Abstract

This paper aims to examine Factors Affecting Small and Micro Enterprise Performance with the Mediating Effect of Government Support; Evidence from Amhara Region Ethiopia. This study used both qualitative and quantitative research methodology. The proposed research model used a Structural equation model, growth path modeling analysis, and correlation matrix. The study also used both primary and secondary data sources. The study employed 384 determined entrepreneur leader and employee respondents through purposive sampling techniques and simple random sampling to estimate the required clusters. The findings of the study show that the mediating role of government support affects the independent variables by 0.971 *** enterprise performance. Moreover, the independent variables entrepreneur competence, 0.841 ***, microfinance, =0.714 **, infrastructure, 0.861 ** and entrepreneur training 0.831 ** have a positive and significant impact on enterprise performance. Microfinance and entrepreneur training are major factors that influence the enterprises’ performance next to the mediating role of government support. Therefore, the Small and micro enterprise besides government supporting role have gaps in enterprises’ performance due to lack of long-term loans, access to lease machines, unfair interest rates, production and selling the place, shortage of defining SMEs, and structural limitations. To solve currently existing limitations, the regional government should take policy measures to supply long-term loan financing, access to lease machines, fair interest rate, and working and selling places through a cluster management approach, re-define and restructure the existing SMEs strategy. This study suggests to executives, policymakers, SMEs, and microfinance to use the for enterprises’ performance based on the proposed recommendation. Further research should be conducted for knowledge gap of the field in the study area.

1. Introduction

Small and Micro enterprises (SMEs) are required to address the problem of unemployment and related issues in a given country. SMEs make up the majority of businesses in developing nations such as Ethiopia, as they require less starting capital than other large-scale enterprises and produce a big number of jobs [1]. Most studies in Ethiopia and Amhara region researched more about small, micro, and medium enterprises (SMMEs). On the other hand, SMEs are the missing challenges in Ethiopia [2]. On the contrary, small and micro enterprises (SMEs) have not been researched efficiently yet, and still, there are contextual, methodological, and inconsistency gaps in various research findings Amhara region was the most populous region in Ethiopia which lives under poverty line. That is why this study was initiated to conduct the proposed research.

In emerging countries such as Ethiopia, there are no large and medium companies promoting SMEs, which needs holistic intervention and the responsibility of the government. Whereas the issue of SMEs is not such a government task in a developed economy. Furthermore, the performance of Small and micro enterprises in Ethiopia is insignificant as compared to industrialized countries [2]. In addition, SMEs play a significant role in most emerging economies and countries around the world [3]. Comparatively, in developing countries, the role of SMEs accounts for up to 60% of total employment progress, and 40% of SMEs enrich growth and development plan (GDP) contribution, which leads to a significant and higher contribution to SMEs performance [4]. In contrast, the World Bank estimates that 600 million people have entered the global workforce in the last 15 years, predominantly in Asia and Sub-Saharan Africa. In the same argument, World Bank Group studies indicate that the emerging countries have unregistered which is estimated to be 400 million SMEs [5]. Small and micro enterprises contribute to economic growth by reducing poverty, providing alternate employment for urban and rural people, and creating jobs [2,6]. In another survey, small and micro enterprises are critical because they are significant engines of employment, economic growth, and innovation. Consequently, some studies imply SMEs account for more than 90% of the company population in modern economies, 60–70% of employment, and 55% of Growth and Development plans. More than 90% of the company population in modern economies, 60–70 percent of employment, and 55% of GDP [7]. As the literature, in many developing and developed economies, SMEs boosted the gross domestic product rate, and SMEs contribute significantly to economic growth [7]. In some countries such as Turkey (53.9%), China (58%), the United Kingdom (52%), the United States of America (54%), Egypt (80%), Italy (68%), France (58%), Spain (62%), Germany (53%) and Greece (53%) are among the countries that primarily depend on SMEs performance. Another study indicates that SMEs account for 91% of all legal entities in South Africa. They also contribute 57% to GDP and 61% growth rate in employment growth [6], Additional survey by the UNDP (the United Nations Development Program) found that SMEs account for 90% of global business, 60% of jobs, and 58% of gross value added. Rendering to a survey carried out by the Asian Development Bank in 20 countries, SMEs account for 96% of total enterprises and 62% of national workforces across Central, South East Asia, and the Pacific [8]. As the above different literature, various contextual limitations and performance disparities across SMEs may need research and development support.

Furthermore, small and micro enterprises are considered a key driver of growth, poverty alleviation, and reduce unemployment in emerging market economies, because the aggregate share of SMEs is expected a huge percentage of the market, but their expansion has been gradual, and minimal impact on the economy [9]. For instance, SMEs account for over 45% of total employment and 33% of GDP in emerging economies, and when informal enterprises are included, SMEs account for more than half of employment and GDP in emerging economies [10]. Moreover, Ethiopia’s SME sector is the principal source of jobs and income for a large number of unemployed and low-income level of people. According to the 2016 growth and development plan (GDP), the sector contributes 3.4% of the GDP and 33% of the industrial sector [11].

Therefore, the exited SMEs’ performance in Ethiopia, including the Amhara region shows that there is inefficiency and a lack of government support. Researchers did not conduct studies, particularly in the Amhara region, do not draw accurate conclusions or assess the major factors affecting small and microenterprise performance. For instance, ref. [12], explored that regular power outages, a lack of access to financing, and water shortages are all inversely related to SME performance, and failed to a weak market environment [13,14]. In addition, the government supports the SME sector with tax relief, loans, social assistance, and financial assistance [15].

In the context of a supporting role, the government promotes not only supplying sufficient resources but also provides financial and non-financial assistance to SMEs in the early phases of development [16]. On the other hand, government support had a statistically significant and direct effect on other institutions’ support and the performance of SMEs. The research indicates that government support had a positive and significant effect on the performance of SMEs via the partial mediation effect of other institutions’ support [17].

From a financial perspective, microfinance provides saving and credit access to small and micro-enterprises [18]. Microfinance institutions are social organizations that provide financial services to impoverished people who are unable to access traditional banking [19]. These organizations must deal with financial and social goals at the same time [20]. Contemporarily, microfinance institutions have received a lot of attention because of their important role in poverty alleviation [21,22]. For example, microfinance loans make up estimated India’s (70%), China’s (80%), and Malaysia’s (90%) financial system [23]. In this regard, there is a negative influence on innovation, economic growth, and macro-economic resilience in emerging countries [24]; while the relationship between microfinance and enterprise performance is positive and substantial [25]. Here, there are debating issues concerning the association between microfinance and enterprise performance. The impact of microfinance was examined using the evidence from high-quality studies, because the majority of the studies they looked at were conducted in rural areas, they discovered evidence that suggests microcredit isn’t working as well as its proponents anticipated. As a result, microfinance has modest but not uniform positive impacts, and it is not always a silver bullet, but it can cause harm according to their analysis of the evidence [26,27].

In contrast, the direct effect of microfinance as a mediator variable regarding access to infrastructure, entrepreneur training, and entrepreneur competence was examined [28,29,30,31]. On the other hand, the indirect effect of government support as a mediation role was investigated by taking another constraint, especially the consideration of enterprise performance [32,33]. Hence, the above findings indicate, still there is a disparity in variables, and methodology. This implies that there is still a debate on microfinance and government support in having which one is more likely to mediate with enterprise performance.

The other variable, access to infrastructures significantly and positively promotes the integration of goods, services, the distribution of finished items to markets, and promotes social services [34,35,36]. In addition, training is significant for SMEs’ success because demands resources, knowledge, and skills to expand, enhance efficiency, and improve operational performance [37]. Moreover, according to [38], the human resource, or employee of any enterprise, is a favorable asset and a possible source of competitive advantage.

In contrast, a company’s human capital can be viewed as a valuable asset, especially in a knowledge-based economy, where intangibles and services are becoming increasingly important [27,39,40]. This shows that there is a disparity in determining the enterprise performance whether in training, skill, or knowledge.

To sum up, the impacts of enterprise performance on SMEs‘ adoption using government support as a mediator role have still not been well researched and SMEs are not successful. Those gaps initiated the researchers to research in this study area. Therefore, the goal of this study is to identify the mediating role of government support on enterprises’ performance through the consideration of entrepreneur competence, entrepreneur training, access to infrastructure, and microfinance as determining factors in the context of the Amhara region, Ethiopia. Most studies in Ethiopia and Amhara region researched more about small, micro, and medium enterprises (SMMEs). On the other hand, SMEs are the missing challenges in Ethiopia [2]. On the contrary, small and micro enterprises (SMEs) have not been researched efficiently yet, and still, there are contextual, methodological, and inconsistency gaps in various research findings. Necessarily, to meet the stated objectives, this study tried to address three basic research questions such as (1) To what extent does the mediating role of government support affect SMEs’ performance? (2) How does the role of government support mediate between entrepreneur competence, access to infrastructure, entrepreneur training, microfinance, and SMEs performance? (3) Is there a relationship between mediators, predictors, and outcome variables in SMEs’ performance? Therefore, the study used both qualitative and quantitative research approaches supported by a structural equation model, and path modeling analysis using SPSS/AMOS statistical tools. Thus, the proposed research contributes and gives insight to policymakers, academic institutions, SME entrepreneurs, and government professionals who currently doing related to small and micro-enterprise performance.

2. Literature Review and Hypothesis Development

As various literature, there is no clear definition of small and micro-enterprise. Some scholars defined based on their paid-up capital, the number of people employs, and the category of the enterprise. This indicates that there is no universally agreed definition instead of giving contextual meanings. According to Ethiopian studies, micro and small enterprises’ strategy and policy documents are generally defined by their paid-up capital. Micro enterprises have paid-up capital of less than or equal to Birr 20,000 (local currency). A small enterprise is defined with a paid-up capital of less than or equal to Birr 500,000, local currency. However, this does not provide information on job size, or the number of persons employed by SMEs and amount of paid up capital by USD. It also did not indicate the entire asset size of SMEs or distinguish between manufacturing and services. Human capital and assets are essential components of the new concept for meeting the micro and small business’ current established boundaries [41]. Hence, this study reviewed related literature concerning the mediating role of government support on SMEs‘ performance.

However, some scholars have explored the effects of enterprise performance independently. For instance, the linkage between access to microfinance and enterprise performance [32,42]; the integration among government support and SMEs performance [39,40,43].

The impacts of entrepreneur training and infrastructure with enterprise performance, the relationship between entrepreneurs’ competence and enterprises performance [44,45]. This study is unique from the previously mentioned scholars because it used the integrated proposed conceptual research model using mediator variable with structural equation model. This study also focused on the determining factors that influence the performance of SMEs such as entrepreneur competence, access to infrastructure, entrepreneur training, and access to microfinance.

2.1. Entrepreneur Competence and SMEs Performance

Competency is defined as a person’s fundamental quality that leads to actual achievement or greater work performance [46]. The term “competency” refers to traits, motives, specific knowledge, social roles, skills, and self-images that lead to the birth of a new venture, its survival, and growth [47]. The tendency to believe that more effective people have the necessary components for success leads to the attribution of a halo effect [48]. As a result, a comprehensive idea of emotional, social, and cognitive intelligence was developed to provide a useful framework for describing human personalities.

In addition, understanding business sustainability through entrepreneurial competencies is crucial, because it gives entrepreneurs knowledge about how they function and inspires them to be responsive to the possible progressive or bad effects of their conduct [49]. As [50], explored the ten determining dimensions of entrepreneurial competencies such as opportunity, relational, analytical, innovative, operational, human, strategic, commitment, learning, and personal strength. Moreover, the risk-taking and initiative aspects influence the entrepreneur’s skill attribute that contributes to operator success [51,52]. On the other hand, risk-taking, communication, independence, and initiative were considered difficult challenges to measure the aspects of an entrepreneur’s competence [45,53,54,55].

Furthermore, ref. [56] argued that there is a positive effect of entrepreneurial competencies on the performance of SMEs. Furthermore, the competence of entrepreneurs has a substantial impact on the SME’s performance [57]. In addition, the direct effect, and the linkage between entrepreneurs’ competency and SMEs’ success are mediated by government support. The relevant entrepreneurial competency has been measured which shows entrepreneurial competencies have a significant impact on business performance [43]. Therefore, this proposed research observed the impacts of entrepreneur competency and SMEs’ performance using personal relationship, competency, business, and management skill competency, entrepreneurial and human relations competency. Hence, the study has tested the following derived hypothesis to support the research finding.

Hypothesis 1 (H1).

Entrepreneur competency is significantly associated with SME performance.

2.2. Access to Infrastructure and SME Performance

Changes in the quality of infrastructure available for production will have a significant impact on an organization’s output, income, profits, and job creation. Infrastructure is one of the most important factors for economic development. As the findings show that access to infrastructure within the economy through production processes has a direct relationship to productivity [58,59]. In an emerging economy, the availability of infrastructure can have a big impact on a company’s bottom line, where rural and regional infrastructure may be deficient or non-existent [45]. Although, the link between infrastructure availability and quality such as power, potable water, poor road accessibility and economic development in most developing countries examined in Sub-Saharan Africa is missing [60]. Moreover, lack of infrastructure has harmed the industrial sector’s production processes, particularly SMEs’ ability to compete in the global market [34]. Furthermore, weak infrastructure such as terrible roads, insufficient water supply, inconsistent electric supply, and a poor telecommunications system, are all hurdles to SME growth [36].

Furthermore, access to infrastructure affects SMEs‘ performance positively and significantly [61]. In addition, as [62] examined government support ensures an adequate supply of necessary utilities such as electricity, water, and road. Hence, various scholars observed the relationship and effect of access to infrastructure on SME performance. As a result, there is a positive and significant effect on the level of infrastructure and SME performance [34,39,63].

Therefore, this study focused on and estimated the impacts of access to infrastructure on SME performance through the indicators of access to electricity, access to ICT, and access to working and selling areas. So, the study tested the following derived hypothesis.

Hypothesis 2 (H2).

Access infrastructure positively affects SME’s performance.

2.3. The Effect of Entrepreneur Training and SME’s Performance

The concept of training is defined as the formal and systematic change in behavior that occurs due to education, training, development, and planned experience. Furthermore, the primary goal of training is to help the organization to achieve its goals by increasing the value of its most precious asset, particularly the human resource. However, in discussing how companies learn and perform, there are many different approaches. The most known three theoretical approaches such as knowledge-based theory, resource-based theory, and situational-based approach [53]. This implies that entrepreneurship education is designed to assist entrepreneurs in developing the skills, information, and mindset required to start a new business or expand an existing entrepreneur.

Furthermore, a range of internal and external factors influences the functions of enterprises. Small and micro-enterprise performance is positively affected by entrepreneurship training, which is an internal factor [64]. Mainly, entrepreneurship training has a significantly considerable impact on an entrepreneur’s performance [64]. It also observed that regular monitoring was required for the acquired skills translated into more jobs that are practical. Moreover, entrepreneur training has a positive and significant association with SME performance [65]. In most cases, entrepreneur and employee training support significantly in the adaptation of new skills and workplace requirements. The hierarchy provides on-the-job training for recruits.

In addition, some businesses provide common communication, product, or service training to all new workers. In this regard, training has a significant effect that strengthens the employee’s knowledge base, which is necessary for speedy adaptation [66]. Furthermore, entrepreneur training is positively and significantly associated with SME performance [54,64]. Therefore, this study tried to measure the variable entrepreneur training based the contextualized indicators such as training consistency, training effectiveness, and training quality on SMEs performance in the Amhara region, Ethiopia. So, the study stated and tested the following hypothesis to address the research aims and questions.

Hypothesis 3 (H3).

Entrepreneur Training is positively associated with SME performance.

2.4. Access to Micro Finance and SMEs Performance

In developing countries, access to microfinance is an institution, which provides the availability of financial services to business enterprises. Moreover, micro-financial services have a favorable impact on the operation and performance of SMEs [67,68,69,70]. On contrary, microfinance has a coincidental effect on SMEs’ performance [71]. Furthermore, access to finance has a neutral effect on the growth of SME performance [39]. Furthermore, the shortage of finance is the primary obstacle to SMEs realizing their full potential [72]. The capability of small enterprises negatively affected insufficient finance [73].

As financial resource options, loans, leases, and letters of credit are the most common micro-financial services supplied to SMEs [73]. Hence, financial service categories have a major impact on the long-term performance of SMEs [74,75]. Moreover, the amount of loans supplied to businesses has a significant impact on their performance [76,77]; and microcredit has a significant impact on SMEs’ performance [78]. Although leasing has a great deal of potential using finance sources, nearby a scarcity of investigations, particularly in emerging states on the impact of leasing on SMEs’ performance [79].

Even though the significance to SMEs, leasing has little consideration in the literature on capital structure [80]; while leases and debt, on the other hand, are complementary according to some empirical investigations [81]. Nevertheless, of the categories of business facilities provided by microfinance institutions, empirical research has shown that microfinance has a large and favorable impact on small and micro-enterprise performance [81,82,83].

Therefore, this study designed and measured the relationship between microfinance and enterprises’ performance using contextual indicators such as loan cost, time duration of the loan, and loan adequacy for SME performance. Hence, the study tested the derived hypothesis as follows.

Hypothesis 4 (H4).

Microfinance is positively affected SME performance.

2.5. The Mediation Role of Government Support and SME’s Performance

Government support has taken as vital to SME performance. In this sense, administration provision could range fostering a favorable corporate location towards inspiring the sector to complete the supply of various services such as working and selling space, electricity, and ICT [84,85]. Various scholars examined the level of government support [35,86,87], which determines the rate of development of SMEs. The government’s support in terms of tax release, inspiration (incentives), and an adequate controlling structure are significant for SMEs’ performance [48,88,89].

Though, government intervention is not the only entity affecting SME performance [90]; thus, businesses also require government support in a variety of forms, including financial and non-financial assistance. This means, that if government support has not been provided in the public-private partnership, the motivation of the SMEs sector significantly declines. A government can assist businesses in creating a platform that encourages SMEs to collaborate on research and development and mediates SMEs‘ performance [16,91]. Thus, it indicates that the role of government and SMEs are the two sides of one coin because the integration between them has multiplier effects in emerging economies.

Furthermore, government support for SMEs might take the form of creating an environment that encourages positive and healthy competition. According to [92], the struggles regarding equality, laws, regulations, and tax loads are some of the administration provision parts that disturb SME’s performance as seen by entrepreneur leaders. Moreover, government support plays a significant effect in the performance of SMEs, regardless of economic conditions [87,93]. In this regard, this study measured the mediation role of government support on SME performance depending on access infrastructure, electricity, facilities of information communication technology (ICT), and working and selling places for the entrepreneur. Therefore, this research designed and tested a hypothesis based on the previously validated and explored findings.

Hypothesis 5 (H5).

Government support significantly and positively mediates SME performance.

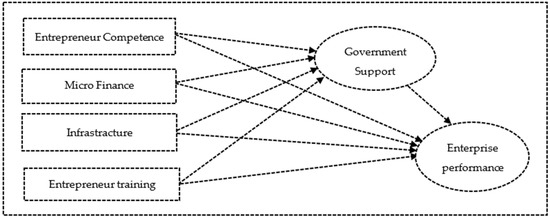

2.6. Conceptual Model of the Study

In this study, the proposed conceptual research model is adapted from previous research findings [94]. The previous studies mainly focused on entrepreneur competency, and government support, they were limited to giving attention to other research constraints. This implies that there are research gaps in the area of enterprise performance in Ethiopia, especially in the Amhara region. Moreover, this study is unique from other scholars by adding additional study variables. Comparatively, the new contextualized insight constraints are entrepreneur competence, microfinance entrepreneur training, infrastructure, and the mediator variable Government support. Hence, the Enterprise performance (EP) is the outcome variable. The entrepreneur competency (EC), microfinance (MF) infrastructure (IF), and entrepreneur training (ET) are predictor variables as shown in Figure 1.

Figure 1.

Authors Proposed Conceptual Model.

3. Research Methodology

3.1. Research Design

The research design is a plan for achieving research objectives and resolving research problems. This study used both quantitative and qualitative research designs. The study designed the mediator variable government support by taking some constraints, which have not yet been researched by other scholars. Some scholars examined, the mediation role of entrepreneur competence has a positive effect on enterprise performance, and government support on enterprise performance [95]; Hence the mediation role of entrepreneur competence is explored in both direct and indirect effects using the independent variable microfinance, and government support with the dependent variable enterprise performance [96]. Here, they did not focus on the other variables’ impacts such as access infrastructure and entrepreneur training on SMEs’ performance. In addition, they also did not examine government support as a mediation constraint concerning SME performance. Therefore, this proposed study is unique from previous studies.

Moreover, this study used the mediator variable government support to identify the direct and indirect effects of the entire variable adopted from previous findings [97]. Therefore, the study used four independent variables such as entrepreneurial competence, microfinance, access to infrastructure, and entrepreneur training concerning the dependent variable enterprise performance.

3.2. Sample and Data Collection

The researchers used the purposive sampling method to determine the number of respondents from the total population [98]; thus, the estimated sample size of SMEs has been taken from the Amhara region, Ethiopia. As a result, the authors used primary and secondary data from SME entrepreneurs by choosing 384 SME leader and employee respondents purposively based on a 5% significant threshold [99]. The researcher distributed 420 questionnaires to respondents. Finally, 384 questionnaires were collected and analyzed using SPSS/AMOS statistical tools.

3.3. Model Specification

When constructing an empirical model, it has not been recommended by other scholars to identify the dependent and independent variables with their estimated values. The empirical model’s independent variables were the mediating effect of government support with the predictor variables, entrepreneur competency, microfinance, infrastructure, and entrepreneur training. Overall, employment growth, capital growth, and sales growth indicate the performance of SMEs, the interventions based on the researcher’s logical judgment, and the accessibility of data. To track the progress of SMEs in Ethiopia, data on capital growth, employment growth, and sales growth are used [10,100]. As a result, in growth-related research, both structural equation models and multiple regressions have been utilized in this study.

According to current research, the multiple linear regression model is consistent [10,45]. Instead of conducting different regression analyses, the structural equation model (SEM) analysis was designed to explore a single analysis model [98]. Moreover, the structural equation model is a useful tool for determining the direct and mediated effects between the outcome and predictor variables supported by the mediator variable. In assumption, when one variable influences a second variable, which influences the third variable, all factors provided for causal estimation are taken into account. As a result, the mediator is M, the intermediate variable. It serves as a relationship between predictors X and the outcome variable Y (SMEs performance). The derived equation for the proposed conceptual research model has predicted as follows:

The dependent variable “Y” has projected to estimate the implications of SMEs performance as follows:

Y = β0 + β1X + ε

The impacts of entrepreneur competence using government support, and intervention roles between variables have been forecast through multiple regression analysis with the “X” and “M” predicted equation.

Y = β0 + β1X1 + β2X2 + β3 X3 + β4 X4 +M + ε

The impact of government support (mediator variable) on SMEs’ performance has been predicted as follows:

where: Y = enterprise performance (dependent variable) X = Independent variables or X1 = entrepreneur competence, X2 = infrastructure, X3 = entrepreneur training, X4 = micro finance. M = government support (the mediating variable), β0 = Intercept, ε = the standard error.

Y = β0 + β1X1 + β2X2 + β3X3 + β4 X4 + ε

3.4. Measurements of Variables

As various literature shows that financial and non-financial performance, metrics can be considered measuring instruments. Hence, this study adopted and contextualized measuring items depending on the aims of the research as shown in Table 1 below.

Table 1.

Measurement of Variables.

4. Results and Interpretations

4.1. Demographic Data Analysis

In this research, findings of 384 SMEs leader and employee respondents’ demographic sample data show 80.2% (308) are male and 20.8% (76) were female. While the statistical data indicates that females’ engagement is too low; this case may be linked to the inability of SMEs sectors to consider female entrepreneurs’ participation. The data analysis indicates 36% of the respondents were 20–30 years, 23% of respondents were between 31–40 years, 17% were between 41–45 years, 13.1% were 46–50 years, and 10.8% of the response participants were greater than 50 years old. It shows that two-thirds of the participants are mature entrepreneurs and they are capable to give a rational answer to the study.

The educational background of respondents’’ response indicates that 45.8% had diplomas holders, 34.5% of the respondents were high school level and below, 17.6% of the respondents were undergraduates (degree holders), and the remaining 2.1% of respondents were postgraduates. The age analysis implies that most of the participants were able to give valued evidence for the study. In addition, the respondents’ work experience implies that 54.9% had 11–20 years of work experience while 18.5% were more than 21 service years acting in SME business tasks. The remaining 11.7% and 3% of respondents were 6–10, and 1–5 years of work experience, respectively.

4.2. Reliability and Validity Statistics Analysis

The correlation matrix analysis results incorporated the inter-correlations of the primary study variables such as EP, EC, MF, IF, ET, and GS, respectively. As a result, indicates, there is a significant impact with a positive correlation at r = 0.656 **, and p < 0.01 between EC and EP. Furthermore, there is also a significant influence with a positive correlation at r = 0.844 **, p < 0.01 between MF and EP. The intercorrelations are also significant effects with a positive association between MF and EC at r = 0.837 **, p < 0.01. So that, there is a higher magnitude of correlation with the outcome variable enterprise performance (EP). The relationship between IF and EP is positive and significant at r = 0.635 **, p < 0.01 as well as between IF and EC has significant and positive integrity at r = 0.845 **, p < 0.01. Likewise, there is also the same significant effect with a positive relationship that exists entirely between IF and MF at r = 0.785 **, p < 0.01.

In addition, there is a significant and positive relationship between ET and EP at r = 0.859 **, p < 0.01. Similarly, a significant positive relationship also exists between ET and EC at r = 0.689 **, p < 0.01. There is also a positive and significant relationship between ET and MF at r = 0.801 **, p < 0.01. As the result reveals, there is also a positive and significant relationship between ET and AI by r = 0.687 **, p < 0.01 level.

In other words, the matrix analysis revealed that the relationship between the outcome variable enterprises performance, the response (independent) variables, and the mediator government support is robust, positive, and substantial. Moreover, the interactions of each predictor variable and the outcome variable enterprises’ performance are direct, which has supported by the mediation of government support at 0.001 and 0.05 levels (2-tailed) of significance, as depicted in Table 2 below.

Table 2.

Correlation Matrix Analysis.

Lastly, the correlation is positive and significant between the mediator variable GS and outcome variable EP at r = 0.835 **, p < 0.033. There is also a positive and significant role between GS and EC r = 0.766 **, p < 0.01 while there is a positive and significant association between GS and MF at r = 0.826 **, p < 0.01. Consequently, there is a favorable relationship between GS and IF at r = 0.855 **, p < 0.01 as well as when looking at the relationship between GS and ET, there is a positive and significant relationship at r = 0.883 **, p < 0.01. Therefore, this implies that all the identified variables have more likely favorable effects on one another both significantly and positively.

4.3. Analysis of Multiple Regressions

The study used multiple regression analysis to identify which responsive variables affect the outcome variable enterprise performance. Each parameter estimate value ranges from to according to regression indicates 0.701 (IF), 0.711 (ET), 0.950 (EC), 0.961 (MF) to 0.730 (EP) with a direct impact between the variables access to infrastructure, entrepreneur competence, and microfinance to enterprise performance have a strongly significant and positive influence. On the other hand, the parameter estimate value ranges from 0.831 (ET), 0.841 (MF), 0.861 (IF), 0.960 (EC), 0.971 (GS) to 0.730 (EP) with an indirect significant and positive impact among variables that is supported by the mediator role of government support. Furthermore, crucial ratio values are created when the estimates are separated and examined in terms of their appropriate standard error (S.E) (C.R). At a 0.05 level of significance, a critical ratio (C.R) score greater than 1.96 is more likely to be positive. As a result, all of the composite reliability (C.R) values are more than 2.526, indicating that at a p-value of 0.05, all of the study limitations are significant.

Furthermore, all of the determined variables have been independently tested to ensure that the proposed research model is fit for its purpose by adhering to the previously stated assumptions. As a result, with a p-value of 0.000, the predictor variables enterprise competency (EC), micro-financing (MF), access to infrastructure (IF), and enterprise training (ET) had a positive and substantial impact on the outcome variable enterprise performance.

Moreover, the mediator variable government support (GS) positively and significantly affects the dependent variable enterprise performance (EP) at β = 0.971 and a p-value of 0.033. This indicates that there is no significant disparity in the variances of the study variables at all dimensions. So that, the effect of the mediator variable government support (GS) plays a more likely positive and significant role on enterprise performance (EP) as shown in Table 3 below.

Table 3.

Levels of Significant and Critical Ratio Regression Weights.

To sum up, all the evaluated variable items support the fitness of the proposed conceptual model positively and significantly affected by the mediator role of government support. The government support mediates the performance of SMEs. Hence, all the indicator items undertake a strong relationship with their respective latent constructs. Therefore, the derived conceptual model has fitted since the estimated results of the stated variable are above the recommended threshold values of the criteria of the model specification assumptions.

4.4. Structural Equation Model Estimate

This research tried to evaluate the influences of response variables on the dependent variables; the study used a supportive path diagram structural equation model (SEM). The summary of structural equation model estimation analysis shows that the goodness of model fit indices is acceptable because all the computed indices are above the criteria values of basic assumptions as shown in Table 4 below. Moreover, the Chi-square for the model is 1.780, which is less than 3.0; the GFI also fits at 0.952, which is above the threshold value of 0.90. The AGFI is also acceptable at 0.937, which is greater than the 0.90 recommended value; the NFI value is also 0.926, which is greater than 0.90; the IFI of the model is 0.972 which is above the recommended value of greater than 0.90. The CFI of the model is 0.982, which is ≥0.90 and TLI is 0.928, which is ≥0.9.

Table 4.

Result of the CFA Model Fit.

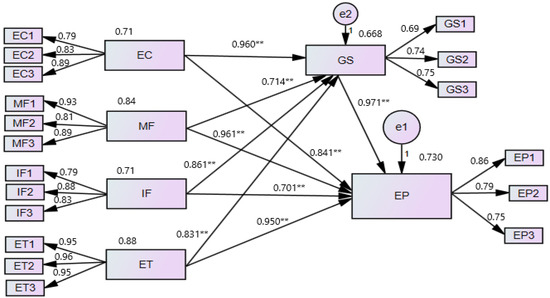

4.5. Results of the Structural Model Goodness-of-Fit and Path Modeling Analysis

In this research, the structural equation model and growth path model have been used to evaluate goodness-of-fit and the impacts of constructs over their respective variables. Furthermore, based on the results of the path-modeling diagram analysis, the study took into account the estimated values of the growth path modeling coefficients or standardized regression weights 0.668 (67%) and the explained variance of model fitness (R2). As a result, the standardized coefficient regression estimated values for the variable suggest that the model is fit. Since R square (R2) is assessed to be 0.730 (73%) and significant at a p-value of 0.000.

As the growth path model demonstrated that the independent variable entrepreneur competency (β = 0.841 ***), microfinance (β = 0.961 ***), access to infrastructure (β = 0.701 ***), and entrepreneur training (β = 0.950 ***) strongly affect the outcome variable enterprise performance which is highly supported by the mediation role of government support (β = 0.971 ***) as shown in Figure 2. Therefore, the role of government support strongly mediates the performance of enterprises in SMEs in the context of the Amhara region.

Figure 2.

Structural Equation Model Path Diagram Analysis. ** Stands for the strong relationship and level of significance between variables.

On the other hand, the impacts of all constraint variables have a multiplier effect on enterprise performance. As a result, when the influence of entrepreneur competency (EC) grows by one unit, the outcome variable enterprise performance (EP) increases by the estimated factor of =0.841 substantially with a p-value of 0.000, as citrus paribus remains constant. With a p-value of 0.000, when the impact of microfinance (MF) grows by one unit, the outcome variable enterprise performance (EP) improves by the estimated factor of =0.961 significantly. Furthermore, when the distribution of access to infrastructure (IF) increases by one unit, the outcome variable enterprise performance (EP) improves by the estimated factor of =0.701, with a p-value of 0.000. Similarly, as entrepreneur training (ET) improves by one unit, the outcome variable enterprise performance (EP) is more likely to be affected by the estimated factor of =0.950, with a p-value of 0.000.

Furthermore, because the mediating role of government support is highly and strongly enhanced by one unit on other constraints such as entrepreneur competency, microfinance, access to infrastructure, and entrepreneur training, the aggregate performance of SMEs will be influenced by the estimated factor of =0.971 significantly at p-value 0.033. As the suggested conceptual model fit indices in Figure 2 reveal, government support has a multifaceted influence in mediating between independent and dependent variables.

4.6. The Mediator Variable’s Direct, Indirect, and Total Effects

In this research, was used to investigate the mediation impact of the study variable using the growth path model. As a result, the path modeling regression weight analysis was used to assess the direct, indirect, and total effects of the mediator variable governing support. The full mediation effects of all the independent factors added to the outcome variable were examined and weighted using the structural equation model (SEM).

The direct, indirect, and total effects of the mediator variable government support have been investigated, as evidenced by the variations in mediation findings. Based on the development path modeling results, the mediation weights may now see from two different perspectives. The first examines the influence of all independent factors as well as the role of government support as a mediator. At =0.970, the mediating effects of government support on entrepreneur competency, microfinance, infrastructure access, and entrepreneur training are extremely dominant, favorable, and significant. As a result, the findings suggest that government support has a significant impact on entrepreneur competency, microfinance, infrastructure availability, and entrepreneur training. The relationship between government support and enterprise performance is the second factor to analyze. As a result, the effects of the government’s supportive role on enterprise performance are favorably and considerably influenced, with favorable total effects of =0.970.

To summarize, the mediating effects of government support and all independent factors on the outcome variable enterprise performance in all measurements of direct, indirect, and total effects are extremely significant and favorable. As a result, the government’s mediation role resulted in a positive effect as shown in Table 5 below.

Table 5.

Direct, Indirect, and Total Effects of the Mediator Variable.

4.7. Mediating Effects of Government Support

The study used the role of government support as a mediator variable to explore the impacts of entrepreneur competence, microfinance, access to infrastructure, and entrepreneur training on enterprise performance as displayed in Table 6. The influence of the mediating variables has been investigated using the Sobel test to verify the level of mediator in catalyzing other determined predictors and outcome variables. As a result, when the Z-score is more than 2.00 (absolute value), mediating effects exist [108,109,110,111]. Therefore, the mediating effects of government support highly support the other study variables in the intervening role; and the Sobel test of Z-score value fulfilled the threshold criteria, which is greater than 2.00 as shown in Table 6 below.

Table 6.

Results of Mediation effects.

In addition, the confidence interval for the direct impacts has been calculated using the product distribution approach. So that, at a 95% confidence level, 0.00 was not included in the confidence range for direct effects, indicating that mediating effects were examined in this study. Hence, the mediating effects of all measurements in this investigation were statistically significant as the results of mediation effects are shown in Table 7. Therefore, the existed result of the Sobel test supports the mediating effect of government support (GS) between entrepreneur competence (EC), microfinance (MF), access to infrastructure (IF), entrepreneur training (ET), and enterprise performance (EP).

Table 7.

Tests of Hypothesized Results.

4.8. Test of Hypothesis Results Analysis

In this study, all of the stated hypotheses were tested. Moreover, the entire hypothesized associations among variables have been supported by the results of the structural equation model (SEM) analysis as shown in Figure 2. In this regard, entrepreneur competence (EC) has a significant and positive effect on enterprise performance (EP) at β = 950, a p-value of 0.01. This implies, that the investigation result of hypothesis 1 is accepted, and supports the aims of the study. The mediating role of government support (GS) has a significant and positive effect on enterprise performance (EP) at β = 0.961, p-value less than 0.05. Therefore, hypothesis 2 is accepted. Access to infrastructure (IF) have a significant and positive effect on enterprise performance (EP) at β = 0.701, p-value < 0.01. This shows that hypothesis 3 is accepted, and significantly supports the aims of the study. Entrepreneur training (ET) has a positive and significant influence on enterprise performance (EP) at β = 0.711, p-value < 0.01. It shows that hypothesis 4 is also accepted and supported by the study. Microfinance (MF) also has positive and significant effect on the dependent variable enterprise performance (EP) at β = 0.971, p-value < 0.01. This indicates, that hypothesis 5, is acceptable and supported the aims of the study. Generally, all stated and proposed hypotheses test results significantly and positively support the outcome of the derived hypothesis as shown in Table 7 below. These results confirm that all stated hypotheses are accepted.

5. Conclusions and Recommendations

The main aim of this study is to examine factors affecting SMEs’ performance with the mediating role of government support in the Amhara Region, Ethiopia. This study used both qualitative and quantitative research designs. The derived research model deployed a Structural equation model, growth path modeling, and multiple regression analysis supported by SPSS/AMOS statistical tools. The study also used both primary and secondary data sources using selected enterprises and entrepreneur respondents. Based on the reviewed literature and the finding, the study concluded the following key points.

To the findings of the study, the theoretical implications indicate that the mediating role of government support has highly significant and positive impacts on enterprise performance at β = 0.971 ** and R2 = 0.730. The derived conceptual model fitted significantly and positively which fulfills all recommended model indices values. Moreover, the independent variables entrepreneur competence (β = 0.960 **), microfinance (β = 0.714 **), access to infrastructure (β = 0.861 **), and entrepreneur training (β = 0.831 **) have a positive and substantial impact on enterprise performance. However, all the indicator measurement items have a favorable impact on the receptive response and outcome variable. Mainly, microfinance (β = 0.961 **), and entrepreneur training (β = 0.950 **) have a major influence on enterprises’ performance next to the mediating role of government support. Hence, the findings of the results have imperative and beneficial effects for theoretical implications.

Theoretical Implication: In this study, the findings coincide with the previously explored outcomes with logical theoretical perspectives. From a resource-based theory perspective, the financial limitation of the entrepreneur can be solved by long-term loan options, access lease machines, and access working areas through a cluster approach. Therefore, the theoretical implications of this study should be addressed through the consideration of resource-based theory.

Managerial Implications: Furthermore, the results of the study, the managerial implications show that the SMEs and government support have gaps in building enterprises performance due to lack of long-term loan financing, access to lease machines, unfair interest rate, production and selling the place, the definition of SMEs, and structural flow bottlenecks. For that reason, the regional government, technical vocational enterprise development bureau, and microfinance institutions should take corrective managerial actions to access a long-term loan, supply of lease machine, fair interest rate, working, selling premises on cluster management approach, re-define SMEs definition and restructure the existing strategy and policy in the context of Ethiopia, including the regional state.

Knowledge Contribution: The contribution of this paper fills the gaps of Government officials, policymakers, academic institutions, and entrepreneurs. From the findings factors affecting SMEs’ performance are a shortage of access to finance, the impact of high-interest rate, limitation of infrastructure entrepreneur training, and absence of entrepreneur competence which were affected by the mediating effect of Government support in Ethiopia Amhara region.

Limitations and future directions: The main limitation of the study is limited only to SME sectors. The study was also limited to the Amhara region, particularly in three metropolitan cities. The study did not consider other constraints. It is also limited in deploying secondary data to measure the financial aspects of the enterprise performance. This all implies that further research should investigate.

The study forwarded some future directions. All the stakeholders who stake in enterprise development should act based on their independent and mutually expected roles. Moreover, this study recommended the government to take actions particularly, about accessing long-term loan financing, balancing the unfair interest rates, supplying long-term machine lease system, re-define the small and micro-enterprises practically, and formulating appropriate clustering management approaches to overcome the existed problems of SMEs performance accordingly. The government should look at the SMEs policy and strategy implementation aligned with those primarily legitimated institutions that have a stake in job creation. Therefore, further studies should conduct, and both the government as well as institutions should experience solving problems supported by research investigations.

Author Contributions

Conceptualization, Y.Z. and E.Y.A.; methodology, software, validation, and formal analysis, investigation, resources, data curation, writing—original draft preparation, E.Y.A.; writing—review, editing, and supervision, Y.Z. and E.Y.A. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Acknowledgments

The authors are grateful for all respondents’ cooperation in providing all the necessary information for the achievement of this study.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Mamo, W.B. Growth Determinants of Micro and Small Enterprises (MSEs): Evidence from Entrepreneurs in the Eastern Region of Ethiopia. J. Knowl. Econ. 2022, 3, 2–19. [Google Scholar] [CrossRef]

- FDRE Ministry of Industry. Ethiopian Industrial Development Strategic Plan (2013–2025); Ministry of Industry: Addis Ababa, Ethiopia, 2013; pp. 1–125.

- Zambad, S.; Londhe, B.R. To Study The Scope & Importance of Amended Patent Act on Indian Pharmaceutical Company with Respect to Innovation. Procedia Econ. Financ. 2014, 11, 819–828. [Google Scholar]

- Morduch, J.; Wagner, R.F.; Haley, B. Analysis of the Effects of Microfinance on Poverty Reduction: The NYU Wagner Working Paper Series. Can. Int. Dev. Agency 2002, 1014, 7. [Google Scholar]

- Wang, Y. What are the biggest obstacles to growth of SMEs in developing countries? An empirical evidence from an enterprise survey. Borsa Istanb. Rev. 2016, 16, 167–176. [Google Scholar] [CrossRef]

- Selvakumar, M.; Sathyalakshmi, V. Economic and social thought. J. Econ. Soc. Thought 2015, 2, 106–120. [Google Scholar]

- Meyer, D.F.; Meyer, N. Management of small and medium enterprise (SME) development: An analysis of Stumbling blocks in a developing region. Polish J. Manag. Stud. 2017, 16, 127–141. [Google Scholar] [CrossRef]

- Asian Development Bank. Asia SME Finance Monitor. Asia Development Bank; Asian Development Bank: Mandaluyong, Philippines, 2014; pp. 1–90. [Google Scholar]

- Nichter, S.; Goldmark, L. Small Firm Growth in Developing Countries. World Dev. 2009, 37, 1453–1464. [Google Scholar] [CrossRef]

- Marolt, M.; Zimmermann, H.D.; Pucihar, A. Enhancing marketing performance through enterprise-initiated customer engagement. Sustainability 2020, 12, 3931. [Google Scholar] [CrossRef]

- Chandrayanti, T.; Nidar, S.R.; Mulyana, A.; Anwar, M. Credit accessibility model of small enterprises based on firm characteristics and business performance. Case study at small enterprises in West Sumatera Indonesia. Int. J. Entrep. 2019, 23, 2–20. [Google Scholar]

- Tefera, H.; Gebremichael, A.; Abera, N. Growth Determinants of Micro and Small Enterprises: Swiss Program for Research for Global Development WP. 2016, 1–27. Available online: http://www.iiste.org (accessed on 31 May 2022).

- Abebe, G.T.; Caria, S.; Fafchamps, M.; Falco, P.; Franklin, S.; Quinn, S. Curse of Anonymity or Tyranny of Distance? The Impacts of Job-Search Support in Urban Ethiopia. NBER Work 2016, 72. [Google Scholar] [CrossRef]

- Abara, G.; Banti, T. Role of Financial Institutions in the Growth of Micro and Small Enterprises in Assosa Zone. Int. J. Sci. Res. 2015, 6, 852–856. [Google Scholar]

- Tether, B.S.; Storey, D.J. Public policy measures to support new technology-based firms in the European Union. Res. Policy 1998, 26, 1037–1057. [Google Scholar]

- Alkahtani, A.; Nordin, N.; Khan, R.U. Does government support enhance the relation between networking structure and sustainable competitive performance among SMEs? J. Innov. Entrep. 2020, 9, 2–19. [Google Scholar] [CrossRef]

- Ntiamoah, E.B.; Li, D.; Kwamega, M. Impact of Government and Other Institutions’ Support on Performance of Small and Medium Enterprises in the Agribusiness Sector in Ghana. Am. J. Ind. Bus. Manag. 2016, 6, 558–567. [Google Scholar]

- Gu, J.; Wang, J.; Yang, Y.; Xu, Z. Credit line models for supply chain enterprises with channel background and soft information. Sustainability 2019, 11, 2985. [Google Scholar] [CrossRef]

- Yang, L.; Zhang, Y. Digital financial inclusion and sustainable growth of small and micro enterprises-evidence based on China’s new third board market listed companies. Sustainability 2020, 12, 3733. [Google Scholar] [CrossRef]

- Piot-lepetit, I.; Nzongang, J. Business Analytics for Managing Performance of Microfinance Institutions: A Flexible Management of the Implementation Process. Sustainability 2021, 13, 4882. [Google Scholar] [CrossRef]

- Xu, W.; Fu, H.; Liu, H. Evaluating the sustainability of microfinance institutions considering macro-environmental factors: A cross-country study. Sustainability 2019, 11, 5947. [Google Scholar] [CrossRef]

- OECD. Enhancing the Contributions of SMEs in a Global and Digitalized Economy. OECD Couns. Minist. 2017, 1, 7–8. [Google Scholar]

- Yoshino, N.; Taghizadeh-hesary, F. The Roles of SMEs in Asia and their Difficulty in Assessing Finance. Asia Bus. Dev. 2018, 911, 1–22. [Google Scholar]

- Bouri, A.; Breij, M.; Diop, M.; Kempner, R.; Klinger, B.; Stevenson, K. Report on Support to SMEs in Developing Countries Through Financial Intermediaries; Dalberg: Washington, DC, USA, 2011. [Google Scholar]

- Ocholah, R.M.A.; Okelo, S.; Ojwang, C.; Aila, F.; Ojera, P.B. Literature Review on the Relationship between Microfinance Provision and Women Enterprise Performance. Greener J. Soc. Sci. 2013, 3, 278–285. [Google Scholar] [CrossRef][Green Version]

- Ahmad, P.S.; Choudhary, U. Microfinance and Socio-Economic Development of Poor Families in Rural India: An Empirical Investigation. Int. J. Manag. 2021, 12, 610–619. [Google Scholar]

- Peter, F.O.; Oladele, P.; Adegbuyi, O.; Olokundun, A.M.; Peter, A.O.; Amaihian, A.B. Data set on training assistance and the performance of small and medium enterprises in Lagos, Nigeria. Data Br. 2018, 19, 2477–2480. [Google Scholar] [CrossRef] [PubMed]

- Diabate, A.; Allate, B.M.; Wei, D.; Yu, L. Do firm and entrepreneur characteristics play a role in SMEs’ Sustainable growth in a middle-income economy like Côte d’Ivoire? Sustainability 2019, 11, 1557. [Google Scholar] [CrossRef]

- Sarfraz, M.; Qun, W.; Abdullah, M.I.; Alvi, A.T. Employees’ perception of Corporate Social Responsibility impact on employee outcomes: Mediating role of organizational justice for Small and Medium Enterprises. Sustainability 2018, 10, 2429. [Google Scholar] [CrossRef]

- Zhao, X.; Lynch, J.G.; Chen, Q. Reconsidering Baron and Kenny: Myths and truths about mediation analysis. J. Consum. Res. 2010, 37, 197–206. [Google Scholar] [CrossRef]

- Stancu, A.; Filip, A.; Rosca, M.I.; Ionita, D.; Caplescu, R.; Cânda, A. Value creation attributes-clustering strategic options for Romanian SMEs. Sustainability 2020, 12, 7007. [Google Scholar] [CrossRef]

- Kim, J.; Hwang, E.; Phillips, M.; Jang, S.; Kim, J.E. Mediation Analysis Revisited: Practical suggestions for addressing common deficiencies. Australas. Mark. J. 2018, 26, 59–64. [Google Scholar] [CrossRef]

- Alavi, A.H.; Buttlar, W.G. An overview of smartphone technology for citizen-centered, real-time, and scalable civil infrastructure monitoring. Future Gener. Comput. Syst. 2019, 93, 651–672. [Google Scholar] [CrossRef]

- Obokoh, L.O.; Goldman, G. Infrastructure deficiency and the performance of small- and medium-sized enterprises in Nigeria’s Liberalized Economy. Acta Commer. 2016, 16, 1–19. [Google Scholar] [CrossRef]

- Chatterjee, S.; Datta, D. Entrepreneurial Ability and Development of Micro Enterprise. J. Econ. Theory Pract. 2020, 8, 1–19. [Google Scholar] [CrossRef]

- Mambula, C. Perceptions of SME growth constraints in Nigeria. J. Small Bus. Manag. 2002, 40, 58–65. [Google Scholar] [CrossRef]

- Agburu, J.I.; Anza, N.C.; Iyortsuun, A.S. Effect of outsourcing strategies on the performance of small and medium scale enterprises. J. Glob. Entrep. Res. 2017, 7, 26. [Google Scholar] [CrossRef]

- Beynon, M.J.; Jones, P.; Pickernell, D.; Packham, G. Investigating the impact of training influence on employee retention in small and medium enterprises: A regression-type classification and ranking believe simplex analysis on sparse data. Expert Syst. 2015, 32, 141–154. [Google Scholar] [CrossRef]

- Cámara, N.; Tuesta, D. Measuring Financial Inclusion: A Multidimensional Index; B BVA: Madrid, Spain, 2014. [Google Scholar]

- McKinney, W. Data Structures for Statistical Computing in Python. Proc. 9th Python Sci. Conf. 2010, 1, 56–61. [Google Scholar]

- MUDHC. National Report on Housing & Sustainable Urban Development; MUDHC: Adis Ababa, Ethiopia, 2014; pp. 1–75. [Google Scholar]

- Marri, H.B.; Nebhwani, M.; Sohag, R.A. Study of government support system in SMEs: An empirical investigation. Mehran Univ. Res. J. Eng. Technol. 2011, 30, 435–446. [Google Scholar]

- Mitchelmore, S.; Rowley, J. Entrepreneurial competencies: A literature review and development agenda. Int. J. Entrep. Behav. Res. 2010, 16, 92–111. [Google Scholar] [CrossRef]

- Sefiani, Y. SMEs: A Perspective from Tangier; Emerald: Bingley, UK, 2013; pp. 1–443. [Google Scholar]

- Ndiaye, N.; Razak, L.A.; Nagayev, R.; Ng, A. Demystifying small and medium enterprises’ (SMEs) performance in emerging and developing economies. Borsa Istanbul Rev. 2018, 18, 269–281. [Google Scholar] [CrossRef]

- Murphy, G.; Trailer, J.; Hill, R. Measuring Research Performance in Entrepreneurship. J. Bus. Res. 1996, 36, 15–23. [Google Scholar] [CrossRef]

- Bird, B. Towards a Theory of Entrepreneurial Competency; JAI Press Inc.: Stamford, CT, USA, 1995; pp. 51–72. [Google Scholar]

- Boyatzis, R.E. Competencies in the 21st century. J. Manag. Dev. 2008, 27, 5–12. [Google Scholar] [CrossRef]

- Ahmad, N.H.; Ramayah, T.; Wilson, C.; Kummerow, L. Is entrepreneurial competency and business success relationship contingent upon business environment? A study of Malaysian SMEs. Int. J. Entrep. Behav. Res. 2010, 16, 182–203. [Google Scholar] [CrossRef]

- Man, T.W.Y.; Lau, T.; Chan, K.F. The competitiveness of small and medium enterprises: A conceptualization with focus on entrepreneurial competencies. J. Bus. Ventur. 2002, 17, 123–142. [Google Scholar] [CrossRef]

- Segal, G.; Borgia, D.; Schoenfeld, J. The motivation to become an entrepreneur. Int. J. Entrep. Behav. Res. 2005, 11, 42–57. [Google Scholar] [CrossRef]

- Kiyabo, K.; Isaga, N. Strategic entrepreneurship, competitive advantage, and SMEs’ performance in the welding industry in Tanzania. J. Glob. Entrep. Res. 2019, 9, 2–17. [Google Scholar] [CrossRef]

- Kamyabi, Y.; Devi, S. The impact of advisory services on Iranian SME performance: An empirical investigation of the role of professional accountants. S. Afr. J. Bus. Manag. 2012, 43, 61–72. [Google Scholar] [CrossRef]

- Atiase, V.Y.; Mahmood, S.; Wang, Y.; Botchie, D. Entrepreneurship development in Africa: Investigating critical resource challenges. J. Small Bus. Enterp. Dev. 2017, 25, 644–666. [Google Scholar] [CrossRef]

- Piot-Lepetit, I.; Nzongang, J. Financial sustainability and poverty outreach within a network of village banks in Cameroon: A multi-DEA approach. Eur. J. Oper. Res. 2014, 234, 2–19. [Google Scholar] [CrossRef]

- Asenge, B.; Lubem, E.; Richard, T. Entrepreneurial Competencies and Entrepreneurial Mindset as Determinants of Small and Medium Scale Enterprises Performance in Nigeria. Int. Res. J. Publ. Glob. J. 2018, 18, 2–21. [Google Scholar]

- Ibidunni, A.S.; Atolagbe, T.M.; Obi, J.; Olokundun, M.A.; Oke, O.A.; Amaihian, A.B. Moderating effect of entrepreneurial orientation on entrepreneurial competencies and performance of agro-based SMEs. Int. J. Entrep. 2018, 22, 1–9. [Google Scholar]

- Ombi, N.; Ambad, S.N.A.; Bujang, I. The Effect of Business Development Services on Small Medium Enterprises (SMEs) Performance. Int. J. Acad. Res. Bus. Soc. Sci. 2018, 8, 114–127. [Google Scholar] [CrossRef]

- Enang, U.; Bassey, E. Human Capital and Industrialization in Nigeria. Nile J. Bus. Econ. 2017, 5, 58–78. [Google Scholar]

- Calderon, C.; Cantu, C.; Chuhan-Pole, P. Infrastructure Development in Sub-Saharan Africa: A Scorecard; World Bank Policy Research Working Paper No. 8425; World Bank: Washington, DC, USA, 2018. [Google Scholar]

- Sefiani, Y.; Bown, R. What Influences the Success of Manufacturing SMEs ? A Perspective from Tangier Yassine Sefiani the University of Gloucestershire Senior Lecturer in Market Interpretation the University of Gloucestershire. Int. J. Bus. Soc. Sci. 2013, 4, 297–309. [Google Scholar]

- Ahmed, K.; Chowdhury, T.A. Performance Evaluation of SMEs of Bangladesh. Int. J. Bus. Manag. 2009, 4, 2–21. [Google Scholar] [CrossRef]

- Islam, S.; Hossain, F. Constraints to small and medium-sized enterprises development in Bangladesh: Results from a cross-sectional study. J. Account. Econ. 2018, 6, 2–18. [Google Scholar] [CrossRef]

- Kithae, P.P. Effect of Legal and Technological Arrangements on Performance of Micro and Small Enterprises in Kenya. Eur. J. Bus. Manag. 2013, 5, 160–168. [Google Scholar]

- Mayuran, L. The Impacts of Entrepreneurship Training on Performance of Small Enterprises in Jaffna District Problem Statement and Research Questions Entrepreneurship training financial management Performance of Small enterprises. Glob. J. Commer. Manag. Perspect. 2016, 5, 1–6. [Google Scholar]

- Ezzahra, K.F.; Mohamed, R.; Omar, T.; Mohamed, T. Training for Effective Skills in SMEs in Morocco. Procedia-Soc. Behav. Sci. 2014, 116, 2926–2930. [Google Scholar] [CrossRef][Green Version]

- Atiase, V.; Mahmood, S.; Yong, W. BAM2019 Conference Proceedings FNGOs and Microfinance Delivery: The Institutional Logic Perspective Victor Yawo Atiase International Centre for Transformational Entrepreneurship; University of Wolverhampton: Wolverhampton, UK, 2019. [Google Scholar]

- Ibor, B.I.; Offiong, A.I.; Mendie, E.S. Financial Inclusion and Performance of Micro, Small and Medium Scale Enterprises in Nigeria. Int. J. Res. 2017, 5, 104–1228. [Google Scholar] [CrossRef]

- Bank, W. Industrial Clusters and Micro and Small Enterprises in Africa: From Survival to Growth; World Bank: Washington DC, USA, 2011. [Google Scholar]

- Parvin, S.S.; Hossain, B.; Mohiuddin, M.; Cao, Q. Capital structure, financial performance, and sustainability of micro-finance institutions (MFIs) in Bangladesh. Sustainability 2020, 12, 6222. [Google Scholar] [CrossRef]

- Kijkasiwat, P.; Phuensane, P. Innovation and Firm Performance: The Moderating and Mediating Roles of Firm Size and Small and Medium Enterprise Finance. J. Risk Financ. Manag. 2020, 13, 97. [Google Scholar] [CrossRef]

- Khan, S.J.M.; Anuar, A.R. Access to finance: Exploring barriers to entrepreneurship development in SMEs. Glob. Entrep. New Ventur. Creat. Shar. Econ. 2017, 92–111. [Google Scholar] [CrossRef]

- Fowowe, B. Access to finance and firm performance: Evidence from African countries. Rev. Dev. Financ. 2017, 7, 6–17. [Google Scholar] [CrossRef]

- Ahmmed, K.F. Increasing SMEs’ Financial Accessibility in Developing Countries: A study in Bangladesh. Int. J. Econ. Manag. Eng. 2016, 10, 893. [Google Scholar]

- Nguyen, T.; Tripe, D.; Ngo, T. Operational Efficiency of Bank Loans and Deposits: A Case Study of Vietnamese Banking System. Int. J. Financ. Stud. 2018, 6, 14. [Google Scholar] [CrossRef]

- Ayuba, B.; Zubairu, M. Impact of Banking Sector Credit on the Growth of Small and Medium Enterprises (SME’s) in Nigeria. J. Resour. Dev. Manag. 2015, 15, 1–9. [Google Scholar]

- Lee, R. The Effect of Supply Chain Management Strategy on Operational and Financial Performance. Sustainability 2021, 13, 5138. [Google Scholar] [CrossRef]

- De Torre, A.; Schmukler, S.L. Bank Involvement with SMEs: World Bank Policy Research Work; WPS4649; World Bank: Washington, DC, USA, 2008; pp. 1–90. [Google Scholar]

- Kozolchyk, B. The Paperless Letter of Credit and Related Documents of Title. Law Contemp. Probl. 1992, 55, 2–39. [Google Scholar] [CrossRef]

- Lang, F. The Importance of Leasing for SME Finance; European Investment Fund: Luxembourg, 2012. [Google Scholar]

- Deloof, M.; Lagaert, I.; Verschueren, I. Leases and Debt: Complements or Substitutes? Evidence from Belgian SMEs. J. Small Bus. Manag. 2007, 45, 491–500. [Google Scholar] [CrossRef]

- Adedeji, A.; Stapleton, R.C. Leases, Debt and Taxable Capacity; Aston University: Birmingham, UK, 2015; Volume 6, pp. 37–41. [Google Scholar]

- Lassala, C.; Apetrei, A.; Sapena, J. Sustainability matter and financial performance of companies. Sustainability 2017, 9, 1498. [Google Scholar] [CrossRef]

- Doh, S.; Kim, B. Government support for SME innovations in the regional industries: The case of government financial support program in South Korea. Res. Policy 2014, 43, 1557–1569. [Google Scholar] [CrossRef]

- Smallbone, D.; Welter, F. The Role of Government in SME Development in Transition Economies. Int. J. Small Bus. 2001, 19, 63–77. [Google Scholar] [CrossRef]

- Nugroho, M.A. Impact of Government Support and Competitor Pressure on the Readiness of SMEs in Indonesia in Adopting the Information Technology. Procedia Comput. Sci. 2015, 72, 102–111. [Google Scholar] [CrossRef]

- Seo, J.H.; Cho, D. Analysis of the effect of R&D planning support for smes using latent growth modeling. Sustainability 2020, 12, 1018. [Google Scholar]

- Lyver, M.J.; Lu, T.J. Sustaining innovation performance in SMEs: Exploring the roles of strategic entrepreneurship and IT capabilities. Sustainability 2018, 10, 442. [Google Scholar] [CrossRef]

- Yi, H.T.; Amenuvor, F.E.; Boateng, H. The impact of entrepreneurial orientation on new product creativity, competitive advantage and new product performance in smes: The moderating role of corporate life cycle. Sustainability 2021, 13, 3586. [Google Scholar] [CrossRef]

- Esubalew, A.A.; Raghurama, A. The moderating effect of size on the relationship between commercial banks financing and the performance of micro, small, and medium enterprises (MSMEs). J. Glob. Entrep. Res. 2021, 5, 2–19. [Google Scholar] [CrossRef]

- Choi, J.H.; Kim, S.; Yang, D.H. Small and medium enterprises and the relation between social performance and financial performance: Empirical evidence from Korea. Sustainability 2018, 10, 1816. [Google Scholar] [CrossRef]

- Ardyan, E. SMEs’ marketing performance: The mediating role of market entry capability. J. Res. Mark. Entrep. 2018, 20, 122–146. [Google Scholar]

- Cardoza, G.; Fornes, G.; Farber, V.; Duarte, R.G.; Gutierrez, J.R. Barriers and public policies affecting the international expansion of Latin American SMEs: Evidence from Brazil, Colombia, and Peru. J. Bus. Res. 2016, 69, 2–21. [Google Scholar] [CrossRef]

- Delmar, F.; Davidsson, P.; Gartner, W.B. Arriving at the high-growth firm. J. Bus. Ventur. 2003, 18, 189–216. [Google Scholar] [CrossRef]

- Adams, D.; Bucior, H.; Day, G.; Rimmer, J.A. Houdini. Make that urinary catheter disappear-nurse-led protocol. J. Infect. Prev. 2012, 13, 44–46. [Google Scholar] [CrossRef]

- Wubet, G.G.; Mmopelwa, G. Performance of Micro and Small Enterprisers in Tigray, Northern Ethiopia. Momona Ethiop. J. Sci. 2020, 12, 103–122. [Google Scholar] [CrossRef]

- Agler, R.; de Boeck, P. On the interpretation and use of mediation: Multiple perspectives on mediation analysis. Front. Psychol. 2017, 8, 1984. [Google Scholar] [CrossRef] [PubMed]

- Morgan. Activities of human RRP6 and structure of the human RRP6 catalytic domain. Rna 2011, 17, 1566–1577. [Google Scholar] [CrossRef]

- Youtang, Z.; Yesuf, A.E. Driving Model of Determinant Factors Affecting the Performance of Small and Micro Enterprises: Empirical Evidence from Amhara Region, Ethiopia. Preprints 2021. [CrossRef]

- Postelnicu, L.; Hermes, N. Microfinance Performance and Social Capital: A Cross-Country Analysis. J. Bus. Ethics 2018, 153, 427–445. [Google Scholar] [CrossRef]

- Li, Y.H.; Huang, J.W.; Tsai, M.T. Entrepreneurial orientation and firm performance: The role of knowledge creation process. Ind. Mark. Manag. 2009, 38, 440–449. [Google Scholar] [CrossRef]

- Sidik, I.G. Conceptual Framework of Factors Affecting SME Development: Mediating Factors on the Relationship of Entrepreneur Traits and SME Performance. Procedia Econ. Financ. 2012, 4, 373–383. [Google Scholar] [CrossRef]

- Leitner, K.H.; Güldenberg, S. Generic strategies and firm performance in SMEs: A longitudinal study of Austrian SMEs. Small Bus. Econ. 2010, 35, 169–189. [Google Scholar] [CrossRef]

- Abor, J.; Quartey, P. Issues in SME development in Ghana and South Africa. Int. Res. J. Financ. Econ. 2010, 39, 218–228. [Google Scholar]

- Taber, K.S. The Use of Cronbach’s Alpha When Developing and Reporting Research Instruments in Science Education. Res. Sci. Educ. 2018, 48, 1273–1296. [Google Scholar] [CrossRef]

- Brusset, X. Production Economics Does supply chain visibility enhance agility ? Intern. J. Prod. Econ. 2016, 171, 46–59. [Google Scholar] [CrossRef]

- Bagozzi, R.P.; Yi, Y.; Phillips, L.W. Assessing Construct Validity in Organizational Research. JSTOR 1991, 36, 421–458. [Google Scholar] [CrossRef]

- Fornell, C.; Larcker, D. Equation Algebra Unobservable Error: Variables. J. Mark. Res. 2012, 18, 382–388. [Google Scholar] [CrossRef]

- Heeren, A.; van Broeck, N.; Philippot, P. The effects of mindfulness on executive processes and autobiographical memory specificity. Behav. Res. 2009, 47, 403–409. [Google Scholar] [CrossRef]

- Tofighi, D.; MacKinnon, D.P.R. Mediation: An R package for mediation analysis confidence intervals. Behav. Res. Methods 2011, 43, 692–700. [Google Scholar] [CrossRef]

- Zaremba, L.S.; Smoleński, W.H. Optimal portfolio choice under a liability constraint. Anal. Oper. Res. 2000, 97, 131–141. [Google Scholar]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).