Abstract

Outward foreign direct investments from innovative Chinese firms pose challenges to American stakeholders regarding how to balance economic gains and nationalistic sentiment. Relying on the stakeholder management framework, we analyze the dual nature of American economic stakeholders’ sentiments towards innovative Chinese firms. Both positive and negative sentiments increase as Chinese companies’ innovative capability improves. While stakeholders in conservative-leaning states may temper their positive sentiment, their negative sentiment is mainly directed at Chinese state-owned companies. Our findings help to gain particular insight into the complex nature of stakeholder sentiment, a key element shaping multinational companies’ operating environment.

1. Introduction

Multinational companies (MNCs) are at the forefront of sustainability research because, with their economic might, MNCs can help unify sustainability standards through production and procurement decisions [1,2,3]. During this process, stakeholder management is at the core of an MNC’s sustainability initiatives [4]. However, although much has been learned about how MNCs from developed countries interact with stakeholders in the host market, little is known about how stakeholders view MNCs, especially innovative ones, from developing regions beyond the presumed liabilities (e.g., origin or emergingness, [5]).

As Chinese MNCs’ innovative capability is growing [6,7,8], their outward foreign direct investments (OFDIs) are viewed with mixed sentiments by local stakeholders, especially those in developed nations such as the United States. On one hand, politicians and lawmakers continuously express concerns over Chinese MNCs’ growing economic and political power in their local market [9]. The surge of the nationalistic movement in the U.S. [10] and the global aggression of Chinese state-owned enterprises (SOEs) [7] have enhanced the suspicion of the motives of innovative Chinese MNCs’ global expansion. On the other hand, research has suggested that average Americans are more moderate than what their politicians have portrayed [11,12]; they tend to appreciate the career opportunities and enriched market options brought about by Chinese MNCs [5]. This paradox, i.e., simultaneously positive and negative sentiments towards Chinese FDIs, can be further enhanced by the innovative capability and the ownership of the firm. As Chinese MNCs become more innovative (e.g., Huawei and TikTok), they have attracted strong national security scrutiny [9] along with their fast-growing consumer base. The scrutiny is enhanced when the firm is endowed with state supports such as state ownership [13], which is viewed as a manipulation or violation of market principles [14]. Hence, it is imperative to accurately understand this paradoxical nature of local economic stakeholders’ sentiments, as it does not just help balance the adversarial impression based on the current Chinese OFDI studies that are dominated by political stakeholders [9,15,16] but also helps Chinese MNCs and policy makers of both home and host nations comprehensively assess the overseas operational environment for these companies.

To this end, we integrate the Chinese OFDI literature with stakeholder management theory [17,18,19,20] to address two questions: (1) How do American economic stakeholders view the growing innovative capability of Chinese companies that invest in their state? (2) How do views vary upon the state-level political environment and the ownership structure (state- or privately owned) of these companies? So far, studies of Chinese MNCs have mainly employed the institutional theoretical framework to examine the antecedents, motives, entry strategies, and investment patterns of their OFDIs [7,15,21,22,23,24]. Similarly, the limited studies on innovative Chinese MNCs’ OFDIs mainly concentrate on the investments’ entry mode and geographical location [25,26]. While these studies provide an overview of how innovative Chinese MNCs engage local stakeholders as a whole, the gaps are notable. First, scholars’ attention has been primarily drawn to just one stakeholder, politicians [9,15,16]. This research stream is “almost exclusively focused on ‘political and institutional constraint’ as a source of risk, and whether this theoretical stance can be generalised is less known” [7]. Second, with only a couple of exceptions [27,28], this research stream is dominated by national-level analysis, which could be problematic for a market as big and diverse as the U.S. In the U.S., states enjoy substantial economic sovereignty [29,30,31,32] and can nurture immensely different, even opposite, sentiments to Chinese OFDIs. As such, state-level analysis is essential to assess local stakeholders’ sentiments.

We aim to complement previous studies with a revealing stakeholder angle. Stakeholder management theory believes that a firm is situated in a web of stakeholders who have an economic or social stake in its decisions and operations [19]. Essential stakeholders can affect the firm’s success through withholding or distributing resources that a company needs [33]. Among them, economic stakeholders such as customers, employees, and suppliers [34,35] are considered especially important as they directly control vital inputs to the company operation [36]. Cultivating a supportive relationship with economic stakeholders is one of the centerpieces of a company’s stakeholder management strategies [37].

To examine the research questions, we have built a unique, manually collected longitudinal dataset on one hundred and eighty-five projects in the U.S. invested in by Chinese firms from 2004–2018 with a six-year span on each investment. We hope to contribute to the global stakeholder management studies and Chinese OFDI literature in two ways. First, we reveal the dual nature of economic stakeholders’ sentiment to innovative Chinese firms in the U.S. We argue that both positive and negative sentiments of these stakeholders will increase as Chinese firms’ innovative capability grows, which are further subject to the effect of the local political environment and the ownership structure of these companies. These findings help us more accurately gauge the complexity of the operating ecosystem for Chinese MNCs, address the need not to “collapse” stakeholders into an “aggregate” concept of the institutional environment [38] (p. 53); [39] (p. 674), and instead provide a finer-grained analysis on how stakeholders react to OFDI providers differently [40]. Second, we reveal how regions within a nation react to Chinese MNCs differently. The investigation of intra-national regional variations is especially imperative during a time when polarized political views emerge and interrupt the moderate consensus across regions at different levels [41]. Both findings help Chinese MNCs and US policy makers to accurately gauge local constituents’ sentiments in pushing their economic and social, including sustainability, agenda.

We next review the relevant Chinese OFDI literature and global stakeholder management studies. Three hypotheses are developed to capture economic stakeholders’ sentiments towards the innovative capability of Chinese MNCs, subject to regional and organizational attributes. Data collection and analysis are elaborated. Findings are presented, followed by discussions and implications.

2. Theoretical Background

In the past two decades of research on Chinese OFDIs, the dominant perspective is the (neo-)institutional framework [20,34,42] with a focus on entry barriers, e.g., liabilities of origin [43] or emergingness [22]. These liabilities are normally related to the under-developed institutional environment where Chinese MNCs originate in the eyes of global stakeholders, especially those from developed nations. These stakeholders can hold “negative perceptions, stereotypes, or beliefs” and a resultant persistent animosity toward these companies [44] (p. 244), producing a “credibility and legitimacy deficit” [28] (p. 547). To handle this deficit, a strong learning [26] or absorptive capability [45] is needed in order to comprehend local stakeholders’ requirements.

However, in recent years, conflicting findings emerged when employing this framework to examine OFDIs from innovative Chinese MNCs. On one hand, Chinese MNCs are encouraged to invest in developed countries for a stronger innovation performance because of richer and better learning opportunities in these markets than what is available in developing countries [26]. On the other, the increasingly intense Sino-American rivalry [46] or (neo) techno-nationalism in which nations strive to have their own enterprises as the market leader in high-technology sectors [47] has made leveraging developed markets more difficult, especially for innovative Chinese firms. These firms constantly run into a more hostile political environment in developed nations than in developing nations [7]. These conflicting findings suggest a limitation of the traditional analysis framework. Multiple stakeholder forces that conflict with each other could be at play.

However, previous examinations of how Chinese MNCs interact with local stakeholders heavily focus on just one stakeholder, governments. For example ref. [16] argued that Chinese MNCs should adopt acquisition rather than greenfield when entering the U.S. to avoid political barriers. With a similar focus on the entry mode, ref. [15] found that Chinese MNCs’ choice between wholly owned and joint ventures was largely determined by the balanced consideration of Chinese and host nations’ regulatory requirements. Ref. [48] found that when Chinese MNCs’ legitimacy was questioned by stakeholders in one host country, the political risk would increase for these companies in other host countries, i.e., the spillover effect. Ref. [49] highlighted how a Chinese MNC evolved over three stages, i.e., exploring, establishing, and embedding, through interacting with Chinese and Congolese governments, in conjunction with state-owned and privately-owned sectors and communities. In fact, Chinese MNCs themselves tend to place a heavier focus on the political stakeholder than other stakeholders [50] and extensively use nonmarket strategies, including corporate political and social activities, to reduce political risks [51].

We should note that other essential stakeholders were also discussed in previous studies, including consumers [52,53], employees [5,22,54], and suppliers [55,56]. While not explicitly applying the stakeholder framework, these studies provided evidence on how Chinese MNCs interacted with a specific stakeholder in the host market. However, in these studies, Chinese MNCs were assumed to suffer from liabilities of origin [57], emergingness [22], or stateness for state-owned firms [43]. This assumption was rarely verified given that economic stakeholders were also likely to benefit from innovative products and services, career opportunities, and an enriched supply chain. They may go beyond the presumed bias and develop a more holistic and realistic view of innovative Chinese firms.

In addition, limited attention to innovative Chinese FDIs also has revealed a mixed picture. On one hand, Chinese firms such as Huawei, ZTE, and TikTok have spearheaded into the U.S. market with creative products or services. These companies have or had achieved notable success among American users [58] and expanded their recruitment footprints [5], leading to momentous strides to be integrated into local economic ecosystems. On the other hand, the concern over their origin [57] and the polarized political environment put these companies under special scrutiny by regulatory stakeholders [9]. The scrutiny did not just bring some of their presence in the US to a halt, but also influenced how economic stakeholders view these companies. For example, polls constantly show that American users have very mixed views on the security risks of TikTok once the 2020 ban was announced [59].

Lastly, for a market as big as the U.S., it would be an oversimplification to assume that all regions are homogenous in viewing and treating Chinese firms. Recent studies have strongly supported a regionalized, instead of nationalized, approach when examining American markets. Ref. [27] found that the presence of Canadian provincial-level investment promotion agencies in China increased Chinese OFDIs in those provinces. Further, ref. [60] found that Mexican states with defamation laws created a chilling effect: there was less media coverage on corruption. Hence, Chinese MNCs can face different regional stakeholder relations even within a nation. The complexity in handling these “stakeholder-mandated” differences within a market is recognized as a major task for MNCs in developed markets [61] (p. 699).

In summary, while previous research has extensively examined how political stakeholders view Chinese OFDIs, the complicated views of essential economic stakeholders are largely missing. This omission may yield incomplete or inaccurate assessment of the operating environment for innovative Chinese firms. Ref. [22] (p. 36) state that “perspectives from important external stakeholders are missing. Yet, such an approach is needed in order to ensure the validity of findings through triangulation”. We thus incorporate the stakeholder management perspective in our investigation to fill this gap.

3. Hypotheses

Based on stakeholder management logic, we argue that for Chinese MNCs that invest in the U.S., a strong innovative capability will induce both positive and negative sentiments from American economic stakeholders. Innovative Chinese MNCs will draw positive attention from these stakeholders. First, the U.S. has a pro-innovation bias [62]. Innovation is considered a key factor for organizational and regional economic growth [63], and innovative firms are expected to have an outsized impact on local communities. This bias will shadow innovative Chinese companies with higher aspirations and more positive expectations. Second, innovative Chinese firms can improve local economic conditions more than their peers. Innovative Chinese MNCs tend to create “good” jobs with career opportunities that can help economic stakeholders to climb up social ladders [5]. Further, innovative Chinese MNCs can provide newer and better products and services than what are currently available and help local communities improve competitiveness in the global economy [64]. Hence, economic stakeholders should view innovative Chinese MNCs’ OFDIs with a positive lens.

However, the uncertainty with or even the distrust in innovative Chinese firms in the U.S. has been growing. It is believed that China has been employing an unfair market access practice such that Chinese innovative firms can enter the U.S. with fewer restrictions than those faced by American firms entering China [65]. Foreign innovative firms are constantly disfavored over domestic rivals or outright banned in China. These indigenous innovation policies [66] can create an unfair advantage [67] for Chinese innovative firms as perceived by American stakeholders. Further, as the Sino-America rivalry intensifies, the wariness that companies from a rival nation leverage American resources to grow their innovative capability is mounting [68]. For example, both Huawei and TikTok have drawn unwanted attention from American stakeholders [69]. American competitors heavily lobby against them in the public and with governments [70]. These firms were put under the microscope by the media due to their potential national security threats. Negative news tends to draw more attention from readers [71], and thus, economic stakeholders are likely to develop a negative sentiment toward innovative Chinese MNCs.

Stakeholders’ sentiments, much like trust and distrust [72], are multidimensional and depict the inherent tension of a relationship. A stakeholder can possess both positive and negative sentiments simultaneously because a stakeholder accepts some aspects of an MNC’s operation while objecting to others. For example, through employing the fintech approach, researchers have found that investors may develop both optimistic and pessimistic views of a company’s performance [73]. Dual sentiments should more accurately reflect the complex feeling American economic stakeholders have towards innovative Chinese MNCs, and the complex sentiments reveal the paradox that American economic stakeholders face: how to interact with companies from a fast-growing rival while still maintaining a sustainable economic advantage. Hence, we hypothesize:

Hypothesis 1.

The innovative capability of Chinese companies draws both (a) positive and (b) negative sentiments among American economic stakeholders.

Further, we argue that the state-level political environment has a strong contextual effect on the relationships between Chinese firms’ innovative capability and American economic stakeholders’ sentiments. Political ideology is ‘‘the shared framework of mental models that groups of individuals possess that provide both an interpretation of the environment and a prescription of how that environment should be structured’’ [61,74]. In conservative ideology-dominated states, two forces are at play: the traditional friendly and laissez faire attitude towards businesses [75] and the rising nationalistic anti-globalization movement [76]. The two seemingly opposite forces are reconciled by one logic: championing the nationalistic interest does not necessarily compromise the state’s efforts in attracting foreign, even Chinese, investments. While it is commonly believed that Republican party members are the loudest critics of innovative Chinese investments [77,78], it is found that no Republican politicians voiced opposition to an OFDI deal that occurred within their own state, reflecting the pragmatic constraints of their political rhetoric [79]. Further, the concern towards Chinese OFDIs is actually shared by both parties. In fact, Democratic party members initiate more anti-OFDI backlashes than Republicans in Congress [79]. Given this track record, we believe that effects of Chinese firms’ innovative capability on local economic stakeholders’ positive and negative sentiments will be less pronounced in conservative-leaning states than in liberal-leaning states.

When a Chinese firm’s innovative capability induces positive sentiment from local stakeholders, economic benefits are the focus. However, although these benefits are appreciated, the conservative-leaning political environment makes it less likely for economic stakeholders to put an emphasis on these benefits than their peers in liberal-leaning states. A heavy emphasis on economic benefits of a Chinese innovative firm is more likely to trigger concerns in conservative-leaning states about successful Chinese rivals than in liberal-leaning states. Populistic and nationalistic sentiment may increase [80], and the investment can thus be portrayed as a potential threat along with opportunities [69,70]. For example, it is found that Chinese firms operating in conservative-leaning states tend to maintain a low profile on economic benefits to the community including jobs and energy supplies to avoid unwanted concerns over U.S. national security [81]. Hence, local stakeholders’ positive sentiment on innovative Chinese firms in conservative-leaning states is likely to be capped.

Further, the business-friendly conservative tradition will prevent the damaging sentiment on innovative Chinese firms from being overly developed. While liberal-leaning policies tend to put more focus on social benefits than economic gains in assessing a company’s operation, conservative-leaning philosophies hold the opposite [82]. When the nationalistic movement leads to negative sentiments on innovative Chinese firms, economic stakeholders in conservative-leaning states are more likely than those in liberal-leaning states to tone down such a negative view in order to preserve the economic benefit. The business-friendly tradition welcomes legitimate businesses that bring economic opportunities to local constituents [83]. Innovative Chinese MNCs are likely to produce more and better economic benefits than non-innovative companies. Economic stakeholders will be among the ones who benefit from the investment directly. This mentality of economic stakeholders in conservative-leaning states is likely to constrain negative sentiment. For example, it is found that conservative-leaning consumers prioritize personal interests over collective values, and they are less likely to boycott a product for ideological reasons [84]. In contrast, stakeholders in liberal-dominant states are more likely to prioritize such social issues as labor treatment and social justice over business success [82] and are more likely to sacrifice or reject economic benefits over ideological values [85]. Thus, the conservative-leaning political environment should reduce the impact of Chinese MNC’s innovative capability on both the positive and negative sentiments of economic stakeholders.

Hypothesis 2.

In contrast to liberal-leaning states, in conservative-leaning states, the positive relationships between Chinese firms’ innovative capability and economic stakeholders’ (a) positive and (b) negative sentiments will be reduced.

Further, we argue that state ownership reduces the moderation effects of the political environment on innovative capability–sentiment relationships. Specifically, while in contrast to liberal-leaning states, American economic stakeholders’ positive and negative sentiments towards innovative Chinese firms are less pronounced in conservative-leaning states, this reduction effect is mainly towards privately owned enterprises (POEs). For state-owned enterprises (SOEs), economic stakeholders in conservative-leaning states will increase their negative sentiment while reducing the positive sentiment.

Most concerns over China’s global expansion are related to SOEs and their ties to governments [86,87,88]. Partially due to their tendency to cultivate cozy relationships with governments in host markets, SOEs are found to engage in such rent-seeking activities as bribery [88] and semi-cartel alliances [14], or to be associated with inefficiency in utilizing resources [87]. These activities damage the image of Chinese SOEs among overseas stakeholders [89]. Further, SOEs’ political connections and the associated resource endowments [13] can be translated into non-market advantages overseas [86,88]. These advantages pose questions concerning Chinese SOEs’ legitimacy in market economies [14,87], which can further develop into a national security concern [16].

These concerns can resonate with conservative-leaning states more than liberal-leaning states. As mentioned, while both ideologies are wary of the potential impact of Chinese OFDIs, the focus is different. Liberal-leaning voters view China through the lens of globalization and focus more on its social impact such as climate change and pollution [90,91], while conservative-leaning voters tend to focus on its economic impact [92]. According to the Chicago Council, which has been conducting surveys to gauge public sentiments for four decades, in contrast to liberal voters, conservative voters’ sentiments are more likely to hinge on market principles, while SOEs are viewed as an extension of the Chinese government’s non-market power [14]. Hence, conservative-leaning stakeholders are more likely than those in liberal-leaning states to view SOEs’ investments and inherent political advantages as an invasion of market-oriented principles.

We have argued that in contrast to liberal-leaning states, economic stakeholders’ positive and negative sentiments towards innovative Chinese firms’ investments are less pronounced in conservative-leaning states. The wariness toward potential Chinese rivals in conservative-leaning states will cap the level of the positive sentiment, and the relatively strong focus on economic benefits can prevent negative sentiment from being escalated. This moderation effect of conservative-leaning states, however, should largely be directed to POEs. SOEs, given their close ties to Chinese governments [13] and the perceived legitimacy deficiency in market economies [86], will dampen the willingness of economic stakeholders in conservative-leaning states to treat them the same as Chinese POEs. The impact of nationalism on economic stakeholders’ sentiments is likely enhanced. As such, conservative-leaning economic stakeholders should be less willing to have a positive view but more likely to hold a negative view of innovative Chinese SOEs. We propose Hypotheses 3(a) and (b).

Hypothesis 3a.

In contrast to POEs, economic stakeholders in conservative-leaning states will reduce the positive sentiment towards Chinese SOEs’ innovative capability.

Hypothesis 3b.

In contrast to POEs, economic stakeholders in conservative-leaning states will enhance the negative sentiment towards Chinese SOEs’ innovative capability.

4. Methodology

4.1. Sample and Data Collection

We draw the sample from fDi Markets and Securities Data Company (SDC) datasets which are widely used in OFDI studies [30,93,94,95]. fDi Markets, a database from the Financial Times, provides comprehensive data on cross-border greenfield investments. The SDC database closely tracks global mergers and acquisitions (M&As). Combining both allows us to identify the investment made by Chinese public companies in the U.S. through either greenfield or M&As from 2004 to 2013. We stopped at 2013 because we intended to collect the sentiment data on these Chinese firms five years after the investment was made, and 2018 was the latest year when the project started. Two hundred and fifty-one investments made by Chinese public companies were identified. We manually verified the accuracy of these records through searching the company’s website, annual reports, Google, and Baidu (the dominant search engine in China), and using Google Maps to identify the subsidiary locations. Fifty-three cases were deleted because of questionable records. Examples included an instance where the investment location in the U.S. had never been identified and, thus, it was impossible to calculate state-level effects. Further, the investment was not finalized due to various reasons such as objections by Congress or business fallout. One hundred and ninety-eight projects remained.

The project information from these two databases was matched with another four databases. First, firm-level financial information was provided by the Wind Financial Terminal (Wind). Wind serves more than 90% of the financial, research, and regulatory institutions in China, and Wind has the most comprehensive stock and financial data and has been widely used in studies [96,97,98]. Second, state-level data such as gross domestic product (GDP), population, and unemployment were collected through the archives of the U.S. Census Bureau, Statista, and the U.S. Bureau of Economic Analysis. Third, state-level political environment data were collected through official Federal Election Commission reports. Lastly, we pulled out all news articles about these companies in the state where an investment took place from Nexis Uni, formerly known as LexisNexis Academic, using the company’s name as the keyword. We excluded financial briefing articles that normally had only one or two lines reporting stock price changes without providing reasons or an indication of sentiments. In the end, 3588 news articles were collected for stakeholders’ sentiment analysis.

4.2. Measures

The dependent variables are economic stakeholders’ positive and negative sentiments. The data were drawn from state-level news reports. The authors first reviewed randomly selected articles and found that an article might cover multiple topics besides the company in our investigation. Further, a stakeholder that was mentioned in the article might or might not be related to the specific company. Thus, in order to ensure we capture the sentiment of the specific stakeholder regarding the company in question, we limited the number of sentences in calculating the sentiment variables. We first searched the company’s name in an article and highlighted the five sentences before and after the company’s name. We then continued to search for economic stakeholders in these highlighted sentences. If there was no economic stakeholder identified, the process stopped and a missing value was assigned. Once an economic stakeholder was identified, we further highlighted three sentences before and after the stakeholder. These sentences would be the most relevant to the economic stakeholder that was associated with the specific company and, thus, served as the basis for the sentiment variable calculation. We adopted a rotation process between human review and automatic text extraction using machines to assure accuracy in capturing texts that are most relevant to a stakeholder. Specifically, five research team members conducted random reviews for stakeholder variations in reports and used them as feed to train initial algorithms. Algorithms would then capture relevant excerpts that were subjected to another round of random human review. With the initial training, the machine would analyze all texts and follow the established criteria to extract another round of similar texts for random human review again. The process continued until both leading researchers were satisfied with the quality of extracted excerpts. The selection of sentence ranges was based on our own article review. In robustness checks, we also changed the range of the sentence selection and calculated extra variables for cross validation.

The calculation of the positive and negative sentiments of economic stakeholders (i.e., customers, employees, and suppliers) followed a similar approach to previous studies [99,100]. Once such stakeholders were identified in selected sentences, sensitive words were drawn based on the combination of the two most-used sentiment word libraries, LIWC and MPQA. When 60 percent of these words were positive (or negative), we coded the article as “1”, or “0” for otherwise. If neither, the article was acknowledged as neutral. We then summed all the positive (or negative) articles in each year for each company to derive the measure for the positive (or negative) sentiment of economic stakeholders towards a company in each year. The higher the value, the stronger the positive or negative sentiment that American economic stakeholders had expressed towards a Chinese company.

The independent variable is the innovation capability of Chinese companies. Following previous studies [101,102,103,104], we measure innovative capability using the logarithm of the company’s expenditure on research and development for each company in each year.

The two moderators are the state-level political environment and Chinese companies’ ownership. Political environment was operationalized as the percentage of votes for the Republican candidate in the closest presidential election of each year. For mid years (e.g., 2010 is equidistant from 2008 and 2012), we took the average of the values for the two closest presidential elections. Further, following previous studies [105,106], we coded “1” if the state owned more than 50% of the company, i.e., SOEs, and “0” for POEs.

We also controlled for covariate effects at the project, firm, state, and industry levels. At the project level, we controlled for whether the investment was through acquisition or not (“1” = acquisition, “0” = greenfield). Local stakeholders are more likely to hold more negative feelings towards acquisition than greenfield because greenfield brings more additional benefits [5]. Ownership of the project indicates if a Chinese firm had the dominant ownership in the invested project (“1” refers to more than 50% and “0” is otherwise). Dominant ownership yields absolute control to Chinese MNCs, which may generate more nationalistic concerns locally [24]. Thirteen firms were excluded due to a lack of ownership information or when the ownership percentage was exactly 50%.

At the firm level, we controlled for both short-term prior financial performance, return on assets (ROA), and slack sources, the ratio of the long-term debt to assets [107]. A higher debt-to-asset ratio indicates that the company needs more external funding and, hence, a reverse measure of slack. Better financial performance and more slack resources indicate more resources available to manage stakeholders [108]. We further controlled for intangible assets, which capture good will, brand recognition, and intellectual property, by their ratio to total sales [109]. The more intangible assets a company has, the more motivated it is to protect its reputation through active stakeholder management [110]. We measure firm size by the logarithm of the total sales of a company. Lastly, given public firms are subject to different security market requirements, we coded the location where the company’s majority stocks were traded. USA (“1” = Yes, “0” = Otherwise) indicated that the majority of the company’s stocks were traded in North American stock markets; if in Chinese stock markets, it was PRC (“1” = Yes, “0” = Otherwise). The default was Hong Kong.

Further, at the state level, we controlled the regional income of each state as measured by the GDP per capita. Firms in more developed regions tend to cater to stakeholders’ needs more than those in less-developed regions do [111]. We controlled the railway miles per capita to approximate the level of transportation infrastructure of a state as OFDIs are attracted to regions with a good transportation [112]. Lastly, we controlled for the logarithm of patents of each state to approximate its innovative level, as innovative foreign companies are more likely to be attracted to innovative locations [113,114]. At the industry level, we coded the industry of companies (“1” = manufacturing industries, and “0” = otherwise). We also coded year dummy variables, i.e., Y1, Y2, Y3, Y4, and Y5, to control for the time-varying effect. The default was the sixth year.

4.3. Analysis and Results

We combined the Heckman two-stage method [34,115] and multilevel mixed-effects Poisson modeling [116,117] to address a series of challenges in the analysis. First, not all Chinese firms attracted economic stakeholder attention and, hence, the Heckman two-stage method could reduce the impact of excluding firms without stakeholder sentiments on our modeling. In the first stage, we included earnings before interest and tax (EBIT) and the state-level unemployment rate as instrumental variables. A company’s gross earnings tend to grab stakeholders’ attention [118]. However, the performance itself may not draw either positive or negative sentiment as stakeholders tend to combine it with other factors (e.g., better or worse than competitors’, the industry average, or the company’s history) to determine their reaction. Further, the local unemployment situation may draw economic stakeholders’ attention to OFDIs as these investments can affect job opportunities in a community. However, OFDIs can either help address unemployment problems [119] or cause local job loss [120]; thus, unemployment is an indecisive factor for economic stakeholders’ sentiments. The correlation analysis also verified that EBIT and unemployment were significantly related to whether economic stakeholders had sentiments for a firm, but not to either positive or negative sentiment. The estimated F statistic was estimated at 12.66, falling between 10 and 20, indicating neither weak nor strong instrumental model specification. Based on the results of the Probit regression in the first stage with whether a firm had triggered economic stakeholders’ sentiments or not as the dependent variable, we calculated the inverse Mills’s ratio and included it in second-stage hypothesis tests.

Second, we aim to analyze an unbalanced longitudinal dataset that has multiple levels (investment, firm, and state) and nested effects (a firm may make multiple investments). We thus adopted multilevel mixed-effects Poisson modeling [121]. This technique allows us to incorporate cluster-specific random effects in the modeling. When subjects are nested in higher-level units, this modeling accounts for within-cluster correlation in the [116]. For unbalanced longitudinal data and panel data, this technique is useful in modeling intracluster correlations; that is, observations in the same cluster are correlated because they share common cluster-level random effects. Further, when the outcome is a count denoting the number of times that an event occurred (like our sentiment measures), the Poisson model can relate the mean number of events to a set of explanatory variables using a logarithmic link function. We later also use other analytical techniques to cross-validate the results and the findings are consistent.

Table 1 shows the means, minimums, maximums, standard deviations, and pairwise correlations of the variables. It shows that economic stakeholders’ positive and negative sentiments are marginally correlated (r = 0.12, p = 0.052), providing preliminary support for our argument that stakeholders can develop both sentiments simultaneously. In addition, regional income has a significant relationship with political environment (r = −0.68, p < 0.001), as does transportation (r = 0.68, p < 0.001). Transportation also correlated with patents at −0.70 (p < 0.001). We thus removed both regional income and transportation and reran all analyses; the findings remained the same. Further, all value inflation factor (VIF) values were lower than the suggested threshold, 10 [108]. We thus still included both variables in analyses as local economic conditions and transportation were among the major factors determining OFDI destinations [111,122,123].

Table 1.

Means, standard deviations, minimums, maximums, and Pearson correlations.

Table 2 shows hypothesis test results. With economic stakeholders’ positive and negative sentiments as the dependent variable, respectively, Models 1~8 provide the test result for H1~3. Models 1 and 5 are the baseline model. Models 2 and 6 further include the innovative capability of Chinese MNCs. Innovative capability is positively related to both positive (coef. = 0.21; p = 0.025) and negative sentiment (coef. = 0.26; p = 0.044). Thus, both H1 (a) and (b) are supported.

Table 2.

Hypothesis test results.

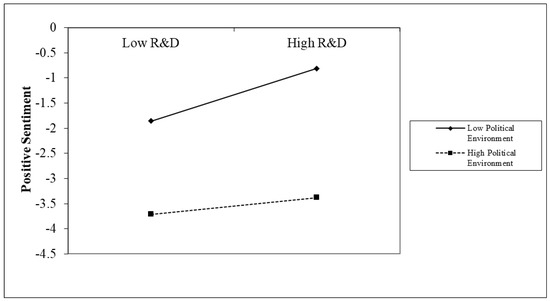

Further, we include political environment and its interaction item with innovative capability in models 3 and 7. Political environment negatively moderates the relationship between innovative capability and positive sentiment (coef. = −1.11; p = 0.042), verifying H2 (a). However, the negative moderating impact of political environment on the innovative capability–negative sentiment relationship is not significant (coef. = −3.15; p = 0.121). H2 (b) is not supported. We plot Figure 1 to visualize H2 (a) test results. Figure 1 shows that in conservative-leaning states, the relationship between innovative capability and positive sentiment is muted compared with liberal-leaning states, signaling a capping effect in conservative-leaning states.

Figure 1.

The two—way moderation effect of the political environment and innovative capability on the positive sentiment.

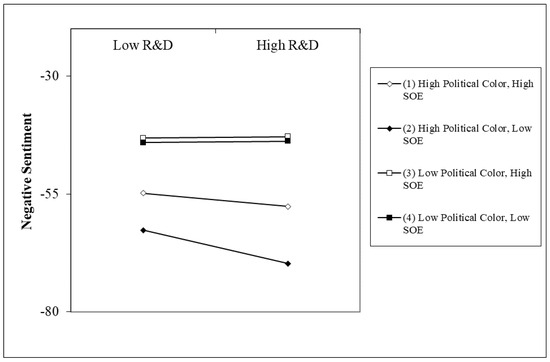

Lastly, we added SOE and its two-way and three-way interaction items with both innovative capability and political environment in models 4 and 8. SOE can indeed reduce the moderating effect of political environment on the innovative capability–positive sentiment relationship, yet not significantly (coef. = −0.73; p = 0.615). Thus, H3 (a) is not supported. State ownership positively moderates the effect of political environment on the innovative capability–negative sentiment relationship (coef. = 32.58; p = 0.034). We draw this three-way moderating effect in Figure 2. The figure shows that in conservative-leaning states, stakeholders’ negative sentiment indeed reduces if MNCs are private. For SOEs, negative sentiment remains high. H3 (b) is supported.

Figure 2.

The three—way moderation effect of SOE, the political environment, and innovative capability on the positive sentiment.

4.4. Robustness Checks and Post Hoc Analysis

To assure that the findings are not attributed to coincidence or specific methodology, and indeed show divergent validity from other stakeholders’ sentiments, we have conducted a series of robustness checks and post hoc analyses. They include (1) examining whether covariate variables are mainly responsible for the findings, (2) an analysis with robust standard errors, (3) different sentiment variables, (4) different analysis techniques, and (5) the post hoc analysis of the executive stakeholder’s sentiments as a reference.

First, we deleted all control variables except the year dummies (to account for the longitudinal effect) and the lambda calculated from the first stage of the Heckman analysis. The findings remained unchanged except that political environment marginally moderated the innovative capability–positive sentiment relationship (coef. = −1.40; p = 0.070). Thus, our findings were largely robust to the presence of covariant effects. Second, to cross-validate the findings obtained from accounting for the clustering effects of multiple investment projects made by one firm, we also conducted tests with robust standard errors in case heteroscedasticity exists. The moderating effect of political environment on the innovative capability–positive sentiment relationship is very close to being significant (coef. = −1.40; p = 0.051). All other findings remained unchanged, indicating the lack of severe heteroscedasticity impact on our findings. Third, we calculated new sentiment variables within one sentence before and after an economic stakeholder was mentioned in an article to examine whether the choice of sentence range would impact the final results. The findings were in alignment with our final report, except that the moderating effect of SOE is marginally significant (coef. = 12.67; p = 0.087), verifying the partially supported moderating role of SOE. This analysis further validated the robustness of our approach to calculate sentiment variables. Fourth, we analyzed the same models with multi-level mixed-effects negative binominal regression for its wide use in longitudinal analysis with count variables as the dependent variable [124]. All else remained unchanged, except that the innovative capability marginally impacts positive sentiment (coef. = 0.13; p = 0.074), largely verifying that our findings are not attributed to a specific analysis method.

Lastly, we conducted an analysis on executive stakeholders’ positive and negative sentiments in the post hoc analysis. Chinese firms’ innovative capability is not related to either executive stakeholders’ positive (coef. = −0.04; p = 0.678) or negative sentiment (coef. = 0.20; p = 0.129). However, state-level conservative-leaning ideology indeed marginally enhances the negative relationship between innovative capability and negative sentiment (coef. = −4.55; p = 0.098), but not the innovative capability–positive sentiment relationship (coef. = −1.45; p = 0.246), confirming previous findings that conservative-leaning politicians tend to voice more concerns over innovative Chinese firms [16]. Further, compared with POEs, Chinese SOEs can enhance the negative moderation effect of the political environment on the innovative capability–negative sentiment relationship (coef. = −24.82; p = 0.009), but not the moderating effect of the political environment on the innovative capability–positive sentiment relationship (coef. = 3.29; p = 0.103). It verifies previous findings that SOEs can trigger more concerns from conservative-leaning states [14]. Hence, the analysis of executive stakeholders’ sentiments confirms previous findings on political stakeholders’ views on Chinese MNCs and highlights the difference between economic stakeholders’ and political stakeholder’s sentiments towards innovative Chinese firms.

5. Discussion

When Chinese MNCs enter developed nations, they are rightfully assumed to face multiple liabilities [22,57]. Political stakeholders often exploit these liabilities, question the economic benefits brought to the local market, and raise concerns based on national security grounds [9]. Research as well as media have painted a hostile stakeholder environment for Chinese MNCs in the U.S., especially those with fast-improving innovative capability and posing a formidable challenge to American companies. For example, the global expansion of Huawei and ZTE, then among the top 10 patent applicants in the world [26], was essentially halted by American regulators. However, innovative Chinese companies continue their global expansion in sectors such as mobile apps (e.g., TikTok and Meituan), electronic products (e.g., Xiaomi and Lenovo), and gaming (e.g., Tencent), with research and development expenditures rivaling those of their Western peers [125]. Thus, it is important to accurately assess all essential stakeholders’ sentiment beyond those of political stakeholders, which can help MNCs and policy makers better understand the opportunities and challenges of Chinese OFDIs.

Through focusing on American economic stakeholders, we are able to identify the dual nature of their sentiments toward Chinese MNCs’ growing innovative capability. Both positive and negative sentiments among stakeholders increase as Chinese MNCs’ innovative capability grows, reflecting the struggle to balance economic considerations and wariness of the growing competence of firms from a rival nation. Further, compared with liberal-leaning states, economic stakeholders from conservative-leaning states tend to reduce their positive sentiments towards innovative Chinese firms, likely due to the rising nationalistic movement. Lastly, the economic stakeholders in conservative states will temper their negative sentiments towards Chinese POEs only. For Chinese SOEs, the negative sentiment will increase. Our findings have both theoretical and practical implications.

5.1. Theoretical Implications

Employing the stakeholder management framework, we can gain particular insight into the operational environment of Chinese MNCs in the U.S. Previous studies on Chinese MNCs mainly employed an institutional perspective and were dominated by the examination of one stakeholder, governments [7]. The study of how non-government stakeholders from developed economies perceive investments from innovative Chinese MNCs has received little attention. While assumptions have been made about these stakeholders’ views towards Chinese OFDIs, such as liabilities of origin and emergingness [22,73], these assumptions have not been extended to fully reflect the dual nature of the relationship between these stakeholders and innovative Chinese MNCs: the economic gains and the potential nationalistic concerns.

Our findings help fill this gap. We indeed reveal the intricate nature of how American economic stakeholders truly feel about innovative foreign firms from a rival nation. The dual nature of economic stakeholders, i.e., simultaneously positive and negative sentiments, greatly expands previous studies that focus on negative political propaganda and Chinese MNCs’ liabilities and puts stakeholders’ economic needs back into the picture. Our study also avoids the pitfall of previous sentiment studies where a stakeholder is only assumed to be dominated with one sentiment and demonstrates the paradox that many stakeholders face in reality. Through doing so, we avoid a biased and incomplete view of the stakeholder environment for Chinese MNCs and instead highlight both the opportunities and challenges inherent in a large advanced market, which is increasingly dominated by polarized views.

These findings confirm the importance of sustainability efforts by MNCs. Previous studies have indicated that socially responsible activities provide an insurance-like effect, i.e., they act as a buffer for a company from negative stakeholder sentiments when public relation crises occur [126]. However, our study indicates that the effort to cultivate positive sentiments among local economic stakeholders (e.g., through responsible and sustainable activities) is also imperative for innovative Chinese MNCs. This is because positive sentiments are not merely the opposite of negative sentiments, and a growing positive sentiment helps balance out the negative sentiments of economic stakeholders.

We by no means try to downplay the importance of the rising tides of polarization and nationalism across the U.S. In fact, we factor the impact of these movements into our model and examine if conservative-leaning states, presumably a hotbed for these movements, indeed host a more hostile stakeholder environment for innovative Chinese MNCs than liberal states. Much like the dual nature of economic stakeholder sentiments, we also identify complicated impacts of state-level ideologies. Compared with their counterparts in liberal-leaning states, economic stakeholders in conservative-leaning states are indeed more likely to reduce their positive sentiments towards innovative Chinese MNCs. However, we do not find evidence that these stakeholders heighten their negative sentiments towards innovative Chinese MNCs. This finding reveals great nuances in how ideologies affect innovative Chinese MNCs’ relationship with American economic stakeholders. These stakeholders are willing to lend less enthusiasm towards foreign investments, i.e., a capping effect, but they also refuse to allow negative sentiments to overgrow, i.e., a lack of a chilling effect. Juxtaposing the presence of the capping effect and the lack of the chilling effect, we reveal the boundaries of how ideologies affect economic stakeholders’ sentiments.

Furthermore, we found that the relatively muted changes in the negative sentiment of economic stakeholders in conservative-leaning states are mostly directed toward Chinese SOEs. For POEs, conservative-leaning stakeholders will in fact reduce their negative sentiment. This finding is important because few Chinese OFDI studies can be conducted without consideration of the ownership structure of Chinese MNCs, given the major role played by the state [34,88] and the aggressive expansion of SOEs in recent years [68]. Often being viewed as an extension of the Chinese government and being associated with various questionable business practices, Chinese SOEs are not received well by American stakeholders, especially in conservative-leaning states. Innovative Chinese SOEs are viewed as a direct threat to the market-driven principles that are dear to these stakeholders. Thus, economic stakeholders demonstrate their clear preference for POEs over SOEs. In other words, although there is a lack of the chilling effect on innovative Chinese MNCs in general, the chilling effect on SOEs is pronounced in conservative states. As such, the application of stakeholder management theory in studying MNCs’ OFDIs can reveal important nuances that are complementary to the institutional perspective.

5.2. Practical Implications

Our findings have important implications for innovative Chinese MNCs. The global expansion of these firms is set to continue even with growing counteracting measures, especially from the U.S. These measures are mostly represented through political talking points and actions [127] and have drawn the most attention from scholars. As a result, Chinese MNCs focus most of their attention on just one stakeholder, governments, and often lack the motivation, knowledge, or skills to interact with non-political stakeholders. This singular stakeholder focus comes with costs. It was found that through placing less emphasis on non-government stakeholders, Chinese MNCs ended up having more frictions and conflicts with them than with government [51]. Our study has suggested that political sentiments do not fully reflect the sentiments of economic stakeholders, and Chinese MNCs should make a clear distinction between them. In a polarized environment, economic stakeholders still have positive sentiments towards innovative Chinese firms. Although economic benefits may help to elevate such positive sentiments, Chinese MNCs should do more to address the concerns of these stakeholders. Many of these concerns are derived from the worry that innovative Chinese firms, especially SOEs, will leverage American resources to grow the Chinese government’s power, extend its influence, and challenge long-held market-driven principles. The uneven openness of markets to each other’s innovative firms also plays a role in forming negative sentiment [65]. Understanding these concerns, innovative Chinese POEs should emphasize their non-state-owned status while SOEs should emphasize their respect and full acceptance of market-driven principles.

5.3. Limitations and Future Studies

There are limitations to this study. First, although we aim to provide a more balanced stakeholder view of innovative Chinese MNCs, we only focus on the contractual economic stakeholders as a contrast to previously dominant views of regulatory stakeholders. The choice of one stakeholder type allows us to thoroughly examine its paradoxical sentiments but also raises a critical question in connecting this study with previous findings: what role is played by regulatory stakeholders in forming economic stakeholders’ paradoxical sentiments or vice versa regarding Chinese FDIs? The answer to this question can significantly improve the predictive nature of the stakeholder theory and offer prescriptive benefits to policymakers as well as investors from China or other similar countries. Second, for the purpose of parsimony, we omitted non-contractual and non-regulatory stakeholders such as communities and activist groups in our study. These stakeholders are strong forces in the U.S. and the omission may indivertibly misrepresent societal sentiments. To offer a comprehensive view on stakeholder sentiment, the inclusion of other stakeholders is highly recommended in future studies.

6. Conclusions

Relying on stakeholder management theory, we reveal a dual nature of American economic stakeholders’ sentiments: simultaneously positive and negative sentiments towards innovative Chinese firms. While stakeholders in conservative-leaning states may temper their positive sentiments compared with their peers in liberal-leaning states, their negative sentiment is not necessarily stronger, unless the investment is made by Chinese SOEs. These findings help gain particular insights into the complex stakeholder sentiment, complementing previous institutional studies.

Author Contributions

Conceptualization, Z.T. and Y.Y.; methodology, Z.T. and Y.Y.; software, Y.Y.; validation, Z.T. and Y.Y.; formal analysis, Z.T. and Y.Y.; investigation, Z.T. and Y.Y.; resources, Z.T. and Y.Y.; data curation, Z.T. and Y.Y.; writing—original draft preparation, Z.T.; writing—review and editing, Z.T. and Y.Y.; visualization, Z.T. and Y.Y.; supervision, Z.T. and Y.Y.; project administration, Z.T. and Y.Y. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data presented in this study are available on request from the corresponding author. The data are not publicly available due to copyright reason.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Riikkinen, R.; Kauppi, K.; Salmi, A. Learning Sustainability? Absorptive capacities as drivers of sustainability in MNCs’ purchasing. Int. Bus. Rev. 2017, 26, 1075–1087. [Google Scholar] [CrossRef]

- Villena, V.H. The missing link? The strategic role of procurement in building sustainable supply networks. Prod. Oper. Manag. 2019, 28, 1149–1172. [Google Scholar] [CrossRef]

- Zhang, Z.; Yang, Z.; Gu, J.; Kim, M.S. How Does Multinational Corporations’ CSR Influence Purchase Intention? The Role of Consumer Ethnocentrism and Consumer Ambivalence. Sustainability 2023, 15, 5908. [Google Scholar] [CrossRef]

- Yakovleva, N.; Vazquez-Brust, D. Stakeholder perspectives on CSR of mining MNCs in Argentina. J. Bus. Ethics 2012, 106, 191–211. [Google Scholar] [CrossRef]

- Schaefer, K.J. Catching up by hiring: The case of Huawei. J. Int. Bus. Stud. 2020, 51, 1500–1515. [Google Scholar] [CrossRef]

- Anand, J.; McDermott, G.; Mudambi, R.; Narula, R. Innovation in and from emerging economies: New insights and lessons for international business research. J. Int. Bus. Stud. 2021, 52, 545–559. [Google Scholar] [CrossRef]

- Buckley, P.J.; Clegg, L.J.; Voss, H.; Cross, A.R.; Liu, X.; Zheng, P. A retrospective and agenda for future research on Chinese outward foreign direct investment. J. Int. Bus. Stud. 2018, 49, 4–23. [Google Scholar] [CrossRef]

- Yiu, D.W.; Lau, C.; Bruton, G.D. International venturing by emerging economy firms: The effects of firm capabilities, home country networks, and corporate entrepreneurship. J. Int. Bus. Stud. 2007, 38, 519–540. [Google Scholar] [CrossRef]

- Lu, J.; Liu, X.; Wright, M.; Filatotchev, I. International experience and FDI location choices of Chinese firms: The moderating effects of home country government support and host country institutions. J. Int. Bus. Stud. 2014, 45, 428–449. [Google Scholar] [CrossRef]

- Rammal, H.G.; Rose, E.L.; Ghauri, P.N.; Jensen, P.D.Ø.; Kipping, M.; Petersen, B.; Scerri, M. Economic nationalism and internationalization of services: Review and research agenda. J. World Bus. 2022, 57, 101314. [Google Scholar] [CrossRef]

- Ahler, D.J. Self-fulfilling misperceptions of public polarization. J. Politics 2014, 76, 607–620. [Google Scholar] [CrossRef]

- Yudkin, D.; Hawkins, S.; Dixon, T. The Perception Gap: How False Impressions Are Pulling Americans Apart. 2019. Available online: https://perceptiongap.us/ (accessed on 26 July 2022).

- Deng, Z.; Yan, J.; Van Essen, M. Heterogeneity of political connections and outward foreign direct investment. Int. Bus. Rev. 2018, 27, 893–903. [Google Scholar] [CrossRef]

- Wang, D.; Cui, L.; Vu, T.; Feng, T. Political Capital and MNE Responses to Institutional Voids: The case of Chinese state-owned enterprises in Africa. Organ. Stud. 2022, 43, 105–126. [Google Scholar] [CrossRef]

- Cui, L.; Jiang, F. FDI entry mode choice of Chinese firms: A strategic behavior perspective. J. World Bus. 2009, 44, 434–444. [Google Scholar] [CrossRef]

- Globerman, S.; Shapiro, D. Economic and strategic considerations surrounding Chinese FDI in the United States. Asia Pac. J. Manag. 2009, 26, 163–183. [Google Scholar] [CrossRef]

- Agle, B.R.; Mitchell, R.K.; Sonnenfeld, J.A. Who matters to Ceos? An investigation of stakeholder attributes and salience, corpate performance, and Ceo values. Acad. Manag. J. 1999, 42, 507–525. [Google Scholar] [CrossRef]

- Bettinazzi, E.L.; Zollo, M. Stakeholder orientation and acquisition performance. Strateg. Manag. J. 2017, 38, 2465–2485. [Google Scholar] [CrossRef]

- Freeman, R.E. Strategic Management: A Stakeholder Approach; Cambridge University Press: Cambridge, UK, 2010. [Google Scholar]

- Marano, V.; Arregle, J.L.; Hitt, M.A.; Spadafora, E.; Van Essen, M. Home country institutions and the internationalization-performance relationship: A meta-analytic review. J. Manag. 2016, 42, 1075–1110. [Google Scholar] [CrossRef]

- Kang, Y.; Jiang, F. FDI location choice of Chinese multinationals in East and Southeast Asia: Traditional economic factors and institutional perspective. J. World Bus. 2012, 47, 45–53. [Google Scholar] [CrossRef]

- Klossek, A.; Linke, B.M.; Nippa, M. Chinese enterprises in Germany: Establishment modes and strategies to mitigate the liability of foreignness. J. World Bus. 2012, 47, 35–44. [Google Scholar] [CrossRef]

- Wei, Z. The literature on Chinese outward FDI. Multinatl. Bus. Rev. 2010, 18, 73–112. [Google Scholar] [CrossRef]

- Yu, Y.; Liu, Y. Country-of-origin and social resistance in host countries: The case of a Chinese firm. Thunderbird Int. Bus. Rev. 2018, 60, 347–363. [Google Scholar] [CrossRef]

- Elia, S.; Kafouros, M.; Buckley, P.J. The role of internationalization in enhancing the innovation performance of Chinese EMNEs: A geographic relational approach. J. Int. Manag. 2020, 26, 100801. [Google Scholar] [CrossRef]

- Piperopoulos, P.; Wu, J.; Wang, C. Outward FDI, location choices and innovation performance of emerging market enterprises. Res. Policy 2018, 47, 232–240. [Google Scholar] [CrossRef]

- Anderson, J.; Sutherland, D. Developed economy investment promotion agencies and emerging market foreign direct investment: The case of Chinese FDI in Canada. J. World Bus. 2015, 50, 815–825. [Google Scholar] [CrossRef]

- Fiaschi, D.; Giuliani, E.; Nieri, F. Overcoming the liability of origin by doing no-harm: Emerging country firms’ social irresponsibility as they go global. J. World Bus. 2017, 52, 546–563. [Google Scholar] [CrossRef]

- Benton, R.A.; Cobb, J.A.; Werner, T. Firm partisan positioning, polarization, and risk communication: Examining voluntary disclosures on COVID-19. Strateg. Manag. J. 2022, 43, 697–723. [Google Scholar] [CrossRef]

- Castaldi, C.; Frenken, K.; Los, B. Related variety, unrelated variety and technological breakthroughs: An analysis of US state-level patenting. Reg. Stud. 2015, 49, 767–781. [Google Scholar] [CrossRef]

- Nadarajah, S.; Atif, M.; Gull, A.A. State-level culture and workplace diversity policies: Evidence from US firms. J. Bus. Ethics 2022, 177, 443–462. [Google Scholar] [CrossRef]

- Pe’Er, A.; Gottschalg, O. Red and blue: The relationship between the institutional context and the performance of leveraged buyout investments. Strateg. Manag. J. 2011, 32, 1356–1367. [Google Scholar] [CrossRef]

- Mitchell, R.K.; Agle, B.R.; Wood, D.J. Toward a theory of stakeholder identification and salience: Defining the principle of who and what really counts. Acad. Manag. Rev. 1997, 22, 853–886. [Google Scholar] [CrossRef]

- Li, J.; Xia, J.; Zajac, E.J. On the duality of political and economic stakeholder influence on firm innovation performance: Theory and evidence from Chinese firms. Strateg. Manag. J. 2018, 39, 193–216. [Google Scholar] [CrossRef]

- Sharma, S.; Henriques, I. Stakeholder influences on sustainability practices in the Canadian forest products industry. Strateg. Manag. J. 2005, 26, 159–180. [Google Scholar] [CrossRef]

- Clarkson, M.E. A stakeholder framework for analyzing and evaluating corporate social performance. Acad. Manag. Rev. 1995, 20, 92–117. [Google Scholar] [CrossRef]

- Tang, Z.; Hull, C.E.; Rothenberg, S. How corporate social responsibility engagement strategy moderates the CSR–financial performance relationship. J. Manag. Stud. 2012, 49, 1274–1303. [Google Scholar] [CrossRef]

- Fisher, G.; Kuratko, D.F.; Bloodgood, J.M.; Hornsby, J.S. Legitimate to whom? The challenge of audience diversity and new venture legitimacy. J. Bus. Ventur. 2017, 32, 52–71. [Google Scholar] [CrossRef]

- Überbacher, F. Legitimation of new ventures: A review and research programme. J. Manag. Stud. 2014, 51, 667–698. [Google Scholar] [CrossRef]

- Devinney, T.M.; Mcgahan, A.M.; Zollo, M. A research agenda for global stakeholder strategy. Glob. Strategy J. 2013, 3, 325–337. [Google Scholar] [CrossRef]

- Löfflmann, G. From the Obama Doctrine to America First: The erosion of the Washington consensus on grand strategy. Int. Politics 2020, 57, 588–605. [Google Scholar] [CrossRef]

- Kolstad, I.; Wiig, A. What determines Chinese outward FDI? J. World Bus. 2012, 47, 26–34. [Google Scholar] [CrossRef]

- Cuervo-Cazurra, A.; Li, C. State ownership and internationalization: The advantage and disadvantage of stateness. J. World Bus. 2021, 56, 101112. [Google Scholar] [CrossRef]

- Ramachandran, J.; Pant, A. The liabilities of origin: An emerging economy perspective on the costs of doing business abroad. In The Past, Present and Future of International Business & Management; Emerald Group Publishing Limited: Bingley, UK, 2010. [Google Scholar]

- Deng, P. What determines performance of cross-border M&As by Chinese companies? An absorptive capacity perspective. Thunderbird Int. Bus. Rev. 2010, 52, 509–524. [Google Scholar]

- Witt, M.A. De-globalization: Theories, predictions, and opportunities for international business research. J. Int. Bus. Stud. 2019, 50, 1053–1077. [Google Scholar] [CrossRef]

- Petricevic, O.; Teece, D.J. The structural reshaping of globalization: Implications for strategic sectors, profiting from innovation, and the multinational enterprise. J. Int. Bus. Stud. 2019, 50, 1487–1512. [Google Scholar] [CrossRef]

- Stevens, C.E.; Newenham-Kahindi, A. Legitimacy spillovers and political risk: The case of FDI in the East African community. Glob. Strategy J. 2017, 7, 10–35. [Google Scholar] [CrossRef]

- Parente, R.; Rong, K.; Geleilate, J.M.G.; Misati, E. Adapting and sustaining operations in weak institutional environments: A business ecosystem assessment of a Chinese MNE in Central Africa. J. Int. Bus. Stud. 2019, 50, 275–291. [Google Scholar] [CrossRef]

- Chen, Y.; Liu, M.; Su, J. Greasing the wheels of bank lending: Evidence from private firms in China. J. Bank. Financ. 2013, 37, 2533–2545. [Google Scholar] [CrossRef]

- Sun, P.; Doh, J.P.; Rajwani, T.; Siegel, D. Navigating cross-border institutional complexity: A review and assessment of multinational nonmarket strategy research. J. Int. Bus. Stud. 2021, 52, 1818–1853. [Google Scholar] [CrossRef]

- Sousa, C.M.; Tan, Q. Exit from a foreign market: Do poor performance, strategic fit, cultural distance, and international experience matter? J. Int. Mark. 2015, 23, 84–104. [Google Scholar] [CrossRef]

- Sun, S.L.; Peng, M.W.; Lee, R.P.; Tan, W. Institutional open access at home and outward internationalization. J. World Bus. 2015, 50, 234–246. [Google Scholar] [CrossRef]

- Zhang, H.; Young, M.N.; Tan, J.; Sun, W. How Chinese companies deal with a legitimacy imbalance when acquiring firms from developed economies. J. World Bus. 2018, 53, 752–767. [Google Scholar] [CrossRef]

- Kubny, J.; Voss, H. Benefitting from Chinese FDI? An assessment of vertical linkages with Vietnamese manufacturing firms. Int. Bus. Rev. 2014, 23, 731–740. [Google Scholar] [CrossRef]

- Sun, S.L.; Peng, M.W.; Ren, B.; Yan, D. A comparative ownership advantage framework for cross-border M&As: The rise of Chinese and Indian MNEs. J. World Bus. 2012, 47, 4–16. [Google Scholar]

- Cuervo-Cazurra, A.; Luo, Y.; Ramamurti, R.; Ang, S.H. The impact of the home country on internationalization. J. World Bus. 2018, 53, 593–604. [Google Scholar] [CrossRef]

- Cartwright, M. Internationalising state power through the internet: Google, Huawei and geopolitical struggle. Internet Policy Rev. 2020, 9, 1–18. [Google Scholar] [CrossRef]

- Kelly, H.; Lima, C.; Guskin, E.; Clement, S. The Biggest Decider of Who Backs a TikTok Ban? If They Use TikTok; Washington Post: Washington, DC, USA, 2023. [Google Scholar]

- Stanig, P. Regulation of speech and media coverage of corruption: An empirical analysis of the Mexican Press. Am. J. Political Sci. 2015, 59, 175–193. [Google Scholar] [CrossRef]

- Kolk, A.; Curran, L. Contesting a place in the sun: On ideologies in foreign markets and liabilities of origin. J. Bus. Ethics 2017, 142, 697–717. [Google Scholar] [CrossRef]

- Karch, A.; Nicholson-Crotty, S.C.; Woods, N.D.; Bowman, A.O.M. Policy diffusion and the pro-innovation bias. Political Res. Q. 2016, 69, 83–95. [Google Scholar] [CrossRef]

- Wong, P.K.; Ho, Y.P.; Autio, E. Entrepreneurship, innovation and economic growth: Evidence from GEM data. Small Bus. Econ. 2005, 24, 335–350. [Google Scholar] [CrossRef]

- He, S.; Khan, Z.; Lew, Y.K.; Fallon, G. Technological innovation as a source of Chinese multinationals’ firm-specific advantages and internationalization. Int. J. Emerg. Mark. 2019, 14, 115–133. [Google Scholar] [CrossRef]

- Atkinson, R.D. Innovation Drag: China’s Economic Impact on Developed Nations; Information Technology and Innovation Foundation: Washington, DC, USA, 2020. [Google Scholar]

- Baark, E. China’s indigenous innovation policies. East Asian Policy 2019, 11, 5–12. [Google Scholar] [CrossRef]

- Ramamurti, R.; Hillemann, J. What is “Chinese” about Chinese multinationals? J. Int. Bus. Stud. 2018, 49, 34–48. [Google Scholar] [CrossRef]

- Witt, M.A.; Redding, G. Authoritarian Capitalism. In The Oxford Handbook of Asian Business Systems; OUP Oxford: Oxford, UK, 2014; Volume 26. [Google Scholar]

- Williams, R.D. Beyond Huawei and TikTok: Untangling US concerns over Chinese Tech Companies and Digital Security. Working Paper for the Penn Project on the Future of US-China Relations, 2020. Available online: https://www.brookings.edu/wp-content/uploads/2020/10/FP_20201030_huawei_tiktok_williams.pdf (accessed on 18 September 2023).

- Delios, A.; Henisz, W.J. Policy uncertainty and the sequence of entry by Japanese firms, 1980–1998. J. Int. Bus. Stud. 2003, 34, 227–241. [Google Scholar] [CrossRef]

- Soroka, S.N. Good news and bad news: Asymmetric responses to economic information. J. Politics 2006, 68, 372–385. [Google Scholar] [CrossRef]

- Lewicki, R.J.; McAllister, D.J.; Bies, R.J. Trust and distrust: New relationships and realities. Acad. Manag. Rev. 1998, 23, 438–458. [Google Scholar] [CrossRef]

- Fang, H.; Chung, C.P.; Lu, Y.C.; Lee, Y.H.; Wang, W.H. The impacts of investors’ sentiments on stock returns using fintech approaches. Int. Rev. Financ. Anal. 2021, 77, 101858. [Google Scholar] [CrossRef]

- Denzau, A.T.; North, D.C. Shared mental models: Ideologies and institutions. Kyklos 1994, 47, 3–31. [Google Scholar] [CrossRef]

- Cerny, P.G. Embedding neoliberalism: The evolution of a hegemonic paradigm. J. Int. Trade Dipl. 2008, 2, 1–46. [Google Scholar]

- Lieven, A. America Right or Wrong: An Anatomy of American Nationalism; Oxford University Press: New York, NY, USA, 2012. [Google Scholar]

- Bonikowski, B.; DiMaggio, P. Varieties of American popular nationalism. Am. Sociol. Rev. 2016, 81, 949–980. [Google Scholar] [CrossRef]

- He, W.; Lyles, M.A. China’s outward foreign direct investment. Bus. Horiz. 2008, 51, 485–491. [Google Scholar] [CrossRef]

- Canes-Wrone, B.; Mattioli, L.; Meunier, S. Foreign direct investment screening and congressional backlash politics in the United States. Br. J. Politics Int. Relat. 2020, 22, 666–678. [Google Scholar] [CrossRef]

- Broomfield, E.V. Perceptions of danger: The China threat theory. J. Contemp. China 2003, 12, 265–284. [Google Scholar] [CrossRef]

- Detsch, J.; Gramer, R. Deep in the Heart of Texas, a Chinese Wind Farm Raises Eyebrows. Foreign Policy, 25 June 2020. Available online: https://foreignpolicy.com/2020/06/25/texas-chinese-wind-farm-national-security-espionage-electrical-grid/ (accessed on 27 July 2022).

- Gupta, A.; Briscoe, F.; Hambrick, D.C. Red, blue, and purple firms: Organizational political ideology and corporate social responsibility. Strateg. Manag. J. 2017, 38, 1018–1040. [Google Scholar] [CrossRef]

- Rao, H. Institutional activism in the early American automobile industry. J. Bus. Ventur. 2004, 19, 359–384. [Google Scholar] [CrossRef]

- Jost, J.T. The marketplace of ideology: “Elective affinities” in political psychology and their implications for consumer behavior. J. Consum. Psychol. 2017, 27, 502–520. [Google Scholar] [CrossRef]

- Gupta, A.; Briscoe, F. Organizational political ideology and corporate openness to social activism. Adm. Sci. Q. 2020, 65, 524–563. [Google Scholar] [CrossRef]

- Cui, L.; Jiang, F. State ownership effect on firms’ FDI ownership decisions under institutional pressure: A study of Chinese outward-investing firms. J. Int. Bus. Stud. 2012, 43, 264–284. [Google Scholar] [CrossRef]

- Li, J.; Xia, J.; Lin, Z. Cross-border acquisitions by state-owned firms: How do legitimacy concerns affect the completion and duration of their acquisitions? Strateg. Manag. J. 2017, 38, 1915–1934. [Google Scholar] [CrossRef]

- Shaheer, N.; Yi, J.; Li, S.; Chen, L. State-owned enterprises as bribe payers: The role of institutional environment. J. Bus. Ethics 2019, 159, 221–238. [Google Scholar] [CrossRef]

- Meyer, K.E.; Ding, Y.; Li, J.; Zhang, H. Overcoming distrust: How state-owned enterprises adapt their foreign entries to institutional pressures abroad. In State-Owned Multinationals; Palgrave Macmillan: Cham, Switzerland, 2018; pp. 211–251. [Google Scholar]

- Kamarck, E. The Challenging Politics of Climate Change, Brookings.edu. 2019. Available online: https://www.brookings.edu/research/the-challenging-politics-of-climate-change/ (accessed on 27 July 2022).

- Witt, M.A. China’s challenge: Geopolitics, de-globalization, and the future of Chinese business. Manag. Organ. Rev. 2019, 15, 687–704. [Google Scholar] [CrossRef]

- Kafura, C.; Smeltz, D. Republicans and Democrats Split on China Policy, The Chicago Council. 2021. Available online: https://www.thechicagocouncil.org/research/public-opinion-survey/republicans-and-democrats-split-china-policy (accessed on 27 July 2022).

- Aybar, B.; Ficici, A. Cross-border acquisitions and firm value: An analysis of emerging-market multinationals. J. Int. Bus. Stud. 2009, 40, 1317–1338. [Google Scholar] [CrossRef]

- Chen, R.; Cui, L.; Li, S.; Rolfe, R. Acquisition or greenfield entry into Africa? Responding to institutional dynamics in an emerging continent. Glob. Strategy J. 2017, 7, 212–230. [Google Scholar] [CrossRef]

- Reuer, J.J.; Shenkar, O.; Ragozzino, R. Mitigating risk in international mergers and acquisitions: The role of contingent payouts. J. Int. Bus. Stud. 2004, 35, 19–32. [Google Scholar] [CrossRef]

- Shan, J.; Zhu, K. Inventory management in China: An empirical study. Prod. Oper. Manag. 2013, 22, 302–313. [Google Scholar] [CrossRef]

- Wang, K.T.; Li, D. Market reactions to the first-time disclosure of corporate social responsibility reports: Evidence from China. J. Bus. Ethics 2016, 138, 661–682. [Google Scholar] [CrossRef]

- Zheng, G.; Wang, S.; Xu, Y. Monetary stimulation, bank relationship and innovation: Evidence from China. J. Bank. Financ. 2018, 89, 237–248. [Google Scholar] [CrossRef]

- Barakat, A.; Ashby, S.; Fenn, P.; Bryce, C. Operational risk and reputation in financial institutions: Does media tone make a difference? J. Bank. Financ. 2019, 98, 1–24. [Google Scholar] [CrossRef]

- Wei, J.; Ouyang, Z.; Chen, H. Well known or well liked? The effects of corporate reputation on firm value at the onset of a corporate crisis. Strateg. Manag. J. 2017, 38, 2103–2120. [Google Scholar] [CrossRef]

- Acs, Z.J.; Audretsch, D.B.; Feldman, M.P. R & D spillovers and recipient firm size. Rev. Econ. Stat. 1994, 76, 336–340. [Google Scholar]

- Ren, S.; Eisingerich, A.B.; Tsai, H.T. How do marketing, research and development capabilities, and degree of internationalization synergistically affect the innovation performance of small and medium-sized enterprises (SMEs)? A panel data study of Chinese SMEs. Int. Bus. Rev. 2015, 24, 642–651. [Google Scholar] [CrossRef]

- Tashman, P.; Marano, V.; Kostova, T. Walking the walk or talking the talk? Corporate social responsibility decoupling in emerging market multinationals. J. Int. Bus. Stud. 2019, 50, 153–171. [Google Scholar] [CrossRef]

- Voutsinas, I.; Tsamadias, C.; Carayannis, E.; Staikouras, C. Does research and development expenditure impact innovation? Theory, policy and practice insights from the Greek experience. J. Technol. Transf. 2018, 43, 159–171. [Google Scholar] [CrossRef]

- Lazzarini, S.G.; Mesquita, L.F.; Monteiro, F.; Musacchio, A. Leviathan as an inventor: An extended agency model of state-owned versus private firm invention in emerging and developed economies. J. Int. Bus. Stud. 2021, 52, 560–594. [Google Scholar] [CrossRef]

- Maung, M.; Wilson, C.; Tang, X. Political connections and industrial pollution: Evidence based on state ownership and environmental levies in China. J. Bus. Ethics 2016, 138, 649–659. [Google Scholar] [CrossRef]

- Lin, W.T.; Cheng, K.Y.; Liu, Y. Organizational slack and firm’s internationalization: A longitudinal study of high-technology firms. J. World Bus. 2009, 44, 397–406. [Google Scholar] [CrossRef]

- Perrini, F.; Russo, A.; Tencati, A. CSR strategies of SMEs and large firms. Evidence from Italy. J. Bus. Ethics 2007, 74, 285–300. [Google Scholar] [CrossRef]

- Arrighetti, A.; Landini, F.; Lasagni, A. Intangible assets and firm heterogeneity: Evidence from Italy. Res. Policy 2014, 43, 202–213. [Google Scholar] [CrossRef]

- Roberts, P.W.; Dowling, G.R. Corporate reputation and sustained superior financial performance. Strateg. Manag. J. 2002, 23, 1077–1093. [Google Scholar] [CrossRef]

- Campbell, J.L. Why would corporations behave in socially responsible ways? An institutional theory of corporate social responsibility. Acad. Manag. Rev. 2007, 32, 946–967. [Google Scholar] [CrossRef]

- Loree, D.W.; Guisinger, S.E. Policy and non-policy determinants of US equity foreign direct investment. J. Int. Bus. Stud. 1995, 26, 281–299. [Google Scholar] [CrossRef]

- Castellani, D.; Lavoratori, K. The lab and the plant: Offshore R&D and co-location with production activities. J. Int. Bus. Stud. 2020, 51, 121–137. [Google Scholar]

- Li, R.Y.; Yan, K.J.; Yao, N.; Tian, K.; Xia, S.; Yang, X.H.; Xiong, Y. Abandoning innovation projects, filing patent applications and receiving foreign direct investment in R&D. Technovation 2022, 114, 102435. [Google Scholar]

- Jia, N. Are collective political actions and private political actions substitutes or complements? Empirical evidence from China’s private sector. Strateg. Manag. J. 2014, 35, 292–315. [Google Scholar] [CrossRef]

- Austin, P.C. A tutorial on multilevel survival analysis: Methods, models and applications. Int. Stat. Rev. 2017, 85, 185–203. [Google Scholar] [CrossRef] [PubMed]

- Austin, P.C.; Stryhn, H.; Leckie, G.; Merlo, J. Measures of clustering and heterogeneity in multilevel Poisson regression analyses of rates/count data. Stat. Med. 2018, 37, 572–589. [Google Scholar] [CrossRef] [PubMed]

- Huang, X.; Nekrasov, A.; Teoh, S.H. Headline salience, managerial opportunism, and over-and underreactions to earnings. Account. Rev. 2018, 93, 231–255. [Google Scholar] [CrossRef]

- Zhang, J. Liability of emergingness and EMNEs’ cross-border acquisition completion: A legitimacy perspective. Int. Bus. Rev. 2022, 31, 101951. [Google Scholar] [CrossRef]