Abstract

Under the Chinese strategy of “carbon peaking and carbon neutrality”, Enterprises’ Environmental Information Disclosure (EEID), as one of the important ways for enterprises to achieve low-carbon development, has gained increased attention from the government, media, investors, and other stakeholders. the EEID is not only an important tool for companies to communicate environmental performance to the outside world, but also an effective way for the government to monitor corporate pollution behavior. Its importance is self-evident. However, relevant research shows that 70% of Chinese listed companies had not implemented the EEID in 2020. Also, there are common problems in the disclosure content and the polarization of the disclosure level among the companies that do disclose. These problems weaken the objectivity and practicability of the EEID and have a negative impact on the government’s environmental supervision, the environmental protection demands of the public, and investors’ decision making. This paper takes listed companies in China’s A-share heavily polluting industries as the research sample to solve the optimization problem of the EEID. By adopting a fixed effects model (FEM), this paper empirically studies the impact of three public pressures on the EEID: government environmental regulation, media attention, and institutional investment preference. Based on China’s unique socialist market economic system, this paper innovatively uses environmental policy uncertainty as a moderator variable. This paper examines the limitations of theoretical research on public pressure and environmental information disclosure by studying the impact of local environmental leadership change on the relationship between public pressure and the EEID. The conclusions of this paper reveal the driving mechanism of how stakeholders such as government, media, and institutional investors influence the EEID. At the same time, it expands the application of public pressure theory in environmental information disclosure research by introducing the perspective of environmental policy uncertainty.

1. Introduction

In recent years, the Chinese government has continually strengthened the supervision of environmental protection and emissions reduction in enterprises. In 2010 and 2015, the Guidelines for Enterprises’ Environmental Information Disclosure (EEID) and the Environmental Protection Law were successively issued. Implementing these laws and regulations clarifies the necessity of the EEID. Moreover, it sets higher requirements for the EEID. Under the general sustainable development policy, the EEID behavior has gradually caught the attention of the government, investors, the media, and other stakeholders. Higher standards for the EEID requirements have put public pressure on enterprises [1]. According to the theory of organizational legitimacy, to ensure sustainable operation, an enterprise needs to disclose evidence of its legal operation to the public and the relevant regulatory authorities to prove its legal status [2].

Moreover, due to the recent attention paid to environmental awareness and sustainability in various scholarly works [3,4,5,6,7], public awareness of environmental issues has increased, which has ultimately increased public pressure on corporations. Scholars’ research on the EEID mainly focuses on the content and form of the EEID, behavioral motivation and influencing factors of the EEID, and the impact the EEID has had on corporate behavior and performance [8]. Only by understanding the behavioral motives behind corporate environmental disclosures can policy makers and other stakeholders effectively guide enterprises to change environmental behaviors.

Therefore, a rich discussion on the behavioral motivation and the factors that influence the EEID is available in the literature. However, the literature includes few studies examining the impact public pressure has had on the EEID. Instead, researchers have been more focused on a single or multiple aspects of public pressure [9,10,11,12,13]. Thus, they do not present the overall picture of the composition of public pressure. Public pressure comes from a wide range of sources and includes internal stakeholders such as shareholders and investors and external stakeholders such as government and media [9,10,11]. Therefore, the totality of public pressure needs to be considered to comprehensively reflect the impact of public pressure on the level of EEID. Furthermore, the impact of different public pressure sources on EEID behavior changes with uncertainty about environmental policies, a point that the existing literature rarely makes [10,11,12,13]. Changes in the Chinese government’s environmental policies often necessitate changes in the EEID. These changes provide us the opportunity to explore the influence mechanism of public pressure on the EEID from the perspective of the government and relevant departments.

This paper takes the theory of organizational legitimacy as the framework to explore the influence mechanism of public pressure represented by government environmental regulation, media attention, and institutional investment preference on EEID behavior. Furthermore, the impact of environmental policy uncertainty caused by changes in local environmental leadership on the relationship between public pressure and the EEID is discussed. The current literature rarely discusses the impact of public pressure exerted by corporate stakeholders on the EEID behavior from the stakeholders’ perspectives, but we maintain that such an approach will enrich the relevant research on the behavioral motivation of the EEID. Moreover, this paper innovatively introduces environmental policy uncertainty as a moderator variable, considering the unique Chinese socialist market economic system. This paper examines the limitations of theoretical research on public pressure and the EEID by studying whether the relationship will be affected by local environmental leadership change. This attempt makes up for the deficiency of relevant studies. This paper uses a heterogeneity analysis of the variable of change to help evaluate how different ways of replacing local environmental protection leaders impact the relationship between public pressure and the EEID. This analysis helps us provide targeted suggestions for relevant departments in selecting and appointing environmental protection leaders. In terms of content, this study reveals the driving mechanism of stakeholders such as the government, media, and institutional investors that affects corporate environmental information disclosure. It expands the application of the public pressure theory in the EEID by introducing the perspective of environmental policy uncertainty.

The main objective of the article and the research questions to be answered with this research work may be listed as follows:

- What is the correlation between government environmental regulation or media attention and the EEID?

- What is the correlation between institutional investment preferences and the EEID?

- How are local environmental protection leadership changes and increased public pressure on the EEID related?

- How may local environmental protection leadership change moderate the relationship between public pressure and the EEID?

In this paper, we briefly discuss the literature to develop the hypothesis in Section 2. Section 3 discusses the study design of this work, including samples and data, the definition of variables, and the regression model. Results and analysis have been discussed in Section 4. The research work has been summarized in Section 5 along with some suggestions to explore this work further.

2. Literature Review and Hypothesis Development

2.1. Public Pressure and the EEID

With the intensification of the global “greenhouse effect”, stakeholders have put forward new requirements for “environmental protection and low-carbon development” for enterprises, leading to public pressure on businesses to comply [14]. From the perspective of organizational legitimacy theory, the legitimacy of an enterprise is the premise of its sustainable operation. If an enterprise violates the “contract”, it will face consequences. Therefore, in the face of public pressure, businesses voluntarily fulfill the social responsibility of disclosing environmental information to avoid risking damages to its legitimacy from accusations that it has violated the explicit “contract” with stakeholders. Scholars believe that public pressure is essential for promoting enterprise information disclosure based on this perspective.

As for the definition and composition of public pressure, scholars generally believe it is composed of the government’s promulgation and implementation of laws and regulations, media exposure of enterprise behavior, and investors’ constraints. In earlier studies, Darrell and Schwartz [15] believed that the cultural, political, and legal environment constituted public pressure on enterprises. Among them, the cultural environment forms pressure on enterprises through the media, public opinion, and market behavior; The political environment mainly exerts pressure on enterprises through the government’s regulatory measures; the legal environment exerts pressure on enterprises through laws and regulations. Cho and Patten [16] maintain that the public, regulatory agencies, and political groups exert public pressure and believe that enterprises disclose environmental information to deal with this pressure. Islam and Deegan [17] found that negative news media reports kindle social pressure on enterprises and have a significant impact on the environmental disclosures of enterprises. Specifically, enterprises with more negative reports tend to actively disclose environmental information. The higher the social pressure is, the higher the disclosure quality will be. Wang et al. [18] called the attention and supervision of stakeholders, such as the government, creditors, shareholders, and the media, public pressure and verified the impact of public pressure on enterprises’ environmental disclosure behavior through empirical research. Ahmad and Zadeh [19] proposed in their study on the audit quality of enterprises that the public pressure formed by media supervision and government supervision has a significant role in promoting the audit quality of enterprises. The above research shows that when companies respond to public pressure, they choose to disclose relevant information to actively gain legitimacy. Thus, researchers do not have a unified understanding of public pressure factors affecting the EEID due to different research perspectives. Based on the EEID research, this paper divides public pressure into government environmental regulation, media attention, and institutional investment preference.

2.2. Government Environmental Regulation and the EEID

The insufficient EEID is essentially the performance of “market failure”. According to the public choice theory and government regulation, the market uses government regulation to solve problems. Government departments have formed rigid constraints on enterprise behavior by adopting regulatory measures based on laws and regulations, supplemented by the EEID and economic means. As one of the essential stakeholders of enterprises, the government’s environmental regulation exerts tremendous pressure on enterprises. To ensure their organizational legitimacy, companies need to comply with external systems and meet stakeholder expectations to avoid the risk of irregularities. Christopher et al. [20] believe that institutional pressure caused by the government’s mandatory regulations is the primary motivation for enterprises to disclose environmental information, but effective reward and punishment mechanisms are still needed to consolidate the effect. Clarkson et al. [21] pointed out in their study that the government’s regulatory intensity has a direct impact on the improvement of the EEID level, and the more specific the regulatory standards of the EEID system are, the higher the level of the EEID will be, especially the level of quantitative EEID. In their study, Li et al. [22] found that the greater the pressure of government supervision on enterprises, the stricter the institutional constraints they are subject to. For legitimacy survival, enterprises will be more motivated to regulate environmental behaviors and improve the level of the EEID. Based on the above analysis, this paper proposes the following hypothesis:

Hypothesis 1:

There is a positive correlation between government environmental regulation and EEID. With the increase in government environmental regulation intensity, the EEID level will be improved.

2.3. Media Attention and the EEID

With the continuous development of modern information technology, people’s access to information has become more convenient. Media supervision has become a vital external supervision force that affects the EEID. According to the agenda-setting theory of communication, mass media can set the social issues that the public pays attention to through the salience or intensity of news reports and information transmission, thus influencing the public’s knowledge of an event [23]. Based on this perspective, the media can guide public opinion through agenda-setting, thus creating reputation pressure on the enterprise and forcing the enterprise to disclose relevant environmental information based on social public opinion and legitimacy requirements [24]. Gray and Vint [25] pointed out in their research that when an enterprise’s environmental pollution problem is exposed by the media and sued, it tends to disclose more social responsibility information to conduct legal management. Clarkson et al. [21] pointed out in their study that compared with positive media reports, negative media reports played a more significant role in promoting the EEID. Kaymak and Bektas [26] maintain that the more media reports, whether positive or negative, the higher the EEID will be. The above studies confirm the role of media attention in corporate governance in the decision making of the EEID. Based on this, the following hypothesis is proposed:

Hypothesis 2:

There is a positive correlation between media attention and the EEID. That is, the more media reports about an enterprise (the greater media attention to the enterprise), the higher the level of the EEID will be.

2.4. Institutional Investment Preference and the EEID

As the direct stakeholders in enterprises, institutional investors participate in distributing corporate interests and have channels to participate in corporate management directly [27]. Moreover, compared with other types of shareholders, institutional investors tend to focus on value-oriented investment behaviors with long-term returns; so they pay more attention to enterprises’ sustainable development ability. Previous studies show that implementing a corporate social responsibility (CSR) strategy can improve the relationship between government and business [28]. CSR can enhance the sustainable development ability of enterprises and enterprise value in many aspects [29]. Moreover, institutional investors tend to hold enterprises with good social responsibility performance due to the consideration of long-term investment potential [30]. Therefore, to obtain institutional investors’ financial resources, enterprise managers have sufficient motivation to cater to their investment preferences and fulfill their social responsibility of the EEID. Relevant studies also show a positive correlation between shareholders’ shareholding, mainly institutional investors, and the EEID. For example, Huang and Zhou [31] found that the higher the control shareholder’s shareholding ratio, the stronger the enterprise’s supervision ability and the more able it is to guide the enterprise to disclose environmental information. He et al. [1] show that the institutional shareholding ratio has a significant promoting effect on the EEID, and the influence on non-public enterprises is significant. Based on the above literature, institutional investors have the ability and motivation to influence enterprises to take the CSR decision of the EEID based on their advantages and investment preferences. Therefore, the following hypothesis is proposed:

Hypothesis 3:

Institutional investment preference is positively correlated with the EEID. With increased institutional investors’ shareholding ratio in enterprises (showing higher investment preference for enterprises), the EEID level will also improve.

2.5. Regulatory Role of the Change of Local Environmental Protection Leadership

In China’s socialist market economy system, enterprises’ production and operation are greatly affected by local governments’ actions [32]. The uncertainty of government actions brought about by changes in local environmental officials will inevitably affect micro-enterprises as the makers and executors of local environmental policies. There are mainly two reasons for this. First, new officials usually form different policy combinations regarding government subsidies and tax incentives due to educational background differences, personal preferences, and ability [33].

For micro-enterprises, the change of officials will change the relationship between government and business established by the enterprise before, which will lead to the loss of the original advantage in resource allocation and further lead to the rise of enterprise operation risk [34]. In this case, to obtain a new round of resource allocation advantages, enterprises will actively fulfill environmental responsibility and better disclose corporate environmental responsibility information to win over the new environmental protection leaders [35]. Simultaneously, the enterprise’s good environmental behavior solves environmental performance assessments for the new environmental leaders, thus providing the corresponding promotion capital. On the other hand, environmental policy uncertainty will affect investors’ judgment of enterprises’ future development prospects, thus exacerbating the information asymmetry between enterprises and investors. Investors will pay more attention to the environmental behaviors of enterprises to reduce the environmental risks of investment. In this case, enterprises will feel the pressure from investors more obviously and will be more inclined to release the performance forecast voluntarily, and the report’s quality and reference value will also be improved [36]. The uncertainty of environmental policy caused by the change of local environmental leadership can directly affect the performance of the EEID but also trigger the stakeholders of enterprises to pay more attention to environmental risks, thus further promoting the enthusiasm for the EEID [37]. Based on the above analysis, the following hypothesis is proposed:

Hypothesis 4:

The local environmental protection leadership change positively moderates the relationship between public pressure and the EEID. When local environmental protection leadership changes, the promoting role of public pressure on the EEID will be enhanced.

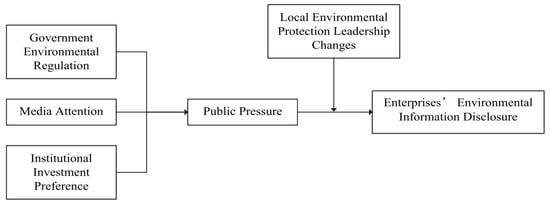

All the hypotheses might be schematically explained in Figure 1.

Figure 1.

Schematic illustration of proposed model indicating the hypotheses.

3. Study Design

3.1. Samples and Data

In this paper, listed companies in heavily polluting industries listed in Shanghai and Shenzhen A-shares were selected as the research objects, and the data from 2015 to 2019 were selected for regression tests to ensure the timeliness of the results. As for the definition of heavily polluting industries, this paper mainly selects the listed companies according to the 16 heavily polluting industries defined in the Guidelines for the EEID of Listed Companies and Classified Management Directory of Environmental Protection Verification Industries of Listed Companies [38]. The 16 heavily polluting industries include thermal power, steel, cement, electrolytic aluminum, coal, metallurgy, chemical industry, petrochemicals, building materials, papermaking, brewing, pharmaceutical, fermentation, textiles, leather, and mining. After eliminating the samples with missing data, this paper obtained the data of 456 sample companies for five years, with a total of 2280 sample observations. To eliminate the influence of extreme values, Winsorize was used for all continuous variables according to 2.5 % and 97.5 % quantile, respectively.

3.2. Definition of Variables

3.2.1. Explained Variable (The Level of the EEID)

In existing studies, content analysis is mainly used to measure the EEID levels. Based on the existing research, this paper draws on Guan and Zhang’s evaluation system [39] to determine an indicator system that contains three first-level indicators and nine second-level indicators, as shown in Table 1. This indicator system aims to evaluate the EEID level from the perspective of information quality. Therefore, the scoring rule adopted in this paper for each second level indicator is as follows. For an indicator, if the enterprise discloses it by combining qualitative and quantitative indicators, it is assigned a value of two. If the company disclosures are in qualitative description (non-monetary form), the value is assigned to one. If the enterprise has not made any disclosure, the value is assigned to zero. Based on the above scoring rules, an EEID level is the sum of each project’s scores. The specific scoring rules are shown in Table 1.

Table 1.

The evaluation index of the EEID level.

3.2.2. Explanatory Variables

Government Environmental Regulation

In this paper, referring to relevant studies [40], the Pollution Information Transparency Index (PITI) was adopted as an indicator to measure the supervision strength of local governments on the EEID. The PITI index is jointly developed by the Institute of Public and Environmental Affairs (IPE) and the Natural Resources Defense Council (NRDC). The index comprises nine major evaluation indicators, including the daily release of records of violation of standards, online monitoring information disclosure, and letters, visits, and complaints. Through the nine projects’ quantitative and qualitative analysis, the PITI index of each region is obtained. The higher the score is, the higher the level of environmental regulation of the government in the region. The index, launched in 2008 and published in 10 issues so far, covers 120 major cities and is a relatively objective reflection of the country’s environmental protection authorities’ supervision efforts.

Media Attention

In this paper, the annual number of news reports of sample companies is used to calculate the companies’ media attention to measure the media’s external governance pressure. This variable’s original data comes from the China research data service platform (CNRDS). The variable’s specific calculation method is as follows: each news report of the company is counted as one point, and the logarithm of the total amount of news reports in the final year is the media attention of the sample company in that year. The higher this score is, the higher the company’s media attention is, and the greater the pressure on media governance. Since some listed companies had no news reports in that year, this paper added the original data before taking the logarithm of the total amount of news reports: media attention =ln (the total amount of news reports in that year +1).

Institutional Investment Preference

Institutional investors are characterized by capital intensive and extensive volume as substantial shareholders of enterprises. Before the implementation of investment decisions, the investment committee first conducts due diligence on the investment targets, comprehensively considers the industry, macro, and micro factors of the target companies, and considers the preferences of the investment institutions to make decisions that are in line with the style of the institutional investors and the subsequent post-investment management. With today’s social awareness of environmental protection and demand gradually strengthening, in choosing investments, institutional investors pay increased attention to the stability and long-term investment potential based on research into the investment’s record on environmental protection, social morality, and public interest considerations to the EEID requirements. Therefore, this paper selects institutional investors’ shareholding ratio to measure investors supervisory pressure on listed companies’ managers.

3.2.3. Moderating Variables: Local Environmental Leadership Changes

In this paper, the change of officials in charge of the Department of Ecology and Environment (DoEE) was used to measure local environmental policies’ uncertainty. By referring to the study of Yu et al. [41], the variable of change of local environmental protection leaders was set as follows: if the director of the DoEE (director of the Bureau of Ecology and Environment) in the province (city) where the enterprise is registered is changed, the value assigned is one; if nothing has changed, the value assigned is zero. Considering the possible time lag in the impact of a change in leadership in the Office of Ecology and Environment, if the personnel change occurs between January and June, the change is considered to have happened in the current year; if the personnel change occurs between July and December, the change is deemed to have occurred in the following year. There are still some micro differences in personnel change in real life, such as different transfer modes, age at taking office, and various sources of origin [42]. Therefore, this paper makes a further study on this moderating variable based on other forms of change:

Transfer Mode

If an official is promoted as head of the local DoEE, the variable is defined as one. However, if the head of local DoEE is new to the department or there is no change, the variable is defined as zero.

Age

If the official is less than 55 years old when he or she is promoted to be the head of the local DoEE, the variable is defined as one; Conversely, if the age at the time of promotion is greater than 55 years old or there is no change, the variable is defined as zero.

Source of Origin

The sample analysis in this paper shows that the appointment and removal of the head of the DoEE are almost all transferred within the province. Therefore, the city where the new head of the DoEE was located before taking office is used to determine whether the enterprise is in the region of origin. If the enterprise is not located there, it is in non-origin, and the variable is defined as one; otherwise, it is defined as zero.

3.2.4. Control Variables

This paper mainly selects enterprise micro characteristic variables and official characteristic variables as control variables. The micro characteristic variables of enterprises mainly include enterprise size, financial leverage, profitability, property right, ownership concentration, and growth rate since financial attributes are directly related to the EEID in China [43]. Referring to the practice of Hu et al. [42] in the paper, this paper included the characteristic variables of officials, gender and education level, when studying the regulating effect of the change of local environmental protection officials. Considering that the change of provincial party secretary or provincial governor may also occur in the same year as the change of environmental protection leaders, the variables of provincial party secretary change and provincial governor change are also included in this paper to control this external impact. This paper introduces the time dummy variable to control the possible influence of the year on the EEID. The definition table of variables in this study is shown in Table 2.

Table 2.

Definition table of variables.

3.3. Regression Model

Since the data used in this paper belong to panel data, this paper selects a suitable regression model through the following tests. First, this paper uses the F-test in the fixed-effects regression model to determine whether to use a fixed-effects or a pooled regression model. The regression analysis shows that the fixed-effects regression model was better than the pooled regression model. Second, this paper uses the BP-LM test to test for random effects. The regression analysis shows that the null hypothesis of “there is no individual random effect” was rejected; therefore the random-effects model was better than the pooled regression model. Finally, this paper uses the Hausman test, and the regression results show that the null hypothesis of "random effect is the most efficient" is rejected. Therefore, this paper builds a fixed-effect model to empirically test the impact of public pressure on the level of the EEID. The specific form of the model is as follows:

where i represents the individual enterprise and t for a particular year, EID represents the level of the EEID of the enterprise, GR represents the level of government environmental regulation, Media stands for Media attention, and Share stands for institutional investor preference. In addition, Controls represent all the control variables in Model 1, including enterprise size, financial leverage, profitability, property right, ownership concentration, and company growth rate. The year-fixed effect is also controlled in this paper.

This paper will test the policy environment uncertainty on public pressure and the relationship between the EEID level adjustment. Based on Model 1, to join the public pressure and the change of local environmental protection leadership cross-terms; public pressure and the way of the official transfer cross-terms; public pressure with age and cross-terms of officials; public pressure, and official source of cross-terms, we construct the following model: The

Among them, PP refers to all public pressure variables, including government environmental regulation GR, media attention, and institutional investor preference share. PPI, TCOEI, T, PPI, Tpromotei, T, PPI, TAGEI, T and PPI, Torigini, T represent the public pressure and local environmental protection leadership change of enterprise i in year t, the way of transferring officials, the age of officials, and the region where officials come from. Controls represents all the control variables, including enterprise size, financial leverage, profitability, property right, ownership concentration, company growth rate, gender, and education level. The year-fixed effect was also controlled in the four models.

4. Results and Analysis

4.1. Descriptive Statistics and Correlation Analysis

Descriptive statistical analysis of variables is shown in Table 3. As can be seen, the average level of the EEID of the sample enterprises is 7.12, indicating that the sample EEID is generally at a low level, and the level of the EEID of each enterprise varies greatly. The level of government environmental regulation varies significantly among cities, but the average level reaches 58, which indicates that the supervision of urban pollution in China has been relatively high in the past five years. There is a slight difference in media attention of sample enterprises. The average shareholding ratio of institutional investors is 46.31%, which indicates that enterprise managers will cater to institutional investors’ preferences to a significant extent to gain the favor of investors. The average level of environmental leadership change was 0.26, indicating that about 26% of the samples changed the local environment department’s head. Among them, about 20% of officials took office as head of the Environment Agency through promotion, 23.8% of officials took office under the age of 55, and 22.1% of the officials went to other cities to take office as head of the environment agency. The control variables in this paper will not be described.

Table 3.

Descriptive statistics of variables.

The correlation coefficients among the main variables were also calculated, as shown in Table 4. The level of the EEID is significantly positively correlated with the government environmental regulation variable (r = 0.047) at the level of 5%, with media attention (r = 0.196) at the level of 1%, and with institutional investment preference (r = 0.206) at the level of 1%, which preliminarily verifies Hypotheses 1 to 3. In addition, there is a significant positive relationship between the EEID level and all the moderating variables, and the moderating effect needs to be further studied below.

Table 4.

Correlation analysis.

4.2. Analysis of Regression Results

4.2.1. Public Pressure and the EEID

This paper conducts a regression test on the impact of public pressure on the level of the EEID. In this paper, the Hausman test was first carried out on the model, and the fixed effect model was determined to be used for the regression test. The test results are shown in Table 5.

Table 5.

Regression results of the benchmark model.

Model 1 is the regression result of the base model. Among them, the government environmental regulation variable is significantly positive at the 1% level (β = 0.032, p < 0.01), indicating that the intensity of government environmental regulation has a significant positive impact on the level of the EEID. Hypothesis 1 is verified. The economic significance of this regression result is that when the intensity of government environmental regulation changes by one standard deviation, the level of the EEID will change by 0.107 standard deviations (0.032 × 13.06/3.897 = 0.107). There is no significant relationship between corporate media attention and the level of the EEID. Hypothesis 2 cannot be confirmed. The reasons may lie in two aspects. First, due to the lack of environmental protection awareness in China and the exposure of a few major environmental incidents that can arouse public attention and force enterprises to strengthen environmental disclosure, the media has not played a fundamental role in supervising enterprises. Second, domestic media’s attention to environmental events is more of a kind of exposure after the event, so there is a time lag in the media’s supervision role. Institutional investment preference is significantly positive at a 10% level (β = 0.006, p < 0.1), indicating that the shareholding ratio of institutional investors will have a significant positive impact on the level of the EEID. Hypothesis 3 is verified. The economic significance of this regression result is that when the shareholding ratio of institutional investors changes by one standard deviation, the level of the EEID will change by 0.035 standard deviations (0.006 × 22.68/3.897 = 0.035). This reflects that when more domestic and foreign institutional investors advocate the investment concept of “environmental protection and low-carbon development”, enterprises need to meet institutional investors’ investment preferences by improving social responsibility performance to win more investors. Based on these results, it can be seen that the government environmental regulation variable and the institutional investment preference variable are both important factors that affect the level of corporate environmental information disclosure, whether from the perspective of statistical significance or economic significance.

4.2.2. The Moderating Effect of Changes in Local Environmental Protection Officials

Model 2 is based on introducing the environmental change variables and environmental leadership change variables and government environmental regulation of cross-terms, environmental leadership change variables, and institutional investment preference of cross-terms to study local environment agency changes in public pressure and the relationship between the EEID level. The study found that environmental leadership change and the overlapping coefficient is not significant government environmental regulation; the change of environmental officials and institutional shareholders holding the overlapping coefficient is 0.006, significantly under the 5 % level. Local environmental officials’ change significantly affects the institutional investment preferences for the role of the EEID. The conclusion verifies Hypothesis 4. This conclusion suggests that when faced with the policy uncertainty caused by the head of the environment agency’s change, enterprises’ environmental performance will further improve in response to public pressure, ultimately consolidating their legal status.

In Model 3, Model 4, and Model 5, environmental leadership change variables were replaced by promotion style, age, and origin based on Model 2, respectively, to evaluate the heterogeneity of environmental leadership change a moderating effect. The results show that the cross-term between promotion mode and institutional shareholders is significantly positive at a 5% level (β = 0.007, p < 0.05) when an official’s appointment as head of the environment agency by way of promotion has a positive moderating effect on the relationship between public pressure and the EEID. The cross-term between age and government environmental regulation was significantly positive at a 10% level (β = 0.008, p < 0.1), and the cross-term between age and institutional shareholders was significantly positive at a 1% level (β = 0.007, p < 0.01) when an official is no more than 55 years old and the head of the Environment Agency’s appointment. The cross-term between the region of origin and institutional shareholders was significantly positive at a 5% level (β = 0.006, p < 0.05). When an official takes office as the head of the DoEE in a new region, this change will positively affect the relationship between public pressure and the level of the EEID. The above conclusion further verifies Hypothesis 4. The above findings indicate that when officials are promoted to be the head of the DoEE, they are more motivated to perform their duties than when they are transferred to the same position, thus promoting public pressure to improve local enterprises’ environmental governance. When an official takes office as head of the Environment Agency at the age of 55 or less, because he or she has several years of work before retirement, the official is more motivated to perform his or her duties than other officials older than 55 (who are about to retire). Since the officials have established certain social connections when serving in the place of origin, they will also have policy preferences for the enterprises in the area after being transferred. Therefore, after the new head of the Environment Agency takes office, non-local enterprises are likely to bear higher pressure of environmental supervision than local enterprises, thus promoting enterprises’ environmental management ability.

Regarding the control variables, each model obtains the same result. The enterprise size is significantly positive at the 1% level, indicating that larger enterprises pay more attention to fulfilling their social responsibilities, so the EEID level is higher. The coefficient of ownership concentration is significantly negative, indicating that the higher the ownership concentration is, the lower the level of the EEID is. The company’s growth rate is significantly positive at the 1% level, indicating that the more robust its growth, the higher its EEID.

4.3. Robustness Test

4.3.1. Change the Measurement Method of the Explained Variable

Referring to the practice of Yu et al. [41], this paper uses the industry average as the benchmark to standardize the EEID, aiming to enhance the industry comparability of this indicator. Table 6 reports the regression test results of explained variables with standardization. The results show that the government environmental regulation variable is significantly positive at the 1% level (β = 0.008, p < 0.01) and the institutional shareholder ownership variable was significantly positive at the 10% level (β = 0.002, p < 0.1). The public pressure represented by government regulation pressure and institutional investment preference has a significant promoting effect on the level of the EEID, which supports Hypothesis 1 and Hypothesis 3. The cross-term coefficient of institutional shareholder ownership and environmental leadership change is significantly positive at a 5% level (β = 0.002, p < 0.05), indicating that local environmental leadership can significantly strengthen an institutional shareholder’s pressure on the EEID, supporting Hypothesis 4. The robustness test conclusion is consistent with the regression model’s results above, so the research results are robust and reliable.

Table 6.

Regression results of the robustness test.

4.3.2. To Control the Impact of the Change of Governor and Provincial Party Secretary

According to the environmental Kuznets hypothesis, there is a reciprocal relationship between environmental quality and economic development in the early economic development stage [36]. Many empirical studies have confirmed that governors’ and provincial party secretaries’ changes will impact local economic growth. This paper speculates that the demands of provincial party secretaries and governors for economic development may weaken the change of the head of the DoEE on the environmental disclosure of local enterprises. Then, to avoid the estimation deviation of the research conclusions caused by the change of provincial party secretaries and governors, this paper further controls the influence of the change of provincial party secretaries (COS) and governors (COG) based on Model 1. Like the definition of change of head of DoEE, if the local, provincial party secretary and governor change, the value assigned is one; If there is no change, the value assigned is zero, whereas if the year of appointment is after June, change is considered to have occurred in the following year. In terms of the model, this paper added provincial party secretary change, provincial governor change, provincial party secretary change, and provincial governor change successively based on Model 1 to further control the influence of provincial party secretary change and provincial party secretary change on the relationship between the change of director of the DoEE disclosure level.

Table 6 reports the regression test results after controlling for the change of provincial party secretaries and provincial governors. The results show that the cross-term coefficient between institutional shareholders’ shareholding and environmental governance changes is still significantly positive at the 5% level, supporting Hypothesis 4, and the test results remain unchanged. In the three models, the change of provincial party secretary and the change of provincial governor are both significantly positive, indicating that the change of the first leader of provincial and municipal administrative regions has a promoting effect on the level of the EEID of local enterprises. In general, the robustness test’s conclusion is consistent with the above regression model’s test results, so the research results are robust and reliable.

5. Conclusions and Enlightenment

From the perspective of public pressure, this paper explores the impact mechanism of three types of public pressure, namely government environmental regulation, media attention, and institutional investment preference, on EEID behavior. The influence of environmental policy uncertainty caused by local environmental departments’ leadership change on the relationship between public pressure and the EEID was also considered. It was found that the increase of government environmental regulation pressure and institutional investment preference pressure can significantly promote the environmental performance of enterprises and improve the level of the EEID. Local environmental protection officials’ change positively moderates the relationship between public pressure and the EEID. When the main person in charge of the DoEE is replaced, the promoting role of public pressure on the EEID will be further strengthened, and this moderating effect is not affected by the change of prominent provincial leaders. The heterogeneity of the change in local environmental protection leadership was further explored. It was also found that when the main person in charge of the DoEE was appointed through promotion when he was younger than 55 years old, and when he was appointed from other places, the change of personnel could play a significant positive moderating role in the relationship between public pressure and the EEID.

This paper’s conclusion has a particular practical significance for understanding the environmental behavior of enterprises in China. The environmental decision of listed companies of our country has a more extensive motivation than the enterprises in the developed market system. Chinese enterprises’ environmental performance is not only to cater to the capital market in low-carbon, sustainable development for investment at the same time, but also work with the environmental officials at the local level to establish a good relationship between government and enterprises [44]. These have certain policy implications for the government to improve its environmental supervision function and the EEID decisions:

From public pressure, government environmental regulations and institutional investors’ preferences play a particular role in promoting China’s listed environmental disclosure behavior. Therefore, when formulating environmental disclosure policies for listed companies, local governments should make further continuous and in-depth studies to ensure the standardization of the EEID and reduce information asymmetry with enterprises. This will help listed companies have laws to follow and regulations on the EEID.

Local government should make use of the relationship between investors and local enterprises to promote “a sign of low-carbon and sustainable development” andguide rational investors engaged in energy conservation and carbon reduction to invest in local businesses. In this way, local governments can help synchronize the desire of investors to meet financial goals and the desire of enterprises to continue to be viable concerns thus making the enterprise economic benefits and environmental responsibility goals agree.

The change of directors of the DoEE plays a significant role in the relationship between public pressure and the EEID. This role is not affected by the provincial party secretary and governor change.

Therefore, in optimizing the local environmental governance system and considering the governance role of the provincial party and government leaders, more attention should be paid to the vital role of the DoEE, the main person responsible for the local environmental supervision body. Since the firms with environmental information disclosure are more likely to attract attention from the public, the endogenous issue of reverse causality exists. Therefore, the present study might be analyzed in terms of causal relationships, such as Chen et al. [45] studied. In addition, in the context of increasingly prominent ecological and environmental security in China, the selection and appointment of relevant leaders to DoEE should properly consider officials’ characteristics, such as age, origin, and professional expertise, to further optimize officials’ allocation in environmental protection systems.

Author Contributions

Conceptualization, D.W. and H.M.; methodology, D.W.; software, D.W., validation, D.W. and H.M.; formal analysis, D.W. and H.M.; investigation, D.W.; resources, D.W.; data curation, D.W.; writing—original draft preparation, D.W. and H.M.; writing—review and editing, H.M.; visualization, D.W.; supervision, D.W.; project administration, D.W.; funding acquisition, H.M. All authors have read and agreed to the published version of the manuscript.

Funding

The authors would like to acknowledge the Research Fund for International Scientists (RFIS-52150410416), National Natural Science Foundation of China as well as Research Startup grant of ZSTU (20202294-Y).

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Data can be provided by corresponding author on request.

Conflicts of Interest

The authors declare no conflict of interest.

References

- He, P.; Shen, H.; Zhang, Y.; Ren, J. External Pressure, Corporate Governance, and Voluntary Carbon Disclosure: Evidence from China. Sustainability 2019, 11, 2901. [Google Scholar] [CrossRef] [Green Version]

- Fan, Y.; Xia, M.; Zhang, Y.; Chen, Y. The influence of social embeddedness on organizational legitimacy and the sustainability of the globalization of the sharing economic platform: Evidence from Uber China. Resour. Conserv. Recycl. 2019, 151, 104490. [Google Scholar] [CrossRef]

- Dai, X.; Zhu, Z.; Zeng, X.; Luo, F. Research on Environmental Protection and Fire Safety in Furniture Industry Cluster Construction. Furnit. Inter. Des. 2020, 2020, 42–44. [Google Scholar]

- Qian, W.; Xu, P.; Wang, L. A review on the polyester fiber recycling and its environmental impact assessment. Adv. Text. Technol. 2021, 29, 22–26. [Google Scholar]

- Liang, J.; Cheng, W. Research on status and dilemma of sustainable clothing consumption behavior. J. Silk 2020, 57, 18–25. [Google Scholar]

- Yuan, X.-B.; Liu, Y.-T.; Chen, N.; Wu, Y.-Z.; Liu, Y.-J.; Sun, A.-K. Research Progress on Green Packaging Materials. Packag. Eng. 2022, 43, 87–94. [Google Scholar] [CrossRef]

- Wang, T.; Zhao, B. Research on the Design of Household Garbage Can Based on the Concept of Environmental Protection Design. Furnit. Inter. Des. 2020, 04, 68–70. [Google Scholar]

- Luo, W.; Guo, X.; Zhong, S.; Wang, J. Environmental information disclosure quality, media attention and debt financing costs: Evidence from Chinese heavy polluting listed companies. J. Clean. Prod. 2019, 231, 268–277. [Google Scholar] [CrossRef]

- Kathyayini, K.R.; Carol, A.T.; Laurence, H.L. Corporate Governance and Environmental Reporting: An Australian Study. Int. J. Bus. Soc. 2012, 12, 143–163. [Google Scholar]

- Bo, B.C.; Doowon, L.; Jim, P. An analysis of Australian company carbon emission disclosures. Pac. Account. Rev. 2013, 25, 58–79. [Google Scholar]

- Gary, F.P.; Andrea, M.R. Does the Voluntary Adoption of Corporate Governance Mechanisms Improve Environmental Risk Disclosures? Evidence from Greenhouse Gas Emission Accounting. J. Bus. Ethics 2014, 125, 637–666. [Google Scholar]

- Richard, L.; Gray, R. Social and Environmental Accounting and Organizational Change. Soc. Environ. Account. J. 2014, 34, 81–86. [Google Scholar]

- Julie, C.; Muftah, M.N. Institutional investor influence on global climate change disclosure practices. Aust. J. Manag. 2012, 37, 169–186. [Google Scholar]

- Zhang, Y.-J.; Liu, J.-Y. Overview of research on carbon information disclosure. Front. Eng. Manag. 2020, 7, 47–62. [Google Scholar] [CrossRef]

- Darrell, W.; Schwartz, B.N. Environmental disclosures and public policy pressure. J. Account. Public Policy 1997, 16, 125–154. [Google Scholar] [CrossRef]

- Cho, C.H.; Patten, D.M. The role of environmental disclosures as tools of legitimacy: A research note. Account. Organ. Soc. 2007, 32, 639–647. [Google Scholar] [CrossRef]

- Islam, M.A.; Deegan, C. Media pressures and corporate disclosure of social responsibility performance information: A study of two global clothing and sports retail companies. Account. Bus. Res. 2010, 40, 131–148. [Google Scholar] [CrossRef]

- Wang, X.; Xu, X.; Wang, C. Public pressure, social reputation, inside governance and firm environmental information disclosure: The evidence from Chinese listed manufacturing firms. Nankai Bus. Rev. 2013, 16, 82–91. [Google Scholar]

- Hammami, A.; Zadeh, M.H. Audit quality, media coverage, environmental, social, and governance disclosure and firm investment efficiency. Int. J. Account. Inf. Manag. 2020, 28, 45–72. [Google Scholar] [CrossRef]

- Christopher, T.; Hutomo, S.; Monroe, G. Voluntary environmental disclosure by Australian listed mineral mining companies: An application of stakeholder theory. Int. J. Account. Bus. Soc. 1997, 5, 42–66. [Google Scholar]

- Clarkson, P.M.; Li, Y.; Richardson, G.D.; Vasvari, F.P. Revisiting the relation between environmental performance and environmental disclosure: An empirical analysis. Account. Organ. Soc. 2008, 33, 303–327. [Google Scholar] [CrossRef]

- Li, L.; Liu, Q.; Tang, D.; Xiong, J. Media reporting, carbon information disclosure, and the cost of equity financing: Evidence from China. Environ. Sci. Pollut. Res. 2017, 24, 9447–9459. [Google Scholar] [CrossRef]

- Carroll, C.E.; McCombs, M. Agenda-setting effects of business news on the public’s images and opinions about major corporations. Corp. Reput. Rev. 2003, 6, 36–46. [Google Scholar] [CrossRef]

- Chen, X.; Yunhe, H.U. Analysis of public concern on traditional dyeing and printing techniques based on Baidu index. J. Silk 2020, 57, 41108. [Google Scholar]

- Gray, S.J.; Vint, H.M. The impact of culture on accounting disclosures: Some international evidence. Asia-Pac. J. Account. 1995, 2, 33–43. [Google Scholar] [CrossRef]

- Kaymak, T.; Bektas, E. Corporate Social Responsibility and Governance: Information Disclosure in Multinational Corporations. Corp. Soc. Responsib. Environ. Manag. 2017, 24, 555–569. [Google Scholar] [CrossRef]

- Schnatterly, K.; Shaw, K.W.; Jennings, W.W. Information advantages of large institutional owners. Strateg. Manag. J. 2008, 29, 219–227. [Google Scholar] [CrossRef]

- Petersen, H.L.; Vredenburg, H. Morals or economics? Institutional investor preferences for corporate social responsibility. J. Bus. Ethics 2009, 90, 1. [Google Scholar] [CrossRef]

- Ruf, B.M.; Muralidhar, K.; Brown, R.M.; Janney, J.J.; Paul, K. An empirical investigation of the relationship between change in corporate social performance and financial performance: A stakeholder theory perspective. J. Bus. Ethics 2001, 32, 143–156. [Google Scholar] [CrossRef]

- Neubaum, D.O.; Zahra, S.A. Institutional ownership and corporate social performance: The moderating effects of investment horizon, activism, and coordination. J. Manag. 2006, 32, 108–131. [Google Scholar] [CrossRef]

- Huang, J.; Zhou, C.-N. Empirical Research on the Impact of Ownership Structure and Management Behavior on the Environmental Disclosure: Evidence from Heavy Polluting Industries Listed in Shanghai Stock Exchange. China Soft Sci. 2012, 1, 133–143. [Google Scholar]

- Li, D.D.; Feng, M.; Long, S.; Yuan, G.; Zhou, P.; Li, Y. Proactive Macroeconomic Management. In Economic Lessons from China’s Forty Years of Reform and Opening-Up; Springer: Singapore, 2021; pp. 183–251. [Google Scholar] [CrossRef]

- Chunfang, C. Between the Transfer of the Political Power and the Corporate Investment: The Logic of China. Manag. World 2013, 1, 143–157. (In Chinese) [Google Scholar]

- Fraser, J.; Quail, R.; Simkins, B. Enterprise Risk Management: Today’s Leading Research and Best Practices for Tomorrow’s Executives; John Wiley & Sons: San Francisco, CA USA, 2010; Volume 3. [Google Scholar]

- Chuang, S.-P.; Huang, S.-J. The effect of environmental corporate social responsibility on environmental performance and business competitiveness: The mediation of green information technology capital. J. Bus. Ethics 2018, 150, 991–1009. [Google Scholar] [CrossRef]

- Dai, L.; Ngo, P. Political uncertainty and accounting conservatism. Eur. Account. Rev. 2021, 30, 277–307. [Google Scholar] [CrossRef]

- Cailou, J.; Fuyu, Z.; Chong, W. Environmental information disclosure, political connections and innovation in high-polluting enterprises. Sci. Total Environ. 2021, 764, 144248. [Google Scholar] [CrossRef]

- Cai, R.; Lv, T.; Deng, X. Evaluation of Environmental Information Disclosure of Listed Companies in China’s Heavy Pollution Industries: A Text Mining-Based Methodology. Sustainability 2021, 13, 5415. [Google Scholar] [CrossRef]

- Kaolei, G.; Rui, Z. Corporate Reputation and Earnings Management: Efficient Contract Theory or Rent-Seeking Theory. Account. Res. 2019, 59–64. [Google Scholar]

- Mao, Y.; Wang, J. Is green manufacturing expensive? Empirical evidence from China. Int. J. Prod. Res. 2019, 57, 7235–7247. [Google Scholar] [CrossRef]

- Yu, L.; Zhang, W.; Bi, Q.; Dong, J. Environmental Policy Uncertainty and Corporate Environmental Information Disclosure: Evidence from the Turnover of Local Environmental Protection Directors. J. Shanghai Univ. Financ. Econ. 2020, 22, 35–50. [Google Scholar]

- Hu, J.; Long, W.; Song, X.; Tang, T. The driving force in corporate environmental governance: Turnover of environmental protection department directors as an indicator. Nankai Bus. Rev. Int. 2020, 11, 253–282. [Google Scholar] [CrossRef]

- Wu, D.; Zhu, S.; Memon, A.A.; Memon, H. Financial Attributes, Environmental Performance, and Environmental Disclosure in China. Int. J. Environ. Res. Public Health 2020, 17, 8796. [Google Scholar] [CrossRef]

- Wu, H.; Li, Y.; Hao, Y.; Ren, S.; Zhang, P. Environmental decentralization, local government competition, and regional green development: Evidence from China. Sci. Total Environ. 2020, 708, 135085. [Google Scholar] [CrossRef]

- Chen, C.; Jiang, D.; Li, W.; Song, Z. Does analyst coverage curb executives’ excess perks? Evidence from Chinese listed firms. Asia-Pac. J. Account. Econ. 2022, 29, 329–343. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).