Abstract

To address the climate change impact, governments around the world have made financial commitments to dedicate a significant portion of their budgets to “research and development (R&D)” related to cutting-edge technology development. However, there is limited research in the literature that has examined the effects of financial commitment to renewable energy projects and public R&D on the environment and economic growth. Thus, this study is an endeavor to investigate the impact of financial commitments to renewable energy enterprises, public research and development expenditure, and energy technology innovation on CO2 emissions (CO2e) and economic growth for 34 countries over the period 2010–2019. This study performs a nonlinear panel analysis using the “panel non-linear autoregressive distributed lag (PNARDL)” model within the frameworks of the “Environmental Kuznets Curve (EKC) hypothesis and Solow growth model”. The findings reveal that financial commitments do not possess sufficient power to explain fluctuations in CO2e and economic growth in the short term. However, contrasting results are obtained in the long run, when the decreasing effect is more prominent than the growing effect. Moreover, an increase in public R&D expenditure significantly reduces pollution in the long term. This research also found that energy patents have no reliable power to explain the variation in economic growth. In addition, our results do not explicitly disclose the validity of the EKC argument. Accordingly, this study discussed in detail the green policy suggestions that promote the use of renewable energy and enhance the public–private partnership in the fight against climate change.

1. Introduction

Energy is by far regarded as the potential driver for economic development [1,2]. However, the huge dependency on fossil-based fuels leads to undesirable environmental outcomes resulting in severe climate catastrophes and economic threats [3,4]. Among all the determinants, energy is responsible for 73.2% of GHG emissions, followed by land use (18.4%), industry (5.2%), and waste (3.2%). As energy-related products have become a fundamental factor, especially for the leading industrial economies [5], it becomes challenging for policymakers to balance the competing ends of economic development and combat pollution through the restriction of energy usage. This conflicting reality has been posing enormous pressure for sustainability policymakers. In response to this dilemma, 195 countries have adhered to the “Paris Climate Agreement” to implement practical measures for climate change mitigation by controlling the temperature rise “well below 2 °C”. Key steps towards climate change mitigation include “raising renewable energy share, deploying environmentally sound technologies, promoting regional low-carbon development, and creating a comprehensive nationwide green market” [6]. In this respect, several governments have allocated a considerable amount of budget shares to R&D relating to renewable energy sources and developed climate programs to systematically foster the deployment of climate change mitigation technologies.

Investment in renewable energy enterprises lies at the center of climate change programs. Another crucial element of the climate package is the commitment to link domestic targets with an increase in the allocation of public funds towards R&D of energy technologies that promote sustainable energy outcomes [7]. Thus, understanding the implications of the multifaceted and substantial financial, technical, and institutional challenges that come with offering more affordable and cleaner energy solutions for sustainable development is essential for the success of these climate goals. In that respect, the primary objective of this study is to analyze the implications of financial commitments to renewable energy enterprises, public R&D expenditure, and energy technology innovation on sustainable development (sustainable growth and environment).

Financial commitments are financial flows that take the form of pledges coming from public institutions like governments, multilateral development banks, and other public financial institutions, constituting a binding legal agreement to transfer financial resources for renewable energy projects [8]. Theoretically, financial commitments to renewable energy projects can improve environmental state and promote the deployment of cleaner energies through several channels. (i) As the shift towards clean energy becomes a central focus in combating global warming and climate change, making long-term financial commitments to renewable energies can help mitigate the negative effects of uncertain climate policies. Consequently, financial institutions are increasing their R&D budgets and expanding their investments in green energy projects, thereby decreasing pollution levels [9]. (ii) As risk and return are the most important investment decision metrics, the financial commitments to climate change mitigation decrease the risk for private investors in renewable energy projects and carbon-neutral technologies by helping to create positive market conditions that motivate private investors and drive up the renewable/clean power generation capacity [7,10]. (iii) Energy technology innovation can promote energy efficiency and scale renewable power generation, both of which have a favorable impact on environmental results. (iv) Energy technology innovation improves manufacturing efficiency and minimizes the use of material products, leading to a drop in energy utilization, and resulting in low levels of pollution [11,12].

To realize the SDGs and the “Paris Climate Agreement,” which include maintaining global warming “well below” 1.5 °C, fossil fuel consumption must be reduced by 40% annually until 2030 and the proportion of renewable energy sources must rise to 60% of the total energy supply [13]. However, the economic development of economies is predicated on energy consumption contributing to heavy industries [14,15,16]; hence, reducing pollution through energy restriction without causing an economic decline becomes more difficult for policymakers to balance the competing ends of economic development and environmental protection. Technological innovation through R&D spending is hailed as a powerful weapon capable of balancing the old growth-centric paradigm with environmental preservation requirements as crucial to this endeavor [17,18]. In this context, the significance of investment in R&D to systematically foster and encourage technology adoption has become a vital strategy as governments strive to leverage technology’s capacity to drive sustainable development objectives [19,20]. Therefore, there is a mounting interest in R&D spending and clean energy sources as effective pathways to address sustainability challenges [21,22].

Research and development (R&D) for the creation of environmentally friendly energy technology faces numerous challenges despite its enormous promise. These include failures in the market as well as other elements including the government’s powerful influence, variations in national industrial structures, and research capabilities [7]. In light of that, it is imperative for stakeholders to understand the present impact of ascending and descending movements of green financial flows, public R&D budgets, and energy technology innovation policies on environmental quality (CO2e) and economic growth (per capita GDP). Coupled with advanced data analysis, this understanding will pave the way for formulating an efficient energy innovation policy that aligns with the fiscal cycle. In doing so, this study employs a nonlinear panel data analysis using PNARDL estimation for 34 countries over the period 2010–2019. Given the above motivation, this study addresses the following research questions (RQ):

- RQ1: How do environment quality and economic growth respond to the ascending and descending movements in financial commitments to the investment in renewable energy enterprises?

- RQ2: What is the impact of the rise and fall in the public R&D budget on economic and environmental sustainability?

- RQ3: How do positive and negative shocks in energy technology innovations affect environmental quality?

This paper presents the following contributions. Firstly, an extensive line of the literature discussed the potential role of public R&D budgets, energy technology innovation, and green financial development in achieving sustainable growth and environment [16,23,24,25,26,27,28,29,30,31]. These works have provided significant contributions to the ongoing debate, yet they have employed inconvenient estimation strategies when relying on linear models. Applying a linear analysis implicitly means that the effect of the rise and fall in the green financial flows and public budgets for R&D on sustainable development is similar in absolute terms, which might not be entirely valid. This is because both financial flows for green investment and the government’s budget designated for energy technology R&D are noticeably affected by “expansionary and/or contractionary fiscal policies.” Hence, this study will explore whether, and to what extent, the responses of environmental quality and economic growth exhibit asymmetric (non-linear) sensitivity to positive and negative changes in financial commitments to renewable energy enterprises and public R&D budget.

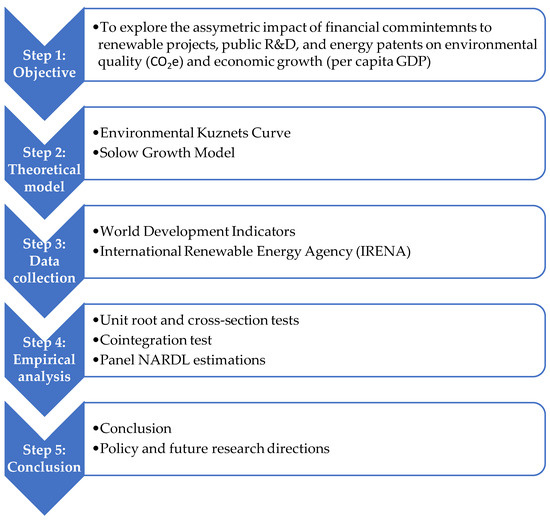

Secondly, most of the existing literature focused on the measure of innovation represented by the total number of registered patents and its impact on the environment. This research differs from prior studies by examining two separate indicators of innovation: energy patents and public R&D expenditures. These indicators are analyzed in two different models that explore the relationship between “economic growth, CO2e, and innovation”. This will aid in comprehending the possible influence of disaggregated innovation on economic growth and sustainable environmental agenda. Thirdly, this study examines a comprehensive sample of 34 nations worldwide, specifically chosen based on the accessibility of data regarding financial commitments in renewable energy initiatives. Therefore, this research will serve as a foundational study, laying the groundwork for future research in this field. Unlike earlier research, this study utilizes non-linear approaches for panel data, specifically the PNARDL method. This approach allows for a better understanding of the impact of positive and negative shocks in the variables under study on the economy and environment. Figure 1 highlights the technical roadmap of this study.

Figure 1.

Technical roadmap of this study.

“The remaining sections are organized as follows. The upcoming section portrays the important literature on the subject. Section 3 highlights the theoretical underpinnings and the model setting, while the methodology and a data description are yielded in Section 4. Section 5 accommodates the estimation outputs and discussions. The conclusion and the policy implications are given in Section 6”.

2. Literature Review

To provide a holistic view of the existing literature on the subject, this part is tightly related to two research spectra. This first spectrum covers a wide range of empirical studies on the potential effect of financial commitment to renewable energy (i.e., green investments) on pollution reduction. There is a lack of available research on the relationship between financial commitment and the environment. Hence, this study also encompasses closely related indicators of financial obligations towards renewable projects, such as investments in green initiatives like renewable energy and environmental conservation, as well as green finance. The second spectrum, on the other hand, highlights the important literature on the emissions-mitigating effect of technological innovation using three measures including government R&D expenditure, total patent index, and energy patent index.

2.1. Green Investment, Environmental Sustainability, and Economic Growth

The concept of green investment and green finance covers a wide scope including sustainable environmental, carbon, and climate financing. Meanwhile, sustainable finance regards governance and social dimensions. Moreover, environmental finance covers environmental protection. Carbon finance focuses on the reduction of carbon emissions, whereas climate finance tries to mitigate climate change by promoting the transition to a low-carbon economy. Although a voluminous number of studies tried to model renewable energy investment as an effective way to spur environmental quality and economic growth, the literature ignores the possible role of green financial commitments in mitigating carbon emissions. This part briefly outlines the limited existing empirical findings on the nexus between green finance and investments and a sustainable environment.

Using the framework of the EKC hypothesis, Huang et al. [23] studied the link between green investment and environmental pollution in China during 1995–2019 using “Cross-sectional Autoregressive Distributive Lag (CS-ARDL)”. The authors found that green investment helps mitigate environmental pollution. Similarly, Li et al. [32] implemented the Westerlund cointegration analysis for China’s provinces over the period 1995–2017. The authors concluded that investing in green projects significantly decreases CO2e. The authors have considered analyzing the nexus between “green investment and environmental sustainability” from the panel data perspective. For example, Luo et al. [27] applied “Fully Modified Ordinary Least Square (FMOLS)” and OLS to assess the link between “green investment and CO2e” for Asian countries using annual data from 2001 to 2019. Their findings indicate that green investment has a reliable power to explain the variation in pollution in the sample countries. Meo and Karim [25] utilized monthly data between 2008 and 2019 to test the possible reducing effect of green investment on CO2e using the quantile approach for the top 10 countries that support the investment in renewables. Overall, the results disclose that green finance is negatively linked to CO2e. Similar results were also obtained by Rokhmawati [24] in Indonesia when the authors implemented a mediation regression analysis. Wang et al. [30] examined the impact of green initiatives on production-based CO2e for China; utilizing the ARDL model for the data spanning 1998–2017, the authors mentioned that green investment can significantly drive emissions reduction.

Similarly, in their study, Caglar et al. [33] examined the environmental consequences of green investment in European countries. They discovered that both green investment and green innovation play a significant role in promoting ecological sustainability. A related study, Sun et al. [34], demonstrated that green investments have a substantial impact on decreasing the ecological footprints in OECD countries. According to [35], green investment has the potential to decrease environmental pollution.

In addition to green investments, numerous studies also utilize green financing as a means to achieve environmental sustainability. For example, China’s provincial data have been analyzed by Shen et al. [28] utilizing the CS-ARDL model during 1995–2017. It has been found there is a strong correlation between an upsurge in green finance and a subsequent reduction in CO2e. Sharif et al. [29] searched the linkage between green financing and CO2e for the G7 economies, using CS-ARDL for the data on a yearly basis covering 1995–2019. The authors highlighted that green financing holds a significant negative effect on CO2e. Deviating from the above evidence, Wan and Sheng [31] concluded an insignificant implication of green finance on CO2e. Such cases are usually attributed to the level of emphasis investors put forward on the concept of green investment.

A few studies have been undertaken in the field of study on the influence of green investments on economic growth. For instance, Lyeonov et al. [36] discovered that investing in green initiatives might stimulate a 6.4% increase in GDP per capita and a 3.08% reduction in GHG emissions. Similarly, D’Angelo et al. [37] showed that an increase in the quantity of green activities had a beneficial impact on economic performance. In their study, He et al. [38] discovered the influence of investing in renewable energy on the development of the green economy index.

2.2. Technological Innovation and Environmental Sustainability

As the implications of climate change are growing more apparent, a huge volume of the literature examined the potential of environment-related technologies in explaining the variation in pollution. However, the findings show conflated effects. The apparently conflicting pieces of evidence are usually attributed to the differences in estimation strategies and the diverse measures of environment-related technological innovations. While some studies used the “total patent index” as a proxy for green technologies innovation, another strand of the literature considered R&D spending as a measure for environment-related technology innovation. Moreover, the “energy patent index” has also been widely used as a proxy for green technology progress. This part briefly summarizes the empirical studies that used the above three measures.

2.2.1. Total Patent Index and Environmental Impact

Many studies used the “total patent index as a proxy for green technology innovation” and stated that technological progress is an essential factor in controlling and monitoring CO2e [39]. Chatti [40] conducted research for 43 countries from 2002–2014 and employed the “two-step system Generalized Method of Moments (GMM)”. The author claimed that the ability of total patents to mitigate pollution is very well adapted in the transportation sector. Demircan Çakar et al. [41] also conducted a study to understand the impact of innovativeness on CO2e in the transport sector, utilizing data from eight developing countries and six advanced countries. The findings of the study revealed that in developing countries, a rise in the level of innovation exerts a favorable impact on CO2e, leading to potential reductions. Awan et al. [42] examined the effect of technological innovation on transport-based CO2e for 33 developed economies using the “Method of Moments Quantile Regression (MMQR)” for data spanning 1996–2014. The authors concluded that “urbanization upsurges while innovation mitigates CO2 pollution”. Other authors [43,44,45] also proposed similar findings. However, despite the various methods employed in the aforementioned studies, all of them consider the overall number of patents as a measure of technological innovation, rather than analyzing energy patents separately. These studies overlook the potential environmental impact of energy patents, which could significantly contribute to energy efficiency and thereby ecological conservation.

2.2.2. Public R&D Expenditure and Environmental Sustainability

This strand of the literature considered R&D spending as a measure for environment-related technology. Ganda [46] claimed that emissions can be reduced by improving innovation and technology adoption and emphasizing on usage of green technology in OECD region. The findings also suggest investing in R&D as an effective pathway towards carbon neutrality. Another study focusing on Japan, by Ahmed et al. [47], explored the linear and nonlinear relationships between “public R&D investments and CO2e”. The study suggests that increasing investments in clean energy technology can help Japan diversify its energy usage and achieve environmentally sustainable economic growth.

The role of R&D in mitigating environmental pollution is getting more important day by day given the pace of technological development. Jiao et al. [48] emphasize that R&D in the renewable energy sector can help reduce CO2e. The authors suggest that governments should take action and support technological innovation to promote the widespread usage of cleaner energy solutions. Along the same line, MA et al. [49] were interested in examining the impact of “investments in the energy sector, expenditure on R&D, and technological innovation on Chinese provincial CO2e.” Their research uncovered that increased investment in R&D has a significant role in supporting and advancing China’s carbon strategy. In their study, Petrović and Lobanov [50] discovered that a 1% increase in R&D investments leads to an average reduction in CO2e of 0.09–0.15% among OECD nations. Li et al. [51] examined the impact of R&D investment on the lowering of CO2e. This research indicated that although investing in R&D is still crucial for reducing CO2e, the impact of technical advancements on CO2e reduction is diminishing. However, all the studies described above utilize a proxy for innovation to indicate its influence on the environment. In contrast, our study employs three proxies for innovation to demonstrate their impact on both the economy and the environment.

2.2.3. Energy Patent Index and Environmental Impact

The “Energy Patent Index” refers to the number of patents granted for energy-related technologies, particularly those focused on renewable and sustainable energy sources. Understanding the environmental impact of the “energy patent index” is crucial for carbon emissions because a higher “energy patent index” indicates greater innovation and development of clean energy technologies, which can effectively reduce reliance on carbon-intensive energy sources and mitigate carbon emissions, thereby combating climate change.

By utilizing patent data as an indicator of technical advancement, it has been discovered that green technologies have a notable impact on the decrease of CO2e [52]. Cheng and Yao [53] extended the discussion for China and reported that the level of renewable energy technology innovation has a negative impact on carbon intensity. In their study, Wang and Zhu [54] discovered a negative correlation between the “development of renewable energy technologies and the release of CO2.” In a similar vein, Huang [23] discovered that energy patents originating from both enterprises and research organizations have a substantial impact on reducing CO2e. Nevertheless, Wang et al. [55] demonstrated that domestic patents pertaining to fossil-fueled technology do not have an impact on the diminishing of CO2e. However, the current body of research lacks a thorough investigation into the effects of energy patents on the economy and environment in financially committed countries that are implementing renewable projects by utilizing non-linear approaches.

3. Theoretical Framework and Model Construction

This paper follows two theoretical framework discourses, namely, the “Environmental Kuznets Curve (EKC) Hypothesis and the Solow-Sawn Growth Model”. Since the seminal work of Kuznets [56], the EKC hypothesis has consistently served as a framework that drives research on the interconnection between “economic growth and environmental quality”, facilitating the search for sustainable approaches to manage ecological and environmental resources. According to this hypothesis, “economic growth can mitigate pollution after a threshold level of income. This level represents the point at which an economy undergoes a transition from energy-intensive activities to service-oriented and less pollutant technology-based activities.” This shift involves replacing outdated technologies with cleaner alternatives; this phenomenon is widely known as the composition and technique effect [57,58].

Following the “Solow Neoclassical Growth” theory, economic growth is basically determined by capital, labor, and the level of technology [59,60]. Since the industrialization age, energy has become another essential factor to promote economic growth. Thus, the Cobb–Douglas production function that describes the technical linkage between the factor of production and the amount produced is given as follows [61,62]:

where Y, L, K, and A correspondingly indicate “economic growth, labor, capital, and exogenous technological factors” with a constant growth rate measuring the total factor productivity. E represents energy utilization in the production process. Based on these two theoretical underpinnings, this study draws interlinkages between investment in clean energies, technology innovation economic growth, and environmental quality as follows:

where CO2 represents carbon emissions. Y and Y2, respectively, indicate the “per capita GDP and per capita GDP square”. URB denotes urbanization, while R&D, TFC, and EPT correspondingly indicate “research and development public expenditure, total financial commitment to investing in renewable energy enterprises, and energy patent index”. Some evidence suggests that the utilization of renewable energy technologies in the economic structure is inseparable from the level of economic growth. Thus, while the world economy is going through an important transition to clean resources, it is a severe matter of interest to examine empirically how economic growth trajectories react to ups and downs in the investment in, and discovery of, clean energy technologies [7]. Accordingly, innovation (INOV) comprises R&D and EPT. Deviating from the existing literature that used linear frameworks, to isolate the ascending and descending movements in the purpose variables, this research defines positive and negative shocks in TFC and INOV as follows:

where and correspondingly indicate the positive and negative shocks in financial commitment to renewable enterprise. Similarly, and consist of cumulative increase and decrease in innovation proxies in the production function at time t and country i, correspondingly. Thus, our testable nonlinear models can be set as follows:

where includes R&D proxy variables in CO2 model, while includes EPT proxy variable in the economic growth model; i refers to countries, t shows the period, and indicates error terms. These models help to understand how CO2e and economic growth respond to positive and negative changes in green financial commitments to renewable energy projects and energy technology innovation with some other control variables such as GDP in the CO2e model and urbanization in the economic growth model.

4. Materials and Methods

To examine how economic growth and CO2e react to changes in “financial commitments to the renewable project, energy technology innovation, and public R&D expenditure” under the nonlinear scenario, the current study utilizes annual data spanning 2010–2019 that were selected based on the data availability for 34 countries, namely, “Armenia, Austria, Belarus, Belgium, China, Germany, India, Indonesia, Italy, Jordan, Kazakhstan, Kyrgyzstan, Malaysia, Norway, Pakistan, Philippines, Poland, Portugal, Moldova, Serbia, Spain, Sweden, Thailand, Türkiye, Ukraine, United Kingdom, Uzbekistan, Vietnam, Brazil, Canada, Russian Federation, South Africa, United States of America, and France”. These countries have been chosen due to the presence of comprehensive data on the financial obligations of renewable energy projects. The primary aim of this research is to investigate the asymmetric impact of financial commitment; however, due to limited data availability, we were constrained to restrict the selection of countries and time frames. All variables were transformed into their logarithmic forms to handle the multiple units of measurement and to express the coefficients as elasticities. Table 1 provides detailed information on our utilized data.

Table 1.

The variables and sources.

The study applies the Panel NARDL (PNARDL) model, also known as asymmetric panel ARDL. Following the theoretical arguments, one can assume that the positive and negative changes in energy technological innovation and public spending for research and development do not have the same effect in terms of size and sign. Therefore, the panel version of Shin et al. [63] is used considering the following versions of Equations (10) and (11):

where and are the associated negative and positive shocks in innovation proxy in the respective model, correspondingly. is a vector of regressors (control variables) entering the model symmetrically. The long-term coefficients are computed as , , , , and, in Equation (10), while for Equation (11), the long-term coefficients are computed as , , , , and, in both equations; correspondingly, the negative and positive shocks are computed as partial sum processes of the changes in regressors as specified in Equations (4)–(7). Following Altıntaş and Kassouri [7] and Alnour et al. [64] the linear symmetrical version of ECT can be modified to account for asymmetries. Thus, the asymmetrical models of Equations (10) and (11) can be defined as follows:

“where the nonlinear error correction terms ( and ) correspondingly identify the long-run equilibrium in Equations (12) and (13), while and show the speed of adjustment towards the long-run equilibrium after the shocks”.

5. Results and Discussion

5.1. Preliminary Analysis

Table 2 outlines some important descriptive statistics for our proposed datasets, including “economic growth measured as per capita GDP, total financial commitments to investment in renewable energy projects, CO2e, public R&D expenditure, energy patent, and urban population growth rate”. Clearly, economic growth is by far the variable with the highest average (18,582.94) over the sample period, varying between 966.15 and 76,005.22 with a standard deviation of 19,685.52. Moreover, financial commitments to clean energy enterprises also show a notable fluctuation, ranging from 0.0012 to 11,354.16 with a mean value of 299.29. In addition, energy patents demonstrate almost a consistent trend with a mean value of 12.02. Carbon emissions, urban population growth, and research and development expenditure have an annual average of 5.84, 1.32, and 1.13, respectively.

Table 2.

Descriptive statistics.

5.2. Panel Unit Root and Cointegration Tests

Prior to performing the PNARDL analysis, the stochastic properties of the underlying series were investigated. In that respect, this research considered both “PP and ADF—Fisher chi-square panel unit root tests” after the non-validation of the “cross-sectional dependence (CSD)” across the sample countries, as most of the variables, including “carbon emissions, financial commitments to renewable energy, and R&D”, cannot reject the H0 of no CSD across the panel members (Table 3). Table 4 reports the panel unit root test results. Obviously, both PP and ADF panel unit root tests demonstrate first-order integration for all the study variables, while both tests assume that public R&D spending and financial pledges for green investment are stationary at levels. In addition to that, the PP panel unit root test CO2e and energy patent are integrated at levels as well as at first difference. As in the case of panel unit root tests, this study tested for cointegration by using Pedroni and Kao tests to estimate the long-run association between the variables (Table 5). Overall, both test results validate the existence of a long-run relationship among the studied variables in both models.

Table 3.

Average correlation coefficients and CD test.

Table 4.

Panel unit root tests.

Table 5.

Cointegration test.

5.3. Nonlinear Panel ARDL Results

5.3.1. Environmental Sustainability Model

With the presence of a cointegration relation between the variables of interest, the study proceeds to perform the PNARDL for environmental sustainability and economic growth models. The selection of an efficient estimate is based on the Hausman test outcomes. Accordingly, the PNARDL model is a more appropriate technique to estimate the asymmetric nexus between “financial commitments to the investment in clean energy projects, public R&D expenditure, energy technology innovation, and GDP” over the period extending 2010–2019. Table 6 and Table 7 correspondingly portray the PNARDL results for the environmental sustainability and economic growth models.

Table 6.

Environmental quality model.

Table 7.

Economic growth model.

Starting with the environmental sustainability model (model 1) in Table 6, the results indicate that an increase or a decrease in financial commitments to renewable energy enterprises has an insignificant effect on CO2e in the shorter run; however, in the longer run, the commitments to the investment in clean energy projects significantly affect the levels of pollution. More precisely, this study observed that negative shocks in green investment () has a significant reducing effect on CO2e, while the positive impulses in ) increase the pollution. The insignificant effect of both positive and negative shock in TFC in the short run ( and on CO2e was unexpected. However, a cursory review of the literature would reveal that it is not surprising, considering the intricate nature of green finance regulations and the criteria used to make green investment decisions. These measures are employed by the corporate sector and other public funding organizations to choose whether to invest in sustainable energy projects.

Possibly, supported by some statistics, this result might be a clear indication that the volume of investments made and/or the commitment to renewable energy enterprises are insufficient to prevent the climate catastrophe. Recent statistics reveal that to keep the temperature ‘well below’ 2 °C, nations must invest at least 1.8$ trillion in renewable energy technologies [10,65] to mitigate global CO2e by 7.6% every year and realize our climate goals based on the Paris Agreement [42]. Following the recent report by IRENA, investment in renewable energy has hit 0.5$ trillion; however, this represents less than one third of the average investment needed each year [66]. Furthermore, the increasing effect of investment in renewable energies () on CO2e supports the arguments put forward by the argument of the green paradox, which claims that inappropriate policies and environmental regulation could prevent clean technologies from having a desirable effect on the environment since they enhance over-exploitation of resources, resulting in more pollution [67]. In this respect, policymakers should ensure appropriate green finance policies to attract the private sector into the renewable energy market.

Turning to the R&D expenditure, it is found that government spendings on research and development have no significant implications on CO2e in the short run, while the opposite influence of R&D on CO2e in the long run was observed ( and ). It is found that a rise in public R&D spending is associated significantly with a decrease in CO2e; a 1% rise in R&D leads to a 2.19% dwindle in CO2e. This result, demonstrating the significant long-term effect of R&D, is compatible with the results of previous studies [7,68,69]. Therefore, our results validate the argument that government policy support plays a pivotal role in fostering the long-term development of renewable energy through research expenditure.

Moving on to the control variable (GDP), the findings uncover that there is a significant reducing impact of the GDP and the square GDP on CO2e in the long run, while the impact of the same variables in the short term is an insignificant effect. The reducing effect of economic growth () in the long term is consistent with the findings of [7]. From the theoretical viewpoint, there are two ways to investigate the conformity of the EKC hypothesis; this study can conduct a comparison between the short-run and long-run coefficients to analyze the relationship, as done by [70] or, alternatively, the coefficient of the GDP and GDP2 can be compared [42]. In both strategies, our results do not explicitly support the validity of the EKC hypothesis across the study sample. The asymmetric “Error Correction Mechanisms (ECM)” with TFC (−0.4055) and R&D (−0.34005) are negative and statistically significant. Moreover, the Wald test results in Table 6 confirm the asymmetric effect of FTC and R&D on CO2e in the long run (Wald LR).

5.3.2. Economic Growth Model

The PNARDL outcomes involving economic growth as a dependent variable are shown in Table 7. As with the environmental sustainability model, the financial commitments to renewables have an insignificant effect on economic growth in the short run (, ), while the opposite is true in the longer term. It was found that a negative shock associated with TFC () increases economic growth while a positive shock () significantly reduces economic growth. Although renewable energy investments are essential for achieving sustainable growth and environmental advantages, they can present obstacles to long-term economic growth due to the significant upfront expenses, opportunity cost, risks associated with technology and the market, concerns about efficiency, challenges related to infrastructure, and costs associated with transitioning to renewable energy sources. To avoid adverse effects and facilitate a seamless transition to a sustainable energy future, it is crucial to strike a balance between these investments and other economic priorities. Furthermore, urbanization has a significant positive impact on long-term economic growth, whereas its effect is not significant in the short term. Urbanization can promote sustained economic growth by increasing productivity through the advantages of scale and agglomeration, stimulating innovation and knowledge spillovers, improving infrastructure and services, creating vibrant labor markets, increasing consumption and demand, attracting investment, and benefiting from efficient governance [71].

Surprisingly, energy patents (EPT) have no significant effect on economic growth either in the short run or in the long run. “This outcome potentially suggests that transitioning from fossil fuels to renewable energy sources could have counterproductive effects for countries with lower levels of economic development.” Therefore, it becomes crucial for these countries to attain a stage of economic development known as the “structural effect stage.” This stage is characterized by promoting and facilitating the utilization of renewable energy, ensuring that the shift away from fossil fuels aligns effectively with the country’s developmental needs [7,22]. The asymmetric ECM is found to be negative and significant (−0.40551). It is worth emphasizing that “the long-run Wald tests, specifically the Wald LR test, reject the null hypothesis of long-run impact and asymmetry at the 1% level of significance for the model.”

6. Conclusions and Policy Implications

6.1. Concluding Remarks

Climate change and global warming are undeniably becoming paramount challenges facing the global community today. Aligning the economic objectives with environmental sustainability is not a choice; rather, it is necessary. This study is an endeavor to dissect the prevailing trend in the economic and environmental asymmetric impact of financial commitments to renewable energy projects, R&D spending, and environmental technologies. To this end, this study considers employing a panel approach for 34 countries during the period 2010–2019, utilizing the PNARDL approach to disentangle the asymmetric effects among the purposed variables. In addition, the environmental sustainability model incorporates GDP per capita as a control variable, whereas the economic growth model incorporates urbanization as a control variable.

The results revealed that financial commitment to renewable projects significantly affects CO2e only in the long term. Similarly, an increase in public R&D expenditure is significantly associated with the decline in CO2e. This outcome clearly reveals that government policy support is the key to the development of renewable energies. However, green financial commitments are found to have a significant reducing effect on economic growth in the long run. Meanwhile, this research found that energy patents have no reliable power to explain the variation in economic growth. In addition, our results do not explicitly disclose the validity of the EKC argument; however, GDP is found to have an undesirable implication on environmental quality in all terms. On the other hand, it has been shown that urbanization promotes economic growth, which supports the claims made by development organizations that urbanization drives development or that cities act as “engines of growth”.

6.2. Policy Insights

Overall, our results have several practical relevance. First, policymakers must increase the amount of financial investment in renewable energy enterprises. To do so, the government can implement several attractive green finance policies to motivate the private sector to invest in renewable energies. Several policies can be implemented including feed-in tariffs, production tax credits/reliefs, and subsidized investment loans. Each of these measures can potentially impact the “rise in grid electricity prices,” hence encouraging investments in renewable energy. In addition, it is important to encourage the adoption of green certificates as transferable certifications that represent the verified production of renewable energy units. These certificates enable consumers and producers to exchange their commitments to using renewable electricity. Second, increasing public R&D expenditure can potentially increase energy efficiency and reduce the amount of energy needed for production. This will reduce the overutilization of natural resources and prevent the green paradox. Third, countries should prioritize incorporating public spending in energy technology research, development, and deployment (RD&D) into their agenda for environmental sustainability as a crucial measure to mitigate CO2e.

As most of our datasets are subject to fiscal conditions (expansionary and contractionary), estimation methods should be able to deal with the dynamic regime. In that respect, although asymmetric analysis may partially detect the nonlinear behavior, the dynamic regime differences are more powerful. Thus, future research may consider applying different models such as “Markov Regime Difference, Wavelet Coherence Transforms, and Quantile on Quantile model.” Furthermore, future studies can utilize the most recent data based on their availability.

Author Contributions

Conceptualization, M.A.; methodology, A.Ö.; software, M.H.; validation, M.A., A.Ö. and İ.Ö.; formal analysis, M.A.; investigation, M.E.H.; resources, M.A.; data curation, M.A.; writing—original draft preparation, M.A., A.Ö., M.H., A.Ö., İ.Ö., M.E.H. and M.Z.R.; writing—review and editing, M.A., İ.Ö., M.A.E. and M.H.; visualization, M.E.H.; supervision, M.A.E.; funding acquisition, M.A.E. and M.Z.R. All authors have read and agreed to the published version of the manuscript.

Funding

The APC for this research was supported by Airlangga University, Surabaya, Indonesia. The authors also extend their sincere appreciation to the Researchers Supporting Project number (RSPD2024R1038), King Saud University, Riyadh, Saudi Arabia.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Data will be made available on reasonable request.

Conflicts of Interest

The authors of this paper declare that there is no known competing interests or sources of funding.

References

- Fang, G.; Tian, L.; Yang, Z. The construction of a comprehensive multidimensional energy index. Energy Econ. 2020, 90, 104875. [Google Scholar] [CrossRef]

- Dogan, E.; Majeed, M.T.; Luni, T. Analyzing the impacts of geopolitical risk and economic uncertainty on natural resources rents. Resour. Policy 2021, 72, 102056. [Google Scholar] [CrossRef]

- Fang, G.; Yang, K.; Tian, L.; Ma, Y. Can environmental tax promote renewable energy consumption?—An empirical study from the typical countries along the Belt and Road. Energy 2022, 260, 125193. [Google Scholar] [CrossRef]

- Udemba, E.N.; Magazzino, C.; Bekun, F.V. Modeling the nexus between pollutant emission, energy consumption, foreign direct investment, and economic growth: New insights from China. Environ. Sci. Pollut. Res. 2020, 27, 17831–17842. [Google Scholar] [CrossRef] [PubMed]

- Jia, Z.; Lin, B. How to achieve the first step of the carbon-neutrality 2060 target in China: The coal substitution perspective. Energy 2021, 233, 121179. [Google Scholar] [CrossRef]

- Liu, Z.; Deng, Z.; He, G.; Wang, H.; Zhang, X.; Lin, J.; Qi, Y.; Liang, X. Challenges and opportunities for carbon neutrality in China. Nat. Rev. Earth Environ. 2022, 3, 141–155. [Google Scholar] [CrossRef]

- Altıntaş, H.; Kassouri, Y. The impact of energy technology innovations on cleaner energy supply and carbon footprints in Europe: A linear versus nonlinear approach. J. Clean. Prod. 2020, 276, 124140. [Google Scholar] [CrossRef]

- IRENA. Global Landscape of Renewable Energy Finance [Internet]. 2020. Available online: https://www.irena.org/Data/View-data-by-topic/Finance-and-Investment/Investment-trends (accessed on 22 December 2023).

- Hoque, M.E.; Soo-Wah, L.; Bilgili, F.; Ali, M.H. Connectedness and spillover effects of US climate policy uncertainty on energy stock, alternative energy stock, and carbon future. Environ. Sci. Pollut. Res. 2023, 30, 18956–18972. [Google Scholar] [CrossRef]

- Polzin, F.; Egli, F.; Steffen, B.; Schmidt, T.S. How do policies mobilize private finance for renewable energy?—A systematic review with an investor perspective. Appl. Energy 2019, 236, 1249–1268. [Google Scholar] [CrossRef]

- Batool, Z.; Raza, S.M.F.; Ali, S.; Abidin, S.Z.U. ICT, renewable energy, financial development, and CO2 emissions in developing countries of East and South Asia. Environ. Sci. Pollut. Res. 2022, 29, 35025–35035. [Google Scholar] [CrossRef]

- Bilgili, F.; Kuskaya, S.; Magazzino, C.; Khan, K.; Hoque, M.E.; Alnour, M.; Khan, K.; Onderl, S. The mutual effects of residential energy demand and climate change in the United States: A wavelet analysis. Environ. Sustain. Indic. 2024, 22, 100384. [Google Scholar] [CrossRef]

- Bilgili, F.; Önderol, S.; Alnour, M.; Balsalobre-lorente, D. Renewable energy and technology adoption: Mitigating CO2 emissions through implementation strategies. Nat. Resour. Forum 2024, 1–58. [Google Scholar] [CrossRef]

- Shah, W.U.H.; Hao, G.; Yan, H.; Yasmeen, R.; Padda, I.U.H.; Ullah, A. The impact of trade, financial development and government integrity on energy efficiency: An analysis from G7-Countries. Energy 2022, 255, 124507. [Google Scholar] [CrossRef]

- Muğaloğlu, E.; Kuşkaya, S.; Aldieri, L.; Alnour, M.; Hoque, M.E.; Magazzino, C.; Bilgili, F. Dynamic regime differences in the market behavior of primary natural resources in response to geopolitical risk and economic policy uncertainty. Resour. Policy 2023, 87, 104340. [Google Scholar] [CrossRef]

- Fang, G.; Yang, K.; Chen, G.; Tian, L. Environmental protection tax superseded pollution fees, does China effectively abate ecological footprints? J. Clean. Prod. 2023, 388, 135846. [Google Scholar] [CrossRef]

- Sinha, A.; Sengupta, T.; Alvarado, R. Interplay between technological innovation and environmental quality: Formulating the SDG policies for next 11 economies. J. Clean. Prod. 2020, 242, 118549. [Google Scholar] [CrossRef]

- Alnour, M.; Awan, A.; Hossain, M.E. Towards a green transportation system in Mexico: The role of renewable energy and transport public-private partnership to curb emissions. J. Clean. Prod. 2024, 442, 140984. [Google Scholar] [CrossRef]

- Min, S.; Kim, J.; Sawng, Y.-W. The effect of innovation network size and public R&D investment on regional innovation efficiency. Technol. Forecast. Soc. Chang. 2020, 155, 119998. [Google Scholar]

- Yumei, H.; Iqbal, W.; Irfan, M.; Fatima, A. The dynamics of public spending on sustainable green economy: Role of technological innovation and industrial structure effects. Environ. Sci. Pollut. Res. 2022, 29, 22970–22988. [Google Scholar] [CrossRef]

- Bilgili, F.; Balsalobre-Lorente, D.; Kuşkaya, S.; Alnour, M.; Önderol, S.; Hoque, M.E. Are research and development on energy efficiency and energy sources effective in the level of CO2 emissions? Fresh evidence from EU data. Environ. Dev. Sustain. 2023, 1–37. [Google Scholar] [CrossRef]

- Yasmeen, R.; Hao, G.; Ye, Y.; Hassan Shah, W.U.; Kamal, M.A. The role of governance quality on mobilizing environmental technology and environmental taxations for renewable energy and ecological sustainability in belt and road economies: A methods of Moment’s quantile regression. Energy Strateg. Rev. 2023, 50, 101258. [Google Scholar] [CrossRef]

- Huang, J.; Li, X.; Wang, Y.; Lei, H. The effect of energy patents on China’s carbon emissions: Evidence from the STIRPAT model. Technol. Forecast. Soc. Chang. 2021, 173, 121110. [Google Scholar] [CrossRef]

- Rokhmawati, A. The nexus among green investment, foreign ownership, export, greenhouse gas emissions, and competitiveness. Energy Strateg. Rev. 2021, 37, 100679. [Google Scholar] [CrossRef]

- Saeed Meo, M.; Karim, M.Z.A. The role of green finance in reducing CO2 emissions: An empirical analysis. Borsa Istanb. Rev. 2022, 22, 169–178. [Google Scholar] [CrossRef]

- Zhou, S.; Tong, Q.; Pan, X.; Cao, M.; Wang, H.; Gao, J. Research on low-carbon energy transformation of China necessary to achieve the Paris agreement goals: A global perspective. Energy Econ. 2021, 95, 105137. [Google Scholar] [CrossRef]

- Luo, R.; Ullah, S.; Ali, K. Pathway towards sustainability in selected asian countries: Influence of green investment, technology innovations, and economic growth on CO2 emission. Sustainability 2021, 13, 12873. [Google Scholar] [CrossRef]

- Shen, Y.; Su, Z.W.; Malik, M.Y.; Umar, M.; Khan, Z.; Khan, M. Does green investment, financial development and natural resources rent limit carbon emissions? A provincial panel analysis of China. Sci. Total Environ. 2021, 755, 142538. [Google Scholar] [CrossRef] [PubMed]

- Sharif, A.; Saqib, N.; Dong, K.; Khan, S.A.R. Nexus between green technology innovation, green financing, and CO2 emissions in the G7 countries: The moderating role of social globalisation. Sustain. Dev. 2022, 30, 1934–1946. [Google Scholar] [CrossRef]

- Wang, L.; Su, C.W.; Ali, S.; Chang, H.L. How China is fostering sustainable growth: The interplay of green investment and production-based emission. Environ. Sci. Pollut. Res. 2020, 27, 39607–39618. [Google Scholar] [CrossRef]

- Wan, Y.; Sheng, N. Clarifying the relationship among green investment, clean energy consumption, carbon emissions, and economic growth: A provincial panel analysis of China. Environ. Sci. Pollut. Res. 2022, 29, 9038–9052. [Google Scholar] [CrossRef]

- Li, Z.-Z.; Li, R.Y.M.; Malik, M.Y.; Murshed, M.; Khan, Z.; Umar, M. Determinants of carbon emission in China: How good is green investment? Sustain. Prod. Consum. 2021, 27, 392–401. [Google Scholar] [CrossRef]

- Caglar, A.E.; Avci, S.B.; Ahmed, Z.; Gökçe, N. Assessing the role of green investments and green innovation in ecological sustainability: From a climate action perspective on European countries. Sci. Total Environ. 2024, 928, 172527. [Google Scholar] [CrossRef] [PubMed]

- Sun, Y.; Guan, W.; Razzaq, A.; Shahzad, M.; Binh An, N. Transition towards ecological sustainability through fiscal decentralization, renewable energy and green investment in OECD countries. Renew. Energy 2022, 190, 385–395. [Google Scholar] [CrossRef]

- Ren, S.; Hao, Y.; Wu, H. How Does Green Investment Affect Environmental Pollution? Evidence from China. Environ. Resour. Econ. 2022, 81, 25–51. [Google Scholar] [CrossRef]

- Lyeonov, S.; Pimonenko, T.; Bilan, Y.; Štreimikienė, D.; Mentel, G. Assessment of Green Investments’ Impact on Sustainable Development: Linking Gross Domestic Product Per Capita, Greenhouse Gas Emissions and Renewable Energy. Energies 2019, 12, 3891. [Google Scholar] [CrossRef]

- D’Angelo, V.; Cappa, F.; Peruffo, E. Green manufacturing for sustainable development: The positive effects of green activities, green investments, and non-green products on economic performance. Bus. Strateg. Environ. 2023, 32, 1900–1913. [Google Scholar] [CrossRef]

- He, L.; Zhang, L.; Zhong, Z.; Wang, D.; Wang, F. Green credit, renewable energy investment and green economy development: Empirical analysis based on 150 listed companies of China. J. Clean. Prod. 2019, 208, 363–372. [Google Scholar] [CrossRef]

- Khan, A.N.; En, X.; Raza, M.Y.; Khan, N.A.; Ali, A. Sectorial study of technological progress and CO2 emission: Insights from a developing economy. Technol. Forecast. Soc. Chang. 2020, 151, 119862. [Google Scholar] [CrossRef]

- Chatti, W. Moving towards environmental sustainability: Information and communication technology (ICT), freight transport, and CO2 emissions. Heliyon 2021, 7, 08190. [Google Scholar] [CrossRef]

- Demircan Çakar, N.; Gedikli, A.; Erdoğan, S.; Yıldırım, D.Ç. A comparative analysis of the relationship between innovation and transport sector carbon emissions in developed and developing Mediterranean countries. Environ. Sci. Pollut. Res. 2021, 28, 45693–45713. [Google Scholar] [CrossRef]

- Awan, A.; Alnour, M.; Jahanger, A.; Chukwuma, O.J. Do technological innovation and urbanization mitigate carbon dioxide emissions from the transport sector? Technol. Soc. 2022, 71, 102128. [Google Scholar] [CrossRef]

- Rej, S.; Bandyopadhyay, A.; Das, N.; Hossain, M.E.; Islam, M.S.; Bera, P.; Yeediballi, T. The asymmetric influence of environmental-related technological innovation on climate change mitigation: What role do FDI and renewable energy play? Environ. Sci. Pollut. Res. 2023, 30, 14916–14931. [Google Scholar] [CrossRef] [PubMed]

- Hossain, M.R.; Rana, M.J.; Saha, S.M.; Haseeb, M.; Islam, M.S.; Amin, M.R.; Hossain, E. Role of energy mix and eco-innovation in achieving environmental sustainability in the USA using the dynamic ARDL approach: Accounting the supply side of the ecosystem. Renew. Energy 2023, 215, 118925. [Google Scholar] [CrossRef]

- Das, N.; Gangopadhyay, P.; Alam, M.M.; Mahmood, H.; Bera, P.; Khudoykulov, K.; Dey, L.; Hossain, E. Does greenwashing obstruct sustainable environmental technologies and green financing from promoting environmental sustainability? Analytical evidence from the Indian economy. Sustain. Dev. 2024, 32, 1069–1080. [Google Scholar] [CrossRef]

- Ganda, F. The impact of innovation and technology investments on carbon emissions in selected organisation for economic Co-operation and development countries. J. Clean. Prod. 2019, 217, 469–483. [Google Scholar] [CrossRef]

- Ahmed, Z.; Cary, M.; Ali, S.; Murshed, M.; Ullah, H.; Mahmood, H. Moving toward a green revolution in Japan: Symmetric and asymmetric relationships among clean energy technology development investments, economic growth, and CO2 emissions. Energy Environ. 2021, 33, 0958305X211041780. [Google Scholar] [CrossRef]

- Jiao, Z.; Sharma, R.; Kautish, P.; Hussain, H.I. Unveiling the asymmetric impact of exports, oil prices, technological innovations, and income inequality on carbon emissions in India. Resour. Policy 2021, 74, 102408. [Google Scholar] [CrossRef]

- Ma, Q.; Murshed, M.; Khan, Z. The nexuses between energy investments, technological innovations, emission taxes, and carbon emissions in China. Energy Policy 2021, 155, 112345. [Google Scholar] [CrossRef]

- Petrović, P.; Lobanov, M.M. The impact of R&D expenditures on CO2 emissions: Evidence from sixteen OECD countries. J. Clean. Prod. 2020, 248, 119187. [Google Scholar]

- Li, L.; McMurray, A.; Li, X.; Gao, Y.; Xue, J. The diminishing marginal effect of R&D input and carbon emission mitigation. J. Clean. Prod. 2021, 282, 124423. [Google Scholar]

- Wang, B.; Sun, Y.; Wang, Z. Agglomeration effect of CO2 emissions and emissions reduction effect of technology: A spatial econometric perspective based on China’s province-level data. J. Clean. Prod. 2018, 204, 96–106. [Google Scholar] [CrossRef]

- Cheng, Y.; Yao, X. Carbon intensity reduction assessment of renewable energy technology innovation in China: A panel data model with cross-section dependence and slope heterogeneity. Renew. Sustain. Energy Rev. 2021, 135, 110157. [Google Scholar] [CrossRef]

- Wang, Z.; Zhu, Y. Do energy technology innovations contribute to CO2 emissions abatement? A spatial perspective. Sci. Total Environ. 2020, 726, 138574. [Google Scholar] [CrossRef] [PubMed]

- Wang, Z.; Yang, Z.; Zhang, Y.; Yin, J. Energy technology patents–CO2 emissions nexus: An empirical analysis from China. Energy Policy 2012, 42, 248–260. [Google Scholar] [CrossRef]

- Kuznets, S. Economic growth and income inequality. Am. Econ. Rev. 1955, 45, 1–28. [Google Scholar]

- Ulucak, R.; Bilgili, F. A reinvestigation of EKC model by ecological footprint measurement for high-, middle-, and low-income countries. J. Clean. Prod. 2018, 188, 144–157. [Google Scholar] [CrossRef]

- Alnour, M. Do Innovation in Environmental- Related Technologies and Renewable Energies Mitigate the Transport-Based CO2 Emissions in Turkey? Front. Environ. Sci. 2022, 10, 1–20. [Google Scholar] [CrossRef]

- Romer, D. Advanced Macroeconomics, 4th ed.; McGraw-Hill: New York, NY, USA, 2012. [Google Scholar]

- Orea Sánchez, L.; Álvarez Pinilla, A.M. Alternative specifications of human capital in production functions. Econ. Bus. Lett. 2022, 11, 172–179. [Google Scholar] [CrossRef]

- Agrrawal, P. An automation algorithm for harvesting capital market information from the web. Manag. Financ. 2009, 35, 427–438. [Google Scholar]

- Jia, Z.; Wen, S.; Sun, Z. Current relationship between coal consumption and the economic development and China’s future carbon mitigation policies. Energy Policy 2022, 162, 112812. [Google Scholar] [CrossRef]

- Shin, Y.; Yu, B.; Greenwood-Nimmo, M. Modelling asymmetric cointegration and dynamic multipliers in a nonlinear ARDL framework. In Festschrift in Honor of Peter Schmidt; Springer: Berlin/Heidelberg, Germany, 2014; pp. 281–314. [Google Scholar]

- Alnour, M.; ALTINTAŞ, H.; Rahman, M.N. Unveiling the asymmetric response of global food prices to the energy prices shocks and economic policy uncertainty. World Dev. Sustain. 2023, 3, 100083. [Google Scholar] [CrossRef]

- Tolliver, C.; Keeley, A.R.; Managi, S. Policy targets behind green bonds for renewable energy: Do climate commitments matter? Technol. Forecast. Soc. Chang. 2020, 157, 120051. [Google Scholar] [CrossRef]

- IRENA. Renewable Energy Finance Flows [Internet]. Abu Dhabi. 2023. Available online: https://www.irena.org/Energy-Transition/Finance-and-investment/Investmen (accessed on 22 December 2023).

- Ulucak, R.; Danish; Kassouri, Y. An assessment of the environmental sustainability corridor: Investigating the non-linear effects of environmental taxation on CO2 emissions. Sustain. Dev. 2020, 28, 1010–1018. [Google Scholar]

- Kocak, E.; Alnour, M. Energy R&D expenditure, bioethanol consumption, and greenhouse gas emissions in the United States: Non-linear analysis and political implications. J. Clean. Prod. 2022, 374, 133887. [Google Scholar]

- Alvarez-Herranz, A.; Balsalobre-Lorente, D.; Shahbaz, M.; Cantos, J.M. Energy innovation and renewable energy consumption in the correction of air pollution levels. Energy Policy 2017, 105, 386–397. [Google Scholar] [CrossRef]

- Al-Mulali, U.; Solarin, S.A.; Ozturk, I. Investigating the presence of the environmental Kuznets curve (EKC) hypothesis in Kenya: An autoregressive distributed lag (ARDL) approach. Nat. Hazards 2016, 80, 1729–1747. [Google Scholar] [CrossRef]

- Nguyen, H.M. The relationship between urbanization and economic growth: An empirical study on ASEAN countries. Int. J. Soc. Econ. 2018, 2, 316–339. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).