Abstract

The incentives for the new energy vehicle industry have been decreasing year by year, and the industry has gradually returned from being “government-oriented” to “market-oriented”. In this context, motivating car companies and consumers to choose new energy vehicles to reach the dual-carbon goal is an urgent problem to be solved. In this study, we consider using blockchain technology to include the new energy vehicle industry in carbon trading, analyze the strategic choices of the government, automobile manufacturers, and consumers from the perspective of evolutionary games, and use MATLAB 2017b to conduct simulation analysis. The results show that (1) the implementation of a carbon trading mechanism by the government is favorable to automobile manufacturers and consumers in choosing new energy vehicles, but it is greatly influenced by the costs of technology implementation; (2) the government can induce consumers and automakers to choose new energy vehicles through total control and initial carbon quotas; and (3) the additional investment costs of automobile manufacturers will affect their willingness to produce new energy vehicles, and the government can adjust the existing “double points” policy to encourage automobile manufacturers to choose to produce new energy vehicles.

1. Introduction

Since the concepts of carbon peaking and carbon neutrality have been proposed, carbon emissions reduction has been incorporated into the long-term goals of the Chinese government. According to the latest data released by the International Energy Agency (IEA), global transportation carbon emissions will account for about 25% of total global carbon emissions in 2022 [1]. Focusing on China, China’s carbon emissions are at the top of the world’s countries, and the fast-growing economy is accompanied by a significant automobile use, which adds more carbon dioxide emissions [2]. Between 1990 and 2021, China’s transportation carbon emissions increased from 94 million tons to about 960 million tons. Due to the growth in the use of electric vehicles, China’s transportation emissions instead declined by 3.1 percent in 2022, contributing significantly to carbon-neutral policies. Promoting new energy vehicles to replace traditional fuel vehicles and reducing energy consumption in the transportation sector is an effective way to achieve carbon-peaking goals and neutrality [3,4]. Despite the rapid growth in the ownership of new energy vehicles in China in recent years, there is still a lot of room for improvement in the market scale of new energy vehicles, and the market share as well as ownership remains far less than that of fuel vehicles. In 2022, the sales of new energy vehicles in China amounted to 6,887,000, which only accounted for 25.6% of the total sales of new automobiles. By the end of 2022, China’s new energy vehicle ownership amounted to 13.1 million units, accounting for only 4.10% of the total automobiles. Therefore, it is necessary to study the proliferation of new energy vehicles to promote replacing fuel vehicles with new energy vehicles and help realize the goal of carbon neutrality [5].

As the leader of macro-control and the policy maker, the government’s relevant policies affect the market’s direction, so the formulation of relevant policies is of great significance to the promotion of new energy vehicles [6,7,8]. China’s new energy vehicle market policy has mainly experienced three stages: government subsidies, subsidy regression, and market orientation, and it is currently in the third stage of subsidies formally withdrawn into the market orientation. In the early stage, the related industrial technology of new energy vehicles is still in the development stage, the research and development costs are high, and the supporting facilities are not perfect enough. The government provides a certain amount of subsidies to new energy vehicle manufacturers, prompting enterprises to start the production of research and development of new energy vehicles and increase the research and development investment in related technology [9]. On the other hand, by providing consumers a certain amount of subsidies for purchasing cars and related policy concessions, consumers are encouraged to buy new energy vehicles, which has achieved specific results [10,11,12]. With the development of the new energy vehicle industry, technology continues to improve, the effect achieved by the government subsidies has gradually weakened, and the incentive effect on the enterprise also shows a marginal diminishing law [13,14,15]. In the later stage, the new energy-related industrial technology continues to develop, and the supporting facilities such as charging piles continue to improve, so the government has adopted the mechanism of subsidy regression [16,17,18].

How the willingness of automakers and consumers to choose new energy vehicles changes when government subsidies are eliminated is a question worth studying and exploring. Existing related studies have proposed that incorporating the road transportation sector into carbon trading is a new way to promote the proliferation of new energy vehicles. In the context of subsidy elimination, the government has implemented a double points policy that constrains the production decisions of new energy vehicles while it lacks a certain degree of guidance on the consumption side. In that case, it will affect consumers’ willingness to purchase new energy vehicles, which in turn affects the production decisions of automakers [19]. Based on this, according to the assumption of finite rationality, the government, automobile manufacturers, and consumers will continuously optimize their strategies to maximize their interests. The evolutionary game can intuitively analyze the strategy evolution process of the government, automobile manufacturers, and consumers. Therefore, this study used the evolutionary game to study the strategy choice of the three parties under the carbon trading mechanism. The innovations of this research are as follows: (1) A new energy vehicle participation carbon trading mechanism based on blockchain technology is constructed. (2) A tripartite evolutionary game model of government-automobile manufacturers-consumers is built, the evolutionary strategy of each subject is analyzed, and the stability of the strategy is explored, seeking a theoretical basis for the implementation of the carbon trading mechanism. The research ideas of this study are as follows: Section 2 combs through the impact of government subsidies and subsidy cancellation on the proliferation of new energy vehicles, and introduces the related research of evolutionary games in the proliferation of new energy vehicles. Section 3 constructs a mechanism based on blockchain technology for new energy vehicles to participate in carbon trading. Section 4 constructs a tripartite game model of the government, automobile manufacturers, and consumers, and analyzes the benefits and strategy stability of each subject. Section 5 conducts a simulation analysis to study the evolution strategy of each subject and conducts a sensitivity analysis. Section 6 summarizes the research of this study and puts forward the corresponding conclusions and suggestions.

2. Literature Review

2.1. Impact of Government Policies on the New Energy Vehicle Market

Many scholars have studied government policies’ impacts on the proliferation of new energy vehicles from multiple perspectives, including government subsidies, subsidy strategies, and subsidy effects. In the form of subsidies, there are mainly purchase subsidies and supporting facilities’ construction subsidies, and the comprehensive subsidy efficiency can be used as a measure of subsidy effect [20]. At the stage of new energy vehicle research and development, different subsidy strategies are formulated to motivate automobile manufacturers to invest in new energy research and development [21]. The government subsidy strategy is mainly divided into supply-side subsidies and demand-side subsidies, which have different effects on consumers and automakers [22,23].

In addition to government policies, consumer low-carbon preferences can also impact the proliferation of new energy vehicles. By cultivating consumers’ awareness of green preferences, consumers can be prompted to choose cleaner new energy vehicles, which will expand the market for new energy vehicles [24]. In addition, the construction of infrastructure such as charging stations also affects the proliferation of the new energy vehicle market. A series of policies, such as investment, construction, and operation subsidies, have been implemented to incentivize the deployment of EV charging infrastructure [25]. Fu and Xia used a system dynamics approach to analyze and forecast China’s EV ownership, and proposed development proposals regarding government subsidies and charging facilities construction [26]. These studies provide opinions and suggestions for policy formulation.

2.2. Study on the Proliferation of New Energy Industry after the Removal of Government Subsidies

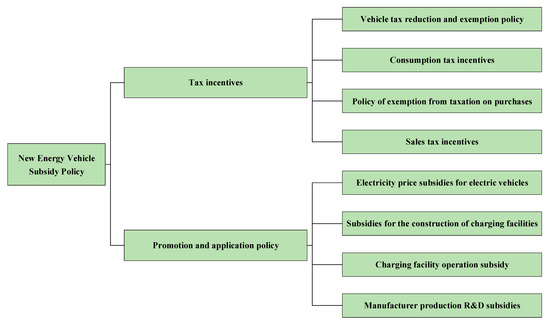

As new energy vehicles are gradually recognized by the market and consumers, government subsidies are gradually withdrawn to enter the post-subsidy era. After the cancellation of government subsidies, there is an urgent need to explore new policy mechanisms to help develop the new energy vehicle industry. In the phase of policy phase-out, it is necessary to guide government policy to exit reasonably, and consider the impact of multiple exit mechanisms on the government and automobile manufacturers [27]. Some scholars have studied the impacts of dual credit and the implementation of new market mechanisms on the proliferation of new energy vehicles after the cancellation of subsidies. Jin et al. studied and simulated the strategic impacts of implementing a dynamic dual credit policy on the evolutionary game between local governments and automobile manufacturers after the cancellation of subsidies. They analyzed it through system dynamics, pointing out that the government and enterprises should focus on technological breakthroughs and infrastructure construction [28]. In addition to the dual credit policy, after the government subsidy is canceled, the carbon trading policy can be considered to be incorporated into the new energy automobile industry to promote the development of the new energy automobile industry. Currently, domestic and international research have mainly studied the impact of individual carbon trading on consumer car replacement, and lack an analysis of the automobile industry in general [29,30] (Figure 1).

Figure 1.

New energy vehicle industry subsidies.

2.3. Evolutionary Games in the Diffusion of New Energy Vehicle Industry

Evolutionary game theory is often used to study the diffusion of the new energy vehicle market [31]. Liao and Tan used evolutionary game theory and empirical analysis to analyze the impact of carbon tax policy on the new energy vehicle market after subsidy cancellation, and the carbon tax mechanism under different scenarios [32]. In addition to the carbon tax policy, some studies have also used evolutionary game theory to analyze the impact of banning the sale of fuel vehicles on the new energy automobile industry, and analyzed the game relationship between the relevant subjects [33]. For example, Liu and Dong constructed a three-party subject game model of the government, automobile manufacturers, and consumers based on the co-evolutionary game theory. They analyzed the impacts of the government-regulated fuel vehicle ban on the strategic choices of each subject [34]. Based on this evolutionary game theory, combined with complex network theory, these have also been used to study the impact of policies and consumer preferences on the construction of electric vehicle charging infrastructure [35]. In addition to studying government policies, some studies have proposed introducing carbon trading mechanisms into the transportation industry to help reduce carbon emissions in the transportation industry [36,37,38].

To summarize the above, most existing studies, when using evolutionary games to study the new energy vehicle market diffusion, only consider the impact of the existing subsidy regression or double integral policy on the new energy vehicle market. However, when government subsidies have been withdrawn from the new energy vehicle industry, what is the subsequent development of the new energy industry? How can the development of the new energy vehicle industry continue to be incentivized after subsidies are removed? The new energy vehicle industry needs new incentives, but little research has considered the evolutionary diffusion of the new energy vehicle market when new energy vehicles are included in carbon emissions trading. In recent years, the automobile market is constantly expanding, and there will be a steady stream of consumers buying new energy or fuel vehicles. Therefore, this study established a tripartite game model of the government, automobile manufacturers, and consumers to analyze the strategic choices of the participants and explore the possibility of implementing carbon trading mechanisms in the field of new energy vehicles.

3. Carbon Trading Mechanism for New Energy Vehicles Considering Blockchain Technology

In the context of carbon emissions reduction, there are many ways for achieving low-carbon transformation in the transportation sector, such as electrification of vehicles, cleaner energy, and greening of energy supplies. The electrification of vehicles can effectively promote carbon emissions reduction in the transportation sector and achieve the goal of carbon neutrality at an early date. Therefore, it is possible to continue to promote the electrification of automobiles and, at the same time, develop energy cleanliness and energy greening technologies so that electric vehicles can make more use of green power in the future. As the market for new energy vehicles matures and government subsidy policies are gradually withdrawn, consideration can be given to including consumers in the carbon trading system to incentivize them to choose new energy vehicles. Personal carbon trading (PCT) is a carbon trading model in which carbon control is realized through total control and an initial carbon allowance allocation mechanism, and the main body of the transaction is the individual consumer.

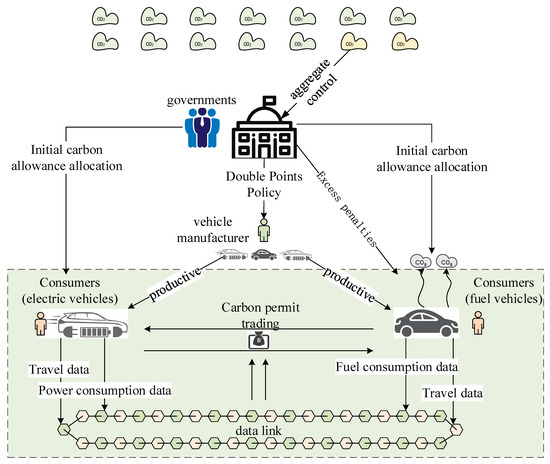

Blockchain technology has the characteristics of non-comparability and decentralization, which can be used for data recording and verification development when applied to new energy vehicle carbon trading. Its application in the field of carbon trading mainly has the following advantages: firstly, it improves the credibility of the data, verifies the natural source of the carbon data, and processes the data through smart contracts; all of the data are recorded in the public ledger, which can be viewed and verified by anyone. The second advantage is that blockchain technology improves the efficiency of the transaction, which can be based on the blockchain underlying design of the carbon emissions proper trading mechanism to realize intelligence and automation to make carbon trading more efficient. Thirdly, it facilitates regulation, utilizing the characteristics of blockchain data that are tamper-proof and traceable to recognize the code and management of carbon trading and provide real-time code and tracking. We constructed a consumer carbon trading mechanism based on blockchain technology, as shown in Figure 2. First, as the regulator, the government allocates initial carbon emission quotas based on the principle of total control. In order to achieve the goal of carbon neutrality, it is possible to consider introducing a carbon trading mechanism on an incremental basis year by year, which will increase the acceptance of the consumer community, and is also in line with the current market situation. On the consumer side, personal and vehicle information are bound to create a unified digital identity that is imported into the data chain. The distributed nature of blockchain technology can record and save the digital identity information that carries the annual driving mileage, charging volume, and green power ratio of electric vehicles or fuel vehicles’ driving mileage and fuel consumption, and then account for the consumer’s carbon emissions. Through blockchain intelligent contracts, consumers can use their digital identities to trade carbon permits. When a consumer binds a digital identity that exceeds the carbon emissions quota allocated by the government and fails to purchase the corresponding carbon emissions permit through the carbon trading system, he or she must pay a certain percentage of the fine. Through the constraints on the consumer side, the guidance of the new energy vehicle market is realized, which in turn influences the production strategy of automobile manufacturers through the relationship between supply and demand. Therefore, the government can guide the development of the new energy vehicle market by implementing the carbon trading mechanism, setting reasonable carbon trading prices, and appropriate penalties. This study analyzed the different strategic choices of the government, automobile manufacturers, and consumers, and explored whether the government will implement a carbon trading mechanism, and the choices of automobile manufacturers and consumers under the new market mechanism.

Figure 2.

Schematic diagram of the new energy automobile industry’s participation in carbon trading.

4. Three-Party Game Model Construction of New Energy Vehicles Participating in Carbon Trading

4.1. Model Assumptions and Parameter Settings

Hypothesis 1:

In the new energy automobile industry under the background of dual carbon, the three parties involved in the game, including the government, automobile manufacturers, and consumers, are all finite rational groups. The three parties will adjust their decision-making behaviors according to the information they obtain.

Hypothesis 2:

The decision choices of the government are {implement a carbon trading mechanism, do not implement a carbon trading mechanism}, with a probability of for choosing to implement, and a probability of for choosing not to implement. The decision choice of automobile manufacturers is {produce new energy vehicles, produce fuel vehicles}, the probability of producing new energy vehicles is , and the probability of producing traditional fuel vehicles is . The new energy vehicles covered in this research are assumed to be electric vehicles, and other energy types such as hydrogen vehicles are not considered. The consumer decision choice is {buy new energy cars, buy fuel cars}, and the probability of choosing to buy new energy cars is , and the probability of choosing to buy traditional fuel cars is .

Hypothesis 3:

The government’s implementation cost of carbon trading is , the environmental benefit is , and the subsidy given to automobile manufacturers is . When consumers choose fuel cars, the government pays the environmental cost of . Consumers’ choice of new energy vehicles brings the government social benefits of . The benefits brought to the government by automobile manufacturers choosing to produce new energy vehicles, such as industrial transformation and international image enhancement, are .

Hypothesis 4:

The additional R&D cost automakers invest in producing new energy vehicles is . The additional benefit brought by consumers’ preference is , and when the government implements the carbon trading mechanism, the additional benefit is , where is the influence factor of consumers’ willingness to purchase new energy vehicles when the government implements the carbon trading mechanism. When the government implements the carbon trading mechanism, the automobile manufacturer produces new energy vehicles and receives government support as . When the automobile manufacturer does not produce new energy vehicles, it loses the potential support from the government with a loss of . At the same time, it loses the loss of the potential market demand from the consumer side as . When the government implements the carbon trading mechanism, it affects the consumers’ willingness to purchase new energy vehicles as , and the automobile manufacturer produces fuel cars with a loss of .

Hypothesis 5:

When consumers choose to buy new energy vehicles, the additional gain due to the cost of car use and green preference is . The carbon trading gain when the government implements carbon trading is . When the car manufacturer chooses to produce new energy vehicles, the additional gain consumers get from purchasing new energy vehicles is , and the loss from purchasing traditional fuel vehicles is . When the government implements carbon trading, the carbon cost of consumers choosing to buy fuel cars is , and the penalty paid for exceeding the carbon quota is .

Under the above assumptions, the government, automakers, and consumers make strategic choices in which the benefits, costs, and losses involved are all positive. Therefore, the benefits matrixes for the government, automobile manufacturers, and consumers are shown in Table 1 and Table 2 below.

Table 1.

Benefits matrix for implementing carbon trading with different options for automakers and consumers.

Table 2.

Benefits matrix of different choices for automobile manufacturers and consumers without implementing carbon trading.

4.2. Analysis of the Tripartite Game

4.2.1. Expected Return of the Government

Assuming that the government’s expected return from implementing carbon trading is , the expected return from not implementing carbon trading is , and the government’s average expected return is ; then, we have the following:

The government’s gain function can be obtained as the government’s replication dynamic equation as follows:

According to the stability theorem of differential equations, a return can be obtained when , , , , and ; at this time, is the government’s evolutionary stabilization strategy; on the contrary, when , , , , and ; at this time, is the government’s evolutionary stabilization strategy.

The remaining parameters are analyzed as follows: let and the partial derivation of other factors are , , , , and , so the government’s probability of implementing carbon trading increases as , , and increase. The government’s probability of implementing carbon trading increases as and decrease. It can be seen that the greater the environmental benefits of the government implementing carbon trading and the greater the penalty for excess carbon emissions, the greater the probability that the government chooses to implement carbon trading. When the government does not implement the carbon trading strategy, the increase in environmental governance costs will push the government toward implementing the carbon trading strategy. The probability that the government will implement carbon trading decreases as the costs of implementation and the support provided to car companies increase.

4.2.2. Expected Returns of Automobile Manufacturers

Assuming that the automaker’s expected return from producing new energy vehicles is , the automaker’s expected return from not producing new energy vehicles is , and the automaker’s average expected return is ; then, we have the following:

The replication dynamic equation of the automobile manufacturer can be obtained from the automobile manufacturer’s gain function as follows:

According to the stability theorem of differential equations, when , , , , and , at this time, is the evolutionary stable strategy of the car manufacturer; on the contrary, when , , , , and , at this time is the evolutionarily stable strategy of the car manufacturer.

The remaining parameters are analyzed: let , and the partial derivation of the other factors are , , , , , and . Therefore, with , , , , and increasing, or decreasing, the probability that an automaker chooses to produce a new energy vehicle increases.

4.2.3. Consumers’ Expected Returns

Assuming that the consumers’ expected return from purchasing new energy vehicles is , the consumers’ expected return from purchasing fuel vehicles is , and the average expected return of consumers is ; then, we have the following:

The consumer’s benefit function can be obtained as the consumer’s replication dynamic equation, which is the following:

According to the stability theorem of differential equations, when , , , , and , at this time, is the consumer’s evolutionary stable strategy; conversely, when , , , , and , at this time is the consumer’s evolutionary stable strategy.

The remaining parameters are analyzed as follows: let , and the partial derivation of the other factors are , , , , and , so with increases in , , , , and , the consumers’ choices to buy new energy vehicles, the probabilities of all of them increase.

4.3. Stabilization Strategy Analysis

Let the replicated dynamic equations of the tripartite subjects be , , and . Eight local equilibrium points can be obtained: . According to the method proposed by Friedman [39], the ESS of the system of differential equations can be derived from the local stability analysis of the system’s Jacobian matrix. From the replicated dynamic equations obtained from the previous analysis, the Jacobian matrix can be obtained as follows:

Among them are the following:

According to Lyapunov’s first method, it is known that the evolutionary stable point ESS of the system needs to satisfy that all eigenvalues of the Jacobian matrix have negative genuine parts. If at least one of the eigenvalues of the Jacobi matrix has a positive fundamental part, the local equilibrium point is unstable. Suppose all eigenvalues of the Jacobi matrix have a negative fundamental part except for those with a zero genuine part. In that case, the equilibrium point is critical, and the eigenvalue sign cannot determine the stability. The eight local equilibrium points were substituted into the Jacobian matrix to obtain the three eigenvalues corresponding to each equilibrium point, as shown in Table 3 below. The conditions required for the local equilibrium points to form an ESS are shown in Table 4 below.

Table 3.

Eigenvalues and stability of equilibrium points.

Table 4.

System equilibrium stabilization conditions.

In scenario 1, the government’s strategic choice is not to implement the carbon trading mechanism because . At this point, the cost of the government to implement carbon trading is higher than the environmental benefits of implementing carbon trading, the relevant technical conditions for implementing carbon trading are not perfect, and the upfront investment cost of implementation is too high. Consumers will also choose to buy fuel cars, which is not the equilibrium point that the system expects to achieve.

In scenario 2, the system strategy is {No carbon trading policy, produce new energy vehicles, buy new energy vehicles}. When the government implements carbon trading at a high cost by giving automakers certain R&D subsidies, combined with the existing double integral policy to reduce the additional input cost for automakers to produce new energy, automakers and consumers are prompted to choose new energy vehicles.

In scenario 3, the strategies of the three main actors are {implementing carbon trading policies, producing new energy vehicles, and purchasing new energy vehicles}. The government implements carbon trading to bring more benefits than the cost of implementation and chooses to implement the carbon trading mechanism, prompting automobile manufacturers and consumers to also shift to choose new energy vehicles to achieve the system stability equilibrium point.

5. Simulation Analysis

According to the assumption of a tripartite game among the government, automobile manufacturers, and consumers, as well as the replication of dynamic equations, the initial parameters to satisfy scenario 3 were set, and numerical simulation was carried out using Matlab 2017b; the values of each parameter were assigned as and were further analyzed through numerical simulation.

5.1. Simulation Analysis of Pure Strategy Games

5.1.1. Government’s Initial Strategy of Choosing Not to Implement a Carbon Trading Mechanism

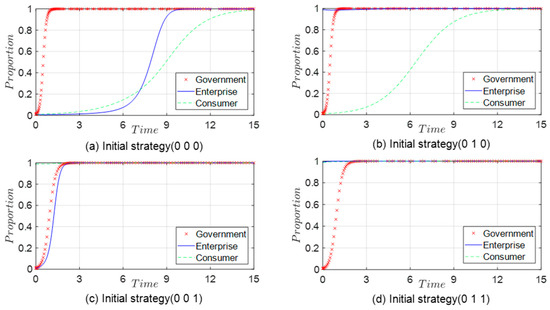

The initial state will adjust the initial values of the pure strategy simulation to study the stability of the equilibrium point of the three-party game subject and set the initial probability of 0 to 0.01 and 1 to 0.99. The strategies of the three-party game subject of the government, car companies, and consumers are (0,0,0), (0,1,0), (0,0,1), and (0,1,1), respectively, and the evolutionary paths are shown in Figure 3.

Figure 3.

Evolutionary path when the initial government strategy is chosen not to be implemented.

As shown in Figure 3a above, when the government’s initial strategy is chosen not to be implemented, the rate at which consumers choose to purchase new energy vehicles is lower than the rate at which automakers produce them. However, when the government’s strategy evolves to implement carbon trading to enhance environmental benefits and reduce carbon emissions, consumers will be willing to purchase new energy vehicles. Due to the rise in market demand, the probability of automakers choosing to produce new energy vehicles will increase substantially. As shown in Figure 3b, when the initial strategy of the automaker is to choose to produce new energy vehicles, the probability of consumers purchasing new energy vehicles increases earlier and faster than the probability of the automaker’s initial strategic choice to produce traditional fuel vehicles. As shown in Figure 3c,d above, when consumers buy new energy vehicles in their initial strategy, the probability of automakers producing new energy vehicles will increase significantly due to market demand. It will eventually evolve to produce new energy vehicles. The government increases the market share of new energy vehicles to enhance environmental benefits, and the strategic choice will also evolve into implementation.

5.1.2. Initial Government Strategy Options to Implement Carbon Trading Mechanisms

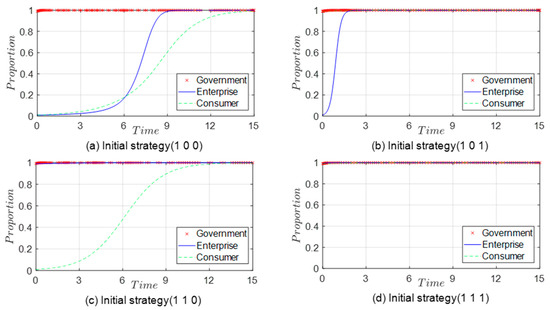

The strategies of the three main parties of the game, i.e., government, automobile manufacturers, and consumers, are (1,0,0), (1,0,1), (1,1,0), and (1,1,1), respectively, and the evolutionary paths are shown in Figure 4.

Figure 4.

Evolutionary path when the government’s initial strategy is selected for implementation.

As shown in Figure 4a above, when the government’s initial strategy is to choose to implement carbon trading, the uncertainty of the implementation policy by automobile manufacturers and consumers in the early stage presents an insignificant increase in the probability of choosing new energy vehicles. With the implementation of the policy, consumers will tend to choose new energy vehicles, and the probability of automakers choosing new energy vehicles also rises immediately compared to the period when the initial government strategy is chosen not to be implemented; the period when consumers and automakers choose new energy vehicles will be earlier. Based on Figure 4a, the initial strategy of consumers is changed to purchase new energy vehicles, and the evolution result is shown in Figure 4b; due to the market demand, the automobile manufacturer chooses to produce new energy vehicles earlier and with a higher probability. As shown in Figure 4c above, when the government’s initial strategy is to choose to implement carbon trading, and the automaker’s initial strategy is to choose to produce new energy vehicles, due to the policy encouraging consumers to purchase new energy vehicles and the increased supply of new energy vehicles, the consumer’s choice of new energy vehicles increases due to the dual influence of policy and market. When the government’s initial strategy is to choose to implement carbon trading, automobile manufacturers choose to produce new energy vehicles and consumers choose to buy new energy vehicles; the evolution reaches the equilibrium point (1,1,1), and the equilibrium point is the system stability point.

5.2. Sensitivity Analysis

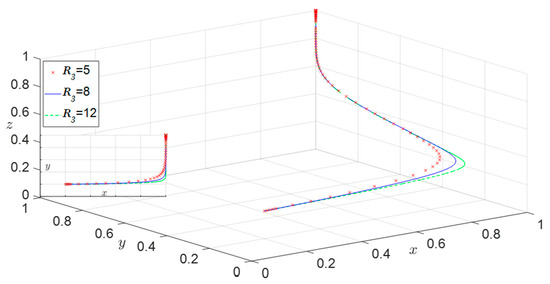

5.2.1. The Influence of the Government’s Implementation of Carbon Trading Benefits and Costs

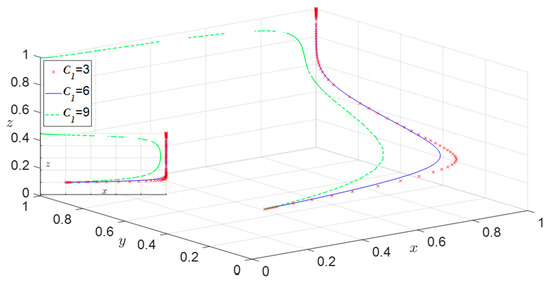

The government’s choice to implement carbon trading is affected by various factors. To explore the impacts of implementation benefits and costs on the government’s strategic choices, to adjust the values of implementation benefits and costs, and to analyze the evolutionary path of the three-party game, the evolutionary process is shown in Figure 5 andFigure 6. When the government implementation benefit increases, the probability that the government chooses to implement carbon trading increases, and it has little effect on the strategic choices of vehicle enterprises and consumption. When the cost of government implementation of carbon trading increases, the probability that the government chooses to implement it decreases. When the cost reaches a certain threshold, the government will choose not to implement carbon trading. The probability that car manufacturers and consumers choose new energy vehicles will have a smaller increase, ultimately reaching the stabilization point strategy of scenario 2. Therefore, to reach the dual-carbon target as soon as possible, the government will consider including the new energy vehicle industry in carbon trading for environmental benefits to promote carbon emissions reduction in the road transportation sector. Considering the implementation costs and other issues, the government needs to implement the carbon trading mechanism when the relevant technical means are more mature, in order to minimize the implementation costs.

Figure 5.

Impact of government implementation of benefit .

Figure 6.

Impact of government implementation of gain .

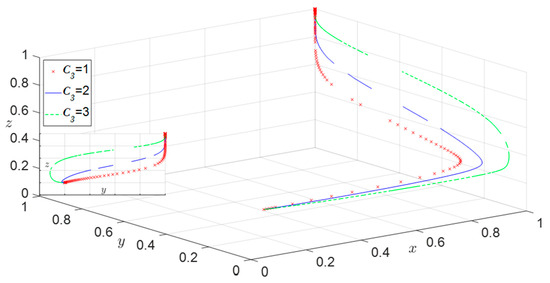

5.2.2. Influence of Additional Input Cost of Automobile Manufacturers

The additional input costs of automobile manufacturers to produce new energy vehicles affects the willingness of automobile manufacturers to produce new energy vehicles, and the probability of automobile manufacturers choosing to produce new energy vehicles further affects the market for new energy vehicles. These factors are transmitted to consumers through the market and affect their choices. As shown in Figure 7, as the additional input cost of car manufacturers to produce new energy vehicles decreases, the probability of car manufacturers choosing to produce new energy vehicles increases, and the probability of consumers buying new energy vehicles also increases. This is because when the cost of producing new energy vehicles by automobile manufacturers decreases, the profit of new energy vehicles increases, and the positive initiative of automobile manufacturers to produce new energy vehicles rises. As the proportion of new energy vehicles in the automobile market increases, the supporting facilities related to new energy vehicles will also be gradually improved so that consumers will choose new energy vehicles more often. Therefore, the government can reduce the cost of producing new energy vehicles by adjusting the existing “double integral” policy standard, in order to encourage automakers to produce new energy vehicles.

Figure 7.

Impact of additional input cost on automobile manufacturers.

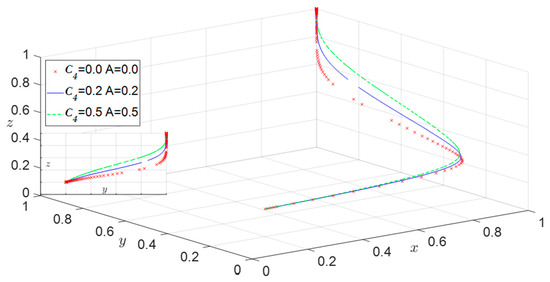

5.2.3. Influences of Consumer Carbon Transaction cost and Carbon Transaction Benefit

Consumer carbon transaction costs and gains will affect the consumer’s car costs, which in turn affect the consumer’s strategic choices, and the consumer’s strategic choices affect the automobile manufacturer’s strategic choices through the market mechanism. As can be seen from Figure 8, when carbon trading costs and carbon trading gains are 0, consumers will also gradually evolve to choose new energy vehicles. In contrast, the probability of consumers choosing new energy vehicles will increase when carbon trading costs and gains gradually increase. This is because currently, the related industrial technology of new energy vehicles is gradually maturing, market recognition is gradually increasing, some consumers will consider choosing new energy vehicles, and implementing carbon trading can accelerate the market share of new energy vehicles. Due to the influences of market demand, the probability of automobile manufacturers choosing to produce new energy vehicles will also increase.

Figure 8.

Impacts of consumer carbon transaction costs and carbon transaction benefits .

6. Conclusions

This study analyzed the situation of applying consumer carbon trading to the new energy automobile industry after the government subsidy is canceled, and discusses the application of blockchain technology in the consumer carbon trading mechanism of the new energy automobile industry. This study constructed a tripartite game model of the new energy automobile industry’s participation in carbon trading involving the government, automobile manufacturers, and consumers, analyzed the replicated dynamic equations as well as the strategy stability of the three subjects, and furthermore analyzed the impacts of the government’s implementation costs and benefits, the automobile manufacturers’ additional input costs, and the consumers’ carbon trading costs and benefits on the stability of the strategies, and finally conducted a simulation analysis using MATLAB.

The conclusions and related recommendations of this research are as follows:

- (1)

- The increase in the government’s revenue from implementing carbon trading and the decrease in implementation costs will increase the probability of the government choosing to implement it. Therefore, the government can consider encouraging the development of industrial technologies related to new energy vehicles, and encouraging the development of industrial technologies related to implementing carbon trading, such as battery technology and blockchain technology.

- (2)

- Reducing additional investment costs for automobile manufacturers to produce new energy vehicles will increase the probability of manufacturers choosing to produce new energy vehicles; the probability of consumers purchasing new energy vehicles will also increase. Therefore, the government can adjust the existing “double integral” policy to encourage automakers to produce new energy vehicles and expand the market share of new energy vehicles.

- (3)

- The increase in carbon trading costs when consumers choose traditional fuel vehicles, or the increase in carbon trading benefits when consumers choose new energy vehicles, will increase the probability of consumers buying new energy vehicles. Therefore, the government can improve the infrastructure related to new energy vehicles by increasing the investment in supporting charging stations, setting reasonable carbon quotas, and implementing incentives and penalties to encourage consumers to choose new energy vehicles.

Author Contributions

Conceptualization, W.Z. and Y.L.; Methodology, Y.L.; Software, Y.L.; Formal analysis, J.H.; Data curation, L.L.; Writing—original draft preparation, Y.L.; Writing—review and editing, W.Z.; Funding acquisition, W.Z. All authors have read and agreed to the published version of the manuscript.

Funding

This research is supported by the National Key Research and Development Program of China (Grant No. 2022YFE0207700).

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data that support the findings of this study are available from the corresponding author, Yimeng Liu, upon reasonable request.

Conflicts of Interest

The authors declare no conflict of interest.

References

- IEA-International Energy Agency. Data and Statistics. IEA 2023. Available online: https://www.iea.org (accessed on 13 May 2023).

- Chen, Z.; Du, H.; Li, J.; Southworth, F.; Ma, S. Achieving Low-Carbon Urban Passenger Transport in China: Insights from the Heterogeneous Rebound Effect. Energy Econ. 2019, 81, 1029–1041. [Google Scholar] [CrossRef]

- Dou, H.; Wang, Y.; Zhou, J.; Liu, Y. Coordinated Control of New Energy Environment and Mixed Vehicle Flow Speed Based on Sensor Network. Mob. Inf. Syst. 2022, 2022, 6161154. [Google Scholar] [CrossRef]

- Li, W.; Long, R.; Chen, H.; Yang, M.; Chen, F.; Zheng, X.; Li, C. Would Personal Carbon Trading Enhance Individual Adopting Intention of Battery Electric Vehicles More Effectively than a Carbon Tax? Resour. Conserv. Recycl. 2019, 149, 638–645. [Google Scholar] [CrossRef]

- Gu, X.; Wang, M.; Wu, J. An Empirical Study on the Green Effects of New Energy Vehicle Promotion in the Context of Global Carbon Neutrality. Chin. J. Popul. Resour. Environ. 2022, 20, 332–340. [Google Scholar] [CrossRef]

- Liu, X.; Xie, F.; Wang, H.; Xue, C. The Impact of Policy Mixes on New Energy Vehicle Diffusion in China. Clean Technol. Environ. Policy 2021, 23, 1457–1474. [Google Scholar] [CrossRef] [PubMed]

- Liao, H.; Peng, S.; Li, L.; Zhu, Y. The Role of Governmental Policy in Game between Traditional Fuel and New Energy Vehicles. Comput. Ind. Eng. 2022, 169, 108292. [Google Scholar] [CrossRef]

- Liu, C.; Liu, Y.; Zhang, D.; Xie, C. The Capital Market Responses to New Energy Vehicle (NEV) Subsidies: An Event Study on China. Energy Econ. 2022, 105, 105677. [Google Scholar] [CrossRef]

- Zhao, H.; Zheng, J. Impact of Different New Energy Vehicle Subsidy Policies on Market Stability. China Manag. Sci. 2019, 27, 47–55. (In Chinese) [Google Scholar]

- Zhao, D.; Ji, S.; Wang, H.; Jiang, L. How Do Government Subsidies Promote New Energy Vehicle Diffusion in the Complex Network Context? A Three-Stage Evolutionary Game Model. Energy 2021, 230, 120899. [Google Scholar] [CrossRef]

- Diao, Q.; Sun, W.; Yuan, X.; Li, L.; Zheng, Z. Life-Cycle Private-Cost-Based Competitiveness Analysis of Electric Vehicles in China Considering the Intangible Cost of Traffic Policies. Appl. Energy 2016, 178, 567–578. [Google Scholar] [CrossRef]

- Sheldon, T.L.; Dua, R. Measuring the Cost-Effectiveness of Electric Vehicle Subsidies. Energy Econ. 2019, 84, 104545. [Google Scholar] [CrossRef]

- Shao, W.; Yang, K.; Bai, X. Impact of Financial Subsidies on the R&D Intensity of New Energy Vehicles: A Case Study of 88 Listed Enterprises in China. Energy Strategy Rev. 2021, 33, 100580. [Google Scholar]

- Zhu, L.; Wang, P.; Zhang, Q. Indirect Network Effects in China’s Electric Vehicle Diffusion under Phasing out Subsidies. Appl. Energy 2019, 251, 113350. [Google Scholar] [CrossRef]

- Zhang, X.; Bai, X. Incentive Policies from 2006 to 2016 and New Energy Vehicle Adoption in 2010–2020 in China. Renew. Sustain. Energy Rev. 2017, 70, 24–43. [Google Scholar] [CrossRef]

- Liu, L.; Wang, Z.; Liu, Y.; Zhang, Z. Vehicle Product-Line Strategy under Dual-Credit and Subsidy Back-Slope Policies for Conventional/New Energy Vehicles. Comput. Ind. Eng. 2023, 177, 109020. [Google Scholar] [CrossRef]

- Shen, F.; Ma, T.J.; Zhao, X.R.; Xu, N.Y.; Feng, J.B.; Ma, Y. Analysis of private electric vehicle proliferation under incentive regression—A case study of Shanghai Municipality. J. Manag. Sci. 2021, 24, 79–104. (In Chinese) [Google Scholar]

- Ministry of Finance of the People’s Republic of China. Notice on Improving the Financial Subsidy Policy for the Promotion and Application of New Energy Vehicles 2020. Available online: http://www.mof.gov.cn (accessed on 14 May 2023).

- Li, W.X.; Li, H.; Dong, J.S.; Li, Y.M. Study on the development path of new energy vehicles with the introduction of carbon trading mechanism. J. Syst. Simul. 2021, 33, 1451–1465. (In Chinese) [Google Scholar]

- Zhang, L.; Wang, L.; Chai, J. Influence of New Energy Vehicle Subsidy Policy on Emission Reduction of Atmospheric Pollutants: A Case Study of Beijing, China. J. Clean. Prod. 2020, 275, 124069. [Google Scholar] [CrossRef]

- Sun, Y.F.; Zhang, Y.J.; Su, B. Impact of Government Subsidy on the Optimal R&D and Advertising Investment in the Cooperative Supply Chain of New Energy Vehicles. Energy Policy 2022, 164, 112885. [Google Scholar]

- Wang, Y.; Fan, R.; Lin, J.; Chen, F.; Qian, R. The Effective Subsidy Policies for New Energy Vehicles Considering Both Supply and Demand Sides and Their Influence Mechanisms: An Analytical Perspective from the Network-Based Evolutionary Game. J. Environ. Manag. 2023, 325, 116483. [Google Scholar] [CrossRef]

- Wang, Z.; Li, X.; Xue, X.; Liu, Y. More Government Subsidies, More Green Innovation? The Evidence from Chinese New Energy Vehicle Enterprises. Renew. Energy 2022, 197, 11–21. [Google Scholar] [CrossRef]

- Fan, R.; Bao, X.; Du, K.; Wang, Y.; Wang, Y. The Effect of Government Policies and Consumer Green Preferences on the R&D Diffusion of New Energy Vehicles: A Perspective of Complex Network Games. Energy 2022, 254, 124316. [Google Scholar]

- Chen, R.; Fan, R.; Wang, D.; Yao, Q. Effects of Multiple Incentives on Electric Vehicle Charging Infrastructure Deployment in China: An Evolutionary Analysis in Complex Network. Energy 2023, 264, 125747. [Google Scholar] [CrossRef]

- Fu, Y.Q.; Xia, T.T. Modeling and simulation of electric vehicle industry development based on system dynamics. J. Syst. Simul. 2021, 33, 973–981. (In Chinese) [Google Scholar]

- Ji, S.; Zhao, D.; Luo, R. Evolutionary Game Analysis on Local Governments and Manufacturers’ Behavioral Strategies: Impact of Phasing out Subsidies for New Energy Vehicles. Energy 2019, 189, 116064. [Google Scholar] [CrossRef]

- Jin, T.; Jiang, Y.; Liu, X. Evolutionary Game Analysis of the Impact of Dynamic Dual Credit Policy on New Energy Vehicles after Subsidy Cancellation. Appl. Math. Comput. 2023, 440, 127677. [Google Scholar] [CrossRef]

- Nie, Q.; Zhang, L.; Li, S. How Can Personal Carbon Trading Be Applied in Electric Vehicle Subsidies? A Stackelberg Game Method in Private Vehicles. Appl. Energy 2022, 313, 118855. [Google Scholar] [CrossRef]

- Li, J.; Gao, L.; Hu, X.; Jia, J.; Wang, S. Effects of Personal Carbon Trading Scheme on Consumers’ New Energy Vehicles Replacement Decision: An Economic Trade-off Analysis. Environ. Impact Assess. Rev. 2023, 101, 107108. [Google Scholar] [CrossRef]

- Fan, R.; Wang, Y.; Chen, F.; Du, K.; Wang, Y. How Do Government Policies Affect the Diffusion of Green Innovation among Peer Enterprises?—An Evolutionary-Game Model in Complex Networks. J. Clean. Prod. 2022, 364, 132711. [Google Scholar] [CrossRef]

- Liao, D.; Tan, B. An Evolutionary Game Analysis of New Energy Vehicles Promotion Considering Carbon Tax in Post-Subsidy Era. Energy 2023, 264, 126156. [Google Scholar] [CrossRef]

- Li, K.; Dong, F. Government Strategy for Banning Gasoline Vehicles: Evidence from Tripartite Evolutionary Game. Energy 2022, 254, 124158. [Google Scholar] [CrossRef]

- Liu, Y.; Dong, F. What Are the Roles of Consumers, Automobile Production Enterprises, and the Government in the Process of Banning Gasoline Vehicles? Evidence from a Tripartite Evolutionary Game Model. Energy 2022, 238, 122004. [Google Scholar] [CrossRef]

- Fang, Y.; Wei, W.; Mei, S.; Chen, L.; Zhang, X.; Huang, S. Promoting Electric Vehicle Charging Infrastructure Considering Policy Incentives and User Preferences: An Evolutionary Game Model in a Small-World Network. J. Clean. Prod. 2020, 258, 120753. [Google Scholar] [CrossRef]

- Nie, Q.; Zhang, L.; Tong, Z.; Hubacek, K. Strategies for Applying Carbon Trading to the New Energy Vehicle Market in China: An Improved Evolutionary Game Analysis for the Bus Industry. Energy 2022, 259, 124904. [Google Scholar] [CrossRef]

- Li, Z.; Zhang, C.; Xu, H.; Lyu, R. The Optimal Vehicle Product Line Strategy Considering Product Information Disclosure under Government Carbon Regulation. Omega 2023, 119, 102887. [Google Scholar] [CrossRef]

- Samuel, O.; Javaid, N.; Almogren, A.; Javed, M.U.; Qasim, U.; Radwan, A. A Secure Energy Trading System for Electric Vehicles in Smart Communities Using Blockchain. Sustain. Cities Soc. 2022, 79, 103678. [Google Scholar] [CrossRef]

- Friedman, D. Evolutionary Game in Economics. Econometrica 1991, 59, 637–666. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).