Abstract

Sustaining a competitive position on the market has become crucial in order to survive in the dynamic environment under the influence of Industry 4.0. Industrial and service sectors have been affected by new technologies, such as automation, robotization, VR, AR or Big data, and their strategies towards future innovation and focus need to be reevaluated. This requires a revision of theoretical models that assess the external environment and following opportunities and threats. Our original study of 573 Slovak companies presents an analysis of Porter’s five competitive forces in the context of innovation activities and perceived impact of Industry 4.0 on companies. The research results provide a deep insight on the relevance of company size, maturity or sector to the different perspectives of the P5F model, as well as make clear the impact of each force on company measures and activities conducted in recent years. Our findings point to the strong technology push and main focus on product innovation, while reveal a paradigm shift in perceiving the power of suppliers. Results of our study lead to practical implications and enrich the theory on the relevance of strategic analysis in current era.

1. Introduction

The concept of the Fourth Industrial Revolution (Industry 4.0) was first presented at Hannover Messe in Germany in 2011. Its characteristics are cyber-physical systems, Internet of Things, Cloud computing and Big Data. The goal is to achieve efficiency and perfection with the help of automation [1]. The number “0” after 4 is based on the analogy of the software version designation, which means that the development of the industry falls under the technological development of information technology [2]. In the current era, product life cycles are shortening, and consumers demand products to be more complex and unique, which poses challenges to the manufacturing process. Industry 4.0 changes production—traditional, centrally controlled processes become decentralized and are based on self-regulation of products and work units that interact with each other. The concept works on the principle that products manage their own production, during which virtual reality is interwoven with the real one [3]. The connection of the physical and virtual world creates industrial ecosystems in which processes arise from the network interaction between objects, people and information. The industrial ecosystem can be understood as a network of firms in geographic proximity that allows firms to benefit from cooperation and gain competitive advantages [4]. It is driven from theories of industrial symbiosis, where companies exchanged input and output materials, for example, or used coordinated resource management [5,6]. Digital systems in today’s networks allow product creation to be planned and implemented with minimal human input, so that organizations will subsequently be able to offer the market a wide range of products tailored to customers without increasing costs. Big Data traveling between machines, robots and logistics processes are able to predict breakdowns, adapt production to new conditions and change inputs in the production process [2]. From the point of view of the competition, it is no longer enough to produce faster, cheaper and better, but it is also necessary to devise new innovative and digital strategies in order to ensure a competitive advantage in the long term [7]. We based our study on Porter’s Five Competitive Forces (P5F) model, which allows managers to anticipate trends in the industry and changes in the competition in order to influence it with strategic decisions that will ensure a competitive advantage. It is an analysis of five forces, comprising customer bargaining power, supplier bargaining power, the threat of substitute products, the threat of new entrants and intra-industry competition. The first four factors operate independently of each other but intensify intra-industry rivalry [8]. However, in today’s environment, companies face competition not only within their own industry, but across different industries. With the exponential increase in information technology, access to various information that provides insight to organizations from other industries is also increasing. Through digitization, companies easily gain knowledge about suppliers and their competition [9].

1.1. Porter’s Model of Five Competitive Forces

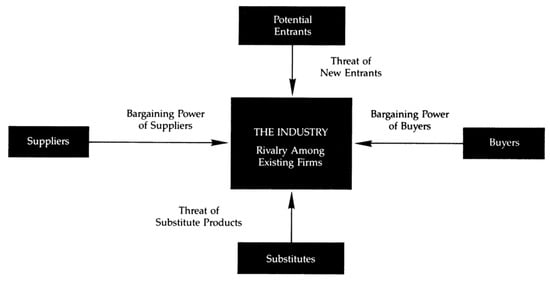

The P5F model was developed by Michael E. Porter and describes five competitive forces and essential causes that reveal the roots of industry profitability and serve to predict and influence competition over time. Understanding the industry structure is necessary for a company’s strategic position. Strategy can be explained as building a defense against competing forces or finding a position where the forces are weakest. Competitive forces reveal the important drivers necessary for competitiveness. Thinking about industry structure helps to uncover opportunities, such as differences in customers, suppliers, substitutes, potential entrants and competitors that are the basis for different strategies, which lead to a good market position. P5F also shows if the industry is attractive to investors [10] (Figure 1).

Figure 1.

The Five Competitive Forces that Determine Industry Competition. Source: Porter, M. E. (1990). The Competitive Advantage of Nations [11].

Porter (1979) describes competitive forces as follows [12]:

- Threat of new entrants: entry barriers protect the industry from newcomers who would try to gain market share. The strength of the threat of entry depends on the existing barriers and the response of existing competitors. Obstacles can be economies of scale, product differentiation, capital requirements, cost disadvantages independent of size and access to distribution channels and government policy.

- Bargaining power of customers: if the power of customers prevails, they will use their influence to lower prices or demand a higher value of the product/service. In this case, the profitability of the industry will be lower because customers will get more value. Consumers are more sensitive to price when products are undifferentiated, expensive relative to income or where quality is not important.

- Bargaining power of suppliers: if suppliers are strong, they will use it to charge higher prices or insist on more favorable terms. The profitability of the industry will be lower because the suppliers will get more value for themselves.

- Threat of substitute products or services: substitutes are products that meet the same needs as the established product. The more substitutable the product, the lower the profitability of the industry. Substitutes require a high degree of attention if they are subject to trends that can improve their price–performance ratio with the industry’s product or if they are produced by industries that achieve high profits.

- Rivalry among existing competitors: if the rivalry between competitors in the industry is high, profitability will be lower. Rivalry can take the form of price competition, advertising, introducing new products to the market and increasing customer service.

The intensity of these five forces varies across industries. In industries where the five forces are balanced (soft drinks, mainframe computers, database publishing, pharmaceuticals, cosmetics), many competitors achieve attractive returns on invested capital. In industries where the pressure of one or more forces prevails (rubber, aluminum, many fabricated metal products, semiconductors, small computers), only a few companies are profitable in the long term. The model determines the profitability of the industry as it shapes the prices that firms can charge, which are the costs and investments needed to be competitive [12].

Porter’s model helps companies to look at the balance of forces in the market, it helps in determining the strengths and weaknesses of the industry, it is also used in identifying the structure of the industry, determining business strategies (especially when establishing a new company or entering a new industry) [13]. The model is oriented towards external analysis, which, unlike the traditional SWOT analysis, allows to focus on the reaction to changes in the external environment. The model can also be combined with other models, such as PEST (political, economic, social, technological environment), through which it is possible to understand the dynamics in the environment. The model also points to the importance of searching for imperfect markets that bring opportunities in the form of high profits (however, this cannot be achieved in perfect competition) [14].

The following examples show the usefulness of P5F In business/economy:

- Through the analysis of the five competitive forces, Apple was able to gain a good position in its industry. With the advent of the Internet and digital distribution of music, its illegal downloading arose. Record companies also tried to develop their own platform for distribution, but major labels did not want to sell their music through a competing platform. Apple entered this market with the iTunes music store, which reduced the number of brands in the market [10].

- In the trucking industry, customers operate large fleets while demanding a low price. Manufacturer Paccar focused on one group of customers in the industry where competitive forces were weakest—individual drivers who own trucks and contract directly with suppliers. These customers are less sensitive to price due to emotional ties to their trucks. For them, Paccar developed features such as luxurious sleeping cabins, plush leather seats, elegant exteriors, etc. [10].

- Shi et al. (2021) conducted a study in which they verified the sustainability of the five forces model and its subsequent integration into the Chinese business economy [15]. The study showed that the five forces model was used to control the profitability and attractiveness of the industry during startups and expansions. However, there are differences between Chinese business and Western business. Chinese companies rely on good relationships, e-commerce, innovation and quality services rather than watching the competition. Their business philosophy is based on the fact that the competitive environment is an ecosystem and all participants in this industry (customers, suppliers, competitors, substitutes, new entrants) are interdependent and develop together. They see competition as temporary, because companies must work together to create and maintain a business environment with joint efforts.

1.2. Criticism of P5F

Critics of Porters model of five forces point to several areas such as its specific emphasis on large organizations [16] or the missing dynamic aspect [17,18], reflecting the expectation that the rivalry on the market may end only in zero-sum results. The current dynamics, however, show that coping with threats from other forces may be achieved through partnering with other entities resulting in mutual benefits. From the perspective of the application of P5F to today’s environment, some authors point to the shift in perspective in the case of specific forces as well as to missing the broader picture [16,19,20], which incorporates other driving forces of the industry and today’s environment. Fisk (2016) points to a noticeable shift in power to customers, while the effect of competitors becomes more inferior [21]. In the context of the power of suppliers, more arguments appear regarding the shift from a rather linear model of collaboration to more network or ecosystem oriented. Quiang et al. (2021) help promote understanding by explaining that the ecosystem allows to focus on more than just a value chain of processes by also looking for opportunities and collaborations in different backgrounds as well as industries [22]. Other critics of Porter’s five competitive forces model represent Shapiro and Varian (1999), who claim that Porter has no explanation for the choice of the given five competitive forces [23]. According to Dälken (2014), an important aspect that the model does not take into account is digitization [24]. The spread of the Internet and technological innovations is changing the global economy. The exponential spread of digital products, thus, questions Porter’s model. Lee et al. (2012) criticizes the model because its analytical power is limited by not being able to quantify the overall competitive state as well as the degree of each force [25].

1.3. P5F and Innovation

Digital transformation has caused organizations to focus their strategy on people. Today, people use products and services differently than they did 40 years ago. Additionally, new competitors are much more aggressive, and as long as competition continues, Porter’s model of competitive forces can provide organizations with a basic overview of it. Technology helps in the fight to all who are willing to use it in the global market [26].

More than 20 years ago Dowes (1997) identified three complementary forces that drive the competition in industries, which are digitalization, globalization and deregulation [27]. While these forces have been specific mainly to the times when Dowes adjusted the model, we can use the idea to shape the P5F model in relation to era specifics, such as currently, as all the world and companies are coping with the challenges of Industry 4.0, which is driven by many technologies, such automation, robotization, digitalization, big data, AI, VR and others. Of course, Industry 4.0 does not only affect technology but regulation as well, thus, we do not only look for deregulation in specific industries as Dowes (1997) pointed out, but also to the change in regulations in the dynamic environment. In Industry 4.0, it could be, for example, directing state investments to specific industries or technologies, such as described in publication by Wellner, S., and Lakotta, J. (2020) [28].

The context of the era specifics gives P5F a new dimension. We perceive that the topicality of this model is constant; however, the power in dimensions can shift due to the dimension of era specifics. Larry et al. (2014) tried to add an additional force to the model, called “level of innovativeness“, building on theories of innovation as a driver for sustaining competitiveness in the market, mainly due to the shortening product and design life cycles [9]. However, innovation has become essential for sustainability in the dynamic environment that we now face. It is apparent that companies focus on innovation activities in coping with the external and internal environment while they develop different kinds of innovation activities, focused on processes, products, organization, technology, marketing or the whole business model [29]. Porter’s five forces model gives input to the process of innovation while giving insight on external dynamics and helps identify opportunities and threats that can drive the change of organizational behaviors, reactions to competitors, strategies, products and portfolios, etc. [16]. In this context, we argue that innovation does not have to be perceived as one of the forces; however, innovation activities could be driven by different forces.

The current era, characterized by the Fourth Industrial Revolution, is moving in an interesting way from only an industrial view of digitization or technological progress to a perspective where it touches all industries, including service sectors, to a greater or lesser extent [30]. This progress is in line with characterizing digitalization by Johnson (2014), in that it leads to the sophistication of existing IT technology (that can be applied across industries), enlargement of the use of digital technologies and digitalization of processes in procurement, for instance, integration of processes across networks and digitalization in output processes and sales [9].

Information technology greatly affects P5F. For example, if the number of competitors increases, the intensity of competitors will be high. Firms in the industry must use information technology to survive and gain a competitive advantage. With their help, they can differentiate their products and create a higher value for the customer, a new product, improve efficiency and cost advantage [24].

A more modern strategy that reflects innovation concerning the concept of coping with the dynamic environment and disruption is Kim a Mauborgne’s (2005) Blue Ocean Strategy, which allows companies to gain advantage by creating new markets without existing competitors (in contrast to red oceans full of competitors) [31] or Ismail’s (2014) concept of “exponential organization“, defined as a strategy to innovating top-down, bottom-up and from sides (using the concept of the Blue Ocean Strategy) [32], thus, combining all approaches to innovation to gain competitiveness. Furthermore, companies can use separated innovation “hubs“ or teams, which can focus on innovative solutions to business problems with high risk potential. By having a separate innovation team and leadership, it is possible to sustain current activities that bring revenues in the current corporate culture while developing new possibilities for future development. Additionally, Chesbrough’s (2003) concept of open innovation is a very topical model that can help speed up innovation processes as well as creating opportunity for sharing knowledge, costs, increasing effectiveness and more mutual benefits for entities collaborating in innovation processes [33]; these can be business partners, universities, customers and consumers, competitors, non-profit organizations, science parks and other institutions.

The literature review on PF5 forces clearly emphasizes the necessity to review this strategic model, which has been used for over decades now. Several authors [16,17,18,19,20,21,22,23,24,25,26,27,28] have pointed out that the specifics of companies, as well as the role of the external environment in the context of globalization, in their drive for innovation or digitalization, may affect the informative value of this analysis. Simultaneously, this model can not be used in order to derive direct predictions in the dynamic environment, which is far from the equilibrium state. This leaves a literature gap on how companies perceive competitive forces in a specific era and environment as well as how accurate the original model is in today’s conditions. To close the literature gap on PF5 accuracy with respect to the current environment, it is necessary to conduct empirical research, testing the assumptions and findings presented by previous research. Following that, this article specifically focuses on the current era in the context of the Fourth Industrial Revolution, which affects companies through new technologies, such automation and digitalization, and creates a strong push for innovation in order to sustain a competitive position in the market.

2. Materials and Methods

The aim of this study is to analyze the approach of companies to innovation activities in the current era under the influence of Industry 4.0, drawing from competitive factors based on Porter’s model of five forces. The approach of our analysis reflects the criticism of Porter’s model in the current era and focuses on explaining the behavior of companies in relation to specific forces in the external environment. For the purpose of analysis, we have conducted an original survey of 573 Slovak companies.

The research was conducted through electronic questionnaire distributed to managers and owners of companies in the period from 2020–2021. The questionnaire was comprised of 5 questions describing the respondent‘s category, including company size, maturity level, domestic or foreign subsidiary, type of industry and subjective perception of company as stable, flexible and efficient, innovative, lean or chaotic. The research questionnaire was part of a research project and consisted of 19 questions, while for the purpose of this paper, we have focused on 7 questions.

The sample size has a confidence level of 98% with a margin of error 5%; thus, the results can be interpreted as representative of the whole population of Slovak companies. This unique research sample represents all company sizes, with 76.79% representing SMEs and 23.21% representing large companies. Furthermore, the sample was categorized based on maturity level, with 2.44% starting companies (startups), 17.98% growing companies and 79.58% mature companies. Within the research, the majority of companies were Slovak-domestic (73.12%), 20% were foreign-based (subsidiaries) and 6,81% were identified as “other”. In the context of Porter’s analysis of external factors in industry, we further analyzed the perspectives of selected sectors, which were represented by industrial sectors (35.43%) and service sectors (50.26%). For the sectoral analysis we have excluded organizations from the public sector (12.22%) and third sector (2.09%) (Table 1).

Table 1.

Categorization of research sample (N = 573).

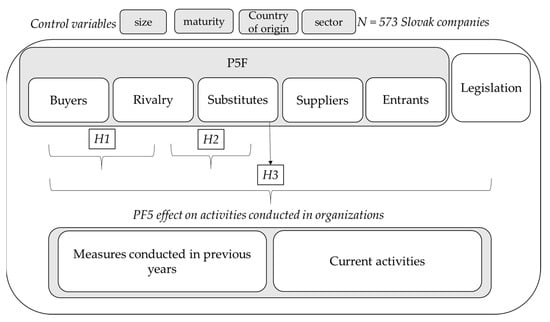

The research framework (Figure 2) consists of two sections of analysis. The first section is focused on in-depth analysis of respondents in the context of Porter’s five forces theoretical model with respect to the classification of respondents based on size, maturity, country of origin and sector. The second section is focused on analysis of impact of each individual factor of the PF5 model on the company’s measures, which have been conducted in previous years in response to the environment, Industry 4.0 and COVID-19, followed by analysis in relation to current activities conducted by companies. In each of these analyses, we used control variables characterizing the research sample to identify which of the PF5 factors significantly impact the company’s behavior, both in previous years and present, with specific focus on activities linked to Industry 4.0 challenges, such as innovation, product development, automation and digitalization. Within the second section of analysis, we formulated three hypotheses following previous research in theoretical background, described in the Data Analysis section.

Figure 2.

Research framework diagram.

The first section of the research is focused on deep analysis of Porter’s five forces in the context of Slovak companies and the current era. The respondents were asked to rate their expectations of the impact of Industry 4.0 on their industry, with six factors, of which five represented competitive forces and added an aspect of legislative norms with a focus on green technology and environment (with regards to EU Agenda 2030). The listed factors were as follows:

- Stronger competition between existing companies;

- Content change—creation of new products based on new technologies, innovations;

- Changing the relationship with suppliers (Procurement 4.0);

- An increase in the demands and expectations of buyers and customers;

- Entry of new competition into the industry (horizontal and vertical integration);

- Legislative standards (green technology, CO2, environmental limits, safety).

Scaling was based on a Likert scale from 1–4, where 1 represented “do not expect impact, or very low”; 2—“low to middle impact”; 3—“middle to high impact”; 4—“very high impact”. Within the deep analysis, we have used Pearson’s correlation coefficient to identify possible relations of company characteristics to their expectations of Industry 4.0 impact and further analyzed specific sectors.

The second section of the analysis was focused on activities of companies in relation to the external environment and PF5. In order to further understanding linked to Industry 4.0 specifics, we have looked at measures that companies have conducted in past years (2020–2021) in response to the environment, Industry 4.0 and COVID-19, where companies could select a suitable number of measures from 19 possible measures:

- Process innovation.

- Automation.

- Computerization.

- Outsourcing.

- Restructuring.

- Implementing cost reduction initiatives.

- Strengthening product development and innovation.

- Aggressive marketing.

- Change of employment–legal relations.

- Hiring/admission of specialists.

- Product diversification.

- Focusing (specialization) on the market or customers.

- Strategic partnerships.

- Re-evaluation of suppliers.

- Optimization of the supply–customer chain.

- Stopping investment activities and projects.

- Introduction of online communication channels for communication with customers.

- No measures.

- Other measures.

For the purpose of the analysis, it was necessary to analyze not only previously conducted activities but also priority activities that companies are focusing on now (How much activity is carried out in your organization for the development of the following factors?), where respondents could answer on Likert scale from 1–4, with 1 representing no activity and 4 representing intensive activity. The analyzed factors were as follows:

- Quality of human resources.

- Optimization and efficiency of processes.

- Knowledge sharing among employees.

- Generation of innovations.

- Building the brand and image of the organization.

- Customer relations.

- Relations with other external entities.

- Technologies—hardware, devices.

- Technologies—applications, software, licenses.

- Automation, digitization.

Data Analysis

For the purpose of data analysis, we have used correlation analysis as well as regression analysis with a significance level at p = 0.05. Linear regression was used in order to identify moderating factors in activities focused on innovation and technological advancement, which are key activities for sustainability in the dynamic and fast changing environment of Industry 4.0. The independent variable selected was the measure or activity of the company, while independent variables were PF5 and control variables, including the company’s characteristics of size, maturity, origin and sector. For the purpose of the assessment of correlation analysis, we followed Rimarčík’s approach to the assessment of qualitative data, where a correlation from 0.1–0.3 was defined as low, from 0.3–0.5 as moderate and from 0.5 or higher as high [34].

Based on the current state of the literature on the topic of industrial competitive forces and its effects on companies’ behavior, we have formulated the following hypotheses for the purpose of data analysis:

In relation to Fisk [21], we perceive the threat of new innovative products to be the key driving force in the current environment under the influence of Industry 4.0 and economic dynamics. However, as Fisk mentions the shift to the power of customers, we argue that the expected impact of Industry 4.0 is not strong on this force, while the products are currently driven more by the industrial sector than customers, thus, we expect that H1 will not be confirmed, but H2 will be confirmed.

H1.

Companies expect changes driven by Industry 4.0 significantly more in buyers’ force than in industry rivalry.

H2.

Companies expect changes driven by Industry 4.0 significantly more in substitute force than in industry rivalry.

Following Bruijl [16], the external environment can have a strong impact on innovation activity, while we expect that the current Fourth Industrial Revolution will lead to a stronger focus on content change in products and innovations driven by new technology.

H3.

Companies innovate in Industry 4.0 technologies significantly more due to substitute force than other Porter’s forces.

3. Results

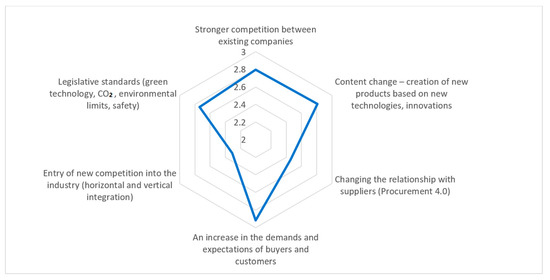

In a general overview of the assessed P5F plus legislative standards in the environment, in the sample group of 573 Slovak companies, we observe that the strongest effect of Industry 4.0 is expected to be on the increase in demands and expectations of buyers and customers and content change—creation of new products based on new technologies, innovations. These represent the buyers’ force and the force of or threats of substitute products, based on strong customer orientation. This is followed by the expected rivalry in the market and expected changes in legislative standards (in this case we mentioned standards linked to Europe’s Agenda 2030 and green energy and environmental policy). Interestingly, the lowest change is expected on threats of new entrants to the industry and changing relationships with suppliers. This general assessment is presented in Figure 3.

Figure 3.

General assessment of expected changes in PF5 under Industry 4.0 (N = 573).

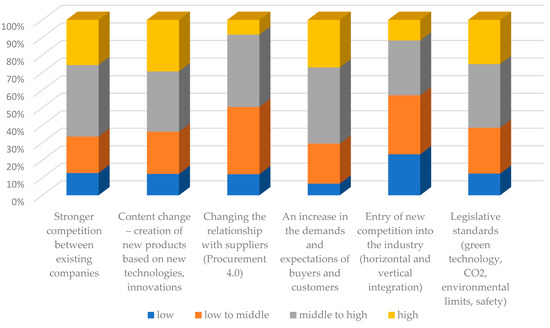

Figure 4 presents a detailed assessment of PF5, based on the percentage of companies that see the impact of Industry 4.0 on each force as low, low to middle, middle to high or high. Of Slovak companies, 57% see only low or low to middle impact on the entry of new competition. However, 70% of companies in the research sample expect an increase in the demands of customers and 63% expect content change.

Figure 4.

Percentual assessment of company expectations of Industry 4.0 on P5F.

While the research sample consisted of companies of different sizes, sectors, countries of origin and maturity levels, we have conducted correlation analysis to identify the possible links and relations to the specific PF5. Within the country of origin (domestic or foreign-based company) and maturity level there was no significant link to the assessment of P5F. On the other hand, the results presented in Table 2 show that the size of a company mattered in case of procurement, increase in demands and legislative norms, which were expected to be affected by Industry 4.0 slightly more within larger companies compared to smaller. In sector analysis, stronger rivalry, content change and entry of new competitors were more expected within service sectors.

Table 2.

Correlation analysis of PF5 forces in context to company categorization.

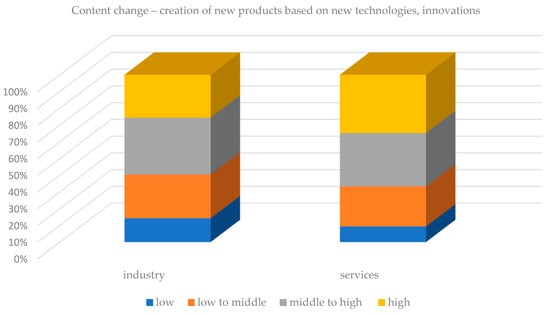

As presented in Figure 5, 67% of companies operating in service sectors expect middle to high or high impact of Industry 4.0 on content change—creation of new products based on new technologies and innovations, compared to 60% of companies in industrial sectors.

Figure 5.

Percentage comparison of companies in industrial and service sectors based on expected change in content within P5F.

While the main purpose of the original PF5 model is based on sectoral analysis, we have conducted in-depth analysis on seven industrial sectors and six service sectors in Slovakia. The correlation analysis presents five forces with the following abbreviations and added legislative standards:

- 1F—Stronger competition between existing companies.

- 2F—Content change—creation of new products based on new technologies, innovations.

- 3F—Changing the relationship with suppliers (Procurement 4.0).

- 4F—An increase in the demands and expectations of buyers and customers.

- 5F—Entry of new competition into the industry (horizontal and vertical integration).

- Legislative standards (green technology, CO2, environmental limits, safety).

Table 3 presents low correlation in the link of the engineering industry to stronger rivalry, and content change expected in the automotive and electrotechnical industries. On the contrary, a negative low correlation of −0.12 in the construction industry presents low expectations for content change. Legislative standards are again linked mostly to the automotive industry in Slovakia, which is a strong leading industry.

Table 3.

Correlation analysis of industrial sectors and PF5.

In service sectors, stronger rivalry under Industry 4.0 is expected mostly in wholesale and retail, with low correlation, as presented in Table 4. Content change is expected in information and communication technologies, and not expected in legal, accounting and business consulting (with a negative low correlation of −0.11). Additionally, in information and communication technologies, legislative standards are the least expected under the influence of Industry 4.0 (with a correlation of −0.13).

Table 4.

Correlation analysis of service sectors and PF5.

P5F in the Context of Current Innovation Activities

This study, however, does not aim to focus on deep sectoral analysis in the context of PF5 but to analyze the specific behaviors of companies in the context of activities and innovations linked to the changes in the environment under Industry 4.0. The current research and literature has already pointed out that Industry 4.0 does not affect only industrial services, but the entire business environment, including service sectors. Following that, we have conducted the following analysis on a sample of 573 Slovak companies, covering all the categories of companies as well as ensuring a statistically sufficient sample of more than 383 companies to provide statistical significance for the generalization of results representative of the whole population of Slovak companies.

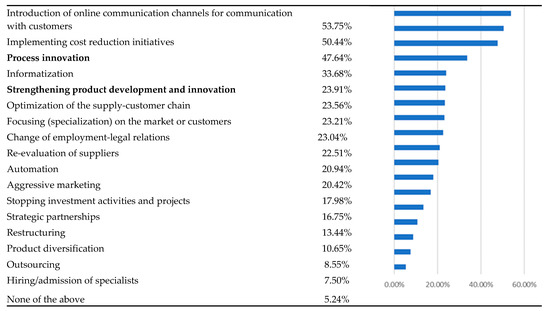

Slovak companies in the era of Industry 4.0 have mainly focused on the introduction of online communication channels, implementing cost reduction initiatives and process innovation. All these measures have been conducted during the period from 2020–2022 in reaction to the external environment, including the COVID-19 pandemic. Interestingly, 18% of companies have stopped investment activities and projects, and only 17% have focused on building strategic partnerships (Figure 6). Strengthening product development and innovation, linked to P5F, was conducted by 24% of companies. While innovative activities are still low in Slovakia compared to other European countries based on the European Innovation Scoreboard (Slovakia on 23rd place in 2021), it is still important to understand the motivation for such innovative behavior, in this case, in the context of PF5. As presented in Table 5, regression analysis shows that the moderating effect on the dependent variable—strengthening product development and innovation can be observed only in F2—expected change in content—the creation of new products based on new technologies and innovations in the industry under the influence of Industry 4.0. This is not affected by size, country of origin, maturity or sector. For comparison, cost reduction initiatives are not significant to any changes in environment or company specifics in regression analysis.

Figure 6.

Percentage comparison of companies that have realized specific measure in response to the environment from 2020–2022 (N = 573).

Table 5.

Regression analysis—drivers for strengthening product development and innovation.

In Table 6, we present regression analysis for conducting automation in companies operating in Slovakia. Automation, as a driving technology for Industry 4.0, is affected as well by F2—change in content in products and innovations from the analyzed P5F. However, automation is also affected by the size of the company, being conducted more in larger companies and more in service sectors. This can be understood in the context of the later effect of Industry 4.0 on services, spreading the technology from industrial sectors to other supporting sectors. Interestingly, growing companies show more automation activities than mature companies. This, however, is mostly linked to the more agile behavior of growing companies (Kohnová et al., 2022 [20]) as well as their stronger innovative drive.

Table 6.

Regression analysis—drivers for automation in companies.

In previous regression analysis, we have focused on measures conducted in previous years. Following that, now we analyze the current activity of companies in the same context of PF5 forces. The current activities linked to adaption of Industry 4.0 technologies, such as automation and digitalization, present another view on the expectations of changes within the market. Companies were analyzed based on how much activity is currently ongoing in the specific areas, in this case, automation and digitalization. Even this analysis presents similar results (Table 7). Current activity is dependent on the size and sector, where more activity in digitalization and automation can be observed in service sectors and larger companies. We observe that the intentions in automation/digitalization are even stronger in service sectors compared to already conducted measures as shown in Table 7, presented by beta coefficients (0.07 in previous activities, 0.21 in current activities shows increasing focus of service sectors on automation/digitalization). As well as the significance of F2—content change within PF5, here, we observe the importance of effects on 4F—an increase in the demands and expectations of buyers and customers.

Table 7.

Regression analysis: Current activity in the area of automation/digitalization.

Similar results can be observed in activities focused on technology, such as software, hardware or applications, with the main significant control independent variables being size, sector, content change and increase in demands of customers. In addition to the analyzed technological activity of Slovak companies, the following analysis presented in Table 8 shows that content change is linked to almost every activity currently conducted in companies and to changes in demands as well. In Table 8, we have highlighted correlations greater or equal to 0.15, which occur mainly in two analyzed factors. However, it is important to point out relations with other external entities, which have only very low links to expected impacts of Industry 4.0 on the industrial environment. For many strong innovators (based on European ranking, for example), it is partnerships and an open innovation approach particularly that allow companies to overcome industrial challenges and develop and implement innovations more quickly, thus, creating and sustaining their competitive advantage [35]. Similarly in the context of Industry 4.0 technologies, their development and implementation is often very cost intensive and requires several operational changes in the organization, as well as changes that effect employee relations, recruitment, communication networks, procurement, etc., thus, affecting other entities that could be part of the innovation process. As shown in the first part of the analysis in this article, a focus on strategic partnerships was low, both in current activities and in previous measures.

Table 8.

Correlation analysis of PF5 in relationship to current activity of companies in selected areas (N = 573).

Similar to our approach to PF5 to Industry 4.0 challenges, Deloitte’s 2020 study of 2029 executives discovered what the priorities are in terms of the strategic focus of investment in Industry 4.0 [36]. More than half of the leaders (56%) prefer protecting organization from the disruption of new or existing competitors, while 26% invest in disrupting competition with new ways of doing business, 53% finding growth opportunities for existing products and services and 40% developing innovative/differentiated products and services [37].

4. Discussion

Technological progress is drastically changing the lives of people all over the world. Technologies such as the mobile phone and the Internet have created a new kind of economy that enables quick access to information, where consumers expect fast delivery, up-to-date information about a product, its price, user feedback and more. In order to ensure such dynamics in the market, organizations are changing their business models and value chains [38]. Results of our study show that the most important impact of Industry 4.0 within P5F is on content change—creation of new products based on new technologies and innovations, which has been significantly higher than the impact on rivalry among competitors. Our results show that activities that have been conducted in previous years, such as the development of new products and innovations or process automation, as well as activities that are currently realized, such as automation/digitalization, has been linked significantly to expected content exchange, not rivalry in the market, proving H2: Companies expect changes driven by Industry 4.0 significantly more in substitute force than in industry rivalry. H2 hypothesis has been proven even in the context of differences in service and industrial sectors. On the other hand, H1: Companies expect changes driven by Industry 4.0 significantly more in buyers’ force than in industry rivalry has not proven statistically significant for higher expected impact of buyer’s power over rivalry. Increase in demands and expectations of customers was found to be a moderating factor for current activity in the automation and digitalization of companies, which can be understood also from the perspective of digitalization services offered by companies. In this context, we can see in our analysis that only wholesale, retail and engineering sectors are significantly affected by change in customer demands. These results point to a strong technology push that is driven by Industry 4.0 and impacts the content change of products and innovations. In the industrial environment, we can observe a so-called technology-first rollout, which represents an approach to innovation based on making solutions without obvious value opportunities. The Fourth Industrial Revolution brought not only the technology push itself (new technologies and improvements) but also changes in the needs of industry and production systems and processes (application-pull) [39]. However, in the context of Industry 4.0 studies, there is still a strong discussion linked to shifting from technology push to pull from customers [40,41,42], for example, through smart factories that enable production that is customer-centric and individualized, or creating innovation ecosystems that allow other entities to participate in innovation processes and projects. Another possibility of customer integration is also through servitization, by introducing service that, on the one hand, benefits customers, and, on the other hand, are beneficial for internal processes [43]. In this context, Industry 4.0 technologies as big data can be used to get a deeper understanding on the customer experience [44] and, thus, help to find the equilibrium of push and pull approaches.

In the context of rivalry, it is important to note that according to Porter, high rivalry can occur when companies want to compete against others, when they are not familiar with each other and where there is a high number of players and they share the same size and power [10]. While we could specifically analyze each sector and define the level of existing rivalry, our results clearly present that rivalry does not have a significant impact on current activities under the influence of Industry 4.0. This can be interpreted by the strong impact of Industry 4.0 on companies, specifically on technology development, automation/digitalization and innovation activities together with strategic necessity for building and developing networks, which is in line with the research of Wang and Wilkessmann [45,46]. These Industry 4.0 challenges lead to a decrease in barriers among companies on the one hand, and, on the other hand, speed up the innovation processes and changes in the content of the market, as well as lead to changes in organizational processes.

The strong importance of content change and substitute products in our research has been proven in innovative activities of companies conducted in past years and current times as well. Innovation and product development was one of the top five measures realized in response to the environment and COVID−19 from 2020–2021, and it was driven mainly by expected content change of products on the market, regardless of size, maturity, sector or country of origin of companies, which confirms our hypothesis H3: Companies innovate in Industry 4.0 technologies significantly more due to substitute force than other Porter’s forces. Similar results were linked to automation activities, where they were implemented significantly more by less mature companies with larger size, and slightly more within service sectors. Automation and following Industry 4.0 technologies were driven by industrial sectors in the beginning of Industry 4.0, while these technologies also affect service sectors, and we can observe a current strong focus on the automation and digitalization of processes and services for customers. Our results, in this case, are in line with the expectations of the European Commission in that a new wave of automation will soon disrupt service sectors, for example, through various applications of service robots [47] Further, growing and larger companies are often the drivers of technological innovations in the Slovak economy based on our results, while many smaller and mature companies lag behind with the implementation of new technology and innovation. In this case, it is especially important for smaller companies to overcome the barriers of transformation to Industry 4.0, such as cost intensity or large operational challenges, through strategic partnerships, for example, building within the supply chain. In this context, it is important to mention that the Slovak Republic is closely linked to the German economy, mainly through automotive industry, where many innovations are driven by German companies and headquarters and are further implemented into supply chains in the Slovak Republic.

Interestingly, our results show that Slovak companies do not expect a large impact due to Industry 4.0 on supplier force, neither in the service or industrial sectors. In previous years, based on our results, 22.5% of Slovak companies did re-evaluate suppliers. These results can be explained through the concept of Procurement 4.0 [48,49,50], utilizing digital technologies and IoT to automate processes and operations that lead to cost saving, building trust within the supply chain, reducing risks, increasing connectivity or introducing new opportunities for innovation within the chain or business model development. The resulting low impact of supplier force, thus, explains change in relations in the supply chain. Companies focus on managing relations with their suppliers rather than finding new suppliers, and by introducing smart systems in their supply chains they can gain long-term mutual benefits from cooperation and supply chain resilience [51].

Industry 4.0 has brought more transparency and accuracy to the systems of procurement and supply chain relations, and we argue that it has shifted the Porters perception of bargaining power of suppliers. It seems, that in assessment of external forces it is not the aim to define the power of supplier, however to analyze the form and structure of supply chain relations together with processes, technologies and communication. Nowadays businesses tend to have close relations with their suppliers and audit their internal processes and price calculations in order to make their internal decisions. On one hand the manufacturer for example is willing to finance not just main costs of the supplier but their innovation activities as well, however is not willing to pay for inefficiencies. Furthermore, these close links with suppliers are one of the key elements of building successful innovation ecosystem around a company [52] and important part of Chesbrough’s topical open innovation approach [33]. Today, many globally oriented organizations have started to build their relationship with the supplier at the partner level, as they realize that this cooperation leads to competitiveness [53,54].

In our analysis, we have focused on Legislative standards (green technology, CO2, environmental limits, safety) in respect to Europe’s Agenda 2030 and thus strategic areas for future development. This external factor did not have a significant impact on current activities in general sample, however within automotive industry, we could observe a low significant correlation. Automotive industry is the strongest leading industry in Slovak republic, and thus we can expect that Legislative standards will have an impact on activities, products and innovations offered by automotive industry in future. The effect of external entities on content change and thus technology-push can be seen even in context of smart specialization, approach based on identifying strategic areas and potential of countries or regions and knowledge-based investments focusing on strengths and comparative advantages. This approach aims at concentration of resources and capabilities in order to generate new activities in specific regions [55,56]. Furthermore, Technology Foresight [57] is another approach linked to technology-push, were by systematic exercise and activities it is possible to see the long-term evolvement of technologies, innovation and science and from that adopt and develop new policies.

When analyzing company activities linked to Industry 4.0 and its technology’s, we believe it is important to mention and important phenomenon of “information asymmetry” [58]. While this has not been a primary topic in our research, we believe that it is important to incorporate this phenomenon in future research of Industry 4.0 technology and its implementation. Information asymmetry represents an imbalance in knowledge between negotiating partners about specific factors, details or information. A specific example can be when a seller offers “lemon to market”, hoping to gain advantage of customer who is unaware of real worth. The level of presented digitalization can in this case have various informational values. First of all, presented level of digitalization is not forthright and could be not reliable for customer and if misled, it could create risks for business partners. On the other hand, higher level of digitalization does not necessarily lead to better state, on contrary theory presents several negative effects [59] such anxiety, organizational culture unfavorable for creativity or creation of unintentional disinformation.

5. Conclusions

Our findings lead to a comprehensive outlook on external forces based on Porter’s model of five competitive forces in the current era under the influence of Industry 4.0. While the current literature focuses on the specifics of each of the external forces, it is necessary to understand the strategic model in the current environment and outline the practical implications of the results. While there is a strong stream of literature focused on the customer-centric impact of Industry 4.0, our results present a still dominant technology push in companies operating in Slovakia. In addition to customer orientation, the theory reveals new concepts, such as Industry 5.0 or Society 5.0, which call for higher focus on societal perspectives, sustainability, resiliency and coping with long-term issues of humanity [60]. Without doubt, these issues need to be addressed; however, the business approach is still driven by many policies and global competition, which strengthens the position of industry-driven innovation. For example, we can mention electric vehicles, which are strongly supported in developed countries, and push manufacturers to shift production from combustion engines to electric, regardless of market demand.

Still, in the current dynamic environment, the key to sustainability and success of organizations is innovation. Innovation in the context of system dynamics can be enriched and sustainable through building strategic partnerships and innovation ecosystems, where organizations can develop new ideas, products and services together with customers, suppliers, universities, research centers and other entities to fight against competition [61,62]. Today, it is not only important to protect against the five competitive forces, but it is essential to cooperate and maintain innovation due to the increasing power of the Internet and new information technologies. The technological advancements we see, whether in logistics, distribution or communication, make it possible for organizations to buy and sell products on a global level. One of the new approaches for how to cope with external forces under the influence of Industry 4.0 is to utilize agile principles and agile management in organizations, in order to create a more flexible environment that can simplify processes of customer integration as well as cope with the everchanging environment and technological progress. Agile management has become observable mostly in growing innovative organizations; however, it is still problematic to implement in stable organizations [20]. Furthermore, strategic partnerships can create a large comparative advantage for partners in the long term, in contrast to only project-oriented activities or short-term-oriented collaborations, which do not create space for the common addressing of strategic issues that arise from coping with the dynamic environment of Industry 4.0. These issues do not only include cost reduction or focus on productivity gains, but also on managing structural changes that will work toward a more qualitative path of future growth and sustainability.

The purpose of this article within the theory was to point out the importance of the specifics of the economic environment in the application of strategic models, in this case the model of five competitive forces according to Porter, which is one of the key analyses used for the characteristics of the industry. We perceive the contribution of this paper, especially in the field of strategic management research, considering that Porter’s model has been adopted and used for decades in an unchanged form. In this analysis of the PF5 model in the context of current challenges linked to the economic environment and Industry 4.0 challenges, our results clearly show that companies are not affected by rivalry in the industry or supplier force in their decisions on activities linked to innovation, automation or digitalization. On the contrary, the strongest effect is created by the threat of substitutes, mainly by content changes in products and innovations on the market. This is an interesting result also in relation to analyzing the dependent market economy (DME), such as the Slovak Republic, where despite this, suppliers are not the main driving force for conducted measures and innovations.

The contribution to the theory of strategic management is also in relation to following previous research and testing hypotheses following Fisk [21], where our results do not prove buyers’ force as a key driver of innovations on the current market; on the contrary, our findings lead to a still persistent strong push to market approach of companies. With regards to Bruijl [16], our findings confirm the necessity of the broader application of the PF5 model through the inclusion and consideration of specific factors, such as era specifics (Industry 4.0 in the case of this era, for example) or size and maturity level of the company in order to interpret the significance and impact on each of the competitive forces.

6. Limitations and Future Research

This study was conducted on a research sample of 573 Slovak companies, which offers a unique statistically significant outline of population behavior. However, Slovakia belongs to moderate innovators based on the European Innovation Scoreboard and falls behind innovation leaders in adapting to Industry 4.0 challenges. Thus, we perceive that these outcomes could be enriched by following studies conducted on countries that belong to innovation leaders to compare and identify possible differences in approach to the external environment based on innovation maturity level. Further studies are also needed to test the relevance of strategic analysis of the environment in current era, which leads to the disruption of many theories that were applicable under circumstances linked to previous decades.

Author Contributions

L.K. conceived and designed the paper; L.K. and N.S. performed the experiments; L.K. and N.S. wrote the paper. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Acknowledgments

This research was supported by VEGA 1/0792/20 Examining Changes in Business Management in Slovakia in Connection with the Transition to Industry 4.0 and funded by the Operational Program Integrated Infrastructure for the project: National infrastructure for supporting technology transfer in Slovakia II—NITT SK II, co-financed by the European Regional Development Fund.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Duda, J.; Gasior, A. Industry 4.0: A Glocal Perspective; Routledge: New York, NY, USA, 2021; ISBN 978-1-003-18637-3. [Google Scholar]

- Ferreira, M.J.; Moreira, F.; Seruca, I. Digital Transformation Towards a New Context of Labour: Enterprise 4.0. In Technological Developments in Industry 4.0 for Business Applications; IGI Global: Hershey, PA, USA, 2019; ISSN 2327-3518. [Google Scholar]

- Pascual, D.G.; Daponte, P.; Kumar, U. Handbook of Industry 4.0 and Smart Systems; CRC Press: Boca Raton, FL, USA, 2019; ISBN 978-1-138-31629-4. [Google Scholar]

- Chertow, M.; Portlock, M. Developing Industrial Ecosystems: Approaches, Cases, and Tools; Yale School of Forestry & Environmental Studies Bulletin Series; Yale School of the Environment: New Haven, CT, USA, 2002; p. 95. [Google Scholar]

- Frosch, R.A.; Gallopoulos, N.E. Strategies for manufacturing. Sci. Am. 1989, 266, 144–152. [Google Scholar] [CrossRef]

- Ashton, W. Understanding the Organization of Industrial Ecosystems. J. Ind. Ecol. 2008, 12, 34–51. [Google Scholar] [CrossRef]

- Matt, D.T.; Rauch, E. SME 4.0: The Role of Small- and Medium-Sized Enterprises in the Digital Transformation. In Industry 4.0 for SMEs: Challenges, Opportunities and Requirements; Palgrave Macmillan: London, UK, 2020; ISBN 978-3-030-25425-4. [Google Scholar]

- Michaux, S. Porter´s Five Forces; Lemaitre Publishing: Namur, Belgium, 2015; ISBN 978-2-8062-6838-9. [Google Scholar]

- Larry, M.; Shamir, L.; Johnson, F. The 5 Competitive Forces Framework in a Technology Mediated Environment. Do These Forces Still Hold in the Industry of the 21st Century? Bachelor Thesis, Faculty of Management and Governance, University of Twente, Enschede, The Netherlands, 2014. Available online: https://essay.utwente.nl/66196/1/Johnson_BA_MB.pdf (accessed on 15 November 2022).

- Porter, M.E. On Competition; Harvard Business School Publishing: Boston, MA, USA, 2008; ISBN 978-1-4221-2696-7. [Google Scholar]

- Porter, M.E. The Competitive Advantage of Nations; The Free Press: New York, NY, USA, 1990; ISBN 0-684-84147-9. [Google Scholar]

- Porter, M.E. How Competitive Forces Shape Strategy; Harvard Business Review, March–April 1979; Macmillan Education UK: London, UK, 1989. [Google Scholar]

- Perera, R. Understanding Porter’s Five Forces Analysis; Nerdynaut: Avissawella, Sri Lanka, 2020; ISBN 979-8627600376. [Google Scholar]

- Goyal, A. A Critical Analysis of Porter’s 5 Forces Model of Competitive Advantage. J. Emerg. Technol. Innov. Res. 2020, 7, 149–152. [Google Scholar] [CrossRef]

- Shi, C.; Agbaku, C.A.; Zhang, F. How Do Upper Echelons Perceive Porter´s Five Forces? Evidence From Strategic Entrepreneurship in China. Front. Psychol. 2021, 12, 649574. [Google Scholar] [CrossRef] [PubMed]

- Bruijl, G.H.T. The Relevance of Porter’s Five Forces in Today’s Innovative and Changing Business Environment. SSRN Electron. J. 2018. [Google Scholar] [CrossRef]

- Srivastava, R.M.; Verma, S. Strategic Management: Concepts, Skills and Practices; PHI Learning Pvt. Ltd.: New Delhi, India, 2012. [Google Scholar]

- Aktouf, O.; Chenoufi, M. The False Expectations of Michael Porter’s Strategic Management Framework. Probl. Perspect. Manag. 2005, 4, 181–2005. [Google Scholar]

- Grundy, T. Rethinking and reinventing Michael Porter’s five forces model. Strateg. Chang. 2006, 15, 213–229. [Google Scholar] [CrossRef]

- Kohnová, L.; Stacho, Z.; Salajová, N.; Stachová, K.; Papula, J. Application of Agile Management Methods in Companies Operating in Slovakia and the Czech Republic. Econ. Res.-Ekon. Istraživanja 2022, 1–16. [Google Scholar] [CrossRef]

- Fisk, P. Is Michael Porter Still Relevant in Today’s Fast and Connected Markets? Thegeniusworks.com. Available online: https://www.thegeniusworks.com/2016/10/michael-porter-still-relevant-todaysdynamic-digital-markets/ (accessed on 16 October 2016).

- Qiang, C.Z.; Liu, Y.; Steenbergen, V. An Investment Perspective on Global Value; World Bank Publications: Washington, DC, USA, 2021. [Google Scholar]

- Shapiro, C.; Varian, H. Information Rules: A Strategic Guide to the Network Economy; Harvard Business School Press: Boston, MA, USA, 1999; ISBN 0-87584-863-X. [Google Scholar]

- Dälken, F. Are Porter’s Five Competitive Forces Still Applicable? A Critical Examination Concerning the Relevance for Today’s Business. Bachelor’s Thesis, University of Twente, Enschede, The Netherlands, 2014. [Google Scholar]

- Lee, H.; Kim, M.-S.; Park, Y. An analytic network process approach to operationalization of five forces model. Appl. Math. Model. 2012, 36, 1783–1795. [Google Scholar] [CrossRef]

- Martinez, M. Porter’s Five Forces, Digital Transformation and Competitiveness: Finding New Paradigms. Linkedin.com. 2020. Available online: https://www.linkedin.com/pulse/porters-five-forces-digital-transformation-finding-new-martinez (accessed on 20 November 2022).

- Downes, L. Beyond Porter. Context Magazine. 1997. Available online: http://www.mbatools.co.uk/Articles/BeyondPorter.pdf (accessed on 11 October 2022).

- Wellner, S.; Lakotta, J. Porter’s Five Forces in the German railway industry. J. Rail Transp. Plan. Manag. 2020, 14, 100181. [Google Scholar] [CrossRef]

- Wirtz, B.W.; Pistoia, A.; Ullrich, S.; Göttel, V. Business Models. Origin, Development and Future Research Perspectives. Long Range Plan. 2015, 49, 36–54. [Google Scholar] [CrossRef]

- Kohnová, L.; Salajová, N. Industrial Revolutions and their impact on managerial practice: Learning from the past. Probl. Perspect. Manag. 2019, 17, 462–478. [Google Scholar] [CrossRef]

- Kim, W.C.; Mauborgne, R. Blue Ocean Strategy: How to Create Uncontested Market Space and Make the Competition Irrelevant; Harvard Business School Press: Boston, MA, USA, 2005. [Google Scholar]

- Ismail, S.; Malone, M.S.; Geest, Y. Exponential Organizations: Why New Organizations Are Ten Times Better, Faster, and Cheaper than Yours (and What to Do about It); Diversion Books: New York, NY, USA, 2014. [Google Scholar]

- Chesbrough, H.W. Open Innovation: The New Imperative for Creating and Profiting from Technology; Harvard Business Press: Boston, MA, USA, 2003. [Google Scholar]

- Rimarčík, M. Štatistika pre Prax. Vlastné Vydanie, 200 s. 2007. Available online: http://rimarcik.com (accessed on 20 November 2022).

- Stachová, K.; Papula, J.; Stacho, Z.; Kohnová, L. External Partnerships in Employee Education and Development as the Key to Facing Industry 4.0 Challenges. Sustainability 2019, 11, 345. [Google Scholar] [CrossRef]

- Deloitte. Strategic Alliances: The Silver Bullet to Recover and Thrive in the New Normal. deloitte.com. Available online: https://www2.deloitte.com/ch/en/pages/financial-advisory/articles/5-success-factors-strategic-alliances.html (accessed on 20 November 2022).

- Döbler, T.M.; Mahto, M.; Sniderman, B.; Ahrens, C. Swim, Not just Float: Driving Innovation and New Business Models through Industry 4.0. Deloitte.com. 2020. Available online: https://www2.deloitte.com/us/en/insights/focus/industry-4-0/industry-4-0-business-models.html (accessed on 20 November 2022).

- Gunal, M.M. Simulation for Industry 4.0: Past, Present and Future; Springer: Berlin/Heidelberg, Germany, 2019; ISBN 978-3-030-04137-3. [Google Scholar]

- Lasi, H.; Fettke, P.; Kemper, H.G.; Feld, T.; Hoffmann, M. Industry 4.0. Bus. Inf. Syst. Eng. 2014, 6, 239–242. [Google Scholar] [CrossRef]

- Fonseca, L.M. Industry 4.0 and the digital society: Concepts, dimensions and envisioned benefits. In Proceedings of the International Conference on Business Excellence; Sciendo: Bucharest, Romania, 2018; Volume 12, pp. 386–397. [Google Scholar]

- Sony, M. Industry 4.0 and lean management: A proposed integration model and research propositions. Prod. Manuf. Res. 2018, 6, 416–432. [Google Scholar] [CrossRef]

- Boyer, J.; Kokosy, A. Technology-push and market-pull strategies: The influence of the innovation ecosystem on companies’ involvement in the Industry 4.0 paradigm. J. Risk Financ. 2022. ahead-of-print. [Google Scholar] [CrossRef]

- Frank, A.G.; Mendes, G.H.S.; Ayala, N.F.; Ghezzi, A. Servitization and Industry 4.0 convergence in the digital transformation of product firms: A business model innovation perspective. Technol. Forecast. Soc. Chang. 2019, 141, 341–351. [Google Scholar] [CrossRef]

- Chen, M.; Mao, S.; Liu, Y. Big Data: A Survey. Mob. Netw. Appl. 2014, 19, 171–209. [Google Scholar] [CrossRef]

- Wang, S.; Wan, J.; Li, D.; Zhang, C. Implementing smart factory of industrie 4.0: An outlook. Int. J. Distrib. Sens. Netw. 2016, 12, 3159805. [Google Scholar] [CrossRef]

- Wilkesmann, M.; Wilkesmann, U. Industry 4.0–organizing routines or innovations? VINE J. Inf. Knowl. Manag. Syst. 2018, 48, 238–254. [Google Scholar] [CrossRef]

- Sostero, M. Automation and Robots in Services: Review of Data and Taxonomys; JRC121893; European Commission: Seville, Spain, 2020. [Google Scholar]

- Mavidis, A.; Folinas, D. From Public E-Procurement 3.0 to E-Procurement 4.0; A Critical Literature Review. Sustainability 2022, 14, 11252. [Google Scholar] [CrossRef]

- Nicoletti, B. The Future: Procurement 4.0. In Agile Procurement; Palgrave Macmillan: Cham, Switzerland, 2018. [Google Scholar] [CrossRef]

- Batran, A.; Erben, A.; Schulz, R.; Sperl, F. Procurement 4.0: A Survival Guide in a Digital, Disruptive World; Campus Verlag: Frankfurt, Germany, 2017. [Google Scholar]

- Ralston, P.; Blackhurst, J. Industry 4.0 and resilience in the supply chain: A driver of capability enhancement or capability loss? Int. J. Prod. Res. 2020, 58, 5006–5019. [Google Scholar] [CrossRef]

- Kohnová, L. Dynamické Prostredie a Inovačný Manažment: Východiská a Výzvy Štvrtej Priemyselnej Revolúcie; Fakulta Veřejnosprávních a Ekonomických Studií v Uherském Hradišti: Uherské Hradište, Czech Republic, 2021; p. 181. ISBN 978-80-88328-14-8. [Google Scholar]

- Foray, D. On the policy of smart specialization strategies. Eur. Plan. Stud. 2016, 24, 1428–1437. [Google Scholar] [CrossRef]

- Haukioja, T.; Kaivo-oja, J.; Karppinen, A.; Vähäsantanen, S. Identification of smart regions with resilience, specialisation andlabour intensity in a globally competitive sector—Examination of LAU-1regions in Finland. Eur. Integr. Stud. 2018, 12, 50–62. [Google Scholar]

- PwC. Supplier Relationship Management: How Key Suppliers Drive Your Company’s Competitive Advantage. pwc.nl. 2013. Available online: https://www.pwc.nl/nl/assets/documents/pwc-supplier-relationship-management.pdf (accessed on 24 November 2022).

- Gutierrez, A.; Kothari, A.; Mazuera, C.; Schoenherr, T. Taking Supplier Collaboration to the Next Level. mckinsey.com. 2020. Available online: https://www.mckinsey.com/capabilities/operations/our-insights/taking-supplier-collaboration-to-the-next-level (accessed on 24 November 2022).

- Pietrobelli, C.; Puppato, F. Technology foresight and industrial strategy. Technol. Forecast. Soc. Chang. 2016, 110, 117–125. [Google Scholar] [CrossRef]

- Chand, P.; William, R. Scott, Financial accounting theory (5th edition), Pearson education, Toronto, Canada (2009) ISBN 978-0-13-207286-1 xiii + 546 pages, CDN$ 122.35, [euro]70.03. Int. J. Account. 2011, 46, 105–108. [Google Scholar] [CrossRef]

- O’Neil, C. Weapons of Math Destruction: How Big Data Increases Inequality and Threatens Democracy; Hardcover, $26; Crown Publishers: New York, NY, USA, 2016; 272p, ISBN 978-0553418811. [Google Scholar]

- Breque, M.; De Nul, L.; Petridis, A. Industry 5.0: Towards a Sustainable, Human-Centric and Resilient European Industry European Commission; Directorate-General for Research and Innovation: Luxembourg, 2021. [Google Scholar]

- Al Ani, M.K.; Imran, R.; Al Awaeed, Z.S. Big Data and Organizational Ambidexterity: A Strategic Perspective. In Fourth Industrial Revolution and Busness Dynamics: Issue and Implications; Palgrave Macmillan: Singapore, 2021; ISBN 978-981-16-3250-1. [Google Scholar]

- Adelakun, A. Should Porters Five Forces have Value in Businesses Today? Computing for Business (BSC); Aston University: Birmingham, UK, 2020. [Google Scholar]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).