Abstract

Although existing work has found that increased director gender diversity can help improve corporate environmental performance, few of them tried to examine whether this improvement is affected by the degree of gender diversity and ownership structure. Using data on Chinese listed companies, this paper contributes to prior work by investigating the extent to which the degree of gender diversity and ownership structure affect the improvement. The findings are twofold: On the one hand, as the proportion of female directors increases, the improvements they bring to firms’ environmental performance fade gradually. On the other hand, the relationship between director gender diversity and a firm’s environmental performance is stronger in state-owned enterprises. The results of this paper have theoretical and practical implications and the results keep steady after a series of econometric tests. We also interpret our findings by relying on insights from different theories (i.e., agency, resource dependence, token hire and ownership theories).

1. Introduction

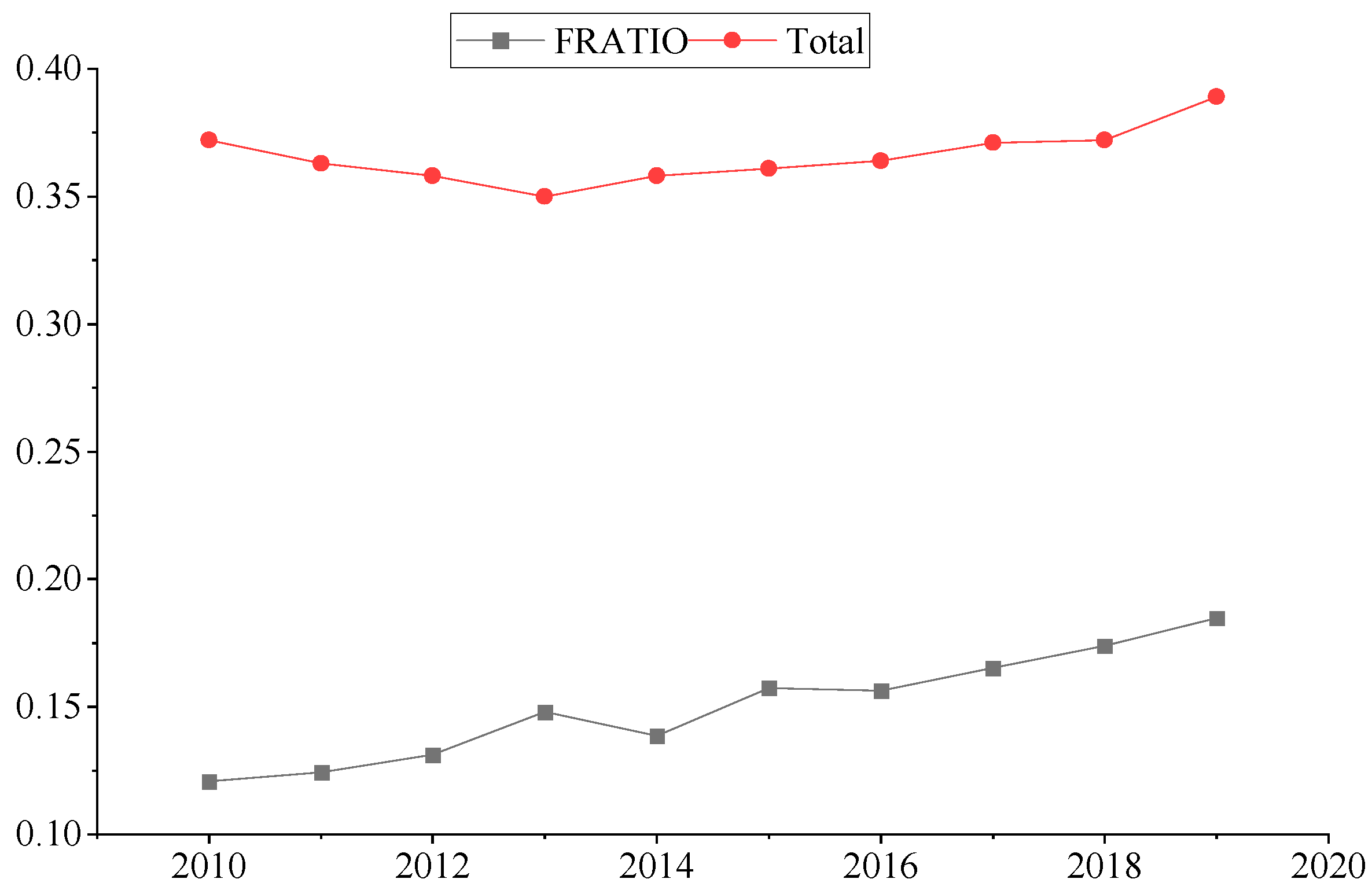

China has made great economic achievements in the past four decades and women workers have contributed greatly. From 2010 to 2019, the proportion of women in employment is about 35–40% (see Figure 1). However, the active role of female leaders in corporate management has not been well played; the proportion of women as directors was only 18.47%, far lower than men. A large part of the reason for this comes from the idea of “men are outside, women are inside” in traditional Chinese culture, and the resulting distorted perception of women’s gender roles. Therefore, great changes may occur and corporates can perform better when the proportion of female leaders in Chinese companies increases. In addition, as the largest developing country, state-owned enterprises play an important role in China’s economy and the differences in ownership make them special in corporate governance. These characteristics motivate us to explore the potential changes caused by the degree of gender diversity and ownership structure.

Figure 1.

Changes in the proportion of women in the workforce and in senior management (the red line represents the share of women in the workforce as a whole and the black line represents the share of women as directors of Chinese listed companies).

The existing literature has linked this topic to environmental protection, exploring the relationship between increased female leadership and corporate environmental performance. In China, rapid economic development was achieved mainly at great environmental and social costs, this motivates us to pay attention to the role of female directors in companies’ environmental performance in China. The environmental dimension of corporate social responsibility (CSR) scores, environmental information disclosure, or implementation of environmental policies are often used as a proxy for firms’ environmental performance and researchers have found that director gender diversity is positively related to the firm’s environmental performance [1,2]. More importantly, the potential changes or improvements brought by female directors deserve further consideration, but few studies have focused on the topic. We used a sample of Chinese listed companies and tried to answer two questions: Will the improvement gradually diminish as the proportion of female directors increases? Or in other words, does a phenomenon similar to the theory of diminishing marginal utility exist here? And will the special position and characteristics of state-owned enterprises (SOEs) also affect the improvement?

There are strong theoretical reasons why the improvements gradually diminish as the proportion of female directors increases: according to the Business Life Cycle theory [3], more attention would be paid to environmental governance in the early stage, causing new female leaders to focus more on sustainable development and have a greater impact on the improvement of corporate environmental performance. Additionally, the Token theory proposed by Kanter [4,5] suggests that when the proportion of minority groups rises to a certain level, they can gain trust and influence, thus their rights to speak will be significantly improved. However, as the ratio rises further, the relationship between the minority and the majority changes qualitatively and great change will happen in the nature of group interactions [5,6,7,8].

There is also theoretical support explaining why the improvements brought by female directors differ between SOEs and private enterprises (PEs). SOEs tend to have more social responsibilities than private companies [9] and their executives are usually government officials [10], which means SOEs are often used as platforms for governments to promote the implementation of environmental governance policies. Thus, there should be differences in environmental performance between SOEs and PEs when new female directors enter the boardroom.

After a series of econometric tests, our results still hold for our sample. Our analysis builds on the existing literature by providing an in-depth analysis of the relationship between an increase in the proportion of female leaders and improved corporate environmental performance, prompting us to rethink the increase in the proportion of women leaders. We also draw insights from agency, resource dependence and ownership theories.

The rest of this paper is arranged as follows: the second part makes a literature review from three perspectives and puts forward our research hypotheses; the third part introduces data sources, samples and variables used in the model; the fourth part presents the results of empirical analysis and discusses endogeneity issues as well as robustness testing; the fifth part summarizes this paper’s conclusions and remarks.

2. Related Literature and Research Hypotheses

2.1. Director Gender Diversity and Environmental Performance

Gender diversity in directors is a hot topic in corporate governance discussions. Just as suggested by Hillman et al. [11], resource dependence theory helps explain why we need gender diversity in directors. Resource dependence theory was first developed by Pfeffer [12]. It assumes that the company operates in an open system and needs to exchange with the external environment and obtain various required resources. The directors of the company act as a bridge between the company and the external environment, providing the funds and materials needed to keep the company running. Hence, gender, as an important measure of diversity in directors, has become a classic perspective for studying corporate performance based on resource dependence theory. The addition of women can not only solve the problem that male executives are prone to overconfidence in major corporate decisions [13,14,15] but also make the decision-making process more democratic and participatory [6].

Then, many researchers have found that women are a group that pays more attention to environmental protection than men [16,17,18,19], for example, female divers pay more attention to the protection of the underwater environment and touch the substrate less than male divers [20]. Thus, when more women gradually entered the decision-making level, the environmental impact of corporate strategy will be more considered [21,22], causing the corporate environmental performance to be improved. Existing research has confirmed a causal relationship between them, the difference is the measurement of environmental performance: Some literature employs the environmental dimension in Corporate Social Responsibility (CSR) [21,23,24,25]. Another part of the literature uses specific scores to measure corporate environmental performance [1,2]. In addition, some studies used corporate environmental information disclosure as an explained variable [23,26,27,28,29,30,31,32]. The relevant literature is classified in Table 1. Therefore, based on the above analysis, we propose the following hypothesis:

Table 1.

Literature about director gender diversity and firms’ environmental performance.

Hypothesis 1 (H1).

Director gender diversity is positively related to the firm’s environmental performance.

2.2. Potential Changes as the Ratio Increases

Existing research has found that the increase in the proportion of female leaders leads to improvements in corporate environmental performance. However, does a higher proportion of female leaders necessarily mean better improvements? Few pieces of literature have tried to answer this question. On 9 December 2005, the gender quota system for the board of directors came into effect in Norway, causing the representation of women on their boards of directors to rise rapidly. However, the effect of this policy does not seem to be satisfactory. Ahern and Dittmar [33] found that this measure caused the firm’s stock price and Tobin’s Q to drop. This reminds us that the same consequences may occur when the proportion of women leaders increases [34].

Two reasons may cause the improvements brought by female directors to change as the ratio of women leaders increases. One comes from the business objectives of the enterprise at different stages (also expressed as the Business Life Cycle theory, which was first proposed by Adizes [3]). It suggests that if a company wants to achieve sustainable development, it must take into account the profitability, social and environmental performance over the long term [35]. Among these business objectives, environmental objectives are often the first to be considered. During the first stage of the business life cycle (usually called the birth stage), firms tend to stabilize the market, improve product reputation, and gain sustainable development capabilities, and then at the second stage (usually called the growth stage), they begin to seek investment opportunities and make profits [36]. Since entering the 21st century, enterprises have paid more and more attention to environmental protection issues, for example, General Electric (GE) launched the “Green Creation” strategy in 2005, which combines profitability and energy conservation to provide profitable environmental protection solutions for global enterprises and in 2009, GE’s annual sales reached USD 157 billion, and products and solutions with environmental advantages brought GE’s revenue of USD 18 billion, accounting for more than 11%. This is strong proof that enterprises pursue “environmental protection first, then profit” in the development process.

Therefore, the company’s initial female directors will pay more attention to improving environmental performance and there are two underlying logics: On the one hand, it is because of the government’s mandatory environmental regulation, which requires enterprises to meet certain environmental governance standards in the process of production, otherwise, they will be punished. Another reason is that taking the lead in environmental governance and obtaining certification can help companies improve their competitiveness. For example, enterprises with ISO14001 certification have more advantages in enhancing their market position and exporting [37,38]. Thus, in order to obtain better sustainable development ability, enterprises will have different business goals at different stages [39] and environmental performance will be considered first. Therefore the existing female leaders will pay more attention to the firm’s environmental performance to establish a good company reputation, which means the new addition of female directors will bring more improvements to the firm’s environmental performance in the beginning, and with further addition of new female leaders, they will focus more on other business goals such as economic benefits because a good reputation and sustainability are formed, thus causing the improvements in the firm’s environmental performance to diminish.

The other reason why the marginal improvement decreases as the ratio of female directors increases comes from the Token theory proposed by Kanter [4,5], who thought that when the proportion of minority groups rises to a certain level, they can gain trust and influence, thus their rights to speak will be significantly improved [6,7]. However, as the ratio rises further, the relationship between the minority and the majority changes qualitatively and great change will happen in the nature of group interactions [4,7]. Therefore, when the proportion of female leaders is low, the addition of new female leaders can bring them more attention and have a greater impact on the improvement of corporate environmental performance. However, when the ratio is further expanded, female leaders are no longer token hires, and the improvement in the company’s environmental performance will be less than it was initially. When the proportion of female leaders gradually equalized with men, the improvement effect was smaller. Thus, the marginal improvement in a firm’s environmental performance diminishes as the ratio of female directors increases.

Therefore, based on the above analysis, we hypothesize that:

Hypothesis 2 (H2).

The marginal improvement in a firm’s environmental performance diminishes as the ratio of female directors increases.

2.3. Potential Impact of Different Ownership on Improvement

Existing studies have found that ownership type is related to CSR performance [40,41,42,43]. For example, family firms tend to care more about the external environment in the community, and thus have a better CSR performance [42]. As an important factor in distinguishing firm ownership, the differences in CSR performance between SOEs and PEs were also validated [43]. Regrettably, all the aforementioned studies just considered the overall CSR performance. As firms’ environmental practices tend to differ from other social aspects [44], it is necessary for us to specifically analyze the potential impact of different ownership on a firm’s environmental performance. Based on existing research, we attribute this effect to the characteristics of the state-owned enterprise itself and its leaders.

SOEs are often defined as “legally independent firms with direct ownership by the state” [9]. The characteristics of direct government management require SOEs to take into account not only economic and social goals but also political implications when conducting corporate governance. Thus, SOEs are more like administrative organizations compared to PEs because they bear more social responsibility and their executives are usually government officials [10]. Environmental governance has always been an important goal of governments and SOEs are often used as platforms for governments to promote the implementation of environmental governance policies, and they are more involved in environmental governance than PEs. Profitability is not the most important goal of SOE governance, instead, its role in maintaining social stability and promoting sustainable development matters most [45] because they usually become an object for other enterprises to imitate. Additionally, the unique advantages of SOEs, such as more accessibility to loans from banks and preferential policies, also give them an edge in the progress of the green transition [46,47]. Based on the findings above, when a new female director enters the boardroom, the improvements she brings to the firm’s environmental performance should be stronger in SOEs than in PEs.

The characteristics of SOE leaders are also an important factor affecting environmental performance improvements. Leaders of SOEs are often appointed by governments and they are more focused on political incentives or administrative ranking [48]. Because SOE leaders are mainly more accountable to the government than to other shareholders [45], they will pay more attention to the environmental impact of corporate strategies to meet the government’s environmental governance requirements. In addition, SOE leaders are more risk-averse [25] and they will deliberately avoid reputational damage to the business due to poor environmental governance. Thus, the female directors in SOEs would make firms perform better in environmental governance than in PEs.

Therefore, based on the preceding arguments and findings, we hypothesize that:

Hypothesis 3 (H3).

The relationship between director gender diversity and a firm’s environmental performance will be stronger in SOEs than in PEs.

3. Research Design

3.1. Data and Sample

The sample was drawn from China’s listed companies on the Shanghai and Shenzhen Stock Exchanges. Data on a firm’s environmental performance were collected from the HeXun database, which was widely used in research on the CSR performance of Chinese corporates [2,49,50]. The wind database and CSMAR were also used to obtain data on other variables. Based on data availability, the sample year was finally restricted from 2010 to 2019. In most cases, we have around 110,000 firm-year observations.

3.2. Variable Definition and Model

Table 2 also shows the names of the variables used in our econometric model and how we measure them. To test our hypothesis, we used the environmental dimension of HeXun scores as a proxy for firms’ environmental performance. In addition, in order to test the robustness of the regression results, we also counted the number of times companies disclosed environmental governance information within a year and the amount of environmental protection investment as dependent variables [51,52].

Table 2.

Measures and variables.

Our independent variables include the company’s total asset size (Size), return on equity (ROE), the net profit margin on total assets (ROA), number of directors (Board), book-to-market ratio (BM), total asset turnover (ATO), debt-to-equity ratio (Lev), number of independent directors (Indep) and two-in-one indicator (Dual). We also counted the age and educational background of the new female leaders of the company. Therefore, we developed the following econometric model:

where represents the company i’s environmental performance in year t; represents the proportion of female leaders in company i in year t; and is the control variable at the enterprise level, including variables such as ROA, ROE, and the number of board members. In order to eliminate the influence of hard-to-observe variables, such as culture, enterprise management level, etc., model (1) also controls the firm fixed effect and time fixed effect to eliminate the endogeneity problem to a certain extent, and is the error term.

4. Empirical Results and Analysis

4.1. Descriptive Statistics

Table 3 presents descriptive statistics on our sample firms’ director gender diversity and environmental performance, as well as other control variables. The average environmental performance score of enterprises is 1.15, and the average proportion of female leaders is 24.6%, higher than that of a study that also used a sample of companies with Chinese firms (Elmagrhi et al. [1], whose sample year was 2011–2015), indicating that women’s voice in corporate governance has grown. The average age of new female leaders is 46 years old and the average degree of education is undergraduate. The sample companies have an average of 2.14 board members, of which approximately 37% are independent directors and approximately 28.52% have the same person performing the dual roles of chairperson and CEO. On average, the ROE is 0.0420 and the average ROA is 0.0375. The average BM is 1.4132, the average gearing ratio is 0.4587, and the average ATO is 0.6306.

Table 3.

Descriptive statistics for variables employed.

In order to identify whether the model has serious multicollinearity problems, Table 4 shows the variance inflation factors (VIF) for each variable in Table 4, and the mean VIF was between one and two, also suggesting that there is no serious multicollinearity problem.

Table 4.

VIF.

4.2. Regression Analysis

Table 5 shows the regression results where we find that the improvement of director gender diversity significantly improves the enterprise’s environmental performance. If the proportion of women in directors increases by 100%, the company’s environmental performance score will increase by three, implying that director gender diversity is positively related to the firm’s environmental performance. Thus, Hypothesis 1 is empirically supported and consistent with the results of previous studies [1,2,53,54] and confirms the theory of Post et al. [22] that when more women gradually entered the decision-making level, the environmental impact of corporate strategy will be considered more.

Table 5.

Regression results.

Secondly, to test Hypothesis 2, we calculated the quintile based on the proportion of female leaders and grouped companies based on different intervals of ratio of female directors: [0.023, 0.148], (0.0148, 0.208], (0.208, 0.263], (0.263, 0.333], (0.333, 1). We divided the sample into five groups according to the proportion of female directors and conducted regression according to model (1), respectively, Table 6 shows the result. All control variables in this paper are consistent and represented as Controls. The results of grouped regression can’t directly be compared before being tested for the difference between them. We perform it in Appendix A. The results show that our coefficients are comparable. As the proportion of female directors increases, the improvements they bring to firms’ environmental performance fade gradually and thus, Hypothesis 2 is supported by empirical evidence. This is also consistent with the prediction of Token theory and business objectives of enterprises in different stages [4,5,6,7,37,38], new female directors in firms with a high proportion of women leaders tend to obtain more attention, and it is more in line with the business goals of the company in the initial stage. Our finding extends the results of prior work by answering the question ‘does a higher proportion of female leaders necessarily mean better improvements?’. Consistent with the finding of Ahern and Dittmar [33], the analysis results show that blindly pursuing an increase in the proportion of women leaders does not necessarily lead to better environmental performance improvements.

Table 6.

Differences in impact within different intervals.

Finally, to test Hypothesis 3, we group companies according to whether they are SOEs and regressed according to model (1); Table 7 shows the results. The coefficient of SOEs is significantly bigger than that of PEs. However, considering Hypothesis 2 was confirmed, the difference in coefficients between SOEs and PEs may be due to the fact that their proportions of women leaders are in different ranges. Therefore, we further grouped our samples based on different intervals of the ratio of female directors: [0.023, 0.148], (0.0148, 0.208], (0.208, 0.263], (0.263, 0.333], (0.333, 1) and their ownership: SOEs or PEs. Table 8 presents the results. We find that in most intervals, the relationship between director gender diversity and the firm’s environmental performance is stronger in SOEs than in PEs, thus we can conclude that Hypothesis 3 is empirically supported. This confirms our conclusion that female directors in SOEs tend to have better improvement in environmental performance than PEs because of the characteristics of the state-owned enterprise itself and its leaders [25,44,46,47].

Table 7.

The effect of ownership difference.

Table 8.

The effect of ownership difference.

4.3. Additional Analyses

We also used other methods to test the robustness of the results and solve endogenous problems. In the previous analysis, we used scores developed by Hexun to measure a firm’s environmental performance (CSR-En) to measure the environmental performance of enterprises. Referring to the relevant research [22,28,30], we also select annual environmental information disclosure times (D-En) and corporates’ annual environmental investment (EnInvest) as the explained variable. Table 6 shows the results in columns (3) and (4), and the results show that the conclusions of this paper are still robust after changing the indicators to measure the environmental performance of enterprises, showing that our conclusions are reliable.

When exploring the effect of ownership structure, we used a grouped regression approach. Another common approach is to introduce a dummy variable representing the ownership structure and multiply it with the explained variable before incorporating it into the model [55,56]. Therefore, we use SOE to represent the ownership of the sample company. SOE is one only when the sample company is state-owned and zero in other cases. The second column of Table 5 shows the regression results and the coefficient of the interaction term is significantly positive, indicating that the increase in the proportion of female executives in state-owned enterprises brings greater improvement in environmental performance. This proves that our previous conclusion is robust.

The regression based on model (1) may have endogenous problems. To solve it, we further adopted the instrumental variable method. Referring to the variable construction method of the relevant literature, we adopted the mean value of the proportion of female directors of other enterprises in the city where the enterprise is located as an instrumental variable [54,55], and regression analysis was performed using panel two-stage least squares. The underlying logic is that the proportion of female directors of enterprises in the same city will be affected by other enterprises, therefore this instrumental variable is correlated with endogenous variables; at the same time, gender diversity in directors at other companies does not directly affect the company’s environmental performance, therefore the instrumental variable satisfies the exogenous condition. The regression results are shown in Table 9, Table 10 and Table 11. By using the instrumental variable two-stage least squares method, we found that after controlling the endogeneity of the model, the aforementioned conclusions still hold.

Table 9.

Endogenous problems (2SLS for H1).

Table 10.

Endogenous problems (2SLS for H2).

Table 11.

Endogenous problems (2SLS for H3).

5. Conclusions

With data on Chinese listed companies, this paper finds that, on the one hand, as the proportion of female directors increases, the improvements they bring to firms’ environmental performance fade gradually. On the other hand, the relationship between director gender diversity and a firm’s environmental performance is stronger in state-owned enterprises.

Although many studies have found that director gender diversity is positively related to corporates’ environmental performance, there is a clear lack of in-depth analysis on what potential changes will happen to the improvements as the proportion of female directors increases. Thus, we perform this study to examine whether changes would happen and the underlying reasons behind them. We also, according to different theoretical points of view, explain our findings (i.e., agency, resource dependence, token hire and ownership theories). The contributions of our study are as follows:

First, the theoretical implications lie in findings that improvements brought by female directors are affected by the degree of director gender diversity and companies’ ownership. According to the conclusions of existing research, an increase in the proportion of female leaders can help companies improve their environmental performance [1,20,22,24], which means that the higher the proportion of female leaders, the better the improvement. However, just as the classic theory of diminishing marginal utility says, excessive pursuit of consumption of a product will gradually weaken its utility. Our research finds that there is a similar phenomenon of diminishing marginal utility in corporate governance: the marginal improvement in a firm’s environmental performance is diminished as the ratio of female directors increases. There are two reasons behind this: On one hand, firms tend to stabilize the market, improve product reputation, and gain sustainable development capabilities at the birth stage, causing new female leaders to pay more attention to environmental performance. With the further addition of other new female leaders, they will focus more on other business goals such as economic benefits because a good reputation and sustainability were formed, thus causing the improvements in the firm’s environmental performance to diminish. On the other hand, when the proportion of female leaders is low, the addition of new female leaders can bring them more attention and have a greater impact on the improvement of corporate environmental performance [8]. However, when the ratio is further expanded, female leaders are no longer token hires [4,5], and the improvement in the company’s environmental performance will be less than initially. In addition, although the importance of ownership was recognized, few studies focus on SOEs’ role in maintaining social stability and promoting sustainable development, and the possible impact it may cause on the relationship between director gender diversity and firms’ environmental performance, our research fills this knowledge gap. Meanwhile, when improving corporate environmental performance, we should not only focus on the ratio of female executives but also pay attention to the combination of multiple measures, such as increasing the proportion of female executives while promoting paperless offices or building more environmentally friendly production lines so as to improve corporate environmental performance more efficiently.

Second, our findings also have practical implications for policymakers and regulators. Increasing the proportion of female leaders does improve corporate environmental performance, taking into account the two important topics of gender equality and environmental protection. However, that does not mean we are going to blindly increase the percentage of women leaders or directly set quotas for women. According to our findings, efforts to increase the proportion of female leaders in SOEs with low female leadership are more efficient than in PEs with relatively high female leadership. When a company’s environmental performance is poor and female leaders are lacking, adding new female leaders can effectively contribute to improved environmental performance and promote gender equality. However, when a company’s environmental performance meets the required standards or the proportion of female leaders reaches a certain level, the improvement in environmental performance brought about by new female leaders declines, thus the company should not blindly increase the proportion of female leaders in order to further improve its environmental performance but find other more efficient ways. This can be very beneficial to improve the effectiveness of policies aimed at increasing the proportion of women leaders for the companies’ sustainable development (such as the gender quota system for the board of directors in the Norwegian and German government’s efforts to make the percentage of women in senior management positions in the country’s listed companies mandatory).

The strength of our study Is that (1) it examines the effects of the degree of gender diversity and ownership structure, which were overlooked in previous studies; (2) Chinese listed companies are used as samples, which are rarely used but of great practical significance. The conclusion of this paper is of great help in further understanding the role of female executives in developing countries. However, due to the availability of data, our sample is limited to the listed company and ordinary companies are not included in the scope of the study. Therefore, our conclusion cannot be directly extended to all companies; a more reasonable sample selection could also enable us to analyze enterprise management issues and draw more universal conclusions [57,58].

Finally, in this paper, we use the proportion of female directors as independent variables, and further research can take the number of female directors as an alternative to explore the existence of ‘critical mass’ in different degrees of director gender diversity (just as Ben-Amar et al. [30] did). In addition, our sample companies only include listed companies in China and further research could extend our study to normal companies in other countries.

Author Contributions

Conceptualization, L.C.; methodology, L.C. and Z.L.; software, Z.L.; investigation, Y.Z.; data curation, Z.L.; writing—original draft preparation, Z.L.; writing—review and editing, L.C. and Y.Z.; project administration, Y.Z.; funding acquisition, Y.Z. All authors have read and agreed to the published version of the manuscript.

Funding

This research was supported by the Major Program of the National Social Science Fund of China (Grant No. 18ZDA068).

Informed Consent Statement

Ethical review and approval were waived for this study because all our data on executives come from publicly available annual reports.

Data Availability Statement

http://www.csmar.com/channels/31.html (accessed on 10 May 2022).

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

Table A1.

Results of seemingly unrelated regression.

Table A1.

Results of seemingly unrelated regression.

| Coefficient Difference Test | Group 1 | Group 2 | Group 3 | Group 4 | Group 5 |

|---|---|---|---|---|---|

| Group 1 | 28.35 (0.0000) | 21.93 (0.0000) | 22.84 (0.0000) | 28.88 (0.0000) | |

| Group 2 | 3.68 (0.0551) | 4.55 (0.0328) | 21.33 (0.0000) | ||

| Group 3 | 17.43 (0.0000) | 4.79 (0.0287) | |||

| Group 4 | 14.02 (0.0002) |

Notes: The p-value is shown in parentheses, the null hypothesis is that the error terms of the grouped regression model are correlated, and the smaller the p-value means the coefficient is comparable.

References

- Elmagrhi, M.H.; Ntim, C.G.; Elamer, A.A.; Zhang, Q. A study of environmental policies and regulations, governance structures, and environmental performance: The role of female directors. Bus. Strategy Environ. 2019, 28, 206–220. [Google Scholar] [CrossRef]

- Zhong, M.; Xu, R.; Liao, X.; Zhang, S. Do csr ratings converge in China? A comparison between rks and hexun scores. Sustainability 2019, 11, 3921. [Google Scholar] [CrossRef]

- Adizes, I. Corporate Life Cycles: How and Why Corporation Grow and Die and What to Do about It; Prentice-Hall: New York, NY, USA, 1988. [Google Scholar]

- Kanter, R.M. Men and Women of the Corporation; Basic Books: New York, NY, USA, 1977. [Google Scholar]

- Kanter, R.M. Some Effects of Proportions on Group Life. Am. J. Sociol. 1977, 82, 965990. [Google Scholar] [CrossRef]

- Bear, S.; Rahman, N.; Post, C. The impact of board diversity and gender composition on corporate social responsibility and firm reputation. J. Bus. Ethics 2010, 97, 207–221. [Google Scholar] [CrossRef]

- Etzkowitz, H.; Kemelgor, C.; Neuschatz, M.; Uzzi, B.; Alonzo, J. The Paradox of Critical Mass for Women in Science. Science 1994, 266, 51–54. [Google Scholar] [CrossRef]

- Torchia, M.; Calabrò, A.; Huse, M. Women directors on corporate boards: From tokenism to critical mass. J. Bus. Ethics 2011, 102, 299–317. [Google Scholar] [CrossRef]

- Cuervo-Cazurra, A.; Inkpen, A.; Musacchio, A.; Ramaswamy, K. Governments as owners: State-owned multinational companies. J. Int. Bus. Stud. 2014, 45, 919. [Google Scholar] [CrossRef]

- Fan, J.P.; Wong, T.J.; Zhang, T. Institutions and Organizational Structure: The Case of State-Owned Corporate Pyramids. J. Law Econ. Organ. 2013, 29, 1217–1252. [Google Scholar] [CrossRef]

- Hillman, A.J.; Cannella, A.A.; Paetzold, R.L. The resource dependence role of corporate directors: Strategic adaptation of board composition in response to environmental change. J. Manag. Stud. 2000, 37, 235–256. [Google Scholar] [CrossRef]

- Pfeffer, J. Size and composition of corporate boards of directors: The organization and its environment. Adm. Sci. Q. 1972, 17, 218–228. [Google Scholar] [CrossRef]

- Huang, J.; Kisgen, D.J. Gender and corporate finance: Are male executives overconfident relative to female executives? J. Financ. Econ. 2013, 108, 822–839. [Google Scholar] [CrossRef]

- Girón, A.; Kazemikhasragh, A.; Cicchiello, A.F.; Monferrá, S. The Impact of Board Gender Diversity on Sustainability Reporting and External Assurance: Evidence from Lower-Middle-Income Countries in Asia and Africa. J. Econ. Issues 2022, 56, 209–224. [Google Scholar] [CrossRef]

- Cicchiello, A.F.; Fellegara, A.M.; Kazemikhasragh, A.; Monferrà, S. Gender diversity on corporate boards: How Asian and African women contribute on sustainability reporting activity. Gend. Manag. 2021, 36, 801–820. [Google Scholar] [CrossRef]

- Davidson, D.J.; Freudenburg, W.R. Gender and environmental risk concerns: A review and analysis of available research. Environ. Behav. 1996, 28, 302–339. [Google Scholar] [CrossRef]

- Chan, H.-W.; Pong, V.; Tam, K.-P. Cross-national variation of gender differences in environmental concern: Testing the sociocultural hindrance hypothesis. Environ. Behav. 2019, 51, 81–108. [Google Scholar] [CrossRef]

- McCright, A.M. The effects of gender on climate change knowledge and concern in the american public. Popul. Environ. 2010, 32, 66–87. [Google Scholar] [CrossRef]

- Zelezny, L.C.; Chua, P.-P.; Aldrich, C. New ways of thinking about environmentalism: Elaborating on gender differences in environmentalism. J. Soc. Issues 2000, 56, 443–457. [Google Scholar] [CrossRef]

- De Brauwer, M.; Saunders, B.J.; Ambo-Rappe, R.; Jompa, J.; McIlwain, J.L.; Harvey, E.S. Time to stop mucking around? Impacts of underwater photography on cryptobenthic fauna found in soft sediment habitats. J. Environ. Manag. 2018, 218, 14–22. [Google Scholar] [CrossRef] [PubMed]

- Post, C.; Rahman, N.; Rubow, E. Green governance: Boards of directors’ composition and environmental corporate social responsibility. Bus. Soc. 2011, 50, 189–223. [Google Scholar] [CrossRef]

- Post, C.; Rahman, N.; McQuillen, C. From board composition to corporate environmental performance through sustainability-themed alliances. J. Bus. Ethics 2015, 130, 423–435. [Google Scholar] [CrossRef]

- Li, J.; Zhao, F.; Chen, S.; Jiang, W.; Liu, T.; Shi, S. Gender diversity on boards and firms’ environmental policy: Gender diversity on boards. Bus. Strategy Environ. 2017, 26, 306–315. [Google Scholar] [CrossRef]

- Hafsi, T.; Turgut, G. Boardroom diversity and its effect on social performance: Conceptualization and empirical evidence. J. Bus. Ethics 2013, 112, 463–479. [Google Scholar] [CrossRef]

- Zhang, Y. Managerial risk preference and its influencing factors: Analysis of large state-owned enterprises management personnel in China. Risk Manag. 2016, 18, 135–158. [Google Scholar]

- Kassinis, G.; Panayiotou, A.; Dimou, A.; Katsifaraki, G. Gender and environmental sustainability: A longitudinal analysis: Gender and environmental sustainability. Corp. Soc. Responsib. Environ. Manag. 2016, 23, 399–412. [Google Scholar] [CrossRef]

- Liao, J.; Smith, D.; Liu, X. Female cfos and accounting fraud: Evidence from China. Pac. Basin Financ. J. 2019, 53, 449–463. [Google Scholar] [CrossRef]

- Liao, L.; Luo, L.; Tang, Q. Gender diversity, board independence, environmental committee and greenhouse gas disclosure. Br. Account. Rev. 2015, 47, 409–424. [Google Scholar] [CrossRef]

- Lagasio, V.; Cucari, N. Corporate governance and environmental social governance disclosure: A meta-analytical review. Corp. Soc. Responsib. Environ. Manag. 2019, 26, 701–711. [Google Scholar] [CrossRef]

- Ben-Amar, W.; Chang, M.; McIlkenny, P. Board gender diversity and corporate response to sustainability initiatives: Evidence from the carbon disclosure project. J. Bus. Ethics 2017, 142, 369–383. [Google Scholar] [CrossRef]

- Hollindale, J.; Kent, P.; Routledge, J.; Chapple, L. Women on boards and greenhouse gas emission disclosures. Account. Financ. 2019, 59, 277–308. [Google Scholar] [CrossRef]

- Rao, K.K.; Tilt, C.A.; Lester, L.H. Corporate governance and environmental reporting: An australian study. Corp. Gov. Int. J. Bus. Soc. 2012, 12, 143–163. [Google Scholar] [CrossRef]

- Ahern, K.R.; Dittmar, A.K. The Changing of the Boards: The Impact on Firm Valuation of Mandated Female Board Representation. Q. J. Econ. 2012, 127, 137–197. [Google Scholar] [CrossRef]

- Elgadi, E.; Ghardallou, W. Gender diversity, board of director’s size and Islamic banks performance. Int. J. Islam. Middle East. Financ. Manag. 2022, 15, 664–680. [Google Scholar] [CrossRef]

- Jamali, D. Insights into triple bottom line integration from a learning organization perspective. Bus. Process Manag. J. 2006, 12, 809–821. [Google Scholar] [CrossRef]

- Kallunki, J.-P.; Silvola, H. The effect of organizational life cycle stage on the use of activity-based costing. Manag. Account. Res. 2008, 19, 62–79. [Google Scholar] [CrossRef]

- Ni, B.; Tamechika, H.; Otsuki, T.; Honda, K. Does ISO14001 raise firms’ awareness of environmental protection? The case of Vietnam. Environ. Dev. Econ. 2018, 24, 47–66. [Google Scholar] [CrossRef]

- Graafland, J.J. Ecological impacts of the ISO14001 certification of small and medium sized enterprises in Europe and the mediating role of networks. J. Clean. Prod. 2017, 174, 273–282. [Google Scholar] [CrossRef]

- Hagedoorn, J.; Haugh, H.; Robson, P.; Sugar, K. Social innovation, goal orientation, and openness: Insights from social enterprise hybrids. Small Bus. Econ. 2022. [Google Scholar] [CrossRef]

- Johnson, R.A.; Greening, D.W. The effects of corporate governance and institutional ownership types on corporate social performance. Acad. Manag. J. 1999, 42, 564–576. [Google Scholar] [CrossRef]

- Cox, P.; Brammer, S.; Millington, A. An empirical examination of institutional investor preferences for corporate social performance. J. Bus. Ethics 2004, 52, 27–43. [Google Scholar] [CrossRef]

- Neubaum, D.O.; Zahra, S.A. Institutional ownership and corporate social performance: The moderating effects of investment horizon, activism, and coordination. J. Manag. 2006, 32, 108–131. [Google Scholar] [CrossRef]

- Aguilera, R.V.; Williams, C.A.; Conley, J.M.; Rupp, D.E. Corporate governance and social responsibility: A comparative analysis of the UK and the US. Corp. Gov. Int. Rev. 2006, 14, 147–158. [Google Scholar] [CrossRef]

- Sharma, P.; Irving, P.G. Four Bases of Family Business Successor Commitment: Antecedents and Consequences. Entrep. Theory Pract. 2005, 29, 13–33. [Google Scholar] [CrossRef]

- Kao, E.H.; Hung-Gay, F.; Qingdi, L. What explains corporate social responsibility engagement in Chinese firms? Chin. Econ. 2014, 47, 50–80. [Google Scholar]

- Walls, J.L.; Berrone, P.; Phan, P.H. Corporate governance and environmental performance: Is there really a link? Strateg. Manag. J. 2012, 33, 885–913. [Google Scholar] [CrossRef]

- See, G. Harmonious society and Chinese CSR: Is there really a link? J. Bus. Ethics 2009, 89, 1–22. [Google Scholar] [CrossRef]

- Yu, H.; Nahm, A.Y.; Song, Z. The power source of Chinese state-owned enterprise leaders, investigation of local core officials, and corporate investment behavior. J. Asia Pac. Econ. 2020, 27, 223–247. [Google Scholar] [CrossRef]

- Han, S.; You, W.; Nan, S. Zombie Firms, External Support and Corporate Environmental Responsibility: Evidence from China. J. Clean. Prod. 2018, 212, 1499–1517. [Google Scholar] [CrossRef]

- Hu, J.; Wang, S.; Xie, F. Environmental responsibility, market valuation, and firm characteristics: Evidence from China. Corp. Soc. Responsib. Environ. Manag. 2018, 25, 1376–1387. [Google Scholar] [CrossRef]

- Ghardallou, W. Corporate Sustainability and Firm Performance: The Moderating Role of CEO Education and Tenure. Sustainability 2022, 14, 3513. [Google Scholar] [CrossRef]

- Ghardallou, W.; Alessa, N. Corporate Social Responsibility and Firm Performance in GCC Countries: A Panel Smooth Transition Regression Model. Sustainability 2022, 14, 7908. [Google Scholar] [CrossRef]

- Lu, J.; Herremans, I.M. Board gender diversity and environmental performance: An industries perspective. Bus. Strategy Environ. 2019, 28, 1449–1464. [Google Scholar] [CrossRef]

- Acemoglu, D.; Naidu, S.; Restrepo, P.; Robinson, J.A. Democracy does cause growth. J. Political Econ. 2019, 127, 47–100. [Google Scholar] [CrossRef]

- Duflo, E. Women Empowerment and Economic Development. J. Econ. Lit. 2012, 50, 1051–1079. [Google Scholar] [CrossRef]

- Cordeiro, J.J.; Profumo, G.; Tutore, I. Board gender diversity and corporate environmental performance: The moderating role of family and dual-class majority ownership structures. Bus. Strategy Environ. 2020, 29, 1127–1144. [Google Scholar] [CrossRef]

- Bakri, A.; Alkbir, M.F.M.; Awang, N.; Januddi, F.; Ismail, M.A.; Ahmad, A.N.A.; Zakaria, I.H. Addressing the Issues of Maintenance Management in SMEs: Towards Sustainable and Lean Maintenance Approach. Emerg. Sci. J. 2021, 5, 367–379. [Google Scholar] [CrossRef]

- Karastathis, D.; Yfantidou, G.; Kormikiari, S.; Gargalianos, D.; Kalafatzi, A. Sampling in Management Studies of Public Organizations: Elite Orientation Model vs. Multiple Informants Model. Emerg. Sci. J. 2021, 5, 221–232. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).