore, the pollution haven theory emphasizes the importance of coordination between environmental regulations and international cooperation to avoid the displacement effect of carbon emissions. This means that countries around the world need to work together to develop consistent environmental regulations to reduce the environmental impact of businesses on a global scale. Through the above theories, we can preliminarily see that environmental regulation is an important means to achieve the goal of carbon reduction. However, in reality, due to the constraints of multiple factors, environmental regulations may not be able to achieve carbon emission reduction. To ensure the effectiveness of environmental regulation, the government should consider the multiple interests of society, the economy, and the environment comprehensively. Under the new historical background, this study will choose China, the largest developing country, as a research sample and focus on testing the carbon emission reduction effect of environmental regulations. In addition, as one of the world’s largest manufacturing and resource-consuming nations, China exhibits significant differences in the production and operational models of its resource-based and non-resource-based industries. These industries may encounter distinct challenges in carbon emissions. Comparing the heterogeneity of these two types of industries can assist the government in more targeted design and adjustment of policies to encourage better adaptation of different sectors to environmental pressures.

From the literature, it can be seen that research on the impact of environmental regulation and the influencing factors of carbon emission reduction has always been the focus of academic attention. However, a large number of studies focus on the macroeconomic effects of environmental regulations [8,9] and environmental effects [10,11], and the impact of macro factors on macro carbon emissions [12,13], while little attention is paid to the impact of micro-enterprises. In addition, although some studies have paid attention to research on the carbon reduction effect of environmental regulations, the more common ones are the carbon market [14], emission permit system [15], environmental tax [16], and other market-based environmental regulations promoting regional carbon emission and enterprise behavior. What is most relevant to this paper is that there are few studies on the carbon emission reduction effect of command-and-control environmental regulation and public participation environmental regulation. However, as the most effective and simple environmental regulation, command-and-control regulation is still the focus of government environmental regulation policy. At the same time, the existing studies often ignore the differences in the effects of environmental regulation among different industries and lack detailed research on the needs of diversified industries. Therefore, this paper aims to fill these gaps and provide more comprehensive theoretical and empirical support through in-depth research on the substantive impact of command-and-control environmental regulations on enterprise carbon emissions. At the same time, this paper also focuses on the heterogeneity of resource-based enterprises.

Based on this, this study calculates the regional environmental regulations and carbon emission intensity indicators of listed enterprises in China from 2012 to 2020 and investigates the impact of environmental regulation policies on the carbon emission intensity of enterprises and its transmission mechanism. At the same time, the heterogeneity effect of resource-based enterprises and non-resource-based enterprises is mainly considered. The results of this paper show that China’s environmental supervision has been increasing year by year, and the carbon emission intensity of enterprises can be reduced through the effect of environmental information disclosure, the effect of environmental system establishment, the effect of environmental management concepts, and the effect of resource allocation. At the same time, the impact of environmental regulations on the carbon emissions of enterprises has a significant heterogeneity of resource-based enterprises, enterprise scale, and enterprise nature. In particular, environmental regulations are more conducive to reducing the carbon emission intensity of resource-based enterprises. This paper not only validates the carbon reduction effect of environmental regulations in the new historical context, but also studies and validates the impact mechanism and heterogeneity effect of environmental regulations in reducing the carbon emission intensity of enterprises from a multi-dimensional perspective, providing accurate efforts for the implementation of environmental regulation policies in China and the world.

In summary, there are three possible contributions of this paper: First, from a research perspective, against the backdrop of global carbon reduction, this article uses China, a major global carbon emitter, as a case study. It connects China’s environmental regulations with the micro-level carbon reduction of enterprises, expanding from the perspective of micro-subjects to explore the impact, mechanisms, and heterogeneity effects of environmental regulations on reducing the carbon emission intensity of enterprises. In particular, the existing studies on environmental regulation and carbon emission reduction are mainly at the macro-regional level, and there is still a lack of evidence at the micro-enterprise level of economic activities, which is the basis and key to understanding the former. Second, from the perspective of research content, based on the research framework of “theoretical analysis–empirical analysis”, this study not only fully and robustly tests the impact of environmental regulations on the carbon emission intensity of enterprises but also analyzes and tests the mechanism based on five aspects: the effect of environmental information disclosure, the effect of environmental institution establishment, the effect of environmental management concepts, the effect of resource allocation, and the effect of technological innovation, filling the gap in the existing theoretical research. At the same time, this paper also focuses on the heterogeneity effect of environmental regulation on the carbon emission reduction of resource-based enterprises, which provides an accurate reform direction for the realization of carbon emission reduction targets of various enterprises. Third, from the perspective of research data, on one hand, in this study, Python and other tools are used to sort out the 2012–2021 government work reports of 31 provinces (municipalities) in China, accurately describing the intensity of environmental regulations. On the other hand, this paperstudy also indirectly calculates the carbon emission intensity of enterprises for the first time based on information such as the main cost of the industry, the total energy consumption of the industry, and the main cost and income of enterprises, which makes up for the lack of existing carbon emission intensity data of Chinese enterprises. The above two aspects of data preparation provide accurate data support for the carbon emission reduction effect of environmental regulations.

The remaining contents of this paper are arranged as follows: Section 2 presents a literature review and the theoretical mechanism; Section 3 presents the variables and model; Section 4 presents the empirical analysis results; Section 5 presents the mechanism inspection; Section 6 presents the heterogeneity analysis; Section 7 presents the conclusions and policy suggestions.

2. Literature Review and Theoretical Mechanism

2.1. Literature Review

The research most relevant to this paper can be divided into three categories: the first is the study on the impact of environmental regulation, the second is the study on the influencing factors of carbon emission reduction, and the third is the study on the carbon emission reduction effect of environmental regulation.

The first category is the study of the impact of environmental regulations. Here, we focus on the various aspects of how environmental regulations affect the economy, society, and the environment, excluding discussions on the impact of environmental regulations on carbon emissions. On the one hand, a large number of studies focus on the macroeconomic and environmental effects of environmental regulations. Refs. [8,9] explored the impact of environmental regulations on macroeconomic growth from the perspectives of resource dependence, technological innovation, and energy efficiency, and the corresponding results showed that environmental regulations may produce “U-shaped” nonlinear effects on regional economic growth. Similarly, [10] established a spatial Durbin model and found that the impact of environmental regulations on carbon productivity under different conditions presents a “U-shaped” curve. On the contrary, the authors of [11] believe that environmental regulation is an effective tool to reduce regional PM2.5. On the other hand, a large number of scholars pay attention to the impact of different types of environmental regulations on enterprise behavior, so as to deeply explore the inhibition or incentive effect of environmental regulations on technological innovation and production efficiency. In terms of inhibitory effects, the authors [17], using the observational data of American factories, found that the Clean Air Act reduced the total factor productivity of manufacturing enterprises, a conclusion that weakened the argument that environmental regulation is cost-free or even beneficial to regulation. At the same time, the “pollution haven” hypothesis also proves that in the short term, stricter environmental regulations will increase the production cost of enterprises, causing enterprises to move out of the local area to the area with more relaxed environmental regulations [18], and the relocation of enterprises is not conducive to local economic development. Of course, different from the inhibition effect, the theory of “innovation compensation” holds that environmental regulations will “force” enterprises to increase R&D investment in cleaner production, change their production mode, and make up for the negative effect of “compliance cost” [1]. At the same time, this can improve the environment [19].

The second category involves the study of factors influencing carbon emissions. Here, our focus is primarily on examining the impact of factors other than environmental regulations on carbon emissions. Recently, research on the influencing factors of carbon emission reduction has become an academic hot spot. However, due to the constraints of carbon emission data acquisition, most studies stay at the macro level. Ref. [12], based on the panel data of prefecture-level cities in China, analyzes the promoting effect of banking competition on local and neighboring carbon emissions. Refs. [20,21] also investigated the promotion effect of the regional digital economy on carbon emission scale and carbon emission intensity based on macro data. Of course, [13] also analyzed the impact of landscape heterogeneity and fragmentation on carbon emissions from a regional perspective. Generally, the lower the landscape heterogeneity and fragmentation, the lower the concentration of urban built-up areas, which is more conducive to carbon emission reduction. Of course, a small number of studies also analyze the influencing factors of carbon emissions of enterprises [22] and analyze the carbon emission reduction effect of digital economy development from the perspective of enterprise digitalization. Ref. [23] also found that carbon price and technological innovation have significant effects on emission reduction from the perspective of enterprises. These factors provide ample empirical support for understanding enterprise emission reduction.

The third category focuses on discussing the impact of environmental regulations on carbon emissions. Literature in this category exhibits various emphases and differences that require further delineation. In fact, this research has been the focus of scholars’ attention. A large number of studies have discussed the implementation methods of different types of environmental regulations (including command-and-control, market incentive, and public participation) and their effects in different industries. The more common ones are carbon markets [14], emission permit systems [15], environmental taxes [16], and other market-based environmental regulations promoting regional carbon emissions and enterprise behavior. For example, Ref. [16] found that environmental protection taxes, resource taxes, vehicle and ship taxes, and urban land use taxes are basically detrimental to a reduction in carbon emission intensity in the region and its surrounding areas, while urban maintenance and construction taxes and farmland occupation taxes are conducive to a reduction in carbon emission intensity. In addition, what is most relevant to this paper is the study on the carbon reduction effect of command-and-control environmental regulation. Relevant literature pays more attention to the impact of regulatory standards on industrial structure transformation [24], enterprise technological innovation, and carbon emissions [25]. Of course, a small number of people pay attention to the carbon emission reduction effect of the environment with public participation [26]. It was found that environmental regulation with public participation can reduce carbon emissions through the dual channels of promoting industrial structure transformation and renewable energy substitution. All these studies provide a lot of concrete empirical experience for the formulation of environmental regulation policy.

Although a large number of studies have explored environmental regulation and emission reduction, there are still some research gaps. First of all, limited by the lack of carbon emission data of micro-enterprises, there is a lack of research and analysis on the impact of environmental regulations on carbon emission of micro-enterprises, and there is a lack of detailed theoretical mechanism analysis. Secondly, existing studies on environmental regulation mainly focus on the market incentive type of environmental regulation, and there is little analysis on the command-and-control type and the public participation type of environmental regulation. However, as the most effective and easiest type of environmental regulation, command-and-control regulation is still the focus of the government’s environmental regulation policy. Finally, existing studies often ignore the differences in environmental regulation effects between different industries and lack detailed research on the needs of diversified industries. Therefore, this paper aims to fill these gaps and provide more comprehensive theoretical and empirical support through in-depth research on the substantive impact of command-and-control environmental regulations on enterprise carbon emissions. At the same time, this paper also focuses on the heterogeneity of resource-based enterprises. Through this paper, we hope to better guide the formulation of future environmental policies to achieve the sustainable development of enterprises and an effective reduction in global carbon emissions.

2.2. Theoretical Mechanism

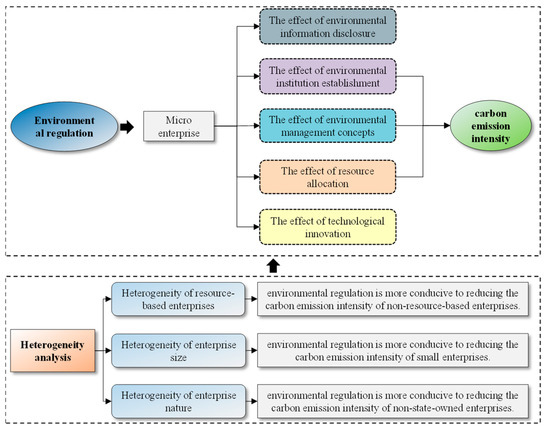

Based on the analysis of the literature review, this paper concludes that the effects and theoretical mechanisms of environmental regulations affecting enterprise carbon emissions are still unclear. Based on the theory of environmental economics, this part attempts to discuss the theoretical mechanism by which environmental regulation reduces enterprise carbon emissions from five perspectives: the environmental information disclosure effect, the environmental system establishment effect, the environmental management concepts effect, the resource allocation effect, and the technological innovation effect (Figure 2).

Figure 2.

Theoretical framework diagram. Source: self-drawn by the author.

First, there is the effect of environmental information disclosure. Environmental regulations can urge enterprises to disclose environmental information in a timely manner, and environmental information disclosure can reduce the carbon emission intensity of enterprises by easing the financing pressure of enterprises and strengthening the supervision of enterprises by the government and the public. On the one hand, environmental regulation, as a kind of external pressure, has a significant impact on the environmental information disclosure of enterprises. Studies have shown that the strengthening of environmental regulations often prompts enterprises to be more proactive in disclosing their environmental performance and sustainable business strategies. For example, [27] found that environmental regulations have a positive incentive on enterprise disclosure behavior, pushing enterprises to disclose more environment-related information to the public, investors, and regulators. Such proactive disclosure not only meets the requirements of regulations, but also builds the trust relationship between enterprises and stakeholders, laying the foundation for reducing the carbon emission intensity of enterprises. On the other hand, another important effect of environmental information disclosure is to reduce the carbon emission intensity of enterprises to a certain extent by influencing the financing pressure of enterprises and strengthening the supervision of the government and the public. By disclosing environmental information, enterprises can improve transparency, enhance investors’ trust in enterprises, and reduce financing costs [28]. At the same time, government and public regulation of enterprise carbon emissions is also more robust, because increased transparency makes it easier for enterprises that do not meet environmental standards to be subject to regulatory sanctions. Therefore, the disclosure of environmental information not only plays a supervisory role in the internal operation of enterprises, but also forms an external restraint mechanism that encourages enterprises to increase emission reduction efforts and achieve a reduction in carbon emissions. Based on this, this paper proposes the following hypothesis:

Hypothesis H1.

Environmental regulation can reduce the carbon emission intensity of enterprises by promoting timely disclosure of environmental information.

Second, there is the effect of environmental institution establishment. Environmental regulation can urge enterprises to establish environmental systems, and the establishment of environmental systems can strengthen environmental management and reduce the carbon emission intensity of enterprises. On the one hand, environmental regulation plays an incentive role at the enterprise level, urging them to establish a perfect environmental system. The research shows that enterprises subject to the constraints of environmental regulations are more inclined to standardize their own environmental management system to adapt to the improvement of environmental protection requirements of regulations. For example, Ref. [29] points out that the strengthening of environmental regulations is positively correlated with the soundness of an enterprise’s environmental management system. Therefore, environmental regulation, as an external pressure, encourages enterprises to establish a more systematic and effective environmental system, laying the foundation for the realization of carbon emission reduction. On the other hand, establishing a sound environmental system is crucial for a reduction in the carbon emission intensity of enterprises. This system is not only a means to cope with the requirements of regulations, but also an important way for enterprises to proactively manage environmental affairs. Through the environmental system, enterprises can systematically identify, evaluate, and manage carbon emission sources and implement corresponding technical and management measures. Relevant studies have pointed out that enterprises with sound environmental systems are more inclined to implement carbon emission reduction measures and improve energy efficiency, thus significantly reducing carbon emission levels [30]. Therefore, the establishment of environmental systems can not only help enterprises fulfill their legal responsibilities, but also promote the realization of carbon emission reduction targets internally and provide support for the sustainable development of enterprises in the low-carbon economy era. Based on this, this paper proposes the following hypothesis:

Hypothesis H2.

Environmental regulation can reduce the carbon emission intensity of enterprises by promoting the establishment of environmental systems.

Third, there is the effect of environmental management concepts. Environmental regulations can enhance the management concepts of enterprises in areas such as environmental protection and social responsibility, thereby reducing the carbon emission intensity to a certain extent. On the one hand, environmental regulations play a crucial role in shaping the management concepts of enterprises, particularly by enhancing their coordinated capabilities in environmental protection, social responsibility, and corporate governance. Research indicates that enterprises guided by environmental regulations are more inclined to strengthen the identification and management of environmental risks to meet evolving regulatory requirements [31]. These management concepts help reduce the probability of environmental pollution incidents, creating favorable conditions for maintaining environmental reputation and sustainable development, thus laying the foundation for reducing carbon emission intensity. On the other hand, the strengthening of management concepts in areas like environmental protection and social responsibility directly influences the level of carbon emission intensity. Studies have pointed out that companies with higher environmental management concepts are more inclined to adopt clean production technologies and measures to improve energy efficiency, thereby reducing carbon emissions levels [32]. These environmental management concepts not only facilitate enterprises in proactively fulfilling social responsibilities but also enhance their competitiveness, enabling better adaptation to changes in the carbon emission market. Therefore, by enhancing the environmental management concepts of enterprises, environmental regulations have, to a certain extent, driven the reduction in carbon emissions of companies, achieving a win-win situation for both environmental protection and economic benefits. Based on this, this paper proposes the following hypothesis:

Hypothesis H3.

Environmental regulation can reduce the carbon emission intensity of enterprises by enhancing their environmental management concepts.

Fourth, there is the effect of resource allocation. Environmental regulation can improve the resource allocation efficiency of enterprises, and the improvement of resource allocation efficiency can not only reduce waste in the production process, but also optimize the production line and improve energy utilization, thus reducing the adverse impact on the environment, including reducing carbon emission intensity. On the one hand, environmental regulation has played a positive role in encouraging enterprises to improve their resource allocation efficiency. Studies have shown that enterprises constrained by environmental regulations are more inclined to optimize internal resource allocation and reduce waste in the production process to adapt to more stringent environmental standards [1]. Through external pressure on enterprises, environmental regulation gives birth to the innovation of internal management so that enterprises pay more attention to the efficient use of resources. This internal and external synergistic effect enables enterprises to allocate resources more effectively, improve production efficiency, and lay the foundation for environmentally friendly production. On the other hand, the improvement of enterprise resource allocation efficiency can not only reduce waste in the production process, but also effectively reduce the adverse impact on the environment, including reducing carbon emission intensity, by optimizing production lines and improving energy utilization. It is found that enterprises with efficient resource allocation are more likely to adopt cleaner production technologies and implement energy management measures, thereby reducing emissions of greenhouse gases such as carbon dioxide in the production process [33]. Therefore, by improving the efficiency of resource allocation, enterprises not only gain advantages in economic benefits, but also make substantial contributions to a reduction in carbon emissions. Based on this, this paper proposes the following hypothesis:

Hypothesis H4.

Environmental regulation can reduce the carbon emission intensity of enterprises by improving their resource allocation efficiency.

Fifth, there is the effect of technological innovation. Environmental regulation can improve the level of technological innovation of enterprises, and the promotion of technological innovation can directly and indirectly reduce the carbon emission intensity of enterprises by improving the efficiency of resource utilization, promoting the adoption of cleaner production technology, and promoting the application of renewable energy. On the one hand, environmental regulation plays an important guiding role in promoting the technological innovation of enterprises. Studies have shown that enterprises under pressure from environmental regulations are more inclined to invest more in technological innovation to adapt to increasingly stringent environmental standards [1]. As an external driving force, environmental regulation stimulates enterprises’ demand for new technologies and encourages them to innovate in production and management. This technological innovation not only makes enterprises more competitive, but also provides technical support and leadership for enterprises in reducing carbon emission intensity. On the other hand, the promotion of enterprise technological innovation can directly and indirectly reduce carbon emission intensity through a variety of ways. First, technological innovation can improve the efficiency of resource utilization and reduce energy consumption and material waste in the production process [34]. Second, the adoption of cleaner production technologies, such as low-carbon production processes and efficient energy utilization technologies, helps to reduce the generation of emissions and thus reduces the carbon emission level of enterprises [35]. Finally, by promoting the application of renewable energy, technological innovation can reduce enterprises’ dependence on traditional high-carbon energy sources and reduce overall carbon emissions. Therefore, environmental regulation creates favorable conditions for enterprises to reduce carbon emissions by improving the technological innovation level of enterprises. Based on this, this paper proposes the following hypothesis:

Hypothesis H5.

Environmental regulation can reduce the carbon emission intensity of enterprises by improving their technological innovation level.

3. Variables and Modeling

3.1. Indicator Measurement

- (1)

- Carbon intensity of enterprises (carbon). The existing research on carbon emission indicators of listed enterprises in China is mainly divided into two categories: the first category of indicators is directly expressed by using the carbon emissions published in the annual reports of listed enterprises. However, these data are seriously missing and not feasible enough. The second type is based on the first type, for enterprises that have not announced their carbon emissions, using their different types of fossil energy consumption, electricity consumption, heat consumption, and other data to indirectly convert carbon emissions. In this paper, we draw on the second type of methodology to approximate the carbon emissions of Chinese listed enterprises based on industry energy consumption [22,36], and to measure the carbon intensity of enterprises using the ratio of their carbon dioxide emissions to their main business revenues [37].

Step 1: Use the following formula for estimating enterprise carbon dioxide emissions (co2) using the industry energy consumption approximation:

where i, j, and t denote the enterprise, industry, and year, respectively. cost_f denotes the main business cost of the enterprise, and the data are from the CSMAR database; cost_i denotes the main business cost of the industry to which the enterprise belongs. The data come from the China Industrial Economy Statistical Yearbook. TEC denotes the total energy consumption of the industry to which the enterprise belongs, and the data come from the China Energy Statistical Yearbook. The carbon dioxide conversion factor of 1 tonne of standard coal is 2.493, which is widely accepted at present.

Step 2: Measure the carbon intensity (carbon) of an enterprise using the ratio of its carbon dioxide emissions to its main business income, with the following formula:

where income_f denotes the main business income of the enterprise, and the data are obtained from the CSMAR database. A larger value of carbon obtained from Equation (2) indicates a greater carbon emission intensity of the enterprise and more serious pollution.

Environmental regulation (re1, re2, lnre3, re4). At present, environmental regulation is usually divided into three categories: command-and-control type, market incentive type, and public participation type. Specifically, the command-and-control type includes legal regulatory policies and administrative regulatory policies. Market incentives include government subsidies, environmental taxes and fees, and tradable permits, while public participation includes information disclosure systems and environmental hearing systems. However, from the perspective of China’s practice, the market incentive and public participation types of environmental regulation are relatively few and weak, and the command-and-control type of environmental regulation is still dominant. Therefore, the command-and-control type of environmental regulation is still chosen as the research object in this paper. Ref. [38] used the ratio of the total number of words of five terms—environment, energy consumption, pollution, emission reduction, and environmental protection—to the total number of words in the full text as a proxy variable for government environmental regulation. Drawing on this measurement practice, in this paper, the proportion of environment-related words to the total number of words in the full text of government reports is selected to represent environmental regulation. Specifically, the measurement method is as follows:

Step 1: Manually collect government work reports of 31 provinces (cities) in China from 2012 to 2021.

Step 2: Subject the text of the government work reports to word splitting.

Step 3: Count the frequency of occurrence of environment-related words. In this paper, a total of 15 environment-related terms were selected: environmental protection, environmental protection, pollution, energy consumption, emission reduction, sewage discharge, ecology, green, low-carbon, air, chemical oxygen demand, sulfur dioxide, carbon dioxide, PM10, and PM2.5.

Step 4: Calculate the frequency of environment-related words and the ratio to the total number of word frequencies in the full government report (re1). Of course, to ensure the robustness of the results, this paper also inscribes the frequency of environment-related words and the ratio to the total number of word frequencies in the full text of the government report (re2) again on the basis of accurate identification of word frequencies. In addition, in this paper, the logarithmic value of the frequency sum of environment-related words (lnre3) and the ratio of the total number of words of environment-related words to the total number of words in the full text of government reports (re4) are chosen to represent the environmental regulation variables.

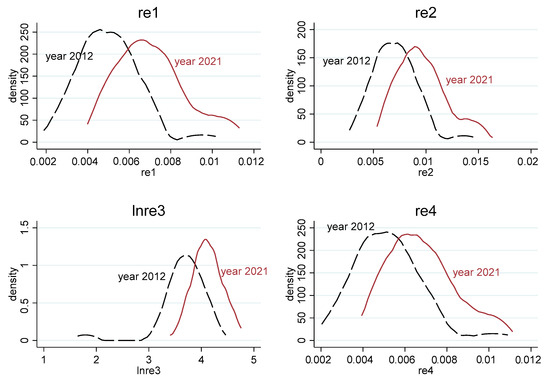

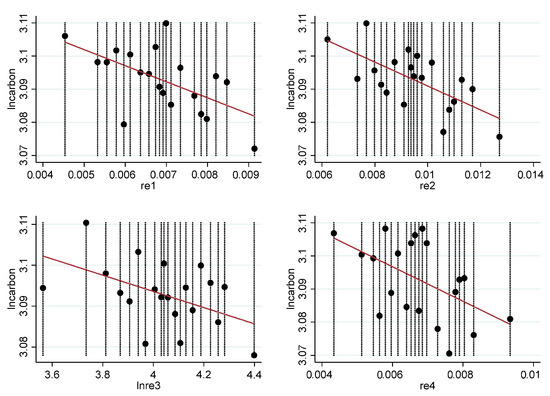

Figure 3 plots the kernel density profiles of the four environmental regulation variables. It can be observed that the proportion and total number of environment-related words in the government work reports are increasing. This is very much in line with the Chinese government’s increasing attention to environmental issues.

Figure 3.

Kernel density profiles for environmental regulation variables. Source: self-drawn by the author.

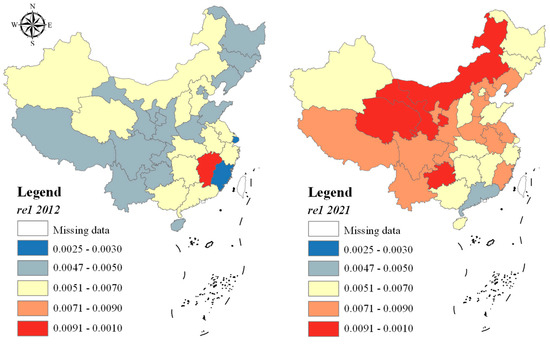

Figure 4 plots the spatial distribution of environmental regulation variables from 2012 to 2021. It can be seen that from 2012 to 2021, the level of environmental regulation in China’s provinces has been greatly improved. This shows that the Chinese government attaches great importance to environmental governance.

Figure 4.

Spatial distribution of environmental regulation variables from 2012 to 2021. Source: self-drawn by the author.

3.2. Model Setting

To study whether environmental regulation can reduce the carbon emission intensity of enterprises, the following fixed effect model is constructed:

where i denotes enterprises, p denotes province (city), and t denotes year. The explanatory variable lncarbon denotes the natural logarithmic value of the carbon emission intensity of enterprises; the core explanation re1 denotes the level of environmental regulation of enterprises. This paper involves a total of two levels of control variables at the enterprise (X) and province (Y) levels. Among them, there are six variables at the enterprise level: enterprise size (lnsize) is expressed using the natural logarithm of the total assets of the enterprise. Cash flow ratio (cash) is measured using the ratio of net cash flow from operating activities to total assets of the enterprise. The nature of the enterprise (owned) is measured using the nature of the enterprise’s equity, taking a value of 1 for a state-owned enterprise and a value of 0 for a state-owned enterprise. Growth rate (grow) is expressed using the growth rate of the enterprise’s total assets. Enterprise age (lnage) is measured as the natural logarithm of the difference between the sample year and the listing year of the enterprise. The degree of shareholding concentration (HHI10) is expressed using the proportion of shares held by the top ten shareholders. There are four variables at the provincial level: The level of foreign investment (fdi) is measured using the share of provincial FDI in GDP. Industrial structure sophistication (indu) is measured using the share of provincial tertiary industry value added to secondary industry value added. The urbanization rate (urban) is measured by the proportion of the urban population to the total population. The level of economic development (lnrgdp) is measured using the natural logarithm of provincial GDP. FEindu, FEpro, FEyear, and FEenterprise denote two-digit industry, province (city), year, and enterprise fixed effects, respectively, and the four fixed effects are controlled for to eliminate the effects of other factors. In addition, this paper introduces robust standard errors clustered to the enterprise-year level in the regressions to ensure the significance of the results.

The core explanatory variable in this paper is provincial (city) data, while the explanatory variable is enterprise data. Although it is difficult for a single enterprise to influence the policy direction of the whole province (city), it is still difficult to exclude endogeneity problems such as “omitted variables”. To eliminate the possible endogeneity problem, instrumental variable regression is adopted in this study. In general, the lag of the core explanatory variables is used as an instrumental variable, which meets the requirements of “correlation” and “exogeneity”. In addition, in this paper, the air mobility coefficient is also chosen as an instrumental variable for environmental regulation based on the results of related literature. Generally speaking, the lower the air mobility coefficient is, the more difficult it is for pollution to spread, forcing the local government to adopt stricter environmental regulations. However, the air mobility coefficient, as a regional climate indicator, does not affect the carbon intensity of enterprises. The amount of carbon dioxide emitted by enterprises is usually determined by government policy and individual circumstances.

3.3. Data Sources

Given the available data, this paper focuses on Chinese A-share listed companies on the Shanghai and Shenzhen stock exchanges in the period from 2012 to 2021 across 31 provinces (city) (data for Hong Kong, Macau, and Taiwan are not available). (In calculating the indicator of enterprise carbon emission intensity in this study, we rely on the main operating costs of the industry to which the enterprise belongs, sourced from the “China Industrial Economic Statistical Yearbook”. Currently, the “China Industrial Economic Statistical Yearbook” only publishes the main operating costs for industries after the year 2012. Therefore, the research sample for this paper covers the period from 2012 to 2021. This point is also confirmed in existing literature [22], where the research sample spans from 2012 to 2020.) The relevant enterprise annual reports and financial information are from the CSMAR database. In addition, this paper also includes a method of deleting the original data: (1) excluding the samples with missing indicators in this paper; (2) excluding ST and *ST samples; and (3) retaining only the manufacturing samples. Table 1 shows the descriptive statistics of this paper, containing 17,479 samples. The mean, maximum, minimum, and standard deviation of all indicators are within a reasonable range.

Table 1.

Results of descriptive statistics.

3.4. Correlation Analysis

Before the econometric regression was carried out, a linear fitting graph of environmental regulation and enterprise carbon emission intensity was drawn, as shown in Figure 5. From Figure 5, it can be seen that there is an obvious negative relationship between environmental regulation and enterprise carbon emission intensity. This is a preliminary indication that environmental regulation is likely to reduce enterprise carbon emissions. This result remains robust even if the explanatory variables are replaced in this study.

Figure 5.

Linear fit of environmental regulation to enterprises’ carbon intensity. Source: self-drawn by the author. Note: The black circle represents the ordinate mean under each abscissa value, the black line is the abscissa value, and the red line is the fitted curve.

4. Results of Empirical Analyses

4.1. Benchmark Regression Results

Table 2 reports the results of the econometric regression of environmental regulation on enterprises’ carbon emission intensity. For this table, a stepwise regression method was employed. Column (1) reports the results of the impact of environmental regulation on enterprises’ carbon emission intensity while controlling only for industry fixed effects, and the regression coefficients are significantly negative at the 1% significance level; columns (2)–(4) add controls for province, year, and enterprise fixed effects in turn; and columns (5) and (6) add controls for enterprise and province control variables in turn. As shown by the results in column (6), the R2 of the model keeps increasing, and the explanatory degree of the model keeps improving. The regression coefficients of environmental regulation on the carbon emission intensity of enterprises are always significantly negative at the 1% significance level. This indicates that the implementation of strict environmental regulation policies by the local government can significantly reduce the carbon emission intensity of enterprises, which is consistent with the expectation of this paper. At the same time, taking the estimated coefficient in column (6) as an example, for each increase of 0.01 units in the frequency of province-related environmental terms in government reports (re1), enterprise carbon intensity decreases by 2.9981%. This estimated coefficient falls within a reasonable range, once again affirming the validity of the estimations presented in this study. In addition, the results of the control variables in this paper are also basically in line with expectations. The higher the enterprise size, enterprise cash flow ratio, enterprise growth rate, and local economic development level, the easier it is to reduce the carbon emission intensity of enterprises; on the contrary, for state-owned enterprises, enterprises listed for a longer time, and enterprises with more concentrated shareholding, the intensity of enterprise carbon emissions will increase.

Table 2.

Results of baseline regression.

4.2. Replacing Variables

To ensure the robustness of the findings, in this paper, re2, lnre3, and re4 are also selected to represent the environmental regulation variables on the basis of re1. The estimation results after re-regression are shown in columns (1)–(3) of Table 3. It can be found that the core conclusion “environmental regulation can reduce the carbon intensity of enterprises” has not changed. Meanwhile, considering that re1, re2, lnre3, and re4 are all related to environmental vocabulary, they are susceptible to interference from the selection of environmental vocabulary. To address this, for this paper, data on completed investments in industrial pollution control and industrial added value were obtained from the China National Bureau of Statistics for the years 2012–2021. The ratio of completed investments in industrial pollution control to industrial added value is used as a measure of environmental regulation (re5). The estimated results after the regression are shown in column (4) of Table 3. The research conclusions remain robust.

Table 3.

Results of replacing variables and controlling for joint effects.

Furthermore, considering that the dependent variable in this study, i.e., enterprise carbon emission intensity, is derived through indirect calculations, despite being validated in the literature [22], there may still be errors. Thus, with reference to the practice presented in [39], based on information disclosed in various sources such as annual reports and social responsibility reports of publicly listed enterprises, in this study, data are compiled to calculate enterprise carbon emissions (Enterprise Carbon Emissions = carbon emissions from combustion and fugitive sources + carbon emissions from production processes + carbon emissions from waste + carbon emissions from changes in land use). Here, carbon emissions from combustion and fugitive sources include fossil fuel carbon emissions, biomass fuel carbon emissions, raw material extraction escape emissions, oil and gas system escape emissions and electricity transfer indirect carbon emissions. Carbon emissions from waste include emissions from solid waste incineration and emissions from sewage treatment. Carbon emissions from changes in land use are the carbon emissions from the conversion of forests to industrial land. This value is then divided by the main business revenue to obtain enterprise carbon emission intensity (carbon1). The estimated results after regression are presented in column (5) of Table 3. The research conclusions remain robust. In summary, the core conclusion of this paper, that “environmental regulation can reduce enterprise carbon emission intensity”, is not affected by variable selection and remains robust throughout.

4.3. Further Control for Joint Effects

Although the baseline regression results in this paper have already controlled for the control variables at the provincial (city) and enterprise levels, as well as the two-digit industry, province (city), year, and enterprise fixed effects, it is still not possible to completely avoid the problem of “omitted variables”. Therefore, on the basis of the baseline regression, this study further gradually incorporates industry–province effects, enterprise–province effects, and enterprise–industry effects. The estimation results after re-regression are shown in columns (6)–(8) of Table 3. The core conclusion that “environmental regulations can reduce the carbon intensity of enterprises” still holds.

4.4. Instrumental Regression

In addition to controlling for joint effects, instrumental regression is an important way to eliminate the problems of “omitted variables” and “two-way causation”. As described in the model setting section, the lagged period of environmental regulation and the air mobility coefficient are chosen as instrumental variables. The estimation results after regression of instrumental variables are shown in Table 4. From the results of the first regression, the single lag period of environmental regulation is significantly and positively related to environmental regulation, and the air mobility coefficient is significantly negatively related to environmental regulation. The F-statistic of the corresponding equation also passes the test. Therefore, the two instrumental variables selected for this paper meet the requirement of “correlation”, and the Cragg–Donald Wald F-statistic and Kleibergen–Paap rk Wald F-statistic are both greater than the critical value of 1%, so the original hypothesis of weak instrumental variables is rejected. In addition, the Anderson canon. corr. LM statistic significantly rejects the over-identification hypothesis in terms of the exogeneity test indicators. Taking the second-stage estimated coefficient in column (2) as an example, for each increase of 0.01 units in re1, enterprise carbon intensity decreases by 11.9148%. In comparison to OLS regression, it is found that without considering endogeneity, the decarbonization effect of environmental regulations may be underestimated. However, the core conclusion of this paper, “environmental regulations can reduce enterprise carbon intensity”, remains robust.

Table 4.

Results of instrumental variable regression. The asterisks **, and *** denote statistical significance at the 5%, and 1% levels, respectively.

4.5. Restricted Sample Regression

Of course, the choice of the study sample also interferes with the results of the econometric regression. To avoid the error caused by sample selection, this study also adopts a variety of restricted sample regressions. First, the outbreak of the COVID-19 pandemic at the end of 2019 led to the reduced or halted operations of numerous Chinese enterprises, which to a certain extent also reduced the carbon emissions of enterprises. To eliminate the effect of COVID-19, the 2020 and 2021 samples are deleted in this study. The estimation results after re-running the regression are shown in column (1) of Table 5. It can be found that the core conclusion “environmental regulation can reduce the carbon intensity of enterprises” has not changed. Second, due to China’s special administrative hierarchy, the four municipalities of Beijing, Shanghai, Tianjin, and Chongqing have a large number of listed enterprises in China despite their small spatial scope. Therefore, to eliminate the interference of the effect of the four municipalities on a large sample of heterogeneous listed enterprises, the sample of the four municipalities is deleted in this study. The estimation results after re-running the regression are shown in column (2) of Table 5. It can be found that the core conclusion “environmental regulation can reduce the carbon intensity of enterprises” has not changed. Third, although this study controls for clustering standard errors and clusters to the enterprise-year level, it still cannot guarantee the robustness of the results. For this reason, in this study, the robust standard error clustering level is adjusted to the smallest enterprise level. The estimation results after re-running the regression are shown in column (3) of Table 5. It can be found that the core conclusion “environmental regulation can reduce the carbon intensity of enterprises” has not been changed. Fourthly, considering the interference of the extreme values of the indicators, we shrink the extreme values of the indicators by 1%. The estimation results after regression are shown in column (4) of Table 5. It can be found that the core conclusion “environmental regulation can reduce the carbon intensity of enterprises” has not changed. Fifth, part of the existing literature mentions that the abatement effect of environmental regulation may be nonlinear. To eliminate this effect, in this study, the quadratic term of environmental regulation is introduced to conduct a nonlinear regression. The estimation results after re-running the regression are shown in column (5) of Table 5. The core conclusion that “environmental regulations can reduce the carbon intensity of enterprises” remains unchanged.

Table 5.

Results of limit sample regression. The asterisks **, and *** denote statistical significance at the 5%, and 1% levels, respectively.

5. Mechanism Test

Based on the five hypotheses proposed by the theoretical mechanism, in this study, several mechanism variables are further selected to test the mechanism of environmental regulation’s impact on enterprise carbon emission intensity.

5.1. The Effect of Environmental Information Disclosure

Research hypothesis 1 proposes that environmental regulation can urge enterprises to disclose environmental information in a timely manner and that environmental information disclosure can reduce the carbon emission intensity of enterprises by alleviating the pressure of enterprise financing and strengthening the regulation of enterprises by the government and the public. To test this hypothesis, in this study, the enterprise environmental information disclosure composite score is adopted to measure the level of enterprise environmental information disclosure to the outside world, and the data are obtained from the CSMAR database. Specifically, enterprise environmental information is divided into two categories and five aspects: indicators in environmental liability disclosure, environmental performance, and governance disclosure are monetized information, and indicators in environmental management disclosure, environmental certification disclosure, and environmental information disclosure carriers are non-monetized information. For monetized information, quantitative and qualitative disclosures are assigned a value of 2, qualitative indicators are assigned a value of 1, and indicators not disclosed are assigned a value of 0. For non-monetized information, indicators disclosed are assigned a value of 2, and indicators not disclosed are assigned a value of 0. There are 25 scoring items for the two categories of five indicators, and the aggregated score of the 25 items is the comprehensive score of the enterprise’s environmental information disclosure (EDI). Column (1) of Table 6 reports the results of the regression of environmental regulation on EDI, and the regression coefficients confirm the expectation of research hypothesis 1. Further, this paper also focuses on the “enterprise CO2 emissions” disclosure score (Disco2) among the 25 disclosure items mentioned above as a robustness indicator. Enterprises are scored as 0 if they do not disclose their enterprise CO2 emissions, 1 if they have a qualitative description, and 2 if they have a quantitative description. Column (2) of Table 6 reports the results of the regression of environmental regulation on Disco2, and the regression coefficients reconfirm the expectations of research hypothesis 1.

Table 6.

Results of mechanism test 1. The asterisks *, **, and *** denote statistical significance at the 10%, 5%, and 1% levels, respectively.

5.2. The Effect of Environmental Institution Establishment

Research hypothesis 2 proposes that environmental regulation can urge enterprises to establish environmental institutions and that the establishment of an environmental system can strengthen environmental protection management, thus reducing the carbon emission intensity of enterprises. To test this hypothesis, this study considers whether the enterprise establishes an emergency response mechanism for environmental incidents (Emerg) and whether the enterprise establishes the “three simultaneous” environmental management system (Three) to indicate the level of establishment of the enterprise’s environmental system, and if the enterprise establishes the corresponding systems, it is assigned a value of 1 to 2. If a corresponding system is established, the value is 1; otherwise, the value is 0. The data are obtained from the CSMAR database. Columns (3) and (4) of Table 6 report the results of the regression of environmental regulation on Emerg and Three, and the regression coefficients confirm the expectations of research hypothesis 2.

5.3. The Effect of Environmental Management Concepts

Hypothesis 3 proposes that environmental regulations enhance management concepts in areas such as environmental protection and social responsibility, leading to a certain degree of reduction in the carbon emission intensity of enterprises. To verify the hypothesis, the ESG level of enterprises (ESG) is adopted in this paper to indicate enterprise environmental management concepts. ESG (Environmental, Social, and Governance) represents sustainable development at the micro-level of enterprises. ESG requires that enterprises go beyond the traditional notion of prioritizing profit as the sole objective and emphasizes contributions to the environment and society in the production process. For this paper, we choose the nine-point data provided by the China Securities ESG evaluation system to portray the ESG level of enterprises, and the data are obtained from the CSMAR database. A higher ESG score represents stronger environmental management concepts of the enterprise. Column (5) of Table 6 presents the regression results of environmental regulation on ESG, with the regression coefficients confirming the expectation of hypothesis 3.

5.4. The Effect of Resource Allocation

Research hypothesis 4 proposes that environmental regulation enhances the resource allocation efficiency of enterprises. The increase in its resource allocation efficiency not only reduces waste in the production process, but also optimizes production lines and improves energy use. This reduces the adverse impacts on the environment, including the reduction in carbon emission intensity. To test the hypothesis, five methods, namely ordinary least squares (lntfp_ols), fixed effects ((lntfp_fe), LP (lntfp_lp), OP (lntfp_op), and GMM (lntfp_GMM), are used in this study to measure enterprises’ total factor productivity to characterize enterprises’ resource allocation efficiency. Table 7 reports the results of the regression of environmental regulation on the five total factor productivity measures, and the regression coefficients confirm the expectations of research hypothesis 4.

Table 7.

Results of mechanism test 2. The asterisks **, and *** denote statistical significance at the 5%, and 1% levels, respectively.

5.5. The Effect of Technological Innovation

Research hypothesis 5 proposes that environmental regulation can enhance the level of technological innovation of enterprises. The enhancement of technological innovation can directly and indirectly reduce the carbon emission intensity of enterprises by improving the efficiency of resource utilization, promoting the adoption of cleaner production technologies, and promoting the application of renewable energy. To test the hypothesis, we match the patent data of enterprises published on the patent search network of the State Intellectual Property Office and obtain the data of enterprises’ annual total number of patents applied (Patents1), total number of patents obtained (Patents2), total number of patents authorized (Patents3), and total number of patents for green inventions obtained (Patents4) in turn. The data above are processed by taking the natural logarithm to characterize the level of technological innovation of enterprises. Table 8 reports the regression results of environmental regulation on the four technological innovation indicators; the regression coefficients do not pass the 10% significance level test, and research hypothesis 5 is rejected. This indicates that China’s current environmental regulation does not really realize the effect of technological innovation, which is also the direction in which China’s environmental regulation needs to be further strengthened in the future. This study found that environmental regulations did not stimulate technological innovation, deviating slightly from the research hypothesis. Some existing relevant literature has indeed found that environmental regulation policies do stimulate technological innovation [2]. One possible explanation for this discrepancy is that corruption associated with stringent environmental regulations impedes their promotional effect on technological innovation. Ref. [4] found that in China, strict environmental regulations promote enterprise innovation only when interacting with regions characterized by severe corruption. The study sample in this paper covers the period from 2012 to 2021, a time when the Xi Jinping government in China implemented a series of rigorous anti-corruption actions, significantly reducing the level of corruption. Therefore, this study concludes that environmental regulations did not stimulate technological innovation. The findings of [5] also support the notion that developing countries can stimulate innovation by reducing environmental regulatory costs through bribery.

Table 8.

Results of mechanism test 3.

6. Heterogeneity Analysis

6.1. Heterogeneity of Resource-Based Enterprises

Theoretically, resource-based enterprises are more afraid of the government’s environmental regulation policy, and they need to pay more pollution reduction costs to fulfill the emission reduction target. Therefore, to a certain extent, environmental regulation is more conducive to reducing the carbon emission intensity of resource-based enterprises. To verify this conjecture, this paper firstly introduces the enterprise industry classification variable (resour) and the interaction term between environmental regulation and enterprise industry classification (re1 × resour) sequentially on the basis of the baseline model Equation (3) where resour = 1 if the enterprise is resource-based and resour = 0 otherwise. Column (1) of Table 9 reports the regression results for heterogeneity of resource-based enterprises, and the coefficients of the interaction term are significantly positive, contrary to the coefficients of the environmental regulation variable. This indicates that in China, the reality is the opposite of the theoretical conjecture, and environmental regulation is more conducive to reducing the carbon emission intensity of non-resource-based enterprises. The possible reason is that non-resource-based enterprises usually focus more on technological innovation and flexibility to adapt to changing market demands, making it easier for them to adopt cleaner production technologies and energy efficiency measures. At the same time, non-resource-based enterprises compete in the marketplace with a greater focus on social image and sustainability and are more proactive in adopting carbon emission reduction measures to maintain a favorable image to meet growing environmental expectations and market demands. By optimizing their large and complex supply chains, non-resource-based enterprises are able to reduce carbon emissions more effectively, for example, by choosing environmentally friendly suppliers and improving logistics efficiency. In addition, compared to resource-based enterprises, non-resource-based enterprises do not rely on energy-intensive natural resource extraction and processing for their production activities, making it easier for them to reduce carbon emissions by adopting cleaner energy sources and improving energy efficiency. Therefore, in the face of stricter environmental regulations and regulatory pressures, non-resource-based enterprises are more likely to endeavor to fulfill their environmental responsibilities to avoid potential legal risks, which pushes them to adopt proactive carbon reduction measures.

Table 9.

Results of heterogeneity test. The asterisks *, **, and *** denote statistical significance at the 10%, 5%, and 1% levels, respectively.

To ensure the robustness of the results, in this study, the resource-saving indicator (resour1) is calculated for each listed enterprise using mining enterprise resource-saving information in listed enterprises’ annual reports, social responsibility reports, and investor relation activities. Here, resour1 = water savings × 0.0002429 + electricity savings × 1.229 + coal savings × 0.7143 + natural gas savings × 13.3 + centralized heating savings × 0.03412. Usually, the larger resour1 is, the more resource-saving the enterprise is. Column (2) of Table 9 again reports the results of the regression on the heterogeneity of resource-based enterprises, and the significance of the coefficient of the interaction term is negative. This indicates that environmental regulations are more favorable for reducing the carbon emission intensity of resource-efficient enterprises, a result that is consistent with column (1) of Table 9.

6.2. Heterogeneity of Enterprise Size

Based on the total enterprise asset size and enterprise employee size, enterprise size heterogeneity can be analyzed. To this end, this paper introduces the variable of total enterprise asset size (lnsize) or the variable of enterprise employee size (lnsize1) and the interaction term between environmental regulation and total enterprise asset size (re1 × lnsize) or the interaction term between environmental regulation and enterprise employee size (re1 × lnsize1), sequentially, on the basis of the baseline model Equation (3). Columns (3) and (4) of Table 9 report the regression results for enterprise size heterogeneity, and the coefficients of the interaction terms are all significantly positive, contrary to the coefficients of the environmental regulation variable. This suggests that environmental regulation is more conducive to reducing the carbon intensity of small enterprises. A possible reason for this is that small enterprises are more conscious of their environmental image in market competition. They are more likely to be pressured by society and investors, and thus, they more actively adopt carbon emission reduction measures.

6.3. Heterogeneity of Enterprise Nature

According to the nature of enterprises, enterprises can be divided into state-owned enterprises and non-state-owned enterprises. To analyze the heterogeneity of the nature of enterprises, this paper introduces the variable of the nature of enterprises (owned) and the interaction term between environmental regulation and the nature of enterprises (re1 × owned) sequentially on the basis of the baseline model Equation (3) where owned = 1 if the enterprise is a state-owned enterprise and owned = 0 otherwise. Column (5) of Table 9 reports the regression results of enterprise nature heterogeneity, and the coefficient of the interaction term is significantly positive, contrary to the coefficient of the environmental regulation variable. This indicates that environmental regulation is more favorable for reducing the carbon intensity of non-state-owned enterprises. The possible reason for this is that non-state-owned enterprises usually face more intense market competition and social responsibility pressure and are subject to the environmental concerns of investors and financial institutions. In contrast, state-owned enterprises may in some cases be subject to less stringent regulations or less competitive market pressures.

7. Conclusions and Policy Recommendations

In the middle of this century, ensuring that the world achieves net-zero emissions and upgrading the quality of the ecological environment has become a crucial goal for global development. It is also a major mission for China’s economy in its movement towards high-quality development. Based on the important policy impacts of environmental regulation on the carbon emission reduction of Chinese enterprises, this paper takes Chinese listed enterprises from 2012 to 2021 as a research sample and investigates the policy effects of the Chinese government’s environmental regulation on the carbon emission intensity of enterprises from both theoretical and empirical perspectives. The study finds that, first, China’s command-and-control environmental regulations have significantly reduced enterprise carbon intensity. For every increase of 0.01 units in re1, enterprise carbon intensity decreases by 2.9981%. After the elimination of endogeneity through the use of instrumental variable regression, for every increase of 0.01 units in re1, enterprise carbon intensity decreases by 11.9148%. In comparison to OLS regression, it is found that without considering endogeneity, the decarbonization effect of environmental regulations may be underestimated. However, the core conclusion of this paper, “environmental regulations can reduce enterprise carbon intensity”, remains robust. Additionally, this core conclusion holds true after replacing variables, further controlling for joint effects, and conducting regressions with sample restrictions. Second, the mechanism test shows that environmental regulation mainly reduces carbon emission intensity through four paths: improving the level of enterprise environmental disclosure, environmental coordination capacity, resource allocation efficiency, and accelerating the establishment of environmental systems by corporations. Unfortunately, the current environmental regulation in China does not really achieve a reduction in enterprise carbon emission intensity through the path of technological innovation. Third, the heterogeneity test shows that environmental regulation is more conducive to reducing the carbon emission intensity of non-resource-based enterprises, small enterprises, and non-state-owned enterprises. The research findings of this paper are generally consistent with existing research results. For instance, in [14], it was found that the implementation of China’s carbon emissions trading policy not only reduced regional carbon emissions but also decreased per capita carbon dioxide emissions. Additionally, in [2], it was discovered that green credit policies significantly reduced the carbon intensity of “high energy-consuming and high-emission” enterprises by optimizing energy structure, promoting technological upgrades, and increasing innovation investment. However, compared to existing literature, this paper is the first to verify the carbon reduction effects of command-and-control environmental regulations from the perspective of enterprise-level analysis. It also validates five influencing mechanisms at the enterprise level, thus serving as a supplement and enhancement to the current body of literature.

Currently, countries around the world are making concerted efforts to implement active carbon reduction measures to mitigate climate change and maintain ecological balance. This is not only a righteous endeavor for the benefit of future generations, but also a last resort to ensure the sustainable development of the planet and reduce the risk of natural disasters. Among these measures, environmental regulation has been regarded by policymakers and academics as an important tool in reducing carbon emissions. It is in this context that this paper argues in detail how environmental regulation policies can reduce enterprise carbon intensity. In summary, this paper argues that the following three points are needed to reduce enterprise carbon emissions from environmental regulation:

Firstly, there is a need to formulate scientific and reasonable environmental regulation policies and to make good use of the role of command-and-control environmental regulation tools in carbon reduction. Command-and-control environmental regulation tools are key to the implementation of environmental policy, and governments should ensure that a mandatory legal framework is in place. Emission reduction standards and requirements should be clearly defined to ensure effective implementation and compliance with the policy. At the same time, the government should establish monitoring, reporting and verification mechanisms to track actual reductions in carbon emissions. This entails ensuring that enterprises and industries comply with emission standards and report their emission data in accordance with policy requirements.

Second, the role of environmental regulation tools should be applied in accelerating the disclosure of enterprise environmental information, the establishment of environmental systems, the enhancement of environmental coordination capacity, and the improvement of resource allocation efficiency. The government should enact laws and regulations to require and supervise enterprises to disclose environmental information and establish environmental management systems. Information disclosure needs to cover the content of environmental reports, frequency of disclosure, standardized reporting formats, and the effectiveness of implementing environmental protection systems. In addition, the government should require enterprises to disclose environmental reports in a timely manner to increase transparency. For example, enterprises should publish these reports on their websites or submit them to government agencies for public scrutiny. In addition, the government should also strongly promote the role of environmental regulation tools in enhancing the green innovation of enterprises. The government can provide financial support to facilitate research and development of green technologies and innovations. This includes providing innovation funds, R&D subsidies, and technology transfer support to help enterprises develop and adopt environmentally friendly technologies.

Third, the government should implement stronger measures in the environmental governance framework to guide and strengthen the role of environmental regulation tools in reducing the carbon emissions of resource-based enterprises. Specifically, it is recommended that the government formulate differentiated environmental regulation policies by enhancing technical support and training for resource-based enterprises to improve their environmental management capabilities. Simultaneously, providing tax incentives or subsidies for non-resource-based enterprises can encourage these entities to adopt low-carbon technologies and sustainable business models more actively. Similarly, in crafting differentiated environmental regulation policies, the government should pay special attention to supporting large enterprises and state-owned enterprises. This ensures that such enterprises actively implement environmental regulation policies, achieving a win-win situation for both environmental sustainability and corporate sustainability.

This paper empirically validates the impact effects and mechanisms of environmental regulations on carbon emission reduction using a sample of Chinese micro-level listed enterprises. Firstly, despite some preliminary exploratory analysis, the mentioned mechanisms have not been exhaustively elaborated due to limitations such as data availability. Environmental regulations may not only reduce the carbon intensity of enterprises through the effects of environmental information disclosure, the establishment of environmental systems, environmental management concepts, and resource allocation but may also involve other undisclosed pathways that require further in-depth research. Secondly, due to data limitations, the carbon intensity data in this study are not directly disclosed by listed enterprises but are derived through our indirect estimation, which may introduce certain errors. As enterprise carbon emission data become more publicly available in the future, the study will need further updates. Thirdly, this research finds that environmental regulations did not stimulate technological innovation, deviating slightly from the research hypothesis. While this paper provides possible explanations, further data validation is required.

Author Contributions

Conceptualization, T.P.; methodology, T.P. and Y.S.; data curation, T.P. and J.Z.; writing—original draft, T.P.; writing—review and editing, J.Z.; supervision, T.P., Y.S., Y.W. and J.Z. All authors have read and agreed to the published version of the manuscript.

Funding

This research was supported by “the Fundamental Research Funds for the Central Universities of China” (Grant No. JZ2023HGQA0083; Grant No. JZ2023HGTA0210).

Institutional Review Board Statement

Not applicable.