Abstract

Government carbon policies and consumers’ preferences are forcing companies to reduce their carbon emissions. Due to financial and technical constraints, carbon-dependent manufacturers are seeking embedded services from energy service companies. By considering these government carbon policies and consumer preferences, this paper constructs a revenue-sharing contract and a two-part contract model for an embedded low-carbon service supply chain using the Stackelberg game to investigate the contractual coordination between the manufacturer and energy service company and their optimal decision making. The equilibrium decisions and the selection of contracts in the supply chain with different parameter levels were obtained. The model’s validity was verified through numerical simulation analysis, and the impacts of the main parameters on the equilibrium decisions and expected utility for the supply chain were analyzed. The results showed that both contracts would enable manufacturers and low-carbon service providers to achieve profit maximization goals when the parameters meet certain constraints. Changes in consumers’ low-carbon and low-price preferences can cause manufacturers to change their business strategies. In addition, the level of technology of ESCOs affects the selection of the type of contract between manufacturers and energy service companies. The findings described in this paper can provide management insights for manufacturers regarding carbon reduction in practice.

1. Introduction

Climate change caused by carbon emissions is the greatest ever threat to our planet and livelihoods [1]. To curb this trend, governments and institutions with higher environmental awareness have implemented carbon policies, including cap-and-trade and tax regulations [2,3]. For example, the European Union Emissions Trading System (EUETS) [4], the Swiss Emissions Trading System [5], the California Emissions Trading Program [6], and the China Carbon Emissions Trading Scheme [7] are well-established regulations. Under cap-and-trade regulations, governments issue companies a certain number of emission allowances and allow them to buy or sell additional allowances on the carbon trading market [8]. In addition, governments can impose a tax on the carbon emissions of businesses, forcing companies to reduce carbon emissions [9].

Meanwhile, as the concept of environmental protection continues to develop, consumers have become increasingly concerned about the environmental attributes of products [10]. Under multiple pressures from government policies, environmental groups, and consumers, carbon-dependent manufacturers are beginning to look for ways to find a balance between lower emissions and economic benefits [11]. In this situation, an increasing number of enterprises are embarking on low-carbon emission reduction [12]. Emission reduction initiatives can benefit companies and enhance their reputation [13]. For example, Apple has announced that its global factory facilities are powered by 100% clean energy and the company committed to eventually using recycled and reclaimed materials for all its products [14]. Despite the benefits of carbon reduction, carbon reduction projects often require significant capital investment [15] and professional technical support [16] and involve high operating expenses [17]. For example, in October 2021, Mitsubishi Corporation in Japan announced that, by 2030, it would invest USD 17.54 billion in alternative energy sources, such as renewable energy and hydrogen, to boost its decarbonization efforts and reduce emissions [18]. For carbon-dependent manufacturers with financial and technical difficulties, embedded services from energy providers with expertise in emissions reduction are a wise option. Embedded low-carbon services are a model in which ESCOs are integrated through investment and business into a manufacturer’s operating environment as low-carbon service providers [19]. For example, Honeywell has invested in and provided carbon reduction services for the Qingdao Brewery in Shenzhen, sharing the benefits of low-carbon activities between the two parties [20]. As the supply chain for embedded low-carbon services is explored, the advantages of embedded low-carbon services over ordinary third-party abatement services, in terms of their comprehensiveness and holistic approach, are becoming apparent. Embedded low-carbon service providers can effectively address the technical, financial, and operational challenges faced by carbon-dependent manufacturers, allowing them to focus on production management.

In the embedded low-carbon service model, the benefits received by energy service companies from providing abatement services to the manufacturer are variable. The manufacturer shares the benefits of the abatement project based on the specifics of the signed contract [21]. However, when we investigated this topic, we found that contracts are often difficult to conclude, and the crucial factor is usually the misallocation of benefits. Therefore, developing contracts with appropriate content for the maximization of the benefits of energy service companies (ESCOs) and manufacturers can promote corporate emissions reductions and the development of low-carbon service industries.

To explore what kind of contract is suitable for an embedded low-carbon service supply chain and how the stakeholders influence the operation of the supply chain, we integrated a model of an embedded low-carbon service supply chain with uncertain market demand under the dual influence of government carbon policy and consumers’ preferences. Specifically, this study aimed to address the following research questions: (1) Can a two-part contract and a revenue-sharing contract reconcile the interests of manufacturers and ESCOs, and under what conditions can this reconciliation be achieved? (2) How do factors such as consumers’ low-price preferences and low-carbon preferences and the technology level of ESCOs affect the decision making for and expected utility of embedded low-carbon service supply chains?

This paper offers the following three contributions: (1) Under the uncertainty of market demand, a decision model for the embedded low-carbon service supply chain is constructed by considering a cap-and-trade mechanism, carbon tax, consumers’ low-carbon preferences, and consumers’ low-price preferences, which enriches the relevant theory of supply chains. (2) The roles of two-part and revenue-sharing contracts in coordinating embedded low-carbon service supply chains are explored, and recommendations are provided to help manufacturers and ESCOs to choose their contracts. (3) The effects of consumers’ low-price and low-carbon preferences, the technology level of the ESCO, and the degree of misreporting of emission reduction costs on the equilibrium decision, as well as the expected utility of the embedded low-carbon service supply chain, are analyzed to provide a reference for proposing practical management countermeasures.

The remainder of this paper is organized as follows. Section 2 outlines the theoretical background by reviewing the relevant literature. Assumptions about this supply chain, the associated notation, and the corresponding game model are presented in Section 3. Parameter analysis and numerical simulations are used in Section 4 to visualize the theoretical results. Then, the main findings, theoretical contributions, and management insights are discussed in Section 5. Finally, conclusions are drawn in Section 6, and future research directions are presented.

2. Literature Review

This section reviews the literature related to our study in detail across three areas: carbon policy, service supply chains, and contract coordination. The research background is outlined, and the innovative character of this study is highlighted.

2.1. Carbon Policy

In recent years, many countries and regions have adopted cap-and-trade mechanisms and carbon tax regulations [22]. Xu et al. [23] studied the operational impact of government choices of carbon tax policies and cap-and-trade systems on manufacturers of a wide range of products. The study found that manufacturers’ profits increased and then decreased with the cap, and the cap-and-trade system is more beneficial to society as it has lower environmental damage factors. Sun and Yang [24] considered consumer environmental awareness under a carbon tax and cap-and-trade regulations to examine the emission reductions of two competing manufacturers. Qi et al. [25] constructed a joint decision model based on the conditional value-at-risk criterion and discussed the effects of the firm’s risk aversion and investment coefficient on the optimal decision. Yang et al. [26] constructed two decentralized models of single/joint abatement schemes under a cap-and-trade system and concluded that online channels in joint abatement can improve firm performance. With regard to corporate emission reduction technology and investment, Li et al. [27] discussed the different impacts of using two policies, green technology investment cost subsidies and emission reduction subsidies, to promote green technology investments and emission reductions as part of a cap-and-trade mechanism. Chen et al. [28] explored the impact of low-carbon technology transfer between two rival manufacturers on their economic, environmental, and social welfare performance under a cap-and-trade policy. Toptal et al. [29] examined retailers’ joint decisions on inventory replenishment and carbon reduction investments under three carbon regulation policies and provided a comparative analysis of various investment opportunities. Daddi et al. [30] surveyed over 400 companies registered with EMSA in the EU to examine the relationship between green supply chain management capabilities and key organizational performance. Some scholars have analyzed the impact of carbon policy on supply chain members by using a Stackelberg model. The Stackelberg game involves a leader and a follower who both make decisions to maximize their respective profits [31]. Du et al. [32] studied the decisions and behavior of each member of a supply chain in an aggregate control and trade mechanism based on Stackelberg game theory. Qu et al. [33] constructed two Stackelberg game models to study the impact of aggregate and trade mechanisms on product warranty policies and carbon reduction strategies.

Most of these studies focus on supply chain decision making, investment, and technology issues when considering carbon policy, and such studies provide important references for this paper. Note that some scholars in the above studies considered consumers’ environmental awareness but did not discuss consumers’ preference for low prices when purchasing products. Therefore, with regard to government behavior, this paper integrates cap-and-trade and carbon tax policies. In terms of consumer behavior, this paper not only takes into account that consumers will buy products with a higher degree of greenness but also consumers’ concern about the price of similar products in the market when purchasing products, which makes this study closer to the real situation.

2.2. Service Supply Chains

With the growing importance of the service concept in the global economy, the service supply chain (SCC) is playing an increasingly important role in modern operations management [34]. Peng et al. [35] divided the research on SSCs into two main topics: (1) SSCs as a related service activity in the traditional supply chain; (2) SSCs as an innovation that applies traditional supply chain theory to the service domain. Wang et al. [36] then categorized SSCs into service-only supply chains (SOSCs) and product service supply chains (PSSCs). In SOSCs, providers do not offer physical goods: “products” are services and solutions. For example, Ren et al. [37] investigated the IT service supply chain in SOSCs, where the “product” is the development and use of the software. Fernando et al. [38] studied SOSCs that provide big data analytics and enterprise-managed data security services and found that these services can improve the innovation and performance levels of service supply chains. Lillrank et al. [39] explored different units of analysis applicable to the supply chain analysis of healthcare services based on two patient cases. Farsi et al. [40] discussed SOSCs that provide customized services, such as customer maintenance and facility management. In contrast, the “products” provided by the service supply chain in PSSCs include both physical goods and services. For example, Maull et al. [41] specifically focused on the inter-relationship between products and services in the PSSC and call for the development of corresponding PSSC models to support the requirements of supply chain integration. Mustafee et al. [42] investigated the use of distributed simulation techniques to improve the performance of blood SSCs, solving the problem related to slow-running discrete event model simulations of the UK National Blood Service supply chain. Jia et al. [43] and Choi et al. [44] studied various issues in supply chains of logistics services, where logistics service providers need to provide manufacturers with transportation capacity calculations, product packaging, and shipping services.

The abovementioned studies on service supply chains are extensive, covering many industries, such as IT, healthcare, and manufacturing. Nonetheless, very little research considers service providers’ technology level and asset investment factors. Considering these gaps in the existing literature, this paper focuses on an embedded low-carbon service supply chain. It explores the role of ESCOs in manufacturers’ emission reduction projects after being embedded in the supply chain through a combination of financial inputs and emission reduction services.

2.3. Contract Coordination

For supply chains, both active and passive emission reductions require cooperation among firms to jointly achieve reduction targets, promoting the study of contract design among firms [45]. Shang et al. [46] argued that, for embedded low-carbon service projects, the issue of benefit sharing in relation to energy efficiency is critical for determining the contract reached between two partners. Li et al. [47] studied the effects of two carbon allowance allocation rules, the grandfathering mechanism and the benchmarking mechanism, on three different incentive contracts—the wholesale price contract, the cost-sharing contract, and the revenue-sharing contract—offered to manufacturers by retailers. Qian and Guo [48] examined the design of shared contracts between ESCOs and manufacturers, analyzing the process of negotiation between parties regarding the allocation of energy-savings benefits. Wang and He [49] examined the contractual design problem for a low-carbon service supply chain comprised of a supplier, a manufacturer, and a low-carbon service provider. Furthermore, they analyzed the influence of the risk aversion levels of the manufacturer and supplier on the contract. Some studies refer to revenue-sharing contracts as agency contracts. For example, Yu et al. [50] and Chen et al. [51] studied the effects of brand competition and consumer fairness on the operation of e-commerce platforms, respectively. Huo et al. [52] focused on the cost-sharing contract between manufacturers and retailers and considered the impact of consumers’ low-carbon preferences on market demand and the effect of uncertainty on emission reduction behavior. Yi and Li [53] developed a Stackelberg game model involving government-subsidized energy-efficient products and carbon tax policies and used cost-sharing contracts to coordinate supply chains with demand for emission reductions. Zhang et al. [54] explored the effects of cost–benefit-sharing contracts on supply chain coordination and abatement strategies and found that the incentive effects of environmental regulation were more effective when supply chain coordination contracts were in place. Most of the current literature on supply chain contract coordination focuses on three types of contracts: revenue-sharing contracts, cost-sharing contracts, and cost–benefit-sharing contracts. This paper expands the diversity of contract coordination research by constructing a two-part contract to coordinate a supply chain while studying a revenue-sharing contract.

The contributions of this paper are as follows. (1) While some studies on carbon policy address consumers’ low-carbon preferences, fewer studies have considered consumers’ low-price preferences. This paper considers the impact of consumers’ low-carbon and low-price preferences on the supply chain, which is more in line with the realistic psychology of consumers when purchasing products. (2) Most studies on service supply chains focus on the process of bargaining between ESCOs and manufacturers, with less consideration of the behavior and characteristics of ESCOs themselves. This paper explores the impacts of low-carbon service providers’ financial investment and the level of emission reduction technology on manufacturers’ emission reduction effects. It provides a reference for supply chains to carry out emission reduction projects. (3) Considering that two-part contracts are less widely studied, this paper discusses a revenue-sharing contract and a two-part contract and verifies the roles of these two contracts. A comparison of the relevant reviewed literature is shown in Table 1.

Table 1.

Comparison of this study and related research.

3. Methodology

3.1. Model Description

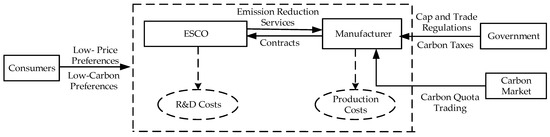

This study constructs an embedded low-carbon service supply chain consisting of a carbon-dependent manufacturer () and an ESCO () providing low-carbon services (as shown in Figure 1). The primary purpose is to explore the role of embedded low-carbon services in reducing manufacturers’ carbon emissions and sustaining economic growth, providing reference suggestions for contractual choices between the two. The manufacturer and ESCO need to consider various aspects, such as market demand uncertainty, carbon policies, consumers’ low-carbon preferences, and low-price preferences, in the process of emission reduction projects, which complements research in related fields. The manufacturer is responsible for the production of the product and pays the energy service company for the project, depending on the type of contract. The ESCO is not only responsible for emission reduction investments but also provides carbon reduction services to manufacturers, which is consistent with Carvallo et al. [55].

Figure 1.

The model of the embedded low-carbon service supply chain.

This paper uses the Stackelberg game approach to model a game with leaders and followers with which it is possible to determine the status differences and information asymmetries that exist between the participants [56]. This model is closer to reality and has a wide range of applications with regard to pricing and decision making in supply chains. In the Stackelberg game, the leader has a significant advantage in predicting the responses of followers and making decisions to maximize profits [57]. In the embedded low-carbon services supply chain, the game’s leader is the manufacturer and the ESCO is the follower. Specifically, the manufacturer first proposes the specifics of the contract to the ESCO, and both parties sign the contract. After that, the manufacturer determines the output of the product and the ESCO decides the level of carbon emission reduction, all based on the principle of revenue maximization.

3.2. Model Assumptions and Parameter Interpretation

To construct the profit functions of the manufacturer and ESCO and to develop a quantitative analysis model, we assume that the embedded low-carbon service supply chain model satisfies the following conditions and that they explain the variables and parameters of the model.

Assumption 1.

When the risk-averse attributes of a manufacturer in an embedded low-carbon service supply chain are not explicit, its characteristics need to be portrayed with the help of the mean-variance (MV) function [58]. The expected utility function is written as .

Assumption 2.

Assume that the market demandis random and satisfies a normal distribution [59]. Consumers tend to buy more environmentally friendly and less expensive products [60], , and , .

Assumption 3.

ESCOs can reduce carbon emissions per unit of a product by, whereis a function of the initial investmentin the low-carbon service project,,is the emission reduction investment scale, andis continuously differentiable [61].

Assumption 4.

The government allows a limited carbon allowancefor the manufacturer [62]. The manufacturers can trade their carbon allowances at a unit price of , and the benefit or cost of the trade is .

Assumption 5.

The manufacturer must pay a tax ofper unit of carbon emissions to the government for its production activities [63], and the total amount of tax paid is .

Assumption 6.

Due to information asymmetry, an ESCO will misreport the unit emission reduction cost () in proportion to [64]. The total abatement cost of an ESCO known to the manufacturer is .

The meanings of other relevant variables and parameters are shown in Table 2.

Table 2.

Explanation of relevant variables and parameters.

3.3. Model Construction

3.3.1. Centralized Decision-Making Model (C)

In the centralized decision-making model, the ESCO and the manufacturer jointly decide on the optimal output of low-carbon products and the optimal emission reduction for certain products, maximizing the total desired utility of the embedded supply chain [65].

In this case, the total expected utility function of the two is as follows.

Taking a partial derivative approach to Equation (1) yields the result of the decision, as shown in Proposition 1. The proof of Proposition 1 and the following propositions is detailed in Appendix A.

Proposition 1.

In the centralized decision model, an optimal output and optimal carbon reduction for products exist, determining the optimal total expected utility, as shown below:

3.3.2. Two-Part Contract Model (T)

In the decentralized decision model, according to Stackelberg game theory, the manufacturer decides the type of contract and the output of the low-carbon products. Then, the ESCO determines the amount of emission reduction for the products.

In detail, for the two-part contract, the manufacturer first pays the ESCO a fixed fee of . Then, the manufacturer pays the ESCO the rest of the fee based on the amount of carbon reduction, and the total amount the manufacturer needs to pay the ESCO is . At this point, the profits for the manufacturer and the ESCOs are expressed as follows:

The equations are solved using inverse operations. Proposition 2 is the result of the equilibrium decision.

Proposition 2.

When, the two-part contract can realize the Pareto optimum. The equilibrium decision and the optimal expected utility of each party in the embedded low-carbon service supply chain are as follows:

3.3.3. Revenue-Sharing Contract Model (RS)

When the manufacturer and ESCO enter revenue-sharing contracts, both parties share the benefits of the embedded low-carbon service supply chain.

In detail, the manufacturer proposes a revenue-sharing ratio . After agreeing on it with the ESCO, the manufacturer determines the output. Next, the ESCO determines the amount of emission reduction per unit of product. In this case, the expected utility functions of the manufacturer and the ESCOs are as follows.

From this, we can obtain Proposition 3.

Proposition 3.

When, there is a value forthat makes the revenue-sharing contract Pareto-optimal. The equilibrium decision and maximum expected utility of the embedded supply chain under the revenue-sharing contract are shown below:

4. Results

4.1. Analysis of Model Properties

4.1.1. Impact of Emission-Reduction Cost-Misreporting Proportion on Embedded Supply Chain

To explore the impact of the ESCO misreporting abatement costs on the embedded supply chain, we used a partial derivative approach and obtained Proposition 4.

Proposition 4.

In the centralized decision model, the revenue-sharing contract model, and the two-part contract model, the manufacturer’s expected utility is negatively related to the proportion of misreported emission reduction costs. The expected utility of the ESCO is positively associated with the proportion of misreporting when the proportion of misreporting is significant. In contrast, the opposite conclusion can be drawn when the proportion of misreporting is small.

Proposition 4 shows that a larger indicates a higher proportion of ESCO misreporting unit emission-reduction costs. For the manufacturer to accept the misreported costs, the ESCO must appropriately reduce the predetermined emission reduction targets to mitigate the trend of increasing total costs. However, this can cause a decrease in consumer desire to purchase low-carbon products, thus damaging economic benefits for manufacturers. If the ESCO’s misrepresentation of costs exceeds a certain threshold, the manufacturer will be unwilling to pay higher fees to the ESCO, leading to a reduction in the ESCO’s profits.

4.1.2. Impact of Consumers’ Low-Price Preferences on the Embedded Supply Chain

To explore the impact of the strength of consumers’ low-price preferences on the embedded supply chain, we again used the method of finding the partial derivatives and obtained Proposition 5.

Proposition 5.

The manufacturer’s expected utility is positively related to the strength of consumers’ low-price preferences in the centralized decision model, the revenue-sharing contract model, and the two-part contract model. When consumers’ low-price preferences are strong, the expected utility of the ESCO is positively associated with it. The opposite conclusion can be drawn when the consumers’ low-price preferences are weak.

Proposition 5 shows that the greater the strength of consumers’ low-price preferences, the more they care about the prices of the same type of products on the market [66]. Consumers’ focus on product prices can cause them to ignore the low-carbon attributes of a product to some extent. The manufacture and ESCO, in this case, will comply with consumers’ preferences by appropriately withdrawing the low-carbon qualities and reducing the prices of their products to stimulate consumers’ desire to buy them. While this initiative will protect the manufacturer from economic harm to a certain extent, it will also prevent the manufacturer from meeting the established emission reduction targets and is not conducive to developing low-carbon emission reductions.

4.2. Numerical Simulation Analysis

In Section 5, we discuss the numerical simulations we performed using Wolfram Mathematica 12 to visually analyze the impact of changes in and on contract selection and the utility of the embedded supply chain. Referring to existing studies [67,68,69], the relevant parameters in this study were set as , , , , , , , , , , , , , , , , . All parameters satisfied the assumptions in the text and the calculated constraints.

4.2.1. Sensitivity Analysis of Consumers’ Low-Carbon Preferences

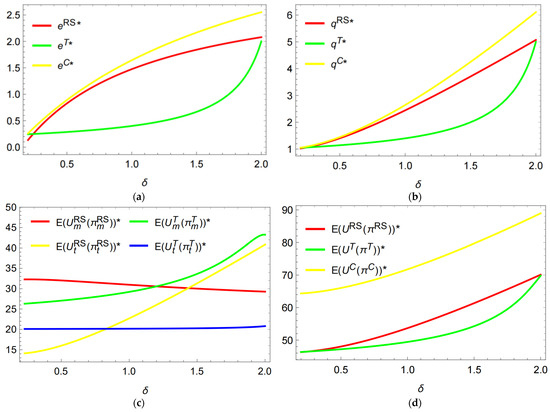

The strength of consumers’ low-carbon preferences reflects the desire of consumers in the market to buy low-carbon products, and the greater this desire, the more consumers are willing to pay for products with low emission levels. The impact of changes in the strength of consumers’ low-carbon preferences on the equilibrium decision and maximum expected utility of the embedded supply chain when other parameters are held constant is shown in Figure 2.

Figure 2.

(a) Effect of change in on carbon reduction per unit of product; (b) effect of change in on the output of product; (c) effect of change in on the expected utility of supply chain members; (d) effect of change in on the overall expected utility of the supply chain.

As shown in Figure 2, the carbon emission reduction per unit of the product shows a positive correlation with the strength of consumers’ low-carbon preferences, which indicates that, when consumers are concerned about the low-carbon attributes of a product, ESCOs try their best to reduce the carbon emission level of the product to cater to consumers’ preferences. After this catering to consumer preferences, the market demand for the product will further increase, and the manufacturer will appropriately increase the output of the product, so the output is also positively correlated with the strength of consumers’ low-carbon preferences.

When the strength of consumers’ low-carbon preferences is low, it is more beneficial for the manufacturer to choose to enter the revenue-sharing contract. Note that an increase in the strength of consumers’ low-carbon preferences will increase the market demand for the product, which means that the manufacturer will need to share more revenue with ESCOs if the revenue-sharing contract is signed. In this case, signing the two-part contract would allow the manufacturer to gain more revenue. Regardless of how consumers’ low-carbon preferences vary over the effective interval, the sum of the expected utility for the manufacturer and the ESCO when they enter a revenue-sharing contract is always greater than when they enter a two-part contract.

4.2.2. Sensitivity Analysis on Emission Reduction Investment Scale

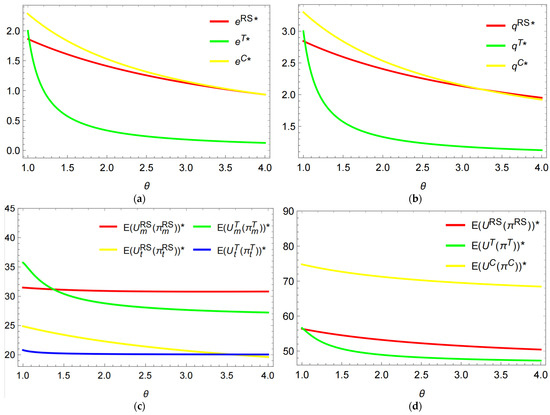

The emission reduction investment scale indicates the amount of capital that an ESCO needs to invest to achieve the expected emission reduction target, and it represents the technical level of the ESCO to a certain extent: the smaller the parameter, the higher the emission reduction technology level of the ESCO. The impacts of changes in the emission reduction investment scale on the equilibrium decision and maximum expected utility of the embedded supply chain when other parameters are held constant are shown in Figure 3.

Figure 3.

(a) Effect of change in on carbon reduction per unit of product; (b) effect of change in on the output of the product; (c) effect of change in on the expected utility of supply chain members; (d) effect of change in on the overall expected utility of the supply chain.

As shown in Figure 3, the equilibrium decisions of the manufacturer and the ESCO are negatively correlated with the scale of the ESCO’s emission reduction investments. This relationship suggests that, if the ESCO has a low level of abatement technology, it will need to invest a higher amount if it wants to accomplish the established abatement goals. ESCOs will reduce their emission reduction targets to alleviate the pressure of investment costs. This will further cause a reduction in the market size for low-carbon products and, thus, a reduction in the expected utility of the manufacturer and ESCO.

For the manufacturer, if the ESCO’s emission reduction technology is strong, entering into a two-part contract will incentivize the ESCO to increase its emission reduction efforts, resulting in higher revenues for the manufacturer. The manufacturer will also be willing to pay the ESCO more to incentivize it to continue reducing emissions. If the ESCO has an average or even lower level of emission reduction technology, the revenue-sharing contract would be a better option for the manufacturer.

In summary, the revenue-sharing contract has a broader application scenario for embedded supply chains than the two-part contract.

5. Discussion

The carbon dioxide produced by enterprises in their production processes contributes to global warming [70]. Carbon policies implemented by governments and consumers’ emphasis on the environmental attributes of products are driving enterprises to reduce carbon emissions [71]. However, most manufacturers cannot independently achieve carbon reduction goals due to limited financial and technical strength. ESCOs and manufacturers working together to form an embedded low-carbon service supply chain can effectively address these issues. However, the distribution of benefits between manufacturers and ESCOs remains challenging in the face of factors such as uncertainty in market demand. In this paper, we develop a Stackelberg game model for an embedded low-carbon service supply chain with uncertain market demand, considering carbon policies and consumers’ preferences. This study investigates the issue of contract selection under different circumstances and analyzes the role played by ESCOs in reducing manufacturers’ carbon emission levels and maintaining economic efficiency.

5.1. Main Results and Findings

Based on the study of contractual coordination for embedded low-carbon service supply chains, our main findings are as follows:

- (1)

- The two-part and revenue-sharing contracts constructed in this paper enable an embedded low-carbon service supply chain to achieve Pareto optimality. This suggests that the problem of benefit distribution between manufacturers and ESCOs in embedded low-carbon service supply chains can be solved by choosing appropriate contracts, as demonstrated in the study by Liao et al. [19]. Similar to Qian and Guo [48], manufacturers can choose different contracts based on consumer preferences and the characteristics of ESCOs. In the context studied in this paper, the revenue-sharing contract has a broader scope of application;

- (2)

- The misreporting of reduction costs by ESCOs will not only make emission reduction targets unattainable but also reduce the economic benefits for the manufacturer, as also found by Yan et al. [64]. According to Zhou et al. [72], manufacturers should fully evaluate and investigate ESCOs’ emission reduction cost information to avoid misreporting as much as possible. In addition, the level of technology of ESCOs largely determines the carbon reduction for a product [73]. Manufacturers can choose the right contract according to the level of technology of ESCOs. When the ESCOs’ technology is strong, entering a two-part contract can bring more benefits to manufacturers. In the opposite situation, it is better to choose a revenue-sharing contract;

- (3)

- Most consumers tend to buy goods at good prices, and these consumer preferences are an important factor in determining the direction of business operations [74]. A lower carbon emission level for a product means that it has a higher price [75]. According to Ouyang and Fu [20], if consumers are more concerned about the price of the product, the manufacturer can sacrifice the low-carbon attributes of the product to some extent, making the product cheaper and catering to consumers’ low-price preferences. This is clearly not conducive to the development of low-carbon products. On the other hand, if consumers value the low carbon level of the product more, the manufacturer should choose a two-part contract, which will not only promote a reduction in the emission level of the product but also enable the manufacturer to gain more economic benefits.

5.2. Theoretical Contributions and Managerial Implications

The theoretical contributions of this paper are as follows: (1) Focusing on the process of ESCOs providing embedded low-carbon services to manufacturers, we revealed the mechanism by which government policies and consumer preferences influence the interactions and decisions among members of embedded supply chains. This paper makes a theoretical contribution to the development of embedded low-carbon services and enriches the information on low-carbon supply chains. (2) Based on Stackelberg game theory, a two-part contract model and a revenue-sharing contract model were constructed. These models deconstruct how the ESCO’s skill level and cost misrepresentation, along with other factors, sway the manufacturer’s choice of contract. Therefore, this paper fills a gap in related research, expands the diversity of research on supply chain contract coordination, and provides a solution to the problem of benefit distribution among members in embedded supply chains.

The managerial implications are as follows: (1) While implementing the cap-and-trade mechanism and carbon tax policies, governments should cooperate with environmental protection organizations and industry associations, strengthen the regulation of environmental management system certification [76], raise the entry threshold for green product production, and continuously cultivate consumers’ awareness of environmental protection. (2) The embedded low-carbon services provided by ESCOs can lower the threshold for manufacturers to reduce emissions. In this cooperation process, ESCO can assist manufacturers in analyzing, tracking, and monitoring their carbon footprint and optimizing their production and operation processes using methods such as LCA [77]. Meanwhile, ESCOs should improve their emission reduction technologies and, thus, enhance their competitive advantages. (3) Manufacturers should eliminate information asymmetry with ESCOs by enhancing data sharing and information communication to avoid unnecessary benefit loss. In addition, manufacturers should positively respond to government regulations, reduce the carbon footprint of their manufacturing operations, and strive to achieve certification for environmental management systems, such as ISO14001, to increase consumer acceptance [78].

6. Conclusions

Investigation of contractual coordination between ESCOs and manufacturers in the embedded low-carbon service supply chain is important to address the challenges of benefit distribution between the two parties and to facilitate their cooperation, thereby promoting the development of energy conservation and emission reduction. In this paper, the contractual choices and production decisions for an embedded low-carbon service supply chain under the influences of governments and consumers were considered in the case of uncertain market demand. A centralized decision model, a two-part contract model, and a revenue-sharing contract model were constructed based on Stackelberg game theory, and their validity was verified. Secondly, the basic parameters were set in conjunction with related studies and constraints. The impacts of different parameter changes on stakeholders’ behavior, such as contract choice, were simulated and analyzed. Finally, corresponding management insights and suggestions were proposed based on the research results.

This paper found that: (1) Consumers’ low-carbon preferences are critical in determining whether two-part and revenue-sharing contracts can coordinate embedded supply chains. Both contracts can achieve Pareto optimality when consumers’ low-carbon preferences satisfy certain conditional constraints. (2) While misreporting by ESCOs can benefit the ESCOs themselves, it can cause adversity throughout the supply chain. (3) Both the technology level of ESCOs and consumer preferences are determinants of contract selection, and consumers’ preferences for low prices can determine the direction in which embedded supply chains operate.

The limitations of this study should also be mentioned. Firstly, only the dominant role of manufacturers in contract selection was considered, and the negotiating power of ESCOs was not considered. Secondly, this study did not consider the potential for ESCOs to borrow from financial institutions when investing in abatement. Finally, the situation where manufacturers face multiple competing ESCOs was not considered in this paper. All of these issues can be considered in future research.

Author Contributions

Conceptualization, C.S. and F.D.; methodology, C.S.; software, F.D.; validation, F.D., C.S., and W.Y.; formal analysis, F.D.; investigation, W.Y.; resources, C.S.; data curation, F.D.; writing—original draft preparation, F.D.; writing—review and editing, F.D.; visualization, F.D.; supervision, C.S.; project administration, C.S.; funding acquisition, C.S. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by National Social Science Foundation of China, grant number 20BGL017.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The original data presented in the study are included in the article; further inquiries can be directed to the corresponding author.

Acknowledgments

We are grateful for the editor’s and reviewers’ time and feedback. Their constructive comments enabled us to greatly improve the quality of the paper. We would particularly like to acknowledge our teammate Huarong Sun for her wonderful collaboration and patient support.

Conflicts of Interest

The authors declare no conflict of interest. The funders had no role in the design of the study; in the collection, analyses, or interpretation of data; in the writing of the manuscript; or in the decision to publish the results.

Appendix A

Proof of Proposition 1.

The second-order partial derivative of Equation (1) with respect to is solved as follows:

Similarly, the second-order partial derivative of Equation (1) with respect to is solved as follows:

It is known that . Therefore, when , , and the expected utility of the embedded low-carbon service supply chain is a concave function.

By calculating the partial derivatives of Equation (1) with respect to e and q, respectively, the optimal decisions of the manufacturer and ESCO can be obtained as Equations (2) and (3). Then, by substituting Equations (2) and (3) into Equation (1), the maximum expected utility of the embedded supply chain in the centralized decision model is obtained as Equation (4). □

Proof of Proposition 2.

Obtaining the second-order partial derivative of Equation (5) with respect to yields:

Obtaining the second-order partial derivative of Equation (6) with respect to yields:

When , the manufacturer’s expected utility function is a concave function, and the manufacturer’s expected utility has the maximum value. When , the expected utility function of the ESCO is concave, and the expected utility of the ESCO has the maximum value.

Based on Stackelberg game theory, backward induction can be used to obtain the optimal decisions of the manufacturer and the ESCO, resulting in Equations (7) and (8).

To verify whether the two-part contract can realize Pareto optimality, let and , resulting in . Then, the service fee paid by the manufacturer to the ESCO per unit of emission reduction can be obtained, as shown in Equation (9).

Hence, it can be deduced that the optimal expected utility of the manufacturer, the ESCO, and the embedded supply chain under the two-part contract can be obtained with Equations (10)–(12), respectively. □

Proof of Proposition 3.

Obtaining the second-order partial derivative of Equation (13) with respect to yields:

Obtaining the second-order partial derivative of Equation (14) with respect to yields:

Clearly, and ; thus, the expected utility functions of both the manufacturer and the ESCO under the revenue-sharing contract are concave functions. Using backward induction, the optimal decisions for the manufacturer and the ESCO can be obtained as Equations (15) and (16).

To verify whether revenue-sharing contracts can coordinate the embedded low-carbon service supply chain, first let , which yields:

Similarly, letting , we obtain:

When , . Furthermore, the final revenue-sharing ratio can be obtained using Equation (17).

Hence, the optimal expected utility of the manufacturer, ESCO, and embedded supply chain under the revenue-sharing contract can be derived, as shown in Equations (18)–(20). □

Proof of Proposition 4.

It is clear from Propositions 2 and 3 that the two-part contract and the revenue-sharing contract enable the embedded low-carbon service supply chain to achieve Pareto optimality. This means that the equilibrium decisions and expected utilities with these two contracts can reach the levels of those with the centralized control decision. Hence, the two-part contract can be chosen as a representative to discuss the parameters.

The partial derivatives of the equilibrium decisions and expected utility with respect to for the centralized decision model are shown below:

Similarly, the partial derivatives of the equilibrium decision and expected utility with respect to τ for the two-part contract model are as follows:

From Proposition 1, it is known that and . Therefore, Proposition 4 is proven. □

Proof of Proposition 5.

The partial derivatives of the equilibrium decisions and expected utility with respect to for the centralized decision model are shown below:

The partial derivatives of the equilibrium decision and expected utility with respect to τ for the two-part contract model are as follows:

Proposition 5 is proved. □

References

- Cheng, P.; Ji, G.; Zhang, G.; Shi, Y. A Closed-Loop Supply Chain Network Considering Consumer’s Low Carbon Preference and Carbon Tax under the Cap-and-Trade Regulation. Sustain. Prod. Consum. 2022, 29, 614–635. [Google Scholar] [CrossRef]

- Yenipazarli, A. Managing New and Remanufactured Products to Mitigate Environmental Damage under Emissions Regulation. Eur. J. Oper. Res. 2016, 249, 117–130. [Google Scholar] [CrossRef]

- Zhang, J.; Zhang, Y. Carbon Tax, Tourism CO2 Emissions and Economic Welfare. Ann. Tour. Res. 2018, 69, 18–30. [Google Scholar] [CrossRef]

- Wei, Y.; Gong, P.; Zhang, J.; Wang, L. Exploring Public Opinions on Climate Change Policy in “Big Data Era”—A Case Study of the European Union Emission Trading System (EU-ETS) Based on Twitter. Energy Policy 2021, 158, 112559. [Google Scholar] [CrossRef]

- Rust, D.; Katharopoulos, I.; Vollmer, M.K.; Henne, S.; O’Doherty, S.; Say, D.; Emmenegger, L.; Zenobi, R.; Reimann, S. Swiss Halocarbon Emissions for 2019 to 2020 Assessed from Regional Atmospheric Observations. Atmos. Chem. Phys. 2022, 22, 2447–2466. [Google Scholar] [CrossRef]

- Grainger, C.; Ruangmas, T. Who Wins from Emissions Trading? Evidence from California. Environ. Resour. Econ. 2018, 71, 703–727. [Google Scholar] [CrossRef]

- Wang, Z.; Wang, C. How Carbon Offsetting Scheme Impacts the Duopoly Output in Production and Abatement: Analysis in the Context of Carbon Cap-and-Trade. J. Clean. Prod. 2015, 103, 715–723. [Google Scholar] [CrossRef]

- Esmaeili Avval, A.; Dehghanian, F.; Pirayesh, M. Auction Design for the Allocation of Carbon Emission Allowances to Supply Chains via Multi-Agent-Based Model and Q-Learning. Comput. Appl. Math. 2022, 41, 170. [Google Scholar] [CrossRef]

- Lin, B.; Xu, M. Exploring the Green Total Factor Productivity of China’s Metallurgical Industry under Carbon Tax: A Perspective on Factor Substitution. J. Clean. Prod. 2019, 233, 1322–1333. [Google Scholar] [CrossRef]

- Zou, H.; Qin, J.; Long, X. Coordination Decisions for a Low-Carbon Supply Chain Considering Risk Aversion under Carbon Quota Policy. Int. J. Environ. Res. Public. Health 2022, 19, 2656. [Google Scholar] [CrossRef]

- Daryanto, Y.; Wee, H.M.; Widyadana, G.A. Low Carbon Supply Chain Coordination for Imperfect Quality Deteriorating Items. Mathematics 2019, 7, 234. [Google Scholar] [CrossRef]

- Li, S.; Dong, C.; Yang, L.; Gao, X.; Wei, W.; Zhao, M.; Xia, W. Research on Evolutionary Game Strategy Selection and Simulation Research of Carbon Emission Reduction of Government and Enterprises under the “Dual Carbon” Goal. Sustainability 2022, 14, 12647. [Google Scholar] [CrossRef]

- Wang, J.; Ma, R.; Lu, X.; Yu, B. Emission Reduction Cooperation in a Dynamic Supply Chain with Competitive Retailers. Environ. Dev. Sustain. 2022, 24, 14261–14297. [Google Scholar] [CrossRef]

- Apple Now Globally Powered by 100 Percent Renewable Energy. Available online: https://www.apple.com/newsroom/2018/04/apple-now-globally-powered-by-100-percent-renewable-energy/ (accessed on 6 November 2022).

- Luo, R.; Chang, H.; Zhang, D. Carbon Emission Reduction and Pricing Decisions of Dual-Channel Closed-Loop Supply Chain with Fairness Concern Under Carbon Tax Policy. Int. J. Econ. Finance Manag. Sci. 2022, 10, 102. [Google Scholar] [CrossRef]

- Tang, J.; Zhong, S.; Xiang, G. Environmental Regulation, Directed Technical Change, and Economic Growth: Theoretic Model and Evidence from China. Int. Reg. Sci. Rev. 2019, 42, 519–549. [Google Scholar] [CrossRef]

- Shen, Q.; Song, X.; Mao, F.; Sun, N.; Wen, X.; Wei, W. Carbon Reduction Potential and Cost Evaluation of Different Mitigation Approaches in China’s Coal to Olefin Industry. J. Environ. Sci. 2020, 90, 352–363. [Google Scholar] [CrossRef]

- Mitsubishi to Spend $17.5 B by 2030 to Drive Decarbonization. Available online: https://www.hydrocarbonprocessing.com/news/2021/10/mitsubishi-to-spend-175-b-by-2030-to-drive-decarbonization (accessed on 8 November 2022).

- Liao, N.; Liang, P.; He, Y. Incentive Contract Design for Embedded Low-Carbon Service Supply Chain under Information Asymmetry of Carbon Abatement Efficiency. Energy Strategy Rev. 2022, 42, 100884. [Google Scholar] [CrossRef]

- Ouyang, J.; Fu, J. Optimal Strategies of Improving Energy Efficiency for an Energy-Intensive Manufacturer Considering Consumer Environmental Awareness. Int. J. Prod. Res. 2020, 58, 1017–1033. [Google Scholar] [CrossRef]

- Suhonen, N.; Okkonen, L. The Energy Services Company (ESCo) as Business Model for Heat Entrepreneurship-A Case Study of North Karelia, Finland. Energy Policy 2013, 61, 783–787. [Google Scholar] [CrossRef]

- Zheng, Y.; Zhou, W.; Chen, X.; Huang, W. The Effect of Emission Permit Allocation in an Early-Stage Cap-and-Trade for a Duopoly Market. Int. J. Prod. Res. 2021, 59, 909–925. [Google Scholar] [CrossRef]

- Xu, X.; Yu, Y.; Dou, G.; Ruan, X. The Choice of Cap-and-Trade and Carbon Tax Regulations in a Cap-Dependent Carbon Trading Price Setting. Kybernetes 2021, 51, 2554–2577. [Google Scholar] [CrossRef]

- Sun, H.; Yang, J. Optimal Decisions for Competitive Manufacturers under Carbon Tax and Cap-and-Trade Policies. Comput. Ind. Eng. 2021, 156, 107244. [Google Scholar] [CrossRef]

- Qi, Q.; Zhang, R.-Q.; Bai, Q. Joint Decisions on Emission Reduction and Order Quantity by a Risk-Averse Firm under Cap-and-Trade Regulation. Comput. Ind. Eng. 2021, 162, 107783. [Google Scholar] [CrossRef]

- Yang, M.; Zhang, T.; Zhang, Y. Optimal Pricing and Green Decisions in a Dual-Channel Supply Chain with Cap-and-Trade Regulation. Environ. Sci. Pollut. Res. 2022, 29, 28208–28225. [Google Scholar] [CrossRef] [PubMed]

- Li, Z.; Pan, Y.; Yang, W.; Ma, J.; Zhou, M. Effects of Government Subsidies on Green Technology Investment and Green Marketing Coordination of Supply Chain under the Cap-and-Trade Mechanism. Energy Econ. 2021, 101, 105426. [Google Scholar] [CrossRef]

- Chen, X.; Wang, X.; Xia, Y. Low-Carbon Technology Transfer between Rival Firms under Cap-and-Trade Policies. IISE Trans. 2022, 54, 105–121. [Google Scholar] [CrossRef]

- Toptal, A.; Özlü, H.; Konur, D. Joint Decisions on Inventory Replenishment and Emission Reduction Investment under Different Emission Regulations. Int. J. Prod. Res. 2014, 52, 243–269. [Google Scholar] [CrossRef]

- Daddi, T.; Heras-Saizarbitoria, I.; Marrucci, L.; Rizzi, F.; Testa, F. The Effects of Green Supply Chain Management Capability on the Internalisation of Environmental Management Systems and Organisation Performance. Corp. Soc. Responsib. Environ. Manag. 2021, 28, 1241–1253. [Google Scholar] [CrossRef]

- Meng, Q.; Li, M.; Liu, W.; Li, Z.; Zhang, J. Pricing Policies of Dual-Channel Green Supply Chain: Considering Government Subsidies and Consumers’ Dual Preferences. Sustain. Prod. Consum. 2021, 26, 1021–1030. [Google Scholar] [CrossRef]

- Du, S.; Ma, F.; Fu, Z.; Zhu, L.; Zhang, J. Game-Theoretic Analysis for an Emission-Dependent Supply Chain in a ‘Cap-and-Trade’ System. Ann. Oper. Res. 2015, 228, 135–149. [Google Scholar] [CrossRef]

- Qu, S.; Yang, H.; Ji, Y. Low-Carbon Supply Chain Optimization Considering Warranty Period and Carbon Emission Reduction Level under Cap-and-Trade Regulation. Environ. Dev. Sustain. 2021, 23, 18040–18067. [Google Scholar] [CrossRef]

- Cheng, F.; Yang, S.; Ma, X. Equilibrium Conditions In Service Supply Chain. Procedia Eng. 2011, 15, 5100–5104. [Google Scholar] [CrossRef][Green Version]

- Peng, L.; Tong, Z.; Li, Q. An Analysis of the Third Party Payment System Based on Service Supply Chain. In Proceedings of the 2009 IEEE International Conference on Information Reuse & Integration, Las Vegas, NV, USA, 10–12 August 2009; pp. 63–67. [Google Scholar] [CrossRef]

- Wang, Y.; Wallace, S.W.; Shen, B.; Choi, T.-M. Service Supply Chain Management: A Review of Operational Models. Eur. J. Oper. Res. 2015, 247, 685–698. [Google Scholar] [CrossRef]

- Ren, T.; Wang, D.; Zeng, N.; Yuan, K. Effects of Fairness Concerns on Price and Quality Decisions in IT Service Supply Chain. Comput. Ind. Eng. 2022, 168, 108071. [Google Scholar] [CrossRef]

- Fernando, Y.; Chidambaram, R.R.M.; Wahyuni-TD, I.S. The Impact of Big Data Analytics and Data Security Practices on Service Supply Chain Performance. Benchmarking Int. J. 2018, 25, 4009–4034. [Google Scholar] [CrossRef]

- Lillrank, P.; Groop, J.; Venesmaa, J. Processes, Episodes and Events in Health Service Supply Chains. Supply Chain Manag. Int. J. 2011, 16, 194–201. [Google Scholar] [CrossRef]

- Farsi, M.; Bailly, A.; Bodin, D.; Penella, V.; Pinault, P.-L.; Thien Nghia, E.T.; Sibson, J.; Erkoyuncu, J.A. An Optimisation Framework for Improving Supply Chain Performance: Case Study of a Bespoke Service Provider. Procedia Manuf. 2020, 49, 185–192. [Google Scholar] [CrossRef]

- Maull, R.; Smart, A.; Liang, L. A Process Model of Product Service Supply Chains. Prod. Plan. Control 2014, 25, 1091–1106. [Google Scholar] [CrossRef]

- Mustafee, N.; Taylor, S.J.E.; Katsaliaki, K.; Brailsford, S. Facilitating the Analysis of a UK National Blood Service Supply Chain Using Distributed Simulation. Simulation 2009, 85, 113–128. [Google Scholar] [CrossRef]

- Jia, J.; Chen, S.; Li, Z. Dynamic Pricing and Time-to-Market Strategy in a Service Supply Chain with Online Direct Channels. Comput. Ind. Eng. 2019, 127, 901–913. [Google Scholar] [CrossRef]

- Choi, T.-M. Facing Market Disruptions: Values of Elastic Logistics in Service Supply Chains. Int. J. Prod. Res. 2021, 59, 286–300. [Google Scholar] [CrossRef]

- Theißen, S.; Spinler, S. Strategic Analysis of Manufacturer-Supplier Partnerships: An ANP Model for Collaborative CO2 Reduction Management. Eur. J. Oper. Res. 2014, 233, 383–397. [Google Scholar] [CrossRef]

- Shang, T.; Zhang, K.; Liu, P.; Chen, Z.; Li, X.; Wu, X. What to Allocate and How to Allocate?—Benefit Allocation in Shared Savings Energy Performance Contracting Projects. Energy 2015, 91, 60–71. [Google Scholar] [CrossRef]

- Li, Q.; Xiao, Y.; Qiu, Y.; Xu, X.; Chai, C. Impact of Carbon Permit Allocation Rules on Incentive Contracts for Carbon Emission Reduction. Kybernetes 2019, 49, 1143–1167. [Google Scholar] [CrossRef]

- Qian, D.; Guo, J. Research on the Energy-Saving and Revenue Sharing Strategy of ESCOs under the Uncertainty of the Value of Energy Performance Contracting Projects. Energy Policy 2014, 73, 710–721. [Google Scholar] [CrossRef]

- Wang, Q.; He, L. Managing Risk Aversion for Low-Carbon Supply Chains with Emission Abatement Outsourcing. Int. J. Environ. Res. Public. Health 2018, 15, 367. [Google Scholar] [CrossRef]

- Yu, J.; Zhao, J.; Zhou, C.; Ren, Y. Strategic Business Mode Choices for E-Commerce Platforms under Brand Competition. J. Theor. Appl. Electron. Commer. Res. 2022, 17, 1769–1790. [Google Scholar] [CrossRef]

- Chen, L.; Nan, G.; Liu, Q.; Peng, J.; Ming, J. How Do Consumer Fairness Concerns Affect an E-Commerce Platform’s Choice of Selling Scheme? J. Theor. Appl. Electron. Commer. Res. 2022, 17, 1075–1106. [Google Scholar] [CrossRef]

- Hou, Q.; Guan, Y.; Yu, S. Stochastic Differential Game Model Analysis of Emission-Reduction Technology Under Cost-Sharing Contracts in the Carbon Trading Market. IEEE Access 2020, 8, 167328–167340. [Google Scholar] [CrossRef]

- Yi, Y.; Li, J. Cost-Sharing Contracts for Energy Saving and Emissions Reduction of a Supply Chain under the Conditions of Government Subsidies and a Carbon Tax. Sustainability 2018, 10, 895. [Google Scholar] [CrossRef]

- Zhang, W.; Xiao, J.; Cai, L. Joint Emission Reduction Strategy in Green Supply Chain under Environmental Regulation. Sustainability 2020, 12, 3440. [Google Scholar] [CrossRef]

- Carvallo, J.P.; Murphy, S.P.; Stuart, E.; Larsen, P.H.; Goldman, C. Evaluating Project Level Investment Trends for the U.S. ESCO Industry: 1990–2017. Energy Policy 2019, 130, 139–161. [Google Scholar] [CrossRef]

- Yang, Y.; Goodarzi, S.; Bozorgi, A.; Fahimnia, B. Carbon Cap-and-Trade Schemes in Closed-Loop Supply Chains: Why Firms Do Not Comply? Transp. Res. Part E Logist. Transp. Rev. 2021, 156, 102486. [Google Scholar] [CrossRef]

- Fiez, T.; Chasnov, B.; Ratliff, L.J. Convergence of Learning Dynamics in Stackelberg Games. arXiv 2019, arXiv:1906.01217. [Google Scholar] [CrossRef]

- Wei, Y.; Choi, T.-M. Mean–Variance Analysis of Supply Chains under Wholesale Pricing and Profit Sharing Schemes. Eur. J. Oper. Res. 2010, 204, 255–262. [Google Scholar] [CrossRef]

- Kalakbandi, V.K. Managing the Misbehaving Retailer under Demand Uncertainty and Imperfect Information. Eur. J. Oper. Res. 2018, 269, 939–954. [Google Scholar] [CrossRef]

- Che, C.; Zhang, Z.; Zhang, X.; Chen, Y. Two-Stage Pricing Decision for Low-Carbon Products Based on Consumer Strategic Behaviour. Complexity 2021, 2021, e6633893. [Google Scholar] [CrossRef]

- Ouyang, J.; Shen, H. The Choice of Energy Saving Modes for an Energy-Intensive Manufacturer Considering Non-Energy Benefits. J. Clean. Prod. 2017, 141, 83–98. [Google Scholar] [CrossRef]

- Entezaminia, A.; Gharbi, A.; Ouhimmou, M. A Joint Production and Carbon Trading Policy for Unreliable Manufacturing Systems under Cap-and-Trade Regulation. J. Clean. Prod. 2021, 293, 125973. [Google Scholar] [CrossRef]

- Bai, Q.; Xu, J.; Chauhan, S.S. Effects of Sustainability Investment and Risk Aversion on a Two-Stage Supply Chain Coordination under a Carbon Tax Policy. Comput. Ind. Eng. 2020, 142, 106324. [Google Scholar] [CrossRef]

- Yan, B.; Wang, T.; Liu, Y.; Liu, Y. Decision Analysis of Retailer-Dominated Dual-Channel Supply Chain Considering Cost Misreporting. Int. J. Prod. Econ. 2016, 178, 34–41. [Google Scholar] [CrossRef]

- Chen, Y.; Liu, X.; Huang, K.; Tang, H. Pricing and Service Effort Decisions of Book Dual-Channel Supply Chains with Showrooming Effect Based on Cost-Sharing Contracts. Sustainability 2022, 14, 11278. [Google Scholar] [CrossRef]

- Xiao, H.; Xu, Y.; Li, S. A Building-Material Supply Chain Sustainable Operations under Fairness Concerns and Reference Price Benefits. Complexity 2021, 2021, e5555307. [Google Scholar] [CrossRef]

- Wu, P.; Yin, Y.; Li, S.; Huang, Y. Low-Carbon Supply Chain Management Considering Free Emission Allowance and Abatement Cost Sharing. Sustainability 2018, 10, 2110. [Google Scholar] [CrossRef]

- Li, J.; Wang, Z.; Jiang, B.; Kim, T. Coordination Strategies in a Three-Echelon Reverse Supply Chain for Economic and Social Benefit. Appl. Math. Model. 2017, 49, 599–611. [Google Scholar] [CrossRef]

- Zhu, J.; Gao, Y.; Shi, Y.; Paul, S.K. Green Investment Mechanism Considering Supply Chain Risk Aversion and Negotiating Power. Comput. Ind. Eng. 2022, 171, 108484. [Google Scholar] [CrossRef]

- Xu, X.; Xu, X.; He, P. Joint Production and Pricing Decisions for Multiple Products with Cap-and-Trade and Carbon Tax Regulations. J. Clean. Prod. 2016, 112, 4093–4106. [Google Scholar] [CrossRef]

- Li, Q.; Long, R.; Chen, H. Empirical Study of the Willingness of Consumers to Purchase Low-Carbon Products by Considering Carbon Labels: A Case Study. J. Clean. Prod. 2017, 161, 1237–1250. [Google Scholar] [CrossRef]

- Zhou, R.; Liao, Y.; Shen, W.; Yang, S. Channel Selection and Fulfillment Service Contracts in the Presence of Asymmetric Service Information. Int. J. Prod. Econ. 2020, 222, 107504. [Google Scholar] [CrossRef]

- Zheng, S.; Lam, C.-M.; Hsu, S.-C.; Ren, J. Evaluating Efficiency of Energy Conservation Measures in Energy Service Companies in China. Energy Policy 2018, 122, 580–591. [Google Scholar] [CrossRef]

- Bogers, M.; Hadar, R.; Bilberg, A. Additive Manufacturing for Consumer-Centric Business Models: Implications for Supply Chains in Consumer Goods Manufacturing. Technol. Forecast. Soc. Chang. 2016, 102, 225–239. [Google Scholar] [CrossRef]

- Peng, W.; Xin, B.; Xie, L. Optimal Strategies for Product Price, Customer Environmental Volunteering, and Corporate Environmental Responsibility. J. Clean. Prod. 2022, 364, 132635. [Google Scholar] [CrossRef]

- Ikram, M.; Zhou, P.; Shah, S.A.A.; Liu, G.Q. Do Environmental Management Systems Help Improve Corporate Sustainable Development? Evidence from Manufacturing Companies in Pakistan. J. Clean. Prod. 2019, 226, 628–641. [Google Scholar] [CrossRef]

- Pattara, C.; Raggi, A.; Cichelli, A. Life Cycle Assessment and Carbon Footprint in the Wine Supply-Chain. Environ. Manag. 2012, 49, 1247–1258. [Google Scholar] [CrossRef]

- Savita, K.S.; Dominic, P.D.D.; Ramayah, T. The Drivers, Practices and Outcomes of Green Supply Chain Management: Insights from ISO14001 Manufacturing Firms in Malaysia. Int. J. Inf. Syst. Supply Chain Manag. 2016, 9, 35–60. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).