Abstract

Japanese companies are making rapid progress in addressing the Sustainable Development Goals (SDGs), and there is growing interest in the relationship between these goals and financial performance. Moreover, the promotion of the SDGs at the local level encourages opportunities for collaboration with companies. This study analyzed the relationship between the status of SDG efforts and the financial data, as well as social activity data of 533 Japanese manufacturing companies from 2016 to 2020. In terms of academic contribution, this study provides a unique case study in Japan, with consideration of the timing of the initiation of SDG efforts. The results showed that large companies and companies with high profitability tended to start working on the SDGs at an early stage. The results of a comparison of industries showed that the timing of the initiation of SDG initiatives is not affected by profitability in the food and electrical equipment sectors, where SDG efforts are already well underway. From the results of multiple regression analysis, it was found that large companies with high profitability that have implemented social activities tend to be early adopters of the SDGs. The results of this analysis suggest that it is important to design measures that are appropriate based on the size of the focal company and that social contribution activities should be incentivized to encourage companies to act on the SDGs.

1. Introduction

1.1. Progress of Japanese Companies’ Commitment to the SDGs

The 2030 Agenda for Sustainable Development, adopted by the United Nations [1], is a commitment made by governments to the international community and not an obligation of businesses themselves. However, industry actors participated in the process of developing the SDGs with the UN, and the role of the private sector in achieving the SDGs has been clearly stated. After a period of dissemination to the international community, the SDGs moved into a Decade of Action in 2020, intended to accelerate and scale up their implementation [2]. The role of business in driving action towards achieving the SDGs is becoming more important.

In Japan, the role of companies in achieving the SDGs is also considered important. In its “SDGs Implementation Guiding Principles” [3], the Japanese government recognizes the critical importance of the private sector’s contribution to the achievement of the SDGs. It promotes measures that encourage businesses to take action. In 2017, the Nippon Keidanren (Japan Business Federation), which is made up of Japan’s leading companies, revised its Charter of Corporate Behaviour and Implementation Guide [4], delineating its commitment to contributing to the achievement of the SDGs through its new economic growth model, Society 5.0. Industry actors declared their commitment to actively engage with the SDGs. Furthermore, the Independent Administrative Institution for Pension Fund Management (GPIF) [5], which has selected ESG indices and managed them since 2017, clearly indicated that the relationship between ESG investment and the SDGs is that “solving social issues creates business and investment opportunities”. In this way, various stakeholders in Japan, including the government, industry actors and investors, are actively encouraging companies to act on the SDGs.

Developments around the SDGs at the local level are also encouraging companies to engage with these goals. The Japan Cabinet Office [6] encourages local governments to implement the SDGs through its “SDG-driven regional development” initiative, and companies that are committed to the SDGs see local governments as potential partners for implementing specific projects. Therefore, the SDGs represent an opportunity for companies and local authorities to collaborate increasingly. Furthermore, “Local SDG Finance” measures, which channel funds back to local businesses and the local economy, emphasize the promotion of SDG efforts by small and medium-sized enterprises (SMEs) and include registration and certification schemes and the promotion of SDG-related investment and financing by local financial institutions as incentives for companies to engage in the SDGs. These measures also include incentives for companies to engage with the SDGs, such as registration and certification schemes and the promotion of SDG-related investment and financing by local financial institutions.

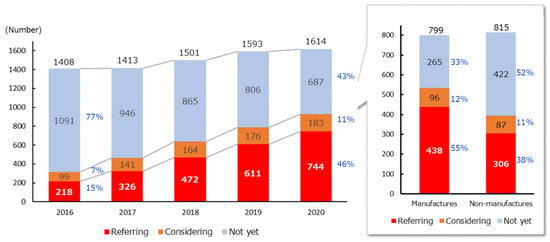

In response to the growing interest in the SDGs in Japan and abroad, the integration of the SDGs into Japanese companies is rapidly progressing. Toyo Keizai Inc., Tokyo, Japan, a major publisher of economic books and magazines in Japan, has conducted an annual questionnaire survey on Corporate Social Responsibility (CSR) to Japan’s leading and developed companies since 2005 and has annually published the survey results as “CSR Corporate Directory”. From the 2016 CSR survey, questions about SDGs were added [7]. According to the “CSR Corporate Directory 2021” published by Toyo Keizai Inc., out of 1614 companies surveyed in 2020, 744 indicated that they were referring to the SDGs in their CSR activities; moreover, 188 responded that they were considering the SDGs, meaning that 57% of the companies surveyed were referring to or considering the SDGs.

Figure 1 shows the results over time from the 2016 survey to the 2020 survey. This figure shows that in 2016, only 21% of the companies were either referring to or considering the SDGs, indicating a rapid increase in the number of companies working on SDG initiatives over the past four years.

Figure 1.

Progress made by Japanese companies on the SDGs. Source: Toyo Keizai Inc., Tokyo, Japan [7].

As mentioned above, in Japan, various stakeholders, including the government, industry and investors, are encouraging companies to engage with the SDGs. However, if companies are to continue working on SDG initiatives, it is desirable for them to be able to not only demonstrate that their efforts will contribute to the achievement of the SDGs but also to clearly show that these efforts will lead to an increase in corporate value. In other words, if a company understands the relationship between its SDG efforts and its corporate value, its engagement in SDG efforts that improve its corporate value will be an important management issue, and information regarding these efforts can be used not only for information disclosure but also for decision-making and business planning.

1.2. Objectives and Framework of This Study

In examining measures that encourage companies to act on the SDGs, it is important to clarify the factors that encourage them to do so. Therefore, this study analyses the relationship between the status of companies’ SDG efforts, their financial performance, and their social activities in the Japanese manufacturing industry, which has been making progress in implementing the SDGs. The objective of this study is to contribute to the development of measures for companies to encourage their actions on the SDGs. In terms of academic contribution, as the research field about the relation of business effort for SDGs to corporate value is still emerging, this study provides a unique case study in Japan, with consideration of the timing of the initiation of SDG efforts.

This study uses the following two analytical methods. First, the relationship between the status of SDG efforts, financial performance and social activities was clarified through cross-tabulation. Regarding financial performance indicators, we adopted total assets and the number of employees as indicators of company size and ROA and ROE as indicators of profitability. Furthermore, regarding the four industries accounting for large proportions of the manufacturing sector (food, chemicals, machinery, and electrical equipment), we conducted a cross-tabulation analysis of the status of the SDG efforts and financial performance of these industries using data for each industry unit. Second, we conducted a multiple regression analysis to examine the causal relationship between the status of SDG efforts, financial performance, and social activity.

To develop an index of the status of SDG efforts, we calculated an “SDG reference score” based on the timing of the initiation of such efforts with reference to the implementation of the SDGs. The timing of the initiation of corporate SDG efforts was judged from Toyo Keizai’s CSR Corporate Directory as the first year when a company answered “Yes” to the question of whether the company referred to the SDGs in its CSR activities. By analyzing the relationship between the “SDG reference score” and corporate size, profitability, and the status of implementation of social activities, we expect to contribute to an understanding of measures that effectively encourage early implementation of the SDGs. In addition, in our analysis of the financial performance relationship, large samples from four industries were selected for comparative analysis. This approach is expected to contribute to the consideration of measures that take into account the characteristics of industries.

This paper is structured as follows. Section 2 explores the literature on corporate nonfinancial performance, including its SDG efforts and corporate value. Section 3 describes the materials and methods of this research. Section 4 consists of data regarding the progress of the SDSs and financial performance, as well as social activity. Section 5 consists of analytical interpretations of the findings and discussions. Finally, Section 6 closes the paper with considerations and policy implications from this study.

2. Literature Review

Corporate nonfinancial performance, potentially including its SDG related efforts, is expected to be linked to corporate value. The number of academic papers on corporate nonfinancial performance and corporate value as a result of sustainability management has increased in recent years. Brogi and Lagasio [8] focused on the relationship between nonfinancial disclosure and return on assets (ROA) and analyzed 3476 US firms between 2000 and 2016. The results of the analysis revealed that nonfinancial disclosures have a statistically significant positive impact on ROA and that this effect differs across industries. Eliwa et al. [9] focused on the relationship between nonfinancial disclosures and the cost of debt and conducted an analysis of nonfinancial firms in 15 European countries from 2005 to 2016. The results of the analysis show that nonfinancial disclosures contribute to decreasing the cost of debt and that this effect tends to be greater in countries where stakeholder-oriented corporate governance is more prevalent. Xie et al. [10] examined the relationship between nonfinancial disclosures and corporate financial performance in 2015 using data from a sample of 6631 firms across 74 countries and 11 industries. In their analysis of the full sample, these authors observed that firms with moderate levels of nonfinancial disclosure tend to become more efficient as their levels of disclosure increase. Li et al. [11] examined the relationship between nonfinancial disclosure and the financial performance of 350 UK listed firms (FTSE 350 listed firms) to explore the relationship between nonfinancial disclosure (Bloomberg ESG disclosure score) and Tobin’s Q, which equals the market value of a company divided by its assets’ replacement cost. The results showed that nonfinancial disclosure is statistically and significantly associated with higher firm value. Meriyani et al. [12] examined the annual report data of companies listed on the Indonesia Stock Exchange (IDX) and the Corporate Social Responsibility Index (CSRI) based on the GRI standard. They indicated that CSRI has a significant influence on improving the financial performance of manufacturing companies as proxied by ROA, ROE (Return on Equity), and ROS (Return on Sales).

Some leading companies are attempting to implement quantitative evaluations of nonfinancial performance for decision-making and communication purposes; BASF [13], LafargeHolcim [14], Crown Estate [15], and others are attempting to translate nonfinancial information into monetary value as the social impact of corporate activities. SAP [16] has also developed a logical hypothesis for the causal relationship between nonfinancial indicators and financial indicators in its integrated report and has shown that improvements in certain nonfinancial indicators can contribute to higher profits. In Japan, Eisai is using regression analysis to examine the impact of 88 key performance indicators related to its ESG criteria on the price book-value ratio (PBR) [17]. Regarding the relationship between the nonfinancial performance of Japanese companies and corporate value, Ikuta and Fujimoto [18] showed that among 225 Japanese companies ranked on the 2017 Forbes Global 2000 list, those that implement nonfinancial reporting tend to have higher financial performance than those that do not.

There has been discussion regarding the SDGs and business management since the inception of the SDGs. Scheyvens et al. [19] point out that the SDGs stimulate the adoption of sustainable practices by the business sector. Sullivan et al. [20] mention that commercial organizations can positively contribute to the SDGs while building competitive advantage through the combination of industrial ecology and strategic management theory. Kahn et al. [21] also underline that corporate commitment to the SDGs has a positive impact on corporate value. According to Donoher [22], the extent to which a multinational company adopts the SDGs is likely to depend on its stakeholder network and the balance of the network’s variety of interests and beliefs from the viewpoint of organizational legitimacy.

While progress has been made in the area of nonfinancial information disclosure in terms of quantitative evaluation and links to corporate value, the content of information disclosures on SDG efforts has not yet progressed to that level. The fact that the Global Reporting Initiative (GRI) [23] and the International Integrated Reporting Council (IIRC) [24] proposed guidelines for nonfinancial disclosures that reflect the SDGs is an indication of the need for standardization of information disclosures on SDG efforts. In addition, Jackson et al. [25] mentioned that many countries had introduced new forms of regulations on mandatory nonfinancial reporting to encourage large companies to disclose their contributions to sustainable development. However, according to Pizzi et al. [26], despite an overall increase in the number of nonfinancial reports published annually in Europe, only a limited number of companies currently explicitly disclose information on their SDG contributions. An analysis of 873 public interest entities revealed that companies operating in institutional contexts characterized by a long-term orientation and an adequate degree of balance between indulgence and restraints are more oriented to disclose their contributions to the SDGs. Information disclosure on SDG efforts is progressing, especially among major corporations. Spallini et al. [27] indicate a positive correlation between SDG citations in nonfinancial disclosure and company size from their study of 134 Italian companies. In many cases, such disclosure has not been used strategically to increase corporate value. Rosati & Faria [28] stated that an increasing number of companies around the world are disclosing SDG information. Still, these efforts are being made without clarity on the factors that lead to various outcomes of the efforts. According to a survey of disclosures made by 1141 companies in 31 countries and territories conducted by PwC [29], 72% of companies disclose SDG information, while only 1% measure their own performance against SDG targets.

Research on SDG commitment and corporate value is still accumulating. Bebbington and Unerman [30] indicate a slow increase in accounting scholars’ engagement in SDG-motivated research from their Scopus-based search, showing that only 805 papers out of 8653 papers that contain the terms “SDGs” in the title, abstract or as a keyword published between January 2015 and 4 May 2020 are categorized as business, management and accounting academic research fields. Pizzi et al. [31] mention that academic literature still lacks studies focusing on the determinants of SDG reporting quality, and their study regarding nonfinancial reports of 153 Italian Public Interest Entities shows a positive relationship between a firm’s SDG Reporting Score and various determinants of firm level, governance level and report level. García-Sánchez et al. [32] show positive dependency relationships between companies’ references to the SDGs and recommendations by financial analysts based on a sample of 989 international companies. Curtó-Pagès et al. [33] indicate that large Spanish companies publishing integrated reports are more likely to consider the SDGs in their disclosures. On the other hand, Sachs and Sachs [34] indicate that the business sector still lacks clarity and consistency on what SDG alignment looks like for the business sector, although the SDGs recognize the critical role of the private sector in their achievement. Gneiting and Mhlanga [35] challenge the assumption that business is making significant contributions to the SDGs based on their survey of 70+ of the world’s largest companies. Regarding research on Japanese companies, Ito [36] theoretically analyzed the impact of the SDGs on corporate value and found that corporate SDG contributions can positively affect the corporate value if they increase companies’ investor bases, i.e., increase the value of SDG-recognized companies. Ishii [37] conducted an analysis of 11,275 companies and found that the profitability (ROA and ROE) of companies working on SDG initiatives tends to be higher than that of companies in general.

3. Materials and Methods

3.1. Status of SDG Efforts and Financial Performance

3.1.1. Materials

To understand the status of SDG efforts in the domestic manufacturing industry, we selected 556 companies for which data were available for all periods covered in the 2017 to 2021 editions of the CSR Corporate Directory. The data in the CSR Corporate Directory are based on questionnaire responses from the previous year, so these data actually cover the period from 2016 to 2020. To compare these data with financial data from the same period, in our analysis, we targeted 542 manufacturing companies whose data for the same five-year period were registered in NEEDS-Financial QUEST (hereafter, NEEDS-FQDB), a database containing corporate financial information.

Regarding financial indicators, we selected indicators that represent firm size and profitability based on previous studies [8,10,12,27,31]. Total assets and the number of employees were employed as indicators of corporate size. In addition, ROA and ROE were used as indicators of profitability. For each indicator, the most recent five-year average was used as the data for the analysis. As the two indicators representing corporate size did change significantly over the five-year period covered by this report, we decided to use the average value of the indicator related to profitability because there is a concern that using single-year data may have a large impact due to fluctuations in business performance.

Next, we determined whether there were any outliers among the financial indices of the 542 target companies, using the mean (μ) ± three times the standard deviation (σ) as a threshold. There were no outlier values for the two indicators of corporate size, but there were nine companies whose ROA or ROE exceeded μ ± 3σ. Therefore, 9 companies were excluded from the analysis, and the remaining 533 companies were selected for analysis in this study. The industry classifications of the 533 manufacturing companies that were ultimately included in the analysis are shown in Table 1.

Table 1.

Industry classification of the target manufacturing companies.

3.1.2. Methods

To quantify the status of the SDG efforts of the 533 target companies, we used data from their responses to the question, “Do you refer to the SDG goals and targets in your CSR activities?” As shown in Table 2, the companies that had been referring to the SDGs since 2016 were given the highest score of 4, those that had been referring to the SDGs since 2017 or 2018 were given a score of 3, and those that had been referring to the SDGs since 2019 or 2020 were given a score of 2. For the companies that did not indicate that they were using the SDGs as a reference in 2020, 1 point was given to those that were considering it, and no points were assigned to those that had not yet considered it.

Table 2.

SDG reference scores.

Next, based on each company’s data corresponding to the four financial indicators, the companies were classified into two groups for each financial indicator. Namely, the top 50% and the bottom 50%, and these groups were organized in descending order of numerical value. Since there were 533 companies in the study, each of the top groups comprised 267 companies, and the bottom groups comprised 266 companies.

By calculating the mean SDG reference scores of the companies falling into each of the financial indicator groups and conducting two-sample t-tests, we analyzed the relationship between the companies’ SDG commitment status and their financial data.

Furthermore, in addition to analyzing the manufacturing industry as a whole as described above, we examined the differences in the relationship between the financial indicators and the SDG reference scores according to industry characteristics. Specifically, taking into account the size of the statistical sample, we selected four industries with no less than fifty companies each (see Table 1), namely, the food, chemicals, machinery, and electrical equipment industries, and similarly classified them into the top and the bottom groups in terms of the financial indicators and analyzed their relationships with the SDG reference scores.

3.2. Status of SDG Efforts and Social Activity

3.2.1. Materials

As for the indicators of corporate social activity, we adopted the indicators on community investment and pro bono activity available from the Toyo Keizai CSR database. Similar to the analysis of financial performance, we used data on community investment and pro bono activity from 2016 to 2020 for 533 manufacturing companies in this study.

The term “community investment” refers to a company’s financial, technical or other contributions to the development of local communities, including those abroad. It is necessary to evaluate the impact of investments made. The whole process of making investments and evaluating their impact is referred to as community investment. These criteria do not apply to donations or other activities that do not involve impact assessments. Therefore, such activities are not categorized as community investments. The corresponding indicator was equal to 1 if the focal company carried out community investment and 0 otherwise.

Pro bono activity is defined as “activities that make use of professional knowledge and skills to contribute to society.” Basically, such activities should be free of charge. The corresponding indicator was equal to 1 if the focal company carried out pro bono activities and 0 otherwise.

3.2.2. Methods

Based on the social activity indicator, which was equal to either 1 or 0, we classified the 533 companies into 2 groups: those that were implementing social activities during the period from 2016 to 2020 and those that were not yet. Regarding community investment, 143 companies were classified as implementing, and 390 companies were classified as not implementing. Similarly, regarding pro bono activity, 182 companies were classified as implementing, and 351 companies were classified as not implementing. In this stage of the analysis, we analyzed the relationship between the status of corporate efforts aimed at achieving the SDGs and social activity by calculating the average SDG reference scores of the companies in each of the two groups of social activity, i.e., those that were implementing the SDGs and those that were not, and conducting two-sample t-tests. The t-tests were conducted to analyze the relationship between the status of corporate SDG efforts and social activity.

3.3. Causal Relationship between the Status of SDG Efforts, Financial Performance and Social Activity

To examine the causal relationship between the status of SDG efforts, financial performance and social activity, we conducted a multiple regression analysis using the SDG reference scores as the dependent variable and the financial and social activity indicators as explanatory variables. For the financial and social activity indicators, the average data from 2016 to 2020 were used. With regard to financial indicators, there is a strong correlation between total assets and the number of employees, which were used as indicators of corporate size, and between ROA and ROE, which were used as indicators of profitability. With regard to financial indicators, there is a strong correlation between total assets and the number of employees and between ROA and ROE. To avoid multicollinearity in the multiple regression analysis, four combinations (total assets-ROA, total assets-ROE, number of employees-ROA, and number of employees-ROE), each with one corporate size indicator and one profitability indicator, were used.

4. Data

4.1. Status of SDG Efforts and Financial Performance

4.1.1. Manufacturing Sector

Table 3 shows the SDG effort status and financial indicators of the 533 manufacturing companies included in this analysis. A total of 337 companies were using the SDGs as a reference as of 2020, and these accounted for 63% of the companies included in the analysis. Out of the 337 companies, 114 companies had been using the SDGs as a reference since 2016 (SDG reference score of 4), 128 companies had been using the SDGs as a reference since 2017 or 2018 (SDG reference score of 3), and 95 companies had been using the SDGs as a reference since 2019 or 2020 (SDG reference score of 2). On the other hand, 70 companies were considering SDG efforts as of 2020 (SDG reference score of 1), and 126 companies were not yet considering SDG efforts (SDG reference score of 0); these groups accounted for 13% and 24% of the companies surveyed, respectively.

Table 3.

Status of SDG efforts, financial indicators and social activity indicators.

In terms of financial indicators, the average total assets of the 533 target companies observed over five years were 753.9 billion yen, the average number of employees was 14,751, the average ROA was 5.7%, and the average ROE was 6.5%. The average values of each of the four indicators were the highest for the companies referring to the SDGs, followed by the companies considering the SDGs; the average values were the lowest for the companies not considering the SDGs. Furthermore, when the SDG reference score groups were compared, it was found that the average values of the companies belonging to the group with the highest SDG reference scores were the largest, and the SDG reference scores coincided with the average financial indicator values. In other words, the companies that started implementing the SDGs early tended to have larger corporate scales in terms of total assets and numbers of employees and higher profitability in terms of ROA and ROE.

Table 4 shows the maximum, minimum, and average values of the top and bottom groups of companies for each of the financial indicators. The top and the bottom groups corresponding to each financial indicator are different. For the total assets and the number of employees, the difference between the maximum and minimum values of the top group is greater than that of the bottom group.

Table 4.

Classification of top and bottom groups according to financial indicators.

4.1.2. Industry Characteristics

We categorized the four industries with no less than fifty companies (food, chemicals, machinery, and electrical equipment) into the top and the bottom groups in terms of the financial indicators and analyzed their relationships with the SDG reference scores. Table 5 shows the SDG effort statuses of the four industries. As shown in Table 5, the ratio of companies that had started to address the SDGs in 2016 was higher in the electrical equipment industry than in the food industry, but since the number of companies in the food industry addressing the SDGs has increased since 2017, the ratio of companies referring to the SDGs as of 2020 reached 78%, exceeding 69% in the electrical equipment industry, and the average SDG reference score of the food industry also exceeded that of the electrical equipment industry. On the other hand, the average SDG reference scores of the chemicals and machinery industries were 1.949 and 1.718, respectively, which were less than the average of the entire manufacturing industry.

Table 5.

Status of SDG efforts in the four industries.

In the case of the chemicals industry, the percentage of companies that had started working on the SDGs as of 2016 was 19%, which was not much different from the 20% of companies in the food industry doing so. However, as the SDG efforts of the chemicals industry were delayed, the average SDG reference score of this industry was lower than the average of the entire manufacturing industry. Machinery was the slowest to take action among the 4 industries, as 37% of its companies had not considered the SDGs as of 2020.

4.2. Status of SDG Efforts and Social Activity

Table 3 also shows the SDG status and social activity indicators of the manufacturing sector, and the trend corresponding to the financial indicators can be observed. In terms of social activity indicators, the average community investment indicator of the 533 manufacturing companies observed over 5 years was 0.21, and the average pro bono activity indicator was 0.26. As social activity indicators were equal to either 1 or 0, we can regard that 21% of companies engaged in community investment and 26% engaged in pro bono activity. Similar to the financial indicators, the average values of each of the social activity indicators were the highest for the companies referring to the SDGs, followed by the companies under consideration of the SDGs; the average values were the lowest for the companies not considering the SDGs. In addition, comparing the SDG reference score groups, the average value of the group with the highest SDG reference score was the largest, and the SDG reference scores coincided with the average social activity indicators. For example, more than half of the companies with an SDG reference score of 4 participated in these activities, while those with an SDG reference score of 0 hardly participated at all. These results suggest that referencing the SDGs in the process of business activities has a significant impact on participation in social activities.

5. Results and Discussion

5.1. Status of SDG Efforts and Financial Performance

5.1.1. Manufacturing Sector

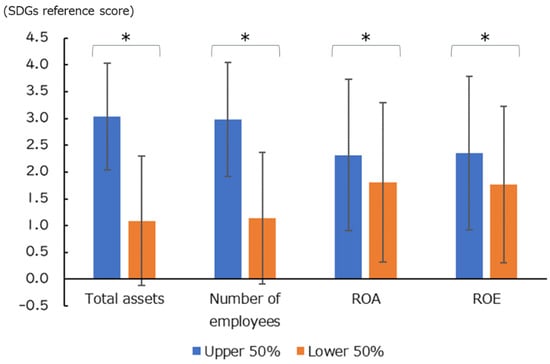

Figure 2 shows the average SDG reference scores of the top and the bottom groups for each of the four financial indicators. The difference between the top group and the bottom group was particularly pronounced for the corporate size indicator, with the average SDG reference score of the top group being approximately 2.9 times higher than that of the bottom group for total assets and the average SDG reference score of the top group being approximately 2.6 times higher than that of the bottom group for the number of employees. The difference between the SDG reference scores of the top group and the bottom group for the profitability indicators was smaller than that for the corporate size indicators, and the SDG reference scores of the top group for both ROA and ROE were approximately 1.3 times those of the bottom group.

Figure 2.

Top and bottom groups in terms of financial indicators and SDG reference scores. Source: Toyo Keizai Inc. [7] and Nikkei NEEDS-FQDB. Note 1: Vertical bars indicate standard deviations. Note 2: * indicates a statistically significant difference at the 5% level.

In addition, a t-test was conducted on the SDG reference scores of the top and bottom groups, and a significant difference was found at the 95% confidence interval for both indicators. This means that companies with larger corporate sizes, namely, those with more assets and employees, have higher SDG reference scores, i.e., they tend to start working on SDG initiatives earlier. Similarly, companies with higher profitability in terms of ROA and ROE are more likely to be early adopters of the SDGs.

This can be attributed to the fact that companies with larger corporate scales are more likely to receive strict requests involving ESG management from investors and other stakeholders, which encourages SDG efforts. It is also possible that companies with more funds and personnel are more likely to secure the internal resources needed to launch SDG initiatives. In terms of ROA and ROE, which were used as indicators of profitability, the top group had a higher average SDG reference score than the bottom group, suggesting that companies with higher profitability tend to start working on SDG initiatives earlier. Regarding this factor, it makes sense that companies with good corporate performance can afford to start working on SDG initiatives. This result supports the idea of a positive relationship between corporate commitment to the SDGs and corporate value [32,36,37].

5.1.2. Comparison of Industry Characteristics

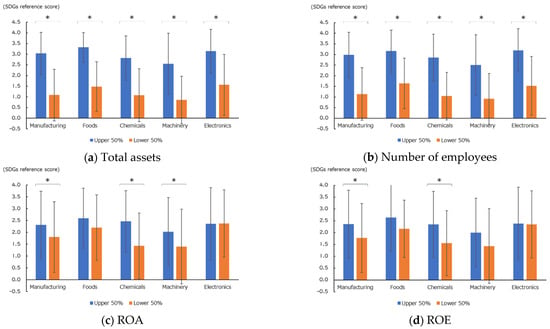

For each of the four industries (food, chemicals, machinery, and electrical equipment), the average of the two indicators of company size (total assets and the number of employees) and that of the two indicators of profitability (ROA and ROE) over the previous five years were used to classify the companies into two groups: the top 50% group and the bottom 50% group. The average scores were compared. In the following, we describe the characteristics of the four industries in relation to each of the financial indicators.

Figure 3 compares the average SDG reference scores of the top and the bottom financial indicator groups for the manufacturing industry as a whole and for each of the four subindustries. In Figure 3a, the companies are grouped by total assets, and in Figure 3b, they are grouped by the number of employees.

Figure 3.

Industry comparison of the SDG reference scores based on top and bottom financial indicator groups. Source: Toyo Keizai Inc. [7] and Nikkei NEEDS-FQDB. Note 1: The vertical bars in the figure indicate the standard deviations. Note 2: * indicates a statistically significant difference at the 5% level.

On the other hand, Figure 3c,d, in which the companies are grouped by the profitability indicators, shows different trends for each industry; in Figure 3c, where the companies are grouped by ROA, the mean SDG reference score of the top group is higher than that of the bottom group for the chemicals and machinery industries, and the difference is statistically significant. However, there is no significant difference between the mean SDG reference scores of the food and electrical equipment industries. Similarly, Figure 3d shows that in the chemical manufacturing industry, the mean SDG reference score of the top group is higher than that of the bottom group. The difference was found to be statistically significant at the 95% confidence interval in a t-test. No significant difference was found across the mean SDG reference scores of the other three industries.

The food and electrical equipment industries, for which no correlation was found between profitability and the SDG reference scores, both had higher average SDG reference scores than the manufacturing industry as a whole (see Table 5). In other words, it is possible that there is no difference between the top and bottom groups of these industries due to their overall progress in addressing the SDGs, regardless of their profitability. Another reason may be that the food and electrical equipment industries have a more B-to-C-oriented business model than the chemicals and machinery industries and therefore must focus on the interests of end consumers. According to the questionnaire survey for 1200 Japanese consumers conducted by Nippon Research Center [38], 72% of respondents showed their willingness to purchase products and services provided by companies that work on sustainability issues. This suggests that many companies in the food and electrical equipment industries may embark on SDG efforts regardless of the corresponding profitability because corporate evaluations of SDG efforts influence the purchase behavior of end consumers.

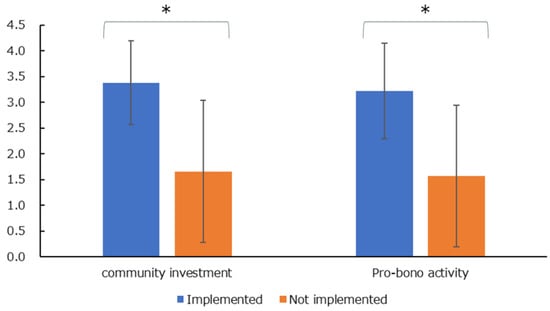

5.2. Status of SDG Efforts and Social Activity

For the two indicators of corporate social activity (community investment and pro bono activity), we categorized the companies into two groups: those that were implementing the respective activities during the period from 2016 and those that were not. Figure 4 provides the average SDG reference scores of each group, showing that the average SDG reference scores corresponding to the two social activity-related indicators were higher for the group of companies that were implementing the activities than for the group of companies that were not implementing the activities. A t-test was conducted on the reference scores of these groups, and the results showed a significant difference at the 95% confidence interval for both indicators. The results contribute to the idea of a positive relationship between corporate SDG efforts and social activity. At the same time, Boiral et al. [39] mentioned the scarcity of the literature regarding corporate community engagement in spite of its importance for ISO 26000 standard as well as achievement of the SDGs.

Figure 4.

SDG reference scores by group, broken down by social action indicators. Source: Toyo Keizai Inc. [7]. Note 1: Vertical bars indicate standard deviations. Note 2: * indicates a statistically significant difference at the 5% level.

In comparison with the results of the aforementioned analysis of financial indicators, the results of grouping by social activities show that the SDG reference scores do not differ as greatly as they do when the companies are grouped by corporate size; however, the differences are greater than they are when we group by profitability. This can be attributed to the fact that efforts related to social activities reflect factors that are influenced by corporate size; for example, the ability to secure human resources capable of carrying out such efforts is an important factor.

5.3. Causal Relationship between the Status of SDG Efforts, Financial Performance and Social Activity

Table 6 shows the results of the multiple regression analysis of the 533 manufacturing companies used in the analysis with the SDG reference scores as the dependent variable and the financial indicators and social activity indicators as explanatory variables. All models, four combinations of one corporate size indicator and one profitability indicator with two social indicators, named Models 1–4, show that the indicators used in each model have statistically significant effects on increasing the SDG reference scores. These results suggest that large companies with high profitability and social activity levels are early adopters of the SDGs. Furthermore, these results not only support the idea of a positive relationship between corporate SDG efforts and corporate value [32,36,37], as well as one between the SDG efforts and social activity but also show the clear cause-and-effect relationship between the SDG efforts, financial performance and social activity.

Table 6.

Regression analysis (the dependent variable is SDG reference scores).

The reasons for these results include (1) the tendency to which large companies receive requests for action from stakeholders due to their size, (2) the abundance of human and financial resources in large companies and their capacity to take action due to high profitability, and (3) a high level of awareness of social contribution activities.

Regarding the two corporate size indicators, the t values of the number of employees in Models 3 and 4 are large enough to indicate significance at the 1% level. In contrast, the t values of total assets indicate significance at the 5% level in Model 1 and at the 10% level in Model 2. For the two financial indicators, the t values of ROA in Models 1 and 3 indicate significance at the 1% level, compared to the t values of ROE in Models 2 and 4 at the 5% level. In addition, the t values of both social activity indicators show significance at the 1% level for all four models. Therefore, Model 3, which includes the number of employees and ROA, shows the strongest causal relationship among the four combinations.

6. Conclusions and Policy Implications

In this study, we analyzed the relationship between the timing of the initiation of SDG initiatives and the financial performance and social activities of Japanese companies that are rapidly implementing the SDGs; moreover, we target the manufacturing industry, which is ahead of the rest. Overall, the results showed that corporate size (total assets and the number of employees), profitability (ROA and ROE), and social activities (community investment and pro bono support) were correlated with an early commitment to the SDGs. Examining this causal relationship, we found that large companies with high profitability and social activities tended to start working on SDG initiatives earlier. In other words, this suggests that large companies and companies with good financial performance are more likely to invest resources in SDG efforts. Similarly, companies that are enthusiastic about social contribution activities are more likely to start working on SDG initiatives.

On the other hand, when we examined the relationship between the timing of the initiation of SDG initiatives and financial performance in four selected industries (food, chemicals, machinery, and electrical equipment), we found a correlation between corporate size and the timing of SDG efforts, similar to that found in the manufacturing industry as a whole. However, no relationship between profitability and the timing of SDG efforts was found in the industries that are ahead of the rest (foods and electrical equipment). This suggests that, depending on the industry, factors other than profitability (e.g., the intensity of requests from stakeholders) may drive SDG efforts.

The limitations and necessary further considerations of this study can be summarized as follows. In this study, we focused on corporate size and profitability as financial indicators. In addition to these indicators, other indicators were used, such as governance-level indicators (board size and its diversity of gender and independent board members, etc.) as Pizzi et al. [31] adopted in their study. In terms of indicators of corporate value, as Eizai uses [17], PBR would be a considerable candidate for future study. The next limitation is the target industry. This study uses manufacturing companies, and we compared only four industries. To deepen the discussion by conducting a detailed analysis of these industry characteristics and by adding nonmanufacturing industries, which were not covered in this study, to compare the trends of some nonmanufacturing industries with the overall trend. Furthermore, an international comparison with the industrial level would be desired for the next step.

Based on the results obtained in this study, we would like to consider measures to encourage companies to act on SDGs. The companies that have made progress in terms of implementing the SDGs are large or well-performing companies. In some industries, such as the food and electrical equipment industries, the SDGs are being implemented regardless of business performance. Moreover, we found that the presence or absence of social contribution activities is related to SDG efforts. Conversely, companies that are small, do not perform well or are not interested in social activities are lagging behind in their efforts to address the SDGs. In considering measures to encourage companies to take action on the SDGs, understanding the characteristics of companies that are lagging behind in such efforts may lead to the formulation of more effective measures.

As seen in the “SDGs Action Plan 2022” [40], the current policy of the Japanese government is to focus on supporting small and medium-sized enterprises, which are lagging behind in their efforts, as major enterprises have made some progress in this regard. However, even among major companies, there are some that have not yet started this process, and measures to promote their efforts are needed. In addition, even among the companies that have begun to take action, measures are needed to ensure that their efforts do not become transient but are sustained. One measure that may be effective in this regard is the creation of a system in which companies themselves recognize the SDGs as an important component of their core business. For example, it is recommended that companies establish data platforms that enable them to understand the impact of SDG efforts on society and on their own businesses. Regarding the impact on a company’s own business, a data platform that lists both financial performance (results against financial targets) and internal nonfinancial performance (results against nonfinancial targets) and facilitates management decisions while taking into account the relationship between the two can be established to improve corporate value. By building such a platform, companies can verify the relationship between financial and nonfinancial performance and communicate with their stakeholders to improve their corporate value. Government measures could include, for example, support for the standardization of SDG effort impact evaluations and support for building data platforms through industry-government-academia collaboration.

In this study, it was shown that social contribution activities are an incentive to take action on the SDGs, so measures to promote SDG activities from the perspective of social contribution activities should be emphasized. In particular, promotion measures for small and medium-sized companies with strong ties to local communities led by local governments are important. For example, in considering measures that promote the involvement of companies in solving the problems of local communities by implementing the SDGs, it is important to make it possible for both local communities and companies that collaborate to solve social issues to understand the impact of such efforts on local communities. The aforementioned data platform concept can also be effective in terms of visualizing the efforts of local small and medium-sized enterprises, and by sharing information regarding the impact of SDG efforts on local communities with these communities, it is possible to utilize this information to improve measures through communication. It may also be possible to provide incentives to companies that demonstrate the results of their SDG efforts, such as preferential treatment in public works procurement or fund procurement.

Author Contributions

T.I. contributed to the writing of the introduction, discussion, and conclusions; H.F. assisted with the literature revision and results. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by a Grant-in-Aid for Scientific Research© [20K12283] from the Ministry of Education, Culture, Sports, Science and Technology (MEXT), Japan.

Data Availability Statement

Data are available from the researchers on demand.

Conflicts of Interest

The authors declare no conflict of interest.

References

- United Nations. Transforming Our World: The 2030 Agenda for Sustainable Development; A/RES/70/1; United Nations: New York, NY, USA, 2015; Volume 16301. [Google Scholar]

- United Nations. Dacade of Action. Available online: https://www.un.org/sustainabledevelopment/decade-of-action/ (accessed on 28 November 2021).

- Japan SDGs Promotion Headquarters. SDGs Implementation Guiding Principles Revised Edition. Available online: https://www.mofa.go.jp/mofaj/gaiko/oda/sdgs/pdf/kaitei_2019_en.pdf (accessed on 28 November 2021).

- Nippon Keidanren. Charter of Corporate Behaviour. Available online: https://www.keidanren.or.jp/en/policy/csr/charter2017.pdf (accessed on 28 November 2021).

- GPIF. ESG Report 2020. Available online: https://www.gpif.go.jp/en/investment/GPIF_ESGREPORT_FY2020.pdf (accessed on 28 November 2021).

- Japan Cabinet Office. Regional Revitalization SDGs. Available online: https://future-city.go.jp/sdgs/ (accessed on 28 November 2021). (In Japanese).

- Toyo Keizai Inc. CSR Companies Complete Guide; Toyo Keizai Inc.: Tokyo, Japan, 2021. [Google Scholar]

- Brogi, M.; Lagasio, V. Environmental, social, and governance and company profitability: Are financial intermediaries different? Corp. Soc. Responsib. Environ. Manag. 2019, 26, 576–587. [Google Scholar] [CrossRef]

- Eliwa, Y.; Aboud, A.; Saleh, A. ESG Practices and the Cost of Debt: Evidence from EU Countries. Crit. Perspect. Account. 2021, 79, 102097. [Google Scholar] [CrossRef]

- Xie, J.; Nozawa, W.; Yagi, M.; Fujii, H.; Managi, S. Do environmental, social and governance activities improve corporate financial performance? Bus. Strategy Environ. 2019, 28, 286–300. [Google Scholar] [CrossRef]

- Li, Y.; Gong, M.; Zhang, X.Y.; Koh, L. The impact of environmental, social, and governance disclosure on firm value: The role of CEO power. Br. Account. Rev. 2018, 50, 60–75. [Google Scholar] [CrossRef]

- Meriyani, M.; Sheren, P.; Nelviana, N.; Ridho, B.; Gazali, S. The Effect of Corporate Social Responsibilities on Financial Performance in Manufacturing Sector Listed in Indonesia Stock Exchange. In Proceedings of the 2021 7th International Conference on Industrial and Business Engineering, Macau, China, 27–29 September 2021; pp. 265–272. [Google Scholar]

- BASF’s Value-to-Society: Results 2013–2020 at Group Level. Available online: https://www.basf.com/global/en/who-we-are/sustainability/we-drive-sustainable-solutions/quantifying-sustainability/value-to-society/impact-categories.html (accessed on 28 November 2021).

- LafargeHolcim. Integrated Profit & Loss Statement 2020. Available online: https://www.holcim.com/sites/holcim/files/atoms/files/55992_lafargeholcim_2020_ipl_statement_aw2_final.pdf (accessed on 28 November 2021).

- Crown Estate. Total Contribution Report 2017. Available online: https://www.thecrownestate.co.uk/media/1692/total-contribution-report-2017.pdf (accessed on 28 November 2021).

- SAP. SAP Integrated Report 2021. Available online: https://www.sap.com/docs/download/investors/2021/sap-2021-integrated-report.pdf (accessed on 28 November 2021).

- Yanagi, R. CFO Policy; Chuokeizai-sha Holdings Inc.: Tokyo, Japan, 2020. [Google Scholar]

- Ikuta, T.; Fujimoto, T. Sustainable and Resilient Corporate Management and Disclosure; Fujitsu Research Institute Kenkyu Report, No. 453; Fujitsu Research Institute Kenkyu: Tokyo, Japan, 2018. (In Japanese) [Google Scholar]

- Scheyvens, R.; Banks, G.; Hughes, E. The private sector and the SDGs: The need to move beyond ‘business as usual’. Sustain. Dev. 2016, 24, 371–382. [Google Scholar] [CrossRef]

- Sullivan, K.; Thomas, S.; Rosano, M. Using industrial ecology and strategic management concepts to pursue the Sustainable Development Goals. J. Clean. Prod. 2018, 174, 237–246. [Google Scholar] [CrossRef]

- Khan, M.; Serafeim, G.; Yoon, A. Corporate Sustainability: First Evidence on Materiality. Account. Rev. 2016, 91, 1697–1724. [Google Scholar] [CrossRef]

- Donoher, W.J. The multinational and the legitimation of sustainable development. Transnatl. Corp. 2017, 24, 49–60. [Google Scholar] [CrossRef]

- GRI. Business Reporing on the SDGs: Integrating the SDGs into Corporate Reporting: A Practical Guide. Available online: https://www.globalreporting.org/search/?query=Business+reporting+on+the+SDGs:+Integrating+the+SDGs+into+Corporate+Reporting:+A+Practical+Guide (accessed on 28 November 2021).

- IIRC. The Sustainable Development Goals, Integrated Thinking and the Integrated Report. Available online: https://www.integratedreporting.org/wp-content/uploads/2017/09/SDGs-and-the-integrated-report_full17.pdf (accessed on 28 November 2021).

- Jackson, G.; Bartosch, J.; Avetisyan, E.; Kinderman, D.; Knudsen, J.S. Mandatory nonfinancial disclosure and its influence on CSR: An international comparison. J. Bus. Ethics 2020, 162, 323–342. [Google Scholar] [CrossRef]

- Pizzi, S.; Del Baldo, M.; Caputo, F.; Venturelli, A. Voluntary disclosure of Sustainable Development Goals in mandatory nonfinancial reports: The moderating role of cultural dimension. J. Int. Financ. Manag. Account. 2022, 33, 83–106. [Google Scholar] [CrossRef]

- Spallini, S.; Milone, V.; Nisio, A.; Romanazzi, P. The Dimension of Sustainability: A Comparative Analysis of Broadness of Information in Italian Companies. Sustainability 2021, 13, 1457. [Google Scholar] [CrossRef]

- Rosati, F.; Faria, L.G.D. Addressing the SDGs in sustainability reports: The relationship with institutional factors. J. Clean. Prod. 2019, 215, 1312–1326. [Google Scholar] [CrossRef]

- PwC. Creating a Strategy for a Better World: SDG Challenge 2019. Available online: https://www.pwc.com/gx/en/sustainability/SDG/sdg-2019.pdf (accessed on 28 November 2021).

- Bebbington, J.; Unerman, J. Advancing Research into Accounting and the UN Sustainable Development Goals. Account. Audit. Account. J. 2020, 33, 1657–1670. [Google Scholar] [CrossRef]

- Pizzi, S.; Rosati, F.; Venturelli, A. The Determinants of Business Contribution to the 2030 Agenda: Introducing the SDG Reporting Score. Bus. Strategy Environ. 2021, 30, 404–421. [Google Scholar] [CrossRef]

- García-Sánchez, I.M.; Aibar-Guzmán, B.; Aibar-Guzmán, C.; Rodríguez-Ariza, L. “Sell” recommendations by analysts in response to business communication strategies concerning the Sustainable Development Goals and the SDG compass. J. Clean. Prod. 2020, 255, 120–194. [Google Scholar] [CrossRef]

- Curtó-Pagès, F.; Ortega-Rivera, E.; Castellón-Durán, M.; Jané-Llopis, E. Coming in from the Cold: A Longitudinal Analysis of SDG Reporting Practices by Spanish Listed Companies since the Approval of the 2030 Agenda. Sustainability 2021, 13, 1178. [Google Scholar] [CrossRef]

- Sachs, J.D.; Sachs, L.E. Business alignment for the “Dacade of Action”. J. Int. Bus. Policy 2021, 4, 22–27. [Google Scholar] [CrossRef]

- Gneiting, U.; Mhlanga, R. The Partner Myth: Analysing the limitaions of private sector contributions to the Sustainble Development Goals. Dev. Pract. 2021, 31, 920–926. [Google Scholar] [CrossRef]

- Ito, H. Analysis of Impacts of SDGs Activities on Firm Value and Utility: Proposals of SDGs Finance and Indices in Japan. J. Real Options Strategy 2018, 10, 42–56. [Google Scholar] [CrossRef][Green Version]

- Ishii, Y. SDGs and Corporate Management. Available online: https://www.tdb-di.com/2020/09/p2020091001.pdf (accessed on 28 November 2021). (In Japanese).

- Nippon Research Center. Survey for Consumers’ Purchasing and Living Behaviour Regarding the SDGs. Available online: https://www.nrc.co.jp/report/img/9fbc247653be83d044749314cb906b167102013b.pdf (accessed on 6 February 2022). (In Japanese).

- Boiral, O.; Heras-Saizarbitoria, I.; Brotherton, M. Corporate sustainability and indigenous community engagement in the etractive industry. J. Clean. Prod. 2019, 235, 701–711. [Google Scholar] [CrossRef]

- Japan SDGs Promotion Headquarters. SDGs Action Plan 2022. Available online: https://www.kantei.go.jp/jp/singi/sdgs/dai11/actionplan2022.pdf (accessed on 6 February 2022). (In Japanese).

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).