Abstract

The construction industry is the lifeblood of the national economy; thereby, to some extent, the green transformation of the construction industry is representative of the industrialization levels of modern construction, especially in China. Based on the panel data of A-share listed companies in China’s construction industry from 2014 to 2019, this work studies the influence mechanism of political connection on corporate green innovation by establishing a multiple regression model, analyzes the realization path of corporate social responsibility as an mediating variable on the impact of political connections on corporate green innovation, and reveals the role boundary of environmental public opinion as a moderating variable on the impact of political connections on corporate green innovation. The results show that political connection has a significant positive impact on corporate green innovation, and this impact exists in both state-owned and non-state-owned enterprises, as well as in the eastern region and the central and western regions of China. Moreover, corporate social responsibility plays a partial mediating role in the relationship between political connection and corporate green innovation, and serves as an effective value transfer intermediary, a benefit balance mechanism, and a risk avoidance method. Political connections urge enterprises to be more socially responsible, thus affecting green innovation. Additionally, environmental public opinion strengthens the positive impact of political connections on corporate green innovation, especially in non-state-owned enterprises and in the eastern regions with a higher degree of marketization. The research conclusions provide a new theoretical reference for promoting the transformation of green innovation and achieving high-quality development in the construction industry.

1. Introduction

The global trend of green development and the goal of carbon peaking and neutrality have brought new opportunities and challenges, putting enormous pressure on China’s economic structural reform and development. In 2020, China’s Environmental Performance Index (EPI) ranked 120th of 180 countries and regions [1]. The statistics from the World Bank show that China has remained the world’s largest emitter of greenhouse gases. As a traditional industry with large energy consumption and carbon emissions, China’s construction industry faces severe challenges. The construction industry is the pillar industry of the national economy. To achieve carbon peaking and neutrality, China urgently needs to accelerate green innovation and low-carbon development in the construction sector.

For the influencing factors of corporate green innovation at the micro level, the existing research mainly focuses on institutional policies [2], market pressure [3,4], government incentives [5,6], and environmental regulations [7]. The high risk and uncertainty in the construction industry determine that building companies must rely on sufficient resources to carry out green innovation. Political connections give corporate executives special political identity and influence; they have advantages in government–enterprise information exchange, resource acquisition, and market transactions [8]. There is an intense ongoing debate regarding the impact of political connections on corporate green innovation. Some scholars believe that political connections can reduce the negative impact of government–enterprise system deficiencies and stakeholder information asymmetry on corporate innovation activities, and play an important role in coordinating the relationship between corporations and the government, market, and environment [9,10]. Some believe that political connections can sometimes be predatory, especially in the case of official turnover, where corporate executives will seek short-term economic benefits at the expense of the environment, thereby hindering green innovation [11,12].

The reason for the above argument may be that existing studies mainly discuss the direct impact of political connections on green innovation from the perspectives of capital and resources [13], but fail to explore its impact paths and mechanisms. In fact, for corporate strategic decision-makers, the executives’ perceptions of social responsibility and environmental issues directly affect corporate green innovation actions [14]. As a major factor influencing corporate green innovation, corporate social responsibility plays an important role in balancing the relationship between government and enterprise, resulting in the coordinated development of the economy, society and the natural environment [15]. The construction industry is characterized by negative externalities of environmental pollution and energy consumption, and by positive externality of green technology spillovers. Political connection, green innovation, and corporate social responsibility are closely related [16]. Nevertheless, theoretical and empirical studies on the deep connections between corporate social responsibility, political connections and corporate green innovation are lacking. At the same time, with the development of modern communication technology, the media reports on corporate environmental issues will create an invisible pressure on corporate behavior. In the theory of institutional economics, public opinion pressure is described as an informal system that affects corporate green innovation behavior, which will urge enterprises to build a green corporate culture and improve their green innovation capabilities [17]. Therefore, this paper considers the realistic background of the green transformation and development of China’s construction industry, investigates the influence of political connections on corporate green innovation, and analyzes the mediating role of corporate social responsibility in the relationship between the two. In addition, environmental public opinion, as a form of external supervision, is introduced into this paper to investigate the mediating role of environmental public opinion on the influence of political connection on corporate green innovation. Based on these research objectives, our research hypothesis is firstly proposed through theoretical analysis. Then, the variables of the study are defined, and the sample data are collected by taking China’s A-share construction listed companies as the research object. Then, a series of multiple regression models are established to empirically test the main effect of political connections on corporate green innovation, the mediating effect of corporate social responsibility, and the moderating effect of environmental public opinion. Finally, we draw conclusions on the management implications of this work.

The contributions of this work are as follows. Firstly, based on the data of listed companies in the construction industry in China, it explores the influence mechanism of political connection on corporate green innovation, which supplements the existing theoretical research. Secondly, it explores the realization path of corporate social responsibility as an intermediary variable in the influence of political connections on corporate green innovation, further verifying the important role of corporate social responsibility as a green strategy in coordinating the relationship between enterprises and the government, the market, the environment, and other stakeholders. Thirdly, political connections can affect the environmental tone of corporate executives and have an impact on corporate green innovation decisions [18]; this paper will reveal the role boundary of environmental public opinion as a moderator variable in the impact of political connections on corporate green innovation. This paper aims to provide theoretical and empirical reference for the green innovation transformation and development of construction enterprises and energy conservation and emission reduction in the construction industry in China.

2. Theoretical Analysis and Hypothesis

2.1. Political Connection and Corporate Green Innovation

Political connections arise from the government’s intervention in the macro- and micro-economy, and also have two opposite economic effects of support and predation. In western countries, due to corporate funding for political candidates, political connections are manifested in the close connections between corporate board members and the ruling party [13]. In China, by contrast, political connection refers to the special relationship between enterprises and the government formed when the actual holders of enterprises are shareholders with political rights and a government background, or when corporate executives have political identities, e.g., NPC deputies and CPPCC members. Due to this special political and economic environment, government intervention in the economy is more serious, and listed companies have formed a complex and diverse political relationship with the government [19]. Compared with other industries, the high risks and uncertainties in the construction industry determine that its green innovation must rely on sufficient resources. Construction enterprises generally rely on government resources and policy support to relieve financial pressure when carrying out green innovation (whether this is green R&D, design, or construction). According to resource dependence theory, the government is a key external resource for enterprise development, and political connection can bring core scarce resources to enterprises to improve them [20]. Many studies have proved that enterprises can gain advantages in investment, financing, fiscal subsidies, taxation, etc., by strengthening political ties with the government. Zhao et al. (2017) [21] and Li et al. (2021) [22] believe that the tax incentives and investment facilitation brought by political connections to enterprises can strengthen an enterprise’s green innovation investment and reduce innovation risk. Moreover, enterprises with political connections are more active in green innovation. This is mainly because, according to the “political order theory” [23], such enterprises often have priority in obtaining investment, financing, and policy preferences from the government. In addition, according to the “information effect”, political connections can enable enterprises to respond more quickly to the needs of the national green development strategy and implement green innovation actions. Muhammad et al. (2021) [24] and Saidatou et al. (2020) [25] believe that politically connected enterprises can better understand the government’s green development policies, act in line with increasingly strict environmental regulations, and respond more quickly to national green development strategies. Thus, the below hypothesis is proposed.

Hypothesis 1 (H1).

Political connection has a significant positive impact on corporate green innovation.

2.2. Mediating Effect of Corporate Social Responsibility

Corporate social responsibility (CSR) is an intermediary of value transmission through which political connection (PC) influences corporate green innovation. According to Upper Echelons Theory, individual behavior and willingness often affect corporate decision-making. Hambrick and Mason (1984) [26] believe that the personal cognition and values of senior management often affect the strategic decisions and actions of enterprises. Enterprises with political connections face both pressure from environmental governance and public opinions on social responsibility. Therefore, corporate executives often have a stronger sense of social responsibility, which translates into corporate strategies and actions, thereby enhancing corporate leaders’ relationships with external stakeholders and the promotion of green innovation [27].

Corporate social responsibility (CSR) serves as an interesting balance mechanism in the relationship between political connections and green innovation. According to stakeholder theory, CSR, as a sustainable development strategy, plays an important role in balancing the interests of multiple entities. Politically connected enterprises should respond to the government’s concerns about energy conservation and environmental governance, and at the same time take into account the interests of other stakeholders. Pan et al. (2021) [28] believe that corporate strategies need to consider the needs of multiple stakeholders such as the government and the market, and CRS is the best mutually beneficial mechanism to balance the interests of enterprises and other stakeholders.

Corporate social responsibility (CSR) is a risk aversion means for political connections to influence corporate green innovation. The signaling theory believes that asymmetric information often leads to the failure of Pareto optimal transactions [29]. Compared with other industries, the construction industry faces greater production and operation risks. By fulfilling their social responsibilities, enterprises with political connections can show their determination of green development to the outside world, and meanwhile establish a good image and improve government satisfaction, bringing a positive reputation and long-term benefits. In this way, they can improve their risk prevention ability in fierce competition and create conditions for green innovation, thereby enhancing their green innovation performance [30]. Thus, the below hypothesis is proposed.

Hypothesis 2 (H2).

Corporate social responsibility has a mediating effect on the relationship between political connection and corporate green innovation.

2.3. Moderating Effect of Environmental Public Opinion Pressure

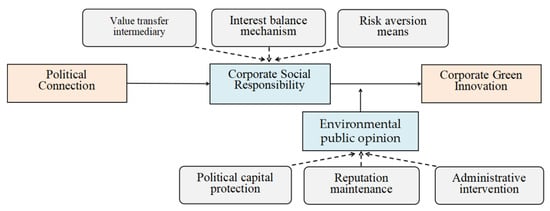

There are many socially sensitive issues in the construction industry, such as energy waste and environmental pollution management at different stages of building material production, construction and operation [31], which often become the focus of the media, and the pressure of environmental public opinion faced by enterprises is also increasing day by day. According to the Agenda Setting Theory, corporate issues are an important part of media public opinion. Media reports can effectively influence people’s attention to certain facts and opinions by providing relevant information on enterprises, and have an impact on the attitudes and behaviors of audiences [32]. Positive media reports can enhance the legitimacy of business operations and expand corporate influence and market share. Negative media reports can damage corporate image and affect corporate performance. Therefore, regardless of whether they face positive media reports or negative media reports, enterprises have to pay attention to the pressure of public opinion for long-term development, and regard public opinion as one of the important factors for the development of enterprise. Fernandez and Santalo (2010) [33] believe that public opinion tends to cause a “focusing effect”. Fama and Jensen (1983) [34] and Dyck et al. (2008) [35] believe that public opinion can influence corporate governance through administrative intervention and reputation. The media’s follow-up reports on companies that violate regulations mean that corporate executives face enormous pressure to uphold their reputation and incite administrative intervention. Due to the high investment and high risk of corporate green innovation, corporate executives may show opportunism in the pursuit of short-term interests. That is, they are more conservative in green innovation and make corporate decisions with low risks and quick returns. Such short-sighted behavior will hinder the green innovation of enterprises. However, continuous environmental public opinion (external supervision) can often attract government attention, leading to opportunistic behavior being stopped by administrative intervention [36]. By contrast, according to reputation theory, executives of politically connected enterprises need to maintain political capital and reputation. Ralf et al. (2020) [37] believe that corporate executives pay special attention to their reputation in the professional manager market, and a positive response to environmental public opinion helps to protect political capital and preserve reputation. According to incentive theory, the purpose of motivation is to stimulate the motivation of correct behavior and mobilize enthusiasm and creativity. Tung et al. (2020) [38] believe that actively publicizing the environmental protection of enterprises can further stimulate the green innovation motivation of enterprises, and mobilize the enthusiasm of enterprise employees to participate in green innovation. The multiple social identities of corporate executives means that their personal behaviors and corporate decisions face are scrutinized by the media. The stronger the corporate political connection, the more public opinion the corporate executives face. For political capital protection, reputation maintenance, or the realization of social value, corporate executives may take positive actions, such as fulfilling social responsibilities, paying attention to environmental issues, or carrying out green innovation (Figure 1). Thus, the below hypothesis is proposed.

Figure 1.

Theoretical model.

Hypothesis 3 (H3).

Environmental public opinion has a positive moderating effect on the relationship between political connection and corporate green innovation.

3. Data and Method

3.1. Sample Selection and Data Sources

In the context of carbon peaking and carbon neutrality, listed companies in China’s construction industry have attached more importance to green innovation and development. In January 2013, the General Office of the State Council issued the “Notice on Forwarding the Green Building Action Plan of the National Commission of Development and Reform and the Ministry of Housing and Urban-Rural Development”, as a landmark event, which determined the methods for accelerating green innovation and development in construction industry. Therefore, considering the lag of the impact of this action plan on green innovation in the construction industry, this paper selected Chinese A-share listed construction companies from 2014 to 2019 as measurement samples. Additionally, the samples were processed as follows: (1) we excluded samples with missing index information; (2) we excluded ST and *ST companies; (3) we excluded samples with zero green patent applications; and (4) we excluded samples with abnormal data or missing control variables. Finally, 68 companies were obtained, with a total of 408 sample observation data.

Sample data collection began in April 2021 and ended in August 2021. Political connection data were collected from the CSMAR database, CCTV.com, YICAI.com, Sina Finance, FortuneChina.com, Baidu Encyclopedia, and the official websites of relevant enterprises. Corporate social responsibility data were from the Runling Evaluation Report on Global Corporate Social Responsibility; environmental public opinion data were from the “Full-text Database of China’s Important Newspapers” of China National Knowledge Infrastructure; green innovation data were obtained by retrieving green patents from the State Intellectual Property Office; the financial data of sample companies came from the CSMAR database and Eastmoney.

3.2. Variable Definitions

(1) Green Innovation (GI)

Existing studies mainly have two types of measurement methods for green innovation: one focuses on the industry and establishes an indicator system based on green product innovation or green technology innovation; the other focuses on enterprises and measures green innovation by the current number of green patent applications or green patent grants of sample companies. For a more accurate observation of differences in corporate green innovation, and considering the time lag of green patent grants [39], this paper adopted the current number of current green patent applications (the sum of green invention patents and green practical patents) as the measurement index of green innovation, and took the logarithm of the number of enterprise current green patent applications +1.

(2) Political Connection (PC)

Existing studies measure political connection mainly based on whether corporate executives have held or are holding certain political positions [21,22]. In fact, corporations can be regarded as politically connected when their corporate executives have received commendations or honors at or above the municipal levels due to their outstanding work performance, or their corporate executives are highly recognized by the government. Therefore, this paper measures political connection by whether corporate executives (chairmen or general managers) have worked as a deputy of the National People’s Congress, a member of the Chinese People’s Political Consultative Conference, or in government departments, and whether they have received commendations or honors from government organizations at or above the provincial level. If the executives meet any of the above conditions, the corporation has political connections and the value 1 is assigned; otherwise, they are assigned the value 0.

(3) Corporate Social Responsibility (CSR)

The Runling Global Corporate Social Responsibility Evaluation System is extensively applied to measure the level of social responsibility fulfillment of listed companies for its objectivity, accuracy, and large amount of information. Thus, this paper uses it to measure CSR level.

(4) Environmental Public Opinion (EPO)

The measurement of environmental public opinion is mainly based on media reports [32], such as online media, newspaper, and television. Considering that newspapers are more authoritative, this paper uses the number of newspapers reports on corporate environmental protection as the measurement index. With reference to existing research, eight influential newspapers were selected: the influential Securities Times, China Business Journal, The Economic Observer, China Securities Journal, Shanghai Securities News, Securities Daily, 21st Century Business Herald, and China Business News. Taking the selected listed companies in the construction industry as the retrieval object, by entering the subject words of environmental protection issues such as “environment”, “pollution”, “resources” and “carbon emissions”, the number of media reports of each sample company was obtained in each newspaper. In the regression analysis, the natural logarithm of this number plus one was taken.

(5) Control Variable

After referring to the relevant practices of Wang et al. (2020) [40], and considering the possible factors affecting corporate green innovation, this paper used company size (SIZE), profitability (EPS), financial leverage (LEV), R&D investment intensity (RD input), ownership property (STATE), and listing age (LISTGE) as control variables, and used the year and industry as dummy variables. The definitions of the variables are shown in Table 1.

Table 1.

Variables and Definitions.

3.3. Model

Model (1) was constructed to test the impact of political connection on corporate green innovation.

GIit = α0 + α1PCit + α2–7∑Controlit + ∑YEAR + ∑INDUSTRY + ε1

With reference to the test method of Xiao et al. (2021) [41], a three-step recursive model was built. Then, based on model (1), multiple regression models (2) and (3) were constructed to test the mediating effect of corporate social responsibility.

CSRit = β0 + β1PCit + β2–7∑Controlit + ∑YEAR + ∑INDUSTRY + ε2

GIit = γ0 + γ1PCit + γ2CSRit + γ3–8∑Controlit + ∑YEAR + ∑INDUSTRY + ε3

With reference to the test method of Wen et al. (2004) [42], a multiple regression model (4) was constructed based on model (1) to test the moderating effect of environmental public opinion.

GIit = λ0 + λ1PCit + λ2EPOit + λ3PCit × EPOit + λ4–9∑Controlit + ∑YEAR + ∑INDUSTRY + ε4

In the above equations, GIit and CSRit are the green innovation and social responsibility of the i-th sample in the t-th period, respectively; PCit and EPOit are the political connection and environmental public opinion of the i-th sample in the t-th period, respectively; and ∑Controlit is the sum of the products of the control variables and the corresponding coefficients in Table 1.

4. Empirical Results

4.1. Descriptive Statistics

As shown in Table 2, the mean and standard deviation of the green innovation (GI) of the selected samples were 1.68 and 1.38, indicating certain differences in the green innovation level of these enterprises. The mean of political connection was 0.77, indicating that political connection was common among the listed construction companies in China. Corporate social responsibility (CSR) had a minimum of 15.12, a maximum of 82.65, and mean of 38.82. These indicate that the listed companies in China’s construction industry varied greatly in the level of social responsibility performance. Environmental public opinion (EPO) had a minimum of 0, a maximum of 6.21, and a mean of 3.19. These mean that the listed Chinese construction companies generally received a lot of pressure from environmental public opinion, but with certain differences.

Table 2.

Descriptive statistics.

4.2. Benchmark Regression Test

Table 3 gives the benchmark regression test. The regression coefficient of political connection was 0.182, p < 0.001. This indicates that political connection had a significant positive correlation with corporate green innovation. The major reason is that construction corporations with political connections are more likely to obtain investment, financing and policy preferences from government departments, which will help ease the resource constraints in carrying out green innovation and create conditions for green innovation. In addition, political connection can eliminate information asymmetry between government and enterprises so that corporations can better understand the government’s green innovation policies, comply with the increasingly strict environmental regulations, respond more quickly to national policies, and carry out green innovation. Thus, H1 is verified.

Table 3.

Benchmark regression results.

4.3. Mediating Effect Test

A three-step recursive model was built to test the mediating effect of corporate social responsibility. The first step, as shown in ①, passed the test. Table 4 shows that the second step, as shown in ②, tested the impact of political connection on CSR. The regression coefficient of political connection was 0.082, p < 0.01, indicating that political connection can significantly positively influence CSR. This mainly because, for companies with political connections, their executives have high expectations from the government and the public, and they are more motivated to fulfill social responsibilities, whether this is due to external pressure or personal emotions. The third step is shown in ③. The regression coefficient of political connection was 0.158, which is smaller than that in ①, and p < 0.001. The regression coefficient of CSR was 0.300, p < 0.001, indicating that CSR plays a partial mediating role in the relationship between political connection and corporate green innovation. Moreover, political connections mean that executives are placed multiple roles. In this case, CSR serves as an effective value transfer intermediary, a benefit balance mechanism, and a risk avoidance means. Political connection promotes enterprises to fulfill social responsibilities, thus affecting green innovation. H2 is therefore verified.

Table 4.

Mediating effect test results.

4.4. Moderating Effect Test

As shown in Table 5, it can be seen from ⑤ that the regression coefficient of political connection was 0.469, p < 0.05. The regression coefficient of environmental public opinion was 0.151, and p < 0.01. The regression coefficient of the interaction term of political connection and environmental public opinion was 0.766, p < 0.001. Additionally, the R2 (0.520) of ⑤ was higher than the R2 (0.468) of ④, indicating that environmental public opinion has a significant moderating effect. A possible reason is that enterprises with political connections are more likely to attract the attention of external media for their executives’ personal behaviors and corporate decisions; the stronger the political connection, the greater the pressure of environmental public opinion. Thus, due to administrative intervention, political capital protection, and reputation maintenance, corporate executives will fulfill social responsibilities, attach importance to environmental problems, and carry out green innovation actions. H3 is therefore verified.

Table 5.

Moderating effect test results.

5. Robustness Test

5.1. Multicollinearity Test

In order to ensure the stability of the model, this paper used the variance inflation factor (VIF) to test whether there was a collinearity problem between the variables. As shown in Table 6, the VIF value of each variable was less than 10, and the tolerance was greater than 0 and less than 1, indicating that the model had no obvious multicollinearity problems. The overall average VIF value of the model was only 2.170, indicating that the model was robust.

Table 6.

Multicollinearity test results.

5.2. Main Effect Robustness Test

The robustness of the main effect was tested by the substitution variables and lagged variables. The results are shown in Table 7. (1) If the corporate executives had worked as a deputy of the National People’s Congress, a member of the Chinese People’s Political Consultative Conference, or in government departments, the political connection was assigned to 1; otherwise, it was assigned to 0. The regression results are shown in ⑥. (2) The measurement method of political connection remained unchanged, and the corporate green innovation variable was delayed by one stage for the robustness test. The test results are shown in ⑦. The robustness test results are consistent with those mentioned above.

Table 7.

Robustness test results of main effect.

5.3. Endogeneity Test of Mediating Effect

The reverse causality between variables may lead to endogenous problems in the benchmark regression results. The fulfillment of CSR is conducive to green innovation, which is shown in the practices of green innovation. With reference to the research methods of Jiang and Huang (2011) [43], simultaneous equation models (5) and (6) were constructed:

CSRit = μ0 + μ1GIit + μ2–7∑Controlit + ∑YEAR + ∑INDUSTRY + ε5

GIit = χ0 + χ1PCit + χ2CSRi,t−1 + χ3–8∑Controlit + ∑YEAR + ∑INDUSTRY + ε6

Table 8 lists the test results. The regression results in ⑧ test the impact of green innovation on CSR. The regression coefficient of green innovation was 0.203, p < 0.001, indicating that green innovation had a significant positive impact on CSR, and there was a reverse causal relationship between the two. Based on this, the regression results in ⑨ were used to further test the mediating effect of CSR. It can be seen that the regression results are roughly consistent with those in the above section.

Table 8.

Endogenous test results of mediating effect.

5.4. Heterogeneity Test of Moderating Effect

(1) Heterogeneity Test of Ownership Property

Due to the differences in institutional norms, executive rights, and agency conflicts among companies with different ownership properties [44], their political connections, CSR, environmental public opinion pressure, and green innovation vary greatly. In view of this, this paper divided the research samples into state-owned enterprises and non-state-owned enterprises, and explored the moderating effect of environmental public opinion under different ownership properties. As shown in Table 9, ⑩ and⑪ are the regression results after introducing environmental public opinion and the interaction terms of political connection and environmental public opinion. It can be seen that the interaction terms of political connection and environmental public opinion were significantly positively correlated with corporate green innovation, verifying hypothesis H3. In addition, the interaction coefficients of state-owned enterprises were significantly positive at the 10% level, and those of non-state-owned enterprises were significantly positive at the 1% level. These mean that, for non-state-owned enterprises, environmental public opinion can enhance the promoting effect of political connection on corporate green innovation. A possible reason for this is that, in state-owned enterprises with political connections, executives will pay more attention to the stability of political capital [45,46], and under the pressure of environmental public opinion, executives tend to be more conservative in green innovation and make decisions with low risks and quick returns [47,48]. For executives of non-state-owned enterprises, political connection can provide more resources for the development of enterprises. Therefore, they will respond more positively to environmental public opinion, and help the enterprises to fulfill social responsibilities and carry out green innovation.

Table 9.

Robustness test results of moderating effect.

(2) Regional Heterogeneity Test

Affected by levels of economic development, resource endowment, and marketization processes, regions may differ in political connections, environmental public opinion pressure, and corporate green innovation. To further verify the moderating effect of environmental public opinion, this paper, according to the province where the sample companies are registered in China, divided the selected samples into two groups (Eastern regions: Beijing, Tianjin, Hebei, Liaoning, Shanghai, Jiangsu, Zhejiang, Fujian, Shandong, Guangdong, and Hainan; Central–western regions: Sichuan, Chongqing, Guizhou, Yunnan, Tibet, Shaanxi, Gansu, Qinghai, Ningxia, Xinjiang, Guangxi, Inner Mongolia, Shanxi, Jilin, Heilongjiang, Anhui, Henan, Hubei, and Hunan), and conducted regression tests. It can be seen from ⑫ and ⑬ that the coefficients of political connection and environmental public opinion interaction terms were both positive, and the coefficients in the eastern regions were more significant than those in the central and western regions. This means that, in the eastern region, environmental public opinion better enhanced the influence of political connection on corporate green innovation. This is probably because, compared with the central and western regions, and the eastern region is more developed in marketization and has a more complete mechanism for media supervision [49,50]. As a result, for companies with political connections, their green innovation activities are more susceptible to environmental public opinion pressure.

6. Conclusions and Discussion

6.1. Research Conclusions

Based on the panel data of Chinese A-share listed companies in the construction industry from 2014 to 2019, this paper conducted an empirical study to investigate the influence mechanism of political connections on the green innovation of construction firms. The research conclusions are as follows. (1) Political connection has a significant positive impact on corporate green innovation, and this conclusion remains unchanged even after distinguishing the nature of equity and regional differences. This is because, in enterprises with political connections, corporate executives, out of cognition of economic development and political sensitivity, tend to show a high sense of moral awareness and social responsibility in promoting green innovation. (2) Corporate social responsibility (CSR) plays a partial mediating role in the relationship between political connections and corporate green innovation. In the reverse causality test and endogeneity test, the mediating effect of corporate social responsibility did not change. This shows that political connections mean that corporate executives play multiple roles. Whether due to external pressures or internal emotions, CSR can serve as an effective value transfer intermediary, interest balancing mechanism, and risk aversion means. Political connection motivates companies to fulfill social responsibility, thereby affecting corporate green innovation. (3) Environmental public opinion positively moderates the impact of political connections on corporate green innovation. This is because political connections make corporate executives’ decisions more vulnerable to external media attention. Executives are actively engaged in social responsibility and green innovation initiatives due to administrative intervention, political capital protection, and reputation maintenance. Thus, environmental public opinion reinforces the positive effect of political connection on corporate green innovation. This effect is more obvious in non-state-owned enterprises and enterprises in eastern China with a higher degree of marketization. The reason for this is that political connections urge state-owned enterprise executives to pay more attention to the stability of political capital. Under the pressure of environmental public opinion, SOE executives tend to be more “conservative” in implementing green innovation and make “safe” decisions with low risk and quick returns. Compared with the central and western regions, the eastern region has a higher degree of marketization as well as a sounder market mechanism for media. In this case, environmental public opinion pressure can better supervise listed companies, and the green innovation activities of politically connected enterprises are more likely to be affected by environmental public opinion pressure.

6.2. Theoretical Contribution

The existing research mainly studies the impact of political connections on corporate green innovation from the “self-interest” perspectives of “capital” and “resources”. However, there is a lack of in-depth exploration of the impact path and mechanisms of political connections on corporate green innovation. In fact, individual behaviors often have an impact on corporate decision-making. As corporate strategic decision-makers, executives’ perceptions of social responsibility and environmental issues directly affect corporate green innovation actions. At the same time, China is in a period of economic transformation and development, and the policy supervision mechanism for the green innovation and development of enterprises is not yet mature, and environmental public opinion supervision can become an effective supplement to corporate environmental governance. Therefore, the current research on the above problems is still insufficient.

Therefore, the theoretical contributions of this paper can be outlined in three aspects. (1) Considering the background of the low carbon transformation of China’s construction industry, taking Chinese construction enterprises as the empirical research object, this paper analyzed the impact of political connections on corporate green innovation, further broadening the scope of empirical research in the field of corporate green innovation, and enriching the theoretical system of enterprise green innovation. (2) This paper further explored the influence path of political connections on corporate green innovation. Based on Upper Echelons, stakeholder theory and signaling theory, this paper analyzed the role of CSR as an intermediary variable in the influence of political connections on corporate green innovation. Moreover, this paper verified that CSR, as a green strategy, plays an important role in coordinating its relationships with stakeholders such as the government, the market, and the environment. (3) This paper further expanded the influence boundary of political connections on corporate green innovation. Political connections can often affect corporate executives’ environmental perceptions which, in turn, impact enterprises’ green innovation decisions. The existing research mainly analyzed the influence of policy constraints and market pressure on executive decisions, but ignored the important role of external supervision. As an effective external supervision mechanism, the media’s continuous reporting of companies that violate regulations exposes corporate executives to enormous pressure for reputation and administrative intervention. Thus, based on reputation theory and incentive theory, this paper analyzed the role boundary of environmental public opinion as a moderator variable in the impact of political connections on corporate green innovation, and verified the important influence of environmental public opinion on preventing enterprises from producing opportunistic behaviors and actively promoting corporate green innovation.

6.3. Practical Enlightenment

In the context of carbon peaking and carbon neutrality, the construction industry is in urgent need of green transformation. Green innovation is of strategic significance to the governance structure of listed construction companies in China, as well as the realization of energy conservation and emission reduction in the construction industry. The management and practical suggestions of the research conclusions of this paper are outlined in the following. (1) It is suggested, in order to optimize the institutional environment, to actively promote the green innovation transformation of construction enterprises, and strengthen the roles of the government and the market in promoting corporate green innovation. It is necessary to emphasize the positive impact of benign political connections on corporate green innovation, and to supervise and control the negative impact of corruption and turnover in order to truly transform the institutional advantages of green innovation into green innovation performance. Additionally, for construction enterprises lacking political connection, the government should further strengthen policy and resource supplies, and construct government–enterprise communication platforms, so as to alleviate information asymmetry between the government and enterprises. Moreover, the government should reduce the negative impact of the institutional defects of government–enterprise connection on the green innovation of construction. (2) Construction enterprises should improve their performance in fulfilling social responsibility. Green innovation in the construction industry is critical to achieving carbon peak and carbon neutrality. While pursuing profits, construction enterprises should pay more attention to national strategic needs and be responsible to stakeholders and the environment. In addition, they should improve the fulfillment mechanism of corporate social responsibility (CSR), integrate CSR with corporate culture and corporate development strategies, and drive corporate green innovation and transformation by CSR. Government departments should attach importance to the role of executives in corporate strategy formulation and policy implementation, cultivate the sense of social responsibility of construction company executives, and build a diversified incentive mechanism to stimulate executives’ enthusiasm for green innovation. Government departments should also improve the supervision mechanism for the release of CSR reports, improve the statistics and assessment systems of CSR indicators, and institutionalize and standardize the supervision and management of CSR performance. (3) The supervision function of media should be fully guaranteed. China should further improve the regulations and legal institutions regarding media, and especially strengthen the guidance and supervision of media in the central and western regions with slower marketization, so as to ensure a good environment for media supervision. Furthermore, the media should be encouraged to reveal the misconduct of enterprises. In the meantime, media practitioners should also improve their professional quality, enhance their sense of responsibility, and reduce misleading reports, so as to provide better external supervision for the green transformation of China’s construction industry.

6.4. Research Limitations and Prospects

This paper empirically tests the impact, realization path and boundary of political connections on corporate green innovation. The research results can provide theoretical support and empirical reference for China to accelerate the low-carbon transformation of China’s construction industry, promote high-quality economic development, and achieve carbon peaking and carbon neutrality.

However, there are still some limitations of this paper. (1) Based on the mediating role of CSR and the moderating role of environmental public opinion, this paper empirically tests the impact path and role boundary of political connections on corporate green innovation. However, in fact, in addition to the decision-making behavior of corporate executives, companies’ fulfillment of social responsibility and active response to public opinion may also be affected by other factors; such factors are not analyzed in this paper due to the limitations of the research data. (2) The effect of political connection on corporate green innovation may differ due to differences in the institutional and policy environments of different countries. For example, in an institutional environment dominated by public ownership, the characteristics of Chinese state-owned enterprises determine that political connection is inevitably associated with green innovation; this paper lacks a comparative analysis of different economic systems and policy environments.

Combined with the limitations of this study, the key areas of future research are as follows. (1) Researchers should continue to expand the number of research samples, enhance the rationality of research data, and minimize research errors. (2) The influencing factors of corporate executives’ green innovation behavior should be the focus of future research. (3) Researchers should comparatively analyze the differences in the impact of political connections, social responsibility and environmental public opinion on corporate green innovation under different economic systems and policy environments, and further verify the impact mechanism and role boundaries of political connections on corporate green innovation.

Author Contributions

Conceptualization, C.P.; methodology, B.W.; software, B.W.; formal analysis, J.W.; investigation, J.W.; resources, C.P.; data curation, F.L. and C.P.; writing—original draft preparation, B.W.; writing—review and editing, F.L. and B.W.; supervision, C.P. All authors have read and agreed to the published version of the manuscript.

Funding

Our heartfelt thanks should be given to the National Natural Science Foundation of China (grant number 71841042), Soft Science Project of Sichuan Provincial Department of Science and Technology (grant number 2022JDR0229), and Doctoral Fund Project of Southwest University of Science and Technology (grant number 18ZX7161).

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data presented in this paper are available on request from the corresponding author.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Hao, C.X.; Shao, C.F.; Dong, Z.F. Analysis of the 2020 Global Environmental Performance Index Report. Environ. Prot. 2020, 16, 68–72. [Google Scholar]

- Clarence, T.; Hidemichi, F.; Keeley, A.R.; Managi, S. Green Innovation and Finance in Asia. Asian Econ. Policy Rev. 2020, 16, 67–87. [Google Scholar]

- Zhao, R.; Liu, Y.; Zhang, N.; Huang, T. An Optimization Model for Green Supply Chain Management by Using a Big Data Analytic Approach. J. Clean. Prod. 2017, 142, 1085–1097. [Google Scholar] [CrossRef]

- Shahzad, M.; Qu, Y.; Javed, S.A.; Zafar, A.U.; Rehman, S.U. Relation of Environment Sustainability to CSR and Green Innovation: A Case of Pakistani Manufacturing Industry. J. Clean. Prod. 2020, 253, 119938. [Google Scholar] [CrossRef]

- Colin, C.; Cheng, J. Sustainability Orientation, Green Supplier Involvement, and Green Innovation Performance: Evidence from Diversifying Green Entrants. J. Bus. Eth. 2020, 161, 393–414. [Google Scholar]

- Jaluza, M.; Lara, B. Green Innovation: Unfolding the Relation with Environmental Regulations and Competitiveness. Resour. Conserv. Recycl. 2019, 149, 449–454. [Google Scholar]

- Wang, M.Y.; Li, Y.M.; Guan, K.X. Influence of Political Market Regulation on Enterprise Green Technology Innovation Decisions and Performance. Syst. Eng.-Theory Pract. 2020, 40, 1158–1177. [Google Scholar]

- Jennings, R.; Kartapanis, A.; Yu, Y. Do Political Connections Induce More or Less Opportunistic Financial Reporting? Evidence from Close Elections Involving SEC-Influential Politicians. Contemp. Account. Res. 2021, 38, 1177–1203. [Google Scholar] [CrossRef]

- Hyejeong, S.; Ahn, J. CEO’s Political Connection and Organization Efficiency: Evidence from Public Institutions in Korea. Public Organ. Rev. 2021, 21, 419–435. [Google Scholar]

- Schweizer, D.; Walker, T.; Zhang, A. False Hopes and Blind Beliefs: How Political Connections Affect China’s Corporate Bond Market. J. Bank. Finance 2020, 106008. [Google Scholar] [CrossRef]

- Grigoriev, I.; Zhirkov, K. Do Political Connections Make Businesspeople Richer? Evidence from Russia, 2003–2010. Res. Politics 2020, 7, 111–126. [Google Scholar] [CrossRef]

- Faraji, O.; Kashanipour, M.; Mohammad, F.; Ahmed, K.; Vatanparast, N. Political Connections, Political Cycles and Stock Returns: Evidence from Iran. Emerg. Mark. Rev. 2020, 45, 100766. [Google Scholar] [CrossRef]

- Ferris, S.; Javakhadze, D.; Rajkovic, T. An International Analysis of CEO Social Capital and Corporate Risk-taking. Eur. Financ. Manag. 2019, 25, 3–37. [Google Scholar] [CrossRef] [Green Version]

- Faccio, M. Politically Connected Firms. Am. Econ. Rev. 2006, 96, 369–386. [Google Scholar] [CrossRef] [Green Version]

- Amore, M.; Bennedsen, M. Corporate Governance and Green Innovation. J. Environ. Econ. Manag. 2016, 75, 54–72. [Google Scholar] [CrossRef]

- Gracezelda, L.; Desi, A. External and Internal Economic Impacts of Eco-innovation and the Role of Political Connections: A Sustainability Narrative from an Emerging Market. J. Clean. Prod. 2020, 258, 120579. [Google Scholar]

- Fang, Z.; Kong, X.; Sensoy, A.; Cui, X.; Cheng, F. Government’s Awareness of Environmental Protection and Corporate Green Innovation: A Natural Experiment from the New Environmental Protection law in China. Econ. Anal. Policy 2021, 70, 294–312. [Google Scholar] [CrossRef]

- Sascha, K.; Rehman, S.U.; García, F.J.S. Corporate Social Responsibility and Environmental Performance: The Mediating Role of Environmental Strategy and Green Innovation. Echnol. Forecast. Soc. Chang. 2020, 160, 120262. [Google Scholar]

- Wu, B.; Liang, H.; Chan, S. Political Connections, Industry Entry Choice and Performance Volatility: Evidence from China. Emerg. Mark. Finance Trade 2022, 58, 290–299. [Google Scholar] [CrossRef]

- Pfeffer, J.; Salancik, G. The External Control of Organizations: A Resource Dependence Perspective; Harper and Row: New York, NY, USA, 1978; pp. 123–137. [Google Scholar]

- Zhao, R.; Zhou, X.; Jin, Q.; Wang, Y.; Liu, C. Enterprises’ Compliance with Government Carbon Reduction Labelling Policy Using a System Dynamics Approach. J. Clean. Prod. 2017, 163, 303–319. [Google Scholar] [CrossRef]

- Li, C.; Wan, J.; Xu, Z.; Lin, T. Impacts of Green Innovation, Institutional Constraints and Their Interactions on High-Quality Economic Development across China. Sustainability 2021, 13, 5277. [Google Scholar] [CrossRef]

- Awanis, G.; Nasih, M. Corporate Performance, Political Connection, Family Firms and CEO Turnover in Indonesia. J. Secur. Sustain. Issues 2020, 9, 171–185. [Google Scholar]

- Raza, M.A.A.; Yan, C.; Abbas, H.S.M.; Ullah, A. Impact of Institutional Governance and State Determinants on Foreign Direct Investment in Asian Economies. Growth Chang. 2021, 52, 2596–2613. [Google Scholar] [CrossRef]

- Saidatou, D.; Hanen, K.; Félix, Z. Political Connections and Voluntary Disclosure: The Case of Canadian Listed Companies. J. Manag. Gov. 2020, 24, 481–506. [Google Scholar]

- Hambrick, D.; Mason, P. Upper Echelons: The Organization as a Reflection of Its Top Managers. Social Sci. Electron. Publ. 1984, 9, 193–206. [Google Scholar]

- Myskova, R.; Hajek, P. Sustainability and Corporate Social Responsibility in the Text of Annual Reports—Case of the IT Services Industry. Sustainabiliy 2018, 10, 4119. [Google Scholar] [CrossRef] [Green Version]

- Pan, X.; Oh, K.-S.; Wang, M. Strategic Orientation, Digital Capabilities, and New Product Development in Emerging Market Firms: The Moderating Role of Corporate Social Responsibility. Sustainability 2021, 13, 12703. [Google Scholar] [CrossRef]

- Attig, N.; Brockman, P. The Local Roots of Corporate Social Responsibility. J. Bus. Eth. 2017, 142, 479–496. [Google Scholar] [CrossRef]

- Porter, M.; Kramer, M. Strategy and Society: The Link between Competitive Advantage and Corporate Social Responsibility. Harv. Bus. Rev. 2006, 84, 78–92. [Google Scholar]

- Charles, J.M.; Manikandan, P.; Nidhu, P. A Study on Proactive Environmental Health and Safety Management System in Construction Industries. SSRG Int. J. Civ. Eng. 2018, 5, 29–32. [Google Scholar] [CrossRef]

- Mccombs, E.M.; Shaw, L.D. The Agenda-Setting Function of Mass Media. Public Opin. Q. 1972, 36, 176–187. [Google Scholar] [CrossRef]

- Fernandez, D.; Santalo, J. When Necessity Becomes a Virtue: The Effect of Product Market Competition on Corporate Social Responsibility. J. Econ. Manag. Strategy 2010, 19, 453–487. [Google Scholar] [CrossRef]

- Fama, E.; Jensen, M. Separation of Ownership and Control. J. Law Econ. 1983, 114, 280–316. [Google Scholar] [CrossRef]

- Dyck, A.; Volchkova, N.; Zinglaes, L. The Corporate Governance Role of The Media: Evidence from Russia. J. Finance 2008, 63, 1093–1136. [Google Scholar] [CrossRef] [Green Version]

- Li, P.G.; Shen, Y.F. The Role of Media Corporate Governance: Empirical evidence from China. Econ. Res. J. 2010, 4, 14–27. [Google Scholar]

- Barkemeyer, R.; Faugère, C.; Gergaud, O.; Preuss, L. Attention to Large-scale Corporate Scandals: Hype and Boredom in the Age of Social Media. J. Bus. Res. 2020, 109, 385–398. [Google Scholar] [CrossRef]

- Tung, L.; Thi, H.; Manh, T. Media Attention and Firm Value: International Evidence. Int. Rev. Finance 2020, 21, 865–894. [Google Scholar]

- Marín-Vinuesa, L.M.; Scarpellini, S.; Portillo-Tarragona, P.; Moneva, J.M. The Impact of Eco-innovation on Performance Through the Measurement of Financial Resources and Green Patents. Organ. Environ. 2020, 33, 285–310. [Google Scholar] [CrossRef] [Green Version]

- Wang, X.Q.; Hao, S.G.; Zhang, J.M. The New Environmental Protection Law and Corporate Green Innovation; China Population Resources and Environment: Jinan, China, 2020; pp. 107–117. [Google Scholar]

- Xiao, X.H.; Pan, Y.; Wang, Z.J. Does Corporate Social Responsibility Promote Corporate Green Innovation? Econ. Surv. 2021, 38, 114–123. [Google Scholar]

- Wen, Z.L.; Zhang, L.; Hou, J.T. Mediation Effect Test Procedure and Its Application. Acta Psychol. Sinica 2004, 36, 614–620. [Google Scholar]

- Jiang, F.X.; Huang, J.C. Management Incentive, Liability and Enterprise Value. Econ. Res. J. 2011, 5, 46–59. [Google Scholar]

- Lepore, L.; Paolone, F.; Cambrea, D.R. Ownership Structure, Investors’ Protection and Corporate Valuation: The Effect of Judicial System Efficiency in Family and non-family Firms. Econ. Res. J. 2018, 22, 829–862. [Google Scholar] [CrossRef]

- Sorin, M.; Alfredo, J. Do Political Connections Matter for Firm Innovation? Evidence from Emerging Markets in Central Asia and Eastern Europe. Technol. Forecast. Social Change 2020, 151, 119669. [Google Scholar]

- Alessandro, G.; Marco, C. Political Connections, Media Impact and State-owned Enterprises: An Empirical Analysis on Corporate Financial Performance. J. Public Budg. Account. Financial Manag. 2020, 33, 261–288. [Google Scholar]

- James, E. Risk Sharing, Fiduciary Duty, and Corporate Risk Attitudes. Decis. Anal. 2004, 1, 114–127. [Google Scholar]

- Wu, T.; Wu, Y.J.; Tsai, H.; Li, Y.T. Top Management Teams’Characteristics and Strategic Decision-Making: A Mediation of Risk Perceptions and Mental Models. Sustainability 2017, 9, 2265. [Google Scholar] [CrossRef] [Green Version]

- Yuan, B.; Li, C.; Xiong, X. Innovation and Environmental Total Factor Productivity in China: The Moderating Roles of Economic Policy Uncertainty and Marketization Process. Environ. Sci. Pollut. Res. Int. 2020, 28, 9558–9581. [Google Scholar] [CrossRef]

- Fan, G.; Ma, G.; Wang, X. Institutional Reform and Economic Growth of China: 40-year Progress Toward Marketization. Acta Oecon. 2019, 69, 7–20. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).