Abstract

Food safety liability has required consideration around the world. It is realistic to establish a system of food safety liability insurance. However, the existing difficulties include members’ behavior decisions, influential factors, and the responsibility as well as obligations between the players. We build an evolutionary game model to discuss the behavior of food firms and the government in the context of food safety liability and identify evolutionary stability strategy of the participants in the game. Then, we simulate the stable evolution trend of the interaction between food firms and the government using MATLAB software. The results indicate that the initial probabilities of two-party game strategies affect the time length and convergence speed of system evolution but not the overall trend and final result of the evolution. Furthermore, decisions on purchasing food safety liability insurance be affected by the returns of food firms and government supervision. The more severe the punishment for food safety issues, the stronger the sense of crisis among food firms, and the higher probability they will purchase food safety liability insurance. The governance cost of food safety risks plays a role in affecting the strategic decision of the government. The ideal stable equilibrium state of the government and food firms cannot be achieved through spontaneous circulation. Suggestions are given from the perspective of government supervision and punishment to motivate food firms to insure actively.

1. Introduction

Food safety issues adversely affect people and the food industry market. These food safety problems have drawn attention worldwide. According to the World Health Organization, foodborne pathogens are a global problem, sickening an estimated 582 million people annually. Food safety is still an important issue for developing countries, which are most affected by foodborne diseases [1]. China’s food supply is subject not only to microbial contamination but also to safety problems related to pollution, chemical contamination, and adulteration. As a country that consumes a large amount of food, China has to pay great attention to food safety issues. General Secretary Xi emphasized the implementation of a food safety strategy in the report of the 19th National Congress of the Communist Party of China, so that the masses can consume safe food. With the continuous improvement in people’s living standards, consumers are paying more attention to food safety, food quality, and nutrition. However, food safety issues still frequently arise such as the national incident of infant milk powder formula with melamine added in 2008 and the waste oil incident in 2011. Food manufacturers or sales companies seriously damage the interests of the public, disrupt the normal market economic order, and impede the positive development of the food industry [2]. It is necessary to regulate the behavior of food companies and food distributors to meet the growing food demands of the public while ensuring the food safety. In addition, food safety risk is partly caused by information asymmetry between consumer and producers, as well as malpractice motivated by profit [3]. Thus, it is urgent to promote a food safety liability insurance system. Food safety liability insurance is emerging as one of the latest trends in market-based food safety regulation [4]. Food safety liability insurance system means to prevent and control food safety risks, provide relief and compensation to consumers, provide safety guarantees for food firm, stabilize social order, reduce government financial pressure, and encourage third-party insurance agencies to participate in food safety governance. In the United States, food safety liability insurance is not separately stated in the law, but the food safety liability is included in the scope of state product liability law. U.S. law does not enforce food safety liability insurance, but in legal practice, U.S. courts tend to favor ordinary consumers in litigation and require companies to make punitive damages. This means that if the U.S. food company is judged to be negligent, it will face huge compensation and face the risk of bankruptcy at any time. Therefore, companies tend to buy food safety liability insurance to transfer risk.

Compared with the United States, food firms have a low cost of breaking the law in China, so that companies can transfer risk without having to buy food safety liability insurance. In order to encourage food firms to purchase food safety liability insurance in Food Safety Law of China, the Chinese government issued the “Guiding Opinions on the Pilot Work of Food Safety Liability Insurance” and proposed adding pilot food safety liability insurance into the local food safety assessment index in 2017. It can be seen that the Chinese government has put forward new requirements for food safety risk management to ensure the safety and quality of food and encourage Chinese food firms to participate in food safety liability insurance. Although food safety liability insurance has been included as a local food safety indicator, most food firms have not purchased insurance for guaranteeing food safety. According to a report from a China Insurance Regulatory Commission official, in the original 2018 insurance premiums for some regions, first-tier, second-tier, and third-tier provinces or cities only focused on four types of insurance: property insurance, life insurance, accident insurance, and health insurance in China [5]. People were not aware of purchasing food safety liability insurance. Moreover, food firms in various regions have not actively responded to government policies. In view of this, analyzing food firms’ purchases of insurance has become an important breakthrough in promoting food safety liability insurance.

2. Literature Review

In this section, we introduce the development of food safety liability insurance in China and review related literature.

2.1. Development of Food Safety Governance in China

Food safety problems pose tremendous threats to public health in China. The government has a strong political will and faces a great deal of pressure. The State Council of China began to promote the establishment of a food safety credit system in 2008. With the implementation of the new Food Safety Law in 2009, Shanghai and Hubei became pilot projects for food safety liability insurance in 2012, and then the China Insurance Regulatory Commission and relevant departments issued the “Guiding Opinions on the Pilot Work of Food Safety Liability Insurance”. A few years later, the Thirteenth Five-Year National Food Safety Plan issued in 2017 clearly stated that the pilot program of food safety liability insurance would be expanded, the food safety liability insurance policy would be improved, and the risk control and social management functions of insurance would be fully utilized. The pilot work was launched nationwide. Current food safety liability insurance in China is not compulsory, and there are no uniform rates or terms. As a type of commercial insurance in China, food firms show low enthusiasm for food safety liability insurance. The contingency of underwriting risk is one of the necessary conditions for insurable risk. Therefore, commercial food safety liability insurance clause generally cover the applicant, the insured, and employees in the event of deliberate or gross negligence in food safety accidents. “Food Safety Development Report 2019” shows that more than 60% food safety issues caused by human factors.

Kang (2019) found coherent logic in the various recurring difficulties regarding food safety governance in China: governance is characterized by the paradox of inadequate state regulatory capacity and exclusive state domination [6]. Jiang and Zhu extensively discussed the roles and functions of government agencies in relation to the enforcement of food safety laws and regulations and the implications for their responsibilities within society [7]. However, government is not the most trusted safety inspection and certificate authority in China [8]. Scholars on the food safety governance in China highlighted the role of third-party regulation [9]. At present, some studies apply the empirical research method to food safety liability insurance in China. From the perspective of function, Zhang (2016) proposed that food safety liability insurance has limited corrective effects and that liability for compensation is limited by the theory of insurability, which is only an auxiliary means for solving food safety problems [10]. The low application rate for food safety liability insurance also restricts the full play of its function. From the perspective of compulsion and autonomy, Yang and Liu (2022) concluded that the core problem for construction of the insurance system is how to deal with the relationship between government compulsion and market autonomy correctly [11].

2.2. Literature on Food Safety Liability Insurance

Food safety liability insurance has emerged as a solution to reduce accident risk and share the risk [12,13]. It is pointed out that since its enforcement, the incentives and the effects of risk sharing have changed, indicating that government has played an important role in the field of food safety. Food safety liability insurance transfers the risks of food firm to insurance companies, so that consumers can be compensated in time and effectively resolve social conflicts. There are a few studies on food safety liability insurance [14,15]. The research mainly focused on the effectiveness and feasibility of the food safety liability insurance system. In the context of food safety, Faure (2006) used economics to study the issue of whether insurance should be compulsory in certain situations and clearly shows the difference between first-party insurance and third-party liability insurance [16]. It is concluded that compulsory insurance may be effective in certain situations. Boys (2013) analyzed the impact of food liability insurance on the sales of special crops [17]. The findings showed that financial burden of foodborne illness outbreaks has historically been borne by firms in both suspected and the actual industries at fault for the incident. Inefficiencies associated with food safety liability insurance could effectively increase the cost of specialty food production, while at the same time limiting the ability of producers to sell products even through direct marketing channels. Furthermore, Meuwissen (2019) analyzed the relationship between food certification and the feasibility of proving insurance [18]. He elaborated on the three agricultural risk cases and potential effects of animal feed industry liability insurance, infectious disease insurance, and breeding industry liability insurance.

A few studies focus on how to improve the dilemma of food safety liability insurance system the implement process. For example, Jiang and Faure (2020) found that state intervention and scope of the coverage are key contributors to fishery mutual insurance in China [19].

Other studies have explored the willingness of food firms to participate in food safety liability insurance, for example in an empirical study based on interviews with Chinese firms by George et al. (2013). They focus on the willingness of firms to participate in food safety liability insurance and its influencing factors through empirical study [14]. Their findings showed that cultural level of the employees, the status of production equipment, the reputation of insurance company, consumers’ awareness of rights protection, scope of the coverage and the completeness of relevant laws are significant for food firms’ intentions to participate in food safety liability insurance. Based on a survey of 210 fishermen in Oman, Zekri et al. (2008) investigated their willingness to pay for and enroll in an insurance scheme [20]. Results show that virtually all the socioeconomic, boat characteristics, attitudinal, and wealth variables are important in explaining the amount of the insurance premium the fishermen are willing to pay, but only a few variables were significant.

From the macro perspective, all research above in the field of food safety liability insurance mainly focuses on the food safety system, food safety risk awareness and other issues. The above research laid a theoretical foundation for the food safety liability insurance system in China and achieved experience in conducting pilot work on the system. From the micro level, when food safety liability insurance refers to relevant stakeholders, it is appropriate to using evolutionary game theory exploring the behavior of stakeholders. Evolutionary game originated from the theory of biological evolution. It is based on the premise of human-bounded rationality; the main stakeholder achieves dynamic equilibrium by continuous learning. All ideology related to evolutionary process or mechanisms can be draw by evolutionary dynamic equations.

The development of food safety liability insurance in China is conducive to protecting the legitimate rights and interests of consumers, reducing the impacts of accidents on the responsible persons and related industries, helping the government to avoid trouble and preventing and reducing the occurrence of disasters. In practical research, we found that there is a big gap between the role of food safety liability insurance and imagination.

There is abundant literature on the food safety liability insurance system, but there are only a few involving the analysis of the system by game theory, and little attention has been dedicated to government and firm behavior under the insurance system. As Fang et al. (2020) and other scholars show, there are few studies on using the stable equilibrium formed by evolutionary game to explain complex systems in reality [21]. In view of this, the research in this paper highlights these aspects. We explore the insurance decision-making and government behavior of food firms for understanding the bottleneck in the popularization of food safety liability insurance in China. In this study, a two-party evolutionary game model comprises the food safety regulator, food firm and government as players in the game. We solve a replicator dynamics equation in an evolutionary game model and seek evolutionary stabilization strategies. It is of practical significance and necessity to analyze the insurance purchase behavior of food firms and the government supervision behavior.

3. Evolutionary Game Model

3.1. The Game Theory Model

Evolutionary game theory includes players, strategy, payoff and evolutionarily stable strategy basic factors. To explain the proposed evolutionary game theory model, we define the related terms as follows:

Players: Government and a population of food firm who play the game.

Strategies: There are four strategies in the game, “purchase insurance” or “not purchase insurance” and “positive supervision” or “negative supervision”, and each player has to adopt one strategy to play the game.

Payoffs: The payoff represents how much profit a player can gain in the game, detailed in Section 3.3.

Evolutionarily stable strategy (ESS): ESS is a basic concept proposed by Maynard Smith in evolutionary game theory [22,23] (Smith & Price, 1973, Smith,1974), which is used to describe a certain strategy in the evolutionary game process. A strategy is an ESS if a whole population using that strategy cannot be invaded by a small group with a mutant genotype [24,25,26,27] (Cheng et al., 2020; Gintis, 2000; Lin et al., 2021; Taylor & Jonker, 1978).

3.2. Basic Hypothesizes of Model

The common solution to alleviate the failure of trust in goods markets is government supervision in market economic activities. Therefore, we establish the evolutionary game model. The food firm and the government have different choices when they participate in a game. The food firm chooses whether to purchase food safety insurance, and the government chooses whether to supervise. Both parties need to meet their maximum utility in economic activities. According to the needs of research and analysis, the following hypothesizes are made here:

Hypothesis 1.

Only consider the behavior of food firm and government. On the market with incomplete information, players act under bounded rationality and pursue maximum profit. The strategy space of food firm is purchase food safety liability insurance or not. The strategy space of government is positive supervision or negative supervision.

Hypothesis 2.

Food firm achieves profit is B1 when it does not purchase food safety liability insurance. The expenditure of food safety liability insurance is C1. The government profit is B2 when it chooses positive supervision. The expenditure of government supervision is C2.

Hypothesis 3.

Because the food firms are completely rational, it is necessary to introduce government penalties or subsidies for food safety threats. The probability that government supervision finds troubled food and uninsured firms is α (0 < α < 1). The penalty is C3 for troubled, uninsured food firm.

Hypothesis 4.

The government has to pay remediation cost C4 on market under the situation of negative supervision when the food firm does not purchase food safety liability insurance.

Hypothesis 5.

The probability that food firm chooses “purchase insurance” is x (0 < x < 1). The probability that government chooses “positive supervision” is y (0 < y < 1).

3.3. Construction of Model

In the case of the bounded rationality of the players, the stable nodes of specific differential equations are analyzed to form a stable equilibrium. The relevant parameters and implications are shown in Table 1. The parameters are assumed to satisfy greater than zero for simplify calculate. Based on the above hypotheses, the game payment matrix is shown in Table 2.

Table 1.

Model parameters and implications.

Table 2.

Game payoff matrix between food firm and government.

3.4. Evolutionary Game Analysis of Players’ Behavior

3.4.1. Analysis of Players’ Stability Strategy

Let the payoff expectation is when food firm chooses “purchase insurance” and the expected return of food firm be under strategy “not purchase insurance”, and average payoff expectation is :

Therefore, the replicator dynamics equation of food firm can be written as:

Let the payoff expectation is when government chooses “positive supervision” and the expected return of government be under strategy “negative supervision”, and average payoff expectation is :

The government replication dynamic equation is:

According to the stability theorem of differential equations and food government’s replication dynamic equation, the following can be known:

Let , we can obtain , , .

Let , we can obtain , , .

3.4.2. Stability Analysis of Equilibrium Points in Evolutionary Game Model

The replication dynamic system of food corporations and government is composed of differential Equations (4) and (8).

In order to find the equilibrium of the evolutionary game between the food firm and the government, it is necessary to discuss the equilibrium point for the abovementioned dynamic replication system. According to the Jacobian matrix theory, which was proposed by Friedman (1991), there are five internal equilibrium points in the system: E1(0,0), E2(0,1), E3(1,0), E4(1,1), E5(x*,y*) [28]. The Jacobian matrix of this system is composed of differential Equations (4) and (8) as shown in Equation (10), as well as its determinant and trace, denoted by det(J) and tr(J), respectively:

where , , and .

To this end, substituting the above five internal equilibrium points into (10) and (11), we can obtain the calculation results of det(J) and tr(J), as shown in Table 3.

Table 3.

Calculation results of det(J) and tr(J) at each internal equilibrium point.

If the Jacobian matrix satisfies tr(J) < 0 and det(J) > 0, the corresponding pure-strategy internal equilibrium point will be an ESS; otherwise it is an evolutionarily unstable equilibrium point or saddle point. When tr(J) > 0 and det(J) > 0, the corresponding equilibrium point will be an unstable equilibrium point. E5(x*,y*) is not ESS when tr(J) = 0. Thus, the other four internal equilibrium points need to be discussed under the following. The eigenvalues of the Jacobian matrix are obtained by substituting four equilibrium points into the matrix, as shown in Table 4. The evolutionary game stability strategy is discussed, and the path of both party evolution is analyzed in three cases (see Table 5) to calculate the eigenvalues of different equilibrium points.

Table 4.

Eigenvalues of the Jacobian matrix.

Table 5.

Local stability of equilibrium points.

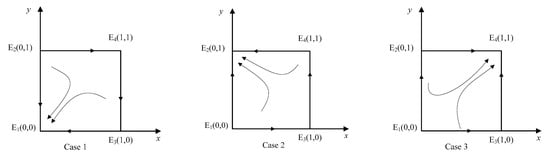

(a) Case 1. When , the eigenvalues of the Jacobian matrix corresponding to equilibrium point E1(0,0) are both negative. Therefore, E1(0,0) is the stable point of the evolutionary game, and the evolutionarily stable strategy is (not purchase insurance, negative supervision).

In this case, if the cost of food safety liability insurance is higher than the income for food firm with the government’ positive supervision, a food safety issue with not purchasing the insurance leads to a penalty, and the government bears the cost of supervision and remediation, then the food firm will choose not purchasing food safety liability insurance, and the government will choose negative supervision due to the high cost of market remediation. It can be seen that the insurance purchase behavior of the food firm is affected by the amount of insurance. In conclusion, when the amount of food safety liability insurance launched by insurance company is relatively high, it will directly affect non-insurance of food firm. The government’s choice of regulation is mainly affected by the high cost of rectifying the market. The conclusion is consistent with the high consumer acceptance of the new consumer insurance mentioned in China Insurance Consumer Confidence Index Report 2018, which is mainly due to its low price and convenient claims process. When using a dynamic phase diagram to describe the evolution process of the dynamic system, no matter what initial state it starts from, it will converge to E1(0,0) (see Figure 1).

Figure 1.

Simple schematic drawing of complete evolutionary dynamics for three cases.

(b) Case 2. When and , the eigenvalues of the Jacobian matrix corresponding to equilibrium point E2(0,1) are both negative. Therefore, E2(0,1) is the stable point of the evolutionary game, and the evolutionarily stable strategy is (not purchase insurance, positive supervision).

In this case, when the food firm’s penalty is less than its expenditure, it will not purchase insurance. Further, the total payoff obtained by the government’s positive supervision is greater than zero. At this time, the stable equilibrium point is E2(0,1). When using a dynamic phase diagram to describe the evolution process of the dynamic system, no matter what initial state it starts from, it will converge to E2(0,1) (see Figure 1).

(c) Case 3. When and , the eigenvalues of the Jacobian matrix corresponding to equilibrium point E4(1,1) are both negative. Therefore, E4(1,1) is the stable point of the evolutionary game, and the evolutionarily stable strategy is (purchase insurance, positive supervision).

In this case, when the expenditure on food quality safety insurance is less than the penalty from government, the food firm will purchase insurance. It can be seen that the severity of punishment is an important factor affecting the purchase insurance behavior of food firm. When the government’s revenue from regulating is greater than zero, the government chooses positive supervision. Using a dynamic phase diagram to describe the evolution process of the dynamic system, no matter what initial state it starts from, it will converge to E4(1,1) (see Figure 1).

4. Results

Based on replication dynamic equations and the analysis of equilibrium stable points, the strategies of two players are directly affected by initial intentions and variable parameters. The following used MATLAB 2018 software through numerical simulation analysis to further confirm that the stable points reflect the evolution trajectory of different initial value points. Evolutionary game numerical simulation is used to analyze dynamic evolution trend of two-population in the asymmetric evolutionary game.

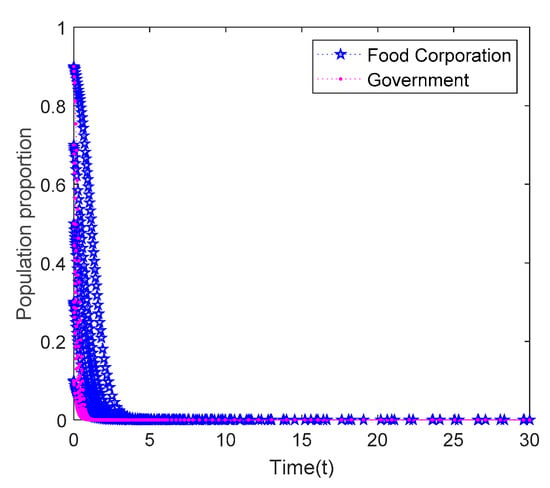

According to the constraint condition in Case 1, the following parametric values are used in the numerical analysis of Figure 2: α = 1/6, C3 = 2, C4 = 2, B2 = 1, C2 = 9, C1 = 2. In Figure 2, food firm is highly sensitive to the expenditure for food safety liability insurance, which is greater than the psychological benefits or returns on food safety liability insurance. The influence of the government’s punishment for not purchasing food safety liability insurance strategy is obvious. However, constrained by human resources and financial expenditure, the government will also weigh the benefits in terms of market supervision. Figure 2 shows that the proportion of food firm and government two-population converges to (0,0) with time: The food firm chooses not the purchase insurance, and the government chooses negative supervision.

Figure 2.

System simulation diagram of Case 1.

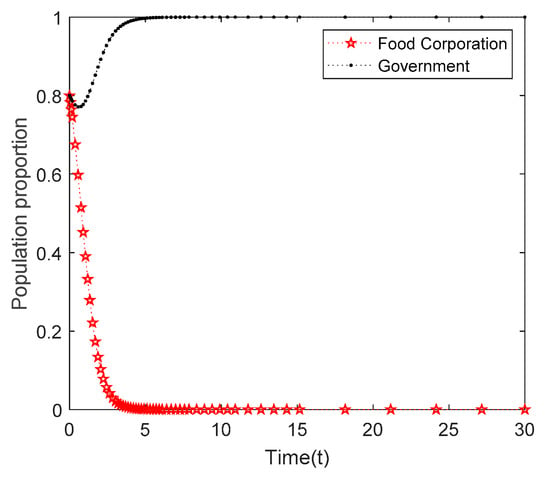

According to the constraint condition in Case 2, the following parametric values are used in the numerical analysis of Figure 3: α = 1/6, C3 = 2, C4 = 2, B2 = 1, C2 = 2, C1 = 2. In Figure 3, in contrast with Case 1, if the cost of government supervision of the market falls, the government will change strategy. Figure 3 shows that the proportion of food firm and government two-population converge to (0,1) with time: The food firm chooses not the purchase insurance, and the government chooses positive supervision.

Figure 3.

System simulation diagram of Case 2.

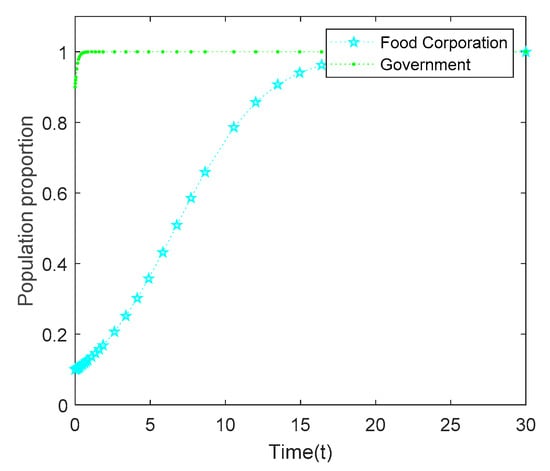

According to the constraint condition in Case 3, the following parametric values are used in the numerical analysis of Figure 4: α = 2/3, C3 = 2, C4 = 2, B2 = 6, C2 = 2, C1 = 1. In Figure 4, in contrast with Case 1 and Case 2, if the probability is high that government supervision will yield troubled food and income from fines, the government prefers positive supervision. Figure 4 shows that the proportion of food firm and government two-population converges to (1,1) with time: The food firm chooses purchase insurance, and the government chooses positive supervision.

Figure 4.

System simulation diagram of Case 3.

5. Conclusions and Implications

In this paper, we propose an evolutionary game theory model to analyze the strategies of food firms purchasing insurance with the government supervision strategy. A two-population game is considered in our model in which two players are randomly selected from the population to play the game, and the strategy with a better-than-expected payoff will be adopted by most of the population by solving the replication dynamic equation, calculating the eigenvalues of the equilibrium points in a Jacobian matrix, and obtaining the evolutionary stable strategy of the game model. Firstly, the benefits and reimbursement rates play an important role in food firms’ decision behavior related to food safety liability insurance. Secondly, the low registration rate of food industry entities in China increases the difficulty of government enforcement. In the short term, it is impossible for the government and food firms to reach stable and balanced decision making. A scheme of reasonable penalties will help mobilize the enthusiasm of government and establish a mutually beneficial incentive mechanism and risk prevention mechanism. Lastly, the government can establish a food safety information database to connect with the public, improve the efficiency of supervision and reduce the risk of food safety accidents.

Food safety liability insurance programs in high-risk industries help improve supervision. Based on the food safety incidents in China, meat and dairy products belong to the high-risk food industry. Therefore, in the high-risk food industry of meat and dairy products, the implementation of food safety liability insurance helps to clarify the food consumer’s liability and insurance liability, improve the service standards of the insurance industry, solve the lack of standards for the normal operation of the food safety liability insurance system, optimize the insurance interest structure of operators in the food value chain and enhance liability pressure on the vertical relationship between operators, which bridges the institutional gap between insurance liability and food safety liability. Furthermore, insurance companies, industry organizations and institutional cooperation can use online platforms to incorporate food safety liability insurance related activities such as insurance information, accident information and compensation information into the credit files of food corporation.

Food safety liability insurance is one of the ways to transfer the main responsibility of food firms and diversify their risks. The promotion of food safety liability insurance to food firm is only an auxiliary method and cannot completely solve food safety problems. Since food safety liability insurance does not have an inherent incentive mechanism, the food industry’s willingness to insure is low, and risk assessment is also difficult. This comprehensive study may facilitate the development of food safety liability insurance and provide some suggestions for government supervision on food safety in further studies.

Author Contributions

Conceptualization, Writing—original draft preparation, Review and editing, Funding acquisition, G.Z.; Methodology; software; Formal analysis, Editing, Y.Z. All authors have read and agreed to the published version of the manuscript.

Funding

The work was financially supported by the young innovative talents project of Guangdong ordinary universities (2017WQNCX066) and the Higher Education Teaching Research and Reform Project of Guangdong Province. “Exploration and practice of PBL Teaching Model of integrating ideological and political elements into Consumer behavior course”.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Odeyemi, O.A.; Sani, N.A.; Obadina, A.O.; Saba, C.K.S.; Bamidele, F.A.; Abughoush, M.; Asghar, A.; Dongmo, F.F.D.; Macer, D.; Aberoumand, A. Food safety knowledge, attitudes and practices among consumers in developing countries: An international survey. Food Res. Int. 2018, 116, 1386–1390. [Google Scholar] [CrossRef] [PubMed]

- Kendall, H.; Kuznesof, S.; Dean, M.; Chan, M.-Y.; Clark, B.; Home, R.; Stolz, H.; Zhong, Q.; Liu, C.; Brereton, P.; et al. Chinese consumer’s attitudes, perceptions and behavioural responses towards food fraud. Food Control 2018, 95, 339–351. [Google Scholar] [CrossRef]

- Chu, M.; Wang, J. Central–local collaboration in regulating food safety in China. Public Money Manag. 2018, 38, 437–444. [Google Scholar] [CrossRef]

- Cogan, J.A. The uneasy case for food safety liability insurance. Brooklyn Law Rev. 2015, 81, 1495. Available online: https://brooklynworks.brooklaw.edu/blr/vol81/iss4/9 (accessed on 22 July 2016).

- China Insurance Consumer Confidence Index Team. China Insurance Consumer Confidence Index Report 2018. Insur. Stud. 2019, 7, 3–13. (In Chinese). Available online: https://www.cnki.com.cn/Article/CJFDTOTAL-BXYJ201907001.htm (accessed on 3 July 2019).

- Kang, Y. Food safety governance in China: Change and continuity. Food Control 2019, 106, 106752. [Google Scholar] [CrossRef]

- Jiang, Q.; Zhu, Y. Challenges for enforcing food safety law and regulations in China: Case studies of government agencies in the Shanghai region. Asian-Pac. Law Policy J. 2011, 18, 36–62. [Google Scholar]

- Liu, R.; Gao, Z.; Nayga, R.M.; Snell, H.A.; Ma, H. Consumers’ valuation for food traceability in China: Does trust matter? Food Policy 2019, 88, 101768. [Google Scholar] [CrossRef]

- Zhang, M.; Qiao, H.; Wang, X.; Pu, M.-Z.; Yu, Z.-J.; Zheng, F.-T. The third-party regulation on food safety in China: A review. J. Integr. Agric. 2015, 14, 2176–2188. [Google Scholar] [CrossRef]

- Zhang, L. Engineering Compulsory Food Safety Liability Insurance in China: A Joint Perspective of Public and Private International Law. J. East Asia Int. Law 2016, 9, 341–342. [Google Scholar] [CrossRef]

- Yang, Z.; Liu, X. The impacts of compulsory food liability insurance policy on stock price crash risk: Evidence from Chinese food industry. Finance Res. Lett. 2022, 50, 103232. [Google Scholar] [CrossRef]

- Shavell, S. On liability and insurance. In Economics and Liability for Environmental Problems; Routledge: London, UK, 2018; pp. 120–132. [Google Scholar]

- Shavell, S. A model of the optimal use of liability and safety regulation. In Economics and Liability for Environmental Problems; Routledge: London, UK, 2018; pp. 271–280. [Google Scholar]

- Kwadz, G.O.T.-M.; Kuwornu, J.K.M.; Amadu, I.S.B. Food Crop Farmers’ Willingness to Participate in Market-Based Crop Insurance Scheme: Evidence from Ghana. Res. Appl. Econ. 2013, 5, 1–21. [Google Scholar] [CrossRef]

- Haymerle, H. An insurance industry perspective on property protection and liability issues in food factory design. In Hygienic Design of Food Factories; Holah, J., Lelieveld, H.L.M., Eds.; Woodhead: Cambridge, UK, 2011; pp. 743–758. [Google Scholar] [CrossRef]

- Faure, M.G. Economic Criteria for Compulsory Insurance. Geneva Pap. Risk Insur.-Issues Pract. 2006, 31, 149–168. [Google Scholar] [CrossRef]

- Boys, K.A. Food product liability insurance: Implications for the marketing of specialty crops. Choices 2013, 28, 1–5. Available online: https://www.jstor.org/stable/choices.28.4.11 (accessed on 28 April 2013).

- Meuwissen, M.P.M. Can certification enhance the feasibility of insurance? In Certification–Trust, Accountability, Liability; Rott, P., Ed.; Springer International: Berlin, Germany, 2019; pp. 133–142. [Google Scholar] [CrossRef]

- Jiang, M.; Faure, M. Risk-sharing in the context of fishery mutual insurance: Learning from China. Mar. Policy 2020, 121, 104191. [Google Scholar] [CrossRef]

- Zekri, S.; Mbaga, M.D.; Boughanmi, H. Fishermen Willingness to Participate in an Insurance Program in Oman. Mar. Resour. Econ. 2008, 23, 379–391. [Google Scholar] [CrossRef]

- Fang, L.; Shi, G.; Wang, L.; Li, Y.; Xu, S.; Guo, Y. Incentive mechanism for cooperative authentication: An evolutionary game approach. Inf. Sci. 2019, 527, 369–381. [Google Scholar] [CrossRef]

- Smith, J.M.; Price G, R. The logic of animal conflict. Nature 1973, 246, 15–18. [Google Scholar] [CrossRef]

- Smith, J.M. The theory of games and the evolution of animal conflicts. J. Theor. Biol. 1974, 47, 209–221. [Google Scholar] [CrossRef]

- Cheng, L.; Liu, G.; Huang, H.; Wang, X.; Chen, Y.; Zhang, J.; Meng, A.; Yang, R.; Yu, T. Equilibrium analysis of general N-population multi-strategy games for generation-side long-term bidding: An evolutionary game perspective. J. Clean. Prod. 2020, 276, 124123. [Google Scholar] [CrossRef]

- Gintis, H. Game Theory Evolving: A Problem-Centered Introduction to Modeling Strategic Behavior; Princeton University Press: Princeton, UK, 2000; pp. 207–209. [Google Scholar] [CrossRef]

- Lin, D.-Y.; Juan, C.-J.; Ng, M. Evaluation of green strategies in maritime liner shipping using evolutionary game theory. J. Clean. Prod. 2020, 279, 123268. [Google Scholar] [CrossRef]

- Taylor, P.D.; Jonker, L.B. Evolutionary stable strategies and game dynamics. Math. Biosci. 1978, 40, 145–156. [Google Scholar] [CrossRef]

- Friedman, D. Evolutionary game in economics. Econometrica 1991, 59, 637–666. Available online: https://www.semanticscholar.org/paper/EVOLUTIONARY-GAMES-IN-ECONOMICS-Friedman/b7778738a1d31c567ae0ae8b637f28a1d90e1710 (accessed on 13 April 2008). [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).